Abstract

This study uses data from the German Socio-Economic Panel to analyze peer effects in risk preferences. Empirical evidence on the impact of peer groups on individual willingness to take risks (‘peer effects’) is very limited so far as causality is hard to establish. To establish a causal relationship between individual and community risk preferences, we use an instrumental variables approach where we track the impact of the East–West migration after the German reunification. We find strong support for peer effects in risk preferences. Peer effects seem particularly relevant for women, less educated individuals, the young population, parents, and married individuals. Individuals with higher social interaction tend to have stronger peer effects. Our findings shed light on the origin and stability of risk tolerance and, more generally, on the determinants of economic preferences.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Ever since the prominent work by Friedman and Savage (1948) as well as Arrow (1962), it is well-known that individuals’ risk preferences have a significant impact on their decision-making under risk. Individuals’ attitudes towards risk are especially important when it comes to financial decisions, such as insurance and investment choices.Footnote 1 Based on Bernoulli’s assumptions and utility theory, most studies analyze decision-making under risk at the individual level. However, peers may play a role leading to a deviation from individual decision-making. The existence of peer effects is very well documented in the literature (see, e.g., Sacerdote 2001), and peer effects supposedly exist in different group settings such as workplaces, schools, and universities as well as in local communities. Our peers shape our financial investments (see, e.g., Brown et al. 2008), our work productivity (see, e.g., Falk and Ichino 2006), and our retirement decisions (see, e.g., Duflo and Saez 2002), just to name a few. All these economic decisions have one thing in common: They are all decisions under risk and uncertainty even though previous studies have rather focused on observing actual behavioral outcomes than potential underlying changes in risk preferences. Accordingly, it is still unclear whether peer effects in the area of decision-making under risk operate at the outcome level or by modifying the underlying risk preferences, or both. Knowing how our peers impact our decisions under risk and uncertainty is a crucial factor to better understand economic decision-making.

We are aware of only experimental studies on the influence of peers’ risk preferences on individual risk preferences. While two recent small-scale field studies explicitly investigate the strength of peer effects in risk preferences of students (Ahern et al. 2014; Balsa et al. 2015), other studies in this field rather focus on individuals’ internal motivation for adapting their behavior to peers, comparing distributional social preferences and social norm-based preferences. We contribute to this literature by investigating peer effects in risk preferences within a large panel survey dataset. We aim to establish a causal relationship between community and individual willingness to take risks (WTR) using a representative sample of the German population from the Socio-Economic Panel (SOEP) study. In contrast to Ahern et al. (2014) and Balsa et al. (2015), we examine peer effects in risk preferences in local communities rather than in academic settings with students. For our purpose, we use data at the federal state level. In addition, we utilize a self-reported measure of risk preference that has been shown to have better stability over time and higher predictive validity than behavioral measures of risk preference, as discussed in a meta study by Mata et al. (2018).Footnote 2

We identify peer effects based on the influence of East–West migration on West German communities after the fall of the Berlin wall in 1989.Footnote 3 We benefit from the unique historical setting with the German division and its later reunification that offers a natural split. Natural dichotomy makes sure that people moving to West Germany after the fall of the Berlin wall do not share the same background with people living in West Germany before the reunification. We are able to establish a causal relationship between individual and community risk preferences by showing that a native individual adapts to peers’ risk attitude.Footnote 4 Following Brown et al. (2008)’s instrumental variables approach, we rule out other factors than peer effects, such as same preferences or common reactions to public information, that could lead to a spurious correlation between one’s own risk attitude and that of one’s neighbors. Since individuals are not randomly assigned to communities, the observed correlation between the WTR of an individual and her community could reflect a variety of unobservable influences that induce a spurious correlation even after controlling for observable characteristics. Unobserved characteristics could drive both individual and community risk preferences. In order to ensure that the independent variable average WTR in a community can be treated exogenously in the second-stage regression, the instrument may only be correlated with the independent variable (i.e., the community WTR), but not with the dependent variable (i.e., the individual WTR). We use the lagged average WTR of non-native neighbors’ original federal states as an instrument for community WTR. Our instrument is motivated by Guiso et al. (2004) and Brown et al. (2008), and is thus based on the assumption that the average risk attitude in a person’s original federal state is potentially highly correlated with her current risk attitude due to long-lasting effects of the original federal state. Therefore, when an individual moves from one federal state to another, her risk preferences are very likely to be shaped by the federal state in which she has lived for a long time. This is particularly the case for people who have lived in former East Germany all their lives or many years prior to the fall of the Berlin wall. When moving to a western federal state, an individual becomes part of a new community and contributes to this community’s average WTR which is correlated with her original federal state’s WTR through her influence on this western community. However, there is no reason why a West German native’s variation in individual WTR should be influenced by variation in average WTR of East German federal states except through their effects on this individual’s non-native neighbors. Particularly in our case, risk attitudes in East and West Germany are unlikely to be correlated with each other prior to the German reunification. This way, we are able to track how differences in risk preferences in the place of origin of the movers impact their local western communities.

This study contributes to prior literature by giving empirical insights into the consequences of peer interaction on individual risk preferences. It improves the understanding of peer effects in risk attitudes by providing causal inference of large-scale community peer effects in a representative measure of the German population. Previous studies in economics have focused on peer effects in different settings. Exploring peer effects in risk attitudes is highly relevant for understanding the stability of individual preferences and, more generally, the determinants of economic preferences. While the impact of peer groups on risk aversion has already been studied experimentally for particular subgroupsFootnote 5, we estimate peer effects in risk preferences in local communities of grown individuals using a large representative panel dataset of the German population. The representative sample allows for assessing the strength of peer effects for different groups. Our article contributes to growing literature on peer effects in economics over the last 20 years, including an increasing number of papers on risk attitudes or risky choices, while having some innovative features: the representative sample, the opportunity to control for covariates, and the innovative estimation strategy. Following the research body on peer effects, we expect that an individual’s risk attitude changes when an interaction with potential peers takes place, which may lead to a deviation from original risk preferences. Our study confirms that a change in overall WTR in a region changes the WTR of the West German native residents in this region. This finding seems to be particularly driven by females, parents, the young population as well as married and less educated people. Individuals with higher social interaction tend to exhibit stronger peer effects.

This article is structured as follows. The next section reviews related literature on the formation of risk attitude, factors associated with changes in risk attitudes, and peer effects; the section also develops general hypotheses resulting from the review. Section 3 introduces the dataset which is suitable for answering the raised research questions and the variables of interest. Our empirical approach is presented in Sect. 4. In Sect. 5, we summarize our empirical results. Section 6 shows a number of robustness checks on the data to confirm the validity of our results. The last section discusses the results and concludes.

2 Related literature and hypothesis development

While almost all economic models assume that individuals only care about their own well-being, there is ample evidence that people also care about others (e.g., Rabin 1993; Trautmann 2009). When it comes to decision-making under risk, peer effects occur if the decision maker chooses not to stay with her individual choice (Lahno and Serra-Garcia 2015). Fairness motives influence the behavior of individuals so that decision-making under risk should not only be examined at an individual level but rather incorporate others’ decisions and economic attitudes (see, for instance, Ahern et al. 2014). Recent studies focus on individuals’ internal motivation for adapting their behavior to peers, comparing distributional social preferences and social norm-based preferences. Manski (2000), for instance, states that, in an environment with complete information, preference interaction may arise from ‘everyday ideas’ such as envy (i.e., individuals care about others’ outcomes) and conformity (i.e., individuals care about others’ choices). Studies in social psychology show that individuals’ decisions may be driven by social norms (e.g., Cialdini and Trost 1998; Cialdini and Goldstein 2004) rather than rational expected utility maximization, which supports Festinger (1954)’s idea of a social anchor to which individuals usually conform. However, less attention has been given to preferences where peers’ choices have a direct impact on individual behavior. Instead, envy is seen as a central concept in models of distributional social preferences, such as in Fehr and Schmidt (1999)’s model of inequity aversion. Viscusi et al. (2011)’s experimental results indicate that simply observing group investment decisions affects individual decision-making, which leads to a shift away from individual choices in isolation. Lahno and Serra-Garcia (2015) investigate the drivers of peer effects by distinguishing between the two sources envy and conformity. The authors show in an experimental setting that peer effects in risk preferences can be explained by both relative payoff concerns and a preference to conform to others. Peer choices thus are important in generating peer effects and have important policy implications. While the above-mentioned studies examine the drivers of peer effects in risk preferences, relatively little is known about the underlying reason for adaptation of behavior. Do peers influence individuals’ behavior, their perception of alternatives and social norms, their risk perception, or their risk tolerance? This paper concentrates on the latter by investigating whether peers do (also) influence the underlying risk attitude of individuals.

A growing literature has been focusing on trying to establish causal peer effects when it comes to decision situations. The literature on how peers may impact individuals’ decision-making processes stems from diverse disciplines, not only economics and psychology. To summarize, peers are known to have an impact on stock market participation (e.g., Shiller 1984; Hong et al. 2004; Brown et al. 2008), investment decisions such as pension plans, savings, and credits (e.g., Duflo and Saez 2002; Banerjee et al. 2013; Bursztyn et al. 2014; Georgarakos et al. 2014; Heimer 2014) as well as insurance choices (Cai et al. 2015). For instance, Cai et al. (2015) find that social networks have an impact on the adoption of a new weather insurance product and that this network effect is driven by the diffusion of insurance knowledge rather than purchase decisions. Furthermore, there exist peer effects in education (e.g., Sacerdote 2001; Zimmerman 2003), labor market participation (e.g., Card et al. 2012) as well as in health (e.g., Trogdon et al. 2008). We explore a different channel for peer effects by focusing on economic attitudes rather than on behavioral outcomes.

Using experimental approaches, Ahern et al. (2014) and Balsa et al. (2015) find evidence for risk aversion being driven by peer interaction. Ahern et al. (2014) state that peers might generally influence individual risk preferences in a repeated survey on MBA students who were randomly assigned to project groups. They attribute these positive peer effects to a desire for conformity. In contrast, Balsa et al. (2015) estimate peer effects in risk attitudes in a sample of high school students using lottery choices. We test whether we can also observe the existence of peer effects in risk preferences in local communities of grown individuals. Given that peer effects seem to build on the diffusion of information, opinions, and knowledge in a community, we formulate the following hypothesis:

Hypothesis 1

Peer groups affect individual willingness to take risks.

Following Hong et al. (2004) and Brown et al. (2008), we aim to investigate the role of sociability in peer effects in risk preferences. It seems intuitive that individuals with higher levels of peer interaction have greater peer impacts than individuals with less social interaction. This idea follows Scherer and Cho (2003) who find that social linkages in a community play an important role in the formation of individuals’ risk perception. Individuals with higher levels of peer interaction, ceteris paribus, are thus predicted to have greater peer impacts when compared to individuals with less interaction. We posit the following hypothesis:

Hypothesis 2

Peer effects are stronger for more sociable individuals.

We then hypothesize about the magnitude of peer effects for male and female native individuals. Interestingly, as shown by Booth and Nolen (2012b), risk preferences of women seem to differ significantly from those of men and may be even more strongly affected by the gender structure of their peer group. This suggests that women are more social, differ in their level of competitiveness when compared to men, and are thus overall more susceptible when it comes to risk preferences. Cárdenas et al. (2012) show that Swedish girls tend to be more competitive than boys in terms of performance change, while boys are more likely to choose to compete in general. However, this is not the case for Colombian children. Booth and Nolen (2012a) also do not find evidence for a difference in the level of competitiveness between men and women. Thus, observed gender differences in behavior under risk and uncertainty might reflect social learning rather than inherent gender traits (Booth and Nolen 2012a). Furthermore, according to Cárdenas et al. (2012) and Charness and Gneezy (2012), females tend to be more risk averse than males. This could lead to females being more likely to ask for advice in the community.

In the studies on gender effects, we cannot find clear evidence for men or women being more prone to peer effects in general, as the findings seem to be context-dependent. With respect to academic outcomes, Hoxby (2000) and Lavy and Schlosser (2011) find that the presence of more females in school classrooms improves male and female learning outcomes equally. The exact mechanism of gender on peer effects is, however, hard to disentangle and gender effects have mostly been examined for children and adolescents. Duflo and Saez (2002) suggest that peer effects in retirement decisions are more dominant among an individual’s own gender group. Only one study exists which investigates gender with regard to peer effects in risk preferences: Balsa et al. (2015) show that male adolescents are more prone to peer effects in risk aversion. As there is only one previous paper investigating the difference and there may be some conceptual differences in how gender affects peer effects in risk preferences among grown adults, we formulate the null hypothesis assuming no gender differences and test whether we will have to reject it:

Hypothesis 3

Peer groups have the same impact on female willingness to take risks and male willingness to take risks.

3 Data and variables

3.1 Data

We use the SOEP to test our hypotheses. The SOEP is a representative panel dataset of the resident adult population living in Germany. It is published by the German Institute for Economic Research in Berlin containing information on approximately 30,000 individuals living in about 11,000 households.Footnote 6 The survey has been conducted on a yearly basis since 1984. The sample has been extended in 1990 due to the German reunification including around 2000 East German households. Each year between January and May, individuals are asked for a wide range of personal and household information, including financials, lifestyle, and health status, and for their attitudes on assorted topics including political and social issues. The SOEP contains information on socio-demographic factors such as age, wealth, educational level, and marital status. In addition, it records individuals’ self-reported WTR and tracks changes in residence. Data is provided at the federal state level. For our purposes, we use the 2004, 2006, and 2008–2015 waves of the SOEP as they comprise information on the self-assessed WTR. Our dataset consists of 2226 individuals aged 18 years or older (or turning 18 in the year they participate in the survey for the first time) and includes 17,980 person-year observations.

3.2 Willingness to take risks (WTR)

To elicit an individual’s risk attitude, the SOEP asks its respondents to self-assess their WTR on a scale from 0 to 10, with 0 representing no tolerance for risks and 10 representing the highest willingness to be exposed to risks. The self-reported WTR was first included in 2004, was included again in 2006, and has been included yearly since 2008. Figure 1 shows the survey question for self-assessment of risk tolerance in the SOEP questionnaire.

Source: SOEP v32.1, SOEP (2016)

Self-assessed WTR.

We use the individual risk tolerance level as dependent variable. Figure 2 illustrates the distribution of this variable lying between 0 and 10.

Figure 3 shows that the average WTR over years differs between federal states ranging from 4.0 to 5.0. On average, Rhineland-Palatinate is the most risk-averse federal state, while people in Saarland are most willing to take risks.

Even though incentivized lottery choices are considered the method of choice to elicit risk preferences for many economists, the self-reported WTR has been shown to be a valid measure in large, longitudinal surveys by, for instance, Dohmen et al. (2011), Lönnqvist et al. (2015), and Vieider et al. (2015). Mata et al. (2018) find in a meta study that self-stated risk preferences outperform lab-elicited preferences in terms of retest stability, convergent validity, and predictive validity. As we investigate longitudinal data, relying on a measure with improved retest stability is a crucial factor for increasing the chance of significant results.

3.3 Sociability

As we expect peer effects to be stronger for more sociable individuals, we identify variables that reveal how social people are and how regularly they are in touch with others. For our purpose, we define a sociability index that indicates whether individuals tend to ask their community or neighbors for advice when making a decision under risk and uncertainty. Following Hong et al. (2004) and Brown et al. (2008), who show that individuals who visit their neighbors or attend church have higher levels of stock market participation, and that this effect is stronger for individuals who live in more sociable regions, we investigate whether peer effects are stronger for residents interacting socially with others. As argued above, social people can be expected to more likely adapt to neighbors’ risk attitude. The SOEP provides information on the following seven variables: attend church or other religious events; attend cultural events; perform volunteer work; participate in local politics; attend cinema, pop and jazz concerts; hours spent on hobbies in leisure time (on weekdays); and visit neighbors and friends. We form three categories each–never (0), less frequently (1), and every week (2)–and add up these values to construct our sociability index. For variables that are not defined for all years, we interpolate the missing interim values by using the values for all years given or by forming the mean of the years before and after.Footnote 7 Figure 4 shows the distribution of the sociability variable. While 0 indicates an individual not being sociable at all, 14 refers to a very social individual.

3.4 Definition of natives and movers

We differentiate between inhabitants from federal states of former West Germany (i.e., Baden-Wuerttemberg, Bavaria, Bremen, Hamburg, Hesse, Lower Saxony, North Rhine-Westphalia, Rhineland-Palatinate, Saarland, and Schleswig–Holstein) and those of former East Germany (i.e., the newly-formed German federal states Brandenburg, Mecklenburg-Vorpommern, Saxony, Saxony-Anhalt, and Thuringia) in order to establish exogeneity as best as possible.Footnote 8 This ensures that the instrumental variable is only correlated with the independent variable (i.e., the community WTR), but not with the dependent variable (i.e., the individual WTR). Since we restrict our sample of western community to natives, there is no reason why a native’s WTR should be influenced by the average WTR of East German federal states except through their effects on her non-native neighbors. Particularly in our case, risk attitudes in East and West Germany are unlikely to be correlated with each other prior to the German reunification. Following Hunt (2006), Berlin is excluded from our sample due to its division in East and West Berlin before the fall of the Berlin wall.Footnote 9 We exploit the ‘reallocation’ of many former GDR citizens after the fall of the Berlin wall in 1989. Natural dichotomy makes sure that people moving to West Germany after the fall of the Berlin wall do not share the same background (e.g., a simultaneous, correlated response across regions to the release of new information) with people living in West Germany before the reunification. Consequently, we benefit from the unique historical setting with the German division and its later reunification that offers a natural split.

In contrast to Brown et al. (2008), we cannot observe birth federal states in our sample. Therefore, we utilize the former separation into East and West Germany and denote the East German federal state in which a person lived at least five years before moving to West Germany as original federal state.Footnote 10 We track the East German federal states in which the GDR migrants lived and calculate weighted averages for each western community depending on where eastern migrants came from.Footnote 11

The definition of a community and the resulting differentiation between ‘movers’, ‘natives’, and ‘incoming movers’ are crucial for our analysis. We define these terms in the following manner:

-

‘Movers’ are individuals who move from any one of the 16 federal states to any other federal state,

-

‘natives’ are individuals that have lived in the same western federal state over the entire observation period from 1989 through 2015 (i.e., even before the fall of the Berlin wall), and

-

the term ‘incoming movers’ refers to those individuals that have lived in former East Germany for at least five years and then moved to any one West German federal state sometime afterwards.

Thus, an ‘incoming mover’ is always a ‘mover’, but not vice versa. A ‘mover’ could be a person moving from Bavaria to Baden-Wuerttemberg, while an ‘incoming mover’ is a person moving from a former East German federal state (e.g., Saxony) to a former West German federal state (e.g., North Rhine-Westphalia). Furthermore, an individual that is not a ‘native’ can be classified as ‘mover’ when referring to the West German population, while only under certain conditions we can also call her ‘incoming mover’.Footnote 12 To provide a highly simplified example, consider a native individual A who has lived in Munich over the entire observation period from at least 1989 through 2015 and who has therefore lived in the federal state of Bavaria all along.Footnote 13 Suppose that individual A has neighbors B, C, and D who currently live in the federal state of Bavaria, and who are originally from the federal states Bavaria, Saxony, and Saxony-Anhalt, respectively. We define the community risk attitude for individual A to be the average WTR of individuals B, C, and D. However, because individual B has lived in Bavaria since at least 1989, we do not include individual B’s origin-state WTR as part of our instrument. Individuals C and D, by contrast, are included in our instrument because they are non-natives. Thus, in the first stage of our regression, we regress the average WTR of the community in which individual A lives upon the lagged average WTR in the federal states from which the non-local neighbors came (in this case, the average of the WTR measure in Saxony and Saxony-Anhalt). Consequently, while our sample is restricted to natives, the average WTR in a community is constructed by adding up all inhabitants’ WTR in a particular federal state, including former East Germans’ risk attitudes (i.e., WTR of incoming movers), and dividing it by the number of inhabitants. The instrument is the one-year lagged average WTR of incoming movers’ former eastern federal states.

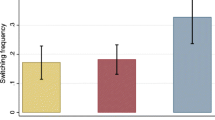

We expect risk attitude to be relevant for the choice to move or to stay in a particular federal state. Figure 5 shows the distributions of WTR for West German natives and movers (i.e., people moving from any one federal state to another). We use the two-sample Kolmogorov–Smirnov test to determine if there are differences in the distribution for both groups. The p-value for the combined test is 0.089, such that the hypothesis that the two distributions are equal cannot be rejected. However, movers and natives can still differ, for example, with respect to their median value, which is the case here.Footnote 14 The correlation coefficient between being a native resident in former West Germany and WTR is -1.7%, albeit statistically significant. We therefore conclude that there is no economically relevant correlation. In contrast to Jaeger et al. (2010), we find no clear evidence for higher WTR and migration being associated as the relationship does not explain very much. This may stem from the rich dataset that is used.Footnote 15

Figure 6 shows boxplots for the explanatory variable WTR_community per federal state. It indicates that there is significant variation of average WTR across federal states. Variation seems to be even more pronounced in former East German federal states. The instrument uses data on the East German federal states’ WTR to estimate community WTR and this variation then draws the identified effects. In order to have a closer look at the instrumental variable used to estimate WTR in the community, Fig. 7 presents boxplots for the instrument across West German federal states.Footnote 16 This figure illustrates the variation in our utilized instrument, which then drives the identified peer effects in a second step. Note that the median value as well as the maximum and the minimum of both WTR within community and the instrument significantly differ with respect to federal states.

4 Empirical analysis

4.1 Methodology

We analyze peer effects by investigating the impact of a community’s risk attitude on the individual residing in this community. Individuals, however, are not randomly assigned to communities. Thus, the observed correlation between individual and community risk attitude could reflect unobservable influences (e.g., a common reaction to public information) that induce a spurious correlation. Furthermore, a main challenge to adequately capture peer effects is to separate geographic clustering from peer effects. Reverse causality has to be ruled out so that people do not move as they want to live close to people with similar risk attitudes (i.e., geographic clustering), but rather adapt their risk attitudes when moving from one area with a different level of risk attitude to another (i.e., peer effects). Our instrumental variables approach overcomes a potential endogeneity problem.Footnote 17

For our purpose, we use SOEP data at the federal state level, which is representative of the entire German population within almost all areas (Knies and Spiess 2007).Footnote 18 Note that it contains only a small number of observations regarding postal or county code analysis due to few people moving from one region to another.Footnote 19 Using WTR as dependent variable and average WTR within a community as explanatory variable, we run an instrumental variables regression with clustered standard errors at the individual level to account for potential within-individual error correlation.Footnote 20 The Hausman test indicates the necessity to use a fixed effects approach. Since our sample is restricted to natives, the individual fixed effects also control for time-invariant community characteristics. In addition, we use a combined measure of individual sociability, which we discussed in Sect. 3.3, to consider social interaction among people located close to each other (Hong et al. 2004; Brown et al. 2008). Hong et al. (2004) and Banerjee et al. (2013), for instance, state that social interaction may serve as a mechanism for information exchange by means of word-of-mouth communication or ‘observational learning’. In comparison to Brown et al. (2008), who focus solely on church attendance, our measure of sociability is more targeted at the German population.Footnote 21

Our empirical strategy follows Brown et al. (2008), who use an instrumental variables estimation to analyze the impact of peer effects in investment decisions. The authors suggest that the stock market participation of one’s birth region can have long-lasting effects on one’s own financial decisions regarding the stock market. They instrument for the average ownership within each native individual’s community with the average ownership of the birth states of non-native neighbors. Our focus is on the German population, exploiting the relocation of many former GDR citizens after the fall of the Berlin wall in 1989. We strategically use the East–West migration after the German reunification instead of out-of-state movers in the United States. As briefly mentioned in the introduction, we consider whether individuals living in a West German federal state since 1989 (before and after the German reunification) adapt their WTR to their community’s risk attitude by allowing for East–West migration. Former East Germans moving in this western region thereby allow us to define an instrumental variable that is not correlated with a native’s WTR.Footnote 22

As we restrict our sample of western community to natives, there is no reason to suspect that a native’s individual WTR will be correlated with the average WTR in East German federal states except through their effects on her non-native neighbors. For instance, if one has lived in Frankfurt one’s entire life and one’s neighbor is from Brandenburg, it is reasonable to think that the level of risk attitude in Brandenburg may be correlated with that neighbor’s risk attitude, but there is no reason to think that the level of risk attitude in Brandenburg should affect one’s own risk attitude unless word-of-mouth effects are at play (see Brown et al. 2008). The average risk attitude in an individual’s original federal state is potentially highly correlated with individual risk attitude due to long-lasting effects of the original federal state. We therefore instrument for the average risk attitude within a community with the average risk attitude of non-native neighbors’ original federal states. The one-year lagged instrument looks as follows:

with \( m \in \left\{ {1,2,3, \ldots ,M} \right\} \) representing all incoming movers (i.e., the individuals emigrated from East Germany) to a region r. For each individual in our model, which we introduce later in this section, we assign the corresponding region in which this individual lives. For our purpose, the one-year lagged average WTR of non-native neighbors’ original federal states serves as an instrument so that WTR within a community can be treated exogenously in the second-stage regression of the 2SLS estimation.

In the first stage of our instrumental variables estimation, we regress the average WTR of a native individual’s community on the average WTR of original federal states of this community’s former GDR citizens. This instrument allows us to estimate the WTR in the community in a first step in order to treat this variable exogenously in the second stage of our instrumental variables approach. In this way, we are able to rule out sorting effects, that is, individuals potentially are more likely to move into communities where people have similar preferences. We also add all exogenous controls from the second-stage regression for factors that have been shown to impact the WTR as well as individual fixed effects, αi, and year fixed effects, δt. Accordingly, we have the following first-stage regression model with the instrument average WTR of non-native community members' original federal states (one-year lagged):

with \( i \in \left\{ {1,2,3, \ldots ,N} \right\} \) and \( t \in \left\{ {1,2,3, \ldots ,T} \right\} \) where N is the number of individuals and T is the number of years. Note that r is the region in which individual i lives. \( WTR_{r,t} \) refers to the average WTR in the western federal state r in year t.Footnote 23 In the following, \( WTR_{i,t} \) is our outcome variable—individual i’s WTR in year t. Our set of control variables is denoted by \( X_{i,t} \) for time-varying individual controls and \( X_{r,t} \) for time-varying community controls, which will be presented in Sect. 4.2. \( \varepsilon_{i,t} \) represents the error term.

In the second stage, we regress individual WTR on the estimated WTR in the community. For our purpose, we use an individual’s level of sociability and interact it with average WTR in the community and additionally include both single variables. We run a year and individual fixed effects model with clustered standard errors. Again, by restricting our sample to natives, individual fixed effects also control for time-invariant community characteristics. We receive the following second-stage regression model:

with \( i \in \left\{ {1,2,3, \ldots ,N} \right\} \) and \( t \in \left\{ {1,2,3, \ldots ,T} \right\} \) where N is the number of individuals and T is the number of years. The results of our instrumental variables estimation are shown in Sect. 5. In the following, we introduce our set of control variables \( X_{i,t} \) and \( X_{r,t} \).

4.2 Control variables

The survey data include a variety of socio-demographic indicators that can be controlled for and that have been found to be associated with risk preferences in previous studies. In the present analysis, we use data for the years 2004, 2006, 2008, 2009, 2010, 2011, 2012, 2013, 2014, and 2015.Footnote 24 As individual fixed effects control for unvarying characteristics, we, for instance, do not have to account for individuals’ sex.

The data include the control variables inflation-adjusted incomeFootnote 25, educational attainment, occupation, type of employment, home ownership, family status as well as dummy variables for German nationality and living in an urban areaFootnote 26. In addition, we account for the number of children per household that qualify for child allowance, age, squared age, as well as a dummy variable for living in one of the five largest German cities (\( plz\_majorcities \)) to differentiate between city dwellers and provincialsFootnote 27. Family status, for instance, is found to be associated with the level of risk attitude of individuals (see, e.g., Halek and Eisenhauer 2001; Browne et al. 2019). Furthermore, it has been repeatedly shown that married individuals are more risk averse (see, e.g., Cohn et al. 1975; Riley and Chow 1992; Lin 2009). We include individuals’ marital status to account for family structure by differentiating between single, married, widowed, and divorced persons. The omitted category is single.

We differentiate between blue-collar employees, white-collar employees, civil servants, and self-employed individuals to incorporate individuals’ occupational status in our analysis. Moreover, we control for traineesFootnote 28 and retirees as well as for individuals without any gainful employment. We distinguish between those having no job despite being able and willing to work, which we refer to as unemployed people, and those who are currently not looking for work, such as housewives and disabled people. The omitted category in our analysis is blue-collar workers.

We account for the level of educational attainment by controlling for individuals who received a German Abitur. The German Abitur is the highest certificate awarded to high school graduates.Footnote 29 Other school-leaving certificates awarded to graduates, such as a medium school degree (i.e., the German Realschulabschluss) or a low school degree (i.e., the German Hauptschulabschluss), do not qualify for university enrollment. We use the medium school level as a reference category.Footnote 30

Concerning time-varying community characteristics, we include the share of former East Germans in western communities as well as the average income. Furthermore, we control for the share of German citizens, the share of people living in urban areas, and the share of unemployed people in western communities.

4.3 Summary statistics

Table 1 presents the descriptive statistics of the variables used in our analysis. The statistics are reported for the group of West German natives.Footnote 31

5 Results

This section reports and discusses our empirical findings. Table 2 shows the ordinary least squares (OLS) regression results without accounting for an instrumental variable. The effect of average risk attitude in the West German community on the native individual is significant at the 1% level and positive throughout all three models. While Model 1 only includes individual fixed effects, Model 2 adds year fixed effects and Model 3 additional control variables presented in Sect. 4.2.Footnote 32 The coefficient estimates are very similar in size in Models 2 and 3, but much greater in Model 1. Year fixed effects seem to be relevant which is not surprising given that the observation period spans the global financial crisis.

As discussed before, we implement an instrumental variable to address a potential endogeneity problem. Table 3 summarizes the results of the first-stage regression. In this first stage of our instrumental variables estimation, a high correlation between the instrumental variable and the average WTR within a community can be identified. More precisely, the one-year lagged average WTR of non-native neighbors’ original federal states serves as an instrument so that WTR within a community can be treated exogenously in the second stage. Model 1 estimates the impact of the instrument without any controls and year fixed effects. We find the instrument to be highly significant, with a coefficient estimate of 0.355. Model 2 adds year fixed effects to the analysis, which can be important as we investigate the WTR during times of the global financial crisis as well as the European sovereign debt crisis. Year fixed effects control for the interdependencies between WTR and economic and financial conditions, which have been shown to be important.Footnote 33 Again, we find our instrument to be significant at the 1% level and the coefficient estimate equals 0.426. Model 3 adds additional control variables. We find the results highly comparable to Model 2 in terms of significance levels and coefficient estimates, which should be interpreted as an indicator of robustness of our empirical findings. In summary, the estimates for our instrument are highly robust and we therefore conclude that the instrument is an adequate measure of community’s risk preferences for our second-stage estimation.

Table 4 summarizes the results from the second-stage regression. In this main part of our analysis, we find strong empirical evidence for peer effects in risk preferences. Therefore, Hypothesis 1 can be confirmed. A major insight is that the instrumented WTR_community is significant at the 1% level in all four models that are used for analysis. As indicated by the fourth column in Table 4, a one-point increase in WTR within a community leads to an increase of individual WTR in this community by 0.810 points. However, we cannot confirm peer effects to be stronger for more sociable individuals as the positive coefficient is found to be significant only at the 10% level throughout all three models that include the interaction term.Footnote 34 Evidence is inconclusive with respect to Hypothesis 2.

Table 5 shows the second-stage regression results for the full sample (i.e., column (4)) from Table 4, while columns (4.1) and (4.2) refer to a subsample of male and female individuals, respectively. We find that peer effects in risk preferences are particularly relevant for female individuals. For male individuals, the magnitude of peer effects is more than twice as small and nonsignificant.Footnote 35 Hence, Hypothesis 3, which states an equal impact of peer groups on the risk preferences of men and women, is rejected. Instead, we conclude that peer effects in risk preferences are stronger for females than for males. Our results are contrary to Balsa et al. (2015), who find evidence of peer effects in risk aversion for male individuals in a sample of adolescent high school students in Uruguay. The authors do not find robust results with respect to females. While Balsa et al. (2015) investigate gender differences experimentally and focus on adolescents, we test those empirically using data from a representative sample of the German population, which may explain the difference in the results.

6 Robustness

6.1 Definition of sociability

When we use another definition of sociability including only two variables (church attendance and neighborhood and friends visits), peer effects in risk preferences remain significant at the 1% level, while the magnitude of the coefficient is similar to our baseline approach.Footnote 36 In contrast to the baseline regression, however, the interaction term becomes significant at the 5% level. Peer effects thus are stronger for more sociable people, which confirms Hypothesis 2. Table 6 summarizes these findings using the sum of the variables attend church and visit neighbors and friends as sociability index.Footnote 37 Sociability is still negative but becomes significant at the 5% level. This indicates that the more sociable an individual is, the higher her level of risk aversion, ceteris paribus. Consequently, our approach is robust with respect to changes in the sociability index.

6.2 Education

Considering that similar studies (Ahern et al. 2014; Balsa et al. 2015) use an experimental sample based on groups with similar education, we are interested in identifying the impact of the level of education on the strength of peer effects. Table 7 presents our findings. Using two subgroups for people with and without the German Abitur, our results indicate that people without a university-entrance diploma adapt to peers’ risk attitude while people with such a diploma do not. We conclude that more educated people have more stable preferences, which is in line with intuition.

6.3 Age

In order to test whether peer effects in risk preferences differ for different age groups, we run an analysis for two subgroups: the young (17–66 years) and the elderly (67–94 years) population. We use the German statutory retirement age as of 2007 as threshold. Table 8 shows that preferences by younger individuals are more malleable, while older ones react less strongly to cues in their neighborhood.

6.4 Children

We include subsamples for parents and people without children to test whether children have an influence on the strength of peer effects. By using an indicator variable for parents, we still have adequate subsample sizes to investigate this question. Table 9 demonstrates the results. We find that peer effects in risk preferences are particularly relevant for parents. This is in line with intuition as parenthood is very likely to have an influence on the acceptance of others’ advice.Footnote 38

6.5 Marital status

Table 10 presents the results when differentiating between married and unmarried individuals. We identify significant peer effects in risk preferences for married people, while peer effects are similar in size but nonsignificant for unmarried individuals. A potential explanation could be that individuals who actively decide to get married might be more willing to compromise and to interact and agree with others. Moreover, children are still a major motive for marriage in modern German societyFootnote 39, such that similar results seem plausible for subgroups of spouses and parents.

7 Conclusion

An increasing body of research documents peer effects in several domains of economic decision-making, where individuals’ decisions may be driven by others’ choices and their social norms rather than following individually rational expected utility maximization. These models of social preferences focus on relative payoff concerns and a preference to conform to others. They can be interpreted as rational behavior in the sense that social conformity may improve long-term utility. Peer groups, therefore, should have an influence on decision-making under risk and WTR. Furthermore, peer effects seem to be important in order to understand individual and group behavior as well. Exploring peer effects in risk attitudes is highly relevant for understanding the stability of individual risk preferences. Our paper contributes to the understanding of peer effects in risk attitudes by providing causal inference of large-scale community peer effects in a representative measure of the German population. We investigate the impact of average WTR in a federal state on an individual’s WTR living in this federal state. While the effect of peer groups on risk aversion has already been studied experimentally for particular subgroups, we estimate peer effects in risk preferences using a large representative panel dataset of the German population. We find strong empirical evidence for peer effects in risk preferences. A major insight is that the instrumented WTR within a community is significant at the 1% level in all models that are used for analysis. Peer effects in risk preferences are particularly pronounced for females, less educated individuals, the young population, parents, and married individuals. In addition, peer effects are found to be stronger for individuals with higher social interaction; however, this result is significant only at the 10% level. The interaction term between community WTR and sociability becomes significant at the 5% level when considering only church attendance and neighborhood and friends visits.

The actual channel of how regional peer effects work is a very interesting, yet challenging question. Our analysis is based on the assumption that local cultures somehow exist which is also documented by the differences in the WTR in the different federal states (see Fig. 3). Unfortunately, our data does not enable to determine the actual channel through which WTR of the native individuals varies. The evidence that specifically female community members are affected by peer effects could be caused by two different channels: Either the peers that influence native females have closer bonds to their former eastern German residences (e.g., by family bonds) or native females may be more receptive to peer effects. Our data does not allow us to rule out one or the other possibility. In line with social role theory, women have been found to put more salience on their family role (see, e.g., Gutek et al. 1991). Assuming that peer effects are more pronounced within the same gender group, one channel of the observed gender differences in peer effects can be that former eastern natives who may interact specifically with female natives have closer ties into their former place of residence.

Notes

See, for instance, Mossin (1968), Barsky et al. (1997), and Dohmen et al. (2011). Recent research has focused on factors changing risk attitudes of individuals, such as macroeconomic conditions and major life events (see, e.g., Malmendier and Nagel 2011; Hoffmann et al. 2013; Browne et al. 2019; Görlitz and Tamm 2019).

Note that we document the existence of peer effects despite the higher time stability.

From the erection of the Berlin wall in 1961 until the fall of the Berlin wall in 1989, Germany was physically and ideologically divided into the Federal Republic of Germany (i.e., West Germany) and the German Democratic Republic (GDR; i.e., East Germany). The fall of the Berlin wall in 1989 paved the way for German reunification, which formally took place on October 3, 1990. Before the fall of the Berlin wall, GDR citizens were usually not allowed to migrate to West Germany. Note that we refer to former western or former eastern federal states as western or eastern federal states throughout this article.

We restrict our sample to ‘native’ individuals, that is, those individuals who have lived in the same federal state in West Germany at least one year prior to and all years after the fall of the Berlin wall. Thus, native individuals have lived in the same western community over the entire panel. This ensures that the results are not contaminated by an individual and her new community members sharing the same background.

See Goebel et al. (2019) for more information on the German SOEP.

Due to interpolation, decimal numbers are also allowed. For reliability analysis, Cronbach’s alpha was calculated to assess the internal consistency of the subscale for sociability, which consists of seven SOEP questions. According to Field (2009), the internal consistency lies within an acceptable range, with a Cronbach’s alpha for sociability of 0.511.

Note that Germany was divided into the Federal Republic of Germany (former West Germany) and the GDR (former East Germany) from 1961 to 1989.

The Berlin wall physically and ideologically divided Berlin from 1961 to 1989 and thus a differentiation between former East and West Germans regarding this particular federal state is impossible.

Note that we drop information on 19 individuals that lived in two different East German federal states during this period.

See Sect. 4.1 for details.

Note that the term ‘mover’ refers to former East Germans and West Germans moving from any one to another federal state, while the term ‘native’ covers only West Germans who have lived in the same federal state all their lives.

Our example is very close to the one presented by Brown et al. (2008) to point out the differences to their approach.

The median value is 4 for movers and 5 for natives.

Jaeger et al. (2010) investigate the 2004 and 2006 waves of the SOEP.

Note that Saarland and Hamburg are not presented in this figure as we do not include them in our analyses for having too few incoming movers.

It is noteworthy that a more detailed structural analysis would come with the challenge that for geographically smaller regional levels, the case numbers in the regions become too low to allow for statistically significant conclusions (Knies and Spiess 2007). See https://www.diw.de/en/diw_02.c.222519.en/regional_data.html for more information.

This may be due to Germans being less willing to move within Germany. Note that our instrumental variable is constructed by adding up all non-natives’ (lagged) average WTR of eastern federal states for each region and dividing it by the number of incoming movers. However, there are many regions in the postal code and county code analyses that do not have incoming movers. Thus, only a small number of observations could be studied due to the instrument having missing values for a large amount of observations.

Clustered standard errors account for possible correlations within a cluster and asymptotically equal unclustered standard errors. Since we cannot rule out that clustered standard errors are necessary, we include them to err on the side of caution.

Note that particularly East Germany has low numbers of church members.

Before the fall of the Berlin wall, GDR citizens were usually not allowed to migrate to West Germany. Even though every citizen had the right to apply for a permit to leave the GDR, applying for such permit usually had severe political repercussions from close observance from the Staatssicherheit (i.e., the national intelligence agency), job loss, and denial of higher education for the whole family to several years in jail. Despite this, around 250,000 GDR citizens migrated to West Germany between 1961 (erection of the Berlin wall) and 1989 (fall of the Berlin wall).

Note that we use this expression synonymously to \( WTR\_community \) throughout this article.

Risk preferences were not surveyed before 2004 and in 2005 and 2007. Data for 2004, however, is not part of the regression but used to derive lagged variables.

Inflation-adjusted income is defined as the natural logarithm of monthly real after tax household income adjusted for inflation.

The dummy variable urban is 1 if a person lives in an urban area, and 0 otherwise (definition according to the German Federal Office for Building and Regional Planning).

Berlin, Hamburg, Munich, Cologne, and Frankfurt are the largest German cities in terms of population size in 2015.

In cooperation with the state governments, German companies have extensive trainee programs where school graduates enroll in a two-year to three-year trainee program. Several weeks of instruction in a public specialized school are followed by several weeks of training on the job.

Students who graduate with the Abitur are allowed to enroll at a university in Germany. An Abitur is comparable to the A-levels in the United Kingdom and the Baccalauréat in France.

The main difference between the lowest and the medium school degree in Germany is related to the fact that most white-collar positions require a medium school degree, whereas certain blue-collar workers only need to have the lowest school degree.

Natives are the focus of our analysis, while information on East Germans is used to construct (1) the average risk tolerance in a western federal state and (2) the instrument.

Note that all regression tables including covariates are listed in the Appendix.

See Coudert and Gex (2008).

When we use clustered standard errors at the federal state level, we obtain similar coefficients for peer effects and the interaction term. Note that the interaction term becomes significant at the 5% level. However, we prefer the more cautious approach with higher standard errors and a higher number of clusters. See Cameron and Miller (2015) for details.

Note that for both sub-analyses, we find the instrument to be highly significant in the first stage.

We include attend church (see Brown et al. 2008) and visit neighbors and friends (see Hong et al. 2004) to construct the sociability index. Since church attendance is less frequent in Germany, our definition of sociability here also involves information on how regularly people visit friends and neighbors to account for their local environment. Both activities refer to a person’s social activities which are important when it comes to sociability.

Note that the instrumental variable is found to be significant at the 1% level in the first-stage regression. This is also the case for the other robustness checks in this section.

However, people with children do not necessarily have to be (more) sociable. It is therefore crucial to differentiate between parenthood and sociability in this approach.

This is supported by the fact that the majority of children in Germany is born in families where parents are married (Statistisches Bundesamt (Destatis) 2017).

References

Ahern, K. R., Duchin, R., & Shumway, T. (2014). Peer effects in risk aversion and trust. The Review of Financial Studies, 27(11), 3213–3240.

Angrist, J. D., & Krueger, A. B. (2001). Instrumental variables and the search for identification: From supply and demand to natural experiments. Journal of Economic Perspectives, 15(4), 69–85.

Angrist, J. D., & Pischke, J.-S. (2009). Mostly harmless econometrics: An empiricist’s companion. Princeton: Princeton University Press.

Arrow, K. J. (1962). The economic implications of learning by doing. The Review of Economic Studies, 29(3), 155–173.

Balsa, A. I., Gandelman, N., & González, N. (2015). Peer effects in risk aversion. Risk Analysis, 35(1), 27–43.

Banerjee, A., Chandrasekhar, A. G., Duflo, E., & Jackson, M. O. (2013). The diffusion of microfinance. Science, 341, 1236498.

Barsky, R. B., Juster, F. T., Kimball, M. S., & Shapiro, M. D. (1997). Preference parameters and behavioral heterogeneity: An experimental approach in the Health and Retirement Study. The Quarterly Journal of Economics, 112(2), 537–579.

Booth, A., & Nolen, P. (2012a). Choosing to compete: How different are girls and boys? Journal of Economic Behavior & Organization, 81(2), 542–555.

Booth, A. L., & Nolen, P. (2012b). Gender differences in risk behaviour: Does nurture matter? The Economic Journal, 122(558), F56–F78.

Brown, J. R., Ivković, Z., Smith, P. A., & Weisbenner, S. (2008). Neighbors matter: Causal community effects and stock market participation. The Journal of Finance, 63(3), 1509–1531.

Browne, M. J., Jaeger, V., Richter, A., & Steinorth, P. (2019). Family changes and the willingness to take risks. Working paper.

Bursztyn, L., Ederer, F., Ferman, B., & Yuchtman, N. (2014). Understanding mechanisms underlying peer effects: Evidence from a field experiment on financial decisions. Econometrica, 82(4), 1273–1301.

Cai, J., De Janvry, A., & Sadoulet, E. (2015). Social networks and the decision to insure. American Economic Journal: Applied Economics, 7(2), 81–108.

Cameron, A. C., & Miller, D. L. (2015). A practitioner’s guide to cluster-robust inference. Journal of Human Resources, 50(2), 317–372.

Card, D., Mas, A., Moretti, E., & Saez, E. (2012). Inequality at work: The effect of peer salaries on job satisfaction. The American Economic Review, 102(6), 2981–3003.

Cárdenas, J.-C., Dreber, A., von Essen, E., & Ranehill, E. (2012). Gender differences in competitiveness and risk taking: Comparing children in Colombia and Sweden. Journal of Economic Behavior & Organization, 83(1), 11–23.

Charness, G., & Gneezy, U. (2012). Strong evidence for gender differences in risk taking. Journal of Economic Behavior & Organization, 83(1), 50–58.

Cialdini, R. B., & Goldstein, N. J. (2004). Social influence: Compliance and conformity. Annual Review of Psychology, 55, 591–621.

Cialdini, R. B., & Trost, M. R. (1998). Social influence: Social norms, conformity and compliance. In D. T. Gilbert, S. T. Fiske, & G. Lindzey (Eds.), The Handbook of Social Psychology (pp. 151–192). Boston: McGraw-Hill.

Cohn, R. A., Lewellen, W. G., Lease, R. C., & Schlarbaum, G. G. (1975). Individual investor risk aversion and investment portfolio composition. The Journal of Finance, 30(2), 605–620.

Coudert, V., & Gex, M. (2008). Does risk aversion drive financial crises? Testing the predictive power of empirical indicators. Journal of Empirical Finance, 15(2), 167–184.

Dohmen, T., Falk, A., Huffman, D., Sunde, U., Schupp, J., & Wagner, G. G. (2011). Individual risk attitudes: Measurement, determinants, and behavioral consequences. Journal of the European Economic Association, 9(3), 522–550.

Duflo, E., & Saez, E. (2002). Participation and investment decisions in a retirement plan: The influence of colleagues’ choices. Journal of Public Economics, 85(1), 121–148.

Falk, A., & Ichino, A. (2006). Clean evidence on peer effects. Journal of Labor Economics, 24(1), 39–57.

Fehr, E., & Schmidt, K. M. (1999). A theory of fairness, competition, and cooperation. The Quarterly Journal of Economics, 114(3), 817–868.

Festinger, L. (1954). A theory of social comparison processes. Human Relations, 7(2), 117–140.

Field, A. (2009). Discovering statistics using SPSS. London: Sage Publications.

Friedman, M., & Savage, L. J. (1948). The utility analysis of choices involving risk. Journal of Political Economy, 56(4), 279–304.

Georgarakos, D., Haliassos, M., & Pasini, G. (2014). Household debt and social interactions. The Review of Financial Studies, 27(5), 1404–1433.

Goebel, J., Grabka, M. M., Liebig, S., Kroh, M., Richter, D., Schröder, C., et al. (2019). The German socio-economic panel (SOEP). Journal of Economics and Statistics, 239(2), 345–360.

Görlitz, K., & Tamm, M. (2019). Parenthood, risk attitudes and risky behavior. Journal of Economic Psychology. https://doi.org/10.1016/j.joep.2019.102189.

Guiso, L., Sapienza, P., & Zingales, L. (2004). The role of social capital in financial development. The American Economic Review, 94(3), 526–556.

Gutek, B. A., Searle, S., & Klepa, L. (1991). Rational versus gender role explanations for work-family conflict. Journal of Applied Psychology, 76(4), 560–568.

Halek, M., & Eisenhauer, J. G. (2001). Demography of risk aversion. Journal of Risk and Insurance, 68(1), 1–24.

Heimer, R. Z. (2014). Friends do let friends buy stocks actively. Journal of Economic Behavior & Organization, 107, 527–540.

Hoffmann, A. O., Post, T., & Pennings, J. M. (2013). Individual investor perceptions and behavior during the financial crisis. Journal of Banking & Finance, 37(1), 60–74.

Hong, H., Kubik, J. D., & Stein, J. C. (2004). Social interaction and stock-market participation. The Journal of Finance, 59(1), 137–163.

Hoxby, C. M. (2000). Peer effects in the classroom: Learning from gender and race variation. NBER Working Paper No. 7867. https://www.nber.org/papers/w7867.pdf.

Hunt, J. (2006). Staunching emigration from East Germany: Age and the determinants of migration. Journal of the European Economic Association, 4(5), 1014–1037.

Jaeger, D. A., Dohmen, T., Falk, A., Huffman, D., Sunde, U., & Bonin, H. (2010). Direct evidence on risk attitudes and migration. The Review of Economics and Statistics, 92(3), 684–689.

Knies, G., & Spiess, C. K. (2007). Regional data in the German socio-economic panel study (SOEP). DIW Data Documentation 17.

Lahno, A. M., & Serra-Garcia, M. (2015). Peer effects in risk taking: Envy or conformity? Journal of Risk and Uncertainty, 50(1), 73–95.

Lavy, V., & Schlosser, A. (2011). Mechanisms and impacts of gender peer effects at school. American Economic Journal: Applied Economics, 3(2), 1–33.

Lin, F.-T. (2009). Does the risk aversion vary with different background risk of households. International Research Journal of Finance and Economics, 34(34), 69–82.

Lönnqvist, J.-E., Verkasalo, M., Walkowitz, G., & Wichardt, P. C. (2015). Measuring individual risk attitudes in the lab: Task or ask? An empirical comparison. Journal of Economic Behavior & Organization, 119, 254–266.

Malmendier, U., & Nagel, S. (2011). Depression babies: Do macroeconomic experiences affect risk taking? The Quarterly Journal of Economics, 126(1), 373–416.

Manski, C. F. (2000). Economic analysis of social interactions. Journal of Economic Perspectives, 14(3), 115–136.

Mata, R., Frey, R., Richter, D., Schupp, J., & Hertwig, R. (2018). Risk preference: A view from psychology. Journal of Economic Perspectives, 32(2), 155–172.

Mossin, J. (1968). Aspects of rational insurance purchasing. Journal of Political Economy, 76(4), 553–568.

Rabin, M. (1993). Incorporating fairness into game theory and economics. The American Economic Review, 83(5), 1281–1302.

Riley, W. B., & Chow, K. V. (1992). Asset allocation and individual risk aversion. Financial Analysts Journal, 48(6), 32–37.

Sacerdote, B. (2001). Peer effects with random assignment: Results for Dartmouth roommates. The Quarterly Journal of Economics, 116(2), 681–704.

Scherer, C. W., & Cho, H. (2003). A social network contagion theory of risk perception. Risk Analysis, 23(2), 261–267.

Shiller, R. J. (1984). Stock prices and social dynamics. Brookings Papers on Economic Activity, 2, 457–498.

SOEP. (2016). Socio-Economic Panel (SOEP). Data for years 1984–2015, version 32.1. Data set. Retrieved from https://doi.org/10.5684/soep.v32.1.

Statistisches Bundesamt (Destatis). (2017). Kinderlosigkeit, Geburten und Familien. Ergebnisse des Mikrozensus 2016 [online]. https://www.destatis.de/DE/Themen/Gesellschaft-Umwelt/Bevoelkerung/Haushalte-Familien/Publikationen/Downloads-Haushalte/geburtentrends-tabellenband-5122203169014.pdf?__blob=publicationFile. Accessed 20 Sept 2019.

Trautmann, S. T. (2009). A tractable model of process fairness under risk. Journal of Economic Psychology, 30(5), 803–813.

Trogdon, J. G., Nonnemaker, J., & Pais, J. (2008). Peer effects in adolescent overweight. Journal of Health Economics, 27(5), 1388–1399.

Vieider, F. M., Lefebvre, M., Bouchouicha, R., Chmura, T., Hakimov, R., Krawczyk, M., & Martinsson, P. (2015). Common components of risk and uncertainty attitudes across contexts and domains: Evidence from 30 countries. Journal of the European Economic Association, 13(3), 421–452.

Viscusi, W. K., Phillips, O. R., & Kroll, S. (2011). Risky investment decisions: How are individuals influenced by their groups? Journal of Risk and Uncertainty, 43, 81–106.

Wooldridge, J. M. (2015). Introductory econometrics: A modern approach. Mason: Cengage Learning.

Zimmerman, D. J. (2003). Peer effects in academic outcomes: Evidence from a natural experiment. The Review of Economics and Statistics, 85(1), 9–23.

Acknowledgements

We are grateful for helpful comments from participants at the 2017 annual meeting of the American Risk and Insurance Association, the 2017 annual meeting of the European Group of Risk and Insurance Economists, the 2018 European Conference on Operational Research, the 2018 CEAR/MRIC Behavioral Insurance Workshop, and the Chubb Research Seminar at St. John's University. We are indebted to Thomas Berry-Stölzle, Irina Gemma, Verena Jäger, Richard Peter, David Pooser, Casey Rothschild, and two anonymous reviewers for valuable comments. Sophie-Madeleine Roth thanks the W. R. Berkley Corporation for supporting her work on this paper within the Visiting Scholars Program at the Maurice R. Greenberg School of Risk Management, Insurance and Actuarial Science at St. John’s University.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Results for covariates

Rights and permissions

About this article

Cite this article

Browne, M.J., Hofmann, A., Richter, A. et al. Peer effects in risk preferences: Evidence from Germany. Ann Oper Res 299, 1129–1163 (2021). https://doi.org/10.1007/s10479-019-03476-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-019-03476-9