Abstract

This paper studies the cost consensus model by considering the uncertain initial opinions and uncertain unit adjustment cost in group decision making. In the past consensus model based on optimization, the initial opinion and unit adjustment cost are usually assumed to be a crisp number for each expert. However, the speed of knowledge updating is often faster than people’s cognitive speed, it is difficult and impractical to ask experts to provide a clear initial opinion and determine the unit adjustment cost of each expert. In this paper, a new consensus approach is proposed to solve the above problems. First, a new distance measure is given based on interval-valued initial opinion, which retains the expert’s initial judgment and is consistent with most practical decision problems. Second, a linear analytical formula is given to reduce the computational cost of the piecewise function. Third, given the advantages of robust optimization in uncertain optimization, three robust cost consensus models are established to deal with the uncertain cost problem in consensus reaching progress. Finally, the proposed method is applied to P2P loan consensus, and sensitivity analysis and comparative analysis are presented.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Group decision-making (GDM) is often used to solve unstructured problems, for example, supplier selection problem [20], emergency plan formulation [21], trans-regional air pollution control [28] and so on. And GDM requires the participation of decision-makers or experts. GDM needs to be discussed and modified many times before a satisfactory solution can be obtained. In general, two processes are necessary for dealing with GDM problems: consensus process and selection process [8, 23]. The consensus process is usually supervised by a rich experience and leadership moderator who represents the collective interests, and experts discuss and revise repeatedly until their opinions are closer to each other. The selection process obtains a set of solutions from experts’ opinions, which involves the aggregation of individual opinions and the use of a collective opinion.

In the consensus reaching progress (CRP), experts need to provide their opinions on the decision problems. There are two types of opinion expression in CRP, one is preference relations based on paired comparison [7, 9, 13, 18, 22, 26, 29, 31, 32], the other usually assumes that experts’ opinions can be numerically expressed as quantitative values [5, 10, 12, 17, 25, 39]. This paper focuses on the second type of expression of opinion. Due to the influence of objective factors such as the uncertainty of things themselves and subjective factors such as the knowledge structure and judgment level of experts, the opinions of experts often have great differences. If the decision results do not take into account the differences among experts, some experts may not accept the decision results because they think their opinions have not been fully adopted. Thus, the CRP has become hotspot research in the field of GDM [18, 45]. In the traditional consensus, the consensus degree of experts is required to be either 0 or 1. This kind of consensus is difficult to reach and unnecessary, especially in the complex and uncertain decision-making environment. In the last few decades, the concept of soft consensus was proposed, which can flexibly evaluate the consensus level of experts and reflect the consensus of the majority of people in the group [15].

The moderator need to consume some resources to persuade experts to modify opinions in the CRP. Of course, the moderator hopes to retain the experts’ opinions as much as possible and reach a consensus at a lower cost. There has been a lot of literature on the consensus method in CRP. For example, Ben-Arieh et al. [1, 2] proposed the concept of the minimum cost consensus method (MCCM) to describe the linear cost of experts’ opinion adjustment process in the case of single criterion and multi-criterion. Dong et al. [6] proposed the minimum adjustment consensus model (MACM). By considering the aggregation operator in GDM, Zhang et al. [38] introduced a novel cost consensus model, which expanded Ben-Arieh and Easton’s work and established the connection between MCCM and MACM. Gong et al. [39] and Zhang et al. [42] put forward two consensus models from the perspective of moderator and experts respectively and discussed the relationship and economic significance between the two models. Cheng et al. [5] constructed the asymmetric cost consensus model from the different directions of opinion adjustment. Recently, Zhang et al. [44] put forward a bi-level consensus model based on the Stackelberg game. So far, many scholars have done a lot of improvement in the consensus model, see [24, 34, 35, 41, 43, 45, 46].

The above literature has greatly promoted the research of the consensus method, but their methods are based on the deterministic situation. With the development of social technology, the speed of people’s cognition is far lower than the speed of knowledge update. Therefore, there are many limitations in the application of the group consensus model with complete information. In the CRP, on the one hand, it is sometimes impractical to ask experts to give a clear original opinion [11, 14, 30, 40]. For example, in the formulation of a talent introduction plan, the university listens to the opinions of various departments and gives the final subsidies plan. In this case, it is difficult for department heads to provide a clear number. They may be more willing to provide an interval value. At present, the research on the consensus method of uncertain opinion is rare, but some related research results can still be found. For instance, Gong et al. [11] established the minimum cost consensus model and the maximum return consensus model from the perspective of the moderator and experts based on the interval value initial opinions and then discussed the relationship between the two models using the linear duality theory. When calculating the deviation of expert opinion in the objective function, by introducing a variable in [0, 1], the expert’s initial opinion was expressed as a value in the interval. This method ignores the psychological factors of experts and changes the initial judgment of experts. Considering the randomness of opinions in decision-making, Zhang et al. [40] constructed a cost consensus model to obtain the minimum consensus budget under a certain confidence level. In Zhang et al.’s model, experts’ opinions (or consensus opinions) satisfied certain distribution in the interval. Using goal programming, Tan et al. [30] established a dual-objective consensus model that considers both minimum consensus budget and maximum return. In Tan et al.’s [30] model, experts’ opinions can be expressed in the form of the utility function and normal distribution. When calculating the deviation of expert opinion, the \(3\sigma\) rule is used to transform the initial (or consensus) interval opinion into a normal distribution. By introducing uncertainty theory, Guo et al. [14] established the minimum cost consensus model based on uncertain distance. In Guo et al.’s [14] models, not only the experts’ initial opinions were assumed to be in an interval, but the adjustment opinions and the consensus opinions were also assumed to be in an interval. Through the above analysis, we find that the interval value judgment well describes the uncertainty of things, but when the experts’ opinion is interval value, there are some limitations in the application of the previous study of calculating the expert adjustment deviation. Because, in many decision-making problems, it is impossible to get the interval value of consensus (or adjustment opinion) in advance. For example, emergency decision-making [21].

On the other hand, the unit adjustment cost provided by the moderator to the expert is an important factor in the CRP. If the unit adjustment cost does not meet the expectations of experts, they may not cooperate with the decision-making, which will lead to the consensus process being too long and ineffective. The above literature does not consider the uncertain unit cost, which has promoted the research of consensus cost. However, the solution obtained from the above cost consensus model may be too ideal, which leads to deviation from the actual decision. In fact, the uncertain unit adjustment cost has attracted scholar’s attention. For example, Li et al. [17] studied the consensus model with uncertain cost in GDM. The unit adjustment cost of experts in Li et al.’s model was estimated according to the change of opinions. By assuming that unit adjustment cost belongs to given uncertainty sets, Han et al. [16] constructed the robust cost consensus model. Lu et al. [25] studied the effect of uncertain cost on consensus cost in large-scale group decision-making on social networks. As pointed out earlier, interval-valued opinions are more convenient for experts to express in an uncertain environment. However, the above studies rarely consider interval-valued opinions.

To the best of our knowledge, there is no work considering the above two factors. To overcome the above shortcomings, this paper constructs new consensus models based on interval-valued initial opinion and uncertain unit adjustment cost. The method in this paper has the following advantage:

-

(1)

A new consensus method to effectively solve the uncertain initial opinions in decision-making problems is proposed in this paper. When the experts are not familiar with the decision-making problems or do not fully grasp the alternative information, the experts will be in an uncertain state. Interval-value provides a good expression for experts.

-

(2)

A new distance measure based on interval-valued initial opinion is proposed. The new distance measure is closer to most practical situations and can be understood and accepted by experts. Then, to reduce the computational cost of the piecewise function, a linear analytical formula is proposed.

-

(3)

Robust optimization is used to describe the uncertainty of unit adjustment cost. Using duality theory, the robust cost consensus model based on interval-valued initial opinion is transformed into a problem that can be solved in polynomial time.

The rest of this article is constructed as follows: Sect. 2 reviews the MCCM optimization-based and MACM optimization-based, and the relationship between them. Section 3 is divided into two parts and describes the proposed method in detail. A case is applied to prove the effectiveness of our proposed methods in Sect. 4. Section 5 provides sensitivity and comparative analysis. Finally, in Sect. 6, we summarize the whole paper and propose future research work.

2 Preliminaries

2.1 A Review of the Optimization-Based Minimum Cost Consensus Model

Assume there is n experts, let \(E=\{e_1, e_2, \ldots , e_n\}\) denotes the expert who participated in GDM. \(O=\{o_1, o_2, \ldots , o_n\}\) represents the initial opinion set of the expert. \(O^{'}=\{o_1^{'}, o_2^{'}, \ldots , o_n^{'}\}\) is the adjustment opinion set of the expert. \(o^c\) denotes consensus opinion. \(c_i (i\in I=\{1, 2, \ldots , n\})\) is the cost of moving expert i’s opinion 1 unit.

In the GDM, there are two commonly used methods to measure the consensus degree of experts: Euclidean distance or Manhattan distance. In this paper, we mainly use Euclidean distance. \(\mid o_i-o^{c} \mid\) denotes the ith expert’s consensus degrees. The smaller the value, the smaller the degree of change of the expert’s initial opinion. \(c_i*\mid o_i-o^{c} \mid\) is the cost paid by the moderator to expert \(e_i\) changing expert i’s opinion from \(o_i\) to \(o^{c}\).

To obtain a solution that produces minimum consensus cost, Ben-tel et al. [1] first presented the concept of consensus cost. As shown in the following model (1).

Assume that each expert has a consensus threshold \(\varepsilon \ge 0\). That is, in the range of \(\varepsilon\) of \(o^c\), the cost is free. Ben-tel et al. [2] presented the concept of \(\varepsilon\) consensus. As shown in the following model (2).

Let \(o_i^{'}\in {\mathbb {R}}\) be the adjusted opinion of the expert \(e_i\). \({\bar{o}}^c\) denotes the adjusted collective opinion. By introducing the concept of aggregation operators, Zhang et al. [38] constructed a novel minimum cost consensus model, as follows

where F is the aggregate operator.

For one thing, aggregation operators have been widely applied in GDM problems. Common aggregation operators are weighted average (WA) operator [37], ordered weighted average (OWA) operator [6, 36], geometric weighted average (GWA) operator [19], harmonic weighted average operator [27]. This paper mainly uses the weighted average operator (WA) to aggregate expert’s opinions, because WA can directly reflect the relationship between individual opinion and group consensus opinion, and other operator can be regarded as a special case of WA.

For another, the consensus threshold \(\varepsilon\) may not be the same in [40], due to the different background and knowledge level of each expert. This article discusses the consensus method under different consensus thresholds.

The minimum cost consensus model (MCCM) based on WA and different consensus threshold \(\varepsilon\) is defined as

where \(w_i\) satisfies \(w_i\in {\mathbb {R}}_+\) and \(\sum _{i=1}^{n}w_i=1\).

2.2 A Review of Minimum Adjustment Consensus Model

Dong et al. [6] proposed the minimum adjustment consensus model (MACM) based on optimization, as follows

where \(d(o_i, o_i^{'})\) is the distance measure between \(o_i\) and \(o_i^{'}\). \(F_w\) is the aggregation operator. If \(c_i\) is 1 in Model (4), the distance measurement method in Model (5) is Euclidean, and the aggregation operator is WA, then Model (4) can be reduced to Model (5). Zhang et al. [38] has proved this and proposed Model (6)

where \(d(o_i, o_i^{'})=\mid o_i-o_i^{'} \mid\).

Although uncertain GDM is more common in real life, uncertain initial opinion and uncertain unit adjustment cost are not considered in the above consensus method.

3 Model Construction

This section extends the consensus model described in Sect. 2 to uncertain GDM circumstances. Some novel consensus models are built that consider uncertain initial opinions \(o_i\) and uncertain unit adjustment cost \(c_i\).

3.1 Consensus Model with Uncertain Opinion

In previous studies, the initial opinions of experts were set to a clear number. However, with the development of the times, there are more and more unknown factors and decision-making knowledge in the CRP, which make a complex and uncertain environment for experts. it may be an uncertain number.

In the following, assume the initial opinion is an interval, that is

where \(0\le o_{il} \le o_{ir}\).

From the expert’s psychological analysis, when the adjustment opinion falls within the range of the initial opinion, he thinks his adjustment deviation is 0 at this time. To reduce the adjustment deviation of opinions, when the adjustment opinion falls outside the range, the adjustment deviation is equal to the distance between the endpoint value and the adjustment opinion. That is, when the adjustment opinion is smaller than the left endpoint of the expert’s initial opinion, the adjustment deviation is equal to the left endpoint minus the adjusted opinion. When the expert’s adjustment opinion is greater than the right endpoint of the expert’s initial opinion, then the adjustment deviation is equal to the adjusted opinion minus the right endpoint.

Based on the above analysis, a new distance measure before and after expert opinion adjustment based on interval initial opinion is provided.

Definition 1

Assume \(o_i^{'}\) is a continuous variable, \(o_i\) is an interval number such that \(o_i=[o_{il}, o_{ir}]\), \(o_{il}\le o_{ir}\). Then, the difference between \(o_i\) and \(o_i^{'}\) can be measured by

Definition 1 in the CRP, on the one hand, retains the expert’s initial judgment. On the other hand, it is closer to most practical situations and can be easily understood and accepted by experts.

The distance function of revising all the expert’s opinion can be denoted as

Then, we put forward the corresponding cost consensus Model (10) of Model (6) under the interval-valued opinion

where consensus threshold \(\varepsilon _i\) is a predefined value, which reflects the maximum deviation between expert’s adjustment opinions and consensus opinions. \(o_i=[o_{il}, o_{ir}]\) is the initial opinion of expert \(e_i\). However, Model (10) contains piecewise function in the objective function, it is not easy to be solved. Therefore, a linear objective function is given below.

Let \(l_i^+=\max (o_{il}-o_i^{'},0), l_i^-=\max (o_i^{'}-o_{il},0), h_i^+=\max (o_i^{'}-o_{ir},0), h_i^-=\max (o_{ir}-o_i^{'},0)\), \(l_i^+- l_i^-=o_{il}-o_i^{'}\), \(h_i^+- h_i^- = o_i^{'}-o_{ir}\). Then, Eq. (9) can be rewritten as follows theorem.

Theorem 1

Assume \(o_i^{'}\) is a continuous variable, \(o_i\) is an interval number such that \(o_i=[o_{il}, o_{ir}]\), \(o_{il}\le o_{ir}\). Then, the distance between \(o_i\) and \(o_i^{'}\) is expressed as follows

Proof

If \(o_i^{'}<o_{il}\), then \(o_i^{'}<o_{il}<o_{ir}\). We obtain \(l_i^+=o_{il}-o_i^{'}, l_i^-=0, h_i^+=0, h_i^-=o_{ir}-o_i^{'}\). According to Eq. (1), we have

If \(o_{il}<o_i^{'}<o_{ir}\), then \(l_i^+=0, l_i^-=o_i^{'}-o_{il}, h_i^+=0, h_i^-=o_{ir}-o_i^{'}\). According to Eq. (1), we have

If \(o_i^{'}>o_{ir}\), then \(o_{il}<o_{ir}<o_i^{'}\). We obtain \(l_i^+=0, l_i^-=o_i^{'}-o_{il}, h_i^+=o_i^{'}-o_{il}, h_i^-=0\). According to Eq. (1), we have

\(\square\)

Next, an important corollary is given from Theorem 1 to show the relationship between variables \(l_i^+, l_i^-, h_i^+, h_i^-\) and \(o_i^{'}\).

Corollary 1

If \(o_i^{'}=o_{il}\), then \(l_i^+=0, l_i^-=0, h_i^+=0, h_i^->0\). if \(o_i^{'}< o_{il}\) , then \(l_i^+>0, l_i^-=0, h_i^+=0, h_i^->0\). if \(o_{il}< o_i^{'} <o_{ir}\), then \(l_i^+=0, l_i^->0, h_i^+=0, h_i^-=0\). if \(o_i^{'} > o_{ir}\), then \(l_i^+=0, l_i^->0, h_i^+>0, h_i^-=0\).

Proof

If \(o_i^{'}=o_{il}\), then \(o_{il}-o_i^{'}=0, o_i^{'}-o_{ir}<0\). We can obtain \(l_i^+=0, l_i^-=0, h_i^+=0, h_i^->0\). If \(o_i^{'}< o_{il}\), then \(o_{il}-o_i^{'}>0, o_i^{'}-o_{ir}<0\). We can obtain \(l_i^+>0, l_i^-=0, h_i^+=0, h_i^->0\). If \(o_{il}< o_i^{'}<o_{ir}\), then \(o_{il}-o_i^{'}<0, o_i^{'}-o_{ir}<0\). We can obtain \(l_i^+=0, l_i^->0, h_i^+=0, h_i^->0\). If \(o_i^{'}=o_{ir}\), then \(o_{il}-o_i^{'}<0, o_i^{'}-o_{ir}=0\). We can obtain \(l_i^+=0, l_i^->0, h_i^+=0, h_i^-=0\). If \(o_i^{'} > o_{ir}\), then \(o_{il}-o_i^{'}<0, o_i^{'}-o_{ir}>0\). We can obtain \(l_i^+=0, l_i^->0, h_i^+>0, h_i^-=0\). \(\square\)

Theorem 1 deals with the problem of piecewise function in the objective function of Model (10). For the convenience of later research, by introducing auxiliary variables \(c=(c_1, c_2, \ldots , c_n)^{T}\), \(l^+=(l_1^+, l_2^+, \ldots , l_n^+)^{T}\), \(l^-=(l_1^-, l_2^-, \ldots , l_n^-)^{T}\) and \(h^+=(h_1^+, h_2^+, \ldots , h_n^+)^{T}\), \(h^-=(h_1^-, h_2^-, \ldots , h_n^-)^{T}\), Model (10) can further convert to the following linear programming model

where \({\bar{o}}^{c}, o_{i}^{'}\), \(l^+, l^-, h^+, h^-\) is the decision variable. In this paper, denote Model (12) as \(P_1\).

Finally, Theorem 2 is given to show the relationship between the Model \(P_1\) and MCCM.

Theorem 2

Model \(P_1\) can be seen as a generalization of MCCM, whereas MCCM can be seen as a special case of Model \(P_1\). When \(o_i=o_{il}=o_{ir}\), then Model \(P_1\) can be reduced to MCCM.

Proof

This result is easy to get, we omit it. \(\square\)

3.1.1 Example

This section verifies the theoretical analysis of the above theorem using the data in References Zhang et al. [40]

Suppose there are four experts \(e_1, e_2, e_3, e_4\) in the GDM and their corresponding initial opinions are \(o_1=[48, 52]\), \(o_2=[50, 55], o_3=[60, 65], o_4=[62, 67]\). The unit adjustment costs paid to the four experts by the moderator are \(c_1=0.8, c_2=1.5, c_3=1.2, c_4=0.9\). Suppose the weight of their opinions is \(w_1=0.25, w_2=0.25, w_3=0.25, w_4=0.25\). respectively. The compromise level of each expert is 0.2, 0, 2, 0.2, 0.3. We construct model P1 as follows:

The solution of model (13) is \(O^*=(55.2, 55, 55, 55.4, 55.4, 0, 7, 3, 0, 0, 5, 0, 0, 4.6, 0, 0,9.6, 6.6, 0, 0, 11.6)\). The right endpoint of expert \(e_1\)’s initial opinion is smaller than its adjustment opinion, then \(l_1^{+}=0, l_1^{+}=7>0, h_1^{+}=3>0, h_1^{-}=0\). The right endpoint of expert \(e_2\)’s initial opinion is equal to its adjustment opinion, then \(l_2^{+}=0, l_1^{+}=5>0, h_1^{+}=0, h_1^{-}=0\). The left endpoint of the expert \(e_3 (e_4)\)’s initial opinion is more than its adjustment opinion, then \(l_3^{+}=4.6>0, l_3^{-}=0, h_3^{+}=0, h_3^{-}=9.6>0 ~(l_4^{+}=6.6>0, l_4^{-}=0,h_4^{+}=0, h_4^{-}=11.6>0)\).

This section establishes a new cost consensus model under interval-valued initial opinion as an example. First, when the expert’s initial opinion is interval value, a new distance measure is given between the adjustment opinion and the initial opinion. Next, Theorem 1 is provided to reduce the computational cost of piecewise functions in Model (10), and the relationship with the MCCM is provided in Theorem 2. Finally, the theoretical analysis of this section is shown using Zhang et al. [40] data.

3.2 Consensus Model with Uncertain Cost

In this section, a novel consensus method is proposed to solve the problem of uncertain unit adjustment cost in the consensus model with interval-valued opinion.

The CRP is a complex process, which needs the moderator to provide some compensation to experts in order to persuade them to change their views. Due to the limited knowledge of decision problems, it is very hard for the moderator to determine the unit adjustment cost of each expert. Thus, the unit adjustment cost \(c_i\) may be uncertain. The optimal solution found using the determine \(c_i\) may no longer be optimal or even infeasible. Previous studies, however, rarely considered the uncertain unit cost in the consensus model of interval-valued opinions.

This observation raises the natural question of finding a solution that is immune to data uncertainty, that is, they are ’robust’. To deal with this situation, robust optimization is introduced into the Model (12). Unlike stochastic programming and fuzzy programming, robust optimization does not need to know the exact distribution of uncertain parameters and the membership function of uncertain parameters. We only need to describe the uncertainty of unit adjustment cost in the form of set.

Let’s consider a robust version minimum cost consensus problem with the interval-valued initial opinion

where \({\bar{o}}^{c}, o_i^{'}, l^+, l^-, h^+, h^-\) is the decision variable, \({\tilde{c}}\in {\mathbb {R}}_{+}^{n}\) is uncertain parameter, and U is the uncertain region for \({\tilde{c}}\).

In the optimization problem, a typical method to characterize uncertain parameters is to construct the perturbation region near the fixed reference point (e.g., Ben-Tal et al. [4]). Let \(c_0\) is the reference point. Q is a \(n\times m\) coefficient matrix which is used to construct the disturbance region around \(c_0\). That is

where \({\mathcal {T}}\) is a given nonempty and compact convex uncertainty set [4]. In this paper, \({\mathcal {T}}\) is used to include all possible implementations of uncertain unit costs.

The selection of uncertain sets affects the complexity of solving the Model (14). In this paper, three classical uncertain sets in robust optimization are selected, such as box uncertainty set, ellipsoidal uncertainty set, and polyhedral uncertainty set. Next, we show how to get some easily handled robust counterpart problems of Model (14) with the help of duality theory.

3.2.1 Box Uncertainty Set

Suppose \({\tilde{c}}\) belongs to the box uncertainty set, let

Box uncertainty set, also known as the interval set [4], is the simplest uncertainty set. As robust optimization can be understood as the worst-case optimization approach. For some models, optimization can be performed on the upper and lower bounds of the interval of uncertain parameters.

Theorem 3

When uncertain unit adjustment cost \({\tilde{c}}\) belongs to the box uncertainty set, the robust counterpart of the problem (14) under the definition Eqs. (15) and (16) is expressed as follows

In this paper, denote Model (17) as \(P_2\).

Proof

The inner maximization problem of (14) is

In order to obtain the dual problem of (18), let’s do the following first

where t is the decision variable.

Because the outer layer of the problem (14) is the min problem and the inner layer is the sup problem. We can transform the inner sup problem into the min problem using the duality theory. So min-min can be written as min problem.

We associate the multipliers \(\lambda \in {\mathbb {R}}_{+}^{n}\) with the inequality \(c_0+Qt\ge 0\), and \(\eta \in {\mathbb {R}}_{+}\) with \(\Vert t\Vert _{1} \le 1\). We form the following Lagrange function

Thus, Lagrange dual function is

Because the conjugate of \(f=\Vert \cdot \Vert\) is given by

We obtain the dual problem of (19)

So the dual problem of (18) is

By substituting \(\sup _{{\tilde{c}} \in U} {\tilde{c}}^T(l^+ + h^+)\) in (14) with (22), we derive (17). \(\square\)

3.2.2 Ellipsoidal Uncertainty Set

Suppose \({\tilde{c}}\) belongs to the ellipsoidal uncertainty set, let

Ellipsoidal uncertainty set can well represent various types of uncertainty sets, facilitate data input, and reflect the correlation among uncertain parameters to a certain extent.

Theorem 4

Suppose there exist \({\hat{t}}\) such that \(c_0+Q{\hat{t}}>0\) and \(\Vert {\hat{t}}\Vert _2<1\). When uncertain unit adjustment cost \({\tilde{c}}\) belongs to the ellipsoidal uncertainty set, the robust counterpart of the problem (14) under the definition Eqs. (15) and (23) is expressed as follows

In this paper, denote Model (24) as \(P_3\).

Proof

The proof process is the same as Theorem 3, we omit it. \(\square\)

Corollary 2 is given based on Theorems 3 and 4, as follows

Corollary 2

Let U be given by (15) and the perturbation set by \({\mathcal {T}}=\{t\in {\mathbb {R}}^m |~ \Vert t\Vert _{p} ~ \le 1\} (1< p< \infty )\), where \(\Vert \cdot \Vert _{p}\) represents the \(l_P\)-norm of a vector. we assume that there exist \({\hat{t}}\in {\mathcal {T}}\), such that \(c_0+Q {\hat{t}}>0\) and \(\Vert {\hat{t}} \Vert _{p}< 1\). Then the problem (14) is equivalent to

where \(1/p+1/q=1\).

3.2.3 Polyhedral Uncertainty Set

Suppose \({\tilde{c}}\) belongs to the polyhedral uncertainty set, let

Polyhedral uncertainty set composed of linear equality and inequality constraints can be regarded as a special case of ellipsoidal uncertainty set [3]. Because of its linear structure and easy control of uncertainty, it is widely favored in practical engineering problems.

Theorem 5

Suppose there exist \({\hat{t}}\) such that \(c_0+Q{\hat{t}}>0\) and \(A{\hat{t}}=a\), \(B{\hat{t}} > b\). When uncertain unit adjustment cost \({\tilde{c}}\) belongs to the polyhedral uncertainty set, the robust counterpart of the problem (14) under the definition Eqs. (15) and (26) is expressed as follows

In this paper, denote Model (27) as \(P_4\).

Proof

The inner maximization problem of (14) is

where t is the decision variable.

Because the outer layer of the problem (14) is the min problem and the inner layer is the sup problem. We can transform the inner the sup problem into the min problem using the duality theory of linear programming. So min-min can be written as min problem.

In order to obtain the dual problem of (28), let’s consider the following questions first

We associate the multipliers \(\lambda \in {\mathbb {R}}_{+}^n\) with the inequality \(c_0+Qt\ge 0\), \(y\in {\mathbb {R}}^p\) with \(At=a\), \(z\in {\mathbb {R}}_+^q\) with \(Bt\ge b\). We form the following Lagrange function

Thus, Lagrange dual function is

The infimum of a linear function is \(-\infty\), except in the special case when it is identically zero, hence the dual function of (29) is

So the dual problem of (28) is

where y, z is the Lagrange multiplier.

Because the Slater condition holds, the above primal (28) and dual (31) have the same optimal value by linear dual theory.

By substituting \(\sup _{{\tilde{c}} \in U} {\tilde{c}}^T(l^+ + h^+)\) in (14) with (31), we derive (27). \(\square\)

4 Application in P2P Loan Consensus

This section illustrates the feasibility and effectiveness of the proposed consensus method through a case study of P2P lending.

With the gradual liberalization of China’s financial regulation, P2P platforms are expected to be popularized in China with explosive growth and substantial development in the context of China’s huge population base, increasingly booming financing demand, and backward traditional banking services.

With the help of the P2P platform, the borrower always hopes to borrow the required funds at a lower interest rate as soon as possible, and the lender hopes to get a higher return by lending to the borrower. When both parties reach an agreement, the platform charges a certain proportion of the service fee to the borrower. Because borrowers (lenders) lack professional financial knowledge, they may not be able to determine the loan interest rate. To make the two sides reach a consensus as soon as possible, the platform needs to take certain subsidies to the borrowers.

Taking the negotiation of loan consensus of online P2P as the background [42], it is assumed there are n borrowers, \(o_i\) is the expected interest rate of the borrower i. For borrowers, because of the volatility of interest rates, they can only give a rough range. That is, the initial opinion is an interval value. \(o_i^{'}\) represents the adjusted interest rate. \(w_i\) represents the proportion of funds allocated by the lender to the borrower i, and \({\bar{o}}^c\) represents the expected return rate of the lender. Because the borrowers are bounded rationality, they are willing to accept the platform’s proposal. \(c_i\) refers to the unit subsidy provided by the platform to the borrower i to change its unit interest rate. The consensus threshold of each borrower is \(\varepsilon _i\), which indicates lenders are flexible about the expected interest rate for each borrower. Due to the speed of data updating, the subsidy of interest rate adjustment for different borrowers may also be an uncertain number.

Assume that the platform has a lender with an investment fund of 20000 yuan at this time. In order to reduce the default risk, the investor selects five borrowers with class credit but different grades from the platform. The investors divided the money into 6000, 5000, 4000, 2000, 3000 and lent them to the five borrowers. The expected interest rates of these five borrowers are \(\{o_1, o_2, o_3, o_4, o_5\}=\left\{ [5.1, 5.6],[6.3, 7.8], \right. \left. [7.3, 8.8],[8.5,9.8], [9.5, 11.5]\right\}\) (unit: \(\%\)). Assume that they are bounded rationality, in order to borrow funds, they are willing to accept the mediation of the platform. The platform provides compensation for each borrower to change its expected interest per unit, \(c=(3.0, 2.5, 1.5, 2.0, 1.0)\). The consensus threshold is \(\varepsilon =(0.8, 0.4, 0.5, 0.6, 1)\).

since \({\tilde{c}}=c_0+Qt\), suppose \(c_0\) takes the nominal value, that is \(c_0=(3.0, 2.5, 1.5, 2.0, 1.0)\), where Q takes the random matrix subject to the normal distribution \(Q\sim N(0,(1/3)^2)\), here

Assume that all the element in matrix A, B and vector a, b in (26) are stochastically generated in [0, 2], [2/1, 5/2]. Here

and

\(a=(1.7273, 1.2641, 1.9915, 1.4493)\), \(b=(1.5392, 1.6465, 1.2006, 1.6749)\).

By solving Model \(P_1\), \(P_2\), \(P_3\), \(P_4\), the minimum cost (fval), consensus opinion \(({\bar{o}}^c)\) are shown in Table 1 . When the parameter Q takes the above value, we can find that the consensus opinions of Model \(P_2\), \(P_3\) and \(P_4\) are the same in Table 1. However, the consensus costs of the three models are different. The cost of Model \(P_1\) is smaller than that of the other three models, but the cost of Model \(P_4\) is closest to that of Model \(P_1\). Therefore, we can conclude that Model \(P_4\) can reduce conservatism compared with Model \(P_2\) and \(P_3\).

5 Model Discussion

In this section, first, the sensitivity analysis method is used to study the influence of some parameters in the model \(P_1\), \(P_2\), \(P_3\), \(P_4\) on the consensus opinion \({\bar{o}}^c\), minimum cost (fval). Then, the advantages of the proposed method are shown compared with the existing methods in the literature.

5.1 Sensitivity Analysis

Sensitivity analysis [33] is often used to study and analyze the sensitivity of the changes of model parameters or surrounding conditions of a model (or system) to the changes of model output, which is helpful for model parameter correction. In addition, sensitivity analysis is also used to determine which parameters in the model have a greater influence on the model. Therefore, sensitivity analysis is the most commonly used analysis method in optimization and scheme evaluation. When we study the influence of one parameter on the model, other parameters in the model remain unchanged. The data in Sect. 4 are still used.

-

(1)

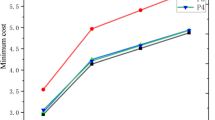

The influence of expert’s initial opinions on the decision results

\(o_i\) represents the initial loan interest rate of the borrower. In this paper, \(o_i\) is an interval value. It is necessary to study the influence of \(o_i\) change on the decision results. The results are shown in Fig. 1 and Table 2.

As can be seen from Fig. 1 and Table 2, when the expected interest rate given by the borrower is too high, the interest rate of the lender also increases, which is in line with the reality. However, for the platform, its subsidy also increase. At this time, for the sake of self-interest, the platform needs to provide help for borrowers, so that they can provide reasonable a range of expected interest rate.

-

(2)

The influence of consensus threshold of experts on the decision results

The consensus threshold \(\varepsilon _i\) reflects the flexibility of the borrower’s expected interest rate for different credit rating borrowers. The decision results under different thresholds are shown in Fig. 2 and Table 3.

It can be seen the larger the consensus threshold, the smaller the expected interest rate and consensus cost. In these circumstances, the too lower interest rate leads to the lenders withdrawing from the platform and makes the transaction impossible to reach. At this time, to promote the two parties to reach a consensus, the platform needs to provide some risk information for the lenders, so that they can make a reasonable judgment. From this, we can see that the platform plays an important role in the loan consensus, considering own interests as well as the interests of both sides.

From Table 3, we can find that the cost of the three models is higher than that of Model \(P_1\), but the cost of Model \(P_4\) is the closest to that of Model \(P_1\). So we can obtain that Model \(P_4\) can reduce the conservative compared with Model \(P_2\) and Model \(P_3\).

-

(3)

The influence of the matrix Q on the decision results

The matrix Q is the coefficient matrix which forms the disturbance area around the reference point \(c_0\). The change of Q changes the disturbance area. Next, we study the influence of the change of Q value and different distribution on the results. First, we use the Monte Carlo simulation method to generate 1000 groups of data according to the normal distribution and uniform distribution. Then, 1000 groups of data are divided into 5 groups, and the data of each group is substituted into the Model \(P_1-P_4\) to get the optimal solution and the optimal value. Finally, the average value of each group is taken as the final result. The results are shown in Fig. 3 and Table 4.

It can be seen when Q obeys uniform distribution, the consensus cost is higher than that of normal distribution. But no matter what distribution Q follows, compared with box uncertainty set and ellipsoid uncertainty set, polyhedral uncertainty set can reduce the conservative type of the model. From Table 4, we can obtain that consensus opinion changes when the parameters of the disturbance region change. And, the consensus of Model \(P_2\), \(P_3\) and \(P_4\) is different, because the box uncertainty set, ellipsoidal uncertainty set and polyhedral uncertainty set do not completely coincide even if the parameters of the disturbance region are the same. Under different distributions, the consensus opinions in the same model are very close. Through the above analysis, we get that the distribution of Q does not affect the optimal opinion of the model, but affects the optimal value.

5.2 Comparison Analysis

In this section, the methods proposed in this paper are compared with those in other related articles. Here, we mainly choose Model \(P_1\) and \(P_4\) in this paper. Because through analysis in Sect. 3, compared with Model \(P_2\) and \(P_3\), Model \(P_4\) can reduce the conservatism of the model.

In the following, the data in [38] is used to perform a detailed analysis. To minimize the influence of data heterogeneity on the final results, the median value of interval-valued initial opinion in \(P_1, P_4\) equal to the initial opinion of MCCM. that is, \(o_i=(o_{il}+o_{ir})/2\). For the parameters Q, A, B, a, and b in Model \(P_4\), the generation method is the same as Sect. 4. Their relevant decision information is listed in Table 5. The decision results of different methods are listed in Table 6.

As can be seen from Table 6, compared with the method of Guo et al. [14] and MCCM, Model \(P_1\) and \(P_4\) cannot only get clear consensus opinions and adjustment opinions, but also the cost of consensus is low. The results show that the methods in this paper are more suitable for consensus decision-making under uncertainty.

6 Conclusion

With more and more application scenarios of GDM, the consensus method under certain conditions is limited in application. Based on this finding, the MCCM is extended to the case of uncertainty. Due to the inherent fuzziness and subjectivity of human nature thinking, the evaluation information given by experts is generally incomplete and uncertain. They may provide a rough interval about the decision-making problem. When the initial opinion is an interval value, a new distance measure is defined between the initial opinion and the adjustment opinion, which retains the expert’s initial judgment and is consistent with most practical decision problems. In order to reduce the computational complexity of the piecewise function, a linear analytical formula is obtained. Next, we study the case that the adjustment cost is uncertain. By assuming that the unit uncertain cost belongs to three uncertain sets: box uncertainty set, ellipsoidal uncertainty set, and polyhedral uncertainty set, three robust cost consensus models which can be solved in polynomial time are obtained by duality theory. Finally, the proposed method is applied to P2P loan consensus and gets some meaningful findings as follows:

-

(1)

Compared with the box uncertainty set and ellipsoid uncertainty set, the polyhedral uncertainty set can reduce the degree of conservation.

-

(2)

As the initial interest rate of the borrower increases, the expected interest rate of the lender and the subsidy cost of the platform increase. For the sake of self-interest, the platform should help the borrower to provide a reasonable initial expected interest range to reduce cost. On the contrary, if the consensus threshold of the lender increases, the expected interest of the lender and the subsidy fee of the platform instead decrease. For the lender, low interest rates can lead to trading failures. Therefore, as an important trading hub, the platform needs to provide more historical data to lenders to help them give a reasonable consensus threshold.

-

(3)

Compared with other methods, the proposed method can get clear consensus opinions and adjustment opinions with lower consensus costs.

It should be pointed out that this paper only considers the uncertain initial opinions of experts and the uncertain unit adjustment cost, but does not consider the behavior of experts in the CRP, such as non-cooperative behavior, game behavior, and so on. In addition, the opinion of experts can not be modified indefinitely in the CRP, because when the deviation between the adjustment opinions and the opinion of experts is large, the experts may not accept the adjustment opinions. Therefore, in the future, the adjustment willingness and behavior of experts should be considered in the design of the group consensus decision-making model.

References

Ben-Arieh, D., Easton, T.: Multi-criteria group consensus under linear cost opinion elasticity. Decis. Support Syst. 43, 713–721 (2007)

Ben-Arieh, D., Easton, T., Evans, B.: Minimum cost consensus with quadratic cost functions, IEEE Trans. Syst. Man Cybern. A Syst. Hum. 39, 210–217 (2009)

Ben-Tal, A., Nemirovski, A.: Robust solutions of uncertain linear programs. Oper. Res. Lett. 25, 1–13 (1999)

Ben-Tal, A., Ghaoui, L.E., Nemirovski, A.: Robust Optimization. Princeton University Press, Princeton, NJ (2009)

Cheng, D., Zhou, Z.L., Cheng, F.X., Zhou, Y.F., Xie, Y.J.: Modeling the minimum cost consensus problem in an asymmetric costs context. Eur. J. Oper. Res. 270, 1122–1137 (2018)

Dong, Y.C., Xu, Y.F., Li, H., Feng, B.: The OWA-based consensus operator under linguistic representation models using position indexes. Eur. J. Oper. Res. 203, 455–463 (2010)

Dong, Y.C., Chen, X., Li, C.C., Hong, W.C., Xu, Y.F.: Consistency issues of interval pairwise comparison matrices. Soft Comput. 19, 2321–2335 (2015)

Dong, Y.C., Zhang, H.J., Herrera-Viedma, E.: Consensus reaching model in the complex and dynamic MAGDM problem. Knowl. Based Syst. 106, 206–219 (2016)

Escobar, M.T., Moreno-Jimenez, J.M.: Aggregation of individual preference structures in AHP-group decision making. Group Decis. Negot. 16, 287–301 (2007)

Gong, Z.W., Xu, X.X., Lu, F., Li, L.S., Xu, C.: On consensus models with utility preferences and limited budget. Appl. Soft Comput. 35, 840–849 (2015)

Gong, Z.W., Xu, X.X., Zhang, H.H., Ozturk, U.A., Herrera-Viedma, E., Xu, C.: The consensus models with interval preference opinions and their economic interpretation. Omega 55, 81–90 (2015)

Gong, Z.W., Xu, C., Chiclana, F., Xu, X.X.: Consensus measure with multi-stage fluctuation utility based on china’s urban demolition negotiation. Group Decis. Negot. 26, 379–407 (2017)

Guo, W.W., Gong, Z.W., Xu, X.X., Krejcar, O., Herrera-Viedma, E.: Additive and multiplicative consistency modeling for incomplete linear uncertain preference relations and its weight acquisition. IEEE Trans. Fuzzy Syst. 29, 805–819 (2020)

Guo, W.W., Gong, Z.W., Xu, X.X., Krejcar, O., Herrera-Viedma, E.: Linear uncertain extensions of the minimum cost consensus model based on uncertain distance and consensus utility. Inf. Fusion 70, 12–26 (2021)

Herrera-Viedma, E., Cabrerizo, F.J., Kacprzyk, J., Pedrycz, W.: A review of soft consensus models in a fuzzy environment. Inf. Fusion 17, 4–13 (2014)

Han, Y.F., Qu, S.J., Wu, Z., Huang, R.P.: Robust consensus models based on minimum cost with an application to marketing plan. J. Intell. Fuzzy Syst. 37, 5655–5668 (2019)

Li, Y., Zhang, H.J., Dong, Y.C.: The interactive consensus reaching process with the minimum and uncertain cost in group decision making. Appl. Soft Comput. 60, 202–212 (2017)

Li, Y., Chen, X., Dong, Y.C., Herrera, F.: Linguistic group decision making: axiomatic distance and minimum cost. Inf. Sci. 541, 242–258 (2020)

Liu, X., Liu, H.: Application of fuzzy ordered weighted geometric averaging (FOWGA) operator for project delivery system decision-making. Soft Comput. 23, 13297–13307 (2019)

Liu, P.D., Zhang, X.H.: A new hesitant fuzzy linguistic approach for multiple attribute decision making based on Dempster-Shafer evidence theory. Appl. Soft Comput. 86, 105897 (2021)

Liu, P.D., Pedrycz, W.: Consistency-and consensus-based group decision-making method with incomplete probabilistic linguistic preference relations. IEEE Trans. Fuzzy Syst. (2021). https://doi.org/10.1109/TFUZZ.2020.3003501

Liu, P.D., Zhang, X.H., Pedrycz, W.: A consensus model for hesitant fuzzy linguistic group decision-making in the framework of Dempster-Shafer evidence theory. Knowl. Based Syst. 212, 106559 (2021)

Liu, Q., Wu, H., Xu, Z.S.: Consensus model based on probability K-means clustering algorithm for large scale group decision making. Int. J. Mach. Learn. Cybern. 12, 1609 (2021)

Ling, Y.Y., Qin, J.D., Luis, M., Liu, J.: A heterogeneous QUALIFLEX method with criteria interaction for multi-criteria group decision making. Inf. Sci. 512, 1481–1502 (2021)

Lu, Y.L., Xu, Y.J., Herrera-Viedma, E.: Consensus of large-scale group decision making in social network: the minimum cost model based on robust optimization. Inf. Sci. 547, 910–930 (2021)

Palomares, I., Martinez, L., Herrera, F.: A consensus model to detect and manage noncooperative behaviors in large-scale group decision making. IEEE Trans. Fuzzy Syst. 22, 516–530 (2014)

Park, J.H., Park, J.M., Kwun, Y.C.: 2-Tuple linguistic harmonic operators and their applications in group decision making. Knowl. Based Syst. 4, 10–19 (2013)

Qu, S.J., Li, Y.M., Ji, Y.: The mixed integer robust maximum expert consensus models for large-scale GDM under uncertainty circumstances. Appl. Soft Comput. 107, 107369 (2021)

Qu, S.J., Xu, Y., Wu, Z., Xu, Z.S., Ji, Y., Qu, D.Q., Han, Y.F.: An interval-valued best-worst method with normal distribution for multi-criteria decision-making. Arabian J. Sci. Eng. 46, 1771–1785 (2021)

Tan, X., Gong, Z.W., Chiclana, F., Zhang, N.: Consensus modeling with cost chance constraint under uncertainty opinions. Appl. Soft Comput. 67, 721–727 (2018)

Wang, P., Liu, P.D., Chiclana, F.: Multi-stage consistency optimization algorithm for decision making with incomplete probabilistic linguistic preference relation. Inf. Sci. 556, 361–388 (2021)

Wu, Z.B., Tu, J.C.: Managing transitivity and consistency of preferences in AHP group decision making based on minimum modifications. Inf. Fusion 67, 125–135 (2021)

Xin, K.L., Zhan, S.J., Tao, T., et al.: Multi-objective calibration of hydraulic model in water distribution network based on sensitivity analysis. J. Tongji Univ. 42, 736 (2014)

Xu, Z.S.: An automatic approach to reaching consensus in multiple attribute group decision making. Comput. Ind. Eng. 56, 1369–1374 (2009)

Xu, W.J., Chen, X., Dong, Y.C., Chiclana, F.: Impact of decision rules and non-cooperative behaviors on minimum consensus cost in group decision making. Group Decis. Negot. (2020). https://doi.org/10.1007/s10726-020-09653-7

Yager, R.R.: On ordered weighted averaging aggregation operators in multi-criteria decision making. IEEE Trans. Syst. Man Cybern. 18, 183–190 (1988)

Yager, R.R.: On mean type aggregation. IEEE Trans. Syst. Man Cybern. 26, 209–220 (1996)

Zhang, G.Q., Dong, Y.C., Xu, Y.F., Li, H.Y.: Minimum-cost consensus model under aggregation operators, IEEE Trans. Syst. Man Cybern. A Syst. Hum. 41, 1253–1261 (2011)

Zhang, H.H., Forrest, J., Li, L.S., Xu, X.X.: Two consensus models based on the minisum cost and maximum return regarding either all individuals or one individual. Eur. J. Oper. Res. 240, 183–192 (2015)

Zhang, N., Gong, Z.W., Chiclana, F.: Minimum cost consensus models based on random opinions. Expert Syst. Appl. 89, 149–159 (2017)

Zhang, B.W., Liang, H.M., Gao, Y., Zhang, G.Q.: The optimization-based aggregation and consensus with minimum-cost in group decision making under incomplete linguistic. Knowl. Based Syst. 162, 92–102 (2018)

Zhang, H.H., Kou, G., Peng, Y.: Soft consensus cost models for group decision making and economic interpretations. Eur. J. Oper. Res. 277, 964–980 (2019)

Zhang, H.J., Dong, Y.C., Chiclana, F., Yu, S.: Consensus efficiency in group decision making: a comprehensive comparative study and its optimal design. Eur. J. Oper. Res. 275, 590–598 (2019)

Zhang, B.W., Dong, Y.C., Zhang, H.J., Pedrycz, W.: Consensus mechanism with maximum-return odifications and minimum-cost feedback: aperspective of game theory. Eur. J. Oper. Res. 287, 546–559 (2020)

Zhang, H.J., Zhao, S.H., Kou, G., Li, C.C., Dong, Y.C., Chiclana, F.: An overview on feedback mechanisms with minimum adjustment or cost in consensus reaching in group decision making: research paradigms and challenges. Inf. Fusion 60, 65–79 (2020)

Zhong, X.Y., Xu, X.X., Chen, X.H., Goh, M.: Large group decision-making incorporating decision risk and risk attitude: a statistical approach. Inf. Sci. 533, 120 (2020)

Acknowledgements

This work was supported in part by Philosophy and Social Science of Shanghai [No. 2020BGL010]. The authors would like to thank the editors and referees for their careful reading and constructive suggestions on the manuscript.

Funding

The Funder was funded by Philosophy and Social Science of Shanghai (Grant No 2020BGL010).

Author information

Authors and Affiliations

Contributions

HZ: Conceptualization, Methodology, Software, Writing-Original draft. YJ: Conceptualization, Methodology, Resources, Funding acquisition, Supervision, Writing-review & editing. RY: Supervision, Methodology, Writing-review & editing. SQ: Conceptualization, Methodology, Writing-review & editing. ZD: Writing-review & editing.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Rights and permissions

About this article

Cite this article

Zhang, H., Ji, Y., Yu, R. et al. The Robust Cost Consensus Model with Interval-Valued Opinion and Uncertain Cost in Group Decision-Making. Int. J. Fuzzy Syst. 24, 635–649 (2022). https://doi.org/10.1007/s40815-021-01168-w

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40815-021-01168-w