Abstract

To mitigate environmental problems and to achieve sustainability, China is striving to transition to low-carbon urban economies. Among several significant steps, the country has made remarkable success in controlling the emissions from transportation, buildings, and energy by shutting down or relocating several polluting industries. This study contributes to the issue of sustainable growth debate using time series data from China for the period 1998–2017 and empirically examines the effects of green investment and renewable energy consumption on production-based carbon emissions for China. The strength of this study is that it tested some new variables such as production-based carbon emissions and green investment. Using autoregressive distributed lag model (ARDL) cointegration technique, we found that production-based emission and its determinants move together in the long run. The study found that green investment and renewable energy consumption are both helpful in controlling production-based carbon emissions, while trade openness increases production-based carbon emissions. Hence, green investment and renewable energy consumption contribute to the achievement of sustainable growth. Moreover, based on a robustness check, human capital, financial development, and environment-specific technological innovation are found to be helpful in curbing production-based carbon emissions. Our study recommends financial technology (fin-tech), green investment, and public-private partnership investment in renewable energy to mitigate the effect of production-based carbon emissions.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The achievement of sustainable growth is the primary concern of the future of humanity, which requires strategies to reduce greenhouse gas emissions. Carbon dioxide (CO2) emissions are considered as one of the critical factors affecting sustainable growth (IPCC 2014). Since the Industrial Revolution, the continuous increase in world output has resulted in global environmental degradation, which is the primary concern for countries around the globe. Moreover, an increase in human activities puts pressure on natural resource exploitation, which severely affects the environment (Dogan and Inglesi-Lotz 2020). Due to increasing human activities, the average temperatures have increased, which ultimately lead to environmental degradation (Canadell et al. 2007). Governments around the globe have committed to work for targeting the reduction of environmental pollution. Several agreements have been acceded to target environmental degradation, such as the Kyoto Protocol in 1997, and most importantly, the Paris Climate Agreement (PCA) signed in 2015. These accords are considered as environmental sustainability initiatives towards a green society. These accords aim to divert the attention of the researchers and decision-makers to global environmental concerns (Balogh and Jámbor 2017). The PCA accord agreed on controlling the global temperature growth below 2 °C. However, decisive actions to promote a low-carbon or efficient energy system have not yet been taken (Sachs et al. 2019).

With a rising trend in global economic growth and carbon emissions due to consumption and production processes, the role of investment is critical. Mega infrastructure projects are on the rise for most Asian countries. Hence, the role of investment in both promoting and controlling carbon emissions is of great importance. Approximately 1.7 trillion US dollars (USD) per year or 26 trillion USD cumulatively from 2016 to 2030 is required to eradicate poverty, promote growth, and coup up with the challenge of climate. Based on these estimates, around 14.7 trillion USD are needed for power, transportation 8.4 trillion USD, telecommunication 2.3 trillion USD, and water and sanitation required 800 billion USD, respectively (Sachs et al. 2019). Countries are concentrating on efficient energy systems to move towards a low-carbon economy. The transition to a low-carbon-efficient energy system requires green financing and pricing the externalities. However, carbon pricing is insufficient to address environmental sustainability challenges (OECD 2018). According to IMF estimates, the level of carbon pricing does not fulfill the requirements to mitigate the global environmental problem (Lagarde and Gaspar 2019). Public investments in the form of green financing play a crucial role in the abatement of greenhouse gas (GHG) emissions and to create an efficient energy system and robust climate markets (Mazzucato 2016).

Nevertheless, financial policies can play a vital role in influencing how private capital is mobilized for a low-carbon transition (Li and Long 2020). In response to environmental issues, countries around the world have been using green investments to reduce greenhouse gas emissions and to fund the transition from high-carbon to low-carbon economies. Financial policies in the form of mobilizing the debt capital markets are becoming more cost-competitive for a low-carbon transition (Heine et al. 2019). To meet the increasing demand for low-carbon projects, countries are required to adopt appropriate strategies in the form of new financial instruments such as green bonds to address climate challenges (Li et al. 2019).

To sum up, green investment is an indispensable strategy to reduce carbon emissions efficiently and in achieving sustainable growth (Li et al. 2018). To achieve sustainability and to finance such a massive amount of investment, the role of multilateral development banks is vital to raise funds. To achieve sustainability, the policy of reducing carbon emissions utilizing green finance projects is essential (Noh 2010). Sustainability can be achieved by following the concept of green finance. Höhne et al. (2012) stated that the term green finance in a broader context could be defined as an investment for environmental protection to promote a sustainable economy in the form of sustainable growth projects and initiatives. It should not be limited to climate finance only as it covers industrial pollution prevention and curbing greenhouse gas emissions (GHGs). Even some of the researchers, such as Zadek and Flynn (2013), used green finance interchangeably for green investment. To finance the investment needs, the concept of green finance can be of great help, not only ensuring funds but also achieving green growth. It helps not only in promoting environmentally friendly technology but also in promoting financial technology (fin-tech) (Noh 2010).

Being the largest producer of industrial goods, China is one of the leading consumers of energy and emitters of carbon, with around 28.5% share in the total global carbon emissions in 2018 (World Bank 2018). China’s economy is on the rise since its economic reforms of opening ups and its accession into the world trade organization (WTO) in 2001. In 2017, China’s export magnitude reached to 2.41 trillion USD (Simoes and Hidalgo 2011). In such circumstances, with rising economic growth, trade opening up with the rest of the world, and rapid industrialization, the fear of increasing carbon emissions is absolute. China’s growing environmental problems are threats to sustainable growth. Similar to the developed world, China’s role in the reduction of carbon emissions is essential, upon realizing the need for a green financial system and commitment to reducing carbon emissions through green investment or financing, renewable energy consumption, and technological innovation (Khan et al. 2019). The implementation of a green financial system following global attention to the sustainable growth of the economy, society, and financial industry is the need for a scientific outlook of the reality on development (Chen 2013). There is a massive demand of about 1 trillion USD in green investment projects in the country (OECD 2018). According to the Research Bureau of the People’s Bank of China, the green investment needs to prevent industrial pollution are estimated to be 450 billion USD to 600 billion USD per year (Hyung and Baral 2019)

The issue of possible determinants of environmental degradation is intensively investigated in the literature with contradictory empirical evidence (Holtz-Eakin and Selden 1992; Ozturk and Acaravci 2010; Dogan and Turkekul 2016; Moutinho et al. 2018; Dogan et al. 2019). However, there are only a few empirical studies available on the role of green investment in affecting environmental degradation (Noh 2010; Dikau and Volz 2019; Sachs et al. 2019). The existing literature on the association between energy consumption and environmental degradation is rich. The main idea behind the positive relationship is that the increase in economic activities leads to a rise in energy demand as more human activities need more energy consumption (Balogh and Jámbor 2017). In a series of studies, GDP per capita has been considered as the primary and core factor responsible for the emission of carbon, evident from the inverted U-shaped EKC hypothesis (Kuznets 1955). After the seminal work of Kuznets (1955), the majority of the studies concentrated on testing the validity of the EKC hypothesis for different countries of the world (Grossman and Krueger 1994; Frank et al. 2005; Meadows et al. 2018). In the existing literature, traditional variables have been considered the important determinants of environmental degradation, such as energy consumption (York 2007; Chen 2008; Baiardi 2012 and Khan et al. 2020), GDP per capita (Arrow et al. 1995), trade openness (Grossman and Krueger 1994; Huang et al. 2008; Lee and Chang 2009; Narayan and Narayan 2010; Shahzad et al. 2017; Oh and Bhuyan 2018), demographic variables (Ahmad et al. 2005; Agena 2007; Jorgenson et al. 2010), deforestation (Duguma et al. 2019), financial development (Zhang 2011; Shahbaz et al. 2013) financial leverage (Rustam et al. 2019), arable land and soil quality (Maroušek et al. 2019), eco-innovation (Li et al. 2020) and urbanization (York 2007; Zhu et al. 2012). Shahbaz et al. (2013) identified growth in GDP, energy consumption, and trade openness as determinants of CO2 emissions. Chen (2008) identified imports and exports in GDP, FDI inflow, population, and proxy of the stringency of environmental regulation for different pollutants as determinants of CO2 emission. Baiardi (2012) found GDP per capita, literacy rate, trade, and structural change as determinants of CO2 emissions. In the literature, the industrial structure is also considered an essential factor in CO2 emissions (Mi et al. 2015). The findings of Hossain (2011) and Michieka et al. (2013) confirm unidirectional causality from trade openness and exports to CO2 emissions. Similarly, the results of Al-Mulali and Sheau-Ting (2014) establish a positive association between both exports and imports with CO2 emissions. In the case of Turkey, Halicioglu (2009) found that carbon emissions are determined by income, energy consumption, and foreign trade. Trade is found to have a positive association with carbon emissions. Shahbaz et al. (2013) found that a negative association between international trade and carbon emissions for Indonesia, as international trade, is found to help curb CO2 emissions.

Regarding the role of renewable energy consumption in curbing carbon emissions, extensive research has been conducted in the case of different countries (Bölük and Mert 2015a; Hu et al. 2018a; Inglesi-Lotz and Dogan 2018; Mensah et al. 2018). These authors confirmed that renewable energy consumption helps to reduce carbon emissions. Hence, renewable energy consumption is considered an important determinant of carbon emissions. On the role of green finance, sustainable development, and green investment, several studies exist (Noh 2010; Hongo 2013; Azhgaliyeva et al. 2019; David and Venkatachalam 2019; Punzi 2019; Sachs et al. 2019). Sachs et al. (2019) focused on achieving sustainable development goals (SDGs) through green investment and promoting green projects. The author also stressed the need for fostering green banking through green funds, green bonds, and carbon market instruments. However, the major shortcoming of this study was that it could not quantify the extent of the effect of green investment on SDGs. Similarly, to achieve green growth, Noh (2010) supports the need for promoting green financing and green financial products through the establishment of green financial institutions with the utilization of green climate fund. However, this study ignores the important role of other key factors in explaining CO2 emissions. Further, Dikau and Volz (2019) focused on the promotion of a development model through green financing and also the imposition of pricing of both carbon and environmental risk via financial institutions. Another study is based on promoting the financing of green energy projects and managing related credit risk (Dhruba 2018). The author considers high transaction cost with high consumer credit risk as crucial barriers to finance distributed renewable energy sector. To ease financing for green energy projects, it is imperative to improve credit information quality through financial intermediaries and to ensure solutions for risk mitigation.

To sum up, the determinants of environmental degradation are explained intensively. Moreover, extensive research has already been conducted to examine the deep determinants of CO2 emissions in the case of China (Chen 2008; Peng et al. 2018; Zhang and Zhang 2018; David and Venkatachalam 2019). However, the literature on determinants of production-based environmental degradation is confined to few studies (Datta 2017 and Karakaya et al. 2019). Moreover, green investment as a determinant of environmental degradation is ignored in the literature. Few studies, such as Li et al. (2020), have examined the green development behavior and performance of industrial enterprises in China. The literature seems to have only concentrated on traditional factors as determinants of CO2 emissions. It is imperative to understand a comprehensive set of production-based determinants of environmental degradation for China. In the case of China, this issue is strongly needed to investigate, especially for policy formulation. This study aims to investigate the effect of green investment in the presence of renewable energy and trade openness on production-based carbon emissions in the case of China for 1998–2017. This study tries to answer the research question of what is the nature of the relationship between green investment and production-based carbon emissions in the case of China. The innovation of this study lies in estimating an empirical model, which departs from the previous studies as this study includes green investment as a determinant of environmental degradation. This study uses investment completed in industrial pollution prevention as our primary independent variable, which is referred to as a green investment. We hypothesize that production-based carbon emissions depend on income, green investment, renewable energy consumption, and trade openness. This study contributes to the existing literature by multifaceted ways. First, the study introduces green investment as determinants of production-based carbon emissions, which has been ignored in the existing literature. The findings from this study are valuable for evolving policies related to green financing and, most importantly, CO2 emissions. Second, the current study uses the production-based carbon emissions (TCO2PC) as a measure to calculate CO2 emission, which is caused by domestic production. Third, the current study analyzes a comprehensive set of production-based determinants of environmental degradation for China. The empirical model of this study departs from the previous studies. This study uses investment completed in industrial pollution prevention as our primary independent variable, which is referred to as a green investment.

Theoretical approach and econometric methodology

Data classification and its sources

This study aims to investigate the effect of green investment on production-based carbon emissions for China for 1998–2017. The time period for this study is based on data availability.

Various proxies for measuring environmental degradation have been proposed in the literature. In recent literature, two approaches have been used to measure human-induced greenhouse gas (GHS) emissions: production-based accounting (PBA) and consumption-based accounting (CBA) system. GHS is calculated by the amount of emissions by a country during a specific period of time (IPCC 2014). The scope of this study is limited to the emission caused by domestic production; hence, we use production-based carbon emissions (TCO2PC) as a measure to calculate CO2 emission. The Intergovernmental Panel for Climate Change (IPCC) guidelines on CO2 emissions write reports based on production-based CO2 emissions, which are standardly adopted internationally. Hence, this study uses production-based carbon emissions to measure carbon emissions. PBA is indirectly calculated from the use of fossil fuel and other relevant processes of industry and agriculture (IPCC, 2014). The data for TCO2PC is obtained from (Boden et al. 2009) database by global carbon atlas (GCA) and is measured in terms of KG CO2 per capita. Following Sachs et al. (2019), Retallack et al. (2018), and Azhgaliyeva et al. (2019), this study introduced green investment as a determinant of CO2 emissions. Green investment (GIPC) data is derived from the China Statistical Yearbook (NBS 2017). Here, the term green investment refers to completed investment to prevent industrial pollution. Following Mensah et al. (2018), Inglesi-Lotz and Dogan (2018), and Hu et al. (2018), this study introduced renewable energy consumption (RECPC) as a determinant of CO2 emissions. The data on RECPC is derived from the World Bank Database or World Development Indicator (WDI 2019). Following Halicioglu (2009), Hossain (2011), Michieka et al. (2013), and Al-Mulali and Sheau-Ting (2014), this study introduced trade openness (TOPC) as a determinant of CO2 emissions. The data on TOPC is derived from the World Bank Database or World Development Indicator (WDI 2019). For robustness checks, this study uses environment-specific technological innovation (TIES), human capital, and financial development (FD) as explanatory variables. The data on TIES is obtained from the organization of economic cooperation development (OECD) database, while data for human capital is obtained from Penn World Table (PWT 9.1). The data on FD is derived from the World Bank Database or World Development Indicator (WDI 2019). In this study, all the variables are measured in both per capita and log form.

Theoretical model

Following the Paris Climate Agreement (PCA 2016) accord, countries around the globe are trying to invest more in environment-friendly technology. In such a scenario, the role of investment to control pollution from the industries and ensuring cleaner production is critical. The role of green investment is vital to reduce carbon emissions caused by the production processes (Datta 2017). Following Sachs et al. (2019), Retallack et al. (2018), and Azhgaliyeva et al. (2019), this study introduced green investment as a determinant of CO2 emissions. The expected sign based on green investment to prevent production-based carbon emissions is negative, i.e., \( {a}_1=\frac{\partial TC{O}_2P{C}_t}{\partial GIP{C}_t}<0 \). Similarly, the role of renewable energy consumption (REC) is also critical to combating increasing emissions. Renewable energy technology uses cleaner and optimal sources of energy, which not only help to produce with a minimum level of the waste but also are sustainable for both current and future social and economic needs. Therefore, REC is considered as a source of mitigating the negative environmental impacts through a reduction in emissions (Panwar et al. 2011). In the existing literature, trade openness is considered as an important determinant of CO2 emissions (Mensah et al. 2018; Inglesi-Lotz and Dogan 2018 and Hu et al. 2018). We expect a negative impact of renewable energy consumption on production-based carbon emissions, i.e., \( {a}_2=\frac{\partial TC{O}_2P{C}_t}{\partial RECP{C}_t}<0 \) In contrast, trade openness, which is the sum of exports and imports divided by gross domestic product (GDP), shows the opening up through trade (Michieka et al. 2013). In the existing literature, trade openness is considered an important determinant of CO2 emissions (Halicioglu 2009; Hossain 2011; Michieka et al. 2013 and Al-Mulali and Sheau-Ting 2014). Trade openness is expected to increase production-based carbon emissions, i.e., \( {a}_3=\frac{\partial TC{O}_2P{C}_t}{\partial TOP{C}_t}>0 \). To investigate the impact of green investment on CO2 emissions in the presence of control variables, the baseline equation is given as follows:

where the subscript t indicates time period, such as from 1998 to 2017, a0, a1, a2, a3 are the parameters, and εt is the residual or the error term. TCO2PCt is the production-based carbon emissions. GIPC represents a green investment. RECPC represents renewable energy consumption, and TOPC represents trade openness.

Econometric methods

Unit root tests

To test for the unit root properties of each variable, this study uses four different unit root tests. Augmented Dickey-Fuller (ADF) is employed over a simple Dickey-Fuller (DF) approach because it incorporates the high-order correlated lags for a series, and the white noise error properties εt is not violated. The test equation for ADF is as follows:

ADF test check the null hypothesis, i.e., H0 : ϑ = 0 while the alternative hypothesis is H1 : ϑ < 0 by using t values, i.e., \( {t}_{\vartheta }=\frac{\vartheta }{\left( SE\left(\vartheta \right)\right)} \), here \( \hat{\vartheta} \) is the estimated value of ϑ and \( \left( SE\left(\hat{\vartheta}\right)\right) \) is the standard error. Here, the asymptotic distribution of both ϑ and \( \left( SE\left(\hat{\vartheta}\right)\right) \) is independent of the number of first difference lags. Elliott et al. (1996) modify the ADF test to detrend the data to take out the independent variables out of regression before running it and also have high test power than the ADF test. This test has higher power than the ADF test. DFGLS approach defines a quasi-difference approach of \( {Z}_t^d \) depending on the values of ϑ for a specific point. The DFGLS simple version equation is given as follows:

Since \( {Z}_t^d \) is detrended, so here in DFGLS equation, \( {x}_t^{\prime } \) is not included. To overcome the issue of serial correlation, Phillips and Perron (1988) developed a new test based on a non-parametric approach modifying t and ϑ coefficient based on dickey fuller autoregressive (AR(1)) process so that the asymptotic distribution is not affected by the serial correlation. PP test also deals with the issue of heteroscedasticity in the errors; however, there is an issue of size distortion in this test, which is overcome by Ng and Perron (2001). Another approach based on residual from the ordinary least square (OLS) developed by Kwiatkowski et al. (1992) is based on the Lagrange multiplier (LM) test statistic. Similarly, Ng and Perron (2001) test is based on GLS detrending data such as \( {Z}_t^d \) by modifying the Phillips and Perron (1988). Ng and Perron (2001) solve the issue of size distortion due to high negative moving averages identified in Phillips and Perron (1988) and the low power of the test against the alternative hypothesis.

Autoregressive distributed lag model

This study uses the bound testing approach or autoregressive distributed lag model (ARDL) developed by Pesaran et al. (2001) to estimate the long-run and short-run relationships among production-based carbon emissions and its determinants such as green investment, renewable energy consumption, and trade openness. This approach is used in the case of mixed order of integration, useful for small size properties, and also solves the problem of endogeneity and autocorrelation (Solarin et al. 2017). Moreover, ARDL provides efficient results in the case of a small sample size. Based on the optimum chosen lags, the long-run equation for the model is provided as follows:

Here, a0, a1, a2, & a4 show long-run parameters, p is for optimal lags, and t for time-periods.

Moreover, the join significance of coefficients is determined by F-statistics calculated by Pesaran et al. (2001). Upper and lower critical bound values are used for I(1) and I(0) order of integration, respectively. The null hypothesis, which suggests no cointegration among the variable, i.e., H0 = a1 = a2 = a3 = a4 = 0 and the alternative hypothesis, suggests the existence of a cointegrating relationship among production-based carbon emissions, green investment, renewable energy consumption, and trade openness, i.e., H1 : a1 ≠ a2 ≠ a3 ≠ a4 ≠ 0. The acceptance or rejection of null and alternative hypothesis is based on F-statistics value.

In the next step, the short-run association among variables is calculated following error correction model:

Equation (6) shows the short-run relationship among variables. Here, ECMt − 1 is the lagged error correction term. The coefficient η shows the adjustment speed towards equilibrium.

For robustness checks, this study employs robust regression analysis by using FMOLS, DOLS, and canonical cointegration regression (CCR).

Results

The purpose of the empirical investigation is to estimate the impact of green investment on production-based carbon emissions for China. Prior to estimating Eq. (1), we employed different unit root tests to know the order of integration of variables. The results of unit root tests (ADF, PP, DFGLS, and KPSS) for cointegration are presented in Table 1. It is essential not only to examine the stationarity properties of each variable but also to know its order so that relevant econometric techniques should be applied for further analysis. The results obtained a different order of integration for each test. However, these differences in outcomes are mainly due to the properties of each test mentioned in the “Theoretical approach and econometric methodology” section. The results suggest that except for green investment, which is stationary at level, i.e., I(0), the rest of the variables are stationary at the first difference, i.e., I(1). The results confirm a mixed order of integration for all variables. All the results are statistically significant; however, the level of significance is different for each variable and procedure. Based on our findings, this study cannot employ (Engle and Granger 2015) cointegration approach, which is used for bivariate analysis, and the order of integration should be the same. Similarly, Johansen and Juselius’s (1990) approach for cointegration cannot be applied in the presence of a mixed order of integration. Therefore, in the next step, this study shall use an autoregressive distributed lag model (ARDL), which is suitable for mixed order of integration, i.e., I(0) and I(1).

The bound testing approach results are given in Table 2. The significant F-bound statistics and t-bound statistics values confirm the long-run cointegrating relationship between production-based carbon emissions and its determinants, i.e., green investment, renewable energy consumption, and trade openness.

Since the findings confirm the cointegrating relationship between production-based carbon emissions and its determinants, the next step is to check for short-run and long-run association among the variables presented in model 1. Following the selected optimum lag model, short-run and long-run results are obtained. Table 3 reveals several interesting results for the effects of green investment on production-based carbon emissions in the presence of energy consumption and trade openness.

First, green investment is negatively associated with production-based carbon emissions both in the long run and in the short run. On average, a − 0.12% decline in the long run and − 0.060% reduction in the short run is caused by green investment in production-based carbon emissions. Second, renewable energy consumption is also negatively linked with production-based carbon emissions both in the short run and in the long run. On average, a − 0.14% decline in the long run and − 0.068% reduction in the short run is caused by REC in production-based carbon emissions. Third, in contrast, trade openness is positively associated with production-based carbon emissions. In the short run and the long run, on average, 0.21% and 0.43% rise is caused in production-based carbon emissions due to a 1% increase in trade openness. Fourth, the term ECM(−1) shows the adjustment speed towards equilibrium or the convergence speed towards equilibrium; this value should be negative and significant for convergence, while positive and significant for divergence. In this study, ECM(−1) value is − 0.48 and highly significant, i.e., at 1%, 5%, and 10%. It suggests that around 48% of disequilibrium is corrected every year, and it shall take approximately 2.5 years to reach an equilibrium level.

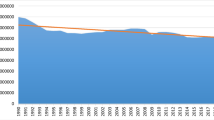

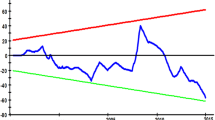

Diagnostic test results suggest that the overall model is significant, and data is normally distributed, with no problem of heteroscedasticity and autocorrelation. Further, the stability of the properties of the model is tested through cumulative sum and cumulative sum of square tests; the results suggest that the model is stable at 5% level of significance. The results for cumulative sum and cumulative sum of square tests are given in Figs. 1 and 2.

Table 4 shows results for robustness check using fully modified ordinary least square (FMOLS), dynamic OLS (DOLS), canonical cointegration regression (CCR), and robust regression analysis. The results found a negative association between green investment and production-based carbon emissions. On average, − 0.090%, − 0.12%, − 0.18%, and − 0.12% decline is caused in production-based carbon emissions by increasing green investment at 1%. Similarly, renewable energy consumption is also found to be negatively associated with production-based carbon emissions. One percent rise in renewable energy consumption cause an average − 0.10%, − 0.11%, − 0.14%, and − 0.12% decline in production-based carbon emissions. In contrast, 1% rise in trade openness causes an average of 0.34%, 0.37%, 0.33%, and 0.38% rise in carbon emissions from production.

Moreover, we have also included environment-specific technological development as an independent variable to check for its effect. The results given in Table 4 show that technological innovation that is in line with the environment is useful to reduce production-based carbon emissions. As innovation provides a more robust approach to cleaner production processes, it helps control emission levels. The results indicate that a 1% increase in environment-specific technological innovation causes to reduce production-based carbon emissions by − 0.011% in the case of China. Furthermore, another variable denoting human capital is also found to be negatively affecting production-based carbon emissions. Financial development is also found to be supportive in controlling production-based carbon emissions. One percent increase in financial development causes production-based carbon emissions to decline by − 0.47%. All the results are significant following the conventional level of significance, i.e., 1%, 5%, and 10%.

Discussion

To mitigate environmental problems and to achieve sustainability, China is striving to transition to low-carbon urban economies. Among several significant steps, the country has made remarkable success in controlling the emissions from transportation, buildings, and energy by shutting down or relocating several polluting industries. In the recent past, it has been observed that China started its plan to promote the green financial system in September 2015 following the communist party of China (CPC) annual meeting. Following the meeting, in August 2016, with approval from the state council, commissions, Ministry of Finance, Peoples Bank of China, and seven ministries approved the establishment of the green financial system. The green financial policy mainly covers the development of green credit, the establishment of green development funds, and green bonds. To mitigate environmental problems and to achieve sustainability, China is striving to transition to low-carbon urban economies. This study empirically examines the significance of green investment in abating production-based carbon emissions in China. The empirical results found that green investment, which is investment completed in industrial pollution prevention control, helps curb emissions from the production sector. Hence, green investment can enable China to transit to a low-carbon, resource-efficient, and competitive economy. The development of green finance based on certain conditions shall be helpful in support of carbon capture, utilization, and storage. Carbon capture storage or carbon capture utilization and storage should be achieved through green finance for green energy. These findings are in line with the outcomes of Noh (2010), Hongo (2013), David and Venkatachalam (2019), Dikau and Volz (2019), Punzi (2019), and Sachs et al. (2019). Their findings focus on the promotion of green projects, green financial institutions, green climate funds, green energy projects through carbon pricing, and, most importantly, public-private partnership investment for achieving low-carbon infrastructure and eventually reducing carbon emissions. Moreover, there is a negative association between renewable energy consumption and CO2 emissions both in the short run and in the long run. These outcomes support the findings of Bölük and Mert (2015b), Hu et al. (2018b), Inglesi-Lotz and Dogan (2018), and Mensah et al. (2018).

Through renewable energy sources, the existing and future needs of energy can be fulfilled by utilizing the pure and sustainable sources of energy, which exerts less pressure on environmental quality. Hence, renewable energy consumption is turning out to be one of the critical sources of curbing carbon emissions. However, Wuester et al. (2016) argue that to achieve benefits from renewable energy, the investment needs would exceed 900 billion USD in 2030. According to IRENA (2015) statistics, investment in the renewable energy sector for China is on the rise, and since 2004, from 3 billion USD, it reached 83.3 billion USD in 2014. Moreover, with a continued increase in renewable energy investment, China avoided 1494 million tonnes of carbon emissions in 2016 only. Further, in contrast, trade openness is positively associated with production-based carbon emissions. These outcomes are similar to the findings of Halicioglu (2009), Hossain (2011), Michieka et al. (2013), and Al-Mulali and Sheau-Ting (2014). China is currently exporting 2.41 trillion USD to the rest of the world, and the magnitude is rising. Trade openness is playing a pivotal role in the rise of production-based carbon emissions for China because a significant portion of both exports and imports are energy-intensive products, i.e., machine products, chemical products, transportations, and textiles among others (Simoes and Hidalgo 2011). Hence, this study finds that green investment, REC, and trade openness are the important determinants of production-based carbon emissions in China. The results of panel cointegration techniques support our hypothesized relationship of green investment and other variables with production-based carbon emissions.

Conclusion

This study explores the effect of renewable energy consumption and green investment on production-based carbon emissions in the presence of renewable energy consumption and trade openness for the economy of China. The empirical findings confirm the cointegrating relationship between production-based carbon emissions with green investment, renewable energy consumption, and trade openness. The theoretical results established a negative correlation for green investment and renewable energy consumption with production-based carbon emissions. However, trade openness is found to be positively associated with carbon emissions. Green investment is found to help control the rise in production-based carbon emissions. Green investment is negatively associated with production-based carbon emissions. Similarly, renewable energy consumption, which is also negatively linked with production-based carbon emissions, is found to be supportive of curbing emissions from the production sector. In contrast, trade openness is found to be harmful to the environment as it causes an increase in carbon emissions from the production sector. Furthermore, human capital, financial development, and environment-specific technological innovation are negatively associated with production-based carbon emissions.

The innovation of this study lies in estimating an empirical model, which departs from the previous studies as this study includes green investment as a determinant of environmental degradation. This study uses investment completed in industrial pollution prevention as our primary independent variable, which is referred to as a green investment. The outcomes of this study suggest that increasing green investment for infrastructure projects and production processes shall help to curb emissions from the production sector. Similarly, the establishment of renewable energy projects through carbon pricing control emissions. The promotion of public-private partnerships in renewable energy projects for the promotion of cleaner production and sustainable growth. Lastly, a tariff on imports of energy-intensive products that are harmful to the environment shall be helpful. This study contributes to the existing literature by introducing green investment as a determinant of production-based carbon emissions, which has been ignored in the existing literature. The findings from this study are valuable for evolving policies related to green financing and, most importantly, CO2 emissions.

The implication for policy sequencing is to achieve sustainable growth, and it is imperative to limit environmental degradation with rising industrial production. To limit the rise in temperature, and to make the economy more resilient, China must finance low-carbon transitions through green bonds. By taking mitigation actions and financing green projects, China has the potential to make the transition to sustainable growth in the near future. There is a need to boost private investment to promote environment-friendly growth, lowering carbon in the global economy, and low-carbon transformation. These funds should be provided to public-private investment partners and also to the government. In a broader sense, green financing is considered in both private and public green investments that would be helpful to improve energy efficiency, environment-friendly technology, low-carbon economy, or green growth. Hence, China should concentrate on a public and private partnership model to improve the environmental quality or mitigation of environmental damages. Besides, to promote a low-carbon energy system and for revenue purposes, the government should levy a carbon tax. Moreover, there is a need for financing required for renewable energy technology; however, for private investment, it is crucial and capital intensive, while for the government investment, the cost is more accessible. Loans are considered necessary for promoting renewable energy technology.

The study is limited to examine the impact of green investment on CO2 emissions in the presence of control variables. We explored that green investment is one of the critical determinants of CO2 emissions in the case of China. The results of the study can be generalized to other countries and regions and times. Further research is required to identify the availability of public finance for mitigation and climate change. Moreover, future research is needed to investigate the impact of green investment on production-based CO2 emissions in the case of provinces, municipalities, and the autonomous regions of China. This would further help to identify the availability of public finance for mitigation and climate change in different parts of the country.

References

Agena T (2007) The relationship between economic activities and environmental degradation in Africa. J Hist Soc Niger 17:28–40

Ahmad MH, Azhar U, Wasti SA, Inam Z (2005) Interaction between population and environmental degradation. Pak Dev Rev 44:1135–1148. https://doi.org/10.30541/v44i4iipp.1135-1150

Al-Mulali U, Sheau-Ting L (2014) Econometric analysis of trade, exports, imports, energy consumption and CO2 emission in six regions. Renew Sust Energ Rev 33:484–498. https://doi.org/10.1016/j.rser.2014.02.010

Arrow K, Bolin B, Costanza R, et al (1995) Economic growth, carrying capacity, and the environment. 15:91–95

Azhgaliyeva D, Kapsalyamova Z, Low L (2019) Implications of fiscal and financial policies on unlocking green finance and green investment. ADBI Working Paper Series

Baiardi D (2012) Innovation and the environmental Kuznets curve: the case of CO, NMVOCs and SOx in the Italian regions. Quaderni di Dipartimento

Balogh JM, Jámbor A (2017) Determinants of CO. Int J Energy Econ Policy 7:217–226

Boden T A, Marland G, Andres RJ (2009) Global, regional, and national fossil-fuel CO2 emissions. Carbon Dioxide Inf Anal Cent Oak Ridge Natl Lab USA Oak Ridge TN Dep Energy 10:U.S. Department of Energy, Oak Ridge, Tennessee. https://doi.org/10.3334/CDIAC/00001

Bölük G, Mert M (2015a) The renewable energy, growth and environmental Kuznets curve in Turkey: an ARDL approach. Renew Sust Energ Rev 52:587–595

Bölük G, Mert M (2015b) The renewable energy, growth and environmental Kuznets curve in Turkey: an ARDL approach. Renew Sust Energ Rev 52:587–595. https://doi.org/10.1016/j.rser.2015.07.138

Canadell JG, Le Quéré C, Raupach MR (2007) Contributions to accelerating atmospheric CO2 growth from economic activity, carbon intensity, and efficiency of natural sinks. Proceedings of the national academy of sciences 104(47):18866–18870. https://doi.org/10.1073/pnas.0702737104

Chen S (2013) Green finance and development of low carbon economy. In: LTLGB 2012. Springer, pp 457–461

Chen W (2008) An empirical test on the environmental Kuznets curve hypothesis in China. IEEE, pp 1–5

Datta TK (2017) Effect of green technology investment on a production-inventory system with carbon tax. Adv Oper Res 2017:1–12. https://doi.org/10.1155/2017/4834839

David D, Venkatachalam A (2019) A comparative study on the role of public–private partnerships and green investment banks in boosting low-carbon investments. ADBI Working Paper Series

Dhruba P (2018) Managing credit risk and improving access to finance in green energy projects

Dikau S, Volz U (2019) Central banking, climate change, and green finance. Handb Green Finance:81–102. https://doi.org/10.1007/978-981-13-0227-5_17

Dogan E, Inglesi-Lotz R (2020) The impact of economic structure to the environmental Kuznets curve (EKC) hypothesis: evidence from European countries. Environ Sci Pollut Res 27:12717–12724. https://doi.org/10.1007/s11356-020-07878-2

Dogan E, Taspinar N, Gokmenoglu KK (2019) Determinants of ecological footprint in MINT countries. Energy Environ 30:1065–1086

Dogan E, Turkekul B (2016) CO2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23:1203–1213

Duguma L, Atela J, Minang P, Ayana A, Gizachew B, Nzyoka J, Bernard F (2019) Deforestation and forest degradation as an environmental behavior: unpacking realities shaping community actions. Land 8:26. https://doi.org/10.3390/land8020026

Elliott G, Rothenberg TJ, Stock JH (1996) Efficient tests for an autoregressive unit root. National Bureau of Economic Research Cambridge. Mass, USA

Engle RF, Granger CWJ (2015) Co-integration and error correction: representation, estimation, and testing. Appl Econ 39:107–135. https://doi.org/10.2307/1913236

Frank RH, Cross ML, MacLean B, Osberg L (2005) Principles of microeconomics. McGraw-Hill Ryerson

Grossman GM, Krueger AB (1994) Economic growth and the environment (No. w4634). NBER Work Pap Ser Camb MA

Halicioglu F (2009) An econometric study of CO2 emissions, energy consumption, income and foreign trade in Turkey. Energy Policy 37:1156–1164. https://doi.org/10.1016/j.enpol.2008.11.012

Heine D, Semmler W, Mazzucato M, et al (2019) Financing low-carbon transitions through carbon pricing and green bonds. The World Bank

Höhne BN, Khosla S, Fekete H, Gilbert A (2012) Mapping of green finance delivered by IDFC members in 2011. 26

Holtz-Eakin D, Selden TM (1992) Stoking the fires? CO2 emissions and economic growth. National Bureau of Economic Research

Hongo H (2013) Renewable and green energy resources technologies: lessons learnt in sub-Saharan Africa (SSA). Renew Energy Sources Their Appl 17

Hossain MS (2011) Panel estimation for CO2 emissions, energy consumption, economic growth, trade openness and urbanization of newly industrialized countries. Energy Policy 39:6991–6999

Hu H, Xie N, Fang D, Zhang X (2018a) The role of renewable energy consumption and commercial services trade in carbon dioxide reduction: evidence from 25 developing countries. Appl Energy 211:1229–1244

Hu H, Xie N, Fang D, Zhang X (2018b) The role of renewable energy consumption and commercial services trade in carbon dioxide reduction: evidence from 25 developing countries. Appl Energy 211:1229–1244. https://doi.org/10.1016/j.apenergy.2017.12.019

Huang J, Liu Y, Hou H, et al (2008) Simultaneous electrochemical determination of dopamine, uric acid and ascorbic acid using palladium nanoparticle-loaded carbon nanofibers modified electrode. 24:632–637

Hyung K, Baral P (2019) Use of innovative public policy instruments to establish and enhance the linkage between green technology and finance. Springer Tokyo

Inglesi-Lotz R, Dogan E (2018) The role of renewable versus non-renewable energy to the level of CO2 emissions a panel analysis of sub-Saharan Africa’s Βig 10 electricity generators. Renew Energy 123:36–43. https://doi.org/10.1016/j.renene.2018.02.041

IPCC (2014) Summary for policymakers, In: Climate change 2014, mitigation of climate change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. Clim Change 2014 Mitig Clim Change Contrib Work Group III Fifth Assess Rep Intergov Panel Clim Change 1–33. https://doi.org/10.1017/CBO9781107415324

IRENA RES (2015) International renewable energy agency. Renew Energy Target Setting Abu Dhabi UAE

Johansen S, Juselius K (1990) Maximum likelihood estimation and inference on cointegration — with applications to the demand for money. Oxf Bull Econ Stat 52:169–210. https://doi.org/10.1111/j.1468-0084.1990.mp52002003.x

Jorgenson AK, Clark B, Kentor J (2010) Militarization and the environment: a panel study of carbon dioxide emissions and the ecological footprints of nations, 1970-2000. Glob Environ Polit 10:7–29. https://doi.org/10.1162/glep.2010.10.1.7

Karakaya E, Yılmaz B, Alataş S (2019) How production-based and consumption-based emissions accounting systems change climate policy analysis: the case of CO2 convergence. Environ Sci Pollut Res 26:16682–16694. https://doi.org/10.1007/s11356-019-05007-2

Khan Z, Ali S, Ali S, Umar M, Kirikkaleli D, Jiao Z (2020). Consumption-based carbon emissions and international trade in G7 countries: the role of environmental innovation and renewable energy. Sci of the Tot Env 730. https://doi.org/10.1016/j.scitotenv.2020.138945

Khan NS, Zuhra S, Shah Z, Bonyah E, Khan W, Islam S, Khan A (2019) Hall current and thermophoresis effects on magnetohydrodynamic mixed convective heat and mass transfer thin film flow. J Phys Commun 3:35009. https://doi.org/10.1088/2399-6528/aaf830

Kuznets S (1955) Economic growth and income inequality. Am Econ Rev 45:1–28

Kwiatkowski D, Phillips PCB, Schmidt P, Shin Y (1992) Testing the null hypothesis of stationarity against the alternative of a unit root. How sure are we that economic time series have a unit root? J Econ 54:159–178. https://doi.org/10.1016/0304-4076(92)90104-Y

Lagarde C, Gaspar V (2019) Getting real on meeting Paris climate change commitments. IMF Blog

Lee CC, Chang CP (2009) Stochastic convergence of per capita carbon dioxide emissions and multiple structural breaks in OECD countries. Econ Model 26:1375–1381. https://doi.org/10.1016/j.econmod.2009.07.003

Li X, Song Y, Yao Z, Xiao R (2018) Forecasting China’s CO2 emissions for energy consumption based on cointegration approach. Discret Dyn Nat Soc 2018:

Li X, Du J, Long H (2019) Green development behavior and performance of industrial enterprises based on grounded theory study: evidence from china. Sustainability 11(15):4133. https://doi.org/10.3390/su11154133

Li X, Du J, Long H (2020) Understanding the green development behavior and performance of industrial enterprises (GDBP-IE): scale development and validation. International Journal of Environmental Research and Public Health 17(5):1716. https://doi.org/10.3390/ijerph17051716

Li J, Zhang X, Ali S, and Khan Z (2020). Eco-innovation and energy productivity: New determinants of renewable energy consumption. Journal of Environmental Management. 271. https://doi.org/10.1016/j.jenvman.2020.111028

Maroušek J, Strunecký O, Stehel V (2019) Biochar farming: defining economically perspective applications. Clean Techn Environ Policy:1–7

Mazzucato M (2016) From market fixing to market-creating: a new framework for innovation policy. Ind Innov 23:140–156. https://doi.org/10.1080/13662716.2016.1146124

Meadows DH, Meadows DL, Randers J, Behrens WW (2018) The limits to growth. Green Planet Blues Crit Perspect Glob Environ Polit 102:25–29. https://doi.org/10.4324/9780429493744

Mensah CN, Long X, Boamah KB, Bediako IA, Dauda L, Salman M (2018) The effect of innovation on CO2 emissions of OCED countries from 1990 to 2014. Environ Sci Pollut Res 25:29678–29698. https://doi.org/10.1007/s11356-018-2968-0

Mi ZF, Pan SY, Yu H, Wei YM (2015) Potential impacts of industrial structure on energy consumption and CO2 emission: a case study of Beijing. J Clean Prod 103:455–462. https://doi.org/10.1016/j.jclepro.2014.06.011

Michieka NM, Fletcher J, Burnett W (2013) An empirical analysis of the role of China’s exports on CO2 emissions. Appl Energy 104:258–267. https://doi.org/10.1016/j.apenergy.2012.10.044

Moutinho V, Madaleno M, Inglesi-Lotz R, Dogan E (2018) Factors affecting CO2 emissions in top countries on renewable energies: a LMDI decomposition application. Renew Sust Energ Rev 90:605–622

Narayan PK, Narayan S (2010) Carbon dioxide emissions and economic growth: panel data evidence from developing countries. Energy Policy 38:661–666. https://doi.org/10.1016/j.enpol.2009.09.005

NBS (2017) National Bureau of Statistics of the People’s Republic of China. China Stat Yearb

Ng S, Perron P (2001) Lag length selection and the construction of unit root tests with good size and power. Econometrica 69:1519–1554. https://doi.org/10.1111/1468-0262.00256

Noh HJ (2010) Financial strategy to accelerate innovation for green growth. Oecdorg:2–3

OECD (2018) Taxing energy use 2018: companion to the taxing energy use database. OECD Publishing, Paris, France

Oh KY, Bhuyan MI (2018) Trade openness and CO2 emissions: evidence of Bangladesh. Asian J Atmospheric Environ 12:30–36. https://doi.org/10.5572/ajae.2018.12.1.030

Ozturk I, Acaravci A (2010) The causal relationship between energy consumption and GDP in Albania, Bulgaria, Hungary and Romania: evidence from ARDL bound testing approach. Appl Energy 87:1938–1943

Panwar NL, Kaushik SC, Kothari S (2011) Role of renewable energy sources in environmental protection: a review. Renew Sust Energ Rev 15:1513–1524. https://doi.org/10.1016/j.rser.2010.11.037

PCA (2016). https://unfccc.int/process-and-meetings/the-paris-agreement/the-parisagreement.

Peng H, Luo X, Zhou C (2018) Introduction to China’s green finance system. J Serv Sci Manag 11:94–100. https://doi.org/10.4236/jssm.2018.111009

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16:289–326. https://doi.org/10.1002/jae.616

Phillips PCB, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75:335–346. https://doi.org/10.1093/biomet/75.2.335

Punzi MT (2019) Role of bank lending in financing green projects. Handb Green Finance:237–259. https://doi.org/10.1007/978-981-13-0227-5_24

Retallack S, Johnson A, Brunert J, et al (2018) Energy efficiency finance programs: Best practices to leverage private green finance. ADBI Working Paper Series.

Rustam A, Wang Y, Zameer H (2019) Does foreign ownership affect corporate sustainability disclosure in Pakistan? A sequential mixed methods approach. Environ Sci Pollut Res 26:31178–31197

Sachs J, Woo WT, Yoshino N, Taghizadeh-Hesary F (2019) Importance of green finance for achieving sustainable development goals and energy security. Handb Green Finance Energy Secur Sustain Dev

Shahbaz M, Khan S, Tahir MI (2013) The dynamic links between energy consumption, economic growth, financial development and trade in China: fresh evidence from multivariate framework analysis. Energy Econ 40:8–21. https://doi.org/10.1016/j.eneco.2013.06.006

Shahzad SJH, Kumar RR, Zakaria M, Hurr M (2017) Carbon emission, energy consumption, trade openness and financial development in Pakistan: a revisit. Renew Sust Energ Rev 70:185–192. https://doi.org/10.1016/j.rser.2016.11.042

Simoes AJG, Hidalgo CA (2011) The economic complexity observatory: an analytical tool for understanding the dynamics of economic development. AAAI Workshop - Technical Report, In, pp 39–42

Solarin SA, Al-Mulali U, Musah I, Ozturk I (2017) Investigating the pollution haven hypothesis in Ghana: an empirical investigation. Energy 124:706–719. https://doi.org/10.1016/j.energy.2017.02.089

WDI T (2019) World development indicators (DataBank)

World Bank T (2018) World Bank open data. World Bank Web Site INTERNET

Wuester H, Jungmin Lee J, Lumijarvi A (2016) Unlocking renewable energy investment: the role of risk mitigation and structured finance. Int Renew Energy Agency IRENA

York R (2007) Structural influences on energy production in South and East Asia, 1971-2002. Sociological Forum. Wiley Online Library, In, pp 532–554

Zadek S, Flynn C (2013) South-originating green finance: exploring the potential. UNEP: SDC: IISD

Zhang Y, Zhang S (2018) The impacts of GDP, trade structure, exchange rate and FDI inflows on China’s carbon emissions. Energy Policy 120:347–353. https://doi.org/10.1016/j.enpol.2018.05.056

Zhang Y-J (2011) The impact of financial development on carbon emissions: an empirical analysis in China. Energy Policy 39:2197–2203

Zhu Q, Peng X, Wu K (2012) Calculation and decomposition of indirect carbon emissions from residential consumption in china based on the input-output model. Energy Policy 48:618–626. https://doi.org/10.1016/j.enpol.2012.05.068

Acknowledgments

We would also like to thank the editor and three anonymous referees for their highly constructive suggestions, which helped in improving earlier versions of this paper.

Funding

This research has been supported by the Humanities and Social Sciences Foundation of the Ministry of Education (Grant No. 18YJC790164), the Shandong Social Science Planning Project (Grant Nos. 18CGLJ15, 18CCXJ08), and the National Social Science Fund of China (Grant No. 17BJY104).

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible Editor: Eyup Dogan

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Wang, L., Su, CW., Ali, S. et al. How China is fostering sustainable growth: the interplay of green investment and production-based emission. Environ Sci Pollut Res 27, 39607–39618 (2020). https://doi.org/10.1007/s11356-020-09933-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-09933-4