Abstract

Experiments on intertemporal consumption typically show that people have difficulties in optimally solving such problems. Previous studies have focused on contexts in which agents are faced with risky future incomes and have to plan over long horizons. We present an experiment comparing decision making under certainty, risk, and ambiguity, over a shorter lifecycle. Results show that behavior in the ambiguity treatment is markedly different than in the risk condition and it is characterized by a significant pattern of under-consumption.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The question of how people cope with solving dynamic optimization problems has been often tested in economics. Several contributions in the literature, including experimental and empirical studies, have shown how people may have difficulties in optimally solving intertemporal consumption/saving problems.Footnote 1 Results have generally shown that participants fail to optimize lifetime utility, in some cases deviating significantly from the optimal consumption strategy (Hey and Dardanoni 1988; Ballinger et al. 2003, 2011; Carbone and Hey 2004; as well as Brown et al. 2009). Other contributions have found evidence of how learning and cognitive abilities may play an important role in improving intertemporal planning.Footnote 2

Experiments on intertemporal consumption/saving problems have typically involved making decisions under risk on the distribution of income (over the lifecycle). In all these cases, participants have knowledge of the stochastic process determining income. In other words, participants know in advance, or are able to easily determine the probability of receiving a specific level of income. However, when decision-makers do not know the true objective probabilities, they then have to plan under ambiguity. This would entail them having some prior beliefs about probabilities and a mechanism to update them. It would not be unreasonable to think that many people everyday are faced with consumption/saving decisions under ambiguity about future income. As far as we know, there are no studies that test experimentally people’s ability to solve this kind of problems in this specific context.

Other studies also report on people’s difficulties in planning ahead, possibly due to the length of the planning horizon. In particular, Ballinger et al. (2003) and Carbone and Hey (2004) include a discussion on the estimation of the planning horizon that participants seem to actually use to solve the inter-temporal consumption problem. They find evidence of myopic behavior in both cases of lifecycles of 25 (Carbone and Hey 2004) and 60 periods (Ballinger et al. 2003). These authors conclude that not only people may be short-sighted relative to the optimal planning horizon, but that there seems to be a significant variability across subjects. For this reason, we decided to run this test with a relatively short horizon. Intuitively, shorter planning horizons might allow agents to reach the optimal solution more easily.

The aim of this experiment is to explore how subjects solve a stochastic optimisation problem in three different decision-making contexts: certainty, risk, and ambiguity, in the specific case of a very short lifecycle. Results show that behavior in the ambiguity treatment is markedly different than in the risk condition. We also find that even in presence of an (unusually) short planning horizon, participants still seem to have difficulties in finding the optimal solution.

The theoretical background for this study is described in Sect. 2. Section 3 presents the experimental design while results are analyzed in Sect. 4 and discussed in Sect. 5.

2 Theory

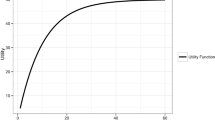

Consider an agent living for a discrete number of periods (\(T\)) and having intertemporal preferences represented by the Discounted Utility model with a discount rate equal to zero. In each period, she receives utility from consumption; utility is assumed to have a functional form of the CARA type:

where “c” is consumption and \(\alpha \) and \(k\) are scaling factors.

In the case of decision making under risk, the objective of our agent is then to maximize the expected lifetime utility, that isFootnote 3

subject to

where \(w\) is available wealth and \(y\) is income. In each period of her lifecycle, the agent receives either a high or a low income, with probabilities \(p=q=0.5\). The rate of return is known and held fixed during the lifecycle. Also, borrowing is not allowed, that is, wealth must always be greater or at most equal to zero. Finally, the agent has no bequest motives, that is, any savings are lost after the last period (\(T\)). The problem is then to choose the sequence of consumption (from period 1 to period \(T\)) that maximizes (1).

The optimal strategy under risk assumes Expected Utility (EU) decision-makers who work with the true objective probabilities. Under ambiguity, as we have implemented it, subjects do not know the true probabilities and therefore EU cannot be applied. There are many models of behavior under ambiguity and we choose the simplest—that is, Subjective Expected Utility (SEU) theory. We do not know their subjective probabilities but in order to compute the optimal solution, we assume a probability of \(0.5\). Of course if their true subjective probability of receiving a high income is lower than \(0.5\) then subjects will save more, compared to what predicted by the computed optimal strategy.

The standard procedure to solve this kind of problems is to use Dynamic Programming.Footnote 4 The Bellman equation of the problem is

where \(V_t\) is the value function, \(w_t\) represents available wealth, and \(E\) is the expectation operator.Footnote 5 The value function establishes a recursive relation between current and future decisions. The expectation is resolved by considering the two possible events: low income and high income. Wealth in period \(t+1\) is optimal because it is determined by the (optimal) consumption choice in \(t\). Using backward induction, the agent starts from the last period (\(T\)), where the optimal solution is obviously to consume all wealth, then moves backwards period by period, choosing the optimal level of consumption which maximizes the value function of that period, until the first period is reached. This allows the determination of optimal consumption as a function of wealth (\(w_t\)) and time (\(t\)).

Some restrictions have been imposed on variables. In particular, borrowing is not allowed (\(w_t\ge 0\)) and all variables are rounded to the second decimal figure. While in the case of certainty it was possible to determine the exact solution of the problem, in the case of risk and ambiguity a numerical solution (also using interpolation) had to be used.Footnote 6

3 Experimental design

The experiment is composed of three treatments, called “certainty,” “risk,” and “ambiguity.” Participants were randomly assigned to a treatment. The rate of interest (\(r\)) was fixed at \(0.4\), while income was set equal to 10 tokens in the certainty case and to \(5\) and \(15\) tokens in the cases of risk and ambiguity. The probability of high or low income was equal to \(0.5\) and this was told to the subjects in the risk treatment but not in the ambiguity treatment. The parameters of the utility function, presented in the experiment as a “conversion function” from tokens to money, were set as follows: \(\rho =0.1\), \(\alpha =0.45\), and \(k=10\). The experiment was run at LABSI at the University of Siena. Thirty undergraduate students took part in three sessions, one for each treatment. The experiment was programed and conducted with the software z-Tree (Fischbacher 2007). Each session involved playing five sequences, each one composed of five periods. In each period of a sequence, subjects were asked to decide how much to convert out of their available tokens (the sum of income, previous savings, and interest) knowing that any tokens not converted would yield interest. In the risk and ambiguity treatments, in each period income was determined by a random draw from an opaque bag containing equal numbers of two colored balls. In the case of risk, at the beginning of the experiment, one participant was asked to publicly open the bag and count the balls.Footnote 7 After each draw, the ball was placed back into the bag so as to not alter the probability of future draws. Instructions also clarified that any savings left at the end of the last period would be worthless. In order to allow participants to check the consequences of their decisions, a calculator was made available in each period.Footnote 8 At the beginning of each period and at the end of a sequence, participants were shown a table summarizing the consequences of their decisions reporting income, available wealth, conversion, savings, interest gained, and earnings (in the previous period or in the whole sequence, period by period). Participants could enter numbers with up to two decimal digits for conversion. At the end of the experiment, one of the five sequences played was randomly selected for payment using a public procedure.

4 Results and discussion

Table 1 presents a summary of the experiment showing, for each treatment, three different types of information. In the top part of the table, there is a comparison between the theoretical maximum utilityFootnote 9 (labeled “Opt. Ut.”) and the average total utility achieved by participants in that treatment (along with its standard deviation).Footnote 10 Results show that all deviations are negative. More interestingly, the second part of Table 1 shows that they are also all statistically significant, according to one-sample parametric and non-parametric tests (t test and signed rank test), which suggests that participants, on average, did not maximize utility. Also, deviations in the case of decision making under ambiguity are generally slightly greater than those in other treatments. Moreover, deviations show a similar pattern of variability across treatments: usually higher in the first and second sequences and lower in the following repetitions. Finally, the third part of Table 1 shows the root mean squared deviation (RMSD) for each sequence and each treatment, in the cases of unconditional and conditional optimum. The main difference here is the point of reference: while unconditional optimum represents the solution to the intertemporal problem and is calculated on optimal wealth (hence assuming optimal behavior throughout the lifecycle), conditional optimum is computed based on actual wealth.Footnote 11 As Table 1 shows, this index tends to decrease across sequences, suggesting an improvement in strategy during the experiment.

In general, the presence of significant deviations from unconditional optimum suggests that participants did not use the optimal strategy. Moreover, this analysis shows that subjects in the ambiguity treatment deviate more from the optimum.

4.1 Estimated planning horizon

Following Ballinger et al. (2003) and Carbone and Hey (2004), the apparent planning horizon used by each participant has been estimated, sequence by sequence, for each treatment. The Null Hypothesis that the average actual and optimal planning horizons are the same has then been tested using both the signed rank test and the t testFootnote 12 (one-sample tests). Results show that in the cases of certainty and risk the average apparent horizon is always significantly shorter than optimal. In the ambiguity case, the average actual planning horizon seems to be longer than the one used in other treatments. Indeed, statistical tests confirm that there is no statistical difference with the optimal horizon in the first three sequences, when considering unconditional optimum and in two cases when considering the conditional optimum.

This result is somewhat at odds with initial findings, suggesting that in the case of decision making under ambiguity participants deviated more from maximum utility. A possible explanation for this could be that given the very short length of the lifecycle, some (possibly extreme) strategies might cause biased estimations. An “informal” analysis of this hypothesis has highlighted that saving “aggressively” (i.e., most or all of available wealth) in the first/second periods seems to result in an estimated planning horizon of four/five periods. This phenomenon seems to be more evident when looking at data from the risk and ambiguity treatments. For this reason and in order to investigate the existence of regularities that influenced the estimation of actual planning horizons, the distribution of the fraction of consumption over available wealth, for all treatments, has been analyzed.

4.2 Consumption-to-wealth ratios

For each treatment and each sequence, the comparison between the optimal consumption-to-wealth ratio (\(c^{*}/w^{*}\)) and the average of actual ratios has been computed.Footnote 13 Graphs in Fig. 1 compare treatments with respect to deviations from optimal ratios. The “x-axis” represents a deviation equal to zero, while positive and negative values can be interpreted as instances of over- and under-consumption. An interesting finding, immediately visible from the graphs, is that in the case of ambiguity, ratios are consistently below zero (implying an average under-consumption with respect to optimum) and consistently below the other two treatments. This finding, together with the patterndescribed at the end of the previous subsection, might help explain the apparent contradiction between deviations from optimum and estimated planning horizons.

4.3 Comparing risk and ambiguity

Tables 2 and 3 show the comparison between risk and ambiguity in each period of each sequence and when pooling data together, respectively. Two-sample tests (Wilcoxon–Mann–Whitney and t test) have been carried out on the average deviations from conditional optimum. Results reported in Table 2 show that, in periods 1–4,Footnote 14 the behavior under ambiguity is different from the behavior under risk. More specifically, in the ambiguity treatment we observe a trend of under-consumption, with a bigger average deviation from conditional optimum (in absolute value) compared to the risk case. In the risk treatment behavior seems to be more “unstable”: in some cases actual consumption is above conditional optimum, in others it falls below it. Table 2 shows that risk and ambiguity treatments are significantly different in sequence 2 (periods 3 and 4) and sequence 3 (periods 2 and 3). However, when looking at the general picture, average deviations in cases of risk and ambiguity are generally very far apart (different). Table 3, where data from all sequences are pooled together, shows that aside from period one, the ambiguity treatment is always significantly different from the risk treatment. While the behavior under risk exhibits over-consumption at the beginning of the horizon (and under-consumption in the second half, as typically reported in the literature), the ambiguity treatment exhibits a persistent pattern of (average) under-consumption. Also, in the ambiguity case, average deviations are almost always negative in sequences 1 to 3, while in sequences 4 and 5 they become positive in the first period and negative elsewhere. This “learning” effect in the last two sequences, can be interpreted in the following way: in SEU theory, subjects have subjective probabilities which may or may not be the true probabilities. As they get more information about the possible states of the world,Footnote 15 they update their beliefs. By the time they got to the last round of the last sequence, they had observed 25 draws from the bag. By then, they would have a pretty good idea of the true probabilities. Obviously, we cannot get inside the subjects minds and observe their subjective probabilities at each stage, but we can make two guesses at what they might be thinking. One guess is that, in the absence of information to the contrary, they would start by assuming that each state was equally likely; evidence from the draws would confirm that. The second guess is that the probability of the good state was low, and this would steadily be revised upward in the light of the observations; this may explain the behavior of the subjects in the ambiguity treatment. We should note that if we use SEU to explain the behavior of our subjects, then it is all to do with their subjective probabilities; there is no parameter of ambiguity aversion.

5 Conclusions

We have presented an experiment designed to study intertemporal consumption choices, in the cases of certainty, risk, and ambiguity about future income, over a short planning horizon. Results show that even when faced with an unusually short lifecycle participants failed to plan optimally, in all treatments.

More interestingly, results show that subjects’ behavior in the ambiguity treatment was markedly different from that in the case of risk. Not having information about the distribution of future income seems to have triggered significant savings across most of the sequences. In particular, in the first three sequences of the experiment participants have (on average) under-consumed (with respect to conditional optimum) throughout the lifecycle. This result is strikingly different from what has been typically reported in the literature. However, by the last two sequences the pattern of deviations has shifted to average over-consumption, in the early periods of the lifecycle, followed by under-consumption in later ones. We believe that this result is directly connected to the learning process about the (unknown) probabilities which seem to have induced more precautionary savings out of wealth available for consumption.

Notes

Having set the discount rate equal to zero, \(\beta \) equals 1, so the same can be expressed by: \(E(U(c_t)+U(c_{t+1})+\cdots +U(c_T))\).

Starred variables indicate optimal choices.

The optimization programs were written using Maple.

This was omitted in the case of ambiguity.

Participants were also provided with tables showing some examples of conversions and of the interest mechanism.

Given our experimental design, the theoretical maximum utility corresponds to the maximum payment that subjects could achieve.

Here we refer to the “ex-post” optimum, i.e., the optimal solution calculated after income realizations.

The tables of the estimated planning horizons, relative to the three treatments, as well as the results of the statistical tests are available on request.

A table reporting optimal and average actual ratios (with their standard deviations) and deviations, is available on request.

Period 5 is not relevant because participants were clearly instructed that “leftovers” after the last periods would be lost.

Which was the case in this experiment as there was a fresh draw from the ambiguous bag after each round of each sequence.

References

Ballinger, T., Palumbo, M., & Wilcox, N. (2003). Precautionary saving and social learning across generations: An experiment. The Economic Journal, 113(490), 920–947.

Ballinger, T. P., Hudson, E., Karkoviata, L., & Wilcox, N. T. (2011). Saving behavior and cognitive abilities. Experimental Economics, 14(3), 349–374.

Brown, A., Chua, Z., & Camerer, C. (2009). Learning and visceral temptation in dynamic saving experiments. Quarterly Journal of Economics, 124(1), 197–231.

Browning, M., & Lusardi, A. (1996). Household saving: Micro theories and micro facts. Journal of Economic Literature, 34(4), 1797–1855.

Carbone, E., & Hey, J. (2004). The effect of unemployment on consumption: An experimental analysis. The Economic Journal, 114(497), 660–683.

Deaton, A. (1992). Understanding consumption (Clarendon Lectures in Economics). Oxford: Oxford University Press.

Fehr, E., & Zych, P. K. (1998). Do addicts behave rationally? Scandinavian Journal of Economics, 100(3), 643–662.

Fischbacher, U. (2007). z-tree: Zurich toolbox for ready-made economic experiments. Experimental Economics, 10(2), 171–178.

Hey, J. (2008). Exploring the experimental economics approach in pensions. Working Paper 43, Department for Work and Pensions.

Hey, J., & Dardanoni, V. (1988). Optimal consumption under uncertainty: An experimental investigation. The Economic Journal, 98(390), 105–116.

Stokey, N. L., Lucas, R. E., & Prescott, E. (1989). Recursive methods in economic dynamics. Cambridge: Harvard University Press.

Acknowledgments

We are grateful to John Hey for useful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Carbone, E., Infante, G. Comparing behavior under risk and under ambiguity in a lifecycle experiment. Theory Decis 77, 313–322 (2014). https://doi.org/10.1007/s11238-014-9443-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11238-014-9443-2