Abstract

Early care and education (ECE) enables parental employment and provides a context for child development. Theory suggests that lower child care costs, through subsidized care or the provision of free or low-cost arrangements, would increase the use of ECE and parents’ employment and work hours. This paper reviews the research literature examining the effects of child care costs and availability on parental employment. In general, research suggests that reduced out-of-pocket costs for ECE and increased availability of public ECE increases ECE attendance among young children, and has positive impacts on mothers’ labor force participation and work hours. However, there is considerable heterogeneity in findings. Among U.S. studies that report the elasticity of employment to ECE price, estimates range from −0.025 to −1.1, with estimates clustering near 0.05–0.25. This indicates that a 10 % reduction in the price of child care would lead to a 0.25–11 % increase in maternal employment, likely near 0.5–2.5 %. In general, studies using more recent data or data from non-U.S. countries find smaller elasticities than those using U.S. data from the 1990s. These differences may be due to historical and cross-national differences in ECE attendance, labor force attachment, and educational attainment among mothers with young children, as well as heterogeneity in the methodological approaches and data used across studies. More research in the U.S. using contemporary data is needed, particularly given recent changes in U.S. ECE policy.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

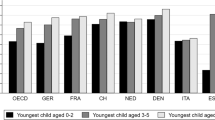

Attending nonparental early care and education (ECE) settings, including child care centers, preschools, and home-based care, has become a normative experience in the lives of young children in the United States. In 2011, more than three-fifths (61 %) of children under five in the United States regularly attended some type of ECE arrangement, and among those in at least one care arrangement, they spent an average of 33 h a week in care (Laughlin 2013).Footnote 1 In 2014, 64 % of women with children under age 6 were employed; more than half of mothers with infants under 1 year were employed (Bureau of Labor Statistics 2015), and more than 6 in 10 households with children are dual-earner or employed single-parent households (i.e., all parents work) (Council of Economic Advisors 2014). Maternal employment rates (mothers with children 0–14 years) in the United States fall near the OECD average, with the Scandinavian countries, Canada, and much of Western Europe averaging higher rates (Sweden at the highest, above 80 %), and Australia, Mexico, and several Southern European countries averaging lower rates (i.e., Mexico at the lowest, below 50 %) (OECD 2015).

Economic theory suggests that lower child care costs, through subsidized care or the provision of free or low-cost arrangements, decreases the costs of employment, and in turn, increases the use of ECE and the likelihood that parents are employed and lengthens their work hours (e.g., Blau and Currie 2006a, b; Connelly and Kimmel 2003; Tekin 2007). This paper reviews the research on the effects of ECE on parental labor force participation in the last 15 years (2001 and after), with a focus on the United States but also including research in other countries. Section 2 describes the ECE policy context and recent policy changes, and relevant background literature. Section 3 summarizes the current research on the impacts of ECE on mothers’ and fathers’ employment and work hours, first presenting research in the United States and then that conducted in other countries, and describes variations in impacts by child and family characteristics. Section 4 discusses the gaps in existing research and future directions, and provides concluding remarks.

2 Review of policies and theoretical framework

ECE can be viewed as a two-generation strategy, both as a necessary prerequisite for most parents to work and as a context for child development. Parental employment, or a change in parents’ work, is the main reason why the parents of children under age 3 search for and use ECE (NSECE Team 2014). A wealth of research demonstrates the importance of high-quality ECE for young children’s development (Li et al. 2013; NICHD ECCRN 2006; Yoshikawa et al. 2013), and a parallel body of research demonstrates the impacts of reliable, affordable child care on parents’ employment, particularly mothers’ work (Brooks-Gunn et al. 1994; Hofferth and Collins 2000; Hofferth 1999; Meyers 1993; Vandell and Wolfe 2000). Although the long-term human capital benefits of investments in ECE have received more research and policy attention (e.g., Barnett 2011; Heckman and Masterov 2004; Masse and Barnett 2002), the economic benefits of increasing parents’ employment, and thus economic self-sufficiency and tax revenue, are also positive and immediate (Morrissey and Warner 2007).

Despite the two-generation benefits of ECE, unlike other developed nations, the United States lacks a publicly provided or heavily regulated and subsidized child care system (Ruhm 2011). The American system relies heavily on the private market, which, in general, provides few affordable, high-quality ECE options, particularly for infants and toddlers (Phillips and Adams 2001). According to the recent National Survey of Early Care and Education (NSECE), 63 % of households using center care and fewer than 60 % of households using family child care rated their arrangements as providing an excellent or good nurturing environment (NSECE Team 2014). Further, child care at any quality constitutes a substantial family expense. In 2011, families with children under 5 spent an average of 10.5 % of their incomes on child care; households below the Federal Poverty Line (FPL) spent more than 30 % of their incomes on child care (Laughlin 2013). Families shoulder this financial burden during the lowest earning years of their lives (Stoney et al. 2006). In the NSECE, only 32 % of households rated their child care centers as good or excellent in terms of affordability (NSECE Team 2014). A 2014 Child Care Aware report found that the average annual cost of center-based care for infants ranged from $5655 in Louisiana to $14,508 in New York, accounting for 7 and 16 %, respectively, of their state median income for a two-parent household, and 29 and 56 % for the state median income for a single-mother household. Center care for 4-year-olds was slightly less expensive, but still pricey—ranging from $4882 per year in Louisiana to $12,280 per year in New York (Child Care Aware 2014). Parents report that fees are the most important consideration in their search for child care, above hours and type of setting (NSECE Team 2014), and the high costs of child care can discourage parents from entering or returning to the workforce (Hofferth 1999; Meyers 1993).

Early childhood policies in the United States typically focus on low-income families. The three main public interventions in ECE are the federal Child Care Development and Block Grant (CCDBG), the federal Head Start and Early Head Start programs, and state-supported public prekindergarten. CCDBG is a block grant to states to provide portable vouchers or contracted subsidized slots to low-income families to be used at child care settings for children up to age 13. The program emphasizes parents’ employment needs and choice of child care, and parental employment is a condition of receipt. By contrast, Head Start, Early Head Start, and public prekindergarten were primarily designed as interventions to improve child outcomes. Typically, these programs have family income eligibility requirements (although many pre-K programs do not), but do not require parental employment. However, by providing free or low-cost ECE to young children during school hours, these supply-side interventions lower families’ child care costs and may affect parents’ employment status, hours, or stability. Unfortunately, these public programs serve only a fraction of those eligible. In 2011, only 40 and 4 % of children under the poverty line attended Head Start and Early Head Start, respectively, and an estimated 17 % of eligible children received child care subsidies (as determined by federal rules) (Office of the Assistant Secretary for Planning and Evaluation 2015). Only a few states, including Oklahoma, Georgia, and Florida, have universal prekindergarten programs for 4 year-olds (NIEER 2014).

In recent years, early childhood has received increased public, political, and legislative attention in the United States. The American Recovery and Reinvestment Act (ARRA) of 2009 provided for temporary expansions in child care subsidies to hundreds of thousands of families. In 2014, the Early Head Start-Child Care Partnership program was created, expanding full-day early care and education services to tens of thousands of additional infants and toddlers, and the CCDBG was reauthorized. CCDBG reauthorization included health and safety inspections and a requirement that states use a 12-month recertification period for child care subsidies, which may enhance the quality of care and stability of subsidy receipt, and potentially parents’ employment stability, but in the context of stable funding, may reduce the total number of families served by subsidies. In 2015, President Obama proposed a major expansion of the CCDF program to low- and moderate-income families with children under 4 years of age. A major motivation of these policies was to support parents’ employment.

A large literature has examined how ECE policies have affected parental (mostly maternal) labor force participation, largely focused on the costs and availability (i.e., supply) of ECE. Theory suggests that reducing the costs of child care or increasing the availability (particularly of low-cost or free slots) increases parents’ likelihood of employment and lengthens work hours by reducing the cost of work (Blau and Currie 2006a, b; Blau 2001). In contexts in which child care is largely private and families’ out of pocket costs vary widely, such as the United States, changes in the cost of care may strongly influence parents’ employment, whereas contexts in which care is mostly publicly provided and potentially rationed, such as in Western European countries, the availability of care may to the more significant determinant of parental employment (Del Boca et al. 2009).

The methodological approaches used to estimate the effects of child care costs or availability on parents’ employment and work hours vary, but are largely quasi-experimental, with exceptions involving random-assignment experiments in the United States (Michalopoulos et al. 2010; Michalopoulos 2010). Another study compared the effect sizes of random-assignment welfare experiments with and without expanded child care assistance (Gennetian et al. 2004). Several studies exploit geographic variation in child care costs, availability, or policies that affect each of these (Blau and Tekin 2007; Brilli et al. 2016; Cannon et al. 2006; Del Boca et al. 2009; Kreyenfeld and Hank 2000; Lefebvre et al. 2009; Meyers et al. 2002; Tekin 2007). Other research, particularly older studies or those using cross-sectional data, use rich household, economic, policy, and other controls to limit unobserved heterogeneity (Baum 2002; Connelly and Kimmel 2003; Han and Waldfogel 2001; Herbst 2010; Loft and Hogan 2014; Viitanen 2005). Two studies in Australia simulate the effects of policy changes (Doiron and Kalb 2002, 2005; Kalb and Thoresen 2010). In general, more recent studies, which constitute the majority of research reviewed in this paper, take advantage of the increased policy attention to ECE and exploit geographic and time variation in program or policy implementation (Bainbridge et al. 2003; Baker et al. 2008; Berlinski et al. 2009; Berlinski and Galiani 2007; Cascio and Schanzenbach 2013; Cascio 2009; Del Boca 2002; Fitzpatrick 2010, 2012; Francesconi and van der Klaauw 2007; Gelbach 2002; Geyer et al. 2014; Haan and Wrohlich 2011; Hanappi and Müllbacher 2013; Hardoy and Schøne 2013; Havnes and Mogstad 2011a; Herbst 2013; Lefebvre et al. 2011; Lefebvre and Merrigan 2008; Schlosser 2011; de la Cruz Toledo 2015; Viitanen 2011).

This literature review summarizes the studies that have examined the effects of child care or preschool availability or prices on parental (largely maternal) employment and work hours, and how these impacts vary by child and family characteristics. Unlike other reviews that are country or region-specific (Datta Gupta et al. 2008; Kalb 2009), the main focus of this review is the United States but also summarizes the available research across other countries (North and South America, Europe, Australia, and the Middle East). Given the changes in United States child care policy since welfare reform in the 1990s, I include research published in peer-reviewed journals or working papers in the last 15 years (2001 and later). The studies included are not exhaustive, but represent the major studies in this area. This review does not focus on research including children of specific ages or from specific backgrounds; however, the majority of studies focus on lower-income or single-mother samples with children aged 5 and younger. Importantly, this review does not include other policies that may change the relative price of child care, such as the rationing of child care slots, parental leave, Cash-for-Care (i.e., transfers to families with children not enrolled in child care), child tax credits, flex-time policies, or wage reforms.

3 Current research on the impacts of early care and education on parent labor force participation

Although the effects of child care on parental labor force participation received substantial research attention in the United States during the 1990s and early 2000s, there is a limited number of recent studies conducted on U.S. samples. Because much of the recent research in this area has been conducted using international data in countries with very different child care, employment, and other policies and structures, this review first summarizes the research conducted in the U.S. and then international research. Studies reviewed are classified into those that examined the effects of ECE costs and those that examined the effects of the availability of public ECE. Table 1 of electronic supplementary material provides a summary of the articles reviewed.

3.1 Research in the United States

In theory, a decrease in families’ care costs increases the value of employment, thus encouraging more parents to enter or re-enter the workforce and for others to increase their hours. Policies that increase the generosity of or eligibility for subsidy would decrease the cost of recipients’ care, and presumably have a positive effect on parent employment. Studies of subsidy policies largely support that these reductions do lead to increases in maternal employment. In general, research also finds the availability of public preschool or kindergarten has small positive effects on maternal employment (Cannon et al. 2006; Cascio 2009; Gelbach 2002), although some studies using recent data find no or smaller effects (Fitzpatrick 2010, 2012). However, there is considerable heterogeneity in the timing, data, methods, and findings across studies.

3.1.1 ECE costs

The majority of studies that examine how changes in child care costs or expenses find that there is a strong, negative association between child care costs and parental labor force participation. Using data from the 1992 and 1993 panels of the Survey of Income and Program Participation (SIPP), Connelly and Kimmel (2003) examined the effect of child care costs on the employment and welfare recipiency of single mothers, finding a negative effect of child care prices on employment, with elasticity estimates between −0.32 and −1.1. When the child care expenditures of women with annual incomes below the median were subsidized by 50 %, welfare recipiency was reduced by 28 percentage points and employment increased by more than 25 percentage points. Notably, these women’s average weekly unsubsidized expenditures were only $58, and thus even a 50 % subsidy was relatively small (Connelly and Kimmel 2003), although the child care expenditure data collected in the SIPP may represent underestimates or unreliable estimates of costs (McCartney and Laughlin 2011).

Baum (2002) used data from 1988 to 1994 from the National Longitudinal Survey of Youth (NLSY) to examine how child care costs affect the employment decisions of mothers in the years following the birth of a child. Using a hazard framework, he found that, among all mothers, the elasticity of returning to work 1 year after giving birth with respect to child care costs was −0.185. Effects are greater among low-income mothers: the elasticity of returning to work in the year after giving birth with respect to child care costs was −0.59 for low-income mothers, compared to −0.025 for non-low-income mothers. Effect sizes decreased as time since birth increased: the elasticity of returning to work 2 years after giving birth with respect to child care costs was −0.155 for all mothers, −0.52 among low-income mothers, although the figure rose to −0.035 for non-low-income mothers. Findings suggest that the sensitivity of mothers’ employment responses with respect to child care costs change as children age (Baum 2002).

Examining changes to child care and tax policies in the 1990s, Bainbridge et al. (2003) separated the employment effects of funds that provided subsidies to nonworking, welfare-receiving families from those received by low-income working families. (Non-employed welfare-recipient families received approximately 45 % of state and federal child care funding in 1996, but this proportion decreased dramatically after federal welfare reform after 1996.) Using data from the 1992 to 1997 March Current Population Survey (CPS), they found that on average, a $1000 increase in average state spending on all subsidies per single woman with a child under 13 was associated with a 3.6 percentage-point increase in employment among these women. However, after separating out the effects of subsidies in welfare-reliant families, a $1000 increase in the average annual subsidy per single mother with a child under 13 translated to an estimated 11 percentage point increase in the probability of employment. They estimated that an expansion of CCDBG specifically would have particularly strong employment effects—a 26 percentage point increase in employment for every $1000 per capita investment (Bainbridge et al. 2003).

Also using data from the March CPS (1991–1994), Han and Waldfogel (2001) found that among women with children under age 6, employment elasticity with regard to child care costs ranged from −0.30 to −0.40 for married women and from −0.50 to −0.73 for unmarried women. Their simulation suggested that reducing child care costs by 25 % would increase the employment of married mothers by 3 percentage points and of unmarried mothers by 5 or 6 percentage points. Increasing the subsidy by $1 per hour would increase married women’s employment by 11–13 percentage points and unmarried by 19–20 percentage points. Notably, the authors had to impute the cost of child care, which is not collected in the CPS (Han and Waldfogel 2001).

Because of the lack of child care cost information in the CPS, Herbst (2010) used SIPP data to impute child care costs on participants in the March CPS from 1990 to 2004. He found the elasticity of employment to hourly child care expenditures was −0.05, considerably smaller than the elasticity of employment with respect to hourly wages (0.33). A $100 increase in subsidy spending per child aged 0–12 would be expected to increase employment rates of single mothers by 1.7 percentage points. A $1000 increase in benefits in the Earned Income Tax Credit (EITC: similar to a wage increase) would be expected to increase the employment rate of single mothers by 1.0 percentage point (Herbst 2010).

Variation in subsidy policies within or across states allow for the use of cross-sectional data. Blau and Tekin (2007) used data from the 1999 National Survey of America’s Families (NSAF) to identify the effects of subsidy receipt on the employment of single mothers. Using variation in subsidy rationing across counties, they found that subsidy receipt had very large positive effects on labor force participation—33 percentage points on employment, 20 percentage points on unemployment (people entering the labor force to search for a job)—but no effects on schooling or welfare receipt (Blau and Tekin 2007). Similarly, using data from the 1997 NSAF, Tekin (2007) examined the effects of child care prices and wage increases on mothers’ employment, parsing out both part- and full-time employment. Results indicate that a high price of child care is a strong deterrent for both part- and full-time employment, with child care price elasticities with respect to full- and part-time employment estimated at −0.14 and −0.07, respectively, and −0.12 with respect to overall employment (Tekin 2007). Using 1992–1995 data on single current and former welfare recipients living in 4 counties in California, Meyers et al. (2002) conducted a simulation suggesting that if a low-income single woman’s probability of subsidy receipt changed from 0 to 50 %, her probability of being in the labor force would change from 21 to nearly 73 %, an increase of 52 percentage points (Meyers et al. 2002). Effects are large, potentially because of the historical policy context; the receipt of a subsidy was a rare event among their sample.

The studies described above utilize statistical techniques or quasi-experimental methods to approximate the causal links between child care availability or costs and parents’ employment. Two experimental studies conducted by MDRC used data from welfare demonstration programs that randomly assigned participants to different child care conditions. The first (Michalopoulos et al. 2010) studied 1884 families in Cook County, Illinois, whose incomes were just above the state subsidy eligibility threshold between 2005 and 2006. Families randomly assigned to the program group were eligible to receive subsidies, while those in the control group were not eligible so long as their incomes remained above the threshold. The program group participants were then randomly assigned to recertification periods of either 6 or 12 months. In the second study, 5106 families in Washington State were randomly assigned to either a control group with standard copayment amounts or a program group with an alternative copayment schedule (Michalopoulos 2010). Copayments were the same across groups for the lowest-income families (under 82 % FPL), slightly lower in the program group for marginally higher-income families (82–138 % FPL), and most different for the highest-income families (138–200 % FPL). Contrary to theoretical expectations, they found that neither increased subsidy eligibility nor reduced copayments affected parental employment. Importantly, in both studies, the highest-income subsidy recipients, who were the newest recipients in the first study and who benefited most from decreased copayments in the second study, were more steadily employed during the study than their lower-income counterparts, and were not representative of the subsidy population generally. Findings suggest that expansions in child care subsidy eligibility to higher-income families may produce lower than (expected) average increases in employment as these new recipients would be more likely to be better off financially and more employable, or have a stronger work history, than existing eligible families or recipients. Decreases in copays for very low-income families (but not relatively high-income families) may have substantial impacts on employment, but this was not tested in these experiments. Finally, in a related study that compared the effect sizes of welfare experiments that included child care assistance and those that did not, Gennetian et al. (2004) found differences in out-of-pocket child care costs but no differences in maternal employment.

3.1.2 Availability of public ECE

Public policies that increase the availability of free or low-cost educational opportunities are often aimed at promoting children’s achievement and developmental outcomes; however, they also serve as important sources of child care during specific hours. Public school essentially provides a full-price subsidy for child care for parents who work less than the length of the school day and year, and a partial subsidy for those who work longer hours, likely encouraging participation in the labor market and longer hours. Alternatively, public school could serve as an income subsidy for those working longer than the school day and year, exerting downward pressure on work hours (Fitzpatrick 2012; Gelbach 2002). Most of the research in this area finds evidence that the provision of free or low-cost ECE has generally small but positive effects on maternal employment, specifically among mothers without other younger children (for whom care is also needed, but for whom public school is yet not available).

Several studies have used kindergarten enrollment or availability, typically the earliest no-fee public school option available in the United States, to estimate the effects of this type of child care during specific hours on maternal employment. Cascio (2009), using data from Decennial Censuses from 1950 to 1990, investigated the substantial increases in public kindergarten funding in the South during the 1960s and 1970s. There were strong effects on the labor supply among single mothers without other young children (4 in 10 entered the workforce with the enrollment of a 5-year-old child, a 12 % increase), but no effects on other groups of women (Cascio 2009). With the 1980 Decennial Census, Gelbach (2002) used quarter-of-birth in 1980 as an instrument for kindergarten enrollment, assuming that children born in April who turned 5 in 1980 had a better chance of kindergarten enrollment that year than those born in December 1980. Estimated increases in labor supply of 6–25 % were found (along with decreases in public assistance receipt) among single mothers (Gelbach 2002). Using a similar methodological approach with newer data, the 2000 Decennial Census long-form data with exact birthdates, Fitzpatrick (2012) used a child’s eligibility for public kindergarten in a regression discontinuity instrumental variables framework to estimate how public school enrollment affects maternal labor supply. Like Cascio, Fitzpatrick found that public school enrollment increased only the employment of single mothers of 5-year-olds without additional young children, and not for other mothers with 5-year-olds.

Fitzpatrick noted several historical differences that may explain why Gelbach’s findings were larger in magnitude and apparent across more mothers, including that mothers were older, less likely to be White, less likely to live in central cities, and households averaged fewer children and more adults in 2000 compared to 1980. More adults and fewer children in the home could mean more sources of income, and less of a need for a mother to enter the workforce when her child begins school. In addition, mothers were more educated in 2000, suggesting that they had a stronger attachment to the labor force regardless of care costs—indeed, more mothers were employed in 2000 than in 1980 (Fitzpatrick 2012).

Similar to an expansion in the availability of kindergarten, a lengthening of the school day, from half to full day, would also serve as a child care subsidy or income subsidy for families, and presumably affect parental employment. Using data from the ECLS-K 1998, Cannon et al. (2006) found that mothers were more likely to work full-time in the year their children attended kindergarten if their children attended full-day programs than if they attended half-day programs. These relationships were larger for households under the poverty line. The associations were not significant in the 1st and 3rd grades, suggesting that longer days during the kindergarten year had initial effects on participation but did not have longer-term effects on mothers’ labor force attachment (Cannon et al. 2006).

Fitzpatrick (2010) examined the introduction of universal prekindergarten for 4-year-olds in Georgia and Oklahoma in the 1990s, finding a 14–17 % increase in preschool enrollment (24 % in rural areas), but little effect on maternal labor force participation in those states. To test the availability of preschool on maternal labor supply at a national level, she used quarter-of-birth in 2000 census data as an instrument for preschool enrollment among 4-year-olds, finding no effects, although standard errors were very large (Fitzpatrick 2010). Fitzpatrick noted that the lack of employment response may be due to women’s lower levels of responsiveness to wage changes in recent years compared to the past (Blau and Kahn 2007), as well as the already high enrollment of 4-year-olds in center care relative to younger children. In a more recent study examining the effects of universal prekindergarten in Georgia and Oklahoma using a triple difference approach exploiting variation in availability over time, across states, and among women with children of different ages, Cascio and Schanzenbach (2013) found some evidence that prekindergarten increased the employment of less-educated mothers (high school degree or less) in the initial 3 years following implementation. Preschool enrollment for children with less-educated mothers increased by about 20 %, with mothers’ labor force participation increasing by 0.8–2 percentage points, but findings were sensitive to specification changes (Cascio and Schanzenbach 2013).

During World War II, the Lanham Act of 1940 provided for a heavily subsidized, universal child care program. Herbst (2013) exploited this drastic change in child care policy and state variation in benefit levels to investigate its effects on maternal employment. Specifically, he compared the employment status and hours of women whose children were eligible for care during the period the Lanham Act was in operation (0–12 years old in 1943–1946) to those whose children were older (13–17 years old in 1943–1946) and to childless women. Using a triple difference estimator with Decennial Census data, 1940 was defined as the pre-reform period and 1950 as the post-reform period. Results indicated that a $1 per child increase in Lanham Act spending increased mothers’ employment by 0.1 percentage points and work hours by 0.04. States varied in the amount of Lanham Act money they spent, with the bottom quartile spending $22 per child and the top quartile spending $65; thus moving from the bottom to the top quartile in spending (an increase of $43 per child) would be expected to result in a 4.3 percentage point increase in maternal employment and an increase of 1.9 in mothers’ work hours. Women with younger children (0–5 years) during the Lanham Act years had a stronger response than those with older children (6–12 years) (Herbst 2013). Notably, these results represent the medium-run employment response to the Lanham Act, as the post-policy period was measured at 1950, 4 years after the Act ended. It is likely that the effects measured while the program was in operation (1943–1946) would have been larger. Findings suggest that subsidized child care may have a sustained effect on mothers’ labor force attachment.

Loft and Hogan (2014) used the concept of care capital, defined as the use of any type of nonparental care prior to a mother’s entry or re-entry into the labor force, as a measure of care availability and accessibility. Using data from the Early Childhood Longitudinal Study-Birth Cohort (ECLS-B) collected in 2001 and 2002, they find that the use of child care preceded employment by an average of 4 weeks, and that this measure of care capital is independently and positively associated with entry or return to employment among mothers in the 36 weeks following childbirth. That is, mothers with more experience using nonparental care were more likely to begin or return to the labor force (Loft and Hogan 2014).

While the availability of no-fee child care provided through social networks is not a public policy intervention per se, it can be used to approximate what the potential employment response to subsidized care. Grandparents provide an important source of child care for young children, and while the families who use grandparent care are heterogeneous, mothers using grandparent care are more likely to be racial or ethnic minority, young, and work nonstandard hours (Vandell et al. 2003). Using fixed effects models with data from the National Longitudinal Survey of Youth 1979 (NLSY79), Posadas and Vidal-Fernandez (2013) found that the availability of grandparent child care increases mothers’ labor force participation by 9 percentage points, and that this effect was driven by minority, single, or never-married mothers (Posadas and Vidal-Fernandez 2013). Similarly, using data from the National Survey of Families and Households (NSFH) merged with Census data, Compton and Pollak (2014) estimate a 4–10 percentage point increase in the predicted probability of employment among married mothers with young children who live in close proximity to their mothers or mothers-in-law, compared to those living farther away from grandparents (Compton and Pollak 2014). These studies suggest that retirement policies may also affect child care use and maternal employment and the availability of grandparents may also serve as a proxy for the availability of low-cost child care.

3.2 Research outside the United States

This section reviews studies conducted in Canada, Mexico, Argentina, Israel, and several European countries regarding the effects of child care costs and availability on parental employment. This section does not include an exhaustive list of all research conducted on ECE policies on parental employment, but the studies included represent those across continents that investigated the effects of ECE costs or the availability of public ECE on parental employment that are published in the peer-reviewed literature and use rigorous experimental or quasi-experimental methods.

3.2.1 ECE costs

Several countries have implemented substantial changes in their ECE policies in the past few decades. As with research in the United States, much of the research in other countries exploits time or regional variation in the implementation of a new ECE policy. In Finland, Viitanen (2011) examined the impacts of the implementation of an experimental voucher for private child care on child care use and labor force participation. Under pressure to reduce public child care expenditures, an experimental voucher program was introduced in 1994, and 33 of the 450 municipalities in Finland chose to offer vouchers to parents. Using propensity score matching to match married mothers with children under 6 in municipalities with and without the vouchers, findings indicate that the use of private child care increased by 3–5 percentage points among children aged 3–6 (no effects on those younger than 3), but that the vouchers had no effects on the use of public care or labor force participation, which the author attributes to Finland’s long-standing, high-quality, low-fee child care system (Viitanen 2011).

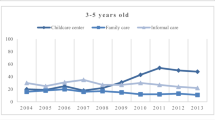

In 1997, the Canadian province of Quebec created its Quebec Family Policy that extended full-time kindergarten to all 5-year-olds and provided child care with out-of-pocket costs of $5 per day to all 4-year-olds. Universal child care was extended to 3-year-olds in 1998, 2-year-olds in 1999, and all children younger than 2 in 2000. The $5 per day fee was in effect from 1997 to 2004, and then increased to $7 per day. New quality regulations on the child care sector were also implemented at this time. This universal approach replaced the prior system of direct child care subsidies (available to low-income families only) and refundable tax credits, which had subsidized 26–75 % of families’ child care costs, dependent on income.

The several studies of Quebec’s policies find substantial positive effects on mothers’ employment and work hours. Using annual data from 1993 to 2002 on mothers with children aged 1–5 years from the Statistics Canada’s Survey of Labour and Income Dynamics (SLID), Lefebvre and Merrigan (2008) estimated strong effects of the policy on mothers’ employment, with employment increases ranging from 8.1 to 12 percentage points, annual earnings increases of $5000–$6000, hours worked increases of 231–270 per year, and weeks worked increases of 5–6 per year (Lefebvre and Merrigan 2008). Also using data from the SLID, Lefebvre et al. (2009) employed difference-in-differences and triple difference approaches for Quebec mothers with children of different ages (0–5, 6–11, and those 12–17) and mothers living elsewhere in Canada. They found that the policy increased annual work hours for mothers, particularly for those with a high probability of receiving a subsidy for a child under age 5, typically those with less education (Lefebvre et al. 2009). The effects in both studies were driven by the employment of less-educated mothers.

Similarly, using data from the National Longitudinal Survey of Children and Youth (NLSCY), Baker et al. (2008) assessed the impact of the Quebec Family Policy on parental labor force participation, employing difference-in-differences models to compare outcomes in Quebec to those of the rest of Canada. They found a large increase in employment among mothers in two-parent families in Quebec, which rose by 7.7 percentage points (14.5 % of baseline) (Baker et al. 2008). Also using a difference-in-differences approach with the NLSCY, Lefebvre et al. (2011) examined the heterogeneous effects and the longer-term effects of the Quebec policy through 2006–2007, as the number of slots grew to meet the high demand for care. Results showed large and positive effects on maternal labor force participation and the number of weeks worked, and generally increasing effects on labor force participation over time. Effects on employment for mothers with children aged 1–4 ranged from 8 to 14 percentage points, and effects on weeks worked ranged from 0.5 to 5.1 weeks. The largest effects were found among mothers with young children, and, contrary to the shorter-term effects in the SLID found by Lefebvre et al. (2009), for those with a college education (Lefebvre et al. 2011).

Traditionally, the United Kingdom has had waitlists for subsidized child care, which are available to low-income families only, and child care prices are higher than in other European countries with universal public systems (Viitanen 2005). Viitanen (2005) examined how child care costs affect the probabilities of using formal child care and of employment, estimating a child care price elasticity with respect to employment of −0.138, and a child care price elasticity with respect to the use of formal child care of −0.464. Simulations of child care price subsidies of 10 and 25 % were estimated to increase labor force participation by 1.5 percentage points (to 75 %) and 3 percentage points (to 77 %), respectively. In a more recent study, Francesconi and van der Klaauw (2007) examined the implementation of the 1999 reform that created the Working Families’ Tax Credit (WFTC), which included a generous child care tax credit, designed to increase parental employment among low-income families. The credit provided for up to 70 % of child care costs, up to a maximum of £70 per week for one child and £105 for two or more children. Using a triple difference strategy with individual fixed effects, they find that the reform increased the use of formal care by 35 % and increased the employment rate of single women aged 16–60 by 5 percentage points. These effects were strongest among single mothers with children under age 5, with very few effects for those with older or multiple children (Francesconi and van der Klaauw 2007).

Austria has relatively high levels of universal monetary transfers to families with children. Hanappi and Müllbacher (2013) simulated a 2009 policy reform that shifted universal child transfers to a general tax deductible for each child (220 € per child per year) and a tax deductible for child care expenditures (up to 2300 € per child per year) with cross-sectional household data from 2004 to 2008. They estimated that this policy change would result in increases in employment and work hours for married and single males and females, with overall increases in full-time employment of 0.7 %. Projected rate increases were highest among married females at 0.8–1.5 %. The Austrian government also offers some public subsidies for child care, and while quality standards are relatively uniform, fees vary by locality. Using Austrian census and administrative data, Mahringer and Zulehner (2015) exploited the regional variability in child care costs in Austria to estimate the effects of child care costs on maternal employment. Employment elasticity with regard to child care costs ranged from −0.13 in 2002 and −0.11 in 1995. A one-euro per hour reduction in child care costs would predict an increase in the employment rate of 8 percentage points. However, child care costs only partly explained the differences in employment between mothers and women without children (Mahringer and Zulehner 2015).

In 2004 and 2006, Norway implemented two policy reforms that capped child care prices (at $460 USD and $380 USD, respectively). Using a triple difference approach exploiting variability in the eligibility for reduced child care costs, Hardoy and Schøne (2013) find that reduced child care prices increases mothers’ labor supply between 3 and 4 percentage points (5 %), with smaller effects on work hours. The authors attribute the small effects to the existing high labor force participation of mothers in Norway prior to reform (Hardoy and Schøne 2013).

In Australia, Kalb and colleagues have conducted several simulations of ECE policy changes and their effects of labor supply and work hours. Using the Melbourne Institute Tax and Transfer Simulator, they find that expected work hours among parents decrease when child care costs are added to the budget constraint, particularly among single parents (reductions of 10 %) and partnered mothers (reductions of 4.3 %) (Doiron and Kalb 2002). Using imputed child care costs, Doiron and Kalb (2005) modeled changes in labor supply from child care demand and costs for informal and formal care. They estimate the elasticity of employment with respect to formal child care costs is −0.10 for single parents and −0.02 for partnered women, and the elasticity of work hours with respect to costs is −0.15 for single parents and −0.03 for partnered women, while the work hours of males in two-parent families were largely unaffected by child care costs (Doiron and Kalb 2005). In a more recent study, Kalb and Thoresen (2010) simulated the adoption of Norway’s universal family payments system in Australia, and the adoption of Australia’s income-based child care subsidies in Norway. They found that reducing child care fees in Australia to Norwegian levels (by 50 %) would increase weekly work hours by 0.02 for men and 0.22 for women with children under age 5. The authors noted these were small effects given the substantial public costs required for a universal system (Kalb and Thoresen 2010).

3.2.2 Availability of public ECE

Norway was an early adopter of a universal public child care system. In 1975, Norway began a staged expansion of subsidized child care slots for children 3–6 years of age. Child care coverage increased from 10 to 28 % in the first few years after reform, and was universally available to families regardless of employment, but had long waiting lists. Using a difference-in-difference design to exploit the temporal and spatial variation in expansion across municipalities, Havnes and Mogstad (2011a) examined the effects of the availability of public child care in Norway on maternal employment rates. They found a strong correlation, but a small causal effect: a 1 percentage point increase in child care coverage caused an average increase of 0.06 percentage points in maternal employment in the short-term (the long-term effects on mothers’ labor force attachment were not investigated). They found that publicly subsidized slots crowded out informal care arrangements (Havnes and Mogstad 2011a). Notably, in other work they found that this shift from the informal to the public sector improved the educational attainment of children and income mobility over time (Havnes and Mogstad 2010, 2011b).

In contrast to Norway and other non-Mediterranean countries, Italy’s increase in female labor force participation over the last few decades was modest, with just 41 % of women employed in 1997 and very few publicly-provided child care options, particularly ones with hours conducive for full-time work or for children under 3 (Del Boca 2002). Using panel data from 1991 to 1995, Del Boca (2002) used fixed effects models to examine how time and geographic variation in the availability of public child care slots for children under 3 affected women’s labor force participation and fertility. She estimated that a 10 % increase in child care availability between the first and second period increases the relative odds of employment in the second period by 0.296, a significant but modest effect.

In the late 1990s and early 2000s, the Italian government created a National Fund for regions and municipalities to increase the number of subsidized child care slots for children aged 0–2, prioritizing children with disabilities and in low-income families. Province-level public child care availability, defined as the ratio of public child care slots to the population of 0–2 year-olds, averaged 8 %, and ranged from near zero to 25 %. Brilli et al. (2016) investigated the effects of increased availability of subsidized child care for infants and toddlers in Italy on maternal employment. They found that a 1 percentage point increase in the availability of public child care increased mothers’ probability of employment by 1.3 percentage points, and these effects were strongest in areas with little child care availability prior to expansion (Brilli et al. 2016).

Between 2005 and 2013, Germany implemented several reforms that increased the availability of publicly subsidized child care slots. In 2002, the availability of slots for children 1–3 years was 2 and 35 % in West Germany and East Germany, respectively; by 2013, these figures were 24 and 52 % (Geyer et al. 2014). In 2013, the government instituted a reform such that all children aged 1–3 would have a legal claim to subsidized care, conditional on parental employment. Haan and Wrohlich (2011) simulated the effects of this anticipated reform, estimating that the expansion of slots (proxied by parents’ expected child care costs and the availability of slots) would lead to a 1.6 % increase in women’s employment and a 2.4 % increase in women’s work hours (Haan and Wrohlich 2011). After the reform was implemented, Geyer et al. (2014) found that mothers with children 13–24 months of age increased their labor force participation by 1.8 %, on average, and these effects were stronger among mothers with incomes below the median (Geyer et al. 2014).

In 1993, Argentina began a dramatic expansion of school attendance for children 3–5 years of age. Between 1994 and 2000, the country created 175,000 preschool slots, an 18 % increase over the baseline of preschool enrollment. Exploiting regional and cohort variation with a difference-in-difference approach, Berlinski and Galiani (2007) examined the effects of preschool expansion on maternal employment. They found that public preschool expansion led to a 7 percentage-point increase in enrollment in 1991–2000 and an increase in maternal employment between 7 and 14 percentage points. These effects did not vary with the presence of a child younger than 3 (Berlinski and Galiani 2007). However, in a follow-up study using a regression discontinuity design that exploited the requirement for mandatory enrollment in preschool for children whose 5th birthdays were before July 1 during a given year, they found that for every 100 children who enrolled and were the youngest in their households, 13 mothers entered the labor force. They also find that mothers were 19.1 percentage points more likely to work more than 20 h per week, and work an average of 7.8 h longer per week, as a consequence of their youngest child attending preschool. These effects were not found in households with other younger children (Berlinski et al. 2009).

Similarly, Mexico phased-in universal preschool for 3, 4, and 5 year-olds between 2004 and 2008. Prior to the reform, enrollment among 3 year-olds was low (19 %) but higher for 5 year-olds (81 %), and maternal employment was relatively low. Initially, the law was compulsory, but was relaxed when the roll-out produced lower enrollment rates than expected, with wide geographic variation. Using a difference-in-difference approach exploiting geographic variation in implementation, de la Cruz Toledo (2015) found that higher preschool enrollment increased the employment of mothers with 3 and 4 year-old children. Effects were between 1.2 and 4.3 percentage points, although effects on mothers’ work hours were mixed, potentially because of the fixed hours of preschool (de la Cruz Toledo 2015).

Schlosser (2011) investigated the expansion of free public preschool for 3 and 4 year-olds in Israel, which began in 1999. Focusing on Israeli Arabs, who tend to have low rates of both preschool enrollment and female employment, the study exploited regional variation in the gradual implementation of preschool. Difference-in-difference estimates indicate that the provision of public preschool increased the employment of mothers with children aged 2–4 years living in towns with expansions by 8.1 percentage points and average weekly work hours by 2.8, and effects were stronger among those whose youngest child was between 2 and 4 years. This represents a sizeable increase over the baseline female labor force participation of 17.1 % (Schlosser 2011).

Examining child care policies across 15 European countries using longitudinal data from 1995 to 2001, Del Boca et al. (2009) found that, in general, the availability of child care, as defined by the percentage of children aged 0–2 using child care facilities, was positively related to women’s employment, with stronger effects for less-educated women (less than secondary education). They estimated that a 10 % increase in child care availability increases the probability of employment from 53 to 67 % among less-educated women, and from 79 to 86 % among college-educated women.

3.3 Variations in impacts

3.3.1 Child age

Most research on child care’s employment effects in the U.S. focuses on the parents of young children (those prior to entering kindergarten or elementary school). In general, the employment decisions of mothers with young children are more sensitive to child care costs than those with older school-age children (Baum 2002; Connelly and Kimmel 2003; Han and Waldfogel 2001; Herbst 2010, 2013). Whereas the parents of older children are more likely to have access to public prekindergarten, Head Start, or K-12 education, families with infants and toddlers lack these options; thus, a subsidy for children under age 3 may have greater increases in parental employment. This is consistent with the findings that the employment effects of public preschool or kindergarten enrollment are stronger among mothers whose youngest children were age-eligible for public school, compared to those with younger children at home (Berlinski et al. 2009; Cascio 2009; Gelbach 2002; Schlosser 2011), as these younger children require other types of child care that may be less available. It should be noted that, however, child age is often confounded with maternal age.

3.3.2 Family income

Much research on child care’s employment effects in the U.S. focuses on low-income families households. However, as might be expected, research that has included families across the income spectrum tends to find that impacts are strongest among those with lower incomes or the highest care costs. In the U.S., the employment responses to child care costs (Baum 2002) and to full-day kindergarten (Cannon et al. 2006) were stronger among low-income and poor families. In Italy and Germany, the labor supply of low-income parents and those in low-skilled jobs was more sensitive to policy changes that affect child care costs (Brilli et al. 2011; Geyer et al. 2014). Finally, Herbst (2010) found that the positive impact of subsidies provide was greater among mothers with higher child care costs.

3.3.3 Parental education

Most research on the employment effects of child care costs and availability in the United States has focused on less-educated families, although research in other countries have included samples with a wider range of educational backgrounds. However, from this body of research, it is unclear whether education moderates the effects of child care policies on parental employment. In Italy, Brilli et al. (2011) found stronger employment responses among mothers with low levels of education. Using U.S. data, Herbst (2010) found that child care costs appear to have similar elasticities regardless of maternal education. In Quebec’s subsidy expansion, the largest labor supply effects were among less educated mothers (Lefebvre et al. 2009; Lefebvre and Merrigan 2008), although long-term impacts on mothers with a college degree were also strong (Lefebvre et al. 2011). In examining preschool expansion in Israel, Schlosser (2011) found larger increases in mothers’ labor force participation among more educated mothers. Across 15 European countries, Del Boca et al. (2009) found that increases in employment in response to child care availability were stronger among less-educated women.

3.3.4 Family structure

Many studies in the United States focused on single mothers, but the few studies that compare the employment effects of both single and married mothers tend to find stronger effects for single-mother than married or partnered households (Cascio 2009; Fitzpatrick 2012; Gelbach 2002; Han and Waldfogel 2001). The employment decisions of never-married mothers in particular appear particularly responsive to changes in child care costs (Herbst 2010). However, in Quebec, the employment responses of single women to the universal child care program were less than those of women in two-parent households, which researchers attributed to single women’s eligibility for direct subsidies or generous refundable tax credits prior to the universal program (Baker et al. 2008).

3.3.5 Type of child care

In general, research finds that child care subsidy receipt increases the likelihood of using center or formal care, which tends to be more expensive than informal or home-based settings (Crosby et al. 2005; Doiron and Kalb 2005; Havnes and Mogstad 2011a; Johnson et al. 2014; Ryan et al. 2011). In turn, the use of center-based care is associated with fewer work disruptions, but more work absences, compared to home-based arrangements (Gordon and Högnäs 2006; Gordon et al. 2008), which may improve parents’ long-term labor force outcomes.

3.4 Other considerations

Although facilitating and increasing parental labor force participation is often cited as the primary goal for policies that expand child care, there are other important consequences to consider. For example, the quality and stability of child care is important to both parents’ labor force participation and to children’s developmental outcomes. Research suggests that subsidies increase families’ use of preferred arrangements and improve their employment stability (Gordon and Högnäs 2006), and reduce work disruptions attributed to child care problems (Forry and Hofferth 2011; Michalopoulos et al. 2010). Indeed, research on the various welfare reform experiments in the 1990s found that they each had similar effects on maternal employment, but the programs with child care assistance reduced families’ out-of-pocket care costs and child care problems that interfered with employment (Gennetian et al. 2004). Further, a small body of research examining employer-provided child care assistance suggests positive impacts on employees’ productivity, tenure, and loyalty to their employer (Halpern 2005; Morrissey and Warner 2011). Research indicates that the most disadvantaged families experience the greatest levels of subsidy instability and child care instability (Ha et al. 2012), suggesting that policies may consider prioritizing those families.

A parallel body of research has examined the effects of ECE policies on children’s development. This is a large literature, and, in general, the effects of nonparental ECE are dependent on the quality of care (NICHD ECCRN 2006; Phillips and Lowenstein 2011). However, in the United States, research suggests that public ECE or preschool attendance is associated with positive child outcomes, some of which last well beyond kindergarten entry (Gormley et al. 2005; Herbst 2013; Weiland and Yoshikawa 2013; Yoshikawa et al. 2013). The research regarding subsidizing private market-based arrangements is more mixed, however. Receipt of child care subsidies and the increased availability of public care increase families’ care options and increase the use of formal and center-based care (Crosby et al., 2005; Doiron and Kalb 2005; Johnson et al., 2014; Ryan et al., 2011; Havnes and Mogstad 2011a), which is associated with improved child outcomes (Havnes and Mogstad 2011b). Following Quebec’s reform, research found evidence for adverse effects of universal subsidized care on children’s health and behavioral outcomes (Baker et al. 2008; Baker 2011). Similarly, other research in the United States has found short-term negative effects of attending subsidized child care on children’s cognitive ability, behavioral problems, and obesity that fade as children age (Herbst and Tekin 2011, 2016), although other research has found that negative impacts are limited to children attending certain care settings (Johnson et al. 2013).

4 Conclusions and future research

In general, the research literature suggests that reductions in child care costs and increases in child care availability increases mothers’ labor force participation, although the effect sizes vary widely. Studies that report elasticities find that a 10 % reduction in child care costs is associated with between a 0.25 and 11 % increase in maternal labor force participation (Bainbridge et al. 2003; Baum 2002; Connelly and Kimmel 2003; Han and Waldfogel 2001; Herbst 2010; Meyers et al. 2002; Ziliak et al. 2008). These figures are calculated using the elasticity of employment to ECE price (elasticity being the ratio of a percentage change in ECE price to a percentage change in maternal employment), which studies estimate at −0.025 to −1.1. However, recent estimates tend to cluster between −0.05 and −0.25 (Doiron and Kalb 2005; Hanappi and Müllbacher 2013; Hardoy and Schøne 2013; Herbst 2010; Mahringer and Zulehner 2015; Viitanen 2005); thus a 10 % reduction in child care costs would be expected to lead to an increase of maternal employment between 0.5 and 2.5 %. There is also evidence that expanding the availability of publicly provided ECE (e.g., universal preschool or kindergarten) leads to small increases maternal employment, although the effect sizes range substantially (from 0 to 19 percentage points).

This heterogeneity in findings likely result from variation in policy, cultural, or historical contexts, as well as in the methodological approaches and data used. American mothers today are more likely to be employed, and are on average more educated and older, than in years past, which may reduce mothers’ employment responses to changes in child care because their attachment to the labor force is stronger (Blau and Kahn 2007; Fitzpatrick 2010). Generalizing findings from other countries to the U.S. context is problematic given that most other developed countries have stronger public early care and education systems, parental leave benefits, and other work-family policies (Gornick and Meyers 2003; Ruhm 2011).

There are several gaps in the research literature that warrant greater attention. First, there is a lack of research on the effects of ECE costs and availability on fathers’ employment responses, which remains an important issue given fathers’ increased involvement in the lives of young children (Bianchi 2000; Milkie et al. 2015). Second, the research on ECE and parental employment has focused on publicly-subsidized or provided child care; as private employers have increased their role in supporting employees’ child care arrangements, more research is needed to better understand how these policies affect parents’ employment (and children’s developmental) outcomes (Galinsky et al. 2008; Matos and Galinsky 2014; Morrissey and Warner 2011). Finally, public ECE policy in the United States is currently undergoing important policy changes that should be examined with new data to assess parental employment responses. Research that uses contemporary data to investigate the impacts of these policies on parental labor force participation, work hours, and stability will be useful for future ECE policy development.

Notes

Source: 2011 Survey of Income and Program Participation (SIPP).

References

Bainbridge, J., Meyers, M. K., & Waldfogel, J. (2003). Child care reform and the employment of lone mothers. Social Science Quarterly, 84(4), 771–791.

Baker, M. (2011). Innis lecture: Universal early childhood interventions: What is the evidence base? Canadian Journal of Economics, 44(4), 1069–1105. doi:10.1111/j.1540-5982.2011.01668.x.

Baker, M., Gruber, J., & Milligan, K. (2008). Universal child care, maternal labor supply, and family well-being. Journal of Political Economy, 116(4), 709–745.

Barnett, W. S. (2011). Effectiveness of early educational intervention. Science, 333(6045), 975–978. doi:10.1126/science.1204534.

Baum, C. L. (2002). A dynamic analysis of the effect of child care costs on the work decisions of low-income mothers with infants. Demography, 39(1), 139–164.

Berlinski, S., & Galiani, S. (2007). The effect of a large expansion of pre-primary school facilities on preschool attendance and maternal employment. Labour Economics, 14(3), 665–680. doi:10.1016/j.labeco.2007.01.003.

Berlinski, S., Galiani, S., & McEwan, P. J. (2009). Preschool and maternal labour market outcomes: Evidence from a regression discontinuity design. Economic Development and Cultural Change, 59(2), 313–344.

Bianchi, S. M. (2000). Maternal employment and time with children: Dramatic change or surprising continuity? Demography, 37, 401–414.

Blau, D. M. (2001). The child care problem: An economic analysis. New York: Russell Sage Foundation.

Blau, D. M., & Currie, J. (2006a). Preschool, day care, and after-school care: Who’s minding the kids? Handbook of the Economics of Education, 2, 1163–1278.

Blau, D. M., & Currie, J. (2006b). Who’s minding the kids? Preschool, day care, and afterschool care. In Handbook of the economics of education. New York: North Holland.

Blau, F. D., & Kahn, L. M. (2007). Changes in the labor supply behavior of married women: 1980–2000. Journal of Labor Economics, 25(3), 393–438. doi:10.1086/513416.

Blau, D. M., & Tekin, E. (2007). The determinants and consequences of child care subsidies for single mothers in the USA. Journal of Population Economics, 20, 719–741. doi:10.1007/s00148-005-0022-2.

Brilli, Y., Boca, D., & Pronzato, C. D. (2016). Does child care availability play a role in maternal employment and children’s development? Evidence from Italy. Review of Economics of the Household, 14(1), 27–51. doi:10.1007/s11150-013-9227-4.

Brilli, Y., Del Boca, D., & Pronzato, C. (2011). Exploring the impacts of public childcare on mothers and children in Italy: Does rationing play a role? Working Paper (5918). Retrieved from http://ftp.iza.org/dp5918.pdf.

Brooks-Gunn, J., McCormick, M. C., Shapiro, S., Benasich, A., & Black, G. W. (1994). The effects of early education intervention on maternal employment, public assistance, and health insurance: The infant health and development program. American Journal of Public Health, 84(6), 924–931. doi:10.2105/AJPH.84.6.924.

Bureau of Labor Statistics. (2015). Employment characteristics of families summary. U.S. Department of Labor. Retrieved December 15, 2015, from http://www.bls.gov/news.release/famee.nr0.htm.

Cannon, J. S., Jacknowitz, A., & Painter, G. (2006). Is full better than half? Examining the longitudinal effects of full-day kindergarten attendance. Journal of Policy Analysis and Management, 25(2), 299–321. doi:10.1002/pam.

Cascio, E. U. (2009). Maternal labor supply and the introduction of kindergartens into american public schools. Journal of Human Resources, 44(1), 140–170. doi:10.1353/jhr.2009.0034.

Cascio, E. U., & Schanzenbach, D. W. (2013). The impacts of expanding access to high-quality preschool (pp. 127–178). Fall: Brookings Papers on Economic Activity.

Child Care Aware. (2014). Parents and the high cost of child care. VA: Arlington.

Compton, J., & Pollak, R. A. (2014). Family proximity, childcare, and women’s labor force attachment. Journal of Urban Economics, 79, 72–90. doi:10.1016/j.jue.2013.03.007.

Connelly, R., & Kimmel, J. (2003). The effect of child care costs on the employment and welfare recipiency of single mothers. Southern Economic Journal, 69(3), 498–519.

Council of Economic Advisors. (2014). Nine facts about American families and work. Washington, DC. Retrieved from https://www.whitehouse.gov/sites/default/files/docs/nine_facts_about_family_and_work_real_final.pdf.

Crosby, D. A., Gennetian, L. A., & Huston, A. C. (2005). Child care assistance policies can affect the use of center-based care for children in low-income families. Applied Developmental Science, 9, 86–106.

Datta Gupta, N., Smith, N., & Verner, M. (2008). Perspective article: The impact of Nordic countries’ family friendly policies on employment, wages, and children. Review of Economics of the Household, 6(1), 65–89. doi:10.1007/s11150-007-9023-0.

de la Cruz Toledo, E. (2015). Universal preschool and mothers’ employment. New York, NY: Columbia Population Research Center Working Paper.

Del Boca, D. (2002). The effect of child care and part time opportunities on participation and fertility decisions in Italy. Journal of Population Economics, 15, 549–573. doi:10.1007/s001480100089.

Del Boca, D., Pasqua, S., & Pronzato, C. (2009). Motherhood and market work decisions in institutional context: A European perspective. Oxford Economic Papers, 61(Supplement 1), i147–i171. doi:10.1093/oep/gpn046.

Doiron, D., & Kalb, G. (2002). Demand for childcare services and labour supply in Australian families. The Australian Economic Review, 35(2), 204–213. doi:10.1111/1467-8462.00237.

Doiron, D., & Kalb, G. (2005). Demands for child care and household labour supply in Australia. Economic Record, 81, 215–236. doi:10.1111/j.1475-4932.2005.00257.x.

Fitzpatrick, M. D. (2010). Preschoolers enrolled and mothers at work? The effects of universal prekindergarten. Journal of Labor Economics, 28(1), 51–85. doi:10.1086/648666.

Fitzpatrick, M. D. (2012). Revising our thinking about the relationship between maternal labor supply and preschool. Journal of Human Resources, 47(3), 583–612. doi:10.1353/jhr.2012.0026.

Forry, N. D., & Hofferth, S. L. (2011). Maintaining work: The influence of child care subsidies on child care-related work disruptions. Journal of Family Issues, 32, 346–368. doi:10.1177/0192513X10384467.

Francesconi, M., & van der Klaauw, W. (2007). The socioeconomic consequences of “In-Work” benefit reform for British lone mothers. Journal of Human Resources, 42(1), 1–31. doi:10.3368/jhr.XLII.1.1.

Galinsky, E., Bond, J. T., Sakai, K., Kim, S., & Giuntoli, N. (2008). National study of employers. New York: Families and Work Institute.

Gelbach, J. B. (2002). Public schooling for young children and maternal labor supply. American Economic Review, 92(1), 307–322. doi:10.1257/000282802760015748.

Gennetian, L. A., Crosby, D. A., Huston, A. C., & Lowe, E. D. (2004). Can child care assistance in welfare and employment programs support the employment of low-income families? Journal of Policy Analysis and Management, 23(4), 723.

Geyer, J., Haan, P., & Wrohlich, K. (2014). The effects of family policy on mothers’ labor supply: Combining evidence from a structural model and a natural experiment. Labour Economics, 36, 84–98. doi:10.1016/j.labeco.2015.07.001.

Gordon, R. A., & Högnäs, R. S. (2006). The best laid plans: Expectations, preferences, and stability of child-care arrangements. Journal of Marriage and Family, 68(2), 373–393. doi:10.1111/j.1741-3737.2006.00259.x.

Gordon, R. A., Kaestner, R., & Korenman, S. (2008). Child care and work absences: Trade-offs by type of care. Journal of Marriage and Family, 70(1), 239–254. doi:10.1111/j.1741-3737.2007.00475.x.

Gormley, W. T., Gayer, T., Phillips, D. A., & Dawson, B. (2005). The effects of universal pre-K on cognitive development. Developmental Psychology, 41(6), 872–884. doi:10.1037/0012-1649.41.6.872.

Gornick, J. C., & Meyers, M. (2003). Families that work: Policies for reconciling parenthood and employment. New York: Russell Sage Foundation.

Ha, Y., Magnuson, K. A., & Ybarra, M. (2012). Patterns of child care subsidy receipt and the stability of child care. Children and Youth Services Review, 34(9), 1834–1844. doi:10.1016/j.childyouth.2012.05.016.

Haan, P., & Wrohlich, K. (2011). Can child care policy encourage employment and fertility? Evidence from a structural model. Labour Economics, 18(4), 498–512. doi:10.1016/j.labeco.2010.12.008.

Halpern, D. F. (2005). Psychology at the intersection of work and family: Recommendations for employers, working families, and policymakers. American Psychologist, 60, 397–409.

Han, W.-J., & Waldfogel, J. (2001). Child care costs and women’s employment: A comparison of single and married mothers with pre-school-aged children. Social Science Quarterly, 82(3), 552–568. doi:10.1111/0038-4941.00042.

Hanappi, T. P., & Müllbacher, S. (2013). Tax incentives and family labor supply in Austria. Review of Economics of the Household,. doi:10.1007/s11150-013-9230-9.

Hardoy, I., & Schøne, P. (2013). Enticing even higher female labor supply: The impact of cheaper day care. Review of Economics of the Household, 123, 1–22. doi:10.1007/s11150-013-9215-8.

Havnes, T., & Mogstad, M. (2010). Is universal child care leveling the playing field? Evidence from non-linear difference-in-differences. Journal of Public Economics. doi:10.1016/j.jpubeco.2014.04.007.

Havnes, T., & Mogstad, M. (2011a). Money for nothing? Universal child care and maternal employment. Journal of Public Economics, 95(11–12), 1455–1465. doi:10.1016/j.jpubeco.2011.05.016.

Havnes, T., & Mogstad, M. (2011b). No child left behind: Subsidized child care and children’s long-run outcomes. American Economic Journal: Economic Policy, 3(2), 97–129.

Heckman, J. J., & Masterov, D. V. (2004). The productivity argument for investing in young children. Invest in Kids Working Group.

Herbst, C. M. (2010). The labor supply effects of child care costs and wages in the presence of subsidies and the earned income tax credit. Review of Economics of the Household, 8, 199–230. doi:10.1007/s11150-009-9078-1.

Herbst, C. M. (2013). Universal child care, maternal employment, and children’s long-run outcomes: Evidence from the U.S. Lanham Act of 1940 (No. 7846). Retrieved from http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2374627.

Herbst, C. M., & Tekin, E. (2011). Child care subsidies and childhood obesity. Review of Economics of the Household, 9, 349–378. doi:10.1007/s11150-010-9087-0.

Herbst, C. M., & Tekin, E. (2016). The impact of child-care subsidies on child development: Evidence from geographic variation in the distance to social service agencies. Journal of Policy Analysis and Management, 35(1), 94–116. doi:10.1002/pam.

Hofferth, S. L. (1999). Child care, maternal employment and public policy. The ANNALS of the American Academy of Political and Social Science, 563, 20–38. doi:10.1177/000271629956300102.

Hofferth, S., & Collins, N. (2000). Child care and employment turnover. Population Research and Policy Review, 19(4), 357.

Johnson, A. D., Martin, A., & Brooks-Gunn, J. (2013). Child-care subsidies and school readiness in kindergarten. Child Development, 84(5), 1806–1822. doi:10.1111/cdev.12073.

Johnson, A. D., Martin, A., & Ryan, R. M. (2014). Child-care subsidies and child-care choices over time. Child Development, 85(5), 1843–1851. doi:10.1111/cdev.12254.

Kalb, G. (2009). Children, labour supply and child care: Challenges for empirical analysis. Australian Economic Review, 42(3), 276–299. doi:10.1111/j.1467-8462.2009.00545.x.

Kalb, G., & Thoresen, T. O. (2010). A comparison of family policy designs of Australia and Norway using microsimulation models. Review of Economics of the Household, 8(2), 255–287. doi:10.1007/s11150-009-9076-3.

Kreyenfeld, M., & Hank, K. (2000). Does the availability of child care influence the employment of mothers? Findings from western Germany. Population Research and Policy Review, 19(4), 317.

Laughlin, L. (2013). Who’s minding the kids? Child care arrangements: Spring 2011 (Vol. 2009). U.S. Census Bureau: Washington, DC.

Lefebvre, P., & Merrigan, P. (2008). Child-care policy and the labor supply of mothers with young children: A natural experiment from Canada. Journal of Labor Economics, 26(3), 519–548. doi:10.1086/587760.

Lefebvre, P., Merrigan, P., & Roy-desrosiers, F. (2011). Quebec’s childcare universal low fees policy 10 years after: Effects, costs, and benefits. Montreal: Cirpee Working Paper 11-01.

Lefebvre, P., Merrigan, P., & Verstraete, M. (2009). Dynamic labour supply effects of childcare subsidies: Evidence from a Canadian natural experiment on low-fee universal child care. Labour Economics, 16(5), 490–502. doi:10.1016/j.labeco.2009.03.003.

Li, W., Farkas, G., Duncan, G. J., Burchinal, M. R., & Vandell, D. L. (2013). Timing of high-quality child care and cognitive, language, and preacademic development. Developmental Psychology, 49(8), 1440–1451. doi:10.1037/a0030613.

Loft, L. T. G., & Hogan, D. (2014). Does care matter? Care capital and mothers’ time to paid employment. Journal of Population Research, 31(3), 237–252. doi:10.1007/s12546-014-9133-5.

Mahringer, H., & Zulehner, C. (2015). Child-care costs and mothers’ employment rates: An empirical analysis for Austria. Review of Economics of the Household, 13(4), 837–870. doi:10.1007/s11150-013-9222-9.

Masse, L. N., & Barnett, W. S. (2002). A benefit cost analysis of the abecedarian early childhood intervention. New Brunswick, NJ. Retrieved from http://nieer.org/resources/research/AbecedarianStudy.pdf.

Matos, K., & Galinsky, E. (2014). National study of employers. New York, NY: Families and Work Institute.

McCartney, S., & Laughlin, L. (2011). Child care costs in the current population survey’s annual social and economic supplement (CPS ASEC): A comparison to SIPP (No. 2011-1). U.S. Census Bureau: Washington, DC. Retrieved from https://www.census.gov/hhes/povmeas/methodology/supplemental/research/ChildCareCPS.pdf.

Meyers, M. (1993). Child care in JOBS employment and training programs: What difference does quality make? Journal of Marriage and Family, 55, 593–603.

Meyers, M. K., Heintze, R., & Wolf, D. A. (2002). Child care subsidies and the employment of welfare recipients. Demography, 39, 165–179.

Michalopoulos, C. (2010). Effects of reducing child care subsidy copayments in Washington State. OPRE 2011-2. U.S. Department of Health and Human Services: Washington, DC. Retrieved from http://www.mdrc.org/publication/effects-reducing-child-care-subsidy-copayments-washington-state.

Michalopoulos, C., Lundquist, E., & Castells, N. (2010). The effects of child care subsidies for moderate-income families in Cook County, Illinois. Final Report. U.S. Department of Health and Human Services: Washington, DC. Retrieved from http://www.mdrc.org/publications/581/overview.html.

Milkie, M. A., Nomaguchi, K. M., & Denny, K. (2015). Does mom time matter? Does the amount of time mothers spend with children or adolescents matter? Journal of Marriage and Family, 77, 1–36. doi:10.1111/jomf.12170.

Morrissey, T. W., & Warner, M. E. (2007). Why early care and education deserves as much attention, or more, than prekindergarten alone. Applied Developmental Science, 11, 57–70. doi:10.1080/10888690701384897.

Morrissey, T. W., & Warner, M. E. (2011). An exploratory study of the impacts of an employer-supported child care program. Early Childhood Research Quarterly, 26(3), 344–354.

National Institute for Early Education Research. (2014). Florida voluntary prekindergarten program. Retrieved from http://nieer.org/sites/nieer/files/Florida_2014_1.pdf.

NICHD ECCRN. (2006). Child care effect sizes for the NICHD study of early child care and youth development. American Psychologist, 61, 99–116.

NSECE Team. (2014). Household search for and perceptions of early care and education: Initial findings from the national survey of early care and education (NSECE) (OPRE Report No. 2014-55a). Washington, DC. Retrieved from https://www.acf.hhs.gov/sites/default/files/opre/brief_hh_search_and_perceptions_to_opre_10022014.pdf.

OECD. (2015). Maternal employment rates. Paris, France. Retrieved from http://www.oecd.org/els/family/LMF_1_2_Maternal_Employment.pdf.

Office of the Assistant Secretary of Planning and Evaluation. (2015). Estimates of child care eligibility and receipt for fiscal year 2011. U.S. Department of Health and Human Services, Washington, DC. Retrieved from http://aspe.hhs.gov/hsp/15/ChildCareEligibility/ib_ChildCareEligibility.pdf.

Phillips, D. A., & Adams, G. (2001). Child care and our youngest children. The Future of Children, 11, 34–51.

Phillips, D. A., & Lowenstein, A. E. (2011). Early care, education, and child development. Annual Review of Psychology, 62, 483–500. doi:10.1146/annurev.psych.031809.130707.

Posadas, J., & Vidal-Fernandez, M. (2013). Grandparents’ childcare and female labor force participation. IZA Journal of Labor Policy, 2, 14. doi:10.1186/2193-9004-2-14.