Abstract

Maintaining a balance between environmental quality and economic growth is now one of the common goals of fiscal and monetary policies in developed and developing economies. This study examines the asymmetric impacts of fiscal and monetary policy instruments on environmental pollution in Pakistan over the period 1985–2019 by employing the asymmetric or nonlinear autoregressive distributed lag (NARDL) framework. The outcomes indicate that in Pakistan, a positive and negative shock in fiscal policy instruments has a significant increasing influence on carbon emissions in the short run, while a positive and negative shock in fiscal policy instruments has a significant decreasing impact on environmental pollution in long run. However, negative and positive shock in monetary policy instruments enhances carbon emissions in short-run, whereas positive shock in monetary policy instruments decreases carbon emissions in the long run. Therefore, the policymakers may consider the usage of fiscal and monetary policy instruments to maintain economic growth along with lowering the environmental pollution.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

At present-day, environmental quality and economic growth are the two key challenges faced by developing economies. In the context of economic growth, one of the core issues that stand up is environmental degradation in developing economies. Therefore, ecological sustainability requires combined efforts of monetary and fiscal policies towards aggravating and adaptation strategies. The important question is how central banks can boost the balance between economic growth and environmental sustainability. The several purposes of the central bank—including monetary and financial stability—essentially involve mobilizing, managing, and allocating resources in a manner that seeks balance; hence, central banks contribute to fighting against climate change in various countries. The fiscal policy is also on the way in environmental quality in many top carbon emitters economies, e.g., China, USA, and India in environmental quality. Therefore, as a matter of fact, twin policies are also important in environments in developing economies, especially Pakistan.

In literature, fiscal policy is a key element of the demand side of the economy through government expenditure, revenue, and taxation in worldwide (Halkos and Paizanos 2013). On the other side, fiscal policy instruments, government expenditures, and taxes are directly and indirectly connected with economic size, agricultural, industrial, and service output level, aggregate energy consumption, and environmental quality respectively. Fiscal policy instruments have various dimensions to affect the environment. The fiscal deficit of any economy enhances the gross capital formation and accumulation, business activities, and energy consumption demand level (Dongyan 2009; Balcilar et al. 2016). Consequently, the fiscal policy instrument of tax can expand the efficiency of energy, and tax incentives have also a positive significant influence on environmental quality (Dongyan 2009; Balcilar et al. 2016; and Liu et al. 2017). Fiscal policy can accelerate the government incomes by imposing carbon-taxes on the industrial, transportation, and energy sector (Rausch 2013). While Halkos and Paizanos (2016) for the USA and Yuelan et al. (2019) for China find that fiscal instruments have a significant effect on carbon emissions.

It is notable to reveal the procedures through which fiscal policy instruments disturb the environmental quality. For instance, fiscal spending hurts the environmental quality by differing the cause of pollution, i.e., whether environmental pollution is consumption or production produced (McAusland 2008). For production-generated environmental pollution, Lopez et al. (2011) distinguish the various instruments through which the level of government spending may influence environmental quality. Considering government expenditure-generated environmental pollution, fiscal spending on education and health sectors increases consumer’s current as well as the future level of income and may, in turn, enhances environmental quality, establishing the income effects. On the contrary, greater levels of government consumption lead the formation, administration, and environmental controls efficiency which in turn may also increase the institution's stability that enhances environmental quality. This implies that government expenditure has a significant positive impact on environmental pollution.

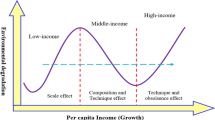

Few important ways of fiscal policy tools are specified as composition effect, income effect, and technique effect, respectively. For instance, first, the income effect is closely linked with government expenditure; hence, a higher level of income enhances the demand for better-quality environments; second, composition effect: government spending increased the human capital related economic activities which are less harmful to the environment than physical capital. Third, technique effect: this channel is also diminished environmental pollution by better labor efficiency that is linked with greater levels of government spending on the education and health sectors (Lopez et al. 2011). Similarly, Halkos and Paizanos (2013) differentiate the direct and indirect impacts of government spending on carbon emissions. Government spending both ways is used directly as well as indirectly to reduces sulfur emissions, while the effect of government spending has inconclusive on carbon emissions. Adewuyi (2016) found direct and indirect negative outcomes among government expenditure and carbon emissions.

In contrast, Halkos and Paizanos (2016) give attention to the USA economy by using the annual data from 1973 to 2013. They showed that a greater fiscal policy instrument (government spending) reduce carbon emissions that get up from the production and consumption side. A similar finding is shown by Katircioglu and Katircioglu (2018), who noted that Turkish government expenditure has a negative significant influence on pollution emissions in the long run. In line, Lopez and Palacios (2010) note that government expenditure has a negative link with pollution emissions because the European government spending more on the public transport sector compared with the private sector which is energy efficient and less pollutant thus reduces air pollution.

Additionally, the research related to finance and inflation stability has revealed that monetary policies may not only directly affect economic growth but also indirectly affects environmental quality through fossil fuel consumption (Jalil and Feridun 2011). With a contractionary monetary policy, consumers and producers alleviate environmental pollution by dropping aggregate demand. Therefore, Chan (2020) revealed that a higher discount rate set by the state bank inspires consumers to consume less and save more while producers are also investing small in the current period. However, in turn, consumption and investment fall with lowering the aggregate demand for goods and services. As a result, carbon emissions decline. They further show that monetary policy stabilizes the carbon emissions level in an economy, but not fiscal policy. Annicchiarico and Di Dio (2017) embodied the New Keynesian pollutant emissions model; in this sense, they revealed in the model that monetary policy is not neutral in environmental pollution emissions. The optimal response of the monetary policy to environmental pollution is high countercyclical. Inflation is always a monetary dilemma, in the long run; therefore, inflation instability is also impeding environmental pollution. While monetary policy shock creates an increase in the discount rate, which in turn, depresses aggregate demand and so aggressively environmental quality achieved. In this respect, Annicchiarico and Di Dio (2017) also explored that stickiness in prices, the central bank plays a main part in determining the effects of environmental quality. Recently, the central bank has been more interested in greening financing; therefore, Chen and Pan (2020) build an environmental dynamic stochastic general equilibrium (E-DSGE) model with the consideration of monetary policy and carbon emissions. According to the model, the dynamic of monetary policy is significantly influenced by climate and environmental regulation.

Pakistan's economy has suffered in history from internal political clashes in many times. Therefore, large dynamics are also captured in macroeconomics policies in terms of fiscal and monetary policies. According to the World Bank (2019), fiscal policy instrument, for instances, government expenditure (% GDP) was the highest in Pakistan at (11.71%) in 2018, followed by Bangladesh (6.35%), Nepal (11.68%), India (11.22%), and Sri Lanka (8.99%), and top two emitters has been (14.67%) in China, (14.13%) in the USA. Similarly, the monetary policy instrument discount rate was the highest in Pakistan in double-digit (13.75%) in South Asia in 2019, followed by Bangladesh (5.00%), Nepal (3.75%), India (6.25%), and Sri Lanka (6.00%) and top two emitters have been (2.90%) in China and (2.50%) in the USA (IMF 2019). These economies are correcting environmental pollution by using macroeconomic policies. While Pakistan’s fiscal expenditure rose to 8.64% in 2000 to 11.71% in 2018 which rose its fiscal deficit by 10% in 2017. To overwhelm the environmental pollution problem, the Pakistan administration along with academics is struggling to decrease carbon emission by increasing green production by concentration on macroeconomic policies (Ullah et al. 2020). Following developing economies, for instance, BRICS countries, Brazil, Indonesia, China, Nigeria, South Africa, and Bangladesh, have been started green banking that facilitates funding of clean-energy projects and therefore contributes to environmental quality (D’Souza and Rana 2020).

Many policymakers and academia’s studies have assumed that fiscal and monetary policy changes have a symmetric impact on environmental quality (Lopez et al. 2011; Halkos and Paizanos 2016; Katircioglu and Katircioglu 2018; Yuelan et al. 2019; Chan 2020), but, in indeed, fiscal and monetary instrument variables behave to be asymmetric manner. However, the asymmetric ARDL method can produce more detailed and reliable findings as compared with symmetric ARDL.

To the best of our knowledge, this is the leading study in the context of Pakistan, which attempts to examine the nexus among selected variables in one scope at the country-level, employing the time-series data. Although there is no other study that inspects the asymmetric effect of fiscal and monetary policy instruments on environments, this study fills the gaps by examining the asymmetric relationship between fiscal and monetary policy instruments and environmental pollution. To determine the gap and answer, this study explains the asymmetric influence of fiscal and monetary policy instruments, government expenditures, and monetary policy rate, on environmental quality for the Pakistan economy.

The remaining study is organized as follows. “Model, methodology, and data” presented the model, methodology, and data. “Results and discussion” describes the results and discussion of fiscal and monetary policy instruments on environmental quality. “Conclusion and policy implications” concludes the studies with some policy implications.

Model, methodology, and data

The study desires to include and examine the effect of fiscal and monetary policy instruments on environmental quality for Pakistan’s. The usage of fiscal and monetary policy is to create clean environments in various stages of the business cycle. To maintain environmental quality, fiscal policy instruments is a notable aspect of environmental quality (Lopez et al. 2011; Yuelan et al. 2019; Ullah et al. 2020). Another aspect is monetary policy instruments that are a unique feature to correct the environment (Chan 2020). To exam the proposition that fiscal and monetary have asymmetrical impacts on environments at Pakistan, we embrace the specification of Chan (2020) and Ullah et al. (2020); therefore, the model is

The model is quantified from the Pakistan environmental outlook; meaning CO2, t is defined as carbon dioxide emissions (Kilotons). The determinants of environmental pollution are given as Gexpt in denoted by government expenditure (% GDP); Dratet in denoted by the discount rate, which defines as the central bank discount rate is the rate that is used by the central bank to implement its monetary policy stance that is charged in percent per annum, and the GDP growth rate symbolized by EGt. We suppose the coefficient of φ1 to be a positive sign and that of φ2 to be a negative sign. Equation (1) gives us long-run estimates of the ARDL model of the exogenous variables on Pakistan's air pollution. In order to suppose short-run effects, in particular with respect to the fiscal and monetary instruments, we postulate Eq. (2) in an error-correction set-up. The error correction term infers how rapidly the variables converge to equilibrium and should be negative and significant. The error correction model of Eq. (2) is denoted as follow:

Pesaran et al. (2001) recommend the standard F statistics to test the null hypothesis H0: η1 = η2 = η3 = η4 = 0 against the alternative of H1: η1 ≠ 0, η2 ≠ 0, η3 ≠ 0, and η4 ≠ 0. If the considered F statistic is statistically significant, this implies that variables are supposed to be cointegrated, which they tabulate new critical values in the context of small samples. Once our cointegration is determined, the error-correction component in Eq. (2) is set equal to be zero and the long-run impacts are originated by normalizing estimate of coefficients η2–η4 on η1. The short-run estimates are arbitrated on the based of first-differenced variables. Under the ARDL method, dependent and independent indicators could be a mixture of I(0) and I(1).

A major supposition behind Eq. (2) is that a shock in any of the fiscal and monetary instruments variables has symmetric or linear effects on the environmental pollution in Pakistan. For the fiscal and monetary instruments, this assumption infers that if positive shock enhances environmental pollution, the negative shock must deteriorate it. Possibly, however, fiscal and monetary instruments may react in a different way to positive shocks versus negative shocks, and thus, fiscal and monetary instruments changes could have asymmetric or nonlinear impacts on the environments. Therefore, partial sum processes of negative and positive changes in the fiscal and monetary instruments variables are introduced in the analysis. More precisely,

Shin et al. (2014) propose replacing the positive shocks (Gexp+t , Drate+t) and negative shocks (Gexp−t, Drate−t) variables in the error-correction model of Eq. (2). The result is the asymmetric ARDL model given by as Eq. (7):

Since assembling partial sum (positive and negative) variables announce into Eq. (7), such models are normally stated as the asymmetric/nonlinear ARDL model while the previous model (2) is devoted to as a symmetric/linear ARDL model. However, in addition to forming asymmetry cointegration, a few extra hypotheses could be tested. First, if ∆Gexp+t − i (∆Drate+t − i) and ∆Gexp−t − i( ∆Drate−t − i) accept dissimilar lag orders in either model, which will be a symbol of short-run dynamic asymmetry. Second, if at the same lag (i) the coefficient estimate devoted ∆Gexp+t − i( ∆Drate+t − i) is different than the two devoted to ∆Gexp−t − i( ∆Drate−t − i), which will show short-run asymmetric effects. Third, strong short-run asymmetric impacts will be recognized if we nullified the proposition of ∑ϕi ≠ ∑ψi and ∑δi ≠ ∑ρi in the nonlinear ARDL equation (7) by the Wald test. Finally, if the Wald test nullified \( \raisebox{1ex}{${\eta_2}^{+}$}\!\left/ \!\raisebox{-1ex}{${\eta}_1$}\right. \) ≠ \( \raisebox{1ex}{${\eta_3}^{-}$}\!\left/ \!\raisebox{-1ex}{${\eta}_1$}\right.\ \mathrm{and}\kern0.5em \raisebox{1ex}{${\eta_4}^{+}$}\!\left/ \!\raisebox{-1ex}{${\eta}_1$}\right. \) ≠ \( \raisebox{1ex}{${\eta_5}^{-}$}\!\left/ \!\raisebox{-1ex}{${\eta}_1$}\right. \)in Eq. (7), the long-run asymmetric effects of fiscal and monetary instruments on environmental pollution will be established. Both the symmetric/linear equation (2) and asymmetric/nonlinear model equation (7) are approached in the next section.

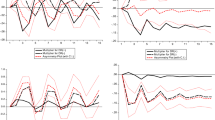

The aspect of under-considered dependent, independent, control variables is offered in Table 1. The choice of variables is based on previous literature (Yuelan et al. 2019; Chan 2020). The dataset is retrieved for Pakistan from World Bank and IMF from 1985 to 2019. The dataset of CO2, Gexp, and EG extracted from World Development Indicator (WDI), while Drate data taken from the IMF. The mean of CO2, Gexp, Drate, and EG are 117,047.6 kt, 11.26%, 11.36%, and 4.532%, respectively, although the standard deviation (S.D) are 42,593.1 kt, 2.13%, 3.41%, and 1.862%, respectively. While, the trend of the Pakistan macroeconomic variables is also shown in Fig. 1.

Results and discussion

n the result section, we estimate both the symmetric or linear model (2) and the asymmetric or nonlinear model (7) for Pakistan using annual data over the period 1985–2019. ARDL methodology confirmed first by using the unit root test statistics are described in Table 2. We have started with an augmented Dickey–Fuller (ADF) unit root test to scrutinize the order of the variables of integration. The outcomes show that CO2, Drate, and EG are integrated at I(0), while Drate has unit root problem at I(0) but stationary at I(1). Similar results have been found in Phillips–Perron (PP) unit root tests. ARDL methodology fulfills the combination of I(0) and I(1), but not I(2), hence we follow this approach. However, in Table 3, Zivot-Andrews unit root test revealed that CO2, Gexp, and Drate are stationary at the I(1), while EG is stationary at the I(0). We impose a maximum of four lags in each model and use Akaike’s Information Criterion to select an optimum model.

The 10%, 5%, and 1% critical values are − 4.58, − 4.93, and − 5.34

Table 4 provides the short-run and long-run basic estimates of linear and nonlinear ARDL model specification. The coefficient of government consumption (ΔGexpt) is significantly negative at a 5% level in the short-run which suggests that government consumption decreases carbon emissions in the short run. However, in the NARDL model, the positive and negative shock of government consumption (ΔGexpt) has a significantly negative impact on carbon emissions with the elasticity of − 0.006 and − 0.009. Similarly, in the short-run, the discount rate (ΔDratet) exert no significant impact on carbon emissions. However, in the NARDL model, the negative shock of the discount rate (ΔDratet) has a significantly positive impact on carbon emissions with elasticity of 0.005, while the positive form of the discount rate (ΔDratet) has no impact on carbon emissions. The rest of the variables are statistically insignificant in the short-run ARDL and NARDL estimation for carbon emissions. On the other hand, in the long run, government consumption (ΔGexpt) has a statistically negative significant impact on carbon emission at a 5% level, while the negative shock of government consumption (ΔGexpt) coefficients have a negative influence on carbon emission. Moreover, the discount rate (ΔDratet) have no influence on CO2 emission in the long run in ARDL model, while similar estimates have found in positive and negative shock of discount rate (ΔDratet) in NARDL model. While EG coefficients suggest that there is a positive and statistically significant relationship that exists between economic growth and environmental pollution in only ARDL models.

The third and lowest panel of Table 4 provides the outcomes of several diagnostic tests. The numerical coefficients of the Lagrange multiplier (LM) and Ramsey RESET test are statistically insignificant in all models which supporting autocorrelation-free residuals and appropriate model forms. While all estimated models are stable in linear and nonlinear ARDL estimates, models are reliable and efficient. While our adjusted R2 infers that the symmetric and asymmetric models have a good fit. The Wald statics are employing for computing the symmetry of negative and positive shock of fiscal and monetary policy instruments on environmental pollution in the short-term and long-term, these outcomes revealed that asymmetric effects are favorable.

To check the robustness of our analysis, Table 5 organizes the symmetric and asymmetric estimates for the environmental pollution models by using the combined fiscal and monetary policy instruments and we compare the results with baseline formulation. The short-run estimates of symmetric ARDL, government consumption (ΔGexpt) is statistically negative significant at 5% level, suggests that a 1% improvement in government expenditure has decreased environmental pollution by 1521 kt. The impact of the discount rate (ΔDrate) is significant at 5% level in the short run; this suggests that 1% increase in the discount rate has increased the 702 kt carbon emissions. While, all other estimates of short-run ARDL are insignificant.

In this study, we also want to examine whether the response of symmetric short-run lasts into the long-term? Therefore, short-run government expenditure result is maintained in long-run; this implies that 1% increase in government spending has decreased carbon emissions by approximately 14,162 kt in the long run. This effect is comparatively larger in the long run. The general meaning of the finding is that fiscal policies are an effective instrument for environmental quality in way of climate change in Pakistan. The results also imply that improvements in government expenditure improve economic activities, capital accumulation, and energy consumption levels within the economy, hence increase the environmental pollution in developing countries. While, our result is favorable in Pakistan because tax policies are correcting the environmental quality in response. The results also show that Pakistan’s fiscal expenditure on education and health may lead to environmental quality, establishing the income channel, which is less dangerous to the environment compared with physical capital activities. Our outcome infers that government consumption expenditures on education and health sector are 2.3% and 1.1% of GDP in 2018–2019 that is non-productive and negatively contributes to environmental pollution, while the development expenditure is also 9.96% of GDP that is most productive and therefore contribute to environmental pollution. The fiscal policy instrument prioritizes the air quality as a result of motivating forest areas, green economic growth by consuming more of clean and green energy sources with low carbon emissions. Thus, it means that the government provides environmental protection through fiscal policies instrument in Pakistan. However, the estimate of the discount rate is statistically insignificant in the long-term. The long-run coefficient shows that a 1% upsurge in economic growth has increased carbon emissions by approximately 7959 kt

Table 5 of Panel C provides the diagnostic statistics of the symmetric ARDL model. The results indicate that the F statistic is significant; this implies that long-run cointegration exists among carbon emissions, fiscal and monetary policy instruments, and economic growth in Pakistan. The estimate for ECMt − 1 is negative statistically significant at 5% level. The coefficient − 0.178 infers that almost 17% disequilibrium in carbon emissions is changed to long-run equilibrium within a year. The symmetric ARDL results are satisfied because the diagnostic tests of LM and RESET do not have any serial correlation and misspecification problems.

Turning to the asymmetric impacts of fiscal and monetary policy instruments on carbon emissions in Pakistan, the results infer that positive and negative changes in government expenditure and discount rate effect on carbon emissions differently. The short-run coefficient estimate of the positive shocks in government expenditure is negative statistical significant at 10% level. This means that a 1% positive shock in government spending increase carbon emissions in Pakistan by approximately 2106 kt in the short run. This result deviates in asymmetric ARDL from symmetric ARDL. On the other hand, a 1% negative shock in government spending declines carbon emissions by approximately 3862 kt in the short run, while this impact is different from positive shock. The short-run estimate of positive shocks in the discount rate is statistically significant at 10% with a positive sign. The estimates show that a 1% positive shock in the discount rate enhances carbon emissions in Pakistan by approximately 585 in the short run. While short-run estimate for negative shocks in the discount rate is statistically positive significant at 5% on carbon emissions and enhances carbon emissions by 2223 kt. The estimate of economic growth is statistically significant in the current period. The estimate infers that a 1% upsurge in economic growth boosts carbon emissions by 819 kt in the short run.

Do these asymmetric or nonlinear short-term responses last into the long-term? However, a 1% upsurge in positive shock in government spending declines carbon emissions by approximately 13,226 kt in the long run, and this effect is estimated to be statistically significant at 10% level. This finding is also in line with (Lopez et al. 2011), who noted that government expenditure on public goods may also discourage carbon pollution that could be pro-environment. The negative shock of government expenditure is a negative significant effect on carbon pollution at 5% level in the long term. This suggests that a 1% upsurge in negative shock in government expenditure decrease carbon emissions by 14,162 kt in the long run. This result is also reliable with (Chan 2020), who suggest that contractionary fiscal policy decline demand of final good by decreasing government and household consumption, which also eventually reduces carbon emissions, respectively. The asymmetric result of the fiscal policy instrument is also the same as symmetric; this also implies that negative and positive shock effects of government expenditure have the same direction but minor differences in magnitude. This suggests that economic implication is also remaining the same in this context. The results also conclude that the negative shock of government expenditure has also more influence on environmental quality compared with the positive shock of government expenditure. It can be reasoned in this study that fiscal policies in Pakistan are environmentally fruitful.

Similarly, the positive shock of the discount rate is a negative significant impact on carbon emissions at 10% level in the long run. This infers that a 1% increase in positive shock in discount rate fall carbon emissions by 1755 kilotons in the long run. This finding is reliable with Chan (2020), who noted that the monetary policy positive shock could decrease the carbon emissions; in contrast, a monetary policy negative shock could increase carbon emissions and hardly achieve the environmental quality target. This outcome suggests that monetary policy can affect environments in two ways; first is the demand side and second relates to the supply-side. While the demand side is relatively better than the supply side to the perspective of climate change.

The possible reason is the expected and unexpected increase in the discount rate is to decrease the household’s consumption and investment level, leading to falls in economic activities as well as the carbon emission level. In the repose of a high discount rate, firms diminished their production level would employ less capital and labor. This economic situation also drives down the capital return and labor wage rate from the investment. A higher discount rate also enhances the inflation rate by squeezing the consumer energy consumption, thus impedes pollution emissions. Another reason is the higher discount rate also stimulates environmental quality by outweighs the fiscal expenditure. This finding implies that positive shock of discount rate negatively influences on stock market returns, which would discourage household investment and improve environmental quality. Thus contractionary monetary policy is strongly responsive to economic activities by improving the environments. This finding is also in line with Chan (2020), who infers that a contractionary monetary policy alleviates pollution emissions by dropping aggregate demand. While the negative shock of the discount rate has an insignificant impact on carbon emissions. Overall, results revealed that a fiscal policy instrument is a positive effect on environmental quality is more than a monetary policy instrument. The finding also implies that monetary policy does not influence on the carbon emissions at very extreme levels in Pakistan. The outcomes in Table 5 are quite similar to the outcomes in Table 4.

In NARDL diagnostic statistics, the LM test shows that there is no issue of autocorrelation and the RESET test shows that there is no problem of model misspecification. While our adjusted R2 infers that the asymmetric model has a good fit. The Wald statics are employing for computing the symmetry of negative and positive shocks of fiscal and monetary policy instruments on environmental pollution in the short-term and long-term. The result supports the negative and positive shocks asymmetric effect of government expenditure on carbon emissions in short-and long run. While asymmetric effects also exist in negative and positive shocks of the discount rate on carbon emissions in the short and long run. Figures 2 and 3 indicate that the CUSUM and CUSUM (SQ) estimated of ARDL and NARDL model was stable and faced no structural change issues in the 1985–2019 periods in Pakistan.

Conclusion and policy implications

The prime objective of the study to examine the asymmetric effects of fiscal and monetary policy instruments on carbon emissions in Pakistan. For this purpose, the time series annual data from 1985 to 2019 is examined by using the asymmetric NARDL method newly developed by Shin et al. (2014). Our findings show that fiscal policy instruments (government expenditures) exert an asymmetric short and long-run impact on carbon emissions. In short-run, the negative and positive shock of fiscal policy leads to enhance carbon emissions. More importantly, our results also show that negative and positive shock of fiscal policy helps improve the environmental quality by lowering the carbon pollution in Pakistan. The asymmetric long-run results concluded that positive shock to monetary policy instruments (discount rate) helps to increase the environmental quality of Pakistan, and negative shock has an insignificant effect on carbon emissions. The positive shock of fiscal policy instruments contributes to environmental quality in the same lines as the negative shock of the fiscal policy instruments. The empirical statistics show that the influence of positive shocks in fiscal and monetary policy instruments on carbon emissions is significantly different from that of negative shocks in Pakistan. Moreover, the influence of economic growth is positively significant in the short and long term signifying that the major suppliers to increased carbon emissions in Pakistan. Also, the outcome suggests that monetary policy can affect environments in two ways; first is the demand side, and second relates to the supply-side. While the demand side is relatively better than the supply side to the perspective of climate change.

For policy implications, our outcomes focus on the significance of fiscal and monetary policy coordination in the environment. Government expenditure is more influence on carbon emissions due to the small share of government expenditure in the health and education sector in Pakistan. Developing countries, especially Pakistan commenced programs that not only significantly enhance government expenditure but also boost the importance of public goods and social spending in health, education, green infrastructure, and environmental protection. In addition to renewable sources, the government should also focus on improving the infrastructure of already installed fossil fuels (non-renewable sources) plants. The investment in pre-installed plants will help in reducing the detrimental effect on the environment by minimizing the leaks of greenhouse gasses. Fiscal policy instruments, affecting both expenditure and revenue, have a key role in climate change. Therefore, efficient fiscal policies can help maximize their positive effects on environmental quality. Pakistan should devote government expenditures to green public goods which are totally environment-friendly. Pakistan should invest in green transportation in the economy that will be helpful in the correction of environmental pollution.

Decarbonization requires a transformation in the underlying structure of monetary policy instruments. A unified monetary policy is a gravitational force required to finance the greening of our economy. The monetary policy encourages environmental quality finance to contain better access to state bank finance schemes for public and private banks that invest in low-carbon projects. Policy studies and academic suggests that fiscal policy instruments are first in line, they need to be complemented by monetary policy instruments. Pakistani authorities extensively adopt fiscal policies to cope the climate change and economy, fiscal policy cannot provide a complete solution; therefore monetary policy should be jointly used with the fiscal policy for better results. Regarding twin policies, fiscal and monetary policy coordination is more important in the environmental quality process in developing economies. The governments in developing economies should also allocate more budgets to environmental projects in their fiscal and monetary reforms for the sake of moving to more inclusive and greener economies with low-pollution activities. In short, Pakistani authorities should extensively adopt fiscal and monetary policies to control environmental quality.

This study has announced a novel and significant inquiry research area in the environmental economics; further asymmetric ARDL studies (e.g., for the fiscal policy instruments or monetary policy instruments) will be required for taxation purposes and can also be similarly connected to macroeconomic policies in other economies.

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

References

Adewuyi AO (2016) Effects of public and private expenditures on environmental pollution: a dynamic heterogeneous panel data analysis. Renew Sust Energ Rev 65:489–506

Annicchiarico B, Di Dio F (2017) GHG emissions control and monetary policy. Environ Resour Econ 67(4):823–851

Balcilar M, Ciftcioglu S, Gungor H (2016) The effects of financial development on Investment in Turkey. Singap Econ Rev 61(4):1650002–16500018

Chan YT (2020) Are macroeconomic policies better in curbing air pollution than environmental policies? A DSGE approach with carbon-dependent fiscal and monetary policies. Energy Policy 141:111454–111468

Chen C, Pan D (2020) The Optimal Mix of Monetary and Climate Policy. MPRA Paper No 97718

D’souza R, Rana T (2020) The Role of Monetary Policy in Climate Change Mitigation. Observer Research Foundation: ORF issue brief No. 350

Dongyan L (2009) Fiscal and tax policy support for energy efficiency retrofit for existing residential buildings in China’s northern heating region. Energy Policy 37(6):2113–2118

Halkos GE, Paizanos EΑ (2013) The effect of government expenditure on the environment: an empirical investigation. Ecol Econ 91:48–56

Halkos GE, Paizanos EΑ (2016) The effects of fiscal policy on CO2 emissions: evidence from the USA. Energy Policy 88:317–328

International Monetary Fund (2019) International Featured Standards 2019. International Monetary Fund Publications

Jalil A, Feridun M (2011) The impact of growth, energy and financial development on the environment in China: a cointegration analysis. Energy Econ 33(2):284–291

Katircioglu S, Katircioglu S (2018) Testing the role of fiscal policy in the environmental degradation: the case of Turkey. Environ Sci Pollut Res 25(6):5616–5630

Liu Y, Han L, Yin Z, Luo K (2017) A competitive carbon emissions scheme with hybrid fiscal incentives: the evidence from a taxi industry. Energy Policy 102:414–422

Lopez R, Galinato GI, Islam A (2011) Fiscal spending and the environment: theory and empirics. J Environ Econ Manag 62(2):180–198

Lopez R E, Palacios A (2010) Have government spending and energy tax policies contributed to make Europe environmentally cleaner? Working paper no 1667-2016-136345

McAusland C (2008) Trade, politics, and the environment: Tailpipe vs. smokestack. J Environ Econ Manag 55(1):52–71

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326

Rausch S (2013) Fiscal consolidation and climate policy: an overlapping generation’s perspective. Energy Econ 40:S134–S148

Shin Y, Yu B, Greenwood-Nimmo M (2014) Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In: Festschrift in honor of Peter Schmidt. Springer, New York, pp 281–314

Ullah S, Majeed MT, Chishti MZ (2020) Examining the asymmetric effects of fiscal policy instruments on environmental quality in Asian economies. Environ Sci Pollut Res: 1-13

World Bank (2019) World development indicators 2019. World Bank Publications

Yuelan P, Akbar MW, Hafeez M, Ahmad M, Zia Z, Ullah S (2019) The nexus of fiscal policy instruments and environmental degradation in China. Environ Sci Pollut Res 26(28):28919–28932

Author information

Authors and Affiliations

Contributions

Sana Ullah and Sidra Sohail analyzed the data and wrote the complete paper. Ilhan Ozturk read and approved the final version.

Corresponding author

Ethics declarations

Conflicts of interests

The authors declare that they have no conflict of interest.

Ethical approval

Not applicable

Consent to participate

I am free to contact any of the people involved in the research to seek further clarification and information

Consent to publish

Not applicable

Additional information

Responsible Editor: Philippe Garrigues

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ullah, S., Ozturk, I. & Sohail, S. The asymmetric effects of fiscal and monetary policy instruments on Pakistan’s environmental pollution. Environ Sci Pollut Res 28, 7450–7461 (2021). https://doi.org/10.1007/s11356-020-11093-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-11093-4