Abstract

Studies regarding new venture success and failure are at the forefront of entrepreneurship research. While individual factors are extensively investigated and revealed as antecedents of new venture success, organizational and environmental factors are rather underrepresented in research. Especially a missing market need or a mistimed market entry are shown in practical surveys to be key determinants of new venture failure. However, research has rarely incorporated these aspects. This study aims to extend research on new venture success by investigating the effects of new venture market entry timing. Furthermore, we differentiate the timing effects depending on the geographical context. To this end, we analyze data of more than 700 European new ventures that focus on important technologies. Combining the concepts of the diffusion of innovations and technology acceptance, we argue that the amount of new ventures, covering a certain technology over time, proceeds as a technology wave. Building on these technology waves, this study shows that the timely positioning of new ventures within those waves determine their success. Moreover, building on uncertainty avoidance literature, we reveal that the aforementioned relation varies depending on the uncertainty avoidance level of a geographical region. We find the temporal distance to the peak of a technology wave to be a significant antecedent of new venture success. Whereas this negative relationship is mitigated by below median uncertainty avoidant regions, new ventures in contexts of above median uncertainty avoidance are likely to show a lower success. With these results, we contribute to entrepreneurship and technology acceptance literature.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Entrepreneurs and their corresponding new ventures are essential for fostering innovation and for creating value for countries (Minniti and Lévesque 2010; Valliere and Peterson 2009). The realization of innovative ideas leads to the formation of organizations, creates new jobs, and boosts economic growth (e.g., Baumol 1993; Davidsson and Wiklund 2001; McGrath 1999; Robinson and McDougall 2001). New technology-based ventures that generate technological innovations especially drive entrepreneurship (Audretsch 1995; Kellermanns and Eddleston 2006; Shane 1993). Hence, entrepreneurship is inevitable for economic growth and for society. Despite the economic importance, many new ventures struggle to survive in the long-term. The majority of newly founded firms are out of business within the first 3–5 years (Eckhardt and Shane 2011; Gao et al. 2010; Song et al. 2010). In particular, new technology ventures struggle to survive and also exhibit the lowest survival rates among new ventures in general (Song et al. 2008).

Accordingly, factors and circumstances that influence new venture success and failure are at the forefront of entrepreneurship research. Traditional entrepreneurship literature mainly examines individual attributes of entrepreneurs (Gartner 1988; Garud and Karnøe 2003), such as behavioral and cognitive aspects (e.g., West 2007) or prior experience and knowledge (Carroll and Mosakowski 1987; Li et al. 2012; Shane and Stuart 2002; Unger et al. 2011). Besides individual factors, organizational and environmental factors are indicated to influence new venture success. Research in this context shows that certain factors, such as market scope, firm age, size of founding team, and financial resources impact new venture success (e.g., Song et al. 2008; Stucki 2014). While research already shows extensive insights about how individuals and founding teams influence new venture success, studies covering organizational and environmental factors remain rather scarce.

A lack of market need or a mistimed market entry are major reasons for new venture failure. A recent study indicates that a lack of market need in general or as a result of a mistimed market entry, is one of the most dominant reasons for new venture failure (e.g., CB Insights 2018). Napster, for example, tried to establish the first music-streaming platform around the beginning of the new millennium (Webb et al. 2009). Internet bandwidth and speed were very limited at this time, and consequently, customers did not adopt the new offering (Bartsch 2017). The later success of Spotify shows that under better technological conditions a general market need is given. This is only one practical example out of a long list, indicating that not the idea in general, rather a wrong timing triggered new venture failure. In contrast, studies frequently state that companies, which enter the market very early, can achieve a first-mover advantage (Barney 1991; Kollmann et al. 2017; Lieberman and Montgomery 1988). However, studies investigating the market entry timing and the effect on new venture success are limited, sometimes even contradicting (e.g., Bonnet and Wirtz 2012; Dobrev and Gotsopoulos 2010; Greve and Seidel 2015; Kollmann et al. 2017). By adding the factor of time, we aim to approach a more sophisticated perspective on new venture success literature.

We extend research on new ventures by investigating the effects of new venture market entry timing and new venture success. Applying the concepts of diffusion of innovations (Rogers 2003) and technology acceptance (Davis 1989) on entrepreneurs, we argue that their new ventures accept and make use of new technologies similar to users. Analogical to the diffusion of innovations, the amount of new venture creations focusing on a certain technology proceeds as bell curve over time, which we refer to as a ‘technology wave’. We hypothesize that a new venture’s market entry timing within a technology wave influences its success. At the beginning of a technology wave, stakeholder (e.g., investors) behave risk and uncertainty-averse, which is the result of missing information that creates a legitimacy vacuum for new technologies (Dobrev and Gotsopoulos 2010). With increasing technology acceptance and information distribution, risk and uncertainty diminish over time. However, the saturation and the resulting competition increases with more and more new ventures entering the market, which in turn leads to higher investment risks. Taken together, we argue that new venture market entry timing (i.e., higher temporal distance to technology wave peak) negatively affects new venture success. Moreover, based on the concept of uncertainty avoidance, we argue that geographical uncertainty avoidance influences the willingness to take risks. Regions that are characterized by lower or higher uncertainty avoidance are hypothesized to mitigate or intensify the negative relationship between new venture timing and new venture success.

We contribute to the entrepreneurship literature by extending research on new venture success. Timing is an important, but so far underrepresented organizational factor, which helps to better understand the high failure rates of new ventures. We link the user-centric concepts of diffusion of innovations and technology acceptance and argue that similar logics can be used to conceptualize firm-centric technology waves, which depict the amount of technology new venture formations. The position of a focal new venture within a technology wave is revealed to influence its success. Moreover, we add the geographical context as an environmental factor that determines new venture success. Knowing the timing effect and the influence of geographical uncertainty avoidance tendencies, new ventures have to carefully consider their market entry timing and the location of their new venture formation.

2 Theory and hypotheses

2.1 Entrepreneurship and new venture success

Entrepreneurship is vital to the progress of every economy and society. In particular, entrepreneurship is commonly regarded as a crucial engine to drive innovation in products and services (Schumpeter 1934) and as the reason why new ventures emerge (Hitt et al. 1999; Langlois 2007; Robinson and McDougall 2001). Identifying new products, new markets, new ways of organizing, and new processes in response to technological change build the foundation of every entrepreneurial concept (Eckhardt and Shane 2011; Schumpeter 1934). The awareness that such activities have profound effects on employment and economic growth (e.g., Baumol 1993; McGrath 1999) is a major reason for the increased interest in entrepreneurship (Davidsson and Wiklund 2001; Minniti and Bygrave 1999). Research shows that entrepreneurship contributes especially to economic growth in higher-income countries (Acs and Amorós 2008; Carree and Thurik 2008; Minniti and Lévesque 2010; Valliere and Peterson 2009). In this vein, Audretsch and Keilbach (2008) reveal that entrepreneurial activities foster economic performance and growth, especially in knowledge-intensive industries. Indeed, not all entrepreneurial activities (e.g., rent seeking) promote economic growth (Baumol 1990). Nevertheless, high-expectation or high-growth-potential entrepreneurial activities, particularly in the form of ambitious high-technology new ventures (Terjesen et al. 2016), foster economic growth (Terjesen et al. 2016; Valliere and Peterson 2009; Wong et al. 2005). Therefore, novelty rising from technological innovations, and the resulting value creation for the economy, are central aspects of entrepreneurship (Davidsson and Wiklund 2001).

Entrepreneurship can be described along a process, which starts with a simple idea and ideally ends in a well-functioning, successful new venture. While for a long time researchers defined the field of entrepreneurship only in respect to entrepreneurs and their actions, recent academic research has focused on various aspects of the entrepreneurial process (e.g., Eckhardt and Shane 2003; Shane and Venkataraman 2000; Venkataraman 1997). An entrepreneurial process generally consists of the stages discovery and/or creation, evaluation, and exploitation of entrepreneurial opportunities (e.g., Grichnik 2006; Shane and Venkataraman 2000; Short et al. 2010). Focusing on how these entrepreneurial opportunities are triggered through innovations, recently a new research stream emerged: technology entrepreneurship (Beckman et al. 2012a). Technology entrepreneurship “focuses on new ventures where developments in science or engineering constitute a core element of the entrepreneurial opportunity” (Beckman et al. 2012b: 203). These developments typically require various actors that ultimately shape an emerging technology, for instance in the discovery or creation stage (Garud and Karnøe 2003). Although the beginning of an entrepreneurial process can be shaped by either an individual entrepreneur or various actors, both types ideally result in the creation of a new venture. Unfortunately, most of the newly created ventures fail during the first years and only a few are able to achieve long-term success (e.g., Song et al. 2008, 2010).

The question of ‘why some new ventures are successful and manage to grow, while the majority does not’, is central to the field of entrepreneurship (e.g., Davidsson et al. 2006; Delmar et al. 2003; Eckhardt and Shane 2011). Traditional entrepreneurship literature mainly refers the success and failure of new ventures to individual attributes (Gartner 1988; Garud and Karnøe 2003). For instance, various behavioral and cognitive aspects of entrepreneurs and the corresponding founding teams, that undergo the entrepreneurial process, influence the success of new ventures. West (2007), for example, analyzed a sample of new ventures in three technology-based industries and reveals an U-shaped relationship between collective cognition and new venture performance. Highly uniform views as well as extremely divergent views among top management team members negatively affect new venture performance, while a balanced level of differencing opinions in the top management team leads to higher performance (West 2007). Moreover, research indicates that founders’ knowledge and experience shape new venture performance (Carroll and Mosakowski 1987; Li et al. 2012; Shane and Stuart 2002; Unger et al. 2011). Delmar and Shane (2006) test the effect of founding team industry and new venture experience on the survival and sales rates of 223 new ventures in Sweden. The authors indicate that founding team experience enhances new venture success, even though these effects are non-linear and might vary with venture age (Delmar and Shane 2006). Dencker and Gruber (2015) further specify the industry aspect and reveal that different industries show different risk and opportunity potentials, hence, new venture performance potentials depend on the industry in which the venture is founded. To gain a more profound picture of the aspect of prior experience, Eesley and Roberts (2012) differentiate between entrepreneurial talent and founding experience in order to examine their relative effects on new venture performance. The authors indicate that experience enhances new venture performance when the market or technology is familiar (Eesley and Roberts 2012). Entrepreneurial talent, in contrast, becomes effective when the new venture’s context is unfamiliar (Eesley and Roberts 2012). Moreover, entrepreneurs with high levels of social capital, such as networking ability, are more successful because the founders’ professional social networks provide required means, such as information and resources (Shane and Stuart 2002; Sigmund et al. 2015; Spiegel et al. 2016).

Besides individual factors, organizational and environmental factors are indicated to influence new venture success. Market scope, firm age, size of founding team, financial resources, and the existence of patent protection impact new venture success (Song et al. 2008). In particular, financial constraints negatively impact firm survival (Stucki 2014). In contrast, the degree of novelty of a business idea positively influences new venture success (Shepherd et al. 2000). Song and colleagues (2010) confirm this relationship and show that products based on ideas that reflect both, technology development and an analysis of customer needs, correlate with new venture success. Nevertheless, organizational and environmental factors seem underrepresented in research. While research already shows insightful guidance how individual and founding team characteristics influence new venture success, studies covering organizational and environmental factors remain rare. Therefore, a holistic research agenda is still missing and current literature calls for research on these factors (von Briel et al. 2018; Davidsson 2015; Nambisan 2017; Ramoglou and Tsang 2016). Especially new concepts, such as technology acceptance (e.g., Kohl et al. 2018) and diffusion of innovations (Compagni et al. 2015; Rogers 2003) seem promising to better understand why some firms establish their technology in the market and hence survive, while most fail.

2.2 Diffusion of innovations and technology acceptance

According to Rogers (1962, 1995, 2003), the diffusion of an (technological) innovation proceeds as a bell curve over time. At the very beginning of a technology’s introduction, only a few ‘innovators’ engage with the new technology. Their risk tolerance allows them to adopt technologies that may ultimately fail, as abundant financial resources help them to tolerate these failures (Rogers 2003). Afterwards, ‘early adopters’ accept the new technology. They are more discreet in adoption choices than innovators but still exhibit a high social status, financial liquidity, and advanced education (Rogers 2003). In the subsequent passage of time, the ‘early majority’, which have an above average social status, becomes willing to adopt to the new technology (Compagni et al. 2015; Rogers 2003). At the end of the early majority group, the assumed bell curve reaches its peak level. After the peak of diffusion, the ‘late majority’ and the ‘laggards’ adopt to the technology. While the late majority approaches an innovation with a high degree of skepticism, laggards show an aversion towards change (Rogers 1962, 2003). Following the temporal diffusion, the adoption of a technological innovation can be depicted as a bell curve over time. Current research frequently adopts this model and investigates factors that foster or hinder the diffusion of innovations (e.g., Chong et al. 2012; Wang et al. 2016). In this context, technology acceptance is revealed as a promising factor that promotes the diffusion of technology enabled innovations (e.g., Chong et al. 2012; Davis 1989; Wang et al. 2016).

The Technology Acceptance Model proposes that two particular beliefs, ‘perceived usefulness’ and ‘perceived ease of use’, are of primary relevance in order to understand why individuals accept or reject new technologies (Davis et al. 1989; Hwang 2005; Venkatesh et al. 2016). Perceived usefulness refers to “the degree to which a person believes that using a particular system would enhance his or her job performance” (Davis 1989: 320). Perceived ease of use, in contrast, refers to “the degree to which a person believes that using a particular system would be free of effort” (Davis 1989: 320). Perceived usefulness and perceived ease of use determine the strength of the ‘behavioral intention’ to use a technological innovation, which ultimately leads to its actual usage (Davis 1989; Miltgen et al. 2013). Consequently, if individuals belief that the use of a certain technology might not enhance their job performance or involves too much time and effort, the spread of a technological innovation is impeded (Davis 1989; Miltgen et al. 2013). Moreover, researchers emphasize the importance of ‘risk perception’ for user acceptance (for a review, see Venkatesh et al. 2016). Siegrist (2000), for example, indicates that trust influences risk perception, which in turn, directly influences technology acceptance. Testing the relation of risk perception and technology acceptance for different technological innovations, Miltgen and colleagues (2013) confirm that privacy risk is important for end-user acceptance of biometrics. Similarly, Martins and colleagues (2014) verify that risk perception is an important factor for internet banking. Thus, the Technology Acceptance Model comprises further determinants that influence individuals’ decision to accept and adopt a new technology and, consequently, contribute to its diffusion.

Technology acceptance and the diffusion of innovations are both user-centric models that explain how individual user accept and adopt new technological innovations. However, considering a firm-centric view, the question arises how entrepreneurs accept and adopt new technologies and, consequently, make use of these technologies through new venture formations. We argue and conceptualize that arguments of the user-centric concepts of diffusion of innovations and technology acceptance can be transferred to a firm-centric perspective, especially in the context of new ventures. New ventures are mainly characterized by its entrepreneur as an individual, in contrast to established organizations with long histories, routines, and path dependencies (Hannan and Freeman 1984; Leonard-Barton 1992). Therefore, arguments explaining individual acceptance of technologies and the subsequent diffusion of innovations seem applicable to entrepreneurs and their new ventures.

We argue that the technology acceptance of entrepreneurs leads to a diffusion of technological innovation through new venture formations. The early stage of emerging technologies is accompanied by great uncertainty regarding the technology’s future success (Kohl et al. 2018). Perceived usefulness and ease of use are hard to estimate a priori for entrepreneurs and the lack of information about technology acceptance of potential customers will increase the perceived risk (Geroski 2000). Only entrepreneurs with a high risk tolerance will accept the new technology and thus create a new venture. The initial creation of some new ventures that engage in the new technology will lead to first customers, which hazard the consequence of technological failure and adopt to new technologies in early stages. Innovative entrepreneurs seek to attract innovative customers for the initial acceptance and diffusion of the new technology. Subsequently, as a rising number of customers use the new technology, information and experiences about the usefulness and ease of use becomes more readily available (Geroski 2000; Greve and Seidel 2015). With decreasing perceived risk, technology acceptance increases, which in turn, attracts early adopting customers (Siegrist 2000). An increasing amount of customers heightens the technology and market attractiveness, which leads to a rising number of new venture formations that focus on the technology. This mechanism of decreasing risk perception, increasing information about the usefulness, and increasing technology acceptance will persist and, consequently, attract more and more customers. An increasing amount of new ventures tries to satisfy the demand. With the majority of the general public accepting and adopting the technology, the diffusion of the innovation reaches its peak. This environment leads to the time where most new ventures emerge in the market.

However, the increasing emergence of new ventures also fosters competition, which mitigates the market attractiveness. After the peak of diffusion, even individuals that display a high risk aversion finally start to accept the technology, until the technology is completely diffused (Davis et al. 1989). Yet, at this stage, the amount of customers only increases at a decreasing rate (Davis et al. 1989). Since existing ventures also try to grow further within the existing market, rivalry increases among competitors, which lowers market attractiveness. Consequently, a decreasing amount of new ventures enters the market.

Taken together, we propose that the creation of new ventures (i.e., amount of new ventures focusing on a certain technology) proceeds as a bell curve over time, henceforward referred to as a ‘technology wave’. Figure 1 illustrates selected technology waves. However, how the position of a focal new venture within a technology wave influences its success remains unclear.

2.3 Market entry timing and new venture success

New ventures entering the market very early face a legitimacy vacuum for the focused new technology and, consequently, are less successful. At the beginning of a technology wave, new ventures face no or only few competition and can profit from a period of monopoly until the entrance of competitors (Choi and Shepherd 2004). Prior studies link new ventures that enter a market very early to a first-mover advantage (Barney 1991; Kollmann et al. 2017; Lieberman and Montgomery 1988). However, at an early stage, new ventures are typically characterized by low information density, resulting from venture size and age (Dos Santos et al. 2011), thus facing a ‘liability of newness’ (Dobrev and Gotsopoulos 2010; Tucker et al. 1986). New ventures mostly cannot provide past financial information, as required by most investors (Waleczek et al. 2018). Investors need to trust in the success of a business idea and abilities of the entrepreneur or the belonging team without having a true guarantee of the new venture’s competence and financial development (Waleczek et al. 2018). This condition itself leads to investor hesitation. Furthermore, investing in new technologies poses an additional risk, as technology acceptance and, consequently, innovation diffusion remains unclear (Kohl et al. 2018). The combination of a liability of newness and the differentness to established technologies creates a legitimacy vacuum (Dobrev and Gotsopoulos 2010; Kimberly 1979). This legitimacy vacuum is accompanied by an increased investors risk and hence, lower possibilities of funding (Dobrev and Gotsopoulos 2010). Consequently, new ventures entering the market at the beginning of a technology wave are indicated to be less successful.

New ventures that enter the market around the peak of a technology wave are argued to show higher success rates. After some time, the infrastructure develops and a rising number of new ventures adapt the technology. As initial and early adopters share their experience, the perceived usefulness and the perceived ease of use progressively become apparent to the public (Geroski 2000; Greve and Seidel 2015). Information is distributed among all stakeholders, the associated uncertainty and risk decrease gradually, and technology acceptance rises, which in turn, heightens the legitimacy for new ventures focusing on a new technology (Dobrev and Gotsopoulos 2010). Increasing legitimacy paves the way for important resources that are essential for new venture success (Bitektine and Haack 2015; Suchman 1995). Thus, new ventures that enter the market around the peak of a technology wave are indicated to have the highest chances of success.

New ventures that enter the market after the peak of a technology wave are likely to show lower success. While these new ventures can build upon increased technology acceptance, legitimacy, and consequently, reduced uncertainties (Geroski 2000), the late positioning also bears major challenges. The competition within the market is high and new ventures struggle to compensate for the time advantage of competitors, who entered the market at an earlier stage and arises from already set standards, gained reputation, or increased switching costs (Lieberman and Montgomery 1988). Based on the market saturation, fewer customers will engage with the new venture and again, investors perceive a rising investment risk. Thus, new ventures entering the market at the end of a technology wave are indicated to be less successful.

Taken together, we hypothesize that a new venture’s position within a technology wave (i.e., market entry timing) influences its success. At the beginning of a technology wave, new ventures are hypothesized to show lower success, because of a legitimacy vacuum and risk-averse stakeholders. The more the technology is accepted, the more legitimacy for new ventures emerges, which heightens the possibility of new venture success. However, rising competition and market saturation increases the investment risk again. Hence, new ventures entering the market at the end of a technology wave are hypothesized to show lower success. Combing these effects, we argue that the temporal distance (i.e., timely distance of market entry to technology wave peak) negatively affects new venture success. Put formally:

Hypothesis 1

The higher the temporal distance (between market entry timing and the peak of technology wave), the lower the new venture success.

2.4 Geographical uncertainty avoidance tendencies

Entrepreneurial activity differs between geographical contexts. According to institutional theory, organizations are influenced by the society in which they operate (DiMaggio and Powell 1983; Granovetter 1985). Consequently, organizational behavior reflects societal values and attitudes, e.g., towards authority, trust, communication, participation, or uncertainty (Tayeb 1988). In this vein, Kanter (1983) reveals that different organizational behavior influences the rate of innovation generation and adoption. As organizational behavior is shaped by individuals, cultural differences can explain national differences in innovation rates and entrepreneurial activities (Cullen et al. 2014; Shane 1993). In particular, the rates of innovation are most closely associated with the cultural value of uncertainty avoidance (Shane 1993). Uncertainty avoidance generally refers to a society’s tolerance towards the unknown, their resistance to change, and risk aversion (Hofstede 1980, 2001).

Uncertainty avoidance varies depending on the geographical context and thus determines regional new venture activities. Research shows that uncertainty avoidance has a significant negative influence on risk-taking levels on an organizational level (Gartner et al. 2008; Kreiser et al. 2010). On an individual level, low uncertainty avoidance leads individuals to develop a greater willingness to take risks (Hofstede 1980). Table 1 shows the country-specific uncertainty avoidance index (Hofstede 2015). As illustrated, uncertainty avoidance varies among countries, which influences the society’s willingness to take risk, and therefore, the engagement with new ventures.

Based on geographical uncertainty avoidance, the geographical context moderates the relationship between new venture timing and new venture success. Transferring cultural dimensions to the Technology Acceptance Model, Hwang (2005) reveals that uncertainty avoidance of users influences the perceived usefulness and ease of use of technologies. Individuals from uncertainty avoiding societies are more restrained to accept new technologies (Hwang 2005). Given the high uncertainty and risk at the beginning as well as the high risk at the end of a technology wave, individuals from uncertainty avoiding cultures are less likely to engage with new ventures. The level of uncertainty avoidance in a certain region, is likely to moderate technology acceptance of customers and investors, and hence, new venture success. More precisely, regions that are characterized by lower uncertainty avoidance are likely to mitigate the relationship between new venture timing and new venture success. In contrast, regions that are characterized by higher uncertainty avoidance are likely to intensify the relationship between new venture timing and new venture success. Put formerly:

Hypothesis 2

The relationship between new venture timing and new venture success is mitigated in regions of low uncertainty avoidance and intensified in regions of high uncertainty avoidance.

3 Method and data

3.1 Sample

We test our hypotheses using a European sample of 727 new ventures. In doing so, we first collected technologies of the last decades that significantly shaped our economic landscape, such as 3D printing, cloud computing, or near field communication. To validate our identified technologies, we compared our results with technologies listed in established models and literature, e.g., the Gartner Hype Cycle or the MIT Technology Review. In total, we identified 39 technologies. Second, we collected data of European new ventures listed in CrunchBase (www.CrunchBase.com). CrunchBase is a public database that provides a substantial overview of technology-related venture creations, including information about founding year, headquarter location, industrial sector, number of employees, number of financing rounds received as well as the amount raised. Third, we matched the identified technologies with the ventures represented in CrunchBase.

3.2 Dependent variable

New venture success, captured as number of funding rounds, serves as our dependent variable. Success variables, such as sales, return on assets, market capitalization, or value-based models, are established measurements that are frequently used to measure firm performance (Short et al. 2009). In entrepreneurship research, these measurements are difficult to apply, as new ventures are typically reluctant to provide such sensitive data and usually are not profitable yet. When deriving data from interviews or surveys, self-reported performance measures like sales, sales scores (e.g., Gao et al. 2010), or revenue growth (e.g., Sigmund et al. 2015) are commonly used. However, using self-reported performance measures is challenging for scholars that investigate new venture success on a large scale (Chandler and Hanks 1993; Su et al. 2015). Consequently, alternative measures have to be used to depict new venture success. Research shows that new venture performance is positively influenced by the ability to acquire resources (Cai et al. 2014). In particular, financial resources and thus the funding that a new venture can acquire plays a decisive role for its survival and success (Alexy et al. 2012; Audretsch et al. 2012; Croce et al. 2018; Mann and Sager 2007). Especially new ventures that operate in high-tech sectors typically require several funding rounds at short intervals of time in order to develop and commercialize their products and services (Gompers 1995; Ter Wal et al. 2016). Various founding rounds signal trust and belief in new ventures and the technological innovation, as investors can evaluate and terminate the investment after each round. Thus, prior studies reveal number of founding rounds to be an adequate proxy for new venture success (Gompers and Lerner 2001; Mann and Sager 2007). Following this approach, we operationalize new venture success as the venture’s ability to attract various funding rounds. We operationalize additional new venture success variables to underline our selected measure, as discussed in the robustness section.

3.3 Independent variables

3.3.1 Time to peak

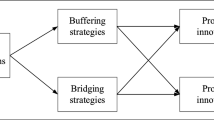

We calculated the market entry of a new venture in relation to the peak of a technology wave as our independent variable. As illustrated in Fig. 1, the amount of new ventures, covering certain technologies proceed as technology waves. The peak of a technology wave is defined as the year with the most new venture formations focusing on a particular technology. To avoid inaccuracies, we only included completed technology waves. In sum, we used 17 technologies as displayed in the Appendix. Following our hypothesis that new ventures are more likely to be successful when they found their business around the peak of a technology wave, we calculated the temporal distance between every new venture’s founding date and the peak of the technology wave to which they contribute. We used the absolute time distance to test positive and negative deviations within one model. Figure 2 illustrates the operationalization of our independent variable. Again, we performed additional tests to underline the robustness of our technology wave operationalization, as discussed in the robustness section.

3.3.2 Geographical context as moderator

Geographical context, operationalized as a dummy variable, serves as our moderating variable. To test our hypothesis that the geographical context of new ventures and its stakeholders moderates the chances of success, we identified two different areas in our sample. Following Hofstede’s (2015) classification, Table 1 presents the values of all countries that were included in our sample. We used countries with lower uncertainty avoidance than the median of our sample as regions that are characterized by low uncertainty avoidance. Consequently, the dummy variable equals the value 1 if the new venture’s headquarter is located in a region with below median uncertainty avoidance and 0 for regions with above median uncertainty avoidance.

3.3.3 Controls

We controlled for numerous factors that have been revealed in prior studies to influence new venture success. First, we controlled for firm age, because newly-founded firms have had less time to acquire various funding rounds (Schmidt et al. 2018). We used the natural logarithm of firm age (e.g., Justo et al. 2015). Second, we controlled for firm size, as research shows that firm size influences new venture survival (Sigmund et al. 2015). As CrunchBase only provides intervals (e.g., ‘1–10’, ‘11–50’, and so forth) of employees, we had to code the given intervals as consecutive numbers to measure firm size. We used the natural logarithm of this coding (e.g., Shu et al. 2014; Stam and Elfring 2008). Third, we included founding team size as the number of founders, because team size is an important indicator of the human capital available in a new firm (Dencker and Gruber 2015; Gruber et al. 2008; Song et al. 2008). Fourth, we incorporated the total funding amount a new venture has received so far as an indicator of its previous development (Croce et al. 2018). Fifth, we included the annual total venture capital that was invested in Europe, in order to control for years where the general capital market was exceedingly high in volume. Due to missing data and rather short time periods that report the total European venture capital amount, we aim to create a control variable that is less sensitive to inaccuracies. We divided the total venture capital in a focal year by the average venture capital per year over the complete time-horizon. The control variables maintain the calculated value when the result exceeds the average venture capital and were set one otherwise. Thus, the variable controls for years with over-proportionally high amounts of venture capital in the market. Sixth, we controlled for multiple assignments, because new ventures can focus on more than one technology. Seventh, the focused technology in general can influence a new venture’s long-term success (Dencker and Gruber 2015). Despite the possibility of general failure of a technology’s diffusion, different technologies can vary in their cost intensity for new ventures and, consequently, affect new venture’s requirement for various funding rounds (Schmidt et al. 2018). In line with Block and Sandner (2009), we included technology dummies. Eighth, we controlled for the stage (e.g., seed stage, early-stage) the new venture was in (Croce et al. 2018) via capital series dummies. Ninth, we controlled for regional differences by including regional dummies (Alexy et al. 2012; Sorenson and Stuart 2001), as countries with a general higher provision of capital or structures that foster new venture creation might positively influence regional new venture funding and success. Lastly, we included year dummies to account for general business cycle effects that might influence the provision of capital (Alexy et al. 2012).

3.4 Model

A Poisson regression model seems generally appropriate, because our dependent variable, number of funding rounds, takes on non-negative integer values (count variable). However, a likelihood ratio test showed significant evidence of overdispersion, meaning that the conditional variance exceeded the conditional mean (Greene 2003). Consequently, we applied a negative binomial regression model to test our hypotheses. Negative binomial regression models generalize Poisson models by introducing an individual unobserved disturbance term (Hardin and Hilbe 2007; Hausman et al. 1984).

4 Results

Table 2 summarizes the statistics and pairwise correlation for the variables in our study. As the correlations between firm age and time to peak (β = 0.80), and firm age and venture capital intensity (β = – 0.87) are critically high, we had to remove firm age from the analysis. Notably, we received similar results after we excluded firm age. Apart from firm age, no critically high correlation is included in our model. Thus, multicollinearity is not supposed to be a problem in our model.

Table 3 shows the results of our negative binomial regression analysis on new venture success. Model 1 is the control model showing that firm size, the total funding amount, and multiple assignments have a significant influence on new venture success. The included technology dummies are significant for Data Center (β = – 0.834; p < 0.001) and QR Codes (β = – 0.617; p < 0.05), indicating that new ventures focusing on these technologies are generally less likely to be successful. Furthermore, the regional dummies of Norway (β = 0.435; p < 0.05), Sweden (β = 0.515; p < 0.05) and Latvia (β = 0.532; p < 0.05) are positively and significantly related to new venture success, while Luxemburg (β = – 0.428; p < 0.05) has a negative and significant impact. The year dummies are significant and positive for the years 2006, 2008, 2012, and 2014.

In Model 2, we test our Hypothesis 1, which indicates a negative relationship between time to peak and new venture success. The results show a negative (β = – 0.071) and significant (p < 0.01) relationship, hence, supporting our Hypothesis 1. Model 3 tests our Hypothesis 2 and reveals that the geographical context of low uncertainty avoidance has a positive (β = 0.037) and significant (p < 0.05) influence on the baseline hypothesis. Consequently, high uncertainty avoidance has a negative (β = – 0.037) and significant (p < 0.05) influence on the baseline hypothesis. Hence, the results support our Hypothesis 2. Figure 3 graphically depicts our results. Low uncertainty avoidance mitigates the baseline relationship, while high uncertainty avoidances intensifies the relationship between new venture timing and new venture success.

5 Additional robustness checks

We performed several additional tests to check the robustness of our results. To ensure robustness of our dependent variable, we used two alternative measurements of new venture success. First, in line with recent research (Croce et al. 2018), we operationalized new venture success via the total amount of funding raised by a new venture. Second, we used our firm size control variable as dependent variable and, thus, as an alternative success measurement (Chaganti et al. 2008; Ensley et al. 2006). We obtained similar results for total amount of funding (β = – 1,202,786; p < 0.05) and number of employees (β = − 0.048; p < 0.01) as dependent variable.

Furthermore, to ensure robustness of our independent variable, we used two alternative measurements to operationalize time to peak. First, patent data is a frequently used variable to measure overall innovation (Eckhardt and Shane 2011; Shane 1993). We collected the annual patent applications for each technology from the European Patent Office (www.epo.org). We identified the technology wave peak as the year with the highest increase in patent applications. Subsequently, we calculated the new venture’s position, in line with our main independent variable, as absolute time distance between new venture foundation and patent data peak. We obtained similar results (β = – 0.032; p < 0.05). Second, we operationalized the peak of a technology as the year with the highest media attention, as media coverage can be seen as a proxy for user-centric technology acceptance. To this end, we gathered data of the five major publishing houses in Europe, which are available in the Nexis database (www.nexis.com). We collected the amount of articles that referred to a specific technology every year and determined the peak of a technology as the year with highest media attention. We limited the search process to the five major publishing houses in Europe since over time more and more newspapers, internet references, and press agencies are added to the database, which are likely to distort the results. Relying on the same data source seems beneficial in order to measure the public attention upon a certain technology. We calculated the new venture’s position, in line with our main independent variable, as absolute time distance between new venture foundation and media attention peak. We obtained similar results (β = – 0.029; p < 0.05). Furthermore, to test the robustness of the selected publishing houses, we successively excluded one of the publishing houses from the variable. We obtained similar and, consequently, robust results.

Moreover, we ran two sub-sample analyses. First, in order to specifically compare the timing effect before and after the peak of a technology wave, we split the sample and tested the left side (before the peak of a technology wave) and the right side (after the peak of a technology wave) separately. Our results, confirm our main hypothesis, as the left side shows a positive and slightly significant relationship (β = 0.089; p < 0.1), while the right side exhibits a negative and significant relationship (β = – 0.217; p < 0.01). In addition, we examined the peripheral areas of the technology wave, namely the first 10% (i.e., front-runner) and the last 10% (i.e., laggards) of a technology wave in separate models. The results confirm our hypothesis. Front-runner show a positive and significant (β = 0.006; p < 0.001) and laggards a negative and significant relationship (β = – 0. 318; p < 0.05).

Second, we analyzed the technology waves for the various technologies in detail by running a sub-sample analysis. Most technologies show results in line with our main hypothesis. While most technologies support our hypothesis, a few technologies (Biometrics, Video on Demand, and QR Codes) do not follow this pattern. Notably, these technologies only show a limited number of observations. Nevertheless, as we were testing all technologies independently as well as leaving out every technology successively without considerable changes in our main effects, we are confident that our findings are not driven by a single technology.

6 Discussion

This study investigates the effect of new venture market entry timing and geographical context on new venture success. Based on the concepts of the diffusion of innovations and technology acceptance, we argue that the amount of new ventures over time, covering a certain technology, proceeds as a technology wave. Taking into consideration stakeholders’ perception of risk and uncertainty, fewer stakeholders engage with new ventures at the beginning and the end of a technology wave, which lowers the probability of new venture success. Our findings indicate that new ventures, which are founded around the peak of a technology wave, are more likely to be successful. Therefore, we reveal a negative linear relationship between time and peak within a technology wave and new venture success. Furthermore, we hypothesize and test the uncertainty avoidance level of geographical regions as a moderator, which mitigates or intensifies the baseline relationship. Our findings reveal that a low level of uncertainty avoidance weakens the relationship between new venture timing within a technology wave and new venture success. In contrast, regions that exhibit high uncertainty avoidance are shown to intensify the relationship between new venture timing within a technology wave and new venture success.

6.1 Theoretical and practical implications

Our study makes several contributions. First, we contribute to technology acceptance literature. By linking the concepts of diffusion of innovations and technology acceptance, we incorporate the important time dimension to better describe how new ventures accept and adopt new technologies over time (e.g., Chong et al. 2012; Davis 1989; Wang et al. 2016). As demanded by Chong and colleagues (2012), we measure the diffusion of technologies across time and investigate how adoptions changes at various stages of diffusion. We conceptualize that arguments of the user-centric concepts of diffusion of innovations and technology acceptance can be transferred to a firm-centric perspective, especially in the context of new ventures. In early stages, entrepreneurs accept a new technology, similar to users, and form their new venture around this technology. Thus, the formation of new ventures (i.e., amount of new ventures focusing on a certain technology) proceeds as a bell curve over time, namely a technology wave, as displayed in Fig. 1. Subsequently, we show that the diffusion of innovations and technology acceptance among new ventures and users proceed equally, as both are dependent on and reinforcing each other. This finding helps to understand the market dynamics of the interplay between new technologies and new venture formations. As requested by Venkatesh and colleagues (2016), we incorporate and clarify the time dimension in the Technology Acceptance Model, which helps to better understand user perceptions of technologies, especially their procedure over time.

Second, and equally important, we contribute to the entrepreneurship literature. Despite the strong academic interest in new venture success factors, most studies focus on individual characteristics of the entrepreneur (e.g., Delmar and Shane 2006; Gartner 1988; Garud and Karnøe 2003; Li et al. 2012). Organizational and environmental factors seem underrepresented in current research. Scholars have called for more consideration of factors, such as temporality in organizational theorizing (George and Jones 2000; Short and Payne 2008). We contribute to entrepreneurship literature by conceptualizing and testing time and geographical context as important antecedents of new venture success. Both antecedents significantly influence new venture success, and consequently, provide an answer to the initially raised question of ‘why some new ventures are successful and manage to grow, while the majority does not’.

Third, we contribute to literature by empirically testing the first-mover advantage in the context of new venture formations that focus on new technologies. Prior studies have suggested that firms can achieve higher market shares (Kerin et al. 1992) and an increased brand perception by customers (Kamins et al. 2007) when they are first to market with their new offering. While this might be true for technological innovations as well, a higher market share in the early stage of a new technology might not turn into an advantage for, at least, two reason: First, low technology acceptance and high risk perception of customers can result in a rather limited market size at the beginning of a technology wave. Therefore, a high market share does not necessarily lead to a performance advantage. Second, and related to the first argument, first-mover need to protect and sustain their initial market share until the market matures so that they can scale up their business model, and finally, become profitable. While this is already challenging for existing firms that enter a new market (Lieberman and Montgomery 1988), it is even more challenging for new ventures. As investors perceive low technology acceptance and high risk, new ventures struggle to receive sufficient funding, which is needed to protect and develop their market share. We find that the magnitude of the left side of the technology wave (β = 0.089) is larger than the peripheral area of the first 10%, namely front-runner (β = 0.006), thus, second-mover and later entrants show higher success. Consequently, in initial stages, the need for funding seems to outweigh the advantages of a high market share of new ventures, at least for new ventures that focus on technological innovations that, by nature, require a high resource endowment. At later stages, however, when technology acceptance increases and risk perception decreases, more customers and investors engage. In this context, market share might turn into an important success determinant of new ventures. Prior studies indicate that firms can gain a first-mover advantage, depending on the pace of technology and market evolution (Suarez and Lanzolla 2007), but note that a precise knowledge about the interplay of technology and market aspects, especially “the cyclical nature of pace”, is needed (Short and Payne 2008: 267). We contribute to first-mover advantage literature, by taking a closer look at the aspect of timing for technology new ventures.

Fourth, we conceptualize and test a measurement construct that seems applicable to detect firm-centric technology acceptance and diffusion over time (e.g., Kohl et al. 2018). Relying on new ventures’ formations, we show that the adoption of new technologies proceeds as a bell curve over time, which reflects a firm-centric perspective. Using media attention, which reflects a user-centric perspective, leads to a similar procedure of the bell curve, which supports our argumentation that both concepts are different, but intertwining and reinforcing each other. These results underline the existence of technology waves. Additionally, we reveal that both perspectives—user-centric and firm-centric technology acceptance—similarly effect new venture success. Technology waves are suitable to further vitalize entrepreneurship literature, and hence, gain a more holistic research agenda about new venture success and failure.

Our study also shows several practical implications. First, entrepreneurs should bear in mind their geographical location, i.e., the headquarters choice. Uncertainty-avoiding cultures intensify the relationship between timing within a technology wave and new venture success. Therefore, new ventures founded in these cultures during the beginning or the end of a technology wave are indicated to feel the negative impact more strongly. Second, and closely related to the first implication, entrepreneurs can consider the uncertainty avoidance level of a region in their public image. Entrepreneurs can include the aspect of uncertainty avoidance in investor pitches and offer further information to reduce the perceived risk and uncertainty. In the customer dialogue, new ventures can try to build a trustworthy image, which also seems suitable to reduce uncertainty in early stages. Third, entrepreneurs should be aware that their success could be influenced by their market entry timing. When engaging with a certain technology, entrepreneurs should analyze the current state of a technology. More precisely, the technology acceptance and diffusion. Therefore, possibly a disadvantageous positing at the beginning or at the end of technology waves could be avoided.

6.2 Limitations and future research

As any empirical study, this study has several limitations, which provide avenues for future research. First, regarding our sample, the CrunchBase database provides a broad overview of technology-related venture creations. The data in CrunchBase is frequently updated and added to by various sources, such as investor networks, community contributors, and a data team. Moreover, CrunchBase assures manual data validation and additionally employs artificial intelligence and machine learning to validate data accuracy. Nevertheless, the obtained data is largely based on self-reported company information and hence might lack entire objectivity.

Second, the investor type might influence the funding amount, and hence, new venture success. Research indicates that venture capitalists differ in their new venture valuations (e.g., Röhm et al. 2018). Gompers and Lerner (2001), for example, find empirical evidence that corporate venture capitalists assign significantly higher new venture valuations than independent venture capitalists. Future research can analyze how different investors perceive uncertainty and risk, and consequently, influence the relationship of timing within a technology wave and new venture success.

Third, we argue that investors, which believe in a new venture and the technology it focuses on, will express their trust by investing money in the new venture. Consequently, number of funding rounds reflects the acceptance and diffusion of a technology and, finally, new venture success. However, the investment decision can also be triggered by other factors, such as the fear of missing an opportunity rather than the acceptance of the technology by investors. Especially, the comparison of investors with their peers might influence their investment decision, which can be investigated and included in future studies.

Fourth, our results challenge previous findings that reveal a first-mover advantage for innovations (Barney 1991; Kollmann et al. 2017; Lieberman and Montgomery 1988). We provide evidence that the first new ventures in the market show lower success compared to fast-followers. These findings are not inherently contradicting one another, rather future studies can investigate at which degree of newness or which type of technology the first-mover advantage turns into a disadvantage. It is likely that (technological) innovations that are very different to existent and accepted technologies are challenged by a lack of acceptance, which lowers investor engagement. In this context, a lack of funding might outweigh the benefits of market share that result from being first in the market. Future research might include the degree of newness to verify our argumentation and results, and consequently, to determine the turning point from a first-mover advantage to a disadvantage.

Fifth, regarding the concept of uncertainty avoidance, Hofstede’s culture measures receive a long-standing popularity (Tang and Koveos 2008). Nevertheless, several studies have questioned the general applicability of Hofstede’s cultural value scores (Taras et al. 2010). For example, the cultural dimension scores fail to capture the change of culture over time (Kirkman et al. 2006). Nevertheless, our study does not draw on the exact country scores of uncertainty avoidance, but rather focuses on general high or low uncertainty avoiding countries. In this context, Tang and Koveos (2008) find that uncertainty avoidance reflects a rather stable dimension and is less likely to change over time. Nevertheless, future research could reinforce our findings by drawing on alternative or updated frameworks (Tang and Koveos 2008; Taras et al. 2010).

Sixth, when investigating the effect of new venture market entry timing and geographical context on new venture success, our study focuses on technological innovations. However, other innovations that are not triggered by technologies, such as certain business model innovations, could be influenced by the aspect of timing or the geographical context as well. Future research should consider different types of innovations and investigate the effects of timing and the geographical context on new venture success. We hope that this study inspires future research to extant entrepreneurship research.

References

Acs ZJ, Amorós JE (2008) Entrepreneurship and competitiveness dynamics in latin America. Small Bus Econ 31:305–322. https://doi.org/10.1007/s11187-008-9133-y

Alexy OT, Block JH, Sandner P, Ter Wal ALJ (2012) Social capital of venture capitalists and start-up funding. Small Bus Econ 39:835–851. https://doi.org/10.1007/s11187-011-9337-4

Audretsch DB (1995) Innovation and industry evolution. MIT Press, Cambridge

Audretsch DB, Keilbach M (2008) Resolving the knowledge paradox: knowledge-spillover entrepreneurship and economic growth. Res Policy 37:1697–1705. https://doi.org/10.1016/j.respol.2008.08.008

Audretsch DB, Bönte W, Mahagaonkar P (2012) Financial signaling by innovative nascent ventures: the relevance of patents and prototypes. Res Policy 41:1407–1421. https://doi.org/10.1016/j.respol.2012.02.003

Barney J (1991) Firm resources and sustained competitive advantage. J Manage 17:99–120. https://doi.org/10.1177/014920639101700108

Bartsch K (2017) The napster moment: access and innovation in academic publishing. Inf Serv Use 37:343–348. https://doi.org/10.3233/ISU-170842

Baumol WJ (1990) Entrepreneurship: productive, unproductive, and destructive. J Bus Ventur 11:3–22. https://doi.org/10.1016/0883-9026(94)00014-X

Baumol WJ (1993) Entrepreneurship, management, and the structure of payoffs. MIT Press, Cambridge, London

Beckman C, Eisenhardt K, Kotha S, Meyer A, Rajagopalan N (2012a) Technology entrepreneurship. Strateg Entrep J 6:89–93. https://doi.org/10.1002/sej.1134

Beckman CM, Eisenhardt K, Kotha S, Meyer A, Rajafopalan N (2012b) The role of the entrepreneur in technology entrepreneurship. Strateg Entrep J 6:203–206. https://doi.org/10.1002/sej.1136

Bitektine A, Haack P (2015) The ‘macro’ and the ‘micro’ of legitimacy: toward a multilevel theory of the legitimacy process. Acad Manag Rev 40:49–75. https://doi.org/10.5465/amr.2013.0318

Block J, Sandner P (2009) What is the effect of the financial crisis on venture capital financing? Empirical evidence from us internet start-ups. Ventur Cap 11:295–309. https://doi.org/10.1080/13691060903184803

Bonnet C, Wirtz P (2012) Raising capital for rapid growth in young technology ventures: when business angels and venture capitalists coinvest. Ventur Cap 14:91–110

Cai L, Hughes M, Yin M (2014) The relationship between resource acquisition methods and firm performance in chinese new ventures: the intermediate effect of learning capability. J Small Bus Manag 52:365–389. https://doi.org/10.1111/jsbm.12039

Carree MA, Thurik AR (2008) The lag structure of the impact of business ownership on economic performance in oecd countries. Small Bus Econ 30:101–110. https://doi.org/10.1007/s11187-006-9007-0

Carroll GR, Mosakowski E (1987) The career dynamics of self-employment. Adm Sci Q 32:570–589

CB Insights (2018) The top 20 reasons startups fail. https://www.cbinsights.com/research/startup-failure-reasons-top/. Accessed 23 Oct 2018

Chaganti RS, Watts AD, Chaganti R, Zimmerman-Treichel M (2008) Ethnic-immigrants in founding teams: effects on prospector strategy and performance in new internet ventures. J Bus Ventur 23:113–139. https://doi.org/10.1016/j.jbusvent.2006.07.004

Chandler GN, Hanks SH (1993) Measuring the performance of emerging businesses: a validation study. J Bus Ventur 8:391–408. https://doi.org/10.1016/0883-9026(93)90021-V

Choi YR, Shepherd DA (2004) Entrepreneurs’ decisions to exploit opportunities. J Manage 30:377–395. https://doi.org/10.1016/j.jm.2003.04.002

Chong AYL, Chan FTS, Ooi KB (2012) Predicting consumer decisions to adopt mobile commerce: cross country empirical examination between China and Malaysia. Decis Support Syst 53:34–43. https://doi.org/10.1016/j.dss.2011.12.001

Compagni A, Mele V, Ravasi D (2015) How early implementations influence later adoptions of innovation: social positioning and skill reproduction in the diffusion of robotic surgery. Acad Manag J 58:242–278. https://doi.org/10.5465/amj.2011.1184

Croce A, Guerini M, Ughetto E (2018) Angel financing and the performance of high-tech start-ups. J Small Bus Manag 56:208–228. https://doi.org/10.1111/jsbm.12250

Cullen JB, Johnson JL, Parboteeah KP (2014) National rates of opportunity entrepreneurship activity: insights from institutional anomie theory. Entrep Theory Pract 38:775–806. https://doi.org/10.1111/etap.12018

Davidsson P (2015) Entrepreneurial opportunities and the entrepreneurship nexus: a re-conceptualization. J Bus Ventur 30:674–695. https://doi.org/10.1016/j.jbusvent.2015.01.002

Davidsson P, Wiklund J (2001) Levels of analysis in entrepreneurship research: current research practice and suggestions for the future. Entrep Theory Pract 25:81–99. https://doi.org/10.1007/978-3-540-48543-8_12

Davidsson P, Delmar F, Wiklund J (2006) Entrepreneurship and the growth of firms. Edward Elgar Publishing, Northampton

Davis FD (1989) Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Q 13:319–340. https://doi.org/10.2307/249008

Davis FD, Bagozzi RP, Warshaw PR (1989) User acceptance of computer technology: a comparison of two theoretical models. Manage Sci 35:982–1003

Delmar F, Shane S (2006) Does experience matter? The effect of founding team experience on the survival and sales of newly founded ventures. Strateg Organ 4:215–247. https://doi.org/10.1177/1476127006066596

Delmar F, Davidsson P, Gartner WB (2003) Arriving at the high-growth firm. J Bus Ventur 18:189–216. https://doi.org/10.1016/S0883-9026(02)00080-0

Dencker JC, Gruber M (2015) The effects of opportunities and founder experience on new firm performance. Strateg Manag J 36:1035–1052. https://doi.org/10.1002/smj.2269

DiMaggio PJ, Powell WW (1983) The iron cage revisited institutional isomorphism and collective rationality in organizational fields. Am Sociol Rev 48:147–160. https://doi.org/10.2307/2095101

Dobrev S, Gotsopoulos A (2010) Legitimacy vacuum, structural imprinting, and the first mover disadvantage. Acad Manag J 53:1153–1174. https://doi.org/10.5465/AMJ.2010.54533229

Dos Santos BL, Patel PC, D’Souza RR (2011) Venture capital funding for information technology businesses. J Assoc Inf Syst 12:57–87. https://doi.org/10.17705/1jais.00253

Eckhardt JT, Shane SA (2003) Opportunities and entrepreneurship. J Manage 29:333–349. https://doi.org/10.1177/014920630302900304

Eckhardt JT, Shane SA (2011) Industry changes in technology and complementary assets and the creation of high-growth firms. J Bus Ventur 26:412–430. https://doi.org/10.1016/j.jbusvent.2010.01.003

Eesley CE, Roberts EB (2012) Are you experienced or are you talented? when does innate talent versus experience explain entrepreneurial performance? Strateg Entrep J 6:207–219. https://doi.org/10.1002/sej.1141

Ensley MD, Hmieleski KM, Pearce CL (2006) The importance of vertical and shared leadership within new venture top management teams: implications for the performance of startups. Leadersh Q 17:217–231. https://doi.org/10.1016/j.leaqua.2006.02.002

Gao J, Li J, Cheng Y, Shi S (2010) Impact of initial conditions on new venture success : a longitudinal study of new technology-based firms. Int J Innov Manag 14:41–56. https://doi.org/10.1142/S1363919610002544

Gartner WB (1988) “Who is an entrepreneur” is the wrong question. Am J Small Bus 12:11–32. https://doi.org/10.1177/104225878801200401

Gartner WB, Shaver KG, Liao J (2008) Opportunities as attributions: categorizing strategic issues from an attributional perspective. Strateg Entrep J 2:301–315. https://doi.org/10.1002/sej

Garud R, Karnøe P (2003) Bricolage versus breakthrough: distributed and embedded agency in technology entrepreneurship. Res Policy 32:277–300. https://doi.org/10.1016/S0048-7333(02)00100-2

George J, Jones GR (2000) The role of time in theory and theory building. J Manage 26:657–684. https://doi.org/10.1016/s0149-2063(00)00051-9

Geroski PA (2000) Models of technology diffusion. Res Policy 29:603–625. https://doi.org/10.1016/S0048-7333(99)00092-X

Gompers PA (1995) Optimal investment, monitoring, and the staging of venture capital. J Finance 50:1461–1489. https://doi.org/10.1111/j.1540-6261.1995.tb05185.x

Gompers PA, Lerner J (2001) The money of invention: How venture capital creates new wealth. Harvard Bus Sch Press, Boston

Granovetter M (1985) Economic action and social structure: the problem of embeddedness. Am J Sociol 91:481–510. https://doi.org/10.1002/9780470755679.ch5

Greene W (2003) Econometric analysis. Prentice Hall, Upper Saddle River

Greve HR, Seidel M-DL (2015) The thin red line between success and failure: path dependence in the diffusion of innovative production technologies. Strateg Manag J 36:475–496. https://doi.org/10.1002/smj

Grichnik D (2006) Die opportunity map der internationalen entrepreneurshipforschung: zum kern des interdisziplinären forschungsprogramms. J Bus Econ 76:1303–1333. https://doi.org/10.1007/s11573-006-0063-3

Gruber M, MacMillan IC, Thompson JD (2008) Look before you leap: market opportunity identification in emerging technology firms. Manage Sci 54:1652–1665. https://doi.org/10.1287/mnsc.1080.0877

Hannan MT, Freeman J (1984) Structural inertia and organizational change. Am Sociol Assoc 49:149–164. https://doi.org/10.2307/2095567

Hardin JW, Hilbe JM (2007) Generalized linear models and extensions. Stata Press, College Station

Hausman JA, Hall BH, Griliches Z (1984) Econometric models for count data with an application to the patents-r&d relationship. Econometrica 52:909–938. https://doi.org/10.3386/t0017

Hitt MA, Ireland RD, Camp SM, Sexton DL (1999) Call for papers. Strategic management journal, special issue: entrepreneurial strategies and wealth creation in the 21st century. Acad Manag News 30:32–33

Hofstede G (1980) Culture’s consequences: international differences in work-related values. Sage Publications, London

Hofstede G (2001) Culture’s consequences: comparing values, behaviors, institutions and organizations across nations. Sage Publications, Thousand Oaks

Hofstede G (2015) Dimension data matrix. https://geerthofstede.com/research-and-vsm/dimension-data-matrix/. Accessed 09 Oct 2018

Hwang Y (2005) Investigating enterprise systems adoption: uncertainty avoidance, intrinsic motivation, and the technology acceptance model. Eur J Inf Syst 14:150–161. https://doi.org/10.1057/palgrave.ejis.3000532

Justo R, DeTienne DR, Sieger P (2015) Failure or voluntary exit? Reassessing the female underperformance hypothesis. J Bus Ventur 30:775–792. https://doi.org/10.1016/j.jbusvent.2015.04.004

Kamins MA, Alpert F, Perner L (2007) How do consumers know which brand is the market leader or market pioneer? Consumers’ inferential processes, confidence and accuracy. J Mark Manag 23:590–611. https://doi.org/10.1362/026725707x229957

Kanter MR (1983) The change masters: innovation and entrepreneurship in the American corporation. Simon and Schuster, New York

Kellermanns FW, Eddleston KA (2006) Corporate entrepreneurship in family firms: a family perspective. Entrep Theory Pract 30:809–830. https://doi.org/10.1111/j.1540-6520.2006.00153.x

Kerin RA, Varadarajan PR, Peterson RA (1992) Propositions first-mover advantage: a synthesis, conceptual framework, and research propositions. J Mark 56:33–52

Kimberly JR (1979) Issues in the creation of organizations: initiation, innovation, and institutionalization. Acad Manag J 22:437–457

Kirkman BL, Lowe KB, Gibson CB (2006) A quarter century of culture’s consequences: a review of empirical research incorporating hofstede’s cultural values framework. J Int Bus Stud 37:285–320. https://doi.org/10.1057/palgrave.jibs.8400202

Kohl C, Knigge M, Baader G, Böhm M, Krcmar H (2018) Anticipating acceptance of emerging technologies using twitter: the case of self-driving cars. J Bus Econ 88:617–642. https://doi.org/10.1007/s11573-018-0897-5

Kollmann T, Stöckmann C, Kensbock JM (2017) Fear of failure as a mediator of the relationship between obstacles and nascent entrepreneurial activity—an experimental approach. J Bus Ventur 32:280–301. https://doi.org/10.1016/j.jbusvent.2017.02.002

Kreiser PM, Marino LD, Dickson P, Weaver KM (2010) Cultural influences on entrepreneurial orientation: the impact of national culture on risk taking and proactiveness in smes. Entrep Theory Pract 34:959–983. https://doi.org/10.1111/j.1540-6520.2010.00396.x

Langlois RN (2007) The entrepreneurial theory of the firm and the theory of the entrepreneurial firm. J Manag Stud 44:1107–1124. https://doi.org/10.1111/j.1467-6486.2007.00728.x

Leonard-Barton D (1992) Core capabilities and core rigidities: a paradox in managing new product development. Strateg Manag J 13:111–125. https://doi.org/10.1002/smj.4250131009

Li H, Zhang Y, Li Y, Zhou LA, Zhang W (2012) Returnees versus locals: who performs better in China’s technology entrepreneurship? Strateg Entrep J 6:257–272. https://doi.org/10.1002/sej.1139

Lieberman MB, Montgomery DB (1988) First-mover advantages. Strateg Manag J 9:41–58. https://doi.org/10.1002/smj.4250090706

Mann RJ, Sager TW (2007) Patents, venture capital, and software start-ups. Res Policy 36:193–208. https://doi.org/10.1016/j.respol.2006.10.002

Martins C, Oliveira T, Popovič A (2014) Understanding the internet banking adoption: a unified theory of acceptance and use of technology and perceived risk application. Int J Inf Manage 34:1–13. https://doi.org/10.1016/j.ijinfomgt.2013.06.002

McGrath RG (1999) Falling forward: real options reasoning and entrepreneurial failure. Acad Manag Rev 24:13–30. https://doi.org/10.5465/amr.1999.1580438

Miltgen CL, Popovič A, Oliveira T (2013) Determinants of end-user acceptance of biometrics: integrating the ‘big 3’ of technology acceptance with privacy context. Decis Support Syst 56:103–114. https://doi.org/10.1016/j.dss.2013.05.010

Minniti M, Bygrave W (1999) The microfoundations of entrepreneurship. Entrep Theory Pract 23:41–52. https://doi.org/10.1177/104225879902300403

Minniti M, Lévesque M (2010) Entrepreneurial types and economic growth. J Bus Ventur 25:305–314. https://doi.org/10.1016/j.jbusvent.2008.10.002

Nambisan S (2017) Digital entrepreneurship: toward a digital technology perspective of entrepreneurship. Entrep Theory Pract 41:1029–1055. https://doi.org/10.1111/etap.12254

Ramoglou S, Tsang E (2016) A realist perspective of entrepreneurship: opportunities as propensities. Acad Manag Rev 41:410–434. https://doi.org/10.5465/amr.2014.0281

Robinson KC, McDougall PP (2001) Entry barriers and new venture performance: a comparison of universal and contingency approaches. Strateg Manag J 22:659–685. https://doi.org/10.1002/smj.186

Rogers EM (1962) Diffusion of innovations. The Free Press, New York

Rogers EM (1995) Diffusion of innovations. The Free Press, New York

Rogers EM (2003) Diffusion of innovations. The Free Press, New York

Röhm P, Köhn A, Kuckertz A, Dehnen HS (2018) A world of difference? the impact of corporate venture capitalists’ investment motivation on startup valuation. J Bus Econ 88:531–557. https://doi.org/10.1007/s11573-017-0857-5

Schmidt S, Bendig D, Brettel M (2018) Building an equity story: the impact of effectuation on business angel investments. J Bus Econ 88:471–501. https://doi.org/10.1007/s11573-017-0868-2

Schumpeter JA (1934) The theory of economic development. Harvard University Press, New York

Shane S (1993) Cultural influences on national rates of innovation. J Bus Ventur 8:59–73. https://doi.org/10.1016/0883-9026(93)90011-S

Shane S, Stuart T (2002) Organizational endowments and the performance of university start-ups. Manage Sci 48:154–170. https://doi.org/10.1287/mnsc.48.1.154.14280

Shane S, Venkataraman S (2000) The promise of entrepreneurship as a field of research. Acad Manag Rev 25:217–226. https://doi.org/10.5465/amr.2000.2791611

Shepherd D, Douglas EJ, Shanley M (2000) New venture survival: ignorance, external shocks, and risk reduction strategies. J Bus Ventur 15:393–410. https://doi.org/10.1016/S0883-9026(98)00032-9

Short JC, Payne GT (2008) First movers and performance: timing is everything. Acad Manag Rev 33:267–269. https://doi.org/10.4135/9781483386874.n4

Short JC, McKelvie A, Ketchen DJ, Chandler GN (2009) Firm and industry effects on firm performance: a generalization and extension for new ventures. Strateg Entrep J 3:47–65. https://doi.org/10.1002/sej

Short JC, Ketchen DJ, Shook CL, Ireland RD (2010) The concept of ‘opportunity’ in entrepreneurship research: past accomplishments and future challenges. J Manage 36:40–65. https://doi.org/10.1177/0149206309342746

Shu C, Liu C, Gao S, Shanley M (2014) The knowledge spillover theory of entrepreneurship in alliances. Entrep Theory Pract 38:913–940. https://doi.org/10.1111/etap.12024

Siegrist M (2000) The influence of trust and perceptions of risk and benefits on the acceptance of gene technology. Risk Anal 20:195–203. https://doi.org/10.1111/0272-4332.202020

Sigmund S, Semrau T, Wegner D (2015) Networking ability and the financial performance of new ventures: moderating effects of venture size, institutional environment, and their interaction. J Small Bus Manag 53:266–283. https://doi.org/10.1111/jsbm.12009

Song M, Podoynitsyna K, Bij HVD, Halman JIM (2008) Success factors in new ventures: a meta-analysis. J Prod Innov Manag 25:7–27. https://doi.org/10.1111/j.1540-5885.2007.00280.x

Song LZ, Song M, Parry ME (2010) Perspective: economic conditions, entrepreneurship, first-product development, and new venture success. J Prod Innov Manag 27:130–135. https://doi.org/10.1111/j.1540-5885.2009.00704.x

Sorenson O, Stuart TE (2001) Syndication networks and the spatial distribution of venture capital investments. Am J Sociol 106:1546–1588

Spiegel O et al (2016) Business model development, founders’ social capital and the success of early stage internet start-ups: a mixed-method study. Inf Syst J 26:421–449. https://doi.org/10.1111/isj.12073

Stam W, Elfring T (2008) Entrepreneurial orientation and new venture performance: the moderating role of intra- and extraindustry social capital. Acad Manag J 51:97–111. https://doi.org/10.5465/AMJ.2008.30744031

Stucki T (2014) Success of start-up firms: the role of financial constraints. Ind Corp Chang 23:25–64. https://doi.org/10.1093/icc/dtt008

Su Z, Xie E, Wang D (2015) Entrepreneurial orientation, managerial networking, and new venture performance in China. J Small Bus Manag 53:228–248. https://doi.org/10.1111/jsbm.12069

Suarez FF, Lanzolla G (2007) The role of environmental dynamics in building a first mover advantage theory. Acad Manag Rev 32:377–392. https://doi.org/10.5465/AMR.2007.24349587

Suchman MC (1995) Managing legitimacy: strategic and institutional approaches. Acad Manag Rev 20:571–610. https://doi.org/10.5465/amr.1995.9508080331

Tang L, Koveos PE (2008) A framework to update hofstede’s cultural value indices: economic dynamics and institutional stability. J Int Bus Stud 39:1045–1063. https://doi.org/10.1057/palgrave.jibs.8400399

Taras V, Kirkman BL, Steel P (2010) Examining the impact of culture’s consequences: a three- decade, multilevel, meta-analytic review of hofstede’s cultural value dimensions. J Appl Psychol 95:405–439. https://doi.org/10.1037/a0018938

Tayeb M (1988) Organizations and national culture. Sage, London

Ter Wal ALJ, Alexy O, Block J, Sandner PG (2016) The best of both worlds: the benefits of open-specialized and closed-diverse syndication networks for new ventures’ success. Adm Sci Q 61:393–432. https://doi.org/10.1177/0001839216637849

Terjesen S, Hessels J, Li D (2016) Comparative international entrepreneurship: a review and research agenda. J Manage 42:299–344. https://doi.org/10.1177/0149206313486259

Tucker DJ, Singh JV, House RJ (1986) Organizational legitimacy and the liability of newness. Adm Sci Q 31:171–193

Unger JM, Rauch A, Frese M, Rosenbusch N (2011) Human capital and entrepreneurial success: a meta-analytical review. J Bus Ventur 26:341–358. https://doi.org/10.1016/j.jbusvent.2009.09.004

Valliere D, Peterson R (2009) Entrepreneurship and economic growth: evidence from emerging and developed countries. Entrep Reg Dev 21:459–480. https://doi.org/10.1080/08985620802332723

Venkataraman S (1997) The distinctive domain of entrepreneurship research. Adv Entrep Firm Emerg Growth 3:119–138. https://doi.org/10.12691/jbe-3-1-2

Venkatesh V, Thong JYL, Xu X (2016) Unified theory of acceptance and use of technology: a synthesis and the road ahead. J Assoc Inf Syst 17:328–376. https://doi.org/10.17705/1jais.00428

von Briel F, Davidsson P, Recker J (2018) Digital technologies as external enablers of new venture creation in the it hardware sector. Entrep Theory Pract 42:47–69. https://doi.org/10.1177/1042258717732779

Waleczek P, Zehren T, Flatten TC (2018) Start-up financing: how founders finance their ventures’ early stage. Manag Decis Econ 39:535–549. https://doi.org/10.1002/mde.2925

Wang Q, Sun X, Cobb S, Lawson G, Sharples S (2016) 3D printing system: an innovation for small-scale manufacturing in home settings? Early adopters of 3D printing systems in China. Int J Prod Res 54:6017–6032. https://doi.org/10.1080/00207543.2016.1154211