Abstract

Indian public commercial banks play a crucial role in the financial support for the economic development, poverty alleviation, and women's empowerment. As social banks, they have dual performance objectives of financing the vulnerable sections of society as well as providing mainstream financial services. Balancing these twin missions is the biggest challenge for these hybrid enterprises. To date, no study has been published giving evidence on whether these banks are efficient in both facets of their dual goals. For this reason, this paper adds to the literature by measuring the social and financial efficiency of a sample of 26 Indian public banks over 2011–2014 by using an innovative Multi-activity Data Envelopment Analysis (MDEA) model with shared inputs and undesirable outputs. Our study also examines whether there is a conflict or trade-off between socially responsible and for-profit banking practices. We find that Indian public banks have managed their dual mission relatively well, but on average, they have been much more efficient in social (99.4%) than conventional banking (81.9%) activity. Moreover, this study shows a significant synergy effect between social and financial performance. However, when regional differences across India are considered by comparing the social and financial efficiency scores for different degrees of economic and human development in Indian states, the significant synergy effect is only confirmed in those public banks located in less more economically developed Indian states.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Social banking refers to banks that fight against poverty by pursuing innovation with social goals as well as providing mainstream financial services (Relano 2015). There is a growing consensus that social banks have played an important role in attaining the United Nations' Millennium Development Goals (MDGs). For this reason, they are attracting growing interest from emerging and developing economies due to their professed benefits, particularly in sustainable development (Barai et al. 2015). Access to affordable and nonprofit financial services is central to addressing a number of development challenges.

This scenario is especially prevalent in India, where numerous micro and small enterprises, particularly in agricultural activities, have been hampered by lack of credit (Thampy 2010; Thorat et al. 2017), creating a large distortion in Indian sustainable economic growth (Basu 2005). Accordingly, Indian government has had to engage in an ambitious social banking program (Burgess and Pande 2005; Tzeremes 2015). Since 1969, Indian commercial banks have extended services to those neglected and weaker sectors of the economy (including women), and have established thousands of bank branches across rural India, two essential conditions for socio-economic development (Beck and de la Torre 2007). In particular, India's priority sector lending has been a key instrument in inclusive finance over last decades.

Priority sector lending is a mechanism to transfer financial resources from the richest segment to the low income segments of the population (Casu et al. 2013). In a broad sense, it refers to those sectors of the economy which otherwise lack timely and adequate credit (Srinivasan 1995). They include small value loans for farmers, for low-income people for household consumption, education, and social infrastructure, for micro and small organizations, for DalitsFootnote 1 and other weaker sectors of the society.Footnote 2 In contrast, non-priority sectors, which cover the rest of the Indian economy, are areas where financial institutions are always ready to lend. Commercial banks therefore combine the dual mechanism of social banking activity and mainstream banking activity. However, credit at reduced interest rates to maximizing the social welfare can conflict with the profit-seeking objectives associated with traditional finance (Das and Ghosh 2006; Bhattacharyya and Pal 2013). These contradictory goals raise the policy question of whether trade-off exists in Indian banks performance in priority and non-priority sector commitments.

Certain recent phenomena in the international finance, such as market deregulation, regulatory change, disintermediation, technological innovation and, smaller margins, have intensified competition across national boundaries. In this scenario, attention has naturally focused on banking efficiency as a way to subsist and thrive in an increasingly competitive environment (Wanke and Barros 2014). Banking sector efficiency should impact on the economic well-being and social development of any country through improved profitability, larger intermediated funds, better prices and quality of services offered to clients as well as increased financial strength and stability (Moradi-Motlagh et al. 2015). Thus for Indian commercial banks to prosper in the face of fierce competition and to contribute to the socio-economic development of their economy, they must be as efficient as possible in both roles. To our knowledge, no previous study has evaluated their efficiency in achieving both social and financial goals, nor there is any evidence on the possible trade-off between social and financial efficiency dimensions of Indian banks.

Our paper evaluates the social and financial efficiency in Indian commercial banks, and then it analyzes the presence of a potential trade-off (or synergy) effect between them. Specifically, it focuses on public commercial banks because they play a vital role in financing economic development, poverty alleviation, and women's empowerment in India. Moreover, recent research has shown that public ownership influences firm efficiency, especially in developing and emerging countries (Saeed et al. 2017). To accomplish the two purposes, this study uses data from a sample of 26 public commercial banks during the period 2011–2014 and applies an innovative Multi-activity Data Envelopment Analysis (MDEA) model. Since the overall efficiency of social banks is a function of how well they achieve their dual objectives, exploring the relation between their social and financial performance is of practical relevance to the managers, regulators and policy-makers to shape the development of financial instruments targeted at the poor while informing policy on financial inclusion both in India and globally.

Most previous studies of Indian commercial bank performance have applied conventional Data Envelopment Analysis (DEA) methodology to measure their overall efficiency (Sathye 2003; Casu et al. 2013; Fujii et al. 2014, among others). Their major drawback therefore lies in an inadequate model specification to capture the dual objectives of Indian commercial banks. Indeed, no attention has been paid to distinguishing their social and traditional banking activities. This study is distinct from the prior because it addresses the dual mission of Indian commercial banks using, for the first time, a MDEA model with shared inputs and undesirable outputs. The conventional DEA, based on the implicit assumption that inputs are totally used for achieving either social goals or financial goals, is quite unrealistic in this context. In contrast, our MDEA model considers that Indian banks can use only a share of these resources as an input in their social mission and the remaining share as an input in their financial mission. Accordingly, it provides the overall efficiency, the individual efficiency for each mission, and the portion of inputs associated with each activity when there are shared resources among them. Moreover, in addition to desirable outputs, we include undesirable outputs of both banking activities. Given the growing volume of risky assets in Indian banking industry in general (Fujii et al. 2014) and in priority sector lending in particular (Sinha 2012), their inclusion in the production process helps to obtain more meaningful efficiency estimates.

The rest of the paper is organized as follows. Section 2 provides an overview of the Indian financial system, while Sect. 3 contains the literature review. Section 4 presents the methodology, and a description of the sample and variables is given in Sect. 5. Finally, Sect. 6 discusses the empirical results, and conclusions are drawn in Sect. 7.

2 A brief overview of the Indian financial system

The Indian financial system consists of commercial banks, cooperatives, and regional rural banks. Figure 1 depicts its structure. First, commercial banks are banking entities that can provide credit. They can be further classified on the basis of ownership as public banks (the majority of the shares are held by government of India), comprising the State Bank of India (SBI) and its associates, and nationalized banks; private banks (the majority of the shares are held by private parties), comprising old and new private sector banks; and, finally, foreign banks (the majority of the shares are held by foreign parties). Second, cooperatives are institutions established with principles of cooperation and can be classified on the basis of its area of operation as state cooperative bank (at state level), district cooperative banks (at district level), and primary credit societies (at village level). Finally, regional rural banks can be seen as a unique experiment in improving the efficacy of rural credit delivery mechanism in India, with joint share-holding by central government, the concerned state government and the sponsoring bank. All banking operations are controlled by the Reserve Bank of India (RBI), which is India's central bank since 1935.

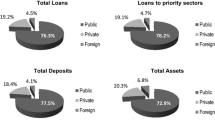

Table 1 presents the market share by asset size in all types of institutions of the Indian financial system in 2014. As shown, the banking sector in India is dominated by commercial banks. These banks represent a blend of social banking activity with traditional financial activity (Burgess and Pande 2005; Tzeremes 2015). This is because they have been called upon by the Indian government to perform an important inclusive function by providing banking service to support for sustainable development and quality of life in India, especially through priority sectors lending schemes.Footnote 3

According to the Annual Reports of the RBI, the number of public banks was constant over 2011–2014, but their branches and workers increased by 23 and 10%, respectively (they had the most number of branches and employees over this 4-year period). Private banks also increased their branches and staff by 77 and 57%, respectively. Although the quantity of foreign banks raised significantly, their branches only increased 5% while their workers declined by almost 11%. Regarding their relative participation, Table 2 shows that, on average, public banks held 76.3% of total negotiated loans compared to 19.2% in private banks and 4.5% in foreign banks. Moreover, they represented 77.5% of total new deposits compared with 18.4 and 4.1% in private and foreign banks respectively, and 72.9% of total banking assets as opposed to 20.3% in private banks and 6.8% in foreign banks. For loans to priority sectors, on average public banks held 76.2% of total credit from all commercial banks versus 19% held by private banks and 4.8% by foreign banks. Consequently, public commercial banks control the Indian financial system and account for the highest percentage share of priority sector lending in total credit. They are therefore the main social banks in India. For this reason, this study focuses on Indian public commercial banks.

3 Review of literature

3.1 The concepts of social and financial efficiency

This study starts from the concept of technical efficiency (Farrell 1957), which implies the use of resources in the most technologically efficient manner. This is the ability of an organization to use minimum resources to produce a given quantity of outputs (input orientation), or to maximize outputs from a given set of resources (output orientation).

As social banks have a dual mission, they must be as efficient as possible in both social and financial facets of their banking activity. Martínez-Campillo et al. (2016) defined the concepts of social and financial efficiency in these institutions. Firstly, technical efficiency in social banking, hereinafter called “Social Efficiency”, refers to the level of optimisation achieved in the use of physical, human and monetary resources to realize social goals. Secondly, technical efficiency in their traditional banking activity, hereinafter called “Financial Efficiency”, refers to the optimal level of inputs used to meet for-profit goals.

3.2 The trade-off between social and financial efficiency in social banking

Social banking should be both socially and financially successful. However, the question arises whether one should first target the poor or profitability. The relationship between social and financial performance may be a trade-off or a synergy, and it is part of an on-going debate between two contrasting approaches (Robinson 2001): the welfarist approach, which propagates the dominance of the social mission, and the institutionalist approach, which emphasizes the financial mission.

On the one hand, the welfarist approach focuses on the social welfare of clients rather than the financial sustainability of institutions. This approach argues that the poor cannot afford to pay the higher interest rates that social banking needs to charge in order to become financially sustainable. It is costlier for a social bank to serve remote rural and poorer communities as compared to urban and marginally poor clients. Consequently social banks may be pushed to increase their loan size as a way to increase financial margins. This means they move up-market and start serving less poor customers (process known as “mission drift”). Thus, financial and social efficiencies would be substitutes and there would be a trade-off between them. A number of studies support this view of social financial intermediaries, i.e. firms that operate with two goals: to be financially self-sufficient, and to achieve a socially desired outcomes (Cull et al. 2007; Hermes et al. 2011; Annim 2012; Louis et al. 2013; Crawford et al. 2014; Wijesiri et al. 2017).

On the other hand, the institutionalist approach suggests that there is no trade-off between financial sustainability and the poor clients served. It focuses on sustainable social banking by charging reasonable rate of interest to cover the costs of lending, increasing revenues from interest income and fees, and reducing operational costs. It argues that a larger pool of poor clients can be serviced once social banks become financially sustainable, so that financial and social performances are complements rather than substitutes. Thus, financial and social performance could go hand in hand. Some studies also find evidence for the existence of synergy between social and financial efficiency in social financial intermediaries (Gutierrez-Nieto et al. 2009, 2011; Louis et al. 2013; Piot-Lepetit and Nzongang 2014; Lebovics et al. 2016; Kaur 2016).

To our knowledge, all previous Indian commercial bank studies have used only overall efficiency scores and so do not capture their dual mission, that is, their social and traditional banking activities. Thus, there is no evidence on their social and financial efficiencies or their trade-off or compatibility. Our paper contributes to the literature by analyzing whether financial and social efficiencies are mutually exclusive or complementary in the context of Indian commercial banks.

4 Methodology

4.1 Traditional DEA with undesirable outputs

DEA is a non-parametric method based on linear programming that calculates the relative efficiency score of a given organization (Decision Making Unit, DMU) in comparison with other homogeneous organizations producing the same outputs by constructing an efficient frontier where the best practices are situated. Thus, each DMU is assigned an efficiency indicator between 0 and 1, with higher scores indicating more efficient organization relative to other organizations in the sample. Thus a score of 1 indicates that a DMU lies on the efficient frontier and hence can be considered a fully efficient unit. Relative inefficiency is measured by the radial distance between the DMU and the frontier. There are several conventional DEA models with different assumptions. Among them, CCR (Charnes et al. 1978) and BCC (Banker et al. 1984) are the most widely used DEA models. The CCR model assumes that each DMU functions with constant returns to scale (CRS) and is only appropriate when all DMUs operate at an optimal scale. The BCC model, on the other hand, has an assumption of variable returns to scale (VRS) for the inputs and outputs.

Conventional DEA models are based on the Shephard's output distance functions (Shephard 1970), so that they credit only for increases in desirable outputs. Therefore, when conventional DEA models are used to measure the efficiency in the presence of undesirable outputs, they lead to yield biased estimates. In this context, Kuosmanen (2005) extends Shephard's VRS formulation by developing a convex and fully linearizable model such that the efficiency models based on the Kuosmanen's VRS formulation become linear programming problems and can be solved easily. In particular, the directional distance functions based on Kuosmanen's formulation allow expanding the desirable outputs while simultaneously contracting the undesirable outputs.

Let \(x = x_{1} , x_{2} , \ldots ,x_{N} \in R_{ + }^{N}\) denote bank's input vector and \(u = u, u_{2} , \ldots ,u_{G} \in R_{ + }^{G}\) bank's output vector, where \(u\) is composed of desirable outputs (\(y\)) and undesirable outputs (\(b\)), i.e., \(u = \left( {y,b} \right) = y_{1} ,y_{2} , \ldots ,y_{M} ;b_{1} ,b_{2} , \ldots ,b_{R} ) \in R_{ + }^{M + R}\). The directional distance function that seeks to increase the desirable outputs and decrease the undesirable outputs and inputs directionally can be defined by the following formulation:

where the nonzero vector \(g = (g_{x} ,g_{y} ,g_{b} )\) determines the directions in which inputs, desirable outputs and undesirable outputs are scaled (i.e., desirable outputs are increased, but inputs and undesirable outputs are decreased), and the technology reference set \(T = \left\{ {\left( {x,u} \right):x \;{\text{can produce}}\; u} \right\}\) satisfies the assumption of VRS, strong disposability of desirable outputs and inputs, and weak disposability of undesirable outputs; \(\beta\) is the directional distance function, which increases the desirable outputs (y) while simultaneously reducing the undesirable outputs (b) along the direction vector (g).

Suppose there are \(j = 1, \ldots ,J\) DMUs in the sample. Each DMU uses inputs \(x^{j} = x_{1}^{j} ,x_{2}^{j} , \ldots ,x_{N}^{J} \in R_{ + }^{N}\) to jointly produce desirable outputs \(y^{j} = \left( {y_{1}^{j} ,y_{2}^{j} , \ldots ,y_{M}^{J} } \right) \in R_{ + }^{M}\) and undesirable outputs \(b^{j} = \left( {b_{1}^{j} ,b_{2}^{j} , \ldots ,b_{R}^{J} } \right) \in R_{ + }^{R}\). The piecewise reference technology allowing for VRS can be constructed as follows:

where \(z^{j}\) are the intensity variables to shrink or expand the individual observed activities of DMU j for the purpose of constructing convex combinations of the observed inputs and outputs.

Relatively to the reference technology \(T\) constructed in (2), traditionally, for each DMU \(j^{{\prime }} = 1, \ldots ,J\), the directional distance function can be obtained by solving the following linear programming problem with \(g = (g_{x} ,g_{y} ,g_{b} ) = \left( {x^{{j^{{\prime }} }} ,y^{{j^{{\prime }} }} ,b^{{j^{{\prime }} }} } \right)\), i.e., when the direction chosen is based on the observed inputs and outputs:

s.t.

where \(\beta^{{j^{{\prime }} }}\) measures the maximum inflation of all desirable outputs and deflation of all inputs and undesirable outputs that remain technically feasible and it can serve as a measure of technical efficiency. If \(\beta^{{j^{{\prime }} }} = 0\), then DMU \(j^{{\prime }}\) operates on the frontier of T with technical efficiency. If \(\beta^{{j^{{\prime }} }} > 0\), then DMU \(j^{{\prime }}\) operates inside the frontier of T. The efficiency measurement constructed in (3) expands all desirable outputs and contracts all inputs and undesirable outputs at the same rate β.

4.2 The multi-activity DEA (MDEA) model with shared inputs and undesirable outputs

Despite its undeniable advantages, conventional DEA models have some limitations. For example, they obtain a single measure of production efficiency of DMUs by assuming that they use an identical technology to produce their outputs. However, this assumption is not valid when DMUs allocate resources to the production of different types of outputs. If DMUs undertake different activities, then they might be efficient in some of them but not in others. This causes the bias of conventional DEA scores. Beasley (1995) developed a new model called “Multi-activity DEA (MDEA) model” to evaluate institutions which face multiple production functions using shared inputs, which can be objectively assigned to different activities by the resolution model itself. Thus, this model provides a performance measure with activity-based information as part of the aggregated score, and helps to cope with the input allocation problem by determining the share of inputs associated with each activity. Later, Tsai and Mar Molinero (1998, 2002) extended the Beasley's MDEA model to encompass VRS. More recently, Chen et al. (2013) have proposed a MDEA model with VRS using directional distance functions to provide information on the efficiency performance of organizations with inputs shared among several activities, and with undesirable outputs. This model is essentially designed to minimize the inputs and undesirable outputs, and at the same time maximize the desirable outputs for each activity.

These issues become especially important for social banking due to some singular characteristics of these institutions. First, these banks have more than one purpose, namely social and financial activities. Second, their stakeholders have different expectations and goals. So some focus on social activities, but others emphasize financial activities. For this reason, we used the MDEA model proposed by Chen et al. (2013) as basis to measure social and financial efficiencies of commercial banks in India. We briefly presented our MDEA model below. The more generalized mathematical formulation of the method can be found in Chen et al. (2013).

Suppose that there is a set of \(j = \left\{ {1, \ldots ,J} \right\}\) DMUs, and that each engages \(I\) activities (specifically, Indian commercial bank work on two different missions: social and financial activities). Assume that inputs, here labor, assets and deposits \(\left( {X_{j}^{i} = x_{a,j}^{s} ,x_{b,j}^{s} ,x_{c,j}^{s} } \right)\), where \(a = \left\{ {1, \ldots ,m_{a} } \right\}\), \(b = \left\{ {1, \ldots ,m_{b} } \right\}\;\; and \;\;c = \left\{ {1, \ldots ,m_{c} } \right\}\), are shared between social and financial activities. Thus only a proportion of them can be considered as input in the social model (α, β and µ, respectively, where 0 < α, β and µ < 1), and the remaining share as input in the financial model (1 − α, 1−β and 1−µ, respectively), to jointly produce desirable outputs \((Y_{j}^{i} = y_{d,j}^{\text{soc}} ,y_{e,j}^{\text{fin}} )\), where \(y^{\text{soc}}\) represents the desirable outputs for a bank's social mission, \(y^{\text{fin}}\) represents the desirable outputs for a bank's commercial mission, \(d = \left\{ {1, \ldots ,s_{d} } \right\} \;\;{\text{and}} \;\;e = \left\{ {1, \ldots ,s_{e} } \right\}\) and undesirable outputs \((B_{j}^{i} = b_{f,j}^{\text{soc}} ,b_{h,j}^{\text{fin}} )\), where \(b^{\text{soc}}\) represents the undesirable outputs for a bank's social mission, \(b^{\text{fin}}\) represents the undesirable outputs for a bank's commercial mission, \(f = \left\{ {1, \ldots ,z_{f} } \right\} \;\;{\text{and}}\;\; h = \left\{ {1, \ldots ,z_{h} } \right\}\) in each activity simultaneously. In our MDEA model, α, β and µ are decision variables to be determined by each bank. We restricted the share of resources that is utilized as an input in each model to lie in the range 0.3–0.7, due to these values represent a realistic choice of shared input allocation. The MDEA model that we used in this study is schematically depicted in Fig. 2.

The production possibility set with VRS, shared inputs and undesirable outputs for social model (\(P^{\text{soc}}\)) and Financial Model (\(P^{\text{fin}}\)) can be defined as follows:\((Y_{j}^{i} = y_{d,j}^{\text{soc}} ,y_{e,j}^{\text{fin}} )\), where \(y^{\text{soc}}\) represents the desirable outputs for bank's social mission, \(y^{\text{fin}}\) represents the desirable outputs for bank's commercial mission, \(d = \left\{ {1, \ldots ,s_{d} } \right\}\; {\text{and }}\;e = \left\{ {1, \ldots ,s_{e} } \right\} ,\) and undesirable outputs \((B_{j}^{i} = b_{f,j}^{\text{soc}} ,b_{h,j}^{\text{fin}} )\),

Regarding the assumption of VRS, it is important to note that the same scaling assumption is considered for each bank. Hence, the Multi-activity efficiency scores for each DMU can be obtained as a solution of a mathematical optimization problem. In particular, the objective function of the MDEA model takes the following form:

where \(\rho^{{j^{\prime}}}\) is the overall multi-activity efficiency score; \(\rho_{{j^{\prime}}}^{i}\) are the efficiency scores of each activity; and \(w^{i}\) are the positive numbers which represent the relative weight of each activity, so that their sum is standardized to be equal to 1. For the sake of clarity, it is noted that:

-

β in model (3) and ρ in model (6) both represent efficiency scores, although model (3) is designed considering a single black-box and model (6), a multi-activity structure.

-

The decision variables α, β and µ represented in Fig. 2 correspond respectively to \(\mu_{{j^{\prime}, l}}^{1}\), \(\mu_{{j^{\prime}, l}}^{2}\) and \(\mu_{{j^{\prime}, l}}^{3}\) in model (6). As long as they are decision variables, they are determined altogether with the efficiency scores and weights each time the model is executed.

-

The equality sign in the second constraint denotes that a weak-disposability assumption is adopted here. According to Kuosmanen (2005), this means that the levels of undesirable outputs in both missions can be reduced whenever the level of activity is reduced.

The optimization process proposed by Chen et al. (2013) therefore maximizes the efficiency of each production process separately and simultaneously. In this study, multi-activity efficiency scores for each Indian commercial bank are obtained as a solution of the above optimization problem, showing social, financial and overall performance scores of each DMU. Specifically, we use as relative weight of each activity the percentage of loans in each mission on the total bank loans portfolio. Finally, the allocation of the shared inputs which jointly maximizes the ratio of outputs to inputs used for social (α, β and µ) and financial (1−α, 1−β and 1−µ) activities is also estimated during the optimization process.

5 Empirical study

5.1 Initial sample

The efficiency of commercial banks operating in India is measured for the period 2011–2014. Specifically, we focus on Indian public commercial banks for three reasons: (a) they dominate the Indian financial market; (b) they are the main social banks in India by lending a much larger part of resources to the priority sectors regarding the total amount of credit destined by all banks; and (c) private and foreign banks had to be excluded from the sample due to the lack of some variables during the period of study. In addition, recent research has shown that public ownership influences firm efficiency (Nakamura 2010), especially in developing countries (Saeed et al. 2017). Our initial sample is therefore a balanced data panel of 26 public banks with a total of 104 DMUs or observations. The dataset was collected from both the Annual Reports of the RBI (RBI 2012, 2013, 2014, 2015) and the Indiastat Database (www.Indiastat.com).

5.2 Outlier detection and final sample

All non-parametric efficiency estimators are highly sensitive to the presence of outliers, which are considered particularly troublesome for DEA models (Bogetoft and Otto 2011). Therefore, before evaluating efficiency, it is important to detect outliers and to treat them appropriately, since they can increase noise and distort the results.

Super-efficiency based procedures are very effective in identifying outliers (Boyd et al. 2016; Banker et al. 2017). In conventional DEA models, all efficient DMUs are assigned an efficiency score of 1, making impossible to differentiate their performance. To overcome this problem, Andersen and Petersen (1993) develop the first super-efficient DEA model, which allow for efficiency scores greater than 1. Specifically, we adopted the super-efficiency model developed by Banker and Gifford (1988), which identifies as outliers those observations whose super-efficiency score exceeds a pre-specified screen levelFootnote 4 (a level of 1.25 is generally accepted). Once detected, all outliers must be removed from the sample, and an ordinary DEA model then estimated the remaining observations (in our case, a MDEA model).

The super-efficiency based outlier detection procedure identified 18 outliers (those observations whose super-efficiency score exceeds a level of 1.25). Thus the final sample includes 86 DMUs.

5.3 Input and output variables

Two approaches have been used in the banking literature to select inputs and outputs (Berger and Humphrey (1997): the production approach, which considers financial institutions as production units that use standard resources to provide financial services; and the intermediation approach, in which financial entities are intermediaries between depositors and final users of banking assets. According to these authors, the approach chosen depends on the context in which the study is made. We choose the intermediation approach for defining the production function of Indian public commercial banks because they are financial institutions whose main emphasis is on using deposits as well as other purchased inputs to provide loans to priority and non-priority sectors.

As social banks, public banks in India have a dual mission in that they play a key role in the financial support for development, poverty reduction, and women's empowerment in India (social activity), as well as providing mainstream banking services, including both traditional and non-traditional activities (financial activity). Based on objectives of the Indian public banks and data availability, we select the input and output variables according to earlier research on bank efficiency under the intermediation approach.

Specifically, inputs and desirable outputs in the social model were chosen in line with the study by Gutiérrez-Nieto et al. (2009), whereas inputs and desirable outputs in the financial model were selected according to a number of prior studies (e.g., Seiford and Zhu 1999; Tortosa-Ausina et al. 2008; Curi et al. 2012; Zha et al. 2016, among others). As a result, we use labor, assets and deposits as shared inputs between the social and financial banking activities. Regarding the desirables outputs in the social model, we consider loans to priority sectors and number of female accounts. The main consideration guiding us in choosing the latter as a social output variable is that more women than men are poor (D'Espallier et al. 2011; Duflo 2012). This is particularly true for India where social norms and religious beliefs have created a large gender gap. Women in India are more likely than men to be constrained in access to credit. Under such circumstances, providing low-income women with access to affordable financial services is often considered as an effective means of women's socio-economic empowerment (Khandker 2005). The desirable outputs in the financial model are loans to non-priority sectors and other income (i.e., commission, exchange and brokerage).

Recently, Fukuyama and Matousek (2017) have suggested that it is appropriate to analyze both desirable outputs (good loans) and undesirable outputs (bad loans) in order to credit the desirable outputs in the model and to penalize firms for producing undesirable outputs. In this regard, several previous studies have shown that non-performing loans (NPLs)Footnote 5 need to be considered as the main bank undesirable output (Fukuyama and Weber 2010; Akther et al. 2013; Fujii et al. 2014; Wijesiri 2016; Fukuyama and Matousek 2011, 2017). This view is also supported by Puri and Yadav (2014), revealing that NPLs have significant influence on Indian public sector banks. For these reasons, we included NPLs as an undesirable output in social (NPLs to priority-sectors) and financial (NPLs to non-priority sectors) models. Definitions of inputs and outputs for both social and financial DEA models are provided in the Table 3.

The inputs are therefore the same for both the financial and social efficiency models because they refer to resources that are shared between both activities, but the outputs are specific for each activity. In order for the efficiency estimates to be robust and reliable, the number of DMUs must be at least the maximum between m × s or 3 × (m + s), with m and s being the number of input and output variables, respectively (Cooper et al. 2007). In this study, the MDEA model to be estimated meets this requirement.

The main descriptive statistics for all input and output variables over 2011–2014 are reported in Table 4. On average, all inputs have increased over time, especially deposits. About output variables, it is worth noting that, on average, non-priority sectors have grown more than twice the credit from Indian public banks than priority sectors. This helps to understand the underlying mechanism by which public banks in India have distributed their funds among different objectives and set their priorities: there is a general consensus that providing credit to non-priority sectors is more profitable and less risky than doing it to priority sectors. Moreover, the mean contribution of non-priority sector lending to NPLs growth has been considerably higher than that of priority sector lending after 2012. This can be explained because in recent years, small industries as well as agricultural loans do not seem to have contributed the lion's share of NPLs as in the past. In contrast, it is the Indian industrial sector -primarily the infrastructure and steel sectors- that have experienced the greater deterioration in asset quality (Mohan and Ray 2017).

6 Results

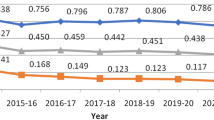

6.1 Multi-activity efficiency estimates: social and financial efficiency scores

The computational results of MDEA are provided in Table 5 show the average values of overall, social and financial multi-activity efficiency estimates in Indian public bank during the period 2011–2014. It also reports the mean values of shared inputs (i.e., α, β and µ) in last three columns of the Table. On average, the overall efficiency over total period is 87.5%. This is well above the 50% the minimum tolerable value for estimates of technical efficiency (Cooper et al. 2007). If we compare the scarce evidence on Indian commercial banks after the second half of the 2000s, this score is in line with the 74.5 and 81.8% of Fujii et al. (2014) and Tzeremes (2015), respectively.

Regarding social and financial efficiency scores, public banks in India have achieved an adequate level of performance in their dual mission, but have been more efficient in social (99.4%) than in conventional banking (81.9%). Indeed, whereas their social efficiency scores range from between 96.1 and 100%, these scores run from 43.5% for financial efficiency. Moreover, while 17 of the 26 Indian public banks are 100% socially efficient, only six entities are 100% financially efficient. Unfortunately, since to our knowledge there is no empirical data on which comparison can be made.

Figure 3 compares the social and financial efficiency scores of each public bank. As efficiency values range from 0 to 1, we have got a flat curve for social efficiency because all public banks in India appear to have a social efficiency equal or very close to 1 (as shown in Table 5). Specifically, a significant number of banks have a relatively higher social than financial efficiency (20 banks from a total of 26). However, no bank is more efficient at a financial level than at a social level. The remaining six institutions are fully efficient in managing both social and financial dimensions of their banking activity (i.e., Corporation Bank, IDBI Bank, Punjab and Sind Bank, State Bank of Bikaner and Jaipur, State Bank of India and State Bank of Travancore).

Overall, our results show that most Indian public banks manage both their overall performance and their dual mission relatively well, albeit at different scales. In particular, they seem to perform much better in social goals in that they lend to the underprivileged sections of the society than pursuing a mainstream financial activities. These findings thus at least suggest that social and financial efficiencies are not mutually exclusive, and that synergy between social outreach and financial sustainability might exist for these banks.

6.2 The relationship between social and financial efficiency scores: trade-off or synergy?

This section provides additional evidence on the relationship between social and financial efficiency for Indian public commercial banks. In particular, we explore whether there is a trade-off or synergy between both dimensions of bank performance by calculating the correlation coefficient for our efficiency scores.

After applying the Kolmogorov–Smirnov test for normality of distribution, we observe that social and financial efficiency values are not normally distributed. For this reason, we used the Spearman's correlation coefficient to analyze the relation between them. Our results show that social and financial efficiency scores are positively and significantly correlated (Rho de Spearman = 0.380; p < 0.05, two-tailed value). Specifically, the Spearman's correlation coefficient is 0.380. Thus, a positive sign suggests the existence of compatibility between them. However, although the coefficient is significantly different from zero at the 5% level, it is rather small. Indeed, as it is closer to 0 than to 1, we observe a weak relationship between social and financial efficiency scores in Indian public banks.

The scatter plot in Fig. 4 shows the average efficiency measures from the social model against those from the financial one for all banks. The figure has been divided into four quadrants—based on both the mean social efficiency (0.9943) and the mean financial efficiency (0.8188) for the 26 banks. Each reveals different behavior patterns of the public banks in India.

The upper right-hand corner of Fig. 4 contains banks with relatively high financial and social efficiencies. 6 Indian banks are in the extreme corner because they are 100% efficient from both points of view. Another six entities achieve high values in both measures of efficiency. These 12 Indian public banks together could be described as sector leaders. The one bank in the top left-hand corner of Fig. 4 is the most financially efficient but among the least socially efficient. The lower left-hand side corner of the graph groups six banks with relatively low values of both social and financial efficiency. Lastly, the fourth quadrant, on the bottom right-hand corner, contains seven banks that could be considered the most socially efficient but the least financially efficient. As only a handful of Indian public banks are in the right bottom and top left quadrants (eight banks from a total of 26), their commitment to social goal not conflict with their profit seeking objectives. Thus, our results support a synergy effect between social and financial efficiencies in Indian public banks during the period 2011–2014. These findings therefore are in line with some previous studies on the compatibility between both dimensions of the efficiency in social financial intermediaries (Gutierrez-Nieto et al. 2009, 2011; Louis et al. 2013; Piot-Lepetit and Nzongang 2014; Lebovics et al. 2016; Kaur 2016).

6.3 Robustness check: controlling for regional differences in socio-economic development

India is an emerging country composed of 29 states and seven union territories (including a national capital territory-Delhi). Table 6 shows 26 Indian public banks based on their location in 11 different Indian states.

In Table 7, we compare the social and financial efficiency scores for different degrees of socio-economic development in Indian states. As the performance values are not normally distributed, we use a Maan-Whitney U (M-W) test to compare differences in levels. On the one hand, Table 7a focuses on the economic development of states, defined in terms of the Gross Domestic Product/GDP per capita. Specifically, two groups of Indian states are considered: High GDP (above the mean value for the 11 states in the analysis) and Low GDP (below the mean value for the 11 states). As shown below, in both groups social efficiency scores are higher than financial efficiency scores, and these scores are around the average for all Indian public banks. Moreover, those public banks located in more economically developed Indian states show less social and financial efficiency than those situated in less more economically developed ones. The M-W test statistics show that both differences are not statistically significant. Thus the level of economic development in Indian states and the social and financial efficiencies of their public banks are not related.

On the other hand, Table 7b considers the human development of states as defined by the Human Development Index/HDI (United Nations Development Program). It measures the development of people in a certain territory on three main dimensions: life expectancy, education, and GDP per capita. Again, two groups of Indian states are considered: High HDI (above the mean value for the 11 states in the analysis) and Low HDI (below the mean value for the 11 states). Both groups' social efficiency values are greater than financial efficiency values, and these values are around the average for all Indian public banks. Unlike the previous case, those public banks located in more developed states at a human level show more social and financial efficiencies compared to the less developed ones. As the M-W test statistics are not statistically significant, the level of human development in Indian states is not related with social and financial efficiencies of their public banks.

Finally, we calculate the Spearman's correlation coefficient to analyze the relation between social and financial performance within each one of the four groups. Our results show that social and financial efficiency scores are positively and significantly correlated only in the group referenced as Low GDP (Rho de Spearman = 0.668; p < 0.01, two-tailed value), that is, in the segment composed by those public banks located in less more economically developed Indian states. In the remaining groups, the correlation is not statistically significant.

7 Conclusions

This paper sought to measure the social and financial efficiency of Indian public commercial banks over 2011–2014 by using an innovative MDEA model with shared inputs and undesirable outputs. It then examined whether there is a trade-off between the performance of socially responsible and for-profit banking practices in Indian social banking. The following conclusions can be drawn from this study.

On the one hand, our results show that Indian public banks manage their dual mission relatively well, but are much more efficient in social than in conventional banking. Indeed, most are fully efficient or almost totally efficient in achieving their social goals. Thus, Indian public banks give priority to social over financial objectives so that they are better in fighting poverty and promoting women empowerment than in providing traditional and non-traditional financial services. This is possibly because their main mission is not to maximise profits, but to achieve a social purpose.

On the other hand, our findings support a synergy effect between social and financial efficiencies in Indian public commercial banks, that suggests that social goals do not conflict with for-profit goals. This provides evidence for compatibility between both performance dimensions in social banking. The fear of a so-called “mission drift,” the trade-off between social and financial efficiency, is thus ungrounded for Indian public banks. They have been able to improve access to finance for weaker sections of Indian society, while maintaining their financial sustainability. Therefore, this study finds lack of evidence of existence of trade-off between social and financial efficiency as suggested by the welfarist approach. In contrast, we find support for the institutionalist approach, which argues that a larger pool of poor clients can be serviced once social banks become financially sustainable. Financial and social performances are therefore complements rather than substitutes. To date, the institutionalist approach seems to dominate academic research, and some authors consider that welfarists should accept the requirement of profitability of institutionalists (Dunford 1998; Woller et al. 1999).

Finally, when regional differences in socio-economic development across India are considered, the synergy effect between social and financial efficiency is only confirmed in those public banks situated in less more economically developed Indian states. In addition, our results confirm that the economic and human development in Indian states is not related with social and financial efficiencies of their public banks.

7.1 Academic and practical implications

At an academic level, this study finds that a clear distinction between different behavioral objectives of social banks in model specifications is key to attaining a more comprehensive picture of their efficiency and so to obtain more meaningful results.

At a practical level, this decomposition of the overall efficiency into their social and financial dimensions helps managers to identify their sources of inefficiency Indian public banks must be both financially and socially efficient in their increasingly competitiveness context so that they can continue their important dual mission. Our findings indicate that although efficient at a social level, they had relative financial inefficiency of 18% over 2011–2014. Such managers should reallocate their resources now on the for-profit goals and follow the example of their more successful peers.

In addition, Indian policy makers should try to coordinate the social function of public banks in all Indian states as they are vital for development, poverty reduction, and women's empowerment. Moreover, although our results reveal that recent reforms in the Indian financial market have helped Indian public banks to achieve their dual objectives, they need to increase their financial efficiency while preserving their social efficiency.

7.2 Limitations and future lines of research

A main limitation of this study is the limited data available in India. This explains our limited sample period and using only public commercial banks. The selection and measurement of the inputs and outputs is also constrained by: (a) the lack of information on several input and output variables for consecutive years; (b) the difficulties of quantifying financial outputs and, especially, social outputs; and (c) the lack of qualitative indicators of the social and financial performance by Indian public banks.

Future researchers will hopefully gain access to more and better input and output variables and so estimate their efficiency better. Research into changing productivity in Indian banks regarding variations in efficiency and/or technological change could be a logical extension to this paper. Finally, it would be useful to determine more about Indian banks' social and financial efficiency by studying exogenous variables that may improve the relation between their inputs and outputs.

Notes

India's Dalits (formerly called “untouchables”) have traditionally been at the lowest caste of Hindu social structures. The Indian caste system is rigid and hierarchical with several disabilities imposed on the bottom castes, which, for centuries, have been kept in subjugation by the higher castes.

See RBI Circular (2015) for the latest instructions, classifications and targets on priority sector lending.

The target for aggregate advances to the priority sector in 2017 is 40% of the adjusted net bank credit or credit equivalent amount of off-balance sheet exposure, whichever is higher for domestic banks. Foreign banks with 20 or more branches in the country must do also by April 1, 2018. For foreign banks with less than 20 branches, the overall target is fixed at 32%.

The RBI states that an asset is considered as “non-performing” if interest and/or instalment of principal has remained “past due” or unpaid for more than 90 days. In this regard, banks are required to classify their assets into four main categories: Standard Assets, Sub-standard Assets, Doubtful Assets and Loss Assets.

References

Akther S, Fukuyama H, Weber WL (2013) Estimating two-stage networks lacks-based inefficiency: an application to Bangladesh banking. Omega 41(1):88–96

Andersen P, Petersen NC (1993) A procedure for ranking efficient units in data envelopment analysis. Manage Sci 39(10):1261–1264

Annim SK (2012) Microfinance efficiency: trade-offs and complementarities between the objectives of microfinance institutions and their performance perspectives. Eur J Dev Res 24(5):788–807

Banker RD, Gifford JL (1988) A relative efficiency model for the evaluation of public health nurse productivity. Mimeo, Carnegie Mellon University, Pittsburgh

Banker RD, Charnes A, Cooper WW (1984) Some models for estimating technical and scale inefficiencies in data envelopment analysis. Manag Sci 30(9):1078–1092

Banker RD, Chang H, Zheng Z (2017) On the use of super-efficiency procedures for ranking efficient units and identifying outliers. Ann Oper Res 250(1):21–35

Barai MK, Rale SK, Kar RN (2015) Embedding corporate social responsibility in business in emerging economics. In: Vajpeyi DK, Oberoi R (eds) Corporate social responsibility and sustainable development in emerging economics. Lexington Books, Maryland, pp 211–237

Basu P (2005) A financial system for India's poor. Econ Political Wkly 40(37):4008–4012 (september 10)

Beasley JE (1995) Determining teaching and research efficiencies. J Oper Res Soc 46(4):441–452

Beck T, de la Torre A (2007) The basic analytics of access to financial services. Financ Mark Inst Instrum 16(2):79–117

Berger AN, Humphrey DB (1997) Efficiency of financial institutions: international survey and directions for future research. Eur J Oper Res 98(2):175–212

Bhattacharyya A, Pal S (2013) Financial reforms and technical efficiency in Indian commercial banking: a generalized stochastic frontier analysis. Rev Financ Econ 22(3):109–117

Bogetoft P, Otto L (2011) International series in operations research & management science: benchmarking with DEA, SFA, and R. Springer, New York

Boyd T, Docken G, Ruggiero J (2016) Outliers in data envelopment analysis. J Cent Cathedra 9(2):168–183

Burgess R, Pande R (2005) Do rural banks matter? Evidence from the Indian social banking experiment. Am Econ Rev 95(3):780–795

Casu B, Ferrari A, Zhao T (2013) Regulatory reform and productivity change in Indian banking. Rev Econ Stat 95(3):1066–1077

Charnes A, Cooper WW, Rhodes E (1978) Measuring the efficiency of decision making units. Eur J Oper Res 2(6):429–444

Chen PC, Hsu S, Chang C, Yu M (2013) Efficiency measurements in multi-activity data envelopment analysis with shared inputs: an application to farmers' cooperatives in Taiwan. China Agric Econ Rev 5(1):24–42

Cooper WW, Seiford LM, Tone K (2007) Data envelopment analysis. Springer, New York

Crawford A, Skully M, Tripe D (2014) Are profitable microfinance programs less efficient at reaching the poor? A case study in Cambodia. Available at SSRN: https://ssrn.com/abstract=1968280 or http://dx.doi.org/10.2139/ssrn.1968280

Cull R, Demirgüç-Kunt A, Morduch J (2007) Financial performance and outreach: a global analysis of leading microbanks. Econ J 117(517):107–133

Curi C, Guarda P, Lozano-Vivas A, Zelenyuk V (2012) Is foreign-bank efficiency in financial centers driven by home or host country characteristics? J Prod Anal 40(3):367–385

D'Espallier B, Guérin I, Mersland R (2011) Women and repayment in microfinance: a global analysis. World Dev 39(5):758–772

Das A, Ghosh S (2006) Financial deregulation and efficiency: an empirical analysis of Indian banks during the post reform period. Rev Financ Econ 15(3):193–221

Duflo E (2012) Women empowerment and economic development. J Econ Lit 50(4):1051–1079

Dunford M (1998) Economies in space and time: economic geographies of development and underdevelopment and historical geographies of modernization. In: Graham B (ed) Modern Europe. Arnold, London, pp 53–881

Farrell MJ (1957) The measurement of productive efficiency. J Royal Stat Soc Ser A (General) 120(3):253–290

Fujii H, Managi S, Matousek R (2014) Indian bank efficiency and productivity changes with undesirable outputs: a disaggregated approach. J Bank Financ 38(1):41–50

Fukuyama H, Matousek R (2011) Efficiency of Turkish banking: two-stage network system. Variable returns to scale model. J Int Financ Mark Inst Money 21(1):75–91

Fukuyama H, Matousek R (2017) Modelling bank performance: a network DEA approach. Eur J Oper Res 259(2):721–732

Fukuyama H, Weber WL (2010) A slacks-based inefficiency measure for a two-stage system with bad outputs. Omega 38(5):239–410

Gutiérrez-Nieto B, Serrano-Cinca C, Mar Molinero C (2009) Social efficiency in microfinance institutions. J Oper Res Soc 60(1):104–119

Gutiérrez-Nieto B, Serrano-Cinca C, Mar Molinero C (2011) Social and financial efficiency of microfinance institutions. In: Armendariz B, Labie M (eds) The Handbook of Microfinance. World Scientific Publishers, Singapore, pp 397–418

Hermes N, Lensink R, Meesters A (2011) Outreach and efficiency of microfinance institutions. World Dev 39(6):938–948

Kaur P (2016) Efficiency of microfinance institutions in India: are they reaching the poorest of the poor? The J Bus Perspect 20(1):54–65

Khandker SR (2005) Microfinance and poverty: evidence using panel data from Bangladesh. The World Bank Econ Rev 19(2):263–286

Kuosmanen T (2005) Weak disposability in non-parametric production analysis with undesirable outputs. Am J Agr Econ 87(4):1077–1082

Lebovics M, Hermes N, Hudon M (2016) Are financial and social efficiency mutually exclusive? A case study of Vietnamese microfinance institutions. Ann Public and Cooperative Econ 87(1):55–77

Louis P, Seret A, Baesens B (2013) Financial efficiency and social impact of microfinance institutions using self-organizing maps. World Dev 46(6):197–210

Martínez-Campillo A, Fernández-Santos Y, Sierra-Fernández MP (2016) How well have social economy financial institutions performed during the crisis period? Exploring financial and social efficiency in Spanish credit unions. J Bus Ethics. doi: 10.1007/s10551-016-3192-9

Mohan R, Ray P (2017) Indian Financial Sector: Structure, Trends and Turns. IMF Working Paper, WP/17/7. International Monetary Fund, Washington DC

Moradi-Motlagh A, Valadkhani A, Saleh AS (2015) Rising efficiency and cost saving in Australian banks: a bootstrap approach. Appl Econ Lett 22(3):189–194

Nakamura E (2010) The effect of public involvement on firm efficiency: evidence using Japanese private firms. RMS 4(3):217–258

Piot-Lepetit I, Nzongang J (2014) Financial sustainability and poverty outreach within a network of village banks in Cameroon: a multi-DEA approach. Eur J Oper Res 234(1):319–330

Puri J, Yadav SP (2014) A fuzzy DEA model with undesirable fuzzy outputs and its application to the banking sector in India. Expert Syst Appl 41(14):6419–6432

RBI Circular (2015) Master circular-priority sector lending-targets and classifications. RBI/2015-16/53, FIDD.CO.Plan.BC.04/04.09.01/2015-16 dated July 1, 2015 (amended up to December 15, 2015)

RBI (2012) Reserve Bank of India Annual Reports from 2011-12 to 2014-15. Mumbai: Reserve Bank of India

RBI (2013) Reserve Bank of India Annual Reports from 2011-12 to 2014-15. Mumbai: Reserve Bank of India

RBI (2014) Reserve Bank of India Annual Reports from 2011-12 to 2014-15. Mumbai: Reserve Bank of India

RBI (2015) Reserve Bank of India Annual Reports from 2011-12 to 2014-15. Mumbai: Reserve Bank of India

Relano F (2015) Disambiguating the concept of social banking. J Financ Risk Perspect 4(3):48–62

Robinson M (2001) The microfinance revolution: sustainable banking for the poor. The World Bank, Washington

Saeed A, Belghitar Y, Clark E (2017) Political connections and firm operational efficiencies: evidence from a developing country. RMS 11(1):191–224

Sathye M (2003) Efficiency of banks in a developing economy: the case of India. Eur J Oper Res 148(3):662–671

Seiford LM, Zhu J (1999) Profitability and marketability of the top 55 US commercial banks. Manag Sci 45(9):1270–1288

Shephard RW (1970) Theory of cost and production functions. Princeton University Press, Princeton

Sinha RP (2012) Undesirable output in efficiency evaluation: a study of priority sector lending by public sector banks in India. The J Inst Public Enterp 35(12):1–16

Srinivasan R (1995) Priority sector lending: a study of Indian experience. Himalaya Publishing House, Bombay

Thampy A (2010) Financing of SME firms in India: interview with Ranjana Kumar, Former CMD, Indian Bank; vigilance commissioner central vigilance commission. IIMB Manag Rev 22(3):93–101

Thorat A, Vanneman R, Desai S, Dubey A (2017) Escaping and falling into poverty in India today. World Dev 93:413–426

Tortosa-Ausina E, Grifell-Tatjé E, Armero C, Conesa D (2008) Sensitivity analysis of efficiency and Malmquist productivity indices: an application to Spanish savings banks. Eur J Oper Res 184(3):1062–1084

Tsai PF, Mar Molinero C (1998) The joint determination of efficiencies in DEA: an application to the UK health service. Department of Management, Discussion Paper. University of Southampton, Southampton

Tsai PF, Mar Molinero C (2002) A variable returns to scale data envelopment analysis model for the joint determination of efficiencies with an example of the UK health service. Eur J Oper Res 141(1):21–38

Tzeremes NG (2015) Efficiency dynamics in Indian banking: a conditional directional distance approach. Eur J Oper Res 240(3):807–818

Wanke P, Barros C (2014) Two-stage DEA: an application to major Brazilian banks. Expert Syst Appl 41:2337–2344

Wijesiri M (2016) Weathering the storm: ownership structure and performance of microfinance institutions in the wake of the global financial crisis. Econ Model 57(1):238–247

Wijesiri M, Yaron J, Meoli M (2017) Assessing financial and outreach efficiency of microfinance institutions. Do age and size matter? J Multinatl Financ Manag 40:63–76

Woller G, Gloria W, Nathan C (1999) A survey of evaluation practices in microcredit institutions. J Dev Entrep 4:59–80

Zha Y, Liang N, Wu M, Bian Y (2016) Efficiency evaluation of banks in China: a dynamic two-stage slacks-based measure approach. Omega 60:60–72

Acknowledgement

A previous version of this paper was accepted to present at the 2016 Asian Development Bank Institute Workshop “Developing Credit Databases and Credit Scoring for Micro, Small, and Medium-Sized Enterprises and Promoting Start-Up Businesses”. The authors would like to thank two anonymous referees, the Managing Editor and Michael Skully for their helpful comments. The first author is thankful to the International Development Research Centre (IDRC) for financial assistance. Any remaining errors are solely the responsibility of the authors.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Wijesiri, M., Martínez-Campillo, A. & Wanke, P. Is there a trade-off between social and financial performance of public commercial banks in India? A multi-activity DEA model with shared inputs and undesirable outputs. Rev Manag Sci 13, 417–442 (2019). https://doi.org/10.1007/s11846-017-0255-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11846-017-0255-y