Abstract

Previous studies failed to account for the effects of major, minor and moderate changes in financial development on environmental sustainability in Nigeria. To provide this necessary fresh evidence, the current study applied the recently proposed multiple threshold nonlinear autoregressive distributed lag model for the provision of such information. Quarterly data series from 2000Q1 to 2018Q4 obtained from various data hosts were used for empirical analysis. Evidence from the estimations proves that the MTNARDL models provide more robust outputs than the NARDL. Equally, results from this enhanced framework indicate that the effects of extremely large changes in financial development on environmental sustainability differ significantly from the effects of extremely small changes. Again, the finding reveals that the positive impacts of financial development on environmental sustainability fizzles out at the lower thresholds. Furthermore, stronger asymmetric effects between financial development and CO2 emissions exist in the long run, as compared with the short run. Therefore, to ensure environmental sustainability and sustainable development in Nigeria, policy makers should pay adequate attention to the long-run dynamics and ensure that financial development level does not degenerate to the lower thresholds where the positive impacts of financial developments fizzle out.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

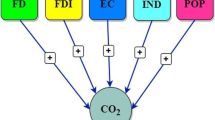

This paper sets for itself the goal of empirically investigating the effects of major, minor and moderate changes in financial development on environmental sustainability (proxied by the amount of greenhouse gas emissions) in Nigeria. The seminal work of Kraft and Kraft (1978) found evidence of a direct causal relationship running from income to energy consumption. Subsequent empirical studies affirm this conclusion that financial development enhances agents’ capacity to access credit, which bolsters their disposable income and budget outlays for households and firms, respectively. The combined effect of households increased income and firms’ access to investible funds, as well as their associated spike in consumption and production activities inevitably leads to economic growth.

However, with increased growth comes the upward pressure for energy demand by those sectors actually involved in generating the national output, as well as in those sectors benefitting from the positive multiplier effects of the initial producing sectors. Investments in and production of energy-intensive technologies (cars, heavy duty manufacturing vehicles, industrial gadgets, etc.) become the dominant feature of the new economy (Gill et al. 2019; Lahiani 2020; Shoaib et al. 2020; Liu and Song 2020), leading predictably to a spike in the consumption of fossil fuels and its derivatives of coal, oil and gas as well as an increase in the quantity of greenhouse gases emitted into the atmosphere. Consequently, environmental quality is compromised (Johnson et al. 2019; Yu and Choi 1985; Asafu-Adjaye 2000; Nasreen and Anwar 2014; Furuoka 2015)). Herein lies the dilemma, the solution which rests squarely within the normative context of either sacrificing environmental sustainability (with its long-term intergenerational effect) for greater financial development and consequential economic growth or vice versa.

On the other hand, studies equally abound which find evidence contrary to the above submissions regarding the effects of financial development on environmental sustainability, collectively referred to as the technological innovation effect of financial development on environmental sustainability. This body of studies argue that financial development actually enhances access to and diffusion of low-carbon energy technologies, thus extenuating environmental degeneration, via less pollution and more sustainable patterns of consumption (see Ahmad et al. 2020a, b; Guo et al. 2019; Omoke et al. 2020; Lahiani 2020). In particular, the findings of Furuoka (2015) indicate a uni-directional causality running from energy demand to financial development, while the results of Asafu-Adjaye (2000) refute the neutrality hypothesis between energy demand and economic growth. These studies and their conclusions inevitably throw up some policy and theoretical paradoxes, namely, that of forging a balance between the imperative of financial development and the demands of mitigating its negative impacts on the environment. Much as it is, the findings emanating from these previous studies investigating financial development–environmental sustainability nexus are by all standards ambiguous. Besides, most employed linear models are considered too restrictive to provide realistic evidences mirroring the complexities of modern economies.

The dominant methodology deployed in most of the studies in this area of research is the autoregressive distributed lag (ARDL) of Pesaran and Shin (1999) (see for instance, Adejumo and Asongu 2019; Ali et al. 2018; Lin et al. 2015). Model specifications and estimations based on the ARDL methodology have the underlying assumptions of linearity and symmetry between the dependent and independent variables. However, these assumptions do not mimic economic policies in reality. First, it is realised that data arising from macroeconomic policies are fundamentally inconsistent and ravaged by exogenous shocks as well as structural changes that are both sectoral and macroeconomic in nature. Business cycle variations also significantly challenge the validity of these assumptions. Thus, as noted by Shahbaz et al. (2016), results obtained from a purely linear and symmetric specification and estimation framework would be flawed and spurious.

Attempts in remedying these drawbacks present two strands of significant extensions in the ARDL methodological literature. First, Shin et al. (2014) modify the linear ARDL structure to allow for the separate dynamic and static estimation of the effect of increases and decreases of the explanatory variables on the dependent variable in a non-linear framework, called the nonlinear ARDL (NARDL). A further extension of the NARDL of Shin et al. (2014) was achieved by Pal and Mitra (2015, 2016), called the multiple threshold NARDL (MTNARDL). This new formulation dichotomises the data series into multiple thresholds of quintiles and deciles and analyses minute variations of the explanatory variable(s) on the explained variable. Our present effort employs this latest methodology in investigating the effects of financial development on environmental quality (measured by carbon dioxide emissions) in Nigeria. To our knowledge, this methodology has not been applied in the finance-environmental sustainability studies in Nigeria. Unarguably, the outcome of this extensive study will have far-reaching implications on the quest for improved environment through developed financial system. Additionally, it will provide knowledge-based policy guidelines to the government and relevant stakeholders’ ways to ensure improved environment in consonance with millennium developmental goals (MDGs).

It is noteworthy to state that very few studies considered Nigeria’s economy vis-a-vis the prevailing state of environmental pollution and financial development. Evidently, Nigeria is a developing economy saddled with daunting environmental challenges. Part of this is contained in a report by the United Nations Development Programme (UNDP),Footnote 1 which reveals that different parts of the country have suffered extensive environmental challenges ranging from coastal and soil erosions, deforestation, flooding, air pollution and constant oil spillage. The report further reveals that these environmental challenges were resultant effects of irresponsible environmental management practices which Sub-Saharan African countries are known for. In addition to this, the state of financial development in Nigeria is still at its developmental stages. According to Omoke et al. (2020), the financial sector in Nigeria has experienced a boom-and-bust cycle in the last four decades. This includes the implementation of direct control and entry restrictions measures adopted in 1970s, the Structural Adjustment Programme (SAP)-induced liberalisation regime and lastly, the financial sector consolidation and reform policies that kick-started in 2006. Furthermore, they report that the depth of financial development in Nigeria, which, hitherto, was at its lowest ebb, has started increasing after the 2006 consolidation programmes. Considering the above submissions, there is urgent need to reconsider the potentiality of financial development and the effects of its extreme deviations on environmental protection in Nigeria. Therefore, an enquiry, such as this, implemented within an extensive econometrics mechanism, while separating the changes in financial development into major, minor and moderate will provide an update to existing knowledge. More so, the inferences thereof will provide necessary pathways to clean/sustainable environment in the country.

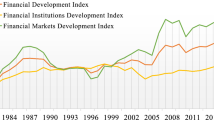

Another justification for the current study derives from a critical analysis of trends in carbon dioxide emissions in Nigeria. Figures 1 and 2 (discussed in greater detail below) portray a casual positive correlation between CO2 emissions and financial development. From the 1990s up to 2018, there has been a general and steady increase in greenhouse gases (GHG) in Nigeria. Specifically, from 1990 to 2014, GHG emissions in Nigeria rose by 25%, representing 98.22 metric tonnes. Of this proportion, 103038.2% came from the forestry and land use change sector. Other sectors with significant contribution include energy (32.6%), waste (14.0%), agriculture (13.0) and industry (2.1) (World Resource Institute 2015). More recently, World Bank (2020) data show that GHG emissions increased to 89.4 metric tonnes in 2015, representing a 4.35% rise, 97 metric tonnes in 2018 and 100.2 million tonnes in 2019, indicating a marginal increase of 2.61%. The combined spike in CO2 emissions and the deepening of financial development across its various measurements compel a study of this nature because of its relevance to policy as well as the theoretical paradoxes the nexus present (Fig. 3).

The novelty of this study lies on its ability to separate the effects of major, moderate and minor changes in financial development on environmental sustainability in Nigeria, which, to the best of our knowledge, had not been previously investigated. The provision of this unique estimate is made possible by the application of the newly proposed multiple threshold nonlinear autoregressive distributed lag model (MTNARDL) by Pal and Mitra (2015, 2016). Among the several advantages and preferences of the MTNARDL over the conventional NARDL, as earlier highlighted, includes its capacity to move a step beyond testing only the effects of positive and negative changes of the exogenous variable. Rather, it disaggregates and compares the effects of extremely high and extremely low changes of the regressor(s) on the explained variable. It traces the locational asymmetric effects by considering the changes and the effects within threshold and captures asymmetry with much precision than the conventional NARDL which is based on zero threshold (Verheyen 2013; Pal and Mitra 2015, 2016; Chang et al. 2019; Chang 2020). The model has enjoyed vast application in several studies, including oil transmission-purchasing power nexus in the USA (Pal and Mitra 2019), exchange rate volatility and US export (Chang et al. 2019) and exchange rate volatility and US imports (Chang et al. 2020). Therefore, separating the major, minor and moderate changes in financial development and accounting for its consequential effects on environmental sustainability in Nigeria could ensure that optimal financial mix leading to sustainable environment is upheld.

As a foreclosure, the estimated results indicate that there is a significant difference between the impacts of considerably large variations in financial development on environmental sustainability compared with the impact of extremely small changes. Specifically, findings reveal that positive impacts of financial development on environmental sustainability peter out at the lower thresholds, while stronger asymmetric effects between financial development and CO2 emissions exist in the long run, as compared with the short run. The rest of the paper proceeds as follows: in the “Literature review” section, we review related and relevant literature; data descriptions and methodology are provided in the “Data and methodology” section. The “Empirical results and discussions” section presents the estimated results and discussion, while the “Conclusion” section concludes with a brief highlight of some policy implications.

Literature review

There are primarily three taxonomies of empirical studies on the relationship and effect of financial development on environmental sustainability. The first proposes that financial development has a deleterious effect on environmental resources, which potentially frustrates efforts at long-term economic development for future unborn generations, who also have a claim on the environment as the most critical resource for economic growth. The second strand of research gravitates to the opposite extreme, claiming that financial development actually does no harm to the environment because of its inherent advantage of enhancing agents’ ability to access and consume cleaner and cost-effective forms of energy, ultimately extenuating environmental degradation and promoting sustainable development. In effect, the model here specifies an inverse relationship between financial development and greenhouse gases (CO2) emissions; that is, the environment is better off with spikes in financial development. There is also a third strand of studies, though relatively unpopular, which argues that financial development neither promotes nor degenerates the environment. This is the neutrality hypothesis. We discuss these strands of research in detail.

We begin with a review of a set of studies which findings aver that financial development exerts a reducing impact on environmental degradation and that it improves environmental quality. Omoke et al. (2020) investigate the effect of financial development on carbon, non-carbon and total ecological footprint in Nigeria. The study particularly corrects the gap in previous studies by providing a more comprehensive measure of environmental sustainability (degradation), namely, ecological footprint decomposed into carbon and non-carbon elements of environmental degradation. Deploying the nonlinear autoregressive distributed lag (NARDL) dynamic analysis, the study finds that increases in financial development significantly reduce ecological footprint, while a decline in financial development significantly deteriorates the environment. Similar sentiments in findings are documented by Yuxiang and Chen 2011; Dogan and Turkekul 2016; Al-Mulali et al. 2015; Saidi and Mbarek 2017; Nasreen et al. 2017; as well as Shahbaz et al. 2018; Khan et al. 2018; Destek and Sarkodie 2019; Nosheen et al. 2019; Hafeez et al. 2019; and Gill et al. 2019.

The findings of Omoke et al. (2020) study were earlier documented by Hafeez et al. (2019) who examined the carbon footprint effect of financial development. Using data spanning 1990 to 2017 of a panel of 49 One Belt and Road (BRI) countries, the study found a statistically significant but negative effect of financial development on carbon footprints. Al-Mulali et al. (2015) similarly examined the effect of financial development on environmental sustainability using data covering the period 1980–2008 for 93 countries, decomposed into low- and high-income economies. With environmental degradation measured by ecological footprint, the result of the study revealed that financial development does not significantly impact on ecological footprint of low-income countries. On the other hand, it was found for the countries in the high-income classification that financial sector development significantly and negatively impacted on ecological footprint. In other words, high-income countries could pursue the path of financial development as such would improve the quality of the environment, whereas low-income countries, with apparent paucity of funds, were more likely to suffer from environmental degradation arising from their lack of alternatives to cheaper and cleaner sources of energy.

In a related study on Malaysia and China using data covering 1977 to 2013, Destek and Sarkodie (2019) conclude that financial development enhances environmental quality. However, Ahmad et al. (2018) as well as Gill et al. (2019) narrowed the scope of their study to just a single country (Malaysia), with the former delineating the study period from 1971 to 2014 and the latter from 1970 to 1976. Their results were indeed a confirmation of the two country study pursued in Destek and Sarkodie (2019). Some recent studies (Ahmad, Khna, Ur Rahman and Khan et al. (2018); Ahmad and Khattak (2020); Ding et al. (2020); Qingquan et al. (2020) and Ahmad et al. (2020b)) consider the effects of various factors, including financial development, aggregate domestic spending, energy productivity and eco-innovation, commercial monetary policy, innovation and foreign direct investment (FDI) on carbon emissions in China, South Africa, G7 nations, Asian nations and OECD regions, respectively. They provided valuable evidence of the effects of those factors on CO2 emissions. However, Ahmad et al. (2018) summit that financial development is symmetrically related to carbon emissions in China. Suffice it to say that none of the studies considered Nigeria economy; more so, they did not consider the extreme effects of the changes in the explanatory variable on the response variable.

The second strand of literature documents evidence of a deteriorating effect of financial development on the environment. A study of the Indian economy by Boutabba (2014), for instance, found evidence that financial development compromised environmental quality, with increases in carbon emissions as financial development increased. Baloch et al. (2019) report that financial development increases ecological footprint in 59 Belt and Road (BRI) countries. For South Africa, Nathaniel et al. (2019) show that financial development exacerbates environmental degradation. Studies with similar conclusions include Shahbaz et al. (2020), Shoaib et al. (2020) and Ibrahiem (2020). Of interest is the study of Fakher (2019) who investigates the effect of financial development on seven OPEC member countries. By incorporating the square of ecological footprint in a Bayesian model, the study presented mixed results of financial development on environmental degradation. Specifically, results indicated that ecological footprint rises at the incipient stage of financial sector development but declines as financial development grows in efficiency and maturity. Further inconclusive evidence of the relationship is documented in Charfeddine and Kahia (2019), who find for a sample of Middle East and North Africa (MENA) countries a weak relationship between financial development and carbon dioxide emissions.

A few studies occupy the third strand of literature on the relationship between financial development and environmental sustainability. For instance, Ozturk and Acaravci (2013), Dogan and Turkekul (2016), Cosmas et al. (2019) and Abokyi et al. (2019) all find that financial development exerts a neutral, or non-significant impact on environmental quality. Ozturk and Acaravci (2013) augment the EKC model with financial development and carbon emission variables. Their study for Turkey validated the EKC hypothesis, stressing that trade openness correlates positively with CO2 emissions, while financial development has no significant long-run effect on environmental degradation in Turkey.

Specific Nigeria studies dealing on the impact of financial development on carbon emissions or environmental degradation are few with contrasting results borne either out of the methodology employed or the measure of environmental sustainability adopted. For instance, Lin et al. (2015) assess the impact of industrialisation on CO2 emissions in Nigeria from 1980 to 2011 using multiple econometric regression protocols involving the Kaya identity framework, Johansen’s cointegration technique, augmented Dickey-Fuller (ADF), as well as vector error correction model (VECM). The findings of the study indicate that industrialisation, proxied by industrial value added, has a negative significant relationship with CO2 emissions in Nigeria. Put differently, industrialisation (which is particularly preceded and catalysed by financial development) does not have any significant retrogressive effect on environmental sustainability. Thus, Nigeria can still pursue the objective of growth to lift millions out of poverty without the risk of endangering the environment. However, the study also concludes that GDP per capita and population positively and significantly impacted on CO2 emissions.

The assessment of the relative impact of foreign direct investment and domestic investment on green growth or environmental sustainability in Nigeria was undertaken by Adejumo and Asongu (2019). Utilising time series data from 1970 to 2017, and employing the ARDL methodology, the study surmised that in the short-run domestic investment exacerbated CO2 emissions (deteriorates the environment), while in the long-run FDI reduces CO2 emissions (improves the environment). In effect, as distortions in the short run smoothen out in the long run, domestic investments and FDI harbour the potential of enhancing environmental sustainability in Nigeria. Ali et al. (2018) on their part incorporate the trade openness and financial development variables to investigate their effects on carbon dioxide emissions in Nigeria. Using the ARDL bounds testing approach from the period 1971 to 2010, the results showed that CO2 emissions were an increasing function of financial sector development, economic growth and energy consumption, while trade liberalisation impacted negatively on CO2. This result implied that environmental sustainability would be better served if the government-initiated programmes will ensure a decline in CO2 while at the same time advancing the policy of trade openness. The intuition here is that, with trade openness, there will be an inflow of FDI, with the potential of importing and domesticating the use of cheaper and cleaner forms of energy that will reduce CO2 emissions. This, then, is a tacit confirmation of the results obtained in Adejumo and Asongu (2019).

Riti and Shu (2016) argue that the environmental Kuznets curve (EKC) does not hold for Nigeria. In particular, they show that renewable energy has a negative impact on environmental degradation, while the consumption of fossil fuel intensifies environmental pollution. Rafindadi (2016) contributes to the debate by deploying the innovation accounting test on data ranging from 1970 to 2011. The study outlines some interesting though contrasting results. First, it finds that financial development is a catalyst of energy demand, decelerating the release of CO2 in the process. Second, it shows that economic growth actually leads to a decline in energy demand but however leads to a spike in CO2 emissions. Furthermore, confirming previous studies (e.g. Ali et al. 2018), it argues that trade liberalisation increases energy demand but enhances environmental quality via the decline in carbon dioxide emissions. Still on the trade openness-environmental sustainability nexus, Ali et al. (2018) incorporate urbanisation and energy demand as key variables of their empirical model. Deploying the ARDL framework on data series for 1971–2011, results show that urbanisation does not significantly influence CO2 emissions in Nigeria, while energy consumption and economic growth are direct and positive predictors of environmental degradation. In line with the previous studies discussed above, trade openness negatively and significantly impacted on CO2 emissions in Nigeria. Interestingly, the study surmises that despite the high level of urbanisation in the country, energy demand is still low due to low levels of income.

A glaring feature of the foregoing evaluation of empirical literature with regard to methodology shows an apparent dominance of the use of the ARDL methodology, though with scant deployment of other econometric techniques. A variant of the ARDL approach is the nonlinear ARDL, which incorporates the concerns of nonlinearity or asymmetry between the dependent and key independent variables. A justification for this methodological extension and variation is the realisation that macroeconomic time series data are products of policy inconsistency, exogenous shocks, sectoral or macro-wide structural changes, as well as variations in the business cycles. These considerations render the results obtained from a purely symmetric and linear framework in the empirical specification and estimation weak and suspicious (Shahbaz et al. 2016). Thus, recent studies have sought to remedy these concerns by specifying a model capable of investigating potential asymmetry (positive and negative variations) of financial development on environmental degradation. These studies include those of Shahbaz et al. (2016) for Pakistan, Lahiani (2020) for China, as well as Karasoy (2019) for Turkey. A key contribution of the present effort is the application of yet another extension of the ARDL technique known as the multiple threshold NARDL introduced by Pal and Mitra (2015, 2016). The methodology traces the effects of extreme changes (large and small) of the explanatory variable(s) on the explained variable. To the best of our knowledge, the vast and bourgeoning financial development and environmental sustainability literature is yet to test this recently introduced methodological algorithm to the Nigerian situation.

Stylised facts on financial development and energy consumption in Nigeria

The financial sector is that segment of the economy that deals with the issues of intermediation between the deficit spending units (agents who are in need of funds to invest) and the surplus spending units—those who have more than enough funds to meet their immediate financial needs. A key function of the financial system is the reduction in the cost of information asymmetry between these two spending units. Levine (2005) argues that with financial development, financial instruments, financial intermediaries and financial markets mitigate significantly the tripartite costs of getting information, contract execution and cost of transaction. Confirming, Čihák et al. (2012) submit that a feature of financial sector development is its ability to overcome transaction costs acquired in the financial system.

The World Bank (2012) specifies some key indicators of financial development to serve as yardsticks for measuring policy efforts of governments in the development of the financial sector. This framework presents four sets of measurable indicators which should characterise an efficient financial system. They include financial depth, access, efficiency and stability. These dimensions are then classified into two main components, namely, market dimension and institutional dimension. The World Bank’s Global Financial Development Database (GFDD) disaggregates both the institutional and market dimensions into the four proxy variables mentioned earlier. For instance, the depth of the financial system can be evaluated using any of these measures: the ratio of private sector credit to GDP, the ratio of broad money supply to the GDP, the ratio of financial institutions’ assets to GDP, commercial banks deposits to GDP or gross value added of the financial sector to GDP. Financial access is proxied by any of the following: commercial banks accounts per a thousand adult, percentage of people with a bank account, commercial banks’ branches per 100,000 adults and percentage of firms with credit lines. Measures of financial efficiency include indicators such as net interest margin, non-interest income to total income, overhead costs as a percentage to total assets, interest rate spread, etc. Finally, stability indicators include capital adequacy ratio, liquidity ratios, net foreign exchange position to capital and asset quality ratios.

Figure 1 graphically portrays the trend in CO2 emissions in Nigeria. With a general upward trend, the message here speaks volumes, namely, that from 1990 where the lowest carbon emission of 113.28 was recorded, CO2 reached its peak of 360.44 in 2015. Thereafter, it plummeted slightly to 340.6 the following year and has since been rising steadily to a current zenith of 397.52 in 2018. This consistent upward trajectory in CO2 emissions correlates positively with an equally rising profile of financial development indicators.

Judging from the evidence in the above graphs, financial development (FDV) rose sharply from 0.753 in 1991 to 0.875 the following year. It thereafter plunged sharply to 0.609 in 1994, rising sluggishly to 0.754 in 1999. Between 2000 and 2009, the financial sector witnessed increasing depth, depicted above as a continuous rise in its indicator. This positive development might not be unconnected with a series of reforms in the banking sector in the years following the return to democratic rule. Key among these reforms was the banking sector consolidation which increased the capital base of deposit money banks from N2 billion to N25 billion (Sani and Alani 2013; Nasiru et al. 2012). This radical policy ensured a considerable increase in the number of bank branches from 3247 in 2003 to 5837 in 2010, with a concomitant increase in banking sector employment from 50,586 in 2005 to over 71,876 in 2010 (Babajide et al. 2015). Thus by 2018, financial access and depth had reached an all-time high of 397.52.

Data and methodology

Data

To provide empirical estimations, we relied on quarterly data series from 1990Q1 to 2018Q4 making a total of 116 observations. The data sets are available at the data bank of International Financial Statistics (IFS) and Enerdata’s global energy data streams, Global Financial Development Database (GFDD). The variables include carbon dioxide emission (CO2) (metric tons per capita) and financial development index (FDV) (an aggregation of financial depth, access and efficiency) compiled by Svirydzenka (2016)Footnote 2 under the auspices of the International Monetary Fund (IMF). Other variables include nominal GDP (local currency equivalent, representing the level of economic activities) and energy consumptions (OLC) million tons of oil equivalents. Carbon dioxide emission (CO2) is the dependent variable, while financial development (FDV), economic activity (GDP) and oil consumptions (OLC) are the independent variables. The inclusion of economic activity (GDP) and energy consumptions (OLC) in the model is premised on the fact that several studies confirmed that they play key roles in carbon dioxide emissions both in Nigeria and other countries (Lin et al. 2015; Mahdi Ziaei 2015; Xing et al. 2017; Yazdi and Beygi 2017; Zaghdoudi 2018; Ahmad et al. 2018; Lahiani 2020; Ehigiamusoe and Lean 2019; Uddin 2020; Shahbaz et al. 2020; Shoaib et al. 2020). All the variables are reported in their natural logarithm values.

From Table 1, the log of GDP (LGDP) records the highest mean, median and maximum values, followed by the LOLC and log of CO2, while financial development has the least expected value. The LGDP has a wider spread than other variables in terms of standard deviation, while LFDV is the least spread, whereas LFDV has the minimum value. All the variables are positively skewed, whereas the kurtosis values are below the acceptable threshold (3) indicating a convergence from the variables. However, the Jarque-Bera values of all the series indicate that the variables are not normally distributed. Therefore, the deviations from normal distribution reveal the time-varying nature of the data sets, which justifies the application of the multiple threshold NARDL, a threshold time-varying model (Pal and Mitra 2015, 2016, 2019; Chang 2020; Hashmi et al. 2020). It further provides necessary justifications to probe for nonlinearity and asymmetric in financial development–carbon emissions nexus in Nigeria.

Methodology

The study mainly centred around the relative influence of financial development on environmental sustainability in Nigeria. It relied on nonlinear extensions of ARDL model of Pesaran and Shin (1999), the NARDL (Shin, Yu and Greenwood-Nimmo, 2014) and the MTNARDLFootnote 3 (Pal and Mitra 2015, 2016). The primary purpose is to account for the effects of extreme variations of financial development on carbon dioxide (CO2) emission within the study period, particularly, to reveal the relevant threshold that provides the most desirable impact. Following the studies (Pal and Mitra 2019; Chang et al. 2019; and Shahbaz et al. 2020), we present the following standard econometric specification for empirical estimations.

where LnCO2, LnFDV, LnGDP and LnOLC refer to logarithmic values of carbon dioxide emissions, financial development index, gross domestic product representing economic activities and oil consumptions in Nigeria, respectively, at different quarters t. f is a functional notation. Specification (1) is used to form the econometrics specification and with the stochastic error term, it is represented in specification (2).

All the variables are as described earlier with the inclusion of their natural logarithm values; the ɛt is the nuisance factor which takes care of other factors not included in the model. The empirical details of the above relationship are based on the autoregressive distributed lag (ARDL) technique advanced by Pesaran and Shin (1999). The model is preferred based on its capacity to simultaneously produce long- and short-run estimations. The model can accommodate fractionally integrated variables, and it can equally be applied even when the explanatory variables are endogenous (Pesaran and Shin 1999). The dynamic error correction linear ARDL model is provided as follows:

where γt is the dependent variable, xt is the independent variable, ∆ is the difference operator, ln is the natural logarithm notation, while ɛt is the stochastic term. \( \sum \limits_{i=1}^n{\varphi}_i\mathit{\ln}\Delta {\gamma}_{t-i} \) represents the short-run dynamics, and β1γt − 1 represents the long-run equilibrium relationship.

Equation 3 is the typical ARDL model which we modify with our variables to form Eq. 4 presented as followsFootnote 4:

Standard nonlinear ARDL model

The ARDL model (Eq. 4) is a linear model subsumed with the assumption of linearity and symmetric relationships between the variables, but several recent studies have shown that most economic fundamentals display nonlinear (asymmetric) dynamics (Shahbaz et al. 2018; Uche and Nwamiri 2020). Thus, we present the nonlinear version of the ARDL tagged NARDL that can accommodate our hypothesis of asymmetry, where this model is specified in Eq. (5) below:

To begin, we present the long-run specification of the NARDL model as follows:

where \( {lFDV}_t^{+} \) and \( {lFDV}_t^{-} \) are respectively the positive and negative partial sums of the financial development differential effects on carbon dioxide emissions with economic activity (GDP) and oil consumptions (OLC) added as control variables. The process to generate the partial sums of positive and negative changes illustrated by Shin et al. (2014) and applied by many researchers (Chang et al. 2018; Chang et al. 2019; Omoke and Uche 2020) is replicated in Eq. 6a and 6b below:

and

where \( {LnFDV}_t={LnFDV}_0+{LnFDV}_t^{+}+{LnFDV}_t^{-} \).

From the above specifications, the long-run coefficients of positive and negative partial sums of financial development differentials on CO2 are respectively given as β1 and β2 while β0 is the coefficient of the dependent variable and β3 and β4 are the coefficients of the two control variables. For empirical estimation, we form the long-run Eq. (7) in an NARDL setting as in Shin et al. (2014) that is

where n is the number of lags determined by AIC. In this case, lag length of 2 is chosen. β1, β2, β3, β4 and β5 are the long-run coefficients of all variables including the positive and negative partial sums of financial development, while β0, β4and β5 are the coefficients of the intercept and the control variables, respectively. The short-run coefficients are represented by θ1, θ2, θ3, θ4 and θ5 for each of the variables, respectively. The dynamic adjustment multiplier which shows the asymmetric adjustment process is obtained in Eq. (8) below.

Note that as \( h\to \infty, {m}_h^{+}\to {\alpha}_1 \) and \( {m}_h^{-}\to {\alpha}_2 \).

Multiple threshold nonlinear ARDL model with quintile series

Following our earlier postulation that the effects of financial development may differ from extremely low to extremely large changes, and following the studies of Pal and Mitra (2015, 2016, 2019), and applied by Chang et al. (2019, 2020), Hashmi et al. (2020) and Chang et al. (2020), we employ the MTNARDL model in our estimations. In this model, we first decompose the financial development variable into series of five partial sums which are

In Eq. (10) above, \( {FDV}_t^i\left({\varphi}_1\right) \), \( {FDV}_t^i\left({\varphi}_2\right) \), \( {FDV}_t^i\left({\varphi}_3\right) \), \( {FDV}_t^i\left({\varphi}_4\right) \) and \( {FDV}_t^i\left({\varphi}_5\right) \) represent the partial sum series set at 80th, 60th, 40th and 20th quintiles of financial development changes as threshold respectively represented by т80, т60, т40 and т20, and they are calculated with the formulae given below:

I{T} is an indicator function that assumes the value one if the underlying conditions, stipulated within the bracket {} in Eq. (10a)–(10e), are satisfied, and zero otherwise. The NARDL form of the decomposed exogenous variables in quintiles is clearly stated in Eq. (11) below:

where k = j + 2.

The cointegration relationship of the long-run variable in Eq. (11) can be estimated through the underlying null hypothesis: β1 = β2 = β3 = β4 = β5 = β6 = β7 = 0. The bounds tests can be calculated through the critical values provided by Pesaran and Shin (1999) and applied by Verheyen (2013), Pal and Mitra (2019), Chang et al. (2020) and Hashmi et al. (2020). The null hypotheses of no short- and long-run asymmetry can be estimated respectively with the following hypotheses: HO θ3 = θ4 = θ5 = θ6 = θ7 = 0 and HO β3 = β4 = β5 = β6 = β7 = 0.

Multiple threshold nonlinear ARDL model with decile series

The NARDL model is further generalised to form the multiple threshold NARDL model by decomposing the financial development index into 10 partial sum series. This will further enable us examine if the effects of the financial development on CO2 emission differ from extremely larger and extremely low changes. The MTNARDLFootnote 5 is presented in Eq. (12) below.

where k = j + 2.

The null of no cointegration of the long-run variables can be examined with null hypothesis HO β1 = β2 = β3 = β4 = β5 = β6 = β7 = β8 = β9 = β10 = β11 = β12 = 0. The bounds tests can equally be calculated through the critical values as explained. The null hypotheses of no short- and long-run asymmetry can be estimated respectively with the following hypotheses: HO θ3 = θ4 = θ5 = θ6 = θ7 = θ8 = θ9 = θ10 = θ11 = θ12 = 0 and HO β3 = β4 = β5 = β6 = β7 = β8 = β9 = β10 = β11 = β12 = 0.

Empirical results and discussions

To apply the MTNARDL, the series are expected to achieve stationarity at order not beyond first difference, as stationarity beyond order one I(1) renders the estimated results spurious. Based on the above inference, we subject the data sets to unit root tests. We conducted the standard augmented Dickey-Fuller unit root test (Dickey and Fuller 1979) and the nonlinear unit root test models using the Zivot-Andrew (Z-A), Zivot and Andrews (1992) and Perron unit root tests, Perron (1997). The Z-A and Perron unit root tests consider the effects of structural breaks in the data sets. Table 2 presents the unit root tests results of the variables.

Expectedly, all our variables achieved stationarity within the accepted threshold, i.e. not beyond order one. However, the overall outcome reveals mutually integrated series of orders zero and one (I(0) and I(1)). Financial development index (FDV) is stationary at level I(0) as indicated by the Perron and Z-A tests, but integrated of order-one I(1) judging by the ADF test. Likewise, the carbon dioxide emission (CO2) and oil consumptions (LOLC) data series achieved stationarity at level I(0) as indicated by the Z-A test, while they achieved stationarity after differencing once, judging by the ADF and Perron tests. Ideally, the evidence of mutually integrated series makes the MTNARDL, an extension of the ARDL more appealing and a model of choice. The Perron and Z-A tests eminently reveal the structural break dates for all the series, and such cannot be adequately captured by linear model or the standard nonlinear ARDL model that relies on exogenous zero threshold (Chang 2020). This equally informs our choice of a nonlinear model that can profoundly account for the effects of these economic cycles on the overall performance of the economy and provides reliable estimations.

Going further, the study applied the nonlinear ARDL and its extension (MTNARDL) model to evaluate the relative impacts of financial development extreme variations on CO2 emissions in Nigeria. The series were estimated within three distinctive models (nonlinear ARDL, MTNARDL decomposed into five partial sums (quintiles) and MTNARDL decomposed into ten partial sums (deciles) for the purpose of robust estimations and comparisons. The results for all the models were outlined in the three panels (panels A, B and C) of Table 3 showing the long-run and short-run effects and diagnostics tests results for all the models, respectively. Findings from the cointegration tests for all the models conducted through the Wald test coefficients (panel C) confirm the existence of long-run relationships among the variables, thereby rejecting the null hypothesis of no cointegration between financial development and environmental sustainability in Nigeria.

From the estimated results of the nonlinear ARDL, we discovered that in the long run, improvement in the financial sector (positive change, FDV+) results to reductions in CO2 emissions, while the opposite is the case when financial development deteriorates (negative change, FDV-). This corroborates the findings of Omoke et al. (2020) for Nigeria, whereas it contradicts Ahmad, Khan, Ur Rahman and Khan et al. (2018) for China and Ahmad et al. (2020a) for 90 belt and road countries. However, it is noteworthy to point out that the long-run effects of both positive and negative changes in financial development on environmental sustainability were not significant. The outcome denotes some concealed evidences, such that only an enhanced technique can reveal. Thus, the multiple threshold nonlinear ARDL (MTNARDL) stands out for such elaborate investigations. Contrary to the findings of Yazdi and Beygi (2017) for selected African countries and Omoke et al. (2020) for Nigeria, the impacts of economic activities (GDP) and oil consumptions (OLC) on environmental sustainability were insignificant in the long run. Considering the short run, positive changes in financial development lead to significant reductions in CO2 emissions, while its negative change does not have any effect on environmental sustainability. Specifically, as financial development increases by 1%, CO2 emissions reduce significantly by 16%. On other hand, a proportionate negative change in financial development leaves carbon emissions unaffected, whereas CO2 emissions increased by 0.42% in response to 1% change in economic activities after some time lags (∆LGDP(-1)).

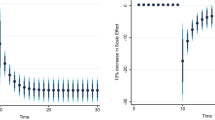

Considering the short-run impacts of oil consumption on CO2 emissions, findings indicate that a contemporaneous change in the level of oil consumption leads to greater carbon dioxide emission, but with the passage of time (∆LOLC-1), significant reductions in CO2 emissions were witnessed. Furthermore, based on evidence from panel C, the Wald tests for asymmetry (WLR and WSR) tests, we accept (reject) the null hypothesis of no long-run (short run) asymmetric effects of financial development on carbon dioxide emissions in Nigeria. The dynamic asymmetric multiplier graph (Fig. 2) provides more insight on the asymmetric relationship between financial development and environmental sustainability in Nigeria. It reveals more asymmetric adjustments to short-run negative changes in financial development which gradually fizzles out in the long run. The post-estimation tests including serial autocorrelation test, stability test, constant variance test and stability provide relevant evidence of robust estimations. However, the CUSUMSQ graph indicates some levels of instability in the model. The observed instability revealed by the unstable CUSUMSQ graph (available at the appendix) demonstrates the influence of structural breaks in the system which the standard nonlinear ARDL model could not account for. This further gives credence for the application of more enhanced estimation technique.

Multiple threshold nonlinear ARDL model with quintiles series

To provide fresh evidence and more robust analysis, we follow Pal and Mitra (2015, 2016) and Chang et al. (2020) and decompose financial development series firstly into quintiles (five partial sum) and thereafter into deciles (ten partial sum) using the enhanced estimation technique (multiple threshold nonlinear ARDL). This step was taken in order to provide fresh insight and update the studies of Omoke et al. (2020) and Ahmad et al. (2018). Findings from the MTNARDL with quantile decomposition indicate that in the long run, changes in financial development contribute significantly to environmental sustainability in Nigeria by reducing the rate of CO2 emissions. At the upper threshold, (FDw2(-1)), 1% change in financial development results to −2.63% reductions in carbon dioxide emissions. Comparatively, at the lower threshold (FDw5(-1)), a proportionate change in financial development results to −0.382% reductions in CO2 emissions. Juxtaposing, the effects are greater in the upper quintile than in the lower quintiles. This implies that environmental sustainability potentials of financial development fizzle out at the lower threshold. Considering the control variables, the long-run coefficient of economic activities (GDP) has a positive but insignificant impact on environmental sustainability, while oil consumption (OLC) results to significant increases in CO2 emissions. A 1% change in oil consumption leads to 0.28% increases in environmental degradations. This is expected, as earlier highlighted, considering the country’s heavy reliance on fossil fuels and other non-renewable energies. This provides a corroborative evidence to Ahmad et al. (2018) and Ding et al. (2020).

In the short run, upper quintiles of financial development lead to increasing carbon dioxide emission; however, such negative impacts fizzle out at the lower quintiles. The similar effects of financial development on environmental sustainability in both time dimensions indicate that sustained financial development ensures environmental sustainability, and such would lead to sustainable development in Nigeria. These findings are consistent with the reports of Lahiani (2020), financial development–CO2 emissions nexus in China, Omoke et al. (2020), financial development–total ecological footprint nexus in Nigeria, and Godil et al. (2020), financial development, institutional quality and CO2 emission in Pakistan. However, our findings contradict the findings of Shahbaz et al. (2020) who report that financial development increases carbon dioxide emissions in China. In the short run, changes in economic activities (GDP) result to negative and insignificant changes in CO2 emission, while the short-run impacts of oil consumption vary considerably between positive and negative with the passage of time.

The Wald test for asymmetry (WLR and WSR) at the lower panel (panel C) from Table 3 provides evidence to reject the null hypothesis of symmetry in the long run; however, we accept the null hypothesis of short-run symmetry. This implies that the effects of financial development on carbon dioxide emission in Nigeria are asymmetric in the long run and symmetric in the short run. Other post-estimation tests including the CUSUM and CUSUMSQ stability tests are in conformity with the accepted standard, which implies that the estimates are robust. The coefficient of adjusted R2 of 75% as against 68% recorded in the NARDL proves that the multiple threshold nonlinear ARDL (MTNARDL) gives better account of the relationship between the variables. This further suggests that the ambiguities in previous studies could be as a result of the application of zero-threshold econometrics frameworks.

We further decompose financial development into deciles series (ten partial sums) to probe further for more robust estimations in line with Pal and Mitra (2015, 2016) and Chang et al. (2020) (see Table 3). However, the results from decile decompositions are similar to that of quintile decompositions. Notably, at the 7th decile, a change in financial development increases carbon dioxide emissions, but at the 9th and 10th deciles (upper deciles), improvements in financial development result to reductions in CO2 emission. Specifically, 1% change in financial development at 9th and 10th deciles leads to −2.765 and −1.01% reductions in CO2 emissions, respectively. This implies that financial development above 7th deciles (9th and 10th) leads to greater reductions in carbon emission in Nigeria. The short-run effects of financial development on CO2 emissions are also similar to long-run effects, while the most desirable impact is recorded at the 8th and 9th deciles. Furthermore, changes in economic activities and oil consumption result to increasing carbon dioxide emissions in the long run, with varying effects in the short run.

The Wald test (WLR and WSR) for symmetric test rejects the null of asymmetry in both long and short run. This implies that the effects of financial development on CO2 emission are asymmetric in both time dimensions. All post-estimation parameters point to a very robust analysis and prove the superiority of the model to the standard nonlinear ARDL. Comparatively, the adjusted R2 when financial development was decomposed into deciles is 80%, which is a stronger goodness of fit than 72 and 68% recorded in the first two models. This further proves the superiority of the decile-decomposed series to the quintile-decomposed series and the standard nonlinear ARDL models.

Conclusion

The absence of studies that account for the effects of financial development major, minor and moderate changes on environmental sustainability in Nigeria motivated this study. Previous studies focused mainly on the asymmetric effects within the conditional mean. However, as stated by Verheyen (2013), the effects of the explanatory variable on the explained variable could differ between the extremes (major, minor and moderate). To provide this unavailable information, the study evaluates the relationship between financial development and carbon dioxide emission (CO2) by accounting for the effects of extremely small and extremely large changes in financial development on carbon dioxide emissions in Nigeria. The Nigerian economy was not adequately considered by previous studies; the very few that did failed to apply enhanced econometrics algorithms. To ensure that the observed missing link and void in extant literature is filled in the context of financial development–environmental sustainability nexus in Nigeria, we applied the multiple threshold NARDL model of Pal and Mitra (2015, 2016). The model has the capacity to account for the effects of extremely large and extremely small changes in the explanatory variable(s) on the explained variable in both long- and short-run simultaneously.

The empirical results of the standard NARDL failed to reveal the actual effects of either positive or negative changes in financial development on environmental sustainability in Nigeria within the period considered. However, the MTNARDLs (quintile and decile decompositions) provide detailed evidence of the effects of financial development on environmental sustainability in Nigeria. It is evident from the two versions of the MTNARDL model that changes in financial development result to declining CO2 emissions at the upper quintiles (deciles) compared to the lower thresholds. This implies positive impacts of financial development on environmental sustainability fizzle out at the lower thresholds. The MTNARDL models provide stronger evidence of cointegration among the variables than the standard NARDL model. Unlike the NARDL, the MTNARDL model account for both short- and long-run asymmetries, and the degree of goodness of fit (r2) from the NARDL model is weaker (68%) compared to 72 and 80% delivered by MTNARDL quintile and decile series, respectively. The above observations highlight the advantages of the improved model over the standard NARDL model. This makes the MTNARDL a model of choice and goes to prove the robustness of its estimations compared to the results of the NARDL model.

The findings of this research provide relevant policy guidelines for policymakers and all stakeholders. Relying on the output of the standard NARDL may be misleading as it fails to provide clear evidence of the effects of financial developments on environmental sustainability in Nigeria. Ideally, the MTNARDL models prove clear-cut evidences of the existing dynamics that could guide policy moderations. The enhanced models prove that asymmetric effects were stronger in the long run, implying that more attention is needed in the long run. Equally, results from the MTNARDL model reveal that positive effects of financial development on environmental sustainability are stronger at the upper thresholds and fizzle out at the lower thresholds. Therefore, concerted efforts are needed to maintain the positive effects recorded at the upper quintiles (deciles).

The choice of carbon dioxide (CO2) emission as a representative of environmental degradation may not provide comprehensive and holistic view of the effects of financial development extreme changes on environmental sustainability. However, CO2 emission is considered the major source of environmental pollution as provided in several studies (see Ahmad et al. 2018). It is therefore suggested that future studies should include other environmental degradation factors like ecological footprint and bio-capacity in environmental degradation models. More so, the application of this enhanced econometric technique might provide more extensive details on the effects of financial development extreme deviations on environmental sustainability in Nigeria or any other country as the case may be.

Notes

The financial development variable (FDV) is a comprehensive summary of nine indices of financial markets and financial institutions in terms of depth, access and efficiency aggregated into an overall financial development index available on annual basis for 183 countries.

References

Abokyi E, Appiah-Konadu P, Abokyi F, Oteng-Abayie E (2019) Industrial growth and emissions of CO2 in Ghana: the role of financial development and fossil fuel consumption. Energy Rep 5:1339–1353

Adejumo AV, Asongu SA (2019) Foreign direct investment, domestic investment and green growth in Nigeria: any spill-overs? Int Bus, Trade and Inst Sustain. Springer Nature, Switzerland, pp 839–861. https://doi.org/10.1007/978-3-030-26759-9_50

Ahmad M, Jiang P, Majeed A, Raza MY (2020a) Does financial development and foreign direct investment improve environmental quality? Evidence from belt and road countries. Environ Sci Pollut Res 27:23586–23601

Ahmad M, Khan Z, Ur Rahman Z, Khan S (2018) Does financial development asymmetrically affect CO2 emissions in China? An application of the nonlinear autoregressive distributed lag (NARDL) model. Carbon Manag 9(6):631–644. https://doi.org/10.1080/17583004.2018.1529998

Ahmad M, Khattak SI (2020) Is aggregate consumption spending per capita determining CO2 emissions in South Africa? A new perspective. Environ Resour Econ 75:529–552. https://doi.org/10.1007/s10640-019-00398-9

Ahmad M, Khattak SI, Khan Z, Rahman U (2020b) Innovation, foreign direct investment (FDI), and the energy-pollution growth nexus in OECD region: a simultaneous equation modelling approach. Environ Ecol Stat 27:203–232. https://doi.org/10.1007/s10651-020-00442-8

Ali HS, Law SH, Lin WL, Yusop Z, Chin L, Bare UAA (2018) Financial development and carbon dioxide emissions in Nigeria: evidence from the ARDL bounds approach. Geo J 84(3):641–655

Al-Mulali U, Weng-Wai C, Sheau-Ting L, Mohammed AH (2015) Investigating the environmental Kuznets curve (EKC) hypothesis by utilizing the ecological footprint as an indicator of environmental degradation. Ecol Indic 48:315–323

Asafu-Adjaye J (2000) The relationship between energy consumption, energy prices and economic growth: time series evidence from Asian developing countries. Energy Econ 22(6:615–625

Babajide AA, Olokoyo FO, Taiwo JN (2015) Evaluation of effects of banking consolidation on small business finance in Nigeria. Int J Adv Manag Econ 4(2):37–47

Baloch MA, Zhang J, Iqbal K, Iqbal Z (2019) The effect of financial development on ecological footprint in BRI countries: evidence from panel data estimation. Environ Sci Pollut Res 26(6):6199–6208

Bayar Y, Diaconu L, Maxim A (2020) Financial development and Co2 emissions in Post-Transition European Union countries. Sust 12:2640

Boutabba MA (2014) The impact of financial development, income, energy and trade on carbon emissions: evidence from the Indian economy. Econ Model 40:33–41

Chang BH (2020) Oil prices and E7 stock prices: an asymmetric evidence using multiple threshold nonlinear ARDL model. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-020-10277-2

Chang BH, Rajput SKO, Ghumro NH (2018) Asymmetric Impact of exchange rate changes on the trade balance: Does global financial crisis matter? Annals of Financial Economics, 1850015. https://doi.org/10.1142/s201049521850015x

Chang BH, Rajput SKO, Bhutto NA (2019) Impact of exchange rate volatility on the US exports: a new evidence from multiple threshold nonlinear ARDL model. J Int Commer Econ Policy 10(2):1950009

Chang BH, Rajput SKO, Bhutto NA, Abro Z (2020) The asymmetric effect of extreme changes in the exchange rate volatility on the US imports: evidence from multiple threshold nonlinear ARDL model. Stud Econ Financ

Charfeddine L, Kahia M (2019) Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: a panel vector autoregressive (PVAR) analysis. Renew Energy 139:198–213

Čihák M, Demirgüç-Kunt A, Feyen E, Levine R (2012) Benchmarking financial development around the World. World Bank Policy Research Working Paper 6175. World Bank, Washington, DC. J Energy Dev 10:249–272

Cosmas NC, Chitedze I, Mourad KA (2019) An econometric analysis of the macroeconomic determinants of carbon dioxide emissions in Nigeria. Sci Total Environ 675:313–324

Destek MA, Sarkodie SA (2019) Investigation of environmental Kuznets curve for ecological footprint: the role of energy and financial development. Sci Total Environ 650:2483–2489

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74:427–431

Ding Q, Khattak SI, Ahmad M (2020) Towards sustainable production and consumption: assessing the impact of energy productivity and eco-innovation on consumption-based carbon dioxide emissions (CCO2) in G-7 nations. Sustain Prod Consump. https://doi.org/10.1016/j.spc.2020.11.004

Dogan E, Turkekul B (2016) CO2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23:1203–1213. https://doi.org/10.1007/s11356-020-08748-7

Durusu-Ciftci D, Ispir MS, Yetkiner H (2017) Financial development and economic growth: some theory and more evidence, J. Pol Modeling 39:290–306

Ehigiamusoe KU, Lean HH (2019) Effects of energy consumption, economic growth, and financial development on carbon emissions: evidence from heterogeneous income groups. Environ Sci Pollut Res 26(22):22611–22624

Fakher HA (2019) Investigating the determinant factors of environmental quality based on ecological carbon footprint index. Environ Sci Pollut Res 26(10):10276–10291

Frankel J, Romer D (1999) Does trade cause growth? Am Econ Rev 89(3):379–399

Furuoka F (2015) Financial development and energy consumption: evidence from a heterogeneous panel of Asian countries. Renew Sust Energ Rev 52:430–444

Gill AR, Hassan S, Haseeb M (2019) Moderating role of financial development in environmental Kuznets: a case study of Malaysia. Environ Sci Pollut Res 26(33):34468–34478. https://doi.org/10.1007/s11356-019-06565-1

Godil DK, Sharif A, Agha H, Jermisttiparsert K (2020) The dynamic nonlinear influence of ICT, financial development, and institutional quality on CO2 emission in Pakistan: new insights from QARDL approach. Environ Sci Pollut Res 27:24190–24200

Guo M, Hu Y, Yu J (2019) The role of financial development in the process of climate change: evidence from different panel models in China. Atmos Pollut Res 10(5):1375–1382

Hu Y, Yu J (2019) The role of financial development in the process of climate change: evidence from different panel models in China. Amos Pollut Res 10(5):1375–1382

Hafeez M, Yuan C, Shahzad K, Aziz B, Iqbal K, Raza S (2019) An empirical evaluation of financial development-carbon footprint nexus in One Belt and Road region. Environ Sci Pollut Res 26:25026–25036. https://doi.org/10.1007/s11356-019-06680-z

Hashmi SM, Chang BH, Shahbaz M (2020) Asymmetric effect of exchange rate volatility on India’s cross-border trade: evidence from global financial crisis and multiple threshold nonlinear ARDL model. Aust Econ Pap:e12194

Ibrahiem DM (2020) Do technological innovations and financial development improve environmental quality in Egypt? Environ Sci Pollut Res 27:10869–10881

Johnson F, Kjarstad J, Rootzien J (2019) The threat to climate change mitigation posed by the abundance of fossil fuels. Clim Pol 19(2):258–274

Kar M, Nazlioglu S, Agir H (2011) Financial development and economic growth nexus in the MENA countries: Bootstrap panel Granger causality analysis. Econ Model 28(1):685–693

Karasoy A (2019) Drivers of carbon emissions in Turkey: considering asymmetric impacts. Environ Sci Pollut Res 26(9):9219–9231

Khan AQ, Saleem N, Fatima ST (2018) Financial development, income inequality, and CO2 emissions in Asian countries using STIRPAT model. Environ Sci Pollut Res 26:6308–6319

Kraft J, Kraft A (1978) On the relationship between energy and GNP. J Energ Dev:401–403

Kumar S (2019) Asymmetric impact of oil prices on exchange rate and stock prices. The Quarterly Review of Economics and Finance 72:41-51

Lahiani A (2020) Is financial development good for the environment? An asymmetric analysis with CO 2 emissions in China. Environ Sci Pollut Res 27:7901–7909. https://doi.org/10.1007/s11356-019-07467-y

Levine R (1997) Financial development and economic growth: views and agenda. J Econ Lit 35(2):688–726

Levine R (2005) Chapter 12 finance and growth: theory and evidence. Handbook of economic growth. Elsevier, pp 865-934

Lin B, Omoju OE, Okonkwo JU (2015) Impact of industrialisation on CO2 emissions in Nigeria. Renew Sust Energ Rev 52:1228–1239

Liu H, Song Y (2020) Financial development and carbon emissions in China since the recent world financial crisis: Evidence from a spatial-temporal analysis and a spatial Durbin model. Science of The Total Environment, 136771. https://doi.org/10.1016/j.scitotenv.2020.136771

Mahdi Ziaei S (2015) Effects of financial development indicators on energy consumption and emission of European, East Asian and Oceania countries. Renew Sust Energ Rev 42:752–759. https://doi.org/10.1016/j.rser.2014.10.085

McKinnon R (1973) Money and Capital in Economic Development. The Brookings Institute, Washington

Nasiru MY, Joshua M, Nasiru AK (2012) Bank recapitalization in Nigeria: resuscitating liquidity or forestalling distress. Int J Bus Soc Sci 3(10):298–305

Nasreen S, Anwar S, Ozturk I (2017) Financial stability, energy consumption and environmental quality: evidence from south Asian economies. Renew Sust Energ Rev 67:1105–1122

Nasreen S, Anwar S (2014) Causal relationship between trade openness, economic growth and energy consumption: a panel data analysis of Asian countries. Energy Policy 69:92–91

Nathaniel S, Nwodo O, Adediran A, Shamma G, Shah M, Adeleye N (2019) Ecological footprint, urbanization, and energy consumption in South Africa: including the excluded. Environ Sci Pollut Res 26(26):27168–27179

Nosheen M, Iqbal J, Hassan SA (2019) Economic growth, financial development, and trade in nexuses of C02 emissions for Southeast Asia. Environ Sci Pollut Res 26:36274–36286. https://doi.org/10.1007/s11356-019-06624-7

Omoke PC, Nwani C, Effiong EL, Evbuomwan OO, Emenekwe CC (2020) The impact of financial development on carbon, non-carbon, and total ecological footprint in Nigeria: new evidence from asymmetric dynamic analysis. Environ Sci Pollut Res 27:21628–21646

Omoke PC, Uche E (2020) Asymmetric impacts of oil price shocks on selected macroeconomic variables: NARDL exposition. Econ Policy Energ Envr 1(/2020):171–189. https://doi.org/10.3280/EFE2020-001008

Ozturk I, Acaravci A (2013) The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ 36:262–267

Pal D, Mitra SK (2016) Asymmetric oil product pricing in India: Evidence from a multiple threshold nonlinear ARDL model. Econ Model 59:314–328

Pal D, Mitra SK (2015) Asymmetric impact of crude price on oil product pricing in the United States: An application of multiple threshold nonlinear autoregressive distributed lag model. Econ Model 51:436–443

Pal D, Mitra SK (2019) Asymmetric oil price transmission to the purchasing power of the U.S. dollar: A multiple threshold NARDL modelling approach. Res Policy 64:101508

Perron P (1997) Further evidence on breaking trend functions in macroeconomic variables. J Economet 80(2):355–385

Pesaran MH, Shin Y (1999) Autoregressive distributed lag modeling approach to cointegration analysis. In Storm, S. edited, Econometrics and economic theory in the 20th Century: The Ragnar Frisch Centennial Symposium, Cambridge University Press,Cambridge, chapter 1.

Qingquan J, Khattak SI, Ahmad M, Ping L (2020) A new approach to environmental sustainability: assessing the impact of monetary policy on CO2 emissions in Asian economies. Sustain Dev:1–16. https://doi.org/10.1002/sd.2087

Rafindadi AA (2016) Does the need for economic growth influence energy consumption and CO2 emissions in Nigeria? Evidence from the innovation accounting test. Renew Sust Energ Rev 62:1209–1225

Riti JS, Shu Y (2016) Renewable energy, energy efficiency, and eco-friendly environment (RE 5) in Nigeria. Energy Sustain Soc 6(1):13

Saidi K, Mbarek MB (2017) The impact of income, trade, urbanization, and financial development on CO2 emissions in 19 emerging economies. Environ Sci Pollut Res 24:12748–12757

Sani J, Alani GO (2013) A comparative analysis of pre and post recapitalization financial performance of banks in Nigeria. Int J Capacity Building in Edu and Manag 2(1):79–90

Shahbaz M, Haouas I, Sohag K, Ozturk I (2020) The financial development-environmental degradation nexus in the United Arab Emirates: the importance of growth, globalization and structural breaks. Environ Sci Pollut Res 27:10685–10699. https://doi.org/10.1007/s11356-019-07085-8

Shahbaz M, Nasir MA, Roubaud D (2018) Environmental degradation in France: the effects of FDI, financial development, and energy innovations. Energy Econ 74:843–857

Shahbaz M, Shahzad SJH, Ahmad N, Alam S (2016) Financial development and environmental quality: the way forward. Energy Policy 98:353–364

Shaw ES (1973) Financial deepening in economic development. Oxford University Press, New York

Shin Y, Yu B, Greenwood-Nimmo M (2014) Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. A Festschrift in Honour of Peter Schmidt. Springer, New York, pp 281–314

Shoaib HM, Rafique MZ, Nadeem AM, Huang S (2020) Impact of financial development on CO2 emissions: A comparative analysis of developing countries (D8) and developed countries (G8). Environ Sci Pollut Res Int:1–15

Svirydzenka K (2016) Introducing a new broad-based index of financial development. IMF Working Paper, WP/16/5

Thirlwall AP (2005) The determinants of saving in developing countries, and the impact of financial liberalization. In Philip Arestis, Michelle Baddeley, and John

Todaro M, Smith S (2012) Population growth and economic development: causes, consequences, and controversies. In: Economic Development, 12th edn. Pearson, New York, pp 269–310

Uche E, Nwamiri SN (2020) Dynamic adjustment of energy demand to exchange rate and income differential: evidence from selected OPEC economies – NARDL approach. Acad J Current Res 7(8):183–199

Uddin MMM (2020) Does financial development stimulate environmental sustainability? Evidence from a panel study of 115 countries. Bus Strateg Environ. https://doi.org/10.1002/bse.2591

Verheyen F (2013) Exchange rate nonlinearities in EMU exports to the US. Econ Model 32:66–76

World Bank. Total Greenhouse Gas Emissions (kt of CO2 Equivalent). 2010. Available online: https://data.worldbank.org/indicator/EN.ATM.GHGT.KT.CE

World Bank. Total Greenhouse Gas Emissions (kt of CO2 Equivalent). 2012. Available online: https://data.worldbank.org/indicator/EN.ATM.GHGT.KT.CE

World Bank. Total Greenhouse Gas Emissions (kt of CO2 Equivalent). 2020. Available online: https://data.worldbank.org/indicator/EN.ATM.GHGT.KT.CE

World Resource Institute (2015). Available at: https://www.wri.org/our-work/topics/energy

Wu J, Hou H, Cheng S (2010) The dynamic impacts of financial institutions on economic growth: evidence from European Union. J Macroecon 32(3):879–891

Xing T, Jiang Q, Ma X (2017) To facilitate or curb? The role of financial development in China’s carbon emissions reduction process: a novel approach. Intl J Environ Res Pub H 14:12222–12239

Yazdi SH, Beygi EG (2017) The dynamic impact of renewable energy consumption and financial development on CO2 emissions: for selected African countries. Ener Sour, Part B: Econ, Plan, Pol 13(1):13–20

Yu E, Choi J (1985) The causal relationship between energy and GNP: an international comparison, J. Energy Dev 16(2):219–226

Yuxiang K, Chen Z (2011) Financial development and environmental performance: evidence from China. Environ Dev Econ 16(1):93–111

Zaghdoudi T (2018) Asymmetric responses of CO2 emissions to oil price shocks in China: a non-linear ARDL approach. Econ Bull 38(3):1485–1493

Zivot E, Andrews DW (1992) Further Evidence on the Great Crash, the Oil-Price Shock, and the Unit-Root Hypothesis. J Bus Econ Stat 10(3):251–270

Acknowledgements

We are greatly indebted to the editor and the two anonymous reviewers for their invaluable comments that gave this study a new shape. We are also grateful to Bisharat Hussain Chang who graciously provided the E-view codes for the estimations.

Availability of data

The data can be made available on request.

Author information

Authors and Affiliations

Contributions

Emmanuel Uche, PhD: conceptualisation, data curation, methodology, formal analysis, review and editing

Lionel Effiom, PhD: writing (original draft), data curation, review and editing

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interest of any kind.

Additional information

Responsible editor: Roula Inglesi-Lotz

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

ESM 1

(DOCX 201 kb)

Rights and permissions

About this article

Cite this article

Uche, E., Effiom, L. Financial development and environmental sustainability in Nigeria: fresh insights from multiple threshold nonlinear ARDL model. Environ Sci Pollut Res 28, 39524–39539 (2021). https://doi.org/10.1007/s11356-021-12843-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-12843-8