Abstract

Environmental concerns have become one of the top inevitable issues the world has been facing nowadays. Human-induced carbon emissions are the main reasons behind these environmental issues and to reduce them and mitigate their consequences, policymakers globally explore their drivers and determinants continuously. Although several socio-economic factors have been explored that affect the level of emissions, relatively less attention has been paid to geopolitical risk (GPR). Over the past few decades, the world has witnessed a significant rise in GPR with economic and environmental impacts. However, the existing body of literature on the GPR-environment nexus documents the contrasting conclusion, which might cause inconvenience while proposing environmental protection policies. Therefore, the present study reinvestigates the impact of GPR on carbon emissions at the global level. The findings document that, in the short run, a 1% rise in GPR impedes emissions by 3.50% globally. On the contrary, a 13.24% rise in emissions is fostered by a 1% increase in GPR in the long run. Also as was expected, we report that energy consumption leads to higher global emissions in both the short and long run. Next, this study also validates the existence of the environmental Kuznets curve (EKC) hypothesis at the global level. Based on these aforementioned outcomes, we propose several policy recommendations to curb global carbon emissions via GPR accomplish, thus, a few sustainable development goals.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

During the last two decades, one of the most repeatedly and globally recognized burning issues is considered to be environmental degradation with its associated detrimental impacts on human health, ecosystem, and economic activities (e.g., production and consumption activities). Next, CO2 emission (i.e., a critical greenhouse gas) is regarded as one of the key reasons behind the aforementioned environmental issues. According to Carbon Dioxide Information Analysis Center (2014), global CO2 emissions surged from 4053 million metric tons in 1970 to 9855 million metric tons in 2014. This indicates that global CO2 emissions have increased almost 143% from 1970 to 2014. Given the high growth rate of emissions, as well as its current and projected levels, policymakers have been making efforts to mitigate emissions via policies at the national level but even more importantly, through intergovernmental and international commitments such as the Kyoto Protocol and the Paris Agreement. However, the levels of emissions have not shown drastic changes and hence more focus is required for promoting future sustainability.

There exists a plethora of empirical literature that explores the drivers of CO2 emissions. Nevertheless, the most inevitable determinants of CO2 emissions are economic growth and energy consumption (Antonakakis et al., 2017; Bekun et al., 2019a, 2019b; Zhang et al., 2019; Adedoyin et al., 2021a). Moreover, past literature highlights several socio-economic indicators as key drivers of CO2 emissions, namely trade (Halicioglu, 2009; Shahbaz et al., 2013; Chen et al., 2019; Haug and Ucal, 2019), financial development (Abbasi and Riaz, 2016; Dogan and Turkekul, 2016; Bekhet et al., 2017; Shoaib et al., 2020), urbanization (Zhu et al., 2012; Sadorsky, 2014; Shahbaz et al., 2016; Ali et al., 2019), natural resources (Bekun et al., 2019a, 2019b; Danish et al., 2019; Khan et al., 2020; Shittu et al., 2021), economic policy uncertainty (Jiang et al., 2019a; Adedoyin & Zakari, 2020; Adedoyin et al., 2020a) globalization (Zaidi et al., 2019), economic structure (Dogan and Inglesi-Lotz, 2020), foreign direct investment (Bulut et al., 2021), R&D (Adedoyin et al., 2020b), coal rent (Adedoyin et al., 2020c), economic complexity (Adedoyin et al., 2021b, 2021c), unemployment (Roni et al., 2021), and tourism (Zhang & Zhang, 2018a, 2018b; Balli et al., 2019; Selvanathan et al. 2020).

Nonetheless, the impact of geopolitical risk (GPR) on CO2 emissions remains understudied. GPR, which is uncertainty associated with war, terrorism, and political tensions, has economic impacts (Caldara and Iacoviello, 2018). Thus, GPR can potentially affect environmental degradation as well (Adams et al., 2020). The literature has paid little to no attention to the role of geopolitical risk (GPR) on emissions internationally. Based on the prior literature on GPR-emissions nexus, GPR can either surge or impede carbon emissions (Anser et al., 2021a, 2021b; Zhao et al., 2021). Parallel to this, Akadiri et al. (2020) noted that GPR has detrimental impacts on economic growth, on the contrary, several studies (see, e.g., Bekun et al., 2019a, 2019b) reveal that economic growth leads to environmental degradation through high carbon emissions. Hence, it could be possible that GPR leads to higher carbon emissions. Likewise, Wang et al. (2018) reported that GPR plunges firm-level investment; parallel to this, many research outlets note that investment affects carbon emissions (see, for example, Blanco et al., 2013; Xie et al., 2020). So, GPR could affect CO2 emissions through investment. Alsagr and Hemmen (2021) reveal that GPR escalates renewable energy consumption in emerging economies. However, Zhao et al. (2021) reported that any shock in GPR impedes non-renewable energy consumption in a few BRICS countries. In addition, Sweidan (2021) reports that GPR ameliorates the renewable energy deployment in the case of the USA. Therefore, it is indispensable to explore the nexus between GPR and CO2 emissions.

The outcomes and findings of the literature have not reached a consensus on the nexus between GPR and carbon emissions. For instance, by using panel ARDL methodology, Adams et al. (2020) concluded that GPR in resource-rich countries has an adverse impact on carbon emissions, implying that the GPR ameliorates the environmental quality. Similarly, Anser et al. (2021b) employed AMG estimators to explore the impact of GPR on the ecological footprint in the case of BRMCC (i.e., Brazil, Russia, Mexico, China, and Colombia) countries. The study notes that GPR impedes ecological footprint in selected countries. On the contrary, Anser et al. (2021a) employ AMG estimators to discern the impact of GPR on carbon emissions in the case of BRICS countries. The findings from the study reveal that GPR leads to higher emissions. Besides, Zhao et al. (2021) employ NARDL (nonlinear ARDL) model, and highlight that there exists an asymmetric impact of GPR on carbon emissions in the case of BRICS countries, and under which conditions. The lack of consensus in the literature might be attributed to the variety of periods and methodologies, and focus on geographical areas—and that strengthens the motivation for this study’s choice to examine the relationship at a global level.

In this paper, we advocate the globality of CO2 emissions and their consequences that is and should be a worldwide concern regardless of geographical boundaries. Thus, this study aims at investigating the impact of GPR on CO2 emissions at the global level for the period 1970–2015. The present study adds to the existing literature of environmental economics in several dimensions. Firstly, given our best knowledge on this issue, such a global analysis has not yet been conducted to explore the nexus between GPR and CO2 emissions. Second, previous studies that examine the validity of the EKC hypothesis at the global level do not use the global income & level of emissions, rather they just collect the data on a large number of countries to proxied global income and emissions (see, for example, Chang and Hao, 2017; Gulistan et al., 2020), which may lead to unreliable findings. To overcome this issue, the present study makes use of data on global GDP and global carbon emissions to test the validity of the EKC hypothesis (at the world level) for the first time in the literature. Further, the study contributes to the growing literature of studies using the environmental Kuznets curve (EKC) theoretical hypothesis by expanding it to take into consideration the GPR. Next, the study employs the methodology of bootstrap ARDL proposed by McNown et al. (2018) for robust and reliable outcomes. It is worth noting that the bootstrap ARDL approach uses an additional F-test to render a complete picture of co-integration among selected variables; thus, it outperforms other ARDL models (e.g., ARDL, NARDL, and QARDL) in terms of size and power properties.

Literature review

This section notes several socio-economic determinants of CO2 emissions. As climate change and global warming are increasing concerns across the world, a substantial number of researchers have analyzed them along with different influential factors impelling carbon emissions (Richmond and Kaufmann, 2006; Katircioğlu and Taşpinar, 2017; Mutascu, 2018; Jiang et al., 2019b). In the economy-environment nexus, the environmental Kuznets curve (EKC) hypothesis has been a prime conjecture (Dogan and Turkekul, 2016; Pata, 2018; Işık et al., 2019), which implies the presence of an inverted U-shaped relationship between income and environmental degradation. Researchers have been investigating the validity of the EKC hypothesis over the last decades and have generated mixed and contrasting results. One group report that an inverted U-shaped relationship between income and environment does exist (Tang and Tan, 2015; Bilgili et al., 2016; Kacprzyk and Kuchta, 2020), while the other group claims that the presence of an N-shaped relationship is valid (Lee and Oh, 2015; Allard et al., 2018). Several other studies expound on the U-shaped and roughly M-shaped relationship between income and environment quality (Sinha et al., 2017; Minlah and Zhang, 2021). It is worth mentioning that models and methods, time, countries, and the choice of control variables are mainly responsible for the mixed findings in the context of the EKC hypothesis (Heidari et al., 2015; Jamel and Maktouf, 2017; Pata, 2018).

Similarly, there are a few other studies that link (un)employment with the environment. More specifically, Witzke and Urfei (2001) examine the determinants of the willingness to pay for environmental issues, and they find the employment status is explicitly considered as one of those determinants. Likewise, Veisten et al. (2004) reported that unemployment impedes the willingness to pay for high environmental quality. In contrast, there exists some empirical evidence which notes that the employment status and willingness to pay for environmental issues do not have any relationship between them (Torgler and García-Valiñas, 2007; Ferreira and Moro, 2013; De Silva and Pownall, 2014). Recently, Kashem and Rahman (2020) put forward the Environmental Phillips curve (EPC) hypothesis, i.e., the presence of a negative relationship between unemployment and environmental quality. Additionally, Joshua and Alola (2020) examine the role of employment within the pollution haven hypothesis for the case of South Africa. They provide evidence that employment leads to high carbon emissions. Similarly, Gyamfi et al. (2020) use the EKC framework to investigate the relationship between employment and the environment. The findings from this study document that rises in employment contribute to high carbon emissions. Next, Anser et al. (2021a) support the validity of EPC for the case of BRICST countries, and also report that economic growth and energy consumption escalate environmental degradation. In contrast, our study probes the impact of uncertainty related to economic policies within the EPC framework, whilst employing the novel dynamic ARDL simulations approach. In other words, our study extends the EPC literature in certain dimensions.

Parallel to this, energy consumption is often cited as one of the eminent drivers of CO2 emissions (Saboori et al., 2014). The use of crude oil, natural gas, and coal emits high levels of CO2 emissions (Destek and Sinha, 2020; Haug and Ucal, 2019). Several works also highlight the direction of causality between energy and the environment (Zhang and Lin, 2012; Nathaniel and Iheonu, 2019). Moreover, one strand of the literature disaggregates energy into renewable and non-renewable energy and notes that these two energy sources have a heterogeneous impact on CO2 emissions (Sadorsky, 2014). Likewise, energy efficiency (i.e., the productivity of energy consumption) plunges CO2 emissions, since the same amount of energy can produce higher output (Afionis et al., 2017). Higher energy prices also can reduce the demand for energy, which eventually mitigates CO2 emissions (Joo et al., 2015; Dogan and Turkekul, 2016).

Foreign direct investment (FDI) can either upsurge or impede CO2 emissions. According to the pollution haven hypothesis, FDI could bring in environmentally unfriendly technologies. As a result, the levels of CO2 emissions can significantly increase (Khavarian et al., 2019; Destek and Sinha, 2020). In contrast, the pollution haven hypothesis notes that FDI encourages environment-friendly technologies, and ultimately reduces CO2 emissions (Belke et al., 2011; Jiang et al., 2019b). The environmental impact of trade is also unclear because a strand of the literature argues that trade escalates environmental quality, while others report that the opposite holds (Chen et al., 2019). More specifically, the trade-environment nexus depends on the nature of goods and services traded, as well as on the direction of the trade (Halicioglu, 2009; Zhao et al., 2018).

Besides, several studies explore socio-economic drives of carbon emissions such as natural resources (Bekun et al., 2019a, 2019b; Danish et al., 2019), urbanization (Sadorsky, 2014; Ali et al., 2019), and tourism (Dietz and Rosa, 1997). It is worth reporting that these aforementioned indicators can either increase or plunge carbon emissions. Next, political, social, and economic globalization can also affect consumption and production decisions, and ultimately hit CO2 emissions (Bilgili et al., 2016; Zaidi et al., 2019). The empirical literature also reports that political instability affects various economic decisions, and in turn, CO2 emissions (Wang et al., 2018; Mahalik et al., 2021). Additionally, corruption, terrorism, and militarization can determine the levels of CO2 emissions (Bildirici and Gokmenoglu, 2020), while monetary, fiscal, and trade policies can also have direct, as well as indirect, impacts on CO2 emissions (Halicioglu, 2009; Dogan and Turkekul, 2016). Finally, a few other research outlets also show that there exists an asymmetric impact of economic policies on CO2 emissions (Danish et al., 2019).

The expansion of R&D investment, innovations, and technological advancements could improve energy efficiency, with these factors being able to put forward new methods to utilize renewable energy. As a result, CO2 emissions are expected to get significantly plunged (Garrone and Grilli, 2010; Zhang and Zhang, 2018a, 2018b). Furthermore, financial development can also promote green investments, which reduce CO2 emissions. By contrast, there exist a few empirical studies which report that financial development upsurges energy consumption and economic growth, therefore, escalating the levels of CO2 emissions (Shahbaz et al., 2013; Bekhet et al., 2017; Shoaib et al., 2020).

It is worth noting that GPR affects several socio-economic indicators that have been reported in the past literature. For instance, Akadiri et al. (2020) find that GPR impedes both economic growth and tourism in Turkey. Likewise, Ghosh (2021) reveal that GPR has a detrimental impact on tourism in the case of India. Next, Dogan et al. (2021) reveal that GPR mitigates the natural resource rents in developing economies. Further, Rasoulinezhad et al. (2020) conclude that GPR escalates the energy transition in the case of Russia. In addition, Olanipekun and Alola (2020) report that GPR mitigates oil production in the short run. Parallel to this, Pan (2019) reveals that GPR hinders the investment in R&D at the firm level.

Parallel to this, there exists a scarcity of literature that links GPR with CO2 emissions. The study of Adams et al. (2020) is one of the seminal studies that examine the impact of GPR on carbon emissions. The findings from the PMG-ARDL approach reveal that GPR mitigates carbon emissions in top resource-rich economies. Next, using AMG estimators, Anser et al. (2021b) report that GPR impedes emissions in the case of selected emerging economies. On the contrary, using AMG estimators, Anser et al. (2021a) note that GPR upsurges carbon emissions in the case of BRICS countries. Using the NARDL approach, Zhao et al. (2021) note that GPR has an asymmetric impact on CO2 emissions in the case of BRICS countries. Based on the above discussion, it could be noted that the relationship between GPR and emissions has been explored solely in emerging economies, and there is the likelihood of different findings in the case of other countries (e.g., developed countries or least developed countries). Also, there exists no study that renders global evidence on GPR-emissions nexus. Next, the prior studies on GPR-emissions nexus have contrasting outcomes that call for reinvestigating the aforementioned nexus for clear and/or certain results. This motivates the present study to reinvestigate the GPR-emissions nexus at the global level.

Theoretical background

The focus of this section is to provide theoretical arguments that link GPR with CO2 emissions. It is well known that GPR affects several socio-economic indicators such as economic growth (Akadiri et al., 2020), energy consumption (Sweidan, 2021), trade (Gupta et al., 2019), investment (Le and Tran, 2021), oil prices (Cunado et al., 2020), tourism (Akadiri et al., 2020), the stock market (Yang and Yang, 2021), and R&D (Pan, 2019). Parallel to this, a plethora of literature in environmental economics notes that these aforementioned indicators (i.e., economic growth, energy, trade, investment, oil prices, tourism, and the stock market) affect carbon emissions (Adedoyin et al., 2021a, 2021b; Zhao et al., 2018; Zhang and Zhang, 2018a, 2018b). Hence, we can believe that GPR affects emissions through these socio-economic indicators.

Recently, Anser et al. (2021b) present two theoretical channels/effects that explain how GPR affects environmental degradation. The “mitigating effect” argues that GPR lowers the level of emissions through lower energy consumption and economic growth. However, the “escalating effect” notes that GPR increases emissions through a low level of R&D, innovations, and green investment. We depict these two channels/effects in Fig. 1.

Data and methods

Data

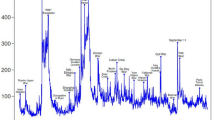

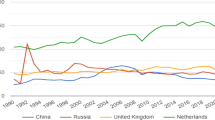

The current study makes use of annual data spanning the period 1970–2015. The key independent variable is the Geopolitical Risk IndexFootnote 1 developed by Caldara and Iacoviello (2018). It is worth mentioning that the GPR index is calculated through the frequency of newspaper articles containing words related to geopolitical risk. Moreover, data on the GPR index are gathered from http://policyuncertainty.com.

On the contrary, the dependent variable of this study is global carbon dioxide emissions (CO2), measured in metric tons. Also, the data on global CO2 emissions are obtained from a database of Carbon Dioxide Information Analysis Center. Moreover, we use world/global GDP (GGDP) and world/global energy consumption (GEN) as control variables. The data on GGDP and GEN are gathered from the World Bank database. Table 1 elaborates the description of selected variables.

Next, all selected variables are transformed into logarithmic form to avoid the issue of heteroscedasticity and interpret the coefficients as elasticities (Anser et al., 2021b). Also, Table 2 reports the descriptive statistics and correlation that show the following information. The average (mean) value of GEN is the highest, whilst the standard deviation of GPR is the highest. Next, all variables of this study are positively skewed and do not have thick tails. Next, findings from the Jarque–Bera test reveal that selected variables are following a normal distribution. Further, correlation is the strongest between GEN and carbon emissions, while it is the lowest between GGDP and GPR.

Model

In the literature of environmental economics, several econometric/empirical models have been applied. However, a critical model/framework/hypothesis is environmental Kuznets curve (EKC) framework that expounds the inverted U-shaped relationship between income and environment. This study employs the EKC framework introduced by Narayan and Narayan (2010) that examines inverted U-shaped relationships based on short- and long-run income elasticity. There exist a plethora of studies that employ the EKC model by Narayan and Narayan (2010) to investigate the socio-economic determinants of CO2 emissions (see, inter alia, Al-Mulali et al., 2015; Shahbaz et al., 2016; Sinha and Shahbaz, 2017). Next, we use energy consumption as a control variable to avoid the issue of omitted variable bias. It is worth reporting that Danish et al. (2020) employ the same model (i.e., employing the EKC framework of Narayan and Narayan (2010) in consort with energy consumption as a control variable) to analyze the impact of economic policy uncertainty amidst the energy-emissions nexus. Hence, we borrow the model from the study of Danish et al. (2020), and the final model yields:

In Eq. (1), CO2 denotes carbon dioxide emissions, GPR represents geopolitical risk index, GGDP is global/world GDP, and GEN denotes global energy consumption. Regarding the choice of control variables, the lack of data availability on other critical variables (e.g., urbanization, FDI, trade, and financial development) at the global level for the selected period restrain this study to solely employ energy consumption. It is worth noting that energy consumption is among the most indispensable drivers of carbon emissions. Fossil fuels consist of high carbon-based sources of energy, and when burnt, emit high levels of carbon emissions. Based on the unavoidable importance of energy consumption as a driver of emissions, several studies include it as a control variable (see, for example, Adedoyin et al., 2020a, 2020b).

Methodology

Since this study makes use of time series data, we conduct a few preliminary tests before employing the bootstrap ARDL approach. It is worth reporting that unit root is one of the most common issues in time series data that can lead to spurious regression/results. Also, the bootstrap ARDL approach requires the dataset with an order of integration not more than I (1). Therefore, this study employs the ADF and Zivot and Andrews unit root test to probe the unit root (order of integration) properties.

To test the long-run relationship (co-integration) among variables, Pesaran et al. (2001) put forward the ARDL bounds test. It is worth mentioning that the ARDL bounds test outperforms other approaches (e.g., Engle and Granger (1987) and Johansen (1988)) because it can be applied if variables have mixed order of integration. Based on the ARDL approach, Eq. (1) can be reported as follows:

Equation (2) is case III of the ARDL approach, which is no trend with unrestricted constant (intercept). In Eq. (2), \(\alpha\) is intercept, whilst \(BD\) is the break date. In addition, \({\beta }_{i}\), \({\gamma }_{i}\), \({\omega }_{i}\), and \({\psi }_{i}\) represent short-run coefficient, whereas \({\pi }_{i}\) (i = 1, 2, 3, 4) is the long-run coefficient. Next, p, q, m, and n represent lag order. Finally, \({\varepsilon }_{t}\) denotes error term.

One of the assumptions of the ARDL bounds test is that the dependent variable does not affect the independent variable(s), meaning that variables are (weakly) exogenous. Nevertheless, this assumption is rarely fulfilled in real data. Hence, if the exogeneity assumption violates, the assumption regarding the distribution of the ARDL bounds test will not be fulfilled (McNnown et al., 2018).

To report the existence of long-run relationship amongst variables, Pesaran et al. (2001) proposed two tests: F-test (Ho:\({\pi }_{1}={\pi }_{2}= {\pi }_{3}= {\pi }_{4}= 0\)) on all lagged level variables (i.e., all long-run coefficients), and t-test (Ho: \({\pi }_{1}\)= 0) on lagged level dependent variable. Nonetheless, McNown et al. (2018) put forward an additional F-test on lagged level independent variables (Ho:\({\pi }_{2}= {\pi }_{3}= {\pi }_{4}= 0\)) in bootstrap ARDL approach, which is complementary to the aforementioned F-test and t-test of Pesaran et al. (2001). McNown et al. (2018) argue that these three tests should be applied to distinguish between co-integration, non-co-integration, and degenerate cases. There exist 2 degenerate cases, and both of them imply that is no co-integration among variables. Degenerate case I arise when lagged level dependent variable is statistically insignificant, whilst degenerate case II is observed when lagged level independent variable(s) becomes statistically insignificant.

It is worth noting that critical values for degenerate case II are provided by Pesaran et al. (2001), whereas critical values for degenerate case I are not rendered. In order to rule out the degenerate case I, the dependent variable must be stationary at I (1). Nevertheless, it is known that unit root tests have low power, implying that the findings from the unit root test could be misleading. So, the bootstrap ARDL test covers this issue by providing an additional F-test on lagged level independent variables. Thus, bootstrap ARDL notes that co-integration will be investigated based on all three tests reported as follows:

F-test (overall): On all lagged level variables;

t-test (dep): On lagged level dependent variable; and.

F-test (indep): On lagged level independent variables.

Next, co-integration exists if and only if the null hypothesis of these aforementioned tests will be rejected. Thus, the bootstrap ARDL approach outperforms conventional ARDL bounds tests because it renders a complete picture of co-integration and rules out the inconclusive findings. Based on the advantages of the bootstrap ARDL approach, this study employs this novel methodology to explore the impact of geopolitical risk on global carbon emissions.

Empirical findings

To provide reliable and robust outcomes, this study follows the procedure depicted in Fig. 3.

To employ the bootstrap ARDL approach, it is necessary to examine the stationary properties of selected variables. Therefore, we apply the ADF unit root test and Zivot and Andrews (1992) test (ZA hereafter). The advantage of ZA test is its ability to cover the structural break in the dataset, which motivates this study to apply it along with the ADF test. The findings from both unit root tests are reported in Table 3.

As can be seen from Table 3, using the ADF test and ZA test, we could not reject the null hypothesis of no unit root at I (0). This implies that all selected variables are non-stationary at I (0). On the contrary, the null hypothesis could be rejected at I (1) based on the findings of both the ADF test and ZA test. Thus, all selected variables of this study are integrated at I (1).

Next, we employ novel bootstrap ARDL approach to investigate the impact of GPR on global carbon emissions. In this regard, Table 4 reports the co-integration results. The co-integration analysis can be seen in Table 4, where the findings from all three tests are reported. The calculated values of F-test (overall), t-test (dep.), and F-test (indep.) are higher than the upper bounds values. This indicates that the null hypothesis of non-co-integration could be rejected at a 1% level of significance. Thus, we report the occurrence of co-integration among the selected variables of the present study.

Further, Table 5 depicts the short- and long-run estimates from the bootstrap ARDL approach coupled with the diagnostics. We set maximum lags at 4, whereas AIC is chosen for optimum lag selection. Regarding the short-run results, reported in panel I, the value of the coefficient of GPR is − 3.50, which is also statistically significant at 1%. This indicates that ceteris paribus, a 3.50% plunge in global carbon emissions is fostered by a 1% increase in geopolitical risk. Therefore, it could be concluded that geopolitical risk impedes global emissions, which, in turn, ameliorates environmental quality. Hence, we report that the magnitude of the mitigating effect is higher than that of escalating effect. This notes that GPR mitigates production activities and energy consumption. As a result, global carbon emissions will be decreased. These findings are in line with the results of Adams et al. (2020) and Anser et al. (2021b). Moreover, the first lag of GPR is also statistically significant, and it has a negative value. This reports that current geopolitical risk mitigates future carbon emissions. It has been observed that during the episodes of high geopolitical tensions, levels of emissions were plunged. For instance, in the short run, the events like Gulf War, the Iraq-US war, Arab Spring, and ISIS attacks affected the energy consumption in consort with the industrial production. As a result, emissions drastically plunged.

Next, the coefficient of GGDP is positive and statistically significant. The value of GGDP is 2.89, indicating that a 1% upsurge in global GDP growth (i.e., global economic growth) escalates the global carbon emissions by 2.89%. Hence, it could be inferred that global economic growth deteriorates the environmental quality in the short run. These findings are backed by the conclusion of Adebayo et al. (2021). Next, the coefficient of GEN is positive and statistically significant. The value of GEN is 0.76, reporting that a 1% increase in global energy consumption leads to higher global emissions by 0.76%. These findings are in line with the results of Agabo et al. (2021).

Similarly, panel II shows the long-run results. The value of GPR is 13.24 that is statistically significant. This expounds that a 13.24% increase in global carbon emissions is fostered by a 1% upsurge in geopolitical risk, ceteris paribus. Hence, we note that, in the long run, the mitigating effect is lower than the escalating effect. That is, GPR impedes R&D, green investment, technological advancement, and innovations. As a result, global carbon emissions will surge. This conclusion is backed by the findings of Anser et al. (2021a). The world has witnessed the fact that geopolitical tensions such as the 9/11 attacks, the US-China trade war, and India-China border conflicts affect global stock markets, R&D investment, research grants, and expenditure on innovations, which, in turn, escalates the levels of emissions. Moreover, the high global geopolitical tensions compelled producers to keep using the traditional energy-inefficient technologies and hence carbon emissions escalated.

The coefficient of CO2 is statistically insignificant, suggesting that global carbon emissions in past do not affect current global carbon emissions. Such a finding gives a note of hope for the future as the emissions at a global level might be proven to reduce by changing various other determinants. Moreover, the value of GGDP is 1.26, and it is statistically significant. This notes that ceteris paribus, a 1% increase in global economic growth leads to higher global carbon emissions by 1.26%. It is worth reporting that the value of the long-run coefficient of income is lower than that of the short-run coefficient, implying that the impact of global economic growth, on global emissions, is relatively profound in the short run. Thus, we conclude that the EKC hypothesis exists across the globe. These results are also backed by the study of Narayan and Narayan (2010) and Danish et al. (2020). Next, the value of GEN is 10.65. Since GEN is also statistically significant, we can explain that a 1% surge in global energy consumption escalates the global carbon emissions by 10.65%, ceteris paribus. This outcome of the present study is similar to the conclusion of Anser et al. (2021a).

Finally, the diagnostics of the bootstrap ARDL model are presented in panel III. The Adj. R-square is 0.78, indicating that the dependent variable is explained by 78% through independent variables. Next, the value of the Ramsey RESET test is 0.51, suggesting that the model is well specified. Moreover, the LM test is employed to discern the correlation among errors (residuals). The calculated value from the LM test is 0.29, suggesting that there does not exist a correlation among errors. Further, CUSUM and CUSUM-square test depicts the stability of the model. The Jarque–Bera test is employed to probe the distribution of errors. The p-value from the test is 0.17, implying that errors (residuals) are normally distributed. The value from the ARCH test is 0.29, reporting that there does not exist the issue of heteroscedasticity. Next, the ECT is statistically significant with a value of − 0.19. This expounds that any shock in the long-run equilibrium will be covered by 19% each year.

Sensitivity analysis

This section presents two sensitivity checks to provide robust outcomes. First, we employ the conventional EKC hypothesis (i.e., inverted U-shaped income-environment relationship) to probe whether the choice of model alters the findings. Second, we employ FMOLS, DOLS, and CCR estimators to explore whether the results remain consistent across different methodologies. Table 6 reports findings from the bootstrap ARDL approach using the conventional EKC model.

As can be seen from the above-mentioned table, the coefficient of GGDP and GGDP2 has a positive and negative sign, respectively. Also, these aforementioned coefficients are statistically significant, confirming that EKC does exist in both the short- and long run. Further, the coefficient of GPR is negative and statistically significant in the short run, whereas it is positive and statistically significant in the long run. This implies that GPR plunges the emissions in the short run, whilst it increases the emissions in the long run. The coefficient on GEN is positive and statistically significant in both the short and long run, inferring that energy consumption leads to higher emissions. Moreover, all the diagnostics presented in panel III show that the model is stable and the residuals are also well-behaved. It is worth reporting that findings from both models, i.e., conventional EKC and EKC developed by Narayan and Narayan (2010) are consistent, confirming that choice of theoretical/empirical model does not affect the outcomes.

Second, we report the findings from FMOLS, DOLS, and CCR estimators in Table 7. The coefficient of GGDP is statistically significant and contains a positive sign from FMOLS, DOLS, and canonical cointegrating regression (CCR) estimators, reporting that economic growth leads to higher emissions globally. Next, the coefficient of GEN is also statistically significant and possesses a positive sign, confirming that energy consumption escalates emissions. Finally, the coefficient on GPR is statistically significant and positive, inferring that geopolitical risk contributes to high levels of emissions. It is worth reporting that the coefficient on GPR is positive and statistically significant across all estimators (i.e., FMOLS, DOLS, and CCR). Also, the findings from these aforementioned methodologies are inconsistent with the outcomes from bootstrap ARDL.

Conclusion

Nowadays, geopolitical risk (GPR) has been increasing across the globe. Further, GPR has both economic and environmental impacts; however, its environmental impacts yet remain unclear due to contrasting outcomes. To fill this gap, the present study investigates the impact of global GPR on global carbon emissions using a novel methodology of bootstrap ARDL approach. The findings from ADF and ZA unit root test reveal that the selected variables of this study are integrated at I (1). Moreover, the results from the bootstrap ARDL bounds test confirm the long-run relationship (co-integration) among the considered variables. Next, we report that energy consumption leads to a higher level of emissions in both the short and long run. Additionally, we report the validity of the EKC hypothesis put forward by Narayan and Narayan (2010). The results also document that GPR impedes global emissions in the short run, whereas it escalates the emissions in the long run. Finally, we use two procedures for the sensitivity analysis: (1) conventional EKC model to check whether the choice of model alters the key findings; and (2) FMOLS, DOLS, and CCR estimators to probe whether the choice of methodology affects the main findings. We confirm that the conventional EKC hypothesis does exist globally, and the GPR has a negative and positive impact on emissions in the short and long run, respectively. Moreover, the findings from FMOLS, DOLS, and CCR estimators reveal that GPR upsurges emissions in the long run, which is consistent with the main findings from the bootstrap ARDL approach.

Moreover, the current study proposes several implications. First, policymakers should try to devise policies to achieve higher economic growth, especially in the long run, to control environmental degradation. To improve income/economic growth, countries should invest in green technologies, R&D, and renewable energy projects, which will enhance the rate of economic growth without affecting environmental quality. Second, the share of renewables in the energy mix should be improved to impede global carbon emissions. In addition to this, there should be subsidies from the governments while investing in renewable energy projects. Next, governments should introduce tariff rationalization on imports of renewable energy-based products. Additionally, to discourage non-renewable energy, governments should impose high taxes and/or tariffs on non-renewables. Governments and international organizations should launch public awareness programs to make people understand the harmful environmental impacts of non-renewable energy. Further, in the short run, policymakers need to adopt measures (e.g., R&D, innovations, and human development) that help to ameliorate environmental quality without affecting GPR. Additionally, in the short run, governments should pay attention to the detrimental economic impacts of GPR. Therefore, governments should introduce expansionary demand- and supply-side policies to offset the harmful economic impact of GPR. However, in the long run, there should be agreements, treaties, and negotiations among countries to plunge GPR since it has detrimental environmental impacts. In addition to this, international organizations should play their role (e.g., as a moderator) to resolve the conflicts between nations to limit GPR. Further, the world’s leaders (e.g., the USA and China) should resolve their geopolitical tensions (e.g., USA-China trade war) since these geopolitical tensions not only affect them but also have spillover effects on the rest of the world. In the long run, strict environmental protection measures should be taken in times of high geopolitical tensions to keep the environment clean. For instance, high carbon prices and active environmental stringency policies could be adopted by the governments during the high geopolitical tensions.

Data availability

Available upon request.

Notes

We use geopolitical risk historical index (GPRH) as proxy for global geopolitical risk Fig. 2.

References

Abbasi F, Riaz K (2016) CO2 emissions and financial development in an emerging economy: an augmented VAR approach. Energy Policy 90:102–114. https://doi.org/10.1016/j.enpol.2015.12.017

Adams S, Adedoyin F, Olaniran E, Bekun FV (2020) Energy consumption, economic policy uncertainty and carbon emissions; causality evidence from resource-rich economies. Econ Anal Policy 68:179–190. https://doi.org/10.1016/j.eap.2020.09.012

Adebayo TS, Adedoyin FF, Kirikkaleli D (2021) Toward a sustainable environment: nexus between consumption-based carbon emissions, economic growth, renewable energy and technological innovation in Brazil. Environ Sci Pollut Res 28:52272–52282. https://doi.org/10.1007/s11356-021-14425-0

Adedoyin FF, Nathaniel S, Adeleye N (2021a) An investigation into the anthropogenic nexus among consumption of energy, tourism, and economic growth: do economic policy uncertainties matter? Environ Sci Pollut Res 28(3):2835–2847. https://doi.org/10.1007/s11356-020-10638-x

Adedoyin FF, Ozturk I, Bekun FV, Agboola PO, Agboola MO (2021b) Renewable and non-renewable energy policy simulations for abating emissions in a complex economy: evidence from the Novel Dynamic ARDL. Renewable Energy 177:1408–1420. https://doi.org/10.1016/j.renene.2021.06.018

Adedoyin FF, Agboola PO, Ozturk I, Bekun FV, Agboola MO (2021c) Environmental consequences of economic complexities in the EU amidst a booming tourism industry: accounting for the role of brexit and other crisis events. J Clean Prod 305:127117. https://doi.org/10.1016/j.jclepro.2021.127117

Adedoyin FF, Afolabi JO, Yalçiner K, Bekun FV (2020a) The export‐led growth in Malaysia: does economic policy uncertainty and geopolitical risks matter?. J Public Affairs e2361. https://doi.org/10.1002/pa.2361

Adedoyin FF, Alola AA, Bekun FV (2020b) An assessment of environmental sustainability corridor: the role of economic expansion and research and development in EU countries. Sci Total Environ 713:136726. https://doi.org/10.1016/j.scitotenv.2020.136726

Adedoyin FF, Gumede MI, Bekun FV, Etokakpan MU, Balsalobre-Lorente D (2020c) Modelling coal rent, economic growth and CO2 emissions: does regulatory quality matter in BRICS economies? Sci Total Environ 710:136284. https://doi.org/10.1016/j.scitotenv.2019.136284

Adedoyin FF, Zakari A (2020) Energy consumption, economic expansion, and CO2 emission in the UK: the role of economic policy uncertainty. Sci Total Environ 738:140014. https://doi.org/10.1016/j.scitotenv.2020.140014

Afionis S, Sakai M, Scott K, Barrett J, Gouldson A (2017) Consumption-based carbon accounting: does it have a future? Wiley Interdiscip Rev Clim Chang 8(1):e438. https://doi.org/10.1002/wcc.438

Agabo T, Abubakar IF, Adedoyin FF (2021) The anthropogenic consequences of energy consumption and population expansion in Africa? Do governance factors make any difference? Environ Sci Pollut Res 28(21):27109–27118. https://doi.org/10.1007/s11356-020-12280-z

Akadiri SS, Eluwole KK, Akadiri AC, Avci T (2020) Does causality between geopolitical risk, tourism and economic growth matter? Evidence from Turkey. J Hosp Tour Manag 43:273–277. https://doi.org/10.1016/j.jhtm.2019.09.002

Allard A, Takman J, Uddin GS, Ahmed A (2018) The N-shaped environmental Kuznets curve: an empirical evaluation using a panel quantile regression approach. Environ Sci Pollut Res 25(6):5848–5861. https://doi.org/10.1007/s11356-017-0907-0

Ali R, Bakhsh K, Yasin MA (2019) Impact of urbanization on CO2 emissions in emerging economy: evidence from Pakistan. Sustainable Cities Soc 48:101553. https://doi.org/10.1016/j.scs.2019.101553

Alsagr N, van Hemmen S (2021) The impact of financial development and geopolitical risk on renewable energy consumption: evidence from emerging markets. Environ Sci Pollut Res 28(20):25906–25919. https://doi.org/10.1007/s11356-021-12447-2

Al-Mulali U, Saboori B, Ozturk I (2015) Investigating the environmental Kuznets curve hypothesis in Vietnam. Energy Policy 76:123–131. https://doi.org/10.1016/j.enpol.2014.11.019

Anser MK, Syed QR, Lean HH, Alola AA, Ahmad M (2021a) Do economic policy uncertainty and geopolitical risk lead to environmental degradation? Evid Emerg Econ Sustain 13(11):5866. https://doi.org/10.3390/su13115866

MK Anser QR Syed N Apergis 2021b Does geopolitical risk escalate CO2 emissions? Evidence from the BRICS countries Environ Sci Pollut Res 1–11 https://doi.org/10.1007/s11356-021-14032-z

Antonakakis N, Chatziantoniou I, Filis G (2017) Energy consumption, CO2 emissions, and economic growth: an ethical dilemma. Renew Sustainable Energy Rev 68:808–824. https://doi.org/10.1016/j.rser.2016.09.105

Balli E, Sigeze C, Manga M, Birdir S, Birdir K (2019) The relationship between tourism, CO2 emissions and economic growth: a case of Mediterranean countries. Asia Pacific J Tour Res 24(3):219–232. https://doi.org/10.1080/10941665.2018.1557717

Bekhet HA, Matar A, Yasmin T (2017) CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: Dynamic simultaneous equation models. Renew Sustainable Energy Rev 70:117–132. https://doi.org/10.1016/j.rser.2016.11.089

Bekun FV, Alola AA, Sarkodie SA (2019a) Toward a sustainable environment: Nexus between CO2 emissions, resource rent, renewable and nonrenewable energy in 16-EU countries. Sci Total Environ 657:1023–1029. https://doi.org/10.1016/j.scitotenv.2018.12.104

Bekun FV, Emir F, Sarkodie SA (2019b) Another look at the relationship between energy consumption, carbon dioxide emissions, and economic growth in South Africa. Sci Total Environ 655:759–765. https://doi.org/10.1016/j.scitotenv.2018.11.271

Belke A, Dobnik F, Dreger C (2011) Energy consumption and economic growth: new insights into the cointegration relationship. Energy Econ 33(5):782–789. https://doi.org/10.1016/j.eneco.2011.02.005

Bhowmik, R., Syed, Q. R., Apergis, N., Alola, A. A., & Gai, Z. (2021). Applying a dynamic ARDL approach to the environmental Phillips curve (EPC) hypothesis amid monetary, fiscal, and trade policy uncertainty in the USA. Environmental Science and Pollution Research, 1–15.

Bildirici M, Gokmenoglu SM (2020) The impact of terrorism and FDI on environmental pollution: evidence from Afghanistan, Iraq, Nigeria, Pakistan, Philippines, Syria, Somalia, Thailand and Yemen. Environ Impact Assess Rev 81:106340. https://doi.org/10.1016/j.eiar.2019.106340

Bilgili F, Koçak E, Bulut Ü (2016) The dynamic impact of renewable energy consumption on CO2 emissions: a revisited environmental Kuznets curve approach. Renew Sustainable Energy Rev 54:838–845. https://doi.org/10.1016/j.rser.2015.10.080

Blanco L, Gonzalez F, Ruiz I (2013) The impact of FDI on CO2 emissions in Latin America. Oxf Develop Stud 41(1):104–121. https://doi.org/10.1080/13600818.2012.732055

U Bulut G Ucler R Inglesi-Lotz 2021 Does the pollution haven hypothesis prevail in Turkey? Empirical evidence from nonlinear smooth transition modelsEnviron Sci Pollut Res 1–10 https://doi.org/10.1007/s11356-021-13476-7

Caldara D, Iacoviello M (2018) Measuring geopolitical risk. FRB International Finance Discussion Paper, (1222). https://dx.doi.org/https://doi.org/10.17016/IFDP.2018.1222

Chang CP, Hao Y (2017) Environmental performance, corruption and economic growth: global evidence using a new data set. Applied Econ 49(5):498–514. https://doi.org/10.1080/00036846.2016.1200186

Chen Y, Wang Z, Zhong Z (2019) CO2 emissions, economic growth, renewable and non-renewable energy production and foreign trade in China. Renew Energy 131:208–216. https://doi.org/10.1016/j.renene.2018.07.047

Cunado J, Gupta R, Lau CKM, Sheng X (2020) Time-varying impact of geopolitical risks on oil prices. Defence Peace Econ 31(6):692–706. https://doi.org/10.1080/10242694.2018.1563854

Danish BMA, Mahmood N, Zhang JW (2019) Effect of natural resources, renewable energy and economic development on CO2 emissions in BRICS countries. Sci Total Environ 678:632–638. https://doi.org/10.1016/j.scitotenv.2019.05.028

Danish UR, Khan SUD (2020) Determinants of the ecological footprint: role of renewable energy, natural resources, and urbanization. Sustain Cities Soc 54:101996. https://doi.org/10.1016/j.scs.2019.101996

Destek MA, Sinha A (2020) Renewable, non-renewable energy consumption, economic growth, trade openness and ecological footprint: evidence from the organisation for Economic Co-operation and Development countries. J Clean Prod 242:118537. https://doi.org/10.1016/j.jclepro.2019.118537

De Silva DG, Pownall RA (2014) Going green: does it depend on education, gender or income? Appl Econ 46(5):573–586. https://doi.org/10.1080/00036846.2013.857003

Dietz T, Rosa EA (1997) Effects of population and affluence on CO2 emissions. Proc Natl Acad Sci 94(1):175–179. https://doi.org/10.1073/pnas.94.1.175

Dogan E, Inglesi-Lotz R (2020) The impact of economic structure to the environmental Kuznets curve (EKC) hypothesis: evidence from European countries. Environ Sci Pollut Res 27(11):12717–12724. https://doi.org/10.1007/s11356-020-07878-2

Dogan E, Majeed MT, Luni T (2021) Analyzing the impacts of geopolitical risk and economic uncertainty on natural resources rents. Resour Policy 72:102056. https://doi.org/10.1016/j.resourpol.2021.102056

Dogan E, Turkekul B (2016) CO2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23(2):1203–1213. https://doi.org/10.1007/s11356-015-5323-8

Engle RF, Granger CW (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica: J Econ Soc 251–276. https://doi.org/10.2307/1913236

Ferreira S, Moro M (2013) Income and preferences for the environment: Evidence from subjective well-being data. Environ Plan A 45(3):650–667. https://doi.org/10.1068/a4540

Garrone P, Grilli L (2010) Is there a relationship between public expenditures in energy R&D and carbon emissions per GDP? Empir Investig Energy Policy 38(10):5600–5613. https://doi.org/10.1016/j.enpol.2010.04.057

Ghosh S (2021) Geopolitical risk, economic growth, economic uncertainty and international inbound tourism: an Indian illustration. Rev Econ Polit Sci. https://doi.org/10.1108/REPS-07-2020-0081

Gulistan A, Tariq YB, Bashir MF (2020) Dynamic relationship among economic growth, energy, trade openness, tourism, and environmental degradation: fresh global evidence. Environ Sci Pollut Res 27(12):13477–13487. https://doi.org/10.1007/s11356-020-07875-5

Gupta R, Gozgor G, Kaya H, Demir E (2019) Effects of geopolitical risks on trade flows: Evidence from the gravity model. Eurasian Econ Rev 9(4):515–530. https://doi.org/10.1007/s40822-018-0118-0

Gyamfi BA, Bein MA, Ozturk I, Bekun FV (2020) The moderating role of employment in an environmental Kuznets curve framework revisited in G7 countries. Indonesian J Sustainability Account Manag 4(2):241–248. https://doi.org/10.28992/ijsam.v4i2.283

Halicioglu F (2009) An econometric study of CO2 emissions, energy consumption, income and foreign trade in Turkey. Energy Policy 37(3):1156–1164. https://doi.org/10.1016/j.enpol.2008.11.012

Heidari H, Katircioğlu ST, Saeidpour L (2015) Economic growth, CO2 emissions, and energy consumption in the five ASEAN countries. Int J Electr Power Energy Syst 64:785–791. https://doi.org/10.1016/j.ijepes.2014.07.081

Haug AA, Ucal M (2019) The role of trade and FDI for CO2 emissions in Turkey: Nonlinear relationships. Energy Econ 81:297–307. https://doi.org/10.1016/j.eneco.2019.04.006

Işık C, Ongan S, Özdemir D (2019) Testing the EKC hypothesis for ten US states: an application of heterogeneous panel estimation method. Environ Sci Pollut Res 26(11):10846–10853. https://doi.org/10.1007/s11356-019-04514-6

Jamel L, Maktouf S (2017) The nexus between economic growth, financial development, trade openness, and CO2 emissions in European countries. Cogent Econ Financ 5(1):1341456. https://doi.org/10.1080/23322039.2017.1341456

Jiang Y, Zhou Z, Liu C (2019a) Does economic policy uncertainty matter for carbon emission? Evidence from US sector-level data. Environ Sci Pollut Res 26(24):24380–24394. https://doi.org/10.1007/s11356-019-05627-8

Jiang Y, Zhou Z, Liu C (2019b) The impact of public transportation on carbon emissions: a panel quantile analysis based on Chinese provincial data. Environ Sci Pollut Res 26(4):4000–4012. https://doi.org/10.1007/s11356-018-3921-y

Johansen S (1988) Statistical analysis of cointegration vectors. J Econ Dyn Control 12(2–3):231–254. https://doi.org/10.1016/0165-1889(88)90041-3

Joo YJ, Kim CS, Yoo SH (2015) Energy consumption, CO2 emission, and economic growth: evidence from Chile. Int J Green Energy 12(5):543–550. https://doi.org/10.1080/15435075.2013.834822

Joshua U, Alola AA (2020) Accounting for environmental sustainability from coal-led growth in South Africa: the role of employment and FDI. Environ Sci Pollut Res 27:17706–17716. https://doi.org/10.1007/s11356-020-08146-z

Kacprzyk A, Kuchta Z (2020) Shining a new light on the environmental Kuznets curve for CO2 emissions. Energy Econ 87:104704. https://doi.org/10.1016/j.eneco.2020.104704

Katircioğlu ST, Taşpinar N (2017) Testing the moderating role of financial development in an environmental Kuznets curve: empirical evidence from Turkey. Renew Sustain Energy Rev 68:572–586. https://doi.org/10.1016/j.rser.2016.09.127

Kashem MA, Rahman MM (2020) Environmental Phillips curve: OECD and Asian NICs perspective. Environ Sci Pollut Res 27:31153–31170. https://doi.org/10.1007/s11356-020-08620-8

Khan A, Chenggang Y, Hussain J, Bano S, Nawaz A (2020) Natural resources, tourism development, and energy-growth-CO2 emission nexus: a simultaneity modelling analysis of BRI countries. Resour Policy 68:101751. https://doi.org/10.1016/j.resourpol.2020.101751

Khavarian GAR, Pourahmad A, Hataminejad H, Farhoodi R (2019) Climate change and environmental degradation and the drivers of migration in the context of shrinking cities: a case study of Khuzestan province. Iran Sustain Cities Soc 47:101480. https://doi.org/10.1016/j.scs.2019.101480

AT Le TP Tran 2021Does geopolitical risk matter for corporate investment? Evidence from emerging countries in Asia J Multi Financ Manag 100703 https://doi.org/10.1016/j.mulfin.2021.100703

Lee S, Oh DW (2015) Economic growth and the environment in China: empirical evidence using prefecture-level data. China Econ Rev 36:73–85. https://doi.org/10.1016/j.chieco.2015.08.009

Mahalik MK, Mallick H, Padhan H (2021) Do educational levels influence environmental quality? The role of renewable and non-renewable energy demand in selected BRICS countries with a new policy perspective. Renew Energy 164:419–432. https://doi.org/10.1016/j.renene.2020.09.090

McNown R, Sam CY, Goh SK (2018) Bootstrapping the autoregressive distributed lag test for cointegration. Appl Econ 50(13):1509–1521. https://doi.org/10.1080/00036846.2017.1366643

Minlah MK, Zhang X (2021) Testing for the existence of the environmental Kuznets curve (EKC) for CO2 emissions in Ghana: evidence from the bootstrap rolling window Granger causality test. Environ Sci Pollut Res 28(2):2119–2131. https://doi.org/10.1007/s11356-020-10600-x

Mutascu M (2018) A time-frequency analysis of trade openness and CO2 emissions in France. Energy Policy 115:443–455. https://doi.org/10.1016/j.enpol.2018.01.034

Narayan PK, Narayan S (2010) Carbon dioxide emissions and economic growth: panel data evidence from developing countries. Energy Policy 38(1):661–666. https://doi.org/10.1016/j.enpol.2009.09.005

Nathaniel SP, Iheonu CO (2019) Carbon dioxide abatement in Africa: the role of renewable and non-renewable energy consumption. Sci Total Environ 679:337–345. https://doi.org/10.1016/j.scitotenv.2019.05.011

Olanipekun IO, Alola AA (2020) Crude oil production in the Persian Gulf amidst geopolitical risk, cost of damage and resources rents: is there asymmetric inference? Resour Policy 69:101873. https://doi.org/10.1016/j.resourpol.2020.101873

Pan WF (2019) Geopolitical Risk and R&D investment. Available at SSRN 3258111. https://ssrn.com/abstract=3258111

Pata UK (2018) Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: testing EKC hypothesis with structural breaks. J Clean Prod 187:770–779. https://doi.org/10.1016/j.jclepro.2018.03.236

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326. https://doi.org/10.1002/jae.616

Rasoulinezhad E, Taghizadeh-Hesary F, Sung J, Panthamit N (2020) Geopolitical risk and energy transition in russia: evidence from ARDL bounds testing method. Sustainability 12(7):2689. https://doi.org/10.3390/su12072689

Richmond AK, Kaufmann RK (2006) Is there a turning point in the relationship between income and energy use and/or carbon emissions? Ecol Econ 56(2):176–189. https://doi.org/10.1016/j.ecolecon.2005.01.011

Saboori B, Sapri M, Baba BM (2014) Economic growth, energy consumption and CO2 emissions in OECD (Organization for Economic Co-operation and Development)’s transport sector: a fully modified bi-directional relationship approach. Energy 66:150–161. https://doi.org/10.1016/j.energy.2013.12.048

Sadorsky P (2014) The effect of urbanization on CO2 emissions in emerging economies. Energy Econ 41:147–153. https://doi.org/10.1016/j.eneco.2013.11.007

Selvanathan EA, Jayasinghe M, Selvanathan S (2020) Dynamic modelling of inter-relationship between tourism, energy consumption, CO2 emissions and economic growth in South Asia. Int J Tour Res 23(4):597–610. https://doi.org/10.1002/jtr.2429

Shahbaz M, Hye QMA, Tiwari AK, Leitão NC (2013) Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew Sustain Energy Rev 25:109–121. https://doi.org/10.1016/j.rser.2013.04.009

Shahbaz M, Loganathan N, Muzaffar AT, Ahmed K, Jabran MA (2016) How urbanization affects CO2 emissions in Malaysia? The application of STIRPAT model. Renew Sustain Energy Rev 57:83–93. https://doi.org/10.1016/j.rser.2015.12.096

Shittu W, Adedoyin FF, Shah MI, Musibau HO (2021) An investigation of the nexus between natural resources, environmental performance, energy security and environmental degradation: Evidence from Asia. Resour Policy 73:102227. https://doi.org/10.1016/j.resourpol.2021.102227

Shoaib HM, Rafique MZ, Nadeem AM, Huang S (2020) Impact of financial development on CO2 emissions: a comparative analysis of developing countries (D 8) and developed countries (G 8). Environ Sci Pollut Res 27(11):12461–12475. https://doi.org/10.1007/s11356-019-06680-z

Sinha A, Shahbaz M, Balsalobre D (2017) Exploring the relationship between energy usage segregation and environmental degradation in N-11 countries. J Clean Prod 168:1217–1229. https://doi.org/10.1016/j.jclepro.2017.09.071

Sweidan OD (2021) The geopolitical risk effect on the US renewable energy deployment. J Clean Prod 293:126189. https://doi.org/10.1016/j.jclepro.2021.126189

Tang CF, Tan BW (2015) The impact of energy consumption, income and foreign direct investment on carbon dioxide emissions in Vietnam. Energy 79:447–454. https://doi.org/10.1016/j.energy.2014.11.033

Torgler B, Garcia-Valiñas MA (2007) The determinants of individuals’ attitudes towards preventing environmental damage. Ecol Econ 63(2–3):536–552. https://doi.org/10.1016/j.ecolecon.2006.12.013

Veisten K, Hoen HF, Navrud S, Strand J (2004) Scope insensitivity in contingent valuation of complex environmental amenities. J Environ Manag 73(4):317–331. https://doi.org/10.1016/j.jenvman.2004.07.008

Wang Z, Zhang B, Wang B (2018) The moderating role of corruption between economic growth and CO2 emissions: evidence from BRICS economies. Energy 148:506–513. https://doi.org/10.1016/j.energy.2018.01.167

Witzke HP, Urfei G (2001) Willingness to pay for environmental protection in Germany: coping with the regional dimension. Reg Stud 35(3):207–214

Xie Q, Wang X, Cong X (2020) How does foreign direct investment affect CO2 emissions in emerging countries? New findings from a nonlinear panel analysis. J Clean Prod 249:119422. https://doi.org/10.1016/j.jclepro.2019.119422

Yang J, Yang C (2021) The impact of mixed-frequency geopolitical risk on stock market returns. Econ Analysis Policy 72:226–240. https://doi.org/10.1016/j.eap.2021.08.008

Zaidi SAH, Zafar MW, Shahbaz M, Hou F (2019) Dynamic linkages between globalization, financial development and carbon emissions: evidence from Asia Pacific Economic Cooperation countries. J Clean Prod 228:533–543. https://doi.org/10.1016/j.jclepro.2019.04.210

Zhang C, Lin Y (2012) Panel estimation for urbanization, energy consumption and CO2 emissions: a regional analysis in China. Energy Policy 49:488–498. https://doi.org/10.1016/j.enpol.2012.06.048

Zhang J, Zhang Y (2018a) Carbon tax, tourism CO2 emissions and economic welfare. Ann Tour Res 69:18–30. https://doi.org/10.1016/j.annals.2017.12.009

Zhang L, Pang J, Chen X, Lu Z (2019) Carbon emissions, energy consumption and economic growth: evidence from the agricultural sector of China’s main grain-producing areas. Sci Total Environ 665:1017–1025. https://doi.org/10.1016/j.scitotenv.2019.02.162

Zhang Y, Zhang S (2018b) The impacts of GDP, trade structure, exchange rate and FDI inflows on China’s carbon emissions. Energy Policy 120:347–353. https://doi.org/10.1016/j.enpol.2018.05.056

Zhao W, Cao Y, Miao B, Wang K, Wei YM (2018) Impacts of shifting China’s final energy consumption to electricity on CO2 emission reduction. Energy Econ 71:359–369. https://doi.org/10.1016/j.eneco.2018.03.004

W Zhao R Zhong S Sohail MT Majeed S Ullah 2021Geopolitical risks, energy consumption, and CO2 emissions in BRICS: an asymmetric analysis Environ Sci Pollut Res 1–12 https://doi.org/10.1007/s11356-021-13505-5

Zhu HM, You WH, Zeng ZF (2012) Urbanization and CO2 emissions: a semi-parametric panel data analysis. Econ Lett 117(3):848–850. https://doi.org/10.1016/j.econlet.2012.09.001

Zivot E, Andrews DWK (1992) Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J Bus Econ Stat 10(3):251–270

Acknowledgements

The authors acknowledge the participatory contribution of all respondents to this study.

Author information

Authors and Affiliations

Contributions

All authors strongly believe that they have made an equal and substantial contribution to preparing this manuscript. S.M.H. performed: project administration, visualization, roles/writing—original draft, writing—review & editing. R.B. performed: conceptualization, data curation, investigation, resources, visualization, roles/writing—original draft, writing—review & editing. R.I.L. performed: investigation, methodology, supervision, writing—review & editing. Q.R.S. performed: conceptualization, data curation, formal analysis, methodology, project administration, software, visualization, roles/writing—original draft, writing—review & editing.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

This article does not contain any studies with human participants or animals performed by any of the authors.

Consent for publication

Not applicable.

Consent to participate

Not applicable.

Competing interests

The authors declare that no competing interests.

Additional information

Responsible Editor: Philippe Garrigues

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Hashmi, S.M., Bhowmik, R., Inglesi-Lotz, R. et al. Investigating the Environmental Kuznets Curve hypothesis amidst geopolitical risk: Global evidence using bootstrap ARDL approach. Environ Sci Pollut Res 29, 24049–24062 (2022). https://doi.org/10.1007/s11356-021-17488-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-17488-1