Abstract

Recent studies argue that CEO option compensation affects executives’ behavior toward risk. Specifically, the literature provides seemingly conflicting evidence regarding the impact of equity compensation (particularly option holding) on financing activities. We propose and test a nonlinear (e.g., inverted U-shaped) relation between corporate borrowing and option compensation. Consistent with our hypothesis, we empirically show that, in the low range of the option vega, a firm’s debt ratio increases as the option vega increases. However, in the high range of the option vega, we find the opposite relation. Our explanation is based on the contrasting effects of option compensation on managerial incentives toward risk. The positive wealth effect on leverage arises from the convexity of the option compensation, while a negative risk-premium effect exists due to managerial risk aversion. This reconciles the conflicting relation between leverage and option compensation that is often observed in the literature.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Option compensation has been a critical element of executive compensation for the last few decades because it is perceived to reduce agency problems by increasing the alignment between managerial and shareholder interests (Hall and Liebman 1998; Aggarwal and Samwick 1999). However, recent studies present two conflicting arguments regarding the direction that CEO option compensation affects executives’ behavior toward risk. One argument is that given the positive relation between the option value and underlying stock volatility, a manager who is compensated with option grants tends to take on more risky (volatility-increasing) decisions such as financing decisions to increase his/her wealth (see Guay 1999; Coles et al. 2006; Chava and Purnannandam 2010).Footnote 1 The other argument is that risk-averse managers are also concerned about their exposure to firm-specific risk arising from equity compensation, and thus have incentives to reduce the risk exposure such as debt levels. For example, Guay (1999) and Lewellen (2006) show a negative relation between debt financing and option convexity.

Given this seemingly conflicting evidence regarding the impact of equity compensation (especially option holding) on financing activities, we propose and test a hypothesis that, all other things being equal, the relation between debt financing as a major risk-taking activity and option compensation may depend on the level of option convexity, measured by the option’s vega.Footnote 2 Specifically, at a low option vega level, managers tend to use more leverage (and thus higher equity risk) to enhance their option compensation. However, beyond a certain level of option vega, risk-averse managers begin to face a high cost for risk bearing and attempt to reduce overall risk by reducing leverage. Our findings are consistent with this hypothesis after controlling for other possible determinants of debt financing activities and for the endogeneity concerns regarding reverse causality that the financing decision itself may also affect option convexity. To the best of our knowledge, this non-linear effect of convex option compensation on risk-taking behavior has not yet been recognized in the literature.

Recent studies have empirically analyzed CEO option compensation as determinants of corporate financial policy and corporate risk (Kim et al. 2017; Iqbal and Vähämaa 2019). Kim et al. (2017) argue that the equity incentives/risk-taking relation is critically determined by the impact of financial leverage on CEO career concerns and external monitoring by bondholders. Meanwhile, Iqbal and Vähämaa (2019) examine the relation between the systematic risk in the financial industry and option delta and vega in the CEO compensation. However, few studies have investigated the two potentially contrasting effects (i.e., wealth effect and risk premium effect) of CEO option convexity on financial leverage.

Thus, this study contributes to the literature by investigating whether variation in a firm’s debt financing policy is caused by risk-averse CEOs’ response to the convexity of CEO option compensation. Consistent with our hypothesis, we empirically show that there is a nonlinear (e.g., inverted U-shaped) relation between corporate borrowing and option compensation. This reconciles the conflicting relation between leverage and option compensation that is often observed in the literature.Footnote 3

The remainder of this paper is structured as follows. Section 2 discusses the literature on the effect of option compensation on risk-increasing behavior, especially on debt financing activity, thus deriving our hypothesis. Section 3 describes the data and empirical methodology, while Sect. 4 provides empirical results. Finally, Sect. 5 concludes the paper.

2 Option convexity, risk aversion and financing decisions

Suppose that a risk-averse CEO is provided with equity-based incentive compensation (e.g., stocks and options) that links his/her pay to the stock price, thus providing incentive alignment between shareholders and the manager. As Guay (1999) argues, a risk-averse CEO may then have an incentive to make his/her financing decisions based on two contrasting effects of equity-based compensation—the wealth effect and risk-premium effect. Following Pratt’s (1964) result on the relation between the risk-averse manager’s utility from a risky payoff and that from a certain payoff, the certainty equivalent is equal to E(wealth)–risk premium. He expresses the relation in his Eq. (2): ∂CE/∂σ = ∂E(wealth)/∂σ—∂(risk premium)/∂σ, where CE is the certainty equivalent of the manager’s utility, E(wealth) is expected wealth from managerial compensation, the risk premium is paid to managers for bearing risk due to uncertain compensation, and σ is firm volatility. That is, on one hand, the CEO’s option compensation promotes incentives for him/her to take more risk-enhancing activities that would increase his/her wealth (i.e., the wealth effect) due to option convexity. However, the CEO’s incentive to reduce volatility arises with excessive option compensation because the risk-premium (i.e., cost of volatility) becomes dominant over the wealth effect.Footnote 4 As a result, we may expect a positive or negative relation between firm leverage and option vega, depending on the relative magnitude of the wealth effect compared to that of the risk-premium effect.Footnote 5

One important and interesting implication of this theoretical argument is that there may be a nonlinear relation between debt financing and option compensation. Below a certain threshold, the CEO may want to increase leverage to increase equity risk because his/her option compensation increases as a result of the increased equity risk (i.e., the wealth effect) as long as the wealth effect dominates the negative risk-premium effect (i.e., ∂CE/∂σ > 0 and thus ∂Debt/∂Convexity > 0). However, beyond that threshold, the risk-premium effect dominates instead, and the CEO may wish to reduce equity risk (lowering the debt ratio) due to risk-reducing incentives (i.e., ∂CE/∂σ < 0 and thus ∂Debt/∂Convexity < 0). The purpose of this study is to propose and test this potential nonlinear relation (more specifically, an inverted U-shaped relation) between firm leverage and option compensation (convexity).Footnote 6

3 Data and empirical methodology

3.1 Data and sample selection

We collect CEO compensation data from the ExecuComp database. The study sample period encompasses 1993–2014. Although ExecuComp provides the raw data from 1992, we drop the first year because its data are limited. We perform an additional data match between firms in ExecuComp and Compustat to obtain financial variables, and exclude both the financial industry (SIC codes between 6000 and 6999) and utility industry (SIC codes between 4900 and 4999) to avoid any regulation effects. Eliminating observations with missing variable values, our final sample consists of 1096 firms with 13,371 firm-year observations. In order to reduce the effect of possible spurious outliers, all variables are winsorized at the 1% and 99% levels. All variable definitions are reported in “Appendix”.

3.2 Empirical methodology

We employ the option vega as a measure of option convexity (i.e., the sensitivity of the option value to stock price volatility), provided by Core and Guay (2002) and Coles et al. (2006). Following Chava and Purnannandam (2010), we use Ln (1 + Vega) and Ln (1 + Delta) as the option vega and option delta to reduce their skewness. We use second-degree polynomial regression to estimate the nonlinear relation between firm leverage and option incentives with some control variables. The following equation describes the regression model:

Coles et al. (2006) suggest that more option grants increase the exposure to risk (higher option delta), which implies the option delta may impact debt financing. Thus, we add the option delta as a control variable. Furthermore, we employ total assets as a proxy for firm size, and the market-to-book ratio and Z-score (defined in 1990) to control for the effects of growth opportunities and financial distress on corporate borrowing, respectively. Following Chava and Purnannandam (2010), we also use ROA, net working capital, and dividend payment as additional control variables, reflecting the effect of a firm’s internal cash flow position on debt financing. In addition, we include governance variables such as CEO tenure, board size, and board independence as control variables to reflect the monitoring effect on corporate borrowing, following Lewellen (2006).Footnote 7 We add investment activities such as capital expenditures and R&D expenditure as control variables because they may also interact with debt financing (refer to Cole et al. 2006). A positive (negative) sign on the coefficient of the option vega squared indicates a U-shaped (inverted U-shaped) relationship.

3.3 Descriptive statistics

Table 1 presents the descriptive statistics of this study’s variables. The mean (median) CEO wealth increases by $122,000 ($54,000) for a 1% increase in a firm’s stock volatility and by $551,000 ($227,000) for a 1% increase in stock price. As we employ the natural log transformation, the mean (median) of Ln (1 + Vega) and Ln (1 + Delta) are about 3.723 (4.001) and 5.406 (5.430), respectively. The average (median) value of firm leverage is 0.228 (0.224).

4 Empirical results

4.1 Multivariate regression results

Table 2 presents the results of our multivariate regression analysis of firm leverage and option vega.Footnote 8 To control for variation across time and industries, we include year and industry (based on the first two digits of the Standard Industrial Classification) dummies.

We first examine the relation between option vega and firm leverage; these results are shown in Models (1) to (4) of Table 2. In Models (1) and (3), we only analyze the linear relation between option vega and firm leverage as the base model. In Model (1), it shows a negative relationship; however in Model (3), when governance variables are included, the significant relation between option vega and firm leverage disappears, probably due to the significant reduction in the sample size. In Models (2) and (4), we include the quadratic term of the option vega and firm characteristic control variables, while we add governance variables in Model (3) and (4). In Models (2) and (4), both results show a consistently strong non-monotonic relation between leverage and the option vega. Specifically, the coefficient on Ln (1 + Vega) is positive and significant, while the coefficient on \(\left({\text{Ln}} \left( {1 + {\text{Vega}}} \right)\right)^{2}\) is significantly negative. Therefore, we confirm a strong inverted U-shape relation between leverage and option vega. Specifically, at the low option vega level, an increase in the option vega leads to greater use of debt, consistent with the positive risk-taking incentives arising from the wealth effect. However, in the high range of the option vega, a manager may want to reduce the debt ratio as the option vega increases, consistent with the risk-premium (i.e., cost of volatility) effect dominating the wealth effect.Footnote 9

Together, these results suggest that, in addition to other relevant factors, managerial incentives toward risk play a significant role in financing decisions. In particular, there seems to be a nonlinear relation between firm leverage and option compensation, supporting the idea that a risk-averse CEO chooses firm leverage optimally in response to the level of option convexity. The result of our analysis remains strong and consistent after we control for the effect of other important determinants of debt/equity choice and corporate governance variables.

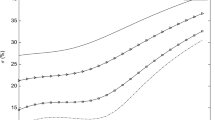

Figure 1 presents a graph that depicts the estimated inverted U-shaped relation between debt financing and option vega using the estimated regression coefficients from the second Model of Table 2. Focusing on the estimated coefficient for the option vega and its square, we obtain the following quadratic equation:

Simulated relation between debt ratio and option vega. The graph is based on the regression coefficients in Table 2 (Model 2) in Eq. (2) below, where β0 = 0.312; β1 = 0.0051; β2 =−0.0012. \({\text{D}} = \beta_{0} + \beta_{1} {\text{OpC}} + \beta_{2} {\text{OpC}}^{2}\) OpC = Ln(1 + Vega). The optimal option convexity is 2.125 which is obtained by—β1/(2*β2)

We use the estimated coefficients from the second Model of Table 2 to calculate the optimal level of convexity. Focusing on the coefficient estimated on option vega and its squared terms, we obtain the quadratic Eq. (1) where β0 = 0.3116; β1 = 0.0051; β2 =−0.0012. The optimal convexity is 2.125 which is obtained by—β1/(2*β2).

Figure 1 shows a simulated inverted U-shaped relation between the debt ratio and option vega, based on the regression estimated using our data. The optimal level of the option vega measured by Ln(1 + Vega) is about 2.125, with a corresponding debt ratio of approximately 32%. It is interesting to observe that the simulated optimal level of the option vega is below its sample mean (= 3.7) and median (= 4.0).

4.2 Endogeneity due to reverse causality and two-stage least squares (2SLS) regression

In this section, we address a potential endogeneity issue due to reverse causality, in which the leverage level may affect option compensation. We estimate a two-stage least squares (2SLS) regression using two instrumental variables for the option vega, the option vega in the earliest year and the industry-average option vega, in the 2SLS estimation, following Jiraporn and Chintrakarn (2013).Footnote 10 The logic is as follows. We first identify the option vega in the earliest year for each firm in the sample. It is very unlikely that this earliest vega is affected by subsequent firm leverage, so reverse causality is not expected. Similarly, each firm’s leverage is not likely to affect the industry-average option vega because there are so many firms in each industry with diverse option vegas across firms. Furthermore, a valid instrument should be strongly correlated with the option vega. In Model (5) of Table 2, we include these two instrumental variables for option vega and all control variables as specified in the baseline model. As expected, both instrumental variables have strong positive associations with the option vega, significant at the 1% level. Moreover, according to Angrist-Pischke’s (2008) F-statistic for weak instruments, we find that the two instruments are very strong at the 1% significance level.

In the second-stage regression results in Model (6) of Table 2, we employ the baseline regression model, except that we replace the option vega with the instrumented option vega and its squared term. We find that the coefficients of the instrumented option vega and its squared term remain strong, consistent with the results of the prior multivariate regressions. Therefore, the 2SLS result corroborates our finding that there is an inverted U-shaped relation between option vega and firm leverage. Thus, the results of our analysis seem to be robust in terms of the issue of reverse causality and support our hypothesis.Footnote 11 Finally, as shown in Models (7) and (8) of Table 2, a non-monotonic association between leverage and option vega is confirmed when corporate governance is controlled.

4.3 Subsampling analysis

In this section, we conduct a subsampling analysis to find out whether the nonlinear relations between the financing decisions and option compensation described above remain under various conditions. In Table 3, we show the results of the regression analyzing the impact of option compensation on firm leverage depending on the level of option vega and option market characteristics (e.g., option “moneyness”).Footnote 12 Due to a significantly-reduced number of observations in this subsample estimation, we do not include the governance variables to obtain more efficient coefficient estimates.

In Models (1) and (2), we separate pooled samples into a high vega group and low vega group based on optimal convexity, which is calculated to be 2.125 from the quadratic Eq. (1) where β0 = 0.3116; β1 = 0.0051; and β2 =−0.0012. We exclude the quadratic term of the option vega in our model to verify whether the coefficient of option vega is significantly different for the low and high vega groups. Although the coefficient of the option vega is not significant (i.e., a flat slope) in the low vega group as shown in Model (1), the coefficient of option vega in the high vega group is negatively significant as shown in Model (2) (i.e., a negative slope). These results support the nonlinear relation between firm leverage and option compensation.

We further examine the association between the option compensation and firm leverage as a function of the CEOs’ option moneyness. The amount of risk exposure that managers are willing to take can depend on the moneyness of their stock option holdings. When it comes to the case of in-the-money options, managers tend to use less leverage because their portfolio becomes more sensitive to stock price changes and thus the volatility cost of debt increases, as argued in Lewellen (2006). In contrast, we expect risk-taking incentives to be relatively stronger in the out-of-money sample due to the wealth effect, thus resulting in a more significant nonlinear relation between financial leverage and option vega. That is, managers may optimally choose firm leverage, balancing between the positive wealth effect and the negative risk-premium (or volatility cost) effect.

Following Campbell et al. (2011) and Core and Guay (2002), we estimate the average exercise price of the aggregated options. First, we compute the realizable value per option by dividing the total realizable value of the exercisable options by the number of exercisable options. Second, we obtain the estimated average exercise price of the options by subtracting the per-option realizable value from the stock price at the fiscal year end. The option is in-the-money (out-of-the-money) when the year-end stock price is greater (smaller) than the average exercise price.

We report the regression results of the quadratic relation between financial leverage and option vega for the subsample of the out-of-the-money in Models (3) and the in-the-money groups in Model (4). Consistent with our hypothesis, we confirm that the inverse U-shaped relation between option compensation and firm leverage strongly remains for the out-of-money sample, while we do not find the quadratic relation for the in-the-money sample. The empirical result is also consistent with the simulated relation between leverage and option vega as shown in Fig. 2.

Simulated relation between debt ratio and option vega under in-the-money versus out-of-the-money sample. a and b presents the relation between leverage and option convexity based on the regression coefficients for the out-of-the-money sample (in-the-money) in Table 3

5 Conclusion

We document that there is a nonlinear (e.g., inverted U-shaped) relation between the debt ratio and option vega. This result supports our hypothesis that a risk-averse manager optimally chooses financing activities by balancing between the wealth effect and risk-premium effect of his/her option-based compensation. That is, the manager’s utility is enhanced by the increased wealth from the convex option compensation when equity risk increases (i.e., the wealth effect) with higher debt financing. Thus, we expect to observe that the CEO would choose more debt with a higher level of option compensation. However, the risk premium required by the risk-averse CEO also increases as the option compensation increases. Beyond a threshold of equity risk where the risk-premium effect begins to dominate the wealth effect, more option compensation will incentivize the CEO to reduce the debt level to reduce equity risk. This non-monotonic relation is particularly evident for the out-of-the-money option sample. In conclusion, we suggest that, among other factors, managerial incentives, driven by equity compensation, toward risk may play an important role in determining firm leverage; we further contribute to the literature by reconciling the positive and negative relations between firm leverage and option compensation shown in the literature.

Notes

Guay (1999) provides evidence that stock options significantly increase the convexity of the relation between managers’ wealth and stock price. We use a firm’s option vega to measure option convexity as in Guay (1999). The option vega is defined as the change in the manager’s option value for a given change in the value of stock return volatility.

The financial crisis of 2008–2009 has triggered an interesting recent literature that examines the relation between executive compensation structures and risk-taking behavior in the financial industry. Refer to Bhagat and Bolton (2014), Minhat and Abdullah (2016), and Gande and Kalpathy (2017). Also refer to Malmendier and Tate (2005) and Yung and Chen (2018) for empirical evidence of the relation between risk-taking investment and CEO characteristics such as confidence and ability.

It is well recognized in the literature that expected wealth increases with risk when a CEO’s stock-based compensation is convex. Refer to Jensen and Meckling (1976), Haugen and Senbet (1981), and Guay (1999), among others. Since the CEO faces a risky payoff from the incentive compensation, s/he demands a risk premium. Lewellen (2006) also recognizes the wealth benefit and volatility cost (due to the manager’s risk aversion) of option compensation. See Lambert et al. (1991), Carpenter (2000), Hall and Murphy (2002), and Ross (2004) for further review regarding the importance of risk aversion on the part of managers.

Lewellen (2006) argues that CEOs may have discretion over a firm’s capital structure because of imperfections in corporate governance, which motivates the inclusion of corporate governance variables as control variables. In fact, our results show significant impacts of some governance variables, such as CEO tenure, board independence, and board size.

Jiraporn and Chintrakarn (2013) also employ a second-order polynomial regression to check the inverted-U shaped relation between CEO pay slices and corporate social responsibility.

We recognize some attempts to minimize the endogeneity issue by examining the exogenous impact of CEO compensation on risk-taking behavior. For example, Hayes et al. (2012) examine the link between option compensation and risk-taking behavior by using Financial Accounting Standards (FAS) 123R and the change in accounting treatment of options. They do not find a strong relation between the option pay and risky investments. More recently, Tosun (2016) employs the Internal Revenue Code 162 tax law as an exogenous shock to compensation structure to consider firm leverage changes as a result of CEO option compensation changes.

We also employed firm fixed-effects regression and found insignificant results. The fixed-effects regression assumes that there is sufficient time variation in the option vega within firms. Similar to Coles et al. (2006) and Zhou (2001), we attribute the insignificant result in the firm fixed-effects analysis to the lack of variation in our sample’s option vega over time within firms.

We appreciate an anonymous referee for bringing up this excellent idea.

References

Aggarwal RK, Samwick AA (1999) Executive compensation, strategic competition, and relative performance evaluation: theory and evidence. J Finance 54:1999–2043. https://doi.org/10.1111/0022-1082.00180

Agrawal A, Mandelker GN (1987) Managerial incentives and corporate investment and financing decisions. J Finance 42:823–837. https://doi.org/10.1111/j.1540-6261.1987.tb03914.x

Angrist JD, Pischke JS (2008) Mostly harmless econometrics: an empiricist's companion. Princeton University Press, Princeton

Bhagat S, Bolton B (2014) Financial crisis and bank executive incentive compensation. J Corp Finance 25:313–341. https://doi.org/10.1016/j.jcorpfin.2014.01.002

Campbell TC, Gallmeyer M, Johnson SA, Rutherford J, Stanley BW (2011) CEO optimism and forced turnover. J Financ Econ 101:695–712. https://doi.org/10.1016/j.jfineco.2011.03.004

Carpenter JN (2000) Does option compensation increase managerial risk appetite? J Finance 55:2311–2331. https://doi.org/10.1111/0022-1082.00288

Chava S, Purnanandam A (2010) CEOs versus CFOs: incentives and corporate policies. J Financ Econ 97:263–278. https://doi.org/10.1016/j.jfineco.2010.03.018

Coles JL, Daniel ND, Naveen L (2006) Managerial incentives and risk-taking. J Financ Econ 79:431–468. https://doi.org/10.1016/j.jfineco.2004.09.004

Core J, Guay W (2002) Estimating the value of employee stock option portfolios and their sensitivities to price and volatility. J Account Res 40:613–630. https://doi.org/10.1111/1475-679X.00064

Gande A, Kalpathy S (2017) CEO compensation and risk-taking at financial firms: evidence from U.S. federal loan assistance. J Corp Finance 47:131–150. https://doi.org/10.1016/j.jcorpfin.2017.09.001

Guay WR (1999) The sensitivity of CEO wealth to equity risk: an analysis of the magnitude and determinants. J Financ Econ 53:43–71. https://doi.org/10.1016/S0304-405X(99)00016-1

Hall BJ, Liebman JB (1998) Are CEOs really paid like bureaucrats? Q J Econ 113:653–691. https://doi.org/10.1162/003355398555702

Hall BJ, Murphy KJ (2002) Stock options for undiversified executives. J Account Econ 33:3–42. https://doi.org/10.1016/S0165-4101(01)00050-7

Haugen RA, Senbet LW (1981) Resolving the agency problems of external capital through options. J Finance 36:629–647. https://doi.org/10.1111/j.1540-6261.1981.tb00649.x

Hayes RM, Lemmon M, Qiu M (2012) Stock options and managerial incentives for risk-taking evidence from FAS 123R. J Financ Econ 105:174–190. https://doi.org/10.1016/j.jfineco.2012.01.004

Iqbal J, Vähämaa S (2019) Managerial risk-taking incentives and the systemic risk of financial institutions. Rev Quant Financ Account 53:1229–1258. https://doi.org/10.1007/s11156-018-0780-z

Jensen MC, Meckling WH (1976) Theory of the firm: managerial behavior, agency costs and ownership structure. J Financ Econ 3:305–360. https://doi.org/10.1016/0304-405X(76)90026-X

Jiraporn P, Chintrakarn P (2013) How do powerful CEOs view corporate social responsibility (CSR)? An empirical note. Econ Lett 119:344–347. https://doi.org/10.1016/j.econlet.2013.03.026

Kim K, Patro S, Pereira R (2017) Option incentives, leverage, and risk-taking. J Corp Finance 43:1–18. https://doi.org/10.1016/j.jcorpfin.2016.12.003

Lambert RA, Larcker DF, Verrecchia RE (1991) Portfolio considerations in valuing executive compensation. J Account Res 29:129–149. https://doi.org/10.2307/2491032

Lewellen K (2006) Financing decisions when managers are risk averse. J Financ Econ 82:551–589. https://doi.org/10.1016/j.jfineco.2005.06.009

MacKie-Mason JK (1990) Do taxes affect corporate financing decisions? J Finance 45:1471–1493. https://doi.org/10.1111/j.1540-6261.1990.tb03724.x

Malmendier U, Tate G (2005) CEO overconfidence and corporate investment. J Finance 60:2661–2700. https://doi.org/10.1111/j.1540-6261.2005.00813.x

Mehran H (1992) Executive incentive plans, corporate control, and capital structure. J Financ Quant Anal 27:539–560. https://doi.org/10.2307/2331139

Minhat M, Abdullah M (2016) Bankers’ stock options, risk-taking and the financial crisis. J Financ Stab 22:121–128. https://doi.org/10.1016/j.jfs.2016.01.008

Pratt JW (1964) Risk aversion in the large and in the small. Econometrica 32:122–136

Ross SA (2004) Compensation, incentives, and the duality of risk aversion and riskiness. J Finance 59:207–225. https://doi.org/10.1111/j.1540-6261.2004.00631.x

Tosun OK (2016) The effect of CEO option compensation on the capital structure: a natural experiment. Financ Manag 45:95–979. https://doi.org/10.1111/fma.12116

Yermack DL (1995) Do corporations award CEO stock options effectively? J Financ Econ 39:237–269. https://doi.org/10.1016/0304-405X(95)00829-4

Yung K, Chen C (2018) Managerial ability and firm risk-taking behavior. Rev Quant Financ Account 51:1005–1032. https://doi.org/10.1007/s11156-017-0695-0

Zhou X (2001) Understanding the determinants of managerial ownership and the link between ownership and performance: comment. J Financ Econ 62:559–571. https://doi.org/10.1016/S0304-405X(01)00085-X

Acknowledgements

We appreciate valuable feedback and encouragement from Catherine Choi, David Emmanuel, Vladimir Gatchev, Sulei Han, and Sangwon Lee. The guidance and feedback from Cheng-few Lee (Editor) and an anonymous referee were instrumental in significantly improving this manuscript. We also acknowledge that this work was supported by Global Research Network program through the Ministry of Education of the Republic of Korea and the National Research Foundation of Korea (NRF-2016S1A2A2912421).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Definitions of variables

Appendix: Definitions of variables

Variable name | Description |

|---|---|

Vega | The sensitivity of the manager’s wealth to the firm’s stock return volatility as defined in Coles et al. (2006) |

Ln(1 + Vega) | The natural logarithm of (1 + vega of CEOs’ compensation) |

Delta | The sensitivity of the manager’s wealth to the firm’s stock price as defined in Coles et al. (2006) |

Ln(1 + Delta) | The natural logarithm of (1 + delta of CEOs’ compensation) |

Leverage | The ratio of total debt (debt in current liabilities + long-term debt) to total assets |

Asset | The natural log of assets |

MTB | The ratio of market value (book value of assets—less the book value of equity + the market value of equity) to total assets |

NWC | The ratio of net working capital to the total assets |

CAPX | The ratio of Capital investment (capital expenditures – sale of property) to total assets |

R&D | The ratio of R&D investment (research and development expense) to total assets |

Z-score | The modified z-score as defined in 1990 and is equal to 3.3(EBIT/Total Assets) + 1.0(Sales/Total Assets) + 1.4 (Retained Earnings/Total Assets) + 1.2 (Working Capital/Total Assets) |

ROA | The ratio of net income (operating income after depreciation plus depreciation) to total assets |

Divpayer | A dummy variable that is set to the value of one if the firm paid a dividend in the year |

Tenure | The number of years the CEO has served in position at given year |

Boardsize | The natural log of number of directors sitting on the board |

Boardindep | The percentage of independent non-executive directors on the board at given year |

Rights and permissions

About this article

Cite this article

Choi, Y.K., Han, S.H. & Mun, S. The nonlinear relation between financing decisions and option compensation. Rev Quant Finan Acc 56, 1343–1356 (2021). https://doi.org/10.1007/s11156-020-00930-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-020-00930-9