Abstract

The role of entrepreneurial ecosystems in fostering economic growth has become a key priority around the globe. To develop such ecosystems, numerous countries have provided significant inducements to multinational enterprises (MNEs) to attract them to locate their operations within their borders. Despite the rise in MNEs’ entry, evidence on their efficacy in invigorating local entrepreneurial systems has been mixed. We propose that this may arise from a lack of focus on local ecosystems’ absorptive capacity, which is essential to spawning different types of entrepreneurial ventures that combine both replicative (imitative) and truly innovative local firms. This occurs as local entrepreneurs in proceed to capture, assimilate, and exploit MNEs’ different knowledge spillovers. Further, we argue that the dynamic interplay between knowledge flows through spillovers from MNEs and absorptive capacity is likely to promote the emergence, evolution, and sustainability of different types of new local firms—in some cases creating conformity and lock-ins and in others enhancing the heterogeneity of entrepreneurial activities. Over time, these developments encourage co-specialization between local new ventures and MNEs. Our analyses highlight key sources of heterogeneity in types of new firms that might emerge in a local ecosystem and how they might develop over time as a result of MNEs’ entry, creating wealth.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

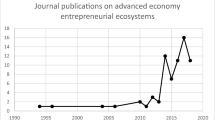

Recent research highlights the vital importance of entrepreneurial ecosystems in promoting the creation and growth of new ventures (Audretsch and Thurik 2004; Acs et al. 2014; Audretsch and Keilbach 2008; Holmes et al. 2016; Isenberg 2011, 2014), which are a major source of technological, economic, and social progress in a society (Carree and Thurik 2010; Naudé 2009). An entrepreneurial ecosystem refers to the “people, institutions, policies and resources that promote the translation of new ideas into products, processes, & services…” (National Science Foundation 2015). While they differ in their composition and dynamics, typical actors/entities in entrepreneurial ecosystems include customers, suppliers, and intermediaries along supply chains, institutions, innovators, entrepreneurs, venture capitalists, governments, research centers, and universities (Adner and Kapoor 2010, 2015; Audretsch et al. 2014; Audretsch and Link 2016; Autio et al. 2014; Colins 2016; Cumming et al. 2016; Holmes et al. 2016; Isenberg 2014; Stangler and Bell-Masterson 2015). As such, an entrepreneurial ecosystem provides the knowledge that local entrepreneurs need to recognize, explore, and commercially exploit opportunities to create different types of new ventures (Audretsch et al. 2014; Adner and Kapoor 2010; DeGhetto et al. 2016; Peterson 2016; Teece 2007). A vibrant ecosystem is essential to supporting and growing these different types of companies that could collaborate and compete, generating a dynamic landscape that contributes to the growth of a nation’s economy. This dynamism is also important for the sustainability of the ecosystem itself.

An entrepreneurial ecosystem denotes the systems, networks, relationships, and institutions that define, shape, guide, and enforce norms govern different actors engaged in the creation and growing of new business. While much of the literature focuses on regional ecosystems, a growing body of research suggests that this concept applies equally well to entrepreneurial activities within a nation. Viewed in this context, an ecosystem encompasses the resources (especially knowledge), policies, and institution that clarify different roles of different actors, provide incentives, create deterrents to opportunistic behavior, and articulate laws and regulations that protect intellectual and other types of properties.

Given the importance of entrepreneurial ecosystems, public policy makers have experimented with different approaches in an effort to promote entrepreneurship (Meyers 2015; Teece 2007; O’Connor 2013). These approaches focus on increasing the incentives and creating the context in which entrepreneurs assume the risks associated with new firm creation. The purpose of these initiatives is to promote local entrepreneurs to develop and grow their companies. However, since local entrepreneurs may lack the technological, managerial, and marketing skills, some governments have sought to attract multinational enterprises (MNEs) that bring in new resources, skills, and knowledge that stimulate innovation and technology development and commercialization (Gardner et al. 2001; Görg and Greenaway 2004; Spencer 2008).

The literature suggests that local firms benefit greatly from MNEs in two different but related ways. The first is through MNEs’ spillovers (Hong and Snell 2013; Adler and Hashai 2007). Indeed, research underscores MNEs’ role in the supply of knowledge; i.e., quantity and quality of these knowledge spillovers, positing that such spillovers are likely to stimulate local discovery, leading to the emergence of new firms. This knowledge is multifaceted, covering technology, marketing, operations, and managerial skills. However, researchers tend to assume that greater infusion of MNEs’ knowledge would automatically foster recognition and discovery of opportunity (Kiss et al. 2012; Eggertsson 2005), enabling local entrepreneurial ecosystems to drive economic growth. However, even though governments have encouraged the infusion of knowledge spillovers into the local ecosystem from MNEs to stimulate local entrepreneurial activities (Spencer et al. 2005; Spencer 2008), evidence on the growth and sustainability of entrepreneurial ecosystems has been mixed at best (Haskel et al. 2007; Hill and Mudambi 2010). For example, some studies (e.g., Spencer 2008; Liu et al. 2009) find that MNEs can inhibit local firms from creating new businesses. Other studies find that MNEs may spur the creation of new firms that imitate (Luo et al. 2011) or become important suppliers to MNEs global value chains (Hong and Snell 2013). A recent review comparing international entrepreneurship across countries notes the differences in the types of local entrepreneurship underscore the critical importance of the ecosystems in which these firms are embedded as a source of this heterogeneity (Terjesesn et al. 2016). Thus, understanding the factors that influence the differences in the development of local entrepreneurship becomes essential to learning how public policy makers can encourage the growth of entrepreneurial ecosystems and stimulate the creation and success of new firms (Welter 2011; Lerner 2009).

The second way MNES contribute to local entrepreneurial ecosystems is by promoting co-specialization. Spillovers from MNEs can stimulate the creation of different types of new ventures. These ventures and MNEs often compete and collaborate, developing strong symbiotic relationships that determine the quality and intensity of competition. Over time, local ventures become important sources of innovations but because of their resource and capability limitations may not be able to commercialize on their own. Instead these ventures may license, sell, or enter alliances with MNES to commercialize their discoveries. This can be a win-win proposition for new ventures and MNES. We argue that the nature of the relationships between these ventures and MNEs is likely to depend greatly on the nature of the local entrepreneurial system and its governance. Early on in the development of that system, MNES are likely to hold significant leadership role in shaping the nature of competition and economic development.

Relatedly, co-specialization within an entrepreneurial ecosystem manifests itself in yet another way. Local entrepreneurial companies are often the source of innovative ideas. But they may suffer serious resource limitations. MNEs, with their global reach and deep pockets, could become great alliance partners with local ventures and thus succeed in commercializing their discoveries.

2 Objective and contributions

In this paper, we examine the effect of MNEs’ entry on the development of local entrepreneurship in an ecosystem in a nation and how this effect might change its governance over time.Footnote 1 We recognize that ecosystems vary in terms of their institutions, legal environments, populations, and histories and these unique and idiosyncratic qualities are likely to affect the dynamics of knowledge flows within them and in turn the local entrepreneurship they can sustain (Audretsch and Link 2016; Corallo et al. 2016; Holmes et al. 2016). Conceptually, we offer a model on the role of ecosystem’s absorptive capacity in fostering local entrepreneurship. In addition, we also examine key conditions under which MNEs’ entry translates into breeding different types of companies pursuing different missions, hence firm heterogeneity within an ecosystem. Further, we propose these developments are likely to profoundly impact the governance of the local ecosystem and its growth trajectory. In terms of governance, we suggest that MNEs and local companies are likely to play different roles in governing the ecosystem, ecosystem governance.

To develop our arguments, we propose that knowledge spillovers from MNEs can influence the availability and quality of external knowledge available for local entrepreneurs to create their new firms. Benefits from these spillovers, in turn, rest on the absorptive capacity of the existing ecosystem, as this capacity facilitates understanding of the external knowledge gained from MNEs and other sources (Girma 2005; Kim 1997; Todorova and Durisin 2007). As a result, absorptive capacity can determine the recognition of different opportunities for creating different types of new firms. By recombining knowledge spillovers with existing local knowledge local entrepreneurs establish different types of new companies. We also advance that MNEs entry forces a change in the dynamics of the ecosystem that brings about changes in the resources, skills, and knowledge, inducing significantly heterogeneity in the types of new firms being formed within the local entrepreneurial ecosystem. Over time, these companies evolve, revising their roles and assuming different strategic missions. Ultimately, these changes encourage the emergence of local entrepreneurial companies that engage in original innovations which could complement, substitute, or even challenge those of MNEs. Moreover, over time, these changes alter the governance of the ecosystems: MNEs which occupy central leadership positions early on may have to change places with local companies that gain greater power status and competence. As a result, we provide insights into the co-evolution of new ventures and MNEs and governance of the entrepreneurial ecosystem.

Our paper contributes to the literature in several ways. First, it shows how MNEs’ entry can have profound ripple effects on the composition of a country’s entrepreneurial ecosystem by enabling the birth and success of new companies (DeGhetto et al. 2015; Holmes et al. 2016). These companies could be stand-alone independent ventures or divisions (units or branches) of existing companies (Zahra and Nambisan 2011). These firms could be replicative or innovative in their operations, depending on their missions and goals. Thus, we explain that knowledge spillovers can enrich the heterogeneity of the types of new ventures being formed in an ecosystem. Second, we suggest that this heterogeneity is at the core of the evolution of an ecosystem and its survival and sustainability (Autio and Thomas 2014; Zahra and Wright 2011). By highlighting firm heterogeneity within an ecosystem, we shift focus away from merely counting the number to examining the quality of these new firms. As countries compete to attract MNEs, they need to promote the formation of particular types of local new firms that spur economic development (Dimelis 2005; Parker 2010). Specifically, by exploring different types of new ventures in an ecosystem, we highlight the significant differences in the contributions that various types of new firms can make to the development of that ecosystem and the economy as a whole.

Third, given the potential heterogeneity of new firms that could be created, we ask: What mix of innovative and replicative local entrepreneurs will be sustainable in an ecosystem and under what conditions? We answer this question by considering the dynamic interplay between MNEs’ knowledge spillovers and their effects on the mix of entrepreneurship within an ecosystem. This is an important issue because relationships between these different types of companies determine the direction and pace of an ecosystem’s evolution and sustainability.

Fourth, we develop theory and advance propositions related to the sustainability of the various types of new firms. Our discussion extends research on the co-evolution between MNEs and local ecosystem based on experimentation and heterogeneity within and across local firms (Cantwell et al. 2010). Our presentation shows that benefits from foreign entry are not automatic—some ecosystems are better positioned to gain from MNEs’ entry, especially when they possess the requisite absorptive capacity to benefit from these companies’ knowledge spillovers. The discussion also highlights the role of local absorptive capacity in capturing and disseminating knowledge spillovers from MNEs. It also suggests that high absorptive capacity does not automatically lead to greater heterogeneity of new firms formed in an ecosystem. Ecosystems and national economies differ widely in their respective absorptive capacity because of their knowledge stocks. While we recognize that several factors like access to finance, legal institutions, bankruptcy laws, government support, and supply of talented labor can affect the creation of new ventures, our focus is on the differences in the types of ventures created and sustained in the local ecosystem because of differences in their absorptive capacities.

Further, contrary to the idea that high absorptive capacity may facilitate and support a heterogeneity of local entrepreneurship, we advance that an ecosystem with high absorptive capacity may be locked in a sub-optimal imitative entrepreneurship that can stifle efforts to grow. We also find that even low levels of knowledge spillovers can infuse heterogeneity in local entrepreneurship in ecosystems with low absorptive capacity, potentially stimulating more productive forms of entrepreneurship. Consequently, we highlight the differential effects of MNEs’ knowledge spillovers on an economy and the need to examine the negative impact of absorptive capacity, an issue that has been overlooked in prior research.

Fifth, we advance discussions on ecosystem governance by exploring the respective roles of MNES and local new ventures and how these roles might change with the evolution of changes in the capabilities of local ventures. We highlight mutual learning and adaptation between MNEs and local firms as key mechanisms that explain these changes. We define ecosystem governance to embody the structures that rules facilitate, guide, and govern the activities of different players within an ecosystem and ensure their effective functioning.

Given our focus on how conditions in a particular ecosystem may shape the heterogeneity of new ventures established in an ecosystem, we will first discuss the relevance of the concept of absorptive capacity of the ecosystem for various types of local entrepreneurs. Next, we will consider how local absorptive capacity influences the potential mix of new firms and its implication for MNEs. We then develop theory on the heterogeneity of new ventures in an ecosystem—under different conditions. Next, we will highlight key conditions that may lock-in the local ecosystem to a particular type of entrepreneurship, affecting the governance of the existing ecosystem. Finally, we present the implications of our paper for practices and theory development with a particular focus on ecosystem governance.

3 Absorptive capacity and sustainability in an entrepreneurial ecosystem

There is a growing recognition among policy makers that deliberate action is necessary to develop and invigorate local entrepreneurial ecosystems. Often these ecosystems are fragmented and their structures do not allow for cooperation across organizational boundaries. In some cases, this is the result of historical events that might inhibited collaboration. Poor education and investment in technological upgrade might also contribute to this condition. Dominance of a few local players competing on local resources and knowledge might stifle the entry of new competitors. Relationships in existing networks may stifle entry. Worse, incentives may reduce willingness to engage in entrepreneurship. For example, IP laws may be obsolete or even non-existent. Corruption may make it hard to get legal permits to create new companies. Poor infrastructure could also contribute to low rates of entrepreneurship. In some countries, poor economic conditions and low levels of technological conditions add to the monumental difficulties entrepreneurs face in create companies. Universities and research institutes are also poorly organized and staffed, generating graduates with limited and even dated skills. Understandably, public policies seeking to reverse these conditions need to invest in creating and diffusing new knowledge.

Creation of new knowledge could be achieved by developing new institutions tasked with this goal. This is a task that takes time and significant resources. To expedite access to new knowledge, public policy makers often seek the entry of MNEs. This entry serves multiple related purposes. First it creates new jobs. Second, it introduces new technology and innovative management and marketing techniques needed to develop the local economy. Third, it brings in new knowledge—technical otherwise that can help promote innovation and discovery—often offering a foundation for new venture creation as we will argue shortly. Fourth and relatedly, foreign entry encourages co-specialization where local companies and MNEs can build on their own respective advantages and create wealth. As the relationship between these two sets of actors’ changes, they are likely to assume different roles that in turn influence the way with which the ecosystem is governed.

Over the past decade, many MNEs have expanded their operations by entering new markets where they can capitalize on the opportunities for growth and profits, gain access to resources, and benefit from the incentives offered by local governments (Globerman and Shapiro 1999; Meyer et al. 2009). Countries have offered great incentives for MNEs to enter their markets in the hopes of acquiring innovative technologies and modern managerial practices. MNEs’ expansion has been driven by their desire for greater profitability and growth. In fact, a key source of MNEs’ advantage lies in their ability to create and accumulate knowledge that they could use to innovate and gain a competitive advantage (Frost 2001; Gupta and Govindarajan 1991; Singh 2007; Spencer 2008). Knowledge, a strategic asset in global markets, determines the effects of competitive rivalry between companies (Helfat 1997), and innovation ecosystems. MNEs often attain competitive advantages by investing heavily in R&D activities which they increasingly disperse around the globe to gain access to scientific and technological discoveries (Ricart et al. 2004). To succeed, MNEs often seek additional knowledge especially about the local economies (Frost 2001; Grant 1996) by developing alliances, acquiring innovative firms, and joining research consortia (Kim 1997; Almeida et al. 2002). These activities enable MNEs to replenish their knowledge base and keep it current. New knowledge may be captured and diffused within MNEs’ own intra-organizational networks, often spurring innovation (Birkinshaw 2004). This quest for resources, knowledge, and opportunities shapes MNEs’ interactions with local companies, affecting the governance of the ecosystem.

4 MNE entry and knowledge spillovers

As noted, policy makers believe MNEs play an important role in infusing new knowledge, skills, and resources into existing local innovation ecosystems. This infusion can stimulate entrepreneurial activities. MNEs usually seek to capitalize on the knowledge in their local context, learn rules of competition, or obtain favorable business positions through innovation. MNEs also contribute to knowledge spillovers (Spencer et al. 2005) through their transactions with other players in the ecosystem and through employee mobility. Local entrepreneurs also get exposed to MNEs’ technologies, business models, organizational skills, competitive strategies, and marketing prowess (Blomström and Kokko 1998). MNEs also demonstrate the validity of unexploited but valuable opportunities in the ecosystem. These activities often draw the attention of local entrepreneurs to promising opportunities while legitimizing those activities associated with new firm creation.

Knowledge spillovers from MNEs could be deliberate, as happens when there is a policy to deliberately transfer technology to local operations. However, these spillovers could be unintentional, occurring in the course of natural transactions with other stakeholders or through employee mobility. Some of these spillovers embody tacit knowledge as happens with learning that occurs through experience. Other spillovers embody more codified and explicit knowledge, such as knowledge related to policies and procedures. These different types of knowledge often become a source of ideas for opportunities for new firm creation and subsequent growth.

Entrepreneurs embedded in a local ecosystem often develop tacit knowledge and rich insights as to how to capture and use MNEs’ knowledge spillovers as they explore opportunities to found new firms (Acs et al. 2008). Vicarious learning enables local entrepreneurs to enrich and expand their firms’ knowledge bases (Zahra et al. 2000). It also helps these entrepreneurs to identify viable business opportunities, innovative business models, and effective organizational skills in an ecosystem. The organizational learning theory suggests that recipients of knowledge need to have the requisite absorptive capacity—i.e., the ability of the ecosystem to facilitate the recognition, acquiring, understanding, assimilation, and exploitation of externally generated knowledge flows (Cohen and Levinthal 1990; Zahra and George 2002). This capacity is usually determined by the configuration and dissemination of knowledge in a given ecosystem which, in turn, is shaped by prior investments in R&D, employment of scientists and engineers, and the level of technical literacy and expertise of its human capital (Kim 1997; Todorova and Durisin 2007). The absorptive capacity of an ecosystem can facilitate (or impede) understanding of the knowledge local entrepreneurs gain from MNEs and other sources (Girma 2005; Kim 1997; Todorova and Durisin 2007). In turn, this facilitates the recognition of different opportunities for creating different types of new firms locally. Local firms may vary in their ability to benefit from external knowledge spillovers but an ecosystem’s ability to nurture and sustain such activities depends greatly on how knowledge is configured and disseminated in the ecosystem.

At the ecosystem level, absorptive capacity denotes the aggregate knowledge different stakeholders have, exchange, share, and apply. As such, it has distinct but complementary components (Zahra and George 2002). These include the following: “acquisition” which is concerned with prior knowledge and prior investments; “assimilation” which focuses on the interpretation of new knowledge; “transformation” which centers on internalization of new knowledge; and “exploitation” which is concerned with application of incoming, external knowledge. Given that the ecosystem provides the context in which entrepreneurs make their decisions, each of these dimensions can influence the type and quality of knowledge available for local entrepreneurship. For example, local entrepreneurs may identify different opportunities within their ecosystem because they differ in their ability to assimilate external knowledge (Girma and Wakelin 2000) or how they interpret this knowledge.

Different ecosystems that exist within the same country also accumulate different types of knowledge because of historical factors, prior investments in knowledge creating activities, and unique national systems of innovation (Acs et al. 2014; North 1990; Wu et al. 2016). National institutional environments also differ (Spencer et al. 2005), further magnifying the potential differences in assimilating external knowledge spillovers. Consequently, different ecosystems would have potentially different levels of absorptive capacity, containing different types of knowledge.

Given that different ecosystems offer different ways for gaining, assimilating, and exploiting knowledge, this may cause variability in the levels of knowledge sharing and diffusion within and across ecosystems (Kenney and Florida 1994; Martinkenaite and Breunig 2016; Roberts 2015). Some ecosystems are characterized by high absorptive capacity, as often occurs when they contain multiple clusters of high technology firms and technology parks. Areas within an ecosystem with low absorptive capacity typically have dated and archaic institutions, poorly trained personnel, and decaying infrastructures that limit knowledge acquisition, assimilation, sharing, and exploitation. High absorptive capacity promotes knowledge assimilation and makes exploitation easier and faster, enabling entrepreneurs within the ecosystem to spot and exploit opportunities for new firm creation. This expectation is consistent with learning theory that suggests the effect of spillovers is greater for areas that have lesser technology gaps between MNEs and existing local firms (Girma and Wakelin 2000). In ecosystems with high absorptive capacity, the overlap in knowledge is greater and therefore can increase and expedite knowledge assimilation and use (Zander and Kogut 1995). Entrepreneurs embedded in high absorptive capacity ecosystems are likely to show greater ability in understanding, assimilating, and using knowledge spillovers (McKeon et al. 2004; Singh 2007).

Though MNE’s knowledge spillovers can influence an ecosystem based on the local absorptive capacity, the heterogeneity of local entrepreneurship may in turn influence these MNEs’ strategies. This interplay between MNEs and the existing mix of local entrepreneurs has influence the growth and trajectories of ecosystems (and indeed national) development. In a given ecosystem, MNEs may be more accommodating and even become strategic allies for local entrepreneurs who complement their capabilities. However, MNEs may become wary of local entrepreneurs who could evolve into potential competitors. The breadth and amount of spillovers between local entrepreneurs and MNEs operating in the same ecosystem depends on their competitive relationship. In turn, the extent and nature of knowledge spillovers emanating from MNEs can profoundly influence the different activities local entrepreneurs may undertake within an ecosystem.

The activities entrepreneurs undertake in an ecosystem frequently change the configuration of that ecosystem, allowing it to support and sustain many different types of new firms. This is important, albeit less understood, aspect of economic development (Terjesesn et al. 2016; Lerner 2009). Ecosystems that support greater heterogeneity of entrepreneurial activities are vibrant, dynamic, and responsive to changes in global business environment. A lack of heterogeneity cannot buffer firms against changes in technology or customer tastes. Furthermore, the heterogeneity of local entrepreneurial activities can promote the exchange of diverse knowledge that advance novel and innovative ideas across fields (Yayavaram and Ahuja 2008). The many failed attempts to develop entrepreneurial ecosystems by harnessing MNEs across the world bear testimony on the importance of having a wide range of heterogeneous entrepreneurial activities in different parts of the national economy. Underscoring this point, Lerner (2009) compares Malaysia’s attempt at singularly focusing on bio-technology in 2005 with their BioValley complex with Singapore’s Biopolis developed in 2004 with wide range of supporting industries. A large ecosystem capable of supporting diverse entrepreneurial activities is often touted as the key in advancing economic development of Singapore vis other nations like Jamaica that initially started out at the same level (Lerner 2009; Dunning and Lundan 2008). Jamaica and Singapore have similar levels of entrepreneurial activity but while Singapore sports a vibrant ecosystem with diverse high technology firms in multiple sectors (Baumol 2010; Dunning and Lundan 2008); Jamaican entrepreneurship is mostly based on ancillary and subsistence ventures (Blavy 2006).

4.1 Heterogeneity in new firm types within the entrepreneurial ecosystem

Our discussion illustrates the heterogeneity of knowledge in an ecosystem and the fact that local firms could benefit differently from that knowledge differently. This is especially the case with knowledge to be gained from MNEs’ entry. This knowledge could fuel different types of entrepreneurial activities. For analytical purposes, we focus on four broad typesFootnote 2 for local entrepreneurship within a given ecosystem: (1) Stable replicators: those entrepreneurs who predominantly imitate without contributing new knowledge; (2) Stable innovators: those entrepreneurs who develop new local innovations that contribute new knowledge to the local market; (3) Partial replicators: those entrepreneurs who usually develop imitative products but may contribute innovations occasionally; and (4) Partial innovators: those entrepreneurs who develop new innovations but may occasionally develop imitative products. Below we show how these four types of local entrepreneurs change as they co-evolve with MNEs.

Local firms within an ecosystem can change over time from being replicators to innovators as the benefits and gains to different types of entrepreneurship may also change over time. For instance, local replicators may need to customize their products and services for a niche market, scale their products as their market grows, or differentiate their products from other competitors. These changes may be small and subtle but over time they can lead to the evolution of more sophisticated innovative firms within an ecosystem. Likewise, innovators can become replicators over time as they gain legitimacy by copying MNEs products and processes, improve product offering and quality, or use the infrastructure already developed by MNEs. Though the exact mechanisms through which local new firms within an ecosystem might evolve could vary in each case, they redefine their business concepts and missions (Bhidé 2000), shifting from one type to another and taking advantage of prevailing conditions.

As noted, the level of knowledge assimilation and utilization depends on the overall absorptive capacity of the local ecosystem. While local entrepreneurs can gain considerably from MNEs’ knowledge spillovers, different entrepreneurs can gain differently from these spillovers. Different entrepreneurs also interact with and capture MNEs’ knowledge differently, further influencing future spillovers from MNEs. These differences reflect variations in absorptive capacity and the modes firms use in exploiting newly acquired knowledge. In turn, this further stimulates entrepreneurial interest in MNEs’ spillovers. Thus, not only do MNEs’ knowledge spillovers impact different local entrepreneurs differently, different types of local entrepreneur also determine the rate of MNEs’ knowledge spillovers within an ecosystem. Therefore, we highlight a dynamic relationship between MNEs’ knowledge spillovers and local entrepreneurship within a given ecosystem. In some cases, this dynamic relationship can lead to mutually reinforcing cycles that favor a particular type of local entrepreneur while in other cases can generate a great deal of heterogeneity in local entrepreneurship.

Innovations are often idiosyncratic and rely heavily on prior experience (Shane 2000). They are also path dependent (Sydow et al. 2009) and often involve multiple factor inputs that makes them socially complex and causally ambiguous (Alvarez and Busenitz 2001). Social complexity and causal ambiguity can significantly improve the potential rents innovators may gain as imitation becomes harder and increasingly inefficient. The high absorptive capacity of an ecosystem implies that the causal ambiguity and social complexity associated with innovations introduced primarily by MNEs (Alvarez and Busenitz 2001; Boschma and Wenting 2007) may be reduced, potentially leading to rapid absorption. Entrepreneurs operating within an ecosystem with high absorptive capacity can exploit their deeper understanding of the technology, process, and knowledge underlying MNEs’ innovations and quickly develop replicative products. For example, knowledge about integrated circuits facilitates easy replication of the design technology behind a microprocessor and thus favors replicators with relevant know-how over innovators who have to re-invent the wheel. As such, innovative local entrepreneurs may have less advantage as the constant stream of the MNE’s innovations erode their advantages significantly compared to replicative entrepreneurs.

In an ecosystem with high absorptive capacity, reductions in causal ambiguity and social complexity are key sources of innovation rents (Alvarez and Busenitz 2001). An MNE profits if the advantages arising from its innovation are not lost through imitation. As discussed earlier, local entrepreneurs can learn through reverse engineering or analyzing market processes and customer responses to better decipher MNEs’ actions. The incenting of local replicative entrepreneurs and the consequent imitation within an ecosystem may further erode MNEs’ advantages. Therefore, the high absorptive capacity of an entrepreneurial ecosystem might paradoxically reduce MNEs’ appropriability of their innovations resulting in relatively short-lived advantages for MNEs’ innovations. Consequently, the proliferation of replicative local entrepreneurs in an entrepreneurial ecosystem may encourage MNEs to keep introducing newer and more innovations, generating greater spillovers over time. Thus, there is a positive loop between local replicators and MNE spillovers, while local innovators may have no systematic effect on MNEs’ knowledge spillovers.

As just noted, both MNE actions and the choices of local entrepreneurs affect each other leading to mutual co-evolution in the ecosystem. These repeated interactions over time between MNEs and local entrepreneurs within an ecosystem give rise to systematic regularities. For instance, in ecosystems with high absorptive capacity, a red queen-like competition is likely to emerge (Barnett and Hansen 1996; Baumol 2010). This may happen because both MNEs and local entrepreneurs within a particular ecosystem may get trapped in an escalating cycle of innovation and imitation, as we have just presented. The “red queen” effect refers to the relation between two competing agents, such as an MNE and stable replicator, where both enter something akin to an “arms race” in which certain capabilities escalate to seemingly unnatural proportions. This competitive dynamic has the added effect of reducing the competitiveness of truly innovative entrepreneurship in relation to replicative activities within the ecosystem, further intensifying replicative entrepreneurial entrepreneurs. Consequently, MNEs may have to undertake more innovations to simply retain their existing market positions. This effect suggests that, regardless of the actual levels of capabilities both MNEs and local replicators may attain within a given ecosystem, they are not likely to change their profits greatly. Both have to work harder and harder to retain their current positions. As a result, the positive feedback will become self-sustaining to the detriment of other forms of local entrepreneurship within that ecosystem. Over time, in high absorptive capacity ecosystems, there will be an escalating dynamic between the MNE and replicative entrepreneurs leading to the dominance of those replicative entrepreneurship. This can lead to a lock-in of replicative entrepreneurship, suggesting the following two propositions:

-

Proposition 1: In ecosystems with high absorptive capacity, when the MNE introduces new innovations into the local ecosystem there will be a lock-in of replicative local entrepreneurship.

-

Proposition 2: In ecosystems with high absorptive capacity, MNEs will introduce greater numbers of innovations when the local ecosystem is dominated by replicative entrepreneurship.

Even though MNEs cannot fully control knowledge spillovers to the local ecosystem, they may use several techniques to manage the fallout of these spillovers. These techniques include strategically organizing their R&D activities, maintaining technology control on standards, and co-opting local entrepreneurs in the emerging economy (Marquis and Raynard 2015). These actions often raise the costs for replicative entrepreneurship relative to genuine innovations by reducing the knowledge available for local entrepreneurs to copy. When MNEs regulate their knowledge flows by capping the innovations introduced in the local ecosystem, there is no significant advantage for either replicative or innovative entrepreneurship. Thus, when spillovers are under check, there is no preference for any particular form of entrepreneurship to dominate the ecosystem. Thus, entrepreneurs who switch between replicative and innovative approaches based on a given condition will tend to do much better. This indicates greater heterogeneity in local entrepreneurship within a given ecosystem when knowledge flows from MNEs’ innovations are regulated. These observations suggest the following proposition:

-

Proposition 3: In ecosystems with high absorptive capacity, when the MNE does not introduce innovations in the local ecosystem there will be greater heterogeneity in local entrepreneurship.

Conversely, in ecosystems with low absorptive capacity, the potential gains from MNEs’ knowledge flows are likely to be minimal and innovations may remain imperfectly imitable for a long time. This enduring effect occurs because low absorptive capacity makes knowledge flows harder to diffuse, translate or use. The causal ambiguity and social complexity associated with host economy MNEs’ innovations are harder to replicate in low absorptive capacity regions of an ecosystem and they undergird the value generated from MNEs’ innovations. The difficulties encountered in using knowledge spillovers can enhance the advantages of MNEs’ innovations by making replicative entrepreneurship harder to achieve. Yet, if local entrepreneurs pursue innovation, their gains also last longer before they are competed away by MNEs or other entrepreneurs operating within the ecosystem. These gains are also less affected by MNEs’ knowledge spillovers as entrepreneurs do not rely on MNEs spillovers for developing their products and/or services.

MNEs that compete under such conditions can manage their knowledge spillovers strategically by developing relationships with local entrepreneurs in close proximity in an ecosystem based on cooperation, trust, and openness that facilitate the transfer of codified knowledge (Saxenian 1994). MNEs who cooperate with local entrepreneurs are less likely to be affected by replicators who come out with cheap substitutes. Consequently, unlike high absorptive capacity ecosystems, local replicators do not have significant impact on MNEs’ spillover strategies. Yet, innovative local entrepreneurs plugged into MNEs’ value chain can help these MNEs improve efficiency, develop better products, lower production costs, and shorten lead times (Clark 1989). Such co-dependence in product development often translates into co-development of knowledge by domestic firms and foreign MNEs within an ecosystem (Finegold 1999), where foreign MNEs and local entrepreneurs upgrade their respective knowledge, capacities, and skills. These engagements are likely to vary based on local competitive conditions. For example, in the brewing industry, where a global product (i.e., beer) is constrained by local tastes, MNEs generally view existing local firms as potential sources of complementary capabilities and local innovations. As local innovators increase in numbers, they often reduce MNEs’ knowledge spillovers as they become the source of innovation for the MNEs.

Over time, an ecosystem stabilizes more towards innovative entrepreneurship, especially when MNEs form alliances with local innovators to gain strategic advantages in speed, access to resources, and overcome liabilities of foreignness (Dyer and Singh 1998). These relationships last while MNEs control the type and quality of knowledge spillovers, effectively delaying the emergence of competitors and rivals. When absorptive capacity is low, MNEs may outsource innovations to local entrepreneurs by co-opting them to develop intermediate products that are part of MNEs’ value chain and thus continue to hold monopsony advantages (Marquis and Raynard 2015). Thus, for low levels of spillovers, MNEs can rely on local innovators locking them into being captive and dependable suppliers for their value chains.

However, rising knowledge spillovers from MNEs can level the playing field for replicative entrepreneurship by increasing knowledge flows while reducing the advantages of local innovation. Though local replicators may benefit from additional spillovers, the low absorptive capacity of the local ecosystem implies that their products and services are often inferior copies. However, additional spillovers can increase the competitiveness of replicative local entrepreneurs as well as intermittently innovative and replicative entrepreneurs’ vis-a-vis innovative local entrepreneurs fostering heterogeneity within an ecosystem. Our discussion underscores two points: (a) beyond a given threshold, there is no significant advantage for either replicative or innovative entrepreneurship within an ecosystem, and (b) heterogeneity in local entrepreneurship is likely to be greater when knowledge flows from MNE innovations are high. These observations suggest the following two propositions:

-

Proposition 4: In ecosystems with low absorptive capacity, when the MNE does not introduce innovations in the local ecosystem there will be a lock-in of sub-par innovative local entrepreneurship.

-

Proposition 5: In ecosystems with low absorptive capacity, when the MNE introduces innovations in the local ecosystem there will be greater heterogeneity in local entrepreneurship.

5 Co-evolutionary processes within the entrepreneurial ecosystem

In Fig. 1, we summarize our discussion on key contingencies influencing heterogeneity in local entrepreneurship by plotting the relative proportions of different local entrepreneurs in an ecosystem. Figure 1 shows predicted changes in the mix of local entrepreneurship as the spillovers from MNEs change over time. For low absorptive capacity ecosystems, low levels of spillovers can significantly increase the proportion of local innovators. The innovative local entrepreneurs that displace other types of entrepreneurs within an ecosystem are usually suppliers in the MNEs’ value chains. Yet, higher levels of an ecosystem’s absorptive capacity favor more heterogeneity in the types of innovations undertaken and in the types of firms created. Under these conditions, local new ventures within an ecosystem that differentially use innovation and replication do slightly better than stable innovators or replicators. This trend is reversed for high absorptive capacity ecosystems. Thus, low levels of spillovers favor all types of ventures equally, while high levels of spillovers can lead to red queen type competition between replicators and MNEs locking an ecosystem into replicative entrepreneurship. Figure 1 plots the changes in relative distributions of local entrepreneurship with respect to MNEs’ knowledge spillovers for different levels of absorptive capacity.

Table 1 captures the overall relationship between absorptive capacity and knowledge spillovers on the heterogeneity of local entrepreneurship in a given ecosystem. Table 1 shows that heterogeneity exists under contrasting conditions for the same rate of MNE knowledge spillovers. While high knowledge spillovers can increase heterogeneity for low absorptive capacity ecosystems, more controlled spillovers can significantly increase heterogeneity when absorptive capacity is high. Greater heterogeneity in local entrepreneurship enables local new firms to develop and diffuse the knowledge they create more easily, improving the absorptive capacity of their ecosystem.

Improvements in absorptive capacity may encourage the entry of more entrepreneurs into an ecosystem, some of whom may have more advanced skills and better knowledge bases. As a result, over time, existing new firms might develop more advanced and innovative ways of organizing and competing increasing knowledge flows, promoting a virtuous cycle in the ecosystem (Agarwal et al. 2010). When firms continuously incorporate new knowledge into their routines, there is a higher likelihood of the emergence of new entrepreneurs who exploit broader and perhaps more complex opportunities. These observations underscore the importance of heterogeneity in the types of opportunities exploited by local entrepreneurs. The variability of the opportunity sets available in a given ecosystem further increases the heterogeneity of the types of future opportunities to be exploited, encouraging even greater heterogeneity among firms in an ecosystem.

In contrast, high profitability for a particular type of local entrepreneurship may inhibit heterogeneity (Zhu et al. 2006), potentially trapping entrepreneurs into one type of specialized organizing form best suited to exploiting external knowledge while blinding them to newer albeit, lower efficiency re-combinations. Consequently, new re-combinations that foster the development and survival of new firms are not sustainable because the other types of entrepreneurship are often less efficient than the dominant way of organizing even though they offer the promise of economic progress. Next, we discuss the implications of our propositions.

6 Discussion

Promoting entrepreneurial ecosystems has become a key component of the national development strategies of many countries (Autio et al. 2014; Bruton et al. 2008; Drexler et al. 2014; Thomas and Autio 2014), such as India, China, Korea, Japan, USA, and several emerging economies. It is also a high priority throughout EU countries (Colins 2016), Canada, Latin America, and African countries. Other countries (e.g., Singapore) have made the creation of dynamic, technologically vibrant innovative ecosystems a national goal. Seeking to understand the factors that stimulate local entrepreneurship, researchers have studied the roles of national cultures and values, national policies as well as formal and informal institutions on the propensity of local entrepreneurs to take risks and create companies (Hoskisson et al. 2013; Kim et al. 2010). We add to this body of research by focusing more directly on ecosystems that form the fabric of national economies by examining the entry of MNEs as a source of knowledge spillovers that can expedite learning that promotes local entrepreneurship (Spencer 2008).

Our discussion illustrates how entrepreneurial ecosystems’ variations in their absorptive capacity can accentuate the heterogeneity observed in the new firms that local entrepreneurs are likely to create exploiting MNEs’ knowledge spillovers. These variations reflect the history, composition, interactions, policies, and institutions governing these ecosystems (Corallo et al. 2016; Lucarelli et al. 2016). Our discussion capitalizes on the fact that entrepreneurial ecosystems vary considerably in their knowledge content and patterns of knowledge development and accumulation as well as absorptive capacity. Our discussion illustrates how entrepreneurs engage in a process of “creative construction” as they convert and combine different types of knowledge, both from their local contexts and MNEs’ knowledge spillovers, to establish different types of firms (Agarwal et al. 2010). While the archetypes of new ventures presented in our study are simplifications of the multitude of ventures that can be created in an ecosystem, our conceptual contribution lays a foundation for future empirical work that explores the consequences of FDI for the evolution of local entrepreneurial ecosystems.

Our paper contributes to the literature on entrepreneurial ecosystems and their governance in several ways. Notably, a key insight from our analyses relates to the negative effect of increased local absorptive capacity within an entrepreneurial ecosystem (den Bosch et al. 1999, p. 565). Though some scholars have noted the diminishing returns of higher absorptive capacity for learning and efficiency of innovation, they have emphasized information processing and competency traps (Christensen 1997). In the context of FDI, recipient countries and their firms may not fully benefit from incoming external knowledge because of faulty or slow information processing. Further, firms may be blindsided to new radical ideas because high absorptive capacity leads them to reinforce and invest in the prior knowledge which they already have, even when this knowledge is outdated. Our discussion highlights another mechanism through which absorptive capacity may hinder the recognition of new opportunities within an ecosystem, one that is not related to the myopia of learning (den Bosch et al. 1999). Instead, high absorptive capacity can undermine causal ambiguity, a cornerstone of competitive advantage that safeguards the potential value to be appropriated by innovators. We propose that ecosystems high in absorptive capacity may even promote imitation by reducing causal ambiguity that often limits the copying of new products and ideas. Increased imitation, in turn, can lower entrepreneurs’ incentives for undertaking original innovation that leads to the creation of different types of new firms.

Thus, high absorptive capacity may have some negative implications for an entrepreneurial ecosystem by increasing the likelihood of imitation and promoting (and sometimes perpetuating) replicative entrepreneurship. As local entrepreneurs proceed to use the knowledge gained from MNEs to build and expand their firms, over time, these entrepreneurs may favor external knowledge sourcing and environmental scanning for new ideas over investing in original internal R&D. Hence, an ecosystem’s high absorptive capacity may encourage new firms to orient themselves to seek external knowledge (Boschma and Wenting 2007) while reducing their internal R&D activities. This focus can promote replicative entrepreneurship, potentially handicapping the evolution of radically innovative companies that pursue bigger opportunities that enhance the development of national entrepreneurial ecosystems.

The proliferation of replicative entrepreneurs in a given ecosystem can also encourage MNEs to increase their innovations, generating additional knowledge spillovers in that ecosystem. Unless there are institutional mechanisms to slow down MNEs’ rapid introductions of innovations and their quick absorption and replication by local entrepreneurs, the escalating cycle of innovation followed by greater replicative entrepreneurship can lead to a red queen-like competition. In this case, continuous co-evolution keeps MNEs and local entrepreneurs at relatively similar levels of competitiveness.

Our work also adds to the literature on co-evolution between MNEs and local firms by studying the dynamic interplay between MNE knowledge spillovers and local entrepreneurship in a given entrepreneurial ecosystem. We observe that MNEs may benefit from establishing and maintaining a co-evolving network with local entrepreneurs through effective knowledge management. Working collaboratively with local innovators can stimulate and expedite MNEs’ capability building activities that could be subsequently diffused in other markets (Almeida and Phene 2004). Even though it might be advantageous for MNEs to promote innovative local entrepreneurs, their closeness to MNEs might make it difficult for them to grow and be sustainable. Close ties with MNEs might stifle the emergence of local competitors and lock an ecosystem into being an innovative complement to these MNEs. Still, the rise of competing local entrepreneurs who benefit from knowledge spillovers might be worrisome for MNEs operating in an ecosystem (Parker 2010), prompting MNEs to change their strategies (Marquis and Raynard 2015) by depressing their knowledge flows. With high absorptive capacity, competing replicative entrepreneurs may instead propel a “red queen” situation by escalating competition with MNEs in select areas within the ecosystem, possibly reducing the heterogeneity of new firms and thus increasing the lock-in to replicative entrepreneurship. These forces can handicap the development and sustainability of a viable and growing ecosystem. Still, suggest that the co-evolution of MNEs and their interactions with local entrepreneurs induce heterogeneity in new firms, creating different paths of resource accumulation that further accentuate firm heterogeneity. These interactions are crucial to knowledge diffusion and subsequent use to create new firms (Lucarelli et al. 2016).

Our discussion highlights three key implications for ecosystem governance. First, the co-specialization that develops between local firms and MNEs early on affects the leadership of these ecosystems. Early on, MNEs have the organizational skills and resources to assume leadership. Later as local companies become more proficient they could share leadership with (or even replace) MNEs. The speed of this change is determined by the nature of interactions that occur among these firms, speed of learning by local companies, and policies enacted by policy makers. The foundations of co-specialization are likely to change as well, further influencing patterns of ecosystem leadership. Second, only truly innovative local companies are best positioned to rise to leadership within the ecosystems because of their social and political capital; these companies are likely to build strong connections with policy makers who are likely to see them as crucial symbols of national progress. These companies are also likely to develop business models that reflect their local contexts, serving as role models for other local entrepreneurs. Third, the structure and rules guiding and shaping the ecosystem are likely to undergo significant changes as firms learn, adapt, and grow. Policy makers also learn how, where, and when to effect change in the ecosystem. These changes, in turn, have serious implications for the future entry of additional MNEs and the ongoing cycle of co-creation that occurs in the local entrepreneurial ecosystem,

6.1 Policy and managerial implications

Our discussion makes clear that the continuous co-evolution of MNEs and local new firms within an ecosystem creates conditions that favor replicative entrepreneurship in high absorptive capacity ecosystems. However, heterogeneity in local entrepreneurship may enable the ecosystem to withstand shocks while generating new knowledge resulting in local spillovers in many different areas (Praag and Versloot 2007). To increase heterogeneity in local entrepreneurial activities within particular ecosystems, policy makers need to proactively develop and enforce policies that stem the erosion of value from innovators while encouraging knowledge spillovers (Parker 2010). This balance may be difficult to achieve because entrenched local entrepreneurs may attempt to cement their relationships with government officials, local suppliers and consumers, and other stakeholders in the ecosystem (Haskel et al. 2007). Hence, there is a need to pursue public policies that promote local entrepreneurship while enacting other policies to limit a lock-in of replicative entrepreneurship within an ecosystem.

One of our contributions is highlighting the heterogeneity of new firms being created in an ecosystem. This is important because different types of ventures within an ecosystem capitalize on distinct opportunities, resources, and skills. The fact that these new firms might compete differently and even evolve at different rates underscores the need for care among policy makers. They need to create the right incentives that encourage the emergence of the desired types of new firms. These incentives could promote the creation of high potential, high growth new firms that can employ a large number of people, fill voids in a country’s skill base, and achieve growth that facilitates resource accumulation (Holmes et al. 2016). Both innovative and replicative ventures contribute to the sustainability of an entrepreneurial ecosystem, one providing the engine and stimulus while the other enhancing productivity and growth. These benefits, in turn, can foster the creation of the next generation of entrepreneurial firms in a given ecosystem, enhancing its sustainability. Besides motivating entrepreneurs to establish certain types of new firms, policy makers need to manage the portfolio of these firms in ways that enhance the growth of an ecosystem.

6.2 Implications for theory and future research

Our discussion indicates that entrepreneurs integrate and combine different types of knowledge flowing from MNEs to develop different types of local new firms. For analytical simplicity, we have focused on two extreme types of local entrepreneurship and their variants: replicative and innovative. Of course, other types of new firms might emerge as a result of the interaction of MNEs’ knowledge flows and absorptive capacity in an ecosystem. Documenting other types may require us to separate different types of knowledge spillovers, as Spencer (2008) suggests. Further, different types of new ventures may interact with each other differently, competing, collaborating, learning, and morphing. We need to examine these processes and how they are likely to influence the emergence and evolution of local entrepreneurship.

Firm creation is a process that entails considerable learning. In studying entrepreneurial ecosystems, this learning occurs among MNEs’ managers, entrepreneurs, public policy makers, and other stakeholders (e.g., suppliers). As noted, this learning could influence the types of new firms being created as well as the direction and speed of their evolution. Hence, researchers need to study these issues to explain the emergence and subsequent evolution of new firms in an ecosystem. It would be especially useful to determine which new firm types remain unchanged vs. those that undergo major changes over time and the conditions that could influence these changes. The possibility of a “red queen” effect also poses important challenges for future studies. How real is this effect? How long does it last? What is its effect on the emergence of different types of new firms and/or the development of an ecosystem? How does a nation’s competitive conditions and stage of development influence the severity, duration, and impact of the red queen effect? Answering these questions requires that we identify the conditions under which an ecosystem is able to avoid this effect in the first place as well as those conditions that allow it to break away from this effect.

Other fundamental questions require attention in future studies. For instance, we need to know more about how different ecosystems develop the absorptive capacity necessary to gain the technological, marketing, and organizational knowledge essential to new firm creation. Different types of knowledge spillovers from MNEs may have different trajectories and can have different temporal and spatial dimensions that should be considered. For example, different parts of an ecosystem may experience greater dynamism because of variations in discoveries that provide radically new knowledges at different times. Further, the geographic distribution of firms (both local and MNE) might have implications for the different types of innovations they undertake and the types of knowledge flows that occur. These variations can profoundly influence the sustainability of an ecosystem. Ecosystems’ growth trajectories can also influence the investments that companies and countries make to promote entrepreneurship. Relatedly, the different contingencies under which different types of new firms complement or substitute each other deserve future research attention. These contingencies may also change over time in their intensity and impact on local entrepreneurship. There may be a path dependent sequence to follow in promoting the creation of new more capable firms and enhancing growth (Bhawe et al. 2016).

In this paper, we have treated foreign MNEs’ entry as an exogenous variable. These MNEs may enter local ecosystems to learn about new technologies and markets (Penner-Hahn and Shaver 2005), exploit an internalization advantage (Hennart 1991), or seek a first-mover advantage (Khanna et al. 2005). These motivations may affect the rate of knowledge spillovers in an ecosystem, suggesting a correlation between MNEs’ entry choice and its knowledge spillovers. For example, MNEs entering high absorptive capacity ecosystems may want to learn and incorporate new technologies. Further, in the process of locally embedding themselves (Frost 2001), these MNEs may indirectly spillover their knowledge into the local ecosystem. Future studies need to explore how MNEs embed themselves within their local entrepreneurial ecosystem.

Future researchers should also consider the composition and governance of entrepreneurial ecosystems as well as the changes that occur in them over time and the factors that drive these changes. Our discussion hints to the changes in governance because of the emergence of local innovative ventures that become increasingly adept at working with and even challenging MNES. In a broader sense, the competitive dynamics and patters of collaboration and competition that unfold within an ecosystem can shape its governance. These dynamics could also alter the social structure (e.g., networks) that undergirds the ecosystem. They can also redefine the boundaries of a given ecosystem. Relatedly, the evolution of different local firms could also revise patterns of co-specialization between MNEs and local firms, further highlighting the need to reconsider governance mechanisms within the ecosystem. Moreover, our discussion suggests that policy makers (very much like the companies they monitor) learn by doing, affecting their views of the right mix of policy initiatives that could guide the next stages of the ecosystem’s evolution.

7 Conclusion

Entrepreneurship is a powerful engine of national economic, technological, and social growth. To catch up with rapid technological advances and foster the creation of their own industries, some countries have adopted policies and incentive programs that encourage the entry of foreign MNEs, aiming to learn from them. This paper suggests that the knowledge spillovers gained from these MNEs can induce different local entrepreneurial activities, but much depends on the absorptive capacity of the recipient ecosystems. It also suggests that replicative entrepreneurship may predominate even when an economy has high absorptive capacity while low absorptive capacity ecosystems may favor innovative entrepreneurship. Our discussion also highlights the contributions of foreign MNEs’ entry and the perils associated with absorptive capacity in causing lock-ins and perpetuating the “red queen” type of competition within an ecosystem. These factors can limit the emergence and growth of new firms that enable the economic and technological progress many countries aspire to achieve. Our paper suggests different options countries can use to avoid this risk while promoting the emergence and the growth of new firms, thereby revitalizing the entrepreneurial ecosystem.

Notes

Throughout this paper, local entrepreneurship refers to domestic entrepreneurs, both independent and corporate, creating new firms.

While most local entrepreneurs may not fall into either extreme category of replicative or innovative entrepreneurship, the dichotomy provides a good handle on understanding variety on a key attribute of entrepreneurship and there exist many ideas that fit one or the other category. For example, television, electric bulb, and many others may be outcomes of innovative entrepreneurship while each successive model of television may constitute replicative entrepreneurship because each new product is slightly better, cheaper, and more user-friendly.

References

Acs, Z. J., Braunerhjelm, P., Audretsch, D. B., & Carlsson, B. (2008). The knowledge spillover theory of entrepreneurship. Small Business Economics, 32(1), 15–30.

Acs, Z. J., Autio, E., & Szerb, L. (2014). National systems of entrepreneurship: measurement issues and policy implications. Research Policy, 43(1), 476–494.

Adler, N., & Hashai, N. (2007). Knowledge flows and the modelling of the multinational enterprise. Journal of International Business Studies, 38(4), 639–657.

Adner, R., & Kapoor, R. (2010). Value creation in innovation ecosystems: how the structure of technological interdependence affects firm performance in new technology generations. Strategic Management Journal, 31(3), 306–333.

Adner, R., & Kapoor, R. (2015). Innovation ecosystems and the pace of substitution: re-examining technology S-curves. Strategic Management Journal, 37(4), 625–648.

Agarwal, R., Audretsch, D., & Sarkar, M. (2010). Knowledge spillovers and strategic entrepreneurship. Strategic Entrepreneurship Journal, 4(4), 271–283.

Almeida, P., & Phene, A. (2004). Subsidiaries and knowledge creation: the influence of the MNC and host country on innovation. Strategic Management Journal, 25(8–9), 847–864.

Almeida, P., Song, J., & Grant, R. M. (2002). Are firms superior to alliances and markets? An empirical test of cross-border knowledge building. Organization Science, 13(2), 147–161.

Alvarez, S. A., & Busenitz, L. W. (2001). The entrepreneurship of resource-based theory. Journal of Management, 27(6), 755–775.

Audretsch, D. B., & Thurik, A. R. (2004). A model of the entrepreneurial economy. International Journal of Entrepreneurship Education, 2(2), 143–166.

Audretsch, D. B., & Keilbach, M. (2008). Resolving the knowledge paradox: knowledge-spillover entrepreneurship and economic growth. Research Policy, 37(10), 1697–1705.

Audretsch, D. B., Heger, D., & Veith, T. (2014). Infrastructure and entrepreneurship. Small Business Economics, 44(2), 219–230.

Audretsch, D., & Link, Al. (2016). Embracing an entrepreneurial ecosystem: an analysis of the governance of research joint ventures. Small Business Economics Special Issue Development Conference: The Governance of Entrepreneurial Ecosystems. Catania, Italy. September, 29–30.

Autio, E., Kenney, M., Mustar, P., Siegel, D., & Wright, M. (2014). Entrepreneurial innovation: the importance of context. Research Policy, 43(7), 1097–1108.

Autio, E., & Thomas, L. D. W. (2014). Innovation ecosystems: implications for innovation management. In M. Dodgson, D. M. Gann, & N. Phillips (Eds.), Oxford handbook of innovation management (pp. 204–228). Oxford: Oxford University Press.

Barnett, W. P., & Hansen, M. T. (1996). The red queen in organizational evolution. Strategic Management Journal, 17(S1), 139–157.

Baumol, W. J. (2010). The microtheory of innovative entrepreneurship. Princeton: Princeton University Press.

Bhawe, N. M., Rawhouser, H., & Pollack, J. (2016). Horse and cart: the role of order in new ventures. Journal of Business Venturing Insights, 6, 7–13.

Bhidé, A. (2000). The origin and evolution of new businesses. New York: Oxford University Press US.

Birkinshaw, J. M. (2004). Strategic management. New York: Edward Elgar Pub.

Blavy, R. (2006). Public debt and productivity: the difficult quest for growth in Jamaica. International Monetary Fund.

Blomström, M., & Kokko, A. (1998). Multinational corporations and spillovers. Journal of Economic Surveys, 12(3), 247–277.

den Bosch, F. A. J. V., Volberda, H. W., & de Boer, M. (1999). Co-evolution of firm absorptive capacity and knowledge environment: organizational forms and combinative capabilities. Organization Science, 10(5), 551–568.

Boschma, R. A., & Wenting, R. (2007). The spatial evolution of the British automobile industry: does location matter? Industrial and Corporate Change, 16(2), 213–238.

Bruton, G. D., Ahlstrom, D., & Obloj, K. (2008). Entrepreneurship in emerging economies: where are we today and where should the research go in the future. Entrepreneurship Theory and Practice, 32(1), 1–14.

Cantwell, J., Dunning, J., & Lundan, S. (2010). An evolutionary approach to understanding international business activity: the co-evolution of MNEs and the institutional environment. Journal of International Business Studies, 41, 561–586.

Carree, M. A., & Thurik, A. R. (2010). The impact of entrepreneurship on economic growth. In Z. J. Acs & D. B. Audretsch (Eds.), Handbook of entrepreneurship research (pp. 557–594). New York: Springer.

Christensen, C. M. (1997). The Innovator’s dilemma: when new technologies cause great firms to fail. Boston: Harvard Business Press.

Clark, K. B. (1989). Project scope and project performance: the effect of parts strategy and supplier involvement on product development. Management Science, 35(10), 1247–1263.

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: a new perspective on learning and innovation. Administrative Science Quarterly, 35(1), 128–152.

Colins, N. (2016). What makes an entrepreneurial ecosystem? The Family Papers.

Corallo, A., Errico, F., Latino, M, and Menegoli, M. (2016). Assuring the sustainability of entrepreneurial ecosystem through governance: a proposed framework. Small Business Economics Special Issue Development Conference: The Governance of Entrepreneurial Ecosystems. Catania, Italy. September, 29–30.

Cumming, D. Werth, J., & Zhang, Y. (2016). Governance in entrepreneurial ecosystems: Venture capitalists vs. technology parks. Small Business Economics Special Issue Development Conference: The Governance of Entrepreneurial Ecosystems. Catania, Italy. September, 29–30.

DeGhetto, K., Sutton, A., Holcomb, T. R., & Holmes, R. M. (2015). It’s who you know and what you do: how SMEs from developing economies capitalize on founder ties to create bargaining power with foreign multinational alliance partners. In T. K. Das (Ed.), Research in strategic alliances (pp. 121–155). Charlotte: Information Age Publishing.

DeGhetto, K.,Sutton, A., Holcomb, T. R., & Holmes, R. M. (2016) It's who you know and what you do: how SMEs from emerging economies capitalize on founder ties to create bargaining power with foreign multinational alliance partners. Available at SSRN: https://ssrn.com/abstract=2718128 or http://dx.doi.org/10.2139/ssrn.2718128.

Dimelis, S. P. (2005). Spillovers from foreign direct investment and firm growth: technological, financial and market structure effects. International Journal of the Economics of Business, 12(1), 85.

Drexler, M., Eltogby, M., Foster, G., Shimizu, C., Ciesinsik, S., Davila, A., Hassan, S. Z., Jia, N., Lee, D., Plunkett, S., Pinelli, M., Cunningham, J., Hiscock-Croft, R., McLenithan, M., Rottenberg, L., & Morris, R. (2014). Entrepreneurial ecosystems around the globe and early-stage company growth dynamics. In Industry agenda. Geneva: World Economic Forum.

Dunning, J. H., & Lundan, S. M. (2008). Multinational enterprises and the global economy. Cambridge, MA: Edward Elgar Publishing.

Dyer, J. H., & Singh, H. (1998). The relational view: cooperative strategy and sources of inter-organizational competitive advantage. The Academy of Management Review, 23(4), 660–679.

Eggertsson, T. (2005). Imperfect institutions: possibilities and limits of reform. Ann Arbor: University of Michigan Press.

Finegold, D. (1999). Creating self-sustaining, high-skill ecosystems. Oxford Review of Economic Policy, 15(1), 60–81.

Frost, T. S. (2001). The geographic sources of foreign subsidiaries’ innovations. Strategic Management Journal, 22(2), 101–123.

Gardner Jr., E. I., Montjoy, R. S., & Watson, D. J. (2001). Moving into global competition: a case study of Alabama’s recruitment of Mercedes-Benz. Review of Policy Research, 18(3), 80–93.

Girma, S., & Wakelin, K. (2000). Are there regional spillovers from FDI in the UK? Nottingham: University Centre for Research on Globalisation and Labour Markets Press.

Girma, S. (2005). Absorptive capacity and productivity spillovers from FDI: a threshold regression analysis. Oxford Bulletin of Economics and Statistics, 67(3), 281–306.

Globerman, S., & Shapiro, D. M. (1999). The impact of government policies on foreign direct investment: the Canadian experience. Journal of International Business Studies, 30(3), 513–532.

Görg, H., & Greenaway, D. (2004). Much ado about nothing? Do domestic firms really benefit from foreign direct investment? The World Bank Research Observer, 19(2), 171–197.

Grant, R. M. (1996). Prospering in dynamically-competitive environments: organizational capability as knowledge integration. Organization Science, 7(4), 375–387.

Gupta, A. K., & Govindarajan, V. (1991). Knowledge flows and the structure of control within multinational corporations. The Academy of Management Review, 16(4), 768–792.

Haskel, J. E., Pereira, S. C., & Slaughter, M. J. (2007). Does inward foreign direct investment boost the productivity of domestic firms? The Review of Economics and Statistics, 89(3), 482–496.

Helfat, C. E. (1997). Know-how and asset complementarity and dynamic capability accumulation: the case of R&D. Strategic Management Journal, 18(5), 339–360.

Hennart, J. F. (1991). The transaction costs theory of joint ventures: an empirical study of Japanese subsidiaries in the United States. Management Science, 37(4), 483–497.

Hill, T. L., & Mudambi, R. (2010) Far from Silicon Valley: how emerging economies are re-shaping our understanding of global entrepreneurship. Journal of International Management, 16(4), 321–327.

Holmes, R. M., Zahra, S., Hoskisson, R., DeGhetto, K., & Sutton, T. (2016). Two way streets: the role of institutions and technology policy for firms’ corporate entrepreneurship and political strategies. Academy of Management Perspectives, 30(3), 247–272.

Hong, J. F. L., & Snell, R. S. (2013). Developing new capabilities across a supplier network through boundary crossing: a case study of a China-based MNC subsidiary and its local suppliers. Organization Studies, 34(3), 377–406.

Hoskisson, R., Wright, M., Filatotchev, I., & Peng, M. (2013). Emerging multinationals from mid-range economies: the influence of institutions and factor markets. Journal of Management Studies, 50(7), 1295–1321.

Isenberg, D. (2014). What an entrepreneurship ecosystem actually is. Harvard Business Review. Retrieved on May, 12 2014.

Isenberg, D. (2011). Introducing the entrepreneurship ecosystem: four defining characteristics. Forbes. Retrieved on May, 25 2011.

Kenney, M., & Florida, R. (1994). The organization and geography of Japanese R&D: Results from a survey of Japanese electronics and biotechnology firms. Research Policy, 23(3), 305–322 May, 30 2011.

Khanna, T., Palepu, K. G., & Sinha, J. (2005). Strategies that fit emerging markets. Harvard Business Review, 83(6), 63–76.

Kim, H., Kim, H., & Hoskisson, R. E. (2010). Does market-oriented institutional change in an emerging economy make business-group-affiliated multinationals perform better? An institution-based view. Journal of International Business Studies, 41(7), 1141–1160.

Kim, L. (1997). Imitation to innovation: The dynamics of Korea’s technological learning. Cambridge: Harvard Business Press.

Kiss, A. N., Danis, W. M., & Cavusgil, S. T. (2012). International entrepreneurship research in emerging economies: a critical review and research agenda. Journal of Business Venturing, 27(2), 266–290.

Lerner, J. (2009). Boulevard of broken dreams: why public efforts to boost entrepreneurship and venture capital have failed and what to do about it. Princeton: University Press.

Liu, X., Wang, C., & Wei, Y. (2009). Do local manufacturing firms benefit from transactional linkages with multinational enterprises in China? Journal of International Business Studies, 40(7), 1113–1130.

Lucarelli, C., Micozzi, A and Marinell, N, 2016. Dynamic interactions of entrepreneurial domains and outcomes: a pattern towards the governance of ecosystems. Small Business Economics Special Issue Development Conference: The Governance of Entrepreneurial Ecosystems. Catania, Italy. September, 29–30.

Luo, Y., Sun, J., & Wang, S. L. (2011). Emerging economy copycats: capability, environment, & strategy. The Academy of Management Perspectives, 25(2), 37–56.

Martinkenaite, L., & Breunig, K. J. (2016). The emergence of absorptive capacity through micro-macro level interactions. Journal of Business Research, 69(2), 700–708.

McKeon, H., Johnston, K., & Henry, C. (2004). Multinational companies as a source of entrepreneurial learning: examples from the IT sector in Ireland. Education and Training, 46(8/9), 433–443.

Marquis, C., & Raynard, M. (2015). Institutional strategies in emerging markets. Academy of Management Annals, 9, 291–335.

Meyer, K. E., Estrin, S., Bhaumik, S. K., & Peng, M. W. (2009). Institutions, resources, & entry strategies in emerging economies. Strategic Management Journal, 30(1), 61–80.

Meyers, M. (2015). Making (and measuring) an entrepreneurial ecosystem. Economic Development Journal, 14(3), 28–36.

National Science Foundation. (2015). What is an innovation ecosystem? National Science Foundation White Paper.

Naudé, W. (2009). Entrepreneurship, developing countries, & development economics: new approaches and insights. Small Business Economics, 34(1), 1–12.

North, D. C. (1990). A transaction cost theory of politics. Journal of Theoretical Politics, 2(4), 355–367.