Abstract

This paper focuses on the comparison of individual and group decision-making, in a stochastic inter-temporal problem in two decision environments, namely risk and ambiguity. Using a consumption/saving laboratory experiment, we investigate behaviour in four treatments: (1) individual choice under risk; (2) group choice under risk; (3) individual choice under ambiguity and (4) group choice under ambiguity. Comparing decisions within and between decision environments, we find an anti-symmetric pattern. While individuals are choosing on average closer to the theoretical optimal predictions, compared to groups in the risk treatments, groups tend to deviate less under ambiguity. Within decision environments, individuals deviate more when they choose under ambiguity, while groups are better planners under ambiguity rather than under risk. Our results extend the often observed pattern of individuals (groups) behaving more optimally under risk (ambiguity), to its dynamic dimension.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Many real-life economic decisions usually share three main characteristics: (1) the decision environment involves some kind of uncertainty, either objective (risk) or subjective (ambiguity); (2) decisions are made by groups rather than by isolated individuals (e.g. households, executive boards or policy committees) and; (3) decisions involve a sequence of choices over either a long time horizon or after the reception of some relevant information compared to a one-shot choice (e.g. savings, investments or insurance). Standard economic theory relies on the assumption that when an agent is confronted with a stochastic, intertemporal decision problem under uncertainty, she takes into consideration all the possible future states of the world and calculates the optimal solution of this dynamic maximisation problem by applying backward induction, satisfying in that way dynamic consistency (what seems to be optimal at time \(t_2\) from the viewpoint of \(t_1\), is still optimal when time \(t_2\) arrives). On top of that, as it is highlighted in Charness and Sutter (2012), a decision-maker in an economics textbook is usually modelled as an individual who acts independently and is not influenced by any other people, and only recently economic research has developed an interest regarding group decision-making and the potential differences with individual decision-making.

Recently, a vast body of experimental literature has been devoted to the comparison of individual and group decision-making. Two recent reviews of this literature (Charness and Sutter 2012; Kugler et al. 2012) conclude that groups tend to behave closer to what is defined as rational choice by economic theory, comply with the predictions of game theoretical models, as well as to decide in a more self-interested manner. Although there is an affluence of studies on collective choice in static frameworks, there is little empirical evidence of group dynamic decision-making.

We present evidence from a consumption/saving laboratory experiment where we study choices from two decision units, namely individuals and groups, in two decision environments, risk and ambiguity. We, therefore, investigate behaviour in four treatments: (1) individual choice under risk; (2) group choice under risk; (3) individual choice under ambiguity and (4) group choice under ambiguity, in a stochastic inter-temporal allocation problem. Groups consist of two members and decisions are made after a phase of communication and deliberation. We compare behaviour both within decision units and within decision environments. Within decision units, analysis [i.e. individuals (groups) under risk vs. individuals (groups) under ambiguity] allows us to investigate whether the introduction of ambiguity, regarding the future level of income, has any significant impact on the way individuals and groups decide; while within decision environments, analysis [i.e. individuals vs. groups under risk (ambiguity)] allows us to explore whether there are fundamental differences between individuals and groups.

Our main results can be summarised as follows. Both groups and individuals substantially deviate from the predicted theoretical optimal level of consumption both under risk and under ambiguity. There are significant treatment effects within a decision environment. We observe an anti-symmetric result, where individuals perform better compared to groups under risk, while groups perform better under ambiguity. Likewise, individuals tend to deviate less from the optimal level of consumption when they plan under risk compared to ambiguity, while groups deviate less in an ambiguous environment rather than in a risky one. The majority of the subjects is characterised by considerably myopic (short) planning horizons. We observe a common pattern across all treatments regarding the factors that drive behaviour (e.g. repetition of the task, available wealth) as well as significant gender effects in consumption/saving choices. Finally, we observe precautionary saving behaviour with individuals saving more under ambiguity than under risk and also individuals saving more compared to groups. Our results extend the often observed pattern of individuals (groups) behaving more optimally under risk (ambiguity), to its dynamic dimension.

The paper is organised as follows. We start in Sect. 2 by reviewing the related literature on life-cycle experiments, dynamic group choice and group decision-making under ambiguity and discuss how our study contributes to this literature. In Sect. 3, we present the decision task as well as the underlying theoretical model that we aim to test. We then move to the experimental design, stimuli and procedures in Sect. 4; while in Sect. 5, we report our results. We then conclude.

2 Related literature

Many studies in the psychology literature, and more recently in the economics discipline, aim to explore differences between individuals and groups in various fields. These studies usually focus on investigating how differently individuals and groups decide, compared to the predictions of some kind of rational decision theory. Kugler et al. (2012) and Charness and Sutter (2012) report extensive experimental evidence supporting the superiority of groups in the domain of game theoretical predictions. When this comparison concentrates on decision-making under risk and ambiguity, the main research question that is often explored, is whether individuals and groups are characterised by different attitudes towards risk and ambiguity or if being member of a group alters the individual levels of these attitudes. Baker et al. (2008) find that groups tend to make decisions that are more consistent with risk neutral preferences; Shupp and Williams (2008) using parametric structural estimations find that groups have a lower risk aversion coefficient; Masclet et al. (2009), on the contrary, find that groups opt for the safer choices; Charness et al. (2010) find that groups perform significantly better on a probability reasoning task; Zhang and Casari (2012) report that group choices are more coherent and closer to risk neutrality; Bougheas et al. (2013) find that groups take more risk than individuals; while Baillon et al. (2016) investigate behaviour in Allais paradox and stochastic dominance tasks, reporting that groups violate less often stochastic dominance but they deviated more in the Allais paradox tasks.

More recently, motivated by the extensive experimental evidence of non-neutral ambiguity attitudes (Halevy 2007; Ahn et al. 2014; Hey and Pace 2014; Stahl 2014 among othersFootnote 1), researchers have started investigating group decision making under ambiguity (imprecise probabilities). Early studies concentrated on the effects of social interaction to ambiguity attitudes, rather than on choices by groups (see Curley et al. 1986; Keller et al. 2007; Trautmann et al. 2008; Muthukrishnan et al. 2009). Charness et al. (2013) show that ambiguity neutral agents are able to persuade the non-neutral ones to make joint, ambiguity-neutral decisions; Keck et al. (2014) find that groups are inclined to make more ambiguity neutral decisions and that ambiguity averse individuals tend to become ambiguity neutral after they consult with their peers. Brunette et al. (2015) report that groups applying the unanimity rule are less risk averse. They found the same pattern for ambiguity but without significance. Similar work has been done by Levati et al. (2016) who test different voting rules in collective choice under ambiguity and by Lahno (2014) who examines the effects of feedback in decision-making under ambiguity.

Almost all the aforementioned studies investigate decision-making in a static framework. Nevertheless, there are a few experiments that investigate collective choice in inter-temporal frameworks. Gillet et al. (2009) find that groups make qualitatively better decisions than individuals in an inter-temporal common pool environment; Charness et al. (2007) report that individuals tend to choose first-order stochastically dominated alternatives more often in a Bayesian updating experiment; Jackson and Yariv (2014) find that social planners exhibited extensive present bias in an inter-temporal common consumption stream experiment; Carbone and Infante (2014) and Carbone and Infante (2015) compared behaviour between individuals and groups in an inter-temporal life-cycle experiment under risk (objective uncertainty) finding significant deviations from the optimal planning strategy as well as significant differences between the treatments; while Denant-Boemont et al. (2016) find that groups are more patient and make more consistent decisions in collective time preferences experiment.

To compare behaviour in a dynamic framework, we use a decision task borrowed from the literature on saving experiments. Literature in incentivised life-cycle experiments is as early as Hey and Dardanoni (1988). A common result of life-cycle experiments is that agents systematically deviate from the theoretically optimal consumption path usually by over-consuming during the early stages of the life-cycle and under-consume later. Several different explanations have been given for this pattern ranging from dynamically inconsistent preferences that include present bias and truncated planning horizons (Ballinger et al. 2003; Carbone and Hey 2004; Carbone 2005; Brown et al. 2009), cognitive skills (Ballinger et al. 2011), external habits and social learning (Carbone and Duffy 2014; Feltovich and Ejebu 2014) to debt aversion (Meissner 2015). Carbone and Infante (2014) study individual choice under ambiguity in a short-horizon savings experiment, while Carbone and Infante (2015) compare group and individuals in a savings experiment under risk.Footnote 2 Our study contributes to the literature in the following ways. To the best of our knowledge, this is the first study to compare individual and group decision-making in a dynamic framework, under risk and ambiguity. In the field of group decision-making under ambiguity, in contrast to Charness et al. (2013), Keck et al. (2014) and Brunette et al. (2015) who compare groups and individuals in a static framework, in a task that involves learning and updating of ambiguous beliefs using a life-cycle experimental design, we report the first experiment that studies dynamic group decision-making under ambiguity. Generally, the experimental literature on dynamic decision-making under ambiguity (updating and learning) is very limited. At the individual decision-making level, there is the work by Cohen et al. (2000) and Dominiak et al. (2012) that test the Ellsberg paradox in a dynamic framework. In the domain of learning under ambiguity, whilst the topic has received significant theoretical attention (see Marinacci 2002; Epstein and Schneider 2007; Epstein et al. 2010; Zimper and Ludwig 2009), there is lack of both experimental and empirical work. A recent study by Nicholls et al. (2015) tests whether learning helps to reduce the violations of the Ellsberg paradox. Recently, Baillon et al. (2018) study the effect of learning on ambiguity attitudes in an experiment using initial public offerings on the New York Stock Exchange. With this study we aim to obtain some preliminary results of dynamic group choice under ambiguity where the participants obtain information during the experiment which allows them to reduce the level of ambiguity.

When it comes to the literature on experiments on savings, although the modelling advances in the literature of choice under ambiguity have been applied to the theoretical analysis of life-cycle decisions. (Campanale 2011; Peijnenburg 2015), there is lack of empirical evidence. We add to this literature by reporting an experimental study of life-cycle choice where ambiguity regarding the future income stream is introduced . In addition, unlike previous saving experiments that only test the effects of social influence on consumption decisions, we explicitly test how groups make similar decisions after deliberation. Using a \(2\times 2\) experimental design, we directly compare behaviour between and within decision units and environments, extending the previous literature in various ways. First, we compare groups and individuals, both within and between risk and ambiguity treatments. Second, we study 15-period lifecycles compared to the shorter periods that have been previously applied. Then, we adopt a suitable Bayesian learning model to capture the decreasing ambiguity characterising the income generation process, caused by the acquisition of additional information.

To summarise, by employing a simple theoretical framework to model decision-making under risk and ambiguity, used as a benchmark, we are able to test whether there is significant difference in the way individual and groups solve stochastic, dynamic decision problems in both environments. Our study contributes to the literature in the following ways. First, whereas most of the studies that compare individual and group choice focus only on one stochastic environment (either risk or ambiguity), our design allows us to compare behaviour both between and within decision units and environments, and therefore to identify a richer set of behavioural patterns. Furthermore, the majority of the studies that conduct a similar comparison focus on static decision-making problems. Our experimental design employs a sequential choice problem exploring the way different decision units solve dynamic decision problems as well as whether individuals and groups differ in their planning capacity. Finally, the present study contributes to the literature on savings experiments. In the existing literature, saving decisions have been studied in environments where either there is no uncertainty regarding the income generation stochastic process, or the uncertainty is objectively quantifiable (risk). Our experiment explores whether behaviour changes when ambiguity characterises the income generation process.

Following Charness and Sutter (2012, p. 174), who claim that “Ultimately, the goal of comparing individual and group decision-making is to identify the contexts and types of decisions where each is likely to work best”, this study provides a framework for understanding differences between individual and group choice in a stochastic inter-temporal consumption-saving problem under ambiguity.

3 Theoretical framework

We present a simple, discrete-time, finite horizon life-cycle model of consumption and savings decisions without discounting. An agent lives for a finite number of periods T and receives utility \(u(c_t)\) from consumption \(c_t\) at every period t with \(t \in \{1,2,\ldots ,T\}\). At the beginning of each period t, the decision-maker is endowed with a stochastic income \(y_t\).Footnote 3 At each period, the agent decides how much of her available wealth to consume and how much to save, given that there is a fixed interest rate applied to the savings each period. The wealth at every period (or the cash-on-hand) includes the savings up to that period plus the endowed income for the period. There is no borrowing allowed (consumption cannot be greater than the available wealth) and there are no bequest motives (all the available wealth must be consumed by the end of the life-cycle).

The utility that the agent receives from consumption is induced by a concave, additive separable, constant absolute relative risk aversion (CARA) utility function of the following form:

where \(c_t\) is the level of the agent’s consumption at each period t, \(\rho \) is the coefficient of risk aversion and the parameters \(A>0, k>0\) are scaling factors of the utility function that allow for affine transformations. Inducing, rather than eliciting risk preferences is a common practice in experimental economics (see Schotter and Braunstein 1981; Berg et al. 1986) and it has been particularly exploited in savings experiments (see Ballinger et al. 2003; Carbone and Hey 2004; Meissner 2015). Adopting this method allows to convert consumption units into monetary payoffs and induce subjects to behave “as if” they are characterised by the underlying preferences. More specifically, inducing a concave functional form for the utility function insures that the optimal consumption path is unique. During the experiment, we set the following values for the parameters: \(\rho =0.1, A=50\) and \(k=1\). These values are in line with the existing literature (Carbone and Hey 2004; Carbone and Duffy 2014; Meissner 2015) and they also ensure that payoffs are always positive and that differences in monetary payoffs due to different consumption paths, are salient for the subjects. The shape of the utility function is shown in Fig. 1.

The objective of the decision-maker is to maximise the utility obtained by the life-cycle consumption. Using the expected discounted utility model, the optimisation program can be written as:

subject to the inter-temporal budget constraint:

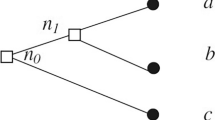

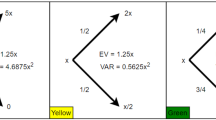

where \(w_{t+1}\) is the wealth of the next period, \(w_t\) is the level of wealth or the cash-on-hand at the beginning of period t, \(\alpha _{t+1}\) represents the available assets or savings at the beginning of period \(t+1\) and r is the rate of return which is known and remained constant during the experiment (at a fixed rate equal to 0.2). The discount rate is assumed to be equal to zero which means that the discount factor \(\beta \) is equal to 1.Footnote 4\(y_t\) represents the income of the agent at the beginning of time t. The income follows a stochastic process which is characterised either by risk or by ambiguity and there are two possible states of the world, a state where the income is High (\({\overline{y}}_t\)) and a state with Low income (\({\underline{y}}_t\)). The stochastic process is following a Bernoulli distribution which is applied with the aid of a two-colour Ellsberg-typeFootnote 5 urn containing 10 black and white balls in equal proportionsFootnote 6 representing High and Low income, respectively. In each period, a ball is randomly drawn from the urn and the colour of the ball defines the state of the world (the income for that period). The sampling method is constituted of draws with replacement so that each draw will not alter the probabilities of the future events. Finally, borrowing is not allowed and therefore, the wealth of the agents should be at all times greater or equal to zero. There are no bequest motives and any savings should be consumed before the end of the last period. In addition, there is lack of uncertainty regarding the planning horizon as the agents know the exact length of their life-cycle.

The absence of discounting or bequest motives, along with the i.i.d binomial income process, made the experimental task relatively transparent and easy to explain to subjects. Nevertheless, despite its simplicity, this kind of intertemporal stochastic problems do not have an analytical solution.Footnote 7 To solve for the optimal consumption-savings levels, we adopt the value function iteration approach and resort to numerical computational methods. The Bellman operator for this problem is given by:

where V is the value function and E is the expected operator which is defined as

where

with \(s \in [L,H]\) for Low and High income, respectively, and \(\mu \) being the subjective probability (belief) of the agent that the future state of the world will be High.Footnote 8 The value function establishes a recursive relation between consumption at every period t and every future period \(t+1\). Based on the assumptions above and the constraints imposed by the experimental design, it is possible to calculate an optimal inter-temporal consumption vector \(c^*=(c_1^*,\ldots ,c_T^*)\) for the agent’s life-cycle, for any given level of wealth and for any given level of beliefs regarding the future state of the world. Before being in position to do so, we need to specify how the subjective probabilities \(\mu \) are formed and updated during the experiment.

Recall that the exogenous income follows a simple i.i.d. Bernoulli process. During the risk treatments, the subjects know that the probability of each outcome is equal to 0.5, no information is provided during the ambiguity treatments. As the income generation process involves draws with replacement, the participants in the ambiguity treatments have the chance to obtain information that will allow them to update their beliefs regarding the parameters that characterise the distribution. Here, it would be useful to provide a clarification regarding the ambiguity the subjects may perceive. One could identify two different types of probabilities that could be known in the Ellsberg task: the first-order probabilities (FOPs) which represent the probability of obtaining a particular outcome, and the second-order probabilities (SOPs), which correspond to the probabilities of the probability of obtaining a particular outcome. For instance, in our risk treatments, the FOPs correspond to probability 0.5 for each outcome and the SOP to probability 1. Under ambiguity, a subject may either obtain information regarding the underlying SOP distribution (i.e. how the ambiguous urn was constructed) which can take various forms such as a uniform, a binomial or a normal distribution, or may not be given any information at all (Camerer and Weber 1992). A recent strand of the literature focuses on the impact of sampling experience of the second-order probability distributions on the ambiguity attitude (see Dutt et al. 2014; Attanasi et al. 2014; Güney and Newell 2015). A common finding of these studies is that subjects are less ambiguity averse when they experience the underlying probability distribution.Footnote 9

In our framework, subjects face what Güney and Newell (2015) characterise as the ambiguous urn, where neither the FOPs nor the SOPs are known. From the point of view of the subjects, the sampling takes place on the possible outcomes (High or Low income), rather than on the form of the SOPs. Nevertheless, to model subjects’ behaviour, one needs to make an assumption on their SOPs. This is an auxiliary assumption and is needed only to define the prior beliefs of the subject, before the sampling over outcomes begins. We adopt a closed-form model of Bayesian learning with additive beliefsFootnote 10 which nests both binomial and uniform SOP distributions. We assume Subjective Expected Utility preferences for the subjects. This is done for simplification reasons as the SEU model by definition assumes neutral attitudes towards ambiguity.Footnote 11 Under this particular model of Bayesian learning, any form of SOP would predict uniform prior FOP equal to 0.5, which would then be updated via Bayes rule.Footnote 12 This assumption is in line with Attanasi et al. (2014) who conclude that the SOP may be thought as uniformly distributed when the subject is not given any information about the composition of the unknown urn.

The decision-maker holds some prior beliefs that are updated based on the relative frequencies that are observed from the sampling. As Zimper and Ludwig (2009) note, in this model of Bayesian learning with additive beliefs, additive posteriors converge to the same limit belief (to the true value of the distribution parameter). This model has initially appeared in the economics literature in Viscusi and O’Connor (1984) and Viscusi (1985). Briefly, the model assumes that the decision-maker holds uniform priors regarding the composition of the urn, that is \(\mu =\mathrm {Pr}(\mathrm {High})=\mathrm {Pr(Low)}=0.5\) before being able to observe any draws. Then, for every draw that is being observed, the prior beliefs are updated according to the Bayes rule and the posterior belief is given by:

where I is the available information, k is the number of successes of High income and n is the total number of draws that has been observed so far.

Under all the assumptions presented above, there is no explicit solution regarding the optimal level of consumption; thus, we resort to numerical optimisation methods. Using backward induction along with the no bequest constraint (all the wealth must be consumed at the end of the life-cycle), we start from the last period, where optimality requires the consumption of all the available wealth, and solve backwards, period by period, for any possible level of wealth. This guarantees that at any period, the Bellman equation is satisfied and the optimal consumption level at period t is a function of the optimal level of consumption at period \(t+1\). Furthermore, similarly to Ballinger et al. (2003), since everything in the experimental design is discrete (the income process, the consumption choices, etc.) an exact solution can be calculated and consequently, there is no need for approximation (interpolation).Footnote 13 Then, for any given income stream, it is possible to work forward and to recover the optimal levels of consumption and savings, for any corresponding level of wealth. In Fig. 2, the optimal life-cycle savings (end-of-period cash balances at the end of each period) path is shown, averaged over 50,000 simulated income streams. For each of the simulations, 15 i.i.d. draws were realised from a uniform distribution (to simulate the High and Low income). Given these draws, the assumptions of the agent’s preferences and the learning model, the optimal consumption path was calculated. This process was repeated 5000 times and the average level of consumption is illustrated for each of the periods. As expected,Footnote 14, the optimal path requires the agent to build a saving profile that is increasing for the first half of the life, reaches a peak at roughly the middle of the life-cycle and then the savings are following a decreasing path till everything is consumed at the last period.

4 Experimental design and procedures

To investigate the differences between individual and group planning within the inter-temporal consumption framework, we design and conduct an economic experiment using a \(2 \times 2\) factorial design, with two treatment variables: decision unit (individuals vs. groups) and decision environment (risk vs. ambiguity). Therefore, the experiment features four between-subjects treatments in total: individual choice under risk (I-R), individual choice under ambiguity (I-A), group choice under risk (G-R) and group choice under ambiguity (G-A).

During an experimental life-cycle (henceforth sequence), there are 15 years (periods). In each period t, an individual (or a group) is endowed with some income expressed in experimental currency units (tokens). This income is determined based on the process described in Sect. 3 and can be either High (\({\overline{y}}_t=15\)) or Low (\({\underline{y}}_t=5\)). Every period, subjects choose how much of their income they would like to consume (they were asked to decide how many of their available tokens they would like to convert into “points”), given that the residual will be saved and earn interest at a fixed rate of return equal to 0.20. As was mentioned earlier, there were no bequest motives (subjects were instructed to consume the total amount of cash-on-hand at the last period of each sequence) and in addition, they could not borrow during a sequence. This task was performed twice, so each subject (or group) participated in two independent, 15-period sequences that we indicate as sequence 1 and sequence 2. Participants received written instructions that explained the meaning of sequences and periods and also clarified what was meant by “independence” of sequences.Footnote 15 Instructions also explained how to use the utility function (called “conversion function”), briefly pointing out some important features, such as the property of decreasing marginal utility.Footnote 16 As was described in Sect. 3, the income in each period was determined by i.i.d. draws from an urn. In the risk treatments, the subjects were told in advance that inside the urn, there were 10 black and white balls in equal proportions, representing High and Low income, respectively. During the ambiguity treatments, the same urn was used but without providing any information to the participants regarding its actual composition. Participants were drawing balls with replacement. When making a decision, subjects were made aware that tokens saved would produce interest (at a fixed rate of 0.2) which, in the next period, would be summed to savings and income to give the total of tokens available for conversion. Instructions also explained that all variables were integers. Participants were advised that interest would be rounded to the nearest integer, and examples were given to clarify this procedure. Finally, participants were told at different points of instructions that any savings left over at the end of the last period would be worthless.

4.1 Individual decision-making

In the case of individual planning (I-R and I-A), subjects were randomly assigned to computer terminals. Any contact with others, apart from the experimenters, was forbidden. For each decision participants had 1 min where they could try different conversions (using a calculator); however, they were not permitted to confirm their decision before the end of the time span. This procedure was implemented to induce participants to think about their strategy and reduce noise in the data. The software included a calculator to allow participants to view the consequences of their decisions (in terms of future interest, savings and utility) and to compare alternative strategies.

4.2 Group decision-making

During the group treatment (G-R and G-A), participants had to make the life-cycle decisions in pairs. We focused on pairs as it is the simplest kind of group . Additionally, pairs are the closest approximation to couples, which is also the typical group decision-makers in a household. Participants were randomly matched in groups at the beginning of the experiment. The identity of the members of the group was not revealed during the experiment. In the second sequence, a random matching rule was enforced, so that the same participants could not be counterparts more than once. This was implemented in an attempt to isolate the performance of groups to the greatest extent possible. As in the treatment with individuals, a strict no talking rule was imposed (with the exception of members within the group). Regarding the group choice rule, we adopt the design that has been implemented in Cooper and Kagel (2005). Groups had a total of 3 min to discuss and confirm a decision; however, a choice could only be confirmed after the first minute. To limit the length of sessions, after the 3-min time, if no decision was confirmed by members, the computer would randomly choose between the last two proposals.Footnote 17 To facilitate interactions between members and increase information about group strategies, an instant messaging system was made available to chat within the group.

4.3 Payment

The final payoff was determined by applying the random incentive mechanism, where one of the two sequences was randomly chosen and the accumulated utility, transformed in monetary units at a fixed rate (two Euros per 100 points), was paid to the participants. Instructions explained that points would be converted into money at a fixed rate of two Euros per 100 points. In the group treatments, both members of the group would receive the payoff calculated as described above. This design choice was made so as to not alter the framing of incentives between treatments. Also, the choice of not imposing a sharing rule or allowing participants to enter into bargaining on how to share the payoff was motivated by considerations on how this might have altered the behaviour of participants during the experiment.

Experimental sessions were run at Università degli Studi di Salerno and LabSi at Università degli Studi di Siena, with participants being undergraduate students of various disciplines. The experiment was programmed and conducted using the z-Tree software Fischbacher (2007). In total, 170 subjects participated to our study (28 subjects in the I-R treatment, 26 subjects in the I-A, 28 groups in the G-R and 30 groups in the G-A). Each subject could participate in only one treatment. The details of the experimental design are summarised in Table 1.

5 Findings

5.1 Deviations from optimal consumption

In the literature of life-cycle experiments, two different definitions of optimality have been adopted, the unconditional and the conditional level of consumption and savings (see Ballinger et al. 2003; Carbone and Hey 2004). The unconditional optimal path is given by the optimal consumption vector \(c^*\) which is calculated based on the assumptions regarding the agent’s preferences, the values of the respective parameters, the income stream and the optimal level of wealth (given that all past consumption decisions were optimal). This definition of optimality is quite rigid and if an agent deviates from the optimal path at a given period, there is no way to converge to the optimal path in the future. The conditional optimal solution provides a more behaviourally plausible definition of optimality, as the optimal consumption path is calculated based on the actual available cash-on-hand (gross returns from savings of previous periods plus the endowment income y of that period) that a given subject has at the beginning of every period. In addition, this approach incorporates a measure of learning effects and improvement of choices along the life-cycle. For a given period t of the life-cycle, the decision-maker is solving a reduced horizon problem of length \(T-t+1\) based on the available cash-on-hand that she has at the beginning of period t. At each period t we calculate the conditional optimal level of consumption given the actual level of the cash-on-hand holdings. Following this approach, the conditionally optimal consumption vector \(\tilde{c_i}^*\) is calculated which is unique for every subject i. We, therefore, adopt the definition of conditional optimality upon which we base all the results presented below.

We have data from 170 participants. As a basic test of understanding, we expected all subjects/groups to consume all of their wealth during the last period of each sequence. Indeed, the vast majority of the participants passed this check test and we consequently excluded from our sample some outlier subjects that left in their saving accounts more than 9 units.Footnote 18

Finding 1

Both individuals and groups tend to systematically over-consume both under risk and under ambiguity compared to the predicted conditional optimal level of consumption.

Evidence for this finding can be found in Fig. 3. Figure 3a, b shows the periods of overconsumption/underconsumption concerning the treatments under risk, for sequences 1 and 2, respectively, while Fig. 3c, d presents the same information for the treatments under ambiguity. In each Figure, the horizontal (vertical) axis represents the total number of periods during which a subject (or group) under-consumes (over-consumes). Points close to where the \(45^{\circ }\) line intersects with the hypotenuse correspond to agents that over-consume for roughly 50% of the rounds and under-consume for the rest, while subjects that behave according to the predicted optimal solution would be represented by points on the origin. Points above (below) the line represent individuals or groups who over-consume (under-consume) for at least half of the periods. There is extensive heterogeneity regarding behaviour and as it can be seen in both Figures, the majority of subjects tends to systematically over-consume for at least 10 out of the 15 periods. The average number of periods displaying an over-consuming behaviour under risk is 9.55 (individuals) and 9.35 (groups) in the first sequence, and 10.02 (individuals) and 10.40 (group) in the second one. The respective number of periods for the ambiguity treatments is 9.20 and 9.25 for individuals and groups during the first sequence and 10.46 and 10.51 during the second. Figure 3b, d visually confirms this amplified over-consumption pattern during the second sequence.

Finding 2

Both groups and individuals substantially deviate from the predicted conditional optimal level of consumption both under risk and under ambiguity.

Figure 4 depicts the mean absolute deviation of the actual consumption choices c observed in the experiment from the conditional optimal (\(|c_t^*(w_t)-c_t|\)), in every period, of the 15-period sequences, for both individuals and groups. Figure 4a, b illustrates the deviations of individuals and groups for the risk treatments, for sequences 1 and 2, respectively, while Fig. 4c, d communicates the same information with respect to the ambiguity treatments. The horizontal axis represents the periods of each sequence, while the vertical axis, the absolute deviation. The observations of a subject who never deviates from the optimal would coincide with the horizontal axis. From the figures, it is apparent that there are clearly systematic differences between decision units within each decision environment regarding how much they deviate from the conditional optimal. First, both individuals and groups, in both decision environments and for the two sequences, begin by significantly deviating from the optimal level. On top of that, the average deviation has a positive sign, confirming the pattern of finding 1, highlighting subjects’ difficulties to adopt a saving strategy that builds up for the first half of the sequence.Footnote 19 Focusing on the risk treatments, individuals seem to significantly deviate more compared to groups during the first sequence, a pattern which is later reversed during the second sequence. In the ambiguity treatments, the pattern of behaviour is less clear for the first half of each sequence. Nevertheless, the gap between individuals and groups dramatically widens since groups substantially reduce their deviation from the optimal on the one hand, while individuals steadily increase theirs, during the last half of each life-cycle.

These different patterns call for a more formal comparison between treatments. To this end, we conduct a series of generalised least squares (GLS) random-effect regressions with robust standard errors clustered at the individual level (similarly at group level for groups). We run regressions both within treatments in an effort to understand how different factors affect deviations from optimum, as well as between treatments to identify potential treatment effects (both between individuals and groups and between risk and ambiguity). We first focus on the risk treatments. As dependent variable we use the conditional absolute deviation from the optimum.Footnote 20 The advantage of using absolute deviations is that the sign of the estimated coefficients can be interpreted as an indicator of the “direction” of the effect (i.e. a positive (negative) sign indicates increasing (decreasing) deviation from optimum). The first two columns of Table 2 report the results of regressions within the risk treatments, for individuals and groups respectively. In addition to a constant term, we include as explanatory variables the following: “period” which refers to the period number and captures the time trend, “seq2” which is a dummy variable indicating whether consumption decision was made during the second sequence, “income” which is the income the subjects received in each period, “wealth” which refers to the level of cash-on-hand at the beginning of period t, “gender”, a dummy variable indicating of whether the subject is male, “gndrmx”, a dummy variable indicating whether the group was formed by a heterogeneous pair.Footnote 21

The constant term is positive and significantly different from zero. This term captures the deviation from the unconditional optimal at the beginning of the life-cycle \(t=1\) and the statistical significance confirms the hypothesis that both individuals and groups have difficulties in calculating the optimal consumption path. The coefficient of the sequence is not significantly different from zero for individuals implying that there is no effect from the experience of the first sequence in improving behaviour. On the contrary, this coefficient is significant and positive for groups indicating a further deviation from the conditional optimal in the second sequence. The rest of the explanatory factors seem to explain behaviour in a symmetric way for both individuals and groups. The coefficient of the time trend is significant and negative, showing that there is reduction to the deviations as subjects make choices towards the end of the sequences. Income plays a positive role as does wealth, indicating that an increase to either of these two measures , leads to further deviations from the optimum. Finally, there seem to be significant gender effects, where male subjects deviate less in the individual treatment, while the same is true when heterogeneous groups are asked to make choices.

We then pool together the data from the I-R and G-R treatments to test whether there is a difference between individuals and groups. We estimate the model using the same explanatory variables with the only difference that we drop the “seq2” and we introduce the dummy variable “treatg” which indicates whether a decision was made by a group. In addition, we use the following control variables: “treatg \(\times \) wealth”, “treatg \(\times \) period” and “wealth \(\times \) period” which capture the interactions between treatment, wealth and period as well as their joint interaction. The results are reported in the third column of Table 2. Not surprisingly, the signs of the explanatory variables remain the same compared to the I-R and G-R treatments alone. Furthermore, the coefficient that captures the treatment effect is positive and statistically significant. This confirms that there is significant difference between individuals and groups and moreover, individuals seem to make choices that are closer to the benchmark. Also, all the interaction terms are significantly different from zero.

Table 3 reports the estimation of a similar set of regressions using the data from the ambiguity treatments. The first column includes the estimates for the I-A treatment, the second for the G-A and the third the coefficients of the the pooled I-A and G-A model. A similar pattern is observed in the within estimations as before. The main difference is that now the coefficient of the sequence is positive and significant for the individuals (compared to groups in the risk treatments) indicating a further deviation from the optimal during the second sequence. The same coefficient for the groups is statistically insignificant, implying no changes to the way the choices were made. The rest of the variables explain behaviour similarly to the risk treatments. In contrast to the risk treatments, focusing now on the pooled model (third column of Table 3), there is a significant and negative treatment effect coefficient, confirming that groups deviate less under ambiguity compared to individuals. It is also interesting to note that the size of this treatment effect is roughly four times larger compared to the treatment effect in the risk treatments (− 3.786 vs. 0.872). We summarise the results of the regressions in the following findings:

Finding 3

Subjects significantly deviate from the conditional optimal path in both risk and ambiguity treatments. This deviation depends positively on the wealth and the income and negatively on the stage of the life-cycle. Within decision units, groups improve their performance under risk while individuals worsen theirs under ambiguity during the second sequence. There are also significant gender effects with male and mixed groups deviating less from the conditional optimal.

Finding 4

There are significant treatment effects between treatments within a decision environment. Individuals perform better compared to groups under risk, while groups perform better under ambiguity.

We proceed by asking the question of whether there are any differences when the same decision unit makes choices in different decision environments. In other words, we are interested to find out whether the introduction of an ambiguous decision environment has significant effects to the way individuals and groups choose. To this end, we pool the together the data from I-R and I-A treatments for individual choice and from G-R and G-A for groups. Table 4 reports the estimated coefficients for the two models where the same explanatory variables as before have been used. Note that the “treatg” variable has now been substituted by “tra”, a dummy variable that indicates whether a choice was made in an ambiguous environment. The first column compares individuals under risk and ambiguity with the main variable of interest being “tra”. This variable in the pooled I-R and I-A model has a significant and positive value, indicating that individuals perform much worse in the ambiguity treatment compared to the risky one, implying that ambiguity has indeed significant effects on choices. On the contrary, as can be seen in the second column of Table 4, when we compare groups under risk and ambiguity, the treatment coefficient is significant and negative, implying that groups are much better planners under ambiguity rather than under risk. The effect of all the remaining explanatory variables remains the same as above.

Finding 5

Individuals tend to deviate less from the conditional level of consumption when they plan under risk compared to ambiguity. On the contrary, groups deviate less in an ambiguous environment rather than in a risky one.

The results above clearly indicate that individuals and groups behave in a substantial different way both within and between decision environments. One could argue that a potential explanation for this kind of differences is the discrepancy regarding the income streams in the various sessions.Footnote 22 For instance, when we compare the I-R and G-R treatments, the further divergence from the conditional optimal could have been the consequence of a larger number of “High” income periods in the G-R treatment which induced groups to consume more. Table 5 reports the average levels of income, consumption and wealth for all treatments. Although there seem to be differences regarding the distribution of income across treatments (first column), both Mann–Whitney–Wilcoxon (MWW henceforth) and \(\chi ^2\) tests show that these differences are not statistically significant.Footnote 23 Therefore, differences in the distribution of income across treatments are not sufficient to explain the observed differences.

5.2 Estimating planning horizons

In this section, we use a bounded rationality approach and estimate the apparent planning horizons used by the subjects (see among others Ballinger et al. 2003; Carbone and Hey 2004; Ballinger et al. 2011), as different levels of potential myopia may be able to explain differences in behaviour. During the experiment, subjects are required to solve a complex inter-temporal decision task and are expected to do so by employing their optimal plans using a “T-period” planning horizon, where T is equal to the 15 periods in each sequence. However, due to the complexity of the problem, some subjects tend to use simplifying rules, such as “using a shorten horizon which is then rolled forward”Footnote 24 to cover the actual length of the life-cycle. As noted in Ballinger et al. (2003) and Carbone and Hey (2004), this leads to dynamic inconsistency and sub-optimal choices. In particular, a subject using this kind of strategy (having a subjective horizon of \(\tau \)) will behave in period t as if period \(t+\tau +1\) were the last one (except for the last period, T, that will be correctly recognised as the end of the life-cycle). For each possible length of the planning horizon (\(1\le \tau \le T\),Footnote 25), the optimal solution has been computed, using the optimal consumption functions (see Carbone and Hey 2004 for the technical details). As before, we estimate the horizons using the definition of conditional optimal consumption (the consumption that would be optimal given the cash-on-hand that the subject actually has in that period). Tables 6 and 7 report the average length of the planning horizons, the standard deviation and the maximum length of the horizons for both individuals and groups, for risk and ambiguity respectively.

Figure 5 depicts the distribution of the estimated horizons. It is obvious from this figure that there is substantive heterogeneity between subjects. The distribution of the planning horizons is left skewed for all treatments, indicating that the majority of the subjects fail to apply a full-horizon plan for the whole life-cycle. The average planning horizon for both sequences is 5.25 (SD 3.31) periods for individuals and 4.97 (SD 3.40) periods for groups in the risk treatments and 4.52 (SD 3.82) for individuals and 4.05 (SD 2.54) periods for groups in the ambiguity treatments. At first sight, there seem to prevail two distinct patterns, that that estimated horizons in the risk treatments are longer and that both individuals and groups do not improve their planning capacity during the second sequence. Nonetheless, according to MWW tests, none of the between treatments comparisons seems to be statistically significant,Footnote 26 nor any of the within treatments comparisons (compare first and second sequence) appears to be different, with the exception of the I-R treatment where subjects perform significantly worst during the second period concerning their planning capacityFootnote 27.

Finding 6

There is extensive heterogeneity regarding the planning horizons in all treatments. The majority of the subjects is characterised by considerably myopic (short) horizons. In addition, there are no significant differences on the length of estimated horizons across treatments.

6 Discussion and concluding remarks

We present results from an intertemporal choice experiment under risk and ambiguity where we compare individual and group decision making. By introducing a stochastic income generation process, keeping the level of interest rate constant, as well as controlling the level of utility derived from consumption, we are able to calculate the optimal path of savings/consumption choices for each lifecycle and for each income history and therefore, to study deviations from optimality. We study differences both within a decision unit [i.e. individuals (groups) under risk vs. individuals (groups) under ambiguity) and within a decision environment (i.e. individuals vs. groups under risk (ambiguity)]. In our analysis, we take into consideration the fact that subjects may face difficulties in successfully solving complex, stochastic problems in a dynamic environment and therefore, we adopt the definition of conditional optimal as a benchmark, which allows for mistakes at the earlier periods of the lifecycle. Our data also allow us to estimate the apparent planning horizons of the subjects, assuming a bounded rationality approach.

Our main findings show that (1) both individuals and groups face difficulties in detecting the optimal decision path that this stochastic, dynamic problem implies, in either environments (risk and ambiguity); (2) groups tend to deviate less from the optimal choice compared to individuals under ambiguity, while on the contrary, they deviate more in a risky environments; and (3) both individuals and groups are characterised by myopic planning horizons in both environments.

Our results seem to be in line with the main experimental findings in the literature of savings experiments that is, people tend to overconsume in the early stages of their lives, failing to build up the required wealth for smooth consumption across the lifecycle and that subjects are characterised by rather myopic planning horizons. We contribute to this literature by showing that these results hold also in the case of ambiguity. The novelty of our experimental design, allows to directly study the effects that ambiguity regarding the future level of income, has to dynamic decision making. Furthermore, we investigate whether there are significant differences in the way that individuals and groups decide in this particular framework. Our results seem to be in line with the pattern that is usually observed in the literature of group choice under risk and ambiguity, that is, individuals tend to behave more optimally under risk, while groups are better in making choices under ambiguity. We observe a similar pattern when choices are made in a dynamic framework.

These results are of interest both from a theoretical point of view and from a public policy perspective. Despite the fact that the theoretical literature on dynamic decision-making under ambiguity is well advanced, only recently these theoretical developments have been applied to model behaviour in relevant applications like lifecycle savings decisions (Campanale 2011; Peijnenburg 2015). Furthermore, there is lack of empirical evidence regarding economic agents’ behaviour during inter-temporal tasks, particularly in an ambiguous environment, both at individual and at group level. Although some recent studies have investigated collective choice and discounting behaviour (Jackson and Yariv 2014; Denant-Boemont et al. 2016), the scope of this literature was to investigate preferences over time rather than to explore sequential group decision-making upon the reception of new information as in our case. In this paper, we have taken a first step towards understanding the effects of uncertainty regarding the future levels of income on optimal planning. From a public policy aspect, it is well established in the literature (Shapiro 2010; Carlsson et al. 2012) that despite the various theoretical violations that groups (pairs or larger) exhibit, they tend to be more patient when making joint decisions rather than individual ones. In our study, we find that groups tend to behave closer to rationality when they plan under ambiguity, achieving in that way higher levels of welfare. This could have potential implications for the design of public policy, given that most of real-life economic decisions are taken in an ambiguous environment.

Our findings should be interpreted with some caution. As we are interested in the qualitative characteristics of inter-temporal choice under risk and ambiguity, we assume risk and ambiguity neutrality of the decision-makers and we use their subsequent behaviour as our reference. The experimental design does not allow us to control for attitudes towards risk and ambiguity. A similar task would require a different design that would involve elicitation tasks (both for the attitudes and the beliefs) that would provide sufficient data in order to parametrically estimate the respective coefficients, as well as the subjective beliefs of the agents. Such a design would add additional levels of complexity to an already difficult decision task, making difficult to focus on the pure effect of ambiguity to planning and the potential differences between individuals and groups, as we have done in this study. Despite this simplifying assumptions, this is a first step towards understanding the effects of ambiguity on inter-temporal consumption/savings problems. In our analysis, we make a speculation that the results might be driven by the existence of non-neutral attitudes towards ambiguity, phenomenon that is frequently observed in the standard experimental subjects population. One might expect that the existence of ambiguity aversion would lead to different optimal saving and consumption decisions (e.g. precautionary saving) or that it would exacerbate the observed deviations. As mentioned before, suitable adaptations of the experimental design are needed, along with the assumed theoretical model that describes subjects’ behaviour. We leave the above extensions for future work.

Notes

For an extensive review of life-cycle experiments, see Duffy (2014).

The income generation process is described shortly.

Setting the discount rate equal to zero is not expected to have an impact on our results (see Carbone and Hey 2004, footnote 1).

The Ellsberg-type urns have been introduced in the literature by Ellsberg (1961) seminal paper. In this paper, he proposed two thoughts experiment with the scope to challenge the ”sure thing principle” of the Subjective Expected Utility model (Savage 1954) and to introduce non-neutral attitudes towards ambiguity. A significant number of experimental studies are making use of either the two-colour or the three-colour urn to introduce ambiguity in the lab.

This information was only provided during the risk treatments. During the ambiguity treatments, subjects obtained no information regarding the composition of the urn and thus, they were facing ambiguity. During the session they had the chance to observe draws from the urn and obtain information regarding the actual distribution.

Caballero (1990) shows that under the assumption of a CARA utility function, a closed-form solution for the optimal consumption can be derived. Nevertheless, an additional assumption requires that the decision-maker is fully aware of the underlying income stochastic process, condition which is not satisfied in the ambiguity treatments.

We elaborate on this issue later.

We are grateful to a careful referee for drawing our attention to this literature.

The theoretical foundations of the model are presented in Appendix A.

We assume that subjects are risk and ambiguity neutral with regard to monetary payoffs. Controlling for averse or loving attitudes towards risk and ambiguity would add two additional layers of complexity to the function mapping from consumption to monetary payoffs (Carbone and Duffy 2014). If one wants to control for attitudes towards risk and ambiguity, she needs to appropriately extend the experimental design with tasks that will perplex an already complicated decision task (see for example Hey and Dardanoni 1988). As our main objective is to understand the effects of ambiguity to saving decisions, we leave this for future work.

Klibanoff et al. (2005) smooth-ambiguity model provides a flexible specification to capture both FOPs and SOPs and there is also experimental evidence in support of this model (Conte and Hey 2013; Attanasi et al. 2014). Nevertheless, one needs to assume non-neutral ambiguity attitudes and particular belief updating rules.

The optimal solution and the subsequent econometric analysis were conducted using the R programming language (R Core Team 2013). The programs and the data are available upon request.

During the experiment expressions like “income”, “wealth”, “consumption” or “utility” were carefully avoided.

Again, there was no explicit reference to decreasing marginal utility but to “increments at a decreasing rate”.

The software recorded all proposals. When members did not confirm a decision within three minutes, the computer would pick the last proposal of each member and then randomly choose one of those as representative of the group. This did not happen very frequently. We recorded 54 cases of “disagreement” out of 900 decisions (6\(\%\)). Preliminary regressions suggested that disagreement was not a significant regressor.

From the sample we excluded the observations of 1 subject in sequence 1 and 2 subjects in sequence 2 in the I-R treatment, 3 subjects in sequence 1 and 1 subject in both sequences in I-A, 2 subjects in sequence 2 and 1 subject in both sequences in G-R and 1 subject in sequence 1 in G-A. We verified that including in our sample the observations of the participants who although failed the rationality test, they left in their saving accounts less than 9 units, does not change quantitatively the results that we report below.

Individuals (groups) exhibit positive deviation of 4.32 (2.62) consumption units under risk and deviation of 2.56 (3.17) units under ambiguity.

We also conducted the regressions using the mean squared deviation from the conditional optimal as dependent variable. Although the results are magnified compared to those where absolute deviation has been used as the dependent variable, the qualitative results regarding the treatment effects remain the same. We report the results of these regressions in the supplementary material.

In the case, the group consisted of one male and one female member, this dummy variable takes the value 1.

Note that, since during the experiment there were actual draws from the urn, there was no way to implement the same income streams to all treatments.

I-R vs. G-R: \(p=0.780\); I-R vs. I-A: \(p=0.550\); I-A vs. G-A: \(p=0.300\); G-R vs. G-A: \(p=0.900\). All reported p-values were generated using pairwise \(\chi ^2\) tests.

Carbone and Hey (2004).

In our experimental design, this \(\tau \) may range from 1 (extreme myopic behaviour) to 15 (optimal behaviour).

I-R vs. G-R: \(p=0.452\); I-R vs. I-A: \(p=0.269\); I-A vs. G-A: \(p=0.620\); G-R vs. G-A: \(p=0.432\). All p-values reported were generated using rank-sum MWW tests for independent samples.

I-R: \(p=0.008\); G-R: \(p=0.330\); I-A: \(p=0.178\); G-A: \(p=0.743\). All reported p values were generated using rank-sum MWW tests for independent samples for the group treatments and signed-rank MWW tests for the individual ones.

The probability of Low income P(L) is defined as the residual \(P(L)=1-P(H)\).

The material referred to in the “Appendix” is the same for all sets of instructions and can be consulted in subsection 1 (Individual Decision-Making).

References

Ahn, D., Choi, S., Gale, D., & Kariv, S. (2014). Estimating ambiguity aversion in a portfolio choice experiment. Quantitative Economics, 5(2), 195–223.

Attanasi, G., Gollier, C., Montesano, A., & Pace, N. (2014). Eliciting ambiguity aversion in unknown and in compound lotteries: A smooth ambiguity model experimental study. Theory and Decision, 77, 485–530.

Baillon, A., Bleichrodt, H., Keskin, U., L’Haridon, O., & Li, C. (2018). Learning under ambiguity: An experiment using initial public offerings on a stock market. Management Science, 64(5), 2181–2198.

Baillon, A., Bleichrodt, H., Liu, N., & Wakker, P. (2016). Group decision rules and group rationality under risk. Journal of Risk and Uncertainty, 52(2), 99–116.

Baker, R., Laury, S., & Williams, A. (2008). Comparing small-group and individual behavior in lottery-choice experiments. Southern Economic Journal, 75(2), 367–382.

Ballinger, T., Hudson, E., Karkoviata, L., & Wilcox, N. (2011). Saving behavior and cognitive abilities. Experimental Economics, 14(3), 349–374.

Ballinger, T. P., Palumbo, M. G., & Wilcox, N. T. (2003). Precautionary saving and social learning across generations: An experiment. The Economic Journal, 113(490), 920–947.

Berg, J., Daley, L., Dichaut, J., & O’Brien, J. (1986). Controlling preferences for lotteries on units of experimental exchange. Quarterly Journal of Economics, 101(2), 281–306.

Bougheas, S., Nieboer, J., & Sefton, M. (2013). Risk-taking in social settings: Group and peer effects. Journal of Economic Behavior and Organization, 92, 273–283.

Brown, A. L., Chua, Z. E., & Camerer, C. F. (2009). Learning and visceral temptation in dynamic saving experiments. Quarterly Journal of Economics, 124(1), 197–231.

Brunette, M., Cabantous, L., & Couture, S. (2015). Are individuals more risk and ambiguity averse in a group environment or alone? Results from an experimental study. Theory and Decision, 78(3), 357–376.

Caballero, R. (1990). Consumption puzzles and precautionary savings. Journal of Monetary Economics, 25, 113–136.

Camerer, C., & Weber, M. (1992). Recent developments in modeling preferences: Uncertainty and ambiguity. Journal of Risk and Uncertainty, 5(4), 325–370.

Campanale, C. (2011). Learning, ambiguity and life-cycle portfolio allocation. Review of Economic Dynamics, 14(2), 339–367.

Carbone, E. (2005). Demographics and behaviour. Experimental Economics, 8, 217–232.

Carbone, E., & Duffy, J. (2014). Lifecycle consumption plans, social learning and external habits: Experimental evidence. Journal of Economic Behavior and Organization, 106, 413–427.

Carbone, E., & Hey, J. D. (2004). The effect of unemployment on consumption: An experimental analysis. The Economic Journal, 114(497), 660–683.

Carbone, E., & Infante, G. (2014). Comparing behavior under risk and under ambiguity in a lifecycle experiment. Theory and Decision, 57, 313–322.

Carbone, E., & Infante, G. (2015). Are groups better planners than individuals? An experimental analysis. Journal of Behavioral and Experimental Economics, 57, 112–119.

Carlsson, F., He, H., Martinsson, P., Qin, P., & Sutter, M. (2012). Household decision making in rural China: Using experiments to estimate the influences of spouses. Journal of Economic Behavior and Organization, 84(2), 525–536.

Charness, G., Karni, E., & Levin, D. (2007). Individual and group decision making under risk: An experimental study of Bayesian updating and violations of first-order stochastic dominance. Journal of Risk and Uncertainty, 35(2), 129–148.

Charness, G., Karni, E., & Levin, D. (2010). On the conjunction fallacy in probability judgment: New experimental evidence regarding linda. Games and Economic Behavior, 68(2), 551–556.

Charness, G., Karni, E., & Levin, D. (2013). Ambiguity attitudes and social interactions: An experimental investigation. Journal of Risk and Uncertainty, 46(1), 1–25.

Charness, G., & Sutter, M. (2012). Groups make better self-interested decisions. Journal of Economic Perspectives, 26(3), 157–76.

Cohen, M., Gilboa, I., & Schmeidler, D. (2000). An experimental study of updating ambiguous beliefs. Risk Decision and Policy, 5(2), 123–133.

Conte, A., & Hey, J. (2013). Assessing multiple prior models of behaviour under ambiguity. Journal of Risk and Uncertainty, 46(2), 113–132.

Cooper, D., & Kagel, J. (2005). Are two heads better than one? Team versus individual play in signaling games. American Economic Review, 95(3), 477–509.

Curley, S., Yates, F., & Abrams, R. (1986). Psychological sources of ambiguity avoidance. Organizational Behavior and Human Decision Processes, 38(2), 230–256.

Denant-Boemont, L., Diecidue, E., & l’Haridon, O. (2016). Patience and time consistency in collective decisions. Experimental Economics (page forthcoming).

Dominiak, A., Dürsch, P., & Lefort, J. (2012). A dynamic ellsberg urn experiment. Games and Economic Behavior, 75, 625–638.

Duffy, J. (2014). Macroeconomics: A survey of laboratory research. Technical report, University of California.

Dutt, V., Arló-Costa, H., Helzner, J., & Gonzalez, C. (2014). The description-experience gap in risky and ambiguous gambles. Journal of Behavioral Decision Making, 27, 316–327.

Ellsberg, D. (1961). Risk, ambiguity and the savage axioms. Quarterly Journal of Economics, 75, 643–669.

Epstein, L., Noor, J., & Sandroni, A. (2010). Non-bayesian learning. The B.E. Journal of Theoretical Economics, 10(1), 1–20.

Epstein, L., & Schneider, M. (2007). Learning under ambiguity. Review of Economic Studies, 74(4), 1275–1303.

Etner, J., Jeleva, M., & Tallon, J. (2012). Decision theory under ambiguity. Journal of Economic Surveys, 26(2), 234–270.

Feltovich, N., & Ejebu, O. (2014). Do positional goods inhibit saving? Evidence from a life-cycle experiment. Journal of Economic Behavior and Organization, 107, 440–454. (Empirical Behavioral Finance).

Fischbacher, U. (2007). z-Tree: Zurich toolbox for ready-made economic experiments. Experimental Economics, 10(2), 171–178.

Gillet, J., Schram, A., & Sonnemans, J. (2009). The tragedy of the commons revisited: The importance of group decision-making. Journal of Public Economics, 93(5–6), 785–797.

Güney, c, & Newell, B. (2015). Overcoming ambiguity aversion through experience. Journal of Behavioral Decision Making, 28, 188–199.

Halevy, Y. (2007). Ellsberg revisited: An experimental study. Econometrica, 75(2), 503–536.

Hey, J., & Pace, N. (2014). The explanatory and predictive power of non two-stage-probability models of decision making under ambiguity. Journal of Risk and Uncertainty, 49(1), 1–29.

Hey, J. D., & Dardanoni, V. (1988). Optimal consumption under uncertainty: An experimental investigation. The Economic Journal, 98(390), 105–116.

Jackson, M. O., & Yariv, L. (2014). Present bias and collective dynamic choice in the lab. American Economic Review, 104(12), 4184–4204.

Keck, S., Diecidue, E., & Budescu, D. (2014). Group decisions under ambiguity: Convergence to neutrality. Journal of Economic Behavior and Organization, 103, 60–71.

Keller, R., Sarin, R., & Sounderpandian, J. (2007). An examination of ambiguity aversion: Are two heads better than one? Judgment and Decision Making, 2(6), 390–397.

Klibanoff, P., Marinacci, M., & Mukerji, S. (2005). A smooth model of decision making under ambiguity. Econometrica, 73(6), 1849–1892.

Kugler, T., Kausel, E. E., & Kocher, M. G. (2012). Are group more rational than individuals? A review of interactive decision making in groups. Wiley Interdisciplinary Reviews Cognitive Science, 3(4), 471–482.

Lahno, A. M. (2014). Social anchor effects in decision-making under ambiguity. Discussion Papers in Economics 20960, University of Munich, Department of Economics.

Levati, V., Napel, S., & Soraperra, I. (2016). Collective choices under ambiguity. Group Decision and Negotiation, 26, 1–17.

Marinacci, M. (2002). Learning from ambiguous urns. Statistical Papers, 43, 145–151.

Masclet, D., Colombier, N., Denant-Boemont, L., & Lohéac, Y. (2009). Group and individual risk preferences: A lottery-choice experiment with self-employed and salaried workers. Journal of Economic Behavior and Organization, 70(3), 470–484. (Field Experiments in Economics).

Meissner, T. (2015). Intertemporal consumption and debt aversion: An experimental study. Experimental Economics, 19, 1–18.

Muthukrishnan, A., Wathieu, L., & Xu, J. (2009). Ambiguity aversion and the preference for established brands. Management Science, 55(12), 1933–1941.

Nicholls, N., Romm, A. T., & Zimper, A. (2015). The impact of statistical learning on violations of the sure-thing principle. Journal of Risk and Uncertainty, 50(2), 97–115.

Peijnenburg (2015). Life-cycle asset allocation with ambiguity aversion and learning. Working paper.

R Core Team. (2013). R: A language and environment for statistical computing. Vienna: R Foundation for Statistical Computing.

Savage, L. (1954). The foundations of statistics. New York: Wiley.

Schotter, A., & Braunstein, Y. (1981). Economic search: An experinental study. Economic In, 19(1), 1–25.

Shapiro, J. (2010). Discounting for you, me and we: Time preference in groups and pairs. mimeo.

Shupp, R., & Williams, A. (2008). Risk preference differentials of small groups and individuals. The Economic Journal, 118(525), 258–283.

Stahl, D. (2014). Heterogeneity of ambiguity preferences. The Review of Economics and Statistics, 96(5), 609–617.

Trautmann, S., & van de Kuilen, G. (2015). Wiley Blackwell handbook of judgment and decision making, chapter Ambiguity Attitudes (pp. 89–116). Oxford: Blackwell.

Trautmann, S., Vieider, F., & Wakker, P. (2008). Causes of ambiguity aversion: Known versus unknown preferences. Journal of Risk and Uncertainty, 36(3), 225–243.

Viscusi, W. (1985). A Bayesian perspective on biases in risk perception. Economics Letters, 17(1–2), 59–62.

Viscusi, W., & O’Connor, J. (1984). Adaptive responses to chemical labeling: Are workers Bayesian decision makers? The American Economic Review, 74(5), 942–956.

Zhang, J., & Casari, M. (2012). How groups reach agreement in risky choices. Economic Inquiry, 50(2), 502–515.

Zimper, A., & Ludwig, A. (2009). On attitude polarization under Bayesian learning with non-additive beliefs. Journal of Risk and Uncertainty, 39(2), 181–212.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Financial support from the MIUR- PRIN 2007 “Consumo, Risparmio e Mercati finanziari: Teorie non Convenzionali, Test e Applicazioni”, is gratefully acknowledged.

Appendices

Bayesian learning with additive beliefs

In this Appendix, we provide the formal Bayesian learning model we adopt which is the benchmark model of Zimper and Ludwig (2009). We consider the income generation process applied to our experimental design where an agent is uncertain about the probability of High income P(H).Footnote 28 Nevertheless, she can observe n i.i.d. draws with replacement. We define a probability space \((\mu ,\Omega ,{\mathcal {F}})\) where \(\mu \) stands for the subjective additive probability measure defined on the events of the event space \({\mathcal {F}}\). The state space is defined as \(\Omega =\Pi \times S^{\infty }\) with generic element \(\omega =(\pi ,s^{\infty })\). The parameter space \(\Pi \) collects all the possible values of the true probability of (H) in any given trial. Similarly, the sample space \(S^{\infty }\times _{i=1}^{\infty }\{H,L\}\) collects all the possible sequences of outcomes. It is assumed that after any given number of n trials, the agent knows the result of each of the trials. In addition, it is assumed that the agent cannot somehow observe the true parameter value of the distribution. Define \({\tilde{\pi }}:\Omega \rightarrow [0,1]\) such that \({\tilde{\pi }}(\pi ,s^{\infty })=\pi \) the random variable that defines at every state the true probability of the outcome (H). The decision-maker holds priors over \({\tilde{\pi }}\) that are assumed to follow the Beta distribution with shape parameters \(\alpha , \beta >0\). The priors are given by:

with \(K_{\alpha ,\beta }=\frac{\Gamma (\alpha +\beta )}{\Gamma (\alpha )\Gamma (\beta )}\) and \(\Gamma \) the Gamma function.

Let \(X_n: \Omega \rightarrow \{0,1\}, n=1,2,\ldots \) denote the random variable that takes the value 1 if the income is High (H) and zero otherwise in n trials. We define as \(I^k_n\) the event in \({\mathcal {F}}\) such that the outcome H has been realised k times out of n trials:

Since it is assumed that the the random variable \(X_n\) is i.i.d. Bernoulli distributed, each \(I_n\) is, conditional on the parameter-value \(\pi \), binomially distributed with probabilities

Each time that the decision-maker observes a draw from the urn she receives information that allows her to update her prior beliefs. This happens with the application of the Bayes rule. The posterior that \(\pi \) is the true value conditional on the information \(I_n^k\) acquired till that point is given by:

The agent’s prior of the true value of the probability of H is given by the expected value of \({\tilde{\pi }}\) with respect to the prior distribution. In the case of a Beta prior, it is possible to show that this prior is equal to:

where \(\alpha , \beta \) are the shape parameters of the Beta distribution. During the experiment, we assume that since there is no prior information on the proportion of H balls in the urn, the only reasonable prior that one can attach is 0.5 probability. Therefore, by setting \(\alpha =\beta =1\) the priors become uniform on the outcomes and equal to 0.5. Then, each draw from the urn provides the decision-maker with additional information regarding the real values of the parameters of the distribution.

Instructions: for online publication

This Appendix includes only the instructions for the treatments I-A(individual ambiguity) and G-A (group ambiguity). The instructions for the treatments I-R (individual risk) and G-R (group risk) are the same with the only difference being that the probability of receiving either of the incomes is known and equal to 0.5.

1.1 Individual decision-making

Welcome!

This is an experiment on decision-making. The experiment will last about 1 hour and a half. Please read these instructions carefully as you have the chance to earn money depending on your decisions. If you have any questions please raise your hand. The experimenter will answer in private. You are not allowed to talk to other participants in the experiment.

The experiment consists of 2 independent “sequences”, each one composed of 15 periods. Sequences are independent because there is no relation between them. This means that your choices in one sequence will not influence future sequences. However, please note that, within one sequence, your decision in each period will influence subsequent periods (for example, your decision in period 1 will have consequences for period 2 and so on).