Abstract

Recently, China has relished rapid green investment, and its influence on clean energy consumption and environment is substantial. Therefore, this study scrutinizes the effects of green investment on clean energy consumption and CO2 emissions in China by using autoregressive distributed lag model (ARDL) approach over time from 1998 to 2019. The results show that green investment tends to have a positive effect on clean energy consumption in China in the long run. The outcomes of study also show that green investment also tends to have a negative effect on CO2 emissions in China, but it has a small effect on carbon emissions in magnitude in the long run. Importantly, possible channels revealed green investment encouraging consumers and producers to consume clean energy, thereby positively affecting the environmental quality in China. Other control variables’ findings show that environmental tax and financial development have increased the environmental quality by decreasing the CO2 emissions. Based on the findings, it recommends that green investment is considered necessary for encouraging clean energy consumption to reduce carbon emissions in high pollutant economies.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Environmental pollution is considered one of the main hurdles in the way of sustainable development. Since the global revolution in industrial field, output increases at the cost of environmental degradation and exploitation of natural resources (Dogan and Inglesi-Lotz 2020). Policymakers and authorities are aimed to work for a reduction in environmental pollution. In order to achieve environmental sustainability and green society revolution, many initiatives have been taken around the globe among them the Kyoto Protocol agreement of 1997 and more recently the Paris Climate Agreement of 2015; both are very important in environmental economics. According to the Paris Climate Agreement, the global temperature growth should not exceed 2 °C, but no influential action has been taken yet, and the role of green investment is getting significant because of a rising trend in worldwide pollution emissions. China’s economy is indulged mostly in mega infrastructure projects; that is why investment plays a significant role in both controlling and promoting pollution emissions. According to Sachs et al. (2019), approximately 1.7 trillion USD per annum is needed to promote growth, to eradicate poverty, and to control climate degradation. Authorities are now more concerned and taking initiatives for high polluted economies. The move towards a low polluted system requires green investment. According to OECD (2018), carbon pricing is not sufficient to address and alleviate global environmental challenges. Green investment results in creating an effective energy system and climate markets that play a significant role in the alleviation of pollution emissions (Heine et al. 2019). No doubt, green investment policies effectively influence the pattern of private capital mobilization for clean energy evolution (Li et al. 2021).

In order to combat environmental degradation issues, economies all over the world are adopting green investment strategies to reduce pollution emissions and to fund the switching from highly polluted to low polluting economies. A green investment policy in the way of mobilization of debt capital markets becomes more cost-competitive for low pollution projects (Heine et al. 2019). In order to address the climate challenges, there is a need to embrace policies in the form of financial instruments like green bonds that helps in fulfilling the increased demand for low pollution projects (Khan 2019; Li et al. 2019).

The green investment strategy paves paths towards attaining sustainable growth and reducing pollution emissions efficiently (Li et al. 2019). Multilateral development banks play a crucial role in raising funds for achieving sustainability and making an investment. Highlighted that green investment in the broader framework is an investment in such projects that are essential for attaining environmental protection and sustainability. Green investment initiatives not only take into account climate investment but also cover prevention measures for industrial pollution and greenhouse gas pollution. Zadek and Flynn (2013) stated that green investment helps in promoting environmentally friendly technology. China is among the world leading manufacturer and exporter of industrial goods; its export magnitude recorded as 2.4 trillion USD in 2017, and its share in global pollution emission reaches 28.5 percent in 2018 (World Bank 2018), while China has 953.9 Billion Yuan spending to prevent industrial pollution. The increasing threat of pollution emission in China is justifiable in such circumstances, as an increasing trend in industrial growth and trade openness. No doubt, China’s government has taken essential initiatives to control carbon emission as the demand for green investment projects in the country has reached 1 trillion USD (OECD 2018) and green investment is increasing day by day in China in different sectors.

In general, pollution emissions not only threaten the quality of the environment but also deteriorate the productivity of the manufacturing sector. Green investment plays a significant role in improving the overall efficiency of the production sector. According to Krushelnytska (2019), green investments are not only limited to those investments that enhance technological efficiency, but it also takes into account waste management and clean energy-related investments. However, green investments are considered a crucial factor for alleviating pollution emissions and promoting green growth. Azhgaliyeva et al. (2018) argued that economic friendly growth can be attained through the promotion of private investment as well. Private investment can restrain global pollution emissions and will transform the global economy into low economy pollution emissions. David and Venkatachalam (2018) also supported the idea of promotion of public-private green investment to ensure the sustainability of pollution-free infrastructure development. Carbon emissions not only destroy the purity of the environment but harm the effectiveness of the industrial sector. Krushelnytska et al. (2017) suggests that green investment primarily involves renewable energy and energy efficiency; in a broader manner, it also covers other areas such as water sanitation, biodiversity protection, water recycling, water processing, industrial carbon emission control, environmental change mitigation, and variation. Azhgaliyeva et al. (2018) identify the importance of green investment and highlighted that private investment plays a crucial role in this regard. Nassiry (2019) suggested that the Paris Climate Agreement 2015 and Sustainable Development Goals can only be achieved through the promotion of green investment.

Thorough research has been done on the issue of investigating possible indicators of climate pollution (for instance, Ozturk and Acaravci 2010 and Doğan et al. 2019). However, the very little empirical literature is available discussing the issue of green investment effect on clean energy consumption and environmental pollution (Noh 2010; Sachs et al. 2019). The prevailing literature reports a positive association between environmental pollution and energy consumption. In support of this positive association, Balogh and Jámbor (2017) study argues that as economic activities increase, it raises the demand for energy consumption. In literature, the most commonly used indicators of climate degradation are energy consumption, trade openness, GDP per capita, demographic variables, deforestation, financial development, urbanization, financial leverage, arable soil and land quality, and eco-innovation (Grossman and Krueger 1995; Dogan and Turkekul 2016; Khan et al. 2018; Duguma et al. 2019; Rustam et al. 2019; Khan et al. 2020a, b; Li et al. 2020a, b, c, d; Ahmad et al. 2020).

Literature also exists on the role of green investment and finance in sustainable development goals (Noh 2010; Azhgaliyeva et al. 2018; Punzi 2019; Li et al. 2020a, b, c, d; Ahmad et al. 2021). Sachs et al. (2019) suggest that there is a need to promote green finance and green investment project for the attainment of sustained development goals. For this purpose, green banking can be enhanced through green bonds and green funds. But the limitation of this study is that it is not reporting the magnitude of green investment’s effect on sustained development goals. Noh (2010) supports the idea of the promotion of green investment through institutions that utilize green funds. But the shortcoming of the study is that it does not incorporate other important indicators that exert a direct impact on carbon emission. Recently, Dikau and Volz’s (2019) study incorporated the role of financial institutions via carbon pricing and climate risk financing in the development of green investment models. Dhurba’s (2018) study argued that management of credit risk is required in the promotion of green investment projects as credit risk attached with higher transaction cost creates hurdles in the promotion of green investment projects.

In short, environmental degradation indicators are quite extensively explored in literature. Furthermore, a vast body of literature is also available for China that examines the indicators of carbon emission China (Chen 2008). But the literature taking into account the issue of production-based climate degradation is still quite limited (Karakaya et al. 2019). In literature, the role of green investment and finance in determining environmental degradation is still ignored. Li et al. (2020a, b, c, d) study evaluated the industrial enterprise’s performance and green investment behavior in the case of China. The study only incorporated the role of traditional indicators of carbon emissions on green investment; however, there is a dire need to explore all possible determinants of climate degradation for China. We select a sample of China because it is the top carbon emitter in the world and more investing in the green economy in the modern era in the context of clean energy and green environment. However, previous studies conclude that green investment is important in environment evidence from China (Wang et al. 2020b), Markaki et al. (2013) for the Greek economy; Meirun et al. (2021) for Singapore. These studies used the ARDL, input output model, and bootstrap ARDL. There are very limited numbers of studies on green investment and CO2 nexus; we empirically emphasize this issue in the context of China. There is a need for massive investigation on this issue especially for policymaking purposes in the case of China. Our study aims to examine the effect of green investment on clean energy consumption and CO2 emissions in the case of China from 1998 to 2019. The paper contributes to infant empirical literature and studies helpful for the policymaking framework. Rhis study is more relevant in the present scenario

The structure of the remaining paper is as follows: Literature review is debated in Section 2, methodology embraced in this study is given in Section 3, Section 4 comprises results, and in the end, Section 5 provides conclusion and some policy recommendations.

Literature review

The modern world has faced a lot of global environmental quality challenges (e.g., Intergovernmental Panel on Climate Change (IPCC) 2018; Rauf et al. 2018). The evaluation of this view is slowly starting by financial and businesses institutions; financial markets are growing to introduce new forms of funding to control environmental pollution. Nowadays, the financial market is developing and joining by public actors, civil society, and non-governmental organizations (NGOs) in the struggles to face the environmental challenge (Khan et al. 2019a, b). The finance of these struggles is generally called green finance. In today, a well-established and unique definition of green finance does not exist. However, Volz (2018) defined green finance as comprising of all kinds of investment that consider the environmental quality and improve environmental sustainability. While Migliorelli and Dessertine (2019) are defining as Green finance is the finance for achieving green economic growth by reducing pollution, greenhouse gas emissions, waste, and also improving efficiency in the usage of natural resources.

As a lot of literature discuss that green finance has influenced on environmental quality. While the pollution crisis grows in dynamic forms in the world, it also carries some additional burden of dirty economic growth to providing funding and generating green economic growth. The modern financial literature is young, and small and the first seminal works on modern financial theory are developed by Markowitz (1952) in the period of the 1950s. Indeed, modern finance is considered an effective system and efficient determinants to activate the economic potential of the economy and shows a favorable impact on the environment. Global warming is increasing with the passage of time, and green finance is a positive impact on the environment and can play an influential role in the adaptation of the green economy (Hafeez et al. 2018).

As the past literature revealed the financial industry itself contributes and improve the environmental quality. The possible reason is that the finance market provides financial help for environmental-friendly enterprises as well as projects; another side shows that financial development can encourage the evolution of industrial and technology structure, which in turn shows an important role in reducing conventional energy consumption and environmental pollution (Khan and Qianli 2017). Dogan and Seker (2016) found that financial development can significantly reduce carbon emissions by using clean energy. Guo et al. (2019) more polished the financial sector indicators and establish a positive impact of financial efficiency on carbon emissions.

While Gianfrate and Peri (2019) suggested that green bonds are also key tools to mobilize financial resources to achieve the environmental quality targets, Tang and Zhang (2018) pointed out that green bonds are beneficial for producers as well as promote the green activities in the economy. The government green finance policies may also increase investments in the clean energy sectors (Khan et al. 2019a, b). However, some environmental researchers’ findings are consistent with mainstream findings. The applied research proves that green financial development promotes the funds flow into green environment enterprises’ activities by improving the green technology. Compared with traditional finance, green finance more underlines environmental interests and favors environmental protection and the effective use of resources as one of the important criteria for computing the usefulness of its economic activities. Green finance has also harmonized the development of financial activities, ecological balance, and environmental protection, and it recognizes sustainable development (Khan et al. 2020a, b; Mahmood et al. 2020). Based on past literature, Wang et al. (2020a) reported that green finance is a “hot topic” of green development and claimed that the financial sector plays a role in sustainability pathways. This literature concludes that green finance is one of the key factors of environmental transition in the globe and helps to achieve environmental goals.

Zhou et al. (2020) reported that China’s economy onto a sustainable development path, therefore, needs a shift in investment away from fossil fuel, greenhouse gas, and natural resource-intensive activities. In this context, the financial sector can play a central role in green transformation. Therefore, green finance is one of the sustainable investments, where investment decisions are taken only based on environmental screening and quality to meet sustainability standards, as well as insurance services that cover climate and environmental risk. Supporting economic growth with sustainable environmental development is one of a universal challenge. This challenge is massive for most pollutant economies because their economic growth models have been very resource and pollution-intensive. Although the carbon intensity of economic growth has been declined substantially in most pollutant-economies over the last few years–with China being notable exceptions (Ahmad et al. 2018; Li et al. 2020a, b, c, d). Thus, green investment is the necessity of the modern era in high pollutant economies.

Model and methodology

Theoretical model

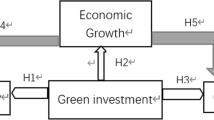

According to the Paris Climate Agreement (2015), pollutant economies around the world are trying to green invest more in the environment; China is the leading in this way. In this scenario, the role of green investment is dynamic to improve clean energy consumption and reduce CO2 emissions caused by the consumption activities and production processes (Datta 2017a, b; Wang et al. 2020b). In doing so, we follow the empirical literature of Liao (2018), Li et al. (2020a, b, c, d), Shen et al. (2020), and Wang et al. (2020b) and assume that green investment is the main determinant of clean energy consumption and CO2 emissions in China. Similarly, the role of green investment is to enhance clean energy consumption combating decreasing carbon emissions but is also sustainable for economic green growth. Therefore, green investment is deliberated as the main source of clean energy consumption and also alleviating the negative environmental effects through a fall in carbon emissions (Panwar et al. 2016). At the first stage, policymakers and authorities use green investment instruments to improve clean energy consumption by making efficient energy use and shutting down fossil fuel energy consumption, and at the same stage, the green investment also reduces environmental stringency. To empirically assess the influence of green investment on clean energy consumption and CO2 emissions in the occurrence of control variables, thus, we embrace the following long-run model specifications:

Equations (1) and (2) measure the determinants of China’s clean energy consumption, and CO2 emissions depend on the level of green investment denoted by Ginv. As the China economy grows, the green invests more in clean energy projects, and people consume more clean energy in economy; hence, we suppose an estimate of ω1 to be positive. The green investment is also improving the environmental quality by dropping the carbon emissions, and we suppose an estimate of φ1 to be negative. Estimates discussed in Eqs. (1) and (2) are the long run. Other control variables are environmental tax (Etax), financial development (FD), and gross domestic product (GDP). The selection of model variables is based on empirical studies (Li et al. 2020a, b, c, d and Wang et al. 2020b). To incorporate the short-term effects, we turn Eqs. (1) and (2) to error correction models which contains the dynamic short-term adjustment manner as follows:

Pesaran et al. (2001) propose a bounds approach to estimate long- and short-run impacts in a single-step testing procedure which is called to be one of the benefits of this approach. In models, the short-run coefficients’ estimates are captured by the first differenced variables, whereas the long-run coefficients are captured by the estimates of ω2-ω5 normalized on ω1 in Eq. (3) and estimates of φ2−φ5 normalize on φ1 in Eq. (4). We can apply the F-test to confirm joint significance of lagged level as a symbol of cointegration, while the F-test has tabulate new critical values instead of the conventional critical values. Certainly, indicators could be combined of order zero, order one, or a mixture of both, and this is the main additional benefit of this method over other methods of cointegration. The ARDL approach does not necessarily that all the indicators to be integrated of the same order. Another advantage is that the long-run relationship test procedure is well suited to small samples than most over conventional cointegration procedures. Once cointegration is established through ARDL approach, in the last step, we can use Granger causality tests in the error correction framework. Granger causality testing approach is employed to investigate the nature of causality among green finance, clean energy consumption, and CO2 emissions, which is mainly helpful in evolving specific policies to tackle environmental pollution (Table 1).

Data and definitions

The objective of this study to scrutinize the influence of green investment on clean energy consumption and environmental quality for China from 1998 to 2019. The time span for this analysis is based on data availability because green investment information is not available for long period in China. The data for clean energy consumption, CO2 emissions, financial development, and GDP are obtained from World Bank (2020). However, the database of green investment and environmental taxes are retried from the China Statistical Yearbook (2020) and organization of economic cooperation development (OECD 2018). Following Azhgaliyeva et al. (2019), Sachs et al. (2019), and Wang et al. (2020b), our study announced green investment as a key determinant of clean energy consumption and CO2 emissions. In our study, green investment, GDP, and financial development variables are used in the log form. The graphical description of clean energy, CO2 emissions, and green investment is shown in Fig. 1.

Result and discussion

The aim of the empirical study is to guesstimate the influence of green investment on clean energy consumption and carbon emissions for China. We employ the augmented Dickey-Fuller (ADF) and Phillips-Perron (PP) for unit root confirmation. The results of ADF and PP unit root are presented in Table 2. The results attained a similar order of integration for each variable in both tests. The outcomes propose that all indicators are stationary at I(1) except green investment, which is stationary at the I(0) in ADF and PP tests. The outcomes are provided mixed order of integration and theoretical justifies the usage of ARDL, which is suitable for a mixed order of integration. Similar outcomes are also retrieved in the structural break unit root test in Table 2. Table 3 reports the short-run and long-run coefficient estimates of clean energy consumption and CO2 emissions.

The results show that green investment is positively affecting clean energy consumption in the long run, while it is statistically insignificant in the short run. This implies that 1% increase in green investment enhances 1.682% clean energy consumption in the long run in China. This study is consistent with Wang et al. (2020b), who noted that green investment is one of the key emerging instruments of clean energy. This finding is also in line with Liao (2018), who noted that the government increases their environmental awareness about clean energy consumption, thereby pushing public and private sectors to invest more in the clean energy sector. This means that green investment plays a crucial role in the increase of efficient energy mix, system, and markets. Green finance also reduces dirty energy consumption by increasing clean energy consumption and also achieves green growth. Besides, green investments especially form of investments in clean energy projects and facilitate the clean energy infrastructure; therefore, it enhanced clean energy consumption in China. This also means that green investments also foster renewable energy transition across the world, which direct effect on consumption and production processes in China. The crux of the discussion is that green investment is a shift energy consumption into a new phase of green development.

However, environmental tax is also significantly positively linked with clean energy consumption in the only short term, and the coefficient estimate is 0.144. This also shows that 1% increase in environmental taxes has improved 0.144% clean energy consumption in the short term. In contrast, GDP is a negative effect on clean energy in the short run, while it is statistically insignificant in the long run. In the short run, on average, 5.146% reduces clean energy consumption due to a 1% increase in GDP. Similarly, financial development has decreased 2.407% clean energy consumption in the long run, while it is statistically insignificant in the short run.

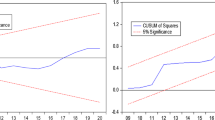

Regarding diagnostic statistics, ECM term shows the adjustment/convergence quickness towards equilibrium, and this value must be negatively significant for the convergence. In the clean energy model, ECM value is (−0.428) and significant cointegration at 5% level. While cointegration is also established by using the F-test, which is also a significant coefficient in diagnostic statistics. The Lagrange Multiplier (LM) and Ramsey’s RESET tests are used for autocorrelation and misspecification of model. Diagnostic LM test for autocorrelation and Ramsey’s RESET test for misspecification are statistically insignificant; supporting free of autocorrelation problem and optimum model is correctly specified. Furthermore, the stability of the model is established through cumulative sum and cumulative sum of a square and suggests that both statistics are stable indicates by “S.” Finally, the goodness of the fit is assessed through R-square, which is normally high in our model.

Table 3 also shows the results of CO2 emissions for the short and long run. The result shows that green investment has a negative impact on carbon emissions in the long term, while it is statistically insignificant in the short run. On average, 0.652% decrease carbon emissions by 1% increase in green investment in long run. This result is also similar to Zhou et al.’s (2020) outcomes, which suggest that green finance solved the environmental problems in China’s provinces. However, due to the early phase of green investment, this effect is very small on carbon emissions in China. Achieving environmental quality targets necessitates significant green investment. Green investment has been increased significantly globally, from $7 billion in 2000 to $154 billion in 2010 (Eyraud et al. 2013). It also reported that China has established a significant amount of green investment getting to 0.106% of overall investment in 2017 that is the lower effect on environmental degradation. However, the more share of green investment has been moved from Europe and the USA in the period of 1990s to China, which positively affects the environmental quality. Despite this, it is assessed that the gap between the financial resources and demand for green investment from 2014 to 2020 is $3.6 trillion dollars in China (Liao 2018). Therefore, green investment is a significant effect, but it is a small effect on carbon emissions. The basic reason is that green investment regulates technological investments that pursue to improve the efficiency of energy use and stimulate clean energy adoption; therefore, green investments mitigate carbon emissions.

Another possible channel is that green investment can encourage green growth by increasing the environmental quality by falling carbon emissions. Green investment is not only affected the energy efficiency and renewable energies but also expands to water sanitation, waste recycling and processing, biodiversity protection, and industrial pollution control. Moreover, to achieve environmental quality, Noh (2010) concentrated on the creation of green financial institutions by encouraging green financing, green products, and smart cities. Our results are also similar economic justification and channels for China case study.

Similarly, environmental tax is also found to be negatively linked with carbon emissions in the short run and long run. A 1% increases in environmental tax decline, an average, -0.136% and -0.265% in carbon emissions. While, in similar, 1% increase in GDP causes, an average, -6.405% and -0.821% fall in carbon emissions in short run and long, but it is insignificant in long run. Moreover, the results also indicate that a 1% increase in financial development causes to reduce carbon emissions by -2.287% in short run and -5.706% in long run in the case of China. Cointegration is recognized either by ECM or F-test in the model in which there are twin statistics that are significant. We have also stated numerous additional diagnostic statistics. The LM and Ramsey’s RESET tests are insignificant; it means that the residuals are free of autocorrelation and our model does not suffer from misspecification problems. Clearly, almost short- and long-run coefficient estimates of CUSUM and CUSUMSQ tests are also stable, which indicates “S.” Of further note, the size of the adjusted R2 is also good.

Finally, the Granger causality test is used to evaluate the causality among the concern variables. As described in Table 4, the results reveal unidirectional causality between green investment and clean energy consumption, in which green investment causes clean energy consumption. This is a novel to the empirical literature. Another economic implication is that green investment increases social, economic, and environmental edge which in turn increases clean energy consumption. Similarly, green investment mostly in green energy project which formulate clean energy consumption in the economy. However, green investment does not either the bidirectional nor the unidirectional causality with CO2 emissions in model. While causality also shows that CO2 emissions is caused by clean energy, it means that clean energy consumption is increasing with environmental pollution in China.

Conclusion and policy implications

There is fact and worldwide considered that climate change occurs mainly due to humanly produced pollution emissions. Environment change is linked to many negative externalities that lead to adverse macro-economic outcomes. However, increasing sea levels, rising temperatures, and severe weather conditions could adversely damage productivity and output (International Monetary Fund 2008). Climate changes also exert a significant direct impact on fiscal aspects; most probably, they directly affect tax structures and spending schedules. It makes the current trend of energy usage unsustainable and increases energy disparity. Meanwhile, the conversion of low-carbon consumption model needs heavy investment in clean energy because clean energy sources are capital intensive especially at the initial stages of transformation (Johnson and Acri Née Lybecker 2009). Green investment not only focuses on investment in low-carbon energy sources but also considers the need of enhancing energy security, controlling health-related issues due to polluted air, and discovering the improved source of green growth (OECD 2011). Nowadays, green investment has been enhanced in many high polluted economies due to technological development and robust environmental policies. Our study pays to the existing theoretical and empirical literature by familiarizing green investment as a key emerging determinant of clean energy consumption and carbon emissions, which has been unnoticed in the previous literature. This study employs the time series data from 1998 to 2019 and empirically examines the study objective through ARDL approach. Our study findings are more valuable for evolving energy and environmental policies related to green investment and financing.

The theoretical literature established a positive and robust link between green investment and clean energy consumption, while it is a negative link between green investment and carbon emissions. The empirical outcomes show that green investment is positively affected clean energy consumption in the long run, while it is an insignificant effect on clean energy consumption in the case of China. However, empirical results also show that green investment is negatively affecting carbon emissions in only the long run in China. Outcomes of green investment are empirical and economically linked with both models; this infers that green investment upsurges the environmental quality by increasing the clean energy consumption in China. Regarding control variables, environmental tax is positive influence on clean energy, but finance development negatively influences clean energy consumption in the short term in the case of China. However, environmental tax is initiated to help control the upsurge in carbon emissions, while financial development could not supportive to control of environmental pollution in long run.

Our study offers numerous policy implications for China and other economies. To limit the rise in dirty energy consumption and environmental pollution, China must finance low-carbon evolutions through green bonds. The energy consumption mix could be moved towards more clean energy from fossil fuel energy consumption, which would help China’s green growth and environmental sustainability. There is also a need for high pollutant economies to increase private investment to encourage green growth and low-carbon transformation. An economic mechanism could be developed to permit public-private participation in investment, which would upsurge green investment and thereby expand sustainable green growth. Government funds should be arises to public-private investment partners that would be helpful to improve environment friendly technology, energy efficiency, green growth, and low-carbon economy. Agricultural, industrial, and service sector structure should be updated to clean energy consumption, which benefits from the green investment. Also, China should promote environmental pollution taxes for revenue purposes and the government should charge a carbon tax for green financing in the economy. The government should also improve the green financial and investment system in the economy that gives priority to approvals of clean energy projects. The findings of our study can be generalized to other pollutant economies and regions. Further empirical research is compulsory to identify a similar nexus for other economies. Future research should more focus on how policymakers and authorities enhance green investment in pollutant economies.

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

References

Ahmad M, Khan Z, Ur Rahman Z, Khan S (2018) Does financial development asymmetrically affect CO2 emissions in China? An application of the nonlinear autoregressive distributed lag (NARDL) model. Carbon Manag 9(6):631–644

Ahmad M, Khattak SI, Anwar Khan ZUR (2020) Innovation, foreign direct investment (FDI), and the energy-pollution-growth nexus in the OECD economies: a simultaneous equation modeling approach. Environ Ecol Stat 27:203–232. https://doi.org/10.1007/s10651-020-00442-8

Ahmad M, Khan Z, Rahman ZU, Khattak SI, Khan ZU (2021) Can innovation shocks determine CO2 emissions (CO2e) in the OECD economies? A new perspective. Econ Innov New Technol 30(1):89–109

Azhgaliyeva D, Kapsaplyamova Z, Low L (2018) Implications of fiscal and financial policies for unlocking green finance and green investment (No. 861). ADBI Working Paper Series

Balogh JM, Jámbor A (2017) Determinants of CO. Int J Energy Econ Policy 7(5):217–226

Chen YS (2008) The driver of green innovation and green image–green core competence. J Bus Ethics 81(3):531–543

Datta TK (2017a) Effect of green technology investment on a production inventory system with carbon tax. Adv Oper Res 2017:1–12

Datta TK (2017b) Effect of green technology investment on a production-inventory system with carbon tax. Advances in operations research

David D, Venkatachalam A (2018) A comparative study on the role of public-private partnerships and green investment banks in boosting low-carbon investments (No. 870). ADBI Working Paper

Dhruba P (2018) Managing credit risk and improving access to finance in green energy projects

Dikau S, Volz U (2019) Why two degrees matters to central banks. Central Banking Focus Report on Climate Change

Dogan E, Inglesi-Lotz R (2020) The impact of economic structure to the environmental Kuznets curve (EKC) hypothesis: evidence from European countries. Environ Sci Pollut Res 27(11):12717–12724

Dogan E, Seker F (2016) The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renew Sust Energ Rev 60:1074–1085

Doğan B, Saboori B, Can M (2019) Does economic complexity matter for environmental degradation? An empirical analysis for different stages of development. Environ Sci Pollut Res 26(31):31900–31912

Duguma LA, Atela J, Minang PA, Ayana AN, Gizachew B, Nzyoka JM, Bernard F (2019) Deforestation and forest degradation as an environmental behavior: unpacking realities shaping community actions. Land 8(2):26

Dogan E, Turkekul B (2016) CO2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23:1203–1213

Eyraud L, Clements B, Wane A (2013) Green investment: trends and determinants. Energy Policy 60:852–865

Gianfrate G, Peri M (2019) The green advantage: exploring the convenience of issuing green bonds. J Clean Prod 219:127–135

Grossman GM, Krueger AB (1995) Economic growth and the environment. Q J Econ 110(2):353–377

Guo R (2020) China Ethnic Statistical Yearbook 2020. Springer Nature

Guo M, Hu Y, Yu J (2019) The role of financial development in the process of climate change: evidence from different panel models in China. Atmos Pollut Res 10(5):1375–1382

Hafeez M, Chunhui Y, Strohmaier D, Ahmed M, Jie L (2018) Does finance affect environmental degradation: evidence from One Belt and One Road Initiative region? Environ Sci Pollut Res 25(10):9579–9592

Heine D, Semmler W, Mazzucato M, Braga J. P, Flaherty M, Gevorkyan A, ..., Radpour S (2019) Financing low-carbon transitions through carbon pricing and green bonds. World Bank Policy Research Working Paper, (8991)

Intergovernmental Panel on Climate Change (IPCC) (2018) Special Report. Global warning of 1.5 °C. Geneva

International Monetary Fund (2008) Climate change and the global economy. World Economic Outlook, Washington

Johnson DK, Acri Née Lybecker KM (2009) Challenges to technology transfer: a literature review of the constraints on environmental technology dissemination

Karakaya E, Yılmaz B, Alataş S (2019) How production-based and consumption-based emissions accounting systems change climate policy analysis: the case of CO2 convergence. Environ Sci Pollut Res 26:16682–16694

Khan SAR (2019) The nexus between carbon emissions, poverty, economic growth, and logistics operations-empirical evidence from southeast Asian countries. Environ Sci Pollut Res 26(13):13210–13220

Khan SAR, Qianli D (2017) Impact of green supply chain management practices on firms’ performance: an empirical study from the perspective of Pakistan. Environ Sci Pollut Res 24(20):16829–16844

Khan SAR, Zhang Y, Anees M, Golpîra H, Lahmar A, Qianli D (2018) Green supply chain management, economic growth and environment: a GMM based evidence. J Clean Prod 185:588–599

Khan SAR, Sharif A, Golpîra H, Kumar A (2019a) A green ideology in Asian emerging economies: From environmental policy and sustainable development. Sustain Dev 27(6):1063–1075

Khan Z, Shahbaz M, Ahmad M, Rabbi F, Siqun Y (2019b) Total retail goods consumption, industry structure, urban population growth and pollution intensity: an application of panel data analysis for China. Environ Sci Pollut Res 26(31):32224–32242

Khan SAR, Yu Z, Belhadi A, Mardani A (2020a) Investigating the effects of renewable energy on international trade and environmental quality. J Environ Manag 272:111089

Khan SAR, Yu Z, Sharif A, Golpîra H (2020b) Determinants of economic growth and environmental sustainability in South Asian Association for Regional Cooperation: evidence from panel ARDL. Environ Sci Pollut Res 27(36):45675–45687

Krushelnytska O (2019) Introduction to green finance. World Bank, Global Environment Facility (GEF), Washington, DC http://documents.worldbank.org/curated/en/405891487108066678/Introduction-to-green-finance. Accessed 11 Jan 2020

Krushelnytska T, Kakhovska O, Kurinnyi O, Matveieva O (2017) Main features of Ukrainian monetary policy during the post-crisis economy reformation. Banks Bank Syst (12, № 4 (cont.)):189–202

Li X, Du J, Long H (2019) Green development behavior and performance of industrial enterprises based on grounded theory study: evidence from china. Sustainability 11(15):4133

Li J, Zhang X, Ali S, Khan Z (2020a) Eco-innovation and energy productivity: new determinants of renewable energy consumption. J Environ Manag. https://doi.org/10.1016/j.jenvman.2020.111028

Li X, Du J, Long H (2020b) Understanding the green development behavior and performance of industrial enterprises (GDBP-IE): scale development and validation. Int J Environ Res Public Health 17(5):1716

Li Y, Peng H, Hafeez M, Ahmad H (2020c) Assessment of energy disparity and financial development nexus in environmental Kuznets curve framework. In International Conference on Management Science and Engineering Management (pp. 613-626). Springer, Cham

Li ZZ, Li RYM, Malik MY, Murshed M, Khan Z, Umar M (2020d) Determinants of carbon emission in China: how good is green investment?. Sustainable Production and Consumption

Li ZZ, Li RYM, Malik MY, Murshed M, Khan Z, Umar M (2021) Determinants of carbon emission in China: how good is green investment? Sustain Prod Consum 27:392–401

Liao X (2018) Public appeal, environmental regulation and green investment: evidence from China. Energy Policy 119:554–562

Mahmood MT, Shahab S, Hafeez M (2020) Energy capacity, industrial production, and the environment: an empirical analysis from Pakistan. Environ Sci Pollut Res 27(5):4830–4839

Markaki M, Belegri-Roboli A, Michaelides P, Mirasgedis S, Lalas DP (2013) The impact of clean energy investments on the Greek economy: An input–output analysis (2010–2020). Energy Policy 57:263–275

Markowitz H (1952) Portfolio selection. J Financ 7(1):77–91

Meirun T, Mihardjo LW, Haseeb M, Khan SAR, Jermsittiparsert K (2021) The dynamics effect of green technology innovation on economic growth and CO 2 emission in Singapore: New evidence from bootstrap ARDL approach. Environ Sci Pollut Res 28(4):4184–4194

Migliorelli M, Dessertine P (2019) The rise of green finance in Europe. Opportunities and challenges for issuers, investors and marketplaces. Palgrave Macmillan, Cham

Nassiry D (2019) The Role of Fintech in Unlocking Green Finance. Handbook of Green Finance 545:315–336

Noh HJ (2010) Financial strategy to accelerate innovation for green growth. Oecd.org:2–3

OECD K (2018) OECD Science, Technology and Innovation Outlook 2018. OECD Publishing, Paris

Ozturk I, Acaravci A (2010) CO2 emissions, energy consumption and economic growth in Turkey. Renew Sust Energ Rev 14(9):3220–3225

Panwar R, Nybakk E, Hansen E, Pinkse J (2016) The effect of small firms' competitive strategies on their community and environmental engagement. J Clean Prod 129:578–585

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econom 16(3):289–326

Punzi MT (2019) Role of bank lending in financing green projects. Handb Green Finance 237–259

Rauf A, Liu X, Amin W, Ozturk I, Rehman OU, Hafeez M (2018) Testing EKC hypothesis with energy and sustainable development challenges: a fresh evidence from belt and road initiative economies. Environ Sci Pollut Res 25(32):32066–32080

Rustam A, Wang Y, Zameer H (2019) Does foreign ownership affect corporate sustainability disclosure in Pakistan? A sequential mixed methods approach. Environ Sci Pollut Res 26:31178–31197

Sachs JD, Schmidt-Traub G, Mazzucato M, Messner D, Nakicenovic N, Rockström J (2019) Six transformations to achieve the sustainable development goals. Nature Sustain 2(9):805–814

Shen Y, Su ZW, Malik MY, Umar M, Khan Z, Khan M (2020) Does green investment, financial development and natural resources rent limit carbon emissions? A provincial panel analysis of China. Sci Total Environ 755:142538

Tang DY, Zhang Y (2018) Do shareholders benefit from green bonds? Social Sci Electron Publ. https://doi.org/10.1016/j.jcorpfin.12.001

Volz U (2018) Fostering green finance for sustainable development in Asia

Wang C, Zhan J, Xin Z (2020a) Comparative analysis of urban ecological management models incorporating low-carbon transformation. Technol Forecast Soc Change 159:120190

Wang L, Su CW, Ali S, Chang HL (2020b) How China is fostering sustainable growth: the interplay of green investment and production-based emission. Environ Sci Pollut Res 27(31):39607–39618

World Bank (2018) World Bank open data. World Bank

World Bank (2020) World development indicators 2020. The World Bank

Zadek S, Flynn C (2013) South-originating green finance: exploring the potential

Zhou X, Tang X, Zhang R (2020) Impact of green finance on economic development and environmental quality: a study based on provincial panel data from China. Environ Sci Pollut Res 27(16):19915–19932

Author information

Authors and Affiliations

Contributions

This idea was given by Shuai Chuanmin and Israt Zahan. Israt Zahan analyzed the data and wrote the complete paper. Shuai Chuanmin provided supervision and approved the final version.

Corresponding author

Ethics declarations

Ethical approval

Not applicable.

Consent to participate

I am free to contact any of the people involved in the research to seek further clarification and information.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Ilhan Ozturk

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zahan, I., Chuanmin, S. Towards a green economic policy framework in China: role of green investment in fostering clean energy consumption and environmental sustainability. Environ Sci Pollut Res 28, 43618–43628 (2021). https://doi.org/10.1007/s11356-021-13041-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-13041-2