Abstract

Recently, China has declared its national objective of becoming carbon neutral by 2060. Hence, mitigating carbon dioxide emissions has become an important agenda of the Chinese government. Against this backdrop, this paper aims to evaluate the effectiveness of pursuing expansionary fiscal and monetary policies on China’s carbon dioxide emission figures by using annual frequency data from 1980 to 2018. Accordingly, this study considers the levels of government expenditure and broad money supply as fiscal and monetary policy instruments, respectively. Besides accounting for structural break concerns in the data, the findings from the empirical analysis reveal that there are long-run associations between carbon dioxide emissions, economic growth, and fiscal and monetary expansion in China. Moreover, the results also show that in both the short- and long-run expansionary fiscal policy trigger higher carbon dioxide emissions while expansionary monetary policy inhibits the carbon dioxide emission figures of China. Furthermore, the results invalidate the existence of the Environmental Kuznets Curve hypothesis since the relationship between China's economic growth and carbon dioxide emissions is evidenced to portray an N-shape. In line with these findings, it is recommended that China achieve environmentally sustainable economic growth by aligning the national fiscal and monetary policies with the 2060 carbon-neutrality objective.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

In the modern era, climate change-related adversities have nudged the world nations to decarbonize their respective economies (Wang and Zhang 2020, 2021; Balsalobre-Lorente et al. 2021). In this regard, the 21st Conference of Parties (COP21) to the 1992 United Nations Framework Convention on Climate Change (UNFCCC) has united 196 of the global countries to ratify the Paris Accord (Wang et al. 2021; Khan et al. 2021). In this agreement, the signatories have promised to minimize their greenhouse gas emission figures in order to limit the rise in the global temperature level. Specifically, the central objective of the Paris Accord is to keep the rise in the global temperature level to well below 2 °C above the pre-industrial level (Nathaniel et al. 2021; Rehman et al. 2021a). Hence, controlling the growth in the rate of discharge of greenhouse gas emissions into the atmosphere has become an utmost important environmental development objective worldwide. Although all forms of greenhouse gas emissions are considered detrimental to environmental well-being, carbon dioxide (CO2) emission, in particular, is acknowledged in the literature as the main driver of climate change (Abbasi et al. 2021a, b). Accordingly, several studies have been carried out to identify the macroeconomic factors that can help the global economies to decouple CO2 emissions from economic growth (Ozturk et al. 2021; Wang and Wang 2022).

Like all other signatories of the Paris Agreement, China has also pledged to decarbonize its economy (Li et al. 2021; Liu et al. 2021). Recently, Chinese President Xi Jinping has declared the vision of its government to make sure China becomes carbon–neutral by 2060 (Jiahua 2021; Ma et al. 2021). It is believed that this declaration came forward due to the persistent deterioration of atmospheric quality which has accompanied the robust growth of the Chinese economy. In 2019, 27% of the total volume of greenhouse gases emitted worldwide was originated from China; thus, the Chinese emission figures exceeded the cumulative emission figures of all developed countries in the (BBC News 2021). Therefore, considering these statistical records, China is currently to be the greatest contributor to the global climate change adversities. As a result, decarbonizing the Chinese economy is not only relevant from the national perspective but also important for the world as a whole.

In order to attain the carbon-neutrality target by 2060, it is crucial for the Chinese government to adopt appropriate policies that can be implemented to generate environmentally sustainable economic growth (Rehman et al. 2021b). Primarily, economic growth and energy consumption have been recognized as the two major drivers of environmental degradation in China (Abbasi and Adedoyin 2021; Shum et al. 2021). Moreover it is important to note that China produces a lion’s share of its national output using coal; thus, the nation is the largest consumer of coal in the entire world. Such significant dependence on coal and other fossil fuels has made the Chinese government admit that China's CO2 emission figures are likely to be keep surging and reach the peak by 2030. This, in turn, implies that China is likely to be unsuccessful in attaining the environmental sustainability targets enlisted under the 2030 Sustainable Development Goals (SDG) agenda of the United Nations. Under such circumstances, mitigating CO2 emissions beckons to be a major challenge for the Chinese government since letting go the nation's traditional fossil fuel dependency is likely to take more time.

Keeping into consideration the 2060 carbon-neutrality agenda, it can be hypothesized that the Chinese government has a critically important role to play in controlling CO2 emission. This is because taxing the agents responsible for generating CO2 emissions can be expected to inhibit the discharge of CO2 and other fossil fuel combustion-based pollutants into the atmosphere. On the other hand, carbon taxes can also encourage the employment of cleaner energy resources to further abate energy use-related emissions. In the same vein, Ulucak et al. (2020) argued that imposing environmental taxes can help to curb CO2 emissions to a large extent. Similarly, deploying stringent environmental regulations, especially in the form of emission taxes, has been claimed to be effective in mitigating CO2 emissions (Ahmed et al. 2021a; Neves et al. 2020). It is estimated that enhancing carbon taxes to 75 United States dollars per ton of CO2 emitted is necessary for realizing the objective of limiting global warming to at least 2 °C above the pre-industrial levels (Gaspar et al. 2019).

Although such fiscal measures, in the form of taxation, are assumed to be necessary for curbing CO2 emissions, government expenditure can also influence the emission levels. This is because public investments in the health and education sectors can be associated with human capital development which, in turn, can contribute to the growth in the future income of the people; consequently, the consumption-based CO2 emission levels can be anticipated to rise (Halkos and Paizanos 2015). However, such fiscal expansion-led income gains can also enable consumers to afford green commodities which can help to reduce emissions (Le and Ozturk 2010). Moreover, government expenditure for infrastructure development can help the industrialization process within an economy whereby the production-based CO2 emissions can be expected to surge (Murshed et al. 2021). Besides, specifically in the context of China, industrialization is believed to be a barrier to decoupling CO2 emissions from economic growth (Wang and Jiang 2019). Moreover, government expenditure for financing the development of the energy infrastructure can facilitate renewable energy transition to abate CO2 emissions (Murshed et al. 2020; Murshed 2021). It is duly mentioned in the literature that budgetary allocations for clean energy development helps to abate CO2 emissions (Ahmed et al. 2021b, c). Therefore, considering the above-mentioned ambiguous environmental effects associated with the government’s fiscal policy, Lopez et al. (2011) argued that the overall effect is conditional on the efficiency and enforcement of environmental regulations.

Likewise fiscal policies, China’s CO2 emission figures can also be assumed to be influenced by monetary policies. It is obvious that monetary expansion is necessary for directly enhancing economic growth; however, such strategies can exert ambiguous indirect impacts on the environment as well (Jalil and Feridun 2011). Enhancing the money supply under an expansionary monetary policy regime is likely to boost investments and facilitate industrialization. Consequently, these policy measures can be associated with a rise in energy demand whereby the energy consumption-based CO2 emission levels are likely to go up (Ullah et al. 2021). In contrast, monetary contraction, especially by increasing the discount rate, is anticipated to reduce the aggregate demand as consumers and producers are likely to consume and produce less, respectively, and save more. Subsequently, the monetary contraction-led decline in economic activities can be associated with lower levels of CO2 emission (Chan 2020).

Although the above-mentioned arguments suggest that monetary expansion is detrimental to environmental quality while monetary contraction exerts environmental welfare-enhancing effects, several studies have put forward counterarguments as rebuttals to these claims. It is acknowledged in the literature that a contractionary monetary policy disrupts technological innovation since it takes hefty investments to finance innovation-related projects (Qingquan et al. 2020; Azhgaliyeva et al. 2020). As a result, the prospects of improving environmental quality through the technological innovation channel become doubtful. On the other hand, greening the monetary policies is likely to neutralize the environmental adversities associated with the use of the conventional expansionary monetary policy instruments (Schoenmaker 2021). In this regard, reducing interest rates charged against funds borrowed for investing in green projects can be effective in reducing CO2 emissions (Zhang et al. 2021). Besides, the extension of low-cost green finances can catalyze technological innovations and renewable energy transition within the economy to further facilitate the attainment of the environmental development objectives (Wang and Zhi 2016; He et al. 2019).

Against this backdrop, using annual frequency data spanning from 1980 to 2018, this study aims to predict the impacts of fiscal and monetary policies on China’s CO2 emission figures under the theoretical framework of the Environmental Kuznets Curve (EKC) hypothesis.Footnote 1 In the event of accelerated economic growth during the study period, the EKC hypothesis-based analysis can help to explain the economic growth-environmental degradation trade-off scenario in China. Besides, this study is particularly relevant from policymaking perspectives concerning the attainment of China’s 2060 carbon-neutrality agenda. Moreover, since the current government has expressed its concerns regarding the aggravation of environmental quality in China, it can be assumed that public policies are to be undertaken keeping China’s energy sustainability objective into cognizance. In this regard, the possible environmental outcomes associated with the execution of fiscal and monetary policies need to be predicted.

The major contributions of this study to the corresponding literature are three-fold. Firstly, although numerous studies on the EKC hypothesis have been conducted in the context of China (Shahbaz et al. 2017; Pata and Caglar 2021), not many of these have controlled for fiscal and monetary policies within the analysis. Although only a limited number of preceding studies have analyzed the impacts of fiscal policy on China's CO2 emission levels (Yuelan et al. 2019); to the best of our knowledge, no study has simultaneously evaluated the effects of fiscal and monetary policies on CO2 emissions in China’s context. Since both fiscal and monetary policies have been recognized in the literature to be effective in influencing the environmental attributes, it is pertinent to control for both these key macroeconomic policies within the EKC model.

Secondly, although the EKC hypothesis postulates CO2 emissions as a quadratic (inverted U-shaped) function of economic growth (Apergis 2016; Apergis et al. 2017; Işık et al. 2019; Rauf et al. 2020), it does not comment on whether this relationship would sustain or not. Therefore, it is important to evaluate this sustainability issue which has largely remained unexplored in the literature. To particularly address this literature gap, this study expresses the CO2 emission figures of China as a cubic function of economic growth. In this regard, if the predicted coefficient attached to the cubic term of the proxy variable used for measuring economic growth is found to be statistically significant, then it can be concluded that the EKC hypothesis is not likely to sustain in the long-run. Lastly, this study adds to the limited literature on EKC-related studies in the context of China that have controlled for the possible structural break issues in the data. It is said that ignoring the structural break data issues generate biased results (Murshed and Alam 2021). Since China has endured several domestic and international macroeconomic shocks during the study period, it is necessary to check for structural breaks in the data. Accordingly, this study identifies the location of the structural break using a second-generation unit root testing technique and controls for it within the regression analysis.

The rest of this paper is arranged as follows: Section 2 presents the trends in CO2 emissions, instruments of fiscal and monetary policies, and the GDP of China during the study period considered in this study. The summaries of the preceding studies are presented in Section 3. Section 4 outlines the methodology followed in this study while Section 5 presents the findings from the econometric analysis. Lastly, the concluding remarks and policy recommendations are put forward in Section 6.

Macroeconomic trends in China

An overview of the evolutionary trends in China’s key macroeconomic variables is illustrated in Fig. 1. The traditional economic growth-environmental degradation trade-off in China is evidenced by the trends in the nation’s per capita CO2 emissions and the GDP. It can be seen that between 1980 and 2018, the per capita CO2 emission figures have multiplied by almost five-fold while the per capita GDP figures have surged by more than 140 times. These rising trends highlight that the economic growth policies executed by the Chinese government have not been able to safeguard the well-being of the environmental attributes in China. Under such circumstances, the monotonic fossil fuel dependency of China can be referred to as the major contributor to the aggravation of environmental quality alongside the growth of the Chinese economy.

Source: World Development Indicators (World Bank 2021)

Macroeconomic trends in China. The CO2 emission figures are presented along the secondary (right) axis while the GDP, Broad Money Supply, and Government Expenditure figures are presented along the primary (left) axis.

Besides, Fig. 1 also provides an understanding of the historical trends in China’s fiscal and monetary policies. It is evident that China has implemented expansionary fiscal policies over the years which can be perceived from the rising trend in the annual expenditure levels of the Chinese government. During the 1980s, the average per capita general government final consumption expenditure budget was around 133 Chinese Yuans which during the 2010s surged to around 8000 Chinese Yuans. Moreover, it can be asserted that under such expansionary fiscal policy regimes, the Chinese government has managed to significantly boost its tax revenues. Consequently, in 2018, China reduced its fiscal deficit figures by 0.4% compared to the level in the previous year, especially by enhancing the tax revenues by around 4% (Yuelan et al., 2019). The surge in the tax revenue figures implies that taxation policies in China have been effective in generating revenue for its government.

On the other hand, as far as monetary policy is concerned, the upward trends in China’s broad money (M2) supplies certify the execution of expansionary monetary policies by the Central Bank. In the 1980s, the average per capita level of M2 in China was around 600 Chinese Yuans which surged to more than 96,000 Chinese Yuans, on average, during the 2010s. The Chinese central bank has implicitly executed inflation targeting mechanisms to maintain price stability whereby the monetary policies are adjusted accordingly (Girardin et al. 2017). Therefore, the collective trends in these key macroeconomic variables (as depicted in Fig. 1) portray that both fiscal and monetary expansion measures have contributed to higher economic growth in China; however, these policies could have also played a major role in aggravating environmental quality in tandem. Hence, it is important to examine the environmental impacts that have accompanied the expansionary fiscal and monetary policies pursued within the Chinese economy.

Literature review

Firstly, in this section, we summarize the findings of different EKC-related studies that have used CO2 emissions to quantify the environmental impacts associated with economic growth. Secondly, the preceding studies that have explored the effects of fiscal and monetary policies on CO2 emissions are reviewed.

The economic growth-CO2 emissions nexus within the EKC hypothesis analysis

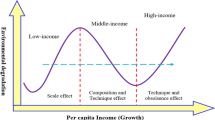

In general, the EKC hypothesis, introduced by Grossman and Krueger (1991), postulates that economic growth is the initiator of environmental adversity and also the means through which these adversities are reduced. Accordingly, the EKC hypothesis is only valid in the context of the economic growth-CO2 emissions relationship depicting an inverted U-shape. Following Grossman and Krueger (1991), the EKC Hypothesis was evaluated using both country-specific and cross-sectional data (Dogan and Ozturk 2017; Salahuddin et al. 2018; Ahmad et al. 2021a; Verbič, M., Satrovic; Verbič et al. 2021; Satrovic et al. 2021). The findings documented revealed mixed evidence concerning the authenticity of the EKC hypothesis for CO2 emissions.

Among the preceding studies that have validated this hypothesis, Danish et al. (2017) asserted that the EKC hypothesis holds for Pakistan. The findings, derived from the Autoregressive Distributed Lag (ARDL) modelling approach, showed evidence of economic growth initially boosting CO2 emissions and later on mitigating them only in the context of the long run. In contrast, the short-run results refuted the authenticity of the EKC hypothesis as the corresponding elasticity estimates suggested a U-shaped relationship between the variables. Apart from economic growth, the authors controlled for renewable and non-renewable energy consumption and remarked that enhancing renewable energy use plays a key role in of-setting the economic growth-environmental degradation trade-off in the long run. Similarly, in the context of the Emerging Seven (E7) nations including China, Bekun et al. (2021) found statistical evidence of the EKC hypothesis holding in the long run. Further, the authors also added that poor institutional quality boosts CO2 emissions while renewable energy abates the emissions. In another study on 66 developing nations, Akram et al. (2020) remarked that energy efficiency improvement and clean energy use contribute to validate the EKC hypothesis. However, controlling for foreign direct investment inflows, Ahmad et al. (2021b) found evidence that the EKC hypothesis is valid for only five out of 23 Chinese provinces.

Conversely, among the existing studies that could not establish the inverted U-shaped nexus to verify the EKC hypothesis for CO2 emissions, Halliru et al. (2020) concluded that that the EKC hypothesis does not hold in the context of six West African countries. Altıntaş and Kassouri (2020) also could not verify the EKC hypothesis for CO2 emissions in the case of 14 European nations. However, the authors did establish the validity of the EKC hypothesis for these countries using their ecological footprints to measure the environmental impacts of economic growth across Europe. Similarly, Alola and Donve (2021) showed that the EKC hypothesis does not hold for Turkey since the findings revealed that the economic growth-CO2 emissions nexus follows a U-shaped association. In another relevant study on South Korea, Koc and Bulus (2020) opined that the inverted U-shaped economic growth-CO2 emissions nexus does not sustain; the results indicated that economic growth in South Korea exerted an N-shaped relationship with the nation’s CO2 emission figures. In the same vein, the N-shaped relationship was also revealed in the studies by Barış-Tüzemen et al. (2020) for Turkey and Allard et al. (2018) for selected high-income, lower-middle-income, and low-income countries.

In the context of country-specific studies on China, controlling for coal consumption and globalization between 1970 and 2012, Shahbaz et al. (2017) employed the ARDL technique and found the EKC hypothesis for CO2 emissions to be valid. Similarly, analyzing annual data from 1965 to 2016, Dong et al. (2018) also verified the EKC hypothesis for CO2 emissions in China while natural gas and renewable energy use were ascertained to boost the CO2 emission figures of the nation. In another time series analysis on China between 1980 and 2014, Chen et al. (2019) also concluded that promoting renewable energy use helps to validate the EKC hypothesis; in addition, the authors emphasized the relevance of facilitating international trade to curb CO2 emissions in China. The CO2 emissions-induced EKC hypothesis for China was also highlighted in the study by Jamil and Mahmud over the 1975–2005 period. Apart from authenticating the EKC hypothesis at the national level, the EKC hypothesis for CO2 emissions was also verified using provincial data. Dong et al. (2017) used annual data from 30 Chinese provinces from 1995 to 2014 and concluded that increasing natural gas consumption can help to authenticate the EKC hypothesis by mitigating the provincial CO2 emission figures.

The literature on the effects of fiscal and monetary policies on CO2 emissions

Different studies have used different fiscal policy instruments to assess the impacts of fiscal policy on CO2 emissions. Yilanci and Pata (2021), in the context of the Group of Seven (G7) countries, used government expenditure level as a proxy for fiscal policy and found that higher public expenditure can be effective in curbing CO2 emissions. Similarly, Katircioğlu and Katircioğlu (2018) investigated the effects of the share of government expenditure on Turkey’s GDP on the nation’s CO2 emission levels under the lens of the EKC hypothesis. The results, although invalidating the EKC hypothesis, showed that a higher government expenditure share in the GDP helps to reduce CO2 emissions. Ike et al. (2020) also studied the relationship between fiscal policy and CO2 emissions for Thailand using the per capita levels of government’s final consumption expenditure and tax revenues as proxies for fiscal policy. Their results indicated that increases in the per capita levels of both these fiscal policy indicators lower CO2 emissions in Thailand. Besides, the EKC hypothesis was also validated for Thailand in this study.

Furthermore, emphasizing pollution tax as a fiscal revenue instrument, several studies have also attempted to predict the effects of revenues generated from carbon taxes on CO2 emissions. In the context of 29 Organization for Economic Cooperation and Development (OECD) member countries, Hashmi and Alam (2019) documented evidence of higher environmental tax revenues being associated with lower CO2 emissions. In another similar study on 15 countries members of the European Union, Aydin and Esen (2018) concluded that carbon taxes initially do not effectively curb CO2 emissions but beyond a threshold tax revenue level, carbon taxation is evidenced to reduce CO2 emissions in Europe. Considering industrial CO2emissions, Mardones and Flores (2018) concluded that high carbon taxes help to stimulate a cleaner fuel transition in Chile whereby the CO2 emission levels can be contained. However, low carbon taxes were found to be ineffective in significantly reducing CO2 emissions in Chile.

In the context of China, Yuelan et al. (2019) scrutinized the effects of fiscal policy on the Chinese CO2 emission levels between 1980 and 2016. In this study, the authors used two alternative fiscal policy instruments namely the respective shares of total government expenditure and revenue in the GDP. The results from the ARDL analysis demonstrated that in the short-run expansionary fiscal policy helps to mitigate CO2 emissions; however, this impact gets reversed in the long run. In line with these findings, the authors concluded that fiscal expansion, although exerting environmentally friendly short-run impacts, is detrimental to the long-run environmental well-being in China. Among the other related studies for China, Hao et al. (2020) and Khan et al. (2020) concluded that increasing public spending, as an indication of the execution of expansionary fiscal policy, is likely to raise CO2 emissions in neighboring Chinese provinces. However, these studies were mostly conducted at the provincial level and overlooked the environmental impacts of monetary policy. Moreover, these studies have also not evaluated whether the EKC hypothesis sustains or not whereby little is known regarding whether the N-shaped economic growth-CO2 emissions nexus exists in China or not.

Now turning to the preceding studies on the monetary policy effects on CO2 emissions, Qingquan et al. (2020) evaluated the effects of expansionary and contractionary monetary policies on CO2 emissions in the cases of selected Asian nations. The results revealed that enhancing money supply (monetary expansion) is likely to boost CO2 emissions while reducing money supply (monetary contraction) can be expected to curb CO2 emissions across Asia. Contrarily, in a large panel data analysis comprising data from 101 global economies, Vo and Zaman (2020) found evidence of a rise in M2 supply helps to curb CO2 emissions in the long run. On the other hand, Qingquan et al. (2021) used the shocks to the real interest rates to proxy for monetary policy and found expansionary and contractionary monetary policies to boost and inhibit CO2 emissions, respectively, in Australia.

Until recently, a limited number of studies have precisely modelled the determinants of CO2 emissions by simultaneously controlling for both fiscal and monetary policies. Among these, Chishti et al. (2021) explored the effects of expansion and contraction in monetary and fiscal policies on CO2 emissions in the context of the BRICSFootnote 2 countries. The results revealed that fiscal expansion amplifies CO2 emissions while fiscal contraction mitigates CO2 emissions. Besides, both monetary expansion and contraction were found to curb the CO2 emission figures of the BRICS countries. In the context of the Association of Southeast Asian Nations (ASEAN) members, Mughal et al. (2021) evaluated the effects of fiscal and monetary policies on CO2 emissions using the government expenditure level and discount rate to proxy for fiscal and monetary policy instruments, respectively. The results from the non-linear ARDL analysis portrayed that in the long-run monetary expansion trigger CO2 emissions while monetary contraction reduces them. As far as the fiscal policy was concerned, fiscal expansion was evidenced to be effective in reducing CO2 emissions. Recently, Bhowmik et al. (2021) concluded that monetary policy uncertainty is associated with higher CO2 emissions in the United States of America (USA) while fiscal policy uncertainty was found to be rated to lower CO2 emissions.

Empirical model and econometric methodology

Empirical model and data

As per the theoretical underpinnings of the EKC hypothesis, the possible non-linearity of the economic growth-CO2 emissions nexus can be evaluated using a quadratic model specification as follows:

However, since this current study is interested in understanding whether or not the EKC hypothesis sustains in the context of China, we transform the traditional EKC by expressing CO2 emissions as a cubic function of economic growth. The transformed model can be expressed as follows:

Moreover, to evaluate the effects of fiscal and monetary policies on the CO2 emission figures of China, we also include instruments of fiscal and monetary policies in our model. The empirical model used in this study is shown as:

where the subscript t denotes the period of the study stemming from 1980 to 2018, ε refers to the error term, \({\partial }_{0}\) is the intercept parameter, and \({\partial }_{{k}} ({k}={1,2},\dots ,5)\) are the elasticity parameters to be predicted. The dependent variable lnCO2 is the natural logarithm of annual per capita CO2 emission figures (measured in metric tons) in China. The changes in the CO2 emission figures can be interpreted as changes in environmental quality. In simple terms, higher CO2 emissions are synonymous with aggravation of environmental quality while lower CO2 emissions are synonymous with improvement in environmental quality in China. Among the explanatory variables of concern, the variables lnGDP, lnGDP2, and lnGDP3 refer to the natural logarithms of the per capita Gross Domestic Product (GDP) level of China (measured in 100 million Chinese Yuans) and its squared and cubic terms, respectively. In this study, the annual GDP level is used to proxy for the growth of the Chinese economy. If the predicted signs of the associated elasticity parameters \({\partial }_{1}\),\({\partial }_{2}\), and \({\partial }_{3}\) are positive, then it can be interpreted as economic growth resulting in higher emissions of CO2. Besides, the EKC hypothesis is verified only if the signs of the predicted elasticity parameters \({\partial }_{1}\) and \({\partial }_{2}\) are positive and negative, respectively, and statistically significant while the elasticity parameter \({\partial }_{3}\) is statistically insignificant. Furthermore, given that the respective signs of the elasticity parameters \({\partial }_{1}\) and \({\partial }_{2}\) are positive and negative, if the predicted sign of the elasticity parameter \({\partial }_{3}\) is statistically significant and positive then the economic growth-CO2 emissions nexus would depict an N-shape (Barış-Tüzemen et al. 2020).

The regressor lnGE refers to the natural logarithm of the government expenditure level of China (measured in 100 million Chinese Yuans). The annual government expenditure levels are used as a proxy for fiscal policy instruments whereby higher expenditure levels indicate fiscal expansion and lower values indicate fiscal contraction. Hence, if the predicted sign of the elasticity parameter \({\partial }_{4}\) is positive, it can be interpreted as expansionary fiscal policy being associated with higher CO2 emissions in China and vice-versa. Lastly, the variable lnM2 stands for the natural logarithm of the annual M2 supply level in China (measured in 100 million Chinese Yuans) which is used as a monetary policy instrument in the context of this study. In this regard, higher levels of M2 would be an indication of monetary expansion while lower M2 levels can be interpreted as monetary contraction. Therefore, if the predicted sign of the elasticity parameter \({\partial }_{5}\) is positive, it can be asserted that expansionary monetary policy is associated with higher CO2 emissions in China and vice-versa.

The data for all these variables have been compiled from the World Development Indicators database provided by the World Bank (2021). The missing values in the data are addressed using the interpolation method. Table 1 presents the descriptive statistics of the variables used in this study. It shows that the variable lnGDP has the highest mean with a value of 4.833, and the variable lnCO2 has the lowest mean value of 0.628. Similarly, the variable lnGDP has the highest median value of 4.930, and lnCO2 has the lowest median value of 0.632. Besides, it can be seen that the variables lnCO2, lnGDP, lnGDP2, and lnM2 are negatively skewed while the rest are positively skewed. Moreover, since the kurtosis values of all variables are below 3, it can be asserted that these variables are platykurtic. Furthermore, the probability values of the Jarque–Bera statistics for all variables indicate that these variables are normally distributed.

Estimation strategy

Firstly, the econometric analysis conducted in this study begins by evaluating the stationarity properties of the variables using a relevant unit root estimator. Since accounting for structural break issues within the unit root analysis is important, the Zivot and Andrews (1992) test is employed in this study. This method corrects for the limitations of the conventionally used unit root test of Phillips and Perron (1988) since those traditional techniques fail to consider information about a structural breakpoint in the data. Ignoring such structural break concerns lead to the estimation of biased and inaccurate stationarity properties of the respective variable (Zivot and Andrews 1992). Under the Zivot-Andrews approach, a test statistic for each variable, either at the level or at the first difference, is predicted considering the null hypothesis of non-stationarity against the alternative hypothesis of stationarity of the variable of concern. Besides, this method also identifies the location of a structural break in the data of the respective variable. The unit root analysis is followed by the cointegration and regression analyses.

Secondly, this study utilizes the ARDL approach of Pesaran et al. (2001) for conducting the cointegration and regression analyses. Under this method, there are two different steps. In the first step, a bounds test is performed to assess the existence of cointegrating relationships among the variables considered within the model. Accordingly, the ARDL bounds test predicts a F-statistic under the null hypothesis of non-cointegration. In the context of the F-statistic being greater than the upper and lower bound critical values, it can be claimed that there are long-run associations between the variables of concern. Given that the presence of cointegration is detected, the ARDL regression analysis is applied to predict the short and long-run elasticity parameters in the second stage.

Compared to the conventional methods employed for performing the cointegration and regression analyses, the ARDL method has some distinct advantages. For instance, the traditional methods require all the variables included within the model to have a unique order of integration at the first difference (Yuping et al. 2021). In contrast, the ARDL method relaxes this requirement and can accommodate variables with mixed order of integration at either the level or the first difference, but not at the second difference. Besides, the ARDL bounds test for cointegration is more efficient in handling short time series data sets while the traditional Johansen (1988) cointegration analysis is more relevant for assessing cointegration in the context of long data sets (Al-Mulali et al. 2016). Moreover, this technique can also correct the endogeneity issues in the data (Murshed et al. 2021).

The empirical model considered in this study (as indicated in Eq. (3)) can be shown using the ARDL specification as follows:

where \(\Delta\) denotes the first difference operator. The subscript i stands for the lag order for the respective variable which can differ across the variables. The optimal lags are chosen as per the Schwarz Information Criterion (SIC).Footnote 3 From Eq. (4), the short-run ARDL elasticity parameters can be predicted using the equation specified below:

where ECT stands for the one-period lagged error-correction term which shows the speed of convergence to long-run equilibrium. The short-run elasticity parameters of CO2 emissions are given by \({\partial }_{{k}} ({k}=1, 2, \dots , 6)\). From Eq. (4), the long-run ARDL elasticity parameters can be estimated using the equation expressed below:

where \({\varphi }_{{m}} ({m}=1, 2, \dots , 6)\) are the long-run elasticity parameters of CO2 emissions to be predicted using the ARDL analysis. Once the short- and long-run elasticities are predicted using the ARDL method, it is necessary to conduct some diagnostic tests. In this regard, the Breusch-Godfrey Lagrange Multiplier (χ2 LM) test is performed to explore the serial correlation problems in the model. Then, to check whether the residuals are normally distributed or not, the Jarque-Berra test (χ2 NORMALITY) is conducted. Besides, the heteroscedasticity issues are diagnosed using the Autoregressive Conditional Heteroskedasticity (ARCH) effects analysis (χ2 ARCH). Furthermore, the model misspecification concerns are addressed using the Ramsey RESET (χ2 RESET) test. Lastly, the stability of the elasticity parameters is examined through the Cumulative Sum (CUSUM) and the Cumulative Sum of Squares (CUSUMSQ) tests. Furthermore, for checking the robustness of the long-run elasticity estimates from the ARDL analysis, the Dynamic Ordinary Least Squares (DOLS), Fully Modified Ordinary Least Squares (FMOLS), and Canonical Cointegrating (CC) regression estimators are utilized in this study.

Lastly, to find out if there is causality in the relationship between the study variables, we apply the Vector Error-correction Model (VECM) method. The approach is used in mustering the long and short-run causality between the variables. The VECM model concerning this study can be expressed as follows:

when the predicted ECTt-1 is negative and statistically significant, then the long-run causality is confirmed. The interpretation of \({\upbeta }_{12,{ i}} \ne 0{\forall }_{i}\), proposes that government expenditure, M2 supply, and economic growth Granger cause the CO2 emission figures of China. The statistical significance of lagged error term, ECTt-1, apart from showing the convergence speeds from short- to long-run equilibrium path, is also the one that helps to confirm the long-run causal relationships between the series.

Results and discussion

Firstly, the Zivot-Andrews unit root analysis is conducted. The corresponding results, as illustrated in Table 2, indicate that all the variables are stationary at the first difference [I(1)] while the variable lnM2 is stationary at level [I(0)]. Therefore, these findings portray the mixed order of integration among the variables. Besides, the location of the structural break for the respective variable, at either the level or the first difference, is also identified.Footnote 4 Following the identification of the integration order, the presence of cointegrating equations within the model is checked using the ARDL bounds text analysis.

Table 3 reports the F-statistic for our econometric model that is predicted using the ARDL bounds test. It can be evidenced that the F-statistic is 4.924 which is above both the lower and upper critical bounds at the 1% level of statistical significance. Hence, the null hypothesis of non-cointegration among the variables is rejected to affirm the presence of at least one cointegrating equation in our model. In light of this finding, it can be claimed that there are long-run associations between China’s per capita CO2 emission figures and per capita levels of GDP, government expenditure, and M2 supply. Since the Zivot-Andrews test revealed mixed integration order among the variables and the ARDL bounds test showed cointegrating relationships, it is relevant to predict the elasticities of CO2 emissions using the ARDL regression method.

The elasticity parameters predicted using the ARDL analysis are reported in Table 4. From the long-run analysis, it can be evidenced that economic growth initially triggers CO2 emissions, then reduces CO2 emissions, and then boosts CO2 emissions again in China. Hence, in line with these findings, it can be claimed that the economic growth-CO2 emissions nexus depicts an N-shaped relationship in the context of China. This implies that the EKC hypothesis for CO2 emissions does not hold for China in the long run. This is a plausible finding since the Chinese President, in his declaration of the 2060 carbon-neutrality agenda, mentioned that CO2 emission in China is likely to sustain till 2030 which would not enable China to attain the environmental sustainability objective of the United Nations’ 2030 SDG agenda. As a result, it is likely that the economic growth-environmental degradation trade-off in China is not likely to be phased out soon which, in turn, justifies the finding of the N-shaped relationship between these variables. This finding is parallel to the findings reported Koc and Bulus (2020) and Barış-Tüzemen et al. (2020) for South Korea and Turkey, respectively.

Besides, the long-run estimates also show that fiscal expansion in China exerts adverse environmental impacts on China. Specifically, it is evidenced that if the per capita government expenditure level increase by 1%, then the Chinese per capita CO2 emission figures are likely to surge by 0.18%, on average, ceteris paribus. This finding is expected since it has been acknowledged in the literature that public investments have played a major role in boosting the growth of China’s manufacturing sector (Kim et al. 2021). Subsequently, the public investment-led manufacturing section boom in China is likely to have increased the energy demand which is met mostly by the traditionally utilized fossil fuels. As a result, the finding of a positive correlation between government expenditure and CO2 emissions in China can be claimed valid. Similar conclusions were made by Yuelan et al. (2019) for China; however, the finding contradicts the results reported by Ike et al. (2020) for the case of Thailand.

Lastly, the long-run estimates also reveal that expansionary monetary policy is environmental welfare-enhancing in the context of China. The corresponding elasticity parameter estimate shows that a 1% rise in the per capita level of M2 supply is likely to curb the per capita CO2 emission figures of China by around 0.30%, on average, ceteris paribus. This finding certifies that the monetary expansion mechanisms executed in China are environmentally friendly whereby favorable environmental outcomes have resulted. It has been acknowledged that the Chinese government’s investments in research and development have facilitated the growth of the economy of China. In this regard, these investments can be expected to finance the technological innovation-led environmental development initiatives in China whereby the CO2 emission figures of the nation can be efficiently contained in the long run. This result corroborates the conclusion made in the study by Vo and Zaman (2020).

The short-run results reported in Table 4 show that the short-run effects of economic growth and fiscal and monetary policies on CO2 emissions are similar to the corresponding long-run effects. This phenomenon is understood from the identical signs of the short- and long-run elasticity parameters. Hence, the N-shaped economic growth-CO2 emissions nexus is also verified in the short run. However, compared to the long run, the adverse environmental effects of fiscal expansion in the short run are relatively larger. This implies that expansionary fiscal policy is comparatively less detrimental to environmental well-being in the long run. However, in the comparison between the short- and long-run environmental effects associated with monetary expansion, it can be witnessed that the marginal CO2 emission-inhibiting impact of monetary expansion tends to reduce with time. This is a concerning finding which casts doubt on China’s prospects of achieving environmental sustainability.

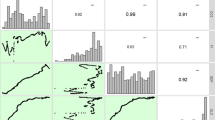

Besides, it can be seen that the parameters associated with the structural break dummies, both in the short and long run, are statistically significant. This justifies the relevance of controlling for the structural break within the ARDL analysis. The adjusted R-squared value is predicted at 0.890 which implies that around 89% of the total variations in China’s per capita CO2 emission figures can be explained by the positive shocks to the nation's per capita levels of GDP, government expenditure, and M2 supply. On the other hand, the lagged ECT is predicted to be negative and statistically significant as well. The value of the ECT (− 0.369) implies that any short-run disequilibrium in the current period is adjusted at a speed of around 37% in the next period. Furthermore, the findings from the diagnostic tests reveal that the ARDL model considered in this study is free from serial correlation, heteroscedasticity, non-normality, and model misspecification problems. Additionally, the CUSUM and CUSUM of squares plots (shown in Fig. 2) verify the stability of the ARDL parameter estimates.

The robustness of the long-run elasticities of CO2 emissions from the ARDL analysis is checked using the DOLS, FMOLS, and CC regression estimators. The corresponding estimates from the robustness analysis are presented in Table 5. It can be seen that although the elasticity parameters predicted using the DOLS, FMOLS, and CC estimators depict identical signs, their magnitudes are relatively smaller than the corresponding long-run ARDL elasticity estimates. This implies that the ARDL method is efficient in reducing the overestimate bias observed from the other three alternative methods considered in this study. The relatively smaller ARDL elasticity parameters could be because the DOLS, FMOLS, and CC regression methods require a common order of integration among the variables, whereas the limitation of these methods is accounted for within the ARDL analysis which allows for a mixed order of integration among the variables which is the case of the data set considered in this study. Finally, the regression analysis is followed by the causality analysis.

The findings from the VECM Granger causality analysis are reported in Table 6. The results indicate that in the short run, there is evidence of unidirectional causalities running from government expenditure and M2 supply to CO2 emissions. However, in the long run, it can be seen that CO2 emissions have bidirectional causal relationships with GDP, government expenditure, and M2 supply. Therefore, the evidence of bidirectional causalities suggests that our model could be subject to endogeneity issues. However, the ARDL approach takes into account the issue of endogenous covariates in the model within the regression analysis. Consequently, the elasticity estimates can be claimed unbiased. Figure 3 presents a graphical summary of the causality findings.

Conclusion

Considering China’s objective of becoming carbon neutral by 2060, it is deemed necessary for the Chinese government to adopt relevant policies to make sure that this objective is achieved. Hence, this study scrutinized the effects of expansionary fiscal and monetary policies on CO2 emissions in China between 1980 and 2018. Controlling for structural break issues, the ARDL bound test results indicated long-run associations between China’s per capita CO2 emission figures and per capita levels of economic growth, government expenditure, and M2 supply. Besides, the ARDL elasticity estimates revealed that fiscal expansion boosts CO2 emissions both in the short and long run. Contrarily, monetary expansion was found to be related to lower CO2 emissions both in the short and long run. Moreover, the N-shaped nexus between economic growth and CO2 emissions was also evidenced in the context of China; thus, the EKC hypothesis for CO2 emissions could not be established.

In line with these major findings, several viable policies can be put forward. Firstly, considering the adverse environmental impacts associated with expansionary fiscal policy, the Chinese government can consider pursuing a contractionary fiscal policy to curb the emissions. However, since fiscal contraction can harm the growth of the Chinese economy, which is not a rational policy to implement, it is recommended that expansionary fiscal policies of China are aligned with the 2060 carbon-neutrality agenda. In this regard, the Chinese government should ideally invest more in research and development-related projects that can facilitate the renewable energy transition. On the other hand, China can also consider imposing progressive carbon taxes to limit emissions of CO2. Enhancing the carbon tax rates would not only boost the public revenue and expenditure figures of the Chinese government but would also neutralize the adverse environmental effects associated with fiscal expansion.

Secondly, monetary expansion should be considered an effective means of achieving the 2060 carbon-neutrality agenda. However, it must be ensured that the expansionary monetary policy should be environmentally sustainable so that access to finance, for investment in green projects, should be significantly enhanced. Accordingly, low-interest credit should be extended to potential borrowers who are likely to invest in environmentally-friendly production processes. Most importantly, more funds should be invested in research and development for developing modern technologies necessary for safeguarding the environmental attributed in China. It can be hypothesized that greening the monetary policies in China can also enable the nation to overcome the financial constraints that have upheld renewable energy transition in China.

Lastly, since the economic growth-CO2 emissions nexus is evidenced to depict an N-shape, it indicates that environmental adversities associated with economic growth in China are not likely to be neutralized unless proactive economic growth-enhancing policies are persistently executed in China. It is known that China is overwhelmingly dependent on coal for meeting its energy demand. Hence, it is ideal for China to augment renewable energy into the national mix so that greater volumes of renewable energy are employed for generating the national output.

Due to the unavailability of long data series, the period of analysis considered in this study was confined between 1980 and 2018. Besides, as part of the future research direction, this study can be conducted to simultaneously estimate the effects of both expansionary and contractionary fiscal and monetary policies on China’s CO2 emission levels. Besides, it is also pertinent to check whether fiscal and monetary policies jointly affect CO2 emissions in China. Identifying the possible interactive impacts can be beneficial for formulating relatively more comprehensive environmental welfare-enhancing policies. Moreover, this study can be extended by assessing the impacts of other fiscal and monetary policy instruments on China’s CO2 emission figures. Lastly, it is also relevant to assess the impacts of fiscal and monetary policies using alternative environmental impact indicators.

Data availability

All the data sources are duly referred in the study and can be downloaded free of charge.

Notes

BRICS denotes Brazil, Russia, India, China, and South Africa.

For brevity, the optimal lag selection output is not reported but can be made available upon request.

The identified structural breakpoint locations for the dependent variable lnCO2 are used to compute dummy variables that are included within the regression model.

References

Abbasi KR, Adedoyin FF (2021) Do energy use and economic policy uncertainty affect CO 2 emissions in China? Empirical evidence from the dynamic ARDL simulation approach. Environ Sci Pollut Res 28(18):23323–23335

Abbasi KR, Hussain K, Redulescu M, Ozturk I (2021a) Does natural resources depletion and economic growth achieve the carbon neutrality target of the UK? A way forward towards sustainable development. Resources Policy 74:102341

Abbasi KR, Shahbaz M, Jiao Z, Tufail M (2021b) How energy consumption, industrial growth, urbanization, and CO2 emissions affect economic growth in Pakistan? A novel dynamic ARDL simulations approach. Energy 221:119793

Ahmad M, Jabeen G, Wu Y (2021) Heterogeneity of pollution haven/halo hypothesis and environmental Kuznets curve hypothesis across development levels of Chinese provinces. J Clean Prod 285:124898

Ahmad M, Muslija A, Satrovic E (2021b) Does economic prosperity lead to environmental sustainability in developing economies? Environmental Kuznets curve theory. Environ Sci Pollut Res 28(18):22588–22601

Ahmed Z, Ahmad M, Rjoub H, Kalugina OA, Hussain N (2021a) Economic growth, renewable energy consumption, and ecological footprint: Exploring the role of environmental regulations and democracy in sustainable development. Sustain Dev. https://doi.org/10.1002/sd.2251

Ahmed Z, Cary M, Ali S, Murshed M, Ullah H, Mahmood H (2021b) Moving towards a green revolution in Japan: Symmetric and asymmetric relationships among clean energy technology development investments, economic growth, and CO2 emissions. Energy and Environment. https://doi.org/10.1177/0958305X211041780

Ahmed Z, Cary M, Shahbaz M, Vo XV (2021c) Asymmetric nexus between economic policy uncertainty, renewable energy technology budgets, and environmental sustainability: Evidence from the United States. J Clean Prod 127723

Akram R, Chen F, Khalid F, Ye Z, Majeed MT (2020) Heterogeneous effects of energy efficiency and renewable energy on carbon emissions: evidence from developing countries. J Clean Prod 247:119122

Allard A, Takman J, Uddin GS, Ahmed A (2018) The N-shaped environmental Kuznets curve: an empirical evaluation using a panel quantile regression approach. Environ Sci Pollut Res 25(6):5848–5861

Al-Mulali U, Solarin SA, Ozturk I (2016) Investigating the presence of the environmental Kuznets curve (EKC) hypothesis in Kenya: an autoregressive distributed lag (ARDL) approach. Nat Hazards 80(3):1729–1747

Alola AA, Donve UT (2021) Environmental implication of coal and oil energy utilization in Turkey: is the EKC hypothesis related to energy? Manag Environ Qual 32(3):543–559. https://doi.org/10.1108/MEQ-10-2020-0220

Altıntaş H, Kassouri Y (2020) Is the environmental Kuznets Curve in Europe related to the per-capita ecological footprint or CO2 emissions? Ecol Indic 113:106187

Apergis N (2016) Environmental Kuznets curves: new evidence on both panel and country-level CO2 emissions. Energy Econ 54:263–271

Apergis N, Ozturk I (2015) Testing environmental Kuznets curve hypothesis in Asian countries. Ecol Ind 52:16–22

Apergis N, Christou C, Gupta R (2017) Are there environmental Kuznets curves for US state-level CO2 emissions? Renew Sustain Energy Rev 69:551–558

Aydin C, Esen Ö (2018) Reducing CO2 emissions in the EU member states: do environmental taxes work? J Environ Planning Manage 61(13):2396–2420

Azhgaliyeva D, Kapoor A, Liu Y (2020) Green bonds for financing renewable energy and energy efficiency in South-East Asia: a review of policies. J Sustain Finance Invest 10(2):113–140

Balsalobre-Lorente, D., Driha, O.M., Leitão, N.C., & Murshed, M. (2021). The carbon dioxide neutralizing effect of energy innovation on international tourism in EU-5 countries under the prism of the EKC hypothesis. Journal of Environmental Management, 298(C), 113513. https://doi.org/10.1016/j.jenvman.2021.113513

Barış-Tüzemen Ö, Tüzemen S, Çelik AK (2020) Does an N-shaped association exist between pollution and ICT in Turkey? ARDL and quantile regression approaches. Environ Sci Pollut Res 27(17):20786–20799

BBC News. (2021). Report: China emissions exceed all developed nations combined. Available at https://www.bbc.com/news/world-asia-57018837

Bekun, F. V., Gyamfi, B. A., Onifade, S. T., & Agboola, M. O. (2021). Beyond the environmental Kuznets Curve in E7 economies: accounting for the combined impacts of institutional quality and renewables. Journal of Cleaner Production, 127924.

Bhowmik R, Syed QR, Apergis N, Alola AA, Gai Z (2021) Applying a dynamic ARDL approach to the Environmental Phillips Curve (EPC) hypothesis amid monetary, fiscal, and trade policy uncertainty in the USA. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-16716-y

Chan YT (2020) Are macroeconomic policies better in curbing air pollution than environmental policies? A DSGE approach with carbon-dependent fiscal and monetary policies. Energy Policy 141(February):111454. https://doi.org/10.1016/j.enpol.2020.111454

Chen Y, Wang Z, Zhong Z (2019) CO2 emissions, economic growth, renewable and non-renewable energy production and foreign trade in China. Renewable Energy 131:208–216

Chishti MZ, Ahmad M, Rehman A, Khan MK (2021) Mitigations pathways towards sustainable development: assessing the influence of fiscal and monetary policies on carbon emissions in BRICS economies. J Clean Prod 292(January):126035. https://doi.org/10.1016/j.jclepro.2021.126035

Danish Z, B., Wang, B., & Wang, Z. (2017) Role of renewable energy and non-renewable energy consumption on EKC: evidence from Pakistan. J Clean Prod 156:855–864

Dogan E, Ozturk I (2017) The influence of renewable and non-renewable energy consumption and real income on CO2 emissions in the USA: evidence from structural break tests. Environ Sci Pollut Res 24(11):10846–10854

Dong K, Sun R, Dong X (2018) CO2 emissions, natural gas and renewables, economic growth: assessing the evidence from China. Sci Total Environ 640:293–302

Dong K, Sun R, Hochman G, Zeng X, Li H, Jiang H (2017) Impact of natural gas consumption on CO2 emissions: panel data evidence from China’s provinces. J Clean Prod 162:400–410

Gaspar, V., Mauro, P., Parry, I., & Pattillo, C. (2019). Fiscal policies to curb climate change. Available at https://blogs.imf.org/2019/10/10/fiscal-policies-to-curb-climate-change/

Girardin, E., Lunven, S., & Ma, G. (2017). China’s evolving monetary policy rule: from inflation-accommodating to anti-inflation policy (No. 641). Bank for International Settlements. Available at https://www.bis.org/publ/work641.pdf

Halkos G, Paizanos E (2015) Fiscal policy and economic performance: a review of the theoretical and empirical literature. Munich Personal RePEc Archive Fiscal 67737:1–36. https://doi.org/10.6000/1929-7092.2016.05.01

Halliru, A. M., Loganathan, N., Hassan, A. A. G., Mardani, A., & Kamyab, H. (2020). Re-examining the environmental Kuznets curve hypothesis in the Economic Community of West African States: a panel quantile regression approach. Journal of Cleaner Production, 276, 124247.

Hamid I, Alam MS, Murshed M, Jena PK, Sha N, Alam MN (2021) The importance of facilitating foreign direct investments, economic growth, and capital investments for decarbonizing the economy of Oman. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-17246-3

Hao Y, Zheng S, Zhao M, Wu H, Guo Y, Li Y (2020) Reexamining the relationships among urbanization, industrial structure, and environmental pollution in China—new evidence using the dynamic threshold panel model. Energy Rep 6:28–39. https://doi.org/10.1016/j.egyr.2019.11.029

Hashmi R, Alam K (2019) Dynamic relationship among environmental regulation, innovation, CO2 emissions, population, and economic growth in OECD countries: a panel investigation. J Clean Prod 231:1100–1109

He L, Liu R, Zhong Z, Wang D, Xia Y (2019) Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renewable Energy 143:974–984

Ike GN, Usman O, Sarkodie SA (2020) Testing the role of oil production in the environmental Kuznets curve of oil producing countries: new insights from Method of Moments Quantile Regression. Sci Total Environ 711:135208. https://doi.org/10.1016/j.scitotenv.2019.135208

Işık C, Ongan S, Özdemir D (2019) Testing the EKC hypothesis for ten US states: an application of heterogeneous panel estimation method. Environ Sci Pollut Res 26(11):10846–10853

Jalil A, Feridun M (2011) The impact of growth, energy and financial development on the environment in China: a cointegration analysis. Energy Econ 33(2):284–291

Jalil A, Mahmud SF (2009) Environment Kuznets curve for CO2 emissions: a cointegration analysis for China. Energy Policy 37(12):5167–5172

Jiahua, P. A. N. (2021). Lowering the carbon emissions peak and accelerating the transition towards net zero carbon. Chinese Journal of Urban and Environmental Studies, 2150013.

Johansen S (1988) Statistical analysis of cointegration vectors. J Econ Dyn Control 12(2–3):231–254. https://doi.org/10.1016/0165-1889(88)90041-3

Katircioglu S, Katircioglu S (2018) Testing the role of fiscal policy in the environmental degradation: the case of Turkey. Environ Sci Pollut Res 25(6):5616–5630

Khan, Z., Hussain, M., Shahbaz, M., Yang, S., & Jiao, Z. (2020). Natural resource abundance, technological innovation, and human capital nexus with financial development: a case study of China. Resources Policy, 65(November 2019), 101585. https://doi.org/10.1016/j.resourpol.2020.101585

Khan Z, Murshed M, Dong K, Yang S (2021) The roles of export diversification and composite country risks in carbon emissions abatement: evidence from the signatories of the Regional Comprehensive Economic Partnership agreement. Appl Econ. https://doi.org/10.1080/00036846.2021.1907289

Kim J, Wang M, Park D, Petalcorin CC (2021) Fiscal policy and economic growth: some evidence from China. Rev World Econ 157:555–582. https://doi.org/10.1007/s10290-021-00414-5

Koc S, Bulus GC (2020) Testing validity of the EKC hypothesis in South Korea: role of renewable energy and trade openness. Environ Sci Pollut Res 27(23):29043–29054

Le HP, Ozturk I (2020) The impacts of globalization, financial development, government expenditures, and institutional quality on CO2 emissions in the presence of environmental Kuznets curve. Environ Sci Pollut Res 27(18):22680–22697. https://doi.org/10.1007/s11356-020-08812-2

Li ZZ, Li RYM, Malik MY, Murshed M, Khan Z, Umar M (2021) Determinants of carbon emission in China: how good is green investment? Sustainable Production and Consumption 27:392–401. https://doi.org/10.1016/j.spc.2020.11.008

Liu J, Murshed M, Chen F, Shahbaz M, Kirikkaleli D, Khan Z (2021) An empirical analysis of the household consumption-induced carbon emissions in China. Sustainable Production and Consumption 26:943–957. https://doi.org/10.1016/j.spc.2021.01.006

Ma, Q., Murshed, M., & Khan, Z. (2021). The nexuses between energy investments, technological innovations, R&D expenditure, emission taxes, tertiary sector development, and carbon emissions in China: a roadmap to achieving carbon-neutrality. Energy Policy, 155, 112345.

Mardones C, Flores B (2018) Effectiveness of a CO2 tax on industrial emissions. Energy Economics 71:370–382

Mughal N, Kashif M, Arif A, Guerrero JWG, Nabua WC, Niedbała G (2021) Dynamic effects of fiscal and monetary policy instruments on environmental pollution in ASEAN. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-15114-8

Murshed M, Alam MS (2021) An estimation of the macroeconomic determinants total, renewable and non-renewable energy demands in Bangladesh: the role of technological innovations. Environ Sci Pollut Res 28:30176–30196. https://doi.org/10.1007/s11356-021-12516-6

Murshed M, Dao NTT (2020) Revisiting the CO2 emission-induced EKC hypothesis in South Asia: the role of Export Quality Improvement. GeoJournal. https://doi.org/10.1007/s10708-020-10270-9

Murshed, M. (2021). Can regional trade integration facilitate renewable energy transition to ensure energy sustainability in South Asia? Energy Reports, 7(C), 808–821. https://doi.org/10.1016/j.egyr.2021.01.038

Murshed M, Chadni MH, Ferdaus J (2020) Does ICT trade facilitate renewable energy transition and environmental sustainability? Evidence from Bangladesh, India, Pakistan, Sri Lanka, Nepal and Maldives. Energy, Ecology and Environment 5(6):470–495

Murshed M, Rashid S, Ulucak R, Dagar V, Rehman A, Alvarado R, Nathaniel SP (2021) Mitigating energy production-based carbon dioxide emissions in Argentina: the roles of renewable energy and economic globalization. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-16867-y

Nathaniel, S.P., Alam, M.S., Murshed, M., Mahmood, H., and Ahmad, P. (2021). The roles of nuclear energy, renewable energy, and economic growth in the abatement of carbon dioxide emissions in the G7 countries. Environmental Science and Pollution Research, 28, 47957–47972. https://doi.org.https://doi.org/10.1007/s11356-021-13728-6

Neves SA, Marques AC, Patrício M (2020) Determinants of CO2 emissions in European Union countries: does environmental regulation reduce environmental pollution? Economic Analysis and Policy 68:114–125

Ozturk I, Majeed MT, Khan S (2021) Decoupling and decomposition analysis of environmental impact from economic growth: a comparative analysis of Pakistan, India, and China. Environ Ecol Stat. https://doi.org/10.1007/s10651-021-00495-3

Paramati SR, Alam MS, Apergis N (2018) The role of stock markets on environmental degradation: a comparative study of developed and emerging market economies across the globe. Emerg Mark Rev 35:19–30

Pata, U. K., & Caglar, A. E. (2021). Investigating the EKC hypothesis with renewable energy consumption, human capital, globalization and trade openness for China: evidence from augmented ARDL approach with a structural break. Energy, 216, 119220.

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to analysis of long run relationships. J Appl Economet 16(3):289–326

Qingquan J, Khattak SI, Ahmad M, Lin P (2021) Mitigation pathways to sustainable production and consumption: examining the impact of commercial policy on carbon dioxide emissions in Australia. Sustainable Production and Consumption 25:390–403

Qingquan J, Khattak SI, Ahmad M, Ping L (2020) A new approach to environmental sustainability: assessing the impact of monetary policy on CO2 emissions in Asian economies. Sustain Dev 28(5):1331–1346

Rauf A, Liu X, Amin W, Ozturk I, Rehman OU, Hafeez M (2018) Testing EKC hypothesis with energy and sustainable development challenges: a fresh evidence from belt and road initiative economies. Environ Sci Pollut Res 25(32):32066–32080

Rehman A, Ulucak R, Murshed M, Ma H, Isik C (2021) Carbonization and atmospheric pollution in China: the asymmetric impacts of forests, livestock production, and economic progress on CO2 emissions. J Environ Manage 294:113059. https://doi.org/10.1016/j.jenvman.2021.113059

Salahuddin M, Alam K, Ozturk I, Sohag K (2018) The effects of electricity consumption, economic growth, financial development and foreign direct investment on CO2 emissions in Kuwait. Renew Sustain Energy Rev 81:2002–2010

Satrovic, E., Ahmad, M., & Muslija, A. (2021). Does democracy improve environmental quality of GCC region? Analysis robust to cross-section dependence and slope heterogeneity. Environmental Science and Pollution Research. https://doi.org/10.1007/s11356-021-15020-z

Schoenmaker D (2021) Greening monetary policy. Climate Policy 21(4):581–592

Shahbaz M, Khan S, Ali A, Bhattacharya M (2017) The impact of globalization on CO2 emissions in China. The Singapore Economic Review 62(04):929–957

WY Shum N Ma X Lin T Han 2021 The major driving factors of carbon emissions in china and their relative importance: an application of the LASSO Model Front Energy Res 435 https://doi.org/10.3389/fenrg.2021.726127

Ullah S, Ozturk I, Sohail S (2021) The asymmetric effects of fiscal and monetary policy instruments on Pakistan’s environmental pollution. Environ Sci Pollut Res 28(6):7450–7461. https://doi.org/10.1007/s11356-020-11093-4

Ulucak R, Kassouri Y (2020) An assessment of the environmental sustainability corridor: investigating the non-linear effects of environmental taxation on CO2 emissions. Sustain Dev 28(4):1010–1018

Verbič M, Satrovic E, Muslija A (2021) Environmental Kuznets curve in Southeastern Europe: the role of urbanization and energy consumption. Environ Sci Pollut Res 28:57807–57817. https://doi.org/10.1007/s11356-021-14732-6

Vo XV, Zaman K (2020) Relationship between energy demand, financial development, and carbon emissions in a panel of 101 countries: “go the extra mile” for sustainable development. Environ Sci Pollut Res 27(18):23356–23363

Wang Q, Zhang F (2020) Does increasing investment in research and development promote economic growth decoupling from carbon emission growth? An empirical analysis of BRICS countries. J Clean Prod 252:119853. https://doi.org/10.1016/j.jclepro.2019.119853

Wang Q, Zhang F (2021) The effects of trade openness on decoupling carbon emissions from economic growth — evidence from 182 countries. J Clean Prod 279:123838. https://doi.org/10.1016/j.jclepro.2020.123838

Wang Q, Jiang R (2019) Is China’s economic growth decoupled from carbon emissions? J Clean Prod 225:1194–1208

Wang Q, Wang S (2022) Carbon emission and economic output of China’s marine fishery – A decoupling efforts analysis. Mar Policy 135:104831

Wang Q, Guo J, Li R (2021) Official development assistance and carbon emissions of recipient countries: a dynamic panel threshold analysis for low-income countries and lower-middle-income countries. Sustain Prod Consumpt. https://doi.org/10.1016/j.spc.2021.09.015

Wang Q, Wang X, Li R (2022) Does urbanization redefine the environmental Kuznets curve? An empirical analysis of 134 Countries. Sustain Cities Soc 76:103382. https://doi.org/10.1016/j.scs.2021.103382

Wang Y, Zhi Q (2016) The role of green finance in environmental protection: two aspects of market mechanism and policies. Energy Procedia 104:311–316

World Bank. (2021). World Development Indicators. Available at https://data.worldbank.org/country/china (Accessed on 30.6.2021)

V Yilanci UK Pata 2021 On the interaction between fiscal policy and CO2 emissions in G7 countries: 1875–2016 J Environ Econ Policy https://doi.org/10.1080/21606544.2021.1950575

Yuelan P, Akbar MW, Hafeez M, Ahmad M, Zia Z, Ullah S (2019) The nexus of fiscal policy instruments and environmental degradation in China. Environ Sci Pollut Res 26(28):28919–28932. https://doi.org/10.1007/s11356-019-06071-4

Yuping L, Ramzan M, Xincheng L, Murshed M, Awosusi AA, BAH, S.I., & Adebayo, T.S. (2021) Determinants of Carbon Emissions in Argentina: the roles of renewable energy consumption and globalization. Energy Rep 7:4747–4760. https://doi.org/10.1016/j.egyr.2021.07.065

Zafeiriou, E., Mallidis, I., Galanopoulos, K., & Arabatzis, G. (2018). Greenhouse gas emissions and economic performance in EU agriculture: an empirical study in a non-linear framework. Sustainability (Switzerland), 10(11). https://doi.org/10.3390/su10113837

Zhang D, Mohsin M, Rasheed AK, Chang Y, Taghizadeh-Hesary F (2021) Public spending and green economic growth in BRI region: mediating role of green finance. Energy Policy 153:112256

Zivot E, Andrews DWK (1992) Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J Bus Econ Stat 10(3):251–270. https://doi.org/10.1080/07350015.1992.10509904

Funding

This research work is funded by ILMA University under the ILMA Research Publication Grant.

Author information

Authors and Affiliations

Contributions

AZ: Conceptualization; methodology; software; writing and original formal analysis; data curation. ZA: Writing original manuscript; writing reviewing and editing. KS: Draft preparation; writing review and editing; visualization. MM: Writing original manuscript; literature review; writing reviewing and editing. SPN: writing, reviewing and editing. HM: Writing literature review, analysis, and conclusion.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zeraibi, A., Ahmed, Z., Shehzad, K. et al. Revisiting the EKC hypothesis by assessing the complementarities between fiscal, monetary, and environmental development policies in China. Environ Sci Pollut Res 29, 23545–23560 (2022). https://doi.org/10.1007/s11356-021-17288-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-17288-7