Abstract

This study, sets up an EOQ model for spoiling commodities by means of inventory tempt demand. Holding cost is measured as portion of inventory echelon for model I and linearly stock dependent for model II. Mathematical models are also presented for these two models. Next, approximate optimal solution for these models is derived. Optimal solution is obtained with the help of algorithm. Numerical results are established to validate the solution algorithm. Second order approximations are applied for finding closed form outcomes. Sensitivity investigation is provided for variation of several key parameters to validate the model.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The deterioration is a natural process for any item (living/non-living) in the universe. Most of the commodities deteriorate with time. Deterioration is the method of becoming spoiled or substandard in quality, performance or circumstance. Examples of the deterioration are (1) marble worsening embraces salt crystallization, aqueous termination, microbiological growth, human contact and innovative structure (2) flood condition in the country has deteriorated quickly (3) health of a person deteriorated week by week due to brutal sickness (4) company’s financial condition deteriorated due lock off and labor strike.

Inventory management is mostly based on the statement that an item is stock-level undergoes no failure in distinction. Stock-induced method is the actuality of current world, where trader in every phase, commodities to offer stock-level as a means of purchasing the sales. It is observed from several investigations that demand rate depends on available inventory in the store. In most cases customers are attracted by more stock in the warehouse.

2 Literature survey

Levin et al. [1] presented the customers are motivated on the subsistence of inventory in the superstore. Silver and Peterson [2] presented that the sales at trade echelon and inventory displayed both are proportional to each other. Gupta and Vrat [3] first recognized an EOQ model for stock-linked demand in utilization environment. Van der Veen [4] presented an EOQ model for supply induced holding price. Weiss [5] presented the model allowing for holding cost is non linear function of stock-point. Giri and Chaudhuri [6] established EOQ model for unpreserved item for consumption with stock-associated demand and erratic holding cost. Padmanabhan and Vrat [7] established EOQ model for stock-dependent advertising rate under deterioration. Hou [8] developed an EOQ model for stock-dependent expenditure rate under deterioration, shortages and price rises. Datta and Paul [9] considered a system where demand depends on both stock-stage and selling charge. Balkhi and Benkherouf [10] designed an EOQ model by means of inventory linked and time-sensitive demand rates for fading objects. Teng et al. [11] recognized a model to allow in favor of (1) a non-ending inventory (2) the inventory capacity is limited (3) the objective is profit maximization and (4) constant deterioration. Yang [12] considered an inventory model under inventory-stimulated demand with shortages. Wu et al. [13] pointed out a most favorable order size for non-instant deteriorating foodstuffs for stock-induced demand and fractional backlogging. Soni and Shah [14] developed a model to establish inventory policy for seller where demand rate is incompletely stable and dependent on stock under progressive credit periods to resolve account. Sicilia et al. [15] considered a deterministic EOQ model for worsening item with time changeable demand and allowable shortages. Other parallel research work in this direction are by Goh [16], Chung and Tsai [17], Modarres and Taimury [18], Rabbani et al. [19], Manna and Chaudhuri [20], Donaldson et al. [21], Ritchie [22], etc.

Khanra et al. [23] designed an EOQ model with variable demand for weakening substances and trade credits. Teng et al. [24] presented a model for non-diminishing time induced demand under permitted delay in payments. Tripathi et al. [25] addressed an EOQ model for failing commodities with stock-linked demand.

In many corporations deterioration of commodities is a genuine problem. Deteriorating inventory administration is one of numerous critical concern that supply chain members are facing since a number of past years. In most of the EOQ models in the literature, rate of weakening of commodities is sighted as an exogenous unpredictable, which is not subject to have power over. In factual market some foodstuff like; green vegetables, fruits, explosive liquids and others loss their originality constantly due to spoilage etc. Deterioration plays a crucial role in all type of business transactions. Maintenance of deteriorating items in its original shape is a big challenge for retailer as well as customer. The majority of items in the world go down over time. Ghare and Schrader [26] established an EOQ model with exponentially decomposing inventory. Tripathi [27] presented an EOQ model in favor of weakening items with linearly increasing demand. Hariga [28] established inventory models for deteriorating objects with increasing demand outline. Dye [29] considered the consequence of skill outlay on refrigeration to get better profit for deteriorating goods. Sarkar et al. [30], Wu et al. [31], Wang et al. [32], Wu et al. [33], Tripathi and Uniyal [34], Tripathi and Shweta [35] etc. developed EOQ models for desertion objects.

The purpose of this effort is to diminish total inventory cost for different holding costs. The results of this research work are expected to help the practitioners for such product while considering the item by means of stock-sensitive demand. Remaining of the paper is planned as follows: Notations and assumption are used in the model are mentioned in Sect. 2. Mathematical formulation is conversed in Sect. 3 followed by optimal solution. Solution algorithm and numerical example are discussed in Sects. 4 and 5 respectively. In Sect. 6 sensitivity analysis is detailed. Conclusion and future research directives are given in Sect. 7.

3 Notations and assumptions

Following notations are used throughout the manuscript:

3.1 Notations

- K :

-

Ordering cost/order

- c :

-

Cost of item/unit

- R :

-

Demand rate

- h :

-

Holding cost parameter

- q(t):

-

Inventory point at time ‘t’

- θ :

-

Deterioration rate and, 0 ≤ θ ≤ 1

- Q :

-

Order quantity

- T :

-

Cycle time

- HC :

-

Holding cost

- CD :

-

Cost of deterioration

- TRC :

-

Total relevant cost/cycle

3.2 Assumptions

In addition following assumptions are made to build up the model proposed in the manuscript:

-

Cost of item is independent with the size.

-

Lead time is negligible.

-

There are instantaneous replenishments.

-

All cycles are alike.

-

Demand rate is stock-dependent i.e. R = α +βq(t), α > 0 consumption rate and β is stock-dependent constraint

-

Deterioration rate is invariable.

-

Holding cost is linked with non-linear inventory linked for model I

-

Rate of change of holding cost function is linearly stock-dependent for model II

4 Mathematical formulation

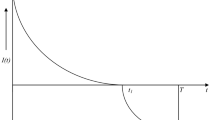

At opening of every cycle, the level of inventory decreases due to customer’s requirement. Inventory depleted due to demand and deterioration and becomes zero at the end of cycle time. Inventory level q(t) is represented by subsequent differential equation (Fig. 1).

With condition q(0) = Q. Solution of Eq. (1) is given by:

Using q(T) = 0, Eq. (2), becomes:

Taking second order approximation of logarithm, (3), reduces to:

4.1 Model I: non linear inventory induced holding cost

In this present model, it is presumed that holding cost for an amount dq(t) of the product up to time ‘t’ is \(h\{ q(t)\}^{n} dq(t)\), where ‘n’ is any positive integer and greater than one. Thus

Cost of deterioration during [0, T] is:

Taking second order approximation for exponential term, Eq. (6), becomes

Therefore, total relevant cost/cycle:

4.2 Model II: linear inventory—induced holding cost

In this case, holding cost rate is considered linearly-inventory dependent:

Holding cost (HC) is obtained by integrating (10) with limit ‘t’ from t = 0 to T, (level of inventory decreases with time), then

Second order approximations have been used for exponential terms on the right hand side of (12), it becomes

Using Eqs. (4), (13) reduces to

5 Optimal solution for models I and II

5.1 Model I

Right hand side of (9) is a function of ‘Q’, optimal value of Q = Q*, is obtained by solving \(\frac{d(TRC)}{dQ} = 0\), which minimizes TRC. Differentiating (9) w.r.t. ‘Q’, twice, it becomes

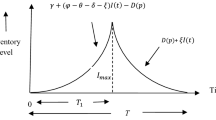

and (see Fig. 2)

Putting \(\frac{d(TRC)}{dQ} = 0,{\text{ we get}}\)

Solving Eq. (17) for Q, optimal value of Q = Q*, is obtained.

5.2 Model II

Right hand side of above Eq. (14) is a function of ‘Q’, Optimal Q = Q* is obtained by solving \(\frac{d(TRC)}{dQ} = 0\), which minimizes TRC. Differentiating (14) w.r.t. ‘Q’ two times, then

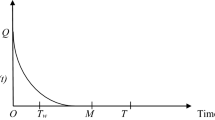

and (see Fig. 3)

Putting Eq. (18) to zero, we get

Solving Eq. (20) for ‘Q’, optimal Q* is obtained.

From the above formulation, we derive following solution algorithm to derive approximate optimal values T*, Q* and TRC*.

6 Solution algorithm

-

Step 1 Initialize the constraints

-

Step 2 Calculate TRC from Eqs. (9) and (14) for different values of Q

-

Step 3 Repeat the above steps for all possible values of ‘Q’, minimum TRC is obtain From Eqs. (9) and (14) for models I and II separately. TRC* values constitute optimal solution for both models

-

Step 4 T* is obtained by substituting Q* into Eq. (4)

-

Step 5 stop.

7 Numerical example

In the present section computational results are presented for optimal behavior of Q*, T*, and TRC*. Following table is developed to demonstrate the results for models I and II presented in this study with the following parameters K = $ 200/order, α = 2, c = $ 10.00/unit, h = $ 0.50/unit, n = 2 and θ = 0.03.

Numerical results shown in Table 1, we obtain optimal values for model I are Q* (optimal order quantity) = 7.0 units, T* = 2.70,647 years, TRC* = $ 101.873, and optimal alternative for model II are Q* = 16.7 units, T* = 3.81804 years, TRC* = $ 36.6386. From Table 1, it is clear that TRC is convex function with respect to Q i.e. \(\frac{{d^{2} (TRC)}}{{dQ^{2} }} > 0\)(in the following figures between TRC and Q are convex, it shows that TRC will be minimum for Q). It means that the value of Q* is obtained on solving \(\frac{d(TRC)}{dQ} = 0\), minimizes TRC* for all Q. Figures for both cases are given below:

8 Sensitivity analysis

8.1 Sensitivity analysis for model I

In the present section computational results are presented for optimal behavior of Q*, T*, and TRC* for variation of n and β. Parameter values for models I and II are taken as K = $ 200/order, α = 2.0, c = $ 10.00/unit, h = $ 0.5/unit, and θ = 0.03.

From Table 2, following suggestions can be made.

From Table 2, it can be seen that (1) Increase of stock-dependent constraints, results decrease in order quantity, cycle time and increase in total relevant cost, keeping ‘n’ fixed. (2) Increase of ‘n’, results decline in order quantity, cycle time and increase in total relevant cost, keeping ‘β’ unchanged.

8.2 Sensitivity analysis for model II

We take the similar stricture values as in model I. Table 3, shows the approximate values of Q*, T*, and TRC* with effect of β.

From Table 3, following deduction can be drawn.

Enlarge of ‘β’ results, decline in most favorable order quantity, cycle time and strengthen in optimal total relevant cost.

9 Conclusion and future research

A deterministic inventory models is developed for deteriorating objects under stock sensitive demand. Sensitivity analysis is presented to find the nature of optimal order quantity, cycle time and total relevant cost. From managerial point of view the following results: (1) increase of ‘n’ results increase of total inventory cost and (2) increase of stock-dependent constraints results augment in total inventory cost.

This model can be generalized for credit sensitive demand, stochastic demand, price dependent demand and time-linked demand can be probable areas for the future research. Some other reasonable restriction like the warehouse.

References

Levin RI Mc, Langhlin CP, Lamone RP, Kottas JF (1972) Production/operations management: contemporary policy for managing operating system. McGraw-Hill, New York, p 373

Silver EA, Perterson R (1985) Decision system for inventory management and production planning, 2nd edn. Wiley, New York

Gupta R, Vrat P (1986) Inventory model for stock-dependent consumption rate. Opsearch 23:19–24

der Veen Van (1967) Introduction to the theory of operational research. Philip technical library. Springer, New York

Weiss HJ (1982) Economic order quantity model with nonlinear holding cost. Eur J Oper Res 9:56–60

Giri BC, Chaudhuri KS (1998) Deterministic models of perishable inventory with stock-dependent demand rate and nonlinear holding cost. Eur J Oper Res 105:467–474

Padmanabhan G, Vrat P (1995) EOQ model for perishable item under stock-dependent demand rate. Int J Prod Econ 32:291–299

Hou KL (2006) An inventory model for deteriorating item with stock-dependent consumption rate and shortages under inflation and time discounting. Eur J Oper Res 168:463–474

Datta TK, Paul K (2001) An inventory system with stock-dependent, price-sensitive demand rate. Prod Plan Control 12:13–20

Balkhi ZT, Benkherouf L (2004) On an inventory model for deteriorating item with stock-dependent and time-varying demand rates. Comput Oper Res 31:223–240

Teng JT, Krommyda IP, Skouri K, Lou KR (2011) A comprehensive extension of optimal ordering policy for stock-dependent demand under progressive payment scheme. Eur J Oper Res 215:97–104

Yang CT (2014) An inventory model with both stock-dependent demand rate and stock-dependent holding cost. Int J Prod Econ 155:214–221

Wu KS, Ouyang LY, Yang CT (2006) An optimal replenishment policy for non-instantaneous deteriorating item with stock-dependent demand and partial backlogging. Int J Prod Econ 101(2):369–384

Soni H, Shah NH (2008) Optimal ordering policy for stock-dependent demand under progressive payment scheme. Eur J Oper Res 184:91–100

Sicila J, Rosa MG De-la, Acosta JF, Pablo DA Lopez-de (2014) An inventory model for deteriorating items with shortages and time varying demand. Int J Prod Econ 156:155–162

Goh M (1994) EOQ models with general demand and holding cost functions. Eur J Oper Res 73:50–54

Chung KJ, Tsai SF (2001) Inventory system for deteriorating items with shortages and a linear trend in demand taking account of the time value. Comput Oper Res 28(9):915–934

Modarres M, Taimury E (2002) Optimal solution in a constrained distribution system. Int J Eng Trans A 15:179–190

Rabbani M, Manavizadeh N, Balali S (2008) A stochastic model for indirect condition monitoring using proportional covariate model. Int J Eng Trans A 21(1):45–56

Manna SK, Chaudhuri KS (2006) An EOQ model with ramp type demand rate, time dependent deterioration rate, unit production cost and shortages. Eur J Oper Res 171:557–566

Donaldson WA (1977) Inventory replenishment policy for a linear trend in demand—an analytical solution. Oper Res Q 28:663–670

Ritchie E (1984) The EOQ for linear increasing demand—a simple optimal solution. J Oper Res Soc 42:27–37

Khanra S, Ghosh SK, Chaudhuri KS (2011) An EOQ model for a deteriorating item with time dependent quadratic demand under permissible delay in payment. Appl Math Comput 218:1–9

Teng JT, Min J, Pan Q (2012) Economic order quantity model with trade credit financing for non-decreasing demand. Omega 40:328–335

Tripathi RP, Pareek S, Kaur M (2016) Optimal ordering policy with inventory dependent demand for deteriorating items under non decreasing shortages and inflation. Int J Mod Math Sci 14(1):42–53

Ghare PM, Schrader GP (1963) A model for an exponentially decaying inventory. J Ind Eng 14(5):238–243

Tripathi RP (2015) Economic order quantity (EOQ) for deteriorating items with non-decreasing demand and shortages under inflation and time-discounting. Int J Eng 28(9):1058–1066

Hariga MA (1996) Optimal EOQ models for deteriorating items with time varying demand. J Oper Res Soc 47(10):1228–1246

Dye CY (2013) The effect of preservation technology investment on a on—instantaneous deteriorating inventory model. Omega 41(5):872–880

Sarkar B, Saren S, Cardenas-Barron LE (2015) An inventory model with trade credit policy and variable deterioration for fixed life time products. Ann Oper Res 229(1):667–702

Wu J, Ouyang LY, Cardenas- Barron LE, Goyal SK (2014) Optimal credit period and lot size for deteriorating item with expiration dates under two level trade credit financing. Eur J Oper Res 237(3):898–908

Wang WC, Teng JT, Lou KR (2014) Seller’s optimal credit period and cycle time in a supply chain for deteriorating item with maximum life time. Eur J Oper Res 232(2):315–321

Wu J, Khateeb FBA, Teng JT, Barron LEC (2016) Inventory models for deteriorating items with maximum life time under downward partial trade credits to credit-risk customers by discounted cash flow analysis. Int J Prod Econ 171:105–115

Tripathi RP, Uniyal AK (2014) EOQ model with cash flow oriented and quantity. Int J Eng 27(7):1107–1112

Tripathi RP, Tomar SS (2018) Establishment of EOQ model with quadratic time-sensitive demand and parabolic time-linked holding cost with salvage value. Int J Oper Res 15(3):135–144

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interests

The author declare that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Tripathi, R.P. Innovative investigation of stock-sensitive demand induced economic order quantity (EOQ) model for deterioration by means of inconsistent holding cost functions. SN Appl. Sci. 2, 594 (2020). https://doi.org/10.1007/s42452-020-2007-x

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s42452-020-2007-x