Abstract

We examine two explanations for peer effects in risk taking: relative payoff concerns and preferences that depend on peer choices. We vary experimentally whether individuals can condition a simple lottery choice on the lottery choice or the lottery allocation of a peer. We find that peer effects increase significantly, almost double, when peers make choices, relative to when they are allocated a lottery. In both situations, imitation is the most frequent form of peer effect. Hence, peer effects in our environment are explained by a combination of relative payoff concerns and preferences that depend on peer choices. Comparative statics analyses and structural estimation results suggest that a norm to conform to the peer may explain why peer choices matter. Our results suggest that peer choices are important in generating peer effects and hence have important implications for modeling as well as for policy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

“Investing in speculative assets is a social activity.” Shiller (1984)

1 Introduction

Decision making under risk is mainly studied at the individual level. Yet, an increasing body of research documents peer effects in risk taking. Peers have a large impact on stock market participation (e.g., Shiller 1984; Hong et al. 2004), investment decisions (Bursztyn et al. 2014) and insurance choices (Cai et al. forthcoming), among others.Footnote 1 Further, recent laboratory studies have documented the existence of peer effects in lottery choice tasks (e.g., Cooper and Rege 2011; Viscusi et al. 2011).

A main open question is what are the sources of peer effects? In the terminology proposed by Manski (2000), a main source of peer effects is preference interactions, whereby individual preferences depend on the actions of others. Such preferences were argued as central to risk taking early on by Shiller (1984). As Manski (2000) writes, preference interactions may arise from “everyday ideas” such as envy or conformity. In other words, in environments with complete information, peer effects may be generated because individuals care about others’ outcomes (envy) or because they care about others’ choices (conformity). In this paper we ask which factor leads to peer effects: concern about others’ allocations, others’ choices, or both? Our study is the first to distinguish between these two sources of peer effects, using two main treatments: a treatment in which peers are randomly allocated a lottery and a treatment in which peers choose between lotteries.

Understanding the sources of peer effects is important for several reasons. First, much attention in the literature on peer effects has been given to envy, a central concept in models of distributional social preferences, e.g., Fehr and Schmidt (1999). These types of preferences have been used to explain peer effects in risk taking, including asset pricing (e.g., Galí 1994; Gebhardt 2004, 2011). However, less attention has been given to preferences where the choices of peers, conditional on payoffs, have a direct impact on an individual’s behavior. Among others, a main reason why choices may matter is provided by studies in social psychology, which show that individuals are often driven by a norm to conform to others’ behavior (e.g., Cialdini and Trost 1998; Cialdini and Goldstein 2004). In models of conformity, others’ choices provide a social anchor to which individuals conform (Festinger 1954). If peer effects are strongly driven by peer choices, as suggested by our data, this suggests that models of social interaction effects in risk taking should not only focus on envy, but also allow for peer choices per se to matter.

The source of peer effects in risk taking is also of central relevance for policy implications. Consider the case of a social planner who aims at increasing the spread of insurance take-up in a society. If peer effects are mainly driven by others’ allocations, a potentially effective policy would be to endow some individuals with insurance (e.g., giving it for free). In contrast, if active choices of peers are relevant, a more effective policy would be to publicly inform people about the choice to purchase insurance by some individuals. Other examples include pension plan choices, where individuals can be viewed as making active choices or following the default plan (through automatic enrollment). Our paper provides a clean laboratory comparison of the two sources of peer effects and as such can be considered a first step towards understanding how policies aimed at shaping risk taking behavior in society would work.

To be able to cleanly identify peer effects, we use a controlled lab experiment in which individuals make risky choices, first individually and then in groups of two. One player is assigned to be the first mover (peer) and the other the second mover (decision maker). Risky choices are made between two simple lotteries, with at most two outcomes and the same probabilities, and there is complete information. We examine behavior in two main treatments. In the first treatment the peer chooses among lotteries (Choice treatment). In the second treatment, the peer is randomly allocated a lottery (Random treatment). We compare these treatments to a control treatment in which the peer makes a random draw, by clicking on a computer-simulated die, whose outcome (odd or even) is completely unrelated to the lotteries or payoffs. Since there are only two equally-likely outcomes, we refer to this as the Coin treatment.

Our experimental design allows us to investigate the question of how decision making changes in the presence of peers. Depending on the type of preference interaction, peer effects may lead to imitation or deviation (Clark and Oswald 1998). To identify the direction of peer effects, as well as to avoid feedback effects, we elicit the decision maker’s choices conditional on the peer’s choice, allocation or unrelated act. This allows us to observe four different potential strategies. The decision maker may condition his choice on the peer’s choice, allocation, or act, by either imitating or deviating. On the other hand, the decision maker may choose not to condition. In this case he either makes the same choice as he made individually or changes it, both being irrespective of the peer’s choice, allocation, or act. We say peer effects occur if the decision maker chooses not to stay with his individual choice.

Our experiment yields three main results. First, we find that peer effects differ significantly when the peer is allocated a lottery compared to when she chooses a lottery, though payoffs remain constant across treatments. Decision makers choose not to stay with their individual choices in 18% of the cases in Random and in 33% of the cases in Choice. Hence, choices of the peer matter, above and beyond their direct impact on payoffs, and almost double peer effects.

Second, we observe that the direction of peer effects in both Random and Choice is towards imitation. The likelihood of imitation increases, more precisely doubles, in Choice compared to Random. This indicates that, conditional on being affected by the peer’s presence, individuals seem to exhibit preferences over others’ payoffs and, in particular, these are such that individuals prefer to imitate their peers. In terms of pure relative payoff concerns, which are present in Random, this indicates that individuals are loss averse with respect to the peer. The dislike of falling behind is higher than the desire to be ahead, leading to imitation. Additionally, imitation is significantly more frequent both in Choice and Random compared to a control treatment, while revision rates (which are not conditional on the peer) do not differ across any of these treatments.

Third, we find that imitation is more frequent when the peer has chosen the “safer” (in terms of variance) lottery, compared to when she chooses the “riskier” lottery. This tendency to imitate the peer especially when she chooses a safer option does not differ across treatments Random and Choice. It is an unexpected and interesting result. It suggests that peer effects may depend on the relative risk positions and thus that decisions such as insurance take-up may spread faster or more strongly through peers than decisions to purchase stocks.

Overall, in our environment, peer effects cannot only be explained by concerns about others’ payoffs relative to own. This implies that a parsimonious explanation of preference interactions in risk taking needs to allow peer choices to matter.

We examine two alternative explanations for why peer choices matter. First, one may consider a more flexible specification of preferences over others’ payoffs, which change depending on whether the peer makes choices or not. Studies of fairness considerations in risk taking (e.g., Cappelen et al. 2013) suggest that the strength of relative payoff concerns might depend on whether the peer actually makes a choice and, if so, whether she chooses to take on more or less risk than the decision maker. Their results suggest that in the Choice treatment we should observe a stronger increase in imitation when the safer lottery is chosen.

A second alternative explanation for the increase in peer effects is, broadly speaking, that individuals are influenced by a norm to conform to others. More specifically, according to Festinger’s (1954) theory of social comparison, individuals care about making correct choices and, in the absence of objective measures of correctness, consider others’ choices as an anchor for correctness. Hence, if individuals exhibit such a preference to conform, peer choices should matter. They should increase the likelihood of imitation in Choice and this increase should not depend systematically on the type of lottery, risky or safe, or its expected payoff.

Since there was complete information, peer effects in our experiment cannot be explained by a model of rational social learning (e.g., Bikhchandani et al. 1998).Footnote 2 In the presence of complete information, under standard assumptions of rationality and self-interest, decision makers do not learn from others. However, decision makers who exhibit preferences for conformity may learn about the correctness of their choice.

Our results reveal that the increase in imitation from Random to Choice does not depend on the lottery choice of the peer. This result is at odds with an increase in envy that is dependent on how much risk the peer chooses to take. However, it is broadly in line with an explanation that choices matter due to a norm to conform to others. As an additional test, we structurally estimate a model of relative payoff concerns and a model based on social comparison theory, where individuals derive a constant utility from conforming to the peer’s choice or allocation. We allow both relative payoff concerns and the utility from conforming to vary depending on whether the peer makes choices or not. We find that, under a model of relative payoff concerns, preference parameters do not change significantly when moving from Random to Choice. In contrast, the utility from conforming increases significantly in Choice. The model based on social comparison theory fits our data significantly better, which provides further suggestive evidence that a reason why choices of peers matter may be due to a norm to conform to others.

Recent laboratory experiments have documented peer effects when peers are allocated lotteries (see Trautmann and Vieider 2011, for an overview). Several studies (Bault et al. 2008; Rohde and Rohde 2011; and Linde and Sonnemans 2012) report that lotteries allocated to peers affect, in varying degrees, individual risky choices and emotions. Other studies focus on peer effects when peers make choices, and show that observing either the desired risky choices of others (Viscusi et al. 2011) or their past choices (Cooper and Rege 2011) significantly affects risk taking. A main contribution of our study is to compare peer effects when peers are allocated lotteries, relative to when they make active choices between lotteries. We show that, over and above relative payoff concerns, the choices of peers play a significant role in the decision maker’s behavior. As mentioned above, this suggests that, when modeling preference interactions in risk taking, it may be misguided to focus only on relative payoff concerns.

Our paper also complements studies testing the channels of peer effects in other environments. Gächter et al. (2013) and Goeree and Yariv (2007) examine whether peer effects are driven by distributional social preferences or social norms (or a norm to act like others), in a gift-exchange game and a social learning environment, respectively. While Gächter et al. (2013) find that peer effects can be explained by distributional social preferences, Goeree and Yariv (2007) find that conforming behavior cannot be explained by distributional social preferences, but is consistent with a preference for conformity.Footnote 3 We find that, in a risky and non-strategic environment, peer effects are explained by both relative payoff concerns and a preference to conform to others.

The remainder of the paper is organized as follows. In Section 2 we describe the experimental design and procedures in detail and derive testable hypotheses. Our main results are presented and discussed in Section 3. Section 4 concludes.

2 Experimental design

2.1 Treatments

Our experiment elicits multiple choices between two lotteries, A and B, with at most two possible outcomes. A always has a larger variance than B. We refer to A as the risky option or lottery, and B as the safe one.Footnote 4 The exact lotteries are described in Section 2.2 below.

In the first part of the experiment (Part I), subjects make lottery choices individually. In the second part (Part II), they make the same choices, but in a different order, and in groups of two. In each group, one subject is assigned to be first mover and the other second mover. We consider a weak form of a peer: the decision maker (second mover) only knows that the peer (first mover) is a subject in the same session, but she remains anonymous throughout.Footnote 5 In Part II risks are perfectly correlated across group members: a single draw of nature determines the payoffs of both members. Perfect correlation is common in risk taking environments where peer effects have been studied. Among others, risks are perfectly correlated in stock purchases as well as for many investment products, such as that considered by Bursztyn et al. (2014). They are also almost perfectly correlated in the weather insurance considered by Cai et al. (forthcoming).

In our two main treatments the decision maker can condition his choice in Part II on the peer. In the first treatment (Random) the peer does not make a decision in Part II; instead she is exogenously (randomly, with equal probability) allocated lottery A or B. In the second treatment (Choice), the peer chooses lottery A or B.

We use the strategy method in Part II, which allows us to observe the strategy of the decision maker conditional on the two possible choices or allocations. This allows us to examine four potential strategies of second movers:

-

i)

Imitate the first mover: choose A if the peer has A, B if the peer has B,

-

ii)

Deviate from the first mover: choose A if the peer has B, B if the peer has A,

-

iii)

Revise own choice: make a different choice than in Part I, independent of the peer,

-

iv)

No change: make the same choice as in Part I.

While the last strategy, no change, implies the absence of a peer effect, the first three strategies all involve different forms of peer effects. As an overall measure, we define a peer effect to occur if the individual switches, i.e. chooses a different lottery in Part II than in Part I for at least one potential choice, allocation or act of the peer.Footnote 6

We also conduct a control treatment (Coin) in which the decision maker can make choices conditional on an unrelated random draw. This allows us to distinguish between choices that are conditional on a relevant act of the peer (allocation or choice) from those conditional on an irrelevant act of the peer (random draw). In particular, at the end of the experiment, the peer rolls a computer-simulated die, by clicking a button on the screen, and the decision maker can condition his choices on whether the outcome is odd or even. For simplicity, we refer to this as a coin flip.Footnote 7

The strategy method avoids any feedback effects, by keeping information about the risk preferences or consistency of the peer absent during the experiment. At the same time, it may potentially affect the choices made by subjects. Brandts and Charness (2000) find that the strategy method does not generally generate differences in treatment effects, and Cason and Mui (1998) do not find an effect of the strategy method in a dictator game where the effects of social information are studied. Similarly, in two additional treatments, we do not find evidence suggesting the strategy method had an effect in our setting.Footnote 8

2.2 Lotteries

The lotteries presented to subjects are summarized in Table 1. A yields the same payoffs throughout, a payoff \({m^{g}_{A}}=20\) in the good state (g), which occurs with probability p, and a payoff \({m^{b}_{A}} = 0\) in the bad state (b). The payoffs of B are similar to those of an insurance product, \({m^{g}_{B}} = 20 - (1-p)cf\) and \({m^{b}_{B}} = 0 + c - (1-p)cf\), with the same probabilities as A. Compared to A, in each state a “premium” of δ = (1−p)c f is subtracted, while in the b state B pays a coverage c. We vary c, p and f across choice situations.

We use the notation \(m^{g}_{p}m^{b}\) in Table 1 to define a lottery that pays m g with probability p and m b with remaining probability 1−p. First, we divide the lotteries into three groups: lotteries with p = 0.2, p = 0.5 and p = 0.8. Within each group, there are six decision problems: two with f = 1.2, two with f = 1 and two with f = 0.8. When f = 0.8, B has a higher expected value than A ( E V B > E V A ), when f = 1, E V B = E V A , and when f = 1.2, E V B < E V A . Throughout the paper we use the terms expected value and f interchangeably. For each possible combination of p and f, c is either 20 or 15. We label lotteries with c = 20 as certainty lotteries, and those with c = 15 as uncertainty lotteries.Footnote 9

Each panel in Table 1, if divided by the level of c, can be seen as a multiple decision list (e.g., Holt and Laury 2002). We presented choices individually, instead of using a list format, to have maximum control over the individuals’ information and potential reference point. The order of the lotteries was randomized across Part I and II. The position of lottery A and B on the screen (left or right) was also randomized across subjects to avoid systematic reference point effects (Sprenger 2012).

2.3 Experimental procedures

Sessions were conducted in MELESSA (Munich Experimental Laboratory for Economic and Social Sciences) at the University of Munich. Each session lasted approximately one hour. Instructions were handed out in printed form and read aloud by the experimenter at the beginning of each session.Footnote 10 In every treatment, subjects were provided with an answer sheet at the beginning of Part I, which displayed every decision problem in Part I and on which they could record their decisions. They kept this sheet until the end of Part II. The experiment was computerized using zTree (Fischbacher 2007). In total, 188 subjects participated in the main treatments of the experiment (68 in Coin, 60 in Random, and 60 in Choice). Their average age was 24 years and roughly 65% of all participants were female. Fields of study were almost equally distributed over 20 different fields, ranging from medicine to cultural studies to business and economics.

One choice from one part was randomly selected at the end of the experiment for payment. If Part I was selected for payment, then one decision problem was drawn for each participant. If Part II was drawn, one decision problem was selected for each and every group only. Thus, for both group members the same decision problem was payoff-relevant.Footnote 11 Subjects were paid a show-up fee of 4 Euro additionally to their earnings from their lottery choices, yielding in total an average of 15 Euro per subject.

2.4 Hypotheses

A large literature argues that individuals have preferences over their outcomes (payoffs) relative to others. It is usually assumed that individuals dislike payoff differences, especially falling behind others, and hence that they want to “keep up with the Joneses”.Footnote 12 A widely used model of relative payoff concerns is that by Fehr and Schmidt (1999), in which individuals dislike being behind but also dislike earning more than the peer.Footnote 13

Across Random and Choice payoffs remain the same. Hence, independently of the specific functional form, if relative payoff concerns are the central motive behind peer effects and if their functional form is independent of the choice situation, these should be the same in Random and Choice. In Coin decision makers cannot condition on the lotteries of peers. Hence, peer effects stemming from relative payoff concerns are not expected. This leads to the following hypothesis.

- Hypothesis 0: :

-

Peer effects are the same in Random and Choice.

Note that Hypothesis 0 relies on the assumption of perfectly correlated risks. This allows for potential imitation of both risky and safe choices. In contrast, under idiosyncratic risks, relative payoff concerns à la Fehr and Schmidt (1999), may yield situations in which choosing the safe lottery is the unique equilibrium, as shown in Friedl et al. (2014).

While the assumption of relative payoff concerns is central in the literature, recent evidence as well as a large literature in social psychology suggest not only that payoffs may matter, but that the fact that the peer makes active choices may be an important factor generating peer effects. We consider two explanations for why peer choices may matter, which lead to two alternative hypotheses on imitation strategies in Random and Choice.

Recent evidence on fairness considerations in risk taking (Cappelen et al. 2013) suggests that relative payoff concerns may depend on whether the peer chose to take on more or less risk. They show that individuals share less when others took on more risk, compared to when they took the same amount of risk but their luck differed. This suggests that relative payoff concerns would increase in Choice, and this increase would be stronger when the peer chooses the safe lottery B.Footnote 14 We formulate the second hypothesis.

- Hypothesis 1A: :

-

Moving from Random to Choice, imitation of the peer increases more when the peer chooses lottery B than when the peer chooses lottery A.

A second mechanism through which peer choices might be important is proposed by an extensive literature on social comparisons in social psychology. According to Festinger (1950, 1954), humans have a drive to evaluate their opinions and attitudes. In the absence of an objective, non-social measure, individuals measure the “correctness” of their opinions and attitudes by comparison with others.Footnote 15 When there are discrepancies between the attitudes of individuals in a group, Festinger predicts that individuals will reduce these discrepancies, either by communicating with others (influence) or by changing their attitudes towards those of the group (conformity). Festinger (1954) also argues that the strength of the influence of others will depend on how divergent their situations are from the individual’s situation. The closer the situation of others to the one of the decision maker, the more likely that this situation will be an important anchor for the evaluation of “correctness”. Empirically, there is a wide range of evidence in support of these predictions in studies in social psychology (for a review, see Cialdini and Trost 1998, and Cialdini and Goldstein 2004).

Our treatments can be interpreted as changing the social anchor. First, in Choice, the decision maker can condition his choice on the choice of his peer, i.e. the peer’s choice is the social anchor. Second, in Random, the decision maker can condition his choice on the lottery allocated to the peer. Hence, the situation of the peer is less similar and can be seen as a weaker social anchor. Though this type of “difference” is not directly discussed by Festinger, if we apply the concept of divergence in terms of the situation of the peer, we would predict a weaker influence of the peer in Random. This should lead to more imitation in Choice, independent of lottery characteristics. The increase should be symmetric with respect to the two available options, A or B.Footnote 16 We close this section with our last hypothesis.

- Hypothesis 1B: :

-

Moving from Random to Choice, the decision maker’s imitation of A and B increases equally.

3 Results

3.1 Decisions in Part I

We start this section with a brief review of decisions in Part I. We find no significant differences across treatments in individual decisions in Part I, as expected. Table 2 describes the average frequency with which A was chosen, over all decisions, by first and second movers, respectively, in each treatment. First movers choose A on average between 17.3% and 23.3% of the time, and second movers choose A between 17.0% and 21.7% of the time. The Mann-Whitney (MW) tests reported in the bottom part of Table 2 reveal that the differences are not significant.

Choices in Part I display a strong variance depending on the decision problem. If B has a lower expected payoff ( f>1), a vast majority of decision makers choose lottery A when p = 0.2 (88.8% and 71.1%). This frequency drops to 19.7% and 20.6% when p = 0.5 and to 17.5% and 16.2% when p = 0.8. Instead, when B has a higher expected payoff ( f<1), it is chosen in the majority of all cases. In the intermediate cases, where A and B have the same expected payoff ( f = 1), the frequency with which A is chosen again varies from over 26% when p = 0.2 down to 7.0% when p = 0.5.Footnote 17 Hence, on average decision makers are risk averse, as is usually observed in experiments.Footnote 18

3.2 Peer effects by treatment

Figure 1 compares the average frequency with which decision makers switch with respect to Part I. As defined above, a switch is a change in lottery choice with respect to Part I, for at least one of the two potential choices made by the peer.

Peer effects by treatment. Note: Switching takes value 1 if the second mover changes his choice in Part II for at least one of the possible choices of the first mover with respect to the choice made in Part I for the same decision. Error bars in Fig. 1 represent ±1.645 SE, a 90% confidence interval

In Coin subjects switch in 17% of the cases, while they switch in 18% of the cases in Random. This difference is not significant (MW-test, p-value = 0.53). The switching frequency differs significantly—goes up to 33%—in Choice (MW-test, p-value=0.03 compared to Coin and 0.07 compared to Random).Footnote 19 Hence, peer effects are significantly larger in Choice than in Coin and Random. This leads to Result 1.

Result 1

-

a) Peer effects are significantly stronger in Choice than in Random.

-

b) Peer effects do not differ significantly in Random and Coin.

Based on Result 1 a) we reject Hypothesis 0. Peer effects in risky choices are significantly different when decision makers can condition on the peer’s choices, relative to allocated lotteries as well as an irrelevant random draw. Surprisingly, peer effects are not significantly stronger when decision makers can condition on the peer’s allocated lotteries relative to her random draw.

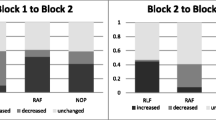

To examine where peer effects stem from we examine the strategies adopted by decision makers when switching. Figure 2 displays the frequency with which decision makers choose to (1) imitate the peer, (2) deviate from the peer or (3) revise their choice from Part I (irrespective of the peer).Footnote 20 Table 3 examines the determinants of strategies using a multinomial logit regression.

Adding the frequency of imitation and deviation reveals that decision makers condition their choice on the peer in 6.9% of the cases in Coin and in 10% of the cases in Random. This difference is not statistically significant, as shown in column (4) of Table 3. In contrast, decision makers condition their choice on the peer in 20.6% of the cases in Choice. The difference compared to Coin and Random is statistically significant (t-test, p-value=0.02, for Coin vs. Choice and t-test, p-value=0.06, for Random vs. Choice). Hence, focusing only on conditional choices, the effect of peers remains the same as outlined in Result 1. Conditional choices are significantly more prevalent in Choice than in Random and Coin.

If we turn to the direction of peer effects, we find, unsurprisingly, the frequency of imitation (3.6%) is similar to that of deviation (3.3%) in Coin, since there was no link between the random draw and the lottery of the peer. In comparison, in Random, the frequency of imitation increases to 8.9% and that of deviation decreases to 1.1%. The increase in imitation is marginally significant as displayed in Table 3, column (1). In Choice imitation is significantly more frequent, and occurs in 19.6% of the cases. The likelihood of imitation increases significantly in Choice relative to Coin. Further, it also increases significantly with respect to Random (t-test, p-value=0.06).

In contrast to imitation, deviation (column (2) of Table 3) and revisions (column (3) of Table 3) are not significantly different across treatments, relative to the decision to stay with Part I choice. Two lottery characteristics influence the decision to revise: (i) if the lottery has a probability of 0.5, the likelihood of revising decreases, and (ii) if the expected value of A is equal to or smaller than that of B ( f ≤ 1), it increases.

The findings so far are summarized below.

Result 2

-

a) Decision makers condition their choices on the peer significantly more frequently in Choice, compared to Random and Coin.

-

b) Imitation is the most frequent conditional choice in Random and Choice. It is significantly more frequent in Choice than in Random, and also more frequent in Random than in Coin.

Hence, when decision makers can condition their choices on peers we mainly observe an increase in imitation, relative to when they can condition on their allocated lotteries. At the same time, on the “intensive” margin, for those decision makers who condition, imitation is the most frequently used strategy in Random, but not in Coin. Thus, the results so far reveal that relative payoff concerns are present when the peer is allocated a lottery. However, actions of the peer matter in addition to their effect on payoffs.

Before we investigate whether the increase in imitation when the peer makes active choices is consistent with Hypotheses 1A or 1B, we briefly address switching behavior of first movers. First movers on average switch, i.e. change their lottery choice from Part I to Part II, in 12.9% of the cases in Coin and 11.7% in Choice. The difference across treatments is small and not statistically significant (MW-test, p-value=0.7).Footnote 21 Thus, treatment effects reported above are specific to second movers.

Since first movers were given the opportunity to record their choices in Part I, switching is unlikely to be driven by forgetfulness but could be explained by indifference or other kinds of mistakes (e.g., first movers changing their minds when making the same choice twice). An interesting question is whether the switching rate by first movers is similar to the rate of revisions by second movers.Footnote 22 If so, it would suggest that revisions by second movers could be interpreted as mistakes (or preference reversals) from Part I to Part II. As stated above, we do not find a difference in revisions by second movers across treatments. Further, the rate of revisions by second movers is 10.3% and 12.2% in Coin and Choice, which is similar and not statistically different from switching rates by first movers in the corresponding treatments, 12.9% and 11.7% (MW-test, p-value=0.28 for Coin and p-value=0.52 for Choice).

Overall, this analysis supports the conclusion above that the main effect of peers is to increase imitation by second movers. In what follows, we analyze the prevalence of imitation strategies in further detail.

3.3 Imitation

Figure 3 displays the average frequency of imitating the choice of A on the left-hand side, and the choice of B on the right-hand side, by treatment, respectively.

The first two main features of imitation in the data are that (i) the frequency of imitation of lottery B is on average higher than imitation of A, both in Random and Choice, and (ii) moving to Choice the average rate of imitation of A and of B increases. Thus, the data seems to be consistent with an overall importance of a social anchor, instead of fairness considerations shaping relative payoff concerns. To substantiate this conjecture, we regress the likelihood of imitation on the treatment, the lottery held by the peer, controlling for lottery characteristics. The results are presented in Table 4.

In particular, we are interested in the interaction term between Choice and imitation of B over all choices. This term is not statistically significantly different from zero, irrespective of whether we control for different probability panels, relative expected values, and certainty of lottery B. Further, estimated coefficients of these control variables are of negligible size and not significant. Overall, the regression result is clearly not consistent with Hypothesis 1A, but consistent with Hypothesis 1B.Footnote 23 This leads to Result 3.

Result 3

-

a) Imitation is on average more frequent when choosing the safe lottery B than when choosing the risky lottery A, in Random and Choice.

-

b) The increase in imitation in Choice is not significantly different when choosing B than A.

Result 3 a) constitutes an interesting and unexpected finding of this experiment, i.e. decision makers are more likely to imitate a safe choice compared to a risky choice of the peer, independent of the treatment. This suggests that the spread of risk-avoiding behaviors through peers could be stronger or faster than that of risk-seeking behaviors. Further, the fact that we find this effect in Random suggests that relative payoff concerns differ depending on the direction of risk, relative to the peer.

Result 3 b) is inconsistent with Hypothesis 1A, but consistent with Hypothesis 1B. This suggests that the increase in imitation when peers make choices is driven by a preference to conform. However, this is an indirect test of Hypothesis 1B, based on the aggregate data. A further test of Hypothesis 1B can be provided by structurally estimating a model of preferences that incorporates a social utility term. This enables us to use all individual decisions and test parameter restrictions across treatments.

In particular, the evidence so far suggests that (a) assuming decision makers derive a constant utility from conforming to others’ behavior (independent of payoffs), we should observe an increase in this utility from Random to Choice, and (b) assuming relative payoff concerns change in Choice compared to Random, we should observe a change in the parameters governing relative payoff concerns from Random to Choice. We test these conjectures by structurally estimating two models of social utility. All details about what follows can be found in Online Appendix C.2. In our estimation we assume the decision maker to exhibit utility that is additively separable into consumption and social utility. In a model of relative payoff concerns, we assume that negative payoff differences with respect to the peer enter negatively into utility and are weighted by a “social” loss aversion parameter λ ≥ 0, while positive payoff differences enter positively and have a weight of one. In a model based on social comparison theory we assume a constant utility γ from conforming to the peer’s choice. Based on decisions in Random and Choice we estimate these parameters, in distinct models, and test for treatment differences in λ and γ.Footnote 24

Our findings reveal that, in a model of relative payoff concerns, decision makers exhibit significant loss aversion with respect to their peer’s payoff ( λ > 1), but this disutility does not change significantly across treatments. In a model based on social comparison theory, decision makers gain significant utility from choosing the peer’s lottery ( γ > 0). Further, this utility is significantly larger in Choice compared to Random. In terms of goodness of fit, the model of relative payoff concerns is significantly inferior to a model based on social comparison theory. Overall, these results suggest that the substantial increase of peer effects when peers make active choices may be explained by a norm to conform to others.

4 Conclusion

This paper examines peer effects in risk taking. We test whether peer effects can be explained by preferences over others’ outcomes or whether preference interactions also depend on others’ choices, in addition to distributional concerns. Our main result is that peer effects increase significantly when peers choose among lotteries, relative to when they are allocated a lottery. This reveals that choices play a significant role, on top of payoffs. At the same time, imitation of the peer is the predominant strategy adopted by those who are affected by the presence of others. This suggests that peer effects in risk taking are explained by both relative payoff concerns and a direct preference over peer choices.

We examine two alternative explanations for why choices of peers matter. First, preferences over others’ payoffs might change if peers make choices. Alternatively, according to social comparison theory (Festinger 1954), peer choices might be perceived as a decision anchor and measure for “correctness”, giving rise to a norm to conform to others’ behavior. Comparative statics reveal that when moving from peer allocations to peer choices, imitation increases both of the safe and of the risky lottery. Hence, at the aggregate level, the increase in imitation when peers make choices is in line with a norm to conform to peers. Structurally estimating these models provides additional suggestive evidence for this result.

Our results contribute to understanding how peers affect risky choices, including stock market participation, investment choices and insurance purchases. They suggest that not only relative payoffs matter, but also the act of choosing between risky prospects. This can have important implications for the spread of risky choices. For example, it suggests that communicating others’ risky choices may have large consequences even in environments where all individuals are equally well informed. At the same time, it reveals that imitative behavior in risk taking is most likely to spread when peers make active choices. Hence, campaigns that give “gifts” to some individuals or endow them with a particular risky asset to leverage demand may only have limited success.

Another interesting finding of our study is that the relative risk position might matter for the willingness to imitate. In the experiment, imitation of the safe alternative appears most frequently, suggesting that peer effects might be more effective in the spread of risk-avoiding behaviors than of relatively risk-seeking behaviors. This first piece of evidence will hopefully initiate further research.

Overall, as argued by Shiller (1984), “investing in speculative assets is a social activity”. It is thus important to understand what “social” means to understand how others shape economic decisions under risk.

Notes

Peers might generally influence risk and other economic attitudes (Ahern et al. 2013). Peers also affect credit decisions (e.g., Banerjee et al. 2013; Georgarakos et al. 2012), savings decisions (e.g., Duflo and Saez 2002; Kast et al. 2012) as well as different teenager (risky) behaviors (for an overview, see Sacerdote 2011). Generally, peer effects are important in education (e.g., Sacerdote 2001; Duflo et al. 2011), in labor (e.g., Falk and Ichino 2006; Mas and Moretti 2009; Card et al. 2010), and pro-social behavior (e.g., Gächter et al. 2013).

To increase the salience of complete information in our experiment, instructions were read aloud, for both potential roles in the experiment, and roles were assigned randomly within the same session. Also, we designed the lotteries to have at most two outcomes to minimize complexity. For a given probability distribution over the good and bad outcome, there were always six pairs of choices, which featured the exact same risky lottery. In half of the situations the safe lottery had two outcomes, and only one in the other half. The number of outcomes of the safe lottery, which can be viewed as a measure of complexity, does not have a significant influence on peer effects.

There are a variety of studies examining social comparison effects in games such as public good games or coordination games (e.g., Falk and Fischbacher 2002; Falk et al. 2013). In social learning environments, Çelen and Kariv (2004) also study herding behavior, and identify substantial herding behavior.

In terms of risk preferences B cannot be labeled as safe since it does not necessarily yield a certain payoff. In comparison to A, we still label it as safe, for simplicity, as its variance is always smaller. But note that a risk averse individual does not necessarily prefer B over A.

Groups remain the same for the whole of Part II. All choices are made without any feedback until the end of the experiment. During Part I participants only know there will be a Part II in the experiment, but do not know anything about the decisions they will be asked to make. At the end of the experiment, individuals are informed about their payoff and, if Part II is drawn for payment, the choice and payoff of the other individual in the group. Throughout, we will refer to the peer as “she” and the decision maker as “he”.

An alternative definition of peer effect is to consider only imitation and deviation (conditional strategies) as peer effects, since revisions could be due to mistakes. In Section 3.2 we examine both types of definitions and find qualitatively similar results.

A similar control treatment was used by Cason and Mui (1998) to study social influence in dictator games. Also, we note that in the Coin treatment we can still examine four potential strategies of second movers in this treatment. However, in Coin the definition of imitation and deviation is arbitrary, as there is no direct link between the lottery choice of the decision maker and that of the peer.

More specifically, we conducted a Base treatment, in which choices were made twice, in Part I and Part II, without the strategy method and without social feedback. We also conducted an Anticipation treatment, without the strategy method, but where individuals were aware they would be given feedback about the peer’s choice at the end of the experiment. Consistent with the effects of our main treatments, we observe peer effects increase significantly with anticipated social feedback, from occurring in 6.7% of the decisions in Base to 17.5% in the Anticipation treatment (Mann-Whitney test, p-value=0.016).

Instructions for all treatments are available in the Electronic Supplementary Materials on the journal’s website. The raw data as well as the z-tree codes are included in the Electronic Supplementary Material as well.

To ensure credibility, one participant was randomly selected as assistant at the end of the experiment. The assistant drew one ball from an opaque bag containing balls corresponding to each part and from a second bag with balls corresponding to each decision problem. For each decision problem, the respective combination of black and white balls was put in an opaque bag and the assistant again drew one ball. Once all draws were done, payoffs were computed and subjects were paid out in cash.

This literature started with Veblen (1899) and Duesenberry (1949), who argued that conspicuous consumption choices can be explained by a desire to signal a superior status, prowess or strength. A game-theoretic literature has focused on the implications of status concerns on conspicuous consumption (see, e.g., Hopkins and Kornienko 2004) and conformity (see, e.g., Bernheim 1994). Here we focus on ex-post payoff differences between the decision maker and his peer, and measure strategy choices of decision makers, who make conditional choices for each of the two possible lotteries of the peer. Related studies on social preferences under risk (e.g., Trautmann 2009; Saito 2013) point out that individuals may exhibit ex-ante relative payoff concerns, i.e. dislike inequality in expected payoffs. In our setting, such concerns yield qualitatively the same predictions, since risks are perfectly correlated. By choosing the lottery of the peer, decision makers can equalize expected payoffs both in Random and Choice.

In the context of risk taking in the presence of others, whether individuals exhibit a desire to be ahead or not may depend on the situation (see Maccheroni et al. 2012, for a discussion). In our context, in which payoff differences are relatively small and the situation allows for a simple comparison with the peer, we would rather expect individuals dislike falling behind others, but enjoy being ahead. In Appendix A.1 we propose such a model in which decision makers are loss averse with respect to the peer’s outcome, and derive conditions under which peer effects are expected to occur. Note that assuming a dislike to being ahead of the peer would even strengthen the incentive to imitate the peer.

One may also consider intention-based social preferences as an alternative explanation for why choices matter for relative payoff concerns (see, e.g., Blount 1995; Bolton et al. 2005; Falk and Fischbacher 2006). In our experiment there is no scope for reciprocity and it hence is unlikely that intention-based preferences are a driver of behavior. However, if intention-based social preferences would play a role, we would predict these to increase the weight on (negatively valued) payoff differences in the decision maker’s utility when moving from Random to Choice, which in expectation crucially depends on how A and B relate in terms of their expected values. Hence, moving from Random to Choice, not only would this theory predict imitation increases, but also that the increase in imitation depends on f. We do not find evidence for this in our data.

According to Festinger, “an opinion, a belief, an attitude is ‘correct’, ‘valid’, and ‘proper’ to the extent that it is anchored in a group of people with similar beliefs, opinions and attitudes”; Festinger (1950), p. 272.

See Appendix A.2 for a straightforward model based on social comparison theory.

A detailed overview of choices in Part I is provided in Table 1 in Online Appendix C.1

We also controlled for consistency of decisions in Part I. If we assume that subjects have CRRA preferences and given the design of our lotteries, we can classify second movers as consistent or inconsistent decision makers. We find across different probability panels, controlling for certainty, that at most 15.4% of decision patterns are inconsistent. If we exclude inconsistent decision makers from our sample our results remain qualitatively the same.

At the individual level, the distribution of switching rates also differs across treatments. It is significantly different in Choice, compared to Random and Coin (Kolmogorov-Smirnov test, p-value=0.02 compared to Coin, p-value=0.09 compared to Random). But it does not differ significantly across Random and Coin (Kolmogorov-Smirnov test, p-value=0.96). Figure 1 in Online Appendix C.1 displays the distribution of switching rates by treatment.

Table 2 in Online Appendix C.1 displays the frequency of each strategy choice for each decision, by treatment.

In Random, the switching rate is close to 50%, since lotteries are randomly assigned to the peer with probability 0.5.

We thank a referee for this suggestion.

One might also argue that an increase in imitation from treatment Random to Choice might depend on the expected value of A relative to B. Intuitively, if agents exhibit relative payoff concerns and lottery B yields a higher expected payoff ( f < 1), the marginal increase in utility from imitation is stronger in magnitude in case the decision maker chooses B. This implies a stronger incentive to imitate B if f < 1 compared to f ≥ 1. We ran additional regressions, similar to the one presented in Table 4, distinguishing between lottery panels with f < 1, f > 1 and f = 1, and find that the interaction between Choice and imitation of B is only significant, and negative, when f = 1. That is, we do not find any systematic relationship between expected values and the increase in imitation. Details can be obtained from the authors upon request.

Another approach could be to simultaneously estimate parameters defining relative payoff concerns and an additional utility from conforming to the social anchor. However, imitation (or deviation) can very generally be explained by a positive (or negative) estimate of γ as well as by λ > 1 (or λ < 1). Identifying both parameters, for both treatments simultaneously, is not possible with our data, but would be an interesting task for future work. Another approach might be to estimate mixture models, a procedure that we applied in a previous version of this paper. Mixture models have been used to estimate risk preferences in heterogeneous populations, amongst others by Conte et al. (2011) and Harrison and Rutström (2009). However, in our setting, assuming heterogeneity with respect to whether decision makers derive a social utility or not causes the following concern. The probability to be of a certain type enters into the log-likelihood function as a multiplicative weight of the social utility, and in this way scales the estimates of λ and γ. Moreover, it leaves one additional degree of freedom.

References

Ahern, K.R., Duchin, R., Shumway, T. (2013). Peer effects in economic attitudes. Working Paper.

Ai, C., & Norton, E.C. (2003). Interaction terms in logit and probit models. Economics Letters, 80(1), 123–129.

Andreoni, J., & Sprenger, C. (2009). Certain and uncertain utility: The Allais paradox and five decision theory phenomena. Working Paper.

Banerjee, A., Chandrasekhar, A.G., Duflo, E., Jackson, M.O. (2013). The diffusion of microfinance. Science, 341 (6144).

Bault, N., Coricelli, G., Rustichini, A. (2008). Interdependent utilities: How social ranking affects choice behavior. PLoS ONE, 3(10), e3477.

Bernheim, B.D. (1994). A theory of conformity. Journal of Political Economy, 102(5), 841–877.

Bikhchandani, S., Hirshleifer, D., Welch, I. (1998). Learning from the behavior of others: Conformity, fads, and informational cascades. Journal of Economic Perspectives, 12(3), 151–170.

Blount, S. (1995). When social outcomes aren’t fair: The role of causal attributions on preferences. Organizational Behavior and Human Decision Processes, 63, 131–44.

Bolton, G.E., Brandts, J., Ockenfels, A. (2005). Fair procedures: Evidence from games involving lotteries. The Economic Journal, 115(506), 1054–1076.

Brandts, J., & Charness, G. (2000). Hot vs. cold: Sequential responses and preference stability in experimental games. Experimental Economics, 2, 227–238.

Bursztyn, L., Ederer, F., Ferman, B., Yuchtman, N. (2014). Understanding mechanisms underlying peer effects: Evidence from a field experiment on financial decisions. Econometrica, 82(4), 1273–1301.

Cai, J., De Janvry, A., Sadoulet, E. (forthcoming). Social networks and the decision to insure. American Economic Journal: Applied Economics.

Cappelen, A.W., Konow, J., Sorensen, E.O., Tungodden, B. (2013). Just luck: An experimental study of risk taking and fairness. American Economic Review, 103(4), 1298–1413.

Card, D., Mas, A., Moretti, E., Saez, E. (2010). Inequality at work: The effect of peer salaries on job satisfaction. NBER Working Paper.

Cason, T.N., & Mui, V.-L. (1998). Social influence in the sequential dictator game. Journal of Mathematical Psychology, 42, 248–265.

Çelen, B., & Kariv, S. (2004). Observational learning under imperfect information. Games and Economic Behavior, 47(1), 72–86.

Cialdini, R.B., & Goldstein, N.J. (2004). Social influence: Compliance and conformity. Annual Review of Psychology, 55(1), 591–621.

Cialdini, R.B., & Trost, M.R. (1998). Social influence: Social norms, conformity and compliance. The Handbook of Social Psychology, 55(2), 151–192.

Clark, A.E., & Oswald, A.J. (1998). Comparison-concave utility and following behavior in social and economic settings. Journal of Public Economics, 70, 133–155.

Conte, A., Hey, J.D., Moffatt, P. G. (2011). Mixture models of choice under risk. Journal of Econometrics, 162(1), 79–88.

Cooper, D.J., & Rege, M. (2011). Misery loves company: Social regret and social interaction effects in choices under risk and uncertainty. Games and Economic Behavior, 73(1), 91–110.

Duesenberry, J.S. (1949). Income, saving and the theory of consumer behavior. Cambridge: Harvard University Press.

Duflo, E., Dupas, P., Kremer, M. (2011). Peer effects, teacher incentives, and the impact of tracking: Evidence from a randomized evaluation in kenya. American Economic Review, 101(5), 1739–1774.

Duflo, E., & Saez, E. (2002). Participation and investment decisions in a retirement plan: The influence of colleagues’ choices. Journal of Public Economics, 85, 121–148.

Falk, A., & Fischbacher, U. (2002). “Crime” in the lab-detecting social interaction. European Economic Review, 46(4-5), 859–869.

Falk, A., & Fischbacher, U. (2006). A theory of reciprocity. Games and Economic Behavior, 54(2), 293–315.

Falk, A., Fischbacher, U., Gächter, S. (2013). Living in two neighborhoods – Social interaction effects in the laboratory. Economic Inquiry, 51(1), 563–578.

Falk, A., & Ichino, A. (2006). Clean evidence on peer effects. Journal of Labor Economics, 24(1), 39–57.

Fehr, E., & Schmidt, K.M. (1999). A theory of fairness, competition, and cooperation. The Quarterly Journal of Economics, 114(3), 817–868.

Festinger, L. (1950). Informal social communication. Psychology Review, 57, 271–282.

Festinger, L. (1954). A theory of social comparison processes. Human Relations, 7(2), 117–140.

Fischbacher, U. (2007). z-tree: Zurich toolbox for ready-made economic experiments. Experimental Economics, 20(2), 171–178.

Friedl, A., Lima de Miranda, K., Schmidt, U. (2014). Insurance demand and social comparison: An experimental analysis. Journal of Risk and Uncertainty, 48(2), 97–109.

Gächter, S., Nosenzo, D., Sefton, M. (2013). Peer effects in pro-social behavior: Social norms or social preferences? Journal of the European Economic Association, 11(3), 548–573.

Galí, J. (1994). Keeping up with the joneses: Consumption externalities, portfolio choice, and asset prices. Journal of Money, Credit and Banking, 26(1), 1–8.

Gebhardt, G. (2004). Inequity aversion, financial markets, and output fluctuations. Journal of the European Economic Association, 2(2-3), 229–239.

Gebhardt, G. (2011). Investment decisions with loss aversion over relative consumption. Journal of Economic Behavior and Organization, 80(1), 68–73.

Georgarakos, D., Haliassos, M., Pasini, G. (2012). Household debt and social interactions. Working Paper.

Goeree, J.K., & Yariv, L (2007). Conformity in the lab. Working Paper.

Harrison, G W., & Rutström, E. (2009). Expected utility theory and prospect theory: One wedding and a decent funeral. Experimental Economics, 12, 133–158.

Holt, C.A., & Laury, S.K. (2002). Risk aversion and incentive effects. The American Economic Review, 92(5), 1644–1655.

Hong, H., Kubik, J.D., Stein, J.C. (2004). Social interaction and stock-market participation. The Journal of Finance, 59(1), 137–163.

Hopkins, E., & Kornienko, T. (2004). Running to keep in the same place: Consumer choice as a game of status. The American Economic Review, 94(4), 1085–1107.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263–292.

Kast, F., Meier, S., Pomeranz, D. (2012). Under-savers anonymous: Evidence on self-help groups and peer pressure as a savings commitment device. IZA Discussion Paper, 6311.

Linde, J., & Sonnemans, J. (2012). Social comparison and risky choices. Journal of Risk and Uncertainty, 44(1), 45–72.

Maccheroni, F., Marinacci, M., Rustichini, A. (2012). Social decision theory: Choosing within and between groups. The Review of Economic Studies, 79, 1591–1636.

Manski, C.F. (2000). Economic analysis of social interactions. The Journal of Economic Perspectives, 14(3), 115–136.

Mas, A., & Moretti, E. (2009). Peers at work. The American Economic Review, 99(1), 112–145.

Rohde, I.M., & Rohde, K.I.M. (2011). Risk attitudes in a social context. Journal of Risk and Uncertainty, 43, 205–225.

Sacerdote, B. (2001). Peer effects with random assignment: Results for dartmouth roommates. Quarterly Journal of Economics, 116(2), 681–704.

Sacerdote, B. (2011). Peer effects in education: How might they work, how big are they and how much do we know thus far? Handbook of the Economics of Education, 46(3), 249–277.

Saito, K. (2013). Social preferences under risk: Equality of opportunity versus equality of outcome. American Economic Review, 103(7), 3084–3101.

Shiller, R.J. (1984). Stock prices and social dynamics. Brookings Papers on Economic Activity, 2, 457–498.

Sprenger, C (2012). An endowment effect for risk: Experimental tests of stochastic reference points. Working Paper.

Trautmann, S.T. (2009). A tractable model of process fairness under risk. Journal of Economic Psychology, 30(5), 803–813.

Trautmann, S.T., & Vieider, F. (2011). Social influences on risk attitudes: Applications in economics In Roeser, S. (Ed.), Handbook of Risk Theory: Springer.

Veblen, T.B. (1899). The Theory of the Leisure Class: An Economic Study in the Evolution of Institutions. New York: Macmillan.

Viscusi, W.K., Phillips, O.R., Kroll, S. (2011). Risky investments decisions: How are individuals influenced by their groups? Journal of Risk and Uncertainty, 43, 81–106.

Acknowledgments

We would like to thank Kenneth Ahern, Jim Andreoni, Daniel Clarke, Dirk Engelmann, Florian Englmaier, Fabian Herweg, Alex Imas, Martin Kocher, Johannes Maier, Jan Potters, Justin Sydnor, Stefan Trautmann, Lise Vesterlund and Joachim Winter for their useful comments as well as seminar participants at Royal Holloway, University of Bamberg, University of Gothenburg, University of Innsbruck, University of Munich, University of Pittsburgh, at the 2014 AEA Meetings, 2012 CESifo Area Conference on Behavioural Economics, 2012 European and North-American ESA Meetings, 7th Nordic Conference in Behavioral and Experimental Economics in Bergen, ESI Workshop on Experimental Economics II, the CEAR/MRIC Behavioral Insurance Conference 2012, the Risk Preferences and Decisions under Uncertainty SFB 649 Workshop, the 2013 theem meeting in Kreutzlingen, and the 2013 Workshop on Behavioral and Experimental Economics in Florence. We gratefully acknowledge funding from the Fritz Thyssen Foundation (Project AZ.10.12.2.097).

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Appendix A: Theoretical framework

Appendix A: Theoretical framework

1.1 A.1 A model of relative payoff concerns

Assume the utility in state j ( j ∈ {g, b}) of having chosen lottery i ( i ∈ {A, B}) and earning \({m^{j}_{i}}\), to be given by the sum of two terms: a consumption utility, which is solely determined by individual risk preferences, plus a social utility term, which depends on payoff differences. This implies \(v^{j}_{i,k}=u\left ({m^{j}_{i}}\right ) + R\left ({m^{j}_{i}}-{m^{j}_{k}}\right ),\) where k ∈ {A, B} is the lottery of the peer, and R(⋅) is a function of payoff differences and defined as follows:

The parameter λ captures how large losses with respect to the peer loom relative to gains. An individual’s expected utility from choosing lottery i is

where U i is the expected consumption utility of lottery i. If the peer holds a lottery that yields a lower consumption utility, the individual may nevertheless choose it, if he experiences a strong disutility from falling behind the peer, i.e. if λ is large enough. Let us define an individual’s strategy space as \(\mathcal {S}=\{\text {imitate} = (i; AA,BB),\, \text {deviate} = (i; BA,AB),\, \text {stay} = (i; iA,iB), \,\text {change} = (i; -iA,-iB); \,\text {for } i\in \{A,B\}\}\). Here i ( −i) denotes his (opposite) choice in Part I, and the tuple ik describes the choice of lottery i in Part II given that his peer has lottery k. Then, the cutoffs are given by the following proposition.

Proposition 1

Define \({\Delta }\equiv \frac {U_{B}-U_{A}}{p\delta }+\frac {(1-p)(c-\delta )}{p\delta }\) and \({\Theta }\equiv \frac {U_{A}-U_{B}}{(1-p)(c-\delta )}+\frac {p\delta }{(1-p)(c-\delta )}\) . An individual imitates if λ > max{Δ, Θ}. An individual deviates if λ< min{Θ, Δ}. An individual stays with his Part I choice otherwise.

Note that whether Δ is smaller or greater than Θ is determined by the individual’s choice in Part I, i.e. by his expected consumption utility U A and U B .

Proof

An individual imitates if V A, A > V B, A and V B, B > V A, B . V B, B > V A, B is equivalent to

V A, A > V B, A is equivalent to

Hence, for an individual to imitate it must hold that λ > max{Δ, Θ}.

Similarly, an individual deviates if V A, A < V B, A and V B, B < V A, B . It follows directly from above that this is satisfied if λ < min{Δ, Θ}. □

1.2 A.2 A model based on social comparison theory

Consider a model in which the closer the individual risky choice is to the social anchor, the more utility the individual derives. In a setting with only two options, this can be captured by an additional utility γ when the option chosen coincides with the social anchor. In particular, the expected utility of lottery i given the anchor k is

where 1(⋅) is the indicator function. (Cooper and Rege, 2011, also assume this form of utility when examining conformity.) Based on the argument above, we would expect γ to differ across treatments and γ C , in Choice, to be larger than γ R , in Random. This would generate an increase in imitation in Choice. Further, since the effect of γ is independent of lottery characteristics, we would expect the change in imitation across treatments to be symmetric with respect to the two available options, A or B.

Rights and permissions

About this article

Cite this article

Lahno, A.M., Serra-Garcia, M. Peer effects in risk taking: Envy or conformity?. J Risk Uncertain 50, 73–95 (2015). https://doi.org/10.1007/s11166-015-9209-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-015-9209-4