Abstract

This paper investigates whether home or host country factors can explain differences in technical efficiency among foreign banks operating in the Luxembourg financial center. We first address heterogeneity across banks by using the group-wise bootstrap to compare DEA measures of bank efficiency between branches and subsidiaries, focused and diversified banks, and euro area and non-euro area banks. We then control for these factors in a second-stage regression indentifying the impact of country-specific regulatory and macroeconomic variables on individual bank efficiency scores. Our regulatory indicators capture the strictness of capital requirements, private monitoring, official disciplinary power and restrictions on bank activities. Our macroeconomic indicators capture GDP per capita in the home country and its position in the business cycle. Our results carry policy implications for bank regulators in both home and host countries and provide insight into banks’ choice between establishing a branch or a subsidiary to develop cross-border activities through international financial centers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

International financial centers contribute to increasing financial integration in capital markets and the growth of cross-border banking. Foreign banks in these financial centers are attracted not just by favourable fiscal and regulatory frameworks, political stability and better infrastructure, but also by the opportunity to “go where the business is”: a presence in financial centers facilitates interaction with other banks (Tschoegl 2000).

Research on international banking has either focused on the impact of foreign banks on competition and performance in their host country or on comparing banking performance across countries. However, the literature has mostly neglected financial centers, although these are a natural laboratory to analyze cross-border banking since they are mainly composed of foreign banks.

Papers studying the impact of foreign banks on competition and performance initially focused on emerging economies and their findings often proved controversial and inconclusive. In part this was because they did account for differences between home and host country characteristics (e.g., Sturm and Williams 2004). More recently, Sturm and Williams (2008, 2009, 2010) stressed the importance of national factors in analyzing foreign bank efficiency in Australia. Lensink et al. (2008) also examined the relationship between foreign bank efficiency and the quality of regulation in home and host economies.

Cross-country comparisons of bank performance included country-specific characteristics as possible explanations for differences in banking efficiency (e.g. Dietsch and Lozano-Vivas 2000; Berger 2007). A recent set of studies using frontier techniques found evidence that national regulation and supervision frameworks had significant effects on bank performance (Delis et al. 2011; Pasiouras et al. 2009; Pasiouras 2008; Barth et al. 2010).

A common finding of these two streams of literature is that accurate measurement of international bank performance requires accounting for the influence of country-specific characteristics. However, there remains little empirical evidence on foreign banks in international financial centers.

This paper attempts to fill this gap. When banks operate across national boundaries, regulatory issues naturally arise. For instance, either the home country regulator or the host country regulator may be responsible for a foreign bank affiliate, depending on the organizational form chosen to go abroad: branch or subsidiary.

We study the Luxembourg banking sector, which has a long tradition as financial center since it started to develop international syndicated loans, euro-bonds and euro-currency markets in the 1970s (OECD 2008). Over time, Luxembourg diversified its financial activities while maintaining a favorable fiscal and regulatory environment to attract foreign banks (IMF 2009). This is an interesting and natural laboratory as it is composed by mainly foreign banks.

The existing literature on the performance of foreign banks in financial centers is limited. Rime and Stiroh (2003) analysed data from Switzerland, Kwan (2006) studied banks in Hong Kong, Sufian and Majid (2007) worked with banks in Singapore, Roubah (2002) and Guarda and Rouabah (2006, 2007) focussed on Luxembourg. However, all these studies neglected differences in home and host country characteristics that could explain differences in bank efficiency.

This paper differs from earlier also because we allow for bank heterogeneity in several dimensions. We first compare bank efficiency by groups, comparing (1) subsidiaries versus branches as the organizational form determines the regulatory scheme (2) diversified versus focused banks as financial centers may attract more diversified banks serving a wider set of clients, and (3) euro area versus non-euro area banks as the latter may face higher entry barriers and restrictions on activities permitted under the EU Directive. We then regress individual bank inefficiency scores on the appropriate regulatory and home-country macroeconomic characteristics for each bank, accounting for differences between groups identified in the first step. This analysis seeks to establish (1) whether foreign banks in financial centers benefit from characteristics of their home economies, and (2) whether more stringent regulation and supervision affect foreign bank efficiency. The latter question is particularly important given discussions on Basel III as a response to the deficiencies in financial regulation revealed by the global financial crisis.

From a methodological point of view, in the first part of our analysis we estimate the efficiency of groups of banks, assuming all banks have access to the same technology, although their level of efficiency in applying this technology could vary depending on certain characteristics. We implement the group-wise data envelopment analysis (DEA) algorithm by Simar and Zelenyuk (2007) to estimate group efficiency and then test whether differences across these groups are statistically significant.

In the second part of our analysis, we examine the main determinants of individual bank efficiency scores using the two-stage DEA algorithm developed by Simar and Wilson (2007): bootstrap estimates of the bias on individual DEA efficiency scores are used to correct before regressing on a set of explanatory variables (including dummy variables identifying bank groups). In this second stage, a truncated regression with a parametric bootstrap provides a valid basis for statistical inference.

Summing up, this paper extends the current international banking literature along two dimensions: (1) it analyzes foreign-bank efficiency in a financial center, (2) it accounts for different home country characteristics, in terms of both economic conditions and regulatory/supervision frameworks. To the best of our knowledge, we are the first to investigate the link between DEA efficiency scores and regulatory/supervisory variables using the statistically rigorous bootstrap procedure. The rest of the paper is structured as follows. Section 2 provides a brief background of the Luxembourg banking sector. Sections 3 and 4 cover the literature overview and the econometric framework. Section 5 describes the possible determinants of foreign bank efficiency while Section 6 the data and source. Section 7 discusses the empirical results and Section 8 concludes.

2 Luxembourg banking sector

The Luxembourg banking sector is mostly made up of foreign banks. Initially associated with international syndicated loans in the early 1960s, the financial sector went on to introduce euro-bonds and euro-currency markets (OECD 2008). More recently, it developed as a centre for private banking and liquidity management within international banking groups. Luxembourg has also become the largest European centre for the domiciliation of investment funds (IMF 2009). Initially financial sector growth was encouraged by tax and regulatory advantages as well as Luxembourg’s swift implementation of EU directives, but increasingly it reflects a concentration of expertise in international banking (OECD 2008, 2010).

Supervisory requirements in Luxembourg differ across three types of banks: banks incorporated under Luxembourg law (including foreign-bank subsidiaries), branches of banks incorporated in other EU countries, and branches of non-EU banks. A foreign bank’s mode of entry may reflect regulatory differences between home and host country. For example, a parent bank may choose to establish a subsidiary that will be supervised under Luxembourg law, or it may prefer to establish a branch to remain subject to its home supervisor. Other aspects also affect the choice between subsidiary and branch: subsidiaries must be at least 50 % foreign-owned and the liability of the parent bank is limited to the amount of capital invested. Branches, instead, are fully owned by their foreign parent bank and do not exist as independent corporations (Cerruti et al. 2007). Although organizationally less demanding, a branch usually only allows the parent bank to run a limited set of operations in the foreign country (Pozzolo 2009), often focussing on inter-bank activities. A subsidiary instead can operate more freely and provides the parent bank complete access to the host country in terms of customers served and product/services offered. As an international financial center, Luxembourg has relatively few domestic banks. There are only two wholly state-owned banks,Footnote 1 two domestic banks with a mix of public and private ownership,Footnote 2 and one privately owned domestic bank (Compagnie de Banque Privée). None of them holds a dominant position in any segment of the market (loans or deposits). This low level of domestic competition probably acted as an additional incitement for foreign banks to establish a local presence.

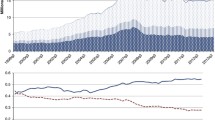

Figure 1 presents the number of banks in Luxembourg, including the breakdown by subsidiaries and branches, as well as the evolution of total assets aggregated across banks. The total number of banks peaked in 1994 at 222, mainly due to rapid growth in the number of branches in the preceding 2 years. After that, the number of both branches and subsidiaries declined to reach a combined total of 148 in 2009. Despite this fall in the number of banks, the aggregate balance sheet grew in all years except during the crises of 2002 and 2009. This indicates that most exits were through mergers, leaving the size of the aggregate balance sheet unaffected, but raising the size of the average bank.

Banks in Luxembourg specialise in different financial activities. Formally, most are universal banks allowed to run both traditional intermediation and financial market activities. Interbank activity was particularly important in the past; particularly within international banking groups (Luxembourg entities provide funding to parent banks and affiliates in other parts of the group). However, over time banks have moved to more complex business model, making the entire sector more heterogeneous (see Curi et al. 2011, for details). Many subsidiaries became less specialised in interbank activities, while branches developed a bimodal distribution (some concentrated on interbank deposits while others specialised away). The share of securities held in total assets varied widely across banks, both for branches and subsidies. The same is true for off-balance activities.

As regards the breakdown of banks according to geographic origin, most of banks are subsidiaries (or branches) of multinational banks established in the neighbouring countries. As in 2009, the highest percentage of foreign banks in Luxembourg is from Germany (31.3 %), followed by bank from France (10.4 %), Italy and Switzerland (7.6 %), Belgium (6.3 %), UK (5.6 %), Sweden and USA (4.2 %). A small percentage is held by Japanese (3.5 %), Chinese and Netherland banks (2.8 %), and Israel banks (2.1 %). Brazil, Denmark, Ireland, Norway, Portugal, Canada, Greece, Liechtenstein, Russia and Turkey have established their presence in Luxembourg through one or two respective foreign banks (CSSF 2009).

3 Literature overview

This section briefly reviews three relevant streams of the banking literature: the first examines factors determining foreign bank efficiency; the second investigates the impact of banking regulations in the context of international comparisons; the third focuses on financial centers.

3.1 Studies on the main determinants of foreign bank efficiency

European banking markets are increasingly integrated through foreign bank branches and subsidiaries, as well as through cross-border mergers or acquisitions. However, recent signs that European banking integration is slowing has motivated research on possible efficiency disadvantages faced by multinational banks operating in a host country. A large academic literature finds that in industrialized economies foreign banks tend to perform poorly relative to domestic banks, while the reverse is usually true for emerging economies (see Berger et al. 2000 and Berger 2007). For instance, Berger et al. (2000) concluded that in France, Germany and the UK, domestic banks have higher cost and profit efficiency on average. However, Sturm and Williams (2004) found that in Australia foreign banks were more efficient. These papers do not distinguish foreign banks by their geographical origin, limiting their conclusions.

These differences in efficiency are explained by two different theories. The limited global advantage hypothesis argues that foreign banks must benefit from some core characteristics of their home economies to offset the diseconomies of operating in distant markets with foreign economic, cultural, and regulatory environments (Berger et al. 2004). Instead, the new trade theory (Markusen 1995) suggests that banks with a comparative advantage in management skills are likely to export them to host economies that are relatively similar to their home economy. Under the limited global advantage hypothesis, foreign direct investment mostly occurs between dissimilar countries, while under the new trade theory it mostly occurs between similar countries.

Sturm and Williams (2008) extended their previous work by disentangling the unspecified nationality factors into home-nation, parent-bank and host-nation effects. Applying general-to-specific modeling to control for additional variables, they found that the unspecified nation-specific factors represented by dummy variables have no additional explanatory power in explaining bank efficiency. This is evidence against the limited global advantage hypothesis as advanced by Berger et al. (2000). Sturm and Williams (2009) took a step further. After estimating bank efficiency using parametric distance functions, they derived common factors to capture features specific to foreign banks. In Sturm and Williams (2010) they combined general-to-specific modeling and extreme bound analysis to evaluate the sensitivity of performance of foreign banks in Australia. They found support for the limited global advantage hypothesis in Berger et al. (2000) also controlling for the relevance of the new trade theory in explaining foreign bank efficiency.

At the international level, Lensink et al. (2008) examine the relationship between the foreign bank efficiency and the quality of institutions in the home and host country. They found that foreign ownership negatively affects bank efficiency although this effect is less pronounced when governance in the host country is fairly good. In addition, foreign bank inefficiency is reduced by higher quality institutions in the home country as well as greater similarity between home and host country.

3.2 Studies on the impact of banking regulations on international bank efficiency

Banks are the most highly regulated industry in the economy (Walter 1985). Therefore, international comparisons of bank efficiency should account for the influence of different regulatory regimes. Dietsch and Lozano-Vivas (2000) showed that neglecting country-specific regulatory characteristics may bias inefficiency estimates in international comparisons. Early studies, including Dietsch and Lozano-Vivas (2000) and Grigorian and Manole (2002), used simple proxies to measure regulatory factors due to data limitations. However, Barth et al. (2003) assembled a broad range of regulatory and supervisory measures over a wide set of countries. This was exploited by Pasiouras (2008) who used DEA to estimate bank efficiency in the first stage and Tobit regression to analyze its determinants in the second stage. Pasiouars found evidence that technical efficiency is positively influenced by stricter capital adequacy standards, more powerful supervisory agencies and more effective market discipline mechanisms. Pasiouras et al. (2009) extended previous work by exploring the impact of regulatory measures on both cost and profit efficiency. They found that higher capital requirements improve cost efficiency but reduce profit efficiency, while restrictions on bank activities have the opposite effect, reducing cost efficiency and improving profit efficiency.

Recently, Barth et al. (2010) examined the impact on bank operating efficiency of regulation, supervision and monitoring. Applying DEA and then regressing inefficiency scores on regulatory and other control variables, they found that tighter restrictions on bank activities are associated with lower bank efficiency, while more stringent capital regulation is associated with marginally higher bank efficiency. In addition, they found that stronger official supervision is positively associated with higher bank efficiency, although only in those countries with independent supervisory authorities. Lastly, market-based monitoring of banks (greater financial transparency) is associated with higher bank efficiency. However, none of these studies consider either the organizational form of foreign banks or home and host country effects.

3.3 Studies on financial centers

International financial centers are of interest to academics, regulators and policymakers (see Park and Essayyad 1989). The consensus is that these centers must have some distinct advantages for international banking in general and the host country in particular. For instance, financial centers improve the international allocation of financial resource by enhancing the integration of capital markets; they benefit local and expatriate employment; they promote the internationalization of the local economy; they provide a favorable fiscal and regulatory climate to encourage the growth of multinational banks. Thus, increasing financial globalization is likely to continue sustaining growth in financial centers. From the point of view of multinational banks, establishing a presence in financial centers is “going where the business is” (Tschoegl 2000) whether to meet other banks through subsidiaries and/or branches, or to develop specific business lines (inter-bank activities or wholesale financial trading). Lastly, financial centers provide agglomeration economies which benefit banks’ revenues, reduce their costs and encourage innovation.

Few papers in the banking literature focus on bank efficiency in financial centers. Kwan (2006) investigates cost efficiency of commercial banks in Hong Kong using a standard multi-product translog function and finds that banks move closer to the frontier over time. On average, large banks were less efficient, but the size effect appears to be related to differences in portfolios. Rime and Stiroh (2003) examine the performance of Swiss banks using the distribution-free approach. They found relatively large cost and profit inefficiencies, with economies of scale for small and mid-size banks. Sufian and Majid (2007) used DEA to study bank efficiency in Singapore. Their evidence that mergers increased efficiency was confirmed by Tobit regressions. Roubah (2002) estimated a stochastic frontier for a panel of Luxembourg banks over 1995–2000, controlling for parent bank home country, bank size and some socio-economic variables. The analysis reveals positive effects on efficiency of some socio-economic variables and significant technological progress, but no evidence of economies of scale. Guarda and Rouabah (2006) apply the user cost approach to the same panel to identify bank inputs and outputs, which are then used to construct Törnqvist productivity indices. Guarda and Roubah (2007) estimate a parametric stochastic output distance function to construct Malmquist productivity indices and provide their decomposition. Aggregating across banks, they find high and volatile productivity growth since the mid-1990s, displaying persistent dynamics and moving pro-cyclically. They also find that efficiency change dominates technical change. However, none of these studies distinguishes between banks with different organizational form or degree of diversification.

4 The econometric framework

In this section we briefly outline the methodology we use to assess foreign bank efficiency. Our approach determines a common frontier based on the conjecture that efficiency differences between foreign banks are determined by home/host differences in regulations and other home country characteristics rather than by differences in bank technology. Because the true technology is unknown, we estimate it using data envelopment analysis (DEA) (Farrell 1957; Charnes et al. 1978).Footnote 3 To briefly outline the DEA estimator, let \( \left( {x_{k}^{{}} = (x_{k}^{1} , \ldots ,x_{k}^{H} )'\; \in \Re_{ + }^{H} } \right) \) be a vector of H inputs that each firm k (k = 1, 2,…, n) uses to produce a vector of M outputs, denoted \( y_{k}^{{}} = (y_{k}^{1} , \ldots ,y_{k}^{M} )'\; \in \Re_{ + }^{M} \) Then the DEA estimate of the technology set (assuming constant returns to scale and free disposability of inputs and outputs) can be written:

where \( \{ z_{k} \ge 0:k = 1, \ldots n\} \) are the intensity variables over which the maximization will be made. Under certain regularity conditions on the data generating process (DGP), the expression in (1) provides a consistent estimator of the unknown technology.Footnote 4 Note that at this first stage of the analysis we impose constant returns to scale (CRS). The main reason for this assumption is that the CRS model given in (1), by measuring all banks relative to the same (and optimal) level of scale, attains greater discriminatory power in the sense that the CRS model is able to identify higher degree of inefficiency for a particular bank than non-CRS models. Clearly, some of the inefficiency identified under the CRS model (1) for a particular bank may be due to the scale effect (when the bank is too small or too large), and this will be tested at the second stage, where we try to isolate the scale effect on bank efficiency scores by including a scale variable (and its square) in the regression model. The CRS model has an additional advantage in that it features faster rates of convergence, which is particularly important for high values of H and M, as in our case.Footnote 5

The DEA estimator can easily handle multiple inputs and outputs and makes no parametric assumptions on the form of the production relationship or the distribution of the inefficiency term. DEA can also accommodate cases when some inputs or outputs are zero, which is important in banking, where zero values may reflect strategic decisions by bank management. The main drawback of DEA is that it attributes all deviations from the frontier to the inefficiency term, while some of them could be due to noise (measurement error or imperfect control). However, all inputs and outputs in our approach are allowed to be random and the efficiency level is also allowed to depend on various factors, including a random error. To some extent, we deal with the problem of randomness and noise at the second (regression) stage of our analysis. To correct for the bias of DEA efficiency estimates, we use the recently developed bootstrap techniques in Simar and Wilson (2007); Kneip et al. (2008) and Simar and Zelenyuk (2007).

Once the technology is estimated, inefficiency scores for each bank can be calculated with a variety of measures and we employ the radial distance to the frontier, according to the Debreu (1951); Farrell (1957) criterion. In particular, we use the output-oriented measure of technical efficiency defined as:

which is a consistent estimator of the true efficiency score from a point (x, y) to the frontier of the true technology set in (1).

Obtaining individual efficiency scores for each bank using (2) is only the first step. We then analyse the aggregate efficiency scores of particular groups in the industry. Intuitively, the aggregation structure we employ is based on economic optimization,Footnote 6 which yields the weights reflecting the importance of each bank within and between groups when averaging efficiency scores. In particular, we use the price-independent weighting scheme derived by Färe and Zelenyuk (2003); Färe and Zelenyuk 2007) and recently extended to a multi-group context by Simar and Zelenyuk (2007). These weights are based on the aggregates of realized shares of each output in the industry. We then use the Simar and Zelenyuk (2007) algorithm, based on the heterogeneous sub-sampling bootstrap, to obtain bias-corrected estimates of efficiency scores for various groups in the industry, as well as their confidence intervals, which allow us to test for significant differences in aggregate efficiency between groups (see Simar and Zelenyuk (2007) for the technical details).

The next step of our analysis explores the relationship between the (unweighted) individual bank efficiency scores and the so-called ‘environmental variables’ that we expect to influence efficiency. When DEA efficiency estimates appear as the dependent variable in such second-stage regressions, Simar and Wilson (2007) show that the standard regression tools (OLS and Tobit) routinely used in this context do not provide a valid basis for inference. To avoid these statistical problems, we use algorithm 2 of Simar and Wilson (2007), which corrects for (1) the bias of DEA estimates, (2) serial dependence among DEA estimates (of unknown structure) and (3) the DEA-related artefact of placing probability mass at 1 for some observations.Footnote 7 Formally, the true model we aim to estimate is given by:

where \( TE_{k}^{{}} \) is the true (in)efficiency score of bank k, while \( Z_{k} \) is the (row) vector of regressors (characteristics of bank k) that are believed to influence the (in)efficiency score of bank k through the (column) vector of parameters β, which we aim to estimate, while \( u_{k} \) is a random error.

Obviously, the true inefficiency score, \( TE_{k}^{{}} \), is unobserved and so we replace it with its DEA estimate from the first stage, corrected for the bias via the bootstrap procedure that accounts for the production model in (1) and the hypothesized structure in (3). Importantly, because \( TE_{k}^{{}} \ge 1 \), we also have \( u_{k} \; \ge 1 - Z_{k} \;\beta , \) for all \( k = 1, \ldots ,n \) and, to account for this boundary issue, we use the truncated regression approach, assuming \( u_{k} \;\sim N(0,\sigma_{\varepsilon }^{2} \;) \) such that \( u_{k} \; \ge 1 - Z_{k} \beta , \) \( k = 1, \ldots ,n \), where \( \sigma_{\varepsilon }^{2} \) is estimated along with β. To improve accuracy of inference, we use the parametric bootstrap (reflecting the structure in (3)) to obtain confidence intervals around each element in β. This procedure is described in more detail in Simar and Wilson (2007).

5 Determinants of bank efficiency

This section describes the explanatory variables considered as possible determinants of foreign bank efficiency in financial centers. Following Sturm and Williams (2008) and Pasiouras (2008), they can be grouped into three categories: (1) country-specific macroeconomic and regulatory variables, including measures of capital requirements, private monitoring, official disciplinary power, restrictions on banks activities, (2) bank-specific characteristics, (3) variables that control for the subgroups identified at the first step. We also include time dummies, to pick up the effects of particular years.

5.1 Country-specific characteristics: economic and regulatory indicators

5.1.1 Economic indicators (home country characteristics)

We introduce two macroeconomic variables to control for economic conditions, per capita GDP and a measure of the business cycle. Economies with higher per capita GDP usually have a more efficient banking sector and therefore are more likely to export efficient practices (Yildirim and Philippatos 2007; Sturm and Williams 2010). We use the logarithm of annual GDP per capita.

We also assume that parent banks could transmit effects of the business cycle in their home economy to their subsidiary and/or branches abroad. Many studies argue there is a close relationship between cyclical movements in output and productivity (e.g. Boisso et al. 2000; Basu and Fernald 2001; Inklaar 2007). We use the Hodrick-Prescott filter to measure the output gap as a proxy for the business cycle. This is defined as the percentage deviation of observed GDP from its trend. When this measure is positive, aggregate demand presumably exceeds aggregate supply, generating inflationary pressure; when this measure is negative, the reverse holds, possibly slowing growth in prices.

These two economic indicators, per capita GDP and business cycle are calculated for the home country, i.e. for each branch and subsidiary we control for the level of per capita GDP and the position in the business cycle of their respective home economy.

5.1.2 Regulatory indicators (home-host country characteristics)

Banks are subjected to regulatory, supervisory and monitoring requirements which could have an important impact on bank performance. In the past, data limitations have discouraged international comparisons from addressing this issue. However, three worldwide surveys on bank regulation and supervision have recently appeared (Barth et al. 2001, 2006, 2008) and are used in this study. Following Pasiouras (2008), we include variables to control for the main regulatory measures, but we first establish for each bank whether it is the regulatory scheme in the home country or the host country that is relevant. Branches of EU banks are subject to the supervisor in their home country (that of their parent bank), while branches of non-EU banks and all subsidiaries are subject to the supervisor in the host country.

The variables we consider are related to the three pillars of Basel II, namely capital requirements (Pillar 1), official supervisory power (Pillar 2), and market discipline (Pillar 3). In addition, we also include restrictions on bank activities as a potential determinant of technical efficiency. According to Barth et al. (2006), the private interest view and the public interest view provide conflicting predictions about the effects on bank efficiency of stricter regulation and supervision, so empirical studies can help provide policy advice. We briefly discuss the variables below, while the details on their computation are reported in “Appendix”.

Capital requirements

This variable is an index of capital requirements, with higher values indicating greater capital stringency. Higher capital requirements will raise the cost of doing business at a given level of risk. This variable can be considered a general proxy for the first pillar of Basel II. According to the public interest view, capital requirements play a crucial role aligning the incentives of bank owners with those of depositors and other creditors, leading to more careful lending and better bank performance (Keeley 1990; Barth et al. 2006). However, this ignores possible costs in the form of higher barriers to entry and greater rent extraction by governments (Barth et al. 2006). Pasiouras (2008) suggests that higher capital requirements can affect bank efficiency through at least three channels: (1) by reducing aggregate lending; (2) by substituting loans with alternative forms of assets; and (3) by influencing the decisions of banks with regard to the mix of deposits and equity, which bear different costs. These arguments, associated with the private interest view, would suggest that more stringent capital requirements are associated with lower bank efficiency.

Private monitoring

The variable Private monitoring measures the degree to which banks are forced to disclose information to the public and whether there are incentives to increase private monitoring. Higher values indicate more informative bank financial statements for auditors and the public. This variable can be considered a general proxy for the third pillar of Basel II. According to the private monitoring hypothesis, powerful supervision might coexist with corruption or other sources of efficiency loss, but market discipline through private monitoring should always improve bank efficiency (Barth et al. 2007). Nevertheless, Pasiouras (2008) notes that higher disclosure requirements can also have a negative impact on efficiency as they may involve direct and indirect costs, for example those associated with investor relations, coordination among departments, and the release of sensitive information to competitors.

Official disciplinary power

The variable official disciplinary power is a measure of supervisory agencies ability to take specific actions against bank management and directors, shareholders, and bank auditors. Higher values indicate broader and greater power for bank supervisors. This indicator is considered a proxy of the second pillar of Basel II. According to the official supervision hypothesis, market failure can be avoided by official supervisors directly overseeing, regulating, and disciplining banks. In so far as a powerful supervisor could improve corporate governance within banks, reduce corruption, and generally improve the functioning of financial intermediaries, high values of this index should be associated with higher bank efficiency (Beck et al. 2006).

Restrictions on bank activities

This variable captures restrictions on bank activities. It reflects whether securities, insurance, real estate activities, and ownership of non-financial firms are unrestricted, permitted but restricted, or prohibited. Higher values indicate greater restrictions.

Barth et al. (2004) discuss several reasons for restricting bank activities as well as reasons for allowing banks to participate in a broader range of activities. On the one hand, allowing a wide range of financial activities may lead to increased risk exposure, or to the establishment of complex and powerful banks that will be difficult to monitor or discipline and may reduce competition and efficiency. On the other hand, fewer regulatory restrictions may allow economies of scale and scope, increase the franchise value of banks and offer opportunities for income diversification. According to Barth et al. (2003) fewer restrictions could provide greater profit opportunities, but banks may be less efficient because they fail to meet the challenge of managing a diverse set of financial activities beyond traditional banking.

5.2 Individual and group‐specific bank characteristics

5.2.1 Individual bank characteristics: Size and risk measures

As in Berger et al. (2010), we use a continuous variable, the logarithm of total assets, rather than a categorical dummy variable to capture bank size. We also include the square of this term to control for potential nonlinearities in the relationship between size and efficiency.

We use bank equity, defined as the ratio of equity book value to total assets, to capture the bank’s capital strength. This measure approximately is equivalent to banks’ tier 1 capital ratio (Berger et al. 2010). A high ratio indicates low leverage and therefore lower risk (see Pasiouras and Kosmidou 2007 among many others). Empirical evidence suggests that regulators may allow relatively efficient banks to operate with higher leverage, all other things being equal (Hughes and Moon 1997; Hughes and Mester 1993). Others, such as Altunbas et al. (2001, 2007) find that financial capital can significantly influence bank cost and profit efficiency measures.

5.2.2 Group-specific characteristics: organizational form, diversification, parent bank nationality

As mentioned in the introduction, in financial centers the organizational form chosen by foreign banks is important given branches and subsidiaries are regulated differently. While branches are an integral part of the parent bank (they draw on the parent’s capital base) and operate in a host country under the authority of the home country supervisor, subsidiaries lend on the basis of their own capital and are subject to the host country supervisor. We define a dummy variable (Branch) equal to 1 if the bank is a branch.

The degree of diversification could affect bank efficiency for two reasons: (1) from the point of view of the single bank, diversification could lead to scope economies and cost advantages (2) from the point of view of the financial center, diversification may attract a wider set of clients. Following the literature (Berger et al. 2010; Mercieca et al. 2007; Acharya et al., 2006), we use the Herfindahl–Hirschman index (HHI) to measure diversification in terms of bank assets. Total assets are disaggregated into bank loans, customer loans, securities held (including government securities and shares), fixed assets and other assets. The HHI is given by the following sum of squares:

where for each bank i, LOAN_B is loans to other banks, LOAN_C is loans to firms and private households, SEC is securities held, FIX_ASS is total fixed assets, Others is other assets and TA is total assets. The index varies between 0 and 1, with higher values for banks that are more focused (less diversification). However, two banks with different compositions of total assets may record the same level of the HHI.Footnote 8

Foreign banks originating outside the European Monetary Union may face additional costs related to currency fluctuations. We therefore consider two groups of banks: those belonging to the euro area versus those which do not. We use a dummy variable (euro area) equal to 1 if the bank originates in a euro area member state.Footnote 9

5.3 Period-specific dummy variables

Lastly, we control for some important events in the host country that may affect foreign bank performance. For some specific years, we introduce dummy variables to capture possible economic and structural changes that are common across the sector. A dummy for the year 2001 aims to pick up the end of a wave of banking consolidation, one for 2003 picks up the aftermath of the stock market crisis, one for 2006 picks up the boom preceding the financial crisis and one for 2009 picks up the recession after the Lehman Brothers collapse.

6 Data and sources

We work with bank reporting data provided by the Luxembourg Central Bank. The sample covers the period 1999Q1–2009Q4 and consists mostly of commercial foreign banks involved in both customer and inter-bank activities. First, we take annual averages to avoid seasonal effects: for the stock variables (from the balance sheet), we take the average of the four consecutive quarters, while for flow variables (from the profit-and-loss account) we report the final year-to-date values. Second, we exclude banks missing balance sheet information. These are mainly branch banks, which face lower reporting requirements because they are regulated and supervised by their home country authorities. Lastly, we exclude domestic banks (two state owned banks and two cooperative banks), a central securities depository with bank status, an investment bank, and a set of four small banks with a very limited market share. These last four banks were excluded after inspecting the distribution of estimated efficiency scores.Footnote 10 In our sample, there are a few cases of banks with zero values in securities or non-interest income and a few cases of banks with zero values in capital or customer deposits. Either case may reflect strategic choices by bank management (Thompson et al. 1993), which we aim to capture in the efficiency assessment (in all cases, banks had positive levels of at least one input and output, as required for DEA). To control for possible heterogeneity in the sample due to these difference strategies, we apply the group-wise heterogeneous bootstrap methodology of Simar and Zelenyuk (2007).

The final sample is an unbalanced panelFootnote 11 which includes 209 foreign banks in Luxembourg during the period 1999–2009, totalling 1,526 observations. Data in nominal values are converted to real terms using the GDP deflator with base year 1995. We use unconsolidated statements.

Our choice of bank inputs and outputs is based on the intermediation approach (Sealey and Lindley, 1977) which is common in the bank efficiency literature (Berger and Humphrey 1997). On the input side, we select (1) labor, measured by total labor expenses, (2) capital, measured by fixed assets, (3) interbank deposits, and (4) customer deposits. On the output side, we select interbank loans, customer loans and securities. However, as discussed in Curi et al. (2011), Luxembourg banks increasingly rely on off-balance sheet activities. We use non-interest income as a measure of fee services associated with these activities (Clark and Siems 2002). Customer activities include those provided for households and for non-financial corporations. Securities include government securities, fixed-income securities, shares, participations and other variable-income securities. Note that interbank activities include those within the parent banking group as well as with other banks.

As is well-known, the DEA estimator can suffer slow convergence rates due to the “curse of dimensionality”. To increase the precision of our estimates, we pool the data across time and treat each observation as an independent realization of the same data generating process (including the same technology). However, in the second-stage regression we account for time effects by using dummy variables.

Tables 1 and 2 presents summary statistics of input and output variables for the pooled sample. All variables are expressed as percentages of total assets to avoid any size effect.Footnote 12 The statistics suggest heterogeneity across groups in terms of their input and output compositions, justifying a group-wise analysis of bank efficiency. We distinguish diversified from focused banks using the mode of the HHI distribution across banks obtained with a kernel density estimator: banks below 0.6 are classified as diversified and the others as focused. Among Luxembourg subsidiaries, it is customer deposits which make up the biggest proportion of financial input, whereas among branches it is interbank deposits. On the output side, interbank loans constitutes the main output for both groups, but only subsidiary banks seem significantly involved also in securities activity. The same comparison could be carried out between diversified and focused banks. While diversified banks have a balanced structure in terms of financial inputs and outputs, specialized banks focus mainly on interbank lending and customer deposits. This difference is even more evident between euro area and non-euro area banks.

Finally, for the whole sample, customer deposits are the most important financial input while interbank loans are the largest financial output.

Table 3 reports descriptive statistics of the environmental variables used in the second stage regression. Country-specific variables come from two different sources. Data for regulatory and supervisory variables (capital requirement, private monitoring, official disciplinary power, restrictions on banks activities) were obtained from the World Bank (WB) database, developed by Barth et al. (2001) and updated by Barth et al. (2006, 2008). These indicators cover all our home countries for the years 2001, 2003, 2005, except for Norway in 2001 and Turkey in 2005.Footnote 13

Macroeconomic indicators (gross domestic product and output gap) were obtained from World Development Indicators, Eurostat and own calculations. Table 3 suggests some heterogeneity in our groups also in terms of the country-specific characteristics. For instance, the home country GDP per capita is higher for subsidiaries, focused banks and non-euro area banks. Instead, home country output gap is higher for subsidiaries and euro area banks. In terms of regulatory indicators, subsidiaries, diversified banks and non-euro area banks face greater capital stringency. Subsidiaries, diversified banks and euro area banks face greater disclosure requirements. Supervisor power is higher for subsidiary, focused and non-euro area banks, and finally banking activity restrictions are lower for subsidiary, diversified and euro area banks. Given these differences, some of the efficiency differences found at the group level may change in our second step regression, where we control for home country characteristics and regulatory indicators.

7 Results

We first present group efficiency estimates (raw and bias-corrected) and confidence intervals from the DEA model with individual bank scores aggregated using bank output share as weights. These are compared to the unweighted (mean and median) efficiency scores for each group that would be reported in more traditional DEA studies. Results are also reported for the entire sample. These first stage results provide initial insights into whether efficiency differences can be explained by differences in organizational form, business orientation and geographical origin. The second-stage regression estimates the impact on foreign bank efficiency of home-country macroeconomic characteristics, regulatory indicators, and group-specific characteristics.

As the aim of the analysis is to explain inefficiency, efficiency scores are reported à la Farrell (1957): scores closer to unity are more efficient banks. However, in the discussion we use brackets to report efficiency scores à la Shephard (1970), which are the reciprocal of Farrell efficiency scores and represent the relative level of efficiency in percentage terms.

7.1 Group efficiency results

Tables 4 and 5 present the first stage results based on the group-wise heterogeneous bootstrap. The first and second columns report, respectively, the raw group efficiency and the bias-corrected group efficiency. The third and fourth column report the estimated bias term and the standard deviation. The final two columns provide the lower and upper bound of the 95 % confidence interval of the bias-corrected group efficiency scores. The estimated bias is negative for all weighted group efficiency terms, suggesting that the raw efficiency scores are overestimated, and the standard deviation indicates that the estimated bias is statistically different from zero in nearly all cases. We therefore focus on the bias-corrected group efficiency and relative confidence intervals.

Table 4 reports weighted and non-weighted efficiency scores for the whole sample. A key result is that there is substantial inefficiency present in our sample. The weighted bias-corrected efficiency (or the relative % weighted bias-corrected efficiency) suggests that foreign banks in Luxembourg operated at 2.405 (or 42 %) efficiency. In other words, given inputs, foreign banks could increase their outputs more than two-fold. However, the confidence intervals indicate substantial variance in this estimate. This may be due to the structure of our sample data, which exhibits heterogeneity. Therefore, low level of aggregate efficiency requires more careful investigation. We therefore group banks within the industry according to organizational form, business model and geographical origin and focus on pair-wise comparisons (Table 5). In this way, we disentangle the efficiency estimate of the entire sector into group efficiency estimates based on groups of more homogenous banks (minimization of within group differences) so that we can compare more dissimilar groups (maximization of the between group differences). In general, we find that in each comparison there is one group performing better than the other. We first discuss the point estimates of bias-corrected group efficiency and then their confidence intervals.

Comparing branch and subsidiary banks, results suggest that branch banks are more efficient than subsidiary banks,Footnote 14 since their bias-corrected group efficiency (relative % bias-corrected group efficiency) is 1.359 (74 %) compared to 2.517 (40 %) for subsidiary banks. These results may reflect the simpler organizational structure and strategy of branch banks, such as their focus on serving parent banks through internal capital markets. We do not know of other results in literature which account for banks’ organizational form.

Comparing diversified and focused banks, the former are more efficient (about 14 % more than focused banks), with a bias-corrected group efficiency score of 2.342 (43 %) compared to 2.666 (0.38 %) for focused banks. There is no consensus in the existing banking literature on the impact of diversification on bank efficiency. While more recent studies suggest that costs may outweigh benefits (e.g.; DeYoung and Roland 2001; Stiroh 2004), more traditional arguments suggest that banks should be as diversified as possible, as banks are typically highly leveraged, and diversification reduces their chance of costly financial distress/bankruptcy. Recent findings by Berger et al. (2010) on foreign banks in China suggest they are able to partially mitigate the diseconomies of diversification.

Lastly, euro area banks appear to be more efficient with a score of 2.316 (43 %). This is consistent with the new trade theory (Markusen 1995) which suggests that banks could benefit from similarity in management between host and home country.

Compared to mean and median group efficiency, the weighted group efficiency scores are smaller. This suggests that larger banks are typically more efficient possibly due to economies of scale within each group. The only exception is for non-euro area banks, possibly because most of them are smaller in size.

Overall, results in Tables 4 and 5 suggest that the heterogeneous performance of foreign banks in Luxembourg is at least in part due to efficiency differences between groups of banks. Some group features may enable banks to be more or less efficient. To test for statistically significant differences between groups of banks, we compare the relative bootstrapped-confidence intervals. These appear to be quite wide but do not overlap, confirming significant differences in efficiency. This is further confirmed by the pair-wise tests carried out with the relative difference statistics in Table 6, based on ratios of the means of groups (see Simar and Zelenyuk 2007, for details). In all cases, the differences between groups are statistically significant, since unity falls outside the confidence intervals of RD statistics (Table 5, column 5 and 6). Thus our initial analysis leads to the conclusion that: (1) the Luxembourg banking sector as a whole is characterized by low efficiency, (2) this low efficiency score might be ascribed to heterogeneity among foreign banks, and (3) these differences in efficiency may be driven by differences in organizational form, business orientation and geographical origin.

Table 5 provides additional insight. The wide confidence intervals related to bias-corrected efficiency in each group indicate substantial variability. In particular, although branch banks seem to perform better than subsidiaries, their group efficiency estimate is subject to the highest level of variability. This variability is lowest when comparing euro area and non-euro area banks. Likewise, the wide confidence intervals of the RD-statistics (Table 6) suggest that heterogeneity (or efficiency differences) is not only present between groups but also within groups. This suggests that efficiency may also be explained by bank-specific features.

Overall, group-wise DEA estimation suggests some possible drivers of (in-)efficiency that need to considered when we turn to consider the impact of bank-specific features in the second-stage regression.

7.2 Second stage regression results

In the second stage of the analysis, we investigate possible determinants of efficiency by estimating the econometric model described in Eq. (3) above using the individual bank bias corrected inefficiency score as the dependent variable, and the set of macroeconomic, regulatory and bank- and group-specific characteristics described above as independent variables. The parameters are estimated according to algorithm 2 of Simar and Wilson (2007), with 1000 bootstrap replications for the bias correction and 1,000 bootstrap replication for the confidence intervals. We first regress the DEA bias-corrected estimates on our environmental variables to obtain the parameter estimates. We test the significance of parameters using the concept of confidence intervals. For each parameter estimate, we estimate the relative 99, 95, and 90 % confidence intervals. The effect of the environmental variable under scrutiny will not be significant at the 0.01, 0.05, and 0.10 level if the relative confidence interval contains zero (that is the parameter value specified in the null hypothesis). Recall that parameters with negative sign indicate sources of efficiency as DEA bias-corrected estimates are expressed à la Farrell.

The estimation results are reported in Table 7. As discussed above, for branches the regulatory variables are based on the home country, while for subsidiaries we have used the host-country values. For the macroeconomic variables, instead, only home-country levels are used. Given that the groups considered in the first stage had statistically different results, we identify them in the regression analysis. In particular, we introduce dummies for branch banks and banks originating in the euro area. To distinguish diversified and focused banks, we prefer to use the continuous HHI variable as suggested by Berger et al. (2010) because of its higher explanatory power.

The results obtained in our second stage regression support the hypothesis that more stringent regulation, supervision and monitoring do not boost foreign bank efficiency in financial centers. Capital stringency appears to have a positive, but insignificant, impact on bank’s efficiency. This is not in line with previous findings by Pasiouras et al. (2009) and Barth et al. (2010). Restrictions on bank activities have a negative and statistically significant impact on efficiency (greater restrictions lead to lower technical efficiency). This is consistent with findings in Pasiouras et al. (2009) as well as in Barth et al. (2010). Private monitoring also has a negative statistically significant impact on the technical efficiency, implying that higher disclosure requirements do not enhance foreign bank efficiency. Lastly, the power of supervisory agencies also has a negative statistically significant impact on efficiency, while Pasiouras et al. (2009) found a positive effect and Barth et al. (2010) found no significant effect. The differences in the results relative to regulatory measures might be due to the different sample of countries or to differences in methodology. In particular, previous studies do not accurately identify the relevant regulatory scheme according to organizational form.

Overall, results do not seem to be consistent with the public interest view, as higher regulation does not enhance the efficiency of foreign banks in Luxembourg. Higher capital requirements appear to have no significant effect, while a more powerful supervisory agency may actually be detrimental to bank efficiency. Lastly, stronger disclosure requirements associated with the third pillar of Basel II have a negative and statistically significant impact on bank efficiency. Summing up, the results are more consistent with the private interest view than with the public interest view.

Macroeconomic conditions at the home country level do not appear to affect foreign bank efficiency in Luxembourg. Our results provide little evidence to support the limited global advantages hypothesis of Berger et al. (2000). GDP per capita does not appear to have a positive impact on efficiency, but the output gap in the home country seems to be positively associated with higher efficiency, although the coefficient is not statistically significant.

The regression results suggest that the organizational form does not play an important role in determining efficiency, since the branch dummy has a negative but insignificant coefficient. Differences between branches and subsidiaries described earlier seem to disappear when controlling for other characteristics in a multivariate context. The geographical origin of the parent bank appears to be significant, as the coefficient on the euro-area dummy suggests a significant impact on efficiency. For diversification, higher values of HHI are associated with lower efficiency levels. This suggests that more specialised banks are less efficient after controlling for other factors. However, when this variable is crossed with the branch dummy, an improvement in efficiency appears. This suggests that specialised branches perform better than specialised subsidiaries. This result is relevant to the debate on which organizational form is preferable to develop cross-border activities.

In terms of bank-specific characteristics, the log of total assets is significantly associated with higher efficiency but its squared term is not significant. This suggests a monotonic relationship between size and performance, meaning there is no optimal size from the efficiency perspective. The ratio of equity to total assets has a positive impact on efficiency, suggesting that well capitalized banks are better run. Finally, the coefficients on the period-specific dummy variables suggest that banks saw a general improvement in efficiency during the boom prior to the financial crisis.

Overall, our results suggest that the performance of foreign banks in Luxembourg’s financial center is in part explained by home country characteristics. While economic conditions in the home country do not seem to be relevant, regulatory indicators related to supervision do have explanatory power. The lack of any effect from economic conditions in the home country is not consistent with the limited global advantage hypothesis, but suggests that foreign banks establish a presence in the Luxembourg financial center to exploit new opportunities. On the other hand, the estimated impact of the regulatory indicators is more consistent with the private interest view than with the public interest view. These results seem to suggest the current home-host model of bank regulation may need to be reviewed to ensure an efficient functioning of the banking system.

8 Discussion and conclusions

This is the first attempt to study the impact of home and host country characteristics on the performance of foreign bank efficiency in a financial center. When banks operate cross-border, national and international authorities need to consider that efficiency could be naturally affected by different regulatory schemes and economic conditions in the home country.

This study aims to contribute to the literature by investigating these aspects on a panel dataset of Luxembourg banks over the period 1999–2009. Our analysis is based on a two-stage DEA using bootstrap tecniques to provide valid inference on the main drivers of bank efficiency. As an innovation in the field of international bank efficiency, we carefully account for the relevant regulatory scheme applied to foreign banks according to their organization form (subsidiary or branch).

In the first stage of the analysis, we show that bank performance differs systematically according to organizational form, business model and geographical origin. In particular, results indicate higher technical efficiency on average among branch banks, more diversified banks and euro area banks. In the second stage, we investigate the link between bank performance, home country economic conditions and applicable regulatory scheme. In the light of first stage results, we also control for organizational form, asset diversification and country of origin.

The regulatory indicators we consider are related to the Basel II framework and relate to capital requirements (pillar 1), official supervisory power (pillar 2) and private monitoring (pillar 3). We also account for possible activities restrictions. Our results suggest that both private monitoring and official disciplinary power have a negative impact on bank efficiency. In contrast, more stringent capital requirements do not appear to have a statistically significant impact. Restrictions on bank activities also have a negative impact. These findings have an interesting implication for banking sector in financial center given the fact that none of them has a positive impact on technical efficiency. From a policy point of view, the results seem to support the need to review the current home-host model of bank regulation and to promote coordination among national authorities in cross-border resolutions.

When controlling for other characteristics, well capitalized and more diversified banks tend to be more efficient, supporting the private interest view of the link between regulation and bank efficiency. Since efficiency is barely affected by home country economic conditions, our results also suggest that multinational banks establish a presence in financial centers mostly to “go where the business is”. In terms of the choice of organizational form, branches appear to perform better than subsidiaries if they are specialized, and subsidiaries do better when more diversified. Summing up, despite the efforts by policymakers and international organizations to promote a unified regulatory framework, our results suggest that the home-host regulation scheme applied to banks operating in financial centers is not successful in fostering bank efficiency. Instead, bank efficiency is better explained by bank-specific characteristics such as asset diversification, size and capitalization.

Notes

Banque et Caisse d’Epargne de l'Etat and Société Nationale de Crédit et d'Investissement.

Fortuna Banque and Banque Raiffeisen (including its local caisses rurales).

See Park et al. (2010) for details.

For instance, minimization of costs or maximization of revenues/profits.

The model in Simar and Wilson (2007) requires some regularity conditions, including the ‘separability’ assumption which could be relaxed in future work.

We consider euro area those nations using the euro as their currency (i.e. Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy Malta, Spain, Netherlands, Portugal, Slovenia, Slovakia). Our sample does not cover all the euro area.

We follow Zelenyuk and Zheka (2006). After observing a few small bumps on the right tails of the efficiency distribution, we trim them and then test the impact of the trimming by comparing the efficiency distributions of the two samples (original sample vs. trimmed sample) using a version of Li (1996) test (adapted to DEA context by Simar and Wilson (2007)). Since the null hypothesis of equality is not rejected, we can reduce the sample without losing much of aggregate information.

This is because the sample contains banks which were closed or merged and newly created banks.

We thank an anonymous referee for this suggestion.

The World Bank database is only available for three points in time. As our time span covers a longer period, we assume that regulatory variables remain constant within short periods. More precisely, (1) for 1999–2001 we use the year 2001, (2) for 2002–2004 we use the year 2003, (3) and for 2005–2009 the year 2006. Other studies that have used this database appear to have used similar assumptions (e.g. Lozano-Vivas and Pasiouras 2010; Demirguc-Kunt et al. 2004; Pasiouras et al. 2009). When we used interpolated values in the regression, results were qualitatively the same.

Recall that we measure efficiency of Banks relative to CRS technology, i.e. relative to the productivity level of optimal scale, which usually yields higher differences in efficiency between banks than otherwise.

References

Acharya V, Hasan I, Saunders A (2006) Should banks be diversified? Evidence from individual bank loan portfolios. J Bus 79:1355–1412

Altunbas Y, Evans L, Molyneux P (2001) Ownership and efficiency in banking. J Money Credit Bank 33(4):926–954

Altunbas Y, Carbo S, Gardener EPM, Molyneux P (2007) Examining the relationships between capital, risk, and efficiency in european banking. Eur Finan Manag 13(1):49–70

Barth JR, Caprio G, Levine R (2001) The regulation and supervision of banks around the world: a new database. In: Litan RE, Herring R (eds) Integrating emerging market countries into the global financial system. Brookings-Wharton Papers in financial services. Brooking Institution Press, Washington

Barth JR, Caprio G Jr, Levine R (2003) Bank Regulation and Supervision: Lessons from a new database. In: Garza JAM (ed) Macroeconomic stability, financial markets, and economic development. Mexico, City, Banco de Mexico

Barth JR, Caprio G Jr, Levine R (2004) Bank regulation and supervision: what works best? J Finan Intermed 13:205–248

Barth JR, Caprio G Jr, Levine R (2006) Rethinking Bank Regulation: Till Angels Govern. Cambridge University Press, Cambridge

Barth JR, Caprio G, Levine R (2007). The microeconomic effects of different approaches to bank supervision. In: Haber S, North D, Weingast B (eds) The politics of financial development. Stanford University Press, California

Barth JR, Caprio G, Levine RE (2008) Bank regulations are changing: for better or worse? World Bank Policy Research Working Paper, 4646

Barth JR, Lin C, Ma Y, Seade J, Song FM (2010) Do bank regulation, supervision and monitoring enhance or impede bank efficiency? http://dx.doi.org/10.2139/ssrn.1579352

Basu S, Fernald JG (2001) Why is productivity procyclical ? Why do we care ? In: Dean ER, Harper MJ, Hulter CR (eds) New developments in productivity analysis. University of Chicago Press/NBER, Chicago, pp 225–301

Beck T, Demirgüç-Kunt A, Levine R (2006) Bank supervision and corruption in lending. J Monetary Econ 53:2131–2163

Berger AN (2007) International comparisons of banking efficiency. Finan Market Inst Instrum 16(3):119–144

Berger AN, Humphrey DB (1997) Efficiency of financial institutions: international survey and directions for future research. Eur J Oper Res 98:175–212

Berger AN, DeYoung R, Genay H, Udell GF (2000), Globalization of financial institutions: evidence from cross-border banking performance, Brookings-Wharton Papers on Financial Services, 3

Berger AN, Buch CB, DeLong G, DeYoung R (2004) Exporting financial institutions management via foreign direct investment mergers and acquisitions. J Int Money Finan 23:333–366

Berger AN, Hasan I, Zhou M (2010) The effects of focus versus diversification on bank performance: evidence from Chinese banks. J Bank Finan 34:1417–1435

Boisso D, Grosskopf S, Hayes K (2000) Productivity and efficiency in the US: effects of business cycles and public capital. Reg Sci Urban Econ 20:663–681

Cerruti E, Dell’Ariccia G, Peria MSM (2007) How banks go abroad: branches or subsidiaries? J Bank Finan 31:1669–1692

Charnes A, Cooper WW, Rhodes E (1978) Measuring the efficiency of decision making units. Eur J Oper Res 2:429–444

Clark AJ, Siems TF (2002) X-efficiency in banking: looking beyond the balance sheet. J Money Credit Bank 34:987–1013

CSSF (2009) Annual Report

Curi C, Guarda P, Zelenyuk V (2011) Changes in bank specialization: comparing foreign subsidiaries and branches in Luxembourg, Banque Centrale du Luxembourg Working Paper, 67

Debreu G (1951) The coefficient of resource utilization. Econometrica 19:273–292

Delis MD, Molineux P, Pasiouras F (2011) Regulations and productivity growth in banking: evidence from transition economies. J Money Credit Bank 43(4):735–764

Demirgüç-Kunt A, Laeven L, Levine R (2004) Regulations, market structure, institutions, and the cost of financial intermediation. J Money Credit Bank 36:593–622

DeYoung R, Roland KP (2001) Product mix and earnings volatility at commercial banks: evidence from a degree of total leverage model. J Finan Intermed 10:54–84

Dietsch M, Lozano-Vivas A (2000) How the environment determines banking efficiency: a comparison between French and Spanish industries. J Bank Finan 24:985–1004

Färe R, Zelenyuk V (2003) On aggregate Farrell efficiency scores. Eur J Oper Res 146(3):615–620

Färe R, Zelenyuk V (2007) Extending Färe and Zelenyuk. Eur J Oper Res 179(2):594–595

Farrell MJ (1957) The measurement of productive efficiency. J Royal Stat Soc [Ser A] 120(3):253–281

Grigorian DA, Manole V (2002) Determinants of commercial bank performance in transition: an application of data envelopment analysis, World Bank Policy Research Working Paper, 2850

Guarda P, Rouabah A (2006) Measuring banking output and productivity: a user cost approach to luxembourg data chapter 10. In: Bandyopadhyay PK, Gupta GS (eds) Measuring productivity in services: new dimensions. Icfai University Press, Hyderabad

Guarda P, Roubah A (2007) Banking output & price indicators from quarterly reporting data, Banque Centrale du Luxembourg Working Paper, 27

Hughes J, Mester LJ (1993) A quality and risk adjusted cost function for banks: evidence on the’too-big-to-fail-doctrine’. J Prod Anal 4:292–315

Hughes JP, Moon CG (1997), Measuring bank efficiency when managers trade return for reduced risk. Rutgers University, Department of Economics Working Paper, 1997-02-03

Inklaar R (2007) Cyclical productivity in Europe and the United States: evaluating the evidence on returns to scale and input utilization. Economica 74(296):822–841

Keeley MC (1990) Deposit insurance, risk, and market power in banking. Am Econ Rev 80:1183–1200

Kneip A, Simar L, Wilson PW (2008) Asymptotics and consistent bootstraps for DEA estimators in non-parametric frontier models. Econ Theory 24:1663–1697

Korostelev A, Simar L, Tsybakov A (1995) Efficient estimation of monotone boundaries. Ann Stat 23(2):476–489

Kwan SH (2006) The X-efficiency of commercial banks in Hong Kong. J Bank Finan 30:1127–1147

Lensink R, Meesters A, Naaborg I (2008) Bank efficiency and foreign ownership: do good institutions matter? J Bank Finan 32:834–844

Li Q (1996) Nonparametric testing of closeness between two unknown distribution functions. Economet Rev 15(3):261–274

Lozano-Vivas A, Pasiouras F (2010) The impact of non-traditional activities on the estimation of bank efficiency: international evidence. J Bank Finan 34:1436–1449

IMF, Luxembourg: 2009 Article IV Consultation—Staff Report; Public Information Notice on the Executive Board Discussion; and Statement by the Executive Director for Luxembourg, IMF Country Report No. 09/178

Markusen JR (1995) The boundaries of multinational enterprises and the theory of international trade. J Econ Perspect 9(2):169–189

Mercieca S, Schaeck K, Wolfe S (2007) Small European Banks: benefits from diversification? J Bank Finan 31:1975–1998

OECD (2008) Luxembourg, OECD Economic Surveys, vol. 2008/12

OECD (2010) Luxembourg, OECD Economic Surveys, vol. 2010/5

Park YS, Essayyad M (1989) International banking and financial centers. Kluwer Academic Publishers, Boston

Park BU, Simar L, Zelenyuk V (2008) Local likelihood estimation of truncated regression and its partial derivatives: theory and application. J Econ 146:185–198

Park BU, Jeong S-O, Simar L (2010) Asymptotic distribution of conical-hull estimators of directional edges. Ann Stat 38(3):1320–1340

Pasiouras F, Kosmidou K (2007) Factors influencing the profitability of domestic and foreign commercial banks in the European Union. Res Int Bus Fin 21:222–237

Pasiouras F (2008) International evidence on the impact of regulation and supervision on banks’ technical efficiency: an application of two-stage data envelopment analysis. Rev Quant Financ Acc 30:187–223

Pasiouras F, Tanna S, Zopounidis C (2009) The impact of banking regulations on banks’ cost and profit efficiency: cross-country evidence. Int Rev Finan Anal 18(5):294–302

Pozzolo AF (2009) Bank cross-border mergers and acquisitions: causes, consequences, and recent trends, in the changing geography of banking and finance. Springer, US

Rime B, Stiroh KJ (2003) The performance of universal banks: evidence from Switzerland. J Bank Finan 27:2121–2150

Roubah A (2002) Economie d’echelle, economies de diversification et efficacité productive des banques luxembourgeoises: une analyse comparative des frontières stochastiques sur données en panel, Banque Centrale du Luxembourg Working Paper, 3

Sealey CW Jr, Lindley JT (1977) Inputs, outputs, and the theory of production and cost at depository financial institutions. J Finan 32:1251–1266

Simar L, Wilson PW (2007) Estimation and inference in two-stage, semi-parametric models of production processes. J Econ 136(1):31–64

Simar L, Wilson PW (2010), Two-stage DEA: caveat emptor, Université Catholique de Louvain Discussion Paper, 1041

Simar L, Zelenyuk V (2007) Statistical inference for aggregates of Farrell-type efficiencies. J Appl Econ 22(7):1367–1394

Simar L, Zelenyuk V (2010) Stochastic FDH/DEA estimators for frontier analysis. Discussion paper 0820, Institut de Statistique, UCL, in press, J Product Anal

Stiroh KJ (2004) Diversification in banking: is noninterest income the answer? J Money Credit Bank 36:853–882

Stragiotti F, Rychtarik S (2009) Liquidity risk monitoring framework: a supervisory tool, Banque centrale du Luxembourg Working Paper, 43

Sturm JE, Williams B (2004) Foreign bank entry, deregulation and bank efficiency: lessons from the Australian experience. J Bank Finan 28:1775–1799

Sturm JE, Williams B (2008) Characteristics determining the efficiency of foreign banks in Australia. J Bank Finan 32:2346–2360

Sturm JE, Williams B (2009) Foreign bank efficiency in Australia: what makes a difference? Manag Fin 35(2):180–201

Sturm JE, Williams B (2010) What determines differences in foreign bank efficiency? Australian evidence. J Int Finan Markets, Inst Money 20:284–309

Sufian F, Majid MZA (2007) Deregulation, consolidation and banks efficiency in Singapore: evidence from an event study window approach and Tobit analysis. Int Rev Econ 54(2):261–283

Thompson R, Dharmapala P, Thrall R (1993) Importance for DEA of zeros in data, multipliers, and solutions. J Product Anal 4:379–390

Tschoegl AE (2000) International banking centers, geography, and foreign banks, Financial Markets, Institutions & Instruments, 9, 1

Walter I (1985) Barriers to trade in banking and financial services. London: Trade Policy Research Centre, Thames Essay, no 41

Yildirim HS, Philippatos G (2007) Restructuring, consolidation and competition in Latin American banking markets. J Bank Finan 31(3):629–639

Zelenyuk V, Zheka V (2006) Corporate governance and firm’s efficiency: the case of a transitional country, Ukraine. J Product Anal 25:143–157

Acknowledgments

The authors are grateful for comments from participants at the International Workshop on Efficiency and Productivity in honour of Professor Knox Lovell, 4-5 October 2010, and participants at the PERFILUX final conference, 28-29 March 2011. We thank Aljar Meesters, Jean-Pierre Schoder and two anonymous referees for their valuable and insightful suggestions. Financial support from the Luxembourg Fonds National de la Recherche through the PERFILUX project is gratefully acknowledged. Ana Lozano-Vivas acknowledges financial support from Ministerio de Ciencia e Innovación, Dirección General de Programas y Transferencia de Conocimiento, grant reference ECO2008-04424. Any remaining errors are solely our responsibility. The opinions expressed in this paper are those of the authors and do not necessarily reflect the view of their institutions.

Author information

Authors and Affiliations

Corresponding author

Appendix

Rights and permissions

About this article

Cite this article

Curi, C., Guarda, P., Lozano-Vivas, A. et al. Is foreign-bank efficiency in financial centers driven by home or host country characteristics?. J Prod Anal 40, 367–385 (2013). https://doi.org/10.1007/s11123-012-0294-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11123-012-0294-y

Keywords

- Foreign bank efficiency

- Home-host country characteristics

- Bank regulation

- Data envelopment analysis

- Bootstrap