Abstract

We explore situations in which a decision maker bears responsibility for somebody else’s outcomes as well as for her own. We study such choices for gains and losses, and for different gain probabilities. For 50–50 lotteries over gains we find that being responsible for somebody else’s payoffs increases risk aversion. In the loss domain, on the other hand, we find significantly different behavior relative to gains, with slightly more risk seeking under responsibility. In a second experiment, we replicate the finding of increased risk aversion for large probabilities of a gain, while for small probability gains we find increased risk seeking under conditions of responsibility relative to large probabilities. This discredits hypotheses of a ‘cautious shift’ under responsibility, and may indicate an accentuation of the fourfold pattern of risk attitudes usually found for individual choices.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Motivation

Economic situations in which an agent is called on to take decisions affecting somebody else’s financial payoffs as well as her own constitute a common class of phenomena. For instance, they represent situations in which a decision maker’s choices affect not only her own outcomes, but those of her family as well. Another common instance of such decision problems consists of financial agency contracts in which the incentive structure of the agent coincides with the one of the principal. An example may be executives who are compensated through company shares, or a stock broker whose payoffs are determined by the outcomes of the investments she undertakes. Nevertheless, such different situations have generally been modeled with a single objective function treating all decisions like individual decisions.

There is an extensive literature on individual decision making under risk and uncertainty (Abdellaoui et al. 2011; Dohmen et al. 2011; Maafi 2011; Viscusi and Huber 2012), as well as a substantial literature on risk attitude in agency problems and how to influence it through performance-contingent pay (Wiseman and Gomez-Mejia 1998). There is, however, much less evidence on decisions under responsibility. To the extent that decisions under responsibility may differ from decisions commonly found in the individual decision making literature, findings from the latter will only constitute an imperfect predictor of attitudes under responsibility. In this paper, we therefore systematically explore the difference in risk attitudes between situations of decision-making for oneself and situations of responsibility, i.e., situations in which the decision maker decides for others as well as herself.

Several recent papers touch upon the issue of responsibility in risky decisions. Bolton and Ockenfels (2010) report results of decisions between payoff pairs in a dyad under payoff equality, but do not find significant differences between individual decisions and decisions under responsibility. Reynolds et al. (2009) found risk aversion to increase relative to an individual benchmark when subjects were deciding only for somebody else, with no consequences for their own payoffs. Chakravarty et al. (2011) found risk aversion to decrease under conditions of responsibility in a similar setup. Humphrey and Renner (2011) found no effect of responsibility on risky choices. In a somewhat related study from the game-theoretic literature, Charness and Jackson (2009) found that in a stag hunt game the efficient equilibrium obtained less frequently under responsibility for someone else than in an individual baseline, giving an indication of increased risk aversion under responsibility.

The literature discussed above reaches widely different conclusions, ranging from increased risk aversion to increased risk seeking or null results. In two experiments, we explore risky decisions for situations in which an anonymous other (the recipient) obtains the same payoff as the decision maker, and compare such decisions to purely individual decisions. We are the first to explore such decisions systematically for risky choices in the gain domain, the loss domain, and the mixed domain, as well as for different probability levels. This allows us to adopt prospect theory (Kahneman and Tversky 1979)—the prevalent descriptive theory of choice under risk and uncertainty today (Starmer 1999, 2000; Wakker 2010)—as a descriptive theory of choice and to systematically explore potential differences along the relevant dimensions in the light of that theory.

We find that in the gain domain, being responsible for others as well as oneself does indeed increase risk aversion for moderate probabilities, thus showing that Bolton and Ockenfels’ (2010) intuition of responsibility inducing a “cautious shift” was correct. In addition, we show that for loss prospects, subjects are unaffected by responsibility and even become slightly more risk seeking when responsible for others. Loss aversion, on the other hand, being already strong in individual decisions, does not seem to increase when subjects are responsible for others.Footnote 1

In a second experiment aimed at exploring social norms on risk taking in the gain domain in more detail, we replicate the finding that risk aversion increases under responsibility for large probabilities. When choices regard small probability prospects, however, we find increased risk seeking under conditions of responsibility. Overall, our results can be organized by an accentuation of the fourfold pattern of risk attitudes typically found in individual decision making when subjects are responsible, with subjects becoming more risk averse for moderate to large probability gains and small probability losses, as well as more risk seeking for moderate to large probability losses and small probability gains when responsible for others.

The paper proceeds as follows. Section 2 describes the first experiment, with Section 2.1 describing the methodology and Section 2.2 presenting the results; Section 2.3 discusses the result of experiment I and derives hypotheses for experiment II. Section 3 introduces experiment II, with Section 3.1 describing the methodology and Section 3.2 presenting the results. Section 3.3 discusses the results of experiment II as well as the overall results. Section 4 concludes this paper.

2 Experiment I: responsibility for gains, losses, and mixed prospects

2.1 Experimental design

We designed a laboratory experiment in which we ask subjects to take binary decisions between two alternatives that are presented to them on a computer screen. Payoffs always affect the decision maker and the recipient in a perfectly parallel manner in the responsibility treatment, in order to avoid issues of payoff inequality (Bolton and Ockenfels 2010; Rohde and Rohde 2011). In what follows, a decision maker will be defined as risk averse whenever she prefers the expected value of a prospect to the prospect itself; conversely, she will be defined as risk seeking whenever she prefers the prospect to a sure amount equivalent to the prospect in terms of expected value (Wakker 2010, p.52).

2.1.1 Subjects

Overall, 144 subjects were recruited at the experimental laboratory MELESSA at Ludwig-Maximilian’s University in Munich, Germany, using ORSEE (Greiner 2004). The experiment took roughly 1 hour, and average earnings were €22.49 (including a show-up fee of €4). The experiment was run on computers using zTree (Fischbacher 2007). Forty-six percent of subjects were female, and the average age was 24.07 years.

2.1.2 Task

Subjects were asked to choose repeatedly between a safe prospect and a risky prospect. The safe prospect usually consisted of a sure amount of money, and sometimes of a prospect with lower variance compared to the risky prospect. The risky prospect always gave a 50–50 chance to obtain one of two outcomes. The prospects could comprise only positive amounts, only negative amounts, or both positive and negative amounts (see below). Overall, subjects had to make 40 choices, with the order of presentation as well as the position of the two prospects on the screen randomized for each subject. Subjects took decisions sequentially and had no opportunity to return to an earlier decision to revise it. All of the above was explained in the instructions.

2.1.3 Prospects

The 40 choices to be made by all subjects in the experiment were constructed systematically in the following way. We chose five different stake levels that we denote henceforth by b, where b = €{2,4,6,8,10}. For every stake level, we let subjects choose between the following eight prospect pairs:

-

Base case: These prospect pairs offered a choice between the safe payment b and a prospect providing a 50% chance of winning twice the safe amount b or zero otherwise.

-

Sensitivity up: Compared to the base case, the safe payment is increased by 25% to assess the degree of subjects’ risk aversion. The risky prospect remained unchanged.

-

Sensitivity down: Similar to “Sensitivity up”, but the safe payment is reduced by 25%, again in order to measure the degree of risk aversion. The risky prospect remained unchanged.

-

Positive shift: Every amount is increased by 50% of the safe payment in the base case. These choices were included to see how choices changed when shifting away from the €0 outcome.

-

Lottery choice: The risky prospect now remains identical to the base case, but the safe payment is replaced by a prospect with a lower variance (0.5 b and 1.5 b) than the risky prospect (0 and 2 b).

-

Mixed prospect: To obtain these prospects, the safe amount in the base case was subtracted from all outcomes, thus obtaining a prospect with an expected value of €0. The safe amount was therefore always 0, the prospect always a lottery between -b and b.

-

Mean-preserving spread: To obtain this prospect, the two risky outcomes of the base case were respectively increased and decreased by 50% of the sure amount. The expected value of the prospect thus remains the same; however, the variance of the prospect increases, and a loss equal to 50% of the sure amount is introduced into the prospect.

-

Loss prospect: The mirror image of the base case where every amount was negative instead of positive. These prospects were inserted to directly compare risk taking behavior for gains and losses.Footnote 2

The following chart gives an overview of the eight different prospect pairs as a function of the stake level b. For a complete overview of all prospect pairs, see Table A1 in the online appendix.

Prospect type | Safe prospect | Risky prospect | ||

|---|---|---|---|---|

Base case | b | 0 | 2 b | |

Sensitivity up | 1.25 b | 0 | 2 b | |

Sensitivity down | 0.75 b | 0 | 2 b | |

Positive shift | 1.5 b | 0.5 b | 2.5 b | |

Lottery choice | 0.5 b | 1.5 b | 0 | 2 b |

Mixed prospect | 0 | –b | b | |

Mean preserving spread (MPS) | b | −0.5 b | 2.5 b | |

Loss prospect | –b | −2 b | 0 | |

2.1.4 Treatments

Subjects were randomly assigned to one of two treatments, with two-thirds of all subjects assigned to the responsibility treatment since only half of them would actively take decisions. We used a between-subjects design inasmuch as it constitutes a more stringent test, avoiding potential contrast effects and experimenter demand effects (Greenwald 1978). In the individual treatment, subjects took their decisions only for themselves. In the responsibility treatment, half of the subjects were randomly assigned to the role of decision maker and the other half to the role of passive recipient. The decision maker was told that she had to take the decision on behalf of herself and another subject sitting in the laboratory, whose identity was not disclosed. All other subjects were told that they were in a passive role and that somebody else in the laboratory would take the decisions on their behalf. The matching remained fixed throughout the rounds. With a lag of one period, recipients were shown the decision problem and the choice of their corresponding decision maker. They could then indicate whether they were “satisfied” or “not satisfied” with the decision (encoded as a dummy taking the value of 1 if a recipient declared they were satisfied with the decision, and 0 otherwise), but this did not affect payoffs nor was it shown to the decision maker. Decision makers knew about the satisfaction ratings, as well as about the fact that the ratings would neither be communicated to them nor have any material consequences.

2.1.5 Incentives

Three out of the 40 decisions were randomly drawn for every subject to be payoff relevant once the experiment was over. Subjects did not learn about any payoffs or extractions before the very end of the experiment. The random incentive system was chosen in order to avoid possible income effects, and because it is the standard procedure used in this kind of tasks. We extracted 3 out of the 40 choices in order to reduce the probability that subjects would actually lose money in the experiment. To make the random mechanism behind lotteries as transparent as possible, we had one participant throw a die for every lottery that determined what outcome of the lottery obtained. In the responsibility treatment, we implemented the payout procedure such that three identical decisions were randomly chosen for the two paired subjects—a decision maker and her passive recipient would thus always obtain the same payoff from a choice. Subjects were told that it was possible—though unlikely—that they would lose money in the experiment. They could either pay such losses directly or work them off in the lab for a wage of €5 per half hour.Footnote 3

2.2 Results

2.2.1 Prospect choices: Descriptive analysis of general choice patterns

We start with some general descriptives of choices in the individual treatment for the intermediate stake level of b = 6.Footnote 4 Table 1 provides an overview of these choice patterns, as well as of average choices across all stake levels. In the base case we find a considerable degree of risk aversion across all stake levels, with about 75% of subjects choosing the sure amount over the prospect with equal expected value (p < 0.001). As one would expect, choices of the sure amount further increase when the sure amount is higher than the expected value of the prospect (sensitivity up), and decrease when the sure amount is lower (sensitivity down) in which case we observe a majority of choices for the prospect (p < 0.01).

When all outcomes are moved upward by 50% of the sure amount compared to the base case (positive shift), we observe increased choices of the prospect across all stake levels, although choices still display significant risk aversion (p < 0.01). When the choice is between two non-degenerate prospects (lottery choice), choice frequencies of the safe prospect are further increased relative to the base case. For mixed prospects, the choice frequency of safe choices is only slightly increased compared to the base case (this however underestimates the effect given the lowering of the stake levels: see below as well as online appendix A3 for a more nuanced discussion). For the mean-preserving spread, choices of the risky prospect increase, but risk aversion remains the dominant pattern (p < 0.001). This may indicate that the increase in the good outcome more than makes up for the slight loss that has been introduced in the bad outcome.Footnote 5 Finally, for loss prospects, subjects are considerably more risk seeking than for gains, and in absolute terms risk neutrality cannot be rejected (p = 0.19).

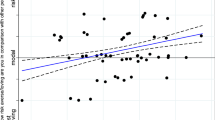

It is also commonly found in the literature that risk attitudes are influenced by stake levels (Binswanger 1980; Holt and Laury 2002; Kachelmeier and Shehata 1992). We thus take a look at the influence of the different stake levels on decisions. Figure 1 shows choices for the safe prospect separately for the base case and the loss prospect in the individual treatment. The stake effect is clearly visible for the base case, with increasing expected values resulting in increased levels of risk aversion. Indeed, we cannot reject risk neutrality for the lowest stakes (p = 0.47), with risk aversion increasing with stake levels and being highly significant for the highest stake level (p < 0.001). For the loss prospect, on the other hand, there is no clear trend and risk aversion has only a very slight (and non-significant: p = 0.31 for the highest stake level) tendency to increase with absolute stake values.Footnote 6 An econometric analysis of these descriptive results can be found in online appendix A3. We next turn to the differences between the individual and the responsibility treatment.

2.2.2 Individual decisions versus responsibility

Figure 2 shows choice frequencies for the safe prospect by treatment, for males and females respectively.Footnote 7 One can see how for the base case subjects take more risk averse decisions under responsibility than in the individual treatment—this holds both for males and females. The same tendency is visible in almost all other positive prospect pairs, except for the upward sensitivity prospect pair, in which there is virtually no difference, and for the downward sensitivity pair for women (although the effect of responsibility in the downward sensitivity pair is very strong for men). There is only a very slight indication of responsibility inducing more risk aversion in the mixed prospect pair, while this tendency is again more pronounced for the mean-preserving spread (MPS) pair. For loss prospects, however, the tendency is inverted, with responsibility decreasing risk aversion.

Table 2 presents a random effects Probit model regressing choices for the safe prospect on a variety of explanatory variables. The random effects model allows us to account for the between-subjects treatment effect and the within-subjects variation in prospect characteristics. Errors are always clustered by subject, taking into account that different choices by the same subject do not constitute independent observations. In the interest of parsimony and statistical power, we bundle the types of prospects in particular ways. For instance, we take all five prospect pairs including only gains to constitute the baseline, omitting the respective dummies, while we insert separate dummies for mixed prospects, the mean-preserving spread, and loss prospects. This is justified for the base prospect and the sensitivity prospects inasmuch as they help us assess the strength of preferences. We further combine them with the positive shift and lottery choice choices to further refine the assessment of preferences for gain prospects. This is further justified by the fact that we have the same hypotheses for those prospects as for the pure gain prospects, and indeed these prospects were inserted with the express purpose of augmenting statistical power and minimizing the incidence of potential noise under the form of random choices.

Specification I regresses choices on the treatment dummy, a dummy variable indicating the loss prospects, a dummy indicating mixed prospects, and a dummy indicating the MPS lottery, as well as interaction terms between each of these three prospect dummies and the treatment dummy. The regression further controls for the difference in expected value between the safe and the risky prospect, and for the difference in standard deviation between the safe and risky prospects.Footnote 8 Finally, we insert a female dummy to control for gender effects.

Being responsible for somebody else’s payoffs as well as one’s own increases risk aversion relative to the individual decision situation; this is a simple main effect, indicating the effect of responsibility for all prospects except the pure loss prospect, the MPS prospect, and the mixed prospect (the dummies for which are held constant at zero). The effect of the loss prospect dummy indicates that for loss prospects subjects are more risk seeking compared to the average for all the gain prospects. The interaction between the treatment dummy and the one identifying loss prospects indicates that for loss prospects the effect of responsibility is significantly different from its effect for gain prospects. While subjects in the responsibility treatment are more risk seeking (or less risk averse) for losses compared to subjects in the individual treatment, the effect is not significantly different from zero (albeit significantly different from the effect observed for gains). The significant effect of the mixed prospect dummy shows that subjects choose the safe option significantly more often for mixed prospects than for pure gain prospects. For the MPS, we find an effect in the opposite direction, indicating that subjects choose the safe option significantly less often. However, we do not find an effect of responsibility for either of these prospects, with the effect thus going in the same direction as for gains. Finally, we also find that females are significantly more risk averse than males. Such an effect is commonly found for decision making under risk (Donkers et al. 2001; Eckel and Grossman 2008).

Regression II further adds an interaction term between the female dummy and the treatment dummy, to test whether the treatment might have a differential effect by sex. The effect is not significant, which shows that being responsible for somebody else does affect males and females in the same way. All the effects previously discussed remain stable. We next turn to the analysis of the satisfaction ratings of recipients in the responsibility treatment.

2.2.3 Choice satisfaction of recipients

In the responsibility treatment, recipients saw the decision maker’s choice with a one period lag and indicated whether they were satisfied with the decision or not (encoded as a dummy taking the value of 1 if a recipient was satisfied with the choice, or else 0). Although this rating was not incentivized, it may nevertheless give an indication of the extent to which decision makers adapted their decision to the commonly acceptable one, or correctly intuited which decision would be deemed more acceptable while doing so. Since satisfaction ratings were not communicated to the decision maker and had no influence on payoffs whatsoever, recipients had no reasons to strategically misrepresent their preferences. Also, the fact that providing such ratings was the only occupation of recipients during the experiments leads us to believe that they took this task seriously.

Figure 3 provides an overview of the satisfaction ratings. The ratings are shown separately for the eight different prospect types, and conditionally on the choice of the decision maker of the safe versus the risky prospect. In the base case, recipients are much more likely to be satisfied upon the choice of the safe than the risky prospect. This tendency is replicated for all the other choices over prospects involving only gains, except for Sensitivity Down, the case in which the sure alternative is lowered in value. Recipients are also more likely to be satisfied with a choice of the safe prospect for the mixed, MPS, and loss prospect, with the difference between the satisfaction ratings being smallest for loss prospects.Footnote 9 Relative to the average over the 5 prospect types involving gains, for which recipients declare being satisfied in 87% of the cases in which the decision maker chose the safe prospect, recipients are even more satisfied upon a safe choice for a mixed prospect (92%), slightly less for the MPS (80%), and much less when the sure amount is chosen for a loss prospect (72%). This ranking is inversed for choices of the risky prospect. In this case, 59% are satisfied with the choice across the 5 gain prospects on average, while only 33% agree with the risky choice for mixed prospects, 44% agree with it for the MPS, and fully 60% find a choice of the risky prospect satisfying for loss prospects.

Table 3 shows a random effects Probit model regressing the recipients’ satisfaction with each choice on a number of independent variables. As above, errors are clustered at the subject level. The highly significant effect of the safe prospect being chosen by the decision maker shows that safe choices are deemed more satisfactory in the gain domain (this being a simple main effect measuring the effect of safe choices with the other dummies held constant at zero). While the fact that a prospect offers only negative outcomes per se does not affect satisfaction ratings, choosing the safe amount for loss prospects is generally not perceived as satisfactory by recipients relative to the same choice for gains, as shown by the highly significant interaction effect of the pure loss and safe choice dummies. This finding confirms that risk seeking is deemed much more acceptable in the loss domain than it is for gains. Satisfaction is lower for mixed prospects in general, and choices of the safe option for mixed prospects increases the likelihood of a recipient being satisfied. For MPS, we find no main effect, but there is a marginally significant effect indicating that recipients are less satisfied relative to gains if a sure amount is chosen. There is no main gender effect for satisfaction ratings. Regression II again adds an interaction term between female and the dummy indicating that a safe prospect was chosen. In keeping with the findings on choice patterns, women generally deem choices of the safe prospect as more satisfactory than choices of the risky prospect.

At the end of the experiment we asked subjects to rate their degree of risk aversion on a scale from being very risk seeking (1) to being very risk averse (6).Footnote 10 This self-declared risk aversion correlates significantly with the number of safe choices taken in the gain prospect pairs during the experiment itself on the basis of the Spearman correlation coefficient (p = 0.01) across decision makers in both treatments. Self-declared risk attitudes are not significantly different between the two treatments (p = 0.26; Mann–Whitney test, two-sided), nor is there a significant difference between decision makers and recipients in the responsibility treatment (p = 0.72; Mann–Whitney test, two-sided). Finally, we also asked subjects to rate themselves according to their risk aversion relative to other participants in the experiment. The rating went from 1 (indicating that a subject considered herself to be amongst the four most risk-loving participants in the session of 24) to 6 (indicating that a subject considered herself to be amongst the four most risk averse participants in the session). On average, decision makers in the responsibility treatment had a rating of 4.17, indicating that they considered themselves more risk averse than the median participant in the experiment. This finding corresponds to existing evidence according to which subjects generally consider others as more risk loving than themselves (Hsee and Weber 1997). Furthermore, this finding also rules out that decision makers may have considered recipients on average to be more risk averse than they are themselves.Footnote 11 This indeed corresponds to a finding by Bateman and Munro (2008), who found that when partners take risky decisions for each other, they sometimes end up choosing the less risky alternative even after correctly predicting the partner’s preference for the riskier alternative—a finding that they attribute to ‘fear of recrimination’.

2.3 Discussion

For gain prospects, we find responsibility to increase risk aversion. An account based on the assumption that decision makers consider others to be more risk averse than they are themselves seems to be ruled out by the answers to the relative risk attitude ranking questions discussed above. Also, Hsee and Weber (1997) found that in a series of different experimental designs subjects systematically predicted others to be less risk averse than themselves. We can thus conclude that subjects do not simply try to adapt their decisions to what they think may be others’ risk attitudes.

A different possibility is that subjects comply with an implicit social rule dictating increased caution when responsible for somebody else as well as oneself, thus increasing their risk aversion when responsible for somebody else.Footnote 12 This explanation is distinct from the argument discussed in the last paragraph, inasmuch as such a social norm may push subjects to be more risk averse when deciding for others even in cases where they expect that others would be more risk loving than themselves if left to decide for themselves. Such a cautious shift explanation, however, cannot explain our null finding for loss prospects. Arguably, different social rules dictating a cautious shift for gains and a ‘risky shift’ or no shift for losses could well exist, but such a hypothesis does have a distinctly ad hoc flavor. Given that individual risk attitudes have been established to be much richer than the simple risk-aversion/risk-seeking dichotomy implicit in such explanations (Abdellaoui 2000; Abdellaoui et al. 2010; Bleichrodt and Pinto 2000; Vieider et al. 2015a), we rather hypothesize that risk attitudes typically found in individual decision making are accentuated under conditions of responsibility.

Prospect theory would predict risk aversion to prevail for moderate to large probability gains. Based solely on the evidence collected for gain prospects, we can thus not separate an account based on a social rule favoring increased risk aversion under responsibility from an alternative account based on the amplification of the fourfold pattern of risk attitudes (Tversky and Kahneman 1992; Scholten and Read 2014). Risk seeking, however, seems to appear more acceptable than risk aversion in the loss domain relative to gains for the moderate probabilities used in our experiment. This amplifies the gain-loss reflection in the responsibility treatment relative to individual decisions. Evidence in this direction comes both from the behavior of decision makers, who under conditions of responsibility in the loss domain are induced to become more risk seeking rather than more risk averse; and from recipients, who are much more likely to be dissatisfied with a choice of the risky prospect in the gain domain than in the loss domain (an effect that is highly significant). This, in turn, cannot be explained by a uniform social norm dictating a cautious shift under responsibility.

As an alternative hypothesis we thus propose that the fourfold pattern of risk attitudes predicted by prospect theory—risk aversion for moderate to large probability gains and small probability losses, risk seeking for moderate to large probability losses and small probability gains—is amplified by responsibility. The hypothesis of an accentuated fourfold pattern of risk attitudes as found in prospect theory and the social norm argument make very different predictions for different probability levels in the gain domain, which makes it easy to test them against each other. For large probabilities, both prospect theory and the social norm argument predict an increase in risk aversion under conditions of responsibility. For small probabilities, on the other hand, the social norm hypothesis still predicts an increase in risk aversion; quite to the contrary, however, prospect theory and the argument of an amplification of the fourfold pattern laid out above now predict an increase in risk seeking under conditions of responsibility.

The same test can also be adopted for yet another alternative explanation that we cannot rule out on the basis of the results from above. When deciding for others as well as themselves—so the objection goes—decision makers effectively decide over twice the amount of money. Given the common finding that risk aversion increases in stake levels, the increased amounts over which decisions are taken may thus well be the factor underlying the finding of increased risk aversion in the responsibility treatment, rather than the responsibility effect itself. This explanation is indeed plausible for the moderate probability gains used in experiment I, and may even explain the effect for losses, where no stakes effects are typically found. Notice, however, that this explanation would again predict increased risk aversion for small probability gains under higher stakes. Indeed, the finding that risk aversion increases with stakes is one of the most established in the risk literature (Binswanger 1980; Fehr-Duda et al. 2010; Holt and Laury 2002), as well as being present in our own data. It has also been found specifically for small probability prospects (Kachelmeier and Shehata 1992; Lefebvre et al. 2010). We thus now proceed to testing the effect of responsibility on decisions for different probability levels in the gain domain.Footnote 13

3 Experiment II: Disentangling social norm and amplification accounts

3.1 Experimental design

3.1.1 Subjects

180 subjects were recruited at the experimental laboratory MELESSA at Ludwig-Maximilian’s University in Munich, Germany, using ORSEE (Greiner 2004). Fifty-nine percent of subjects were female, and the average age was 23.88 years.

3.1.2 Task

This task was run after another, unrelated experiment.Footnote 14 Subjects were asked to choose between a safe option and a risky option in a fashion similar to experiment I. Overall, subjects had to make 10 choices where the order of presentation was randomized for every subject. Subjects took decisions sequentially and had no opportunity to return to an earlier decision to revise it.

3.1.3 Prospects

The choice was always between a sure amount of money and a prospect—both in the gain domain. There were two prospects, one providing a 10% chance to win €10 and zero otherwise; and one providing a 90% chance to win €10 and zero otherwise. The sure amount could take one of five different amounts for each prospect: €0.8, €1, €1.2, €1.5 and €2 for the 10% prospect, and €7, €8, €8.5, €9, and €9.5 for the 90% prospect.

3.1.4 Treatments

Subjects were randomly assigned to one of two treatments that exactly replicated those of experiment I: an individual treatment in which subjects took their decisions only for themselves; or a responsibility treatment, in which half of the subjects were randomly assigned the role of decision maker and half the subjects were assigned the role of passive recipient.

3.1.5 Incentives

One decision was randomly extracted to be played for real pay. Since in the unrelated experiment subjects could obtain at least an approximate knowledge about their payoffs, we decided to fully reveal earnings from the preceding, unrelated, experiment in order to be able to control for the exact income effect in a regression (rather than having unknown perceptions of earnings).

3.2 Results

3.2.1 Individual decisions versus decisions under responsibility

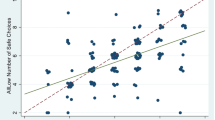

We again start with some descriptive statistics. Figure 4 displays the choice frequencies by treatment separately for small and large probabilities. On average we find the typical pattern of risk seeking for small probabilities and risk aversion for large probabilities. When the subjects face a choice between a prospect and a sure amount of equal expected value, only about 27% of subjects choose the sure amount for the 10% probability (p < 0.001, binomial test), while 99% of subjects do so for the 90% probability (p < 0.001, binomial test). For the 10% probability, subjects who are responsible for somebody else choose the sure amount less often for all but the smallest two certain amounts, where choices of the safe amount are generally low. For the 90% probability, responsible subjects always choose the sure amount at least as often as subjects who only decide for themselves.

Table 4 presents a random effects Probit model regressing choices of the safe alternative on a variety of explanatory variables. As for experiment I, we always cluster errors at the subject level. The effect of the responsibility treatment dummy now indicates the simple main effect of being responsible when probabilities are large (Jaccard and Turrisi 2003). Subjects are thus more likely to choose the sure amount for a 90% probability of winning when responsible compared to the individual treatment. Under small probabilities, subjects are significantly more risk seeking than under large probabilities, as indicated by the highly significant effect of the small probability dummy. More importantly, the interaction of the small-probability dummy with the treatment dummy indicates that the treatment effect is significantly different under small probabilities compared to large probabilities. There is also an increase of risk seeking under responsibility relative to the individual treatment, although this effect fails to reach significance (i.e., the effect is not significantly different from zero). As may be expected, the difference in expected value between the sure amount and the prospect (defined as in experiment I) is also highly significant. Finally, we find a significant, if small, income effect, which goes as expected in the direction of increased risk seeking by subjects who have realized higher earnings from the previous experiment.

Regression II adds two further interaction terms. Almost all effects can be seen to be stable. The gender effect, which had not been significant in regression I, is now also significant. This effect is qualified by the interaction of the female dummy with the responsibility dummy, and thus shows the effect in the individual treatment. The interaction term itself is not significant. Past profits remain significant. Most importantly, however, there is no interaction effect between past profits from the preceding experiment and our treatment manipulation, showing that this is not interfering with our results.

3.2.2 Satisfaction ratings

Exactly as in experiment I, recipients in experiment II saw the decisions of their assigned decision maker with a lag of one period, and had to indicate whether they were satisfied with the decision or not. The satisfaction ratings are summarized in Fig. 5. The numbers on the horizontal axis indicate the safe amounts, and stand for {€0.8, €1, €1.2, €1.5, €2} for the small probability and {€7, €8, €8.5 €9, €9.5} for the large probability. For the small probability of winning, satisfaction is high when the risky prospect is chosen and the sure amount is small, and decreases monotonically as the sure amount increases. As one would expect, satisfaction ratings conditional on a choice of the safe option move in the opposite direction with increasing safe amounts, although the pattern is less regular. For the large probability of winning, satisfaction ratings are generally high for the three lower safe amounts, with no clear differences between choices of the safe or risky prospects overall. For the two highest safe amounts, satisfaction is very high when a decision maker chooses the safe prospect, but is zero upon the choice of the risky prospect. One needs to keep in mind, however, that no responsible decision maker chose the risky prospect for sure amount 4 (equivalent to the prospect’s expected value), and only one did so for a sure amount higher than the expected value (sure amount 5).

Table 5 reports the results of a random effects Probit model regressing the satisfaction dummy on a number of explanatory variables. The first dummy shows the simple main effect of choosing the safe amounts over the large probability prospect. Choosing the safe amount for large probability prospects is deemed much more satisfactory in general than choosing the prospect. The dummy indicating the simple main effect of a small probability choice is also positive, indicating considerable agreement with choices of the prospect in this instance.Footnote 15 Choosing the safe amount for small probability prospects, on the other hand, is considered to be very dissatisfying, as shown by the large negative coefficient of the interaction effect. Recipients are in general less satisfied with choices of the prospect the closer the safe amount is to the expected value of the prospect. They are, however, more satisfied with a choice of the safe alternative for relatively small deviations in expected value.

3.3 Discussion

The social norm hypothesis and the amplification of fourfold pattern hypothesis make very different predictions on behavior for small probabilities in the gain domain. While for large probabilities both theories predict an increase in risk aversion under responsibility, for small probabilities the social norm argument predicts a cautious shift towards increased risk aversion (or reduced risk seeking), whereas the amplification argument predicts increased risk seeking. Having directly tested these contradictory predictions in experiment II, we conclude that the social norm dictating a cautious shift under conditions of responsibility has been discredited as an explanation of the results. An increased fourfold pattern of risk attitudes, on the other hand, would appear to provide a better explanation of our results. At the same time, this finding also excludes explanations based on which our initial effects could have been due to stake effects rather than responsibility. Stake effects would indeed have predicted an increase in risk aversion for small probabilities in the responsibility treatment, which we do not find.

The effects we find are, whilst statistically significant, not very strong from a quantitative point of view. This is however not so surprising if one thinks how our study has been consciously designed so as to constitute a lower bound on responsibility effects. On the one hand, the recipient is an anonymous other about whom no information is disclosed to the decision maker, and who has no power to reward or punish the decision maker. On the other hand, the decision maker is affected by his decisions in a perfectly parallel manner to the recipient, so that deciding in a way that is considered ‘optimal’ for a recipient carries costs in terms of the decision maker’s own preferences. Finally, the between-subject design chosen is generally considered a harder test than within-subjects designs, as it lowers statistical power, and excludes potential contrast effects (see e.g., Greenwald 1978). There may be different possibilities to increase the incidence of responsibility on decisions, including conveying personal information about the recipient, increasing the number of recipients for whom the decision maker is responsible, or reducing the stakes the decision maker herself has in the outcome.

This brings us to the widely different results obtained in the literature. As discussed in the introduction, Reynolds et al. (2009) found risk aversion to increase relative to an individual benchmark when subjects were deciding only for somebody else, Chakravarty et al. (2011) found risk aversion to decrease under conditions of responsibility, and Humphrey and Renner (2011) found no effect of responsibility on risky choices. Since the execution of the experiments in this paper, some investigations have tried to make sense of these widely different results. Most notably, Andersson et al. (2015) explicitly try to compare situations in which decision makers take decisions for others without consequences to themselves, and decisions in which the payoffs are equalized as in this paper, but find no difference between these situations. They do, on the other hand, find a reduction of loss aversion in their equal payoff condition under responsibility, which does not correspond to our findings. More research seems to be needed in order to reconcile these different findings.

The fourfold-pattern hypothesis finds some support in our data, although we have not properly explored this hypothesis for losses (see Vieider et al. 2015b for an investigation including losses and using structural models). However, the more fundamental question of why we may observe such a shift in risk attitudes under responsibility remains to be answered. The fact that typical individual risk attitudes are accentuated under conditions of responsibility provides an indication that increased responsibility does by no means push decisions closer to expected utility maximization—generally held to be normative—but rather farther away from it. There seems, however, to be general agreement on this tendency, as indicated by our satisfaction rating patterns. Indeed in experiment I, we found recipients to be generally satisfied with safe choices in the gain domain, but dissatisfied with such choices in the loss domain. Given that safe choices have already been found to decrease under conditions of responsibility in the loss domain, this is indeed a strong indication for the perceived social acceptance (or at least desirability) of such choices. A similar pattern can be seen in experiment II, where safe choices were deemed satisfactory for the large probability prospect, but much less satisfactory for the small probability prospect. If anything, satisfaction ratings thus seem to indicate that the shift in choice behavior observed under responsibility was perceived as too weak by the recipients themselves.

Whatever the psychological reasons behind our findings may be, the mere economic fact of more extreme decision patterns obtaining under responsibility remains. Such factors may have important consequences for economic predictions and for policy design. Probability weighting—from which the fourfold pattern is thought to derive to a large extent—has been used to explain the simultaneous take-up of insurance and lottery play (Wakker 2010). The fourfold pattern of risk attitudes has also been used to explain reference point effects that have been observed in financial markets (Baucells et al. 2011; Wiseman and Gomez-Mejia 1998) and for investment behavior by firms (Fiegenbaum 1990; Fiegenbaum and Thomas 1988). Our results provide a further indication that typical risk attitudes found for individuals may not only generalize to professional agents or firms, but that they may even be reinforced to some extent. Of course, it remains to be seen how stable these results are to deviations from the exactly equal incentive structure for decision maker and recipient used in this study, which is rarely to be found in this form in real-world settings.

4 Conclusion

We systematically explored decision situations under risk in which a decision maker bears responsibility for somebody else’s outcomes as well as for her own. In the gain domain, and for medium to large probabilities, we confirmed the intuition that being responsible for somebody else’s payoffs increases risk aversion. Looking at risk attitudes in the loss domain, however, we found an increase in risk seeking under conditions of responsibility relative to the effect observed for gains. This raises issues about the extent to which changed behavior under responsibility may depend on a social norm of caution in situations of responsibility, or to what extent pre-existing risk attitudes found at the individual level may simply be accentuated under responsibility. To further explore this issue, we designed a second experiment to explore risk-taking behavior for gain prospects offering very small or very large probabilities of winning. For large probabilities, we found increased risk aversion, thus confirming our earlier finding. For small probabilities, on the other hand, we found an increase of risk seeking under conditions of responsibility. The latter finding sheds doubt on hypotheses of a social rule dictating caution under responsibility, and points towards an amplification of the fourfold pattern of risk attitudes found for individual decisions. At the present point we can only speculate on what may underlie such an amplification of individual risk attitudes. Additional evidence—possibly from neighboring disciplines such as neuroscience—will probably be needed to fully understand the underlying dynamics.

Notes

Pahlke, Strasser, and Vieider (2012) found that adding an accountability mechanism to responsibility significantly reduced loss aversion, while leaving other elements of risk attitude unaffected.

Additional prospects in the gain domain were not mirrored for ethical reasons—indeed, replicating all gain prospects for losses would have resulted in a high chance of overall losses during the experiment.

Two out of 144 participants ended up with an actual loss (€ -3.50 and € -2.00), both in the individual treatment. Three further subjects earned less than their show-up fee of €4.

P-values reported are two-sided and refer to binomial tests for intermediate stakes, with a safe amount of b = €6, unless specified otherwise. Using one specific stake level allows for cleaner statistical tests. Results are qualitatively similar for other stake levels.

Slovic et al. (2002) found a similar pattern for choices under risk with small negative and large positive outcomes, calling it the “contrast effect”.

The Spearman correlation coefficient between the stake size b and choice for the safe option in the individual treatment is indeed significantly positive for the base case (p < 0.001), but not different from zero for losses (p = 0.57).

Expected value is defined as the expected value of the safe prospect minus the expected value of the risky prospect. Standard deviation is defined as the standard deviation of the risky prospect minus the standard deviation of the safe prospect, which is thus always positive.

One may also want to take into account that there are actually fewer choices of the safe prospect for losses to start with, as shown above.

The average rating was 4.04, with a standard deviation of 1.06.

In the literature, self assessment on a risk attitude scale such as this have been found to be highly correlated with incentivized choices for 50–50 prospects in the gain domain (Dohmen et al. 2011). We thus also assume that such self-assessment should reflect choices for 50–50 choices in the gain domain. However, Vieider et al. (2014) found positive correlations in both the gain and the loss domain.

For instance, Lahno and Serra-Garcia (2015) found that the imitation of a peer is more likely in decisions under risk when said peer makes a risk averse choice. This suggests that risk aversion may have some appeal as a social norm.

We test this hypothesis for the gain domain only, since gains are easier to incentivize than losses.

Although the preceding experiment was unrelated, care was taken to distribute the treatments of this experiment orthogonally to the treatments in the other experiment.

Indeed, the dummy indicates the satisfaction levels for small probabilities with all interactions that include that dummy held constant at zero (Jaccard and Turrisi 2003). This in turn means that the safe-choice dummy must be zero, thus resulting in the interpretation that the effect indicates satisfaction with choices of the prospect; this satisfaction in turn is measured relative to the (much fewer) choices of the prospect for the large probability prospect.

References

Abdellaoui, M. (2000). Parameter-free elicitation of utility and probability weighting functions. Management Science, 46(1), 1497–1512.

Abdellaoui, M., L’Haridon, O., & Zank, H. (2010). Separating curvature and elevation: A parametric probability weighting function. Journal of Risk and Uncertainty, 41(1), 39–65.

Abdellaoui, M., Baillon, A., Placido, L., & Wakker, P. P. (2011). The rich domain of uncertainty: Source functions and their experimental implementation. American Economic Review, 101, 695–723.

Andersson, O., Holm, H. J., Tyran, J.-R. & Wengström, E. (2015). Deciding for others reduces loss aversion. Management Science, forthcoming.

Bateman, I., & Munro, A. (2008). An experiment on risky choice amongst households. Economic Journal, 115, C176–C189.

Baucells, M., Weber, M., & Welfens, F. (2011). Reference point formation and updating. Management Science, 57(3), 506–519.

Binswanger, H. P. (1980). Attitudes toward risk: Experimental measurement in rural India. American Journal of Agricultural Economics, 62(3), 395–407.

Bleichrodt, H., & Pinto, J. L. (2000). A parameter-free elicitation of the probability weighting function in medical decision analysis. Management Science, 46(11), 1485–1496.

Bolton, G. E., & Ockenfels, A. (2010). Risk taking and social comparison—A comment on “Betrayal aversion: evidence from Brazil, China, Oman, Switzerland, Turkey, and the United States.” American Economic Review, 100(1), 628–633.

Chakravarty, S., Harrison, G. W., Haruvy, E. E., & Rutström, E. E. (2011). Are you risk averse over other people’s money? Southern Economic Journal, 77(4), 901–913.

Charness, G., & Jackson, M. O. (2009). The role of responsibility in strategic risk taking. Journal of Economic Behavior and Organization, 69, 241–247.

Dohmen, T., Falk, A., Heckman, J., Huffman, D., Sunde, U., Schupp, J., & Wagner, G. G. (2011). Individual risk attitudes: Measurement, determinants, and behavioral consequences. Journal of the European Economic Association, 9(3), 522–550.

Donkers, B., Melenberg, B., & van Soest, A. (2001). Estimating risk attitudes using lotteries: A large sample approach. Journal of Risk and Uncertainty, 22(2), 165–195.

Eckel, C. C., & Grossman, P. J. (2008). Men, women, and risk aversion: Experimental evidence. Handbook of Experimental Economics Results, 1, 1061–1073.

Fehr-Duda, H., Bruhin, A., Epper, T. F., & Schubert, R. (2010). Rationality on the rise: Why relative risk aversion increases with stake size. Journal of Risk and Uncertainty, 40(2), 147–180.

Fiegenbaum, A. (1990). Prospect theory and the risk-return association. Journal of Economic Behavior and Organization, 14, 187–203.

Fiegenbaum, A., & Thomas, H. (1988). Attitudes toward risk and the risk-return paradox: Prospect theory explanations. Academy of Management Journal, 31(1), 85–106.

Fischbacher, U. (2007). z-Tree: Zurich toolbox for ready-made economic experiments. Experimental Economics, 10(2), 171–178.

Greenwald, A. G. (1978). Within-subject designs: To use or not to use? Psychological Bulletin, 314–320.

Greiner, B. (2004). The online recruitment system ORSEE 2.0 – A guide for the organization of experiments in economics. University of Cologne, Working Paper Series in Economics 10.

Holt, C. A., & Laury, S. K. (2002). Risk aversion and incentive effects. American Economic Review, 1644–1655.

Hsee, C. K., & Weber, E. U. (1997). A fundamental prediction error: Self–others discrepancies in risk preference. Journal of Experimental Psychology: General, 146(1), 45–52.

Humphrey, S. J., & Renner, E. (2011). The social cost of responsibility. Working Paper.

Jaccard, J., & Turrisi, R. (2003). Interaction effects in multiple regression (2nd ed.). London: Sage Publications.

Kachelmeier, S. J., & Shehata, M. (1992). Examining risk preferences under high monetary incentives: Experimental evidence from the People’s Republic of China. American Economic Review, 82(5), 1120–1141.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263–291.

Lahno, A. M., & Serra-Garcia, M. (2015). Peer effects in risk taking: Envy or conformity? Journal of Risk and Uncertainty, 50, 73–95.

Lefebvre, M., Vieider, F. M., & Villeval, M. C. (2010). Incentive effects on risk attitude in small probability prospects. Economics Letters, 109, 115–120.

Maafi, H. (2011). Preference reversals under ambiguity. Management Science, 57(11), 2054–2066.

Pahlke, J., Strasser, S., & Vieider, F. M. (2012). Risk taking for others under accountability. Economics Letters, 114(1), 102–105.

Reynolds, D. B., Joseph, J., & Sherwood, R. (2009). Risky shift versus cautious shift: Determining differences in risk taking between private and public management decision making. Journal of Business and Economics Research, 7(1), 63–77.

Rohde, I. M. T., & Rohde, K. I. M. (2011). Risk attitudes in a social context. Journal of Risk and Uncertainty, 43, 205–225.

Scholten, M., & Read, D. (2014). Prospect theory and the “forgotten” fourfold pattern of risk preferences. Journal of Risk and Uncertainty, 48, 67–83.

Slovic, P., Finucane, M. L., Peters, E., & MacGregor, D. G. (2002). The affect heuristic. In T. Gilovich, D. Griffin, & D. Kahneman (Eds.), Heuristic and biases: The psychology of intuitive judgment (pp. 397–420). New York: Cambridge University Press.

Starmer, C. (1999). Experimental economics: Hard science or wasteful tinkering? Economic Journal, 109(453), 5–15.

Starmer, C. (2000). Developments in non-expected utility theory: The hunt for a descriptive theory of choice under risk. Journal of Economic Literature, 38, 332–382.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5, 297–323.

Vieider, F. M., Lefebvre, M., Bouchouicha, R., Chmura, T., Hakimov, R., Krawczyk, M., & Martinsson, P. (2015a). Common components of risk and uncertainty attitudes across contexts and domains: Evidence from 30 countries. Journal of the European Economic Association, 13(3), 421–452.

Vieider, F. M., Villegas-Palacio, C., Martinsson, P., & Mejia, M. (2015b). Risk taking for oneself and others: A structural model approach. Economic Inquiry, forthcoming.

Viscusi, W. K., & Huber, J. (2012). Reference-dependent valuations of risk: Why willingness-to-accept exceeds willingess-to-pay. Journal of Risk and Uncertainty, 44(1), 19–44.

Wakker, P. P. (2010). Prospect theory for risk and uncertainty. Cambridge: Cambridge University Press.

Wiseman, R. M., & Gomez-Mejia, L. R. (1998). A behavioral agency model of managerial risk taking. Academy of Management Review, 23(1), 133–153.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

ESM 1

(DOCX 165 kb)

Rights and permissions

About this article

Cite this article

Pahlke, J., Strasser, S. & Vieider, F.M. Responsibility effects in decision making under risk. J Risk Uncertain 51, 125–146 (2015). https://doi.org/10.1007/s11166-015-9223-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-015-9223-6