Abstract

This paper investigates the impact of political connections on firm operational efficiencies. We test the political interventions in investment and employment decisions. Our results provide strong support for the presence of investment inefficiencies and excessive employment amongst politically connected firms, whereas the detrimental effect of political interventions is substantially larger on employment decisions. We further find that such operational inefficiencies are more pronounced for low-growth connected firms. Finally, the economy-wide cost of the excessive employments is estimated to be 0.19 % of GDP annually.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The effect of political connections on business operations is well recognised. Anecdotal evidence has highlighted that firms secure economic benefits and advantages from connections with politicians (Boubakri et al. 2013; Li et al. 2006; Fisman et al. 2006; Khwaja and Mian 2005). A common impression is that political connections are important for operational efficiencies,Footnote 1 particularly in less developed markets (Chen et al. 2011; Bunkanwanicha and Wiwattanakantang 2009). However, some studies have provided evidence that political connections can hamper the efficiency of business operations and hence reduce the profit of affiliated firms (Faccio 2006; Boubakri et al. 2008; Dombrovsky 2008). The common justification for the lower economic profits of connected firms is the ‘political cost’, i.e. the costs that a firm incurs from taking corporate policies that benefit the politicians more than the firm. Although these studies agree on the political intervention in corporate operations as a reason for lower profits, surprisingly the mechanism of such interventions has generally been overlooked. Hence, the channels through which such interventions are carried out and which ultimately lead to operational inefficiencies is an issue worthy of future research.

Anecdotal evidence suggests that political connections offer several benefits to the connected firms which include the preferential treatment in credit market, government subsidies, tax exemptions and government bailouts (e.g. Guedhami et al. 2014; Boubakri et al. 2012a, b; Bertrand et al. 2007). These additional resources certainly increase the level of financial resources available to a firm that may eventually influence the level of investment and employment of that particular firm. Given that corporate investment in physical capital and human capital are central to a firm’s competitive advantage, as well as aggregate economic growth, firms establish political connections to secure additional financial resources from banks and government institutions to get such competitive advantage. Nevertheless, whether these additional resources translate into improved efficiencies in investment and employment decisions is primarily an empirical question, which we aim to answer in this study.

This paper builds on the view that political connections are symptomatic of political interventions which distort the operational efficiencies of connected firms (Shleifer and Vishny 1994). The possible costs of political connections on businesses provides the motivation to investigate such relationships a step further and tries to reveal the channels through which politicians interfere and distort the performance of connected firms. In order to investigate this premise, two possible operational inefficiencies that political interventions may cause are proposed: the investment inefficiency and the excess employment. The former approach is based on the argument that self-interested politicians intervene in the investment decisions of the affiliated firm to benefit themselves (Chen et al. 2011). Zheng and Zhu (2010) observe the negative impact of political intervention on investment efficiencies of connected firms and this effect is found stronger for state-owned and low growth firms. On the other hand, the latter approach rests on the argument that connected politicians impose corporate policies on affiliated firms that would help them to maximise electoral support (Bertrand et al. 2007). Indeed, Wolfers (2002) shows that employment conditions are paramount to voters when deciding whether to re-elect an incumbent politician.

Our empirical strategy comprises studying differences in investment efficiency and employment size at connected firms compared with other firms that are not politically connected. A central assumption underlying the empirical approach is that both investment inefficiencies and politically motivated employment favours (excess employment) induce a direct negative effect on firm performance. Following the literature on corporate investment theory (Chen et al. 2011; Bushman et al. 2007) we employ the sensitivity of investment expenditure to investment opportunities as a measure of investment efficiencies. The intuition underlying is straightforward: the firm managed efficiently (inefficiently) should invest relatively more (less) in response to its available investment opportunities. With regard to employment size, it is argued that if a politician intervenes in the firm’s employment decision, then the connected firm should have more employees, ceteris paribus, and consequently show lower employee productivity than non-connected firms (Bertrand et al. 2007). Thus, employee productivity is used to identify the presence of excess employment in a firm.Footnote 2

We focus our analysis on Pakistan, which provides a unique platform to assess the cost of political connection. Political connections between firms and politicians are very widespread in Pakistan (see Khwaja and Mian 2005). In fact, our sample shows that 28 % of the selected firms have close ties with politicians, representing 21 % of the Pakistan stock exchange market. In so doing, we draw on a sample of 2199 Pakistani firm-year observations over the period ranging 2002–2010 to test the relationship between political intervention and the efficiency of business operations.Footnote 3 The results show that the sensitivity of investment expenditure to investment opportunities is weaker for connected firms, thereby confirming the hypothesis of investment inefficiencies caused by political interference. Surprisingly, political intervention is found to be significant for investment (allocation) efficiency, but not necessarily for the level of investment expenditure. Subsequently, the negative correlation of employee productivity, with political connections, supports the hypothesis that excessive employment is one of the channels of political intervention. It is worth mentioning that the effect of interference is more pronounced for employment decisions. This finding may be attributed to the fact that a substantial fraction of the connected firms in Pakistan are located in the constituencies of connected politicians, which suits politicians in terms of transferring rents to their constituents in the form of employment favours. Moreover, given that unemployment is regarded as a major social problem in Pakistan, and also under the assumption that voters are myopic, we may assert that voters’ support binds with such employment opportunities. Accordingly, in order to maximise electoral support in electoral districts, politicians are required to provide employment opportunities to their supporters. Our findings show strong evidence of ‘clientelism’ in the Pakistani economy where politicians distribute job favours in exchange for electoral support.

We also examine whether the political intervention relates to growth opportunities available to firms. The findings support this conjecture, and further illustrate that connected firms with high growth opportunities experience political interference less often than their peers with low growth opportunities. Furthermore, whilst investigating the cross-industry variations in economic inefficiencies, the results suggest that industries with a high proportion of politically connected firms are potentially more subject to political intervention in terms of investment inefficiencies and excessive employment. These results suggest that, although the frequently cited industry-specific characteristics (discussed later in Sect. 5.3) have sufficient explanatory power for inter-industry differences, the sectoral extent of political connectedness is nevertheless an important determinant that shapes business decisions across industries. Thus, this facet must be taken into account in the corporate finance literature examining cross-industry heterogeneity. The main results are robust to the problem of endogeneity. Lastly, a sense of economy-wide costs caused by excessive employment is provided, with the estimation that an additional 0.19 % of GDP is lost each year as a result of such political distortions in employment decisions.Footnote 4

This paper relates to two main strands of literature: first, it adds further evidence to the new and growing literature on the implications of political connections (see, e.g. Fraser et al. 2006; Yeh et al. 2013; Boubakri et al. 2008); and second, the paper is also related to the literature on corporate investment and, in particular, on the agency problem (see, for example, Jensen 1986; Hirth and Uhrig-Homburg 2010). The results suggest that political influence acts as another friction that averts firms from making optimal operational decisions. The agency problem is manifested through collusion between politicians and shareholders in operating business activities. On a practical level, the priorities of politicians do not necessarily coincide with those of shareholders; therefore, in contrast to the wealth maximisation objective of shareholders, politicians want management to support their objectives, such as through investing in dictated (inefficient) projects and excessive employment. The paper is most closely related to the work of Chen et al. (2011), who argue that political intervention distorts firms’ investment behaviour and ultimately leads to investment inefficiency; however, their work does not study the way in which political interference may impact corporate employment decisions, which is a central feature of our analysis.

Taken together, this research contributes to the literature in several ways. Firstly, it identifies and demonstrates the channels through which political connections affect the firm’s economic decisions. By showing this, it adds another dimension to the understanding of political connections in general and in developing countries in particular. Secondly, to our knowledge, this study is amongst the first aiming to examine more than one channel of political interference in the analysis. Thirdly, the results provide empirical evidence that shows political connections as being an important determinant of the cross-industry heterogeneity, thereby enhancing our understanding of the cross-industry variation. Finally, our study contributes to the corporate investment literature that is based mainly on standard corporate finance theories, such as trade-off theory, pecking order theory, and agency cost theory (e.g. Shyam-Sunder and Myers 1999; Hirth and Uhrig-Homburg 2010). However, we find that political forces play a significant role in the investment decisions of the firms; thus, the inclusion of the political aspect needs to be considered whilst examining the corporate investment behaviour.

The remainder of this paper proceeds as follows: Sect. 2 describes the theoretical background and develops hypotheses to be tested in this paper; Sect. 3 provides details of the research methodology; the dataset employed in the empirical analysis is described in Sect. 4, whilst Sect. 5 presents our main empirical results; finally, Sect. 6 concludes the paper.

2 Theoretical framework and hypotheses development

From the standpoint of the political economy literature, the impact of political connections on firm performance may be twofold: first, through direct influence on the firm’s economic cost; and, second, through altering the set of growth opportunities. The former channel is usually considered the most important. A distinct stream of studies on political connections observes those effects, and mostly provides evidence of a positive impact on firm performance (Li et al. 2008; Niessen and Ruenzi 2010). However, in sharp contrast, some studies do not observe improved performance of the connected firms. For instance, Bertrand et al. (2007) report that French firms connected to government officials display higher rates of employment during election cycles but lower performance. Dombrovsky (2008) finds that Latvian firms connected only to winning parties experience better performance. Likewise, in the context of Italy, Asquer and Calderoni (2011) find that connections with ex-politicians have no effect on firm performance. In an event study, Fisman et al. (2006) investigated the stock market reaction on news—both negative and positive—relating to the former Halliburton’s CEO and US Vice President Richard Cheney, and accordingly documents that firm returns—including Halliburton, connected to Richard Cheney—are unaffected by events that would credibly impact the value of any such connections. In a cross-country study, Faccio (2006) shows that, besides the considerable political benefits, connected firms underperform in comparison with non-connected firms on an accounting basis. Finally, Fan et al. (2007) find that politically connected Chinese firms underperform in comparison with those without political connections in 3-year post-IPO performance.

In principle, inferior performance implies that the cost of connections outweighs the benefits. The cost of connections stems mainly from the political intervention in business activities that cause the firm to deviate from its profit-maximisation objective.Footnote 5 The analysis of Shleifer and Vishny (1994) highlights that self-interested politicians utilise their power to intervene in connected firms for their own objectives. As a consequence, managers of connected firms pursue strategies that satisfy the political objectives of connected politicians, which undermine overall operational efficiency and accordingly distort performance.

Excess employment is one potential source of performance distortion. Politicians have an incentive to intervene in the operations of connected companies to maintain political support through offering their constituents employment. On the other hand, such surplus employment increases the cost and diminishes the profitability of connected firms. Bertrand et al. (2007) observe that the presence of political directors on the Board significantly increases the level of employment through new plant creation during election periods. Said differently, market forces encourage firms to reduce the excess employment level so as to enhance economic performance, whilst politicians desire the maximisation of their political support by maintaining high employment levels, which subsequently result in deteriorated firm performance.

Firms with political ties are also forced to undertake inefficient investments, which serve as a tool for the private enrichment of politicians. The theory of corporate investment suggests that the wealth-maximisation objective encourages a firm to invest according to the net present value principle (Chen et al. 2011). However, political intervention inexorably alters the objective function of connected firms to that preferred by the politician, thereby leading to investment inefficiencies in two main ways: ex ante, where connected firms most likely forgo profitable investment opportunities to follow political objectives; and ex post, if investment fails to produce the expected outcomes, connected firms find it difficult to either terminate the unsuccessful project or cut their investment owing to conflicts with political objectives. The negative impact of political interference on investment efficiency may become further exacerbated by preferential access to credit of connected firms (Chen et al. 2011). Based on prior research, there is considerable evidence to believe that connected firms have easy access to credit in many countries (Yeh et al. 2013; Faccio 2006; Claessens et al. 2008), as well as in Pakistan (Khwaja and Mian 2005), which may intensify the investment inefficiency problem. Importantly, the reason behind why firms continue to perform inefficient economic activities—without facing the threat of bankruptcy—lies in the fact that connected politicians will bail the firm out with the use of public budget since it is valuable for politicians to keep such firms alive so as to continue to extract political and other benefits.

We may also motivate our argument for operational inefficiencies with Agency theory, which predicts the moral hazard problem between managers and shareholders. The classic principal/agent problem (Jensen 1986) fits well in this context since managers pursue political objectives that may be in conflict with those of outside shareholders. Empirical evidence shows managerial sub-optimal decisions as being substantial (Hainmueller and Eggers 2011; Blanchard et al. 1994). In a recent study, Aggarwal et al. (2012) discussed agency problems in a different but related context, and argued that political connections are the manifestation of an agency problem between managers and shareholders, with contributions for establishing political connections correlated with weaker governance and unobservable to shareholders, which may accordingly instigate agency problems. Taken together, such theoretical and empirical considerations generate testable predictions relating to the firm’s operational decisions that may ultimately harm shareholder value. Therefore, in this study, whether political intervention in connected firms signifies another friction and thus accordingly averts firms from making optimal operational decisions is examined.

Based on the foregoing arguments, we predict that, as a result of political intervention, connected firms will follow inefficient strategies, such as inefficient investments and excess employment, both of which ultimately distort firm performance. In order to provide empirical content to this statement, it is hypothesised that:

Hypothesis 1

Political intervention reduces the investment efficiency in connected firms; i.e. investment efficiency is negatively related to political connections.

Hypothesis 2

Political intervention causes excess employment amongst connected firms, i.e. excessive employment is positively related to political connections.

3 Empirical strategy

3.1 Investment inefficiencies

Theoretically, investment efficiency refers to firms undertaking all and only investments with positive net present value. According to Tobin (1969), in a perfect capital market, firm investment should relate positively to its growth opportunities. However, in the presence of the frictions of the real world, such as agency costs and information asymmetry, firm investment does not respond adequately to available growth opportunities. Numerous empirical studies have tested the implications of such market frictions on firm investment decisions. Nevertheless, growth opportunities have commonly remained a determining construct in these analyses (Bushman et al. 2007; Blundell et al. 1992).

Consistent with this strand of literature, we also employ the sensitivity of investment expenditure to investment opportunities as our measure of investment efficiency. The underlying intuition is that the firm managed efficiently (inefficiently) should invest relatively more (less) in response to its available investment opportunities. Here, the political connection is tested as a source of inefficiency. Following this intuition, the testable Hypothesis 1 may be stated as: ceteris paribus, the sensitivity of investment expenditure to investment (growth) opportunities is lower in politically connected firms compared with non-connected firms. The empirical approach closely follows that of Chen et al. (2011), Bushman et al. (2007), and Hung et al. (2007). Technically, the following econometric specification is utilised:

where the dependent variable INVESTMENT is the investment expenditure of firm i in year t. It is measured as expenditure to acquire fixed assets, proxied by change in fixed assets between year t − 1 and t plus depreciation in year t, divided by total assets in year t.Footnote 6 The explanatory variables of interest are PC and GROWTH_OPP, where the former is a dummy variable indicating the firm’s political connections, whereas the latter indicates the growth opportunities available to a firm. Hereafter, we refer to the specification in Eq. (1) as the investment efficiency model.

To address reverse causality between political connection and investment decision, for example: firms with past good investment positions are more likely to establish political connections because have better resources and/or better investment opportunities, we use control variables for investment that were selected on the basis of the results of earlier empirical studies or of the surveys thereof (see, for example, Hubbard 1998). We include three control variables in the model, all of which may be seen to influence investment. First, cash flow is included in the model as it has been used in numerous studies as a determinant of a firm’s investment, such as in the case of Harris et al. (2000), who found that internal capital has a significantly positive influence on the level of investment in Indonesian firms. Intuitively, large operating cash flows provide a firm with financial resources for investment. Therefore, it is anticipated that there will be a positive coefficient for (CF). Second, the variable (SIZE) is employed in order to control firm size effect. As per prior studies (Ratti et al. 2008; Love 2003; Gelos and Werner 2002), in the presence of non-trivial fixed costs of raising external finance, large firms have easier access to external financing, mainly owing to less information asymmetry with lenders, which ultimately positively impacts their investment decisions. Size consideration may also affect access to political support because establishing political connections may require extensive ex ante costs, which large firms may easily afford. Thus, a positive coefficient is expected for firm size. Third, the firm leverage effect may be taken into account by including the variable (LEVERAGE). It is often argued that the degree of firm leverage may deter access to external capital, which ultimately influences investment. As the cost of leverage increases with the debt ratio, ceteris paribus, one may anticipate a negative relationship between leverage and investment. Investment decisions may have time-specific and industry-specific heterogeneity, which are unobservable in the estimation. In an attempt to control for such unobservable effects, YearDum and IndDum are used for year and industry dummies, respectively. A detailed description of the variable measurement is provided in the next section.

3.2 Excess employment

As discussed earlier, connected politicians impose objectives, mainly in the form of excess employment, on affiliated firms against favours granted that would help them to maximise electoral support. If this is true, connected firms should have more employees, ceteris paribus, and lower employee productivity than non-connected firms. With this in mind, we argue that profit per employee is a better indicator for excess employment owing to the belief that, if employment is value added, higher employment would increase profit, meaning that profitability and employment size should move simultaneously and hence the variation in labour productivity should be smaller. On the other hand, if employment is not value added, employment size and profit would move in opposition, and variation in labour productivity would be large (see footnote 6). Therefore, we use low labour productivity as an indication of excessive employment. In an attempt to test this hypothesis, following Xu and Wang (1999) and Bartel and Harrison (2005), we use the following regression equation:

The dependent variable (EMP_PROD) is employee (labour) productivity, which is measured as profit divided by the total number of employees. Profitability is the operating income plus accumulated depreciation of the firm i in year t. PC is a dummy variable used to distinguish politically connected firms from non-connected firms. Hereafter, we refer to the specification in Eq. (2) as the employment model.

There is a concern that of reverse causality in which firms with past better employee productivity are more likely to establish political connections. To control for the relationship between labour productivity and political connections, the same control variables employed earlier in the investment efficiency model are utilised. Industrial organisation literature supports the view that large firms have more cost-efficient and higher labour productivity than small ones, mainly owing to sufficient technological resources (Papadogonas and Voulgaris 2005; Wakelin 2001). However, in contrast, political economy literature argues that, since political connections are common amongst large firms, they are more likely to experience political interference in employment decisions (i.e. Fraser et al. 2006). Due to such conflicting theoretical arguments, a priori, no relationship is posited for firm size, and is thus left to be empirically determined from the analysis. In Eq. (2), firm size is represented as SIZE. There is a general assumption in much of the literature on the firm’s productivity that growing firms are operationally more efficient than low-growth firms (e.g. Coad and Broekel 2012; Bartel and Harrison 2005). The underlying reasons are the higher research and development activities, the usage of latest technology, specialised knowledge relating to production, and the efficient utilisation of human capital. Prior literature, such as Daveri (2002), argues that corporate employment size and productivity recently are largely influenced by the advances in information technology, which is a trait of growing firms. Accordingly, in this study, to control the firm’s growth effect, a variable (GROWTH_OPP) is included in the specification. The financial resources which may be utilized to increase labour productivity are controlled in Eq. (2) by employing two variables: cash flow (CF) for internal capital and leverage (LEVERAGE) for external finance. Finally, YearDum represents year dummies, IndDum represents industry dummies at the two-digit level of SIC, and ε is the error term.

4 Data

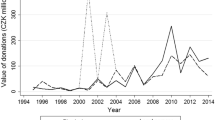

Our firm-level data is taken from two sources. The OSIRIS, a commercial database supported by Bureau van Dijk, provided most accounting data. The sample utilised comprises listed non-financial firms over the period of 2002–2010. The study begins with 2002 as this is when the first election was held and the government was established. The data on politicians (reviewed in order to identify the firms with ties to politicians) has been obtained from the official website of Election Commission of Pakistan (ECP).Footnote 7

Pakistan is based on Westminster, as a federal parliamentary democracy, composed of four provinces, Islamabad Federal Capital and Federally Autonomous Tribal Areas. The legislative body is a bicameral parliament: the lower house is the National Assembly, and the upper house, the Senate. Each province has its own elected legislative body, Provincial Assembly. Under Pakistani electoral system voters elect representatives in National Assembly and Provincial Assemblies every 5 years through a combination of First Past the Post and List Proportional representation. The political party (or coalition of parties) secures the majority seats in the National Assembly forms the government. Pakistan’s elections are contested in a multiparty system dominated by the Pakistan People’s Party (PPP) and Pakistan Muslim League (PML) which are led by two families (Bhutto and Sharif, respectively) since the parties were founded. These two parties operate as mainstream, catch-all parties and have alternated in power since 1971. Other smaller parties provide support to these parties in formation of government in centre and provinces. Political parties operate as electoral entities indulging in public activity as patronage structures. An interesting aspect is that Pakistani political landscape is dominated by a handful of wealthy families and their family members frequently switch their political loyalties to maximize their personal benefits.

Election Commission of Pakistan (ECP) is responsible for organizing and conducting election in Pakistan. It also maintains a dataset containing all information on the names and party affiliations for all the candidates in all elections held since 1971, including the winners, and the number of votes received by each. Each individual (politician) is uniquely identified by a combination of first and last name. Since the sample period in this study is from 2002 to 2010, there are two relevant national and provincial elections held during this duration (2002 and 2008) therefore we remained focus on these two general elections. Individuals participated in the general election (at national or provincial) of 2002 and 2008 are considered as politicians. Regarding information on board of directors, we use Osiris dataset which provides the complete names of board of directors in each year. Following the pertinent literature in this field (Faccio 2006; Boubakri et al. 2013; Li et al. 2006) to identify the politically connected firms, the complete names of board of directors are matched against the list of politicians’ names. If the name of director provides a match with the complete name of the politician that firm is considered as politically connected firm for that year. The corporate political connectedness, which is represented with a dummy variable, is time-variant. This mechanism produced 107 firms as being politically affiliated. Considering that the political arena in Pakistan is dominated by a handful of influential families, the majority of time same individuals contestant the each election. As an outcome, in our sub-sample of connected firms, the politicians serving on boards have participated in both 2002 and 2008 elections. Lastly, political influence of individuals affiliated with the company not only depends on the electoral outcomes, but also on the family influence, constituency (as some constituencies are considered as important that located in the larger cities Islamabad, or Lahore), wining frequency (how many times individual has won the election), and personal relationship with the family heading political party. Therefore, to avoid the complexities inherent in the contextual setting, we did not distinguish between candidates who win or lose the election.

4.1 Sample selection and distribution

The sample includes non-financial listed firms from Pakistan for the period 2002–2010. The decision to restrict the sample to include only the non-financial sector is because the accounting treatment of revenue and profits for financial firms (banks, insurance and investment firms) is significantly different to that of non-financial firms. Rajan and Zingales (1995) argue that financial firms’ leverage is affected significantly by explicit (or implicit) investor insurance schemes, such as deposit insurance. In addition, the capital structure of such firms is influenced heavily by regulatory requirements and, therefore, it is not appropriate to compare the financing policies of such firms with non-financial firms. Another decisive factor put forward in the data selection criteria is that, for each firm, it is required that a minimum of two consecutive years’ information be reported so as to assess the changes in the financing structure of the firm. Moreover, firms with missing values for the important variables are removed from the sample as well.

The firm-level information in the OSIRIS databases is available for approximately 419 non-financial Pakistani-listed firms. Following the application of the aforementioned selection criteria left an unbalanced panel of 2199 firm-year observations on 380 firms for the empirical analysis. The politically connected firms in this sample account for 28 %, whilst 72 % are non-connected firms.

Table 1 presents the distribution of the sample across industries. Sample is distributed according to a narrower eight-industry category based on two-digit SIC, which is an adopted version of industry distribution proposed by Campbell (1996). Firms belonging to the first four industries comprise more than 80 % of the total sample.Footnote 8 Table 1 shows that the percentage of politically connected firms is highest in the Textile and Trade industry (41 %). This is followed by Food and Tobacco industry with 34 % of connected firms.

4.2 Variable measurement

Following Khwaja and Mian (2005) Boubakri et al. (2008) and Faccio (2006), a firm is defined as politically connected if it has a politician on its board of directors. A politician is defined as any individual who stood in the national or provincial elections held in 2002 and 2008. A politician’s full name is matched to a firm’s director and, if their full (first, middle, and last) name matches exactly, the firm is considered as a politically connected firm.

The dependent variable, INVESTMENT, is the ratio of the investment expenditure divided by the total assets, where investment expenditure is taken as the change in fixed assets between year t − 1 and t plus depreciation in year t. It can be expressed as {(Fixed Assets in year t) − (Fixed Assets in year t − 1) + Depreciation (t)}/(Total Assets in year t). This definition of investment is commonly used in corporate investment studies, such as those of Ratti et al. (2008). The second dependent variable for measuring excessive employment, EMP_PROD, is defined as profitability scaled by the total number of employees, where profitability is the firm’s net profit before interest and tax expenses in a given year. This measure of employee productivity is adopted from Xu and Wang (1999) and Bartel and Harrison (2005), who employ a similar measure for Chinese state-owned firms.

Based on prior studies, the following additional variables are utilised in this study: growth opportunities, cash flow, size, and leverage. The growth opportunity variable, GROWTH_OPP, represents a set of firms’ growth opportunities and is measured as the price/earnings ratio. As price/earnings is given by the ratio of the price that investors are willing to pay to buy a share and earnings per share, the market price is a forecast of the present value firm’s potential growth opportunities (Kumar and Hyodo 2001). CF is the cash flow of the firm, measured as operating income (net income before interest and tax) plus accumulated depreciation divided by total assets. This measure is adopted by Ratti et al. (2008) and Love (2003), both of whom used it to measure firms’ dependence on internal capital for their investment outlay. SIZE refers to the firm size, and is defined as the natural log of total assets. Finally, LEVERAGE is measured by the ratio of the book value of a firm’s total debt (short-term and long-term) to total assets. In order to avoid outliers and spurious inferences, we winsorise all variables at the top and bottom 5 % of their respective distributions.

4.3 Data description

The comparison of financing patterns and firms’ characteristics between firms with and without political connections is presented in Table 2. Connected firms are larger in size and tend to have relatively more leverage; however, their performance is inferior to firms lacking such relationships. As expected, politically connected firms tend to have less investment expenditure than non-connected firms. More specifically, the average investment expenditure to total assets for connected firms is 0.53—smaller than the value for non-connected firms (0.58). The result is strongly significant at the 5 % level. The higher leverage and low investment rate by connected firms may be an indication of investment inefficiencies.

The result for excessive employment provides preliminary support for the second hypothesis of operational inefficiencies in connected firms. In particular, the mean ratio of the labour productivity of connected firms is approximately 6.03, whereas that of non-connected firms is 10.57. The last two rows of Table 3 shows that connected firms maintain more employees and have lower profits than unconnected firms.

5 Empirical results

5.1 Impact of political connections on firms’ activities

5.1.1 Investment efficiency

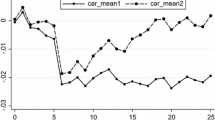

Panel A of Table 3 presents the random effects regression results of the investment inefficiency model, taking investment expenditure as the dependent variable.Footnote 9 Recall that the sensitivity of investment expenditure to available growth opportunities is utilised as a measure of investment efficiency. The results in column 1—in which no control variables are included—report that firms respond positively to their available growth opportunities. More specifically, the estimated coefficient on growth opportunities is positive and strongly significant at the 1 % level. Next, somewhat unexpectedly, the political connections induce a positive but statistically insignificant effect on the investment expenditure, indicating that political connections are not a significant predictor of firms’ investment expenditure. Furthermore, the coefficient on the interactive term is found negative and statistically significant at the 5 % level. The magnitude of the coefficient indicates that firms with political connections, on average, have 5.2 % lower investment efficiency than non-connected firms.Footnote 10

Importantly, the results hold even when the control variables are included in the estimation, as shown in column 2. The coefficient on growth opportunities remains positive and significant at 1 % level. Furthermore, politically connected firms are not significantly different in investment expenditure than those without connections. Finally, political intervention in investment efficiency is still found to be negative and statistically significant, thus implying that, even after controlling for firm-level effects, connected firms have, on average, a lower investment efficiency of 4.3 %. Results support our conjecture that investment inefficiencies is one of the channels of political intervention.

Regarding the effects of the firm’s characteristics on investment expenditure, results partially support the predictions of firm investment literature. The coefficient on the cash flow variable is positive but notably statistically insignificant, thus indicating that internal capital is not an important determinant of investment expenditure of Pakistani firms. Next, as expected, firm size has a positive and significant effect on firm investment expenditure. It can be interpreted that large firms invest more when compared against their small counterparts. Since firm size proxies for the importance of knowledge and capital intensity—the proportion of intangible assets and the share of fixed capital—it is then not surprising that there is higher investment spending amongst large firms. Finally, firm leverage exerts a significant negative effect on investment. The most persuasive argument is the increasing cost of capital due to the degree of financial leverage; this can be seen to adversely affect firm investment.

In summary, the results support the hypothesis of the negative effect of political intervention on firm investment efficiency. Moreover, they support the notion that political intervention acts as another friction, which ultimately increases agency costs for connected firms and thus averts firms from making optimal investment decisions. It is worth noting that political intervention is found significant for investment (allocation) efficiency, but not for the level of investment expenditure. The latter observation is surprising in the sense that studies carried out previously have documented a higher investment rate for connected firms (i.e. Claessens et al. 2008). Nevertheless, our results are understandable in light of politicians’ opportunistic behaviour, where motivation behind decisions to misallocate investment resources rather than to increase the level of investment is clearly self-interest. Before deducing a definite conclusion, however, it is important to explore the alternative channel of intervention, and establish the extent to which political intervention in employment decisions (if any) is used as a source of resource obliteration.

5.1.2 Excessive employment

Panel B of Table 3 reports pooled regression results for the excessive employment model. Column 3 reports the result of the simple specification, which relates employee productivity to a dummy variable, separating connected firms from non-connected firms. The estimated coefficient on the variable political connections is both negative and statistically significant at 5 % level. This result suggests that firms with political ties have lower productivity per employee, thus suggesting the presence of excessive employment. In terms of the estimated magnitude of the political effect, connected firms are found to have, on average, 8.7 % higher employment than their non-connected peers. The results hold even when control variables are included in the estimation, as shown in column 4. The estimated coefficient is significant at the 5 % level, and the magnitude indicates that connected firms have 7.1 % more employees. The negative correlation of labour productivity with political connections corroborates the hypothesis that excessive employment is one of the channels of political intervention, with the main motive of the politicians is transferring rents to supporters. This, together with supportive univariate findings for excess employment, is in line with the results shown in Bertrand et al. (2007).

Next, attention is directed towards the effect of control variables on employee productivity. Firms’ financial resources and size are not significant, thus indicating that these factors are not important determinants of employee productivity. However, the variable capturing firm growth opportunities is positive and statistically significant, supporting the view that growing firms maintain higher productivity owing to their efficient resource management.

The results presented in Table 3 support the notion of political intervention reducing operational efficiencies. In addition, the results strengthen the view that political interference in corporate activities is another type of market friction that drives firms into inefficient business decisions. Collectively, we are now able to indicate the channels through which additional financial resources—as documented in Khwaja and Mian (2005)—are utilised (in fact, wasted) by connected firms. Such channels include investment inefficiencies and excessive employment. Importantly, note that the effect of interference is more pronounced for the latter channel, which seems a somewhat striking result. However, the literature on political patronage offers very contradictory evidence amongst almost every study, which might be rationalised by its own arguments. We may think of two such arguments.

First, a substantial fraction of the connected firms in Pakistan are located in the constituencies of the connected politicians.Footnote 11 Given that unemployment is regarded as a major social problem in Pakistan, and under the assumption that voters are myopic, it may be asserted that voters’ support binds with employment opportunities. Accordingly, in order to maximise electoral support in electoral districts, politicians have to provide supporters with employment opportunities.

Second, one can think of employment favours as a part of an exchange relationship between politicians and supporters. As Robinson and Torvik (2005) indicate, the politicians in fact face commitment problems as they have to honour their promises. Such promises of job provision in election campaigns by politicians, with the intent of wooing potential voters, are relatively popular. Presumably, a politician who diverts from his promised course of action reduces his likelihood of being elected again. This argument is close to what is known as ‘clientelism’ in the literature of political science, where a politician distributes jobs or special favours in exchange for electoral support. Intuitively, clientelism is more pertinent to low-income economies, such as that of Pakistan, where voters’ allegiance is cheaper to buy with employment offers.

5.2 Differential impact of political connections on high- and low-growth firms

Prior financial research argues that investment opportunities available to a firm cause variations in financial policies, mainly investment decisions. For instance, Smith and Watts (1992) found that firms with more growth opportunities employ less debt for their investment and distribute fewer dividends. Similarly, Gul (1999) reports that growing firms generally maintain a lower debt-to-equity ratios. Viewing the relationship between growth opportunity and leverage from a political economic perspective, one may posit that high-growth firms that rely less on debt financing are, in fact, less dependent on political connections (as political connections matter most through preferential credit). Consequently, political involvement in business operations is expected to be lower. Empirically, this conjecture is tested in this section by stratifying the sample into two broad categories, namely high-growth firms and low-growth firms.

To examine this premise empirically, following Belghitar et al. (2011) and Dessi and Robertson (2003) the sample is stratified into three groups based on firm growth opportunities, measured as the price/earnings ratio. More specifically, the sampled firms are arranged in an ascending order based on the average price/earnings ratio for the period 2002–2010, the upper 40 % representing high-growth firms, the lower 40 % representing low-growth firms, whilst the remaining 20 % of firms in the middle were dropped. We estimate both investment efficiency and excessive employment models for the two sub-samples separately.

Panel A of Table 4 presents the results of the investment efficiency model. The regression results show that the estimated coefficient on the interactive term shows that connections influence the investment decisions of both types of firm. Nevertheless, the effect of political influence on investment efficiency is relatively smaller for high-growth firms, which can be interpreted as reflecting less investment inefficiencies. Regarding control variables, the results remain largely unchanged with the exception of size, which loses statistical significance for both sub-samples. Results of excessive employment are shown in Panel B of Table 4. A similar pattern of results emerges from the estimations as in Table 3. Both types of connected firm have excessive employment. Statistically, high-growth, connected firms appear to be slightly less subject to employment inefficiencies by the politicians.

Overall, the results support the conjecture that connected firms with high growth opportunities experience political interference less often than their counterparts with low growth opportunities. Moreover, consistent with the earlier finding, the effect of interference is more pronounced in employment decisions. Finally, the analysis is also coherent with the findings of Zheng and Zhu (2010), although the context is different; they investigate the effects of political involvement in China, whilst this analysis focuses on Pakistan.

5.3 Impact of political connections across industries

It is well recognised that firms’ financing policies, growth opportunities and performances exhibit significant variation across industries. The literature on corporate finance (e.g. Frank and Goyal 2009; Ratti et al. 2008) often reports such inter-industry differences. Essentially, firms within an industry face common forces that influence their operational decisions. Such forces may appear as product market interactions or as competitive intensity. These may also appear as industry heterogeneity in the internal asset composition, business risk factors, technology, or regulatory standards (Frank and Goyal 2009). Following these arguments, it is posited that unique industry-specific factors also affect the extent of political interventions and corporate operational inefficiencies, and thereby cause dissimilarities in investment and employment decisions across the industries.

Our econometric analysis is confined to the four largest sectors, which constitute over 80 % of the sample. These industries include Food and Tobacco, Basic Industries including petroleum, Construction, and Textiles and Trade. The distribution of the sample across industries is provided in Table 1.

The regression results of the investment efficiency model are shown in Panel A of Table 5. The estimated coefficient on the interaction of political connections and growth-opportunities is negative and statistically significant for three industries with the exception of the Construction industry. This indicates that political connections influence the investment efficiencies of firms belonging to Food and Tobacco, Basic Industries, and Textile and Trade. Notably, the magnitudes of the coefficients show that the effect of political inefficiencies is significantly higher for the Food and Tobacco industry. Next, tests are carried out in order to investigate the alternative channel of inefficiency (excessive employment) across the industries. Results are shown in Panel B of Table 5. The firms connected to politicians experience an excessive employment problem, irrespective of the industry to which they belong. Statistically, the Textile and Trade industry is subject to most political interference in the employment decision, whilst Basic Industries is found to experience the least political interference.

When considered in unison, the findings suggest that political intervention is higher for the Food and Tobacco industry and Textile and Trade industry. Research on corporate-political nexus (e.g. Aggarwal et al. 2012; Bertrand et al. 2007) has shown that industries that produce those particular goods and services that are main contributor of GDP can be the target of politicians. Similarly, firms in industries that are heavily regulated or heavily dependent on government contracts would be more likely to be the target of political entrancement. Finally, firms in industries dominated by a relatively small number of large firms are more likely to establish political connections. In the context of Pakistan, Food and Tobacco and Textile and Trade industries have a substantial contribution in country’s GDP and export.Footnote 12 Additionally, Textile and Food industries are dominated by a few large firms owned by influential families namely Arain, Chinioti Sheikhs and Jalundhari Sheikhs. Moreover, politically connected firms in our sample are more concentrated in these two industries, which may cause such a pattern of political interference to occur. Textile and Trade is the largest industry in Pakistan, accounting for approximately 40 % of the total manufacturing within the country. Three notable families control the largest business groups in this industry and these families not only dominate the industry but also the political sense of the region (Rehman 2006). Further, The News, a Pakistani newspaper, reports that in excess of 50 % of the total sugar mills in the country (78 in 2009) are owned by the main political leaders.Footnote 13 Such facts provide a good theoretical reason to believe that industries with a high proportion of politically connected firms are most likely to suffer high political intervention in terms of investment inefficiencies and excessive employment. Overall, this finding emphasises the significance of political connectedness as an important determinant of inter-industry heterogeneity; hence, this facet needs to be taken into account when examining cross-industry variations.

5.4 The Heckman two-stage analysis

One potential concern in the study is that the variable capturing firm political connectedness may not be exogenous. More precisely, some unobserved determinants of firm investment and labour productivity may also explain political connections, regression estimates to be biased and inconsistent. In order to take into account the possible endogeneity problem, the regressions are re-estimated using the Heckman (1979) two-stage model. The first stage of the procedure is the same for both models which involve a probit estimation in which a dummy variable indicating the political connections of a firm (PC) is regressed against the same independent variables used in Eqs. (1) and (2), plus one additional variable that discerns the firm’s political connectedness. That additional variable must be strongly correlated with political connections, but must be uncorrelated with investment or labour productivity. Following Boubakri et al. (2008) and Bertrand et al. (2007), the firm’s location is selected as a discerning variable (instrument) of political connections. These studies have evidently reported that a firm’s location relates only to the political connections—not with outcomes of political connections. In this study, firm location is treated as a dummy variable and takes value 1 if a firm’s headquarter is located in two largest cities of Pakistan: Karachi or Lahore, 0 otherwise.Footnote 14 In the second-stage analysis, the variable PC in Eqs. (1) and (2) is replaced with the fitted value of political connections (inverse Mills ratio, λ), obtained from the first-stage probit model, re-running the previous regressions separately.

Results for the second stage of regressions are displayed in Table 6. The estimated results for the investment model shows that the coefficient on the interactive term containing political connections is negative and significant at the 10 % level, revealing that firms with political connections have lower investment efficiency than their non-connected peers. Regarding the employment model, the estimated coefficient on political connections is negative and statistically significant, which supports our earlier findings of excessive employment amongst connected firms. Importantly, the inverse Mills ratio (λ) is negative but insignificant for both models, suggesting that the self-selection bias is not a problem in our sample. Hence, it may be concluded that our results are not distorted by an endogeneity problem.

5.5 Alternative estimation methods

One of the most important concerns in board related studies is the presence of endogeneity because of omitted variables bias. A number of studies have shown that appointment of politician on board and financing decisions are not exogenously determined (e.g. Guedhami et al. 2014; Boubakri et al. 2008; Khwaja and Mian 2005). In the context of politically affiliated director and investment efficiency, it is plausible that connected firm and politician are affected by the same omitted factor, producing a spurious correlation between politically connected director and firm investment (employment) efficiencies. These unobservable variables can be time-variant and time-invariant. Examples of time-variant unobservable factors are attributes of individual firm management such as managerial ability and management’s intentions, the company culture, a unique location, or country’s political uncertainty. Whereas, firm’s culture of taking risk, widespread optimism or pessimism are considered as time-invariant omitted variables. To address this issue, we use firm fixed effects estimations.

Our results reported in Table 7 shows the similar results as presented in Table 3. The interactive term in investment efficiency model continues to be significantly negative and the variable political connection in employment model is also negative and statistically significant. Thus, it can be concluded that our results are robust to fixed effects estimation.

To strengthen further that our results are not biased with alternative estimation technique, we re-run our models using pooled regression with cluster effect at the firm level. Results are shown in Table 8. Our main findings remain unchanged, that is: political connections continue to exert negative and significant effect on investment and employment efficiencies.

5.6 Propensity score matching estimator

In our analysis, it may be suspected that the firms with politically connected directors have worse operational efficiencies just because firms with poor operational efficiencies are more likely to appoint politicians to improve their efficiencies. To address this endogeneity problem, we adopt the propensity score matching (PSM) technique. The PSM method is used to explore the operational efficiency differences across samples that include all politically connected firms and a sample of non-politically connected firms that are similar in all respects except political connection. These matched firms serve as control sample which help us to rule out the possibility of reverse causality. Subsequently, the nearest neighbours are matched according to these characteristics based on propensity scores of Probit regression. To implement PSM, in the first step we run the Probit regression on the probability to be politically connected. The matching characteristics are all control variables include firm size, leverage, growth opportunities, and cash flow. This model predicts the propensity score for establishing political connections. We impose a tolerance level on the maximum propensity score distance. From this process, we generate 102 pairs with identical characteristics and propensities. We verify the overlap condition to make sure both groups lie in a common support, and conduct the balancing tests to determine whether there are significant differences between matched groups. In the final step, we estimate the average treatment effect on the treated sample.

The results for Probit model are presented in Panel A of Table 9. Firm size and leverage have a significant effect on the probability of being politically connected. The results reported in Panel B of Table 9 show that ATT is negative and significant indicating that firms with political connections have lower investment and employment efficiencies than comparable firms without political connections. As a robustness test, we also use Gaussian kernel matching (0.06 bandwidth) and found qualitatively similar results. Thus, we may conclude that our results are robust to propensity score matching technique.

5.7 Additional tests

We further analyse whether our earlier results for high and low growth firms (Sect. 5.2) are sensitive to the technique used for the analysis. So, for this purpose, we re-estimate only one regression for high/low growth firms with a dummy and interaction terms. This technique would help us to examine whether the difference in coefficients between high and low growth firms are significant or not. The results presented in Model 1 of Table 10. For brevity, results for control variables are not shown in table. For investment efficiencies, the double interactive term is negative and statistically significant indicating that investment efficiency of politically connected high growth firms is 2.1 % more distorted as compared to politically connected low-growth firms. Similarly, employment productivity of politically connected high growth firms is 1.1 % more distorted as compared to politically connected low-growth firms. Our results indicate that the difference between high and low growth firms is significant.

Furthermore, in order to test the impact of operational efficiencies on performance of politically connected firms, we regress firm performance (measured as return on assets) on the investment and employment productivity variables along with all control variables used earlier. The results for interactive terms, presented in Model II of Table 10, show the negative and statistically significant effect of investment and employment productivity on performance of politically connected firms. Particularly, the negative effect of employment is stronger as compared to investment on performance of connected firms. Our findings confirm that these two factors indeed contribute to the lower profitability of politically connected firms.

5.8 Economic welfare cost of political inefficiencies

In this section, we attempt to quantify the economy-wide cost of excessive employment. It seems rather audacious to estimate the economic cost at large of the political interference in the connected firms since there are likely varieties of other costs related with the excessive employment that are not measured. Nevertheless, in this case, the objective is merely to approximate the costs that can be concluded from the results. Theoretically, a welfare loss only arises if the real return (labour productivity) on employees’ investment is less than that of resources invested elsewhere.Footnote 15 Empirically, this cost of excessive employment is calculated by comparing the labour productivity of connected firms with that of non-connected firms.

Following Claessens et al. (2008) and Khwaja and Mian (2005), welfare loss is estimated through two steps. First, the differential in Tobin’s Q is taken in order to measure the difference in employment investment return. Importantly, here we assume that Tobin’s Q captures only the efficiency of employment investment rather than the overall investment, which includes both employment and non-employment investment. As can be seen in Eq. (3), the coefficient of the interaction between political connections and Tobin’s Q—defined as the market value of equity plus book value of the total debts divided by the book value of the total assets—is negative, indicating that Tobin’s Q of the connected firms is 0.031 lower than non-connected firms.Footnote 16 This represents the misallocation of capital through excessive employment amongst connected firms. Second, if we next assume that employment size is the direct representation of the investment level in employment, the coefficient of PC in Panel B of Table 4 can be inferred as the annual employment investment of connected firms as 0.071 higher than non-connected firms. Combining these estimates, it can be established that welfare loss from excess (inefficient) employment is 0.220 % (7.1 % × 3.1 %=) each year of the average firm’s total assets.

On average, our sample of 380 firms—including both connected and non-connected firms—comprises total assets of approximately 1400 million PKR in 2010. Assuming that the employment investment distortion is similar for all 380 listed firms, the gross welfare cost of the political interference in the connected firms is approximately 1.8 billion PKR (=380 × 1400 × 0.00220) each year, or about 0.19 % of GDP annually (GDP of Pakistan in 2010 was 618,530 million PKR). Note that this figure is substantially smaller than the estimates of Khwaja and Mian (2005) for Pakistan. One should bear in mind that we estimate only the cost of distortion in the employment investment. In addition, our sample is relatively small, and includes only listed non-financial firms. Therefore, we caution against generalising this outcome more broadly in the context of any on-going policy debate on political interference.

6 Conclusion

Unlike the previous studies that concentrate on the firm’s advantages of political connections, in this paper, focus is instead directed towards the opposite perspective. Specifically, we investigate the possible adverse impacts of political intervention in business operations in two ways: investment inefficiencies and excessive employment. The analysis is based on a sample of 2199 firm year observations of Pakistani-listed firms for the period 2002–2010. The results support our hypotheses that political intervention adversely affects business investment and employment decisions. More specifically, investment efficiency—measured as sensitivity of investment expenditure to investment opportunities—is distorted by political intervention. Regarding corporate employment decisions, the negative correlation of labour productivity with political connections indicates that excessive employment is one of the channels of political intervention that impairs employment behaviour. Importantly, the distortional effect of political involvement is greater for firms’ employment decisions than investment decisions. In sum, we conclude that political interference in Pakistan harms the overall efficiency of firm investment, and distorts employment decisions. When considered together, the result, whilst certainly worthwhile by itself, presents insights into the forces that shape investment and employment decisions, particularly in less developed economies.

The differential effect of political interference on low- and high-growth opportunity firms is further examined. The results show that connected firms with high growth opportunities experience political interference less often than their peers with low growth opportunities. Finally, our estimates show that there is a welfare loss of 0.19 % of GDP each year due to employment distortion from political interference.

Notes

Operational efficiency is the ability of a firm to produce its products in the most cost-effective manner possible while still ensuring the high quality of its products. In the current context, firms establish political connections to reduce the cost of resources required in production.

We restrict ourselves only to observe altered employment size as an outcome of political interference. Unfortunately, the unavailability of data did not allow us to examine politically motivated hiring of inept employees that is also a significant aspect of political interference in employment decisions.

Throughout this paper we use terms ‘operations’ and ‘activities’ interchangeably which refers only to firm investment and employment decisions.

It is worth mentioning that we constrained ourselves to the investigation of the impact of political connections on investment and employment efficiencies and thereby calculating economy-wide cost caused by such operational inefficiencies. Our analysis does not examine the channels of political extraction—ways through which politicians distort the investment and employment efficiencies of the connected firms. These ways may include undertaking projects with negative NPV, hiring incapable employees or providing protection to unproductive labour which encourages them to keep doing so. Additionally, Boubakri et al. (2013) shows that politically connected firms undertake risky investments and we suspect that such pattern of risky investment decisions is also one of the channel which affects negatively on investment efficiency. The data unavailability on the variables involved did not allow us to examine these channels.

Though cost of political connections also includes the cost of political donation, gifts, and bribes we confine ourselves only to ex post cost of political connections.

Data is available at the following URL: http://www.ecp.gov.pk/.

We have the most firms from textiles and trade industry (132), followed by basic industries, including petroleum (67), and then construction (58).

The results of Lagrangian multiplier (LM) test suggest that the cohort effect is zero and pooled regression is appropriate for estimating the employment model, whilst the random effect model is suitable for investment efficiency model. Further, the results of the Hausman test for investment efficiency model could not reject the null hypothesis, therefore implying that the random effects model outperforms the fixed-effects model.

Recall that a negative sign on interactive term indicates that sensitivity of investment expenditure to investment opportunities, investment efficiency, is distorted by firm’s political connections.

For instance, Ittafaq textile mills and Khalid Siraj textile mills, are owned by Nawaz Sharif (three times elected Prime Minister) located in his constituency in the city of Lahore. Similarly, Gujarat silk mill is connected to Chaudhry Pervaiz Elahi (Member of National Assembly) and is located in his constituency in the city of Gujarat.

Sugar mills belong to Food and Tobacco industries.

The importance of these two cities as the leading industrial hubs of country has been discussed in Rehman (2006).

Employee investment mostly refers to capital investment that firms make in the workplace for employee inducement, such as pay, benefits, career opportunities (Romzek 1990).

The pooled regression includes industry and time effects and R 2 of the estimation is 0.084.

References

Aggarwal RK, Felix M, Wang T (2012) Corporate political contributions: investment or agency? http://ssrn.com/abstract=972670

Asquer R, Calderoni F (2011) Family matters: testing the effect of political connections in Italy. In: Symposium: democracy and its development 2005–2011. Centre for the Study of Democracy, UC Irvine

Bartel A, Harrison A (2005) Ownership versus environment: disentangling the sources of public sector inefficiency. Rev Econ Stat 87:135–147

Belghitar Y, Clark E, Kassimatis K (2011) The prudential effect of strategic institutional ownership on stock performance. Int Rev Financ Anal 20:191–199

Bertrand M, Kramaraz F, Schoar A, Thesmar D (2007), Politicians, firms and the political business cycle: evidence from France. Working paper series, University of Chicago

Blanchard O, Lopez-de-Si Lanes F, Shleifer A (1994) What do firms do with cash windfalls? J Financ Econ 36:337–360

Blundell R, Bond S, Devereux MP, Schiantarelli F (1992) Investment and Tobin’s Q: evidence from company panel data. J Econom 51:233–257

Boubakri N, Cosset J, Walid S (2008) Political connections of newly privatized firms. J Corp Finance 14:654–673

Boubakri N, Cosset J, Walid S (2012a) The impact of political connections on firms’ operating performance and financing decisions. J Financ Res 35:397–423

Boubakri N, Guedhami O, Mishra D, Walid S (2012b) Political connections and the cost of equity capital. J Corp Finance 18:541–559

Boubakri N, Mansi S, Walid S (2013) Political institutions, connectedness, and corporate risk-taking. J Int Bus Stud 44:195–215

Bunkanwanicha P, Wiwattanakantang Y (2009) Big business owners in politics. Rev Econ Stud 22:2133–2168

Bushman R, Piotroski J, Smith A (2007) Capital allocation and timely accounting recognition of economic losses. Working paper, The University of North Carolina at Chapel Hill, Stanford University and the University of Chicago

Campbell JY (1996) Understanding risk and return. J Polit Econ 104:298–345

Chen S, Sun Z, Tang S, Wu D (2011) Government intervention and investment efficiency: evidence from China. J Corp Finance 17:259–271

Claessens S, Feijen E, Laeven L (2008) Political connections and preferential access to finance: the role of campaign contributions. J Financ Econ 88:554–580

Coad A, Broekel T (2012) Firm growth and productivity growth: evidence from a panel VAR. Appl Econ 44:1251–1269

Daveri F (2002) The new economy in Europe: 1992–2001. Oxf Rev Econ Policy 18:345–362

Dessi R, Robertson D (2003) Debt, incentives and performance: evidence from UK panel data. Econ J 113:903–919

Dombrovsky V (2008) Do political connections matter? Firm-level evidence from Latvia. Stockholm School of Economics in Riga, BICEPS Working paper series

Faccio M (2006) Politically connected firms. Am Econ Rev 96:369–386

Fan JPH, Wong TJ, Zhang T (2007) Politically connected CEOs, corporate governance, and post-IPO performance of China’s newly partially privatized firms. J Financ Econ 84:343–364

Fisman D, Fisman R, Galef J, Khurana R (2006) Estimating the value of connections to Vice-President Cheney. Working paper, Columbia University, Reported in NBER Digest

Frank MZ, Goyal V (2009) Capital structure decisions: which factors are reliably important? Financ Manag 38:1–37

Fraser DR, Zhang H, Derashid C (2006) Capital structure and political patronage: the case of Malaysia. J Bank Finance 30:1291–1308

Gelos G, Werner A (2002) Financial liberalization, credit constraints, and collateral: investment in the Mexican manufacturing sector. J Dev Econ 67:1–27

Guedhami O, Pittman J, Saffar W (2014) Auditor choice in politically connected firms. J Account Res 52:107–162

Gul FA (1999) Growth opportunities, capital structure and dividend policies in Japan. J Corp Finance 5:141–168

Hainmueller J, Eggers A (2011) Political capital: corporate connections and stock investments in the U.S. congress, 2004–2008. Q J Polit Sci 9:169–202

Harris JR, Schiantarelli F, Siregar MG (2000) The effect of financial liberalization on the capital structure and investment decisions of Indonesian manufacturing establishments. World Bank Econ Rev 8:17–47

Heckman J (1979) Sample selection bias as a specification error. Econometrica 47:153–161

Hirth S, Uhrig-Homburg M (2010) Investment timing, liquidity, and agency costs of debt. J Corp Finance 16:243–258

Hubbard RG (1998) Capital-market imperfections and investment. J Econ Lit 36:193–225

Hung M, Wong TJ, Zhang T (2007) Political relations and overseas stock exchange listing: evidence from Chinese state-owned enterprises. Working paper, University of Southern California, the Chinese University of Hong Kong and City University of Hong Kong

Jensen MC (1986) Agency cost of free cash flow, corporate finance, and takeovers. Am Econ Rev 76:323–329

Khwaja AI, Mian AR (2005) Do lenders favour politically connected firms? Rent provision in an emerging financial market. Q J Econ 120:1371–1411

Kumar S, Hyodo K (2001) Price-earnings ratios in Japan: recent findings and further evidence. J Int Financ Manag Account 12:24–49

Li H, Meng L, Zhang J (2006) Why do Entrepreneurs enter politics? Evidence from China. Econ Inq 44:559–578

Li H, Meng H, Wang Q, Zhou LA (2008) Political connections, financing and firm performance: evidence from Chinese private firms. J Dev Econ 87:283–299

Love I (2003) Financial development and financing constraints: international evidence from the structural investment model. Rev Financ Stud 16:765–791

Niessen A, Ruenzi S (2010) Political connectedness and firm performance: evidence from Germany. Ger Econ Rev 11:441–464

Papadogonas T, Voulgaris F (2005) Labour productivity growth in Greek manufacturing firms. Oper Res Int J 5:459–472

Rajan RG, Zingales L (1995) What do we know about capital structure? Some evidence from International data. J Finance 50:1421–1460

Ratti R, Lee S, Seol Y (2008) Bank concentration and financial constraints on firm-level investment in Europe. J Bank Finance 32:2684–2694

Rehman UR (2006) Who owns Pakistan, 5th edn. Mr. Books (Pvt.) Ltd., Islamabad

Robinson JA, Torvik R (2005) White elephants. J Public Econ 89:197–210

Romzek BS (1990) Employee investment and commitment: the ties that bind. Public Adm Rev 50:374–382

Shleifer A, Vishny R (1994) Politicians and firms. Q J Econ 109:995–1025

Shyam-Sunder L, Myers SC (1999) Testing static trade-off against pecking order models of capital structure. J Financ Econ 51:219–244

Smith CW Jr, Watts RL (1992) The investment opportunity set and corporate financing, dividend, and compensation policies. J Financ Econ 32:263–292

Tobin J (1969) A general equilibrium approach to monetary theory. J Money Credit Bank 1:15–29

Wakelin K (2001) Productivity growth and R&D expenditure in U.K. manufacturing firms. Res Policy 30:1079–1090

Wolfers J (2002) Are voters rational? Evidence from gubernatorial elections. Stanford GSB research paper no. 1730

Xu X, Wang Y (1999) Ownership structure, corporate governance, and corporate performance. China Econ Rev 10:75–98

Yeh Y, Shu P, Chiu S (2013) Political connection, corporate governance and preferential bank loans. Pac Basic Finance J 21:1079–1101

Zheng Y, Zhu Y (2010) Bank lending incentives and firm investment decisions in China. J Multinatl Financ Manag 23:146–165

Author information

Authors and Affiliations

Corresponding author

Appendix

Rights and permissions

About this article

Cite this article

Saeed, A., Belghitar, Y. & Clark, E. Political connections and firm operational efficiencies: evidence from a developing country. Rev Manag Sci 11, 191–224 (2017). https://doi.org/10.1007/s11846-015-0185-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11846-015-0185-5