Abstract

Geopolitical risk (GPR) and other social indicators have raised many somber environmental-related issues among government environmentalists, and policy analysts. To further elucidate whether or not these indicators influence the environmental quality, this study investigates the impact of GPR, corruption, and governance on environmental degradation proxies by carbon emissions (CO2) in BRICS (Brazil, Russia, India, China, and South Africa) countries, namely Brazil, Russia, India, China, and South Africa, using data over the period 1990 to 2018. The cross-sectional autoregressive distributed lag (CS-ARDL), fully modified ordinary least square (FMOLS), and dynamic ordinary least square (DOLS) methods are used for empirical analysis. First and second-generation panel unit root tests report a mixed order of integration. The empirical findings show that government effectiveness, regulatory quality, the rule of law, foreign direct investment (FDI), and innovation have a negative effect on CO2 emissions. In contrast, geopolitical risk, corruption, political stability, and energy consumption have a positive effect on CO2 emissions. Based on the empirical outcomes, the present research invites the concentration of central authorities and policymakers of these economies toward redesigning more sophisticated strategies regarding these potential variables to protect the environment.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Climate change is one of the most important environmental burdens affecting the sustainable economic growth of almost all countries worldwide. These days, the most contentious problems are global warming, climate change, and environmental destruction. The average increase in the world’s temperature and the occurrence of extreme weather is caused mainly by the aforementioned variables. Additionally, distortions in both consumption and production activities are mostly caused by these factors, namely climate change, environmental degradation, and global warming (Ahmad and Du 2017; Jahanger et al. 2023; Saqib et al. 2023). Additionally, GHGs (greenhouse gases) are mostly to blame for the deterioration of the ecosystem. CO2 emissions account for approximately 76% of all GHGs (Coskuner et al. 2020; Usman et al. 2023).

Geopolitical risk (GPR) has grown in every region over the past few decades. Wars, acts of terrorism, and political unrest among nations have all occurred across the globe. The GPR also affects society and politics, as well as the economy. Businesses and investors must consider GPR when deciding where to invest or operate. For example, a company might avoid investing in a country experiencing political turmoil or economic instability, or diversify its investments across multiple countries to minimize risk. GPR can have significant effects on global markets, as well as on individual businesses and industries. It is essential for businesses and investors to stay informed about geopolitical developments and to have strategies in place to mitigate potential risks.

Additionally, geopolitical occurrences, such as the US-China trade war, 9/11, and the Bombay assaults, have altered economic agents’ perspectives (behavior). Investors, businesses, and central banks see GPR as a crucial indicator of economic success. The World Bank and the IMF have recently reported growing worries about GPR. Numerous pieces of research have focused on the economic effects of GPR. According to Saint Akadiri et al. (2020), GPR has a detrimental impact on tourism and economic growth. Similar conclusions on how GPR influences tourist receipts are drawn by Alola et al. (2019) and Athari et al. (2021). While Su et al. (2019) provide evidence that GPR influences oil prices and financial liquidity, Rasoulinezhad et al. (2020) indicate that GPR affects energy use.

In addition, Wang et al. (2019) conclude that GPR and investments have a bad association. Olanipekun and Alola (2020) have discovered that positive shocks negatively impact oil production to geopolitical concerns. GPR could have an impact on the environment. GPR may hinder energy use and economic growth, which would reduce CO2 emissions. Additionally, GPR may hinder R&D, innovation, and sustainable energy use, all of which would increase carbon emissions, similar to how GPR could incentivize companies to use conventional, environmentally harmful manufacturing techniques, increasing carbon emissions. Researchers must investigate the connection between GPR and emissions to reduce pollution levels. The results showed that GPR increased CO2 emissions.

Furthermore, these nations’ use of renewable energy reduces emission levels. Syed et al. (2022) investigated whether uncertainty in economic policy and geopolitical risk increased CO2 emissions. In BRICS countries, the finding reveals that geopolitical risk increases carbon emissions in the lowest quartiles while decreasing them in the middle and upper quartiles. The conditional distribution of CO2 emissions also shows that GDP per capita, renewable and non-renewable energy, and urbanization all have different effects on CO2 emissions.

Political stability can be an important factor in economic growth and development, as it can provide a conducive environment for businesses and investors to operate. Countries with political stability are generally more attractive to foreign investors, as they offer a lower level of risk and a more predictable business environment. Additionally, political stability can lead to increased consumer confidence, which can boost economic growth. Conversely, countries that experience political instability, such as coups, civil unrest, or frequent changes in government, are often viewed as risky for investment and can lead to economic decline. Political instability can also have negative effects on a country’s social and cultural fabric, leading to division and conflict within society. In summary, political stability is an important factor for a country’s economic and social well-being and is closely tied to its ability to maintain a reliable and effective system of governance.

A variety of illicit behaviors that endanger society, the economy, and global warming and environmental challenges is reflected in corruption. In empirical investigations, corruption and CO2 emissions are linked from two different angles. Accordingly, Sekrafi and Sghaier (2018), Jahanger et al. (2022), and Akhbari and Nejati (2019) establish a negative association between corruption and carbon emissions and concludes that controlling corruption enables lowering polluting emissions. The opposing viewpoint contends corruption can increase carbon dioxide emissions (Ridzuan 2019). Sahli and Rejeb (2015) and Hassaballa (2015) examined the connection between corruption and carbon dioxide emissions in the MENA area. Both empirical studies show that corruption has a beneficial impact on the environment. However, Sahli and Rejeb (2015) find a positive relationship between corruption and CO2 emissions. Dincer and Fredriksson’s (2018) examined data from 48 US states between 1977 and 1994. They found that corruption and trust have a positive effect on emissions and per capita income. Wang et al. (2018) examined the corruption, economic growth, and CO2 emission nexus for BRICS countries from 1996 to 2015. They discovered that the control of corruption lowers CO2 emissions and that the moderating effect of corruption is critical in the link between economic growth and carbon dioxide emissions. Sinha et al. (2019) examined the BRICS countries to examine the nexus between environmental quality and corruption. They showed that EKCs with an inverted N form exist and that corruption changes where EKCs turn around.

Numerous variables contribute to carbon emissions, but it is vital to remember that there is always a solution to any issue. Strong governance is a remedy to environmental degradation brought on by excessive carbon emission (Sarwar and Alsaggaf 2021; Yang et al. 2021; Mohammed et al. 2023). According to Sarpong and Bein (2020), who examined the link between good governance and CO2 emissions in SSA area nations, good governance is inversely associated with carbon emissions in oil-rich countries. However, nations that do not produce oil also benefit from this arrangement. Although there is a clear correlation between these two factors, effective governance also has various indirect effects on carbon emissions. In MENA economies, the link between good governance and the environment was examined by Omri and Mabrouk (2020). Results of the investigation, which used data from 1996 to 2014, showed that excellent governance reduces carbon emissions because it alters human behavior or leads to human development that contributes to the drop-in emissions. Oliveira (2019) examined the connection between governance and the environment using data from Brazil and concluded that both formal and informal aspects of governance contributed to the addition of green practices, improving the environment overall. Baloch and Wang (2019) studied the BRICS nations to see whether governance had any bearing on the countries’ ability to reduce their carbon emissions. According to a panel data analysis of data from 1996 to 2017, there is a strong and unfavorable association between governance and carbon emissions in these nations. Also, good governance does encourage green behaviors, which are important for protecting the environment and reducing carbon emissions.

This study contributes to the literature in four major aspects. First, this study simultaneously investigates the effects of geopolitical risk, corruption, and governance indicators on CO2 in BRICS countries. The inclusion of these variables collectively is vital because formulating appropriate and effective strategies for protecting environmental quality demands the exploration of all possible factors and quantifying their impact, which has been ignored in previous studies. Second, along with these variables, a few other important variables, namely FDI and innovation, are also included, further strengthening the study and providing more in-depth information regarding the causes of carbon emissions. Third, in contrast to the previous research, which employed conventional econometrics techniques, this empirical study employs more sophisticated techniques, such as second-generation techniques, to address the problem of heterogeneity and cross-sectional dependency. Finally, exploring the determinants of CO2 in the case of BRICS will provide new insight to researchers in the relevant area and seems to be a valuable addition to the literature. Considering their determined economic development tactics demands ever-increasing energy and progressively sophisticated consumer commodities, it is significant to acquire how BRICS countries tactic ecological defense. The important empirical conclusions of this research strain the position of appropriate measures for well-organized energy consumption and reserves in the product sphere for complication in light of the sequence for a sustainable atmosphere. Long-run times of low-slung geopolitical risk and other study indicators need representatives to progress solutions to protect the environment, being the present contribution’s policy-level extension.

The rest of the paper is organized as follows. The study’s “Literature review” section deals with the literature review, and the research methodology is given in the “Data description, model specification, and research methodology” section. The “Results and discussion” section presents the results, and the discussion, conclusions, policy recommendations, and further research are given in the “Conclusion, policy recommendation, and future research direction” section.

Literature review

Geopolitical risk and CO2 emission

Anser et al. (2021a) investigated the nexus between environmental degradation, uncertainty, and geopolitical risk in emerging economies from 1995 to 2015. This study applied the IPAT theoretical model through the FMOLS econometrics model. They found that a 1% surge in the GDP leads to a rise in EFP by 0.31% in an emerging economy. Another study by Anser et al. (2021b) examined the nexus between the environment and geopolitical risk in BRICS countries. According to the findings, GPR increased CO2 emissions. Hashmi et al. (2022) analyzed the environmental Kuznets Curve hypothesis amidst geopolitical risk in the global evidence. The results show that a short-term increase in GPR of 1% reduces emissions globally by 3.50%.

On the other hand, over time, a 1% increase in GPR promotes a 13.24% increase in emissions. They found that energy consumption increases global emissions over the long and short terms, which is also what was predicted. Syed et al. (2022) investigated whether economic policy uncertainty and geopolitical risk increase environmental pollution in BRICS nations. The finding reveals that geopolitical risk increases CO2 emissions in the lowest quartiles while decreasing them in the middle and upper quartiles. The conditional distribution of CO2 emissions also shows that GDP per capita, renewable and non-renewable energy, and urbanization all have heterogeneous effects on CO2 emissions. Riti et al. (2022) worked on geopolitical risk and environmental degradation in BRICS. The outcomes also demonstrate that the disaggregated level results do not support the aggregate level environment-GPR findings. As a result, the following conclusions about aggregation bias in estimations might be made: Policymakers may be misled by the false evidence to provide improper policies about environmental issues since the aggregation bias may result in an incorrect environmental GPR postulation.

Corruption and CO2 emission

Yao et al. (2021) used the STIRPAT model to analyze data from the BRICS and the following 11 countries between 1995 and 2014 to assess the effects of financial development and corruption on energy efficiency and ecological footprint. Brazil is the most efficient of the BRICS nations regarding GDP growth, input reduction, and undesired output (CO2 emissions). Wang et al. (2018) used a panel of BRICS nations from 1996 to 2015 to use a partial least square regression model to examine the moderating effect of corruption on economic growth and CO2 emissions. By manipulating the model with urbanization, trade, and population growth rates for a panel of BRICS nations, they establish a newly designed framework to investigate the moderating function of control of corruption in the growth and CO2 emission nexus. For the BRICS and the following 11 countries, Sinha et al. (2019) looked at the implications for the sustainability of corruption in the public sector using a conventional EKC model with a cubic specification for 1990–2017. This work has demonstrated the existence of EKCs with an inverted N form and how corruption alters EKC turnaround points. Sekrafi and Sghaier (2018) conducted a panel analysis in the MENA region to examine the relationship between corruption, economic growth, environmental degradation, and energy use using dynamic panel data techniques (Diff-GMM and Sys-GMM) over the years 1984 to 2012. The findings support the direct impact of corruption control on economic development, but the overall impact is negative. Chen et al. (2018) investigated how corruption, the shadow economy, and environmental legislation affect environmental quality in China. They incorporate dynamic effects for the years 1998–2012 and adjust for any endogeneity using the GMM technique. This research examines the efficiency of environmental legislation while considering China’s shadow economy and corruption in full. Akhbari and Nejati (2019) looked at how corruption affects carbon emissions in both rich and developing nations. They applied a panel threshold model for the time frame from 2003 to 2016. Due to this hypothesis’s theoretical underpinnings, the GDP coefficient is anticipated to be negative.

In contrast, the GDP square coefficient would be positive, leading to the establishment of EKC. To consider the simultaneity of corruption, growth, and CO2 emission, Bae et al. (2017) used a multiple-equation GMM methodology to study the determinants of CO2 emission for post-Soviet Union independent countries from 2000 to 2011. The outcomes demonstrated that this method produced superior results to the other single or combined estimating methods. Haseeb and Azam (2020) examined the relationship between tourism, corruption, democracy, and environmental degradation. They employed FMOLS from 1995 to 2015. The findings from the five panels—low-income countries, lower-middle-income countries, upper-middle-income countries, high-income countries, and the global data panel—indicate that tourism and corruption favorably impact the capacity to explain variation in carbon emissions. The evidence of environmental deterioration from the top six Asian nations was studied by Zandi et al. (2019) concerning the effects of democracy, corruption, and military spending. For the years 1995 to 2017, they make use of the FMOLS and DOLS estimators. The results of FMOLS and DOLS demonstrate that corruption and military spending positively and significantly influence carbon dioxide emissions. Moreover, Yahaya et al. (2020) investigated the contribution of corruption and financial development to environmental degradation in Sub-Saharan African nations (SSA). For the years 2000 to 2014, FMOLS methods were used in the investigation. The results suggest that the FMOLS method can determine the long-term coefficients of factors that reduce CO2 emissions.

Governance and CO2 emission

Baloch and Wang (2019) examine the impact of governance in reducing CO2 emissions: The BRICS experience using panel data from 1996 to 2017 and the Environmental Kuznets Curve (EKC) theory. According to the study’s descriptive statistics, among the BRICS nations, the Russian Federation has the most significant per-capita emissions (10.384), and India has the lowest (1.200). Using a variety of econometric approaches for the years 1996–2017, Liu et al. (2020) investigated the connection between economic development and CO2 emissions: does governance test the existence of EKC? The findings support the U-shaped EKC theory and the existence of an N-shaped trajectory. Mahmood et al. (2021) studied the role of the rule of law and corruption control in managing Pakistan’s CO2 emissions problem. They employ cointegration and unit root testing for the years 1996 through 2019. The outcome demonstrated that environmental repercussions are positively impacted by economic expansion. Chen (2021) examined the relationship between CO2 emissions and changes in the extent and degree of government digitization in the BRICS nations. Between 1990 and 2018, they applied the ARDL method. This empirical study’s primary goal is to examine how the BRICS countries’ varying levels of governance and digitalization affect CO2 emissions. The impact of finance, resources, and governance on the environment and economic development in South Asian nations is examined by Yang and Khan (2021). The variables for the years 1996–2018 have been analyzed using the panel cointegration tests and long-run methods capable of addressing endogeneity and cross-sectional dependency. According to empirical findings calculated using FGLS for the first specification, an increase in GDP growth of 1% has been found to increase environmental degradation by 0.039%. In the context of the environmental Kuznets curve, Le and Ozturk (2020) investigated the effects of globalization, financial development, public spending, and institutional quality on CO2 emissions. Panel data with cross-sectional dependency and slope heterogeneity are used to validate the stationarity of the variables from 1990 to 2014. This is done using CADF and CIPS unit root tests. They discovered that poor governance had a detrimental impact on CO2 emissions. Teng et al. (2021) used the panel ARDL for 1985 to 2018 to examine the impact of foreign direct investment on CO2 emission with the influence of globalization, and institutional quality. According to the findings, non-effective environmental rules and regulations, economic expansion to meet economic problems, and power consumption for economic activities are the primary causes of environmental deterioration in the research nations.

Energy consumption and CO2 emission

Younis et al. (2021) examined fresh evidence from the BRICS nations to examine the effects of the stock market, renewable energy usage, and urbanization on environmental deterioration from 1993 to 2018. They used the generalized method of moments GMM approach. They discovered that using renewable energy had a negative impact on carbon emissions. Additionally, other studies (Yang et al. 2022; Yue et al. 2023; Azam et al. 2023 and Duran et al. 2023) have come to the same conclusions. Both Aggregate Energy Demand and Energy-Efficient R&D Investment: Evidence from OECD Countries for the years 1980 to 2006 were analyzed by Karimu and Brännlund (2015). Based on the empirical findings, they applied a second-generation test. The findings suggest that none of the series in our data could reject the null hypothesis of cross-sectional independence, indicating that each series is likely correlated across panel units and that the estimate method should consider this. Using data from 1993 to 2017, Isiksal (2021) will assess the impact of sustainable energy and military spending on environmental deterioration. The outcome demonstrates that there is a CSD in every series. As a result, it demonstrates how a shock in one nation may spread to another. The Dynamic Connection between Energy Consumption and Environmental Degradation in Pakistan was examined by Sharif and Raza (2016) from 1972 to 2013. The study used three co-integrations. This study uses annual time series data to determine the connection between urbanization and carbon dioxide emissions in Pakistan. More to the point, by applying the Westerlund cointegration and AMG estimation approach, Usman et al. (2020) explore the linkage of financial development, energy usage, and tourism in the EKC framework from 1995 to 2017 in the 20 highly polluted countries. The findings of estimators signify that non-renewable energy usage and financial development increase the emission level. In contrast, tourism development has a negative impact on the ecological footprint in these countries. Abbasi and Adedoyin (2021) looked at whether China’s CO2 emissions depend on its energy use and the state of its economy. Using a new dynamic ARDL simulation model and empirical data from the dynamic ARDL simulation technique from 1970 to 2018, the empirical data demonstrates that energy consumption has both a short-and long-term positive and considerable influence on CO2 emissions. Similarly, Jalil and Feridun (2011) employed the autoregressive distributed lag (ARDL) technique in the case of China, during the period from 1953 to 2006. They reported that, with a piece addition of financial development, environmental quality also improves due to a decline in carbon emissions. Saqib (2018) and Mahmood and Saqib (2022) supported the same view that energy consumption positively impacts CO2 emissions. According to the study, when energy use rises, CO2 emissions also rise, eventually reaching unhealthy levels Saqib (2021, 2022). Another study by Dong et al. (2017) investigated whether using natural gas and renewable energy reduced CO2 emissions in BRICS countries from 1985 to 2016. They used the panel unit root, cointegration, causality (AMG) estimator, and EKC. The results of the panel AMG estimator well support the panel sample EKC hypothesis. The results show that increasing natural gas and renewable energy consumption reduces CO2 emissions. Therefore, for the BRICS nations, a 1% increase in natural gas and renewable energy consumption will result in a 0.1641% and 0.2601% reduction in CO2 emissions, respectively. Applying the vector error correction model (VECM) based on Granger causality tests, Zhang et al. (2019) examined the association between energy consumption, GDP growth, and carbon emissions in the agricultural sector for China’s major grain-producing districts for the period from 1996 to 2015. The findings revealed that bidirectional causality relation was discovered between agricultural economic growth and agricultural carbon emissions in both, the long-run and the short-run; furthermore, unidirectional causality relationships are exposed to running from agricultural energy utilization to agricultural GDP growth and agricultural carbon emissions. Later, Irandoust (2016) proved these results, who used the Granger causality approach and observed adverse and statistically significant effects of renewable energy utilization on CO2 emission in the case of Denmark, Finland, Sweden, and Norway.

Data description, model specification, and research methodology

Data and model specification

This study examines the impact of geopolitical risk, corruption, and governance on the evidence of environmental degradation from BRICS countries. The model used in this study emerged from the previous research done by Syed et al. (2022), Hashmi et al. (2022), Azam et al. (2022), Yao et al. (2021), Haseeb and Azam (2020), Mahmood et al. (2021), Chen (2021), and Younis et al. (2021).

where CO2, GPR, COR, PS, GE, RQ, ROL, EC, FDI, and INO represent carbon emission, geopolitical risk, corruption, political stability and absence of violence, government effectiveness, regulatory quality, the rule of law, energy consumption, foreign direct investment, and innovation respectively. Where \({\upmu }_{\mathrm{it}}\) = error term, the countries are indicated by the subscript (i = 1….n), and the time is indicated by the subscript (t = 1….t). In Eq. (1), CO2 is a dependent variable, while GPR, COR, PS, GE, RQ, ROL, EC, FDI, and INO are the independent variables. \({\upbeta }_{0}\) is the intercept, while \({\upbeta }_{1}-{\upbeta }_{9}\) are slope coefficients of the explanatory variables. The ln represents logarithmic form.

Variables description and data source

The study uses data from the panel of BRICS countries from 1990 to 2018. The countries’ panel included Brazil, Russia, India, China, and South Africa. The definition of candidate series is presented as follows:

Geopolitical risk

It refers to the potential impact that political, social, and economic factors in a particular country or region can have on businesses, investments, and other activities. Geopolitical risks can arise from various factors, including conflicts, political instability, terrorism, trade disputes, natural disasters, and regulatory changes.

Political stability

It refers to the ability of a government to maintain a consistent and predictable political environment. A politically stable country is one in which the government is able to provide a reliable and effective system of governance, maintain law and order, and ensure the safety and security of its citizens. Such a country typically has a well-functioning legal system, stable institutions, and a peaceful political environment.

Government effectiveness

It refers to the ability of the government to provide public goods and services to its citizens efficiently and effectively. It includes the capacity of the government to implement policies and programs, deliver public services, and maintain social order.

Regulatory quality

It refers to the effectiveness of regulatory systems that govern economic and social activity. It includes the capacity of the government to establish and enforce rules and regulations that create an environment conducive to economic development, trade, and investment.

Rule of law

The rule of law refers to the principle that all individuals and institutions are subject to and accountable to the law. It includes the notion that the law should be applied equally to all individuals, regardless of their status, and that the legal system should be transparent, accessible, and impartial.

Energy consumption

Energy consumption refers to the amount of energy used by individuals, businesses, or organizations to provide products and services. It includes using fossil fuels, renewable energy, and other energy sources.

Foreign direct investment (FDI)

FDI refers to investment made by foreign entities in a country’s economy. It includes investments to start a new business or acquire an existing business and investments in real estate or infrastructure projects.

Trademark application

Trademark application refers to the process of registering a unique name, logo, symbol, or other identifiers that distinguish a product or service from others in the market. It provides legal protection against infringement and allows the owner to monetize their intellectual property by licensing or selling the rights to use the trademark. Table 1 presents the variables’ description, their symbol, and unit of measurement and data sources.

Table 2 provides a summary of the descriptive statistics; the mean value of lnCO2, lnGPR, lnCOR, PS, GE, RQ, ROL, LnEC, lnFDI, and lnINO are 5.64, 7.44, 2.42, − 0.27, 0.04, − 0.56, − 0.27, 4.87, 24.05 and 12.42 respectively. While the standard deviation of lnCO2, lnGPR, lnCOR, PS, GE, RQ, ROL, LnEC, lnFDI, and lnINO are 3.67, 0.62, 1.25, 0.42, 0.31, 0.43, 0.35, 0.38, 1.52 and 1.81 respectively. The Jarque–Bera states reveal that GE, RG, lnEC, and lnFDI are normally distributed. Moreover, Table 3 presents the findings of the correlation analysis of the study’s variables. It is found that there is a negative correlation between RQ, ROL, FDI, and lnINO with CO2 emissions. While there is a positive correlation existing between lnGPR, lnCOR, PS, GE, and lnEC with CO2 emissions.

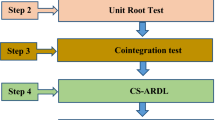

Methodological framework

The initial econometric step is to estimate the cross-sectional dependency (CSD) in panel data analysis. The CSD refers to a situation where the observations or units being studied are not independent of each other (Usman et al. 2022a; Usman and Radulescu 2022). This can arise in statistical analysis when some common factors or influences affect multiple observations or units being analyzed (Usman et al. 2021). For example, in a study of the relationship between GPR, COR, PS, GE, RQ, ROL, EC, FDI, INO, and carbon emissions, CSD may arise if there are shared regional factors, such as local economic conditions or cultural norms, that affect the overall environmental conditions. In this case, the observations are not independent, as the variation in carbon emissions level may be influenced by the same underlying factors (Chandio et al. 2022). The possible CSD can complicate statistical analysis and may lead to biased estimates of relationships between variables. To address this issue, researchers may use techniques such as second-generation analysis to account for the shared influences on the observations.

The second step of panel data analysis is to specify the order of integration of variables. Ignoring the order of integration and running the conventional OLS estimators will provide spurious estimates. This study used panel unit root tests developed by Levin et al. (2002) and CIPS by Pesaran (2007). The second-generation panel unit root (CIPS) has the ability to tackle the issue of possible CSD and slope heterogeneity (Yang et al. 2022). Therefore, it is a dire requirement to implement the CIPS unit root test. The null hypothesis (H0) of all panel unit tests is the non-stationarity of the variables following the unit root process, against the alternative hypothesis (H1) following the series’ stationary property with the absence of the unit root process.

In the very next step, this study further applies the Kao (1999) cointegration test to check the long-run cointegration. This study applies Kao’s (1999) residual-based cointegration test to the ADF panel version to approximate the residuals. This study applies the first-generation panel cointegration because there are more than six regressors. However, the authors cannot apply the second-generation unit root test in this regard. The functional form of ADF test statistics is Eq. 2 as follows:

After the presence of a long-term cointegration connection is verified between the considered variables, the fourth step of this study is to examine the long-run impact of GPR, COR, PS, GE, RQ, ROL, EC, FDI, and INO on CO2 emissions, by using the cross-sectionally autoregressive distributed lag model (CS-ARDL) and for robustness, panel fully modified–OLS (FMOLS) and panel dynamic–OLS (DOLS) techniques. Consider the conventional panel ARDL general form given in Eq. 2. The term \({X}_{ i, t-j}\) denotes lagged of the dependent variable, \({y}_{i, t-j}\) is the vector of all explanatory variables. In the subscripts, \(i\) and t stand for countries (1, 2…., n) and time periods (2002 to 2020), respectively. The \({Z}_{i}\), \({\delta }_{ij}\), \({\yen }_{ij}\) and \({e}_{it}\) represent the fixed effects, coefficient of the lagged regressed, m × 1 coefficient vectors (lagged regressors), and the error term, respectively.

In the occurrence of CSD, the conventional panel ARDL given in Eq. 3, results are biased (Phillips & Sul 2003). Consequently, a different estimating technique known as the CS-ARDL is utilized to address the issue of the presence of CSD. According to Chudik and Pesaran (2013), the cross-sectional averages of the regressors should be included as extra lags to the ARDL specification in Eq. 4. The updated equation is stated as follows with the inclusion of the cross-sectional lag term:

where in Eq. 3, \({\overline{M} }_{t-1}=({\overline{CO} }_{2, i,t-j},{\overline{y} }_{ i,t-j})\) are the averages of regressed and regressor. Moreover, p, q, and r represent lags for each variable and the number of lags of the cross-sectional averages to be involved. While \(\overline{M }\) essentially depicts cross-section averages and eliminates cross-section dependencies (Azam et al. 2022). The CS-ARDL approach’s long-run coefficient estimations may be computed in Eq. 5 as follows:

Furthermore, Eq. 6 can be presented in error correction form as given below:

where \({\Delta }_{I}=t-(t-1)\)

For robustness analysis, this study applies the FMOLS and DOLS tests. The FMOLS method was developed by Pedroni (2001a), whereas the DOLS method was proposed by Pedroni (2001b). The justification behind applying both methodologies is to confirm the long-run relationship amid the studied variables in a heterogeneous panel together with accounting for problems like serial correlation and endogeneity that commonly arise in the OLS procedure (Pedroni 2001a, 2001b). The FMOLS and DOLS employ parametric as well as non-parametric techniques to overwhelm the basic endogeneity and serial correlation problems in the panel dataset (Ibrahim et al. 2022; Usman et al. 2022b). The computed FMOLS and DOLS long-run coefficients can be expressed as follows in Eqs. 7 and 8.

Figure 1 reports the graphical presentation of the methodological framework of this study.

Results and discussion

Cross-sectional dependency and panel unit root tests

In this study, the authors employed the CSD test and panel unit root test such as Levin et al. (2002), the Levin Lin and Chu (LLC) test (first-generation unit root test), and Pesaran (2007) the cross-sectionally Augumented Im Pesaran and Shin (CIPS) test (second generation unit root test) to study the stationary properties of the variables of interest. Table 4 shows the CSD test estimates, and all statistics reject the null hypothesis of no CSD at the 1% level of significance. While Table 5 shows the LLC estimates at level and first difference, the results of the LLC test show that lnCO2, PS, LnFDI, and LnINO are stationary at level. While, all the potential series (i.e., lnGPR, lnCOR, GE, RQ, ROL, and LnEC) are following the stationary process after the first difference. The LLC estimates are biased in the presence of CD; the study used the second-generation unit root test for unbiased estimates. The estimates of the CIPS Test are shown in Table 6. The results of the CIPS test show that PS GE, ROL, lnEC, and lnINO are stationary at level, while the lnCO2, lnGPR, lnCOR, GE, RQ, and lnFDI are stationary after the first difference. It was discovered that the model’s variables had a mixed order of integration, i.e., stationary levels for both I(0) and I(1). In this instance, CS-ARDL is the best-suited approach for the data analysis.

Panel cointegration test

We employed the Kao residual co-integration test to determine panel cointegration. Table 7 shows the results of the Kao cointegration test. The null hypothesis of no integration has been rejected at a 1% significance level, which depicts the existence of long-run cointegration among the variables.

CS-ARDL estimates

The panel CS-ARDL findings are shown in Table 8. In the long run, GE, RQ, ROL, lnFDI, and lnINO have a negative effect on CO2 emissions, while the lnGPR, lnCOR, PS, and LnEC have a positive effect on CO2 emissions. The coefficient of lnGPR is 0.1120%, which means that a 1% increase in GPR leads to an increase of 0.1120% in CO2 emissions. This finding is consistent with the findings of Bildirici (2021), Abid (2016), and Mikkelsen et al. (2010). According to Anser et al. (2021a), the reasons for GPR’s having a positive effect on CO2 emissions are as follows: first, the use of renewable energy sources may be discouraged by GPR, leading to an increase in CO2 emissions. Second, GPR may deter international FDI, leading to more CO2 emissions. Third, growing security concerns about GPR push manufacturers to continue employing production methods harmful to the environment (e.g., production plants that use fossil fuel energy). Fourth, geopolitical policies may receive more attention from policymakers than environmental protection measures as a result of GPR. The coefficient of lnCOR is positive, indicating that a 1% rise in corruption leads to a surge in CO2 emissions by 0.0267% in the long run. This finding is consistent with the findings of Ridzuan (2019) and Makhdum et al. (2022).

Moreover, Wang et al. (2018) used partial least squares regression for BRICS for the period from 1996 to 2015. They found that corruption, economic growth, and urbanization all positively affect pollution emissions. The coefficient of governance indicators such as GE, RQ, and ROL are negative, while other indicators, such as PS, are positive. More specifically, a one-unit surge in the GE, RQ, and ROL led to a rise in CO2 by 1.5229%, 0.9992%, and 1.0979% in the long run. According to Sarpong and Bein’s (2020), good governance has a detrimental effect on carbon emissions in oil-rich nations. Additionally, Baloch and Wang (2019) studied the BRICS nations to see if governance has any bearing on the countries’ ability to reduce their carbon emissions. According to a panel data analysis of data from 1996 to 2017, there is a strong and negative association between governance and carbon emissions in these nations. The coefficient of LnEC also has a positive effect on CO2 emissions, indicating that a 1% rise in energy consumption leads to a surge in CO2 emissions by 0.5705% in the region. Elevated energy consumption degrades the environment since the conformist energy source releases greenhouse gases (GHGs) into the atmosphere. Omri (2013) investigated the MENA region from 1990 to 2011, and they found that environmental variables and energy policy are to blame for influencing the relationship between energy usage and economic growth.

Using the ARDL technique, Dogan and Turkekul (2016) studied the American economy from 1960 to 2010. They found a causal relationship between GDP and CO2, energy usage and CO2, urbanization, and GDP in both directions. The coefficient of lnFDI is negative, which indicates that a 1% rise in the lnFDI leads to a reduction in CO2 emissions of 1.4527%. The study on the effects of stock market growth on CO2 emissions found that, over the long term, FDI inflows reduce CO2 emissions (Paramati et al. 2017; Uddin et al. 2023). The coefficient of innovation also has a negative effect on CO2 emissions, indicating that a 1% surge in innovation will reduce CO2 emissions by 0.0411% in the long run. Sohag et al. (2015) studied how technological advancements have affected Malaysia’s energy use. They discovered that increased trade openness and GDP per capita growth cause technological innovation to have a rebound impact on energy use. According to Li et al. (2020), Sharif et al. (2022), Zhang et al. (2022), Saqib et al. (2022a; 2022b, and Wang et al. (2023), technological innovation may be crucial in easing environmental problems. For instance, technological advances can result in environmental-related technologies, which can be considered environmental regulations that stop garbage from being disposed of in the ecosystem.

Table 8 also shows the short-run estimates of the CS-ARDL test. In the short run, the coefficient of lnGPR, lnCOR, PS, and LnFDI positively affect CO2 emission, while GE, RQ, ROL, and LnEC have a positive effect on CO2 emission. The ECM coefficient is − 0.538100, negative and statistically significant at the 10% significance level. These findings show that the model’s adjustment to long-run equilibrium is around 53% each year. ECM negative and statistically significant outcomes backed with theoretical predictions. Figure 2 shows the graphical presentation of empirical findings.

Robustness checks

As a robustness analysis, this study also applied the FMOLS and DOLS to assess the reliability of the CS-ARDL approach’s long-term estimates. Table 9 presents the results of these two tests. As per the findings, in the long run, GE, RQ, ROL, lnFDI, and lnINO have a negative effect on CO2 emission, while the lnGPR, lnCOR, PS, and LnEC have a positive effect on CO2 emission. These studies produced results precisely the same as those from earlier ones, proving the reliability and consistency of the CS-ARDL approach findings.

Conclusion, policy recommendation, and future research direction

This empirical study examined the impact of geopolitical risk, corruption, and governance on environmental degradation evidence from BRICS countries for the period from 1990 to 2018. This study used LLC, CIPS unit root tests, CS-ARDL, FMOLS, and DOLS estimators. The LLC and CIPS unit root tests confirmed the mixed order of integration. The long-run CS-ARDL, FMOLS, and DOLS estimates reveal that GE, RQ, ROL, lnFDI, and lnINO have a negative effect on CO2 emission, while the lnGPR, lnCOR, PS, and LnEC have a positive effect on CO2 emission.

Based on the study’s findings, several policy recommendations for reducing CO2 emissions in the BRICS were proposed. First, government representatives and policymakers should work to reduce GPR through talks, accords, and peace treaties. Second, governments should thus increase their regulatory, oversight, and anti-corruption efforts since this unfair behavior affects competitive laws and policies. Third, policymakers should focus on more comprehensive governance to stop environmental deterioration and include environmental policy in fundamental national legislation. To increase environmental protection and awareness, which reduces carbon emissions, government effectiveness needs to be improved. Fourth, to reduce CO2 emissions, the proportion of renewable energy in overall energy consumption should be raised.

Similarly, the budget allocation needs to be increased on innovation to achieve a more sustainable energy agenda, ultimately ensuring the well-being of society. Finally, to impulsion the firms towards implementing these explanations, the representatives might gradually upsurge the fossil fuel-based/nonrenewable energy price solutions. This will dishearten companies practicing nonrenewable energy, and the petition for cleaner energy explanations might increase progressively. Moreover, in order to provide cleaner energy demand explanations and lessen carbon emissions, the companies will initiate availing the disinfectant technological solutions. This advanced financialization procedure might support producing a sustained watercourse of attention income without causing damage to the cash stream of the companies. This revenue might be abstracted toward supporting the green energy discovery and technological innovation projects.

This study has several limitations, suggesting a direction for future research. This study uses CO2 emissions per capita instead of ecological footprints and their sub-components, such as grazing lands, carbon footprints, cropland, and bio-capacity. This opens new ways for future research work. The research is limited to only BRICS countries. It may be extended to all the developing and developed Asian countries and more globally. There are many other variables, such as financial devolvement, globalization, and population growth, which can also affect the CO2 emissions of a country. This study has been conducted under the CS-ARDL FMOLS and DOLS estimators, but one can also use AMG and CCEMG estimators and many other tests and techniques for such types of studies. The study can be extended to asymmetric ARDL techniques.

Data availability

The datasets used and/or analyzed during the current study are available from the first author on reasonable request.

Change history

02 June 2023

A Correction to this paper has been published: https://doi.org/10.1007/s11356-023-28076-w

References

Abbasi KR, Adedoyin FF (2021) Do energy use and economic policy uncertainty affect CO2 emissions in China? Empirical evidence from the dynamic ARDL simulation approach. Environ Sci Pollut Res 28(18):23323–23335. https://doi.org/10.1007/s11356-020-12217-6

Abid M (2016) Impact of economic, financial, and institutional factors on CO2 emissions: evidence from sub-Saharan Africa economies. Util Policy 41:85–94. https://doi.org/10.1016/j.jup.2016.06.009

Ahmad N, Du L (2017) Effects of energy production and CO2 emissions on economic growth in Iran: ARDL approach. Energy 123:521–537. https://doi.org/10.1016/j.energy.2017.01.144

Akhbari R, Nejati M (2019) Does the effect of corruption on carbon emissions vary in different countries? Environ Sci 17(1):105–120. https://doi.org/10.29252/envs.17.1.105

Alola UV, Cop S, AdewaleAlola A (2019) The spillover effects of tourism receipts, political risk, real exchange rate, and trade indicators in Turkey. Int J Tour Res 21(6):813–823. https://doi.org/10.1002/jtr.2307

Anser MK, Syed QR, Lean HH, Alola AA, Ahmad M (2021a) Do economic policy uncertainty and geopolitical risk lead to environmental degradation? Evidence from Emerging Economies. Sustainability 13(11):5866. https://doi.org/10.3390/su13115866

Anser MK, Syed QR, Apergis N (2021b) Does geopolitical risk escalate CO2 emissions? Evidence from the BRICS countries. Environ Sci Pollut Res 28(35):48011–48021. https://doi.org/10.1007/s11356-021-14032-z

Athari SA, Alola UV, Ghasemi M, Alola AA (2021) The (Un) sticky role of exchange and inflation rate in tourism development: insight from the low and high political risk destinations. Curr Issue Tour 24(12):1670–1685. https://doi.org/10.1080/13683500.2020.1798893

Azam M, Uddin I, Khan S, Tariq M (2022) Are globalization, urbanization, and energy consumption cause carbon emissions in SAARC region? New evidence from CS-ARDL approach. Environ Sci Pollut Res 29(58):87746–87763. https://doi.org/10.1007/s11356-022-21835-1

Azam M, Uddin I, Saqib N (2023) The determinants of life expectancy and environmental degradation in Pakistan: evidence from ARDL bounds test approach. Environ Sci Pollut Res 30(1):2233–2246. https://doi.org/10.1007/s11356-022-22338-9

Bae JH, Li DD, Rishi M (2017) Determinants of CO2 emission for post-Soviet Union independent countries. Clim Policy 17(5):591–615. https://doi.org/10.1080/14693062.2015.1124751

Baloch MA, Wang B (2019) Analyzing the role of governance in CO2 emissions mitigation: the BRICS experience. Struct Chang Econ Dyn 51:119–125. https://doi.org/10.1016/j.strueco.2019.08.007

Bildirici ME (2021) Terrorism, environmental pollution, foreign direct investment (FDI), energy consumption, and economic growth: evidences from China, India, Israel, and Turkey. Energy Environ 32(1), 75–95. https://journals.sagepub.com/doi/pdf/10.1177/0958305X20919409

Chandio AA, Sethi N, Dash DP, Usman M (2022) Towards sustainable food production: what role ICT and technological development can play for cereal production in Asian–7 countries? Comput Electron Agric 202:107368. https://doi.org/10.1016/j.compag.2022.107368

Chen L (2021) How CO 2 emissions respond to changes in government size and level of digitalization? Evidence from the BRICS countries. Environ Sci Pollut Res 29:457–467. https://doi.org/10.1007/s11356-021-15693-6

Chen H, Hao Y, Li J, Song X (2018) The impact of environmental regulation, shadow economy, and corruption on environmental quality: theory and empirical evidence from China. J Clean Prod 195:200–214. https://doi.org/10.1016/j.jclepro.2018.05.206

Chudik A, Pesaran MH (2013) Large panel data models with cross-sectional dependence: a survey. CAFE Res Pap (13.15). https://doi.org/10.2139/ssrn.2316333

Coskuner C, Paskeh MK, Olasehinde-Williams G, Akadiri SS (2020) Economic and social determinants of carbon emissions: evidence from organization of petroleum exporting countries. J Public Aff 20(3):e2092. https://doi.org/10.1002/pa.2092

de Oliveira JAP (2019) Intergovernmental relations for environmental governance: cases of solid waste management and climate change in two Malaysian States. J Environ Manag 233:481–488. https://doi.org/10.1016/j.jenvman.2018.11.097

Dincer OC, Fredriksson PG (2018) Corruption and environmental regulatory policy in the United States: does trust matter? Resour Energy Econ 54:212–225. https://doi.org/10.1016/j.reseneeco.2018.10.001

Dogan E, Turkekul B (2016) CO2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23(2):1203–1213. https://doi.org/10.1007/s11356-015-5323-8

Dong K, Sun R, Hochman G (2017) Do natural gas and renewable energy consumption lead to less CO2 emission? Empirical evidence from a panel of BRICS countries. Energy 141:1466–1478. https://doi.org/10.1016/j.energy.2017.11.092

Duran IA, Saqib N, Mahmood H (2023) Assessing the connection between nuclear and renewable energy on ecological footprint within the EKC framework: implications for sustainable policy in leading nuclear energy-producing countries. Int J Energy Econ Policy 13(2):256–264. https://doi.org/10.32479/ijeep.14183

Haseeb M, Azam M (2020) Dynamic nexus among tourism, corruption, democracy and environmental degradation: a panel data investigation. Environ Dev Sustain 23(4):5557–5575. https://doi.org/10.1007/s10668-020-00832-9

Hashmi SM, Bhowmik R, Inglesi-Lotz R, Syed QR (2022) Investigating the Environmental Kuznets Curve hypothesis amidst geopolitical risk: global evidence using bootstrap ARDL approach. Environ Sci Pollut Res 29(16):24049–24062. https://doi.org/10.1007/s11356-021-17488-1

Hassaballa H (2015) The effect of corruption on carbon dioxide emissions in the MENA region. Eur J Sustain Dev 4(2):301–301. https://doi.org/10.14207/ejsd.2015.v4n2p301

Ibrahim RL, Ajide KB, Usman M, Kousar R (2022) Heterogeneous effects of renewable energy and structural change on environmental pollution in Africa: do natural resources and environmental technologies reduce pressure on the environment? Renew Energy 200:244–256. https://doi.org/10.1016/j.renene.2022.09.134

Irandoust M (2016) The renewable energy-growth nexus with carbon emissions and technological innovation: evidence from the Nordic countries. Ecol Ind 69:118–125. https://doi.org/10.1016/j.ecolind.2016.03.051

Isiksal AZ (2021) Testing the effect of sustainable energy and military expenses on environmental degradation: evidence from the states with the highest military expenses. Environ Sci Pollut Res 28(16):20487–20498. https://doi.org/10.1007/s11356-020-11735-7

Jahanger A, Hossain MR, Usman M, Onwe JC (2023) Recent scenario and nexus between natural resource dependence, energy use and pollution cycles in BRICS region: does the mediating role of human capital exist? Resour Policy 81:103382. https://doi.org/10.1016/j.resourpol.2023.103382

Jahanger A, Usman M, Ahmad P (2022) Investigating the effects of natural resources and institutional quality on CO2 emissions during globalization mode in developing countries. Int J Environ Sci Technol 1–20. https://doi.org/10.1007/s13762-022-04638-2

Jalil A, Feridun M (2011) The impact of growth, energy and financial development on the environment in China: a cointegration analysis. Energy Econ 33(2):284–291. https://doi.org/10.1016/j.eneco.2010.10.003

Kao C (1999) Spurious regression and residual-based tests for cointegration in panel data. J Econom 90(1):1–44. https://doi.org/10.1016/S0304-4076(98)00023-2

Karimu A, Brännlund R (2015) Energy efficient R&D investment and aggregate energy demand: evidence from OECD countries (December 11, 2015). CERE Working Paper, 2015:14, Available at SSRN: https://doi.org/10.2139/ssrn.2703247

Le HP, Ozturk I (2020) The impacts of globalization, financial development, government expenditures, and institutional quality on CO 2 emissions in the presence of environmental Kuznets curve. Environ Sci Pollut Res 27(18):22680–22697. https://doi.org/10.1007/s11356-020-08812-2

Levin A, Lin CF, Chu CSJ (2002) Unit root tests in panel data: asymptotic and finite-sample properties. J Econom 108(1):1–24. https://doi.org/10.1016/S0304-4076(01)00098-7

Li J, Zhang X, Ali S, Khan Z (2020) Eco-innovation and energy productivity: new determinants of renewable energy consumption. J Environ Manag 271:111028. https://doi.org/10.1016/j.jenvman.2020.111028

Liu X, Latif K, Latif Z, Li N (2020) Relationship between economic growth and CO 2 emissions: does governance matter? Environ Sci Pollut Res 27(14):17221–17228. https://doi.org/10.1007/s11356-020-08142-3

Mahmood H, Tanveer M, Ahmad AR, Furqan M (2021) Rule of law and control of corruption in managing CO2 emissions issue in Pakistan. https://mpra.ub.uni-muenchen.de/109250/

Mahmood H, Saqib N (2022) Oil rents, economic growth, and CO2 emissions in 13 OPEC member economies: asymmetry analyses. Front Environ Sci 10:2104. https://doi.org/10.3389/fenvs.2022.1025756

Makhdum MSA, Usman M, Kousar R, Cifuentes-Faura J, Radulescu M, Balsalobre-Lorente D (2022) How do institutional quality, natural resources, renewable energy, and financial development reduce ecological footprint without hindering economic growth trajectory? Evidence from China. Sustainability 14(21):13910. https://doi.org/10.3390/su142113910

Mikkelsen M, Jørgensen M, Krebs FC (2010) The teraton challenge. A review of fixation and transformation of carbon dioxide. Energy Environ Sci 3(1):43–81. https://pubs.rsc.org/en/content/articlehtml/2010/ee/b912904a

Mohammed KS, Usman M, Ahmad P, Bulgamaa U (2023) Do all renewable energy stocks react to the war in Ukraine? Russo-Ukrainian conflict perspective. Environ Sci Pollut Res 30(13):36782–36793. https://doi.org/10.1007/s11356-022-24833-5

Olanipekun IO, Alola AA (2020) Crude oil production in the Persian Gulf amidst geopolitical risk, cost of damage and resources rents: is there asymmetric inference? Resour Policy 69:101873. https://doi.org/10.1016/j.resourpol.2020.101873

Omri A (2013) CO2 emissions, energy consumption and economic growth nexus in MENA countries: evidence from simultaneous equations models. Energy Econ 40:657–664. https://doi.org/10.1016/j.eneco.2013.09.003

Omri A, Mabrouk NB (2020) Good governance for sustainable development goals: getting ahead of the pack or falling behind? Environ Impact Assess Rev 83:106388. https://doi.org/10.1016/j.eiar.2020.106388

Paramati SR, Alam MS, Chen CF (2017) The effects of tourism on economic growth and CO2 emissions: a comparison between developed and developing economies. J Travel Res 56(6):712–724. https://doi.org/10.1177/0047287516667848

Pedroni P (2001b) Purchasing power parity tests in cointegrated panels. Rev Econ Stat 83(4):727–731. https://doi.org/10.1162/003465301753237803

Pedroni P (2001a) Fully modified OLS for heterogeneous cointegrated panels. In Nonstationary panels, panel cointegration, and dynamic panels. Emerald Group Publishing Limited, Vol. 15, pp. 93–130. https://doi.org/10.1016/S0731-9053(00)15004-2

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Economet 22(2):265–312. https://doi.org/10.1002/jae.951

Phillips PC, Sul D (2003) Dynamic panel estimation and homogeneity testing under cross section dependence. Economet J 6(1):217–259. https://doi.org/10.1111/1368-423X.00108

Policy uncertainty (2022) Policy uncertainty database website. http://policyuncertainty.com/. Accessed 12 Dec 2022

Rasoulinezhad E, Taghizadeh-Hesary F, Sung J, Panthamit N (2020) Geopolitical risk and energy transition in Russia: evidence from ARDL bounds testing method. Sustainability 12(7):2689. https://doi.org/10.3390/su12072689

Ridzuan AR (2019) The impact of corruption on environmental quality in the developing countries of ASEAN-3: the application of the bound test. http://zbw.eu/econis-archiv/bitstream/11159/5191/1/1747997382.pdf.

Riti JS, Shu Y, Riti MKJ (2022) Geopolitical risk and environmental degradation in BRICS: aggregation bias and policy inference. Energy Policy 166:113010. https://doi.org/10.1016/j.enpol.2022.113010

Sahli I, Rejeb JB (2015) The environmental Kuznets curve and corruption in the MENA region. Procedia Soc Behav Sci 195:1648–1657. https://doi.org/10.1016/j.sbspro.2015.06.231

Saint Akadiri S, Eluwole KK, Akadiri AC, Avci T (2020) Does causality between geopolitical risk, tourism and economic growth matter? Evidence from Turkey. J Hosp Tour Manag 43:273–277. https://doi.org/10.1016/j.jhtm.2019.09.002

Saqib N (2018) Greenhouse gas emissions, energy consumption and economic growth: empirical evidence from gulf cooperation council countries. Int J Energy Econ Policy 8(6):392–400. https://doi.org/10.32479/ijeep.7269

Saqib N (2021) Energy consumption and economic growth: empirical evidence from MENA region. Int J Energy Econ Policy 11(6):191–197. https://doi.org/10.32479/ijeep.11931

Saqib N (2022) Green energy, non-renewable energy, financial development and economic growth with carbon footprint: heterogeneous panel evidence from cross-country. Econ Res-Ekonomska Istraživanja 35(1):6945–6964. https://doi.org/10.1080/1331677X.2022.2054454

Saqib N, Duran I, Sharif I (2022) Influence of energy structure, environmental regulations and human capital on ecological sustainability in EKC framework; evidence from MINT countries. Front Environ Sci 10:968405. https://doi.org/10.3389/fenvs.2022.968405

Saqib N, Usman M, Radulescu M, Sinisi CI, Secara CG, Tolea C (2022b) Revisiting EKC hypothesis in context of renewable energy, human development and moderating role of technological innovations in E-7 countries. Front Environ Sci 10(2509):10–3389. https://doi.org/10.3389/fenvs.2022.1077658

Saqib N, Ozturk I, Usman M, Sharif A, Razzaq A (2023) Pollution haven or halo? How European countries leverage FDI, energy, and human capital to alleviate their ecological footprint. Gondwana Res 116:136–148. https://doi.org/10.1016/j.gr.2022.12.018

Sarpong SY, Bein MA (2020) The relationship between good governance and CO2 emissions in oil-and non-oil-producing countries: a dynamic panel study of sub-Saharan Africa. Environ Sci Pollut Res 27(17):21986–22003. https://doi.org/10.1007/s11356-020-08680-w

Sarwar S, Alsaggaf MI (2021) The role of governance indicators to minimize the carbon emission: a study of Saudi Arabia. Manag Environ Qual: An Int J 32(5):970–988. https://doi.org/10.1108/MEQ-11-2020-0275

Sekrafi H, Sghaier A (2018) Examining the relationship between corruption, economic growth, environmental degradation, and energy consumption: a panel analysis in MENA region. J Knowl Econ 9:963–979. https://doi.org/10.1007/s13132-016-0384-6

Sharif A, Saqib N, Dong K, Khan SAR (2022) Nexus between green technology innovation, green financing, and CO2 emissions in the G7 countries: the moderating role of social globalisation. Sustain Dev 30(6):1934–1946. https://doi.org/10.1002/sd.2360

Sharif A, Raza SA (2016) Dynamic relationship between urbanization, energy consumption and environmental degradation in Pakistan: evidence from structure break testing. J Manag Sci 3(1):1–21. https://geistscience.com/JMS/Issue1-16/Article1/JMS1603101.pdf

Sinha A, Gupta M, Shahbaz M, Sengupta T (2019) Impact of corruption in public sector on environmental quality: implications for sustainability in BRICS and next 11 countries. J Clean Prod 232:1379–1393. https://doi.org/10.1016/j.jclepro.2019.06.066

Sohag K, Begum RA, Abdullah SMS (2015) Dynamic impact of household consumption on its CO 2 emissions in Malaysia. Environ Dev Sustain 17:1031–1043. https://doi.org/10.1007/s10668-014-9588-8

Su CW, Khan K, Tao R, Nicoleta-Claudia M (2019) Does geopolitical risk strengthen or depress oil prices and financial liquidity? Evidence from Saudi Arabia. Energy 187:116003. https://doi.org/10.1016/j.energy.2019.116003

Syed QR, Bhowmik R, Adedoyin FF, Alola AA, Khalid N (2022) Do economic policy uncertainty and geopolitical risk surge CO2 emissions? New insights from panel quantile regression approach. Environ Sci Pollut Res 29(19):27845–27861. https://doi.org/10.1007/s11356-021-17707-9

Teng JZ, Khan MK, Khan MI, Chishti MZ, Khan MO (2021) Effect of foreign direct investment on CO2 emission with the role of globalization, institutional quality with pooled mean group panel ARDL. Environ Sci Pollut Res 28:5271–5282. https://doi.org/10.1007/s11356-020-10823-y

Transparency International (2022) Transparency International database website. https://www.transparency.org/

Uddin I, Ullah A, Saqib N, Kousar R, Usman M (2023) Heterogeneous role of energy utilization, financial development, and economic development in ecological footprint: how far away are developing economies from developed ones. Environ Sci Pollut Res 1–21. https://doi.org/10.1007/s11356-023-26584-3

Usman M, Radulescu M (2022) Examining the role of nuclear and renewable energy in reducing carbon footprint: does the role of technological innovation really create some difference? Sci Total Environ 841:156662. https://doi.org/10.1016/j.scitotenv.2022.156662

Usman M, Kousar R, Makhdum MSA (2020) The role of financial development, tourism, and energy utilization in environmental deficit: evidence from 20 highest emitting economies. Environ Sci Pollut Res 27:42980–42995. https://doi.org/10.1007/s11356-020-10197-1

Usman M, Khalid K, Mehdi MA (2021) What determines environmental deficit in Asia? Embossing the role of renewable and non-renewable energy utilization. Renew Energy 168:1165–1176. https://doi.org/10.1016/j.renene.2021.01.012

Usman M, Balsalobre-Lorente D, Jahanger A, Ahmad P (2023) Are Mercosur economies going green or going away? An empirical investigation of the association between technological innovations, energy use, natural resources and GHG emissions. Gondwana Res 113:53–70. https://doi.org/10.1016/j.gr.2022.10.018

Usman M, Jahanger A, Makhdum MSA, Radulescu M, Balsalobre-Lorente D, Jianu E (2022a) An empirical investigation of ecological footprint using nuclear energy, industrialization, fossil fuels and foreign direct investment. Energies 15:6442. https://doi.org/10.3390/en15176442

Usman M, Radulescu M, Balsalobre-Lorente D, Rehman A (2022b) Investigation on the causality relationship between environmental innovation and energy consumption: empirical evidence from EU countries. Energy Environ 0958305X221120931. https://doi.org/10.1177/0958305X221120931.

Wang Z, Zhang B, Wang B (2018) The moderating role of corruption between economic growth and CO2 emissions: evidence from BRICS economies. Energy 148:506–513. https://doi.org/10.1016/j.energy.2018.01.167

Wang H, Liu Y, Xiong W, Song J (2019) The moderating role of governance environment on the relationship between risk allocation and private investment in PPP markets: evidence from developing countries. Int J Project Manag 37(1):117–130. https://doi.org/10.1016/j.ijproman.2018.10.008

Wang R, Usman M, Radulescu M, Cifuentes-Faura J, Balsalobre-Lorente D (2023) Achieving ecological sustainability through technological innovations, financial development, foreign direct investment, and energy consumption in developing European countries. Gondwana Res 119:138–152. https://doi.org/10.1016/j.gr.2023.02.023

WDI (World Development Indicators) (2022) The World Bank. https://databank.worldbank.org/source/world-development-indicators. Accessed 9 Jan 2023

Yahaya NS, Mohd-Jali MR, Raji JO (2020) The role of financial development and corruption in environmental degradation of Sub-Saharan African countries. Manag Environ Qual: An Int J 31(4):895–913. https://doi.org/10.1108/MEQ-09-2019-0190

Yang Y, Khan A (2021) Exploring the role of finance, natural resources, and governance on the environment and economic growth in South Asian countries. Environ Sci Pollut Res 28(36):50447–50461. https://doi.org/10.1007/s11356-021-14208-7

Yang B, Usman M, Jahanger A (2021) Do industrialization, economic growth and globalization processes influence the ecological footprint and healthcare expenditures? Fresh insights based on the STIRPAT model for countries with the highest healthcare expenditures. Sustain Prod Consum 28:893–910. https://doi.org/10.1016/j.spc.2021.07.020

Yang Q, Huo J, Saqib N, Mahmood H (2022) Modelling the effect of renewable energy and public-private partnership in testing EKC hypothesis: evidence from methods moment of quantile regression. Renew Energy 192:485–494. https://doi.org/10.1016/j.renene.2022.03.123

Yao X, Yasmeen R, Hussain J, Shah WUH (2021) The repercussions of financial development and corruption on energy efficiency and ecological footprint: evidence from BRICS and next 11 countries. Energy 223:120063. https://doi.org/10.1016/j.energy.2021.120063

Younis I, Naz A, Shah SAA, Nadeem M, Longsheng C (2021) Impact of stock market, renewable energy consumption and urbanization on environmental degradation: new evidence from BRICS countries. Environ Sci Pollut Res 28:31549–31565. https://doi.org/10.1007/s11356-021-12731-1

Yue L, Yan H, Ahmad F, Saqib N, Chandio AA, Ahmad MM (2023) The dynamic change trends and internal driving factors of green development efficiency: robust evidence from resource-based Yellow River Basin cities. Environ Sci Pollut Res 30(16):48571–48586. https://doi.org/10.1007/s11356-023-25684-4

Zandi G, Haseeb M, Abidin ISZ (2019) The impact of democracy, corruption and military expenditure on environmental degradation: evidence from top six ASEAN countries. Humanit Soc Sci Rev 7(4):333–340. https://doi.org/10.18510/hssr.2019.7443

Zhang L, Pang J, Chen X, Lu Z (2019) Carbon emissions, energy consumption and economic growth: evidence from the agricultural sector of China’s main grain-producing areas. Sci Total Environ 665:1017–1025. https://doi.org/10.1016/j.scitotenv.2019.02.162

Zhang J, Liu Y, Saqib N, Waqas Kamran H (2022) An empirical study on the impact of energy poverty on carbon intensity of the construction industry: moderating role of technological innovation. Front Environ Sci 10:929939. https://doi.org/10.3389/fenvs.2022.929939

Author information

Authors and Affiliations

Contributions

Ijaz Uddin: conceptualization, introduction, methodology, interpreted results, writing—original draft preparation. Muhammad Usman: project administration, software, formal analysis, supervision, writing—original draft preparation, review, and editing. Najia Saqib: visualization, writing original draft, and preparation. Muhammad Sohail Amjad Makhdum: literature review, validation, finalizing manuscript, review, and editing.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Philippe Garrigues

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Uddin, I., Usman, M., Saqib, N. et al. The impact of geopolitical risk, governance, technological innovations, energy use, and foreign direct investment on CO2 emissions in the BRICS region. Environ Sci Pollut Res 30, 73714–73729 (2023). https://doi.org/10.1007/s11356-023-27466-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-27466-4