Abstract

This paper aims to find out relationships among the energy, environment, and the industrial production for a developing country which is in earlier stages of development. It also tests a few contradicting hypotheses to find the possible shape of an environmental Kuznets curve. Using the time series data, the study finds robust long-run relationships between energy, environment, and industrial production for Pakistan. The scale economy is also assumed. It is also found that the capital and labor elasticities of income show increasing returns in the presence of energy and emission variables. It finds evidence of EKC in a quadratic restricted model but not in a cubic function. This analysis implies that the focus of policy authorities should be to persuade environment-friendly energy resources. After an initial stage of economic development, society has to take serious measure to tackle the issues of environmental degradation.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The rapid increase in economic activities and development increase the anthropogenic gases and environmental degradation in recent decades (Ahmed et al. 2019). The rapid growth in industrialization and population is also creating global warming and affects climate changes (Yuelan et al. 2019). Therefore, global warming is declared to be the most important environmental problem of our era with the increasing quantity of worldwide carbon dioxide (CO2) emissions (Mahmood and Shahab 2014). Yuelan et al. (2019) suggest that the major challenges of the modern era are economic development and environmental protection across the globe. The economic development of developed countries is contributing about 75% of the total global CO2 emissions (Seetanah et al. 2019). Since fossil fuels’ consumption is a general cause of these emissions, reducing energy spend appears as the shortest means of managing the emissions crisis. Nevertheless, because of probably negative concern for an economy, the decline in energy use is generally considered as a “less chosen road.” Likewise, if the Kuznets curve-type phenomenon holds for the environment, then economic expansion automatically might become a resolution to the crisis of environmental deprivation (Soytas et al. 2007; Rothman and de Bruyn 1998).

Pakistan is a good relative case study for the empirical investigation since it needs to change its structure of the economy and institutional arrangements to make them inline the worldwide prerequisites of modern development. Furthermore, amid industrialization, there is an expanding pattern in CO2 emissions in Pakistan for the last three decades. Table 1 shows some statistics of Pakistan’s power sector including both imported and domestic supplies. The energy is mainly demanded by households, industry, transport, agriculture, and the government (Pakistan 2018). The problem of allocation of energy resources yet remains topical.

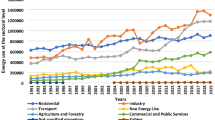

Figure 1 shows the trend in CO2 emissions in Pakistan. The encircled period is the severe energy crises span when hundreds of small and medium industrial units closed and use of energy reduced. However, after 2015, it has started increasing again. Figure 2 also vindicates our hypothetical statement that industrial production and environmental degradation move cyclically together (pro-cyclic to each other).

Over time, the energy requirement has increased enormously (Fig. 3, below), particularly in the transportation and manufacturing sectors. The share of household and industrial gas consumption increased by 1990–2012 but started to decrease over the last 5 years. During 1990–2012, the share of electricity decreased. Although its share in the use of natural gas has increased, its use in transport has declined in 2013–2017. Transport and energy sectors are now main petroleum consumers, and their share has gradually grown. Oil products have declined household, agricultural, and manufacturing expenditure during the entire study. It indicates that the industrial sector primarily substitutes sources of electricity, gas, and coal. The manufacturing sector had never favored coal until 1990. Minor coal use began after 2000, but brick kilns (about 80%) are still a major user of this energy source. There were recent big swings in the demand for coal, while the consumption of gas was relatively constant. In the last two to three decades, electricity consumption in Pakistan has been very volatile.

Coondoo and Dinda (2002) argue that both developing and industrial economies must forfeit some economic expansion by limiting industrial production. High-income economies activate the industrial sector and upsurge the energy consumption (Al Mamun et al. 2014). However, modeling the relationship between energy, environment, and productions, countries can choose some blend of policy to fight global environmental problems (Soytas and Sari 2006; Chandio et al. 2019). As Shaheen et al. (2020) conclude that industrialization is one of the prime drivers of CO2 emission in the Pakistan economy. Similarly, Hafeez et al. (2018) argue that the production level is directly associated with CO2 emission. Consequently, the relationship energy, environment, and industrial production require being addressed cautiously and in depth for almost every economy around the globe, but more emphasis should be for developing ones. In the study under review, the link between energy capacity, CO2 emissions, and industrial production is investigated for a developing economy. A long-run analysis is done in a multivariate structure gross fixed capital and labor as control variables, employing autoregressive distributed lag (ARDL) model.

This study is organized as follows: After this concise beginning of the paper, in “Background literature” section, we present some academic literature linking applied models; “Model and methodology” section presents the model and methodological issues of this study; “Empirical results” section discusses the empirical results and discussion of estimates, and “Conclusions and implications” section concludes and implies the results.

Background literature

Numerous hypothetical investigations formally model an immediate connection between energy and development and energy and ecology. For that point, we present the exact reviews that relate the transmission instruments inside the energy industrial production and the environment. The hypothetical work on financial/capital development generally depends on the Solow (1956) model. All of the late developments depend intensely on endogenous growth hypothesis. A countless number of academic papers have examined the model connecting financial conditions and the production process (for a survey, Xepapadeas 2005). Similarly, Jorgenson and Wilcoxen (1993) specifically spread hypothetical work that models intergenerational broad structure to build up the interrelationships between environmental decay, energy, and industrial production.

Kolstad and Krautkraemer (1993) identify that the uses of resources (mainly fossil fuels) in industrial production yield direct economic payback; its harmful contact on the environment could be found for the long run. Jorgenson and Wilcoxen (1993) observe that the general aspect of empirical models is their main reliance on the consequence of the course of action on capital formation. Hypothetically, there may be numerous transmission frameworks relating environmental strategy and economic development/growth; partially due to several models are given pollution as an input in the industrial production process. Generally speaking, the environmental policies are considered to impede growth, because of their role as extra constraints in the production models. Therefore, the analytical methodology for a fresh empirical analysis should be found on the dynamic effects. Theoretical studies mostly deem that any useful strategy must capture the dynamic relationships and picture for a long-run viewpoint.

The recent literature identifies numerous aspects that cause the existence of the environmental Kuznets curve (EKC, henceforth) and the main determinants of the growth–pollution relationship (Stern 2004; Van Alstine and Neumayer 2010; Panayotou 2016). The evidence of EKC of growth pollution is validated in 13 out of 16 divisions across the globe (Hafeez et al. 2019b). Also, Brock and Taylor (2005) point out that the supposed EKC is a key to analyze the literature and there is a close relationship between theory and data. Similarly, the study of Hafeez et al. (2019b) has mentioned that EKC computes the marginal impacts of per capita income on environmental degradation during various stages of the economy: scale, composition, and technique effect, respectively. Several studies investigated different aspects of pollution–economy relationships and found multiple results. Some argued about the linear relationship involving ecosystem and economic expansion (see Stern 2004; Shafik 1994). Some found it to be quadratic and cubic (see, for example, Canas et al. 2003; Mahmood and Shahab 2014; de Bruyn et al. 1998; Shafik 1994; Ghali and El-Sakka 2004; Heil and Selden 1999; Yang 2000). Canas et al. (2003) discover a time-variant relation linking emissions per capita and income, and emissions per capita might lead the growth from a manufacturing viewpoint.

Al-Mulali et al. (2016) found that the EKC hypothesis does exist in Kenya and emphasize that renewable energy consumption lessens air pollution in the long run. On the other hand, financial development has only long-run implications for reducing air pollution. There is yet a possibility to view the emissions directing towards energy utilization, particularly when energy production procedure of an economy is a source of emissions. The study of Al Mamun et al. (2014) also pointed out that high-income economies trigger the economy through the industrial sector which increases (directly or indirectly) the energy consumption. Likewise, Rauf et al. (2018) argue that energy consumption is nurturing the economic growth.

The rationale of environmental Kuznets curve

Through the literature, we conclude and test the following propositions in this paper:

Proposition I

Holding technology and mix of production inputs constant, the expansion of industrial production deteriorates the environmental quality (Yao et al. 2019; Yasmeen et al. 2019; Panayotou 2016).

Proposition II

During the transition of the economy from one stage to another, the output components of an economy changes, particularly in early stages of growth and development where the agriculture sector is the main contributor to the GDP. In the transitional phases, scale effect, at the beginning of industrialization, environmental degradation increases. At the composite effect, this effluence amount is ultimately reduced as the economy grows further and depends more on the services side (Yasmeen et al. 2019; Copeland and Taylor 2004).

In a different row of the empirical literature, large numbers of studies test the link between consumption of power and the output. This literature has investigated the causality between GDP and energy with varied outcomes (Akarca and Long 1980). Stern (1993) was the first striking research who chains using a multivariate analysis, instead of simple regression. Following Stern (1993), much of research on this issue followed the latest and influential time series methods to find the long-run interrelationship among CO2 emissions, energy, and growth for different economies (for a review, see Stern 2000; Dinda 2004; Sari and Soytas 2004; Lee 2006). All this literature verifies that the foremost source of emissions is energy.

In the EKC literature, the degree of major research is done for the developed economies. However, a very limited text is available that studies environmental degradation concerning other the economic variables in Pakistan, particularly using industrial production variable instead of GDP. For Pakistan economy, Siddiqui (2004) among the pioneer researches analyzes the association among growth, energy, and their ecological implications. It is found that although energy is the main cause of economic progress, it points towards the opportunity of interfuel substitution due to changes in price composition. Nasir and Rehman (2011) found mixed results and do not maintain the idea of EKC for short run.

Model and methodology

In this paper, the vigorous relationship between industrial productions, energy, and emissions is investigated and tested for a small economy, Pakistan, additionally assuming for likely effects of labor (L) and gross fixed capital formation (K) on this relationship.Footnote 1 Energy is a primal determinant to nurture production process (Hafeez et al. 2019a; Liu et al. 2018). Industrial production stimulates the production process by machinery operation (Hafeez et al. 2019a; Rauf et al. 2018). The advancement in business and suitable population growth requires additional demand for energy (Rauf et al. 2018). Production efficiency of the industrial sector can be achieved through trade openness by sustaining the pollution (Hafeez et al. 2019c; Yasmeen et al. 2018). Similarly, the study of Hafeez et al. (2019c) argues that investment creates energy efficient in the production process. Per capita, CO2 emission is used to quantify the environment (Hafeez et al. 2018; Liu et al. 2018, 2019). The labor force is considered as an input factor for labor (Ali et al. 2018). Thus, the model is summarized as follows:

where IP is the log of industrial productivity index, E is the log of energy, transformed to giga-watt-hours (GWh), CO2 is the log of per capita emission (carbon dioxide), K is the log of investment (here GFCF), originally in Rs. millions, and L is the log of labor force.

The econometric specification of the model will be

In Eq. 2, the expected signs of parameters are β1 < 0, β2 > 0, β3 > 0, and β4 > 0.

Econometric strategy

To analyze this time series framework, we extend a method based on Pesaran et al. (2001) that presents bounds testing way to detect the possible long-run relationships between variables with a different order of integration. So, for the identification of order of integration, augmented Dickey and Fuller’s unit root test is applied.

The Pesaran et al. (2001) method frames the

“autoregressive distributed lag model (ARDL).”

That test involves two steps to confirm and estimate the long-run path. First is to look at the presence of a long-run association between every variable in a model. If the cointegration is found, then in the second stage, the estimation is done for the long and short run.

To test for long-run stable path in Eq. 2 by the bound test, the unrestricted error correction model (UECM) given below is built.

This model resembles the conventional error correction model (ECM). The subscripts i, j, k, l, and m, underneath each variable, define the lag formation of that variable, i.e., decided based on Schwarz criterion. To examine the occurrence of long-run relationships among the IP, CO2, E, L, and K, the Wald test is applied (as the second step) under the null hypothesis: H0: ϕ0 = ϕ1 = ϕ2 = ϕ3 = ϕ4 = 0 assuming no long-run stable relationship among variables.

EKC methodology for industrial productivity

The experimental investigation for the presence of an EKC has been found in different academic jobs. These examinations share some regular attributes regarding the information and strategies utilized. A large portion of the information utilized in these studies is based on cross-sectional and/or panel data. A simple reduced-form equation is utilized to test different potential connections among environmental degradation and the industrial output

and we restrict this equation by assuming π3 = 0 and then estimate the following restricted model:

Here, both variables are used in log form, and instead of the conventional use of GDP per capita for the estimation of EKC, we have used industrial productivity index, which is a novel feature of this research. We, then, test whether model (4) or model (5) is better through the F test.

Here, subscripts R and U are used for restricted and unrestricted models, respectively.

This model tests several shapes of the environment–production relationships, and we justify our Propositions I and II (discussed above in “The rationale of environmental Kuznets curve” section). It follows

π1 = π2 = π3 = 0. A flat pattern (no statistically significant relationship).

π1 > 0 and π2 = π3 = 0. A linear but positive relationship between environment and economy (Proposition I).

π1 < 0 and π2 = π3 = 0. A decreasing linear relationship (inverse of Proposition I).

π1 > 0, π2 < 0, and π3 = 0. An inverted U-shaped EKC (Proposition II).

π1 < 0, π2 > 0, and π3 = 0. A U-shaped curve (inverse of Proposition II).

π1 > 0, π2 < 0, and π3 > 0. A cubic or N-shaped curve (Proposition I and Proposition II).

π1 < 0, π2 > 0, and π3 < 0. Opposite to N-shaped curve.

Johansen’s vs MLE cointegration for EKC

Table 2 below suggests that all the variables of the model (5) are integrated of order 1 and applying ordinary least squares to this model will create the issue of spurious regression. In a spurious regression, the errors would be correlated and the standard t statistic will be wrongly calculated because the variance of the errors is not consistently estimated. Thus, the solution lies in applying cointegration techniques. An m × 1 vector time series Yt is said to be cointegrated of order (d, b), where 0 < b ≤ d, if each of its component series Yit is I(d), but some linear combination α′Yt is I(d-b) for some constant vector α ≠ 0.

Johansen’s approach: a summary

In this regard, for the multivariate model, the Johansen’s technique is preferred over the Engle–Granger two-step procedure because Johansen’s method allows to a multivariate VAR model. Consider a level VAR(p) model:

Here, Yt is a time series m × 1 vector of I(1) variables.

The VAR(p) model is stable if Det(In − Φ1z − · · · − Φpzp) = 0 has all roots outside the complex unit circle. If there are roots on the unit circle, then some or all of the variables in Yt are I(1) and they may also be cointegrated.

Maximum likelihood estimation: a summary

Suppose we find Rank(π) = k 0 < k < m (m is the number of endogenous variables in the model). Then, the cointegrated VECM

This is a reduced rank of the multivariate regression. Johansen derived the ML estimation of the parameters under the reduced rank restriction Rank(π) = k. The ML estimates of the remaining parameters are obtained by OLS of Eq. 8. The factorization π = \( \gamma \overset{\hbox{'}}{A} \) is not unique. The columns of AML may be interpreted as linear combinations of the underlying cointegrated relation. This methodology is compared with Johansen’s technique in this paper for empirical evidence purpose.

Data

The data used for empirical analysis are collected from different sources for the period 1976–2016: We obtained industrial production from international financial statistics, CO2 emissions’ data from world development indicators (WDI) of World Bank and KNOEMA CorporationFootnote 2, labor force from Pakistan Economic Survey (PES) and State Bank of Pakistan, and investment (GFCF) from international financial statistics (IFS). The data for energy is collected from the economic survey WDI. All these data are in log form. Since combined data of energy from all resources are being used, it needed to be converted into a sole unit after using certain scientific modus operandi of energy quantification. The million cubic feet of natural gas, barrels of fuel utilization, and metric tons of coal use are taken into account to change all energy resources into GWh of power it might create.

Empirical results

As discussed in “Model and methodology” section, we have applied augmented Dickey and Fuller (ADF) and Phillips Perron (PP) unit root tests for stationarity of individual time series. The results are reported in “The results of the long-run approach” section. Then, we move towards main results, based on the ARDL bound testing approach. In the last part of this section, we have estimated the EKC for Pakistan’s economy through multiple techniques. Table 2 below illustrates the results of the stationarity test using the ADF and PP tests. The time series of CO2 emissions, industrial production, and energy are stationary at first difference and do not hold mean-reverting property. Investment (GFCF) and labor force are stationary at level.

The order of integration is one for CO2, IP, and E, whereas it is zero for labor and capital. Thus, usual cointegration technique (e.g., Engel–Granger or Johansen) cannot be applied to this model with all five variables. So, the different stationarity level advocates the use of supposed ARDL test for the long run (Ahmed et al. 2019).

The results of long-run approach

For the long-run study, the unrestricted error correction model is applied. Altinay (2007) and Sultan (2010) provide earlier evidence of such modeling practice. Mostly individual parameters in Table 3 are statistically different from zero (at 5% and 10% levels of significance). Now the purpose is to calculate F statistics with the help of Wald test of combined significance of this model to analyze the proposition of the long-run relationships among variables of interest. For the needful, we applied the Wald test on the coefficients ϕ0, ϕ1, ϕ2, ϕ3, and ϕ4.

Table 4 shows that our specified model is tested through the diagnostic tests, and we can conclude (i) the residuals are distributed normally; (ii) the F stat in Ramsey RESET test shows the correct specification of the model; (iii) the LM test is applied to confirm serially independent residuals, failed to reject the null hypothesis of the absence of autocorrelation, but ARDL and ECM have an intrinsic property to cater to the issue of serial correlation; and (iv) the residuals are homoskedastic, as indicated by the ARCH LM test.

Hence, there is a perceived complexity in short-run behavior of the variables. The bound test indicates that the F statistics = 5.33. It is evaluated against the lower and upper bound at 5% level from the tables in Pesaran et al. (2001) case III to confirm the stable relationships at level, with drift but no trend at the degree of freedom, k = 4.

The statistics in Table 5 demonstrate that F calculated > than upper bound, demonstrating the presence of stable relationships in the long run among the variables. So, the cointegration is found indicating that estimated coefficients of Eq. 3 are meant to use for calculating elasticities in the long run. The long-run elasticities are computed as given in Table 6.

The negative emission elasticity of output shows that environmental degradation reduces the output due to its negative impact on the health and cost of production increases too. The long-run elasticity output to energy leads the inference that energy is one of the most significant sources of production. That is the reason that a unit increase in the energy prices increases the cost of production, and as a result, the economy faces a supply shock. The values of these two elasticities are greater than unity in (absolute terms), showing the negative externality created from the utilization of energy (particularly from the use of fossil fuel) in the form of emission which can hold back the economic process. Nonetheless, the net consequence of energy is negative (− 0.16) that indicates that the energy is not being efficiently used. This implies that Pakistan can still use more energy, but the scale or efficiency should improve accordingly to grow at a rapid pace.

Similarly, the positive values of elasticities of labor show that both have typical theoretical relationships, and but interestingly, these results imply increasing return to scale for industrial production, despite externality. This may be due to lack of regulations and other control measures of environmental degradation, that producers are sometimes least concerned about the externality.

Short-run results

The results for short-run (i.e., impact period) analysis are presented in Table 7. The parameter of error term Zt is negative but statistically significantly different from zero. This confirms the existence of a long-run stable path among variables and also that this long-run balance is achieved through short-run error correction of 21.9%. So in each period, almost 22% of disequilibrium is corrected. All other variables except labor are contributing significantly to this error correction process.

Environmental Kuznets curve

The existence of EKC needs to be addressed, and a quicker turning point will resolve after an initial stage of economic development (Yasmeen et al. 2019). The scale effect proposes that at the start of industrialization and urbanization, the economy should increase the productivity of its input factor (Yao et al. 2019; Yasmeen et al. 2019; Rauf et al. 2018). While, for composition effect, the economies should try to reach that turning point with severe effort to deal with the issues of ecological degradation (Yao et al. 2019; Yasmeen et al. 2019). The results in the previous subsection have shown some significant inferences for the economy in general. Now, we estimate the EKC with the given data and test the Propositions I and II framed in “The rationale of environmental Kuznets curve” and “Short-run results” sections, above. The estimation of Eqs. 4 and 5 is done separately. The data were non-stationary and have the same order of integration, so the most appropriate technique is Johansen’s cointegration test. However, the OLS and fully modified OLS (ML cointegration) proposed by Pedroni (2000) are also applied, and reported in Table 8 to validate the estimated results (Pesaran et al. 2001; Hafeez et al. 2018).

Based on F stat in Eq. 6, we confirm that both models cannot be rejected. The unrestricted model confirms that the hypotheses (I), (II), and (II) of “Short-run results” section are not valid in all three models presented in columns 2, 3, and 4, because the coefficients are significantly different from zero in all cases. However, Johansen’s cointegration brings speedier turning point with a U-shaped curve. Only hypothesis (VII) is confirmed, and an opposite to N-shaped curve is expected under the cubic function estimation of EKC.

On the other hand, restricted model confirms EKC with all three methodologies and confirm our Propositions I and II which state that there is a positive relationship between environment and output whereas this is an increasing function at early stages of development while after a certain turning point, it then becomes a decreasing function. Thus, a possibility of the presence of EKC in our case study economy cannot be neglected. So hypothesis (VI) is valid in this case. Again the coefficients of Johansen’s approach show a sharp EKC compared with others. So we can find a monotonically increasing EKC at early stages of development and industrial growth. Since EKC is largely used as a case that economy and environmental quality move pro-cyclically, this might be true for developing countries (Van Alstine and Neumayer 2010) but not as an N-shaped EKC.

Analytical summary

As the economy grows richer, the demand for environmental value increases, too. This implies that environmental quality is a normal good, having positive income elasticity (Beckerman 1992). However, in developing countries, the demand for environmental excellence is relatively small, due to incomplete knowledge and moral hazards (Lopez 1994). Our estimates suggest that for the long run, the presence of EKC is a quadratic function, and we can forecast a near future only.

Conclusions and implications

This paper has used an ARDL methodology to uncover a long-run stable association between industrial production and the environment in the presence of energy use. The results indicate some plausible conduct of the arguments of the model. The energy elasticity of output is positive and greater than one, but due to the negative externality formed by energy use, suspected lowering this impact. The elasticities of investment (GFCF) and employment show that despite negative offshoots of energy consumption, production function demonstrates (little) increasing return to scale. Another objective of this study was to estimate the model to test the EKC and find its evidence in a quadratic restricted model. In the descriptive analysis, we found energy switching behavior (as claimed by Siddiqui 2004), principally in the industrial sector.

This research work proposes some policy suggestions based on empirical outcomes as follows: Energy, being a catalyst of output, should be used efficiently with technical augmentation to have lesser damage to the environment, and in this regard, fuel switching from expensive to cheaper must be observed by regulators. An introduction of the carbon tax on the industries producing more contaminants may be recommended. In this regard, the industries should be characterized as black, gray, and green according to their relative impact on the ecology. The estimated results of the present study also imply that the existence of EKC needs to be addressed and a quicker turning point will resolve after an initial stage of economic development. The economies should try to reach that turning point with severe effort to deal with the issues of ecological degradation. The scale effect proposes that at the start of industrialization and urbanization, the economy should increase the productivity of its input factor.

This analysis limits in many ways. It is already suggested that future research can be done for an elasticity of substitution function considering the environmental demand as a normal good. The numerical solutions of turning points and applied measures can be tested too.

Notes

To account for capital accumulation is suggested by Jorgenson and Wilcoxen (1993)

References

Ahmed Z, Wang Z, Mahmood F, Hafeez M, Ali N (2019) Does globalization increase the ecological footprint? Empirical evidence from Malaysia Environ Sci Pollut Res 1–18

Akarca AT, Long TV (1980) On the relationship between energy and GNP: a reexamination. J Energy Dev 5:326–331

Al Mamun M, Sohag K, Mia MAH, Uddin GS, Ozturk I (2014) Regional differences in the dynamic linkage between CO2 emissions, sectoral output and economic growth. Renew Sust Energ Rev 38:1–11

Ali TM, Kiani A, Hafeez M (2018). Impact of trade liberalization on employment, poverty reduction and economic development. Pak Econ Rev

Al-Mulali U, Solarin SA, Ozturk I (2016) Investigating the presence of the environmental Kuznets curve (EKC) hypothesis in Kenya: an autoregressive distributed lag (ARDL) approach. Nat Hazards 80(3):1729–1747

Altinay G (2007) Short-run and long-run elasticities of import demand for crude oil in Turkey. Energy Policy 35:5829–5835

Beckerman W (1992) Economic growth and the environment: whose growth? Whose environment? World Dev 20(4):481–496

Brock WA, Taylor MS (2005) Economic growth and the environment: a review of theory and empirics. In: Aghion P, Durlauf SN (eds) Handbook of Economic Growth, vol. 1B, pp. 1749–1821

Canas A, Ferrao P, Conceicao P (2003) A new environmental Kuznets curve? Relationship between direct material input and income per capita: evidence from industrialised countries. Ecol Econ 46(2):217–229

Chandio AA, Rauf A, Jiang Y, Ozturk I, Ahmad F (2019) Cointegration and causality analysis of dynamic linkage between industrial energy consumption and economic growth in Pakistan. Sustainability 11(17):4546

Coondoo D, Dinda S (2002) Causality between income and emission: a country group-specific econometric analysis. Ecol Econ 40(3):351–367

Copeland BR, Taylor MS (2004) Trade, growth, and the environment. J Econ Lit 42(1):7–71

De Bruyn SM, van den Bergh JC, Opschoor JB (1998) Economic growth and emissions: reconsidering the empirical basis of environmental Kuznets curves. Ecol Econ 25(2):161–175

Dinda S (2004) Environmental Kuznets curve hypothesis: a survey. Ecol Econ 49(4):431–455

Ghali KH, El-Sakka MI (2004) Energy use and output growth in Canada: a multivariate cointegration analysis. Energy Econ 26(2):225–238

Hafeez M, Chunhui Y, Strohmaier D, Ahmed M, Jie L (2018) Does finance affect environmental degradation: evidence from one belt and one road initiative region? Environ Sci Pollut Res 25:9579–9592. https://doi.org/10.1007/s11356-018-1317-7

Hafeez M, Yuan C, Khelfaoui I, Sultan Musaad OA, Waqas Akbar M, Jie L (2019a) Evaluating the energy consumption inequalities in the one belt and one road region: implications for the environment. Energies 12(7):1358

Hafeez M, Yuan C, Yuan Q, Zhuo Z, Stromaier D (2019b) A global prospective of environmental degradations: economy and finance. Environ Sci Pollut Res 26(25):25898–25915

Hafeez M, Yuan C, Shahzad K, Aziz B, Iqbal K, Raza S (2019c) An empirical evaluation of financial development-carbon footprint nexus in one belt and road region. Environ Sci Pollut Res 1–11

Heil MT, Selden TM (1999) Panel stationarity with structural breaks: carbon emissions and GDP. Appl Econ Lett 6(4):223–225

Jorgenson DW, Wilcoxen PJ (1993) Energy the environment, and economic growth. Handb Natl Resour Energy Econ 3:1267–1349

Kolstad CD, Krautkraemer JA (1993) Natural resource use and the environment. Handb Natl Resour Energy Econ 3:1219–1265

Lee CC (2006) The causality relationship between energy consumption and GDP in G-11 countries revisited. Energy Policy 34(9):1086–1093

Liu J, Yuan C, Hafeez M, Yuan Q (2018) The relationship between environment and logistics performance: evidence from Asian countries. J Clean Prod 204:282–291

Liu J, Yuan C, Hafeez M, Li X (2019) ISO 14001 certification in developing countries: motivations from trade and environment. J Environ Plan Manag 1–25

Lopez R (1994) The environment as a factor of production: the effects of economic growth and trade liberalization. J Environ Econ Manag 27(2):163–184

Mahmood MT, Shahab S (2014) Energy, emissions and the economy: empirical analysis from Pakistan. Pak Dev Rev 53(4-II):383–401

Nasir M, Rehman FU (2011) Environmental Kuznets curve for carbon emissions in Pakistan: an empirical investigation. Energy Policy 39(3):1857–1864

Pakistan (2018) Economic survey. Economic Advisor's Wing, Ministry of Finance, Islamabad

Panayotou T (2016) Economic growth and the environment. Environ Anthropol 140–148

Pedroni P (2000) Fully modified OLS for heterogeneous cointegrated panels. In: Baltagi BH (ed) Nonstationary panels, panel cointegration and dynamic panels, 15. Elsevier, Amsterdam, pp 93–130

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326

Rauf A, Liu X, Amin W, Ozturk I, Rehman OU, Hafeez M (2018) Testing EKC hypothesis with energy and sustainable development challenges: a fresh evidence from belt and road initiative economies. Environ Sci Pollut Res 25(32):32066–32080

Rothman DS, de Bruyn SM (1998) Probing into the environmental Kuznets curve hypothesis. Ecol Econ 25:143–145

Sari R, Soytas U (2004) Disaggregate energy consumption, employment and income in Turkey. Energy Econ 26(3):335–344

Seetanah B, Sannassee RV, Fauzel S et al (2019) Impact of economic and financial development on environmental degradation: evidence from Small Island developing states (SIDS). Emerg Mark Financ Trade 55:308–322

Shafik N (1994) Economic development and environmental quality: an econometric analysis. Oxf Econ Pap 46(4):757–774

Shaheen A, Sheng J, Arshad S, Salam S, Hafeez M (2020) The dynamic linkage between income, energy consumption, urbanization and carbon emissions in Pakistan. Pol J Environ Stud 29(1):1–10

Siddiqui R (2004) Energy and economic growth in Pakistan. Pak Dev Rev 175–200

Soytas U, Sari R (2006) Energy consumption and income in G-7 countries. J Policy Model 28(7):739–750

Soytas U, Sari R, Ewing BT (2007) Energy consumption, income, and carbon emissions in the United States. Ecol Econ 62(3–4):482–489

Stern DI (1993) Energy and economic growth in the USA: a multivariate approach. Energy conomics 15(2):137–150

Stern DI (2000) A multivariate cointegration analysis of the role of energy in the US macroeconomy. Energy Econ 22(2):267–283

Stern DI (2004) The rise and fall of the environmental Kuznets curve. World Dev 32(8):1419–1439

Sultan R (2010) Short-run and long-run elasticities of gasoline demand in Mauritius: an ARDL bounds test approach. Journal of Emerging Trends in Economics and Management Sciences 1(2):90–95

Van Alstine J, Neumayer E (2010) The environmental Kuznets curve. Handb Trade Environ 2(7):49–59

Xepapadeas A (2005) Economic growth and the environment. Handb Environ Econ 3:1219–1271

Yang HY (2000) A note on the causal relationship between energy and GDP in Taiwan. Energy Econ 22(3):309–317

Yao X, Yasmeen R, Li Y, Hafeez M, Padda IUH (2019) Free trade agreements and environment for sustainable development: a gravity model analysis. Sustainability 11(3):597

Yasmeen R, Li Y, Hafeez M, Ahmad H (2018) The trade-environment nexus in light of governance: a global potential. Environ Sci Pollut Res 25(34):34360–34379

Yasmeen R, Li Y, Hafeez M (2019) Tracing the trade–pollution nexus in global value chains: evidence from air pollution indicators. Environ Sci Pollut Res 26(5):5221–5233

Yuelan P, Akbar MW, Hafeez M, Ahmad M, Zia Z, Ullah S (2019) The nexus of fiscal policy instruments and environmental degradation in China. Environ Sci Pollut Res 1–14

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible Editor: Muhammad Shahbaz

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Mahmood, M.T., Shahab, S. & Hafeez, M. Energy capacity, industrial production, and the environment: an empirical analysis from Pakistan. Environ Sci Pollut Res 27, 4830–4839 (2020). https://doi.org/10.1007/s11356-019-07161-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-019-07161-z