Abstract

The present article investigates entrepreneurial sustainable innovations (ESIs) that work against the five elements (policy, finance, human capital, support and culture) of the entrepreneurial ecosystem (EE) model (Isenberg, 2011). By conducting empirical research on 14 European countries, the study addresses how an EE can support entrepreneurs in creating sustainable innovations. Overall, the study contributes to exploring the relations between the EE and the relevant classes of ESIs, providing entrepreneurs and policymakers a framework by using a holistic examination of the EE and contributing to more effective policy solutions to encourage sustainable and resilient entrepreneurship-led economic growth. As shown by a quantitative analysis, ESIs are positively correlated with policy, finance and support in terms of infrastructural and administrative support, whereas culture and human capital do not significantly influence ESIs. The results also highlight that the EE’s key factors have different impacts on ESIs over time because the effect of EEs can be considered a complex system because of its heterogeneous and dynamic nature. In addition, the country-level capability of ESIs are measured, showing that Ukraine, Romania, Poland and the Czech Republic demonstrate a low-level capability of ESIs, while Germany, the UK, Sweden, Netherlands, France and Belgium show a high-level capability. By contributing to the entrepreneurial literature, the research invokes sustainable mechanisms of innovation to boost national economic performance in European countries.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The role of entrepreneurial ecosystems (EEs) in fostering national economic growth has become a key priority (Bhawe & Zahra, 2019). In recent years, attention towards EEs has increased drastically (Malecki, 2018), highlighting the role of EEs in innovation rounds (Al-Abri et al., 2018; Spigel & Harrison, 2018). An EE’s multifactor conceptualisation has several implications on several scales, suggesting that policymakers can identify and use many types of metrics used in their evaluations (Roundy et al., 2018). However, computing entrepreneurial indicators for country-level contexts constitutes a challenge for EE research; hence, being able to analyse entrepreneurial indicators can contribute to a better understanding of the drivers and economic consequences of EE territories (Szerb et al., 2019).

The literature on EEs provides a definition of two essential components: entrepreneurial opportunities (Kuckertz & Prochotta, 2018) and activity (Berger & Kuckertz, 2016; Kuckertz et al., 2019). EEs are an emerging and novel theoretical stream (Ács et al., 2014; Adner et al., 2013; Cohen, 2006; Spigel, 2017) that carry increasing weight in entrepreneurship (Audretsch & Belitski, 2017). Nowadays, EEs have been developed as a popular idea inside business enterprise strategy and professional networks (Spigel & Harrison, 2018) concerning visual ecosystem key factors and elements (Theodoraki et al., 2018). An EE is defined as an interconnected group of actors in a local geographic community committed to sustainable development through the support and facilitation of new sustainable ventures (Cohen, 2006). Six elements are used to describe an EE: policy, finance, markets, human capital, support and culture along with some sub-elements: policy (leadership, government), finance (financial capital), culture (success stories, societal norms), supports (infrastructure, support professions), human capital (labour and educational institutions) and markets (early customers, networks) (Isenberg, 2011). Although an EE is relevant, the literature in entrepreneurship has been concerned with the characteristics and behaviours of entrepreneurs (Shane, 2003) who show multifunctional interactions (Cardon et al., 2009). In addition, the literature on EEs’ growth in a global network has been oriented toward lessons and transformations (e.g., Kshetri, 2014; Mason & Brown, 2014; Stam, 2015; Zahra & Nambisan, 2011). As mentioned by Cavallo et al. (2018), the interaction among entrepreneurs and other contextual elements/actors is key (e.g., Neck et al., 2004; Kenney & Patton, 2005). In addition, the EE has been defined as the influential role of community and culture on entrepreneurship, which can be seen through the studies of Cohen (2006), Isenberg (2010) and Feld (2012). Hence, a main gap emerges: the lack of studies on EE models that can directly enable entrepreneurs to develop sustainable innovations. Our work contributes to filling this gap by exploring the relations between some key factors of an EE (namely, policy, finance, culture, supports and human capital) and the relevant classes of entrepreneurial sustainable innovations (ESIs; e.g., environmental communication, resource conservation, corporate social responsibility, sustainability management and technology innovation). In this regard, we provide a framework that can help entrepreneurs and policymakers carry out a holistic examination of the EE, hence contributing to more effective policy solutions that can encourage sustainable and resilient entrepreneurship-led economic growth.

The need for an in-depth investigation of this topic can be seen in the fact that the connection between EE and ESIs is still scarce. In this line, the current paper addresses the matter of how the EE affects ESIs. We construct our investigation on the empirical analysis of 14 European countries from 2007–2016, selecting five out of the six elements (e.g., policy, finance, human capital, support and culture) because the market factor requires research at a much narrower level of the presence of early customers to join local supply chains (as mentioned by Spigel, 2020). Within the literature on EEs, we find that recent research has established investigations on specific elements of EEs because of the complexity of the interactions among these elements to help policymakers in enhancing entrepreneurship (Cavallo et al., 2019).

Given this, the datasets depend on the EE’s theoretical models and sustainable innovation, and the statistical data analysis relies on applying a principal component analysis (PCA), hierarchical clustering analysis (HCA) and correlation test procedures. In this regard, the present research relies on 11 databases as the data source, including the International Energy Agency (IEA), International Labour Organization (ILOSTAT), International Monetary Fund (IMF), World Bank Doing Business Project (WBDBP) and World Bank staff estimates (WBSE).

The research scenario conceptually conforms to recent entrepreneurship projects, such as the Global Entrepreneurship Monitor (GEM) project (see Bosma & Kelley, 2018) and the Regional Entrepreneurship and Development Index (REDI) project for EU countries (see Szerb et al., 2017), long with a framework measurement of EEs that addresses the elements of EEs at the regional levels. The importance of investigating entrepreneurship indicators at the country level of the EU region connects to the venturing policies’ contribution to improving economic growth (Sternberg et al., 2019). Investigations on the links between EE and ESIs can help policymakers make rapid and large-scale comparisons between countries, which has not been done before.

As a result, the current study suggests that leadership, government, infrastructure, nongovernment institutions and financial elements help entrepreneurs. Our findings indicate that the key factors of policy, finance and support (in terms of infrastructural and administrative) can positively influence the growth of sustainable innovations at the country level. Meanwhile, our findings show the correlations and the comparative results between the 14 European countries, here by presenting a clustering dendrogram of the countries based on sustainable innovations. Six countries with high sustainable innovations were identified; for instance, Ukraine demonstrates a low capability level, German and the UK have high ESI levels, and Italy and Spain have medium ESI levels. In conclusion, our results present the importance of sustainable innovations, revealing the weak role of labour, education, early customers and societal norms on ESIs in the studied European countries.

Several distinct contributions can support the development of a successful EE at the country level. Our results reinforce the literature that exercises the empirical and quantitative frameworks of an EE and its key factors regarding ESIs in each region (e.g., Cavallo et al., 2019). Our research also provides evidence and insights, helping provide the regional and national norms of entrepreneurial actions that can create an appropriate ecosystem because an EE, as an aspect of entrepreneurship, plays an essential role in how ecosystems support firm growth through their direct impact on entrepreneurs (Spigel, 2020). A regional and complex agglomeration of EEs provides enhanced entrepreneurial activity benefiting the national economic and societal environment (Kuckertz, 2019). Hence, theoretically, our research can help invoke the sustainable mechanisms of innovation to boost national economic performance.

The present study is structured as follows: In the introduction section, the importance and significance of the research are described. The theoretical background and hypotheses development section includes a literature review concerning the entrepreneurial ecosystem model, sustainable innovation procedure and hypotheses development. In the section on data and methods, 14 European countries’ profiles are defined. In addition, the data collection procedure to prepare the formatted variables is described to measure the comparative variables within time series and spatial sequences. In the methodology subsection, a conceptual model is addressed to answer five research hypotheses using certain statistical and quantitative approaches, such as a PCA, an HCA, and correlation tests. In the results section, we reveal all the data estimations, correlations and clustering analysis. In the discussion section, we present the discussion of the results and the study’s contributions. Finally, in the conclusions section, a set of conclusions is described, as well as the limitations of the study and implications for policymakers.

Theoretical background and hypotheses development

Entrepreneurial ecosystems and their key factors

Entrepreneurship is a crucial driver of job creation within EEs, and even though the EE is a preparadigmatic field, there is no single accepted definition for this concept (Spigel, 2020). In recent years, the EE has been defined through different scholars’ research (Ács et al., 2017; Audrestch & Belitski, 2017; Stam, 2015; Mason & Brown, 2014). All of these studies imply the same phenomenon. Ács et al. (2017) mention that the EE approach, just like the strategy and regional development literature, emphasising the interdependence between actors and factors, but entrepreneurship (new value creation by agents) is observed as the output of the EE (Spigel, 2020). Stam (2015) also describes an EE as a set of interdependent actors and factors coordinated to enable productive entrepreneurship. However, the definition used by Stam and Spigel (2018) is the most general and widely accepted for an EE: a set of interdependent actors and factors coordinated in a way to enable productive entrepreneurship within a particular territory. This definition has four key components: (1) interdependent actors and factors, (2) coordinating along with a given way, (3) enable productive entrepreneurship and (4) within a particular territory (Spigel, 2020).

EEs are the framework for studying the interactions between the different actors interacting in a complex economic system, such as individuals, organisations, entities, local, regional and national institutions, policymakers and stakeholders in a national context (Cohen, 2006; Nambisan & Baron, 2013). EEs generate various conceptualisations that share many standard features and factors (Ács et al., 2014; Feld, 2012; Isenberg, 2010; Neck et al., 2004; Spigel, 2017; Stam, 2015). Some of these common elements are the supportive culture, venture capital, active networks of entrepreneurs, local government officials, investors, education and services (Neumeyer & Santos, 2018).

Some researchers have developed new EE models (e.g., Isenberg, 2010; Spigel, 2017; Stam, 2015); these models attempt to explain the different elements of an EE and the way they support entrepreneurship. Because Isenberg’s model (Isenberg, 2011) is the most well-known and cited model in academic and policy work, we use it in the present research. This model describes six different EE factors: policy, finance, culture, supports, human capital and markets. Each of these factors is linked to more specific elements (Malecki, 2018; Spigel, 2020).

The policy factor is the first element, and it involves government and leadership aspects. Decisive leadership can hold entrepreneurs within the society, and good government can create stimulus policy and remove all the possible barriers for entrepreneurial activities (Maroufkhani et al., 2018). The finance element, which depends on the capital investment and funds received from local or nonlocal investors, can ease access to loans or supply the prevalence of informal investors (Feld, 2012; Feldman & Zoller, 2012; Isenberg, 2010; Spigel & Harrison, 2018; Vedula & Fitza, 2019). The culture element reflects the degree to which entrepreneurship is valued in society, which is analysed by measuring new firms’ prevalence and self-employment (Stam, 2018). The support element includes the physical infrastructure, such as the institutions and agencies providing various kinds of business support and advice (Spigel, 2020). The human capital element, such as labour and educational aspects, provides sufficient knowledgeable human resources, including organisational development, structural design, system control, professional board membership and professional advisory committee (Stam, 2018).

Furthermore, the market element is the presence of early customers and low barriers of entry for new ventures to join local supply chains (Spigel, 2020), but it can relate to the potential customers who have viewpoints on new products and a cash flow that is conducive for an EE (Maroufkhani et al., 2018). Our paper is focused on a national level, which is consistent with just five of Isenberg’s factors; the market factor, as Isenberg (2011) describes it, requires research at a much narrower level (the individual entrepreneur’s network). Hence, a model with five key factors and eight elements has been made, here being comprised of policy (leadership, government), finance (financial capital), culture (societal norms), supports (infrastructure, support professions) and human capital (labour, educational institutions).

Entrepreneurial sustainable innovations (ESIs)

Starting from the idea that inflow and outflow knowledge processes generate innovations, an EE connects industries and innovations (Attia & Essam Eldin, 2018; Bresciani, 2017; O’Connor & Kelly, 2017; Trägårdh, 2018). An EE is defined as an interconnected group of actors in a local geographic community who are committed to sustainable development through the support and facilitation of new sustainable ventures (Cohen, 2006). In this scenario, enterprises pay more attention to the sustainability values (Chaurasia et al., 2020; Horng et al., 2017; Siqueira & Honig, 2019) that drive innovations with the involvement of environmental communication (e.g., environmental education of guests), resource conservation (e.g., pay attention to recycling), corporate social responsibility (e.g., respect and protect the natural environment), culture innovation (e.g., combine local culture to enhance innovation value), sustainability management (e.g., assessment of greenhouse gas emissions and carbon footprint) and technology innovation (e.g., cloud systems and electronic forms) (Horng et al., 2017; Salmones et al., 2005; Smerecnik & Andersen, 2011). The notion of sustainable entrepreneurship has been raised more recently as a way to address the contribution of entrepreneurial activities towards sustainable development in a more comprehensive way (Del Giudice et al., 2017; Schaltegger & Wagner, 2011); this, though, depends on a cycle of the prosperity of innovation, knowledge-based economies and national competitiveness policies to produce success entrepreneurship (Maroufkhani et al., 2017; Scuotto & Morellato, 2013; Usai et al., 2018). In this regard, countries and regions encourage the creation of sustainable entrepreneurial ecosystems to increase the level of economic development (Cohen, 2006; Cohen & Winn, 2007; Isenberg, 2011; Spigel, 2017), and recent investigations demonstrate the importance of examining this concept in university settings (Clarysse et al., 2014; Hayter, 2016; Regele & Neck, 2012; Rice et al., 2014), which is where new entrepreneurs are nurtured (Murray et al., 2018; Scuotto & Murray, 2018; Verbano et al., 2017). ESIs can offer solutions to entrepreneurial problems and benefit businesses through economies of scale, ultimately contributing to economic growth (Duvnäs et al., 2012; Hossain et al., 2017). In this regard, ESIs may also revolutionise an organisation, leading to a change in the relevant set of exploitable opportunities, providing a competitive advantage in generating new business performance (Del Giudice et al., 2019; Miles et al., 2009). For example, the innovative ways found in a specialised industry may be involved in shaping local/regional responses to the development crisis (Marsden & Smith, 2005).

Hypotheses development

The concept of the EE gained momentum through the pioneering studies of Cohen (2006), Isenberg (2010) and Feld (2012), which show that the community and culture of a given place can have a significant impact on entrepreneurship contexts (Mack & Qian, 2016; Scuotto et al., 2017; Spigel, 2017; Stam & Spigel, 2016). Much like financial capital performance (Cantele & Zardini, 2018), all of the EE’s key factors are related to certain ESIs in each business and industry (Maroufkhani et al., 2017).

Research on EEs has taken a bifurcated attitude towards the role of entrepreneurship policy (Spigel, 2020). The challenge of ESI policy is to develop enabling policy frameworks, strategies and processes that support technological and institutional innovation in ways that encompass the economic, environmental and social dimensions of sustainability, leading to the promotion of ESIs. Based on this, policy regimes have been addressed regarding their innovation and environmental sustainability in different studies (Foxon et al., 2004).

In line with this, we state the following:

Hp.1: The higher the level of the policy element in the EE, the higher the ESI level will be.

Moreover, one part of the role of innovations is to provide financing, either directly or indirectly, by sharing information about the appropriate actors in the economy (Trägårdh, 2018) because limited funding has been a challenge for successful entrepreneurship. According to Pope (2010), more than 97% of entrepreneurs fail to acquire financial capital. Finance can positively contribute to the development of ESIs (Cantele & Zardini, 2018).

Hence, we declare the following:

Hp. 2: The higher the level of the finance element in the EE, the higher the ESI level will be.

The ecosystem’s culture and institutional structure can help experienced entrepreneurs become mentors (Spigel, 2017b). Culture is one of the most important influences on the entrepreneurship process, and the cultural impacts of an entrepreneurship have been investigated on entrepreneurial values and norms in numerous works (Malecki, 2011; Spigel, 2017b; Rezaei et al., 2017). Krueger and Kickul (2006) have mentioned that cultural norms play a role in promoting sustainable intentions and innovations.

Hence, we consider the following:

Hp. 3: The higher the level of the culture element in the EE, the higher the ESI level will be.

In addition, the importance of a global network of supporters in helping entrepreneurs scale is important in bringing their new ideas into world-leading companies (Spigel, 2020). Contrarily, the impact of localised support of professionals and dealmakers is limited (Kenney & Patton, 2005). Support infrastructures such as innovation hubs or accelerators have popped up throughout the developing world (Friederici, 2019). In this regard, advanced countries have innovative institutional ecosystems favourable to certain economic activity types that entrepreneurs can harness to increase business performance (Ratten et al., 2017). The business focuses on inducing an ecosystem to support business performance, but innovation is a system to create innovative methods, reduce time-to-market and increase collaborative values. An innovative ecosystem stems from entrepreneurial ecosystems and could be considered a narrower part of entrepreneurship that is focusing on the process of ESIs.

In this regard, we state the following:

Hp. 4: The higher the level of the supports element in the EE, the higher the ESI level will be.

A sustainability study needs to consider the role of capital, biological, social, technological, financial and cultural elements, along with the complex ways in which they interact. All capital forms derive their value, utility and application from human mental awareness, creativity and social innovation. This role makes human capital, including social capital, the central determinant of resource productivity and sustainability. The importance of human choice depends on the important link between human capital and sustainable development (Diebolt & Hippe, 2019). The crucial role of ESIs in economic development and growth has been underlined by extensive literature in this area. According to Dameri and Ricciardi (2015), institutional and environmental capital are the relevant resources needed for an innovative ecosystem. According to Mercan and Göktas (2011), labourers’ innovation ecosystems develop because of the changing economy and policy conditions. As mentioned by Jackson (2015), ESIs can be geographically localised or strategically linked between actors.

Therefore, we assert the following:

Hp. 5: The higher the level of the human capital element in the EE, the higher the ESI level will be.

Data and methods

Sample description

The present paper uses a hierarchical clustering analysis for classifying the countries based on more appropriate correlations acquired between the indicators of the EE and those of ESIs. The current paper is focused on a set of 14 European countries with a total population above 10,000,000 inhabitants, a number derived from the population data in 2018 (World Bank, 2018). These 14 countries are Belgium, the Czech Republic, France, Germany, Greece, Italy, Netherlands, Poland, Portugal, Romania, Spain, Sweden, Ukraine and the UK; together, they have 496 million inhabitants in total (Table 1).

In addition to data accessibility and the completeness of time series, the main reason to select those countries depends on embracing the role of their multifaceted economies in entrepreneurship because of the population’s labour force demographics (Bosma & Kelley, 2018).

Data preparation

In the present study, the formatted variables (all 27 indicators) provided by the World Bank development indicators (World Bank, 2018) were considered for measuring the comparative variables within time series and spatial sequences. For more details, please see Table 2. Furthermore, each indicator’s description has been added in Table 3, and all indicators were obtained within an annual scale of 10 time windows as a research data depository. The current research collects different variables describing 21 independent characteristics of the EE model and six dependent variables of sustainable innovation indicators in the 14 European countries during the period 2007–2016. The scope is to compare the impacts of the EE on sustainable innovations among leading European countries. Hence, 27 annual time series, including quantitative raw indicators, were obtained to further combine them through a statistical approach.

In detail, the obtained variables were controlled using an originated source to obtain reliable data. All indicators correspond to the research methodological approach that applies the two main subjects of the EE model (Isenberg, 2011; Spigel & Harrison, 2018) and sustainability innovation (Horng et al., 2017). According to each subject’s conceptual basis and its key factors and elements, all indicators were classified into their respective factors and subjects (Table 4).

Furthermore, the coordinated direction of indicators was detected in Table 4, which shows the respective subject and its definition. A simple method to standardise the positive directed or coordinated negative indicators was considered by dividing the values by the maxima. Standardisation of the variables was assumed because of the various units of the indicators.

Because of data accessibility and the completeness of the time series, one economic indicator of GDP growth was selected from the WBSE (2019) for all countries. As the primary World Bank collection of development indicators, this databank includes official international sources for present national staff estimations. The business-based database for research approaches—such as the five indicators of the business’ extent of disclosure index, cost of business start-up procedures, start-up procedures to register a business, the time required to enforce a contract and time needed to start a business—was gathered from the WBDBP (2019). Another indicator—called access to clean fuels and technologies for cooking—was gathered from the World Bank, Sustainable Energy for All (SE4ALL, 2019).

Five indicators related to contributions from family workers, employment in agriculture and services and labour force data were compiled from the International Labour Organization (ILOSTAT, 2019). ILOSTAT is a United Nations agency whose mandate is to advance social justice and promote decent work by setting international labour standards. Four financial and revenue indicators comprised of domestic credit provided by the financial sector, domestic credit to the private sector, insurance and financial services, taxes on income, profits and capital gains were compiled from the IMF (2019).

three educational indicators related to current education expenditure, educational attainment and research and development expenditure were obtained from the UNESCO Institute for Statistics (UNESCO, 2019). UNESCO is a specialised agency of the United Nations that focuses on promoting international collaboration in education, sciences and culture in the world. Three energy indicators of electric power consumption, electricity production from renewable sources and energy use were gathered from the IEA (2019).

One technical indicator of machinery and transport equipment was gathered from the UN Industrial Development Organization (UNIDO, 2019). Two indicators of carbon dioxide damage and natural resource depletion were obtained from Changing Wealth of Nations (CWN, 2019), here based on Lange et al.’s (2018) research. Ultimately, two independent indicators titled high technology and tariff rates were collected from different sources of the UN Conference on Trade and Development (UNCTAD, 2019) and the World Trade Organization’s integrated data base (WTO, 2019), respectively.

Methodology

Research model

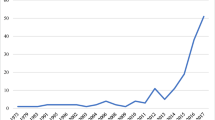

The investigation of the sustainability potential of local businesses is a method used in the literature (Bosona & Gebresenbet, 2011). Hence, the main procedure in the current study is to assess potential sustainability innovations using a quantitative analysis. Here, two main groups of dependent and independent variables (describing 21 independent characteristics of the EE model and six dependent variables of sustainable innovation indicators) were developed to uncover the relationships between the EE and ESIs. Statistical Package for Social Science (SPSS) software was used to analyse the quantitative data by measuring the range of correlation tests (Fig. 1) and evaluate the mentioned hypotheses.

The research model stems from the data collection and hypothesis development that occurred after an in-depth literature review, objective interpretation and study area description. Based on the spatial and temporal scale of the research, all key variables, which are based on theoretical models, EEs (Isenberg, 2011) and sustainable innovation (Horng et al., 2017), were extracted, coordinated, standardised and combined in statistical analyses, a PCA, an HCA and correlation test procedures. The outputs of the model lead to answering the hypotheses and classifying the countries through a dendrogram (Fig. 2).

Principal component analysis (PCA) and hierarchical cluster analysis (HCA)

Because of our dataset’s diverse sources, we have employed a PCA and an HCA. The main reason to carry out a PCA is to determine the quantity and character of linearly independent variables (factors) that are precisely expressing the interdependence of the initial variables. A PCA is functionally similar to a cluster analysis, which is used to classify cases into suitability classes (clusters) based on similarities within a group and dissimilarities between groups (Daneshvar et al., 2013). The purpose of a PCA is to identify the most important correlation structures between several variables to obtain a description of the major part of the overall variance, here with a few linear combinations being based on the original variables (Muñoz-Díaz & Rodrigo, 2004). The PCA’s retained scores can be subjected to an HCA to better identify different zones (e.g., Marzban & Sandgathe, 2006). Like a PCA, an HCA is known for its ability to divide the dataset into homogeneous and distinct groups, creating members with similar characteristics (Shukla et al., 2000). Both the PCA and HCA methods are the most useful data mining tasks for discovering groups and identifying interesting patterns in the underlying data (Halkidi et al., 2001). There are hierarchical and nonhierarchical methods that can be used for a cluster analysis. Hierarchical methods are based on a distance matrix. The Euclidean distance is the most commonly used measure although many other distance measures exist (Gong & Richman, 1995). The HCA and PCA are widely used for the clustering of geographical data (Daneshvar, 2015).

In the first step, the total chosen variables (27 variables) were coordinated based on subject direction, standardised and averagely combined from 2007 to 2016 to overcome the effects caused by the scale differences of the variables. The standardising of the raw values of the variables were carried out using Equations 1 and 2. Eq. 1 was used for converged raw data, and Eq. 2 was used for nonconverged raw data to produce the final coordinated and standardised variables.

where Xraw is the real and raw variable’s value, Xmax is the maximum of the variable’s value, and X is the converged and standardised variable value, which is estimated in each column of the data matrix. The combination of the standardised values was done based on Eq. 3:

where Xi is the converged and standardised value for variable X in column i, n is the number of variables {from i=1 to i=n}, and Xmean is the average of combined values for total variables in all columns of the data matrix.

In the second step, the PCA method was considered to make a proximity matrix from the distance correlations and dissimilarity measure of the squared Euclidean distance. In the final step, an HCA was used to cluster the cases. The Euclidean distance measure for the observations and Ward’s method for the linkage rule were used. This combination can present distinctive groups for the data within the HCA. A PCA and an HCA were briefly performed for all 10 time windows (2007–2016), along with the following steps: (1) selecting, coordinating, standardising and combining the variables, (2) computing the correlation matrix of the variables, (3) estimating the correlation tests between dependent and independent variables and (4) clustering the cases (countries) for the appropriate correlation results of variables. Ultimately, a clustering dendrogram was considered to classify the cases (countries).

Results

Application of PCA

In this section, the total indicators (variables) were examined using a PCA to detect the homogeneity in the variables resulting from the similarity of the values. Here, the mean values of the standardised variables during 2007–2016 were summarised into the initial matrix. Based on a PCA in SPSS, a correlation matrix and communality matrix of variables were used to initially cluster the variables (Tables 5 and 6). The constant correlations were considered with a meaningfully of R<-0.5 or R>0.5 at a confidence level P>90% (Sig.<0.1) between the dependent and independent variables. The distribution of the extracted communalities from 0.70 to 0.98 for all 27 variables revealed that each variable has sufficient membership capability in a dataset collection.

Furthermore, the results of the correlation matrix revealed that the indicators could be clustered through seven components, explaining approximately 89% of the total variance, with eigenvalues greater than 1 (Table 7).

The first and second components, which mainly comprise the EE factors, explain 47.11% of the total variance, with an eigenvalue of 12.72. The third and fourth components, mostly including sustainable innovation factors, explain 24.11% of the total variance, here with an eigenvalue of 6.51. The other components with different members explain 28.78% of the total variance, with an eigenvalue of 7.77. Overall, the correlation matrix and descriptive component analyses of the variables illustrated some main correlative factors to categorise the dependent and independent indicators (variables) in the next step.

Correlation tests

Here, the Pearson correlation coefficients between the dependent and independent variables were produced. Initially, the dependent and independent variables were summarised based on their combined values of the component indicators for the 14 countries and period of 2007–2016. For this purpose, the standardised mean values of six indicators for sustainable innovations and 21 indicators for EE were summarised in new matrices, respectively (Tables 8 and 9).

As mentioned earlier, the tables initially revealed that three countries—Germany, the Czech Republic and Sweden—have a higher degree of sustainable innovations. Also, the UK, France and Sweden have higher degrees of EEs. The correlation between the indicators of EE and ESIs is presented in Fig. 3.

Based on this, the correlation tests between the key factors of the EE and ESI variables were used to examine the five hypotheses. The correlation results revealed the mean relatively significant and positive correlations (R=+0.30 to +0.39, P>70 to 75%) between the key factors of policy, finance, support and ESIs, exposing the influential role of leadership, government, infrastructure, nongovernment institutions and financial elements on ESIs (Table 10). In Table 10, the relatively significant correlations were considered to be dominant at a confidence level of P>75% (Sig.<0.25). Some correlations between sustainable innovations and EE factors (e.g., finance in 2009, 2014 and 2015) are entirely significant at the confidence level of P>99% (Sig.=0.00), while some other correlations (e.g., policy in 2007, 2008 and 2011) are relatively significant at a confidence level of P>80% (Sig.< 0.2).

Contrarily, negative correlations (R=-0.20 to -0.27) were observed between the key factors of human capital, culture and SI. Furthermore, the correlation results revealed that the key factors of policy, finance and support could positively sustainable innovations, supporting three research hypotheses (Hp. 1, Hp. 2 and Hp. 4). Contrarily, three hypotheses (Hp. 3 and Hp. 5) were rejected because the key factors of culture and human capital negatively influenced sustainable innovations. This revealed the weak role of labour, education, early customers and societal norms on sustainable innovations in the studied European countries.

Application of HCA

An HCA was performed to group the sustainable innovations using Ward’s method. The mean standardised value of eight indicators for sustainable innovations was used (see Table 8). The HCA was then carried out to obtain a proximity matrix based on the squared Euclidean distance (Table 11) and consequent clustering, which is illustrated graphically as a dendrogram, as shown in Fig. 2; this graph has a rescaled distance cluster combination of 25. According to Fig. 2, the case studies of 14 countries were classified into three main clusters: high, medium and low levels of sustainable innovations.

The four critical countries with low sustainable innovations were Ukraine, Romania, Poland and the Czech Republic. Contrarily, the stable six countries regarding high sustainable innovations were Germany, UK, Sweden, Netherlands, France and Belgium. The other four countries—Italy, Spain, Portugal and Greece—were classified as having a medium level of ESIs.

Discussion

In the last decade, the concept of entrepreneurship has been transformed (Jafari-Sadeghi et al., 2021). EE is an aspect of the entrepreneurship domain that plays an important role in enterprises’ sustainable innovation growth through local or national norms and support (Malecki, 2018; Spigel, 2020). Investigations into the links between EEs and ESIs can help policymakers make a rapid and large-scale comparison between countries, which has not been done before, particularly when it comes to an analysis that uses global data. Hence, it is important to understand how the elements of an EE (e.g., policy, finance, human capital, support and culture) can affect ESIs. By developing five hypotheses, the research attempted to understand the elements of an EE and their role in ESIs. Our findings supported three hypotheses (Hp. 1, Hp. 2 and Hp. 4), exposing the positive influence of the entrepreneurial key factors of policy, finance and support on sustainable innovations. The innovations that entrepreneurs introduce into an EE can also produce coherence in agents’ actions and values (Muñoz & Encinar, 2014; Roundy et al., 2018), such as in policy and finance configurations. For instance, they essentially can help innovative start-ups by providing information about the financial resources to overcome the cost of the obstacles towards innovation (Bjørgum et al., 2013; Hsu, 2007).

In particular, the study analyses the correlation of five out of six elements of the EE model using the ESIs from a sample of 14 European countries between 2007 and 2016. The correlation test results indicate a mean weak positive correlation (R=+0.27, P>60%) between the EEs and ESIs in each country. The correlation test revealed the mean relatively significant and positive correlations (R=+0.30 to +0.39, P>70 to 75%) between the key factors of policy, finance, supports and ESIs, exposing the influential role of leadership, government, infrastructure, nongovernment institutions and financial elements. Having found support for hypotheses Hp. 1, Hp. 2 and Hp. 4, our results reveal that the key factors of policy, finance and support (in terms of infrastructural and administrative) could positively influence ESIs at the national level. Supporting three hypotheses, the results highlight that an EE’s key factors have different impacts on ESIs over time. Similarly, as mentioned in the literature, the effects of an EE can be considered as a system that is complex because of its heterogeneous nature and as dynamic or adaptive because it changes over time (Ács et al., 2017; Spigel, 2017; Borissenko & Boschma, 2017; Cavallo et al., 2019). Also, on average, among the key elements, policy, finance and support components had an influential role in the ESIs during the studied period. Here, an intervention policy’s role in improving the mechanisms of the businesses is important (Varese & Bonadonna, 2019).

However, we found that culture and human capital exposed the weakest and most negative impacts on ESIs (Hp. 3 and Hp. 5). This may relate to governments’ attention to enhancing the level of technology instead of the socio-cultural improvement of human capital and social support. For instance, industrial districts in Italy play a major role in new venture creation and support innovative start-ups (Cavallo et al., 2018). This finding highlights the need for further research to uncover the role of the supply chain network and how it contributes to the success of local businesses (Gruchmann et al., 2019). The lack of human capital initially limits the ability to establish certain types of ventures, for example, in high-technology enterprises (Roundy et al., 2018). The lack of the influence on human capital is a big concern because the world is moving towards Society 5.0 (Konno & Schillaci, 2021), which utilises a human-centred approach where the government and policymakers should give more relevance to the intellectual capital of human beings in developing new innovations (Dabic et al., 2020; Chierici et al., 2020; Orlando et al., 2020).

The current study contributes to the literature on entrepreneurship and innovation by relating time to the specific elements of an EE. By considering this link, the present study has demonstrated that the different elements of an EE simultaneously develop tools to support innovations over time. Our findings shed light on providing a dynamic empirical study that analyses the elements of an EE instead of the static models (e.g., Ács et al., 2017; Alvedalen & Boschma, 2017). Furthermore, from the viewpoint of time series, the finance and culture correlations with ESIs showed a promoting trend, while the other correlations presented decreasing trends during the study period. Following Randerson et al. (2015), this relates to the increasing effects of family members working in a business and the private sector’s function (as the indications of the cultural and financial key factors) in the innovations of all the studied European countries. The importance of family on entrepreneurship and family business is preponderant, where about 85% of all established ventures start with family backing (Astrachan et al., 2003).

Moreover, an HCA procedure was used to classify the case studies of 14 countries into three main clusters: high, medium and low levels of ESIs. The most stable six countries regarding high sustainable innovations were Germany, UK, Sweden, Netherlands, France and Belgium. European countries have innovative institutional ecosystems that are favourable to certain economic activity types that entrepreneurs can harness to increase business performance. Hence, a long-term investigation of the effects of an EE on ESIs can be beneficial for entrepreneurship management when it comes to new product development and innovative approaches to sustainable business operations. In the present paper, we assumed a long-term investigation during a 10-year time series (2007–2016), while previous studies on EEs have shown a static framework without using a time series (Ács et al., 2017; Alvedalen & Boschma, 2017; Borissenko & Boschma, 2017).

The contribution of the current research can be considered for both practical and academic applications. Recent research has found a link between EEs and ESIs (e.g., Al-Abri et al., 2018; Rampersad, 2016; Stam, 2018; Walter & Zondo, 2016). We have taken this further by trying to investigate this issue using country-level databases. Moreover, the present paper attempts to show the correlations and can benefit from comparative results among the given countries. These relationships go beyond short-term contractual agreements and become long-term relationships that act as a valuable information source in EE studies (Prajogo & Olhager, 2012).

Consequently, the current study has contributed to the literature of entrepreneurial ecosystems by reviewing the key factors of entrepreneurial ecosystems by referring to the new impacts of these factors and providing an expanded view of EE for further research in this field. From a broader perspective, the current study associates various theoretical backgrounds by using accessible data sets and indicators, improving the concept of entrepreneurial and innovative ecosystems. Theoretically, the present research can create sustainable mechanisms of innovation to boost national economic performance. Similarly, Stam (2013) probes the knowledge level and employees of an EE in a country-level analysis. Also, Szerb et al. (2019) have analysed the relevance of EE’s quantity and quality for regional and national performance. Our study complements these macro-level analyses by offering a comprehensive investigation using a 10-year time series to examine the role of EEs in ESIs. Our framework describes and specifies the distinct practices in which an EE shapes new ventures, here looking at the impactful drivers of sustainability in a national economy.

Managerial implications

Research has identified the influences of an EE for entrepreneurs and businesses in advanced economies. For instance, the worldwide focus is on understanding EEs from a macro-perspective (Autio et al., 2014; Colombelli et al., 2019; Zahra et al., 2014), along with a micro-outlook (Alvedalen & Boschma, 2017; Cantino et al., 2017; Cavallo et al., 2019; Corazza et al., 2019). However, a comprehensive approach has not been considered to analyse the interrelated research between EEs and ESIs within the literature, while a range of policymakers have shed light on the importance of developing all the aspects of EE to facilitate the development of ESIs. It also highlights that if policymakers want to encourage ESIs, they need to pay more attention to strengthening the dimensions of EE. In this regard, policymakers can significantly appraise their performance levels to identify the organisations’ innovation levels, significantly enhancing the EE in respected subjects. Therefore, they can facilitate the individualities of an EE to promote sustainable innovation levels in organisations by using telecommunications, technical experts and advisors, private equity, venture capital funds and venture friendly legislations. All of these mentioned prospects could strengthen the overall support, financial and policy elements of EE employees by implementing sustainable innovations and creative manners, along with providing appropriate feedback. As mentioned by Noelia and Rosalia (2020), innovative entrepreneurships face serious obstacles in their innovation processes because of the costs of innovations, lack of managerial competencies and difficulties in cooperating agents. Hence, the reduction of obstacles through the development of ESIs using the dynamic nature of EEs is crucial for managers and policymakers.

Conclusions and research limitations

The limitations of the current research can be divided into four categories. The first limitation depends on the actual accessibility, durability and reliability of the indicators during the long-term temporal windows and the countries’ broad case studies. The second limitation depends on the data sampling; here, the current study was based on a confined sample (14 countries in 10 points in time and 27 indicators). This type of analysis should be repeated in other countries with multiple time periods and a larger indicator set to reach more robust findings. This would also allow for the feedback effects of the systemic outputs of the entrepreneurial ecosystem. The third limitation is the exclusion of the market element because of its dependence on early customers and low barriers of entry for new ventures to join local supply chains. As a final limitation, the lack of a practical field study to prepare the data is another limitation that results in some possible uncertainties. Most data sets in the obtained data banks are observed from 2010 up to 2018.

To overcome this problem, further research needs to take novel approaches concerning data mining, validating and forecasting in addition to using field data. Regarding the market, further research should provide new distribution channels, evolving customer needs, the possibilities for the expansion of existing product ranges, new functional requirements and multiple commercial uses of technologies on a regional scale. Also, regarding the case studies, the low level of capacity of ESIs in the countries of Ukraine, Romania, Poland and the Czech Republic should be examined more to understand the causes behind this. There might be location-based effects that could influence the confidence level of the results. For instance, we suggest new research focusing on the innovative start-up level of these countries instead of the innovation status. Here, we have conducted a pilot testing of the nation-level correlations between five of Isenberg’s elements of an EE and ESIs, finding that only some of these elements of an EE are actually correlated to ESIs, thus paving the way for further studies on what are the core elements of an EE that actually nurture ESIs at the macro-level and why. Apart from the European countries, further research could consider the other regions around the world to compare the results. In line with this, a comparative analysis could be made to offer the differences between these two categories of countries (European countries and other developed or developing countries). In this regard, a qualitative methodology can be applied to understand the EE in a company with sustainable innovation.

The current article focused only on a general category of business, so further research can develop empirical methods such as a panel data analysis, trend analysis or spectral analysis to reveal other sectors of businesses. Consequently, a holistic examination of an EE can help researchers better understand the relationships between geography, personality and the entrepreneurial phenomenon, contributing to more effective policy solutions to encourage sustainable and resilient entrepreneurship-led economic growth. Our findings have supported some of our hypotheses, exposing the positive influence of the entrepreneurial key factors of policy, finance and support on sustainable innovations. The innovations that entrepreneurs introduce into an EE can also produce coherence in agents’ actions and values, such as the policy and finance configurations. Innovative entrepreneurships face serious obstacles in their innovation processes because of the costs of innovations, lack of managerial competencies and difficulties in cooperating agents. Hence, the reduction of obstacles through the development of ESIs by using the dynamic nature of EEs are crucial for managers and policymakers. Overall, an EE promotes and has a key role in spurring new ESIs by supporting start-ups and policymakers to identify the key elements and resources needed to sustain start-ups’ innovations and establish the most important priorities.

References

Ács, Z. J., Autio, E., & Szerb, L. (2014). National systems of entrepreneurship: Measurement issues and policy implications. Research Policy, 43(3), 476–494.

Ács, Z. J., Stam, E., Audretsch, D. B., & O’Connor, A. (2017). The lineages of the entrepreneurial ecosystemapproach. Small Business Economics, 49(1), 1–10.

Adner, R., Oxley, J. E., & Silverman, B. S. (2013). Collaboration and competition in business ecosystems. Emerald.

Al-Abri, M. Y., Rahim, A. A., & Hussain, N. H. (2018). Entrepreneurial ecosystem: An exploration of the entrepreneurship model for SMEs in sultanate of Oman. Mediterranean Journal of Social Sciences, 9(6), 193–206.

Alvedalen, J., & Boschma, R. (2017). A critical review of entrepreneurial ecosystems research: Towards a future research agenda. European Planning Studies, 25(6), 887–903.

Astrachan, J. H., Zahra, S. A., & Sharma, P. (2003). Family-sponsored ventures. Kauffman Foundation.

Attia, A., & Essam Eldin, I. (2018). Organizational learning, knowledge management capability and supply chain management practices in the Saudi food industry. Journal of Knowledge Management, 22(6), 1217–1242.

Audretsch, D. B., & Belitski, M. (2017). Entrepreneurial ecosystems in cities: Establishing the framework conditions. Journal of Technology Transfer, 42(5), 1030–1051.

Autio, E., Kenney, M., Mustar, P., Siegel, D., & Wright, M. (2014). Entrepreneurial innovation: The importance of context. Research Policy, 43(7), 1097–1108.

Borissenko, J., & Boschma, R. (2017). A critical review of entrepreneurial ecosystems research: Towards a future research agenda. European Planning Studies, 25(6), 887–903.

Berger, E. S. C., & Kuckertz, A. (2016). Female entrepreneurship in startup ecosystems worldwide. Journal of Business Research, 69(11), 5163 All journal names need to be fully spelled out 5168.

Bosma, N., & Kelley, D. (2018). Global entrepreneurship monitor, 2018/2019 global report. Global Entrepreneurship Research Association.

Bhawe, N., & Zahra, S. A. (2019). Inducing heterogeneity in local entrepreneurial ecosystems: The role of MNEs. Small Business Economics, 52(2), 437–454.

Bjørgum, Ø., Moen, Ø., & Madsen, T. K. (2013). New ventures in an emerging industry: Access to and use of international resources. International Journal of Entrepreneurship and Small Business, 20(2), 233–253.

Bosona, T., & Gebresenbet, G. (2011). Cluster building and logistics network integration of local food supply chain. Biosystems Engineering, 108, 293–302.

Bresciani, S. (2017). Open, networked and dynamic innovation in the food and beverage industry. British Food Journal, 119(11), 2290–2293.

Cantele, S., & Zardini, A. (2018). Is sustainability a competitive advantage for small businesses? An empirical analysis of possible mediators in the sustainability-financial performance relationship. Journal of Cleaner Production, 182, 166–176.

Cantino, V., Devalle, A., Cortese, D., Ricciardi, F., & Longo, M. (2017). Place-based network organizations and embedded entrepreneurial learning: Emerging paths to sustainability. International Journal of Entrepreneurial Behavior and Research, 23(3), 504–523.

Cardon, M. S., Wincent, J., Singh, J., & Drnovsek, M. (2009). The nature and experience of entrepreneurial passion. Academy of Management Review, 34(3), 511–532.

Cavallo, A., Ghezzi, A., Colombelli, A., Casali, G. L. (2018). Agglomeration dynamics of innovative start-ups in Italy beyond the industrial district era. International Entrepreneurship and Management Journal, 1–24. https://doi.org/10.1007/s11365-018-0521-8

Cavallo, A., Ghezzi, A., & Balocco, R. (2019). Entrepreneurial ecosystem research: Present debates and future directions. International Entrepreneurship and Management Journal, 15(4), 1291–1321.

Chaurasia, S. S., Kaul, N., Yadav, B., & Shukla, D. (2020). Open innovation for sustainability through creating shared value-role of knowledge management system, openness and organizational structure. Journal of Knowledge Management. https://doi.org/10.1108/JKM-04-2020-0319

Chierici, R., Tortora, D., Del Giudice, M., & Quacquarelli, B. (2020). Strengthening digital collaboration to enhance social innovation capital: An analysis of Italian small innovative enterprises. Journal of Intellectual Capital. https://doi.org/10.1108/JIC-02-2020-0058

Clarysse, B., Wright, M., Bruneel, J., & Mahajan, A. (2014). Creating value in ecosystems: Crossing the chasm between knowledge and business ecosystems. Research Policy, 43(7), 1164–1176.

Cohen, B. (2006). Sustainable valley entrepreneurial ecosystems. Business Strategy and the Environment, 15(1), 1–14.

Cohen, B., & Winn, M. I. (2007). Market imperfections, opportunity and sustainable entrepreneurship. Journal of Business Venturing, 22(1), 29–49.

Colombelli, A., Paolucci, E., & Ughetto, E. (2019). Hierarchical and relational governance and the life cycle of entrepreneurial ecosystems. Small Business Economics, 52(2), 505–521.

Corazza, L., Cisi, M., Dumay, J. (2019). Formal networks: The influence of social learning in meta-organisations from commons protection to commons governance. Knowledge Management Research and Practice, 1–16. https://doi.org/10.1080/14778238.2019.1664270

CWN. (2019). Changing Wealth of Nations.

Dabić, M., Vlačić, B., Scuotto, V., & Warkentin, M. (2020). Two decades of the Journal of Intellectual Capital: A bibliometric overview and an agenda for future research. Journal of Intellectual Capital, Retrieved July 10, 2019, from https://doi.org/10.1108/JIC-02-2020-0052https://openknowledge.worldbank.org/handle/10986/29001

Dameri, R. P., & Ricciardi, F. (2015). Smart city intellectual capital: An emerging view of territorial systems innovation management. Journal of Intellectual Capital, 16(4), 860–887.

Daneshvar, M. R. M. (2015). Climatic impacts on hydrogeochemical characteristics of mineralized springs: A case study of Garab travertine zone in northeast of Iran. Arabian Journal of Geosciences, 8(7), 4895–4906.

Daneshvar, M. R. M., Bagherzadeh, A., & Alijani, B. (2013). Application of multivariate approach in agrometeorological suitability zonation at northeast semiarid plains of Iran. Theoretical and Applied Climatology, 114(1–2), 139–152.

Del Giudice, M., Garcia-Perez, A., Scuotto, V., & Orlando, B. (2019). Are social enterprises technological innovative? A quantitative analysis on social entrepreneurs in emerging countries. Technological Forecasting and Social Change, 148, 119704.

Del Giudice, M., Khan, Z., De Silva, M., Scuotto, V., Caputo, F., & Carayannis, E. (2017). The microlevel actions undertaken by owner-managers in improving the sustainability practices of cultural and creative small and medium enterprises: A United Kingdom-Italy comparison. Journal of Organizational Behavior, 38(9), 1396–1414.

Diebolt, C., & Hippe, R. (2019). The long-run impact of human capital on innovation and economic development in the regions of Europe. Applied Economics, 51(5), 542–563.

Duvnäs, H., Stenholm, P., Brännback, M., & Carsrud, A. L. (2012). What are the outcomes of innovativeness within social entrepreneurship? The relationship between innovative orientation and social enterprise economic performance. Journal of Strategic Innovation and Sustainability, 8(1), 68–80.

Feld, B. (2012). Startup communities: Building an entrepreneurial ecosystem in your city. John Wiley & Sons.

Friederici, N. (2019). Innovation hubs in Africa: What do they really do for digital entrepreneurs? In N. D. Taura, E. Bolat, & N. O. Madichie (Eds.), Digital entrepreneurship in sub-Saharan Africa. Springer International Publishing. 12, 9–28.

Feldman, M., & Zoller, T. D. (2012). Dealmakers in Place : Social Capital Connections in Regional Entrepreneurial Economies Dealmakers in Place : Social Capital Connections in Regional Entrepreneurial Economies, (September 2014), 37–41.

Foxon, T., Makuch, Z., Mata, M., & Pearson, P. J. (2004). Towards a sustainable innovation policy—Institutional structures, stakeholder participation and mixes of policy instruments. Berlin Conference on the Human Dimensions of Global Environmental Change, 3–4 December 2004, 1–21.

Gong, X., & Richman, M. B. (1995). On the application of cluster analysis to growing season precipitation data in North America East of the Rockies. Journal of Climate, 8, 897–931.

Gruchmann T., Böhm M., Krumme K., Funcke S., Hauser S., & Melkonyan A. (2019). Local and sustainable food businesses: Assessing the role of supply chain coordination. In: A. Melkonyan & K. Krumme (Eds.), Innovative logistics services and sustainable lifestyles. Springer.

Halkidi, M., Batistakis, Y., & Vazirgiannis, M. (2001). On clustering validation techniques. Journal of Intelligent Information Systems, 17, 107–145.

Hayter, C. S. (2016). A trajectory of early-stage spinoff success: The role of knowledge intermediaries within an entrepreneurial university ecosystem. Small Business Economics, 47(3), 633–656.

Horng, J., Liu, C., Chou, S., & Tsai, C. (2017). From innovation to sustainability: Sustainability innovations of eco-friendly hotels in Taiwan. International Journal of Hospitality Management, 63, 44–52.

Hossain, S., Saleh, M. A., & Drennan, J. (2017). A critical appraisal of the social entrepreneurship paradigm in an international setting: A proposed conceptual framework. International Entrepreneurship and Management Journal, 13(2), 347–368.

Hsu, D. H. (2007). Experienced entrepreneurial founders, organizational capital, and venture capital funding. Research Policy, 36(5), 722–741.

IEA. (2019). International Energy Agency. Retrieved July 10, 2019, from https://www.iea.org

ILOSTAT. (2019). International Labour Organization. Retrieved July 10, 2019, from https://www.ilo.org/global/lang--en/index.htm

IMF. (2019). International Monetary Fund. Retrieved July 10, 2019, from https://www.imf.org

Isenberg, D. J. (2010). How to start an entrepreneurial revolution. Harvard Business Review, 88(6), 40–50.

Isenberg, D. (2011). The entrepreneurship ecosystem strategy as a new paradigm for economic policy: Principles for cultivating entrepreneurship. Institute of International European Affairs.

Jackson, D. (2015). What is an innovation ecosystem? National Science Foundation.

Jafari-sadeghi, V., Garcia-perez, A., Candelo, E., & Couturier, J. (2021). Exploring the impact of digital transformation on technology entrepreneurship and technological market expansion: The role of technology readiness, exploration and exploitation. Journal of Business Research, 124 (April 2020), 100–111.

Konno, N., & Schillaci, E. (2021). Intellectual capital in Society 5.0 by the lens of the knowledge creation theory. Journal of Intellectual Capital, Forthcoming

Krueger, N., & Kickul, J. (2006). So you thought the intentions model was simple: Cognitive style and the specification of entrepreneurial intentions models [Conference presentation]. USASBE Conference, Tucson, AZ.

Kshetri, N. (2014). Developing successful entrepreneurial ecosystems lessons from a comparison of an Asian tiger and a Baltic tiger. Baltic Journal of Management, 9(3), 330–356.

Kuckertz, A. (2019). Let's take the entrepreneurial ecosystem metaphor seriously! Journal of Business Venturing Insights, 11, e00124.

Kuckertz, A., Berger, E. S. C., & Gaudig, A. (2019). Responding to the greatest challenges? Value creation in ecological startups. Journal of Cleaner Production, 230, 1138–1147.

Kuckertz, B. A., & Prochotta, A. (2018). What’s hot in entrepreneurship research 2018? Hohenheim Entrepreneurship Research Brief, 4(4), 1–7.

Kenney, M., & Patton, D. (2005). Entrepreneurial geographies: Support networks in three high-technology industries. Economic Geography, 81(2), 201–228.

Lange, G. M., Wodon, Q., & Carey, K. (2018). The changing wealth of nations 2018: building a sustainable future. World Bank.

Mack, E. A., & Qian, H. (2016). Geographies of entrepreneurship. Routledge.

Malecki, E. (2018). Entrepreneurship and entrepreneurial ecosystems. Geography Compass, 12(3), e12359.

Malecki, E. J. (2011). Connecting local entrepreneurial ecosystems to global innovation networks: open innovation, double networks and knowledge integration. International Journal of Entrepreneurship and Innovation Management, 14(1), 36–59.

Maroufkhani, P., Wagner, R., & Ismail, W. K. (2017). Entrepreneurial ecosystems: A systematic review. Journal of Enterprising Communities: People and Places in the Global Economy, 12(4), 545–564.

Marsden, T., & Smith, E. (2005). Ecological entrepreneurship: Sustainable development in local communities through quality food production and local branding. Geoforum, 36(4), 440–451.

Marzban, C., & Sandgathe, S. (2006). Cluster analysis for verification of precipitation fields. Weather and Forecasting, 21, 824–838.

Mason, C., & Brown, R. (2014). Entrepreneurial ecosystems and growth oriented entrepreneurship. Final Report to OECD.

Mercan, B., & Göktas, D. (2011). Components of innovation ecosystems: A cross-country study. International Research Journal of Finance and Economics, 76.

Miles, M. P., Munilla, L. S., & Darroch, J. (2009). Sustainable corporate entrepreneurship. International Entrepreneurship and Management Journal, 5, 65–76.

Maroufkhani, P., Wagner, R., Khairuzzaman, W., & Ismail, W. (2018). Entrepreneurial ecosystems : a systematic review Journal of Enterprising Communities : People and Places in the Global Economy Article information.

Muñoz-Díaz, D., & Rodrigo, F. S. (2004). Spatio-temporal patterns of seasonal rainfall in Spain (1912–2000) using cluster and principal component analysis: Comparison. Annales Geophysicae, 22, 1435–1448.

Muñoz, F. F., & Encinar, M. I. (2014). Agents intentionality, capabilities and the performance of systems of innovation. Innovations, 16(1), 71–81.

Murray, A., Crammond, R. J., Omeihe, K. O., & Scuotto, V. (2018). Establishing successful methods of entrepreneurship education in nurturing new entrepreneurs: Exploring entrepreneurial practice. Journal of Higher Education Service Science and Management, 1(1), 1–11.

Nambisan, S., & Baron, R. A. (2013). Entrepreneurship in innovation ecosystems: Entrepreneurs’ self-regulatory processes and their implications for new venture success. Entrepreneurship Theory and Practice, 37, 1071–1097.

Neck, H. M., Meyer, G. D., Cohen, B., & Corbett, A. C. (2004). An entrepreneurial system view of new venture creation. Journal of Small Business ManaGement, 42, 190–208.

Neumeyer, X., & Santos, S. C. (2018). Sustainable business models, venture typologies, and entrepreneurial ecosystems: A social network perspective. Journal of Cleaner Production, 172, 4565–4579.

Noelia, F. L., & Rosalia, D. C. (2020). A dynamic analysis of the role of entrepreneurial ecosystems in reducing innovation obstacles for startups. Journal of Business Venturing Insights, 14, e00192.

O’Connor, C., & Kelly, S. (2017). Facilitating knowledge management through filtered big data: SME competitiveness in an agri-food sector. Journal of Knowledge Management, 21(1), 156–179.

Orlando, B., Mazzucchelli, A., Usai, A., Nicotra, M., & Paoletti, F. (2020). Are digital technologies killing future innovation? The Curvilinear Relationship between Digital Technologies and Firm’s Intellectual Property. Journal of Intellectual Capital. https://doi.org/10.1108/JIC-03-2020-0078

Pope, N. D. (2010). Crowdfunding microstartups: It’s time for the securities and exchange commission to approve a small offering exemption. University of Pennsylvania Journal of Business Law, 13(4), 973.

Prajogo, D., & Olhager, J. (2012). Supply chain integration and performance: The effects of long-term relationships, information technology and sharing, and logistics integration. International Journal of Production Economics, 135(1), 514–522.

Randerson, K., Bettinelli, C., Fayolle, A., & Anderson, A. (2015). Family entrepreneurship as a field of research: Exploring its contours and contents. Journal of Family Business Strategy, 6, 143–154.

Ratten, V., Dana, L. P., Ramadani, V., & Rezaei, S. (2017). Transnational entrepreneurship in a diaspora. In S. Rezaei, L. P. Dana, & V. Ramadani (Eds.), Iranian entrepreneurship. Springer.

Regele, M. D., & Neck, H. M. (2012). The entrepreneurship education subecosystem in the United States: Opportunities to increase entrepreneurial activity. Journal of Business and Entrepreneurship, 23(2), 25–47.

Rezaei, S., Dana, L. P., & Ramadani, V. (Eds.). (2017). Iranian entrepreneurship: Deciphering the entrepreneurial ecosystem in Iran and in the Iranian diaspora. Springer.

Rampersad, G. (2016). Entrepreneurial ecosystems: A governance perspective. Journal of Research in Business, Economics and Management, 7(3), 1122–1134.

Rice, M. P., Fetters, M. L., & Greene, P. G. (2014). University-based entrepreneurship ecosystems: A global study of six educational institutions. International Journal of Entrepreneurship and Innovation Management, 18(5/6), 481–501.

Roundy, P. T., Bradshaw, M., & Brockman, B. K. (2018). The emergence of entrepreneurial ecosystems: A complex adaptive systems approach. Journal of Business Research, 86, 1–10.

Salmones, M. G., Crespo, A. H., & Bosque, I. (2005). Influence of corporate social responsibility on loyalty and valuation of services. Journal of Business Ethics, 61(4), 369–385.

Schaltegger, S., & Wagner, M. (2011). Sustainable entrepreneurship and sustainability innovation: Categories and interactions. Business Strategy and the Environment, 20(4), 222–237.

Scuotto, V., Giudice, M. D., Holden, N., & Mattiacci, A. (2017). Entrepreneurial settings within global family firms: Research perspectives from cross-cultural knowledge management studies. European Journal of International Management, 11(4), 469–489.

Scuotto, V., & Murray, A. (2018). A holistic approach to the delivery of effective enterprise education. In Experiential learning for entrepreneurship. Palgrave Macmillan. 125–144.

Scuotto, V., & Morellato, M. (2013). Entrepreneurial knowledge and digital competence: Keys for a success of student entrepreneurship. Journal of the Knowledge Economy, 4(3), 293–303.

SE4ALL. (2019). World Bank, Sustainable Energy for All. Retrieved July 10, 2019, from https://datacatalog.worldbank.org/dataset/sustainable-energy-all

Shane, S. A. (2003). A general theory of entrepreneurship: The individual-opportunity nexus. Edward Elgar Publishing.

Siqueira, A. C. O., & Honig, B. (2019). Entrepreneurs’ ingenuity and self-imposed ethical constraints: Creating sustainability-oriented new ventures and knowledge. Journal of Knowledge Management. https://doi.org/10.1108/JKM-11-2018-0707

Shukla, S., Mostaghimi, S., & Al-Smadi, M. (2000). Multivariate technique for base flow separation using water quality data. Journal of Hydrologic Engineering, 5(2), 172–179.

Smerecnik, K. R., & Andersen, P. A. (2011). The diffusion of environmental sustainability innovations in North American hotels and ski resorts. Journal of Sustainable Tourism, 19(2), 171–196.

Spigel, B. (2017). The relational organization of entrepreneurial ecosystems. Entrepreneurship Theory and Practice, 41(1), 49–72.

Spigel, B., & Harrison, R. (2018). Towards a process theory of entrepreneurial ecosystems. Strategic Entrepreneurship Journal, 12(1), 151–168.

Spigel, B. (2020). Entrepreneurial ecosystems theory, practice and futures. Edward Elgar Publishing.

Stam, E. (2013). Knowledge and entrepreneurial employees: A country-level analysis. Small Business Economics, 41(4), 887–898.

Stam, E. (2015). Entrepreneurial ecosystems and regional policy: A sympathetic critique. European Planning Studies, 23(9), 1759–1769.

Stam, E. (2018) Measuring Entrepreneurial Ecosystems. In: O'Connor, A., Stam, E., Sussan, F., Audretsch, D.B. (eds) Entrepreneurial Ecosystems. Place-Based Transformations and Transitions. New York: Springer. 173–196.

Stam, F. C., & Spigel, B. (2016). Entrepreneurial ecosystems. USE Discussion Paper Series, 16(13).

Sternberg, R., Bloh, J., & Coduras, A. (2019). A new framework to measure entrepreneurial ecosystems at the regional level. Zeitschrift für Wirtschaftsgeographie, 63(2-4), 103–117.

Szerb, L., Lafuente, E., Horvath, K., & Pager, B. (2019). The relevance of quantity and quality entrepreneurship for regional performance: The moderating role of the entrepreneurial ecosystem. Regional Studies, 53(9), 1308–1320.

Szerb, L., Vörös, Z., Komlósi, É., Acs, Z. J., Páger, B., & Rappai, G. (2017). The regional entrepreneurship and development index: Structure, data, methodology and policy applications. Retrieved from http://www.projectfires.eu/publications/reports

Theodoraki, C., Messeghem, K., & Ricc, M. P. (2018). A social capital approach to the development of sustainable entrepreneurial ecosystems: An explorative study. Small Business Economics, 51(1), 153–170.

Trägårdh, A. (2018). Innovation ecosystems in the food industry: Creating innovative food by sharing knowledge—A qualitative study of the Swedish and Danish food industry. Göteborgs Universitet. Retrieved September 30, 2019, from https://gupea.ub.gu.se/handle/2077/57056

UNCTAD. (2019). UN Conference on Trade and Development. Retrieved July 10, 2019, from https://unctad.org/en/Pages/Home.aspx

UNESCO. (2019). UN Educational, Scientific and Cultural Organization Institute for Statistics. Retrieved July 10, 2019, from http://uis.unesco.org

UNIDO. (2019). UN Industrial Development Organization. Retrieved July 10, 2019, from https://www.unido.org

Usai, A., Scuotto, V., Murray, A., Fiano, F., & Dezi, L. (2018). Do entrepreneurial knowledge and innovative attitude overcome “imperfections” in the innovation process? Insights from SMEs in the UK and Italy. Journal of Knowledge Management, 22(8), 1637–1654.

Varese, E., & Bonadonna, A. (2019). Food wastage management: The “Una Buona Occasione—a good opportunity” contribution. Food Safety Management, 20(168), 139–147.

Verbano, C., Crema, M., & Scuotto, V. (2017). Adding the entrepreneurial orientation among the theoretical perspectives to analyse the development of research-based spin-offs. The International Journal of Entrepreneurship and Innovation, 1465750319874592.

Vedula, S., & Fitza, M. (2019). Regional recipes: A configurational analysis of the regional entrepreneurial ecosystem for US venture capital-backed startups. Strategy Science, 4(1), 4–24.

WBDBP. (2019). World Bank Doing Business Project. Retrieved July 10, 2019, from https://datacatalog.worldbank.org/dataset/doing-business

WBSE. (2019). World Bank Staff Estimates. Retrieved July 10, 2019, from https://databank.worldbank.org/source/world-development-indicators

World Bank. (2018). World development indicators archived by online public web resource of World data bank. Retrieved August 11, 2019, from https://databank.worldbank.org/databases

Walter, R., & Zondo, D. (2016). The influence of entrepreneurship ecosystem for sustainable growth on the rural small and micro retail businesses: Case study. International Journal of Innovative Research and Development, 5(12), 218–225.

WTO. (2019). World Trade Organization’s integrated data base. Retrieved July 10, 2019, from http://tariffdata.wto.org

Zahra, S. A., & Nambisan, S. (2011). Entrepreneurship in global innovation ecosystems. AMS Review, 1(1), 4.

Zahra, S. A., Wright, M., & Abdelgawad, S. G. (2014). Contextualization and the advancement of entrepreneurship research. International Small Business Journal, 32(5), 479–500.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Khatami, F., Scuotto, V., Krueger, N. et al. The influence of the entrepreneurial ecosystem model on sustainable innovation from a macro-level lens. Int Entrep Manag J 18, 1419–1451 (2022). https://doi.org/10.1007/s11365-021-00788-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11365-021-00788-w