Abstract

Motivated by concerns that stock-based compensation might lead to excessive risk-taking, this paper’s main purpose is to examine the relations between CEO incentives and the cost of debt. Unlike prior research, this paper uses the sensitivities of CEO stock and option portfolios to stock price (delta) and stock return volatility (vega) to measure CEO incentives to invest in risky projects. Higher delta (vega) is predicted to be related to lower (higher) cost of debt. The results show that yield spreads on new debt issues are lower for firms with higher CEO delta and are unrelated to CEO vega. The results also show that yield spreads are higher for firms whose CEOs hold more shares and stock options. In sum, the results suggest that both percentage-ownership and option sensitivity variables are important in understanding relations between CEO incentives and the cost of debt.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Stock-based CEO compensation and debt financing are ubiquitous in modern capital markets. Stock-based pay makes CEO wealth sensitive to stock return volatility and to movements in the underlying stock price, but, as noted by several authors (e.g., Lambert et al. 1991; Carpenter 2000; Knopf et al. 2002; Coles et al. 2006), these sensitivities imply competing effects on CEO’s risk-seeking. Sensitivity to stock return volatility (share price) motivates more (less) risky investments.Footnote 1 The relations between these sensitivities and risk-seeking in turn imply competing effects of stock-based CEO compensation on the cost of debt. Ceteris paribus, CEO wealth more sensitive to stock return volatility (share price) should be related to higher (lower) cost of debt. This paper examines how yield spreads on new debt issues are related to the sensitivities of CEO stock and option compensation portfolios to stock price and stock return volatility.

This issue is important. First, debt is a widely-used form of financing, and evidence suggests lenders are aware of a potential relation between CEO incentive compensation and their risk-seeking behavior. For example, Moody’s (2003) argues that “executive pay arrangements that provide large short-term incentives—particularly those related to equity valuations, may pose excessive risk, particularly from a credit standpoint.” However, the relation between CEO delta and vega and the cost of debt remains unexplored.

Second, stock-based compensation is designed in part to encourage risk-averse and under-diversified managers to invest in risky but positive net present value projects. While potentially better aligning managers’ interests with those of shareholders, stock-based compensation might encourage excessive risk-taking, thus aggravating stockholder-debtholder conflicts (John and John 1993; Parrino and Weisbach 1999). Alternatively, research also suggests stock-based compensation might not increase CEO risk-seeking (Carpenter 2000; Ross 2004; Hanlon et al. 2004). Examining the relation between CEO delta and vega and the cost of debt provides insights into debtholders’ assessment of the link between CEO stock-based compensation and their firms’ risk-taking.

Third, extant research on the relations between option compensation and debt costs typically uses either the existence of an option plan or the number of options held by managers to proxy for managerial incentives. For example, DeFusco et al. (1990) document a negative bond price reaction to the announcement of adoption of a managerial stock option plan for a sample of firms over 1978–1982. Ortiz-Molina (2006) finds a positive relation between the yield spread on new debt issues and the number of options held by the firm’s top five managers. Importantly however, the managerial incentive measures used in these studies fail to exploit potential cross-sectional variation in stock-based incentives that arise from, for example, different option times to maturity or exercise prices.

Research suggests ignoring these potential sources of cross-sectional variation in CEO incentives can lead to misleading inferences. In contrast to results in DeFusco et al. (1990), Billet et al. (2010) find a positive (negative) market reaction to the delta (vega) of first-time grants of option compensation to CEOs over 1992–2004.Footnote 2 Knopf et al. (2002) initially find a positive relation between the number of options held by the CEO and his firm’s use of derivatives, but then they find a negative (positive) relation between CEO vega (delta) and the use of derivatives. Tests incorporating CEO delta and vega address these potentially competing effects, and thus enable insights beyond those available from using more crude proxies for CEO incentives.

The sample includes 598 new debt issues by 274 distinct S&P 1500 firms over 1993–2004. I use the Core–Guay (2002) method of estimating option sensitivities to better understand the relation between CEO incentives and the cost of debt.Footnote 3 This approach uses one year of proxy statement data, along with some reasonable assumptions on times to maturity and exercise prices for previously granted options, to exploit the cross-sectional variation in CEO stock option portfolios and thus better capture CEO incentives. This method yields estimates of the separate sensitivities of CEO portfolios to stock price (delta) and stock return volatility (vega). I then empirically examine the relations between yield spreads on new debt issues, the sensitivities of CEO stock and option portfolios to stock price and stock return volatility, and control variables.

These analyses provide new insights into the relation between stock-based CEO compensation and the cost of debt. First, the more sensitive the CEO’s wealth is to share price, the lower is the yield spread on new debt issues. This effect is economically significant. For example, a sample firm with a CEO at the 3rd quartile level of price sensitivity would expect an estimated 35 basis point reduction on the yield spread on a new debt issue, compared with a sample firm with a CEO at the median level of price sensitivity. This is comparable to evidence in Anderson et al. (2003, debt costs are about 32 basis points lower in firms with founding family ownership than in firms without founding family ownership), and Klock et al. (2005, debt costs are about 30 basis points lower for firms with high antitakeover provisions versus firms with low antitakeover provisions). In stark contrast to results in Ortiz-Molina (2006), but consistent with theory in Carpenter (2000) and Ross (2004), stock-based incentives do not unambiguously lead to higher cost of debt.

Second, the sensitivity of the CEO’s stock and option portfolio to stock return volatility has little impact on the cost of debt. This is consistent with large-sample evidence in Hanlon et al. (2004), who find little effect of CEO option vega on subsequent stock return volatility. Third, after including CEO delta and vega, CEO option and share holdings remain positively related to the cost of debt. These results are robust to inclusion of a long list of control variables, a changes specification, alternative measures of the cost of debt, and other sensitivity tests.

This paper provides several contributions. First, to my knowledge this is the first paper to examine the relation between CEO incentives, measured by sensitivity to share price and stock return volatility, and the cost of debt financing. Debtholders’ perspective is important, given the wide use of debt financing and debtholders’ concern with shareholders expropriating wealth via risky investments (Jensen and Meckling 1976; John and John 1993; Parrino and Weisbach 1999). Tests employing delta and vega, in addition to CEO share and option ownership, enable a more complete understanding of the link between CEO stock-based incentives and the cost of debt.

The paper also contributes to research on the incentive effects of CEO stock-based compensation. While often maligned, options remain important in compensation plans, and a growing body of evidence suggests benefits from option compensation. For example, Hanlon et al. (2003) find a positive relation between stock option usage and future earnings. Knopf et al. (2002) find a net positive effect of option plans on risk hedging with derivative instruments. Balsam and Miharjo (2007) find that greater use of option compensation is related to lower levels of voluntary CEO turnover, particularly among the strongest-performing CEOs. Boone et al. (2010) find that CEO equity incentives increase firm value, through a lower cost of equity capital. The results in this paper suggest a benefit, in the form of lower cost of debt on new issues, from CEO option compensation plans with greater sensitivity to share price.

The remainder of this paper is organized as follows. Section 2 discusses related research and develops this paper’s hypotheses, Sect. 3 describes sample selection and variable measurement, and Sect. 4 discusses the empirical model. Section 5 presents the results and Sect. 6 concludes.

2 Related research and hypotheses

2.1 Analytical research

Agency conflicts between firm managers and outside shareholders have long been recognized (e.g., Berle and Means 1932). Generally, CEOs prefer less risk than do more well-diversified outside shareholders. Stock-based compensation arguably aligns managers’ incentives with those of outside shareholders, and thus induces managers to take firm-value increasing actions. Jensen and Meckling (1976) and Smith and Stulz (1985) argue that compensation payoffs that are a convex function of share price are needed to mitigate managers’ tendencies towards risk-aversion and encourage them to invest in risky but positive net present value projects.

Other analytical research however suggests the mere existence of a stock-based compensation plan might not encourage managerial risk-seeking behavior. Lambert et al. (1991) employ a single-period model in which a manager’s pay for the period is based on performance for that period. Their results suggest that if a risk-averse manager has a sizable portion of his other wealth tied to his firm’s stock price, he values the incentive compensation contract less than its cost as perceived by shareholders. Lambert et al. (1991) also show that an incentive stock option contract does not necessarily provide a risk-averse manager with incentives to take actions that increase the variability of stock price.

In an intertemporal model, Carpenter (2000) models how a risk-averse manager adjusts to a convex compensation scheme. Carpenter (2000) shows that option compensation does not strictly lead to greater risk-taking, and under certain assumptions leads the manager to prefer less risk-taking. Ross (2004) sums up this literature by stating “The common folklore that giving options to agents will make them more willing to take risks is false.” In sum, extant theory presents competing predictions on how incentive compensation should impact CEOs’ risk-seeking behavior.

2.2 Empirical research

Lambert et al. (1991) suggest that measuring the partial derivative (or, sensitivity) of the change in manager compensation with respect to a change in a performance variable is the preferred way to assess managers’ incentives. Recent empirical research examines the relations between CEO stock and option portfolio sensitivities and firms’ investment decisions.

Guay (1999) finds that the sensitivity of CEO wealth to stock return volatility is positively related to the firm’s growth opportunities. This is consistent with firms providing managers incentives to invest in risky projects when their risk-aversion might otherwise cause them to forgo risky but positive net present value projects. Rajgopal and Shevlin (2002) find that greater sensitivity of CEO wealth to stock return volatility is related to greater exploration risk, and less risk hedging, for a sample of oil and gas firms. Knopf et al. (2002) find that as the sensitivity of CEO stock and option portfolios to stock price (return volatility) increases, firms’ hedge more (less) through derivatives. Hanlon et al. (2004) find that CEO option portfolios more sensitive to stock return volatility are associated with greater one-year ahead stock return volatility, though the effects are economically small. Finally, Coles et al. (2006) find that greater sensitivity of CEO wealth to stock return volatility is related to greater research and development expenditures and less capital expenditures.

2.3 Hypotheses

The analytical research above provides competing predictions on how stock-based compensation impacts risk-seeking, and suggests the need to examine detailed features of CEO options. The empirical research above suggests CEO delta and vega are related to firms’ investment decisions. In setting yield spreads on new debt issues, lenders can be expected to rationally consider the impact of incentive compensation on CEOs’ risk-seeking behavior (e.g., Moody’s 2003; Jensen and Meckling 1976; Parrino and Weisbach 1999). Thus, features of CEO compensation contracts that encourage risk-seeking behavior should be related to costlier debt, while CEO compensation contract features that encourage risk-hedging and/or less risky investments should be related to less costly debt. This leads to this study’s two hypotheses, stated in alternate form:

H 1

The cost of debt is inversely related to the sensitivity of CEO wealth to share price.

H 2

The cost of debt is positively related to the sensitivity of CEO wealth to stock return volatility.

3 Sample selection and data

3.1 Sample selection

Sample selection begins with firms with CEO stock option data on Standard and Poor’s Execucomp in any of the years 1992–2004.Footnote 4 Firms lacking Compustat, CRSP, or CDA/Spectrum data needed to compute control variables (see Sect. 3.4) are deleted. The SDC Global New Issues database is then used to obtain a list of fixed-rate debt issues by these firms over 1993–2004.Footnote 5 If a firm makes multiple debt issues in a given year the first such issue is used for that firm-year. Using the first issue of the year most closely matches the timing of the yield spread data with the CEO portfolio data, which are measured as of the prior year-end (see Sect. 3.3).Footnote 6 The final sample includes 598 new debt issues by 274 distinct firms.

3.2 Dependent variable: yield spreads on new debt issues

To measure the cost of debt I use SPREAD, the spread (in basis points) between the yield to maturity on the firm’s first debt issue of the year and the yield to maturity on a US Treasury bond of similar maturity on the issuance date. These data are from the SDC Global New Issues database. Considerable research in this area also employs yield spread as the primary dependent variable (e.g., Bhojraj and Sengupta 2003; Klock et al. 2005; Anderson et al. 2004; Ortiz-Molina 2006).

Related research suggests alternative measures of the cost of debt, including yield to maturity (Khurana and Raman 2003), realized interest cost (Sengupta 1998; Francis et al. 2005), and the credit rating on the new debt issue (Shi 2003, Sengupta 1998). In comparison to yield spreads, yield to maturity is not adjusted for general economic conditions. Realized interest costs are noisy (Pittman and Fortin 2004) and include the effect of borrowings other than just the new issue, and the discontinuous nature of credit ratings results in a cruder partition of credit risk across borrowers (Wilson and Fabozzi 1990). Nevertheless, these alternative measures of cost of debt are employed in sensitivity analyses.Footnote 7

3.3 CEO incentive variables

3.3.1 Number of CEO options and shares held

Standard and Poor’s Execucomp is used to obtain data on the number of CEO options and shares held. OPT (STK) is the number of options (common shares) held by the CEO, deflated by the number of common shares outstanding (Ortiz-Molina 2006). Baker and Hall (2002) argue that such percentage-based measures are appropriate when the CEO’s actions primarily affect firm dollar returns, for example through perquisite consumption.

While OPT captures the level of CEO option usage, it does not capture cross-sectional variation in key aspects of those options, e.g., time to maturity, volatility, and exercise prices. Further, OPT does not distinguish between newly granted and previously granted options. Thus, although OPT is predictably positively correlated with option sensitivities, it likely does not exploit all the variation in CEO incentives that use of the separate sensitivities does. Importantly, related research (Billet et al. 2010; Knopf et al. 2002) suggest ignoring the separate sensitivities can lead to misleading inferences. The next section discusses the method to incorporate these features of CEO option portfolios.

3.3.2 Price and volatility sensitivity of CEO option and share portfolios

I augment the CEO percentage ownership variables with the sensitivity of the CEO’s portfolio of options and stock to small changes in stock price and stock price volatility. This proceeds in two stages: First, I use the Core–Guay (2002) approach to estimate the sensitivity of CEO options to small changes in stock price and volatility. Then, I follow Rajgopal and Shevlin (2002), Coles et al. (2006) and others in measuring the sensitivity of the value of CEO shareholdings to small changes in stock price and volatility. The sums of the individual option and share sensitivities to return volatility and share price form the key independent variables in this study. Their computation is discussed in detail next.

Core and Guay (2002) estimate option portfolio values and sensitivities to stock price and stock return volatility using one year of proxy statement data and some reasonable assumptions about inputs for previous option grants. Core and Guay (2002) show that their “one-year approximation” method explains about 99 percent of the variation in option portfolio values and sensitivities that one would obtain from having full proxy statement information on previously granted options.

The Core and Guay (2002) method requires option data to be partitioned into option grants made in the current year and previously granted options. For current year grants, Execucomp provides the number of options granted, option exercise price, and the time to maturity. These values, along with the firm’s expected dividend yield, the firm’s expected stock return volatility, and the risk-free interest rate for that year, all from Execucomp, are used to estimate option values and sensitivities from the formulas in “Appendix”.

Execucomp does not provide complete data on previously granted options, thus the Core–Guay (2002) method makes assumptions on these options’ exercise prices and times to maturity to estimate their values and sensitivities. To estimate average exercise prices of previously granted options I use the realizable values (excess of stock price over exercise price) for the firm’s unexercisable and exercisable options, from Execucomp. These amounts are measured at year-end, thus I deduct the number and fiscal-year end values of currently granted options (see above) in this computation. I then divide the realizable values of the unexercisable and exercisable options by the number of unexercisable and exercisable options to obtain an estimate of how far (per share) these options are “in the money.” Subtracting this from the firm’s end of year stock price yields an estimate of the average exercise price on the unexercisable and exercisable options.

I also follow Core and Guay (2002) in estimating the remaining time to maturity of outstanding options. Since options typically include vesting provisions, exercisable options likely have shorter times to maturity than unexercisable options. If a firm grants options in the current year, then the time to maturity of previously granted unexercisable (exercisable) options is set to the time to maturity of the current option grant minus one (three) years. If no option grants are made in the current year, the time to maturity of previously granted unexercisable (exercisable) options is set to nine (six) years, as options typically are granted with ten years to maturity.

Following related research, the price and stock return volatilities of each type of option grant (current year option grants, previously granted unexercisable options, and previously granted exercisable options) are multiplied by the number of shares of each type of grant, and then summed. Then, like Coles et al. (2006), Rajgopal and Shevlin (2002), Knopf et al. (2002) and others, I add the sensitivity of CEO shareholdings from a 1 percent change in stock price (computed as 1 percent times the total year-end dollar value of CEO shares and restricted stock held) to the sensitivity of CEO options to share price.Footnote 8 The resulting variables, labeled DELTA and VEGA, measure the sensitivity of CEO stock and option portfolios (in $thousands) resulting from one-percent changes in the firm’s stock price and stock return volatility, respectively.Footnote 9

3.4 Control variables

A long line of research suggests the need to control for features of the debt issuer, and characteristics of the debt issue itself, in studying determinants of yield spreads. Relatively more recent research (e.g., Bhojraj and Sengupta 2003; Ashbaugh-Skaife et al. 2006) suggests corporate governance mechanisms are also related to either yield spreads or credit ratings. Some of these governance variables might impact CEO incentives, necessitating governance controls. Thus, the regression analyses include a host of control variables, discussed next.

3.4.1 Corporate governance features

As CEO compensation might be impacted by CEO power and board of directors’ independence, I include an indicator variable CEO which equals 1 if the CEO is also the chairman of the board, and otherwise zero, and INDEP, the percentage of directors that are independent (not officers or directors of the firm). CEO is measured with Execucomp data, and INDEP is measured using CDA/Spectrum data. Following Bhojraj and Sengupta (2003) and Ashbaugh-Skaife et al. (2006) I include the percentage of shares held by institutional investors (INST) and a measure of concentrated ownership, defined as the percentage of outstanding shares held by the top five largest institutional investors (TOP5).Footnote 10

Research also suggests accounting quality impacts the cost of debt (e.g., Sengupta 1998; Francis et al. 2005; Ashbaugh-Skaife et al. 2006).Footnote 11 I include two measures of accounting quality. The first is a measure of working capital accruals quality (AQ) based on Dechow and Dichev (2002). Calculation of this variable begins with cross-sectional estimation, by year and within 2-digit SIC code for all groups with at least 30 observations, of the model:

where WCA t is working capital accruals for firm i in year t, and CFO is net operating cash flows in either year t − 1, t, or t + 1, and all variables are scaled by average total assets. Working capital accruals are computed as the change in current assets minus the change in current liabilities minus the change in cash plus the change in debt in current liabilities. Data to compute the variables in Eq. 1 are from Compustat. The standard deviation of the residuals from these industry-year regressions over the past 5 years, multiplied by negative one, is the measure of working capital accruals quality (AQ) in the current year. Larger values of AQ imply a better mapping between working capital accruals and cash flows, and thus higher quality working capital accruals. AQ is thus predicted to be inversely related to yield spreads.

A second measure of accounting quality, based on Gu (2007) and employed in Ashbaugh-Skaife et al. (2006) is also used. This measure is labeled TRANSP, and it is a measure of financial transparency based on the timeliness of accounting earnings in explaining contemporaneous stock returns. More precisely, this measure is derived from the following regression model:

where RET i,t is firm i’s market-adjusted stock return over fiscal year t, computed from the CRSP monthly return file. NIBE i,t is firm i’s year t net income before extraordinary items scaled by firm i’s market value of equity at the beginning of year t (data from Compustat). LOSS i,t is an indicator variable which equals 1 if NIBE i,t is negative, otherwise zero. ΔNIBE i,t is firm i’s change in net income before extraordinary items from year t − 1 to year t, scaled by firm i’s beginning of year t market value of equity. The loss interaction term allows for differential market reaction to profits and losses, based on Hayn (1995). These regressions are estimated cross-sectionally, within 2-digit SIC and year groups having at least 30 observations.

The (squared) firm-specific residuals from Eq. 2 reflect the degree of stock return not explained by contemporaneous earnings. Higher squared residuals imply less timely earnings (Gu 2007). As with the accruals quality variable, I multiply the squared residuals from Eq. 2 by negative one. Thus, larger values of TRANSP indicate more timely earnings, which should correspond to lower yield spreads.

3.4.2 Issue characteristics

Debt premiums are related to proxies for the firm’s default risk (Fisher 1959). To control for default risk I include the Standard and Poor’s debt rating on the new issue, from SDC. For this sample S&P debt ratings vary from AAA to B−, and I create the ordinal variable RATING, which ranges from 1 (AAA) to 16 (B−).Footnote 12

Research also shows that debt premiums are related to other characteristics of the debt issue. Thus I also include the size of the debt issue (SIZE), the number of years to maturity (MATURITY), and the years to the first call divided by the years to maturity (CALL). The longer the time to maturity and the sooner the debt can be called by the issuer, the more interest rate risk exposure to debtholders. Thus, SPREAD is predicted to be positively (inversely) related to MATURITY (CALL). The size of the debt issue might proxy for greater marketability of the debt, implying lower risk premium, or alternatively higher debt burden and higher risk premium (Shi 2003). Thus, no directional prediction is made for SIZE. Data to compute these variables are from SDC.Footnote 13

3.4.3 Issuer characteristics

Following related research (e.g., Sengupta 1998, Shi 2003; Ortiz-Molina 2006), I add issuer controls, including firm size, measured as total assets (ASSET), the ratio of total long term-debt to total assets (DEBT), the times interest earned ratio (TIMES) which is equal to income before interest expense divided by interest expense, and profitability (EBITDA), measured as earnings before interest, taxes, depreciation, and amortization, scaled by total assets, to control for default risk. Larger, more profitable firms are expected to have lower default risk, suggesting SPREAD should be inversely related to ASSET, EBITDA, and TIMES. In contrast, greater leverage implies greater risk of default, suggesting SPREAD should be positively related to DEBT. Data to compute these measures are obtained from Compustat. To capture general economic conditions that might impact yield spreads I include MKT_RATE, the interest rate on a 10-year US Treasury bond issued in the same month and year as the firm’s issuance, obtained from the Federal Reserve Economic Database.

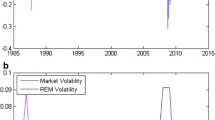

The evidence in Guay (1999) shows that the sensitivity of CEO wealth to stock return volatility is related to their firm’s investment opportunities. Following Guay (1999) I include the factor score (INV_OPP) from a common factor analysis that uses research and development expenditures divided by market value of assets, the book-to-market ratio and total capital expenditures plus acquisitions divided by market value of assets.Footnote 14 Missing values of research and development, capital expenditures, and acquisitions are set to zero. A positive relation between SPREAD and INV_OPP is predicted. Finally, Sengupta (1998) shows that debt yield spreads are also related to stock return volatility and firm performance. Thus, I include STDRET, the standard deviation of monthly stock returns, and RET, cumulative annual stock return, both from CRSP, as additional controls.

3.5 Descriptive statistics on CEO incentive compensation variables

Panel A of Table 1 presents descriptive information on the CEO incentive and yield spread variables. Sample CEOs on average (median) hold options (shares) totaling about 0.441 (0.325) percent of their firm’s outstanding shares (i.e., less than one percent in total). Median values of DELTA and VEGA, at 247.47 and 70.56 ($thousands) respectively, are comparable to those in related research. For example, median values for these variables are 210.209 and 104.06 in Knopf et al. (2002) and 206 and 34 in Coles et al. (2006), respectively.Footnote 15 The median yield spread is 110 basis points.Footnote 16

Panel B of Table 1 presents Pearson correlations between the CEO incentive and ownership variables and the yield spread on the new debt issue. As expected, OPT is positively correlated with both DELTA (ρ = 0.329) and VEGA (ρ = 0.258). Further, while DELTA and VEGA are also positively correlated with one another (ρ = 0.656), the correlations across OPT, DELTA, and VEGA are far from one, suggesting these measures capture, at least to some extent, different features of CEO incentives.

Consistent with expectations, SPREAD is positively correlated with the number of CEO options (ρ = 0.327) and shares held (ρ = 0.140), and inversely related to the sensitivity of CEO options to share price (ρ = −0.149). The correlation between SPREAD and the sensitivity of CEO options to price volatility, while unexpectedly negative, is modest (ρ = −0.077).

3.6 Descriptive statistics on debt issue and issuer characteristics

Table 2 presents descriptive statistics on the debt issue (Panel A) and issuer characteristics (Panel B). From Panel A of Table 2, the median debt issue is for $248 million, is rated A—by Standard and Poor’s (median value of 7 for RATING), matures in 10 years, and the first call is on average about 5 years from the date of issuance (mean value of 0.47 for CALL).

Panel B of Table 2 presents descriptives on issuer characteristics. The median firm has about $7.90 billion of total assets, a debt-assets (DEBT) ratio of 24.1 percent, EBITDA of 14.0 percent of total assets, and a times-interest earned ratio above 3.5. Values for INV_OPP, a measure of investment opportunities from a common factor analysis, exhibit considerable variation, as shown by the 1st (3rd) quartile value of −0.489 (0.529). The standard deviation of monthly stock returns has a mean (median) of 0.091 (0.084), and MKT_RATE averages 5.18 percent.

Descriptive statistics for the governance variables are also comparable to prior research. Institutional owners hold on average (median) about 63.51 percent of the sample firms’ outstanding shares and the largest five institutional owners hold a median of 21.50 percent of outstanding shares. The typical board has about 80 percent independent members, and the CEO is chairman of the board for 80.27 percent of the sample observations. Both measures of accounting quality exhibit considerable variation. TRANSP averages −0.044, and it has a 1st (3rd) quartile value of −0.123 (−0.008). AQ averages −0.025, and it has a 1st (3rd) quartile value of −0.040 (−0.017).

3.7 Credit ratings and CEO incentives

Evidence suggests that credit rating agencies consider CEO ownership and options when rating debt. For example, Standard and Poor’s (2004) notes that ownership structure and usage of stock options is one of the key components of its Corporate Governance Score, while Moody’s (2003) notes that “executive pay arrangements that provide large short-term incentives—particularly those related to equity valuations, may pose excessive risk, particularly from a credit standpoint.” Empirical research also suggests that CEO ownership impacts credit ratings (e.g., Ortiz-Molina 2006). Thus, RATING likely captures some of the variation in the CEO incentive variables of interest in this study. I therefore follow related research and use RES_RATING, the residual from OLS estimation of a regression of the credit rating on the new debt issue on CEO option and share ownership, and the CEO delta and vega variables.Footnote 17 Thus, RES_RATING is the information in a firm’s new issuance debt rating not explained by the CEO incentives of interest in this study. The adjusted-R 2 of 31.31 suggests these variables have nontrivial explanatory power for credit ratings on new issues.Footnote 18

4 Empirical models

4.1 Primary regression model

In addition to the independent variables discussed above, the regression model includes industry dummies (IND), corresponding to SIC codes 0–999, 1000–1999, …, 8000–8999, and year (YR) dummies.Footnote 19 All CEO share, option, and sensitivity variables are measured as of the last fiscal year-end (i.e., year t − 1) before the debt issuance. All issuer characteristics are also measured as of year t − 1 relative to the debt issue. Industry (j) and year (t) dummies pertain to year t, the year of debt issue. Thus, the empirical model is:

Variables are as defined above, with the exception of LDELTA, LVEGA, LASSET, LSIZE, and LMATURITY, which, due to skewness in their distributions and consistent with related research, are the natural logarithms of DELTA, VEGA, ASSET, SIZE, and MATURITY, respectively. To mitigate potential econometric concerns due to autocorrelation or heteroscedasticity I use Huber-White robust standard errors in computing t-statistics (Huber 1967; White 1980). These standard errors employ a by-firm cluster that assumes observations are independent across firms but not necessarily independent within firms.

5 Empirical results

5.1 Primary regression results

Results of OLS estimation of Eq. 3 appears in the “Levels” column of Table 3.Footnote 20 As expected, lower-rated debt (RES_RATING) receives higher yield spreads (γ5 = 17.372, p < 0.01).Footnote 21 In addition, more highly leveraged firms, with more volatile stock returns, also receive higher yield spreads, as shown by the coefficients on DEBT (γ6 = 28.039, p < 0.10) and STDRET (γ14 = 307.416, p < 0.01). Longer times to maturity and larger debt issues are also associated with higher yield spreads (γ11 = 25.082, p < 0.01; γ10 = 4.690, p < 0.10). Larger, better-performing firms receive lower yield spreads, as evidenced by the coefficients on LASSET (γ9 = −5.771, p < 0.10) and RET (γ22 = −18.804, p < 0.05).

Yield spreads are also related to all but one of the corporate governance variables. In particular, yield spreads are lower for firms with a greater percentage of shares held by institutions (γ16 = −0.464, p < 0.05), firms with more timely earnings (γ20 = −33.444, p < 0.05), better working capital accruals quality (γ21 = −207.199, p < 0.05), and firms with their CEO as chairman of the board (γ19 = −17.068, p < 0.01).Footnote 22 Finally, yield spreads are higher for firms with higher levels of concentrated institutional ownership (TOP5), as γ17 equals 0.644, significant at p < 0.10.

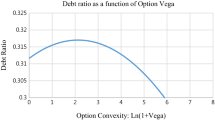

In addition, higher levels of CEO option (γ1 = 21.576) and share ownership (γ2 = 1.251) are related to higher yield spreads, and these relations are significant at p < 0.01 and p < 0.05, respectively. These results are consistent with those in Ortiz-Molina (2006). More importantly, after controlling for the number of CEO shares and options held, the sensitivity of CEO option and share portfolios to share price emerges as a significant explanator of yield spreads. Specifically, the coefficient on LDELTA is negative (γ3 = −17.068) and significant at p < 0.01. Finally, the results suggest no relation between yield spread and CEO vega.

The results are consistent with this study’s first hypothesis—the cost of debt is inversely related to the sensitivity of CEO stock option portfolios to share price. Little support is found for this study’s second hypothesis—the results instead suggest the cost of debt bears little relation to the sensitivity of CEO portfolios to stock return volatility. In the presence of CEO ownership and other control variables, the sensitivity of CEO wealth to stock price, but not return volatility, helps explain yield spreads on new debt issues. The results suggest percentage-based measures, employed in Ortiz-Molina (2006), and the sensitivity measures advanced in this study, are both useful in better understanding the role of CEO incentives on the cost of debt.

To provide information on the economic significance of the results, I compare a firm at the median level of each of OPT, STK, LDELTA, and LVEGA with a firm at the 3rd quartile level of each of these variables. The CEO of a sample firm at the 3rd quartile level of these variables has a value of OPT of 0.511 (0.952 − 0.441) higher than the CEO of a sample firm at the median level of OPT. This generates an estimated 11 basis point increase (0.511 × 21.576) in yield spread for a firm at the 3rd quartile of OPT compared to a firm at the median quartile level of OPT. Computed similarly, a firm at the 3rd quartile of STK would expect about a 1.10 basis point higher yield spread, compared to a firm at the 2nd quartile level of STK. The magnitude of these effects is comparable to that reported in Ortiz-Molina (2006).

Since delta and vega are logged, their regression coefficients measure how a one-percent change in LDELTA (or LVEGA) impacts SPREAD, in units of regression coefficient/100 (Wooldridge 2000). For instance, a one-percent increase in LDELTA is related to an estimated −0.1707 (computed as −17.068/100) basis point decrease in SPREAD. A sample firm at the 3rd quartile level of OPT has a 516.12 ($000 s) higher level of DELTA (763.59 − 247.47, from Panel A of Table 1) relative to a firm at the 2nd quartile level of DELTA. This roughly 208% percent higher value of DELTA translates into roughly a 35 basis point reduction in SPREAD for a sample firm at the 3rd quartile level of DELTA, relative to a sample firm at DELTA’s 2nd quartile value. This is comparable to evidence in Anderson et al. (2003, debt costs are about 32 basis points lower in firms with founding family ownership than in firms without founding family ownership), and Klock et al. (2005, debt costs are about 30 basis points lower for firms with high antitakeover provisions versus firms with low antitakeover provisions).

5.2 Regression results using changes model

The analyses thus far treat CEO ownership and wealth sensitivities as exogenous. It is possible however the CEO compensation variables are endogenous. This endogeneity might arise if an omitted variable correlated with CEO incentives and yield spreads drives this study’s results, or if the cost of debt impacts how firms establish their CEO option incentive contracts.Footnote 23

The use of year t − 1 option variables to explain yield spreads on year t debt issues helps alleviate concerns with endogeneity. In addition, the option sensitivity variables employ data from several years before the debt issuance, making it even less likely that option vega and delta are determined simultaneously with yield spreads.

One standard technique to address endogeneity is to employ a changes model (e.g., Klock et al. 2005; Anderson et al. 2004). I compute percentage changes in each of the variables in Eq. 3, and estimate an OLS regression of the percentage change in yield spread on percentage changes in CEO incentives and control variables. These tests are limited to firms that issue debt in consecutive years. Therefore, the sample size and the power of the tests are reduced. Nevertheless, the results, reported in the “Changes” column in Table 3 are consistent with those reported earlier. Changes in yield spreads are positively related to changes in CEO option ownership (γ1 = 0.310) and inversely related to changes in the sensitivity of CEO option portfolios to share price (γ3 = −1.448), and both relations are significant at better than the 0.05 level. In sum, the results from changes regressions mitigate the likelihood this study’s results are driven by endogeneity. Results of further attempts to address endogeneity are reported in Sect. 5.4.1.

5.3 Alternative cost of debt measures

Prior research suggests yield to maturity (Khurana and Raman 2003), total interest cost (Pittman and Fortin 2004; Francis et al. 2005), and credit ratings on new debt issues (Shi 2003, Sengupta 1998) as alternative measures of the cost of debt. I test the sensitivity of the results to each of these alternative cost of debt measures. Yield to maturity (YTM i,t ) and the S&P rating on the new debt issue (Rating i,t ) are collected from SDC and interest cost (Int_Cost i,t ) is total interest expense (from Compustat) divided by total long-term borrowings (from Compustat). Consistent with Francis et al. (2005) and Pittman and Fortin (2004), interest cost is winsorized at the 5th and 95th percentiles of its sample-wide distribution. The model is,

where all variables are as defined as above and COST i,t is either YTM i,t , Int_Cost i,t or Rating i,t .Footnote 24 Results are reported in Table 4.

From the “YTM” column of Table 4, yield to maturity is positively related to OPT (ϕ1 = 0.226, p < 0.01) and STK (ϕ2 = 0.08, p < 0.05), and inversely related to LDELTA (ϕ3 = −0.164, p < 0.01). These results corroborate evidence reported in Table 3; the cost of debt decreases (increases) with the sensitivity of CEO wealth to share price (the number of options and shares held by the CEO). Likewise, column 2 of Table 4 shows that total interest cost is positively related to OPT (ϕ1 = 0.234, p < 0.05) and inversely related to LDELTA (ϕ3 = −0.281, p < 0.01). The cost of debt bears no significant relation with CEO vega.

Column 3 of Table 4 reports results of estimating Eq. 4 with the Standard and Poor’s rating on the new debt issue as the dependent variable. Recall that a higher value for Rating indicates a lower (worse) credit rating. The results suggest new debt ratings are worse for firms with higher levels of CEO option and share ownership, as ϕ1 and ϕ2 are positive (= 0.423 and 0.028, respectively) and significant at p < 0.01 and p < 0.05 respectively. Results on LDELTA are consistent with those reported earlier, as ϕ3 is negative (= −0.140) and significant at p < 0.05. While the tabulated results use OLS, qualitatively similar results are obtained with logistic regression.

5.4 Other tests

5.4.1 Additional methods to address endogeneity

In addition to the changes tests discussed in Sect. 5.2, I employ several other approaches to address endogeneity concerns. First, I exclude current year option grants in my computation of CEO delta and vega variables. This places measurement of the key independent variables in this study at least 2 years in advance of the debt issuance. Results with these alternative CEO incentive variables are comparable to those reported in the paper.

Second, Guay (1999) argues that CEOs with higher cash compensation are more diversified and thus less risk-averse. Berger et al. (1997) argue that CEOs with longer tenures and higher cash compensation are more entrenched, and more risk-averse. The results of this study are unchanged when variables for CEO tenure and cash compensation (salary plus bonus), collected from Execucomp, are included as independent variables.

Third, the volatility of stock returns is an input in the Black–Scholes option value used to compute the CEO sensitivity variables. As noted by Guay (1999), it is thus possible that a mechanical relation between stock price volatility and the CEO wealth sensitivity variables influence the regression coefficients. Following Guay (1999) I recompute CEO delta and vega by using the mean stock price volatility, by year, for the entire Execucomp population with data, instead of firm-specific measures of stock price volatility. Once again the results are qualitatively similar to those tabulated. While this battery of tests confirms the paper’s findings, a potential role for endogeneity can never be completely eliminated.

5.4.2 Alternative control variables

Qualitatively similar results are obtained when estimating the regressions with the natural logarithm of market value of equity instead of total assets, alternative measures of firm performance (sales margin and return on assets), and after replacing the factor score for investment opportunities with its three separate components. Similar results are also obtained when adding an indicator variable for loss years and including the book-market ratio. Some studies (e.g., Klock et al. 2005) use a governance index developed by Gompers et al. (2003). Including this variable reduces sample size but does not impact the results.Footnote 25

5.4.3 Regression diagnostics

Variance inflation factors for certain of the industry dummy variables in certain regressions approach 30, a threshold beyond which Belsley, Kuh, and Welsch (1980) deem multicollinearity to be a concern. Qualitatively similar results to those reported in the paper are obtained after dropping the industry dummy variables. The highest variance inflation factor on variables other than the industry dummies is 6.24. The variance inflation factors on OPT, STK, LDELTA, and LVEGA for the regression reported in column 1 of Table 3 are 2.47, 1.75, 3.53, and 3.82 respectively, suggesting little impact of multicollinearity from these independent variables. Similar results to those reported in the paper are obtained after deleting observations with absolute studentized residuals above three (Belsley et al. 1980).

6 Conclusion

This paper examines the relation between CEO incentives and the cost of debt. Stock-based pay and debt financing are ubiquitous in modern capital markets, and it is often asserted that stock-based pay increases manager’s risk-seeking, and thus harms debtholders. To my knowledge this is the first study to incorporate the sensitivities of CEO option portfolios to stock price (delta) and stock return volatility (vega) in a study of debt costs. These individual sensitivities, estimated via the Core–Guay (2002) approach, reflect cross-sectional differences in underlying characteristics of option plans that are arguably important in understanding CEO incentives.

The sample includes 598 new debt issues by 274 distinct S&P 1500 firms over 1993–2004. The yield spread on a new debt issue is regressed on CEO delta and vega, CEO option and share ownership, and controls for characteristics of the debt issue and issuer. These controls include a battery of corporate governance variables. I find that a greater sensitivity of CEO wealth to share price is associated with a lower cost of debt on new issues, while greater sensitivity to return volatility has an insignificant impact on the cost of debt on new issues. The results also show that a greater percentage of options and shares owned by the CEO are related to higher yield spreads. The results highlight the importance of employing CEO percentage-ownership and sensitivity variables in understanding relations between CEO incentives and the cost of debt.

The study is not without limitations. First, like all studies of managerial choice, endogeneity is a potential concern. While the paper employs a battery of design features and tests that reduce the likelihood that endogeneity impacts the results, it can never completely be ruled out. Second, as the sample consists of large S&P 1500 firms, care should be taken in attempting to generalize the results.

Notes

Sensitivity to return volatility (stock price) is also commonly referred to as vega (delta).

These results are most pronounced for firms with relatively low levels of managerial share ownership.

Firms without options held by their CEO’s are excluded from the sample.

The regressions (see Sect. 4) use lagged values of certain independent variables. Since Execucomp data begin in 1992, 1993 is the first year of debt issue data applicable.

Some firms have more than one debt issue during a year. Sensitivity tests using either a weighted-average yield spread across all of a firm’s debt issues during a year or the largest (dollars of proceeds) issue of the year yield results similar to those reported in the paper.

Some research uses the firm’s overall credit rating, rather than the credit rating on the new issue (e.g. Ashbaugh-Skaife et al. 2006). I do not study this measure as evidence in Holthausen and Leftwich (1986) suggests these credit ratings are subject to rigorous analysis only at the time of a new issue or around special events; thus, these ratings tend to be sticky. Further, firm-level credit ratings are less likely to reflect issue-specific features, like covenants, that protect debt investors.

Guay (1999) provides a method of measuring the impact of small changes in stock price volatility on the value of CEO shareholdings. His results suggest this effect is immaterial, and like other studies I do not include an estimate of the effect of volatility on CEO shareholdings in my measure of vega.

Consistent with Coles et al. (2006), untabulated analyses show that VEGA is positively related to R&D expenditures and inversely related to capital expenditures, suggesting that VEGA is related to the riskiness of investment projects for this paper’s sample.

Results are similar if concentrated ownership is defined instead as the percentage of outstanding shares owned by blockholders holding at least 5 percent of the firm’s outstanding shares.

Along similar lines, Nagata and Hachiya (2007) find that firms with more conservative earnings management have higher initial offering prices.

This sample includes debt rated as AAA, AA+, AA, AA−, A+, A, A−, BBB+, BBB, BBB−, BB+, BB, BB−, B+, B, and B−.

Some studies control for the presence of subordinated debt. Less than three percent of the debt issuances in this study are for subordinated debt. Including an indicator variable for subordinated debt does not qualitatively impact this study’s inferences.

Data to compute these measures are from Compustat. Market value of assets is defined as the book value of debt plus the market value of equity.

Studying a broad cross-section of industries, Core and Guay (2002) report a median of $28 million for option sensitivity to return volatility.

The (untabulated) estimated equation is RATING = 10.090 +1.261*OPT +0.086*STK − 0.543*LDELTA − 0.210*LVEGA. The coefficients on OPT, STK, and LDELTA are each significant at p < 0.01. The coefficient on LVEGA is not significant at conventional levels (p = 0.14).

SIC codes 9000 and above and year 2004 are captured in the intercept.

Coefficients on the industry (IND) and year (YR) indicator variables are not tabulated for brevity. p-values reported in the paper are for one-tailed tests where coefficient signs are predicted, and for two-tailed tests where coefficient signs are not predicted.

Results of untabulated regressions suggest credit ratings explain a large portion of the variation in yield spreads, thus usurping some of the potential explanatory power of the other control variables.

Results on the earnings timeliness and accruals quality variables are consistent with Crabtree and Maher (2005), who find earnings predictability is related to better credit ratings and lower yield spreads on new issues.

For example, less risky firms (with lower-cost debt) might increase delta to encourage CEO risk-taking Ortiz-Molina (2007) finds that the relation between the change in CEO wealth and current stock return decreases in straight-debt leverage and increases with convertible-debt leverage. This suggests CEO pay-performance sensitivity is related to capital structure.

The residual credit rating variable (RES_RATING i,t ) is excluded from the regression with Rating i,t as the dependent variable.

Anderson et al. (2003) show that founding family ownership is associated with lower yield spreads. Execucomp does not identify founders, and identifying firms with founding family owners involves non-trivial manual data collection. However, as noted by Baker and Hall (2002), CEOs rarely hold more than 5 percent of the company’s shares unless they are founders. Results are not sensitive to dropping firms with CEO ownership greater than 5 percent.

References

Anderson R, Mansi S, Reeb D (2003) Founding family ownership and the agency costs of debt. J Financ Econ 68:263–285

Anderson R, Mansi S, Reeb D (2004) Board characteristics, accounting report integrity, and the cost of debt. J Acc Econ 37:315–342

Ashbaugh-Skaife H, Collins D, LaFond R (2006) The effects of corporate governance on firms’ credit ratings. J Acc Econ 42:203–243

Baker G, Hall B (2002) CEO incentives and firm size. Working paper, Harvard University and NBER

Balsam S, Miharjo S (2007) The effect of equity compensation on voluntary executive turnover. J Acc Econ 43(1):95–120

Belsley D, Kuh E, Welsch R (1980) Regression diagnostics. Wiley, New York

Berger P, Ofek E, Yermack D (1997) Managerial entrenchment and capital structure decisions. J Finance 52(4):1411–1438

Bergstresser D, Philippon T (2006) CEO incentives and earnings management. J Financ Econ 80(3):511–530

Berle A, Means G (1932) The modern corporation and private property. Transaction Publishers, London

Bhojraj S, Sengupta P (2003) Effect of corporate governance on bond ratings and yields: the role of institutional owners and outside directors. J Bus 76(3):455–475

Billet M, Mauer D, Zhang Y (2010) Stockholder and bondholder wealth effects of CEO incentive grants. Finan Manag 39(2):463–487

Black F, Scholes M (1973) The pricing of options and corporate liabilities. J Polit Econ 81(3):637–654

Boone J, Khurana I, Raman KK (2010) Investor pricing of CEO equity incentives. Rev Quant Financ Acc (forthcoming)

Burns N, Kedia S (2006) The impact of performance-based compensation on misreporting. J Financ Econ 79:35–67

Campbell J, Taksler G (2003) Equity volatility and corporate bond yields. J Finance 58(6):2321–2350

Cao J, Laksmana I (2010) The effect of capital market pressures on the association between R&D spending and CEO option compensation. Rev Quant Financ Acc 34(2):273–300

Carpenter J (2000) Does option compensation increase managerial risk appetite? J Finance 55(5):2311–2331

Cheng Q, Warfield T (2005) Equity incentives and earnings management. Acc Rev 80(2):441–476

Coles J, Naveen D, Naveen L (2006) Managerial incentives and risk-taking. J Financ Econ 79:431–468

Core J, Guay W (2002) Estimating the value of employee stock option portfolios and their sensitivities to price and volatility. J Acc Res 40:613–630

Crabtree A, Maher J (2005) Earnings predictability, bond ratings, and bond yields. Rev Quant Financ Acc 25(3):233–253

Dechow P, Dichev I (2002) The quality of accruals and earnings: the role of accrual estimation errors. Acc Rev 77(4):35–59

DeFusco R, Johnson R, Zorn T (1990) The effect of executive stock option plans on stockholders and bondholders. J Finance 45(2):617–627

Erickson M, Hanlon M, Maydew E (2006) Is there a link between executive equity incentives and accounting fraud? J Acc Res 44(1):113–143

Fisher L (1959) Determinants of risk premiums on corporate bonds. J Polit Econ 67(3):217–237

Francis J, LaFond R, Olsson P, Schipper K (2005) The market pricing of accruals quality. J Acc Econ 39(2):295–327

Gompers P, Ishii J, Metrick A (2003) Corporate governance and equity prices. Quart J Econ 118(1):107–155

Gu Z (2007) Across-sample incomparability of R2’s and additional evidence on value relevance changes over time. J Bus Fin Acc 34(September/October):1073–1098

Guay W (1999) The sensitivity of CEO wealth to equity risk: an analysis of the magnitude and determinants. J Financ Econ 53(1):43–71

Hanlon M, Rajgopal S, Shevlin T (2003) Are executive stock options associated with future earnings? J Acc Econ 36:3–44

Hanlon M, Rajgopal S, Shevlin T (2004) Large sample evidence on the relation between stock option compensation and risk taking. Working paper, University of Michigan and University of Washington

Hayn C (1995) The information content of losses. J Acc Econ 20(2):125–153

Holthausen R, Leftwich R (1986) The effect of bond rating changes on common stock prices. J Financ Econ 17(1):57–89

Huber P (1967) The behavior of maximum likelihood estimates under non-standard conditions. In: LeCam LM, Neyman J (eds) Proceedings of the 5th annual Berkeley symposium on mathematical statistics and probability, vol 1. University of California Press, Berkeley, pp 221–233

Jensen M, Meckling W (1976) Theory of the firm: managerial behavior, agency costs, and ownership structure. J Financ Econ 3(4):305–360

John T, John K (1993) Top-management compensation and capital structure. J Finance 48(3):949–974

Khurana I, Raman KK (2003) Are fundamentals priced in the bond market? Contemp Acc Res 20(3):465–494

Klock M, Mansi S, Maxwell W (2005) Does corporate governance matter to bondholders? J Financ Quant Anal 40(4):693–719

Knopf J, Nam J, Thornton J Jr (2002) The volatility and price sensitivities of managerial stock option portfolios and corporate hedging. J Finance 57(2):801–812

Lambert R, Larcker D, Verrecchia R (1991) Portfolio considerations in valuing executive compensation. J Acc Res 29(1):129–149

Merton R (1973) Theory of rational option pricing. Bell J Econ 4(1):141–183

Moody’s Investor Service (2003) US and Canadian corporate governance assessment. August: 1–8

Nagata K, Hachiya T (2007) Earnings management and the pricing of initial public offerings. Rev Pacific-Basin Finan Markets Pol 10(4):541–559

Ortiz-Molina H (2006) Top-management incentives and the pricing of corporate public debt. J Financ Quant Anal 41(2):317–340

Ortiz-Molina H (2007) Executive compensation and capital structure: the effects of convertible debt and straight debt on CEO Pay. J Acc Econ 43(1):69–94

Pittman J, Fortin S (2004) Auditor choice and the cost of debt capital for newly public firms. J Acc Econ 37(February):113–136

Rajgopal S, Shevlin T (2002) Empirical evidence on the relation between stock option compensation and risk taking. J Acc Econ 33(2):145–171

Ross S (2004) Compensation, incentives, and the duality of risk aversion and riskiness. J Finance 59(1):207–225

Sengupta P (1998) Corporate disclosure quality and the cost of debt. Acc Rev 73(4):459–474

Shi C (2003) On the trade-off between the future benefits and riskiness of R&D: a bondholders’ perspective. J Acc Econ 35:227–254

Standard and Poor’s (2004) Corporate governance scores and evaluations: Criteria Methodol Defin July: 1–23

White H (1980) A heteroscedasticity-consistent covariance matrix estimator and a direct test for heteroscedasticity. Econometrica 48(4):817–838

Wilson R, Fabozzi F (1990) The new corporate bond market. Probus, Chicago

Wooldridge J (2000) Introductory econometrics: a modern approach. South-Western College Publishing, New York

Acknowledgments

Helpful comments from C.F. Lee (editor), two anonymous referees, workshop participants at the University of Missouri, North Carolina State University, and the American Accounting Association national meeting (Chicago) and Midwest Regional meeting (St. Louis) are appreciated.

Author information

Authors and Affiliations

Corresponding author

Appendix: Calculating Black–Scholes option values and sensitivities

Appendix: Calculating Black–Scholes option values and sensitivities

This appendix describes the methods to estimate the modified Black–Scholes (1973) option pricing model, and the related sensitivities of CEO option value to share price and stock return volatility.

The Black–Scholes model (1973), as modified by Merton (1973) to account for dividends, is used to compute option values:

where:

- Z :

-

[ln(S/X) + T(r − d+2 /2)]/T(1/2)

- N :

-

cumulative probability function for the normal distribution

- S :

-

stock price

- X :

-

option exercise price

- σ:

-

expected stock return volatility

- r :

-

natural logarithm of risk-free interest rate

- T :

-

option time to maturity, in years

- d :

-

natural logarithm of dividend yield

The sensitivity of option value to a 1% change in stock price is:

The sensitivity of option value with respect to a 0.01 change in stock return volatility is:

where N′ is the normal density function.

Rights and permissions

About this article

Cite this article

Shaw, K.W. CEO incentives and the cost of debt. Rev Quant Finan Acc 38, 323–346 (2012). https://doi.org/10.1007/s11156-011-0230-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-011-0230-7