Abstract

According to the knowledge spillover theory of entrepreneurship, knowledge created endogenously results in knowledge spillovers, which allow independent entrepreneurs to identify and exploit opportunities (Acs et al. in Small Bus Econ 32(1):15–30, 2009). The knowledge spillover theory of entrepreneurship ignores entrepreneurial activities of employees within established organizations. This ignorance is largely empirical, because there has been no large-scale study on the prevalence and nature of entrepreneurial employee activities. This article presents the outcomes of the first large-scale international study of entrepreneurial employee activities. In multiple advanced capitalist economies, entrepreneurial employee activity is more prevalent than independent entrepreneurial activity. Innovation indicators are positively correlated with the prevalence of entrepreneurial employee activities, but are not or even negatively correlated with the prevalence of independent entrepreneurial activities.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Where do entrepreneurial opportunities come from and in which organizational setting are they recognized and pursued? Investments in knowledge are seen as a key source of entrepreneurial opportunities. This has been studied on the individual level (Shane 2000), the firm level (Cohen and Levinthal 1989), the regional level (Audretsch and Lehmann 2005), and the national level (Acs et al. 2009; Braunerhjelm et al. 2010). Most entrepreneurship studies on innovation emphasize the role of new firms and independent entrepreneurs (Shane 2000; Shane and Stuart 2002; Hellmann 2007; Stam and Wennberg 2009; Qian and Acs 2013). This is largely the legacy of Schumpeter (1934; also known as Schumpeter Mark I) in which the independent entrepreneur as innovator turns new ideas into commercial products. In recent theorizing on knowledge spillovers and entrepreneurship (Audretsch et al. 2006; Audretsch and Keilbach 2007; Acs et al. 2009; Braunerhjelm et al. 2010), the role of the (independent) entrepreneur is to commercialize the new ideas that are developed in established organizations, but exploited in newly created independent firms. The Schumpeter Mark I legacy and the knowledge spillover theory of entrepreneurship ignore entrepreneurial activities of employees within established organizations. This ignorance has two roots. The first one is empirical, because there has been no large-scale study on the prevalence and nature of entrepreneurial employee activities. There have been many studies on corporate entrepreneurship, but these never involve large-scale adult population surveys, which simultaneously compare the prevalence of both independent entrepreneurship and entrepreneurial employee activity, in a large set of countries. The second root of ignorance is conceptual, in the sense that entrepreneurship has predominantly been seen as either individual-level organization creation activity (Gartner 1985; Gartner and Carter 2003) or as a firm-level characteristic (Teece 2007; Wiklund and Shepherd 2003; even in studies on corporate entrepreneurship, such as Zahra and Covin 1995; Ahuja and Lampert 2001), but not as an individual-level activity within an established organization that can be compared to independent entrepreneurship.Footnote 1 Many corporate entrepreneurship studies deal with venturing activities that are initiated by the top management of an organization, not with venturing activities that emerge bottom up by entrepreneurial employees.Footnote 2

The key question in this article is whether innovation indicators are more related to independent entrepreneurship or entrepreneurial employee activities on the national level. The purpose of this study is to reveal and explain why knowledge is related to entrepreneurial employee activity on the national level, to complement the knowledge spillover theory of entrepreneurship with its focus on independent entrepreneurship as the mechanism to turn new ideas into new business activity. In order to answer the key question, a new measure of entrepreneurial employee activity on the national level is introduced. This enables an analysis of the prevalence of entrepreneurial employee activity in a large set of developed economies. This measure provides insight into entrepreneurial activity on the national level of aggregation, but is based on individual-level responses, doing justice to the choices made by individuals about how they would like to pursue the opportunity that they have discovered (Hayek 1937). This article presents the outcomes of the first large-scale international study into entrepreneurial employee activities. If this is a marginal phenomenon there is no need to further inquire into entrepreneurial employee activities. However, we find, quite in contrast, that entrepreneurial employee activity is more prevalent than independent entrepreneurial activity in multiple advanced capitalist economies. Still, this would not be such a noteworthy finding if this entrepreneurial employee activity would just be an extended version of independent entrepreneurship, i.e., if its characteristics would not substantially differ, especially with respect to the innovative nature of the phenomenon. It is tested whether knowledge at the national level is more related to independent entrepreneurial activity or to entrepreneurial employee activity. This would provide further evidence on the relevance of entrepreneurial activities within established organizations and show why the intra-organizational dimension has been a very important area neglected in the debates on entrepreneurship and innovation in general, and the knowledge spillover theory of entrepreneurship in particular. The innovation indicators turn out to be positively correlated with the prevalence of entrepreneurial employee activities, and are not or even negatively correlated to the prevalence of independent entrepreneurial activities.

These findings are highly relevant for public policy. Most policy attention until now has been focused on stimulating individuals to become independent entrepreneurs. However, if entrepreneurial employee activity is as prevalent as independent entrepreneurial activity and if it is even more strongly related to innovation, public policy should more explicitly take into account entrepreneurial employee activity as a possible conduit for knowledge to be turned in economic value. Investments in innovation in established organizations might as well be the source of opportunity recognition and pursuit by entrepreneurial employees.

2 Knowledge, entrepreneurship, and innovation

The founding father of the economics of innovation, Joseph Schumpeter, is well known for his two models of innovation. The first, also known as Schumpeter Mark I (Schumpeter 1934), emphasizes the role of new entrants that introduce innovation into the market. This has provided the starting point for a long tradition in the economics of entrepreneurship, in which entrepreneurs are seen as the individuals that create new firms in order to exploit opportunities for innovation. In the second model, also known as Schumpeter Mark II (Schumpeter 1942), innovation is the result of R&D investments of large incumbents. This R&D is performed by groups of employees, with interchangeable individuals, so without a distinctive role for the individual entrepreneur (see also more recent interpretations in Nelson and Winter 1982; Baumol 2002). In empirical terms, Schumpeter Mark I is measured with data on new (innovative) entrants in the economy, while Schumpeter Mark II is measured with data on R&D and/or the most straightforward output indicator of R&D, namely patents. In international comparisons on innovation, this comes down to measuring new firm formation or rates of (new) independent entrepreneurship, and the level of R&D investments and/or the rate of patenting.

These two Schumpeterian models of innovation and theorizing on economic growth, e.g., by Lucas (1988), Romer (1990) and Aghion and Howitt (1992), are brought together in the so-called knowledge spillover theory of entrepreneurship (Audretsch et al. 2006; Audretsch and Keilbach 2007; Acs et al. 2009). According to this theory, knowledge created in an incumbent organization is an important source of entrepreneurial opportunities. Not all this knowledge is perceived to be valuable by the incumbent, and by commercializing knowledge that otherwise would remain uncommercialized through the start-up of a new venture, independent entrepreneurship serves as a conduit of knowledge spillovers. According to the theory of knowledge spillover entrepreneurship, a context with more knowledge will generate more entrepreneurial opportunities. In contrast, a context with less knowledge will generate fewer entrepreneurial opportunities. We thus expect the level of new independent entrepreneurship to be positively related to the level of knowledge investments, activities, and outputs in a country.

However, this assumes that entrepreneurial activity is most likely to be activity by independent entrepreneurs. Most studies on entrepreneurship, knowledge, and innovation indeed only use independent entrepreneurship as an empirical indicator of entrepreneurship (see, e.g., Shane 2000; Shane and Stuart 2002; Stam and Wennberg 2009; Qian and Acs 2013). There are many reasons to also consider entrepreneurial activity within existing organizations next to entrepreneurship embodied in new organizations (see Sørensen and Fassiotto 2011; Stam et al. 2012). There might be many knowledge investments in established organizations that lead to the recognition and pursuit of entrepreneurial opportunities by employees of these very same organizations. Two mechanisms make entrepreneurial employee activity more likely than independent entrepreneurship. First, highly educated entrepreneurial employees in established organizations are more likely to recognize opportunities because of their own high levels of absorptive capacity.Footnote 3 Second, entrepreneurial employees are more likely to pursue opportunities for innovation because of their access to a larger knowledge base and to more complementary assets within their employer organization, which are needed to exploit these new ideas on a sufficiently large scale (cf. Teece 1987). Independent entrepreneurs in contrast often have a more limited knowledge base and set of complementary assets. So we expect the level of entrepreneurial employee activity to be positively related to the level of knowledge investments, activities, and outputs in a country.

3 Data and empirics

3.1 Dependent variables

The dependent variables are all based on the 2011 data collection of the Global Entrepreneurship Monitor (see GEM 2012). The Global Entrepreneurship Monitor (GEM) assesses entrepreneurial activity at the national level on an annual basis. This is based on data collection through telephone surveys of a randomly selected adult sample. These surveys include a minimum number of 2,000 respondents in each participating country as to their attitudes toward entrepreneurship, their participation in entrepreneurial activity, and their entrepreneurial aspiration. See Reynolds et al. (2005) for a detailed description of the GEM methodology.

The GEM normally focuses on independent entrepreneurship, and its central measure is the so-called Total Entrepreneurial Activity (TEA) rate. The TEA rate reflects the percentage of the adult population (aged 18–64 years) that is actively preparing to set up an independent business (nascent entrepreneurs) or currently owns an independent business that is less than 42 months old (owner-managers of new businesses). More in particular, a nascent entrepreneur is an individual who is currently actively involved in setting up a business he/she will own or co-own; this business has not paid salaries, wages, or any other payments to the owners for more than 3 months. An owner-manager of a new business refers to an individual who currently, alone or with others, owns and manages an operating business that has paid salaries, wages, or other payments to the owners for more than 3 months, but not more than 42 months. We also used a subset of the TEA rate, which reflects independent entrepreneurship activities that have a relatively strong emphasis on the pursuit of innovation opportunities, namely independent entrepreneurial activity that involves new products (TEA_NEWPRO). TEA_NEWPRO reflects the percentage of the adult population involved in entrepreneurial activities that deliver products or services that are regarded as new and unfamiliar by their (potential) customers.

Entrepreneurial employee activity (EEA) is a completely new measure of entrepreneurship. The data for this new measure were collected through a special theme study on entrepreneurial employee activity in the framework of the Global Entrepreneurship Monitor in 2011. Fifty-two countries participated in this study on entrepreneurial employee activity using a set of specific questions targeted at all employees—excluding those already identified as owner-managers of businesses—aged between 18–64 years in the GEM samples (Bosma et al. 2012). This cumulates into a total of over 140,000 respondents, of which more than 70,000 are employees, of the GEM Adult Population Survey. A particular advantage of this methodology is the opportunity to compare entrepreneurial employee activity with ‘regular’ entrepreneurial activity (i.e., individuals who own and manage a business, or expect to own the business they are setting up) at both the macro and micro level.

Regarding the scope of entrepreneurial employee activity, GEM operationalized entrepreneurial employee activity as employees developing new business activities for their employer, including establishing a new outlet or subsidiary and launching new products or product-market combinations. Two phases are distinguished in the entrepreneurial process (comparable with the phases in TEA): idea development for new business activities and preparation and (emerging) exploitation of these new activities. For the role of entrepreneurial employees in each of these phases, we distinguish between leading and supporting roles. Based on these elements GEM distinguishes between employees who, in the past 3 years, have been actively involved in and have had a leading role in at least one of these phases and who are also currently involved in entrepreneurial employee activity.Footnote 4 All employees participating in the GEM Adult Population Survey could be classified in terms of their involvement in entrepreneurial employee activity. Accordingly, the EEA rate measures the prevalence (in the population of 18–64 years) of employees who, in the past 3 years, have been actively involved in the development of new activities for their main employer, had a leading role in at least one phase of the entrepreneurial process, and are also currently involved in the development of such new activities.Footnote 5 The differences (locus of entrepreneurial activity) and similarities (phases in the entrepreneurial process) between EEA and TEA are represented in Fig. 1.

This approach to entrepreneurial employee activity is in many ways comparable to the measure of independent early stage entrepreneurial activity, albeit within the context of established organizations. In practice, entrepreneurial employee activity can occur in many different functions within organizations: employees developing new products (in a new business development function), launching new products or launching existing products in new markets (in a marketing function), setting up a new branch (in a HRM function), introducing new technologies, or outsourcing the production to external organizations (in an operations function) (see Bosma et al. 2010). The difference with ‘regular’ R&D and marketing work is that only new business activities initiated by the individual employee are included in entrepreneurial employee activity, and this individual should be in a leading role in the recognition of the opportunity or the pursuit of the opportunity, emphasizing proactiveness, which has been acknowledged as a key element of entrepreneurial behavior (Crant 2000; Frese and Fay 2001; Parker and Collins 2010). In a similar vein, EEA does not include corporate venturing activities by employees that are initiated by the top management of an organization. This however does not rule out that aggregate measures, e.g., of R&D and marketing, partly overlap with aggregate measures of entrepreneurial employee activity, since R&D workers might take the initiative to develop a new product and marketing workers might take the initiative to exploit new markets.

3.2 Independent variables

In this study, we regard innovation indicators as precursors of entrepreneurial activity and thus treat them here as independent variables. In practice, this distinction might not always hold as entrepreneurial activity might be more simultaneously related to innovation, for example, when entrepreneurial employees are funded by the R&D budget of their employer or when their entrepreneurial activity also results in patents during the process. R&D and the resulting patents might however also be the raw material (inventions) that entrepreneurial employees or independent entrepreneurs use as input for their new business activities. We used the most general national-level indicators of innovation, namely gross expenditure on R&D investments (as percentage of GDP), patents (per resident), (percentage of the population with) tertiary education, and knowledge-intensive employment (as percentage of total employment). Table 1 shows the source (year) of the innovation indicators. There is a time lag between the innovation indicators (measured in 2007–2009) and the entrepreneurship indicators (measured in 2011), taking into account that it may take several years for the innovation indicators to affect the entrepreneurship indicators.

4 Results

We analyze a subsample of the total set of countries that is taken into account in the Global Entrepreneurship Monitor: this subsample of 25 countries includes all OECD countries in the total GEM sample, which allows us to take into account all innovation indicators, and a relatively homogenous set of countries with respect to the level of economic development.Footnote 6 In Table 2 we show the descriptive statistics and correlations between the country-level variables. Two sets of variables are highly positively correlated: the two TEA measures and the four innovation indicators. The most striking correlations are the strongly positive correlations between EEA and all four innovation indicators. In contrast, the TEA measures are negatively (but mostly not statistically significantly) related to innovation. This disconfirms our expectation that the level of new independent entrepreneurship is positively related to the level of knowledge investments, activities, and outputs in a country–and confirms our expectation that the level of entrepreneurial employee activity is positively related to the level of knowledge investments, activities, and outputs in a country.

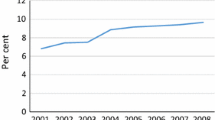

When we focus on two of the key drivers of economic growth—R&D and education (see, e.g., Helpman 2004)—and visually inspect the data (see Fig. 2, 3), a clear pattern arises: a positive correlation of tertiary education and R&D with EEA, and a negative correlation of tertiary education and R&D with TEA. The values of the innovation indicators are rather equally distributed. Several outliers with respect to entrepreneurial activity rates stand out: Chile with a TEA rate of 23.7 percent, Sweden with an EEA rate of 13.5 percent, and Turkey, Mexico, and Greece with very low EEA rates (respectively 0.6, 0.8, and 1.3 percent).

If we take a more country-specific approach and focus on the countries that are innovation leaders, how do these countries rank on EEA and TEA? Out of the 25 countries we analyzed, four countries ranked in the top three of the innovation indicators at least two times: Finland, Japan, Sweden, and Switzerland. These countries have also been classified as innovation leaders in prior OECD, World Economic Forum, Global Innovation Index, and Innovation Barometer studies. All four of these countries rank relatively low on the TEA index, but two out of four (Finland and Sweden; both ranking very high on R&D and patents) perform very well on the EEA index as well.

We also performed a linear regression to discover which of the innovation indicators is most strongly related to TEA, TEA_NEWPRO, and EEA, controlling for the other innovation indicators. The results are shown in Table 3.Footnote 7 This reveals that especially R&D is strongly related to both types of entrepreneurial activity, albeit in completely contrasting ways: negatively related with TEA and positively related with EEA. Employment in knowledge-intensive services is only positively related to EEA, while patents and educational level seem to become insignificant once the effects of other innovation indicators are controlled for.

5 Discussion

The results of the very first large-scale international analysis of the relation between knowledge and two types of entrepreneurship—independent new entrepreneurship and entrepreneurial employee activity—show some very clear patterns, disconfirming the received wisdom that independent new entrepreneurship is highly related to the level of knowledge investments, activities, and outputs in a country, and revealing that entrepreneurial employee activity is both very prevalent and positively related to innovation on the country level. Two explanations might be relevant. First, a lot of knowledge developed by incumbents is still exploited by employees of these incumbents, or even spurred by entrepreneurial activity of employees. This does not leave many opportunities to pursue for independent entrepreneurs (in contrast to what the narrow version of the knowledge spillover theory of entrepreneurship would hypothesize). A second explanation might be that entrepreneurial employees on average have a better absorptive capacity and access to more complementary assets to pursue opportunities arising from knowledge creation in other (public and private) organizations than independent entrepreneurs, with on average lower levels of education (see Bosma et al. 2010) and less access to complementary assets. We will discuss our findings on the macro and micro levels, and finally discuss their relation to high-impact entrepreneurship and radical innovation.

5.1 Macro level

There has been no empirical study on the country-level relations between knowledge and entrepreneurship in incumbent organizations, what we label here as entrepreneurial employee activity. Our findings suggest that on average, knowledge investments, activities, and outputs in a country are more related to entrepreneurial employee activity than to independent entrepreneurship in developed economies. The implications of our analyses are primarily relevant for developed countries and not for developing countries. However, we expect our results to be even stronger when developing countries are included in the analyses, because these countries on average perform rather poorly on the traditional innovation indicators, and have high independent entrepreneurship rates and low intrapreneurship rates (see Bosma et al. 2010; 2012).

5.2 Micro level

Correlations do not necessarily indicate causalities. We should be very careful with making inferences about causal relations and should also provide proper micro foundations. On the micro level, the relation between innovation and entrepreneurship in incumbent organizations is not a completely novel insight: the classical work by Edith Penrose (1959) already emphasized the entrepreneurial function of individual managers in incumbent organizations, which comprised the recognition and pursuit of productive opportunities. Also more recent work on intrapreneurship emphasizes the importance of entrepreneurial activity within incumbent organizations (Lumpkin 2007; Parker 2011). Our findings on the macro level confirm recent findings on the micro level, which reveal that intrapreneurship involves new products more often than independent entrepreneurship (Bosma et al. 2010; Parker 2011). However, these empirical findings do not provide much insight into the relevant organizational and institutional mechanisms that explain why certain opportunities are recognized and pursued in established organizations or with new independent firms.

It is an empirical question to what extent incumbent firms efficiently exploit knowledge flows. The original formulation of the knowledge spillover theory of entrepreneurship also leaves this option open: “(t)he more efficiently incumbents exploit knowledge flows, the smaller the effect of new knowledge on entrepreneurship” (Acs et al. 2009, p. 17). Acs et al. (2009) suggest that this efficiency can be measured with the number of patents per capita, a measure that can also be seen as an indicator of general knowledge production (the way this variable is treated in this article). They indeed find a statistically significant negative relation between patents per capita and their measure of entrepreneurship (share of self-employed as a percentage of the labor force). In contrast to our findings, their results show a positive relation between knowledge stock (also measured with R&D expenses) and independent entrepreneurship. Further research should show whether these contrasting findings are contingent on the time period, set of countries, and/or type of data (longitudinal or cross-sectional).

5.3 High-impact entrepreneurship and radical innovation

From an empirical point of view, it has been suggested that many individuals that start new independent businesses are only marginally innovative and do not apply novel (scientific and technological) knowledge at all in their commercial offerings (Santarelli and Vivarelli 2007). Most of these founders of new independent businesses might fill small niches of product markets that have not yet been served adequately by large incumbents (Penrose 1959) or adapt goods and services to local contexts (Kirzner 1973). These entrepreneurs make a living with these activities and might even be relatively happy with this (Benz and Frey 2008; Lange 2012). Entrepreneurial employees not only have to make a living with their activities, or become happy themselves, but have to convince their colleagues and superiors that investing resources in their ideas is really worthwhile. Their ventures need to have much more potential impact than the average independent new business. This is confirmed by the previous finding that entrepreneurial employees have high expectations of their new business much more often than independent entrepreneurs (Bosma et al. 2010). They can also have more impact, because they have better access to complementary assets within their employer’s organization (Teece 1987), which are needed to exploit these new ideas on a sufficiently large scale.

However, radical high-impact innovations will not come from the ‘average’ independent entrepreneur and will probably also not be realized by the ‘average’ entrepreneurial employee. Radical high-impact innovations are likely to be recognized by employees (or other members, like students) of knowledge-intensive organizations that are not able (e.g., universities) or willing (e.g., large companies) to pursue those high-risk activities (see Hellmann 2007; Klepper 2007; Klepper and Thompson 2010). In the end, it may be a very small subset of entrepreneurial employees that leave their employer to found a spinoff firm in order to pursue a high-risk, (potentially) high-gain opportunity and an even smaller subset of this group that is successful in realizing these high impact opportunities. These are independent entrepreneurs turned entrepreneurial employees. In practice, these (potentially) high-impact independent ventures might be acquired by established organizations, stimulating entrepreneurship within their boundaries or killing these ventures if the acquiring firm is insufficiently entrepreneurial. This interpretation does justice to the original formulation of the knowledge spillover theory of entrepreneurship, which stated that “(s)tart-ups with access to entrepreneurial talent and intra-temporal spillovers from the stock of knowledge are more likely to engage in radical innovation leading to new industries or replacing existing products” (Acs et al. 2009, p. 16). However, neither their empirical test nor ours is able to pick the proper empirical indicator for this type of radical innovation and the actors involved in pursuing such high-risk, high-gain opportunities.

6 Conclusions

In this study we presented the results of the first large-scale international study into knowledge and the relation with two types of entrepreneurship: independent new entrepreneurship and entrepreneurial employee activity. We expected positive relations of knowledge with both types of entrepreneurship on the country level. Our key findings disconfirm the expected positive relation among the level of knowledge investments, activities, and outputs in a country on the one hand and the level of new independent entrepreneurship on the other. The level of entrepreneurial employee activity was revealed to be positively related to the level of knowledge investments, activities, and outputs in a country. These findings turn most current research on the relation between entrepreneurship and knowledge on its head and reveal that when we talk about knowledge, innovation, and entrepreneurship, we should be talking predominantly about knowledge, innovation, and entrepreneurial employee activity.

This has profound implications for research in that the omission of entrepreneurial employee activity has been a major shortcoming for international studies on entrepreneurship (see Marcotte 2013 for a recent review), not only because entrepreneurial employee activity is equally prevalent as independent new entrepreneurship in many developed economies, but also because entrepreneurial employee activity is much more strongly related to knowledge than independent new entrepreneurship. It also redirects attention from the narrow version of the knowledge spillover theory of entrepreneurship to the original ‘broad’ version of the knowledge spillover theory of entrepreneurship (Acs et al. 2009), in which the knowledge exploitation efficiency of incumbents is one of the central variables. This includes the possibility that societies with high levels of investment in knowledge and human capital have relatively many organizations that fuel entrepreneurial activity of their employees and do not trigger independent new entrepreneurship on a large scale. An interesting avenue for future research would be to disentangle the effects of private and public R&D on the prevalence of (innovative) independent entrepreneurship and entrepreneurial employee activity. One would expect a stronger relation between private R&D and entrepreneurial employee activity than between public R&D and entrepreneurial employee activity (cf. Acs et al. 1994).

Our findings also have substantial implications for entrepreneurship and innovation policy, which used to focus on independent new entrepreneurship as a driver of innovation—mainly derived from the Schumpeter Mark I heritage—and that tended to stimulate R&D as a source of routinized innovation—mainly derived from the Schumpeter Mark II heritage. This study reveals that a significant relation exists between investments in new knowledge and human capital and entrepreneurial employee activity, which neither reflects Schumpeter Mark I nor Schumpeter Mark II inspired twentieth-century innovation policy. It redirects attention to creating the institutional context and organizational conditions that enable productive entrepreneurial employee activity in the twenty-first century. The last century has seen an enormous increase in individual rights in most countries (Acemoglu 2012) and an increase in the knowledge intensity of their economic activities (Thurik et al. 2013). Combined, this means that firms are increasingly communities in which individuals share and create knowledge (Kogut and Zander 1992). Firms should be seen as value-creating institutions that inspire and enable individual initiative (Ghoshal and Bartlett 1997), and public policy should create, adopt, and abolish institutions in order to enable productive entrepreneurship in society (Stam and Nooteboom 2011). Two examples of public policy that might foster entrepreneurial activity by employees are first stimulating the provision of entrepreneurship courses that do not narrowly focus on independent entrepreneurship as the only mode of opportunity pursuit and second abolishing non-compete agreements. The latter policy intervention could cut both ways: employers would be more inclined to invest in their employees in order to retain them, and employees who want to pursue radical innovations that might cannibalize their employer’s product markets cannot be withheld, enabling high-risk, high-gain opportunities to be pursued by spinoffs.

Notes

Previous large-scale research on entrepreneurial employee activity (Bosma et al. 2010) has shown that higher educated individuals are more likely to be intrapreneurs than lower educated individuals, and that lower educated individuals are more likely to be independent entrepreneurs than higher educated individuals. This has been confirmed in follow-up research by Bosma et al. (2012). Research on intrapreneurship has shown that higher educated employees are more likely to be involved in intrapreneurship than lower educated employees (Stam et al. 2012, chapter 3). So both within society and within organizations, education seems to be positively correlated to entrepreneurial employee activity.

This is a much more narrow definition than that of Martiarena (2013), which includes all employees that have been involved in the development of new business activities for their employer, irrespective of whether they had a leading role in this.

As Morris et al. (1994, p. 84) mention, entrepreneurial employee activity is unlikely to be a completely individual exercise: ‘The key is to balance the need for individual initiative with the spirit of cooperation and group ownership of innovation. This balance occurs over the entrepreneurial process, not all at once, and as micro-level innovation evolves into macro-level organizational change. Individuals are needed to provide the vision, unwavering commitment, and internal salesmanship without which nothing would be accomplished. But as the process unfolds, the entrepreneur requires teams of people with unique skills and resources’ (cf. Bartlett and Ghoshal 1997).

The 25 countries are: Australia, Belgium, Chile, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Japan, Korea (Rep.), Mexico, The Netherlands, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, UK, and USA.

Given that the dependent variables are positive, we also ran Tobit regressions as a robustness check. This delivered the same outcomes. We also performed a linear regression with new technology based TEA: this type of independent entrepreneurship is not (statistically significantly) related to the innovation indicators. Results are available upon request.

References

Acemoglu, D. (2012). The World our Grandchildren Will Inherit: The rights revolution and beyond. NBER Working Paper No. 17994.

Acs, Z. J., Audretsch, D. B., & Feldman, M. P. (1994). R&D spillovers and recipient firm size. Review of Economics and Statistics, 76(2), 336–340.

Acs, Z. J., Braunerhjelm, P., Audretsch, D. B., & Carlsson, B. (2009). The knowledge spillover theory of entrepreneurship. Small Business Economics, 32(1), 15–30.

Aghion, P., & Howitt, P. (1992). A model of growth through creative destruction. Econometrica, 60, 323–351.

Ahuja, G., & Lampert, C. M. (2001). Entrepreneurship in the large corporation: A longitudinal study of how established firms create breakthrough inventions. Strategic Management Journal, 22(6–7), 521–543.

Audretsch, D. B., & Keilbach, M. (2007). The theory of knowledge spillover entrepreneurship. Journal of Management Studies, 44(7), 1242–1254.

Audretsch, D. B., & Lehmann, E. E. (2005). Does the knowledge spillover theory hold for regions? Research Policy, 34(8), 1191–1202.

Audretsch, D. B., Keilbach, M. C., & Lehmann, E. E. (2006). Entrepreneurship and economic growth. Oxford: Oxford University Press.

Baumol, W. (2002). The free market innovation machine: analyzing the growth miracle of capitalism. Princeton: Princeton University Press.

Belousova, O., & Gailly, B. (2013). Corporate entrepreneurship in a dispersed setting: actors, behaviors, and process. International Entrepreneurship and Management Journal, 9, 361–377.

Benz, M., & Frey, B. S. (2008). Being independent is a great thing: Subjective evaluations of self-employment and hierarchy. Economica, 75, 362–383.

Birkinshaw, J. (1997). Entrepreneurship in multinational corporations: The characteristics of subsidiary initiatives. Strategic Management Journal, 18(3), 207–229.

Bosma, N. S., Stam, E., & Wennekers, A. R. M. (2010). Intrapreneurship–An international study, EIM research report H201005. Zoetermeer: EIM.

Bosma, N., Stam, E., & Wennekers, S. (2012). Entrepreneurial employee activity: A large scale international study. Tjalling Koopmans Institute working paper 12–12. Utrecht: Utrecht University School of Economics.

Braunerhjelm, P., Acs, Z. J., Audretsch, D. B., & Carlsson, B. (2010). The missing link: knowledge diffusion and entrepreneurship in endogenous growth. Small Business Economics, 34, 105–125.

Crant, J. M. (2000). Proactive behaviour in organizations. Journal of Management, 26(3), 435–462.

Cohen, W. M., & Levinthal, D. A. (1989). Innovation and learning: The two faces of R&D. Economic Journal, 99, 569–596.

Frese, M., & Fay, D. (2001). Personal initiative: An active performance concept for work in the 21st century. Research in Organizational Behaviour, 23, 133–187.

Gartner, W. B. (1985). A conceptual framework for describing the phenomenon of new venture creation. Academy of Management Review, 10(4), 696–706.

Gartner, W. B., & Carter, N. M. (2003). Entrepreneurial behaviour and firm organizing processes. In Z. J. Acs & D. B. Audretsch (Eds.), Handbook of entrepreneurship research (pp. 195–222). Dordrecht: Kluwer.

Ghoshal, S., & Bartlett, C. A. (1997). The individualized corporation: A fundamentally new approach to management. New York: Harper Collins.

Hayek, F. A. (1937). Economics and knowledge. Economica (New Series), 4, 33–54.

Hellmann, T. (2007). When do employees become entrepreneurs? Management Science, 53(6), 919–933.

Helpman, E. (2004). The mystery of economic growth. Cambridge, MA: The Belknap Press of Harvard University Press.

Hornsby, J. S., Kuratko, D. F., & Zahra, S. A. (2002). Middle managers’ perception of the internal environment for corporate entrepreneurship: assessing a measurement scale. Journal of Business Venturing, 17(3), 253–273.

Kirzner, I. M. (1973). Competition and entrepreneurship. Chicago: University of Chicago Press.

Klepper, S. (2007). Disagreements, spinoffs, and the evolution of detroit as the capital of the u.s. automobile industry. Management Science, 53(4), 616–631.

Klepper, S., & Thompson, P. (2010). Disagreements and intra-industry spinoffs. International Journal of Industrial Organization, 28(5), 526–538.

Kogut, B., & Zander, U. (1992). Knowledge of the firm, combinative capabilities, and the replication of technology. Organization Science, 3, 383–397.

Lange, T. (2012). Job satisfaction and self-employment: Autonomy or personality? Small Business Economics, 38(2), 165–177.

Lucas, R. (1988). On the mechanics of economic development. Journal of Monetary Economics, 22, 3–39.

Lumpkin, G. T. (2007). Intrapreneurship and innovation. In J. R. Baum, M. Frese, & R. Baron (Eds.), The psychology of entrepreneurship (pp. 237–264). Mahwah, New Jersey: Lawrence Erlbaum Associates.

Marcotte, C. (2013). Measuring entrepreneurship at the country level: A review and research agenda. Entrepreneurship and Regional Development, 25(3–4), 174–194.

Martiarena, A. (2013). What’s so entrepreneurial about intrapreneurs? Small Business Economics, 40(1), 27–39.

Morris, M. H., Davis, D. L., & Allen, J. W. (1994). Fostering corporate entrepreneurship: Cross-cultural comparisons of the importance of individualism versus collectivism. Journal of International Business Studies, 25(1), 65–89.

Nelson, R. R., & Winter, S. G. (1982). An evolutionary theory of economic change. Cambridge, MA: The Belknap Press of Harvard University Press.

Parker, S. C. (2011). Intrapreneurship or entrepreneurship? Journal of Business Venturing, 26(1), 19–34.

Parker, S. K., & Collins, C. G. (2010). Taking stock: Integrating and differentiating multiple proactive behaviors. Journal of Management, 36(3), 633–662.

Penrose, E. (1959). The theory of growth of the firm (revised version 1995). Oxford: Oxford University Press.

Qian, H. F., & Acs, Z. J. (2013). An absorptive capacity theory of knowledge spillover entrepreneurship. Small Business Economics, 40(2), 185–197.

Reynolds, P. D., Bosma, N. S., Autio, E., Hunt, S., De Bono, N., Servais, I., et al. (2005). Global Entrepreneurship Monitor: Data collection design and implementation 1998–2003. Small Business Economics, 24(3), 205–231.

Romer, P. (1990). Endogenous technological change. Journal of Political Economy, 98, 71–102.

Santarelli, E., & Vivarelli, M. (2007). Entrepreneurship and the process of firms’ entry, survival and growth. Industrial and Corporate Change, 16(3), 455–488.

Schumpeter, J. A. (1934). The theory of economic development. Cambridge, MA: Harvard University Press.

Schumpeter, J. A. (1942). Capitalism, socialism, and democracy. New York: Harper and Brothers.

Shane, S. (2000). Prior knowledge and the discovery of entrepreneurial opportunities. Organization Science, 11(4), 448–469.

Shane, S., & Stuart, T. (2002). Organizational endowments and the performance of university start-ups. Management Science, 48(1), 154–170.

Sørensen, J. B., & Fassiotto, M. (2011). Organizations as fonts of entrepreneurship. Organization Science, 22(5), 1322–1331.

Stam, E., & Nooteboom, B. (2011). Entrepreneurship, innovation and institutions. In D. Audretsch, O. Falck, & S. Heblich (Eds.), Handbook of research on innovation and entrepreneurship (pp. 421–438). Cheltenham: Edward Elgar.

Stam, E., & Wennberg, K. (2009). The roles of R&D in new firm growth. Small Business Economics, 33(1), 77–89.

Stam, E., Bosma, N., Van Witteloostuijn, A., De Jong, J., Bogaert, S., Edwards, N., et al. (2012). Ambitious entrepreneurship. Adviesraad voor Wetenschap en Technologiebeleid (AWT): A review of the academic literature and new directions for public policy. Den Haag.

Teece, D. J. (1987). Profiting from technological innovation: Implications for integration, collaboration, licensing and public policy. Research Policy, 15(6), 285–305.

Teece, D. J. (2007). Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strategic Management Journal, 28(13), 1319–1350.

Thurik, R., Stam, E., & Audretsch, D. (2013). The Rise of the entrepreneurial economy and the future of dynamic capitalism. Technovation, 33(8–9), 302–310.

Wiklund, J., & Shepherd, D. (2003). Knowledge-based resources, entrepreneurial orientation, and the performance of small and medium-sized businesses. Strategic Management Journal, 24(13), 1307–1314.

Zahra, S. A., & Covin, J. G. (1995). Contextual influences on the corporate entrepreneurship performance relationship–a longitudinal analysis. Journal of Business Venturing, 10(1), 43–58.

Acknowledgments

I would like to thank two anonymous reviewers for very helpful comments. A previous version of this article was presented at the Academic Policy and the Knowledge Theory of Entrepreneurship Workshop, University of Augsburg, 20–21 August 2012. In addition I would like to thank Olivier Paling and Niels Bosma for research assistance and obtaining access to data.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Stam, E. Knowledge and entrepreneurial employees: a country-level analysis. Small Bus Econ 41, 887–898 (2013). https://doi.org/10.1007/s11187-013-9511-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-013-9511-y

Keywords

- Entrepreneurial employees

- Knowledge spillover theory of entrepreneurship

- Independent entrepreneurship

- Innovation

- GEM