Abstract

This paper uses CPS and SIPP data between 1990 and 2004 to examine the effects of child care expenditures and wages on the employment of single mothers. It adds to the literature in this area by incorporating explicit controls for child care subsidies and the EITC into the estimation. Doing so provides an opportunity to examine mothers’ sensitivity to prices and wages net of policies that influence these amounts. Results suggest that lower child care expenditures, higher wages, and more generous subsidy and EITC benefits increase the likelihood of employment. Allowing the impact of child care subsidies and the EITC to vary with expenditures and wages reveals substantial heterogeneity. In particular, the largest labor supply effects of child care subsidies are generated for mothers with higher child care costs, while the largest labor supply effects of the EITC are found for mothers with lower wages.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The 1990s marked a watershed period in the evolution of US social policy. Significant changes were introduced across a number of policy domains, each with the goal of increasing the incentive for single mothers to reduce welfare dependency and enter the labor force. Additional funding for child care subsidies and the Earned Income Tax Credit (EITC) are among the most prominent vehicles through which the federal and state governments have eased the transition from welfare to work. Expenditures on child care subsidies increased from $168 million in 1990 to $9.4 billion in 2004, owing in large part to the 1996 passage of the Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) and the creation of the Child Care and Development Fund (CCDF) (Besharov and Higney 2006). Similarly, dramatic expansions of the EITC in 1990 and 1993 increased funding from $6 billion to $38 billion over the same period (Tax Policy Center 2008).

A growing empirical literature examines the impact of recent child care and tax policy changes on the employment of single mothers.Footnote 1 However, isolating the causal effect of these policies is a difficult task for several reasons. First, a large number of social policy changes occurred contemporaneously with reforms to child care subsidies and the EITC. States experimented with welfare waivers in the early 1990s that ultimately became the basis for the 1996 PRWORA. Distilling the effects of welfare reform has been challenging in and of itself because states often made many changes simultaneously. In addition, the strong economy throughout the 1990s increased real earnings for low-skilled workers for the first time in nearly two decades, providing an unambiguous incentive to leave welfare for work. A further complication relates to whether and how child care costs and wages should be adjusted for subsidies and taxes in labor supply models. Economic theory suggests that employment decisions depend on net-child care prices and net-wage rates, raising questions over whether such policy adjustments matter in practice. Adjusting hourly wages for taxes is relatively straightforward, and a number of EITC studies include the net-of-taxes wage in the estimation (Dickert-Conlin et al. 1995; Eissa and Hoynes 2004; Keane and Moffitt 1998; Meyer and Rosenbaum 2001). Adjusting child care prices for subsidies is more difficult, and only a few studies have made such an attempt (Averett et al. 1997; Tekin 2007a). To my knowledge, only one study adjusts prices and taxes (Rusev 2006). A final complication arises from the fact that nationally representative surveys either do not provide information on child care expenditures (e.g., Current Population Survey, CPS) or do not collect large and consistent samples of single mothers (e.g., Survey of Income and Program Participation, SIPP). As a result, most child care studies exploit only cross-sectional variation in prices, do not control for the social policy environment, and do not account for unobserved heterogeneity.

This paper builds upon previous research by simultaneously estimating the effects of hourly child care expenditures and wages on the employment of single mothers, and incorporating explicit controls for CCDF subsidies and the EITC into the estimation. Although this technique does not permit the creation of net-price and net-wage variables, it does provide an opportunity to examine whether the employment response to these policy reforms varies over the price and wage distributions. I create a dataset that merges child care expenditure data from multiple panels of the SIPP with demographic and employment data from the 1990 to 2004 March CPS. This is accomplished by first constructing SIPP and CPS samples in an identical manner and then assigning a potential child care expenditure to single mothers in the CPS based on shared characteristics with mothers in the SIPP. Estimating the employment models using CPS data provide several advantages. Given that all states are identifiable in the CPS, data on single mothers are supplemented by information on states’ social policy and economic environments, and the repeated cross-sectional data structure permit controls for state-level unobserved heterogeneity. In addition, the comparatively large sample sizes in the CPS are ideal for examining heterogeneity in the impact of child care costs and wages across sub-samples of single mothers and alternative work margins.

Estimates from the main employment model yield elasticities of employment with respect to hourly child care expenditures and wages of −0.05 and 0.33, respectively. These results are fairly consistent across sub-samples of single mothers, but there is evidence of a differential employment response across alternative work margins. The estimates for CCDF subsidies and EITC benefits indicate that increases in both are strongly related to employment for single mothers. The effects of child care expenditures and wages do not change substantially after controls for subsidies and the EITC are added to the model. However, allowing the subsidy and EITC effects to vary across the price and wage distributions reveals substantial heterogeneity in employment responses. In particular, the largest labor supply effects of child care subsidies are generated for mothers with higher child care costs. Conversely, the largest labor supply effects of the EITC are found for mothers with lower wages. Policy implications focus on the optimal targeting of these benefits.

The remainder of this paper is organized as follows. Section 2 provides an overview of key child care and EITC policy changes between 1990 and 2004, and reviews the relevant literature in each domain. Section 3 describes the data and empirical strategy. Section 4 presents results from the main employment model as well as from several robustness checks, and conclusions are discussed in Sect. 5.

2 Review of policy changes and relevant literature

2.1 Child care prices and subsidies

Throughout the early-1990s, the federal government operated four major child care assistance programs that eventually became the Child Care and Development Fund (CCDF) after welfare reform in 1996.Footnote 2 The primary focus of child care subsidies is to facilitate the transition of low-income families from welfare to work by defraying the expenses associated with child care. To be eligible for CCDF funds, families must be engaged in a state-defined acceptable work activity (e.g., employment, education, or job training), have incomes below 85% of the state median income (SMI), and have at least one child ages 0–12. States are given substantial flexibility in designing their subsidy systems, including being able to transfer up to 30% of their TANF block grant to the CCDF, setting reimbursement and co-payment rates, and defining acceptable work activities. Expenditures on the programs that eventually became the CCDF grew steadily between 1990 and 1996, but exploded after the passage of welfare reform. By 2004, approximately $9.4 billion was spent on child care subsidies through the CCDF, serving an average of 1.7 million children per month (Child Care Bureau 2005).

An important design feature associated with child care subsidies is the non-linear benefit structure. Recipients experience substantial variation in benefits, determined by states’ copayment and reimbursement policies. Most states require families to cover a portion of their child care costs through a sliding scale fee that varies with income. Reimbursement rates are the maximum amounts that states pay families or child care providers for expenses incurred. These rates vary significantly within and across states, income level, ages and number of children, and the type of child care provider. States have a complex system of reimbursement rates, containing numerous piecewise linear segments that distribute subsidy benefits as a decreasing function of family income. Child care subsidies create an unambiguous positive incentive to enter the labor force, but the program’s non-linearities may lead workers to reduce their labor supply in order to qualify for a larger subsidy. A large body of research examines the relationship between child care costs and women’s work decisions. Non-experimental evidence comes from three primary sources: reduced form/structural studies of price effects, reduced form studies of actual subsidy programs, and studies using quasi-experimental methods. The most common methodological approach to examining price effects includes a discrete choice participation probit with predicted child care costs and wages as the key right-hand-side variables. Both measures are derived from OLS models that control for selectivity on employment and the decision to pay for child care. This basic approach is common in the literature, and the results consistently point to a negative relationship between child care costs and mothers’ employment (Baum 2002; Blau and Robbins 1991; Ribar 1992; Connelly and Kimmel 2003a, b; Kimmel 1995; U.S. GAO 1994; Connelly 1992; Han and Waldfogel 2001; Anderson and Levine 2000; Tekin 2007a). However, the range of estimated price elasticities is quite large: 0.06 to −1.36.

The second approach examines the impact of actual subsidy receipt on employment. The basic empirical framework involves a first-stage subsidy receipt equation that is used to assign all mothers a predicted probability of receipt. The second-stage equation models the employment status with predicted child care subsidy receipt as the key right-hand-side variable. Representative studies in this stream of literature include Blau and Tekin (2007), Meyers et al. (2002), and Tekin (2005, 2007b). These studies consistently find that child care subsidy receipt among single mothers increases the likelihood of employment. Two studies investigate the labor supply effects of the CDCTC (Averett et al. 1997; Michalopoulos et al. 1992). The former study finds an elasticity of hours worked of −0.78, while the latter estimates elasticities of essentially zero. The final cluster of studies exploits quasi-experimental variation in child care subsidies to examine mothers’ employment. Using data from two subsidy programs in Kentucky, Berger and Black (1992) create a natural experiment by comparing employment probabilities for single mothers who received subsidized child care with those on a waiting list. The authors estimate elasticities with respect to subsidies of 0.09–0.35. Gelbach (2002) uses children’s quarter-of-birth in the 1980 Census to instrument for participation in public kindergarten. This study estimates price elasticities in the range −0.13 to −0.36. Finally, Baker et al. (2008) use a difference-in-differences strategy to examine the employment response to geographic-based policy shifts in Canada. Results for this study imply a price elasticity of 0.24. Together, these studies report elasticities at the low end of the range.

2.2 Earned income tax credit

Arguably the most important change to work incentives faced by single mothers comes from the EITC.Footnote 3 The federal EITC received three major expansions, but for the purposes of this study, the key reforms came through the 1990 and 1993 Omnibus Budget Reconciliation Acts.Footnote 4 As of 2004, families with one child could receive a wage subsidy of 34%, while families with two or more children could receive a subsidy of 40%. The maximum credit available to both families was $2,604 and $4,300, respectively. Another important development is the proliferation of state EITC programs. These programs simply “piggyback” onto the federal EITC by using its eligibility rules and credit rates. States have the option to structure their EITC programs as refundable or nonrefundable tax credits. Of the 17 states (including the District of Columbia) that implemented an EITC before 2004, 11 made the program refundable for the entire period of operation, while two states (Illinois and Maryland) changed from nonrefundable to refundable tax credits. Annual foregone revenue from state EITCs ranges from $17 million in Vermont to $591 million in New York (Nagle and Johnson 2006). As is the case with child care subsidies, non-linearities in the EITC create a complicated set of work incentives. The tax credit is comprised of three regions: phase-in, plateau, and phase-out. With its negative marginal tax rate, the phase-in region operates like a wage subsidy by increasing workers’ net-of-taxes hourly wage. The plateau range, where the credit rate is zero, acts like a lump sum transfer. Finally, the phase-out region acts like an implicit tax on earnings by reducing the amount of the EITC by a flat rate as earnings continue to rise. These regions distort employment behavior in conflicting ways, but the EITC creates an unambiguous positive incentive to enter the labor force. A growing body of research evaluates the labor supply effects of the EITC. A majority of this work focuses on analyzing major changes to the EITC embedded in tax laws (Ellwood 2000; Hotz et al. 2005; Eissa and Liebman 1996; Meyer and Rosenbaum 1999, 2000, 2001) or geographic disparities in the generosity of state EITCs (Cancian and Levinson 2006). The basis for this approach is to observe participation rates for a sample of individuals most likely affected by an EITC expansion before and after passage of the law, relative to changes in a comparison group. Results from these studies as a whole find strong, positive effects of EITC expansions on the employment of single mothers. Another set of studies uses a structural approach, drawing on economic theory to suggest parameterizations of policy and budget constraint variables that enter the work decision. Most of this research focuses on estimating employment models at the extensive margin (Fang and Keane 2004; Looney 2005; Meyer and Rosenbaum 1999, 2001; Grogger 2003; Neumark and Wascher 2000), while others concentrate on the intensive margin (Dickert-Conlin et al. 1995; Hoffman and Seidman 1990; Keane 1995; Keane and Moffit 1998). Results from these studies find elasticities of employment with respect to the return to work in the range 0.59–1.16.

In sum, it is important to place the current study in the context of previous work on child care costs, wages, CCDF subsidies, and the EITC. This study is similar to recent child care work by Anderson and Levine (2000), Han and Waldfogel (2001), and Connelly and Kimmel (2003a, b) in its econometric approach to studying price effects. However, the current study differs from this work because the repeated cross-sectional data structure allows for careful controls of the social policy and economic environments, along with controls for unobserved heterogeneity. In this way, the current study is similar to recent EITC studies, especially Fang and Keane (2004), Grogger (2003), and Meyer and Rosenbaum (2001). Finally, although the current study does not adjust prices and wages for subsidies and taxes, it does incorporate explicit controls for CCDF spending and EITC benefits into the employment models. Therefore, recent work by Fang and Keane (2004), Meyer and Rosenbaum (2001), Rusev (2006), and Tekin (2007a) are most relevant to the current study.

3 Empirical implementation

3.1 Data sources and the SIPP-CPS matching procedure

Data for this research are drawn from multiple sources, principally the March Current Population Survey (CPS) and the Survey of Income and Program Participation (SIPP). The CPS is a nationally representative survey of approximately 60,000 households, providing detailed data on labor market behavior, income, and demographic characteristics for individuals ages 15 and over. March CPS surveys from 1991 to 2005 are used, yielding information on employment and income from 1990 to 2004. I include in the sample single women (widowed, separated, divorced, and never married) ages 21–64 who have at least one child ages 0–12. Single mothers from census-defined families comprise the unit of analysis.Footnote 5 After applying a number of standard exclusions on the sample composition, the final analysis sample consists of 74,042 single mothers with at least one child ages 0–12.Footnote 6 Table 1 presents summary statistics for the CPS sample.

A drawback of the CPS is that data on child care costs are not collected. Therefore, I draw from various panels of the SIPP to impute child care expenditures for single mothers in the CPS.Footnote 7 The SIPP comprises a series of national panels, with sample sizes ranging from approximately 14,000–37,000 households.Footnote 8 Although most SIPP survey content focuses on a “core” of labor force, program participation, and income questions, the survey is supplemented by several “topical” modules, one of which covers child care. A typical child care module collects data on all child care arrangements for children (under age 15) of employed mothers. Detailed information is ascertained on the type of child care used, the number of hours per week a child spends in care, and the cost associated with purchasing it.Footnote 9

Since the SIPP collects much of the same information as the CPS, it is possible to define both samples in exactly the same manner.Footnote 10 A critical step in this process is to achieve a close temporal match between the collection of SIPP child care data and CPS labor market and earnings data.Footnote 11 Fortunately, the SIPP introduces a child care module at several points throughout the study period. Specifically, I draw from the 1990, 1991, 1992, 1993, 1996 (Waves 4 and 10), and 2001 panels to conduct the match in the manner displayed in Table 2. For example, child care expenditure data in SIPP’s 1990 panel (wave 3), which were fielded in the fall of 1990, are used to assign child care expenditures to a similarly constructed sample of single mothers in the 1990 CPS. Since the child care module is not implemented every year, there are several years during the study period that a single wave of child care data is applied to multiple years of CPS data. After both samples are created, I estimate a separate OLS child care expenditure equation for each SIPP child care module, and apply the parameter estimates from these equations to the corresponding characteristics of single mothers in the CPS.

A criticism of using the SIPP to predict child care expenses for CPS single mothers is that it adds unnecessary complexity to what could be a straightforward exercise by conducting the analysis using the SIPP. However, the CPS has a number of advantages that outweigh the complexity introduced by matching these surveys. First, given that the March CPS is an annual survey, it captures year-to-year changes in employment behavior. This is particularly important after the passage of welfare reform in 1996, when employment rates for single mothers increased dramatically. Unfortunately, the SIPP child care module has been implemented only three times since 1996 throughout the study period. Second, nine states in the early SIPP panels cannot be uniquely identified. More recent rounds of data collection reduce this number to five states.Footnote 12 This is a potentially serious omission that precludes even multiple cross-sections of SIPP data from fully exploiting variation in employment rates and policy variation in the CCDF and EITC. Finally, the CPS contains comparatively large samples of single mothers, which facilitates detailed sub-group analyses and specification checks that require dropping multiple states or years.Footnote 13

3.2 Empirical framework

Estimating the effects of child care expenditures and wages is complicated because these variables are endogenous to the work decision and are observed only for employed single mothers. Therefore, a large number of supporting equations must be specified in order to handle these issues. Table 3 provides an overview of the empirical framework. It summarizes the variables included in each equation, the data used for the estimation, and the econometric method. This layout also makes explicit the exclusion restrictions relied upon to identify the underlying structural model. The following discussion outlines the steps taken to implement the empirical framework.

The equation-of-interest uses CPS data over the period 1990–2004 to examine the effects of child care expenditures, wages, CCDF spending, and EITC benefits on the employment decisions of single women with children ages 0–12. I estimate a discrete choice participation equation that uses parameterizations of budget constraint, policy, and economic variables thought to influence the relative utility from employment. Stated formally, the estimated employment probit is:

for i = 1, …, N si; s = 1, …, S; t = 1, …, N, where i, s, and t indexes individuals, states, and years, respectively. The emp is a binary employment outcome for the ith mother in state s and year t. Three primary employment outcomes are investigated in this study. I first examine a measure of annual employment, defined as whether a single mother was ever employed in the previous year. This measure reflects the dichotomous work decision, or employment at the extensive margin, that has been the focus of most previous research. In addition, two infra-marginal employment measures are constructed: whether the mother was employed and did not receive welfare in the previous year, and whether the mother was employed full-time (35+ hours/week), full-year (48+ weeks). Although neglected by earlier work, participation along these two work margins increased substantially throughout the 1990s. The fraction of mothers working without welfare increased from 56% in 1990 to 72% in 2004, while full-time (full-year) work increased from 54 to 62% (Author’s calculations from the March CPS, 1991–2005).

The variables lnE and lnw are, respectively, the natural logarithms of predicted hourly child care expenditures and predicted hourly wages. The P′ is a vector of social policy and macro-economic controls. The key variables included here are measures of child care subsidy policy and the EITC. I parameterize changes to subsidies by summing federal and state expenditures through the CCDF (and its predecessor programs) and dividing by the number of children ages 0–12 in a given state-year cell. Changes to the EITC are captured by summing the federal and state EITC maximum credits that apply to families with a given number of children. By incorporating these policy variables, I avoid many of the difficulties associated with adjusting child care expenditures and wages for subsidies and the EITC.Footnote 14 However, these variables provide an opportunity to estimate the effects of prices and wages net of policies that influence these amounts. Also included in P′ are states’ maximum AFDC/TANF benefits available to a family of three; a dummy variable that equals unity for all state-years after the initial implementation of any statewide waiver or welfare reform; a dummy variable that equals unity for all state-years after the implementation of a time limit; the AFDC/TANF participation rate for female-headed families; and the average, annual state unemployment rate.Footnote 15 Child care expenditures, wages, and the EITC maximum credit are allowed to vary across women, state of residence, and year, while the remaining controls vary across state-year cells.

The X′ is a vector of human capital and demographic controls, including age, education, marital status, race, non-wage income, and the presence and number of children in various age groups. These variables capture underlying preferences for work and leisure as well as the opportunity costs associated with remaining out of work. I also include a number of controls for state-level unobserved heterogeneity. The parameters μ and ν denote state fixed effects and period effects. State fixed effects capture unobserved state-specific, time-invariant determinants of child care costs and wages that are related to the work decision. The year effects account for time-varying factors influencing all states, such as national economic or attitudinal shifts, that are correlated with employment decisions. In other models, I include state-specific linear time trends, which control for unobservable factors that are trending linearly over time.

As shown in Table 3, a number of adjustments are made to child care expenditures (lnE) before moving these data from the SIPP to the CPS. These adjustments are required for several reasons. First, idiosyncrasies in the SIPP design coupled with the underlying decision-making process of single mothers leads researchers to observe child care expenditures if the mother is employed and paying for child care. It is therefore necessary to assign a potential child care expenditure to mothers with missing data because the cost structure faced by working mothers may not reflect that of non-working mothers had they been employed. In other words, the single mothers for whom these data are non-missing are likely a self-selected group. Second, child care expenditures are endogenous in the presence of unobserved factors related to the work decision. Unobserved child care quality is a common example: quality is related to the decision to use paid care, which in turn affects how much is spent and ultimately the employment decision. To deal with missing child care expenditures, I use the bivariate sample selection correction outlined by Tunali (1986). This procedure has been the primary econometric technique for researchers examining the impact of child care costs using censored survey data (Anderson and Levine 2000; Baum 2002; Ribar 1992; Connelly and Kimmel 2003a, b; Kimmel 1995; U.S. GAO 1994; Connelly 1992; Han and Waldfogel 2001; Tekin 2007a). Three supporting equations are required to implement this sample selection correction: first-stage employment and pay-for-care equations, followed by a child care expenditure equation. The first-stage models are jointly estimated by a bivariate probit, and the (log of) child care expenditures is estimated by an OLS regression. It is important to note that I estimate these models separately for each SIPP child care module implemented during the observation period, yielding a total of seven sets of supporting equations. The two-first-stage equations are used to construct sample selection terms for the expenditure model; that is, child care expenditures are corrected for selectivity on employment and the decision to pay for child care. These equations are estimated jointly on the full SIPP sample of single mothers. Variables included in these models are thought to influence preferences for work and paid modes of child care. For example, I incorporate such demographic and human capital controls as age, educational attainment, marital status, race, non-wage income, the presence and number of children in various age groups, the availability of informal caregivers, metropolitan residence, and region of residence. I also control for state-level policy and economic determinants of the work decision by including the AFDC/TANF benefit for a three-person family and the average, annual state unemployment rate.

The child care expenditure equation is estimated on the SIPP sub-sample of employed single mothers for whom child care expenditures are observed, and parameter estimates from this model are used to predict expenditures for CPS single mothers. The measure of hourly child care costs is calculated by summing expenditures across all child care arrangements for the three youngest children in a family, and then dividing this amount by total hours worked during the reference week.Footnote 16 Exogenous determinants of child care costs include age, education, race, non-wage income, the number of children in various age groups, metropolitan residence, region of residence, and state-level characteristics of child care regulations and child care labor markets. Variables such as age, education, and race control for individual preferences in the choice of child care services, while children’s age groupings account for the fact that market prices vary according to the age of the child. As shown in Table 3, a set of auxiliary regressions is needed to deal with a similar issue for hourly wages. Specifically, wages are observed only if a single mother is working. To estimate the impact of wages on the work decision, a predicted hourly wage needs to be imputed for the sub-sample of non-working mothers. This is accomplished in the CPS through the two-step Heckman (1979) sample selection correction. The first step models the employment decision on the full sample of single mothers, and the second step estimates an OLS (log) hourly wage equation on the sub-sample of working mothers.Footnote 17 Estimates from the first-stage model are used to construct a sample selection term that is inserted into the wage equation. This term controls for differential employment tastes across mothers. To allow for structural shifts in wage determination, a separate Heckman procedure is conducted for each year of the observation period. A key estimation issue is the identification of the child care expenditure, wage, and employment equations. I draw upon the most recent work by Anderson and Levine (2000) and Connelly and Kimmel (2003a, b) for guidance on an appropriate set of exclusion restrictions. To identify each equation, one or more statistically significant and theoretically justifiable variables appearing in the first-stage equation must be omitted from the second-stage equation. As shown in Table 3, key variables identifying the child care expenditure equation include marital status, the presence of an unemployed adult, maximum AFDC/TANF benefits, and the state unemployment rate. Marital status and the state-level variables influence the likelihood of employment without directly affecting a family’s child care expenses. The presence of an unemployed adult is likely correlated with a family’s decision to use paid child care but unrelated to expenses after decisions about child care arrangements are made. The wage equation is identified by including the presence of children in various age groups and non-wage income in the first-stage employment model. These variables influence women’s employment decisions, but conditional on finding a job, are unlikely to be related to the wage offer. The final employment model is identified by incorporating into the child care expenditure or wage equation detailed controls for state-level child care regulations (e.g., child-staff ratios and educational requirements), private child care workers’ wages, private child care establishments, and per capita income.Footnote 18 To be theoretically plausible, one must assume that these variables reflect structural attributes of states’ child care markets, and are therefore associated with market prices but have no direct effect on employment. Many of these state-level child care exclusions are statistically significant in the expenditure equation.Footnote 19 Appendix Tables 10 and 11 present results from the price and wage selection correction procedures based on SIPP’s 1990(3) child care module and the 1991 March CPS. Full results from all survey years are available from the author upon request.

4 Estimation results from the employment model

4.1 Main results

Results from the main employment equation are presented in Table 4. Here, the outcome variable is the binary work decision, or employment at the extensive margin. I then examine heterogeneity in the effects of child care expenditures, wages, CCDF subsidies, and the EITC across sub-samples of single mothers (Table 5) and alternative work margins (Table 6). Finally, I check the robustness of the main results by discussing a number of specification checks (Table 7).

The estimates in columns (1) through (4) of Table 4 are derived from increasingly full specifications. Column (1) presents results from the baseline model, while column (2) adds state-specific time trends. Column (3) incorporates the child care subsidy and EITC variables, and column (4) checks the robustness of the policy estimates by adding the time trends back into the model. Looking at column (4), the coefficients on hourly child care expenditures and wages take the expected sign and are statistically significant. Increases in child care costs are associated with reductions in single mothers’ employment, while increases in wages are expected to increase employment levels. The estimated elasticity of employment with respect to child care expenditures is −0.05, and the elasticity of employment with respect to wages is 0.33. Relative to previous studies using samples of older children, the price elasticity is at the low end of the range. For example, Anderson and Levine (2000) estimate an elasticity of −0.47, and the U.S. GAO (1994) finds elasticities as high as −0.50. These estimates are also lower than those based on samples of young children: Connelly and Kimmel (2003a) (−0.42) and Connelly and Kimmel (2003b) (−0.98). Results in this study, however, reflect recent work by Gelbach (2002) (−0.13), Baker et al. (2008) (−0.24), Rusev (2006) (−0.12), and Tekin (2007b) (−0.12). The estimates for CCDF spending and EITC benefits indicate that increases in both are strongly related to employment for single mothers. In fact, marginal effects in column (4) imply that a $100 increase in CCDF spending (per child ages 0–12) is expected to increase employment rates by 1.7% age points. Similarly, increasing EITC benefits by $1,000 is associated with a 1.0 percentage point increase in the employment rate. These results accord with those estimated in previous studies (Fang and Keane 2004; Grogger 2003; Herbst 2008a; Meyer and Rosenbaum 2001).

As noted earlier, it is important to determine whether, in practice, adjusting prices and wages for subsidies and taxes is important to estimating price and wage effects. Economic theory predicts that single mothers respond to child care prices and wages net of CCDF subsidies and the EITC, conditional on being eligible for and receiving these benefits. Recent evidence suggests that eligibility and take-up rates for child care subsidies, in particular, are low. For example, Herbst (2008b) estimates that just over half of female-headed households are eligible for subsidies and that approximately 23% of such eligible households receive assistance.Footnote 20 Low participation rates for child care subsidies are not surprising, given the block grant structure of the CCDF. Although take-up rates for the EITC are substantially higher, the program is not operating at full coverage and not all single mothers are eligible.Footnote 21 Therefore, one might not expect the estimates for child care prices and wages to change dramatically after adding controls for policies that alter these amounts. Results in columns (3) and (4) appear to confirm this story: the coefficient on prices and wages are insensitive to the inclusion of CCDF spending and EITC benefits.

These results imply that, for the average single mother, price and wage effects are not sensitive to variables capturing subsidy and EITC generosity. This ignores the possibility of a differential responsiveness to these policies across the price and wage distributions. For example, it is reasonable that adjustments to child care costs influence mothers’ employment decisions differently when costs are higher, as compared to when costs are lower. Adjustments to wages through the EITC are also expected to have differential employment effects, especially in light of the EITC’s structure: the amount of the credit initially increases with earnings, but eventually phases-out after earnings reach a certain point. Columns (5) and (6) present results from an explicit test of a differential CCDF and EITC response across mothers with varying child care expenditures and wages. In particular, I incorporate interactions between the child care price and subsidy variables and the between the wage and EITC variables. Coefficients on the interaction terms suggest that the impact of these policy adjustments depends on the level of hourly child care costs and wages. Specifically, I find that the positive impact of subsidies is greater among mothers with higher child care costs. Conversely, the positive impact of the EITC declines as wages grow. In sum, it is important to reconcile the story that emerges from the results in columns (4) and (6). While single mothers are sensitive to child care expenditures and wages, adding controls for policies that alter these amounts does not lead to further changes in responsiveness. This is due, in part, to the fact that large numbers of single mothers are not eligible for the CCDF or EITC, and conditional on being eligible, these programs are far from reaching full coverage. It is therefore important to allow the effects of price and wage policy adjustments to vary with the amount of child care costs and wages. In doing so, one explicitly conducts the analysis on mothers with varying propensities to receive subsidies and the EITC. Results from this exercise suggest that these policies have differential impacts on employment depending on the level of child care costs and wages. Mothers who are more likely to benefit from subsidies because they are paying higher child care costs are more likely to be employed. On the other hand, mothers who are more likely to claim higher EITC benefits because they have low wages are more likely to be employed. Table 5 explores heterogeneity in the impact of child care expenditures, wages, subsidies, and the EITC across sub-groups of single mothers defined by educational attainment, the presence of children in various age groups, and marital status. A common finding in the literature is that low-skilled mothers and those with young children are more sensitive to child care costs and wages (Anderson and Levine 2000; Connelly and Kimmel 2003a, b; Han and Waldfogel 2001). Comparing the magnitude of price and wage coefficients across categories of educational attainment and age appears to confirm previous results, although specification tests cannot reject the null hypothesis of equality of cross-equation coefficients. Indeed, price and wages elasticities are quite similar across mothers’ education levels (prices: −0.07/−0.03; wages: 0.47/0.27) and children’s age (prices: −0.08/−0.04; wages: 0.37/0.23). Furthermore, the differential effect of subsidies and the EITC does not operate differently across education and age categories. Table 5 also explores heterogeneity within the unmarried population. Investigating these groups separately is important given that never married mothers tend to be younger and lower-skilled than their previously married counterparts.Footnote 22 I find that never married mothers are more responsive to child care expenditures and wages (prices: −0.06/−0.04; wages: 0.42/0.25). However, only the p-value on the wage difference is small enough to reject the null hypothesis of equality of coefficients. There also appears to be structural differences by marital status in the effects of CCDF spending and the EITC across the price and wage distributions. In particular, never married mothers are significantly more likely to alter their employment decisions in response to policies that change child care costs and wages.

Table 6 presents evidence on a final source of heterogeneity: across different work margins. Specifically, I explore three infra-marginal employment measures: whether the mother was unemployed and received welfare in the previous year, whether the mother worked without welfare, and whether the mother was employed full-time (35+ hours/week), full-year (48+ weeks). Generally speaking, I find substantial heterogeneity across the various work margins. Looking first at column (2), increases in hourly child care expenditures and decreases in hourly wages are expected to increase the likelihood of combining welfare participation without work. Both effects accord with theoretical predictions. Compared to the results for any work, the decision to work without welfare receipt [column (3)] is substantially more sensitive to child care expenditures and wages. At this work margin, the price elasticity increases to −0.08 and the wage elasticity increases to 0.77. The influence of child care expenditures at the full-time work margin [column (4)] is significantly less, with an estimated elasticity of −0.03. Wages, however, remain strongly related to employment at this margin, with an estimated elasticity of 0.74. Interestingly, the differential impact of policy reforms across the price and wage distributions does not differ markedly with respect to the various work margins, although in most cases the coefficient on the interactions remains precisely estimated. Such results suggest that policies aimed at reducing child care costs and increasing wages continue to influence work decisions across increasingly demanding work margins.

4.2 Sensitivity tests and alternative specifications

Results for child care costs and wages, in particular, are subjected to extensive sensitivity tests to determine whether they are robust to changes in the specification, assumptions regarding the nature of selectivity, and the inclusion of additional control variables. As shown in Table 7, the estimates are generally robust to these sensitivity tests. Given space limitations, I provide only a brief discussion of a few tests below.

I first alter the assumptions regarding the selectivity of mothers for whom child care expenditures are observed. The SIPP survey design actually includes three criteria that must be met before families are asked questions about child care expenditures: one of the caretakers must be employed, the family must be using a SIPP-defined mode of paid child care, and the family must be paying for that care. The bivariate selection procedure used in this paper accounts for the first and third of these sample selection mechanisms. However, it might be important to account for the second mechanism as well, given that one-quarter to one-third of single mothers do not use a SIPP-defined mode of paid child care.Footnote 23 Therefore, I present results based on a trivariate sample selection framework estimated using a multivariate probit model.Footnote 24 The price elasticity increases only slightly using this selection correction (−0.08). I also assign expenditures to non-working mothers without correcting for selectivity on employment or paying for child care. Estimates for hourly child care expenditures remain statistically significant at conventional levels, but the magnitude of the price elasticity experiences a substantial reduction (−0.003). As previously stated, I conduct separate Heckman sample selection wage corrections for each year in the CPS. The assumption behind this approach is that the underlying wage determination process has changed over time. A criticism of this approach is that a changing wage structure would necessitate the estimation of separate labor supply models as well. Consequently, I alter the paper’s initial assumption by creating a wage variable through a single Heckman sample selection correction over the entire observation period. The coefficient on hourly wages increases by a nontrivial amount, and the elasticity more than doubles (0.70). I also experiment with additional identifying variables in the OLS wage equation. Specifically, I add to the second-stage wage equation a control for state per capita income. Per capita income is expected to be highly correlated with the generosity of wage offers, but uncorrelated with employment decisions. Adding this variable does not significantly change the wage elasticity (0.32). Finally, given the criticisms of SIPP child care data (Besharov et al. 2006), it is instructive to examine the sensitivity of price-effects to changes in the measure of child care expenditures. One of the primary drawbacks of the SIPP is that analysts cannot uniquely identify nine states in the early panels. More recent data reduce this number to five states. This is a potentially serious omission that precludes even multiple cross-sections of data from taking full advantage of geographic variation in child care prices. To assess the influence of these states, I estimate models that omit from the CPS the nine states that cannot be uniquely identified in the SIPP. The results remain unchanged (prices: −0.05; wages: 0.34). I also examine a proxy variable for hourly child care expenditures: states’ weekly wage for private child care workers. Although this reduces substantially the available variation to identify price-effects, the qualitative story is unchanged. In a model that includes state time trends, the coefficient on the wage variable implies that a $100 increase in weekly wages for private child care workers reduces single mothers’ employment by 5.2 percentage points, although the coefficient is imprecisely estimated. When the time trends are omitted, however, the coefficient becomes statistically significant.

4.3 Discussion of empirical results

It is important to discuss briefly potential explanations for the lower child care price elasticities estimated in this paper. Recall that recent analyses defining similar samples and using comparable empirical methods consistently find larger elasticities. In particular, analyses based on samples of single women with older children estimate elasticities of −0.47 (Anderson and Levine 2000) and −0.50 (U.S. GAO 1994). Samples comprised of single women with younger children tend to yield higher estimates, with elasticities of −0.42 (Connelly and Kimmel 2003a), −0.98 (Connelly and Kimmel 2003b), −0.50 to −0.73 (Han and Waldfogel 2001), and −0.73 (Anderson and Levine 2000).

One explanation is the current study’s use of repeated cross-sectional data, which permits detailed controls for time-varying social policy reforms and macro-economic conditions that are correlated with single mothers’ employment decisions. This data structure also allows me to account for unobserved geographic and time factors that are related to child care prices and employment. With a few exceptions, previous child care studies rely on a single cross section of data. For example, Connelly and Kimmel (2003a, b) use multiple years of SIPP data. However, the authors do not control for other policy reforms and the unemployment rate and do not incorporate controls for state-level unobservables. Anderson and Levine (2000) use 3 years of SIPP data, although the authors omit several basic demographic controls and state fixed effects (year effects are included in the specification). Finally, Han and Waldfogel (2001) utilize 4 years of CPS data but do not control for states’ social policy and economic environments and do not add controls for unobserved heterogeneity.

Another explanation deals with the construction of hourly child care expenditures. Recall that the current study defines the expenditure variable to include child care costs for all arrangements used by the three youngest children in a given family. It is more common for studies to define expenditures to include only the primary child care arrangement for a family’s youngest child. An implication of summing child care costs over the three youngest children is that I necessarily include the costs associated with older children. This possibility is particularly likely given that I define the sample around children ages 0–13, whereas some previous studies focus on children ages 0–5. Given that samples comprised of younger children tend to yield larger price elasticities (as shown above), it might not be surprising that the estimates generated in the current study are on the lower end of the range.

A final explanation for the lower price elasticities focuses on the time period included in the analysis. The current study is able to take advantage of child care expenditures and employment outcomes between 1990 and 2004, whereas most previous studies rely on data from the early-1990s. For example, Connelly and Kimmel (2003a, b) use the 1992 and 1993 SIPP panels, while Anderson and Levein (2000) use SIPP data between 1990 and 1993. Analyses conducted by the U.S. GAO (1994) rely on the 1990 NCCS, and more recent work by Han and Waldfogel (2001) use CPS data between 1991 and 1994. This cluster of work is conducted before the passage of major welfare reform in 1996 and the expansion of child care subsidies and the EITC throughout the 1990s. As a result of these reforms, single mothers’ employment rates in the current study are considerably higher than those in previous research, leading to the possibility that employment decisions have become less responsive to child care prices.

5 Conclusions

Throughout the 1990s, significant changes were enacted across a number of social policy domains that increased the incentive for single mothers to work. Two of the most significant policy shifts were expansions to child care subsidy programs and the EITC. Although a number of studies examine the role of child care prices, wages, subsidies, and the EITC, difficulties arise when researchers attempt to adjust prices and wages for these policies. The purpose of this paper, therefore, is to examine the labor supply effects of child care costs and wages, and adjust these effects by incorporating explicit controls for subsidies and the EITC into the estimation.

The main results suggest that the employment decisions of single mothers are sensitive to child care costs and wages. For the average mother, the employment response is not markedly different after accounting for subsidies and the EITC. However, these policies have differential impacts on employment depending on the level of child care costs and wages. The largest labor supply effects of subsidies are generated for mothers with higher child care costs. Conversely, the largest labor supply effects of the EITC are found for mothers with lower wages. These findings seem reasonable in light of the CCDF and EITC structures. Families with greater numbers of young children pay more for child care, and many states design their subsidy regimes to allocate benefits according to the number of subsidized children within a family. The EITC’s structure is such that the amount of the credit is initially increasing in earnings, so the largest benefits are paid to workers at very low wage levels. Together, findings in this study suggest that mothers who are more likely to benefit from subsidies because they are paying higher child care costs are more likely to be employed. Furthermore, mothers who are more likely to claim a larger EITC because they have lower wages are more likely to be employed.

These findings are important in light of the reauthorization of TANF and the CCDF through the 2005 Deficit Reduction Act. This legislation introduces several punitive measures for welfare recipients and states, including greatly accelerated work participation rates, a narrowing of acceptable work activities, and the imposition of financial penalties on states that fail to comply with federal guidelines. The new work requirements are matched with small increases in funding for child care subsidies, a TANF block grant that is not adjusted for inflation, and an economic climate less favorable than the one throughout the late-1990s.

Overall, the new legislation is likely to increase the intensity with which states ration subsidy benefits. Program administrators already rely on a number of tools to identify families with “favored” characteristics. For example, as of 2004, 22 states guaranteed subsidies for TANF families, another 18 states deemed such families a “priority,” and 15 states guaranteed assistance for families transitioning from welfare to work (U.S. Department of Health and Human Services, Administration for Children and Families 2005). It is not clear whether these rationing practices are optimal from an employment perspective, but such practices are likely to continue in the wake of the TANF/CCDF reauthorization. Given the accelerated work participation goals, results in this study suggest another mechanism to distribute subsidies that takes advantage of the differential employment response to these benefits. Specifically, states might explicitly take into consideration the number of children within a family—as well as the total amount families are paying for child care—so that families with higher costs are provided more generous subsidies.

Notes

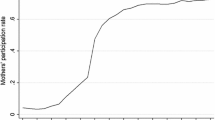

Concurrent with these policy changes has been the explosion in employment among single mothers and a rapid decline in the welfare rolls. Specifically, between 1990 and 2004, the employment rate for single women with children (ages 0–12) increased from 69 to 77%, peaking at 82% in 2000 (Author’s calculations from the March CPS, 1991–2005). Conversely, after reaching five million families in 1994, welfare caseloads declined to approximately 2.2 million, its lowest level in 30 years (U.S. DHHS 2006).

Congress repealed three Title IV-A programs, and along with money from the Child Care and Development Block Grant (CCDBG), consolidated these funding streams into the CCDF. The four programs were called Aid to Families with Dependent Children Child Care (AFDC-CC), Transitional Child Care (TCC), and At Risk Child Care (ARCC). The first two programs were created by the Family Support Act of 1988, and the third was created by the Omnibus Budget Reconciliation Act of 1990. Another policy that provides child care assistance is the Child and Dependent Care Tax Credit (CDCTC). Created in 1976, the CDCTC initially provided a non-refundable credit of $4,800 (2+ children) for child care expenses incurred. Tax legislation in 2001 expanded the CDCTC by allowing families to claim additional child care expenses and increasing the credit rate for families below $43,000. However, expenditures on the program remain modest (at $2.8 billion as of FY 2006), and it still operates as a non-refundable tax credit, making benefits largely inaccessible to low-income families (Burnam et al. 2005). See Blau (2000) for a detailed summary of previous and current child care subsidy policy.

Enacted in 1975 as part of the Tax Reduction Act (TRA), expenditures on the EITC increased dramatically throughout the 1990s. By 2004, foregone revenue due to the credit totaled $38 billion, up from $6 billion in 1990. Claimant families also grew steadily during this period, from 13 million to 22 million. Single-parent families comprise 48% of all claimants, and 76% of EITC dollars go to these families (Liebman 1999; U.S. House of Representatives 2004). See Hotz and Scholz (2001) for a detailed description of the EITC.

The first expansion came with the passage of the 1986 Tax Reform Act (TRA86). This legislation indexed the EITC for inflation, increased the phase-in rate, and decreased the phase-out rate.

I include not only independent female-headed families (primary families), but also female heads of related sub-families and (unrelated) secondary families. Defining families in this manner provides the closest match to a tax-filing unit, which is crucial for determining eligibility for the EITC and other means-tested programs.

Exclusions to the sample include women in the armed services; women with negative earnings, negative non-labor income, positive earnings but zero hours of work, or positive hours of work but zero earnings; and women with hourly wages over $150.

It is important to note that a recent paper by Kimmel and Connelly (2007), which imputes child care expenditures for the American Time Use Survey, utilizes a strategy similar to the one described in this paper.

The duration of each panel ranges from 2.5 to 4 years. Households included in a given panel are divided into four rotation groups, each of which is interviewed in successive months. The 4-month period required to interview each rotation group is called a wave.

There are well-known criticisms of the SIPP child care module, many of which I attempt to handle in this paper. For a review of these criticisms, see Besharov et al. (2006). Many of these issues focus on changes to the survey design throughout the 1990s. For example, it was fundamentally altered three times, leading to changes in the wording of the child care questions and the timing of the module itself. During the early-1990s, the child care module was conducted throughout the fall but was changed to the spring during the late-1990s. The coverage of child care questions was also dramatically expanded to include a larger number of child care arrangements per child, a larger number of children per family, and non-working (in addition to working) mothers. Finally, the list of available arrangements increased, and the SIPP tailored many of these arrangements to specific age ranges.

Obtaining a close temporal match between the datasets is justified because the structure of child care prices likely changed in important ways over the sampling period. First, employment growth among single mothers increased the demand for and supply of child care. A by-product of increased demand for child care services is the growing demand for child care labor, which accounts for 70% of child care prices (Helburn 1995). Finally, public policies aimed at lowering costs and increasing quality have contributed to a changing price structure.

The nine missing states are Maine, Vermont, Iowa, North Dakota, South Dakota, Alaska, Idaho, Montana, and Wyoming.

The relatively small sample sizes in the SIPP have caused specification problems in previous child care studies. In particular, key variables such as age and education are added to the OLS child care price and wage equations but do not appear in the employment model (See, for example, Connelly and Kimmel 2003a). Given that age and education are highly significant in both OLS equations, there is little remaining variation independent of prices and wages to predict employment. Therefore, the impact of prices and wages is very sensitive to the inclusion of these key demographic variables, so some analysts omit them from the employment model. The larger sample size in this study, which uses pooled CPS samples, mitigates much of the sensitivity of price and wage effects to the inclusion of age and education.

As explained in the Introduction, adjusting wages for taxes and the EITC is a straightforward process. However, doing the same for child care prices is made difficult by the lack of subsidy reimbursement data prior to welfare reform. Even after welfare reform, reimbursement figures are only available for select states and years. Another difficulty is that CCDF subsidies are highly rationed at the state-level, given that the program is not an entitlement. Therefore, only a small number of eligible families receive a subsidy, with take-up rates estimated between 12 and 15% (U.S. DHHS 1999). To assign all single mothers a subsidy would introduce measurement error to child care prices that far exceeds the error from leaving prices unadjusted.

Building on research by Grogger (2003) and Grogger and Michalopoulos (2003), I capture the effects of time limits through the dummy variable and its interaction with the age of the mother. Allowing the effect of time limits to vary by age accounts for the possibility that mothers save their welfare benefits until an employment shock occurs. Indeed, the theoretical model developed by Grogger and Karoly (2005) suggests that forward-looking mothers will not draw upon their benefits today, opting instead to save them for future use.

This definition deviates from most in the literature, which includes expenditures covering only the primary arrangement of the youngest child. Connelly’s (1992) definition—total child care expenditures per hour of work—is quite similar to the one used in this study. The approach taken here is preferable because it exploits all available information on mothers’ child care use, and it assumes that employment decisions depend on total expenditures and not just those from a single child. However, it should be noted that this definition necessarily includes older children, whose child care price structure differs from younger children. Such differences might be reflected in the estimated elasticities, and therefore should be noted when comparing estimates with other studies.

Variables in the employment equation include age, education, marital status, race, non-wage income, presence and number of children in various age groups, urban residence, region of residence, and the state unemployment rate. Variables in the wage equation include age, education, marital status, race, non-wage income, number of children ages 0–18, urban residence, region of residence, the state unemployment rate, and state per capita income.

Several studies find that more stringent regulations lead to higher prices for child care (Blau 2002; Heeb and Kilburn 2004; Hotz and Kilburn 1995), with either a small or statistically insignificant effect on employment (Blau 2003; Ribar 1992; Heeb and Kilburn 2004; Hotz and Kilburn 1995). To date, only a handful of studies use child care regulations as instruments in the expenditure equation, and in each case, regulations are strongly related to prices. These results suggest that child care regulations influence labor supply indirectly and only through their influence on child care prices.

Results are generally consistent with those found in the literature. Higher child-staff ratios and educational requirements are associated with lower child care expenditures. Both results accord with the findings in Hotz and Xiao (2005), whose estimates indicate that private child care firms gain when state regulations mandate lower child-staff ratios but lose from increased educational requirements. Results also suggest that raising salaries for and the supply of private child care workers are associated with greater expenditures among single mothers, confirming theoretical predictions.

Other studies estimate low subsidy participation rates as well. For example, a study by the U.S. Department of Health and Human Services finds that only 12 to 15% of eligible children receive subsidies (U.S. DHHS 1999). Findings from a U.S. General Accounting Office (1999) study confirm this, estimating that states are serving no more than 15% of the CCDF-eligible population.

Scholz (1994) estimates that between 80 and 86% of eligible taxpayers receive the EITC.

In the current sample, never married mothers are about 29 years old, on average, while widowed, divorced, and separated mothers are 37 years old. Seven percent of never married mothers have at least a B.A. degree, compared to 13% among widowed, divorced, and separated mothers.

Since algorithms to evaluate multivariate normal integrals are not readily available, I rely on simulated maximum likelihood methods to jointly estimate the trivariate probit. Specifically, I use the Geweke-Hajivassilioiu-Keane (GHK) smooth recursive simulator. The GHK simulator exploits the computational tractability and accuracy of the univariate normal by approximating the multivariate normal as the product of sequential univariate normal distribution functions (Cappellari and Jenkins 2003).

References

Anderson, P., & Levine, P. (2000). Child care and mothers’ employment decisions. In R. M. Blank & D. Card (Eds.), Finding jobs: Work and welfare reform. New York, NY: Russell Sage Foundation.

Averett, S., Peters, E., & Waldman, D. (1997). Tax credits, labor supply, and child care. Review of Economics and Statistics, 79, 125–135.

Baker, M., Gruber, J., & Milligan, K. (2008). Universal childcare, maternal labor supply, and family well-being. Journal of Political Economy, 116, 709–745.

Baum, C., I. I. (2002). A dynamic analysis of the effect of child care costs on the work decisions of low-income mothers with infants. Demography, 39, 139–164.

Berger, M., & Black, D. (1992). Child care subsidies, quality of care, and the labor supply of low-income, single mothers. The Review of Economics and Statistics, 74, 635–642.

Besharov, D., & Higney, C. (2006). Federal and state child care expenditures (1997-2003): Rapid growth followed by steady spending. Report prepared for administration on children, youth, and families; administration for children and families; U.S. Department of Health and Human Services. College Park, MD: Welfare Reform Academy, University of Maryland School of Public Policy.

Besharov, D., Morrow, J., & Shi, A. (2006). Child care data in the survey of income and program participation: Inaccuracies and corrections. College Park, MD: Welfare Reform Academy, University of Maryland School of Public Policy.

Blau, D. (2000). Child care subsidy programs. Working Paper 7806. Cambridge, MA: National Bureau of Economic Research.

Blau, D. (2002). The effect of input regulations in input use, price, and quality: The case of child care. Working Paper. Chapel Hill, NC: Department of Economics, University of North Carolina.

Blau, D. (2003). Do child care regulations affect the child care and labor markets? Journal of Policy Analysis and Management, 22, 443–465.

Blau, D., & Robins, P. (1991). Child care and the labor supply of young mothers over time. Demography, 28, 333–351.

Blau, D., & Tekin, E. (2007). The determinants and consequences of child care subsidies for single mothers in the USA. Journal of Population Economics, 20, 719–741.

Burnam, L., Maag, E., & Rohaly, J. (2005). Tax credits to help low-income families pay for child care. Brief #14. Washington, DC: Urban Institute and Brookings Institution.

Cancian, M., & Levinson, A. (2006). Labor supply effects of the earned income tax credit: Evidence from Wisconsin supplemental benefit for families with three children. National Tax Journal, 59, 781–800.

Cappellari, L., & Jenkins, S. (2003). Multivariate probit regression using simulated maximum likelihood. The Stata Journal, 3, 278–294.

Child Care Bureau. (2005). 2005 CCDF State Expenditure Data. Washington, DC: U.S. Department of Health and Human Services, Administration for Children and Families, Child Care Bureau. Accessed from http://www.acf.hhs.gov/programs/ccb/data/index.htm on March 1, 2008.

Connelly, R. (1992). The effect of child care costs on married women’s labor force participation. The Review of Economics and Statistics, 74, 83–90.

Connelly, R., & Kimmel, J. (2003a). The effect of child care costs on the employment and welfare recipiency of single mothers. Southern Economic Journal, 69, 498–519.

Connelly, R., & Kimmel, J. (2003b). Marital status and full-time/part-time work status in child care choices. Applied Economics, 35, 761–777.

Dickert-Conlin, S., Houser, S., & Scholz, J. (1995). The earned income tax credit and transfer programs: A study of labor market and program participation. In J. Poterba (Ed.), Tax policy and the economy (Vol. 9). Cambridge, MA: MIT Press.

Eissa, N., & Hoynes, H. (2004). Taxes and labor market participation of married couples: The earned income tax credit. Journal of Public Economics, 88, 1931–1958.

Eissa, N., & Liebman, J. (1996). Labor supply to the earned income tax credit. Quarterly Journal of Economics, 111, 605–637.

Ellwood, D. (2000). The impact of the earned income tax credit and social policy reforms on work, marriage, and living arrangements. National Tax Journal, 53(4), 1063–1105.

Fang, H., & Keane, M. (2004). Assessing the impact of welfare reform on single mothers. Brookings Papers on Economic Activity, 2004, 1–116.

Gelbach, J. (2002). Public schooling for young children and labor supply. American Economic Review, 92, 307–322.

Grogger, J. (2003). The effects of time limits, the EITC, and other policy changes on welfare use, work, and income among female-headed families. Review of Economics and Statistics, 85, 394–408.

Grogger, J., & Karoly, L. (2005). Welfare reform: Effects of a decade of change. Cambridge, MA: Harvard University Press.

Grogger, J., & Michalopoulos, C. (2003). Welfare dynamic under time limits. Journal of Political Economy, 111, 530–554.

Han, W., & Waldfogel, J. (2001). Child care and women’s employment. A comparison of single and married mothers with pre-school age children. Social Science Quarterly, 82, 552–568.

Heckman, J. (1979). Sample selection bias as a specification error. Econometrica, 47, 153–161.

Heeb, R., & Kilburn, R. (2004). The effects of state regulations on childcare prices and choices. Working Paper. Labor and Population Program. Santa Monica, CA: RAND.

Helburn, S. (1995). Cost, quality, and child outcomes in child care centers: Technical report. Denver, CO: Department of Economics, University of Colorado.

Herbst, C. (2008a). Do social policy reforms have different impacts on employment and welfare use as economic conditions change? Journal of Policy Analysis and Management, 27, 867–894.

Herbst, C. (2008b). Who are the eligible non-recipients of child care subsidies? Children and Youth Services Review, 30, 1037–1054.

Hoffman, S., & Seidman, L. (1990). The earned income tax credit: Antipoverty effectiveness and labor market effects. Kalamazoo, MI: Upjohn Institute for Employment Research.

Hotz, J., & Kilburn, R. (1995). Regulating child care: The effects of state regulations on child care demand and its cost. Working Paper No. 93-03. Labor and Population Program. Santa Monica, CA: RAND.

Hotz, J., Mullin, C., & Scholz, J. (2005). The earned income tax credit and labor market participation of families on welfare. Working Paper. Joint Center for Poverty Research. Evanston, IL: Northwestern University.

Hotz, J., & Scholz, J. (2001). The earned income tax credit. Working Paper 8078. Cambridge, MA: National Bureau of Economic Research.

Hotz, J., & Xiao, M. (2005). The impact of minimum quality standards on firm entry, exit, and product quality: The case of the child care market. Working Paper 11873. Cambridge, MA: National Bureau of Economic Research.

Keane, M. (1995). A new idea for welfare reform. Federal Reserve Bank of Minneapolis Quarterly Review, 19, 2–28.

Keane, M., & Moffit, R. (1998). A structural model of multiple welfare program participation and labor supply. International Economic Review, 39, 553–589.

Kimmel, J. (1995). The effectiveness of child-care subsidies in encouraging the welfare-to-work transition of low-income single mothers. American Economic Review, 85, 271–275.

Kimmel, J., & Connelly, R. (2007). Mothers’ time choices: Caregiving, leisure, home production, and paid work. Journal of Human Resources, 42, 643–681.

Liebman, J. (1999). Who are the ineligible EITC recipients? Working Paper. J.F.K. School of Government. Cambridge, MA: Harvard University.

Looney, A. (2005). The effects of welfare reform and related policies on single mothers’ welfare use and employment in the 1990s. Finance and Economics Discussion Series. Washington, DC: Division of Research, Statistics, and Monetary Affairs, Federal Reserve Board.

Meyer, B., & Rosenbaum, D. (1999). Welfare, the earned income tax credit, and the labor supply of single mothers. Working Paper 7363. Cambridge, MA: National Bureau of Economic Research.

Meyer, B., & Rosenbaum, D. (2000). Making single mothers work: recent tax and welfare policy and its effects. National Tax Journal, 53, 1027–1061.

Meyer, B., & Rosenbaum, D. (2001). Welfare, the earned income tax credit, and the labor supply of single mothers. Quarterly Journal of Economics, 116, 1063–1114.

Meyers, M., Heintz, T., & Wolf, D. (2002). Child care subsidies and the employment of welfare recipients. Demography, 39, 165–179.

Michalopoulos, C., Robins, R., & Garfinkel, I. (1992). A structural model of labor supply and child care demand. The Journal of Human Resources, 27, 166–203.

Nagle, A., & Johnson, N. (2006). A hand up: How state earned income tax credits help working families escape poverty in 2006. Washington, DC: Center on Budget and Policy Priorities.

Neumark, D., & Wascher, W. (2000). Using the EITC to help poor families: New evidence and a comparison with the minimum wage. Working Paper 7599. Cambridge, MA: National Bureau of Economic Research.

Ribar, D. (1992). Child care and the labor supply of married women: Reduced form evidence. The Journal of Human Resources, 27, 134–165.

Rusev, E. (2006). The relative effectiveness of welfare programs, earnings subsidies, and child care subsidies as work incentives for single mothers. Working Paper. Department of Economics, University of North Carolina, Chapel Hill.

Scholz, J. (1994). The earned income tax credit: Participation, compliance, and anti-poverty effectiveness. National Tax Journal, 47, 63–87.

Tax Policy Center. (2008). Spending on the EITC, child tax credit, and AFDC/TANF, 1976–2010. Washington, DC: Urban Institute and Brookings Institution. Accessed from http://www.taxpolicycenter.org/taxfacts/displayafact.cfm?Docid=266 on September 1, 2008.

Tekin, E. (2005). Child care subsidy receipt, employment, and child care choices of single mothers. Economic Letters, 89, 1–6.

Tekin, E. (2007a). Child care subsidies, wages, and the employment of single mothers. Journal of Human Resources, 42, 453–487.

Tekin, E. (2007b). Single mothers working at night: Standard work, child care subsidies, and implications for welfare reform. Economic Inquiry, 45, 233–250.

Tunali, I. (1986). A general structure for models of double-selection and an application to a joint migration/earnings process with remigration. Research in Labour Economics, 8, 235–282.

U.S. Department of Health and Human Services (U.S. DHHS). (2006). U.S. welfare caseloads information: Total number of families and recipients. Retrieved September 1, 2006, from http://www.acf.hhs.gov/news/stats/newstat2.shtml.

U.S. Department of Health and Human Services, Administration for Children and Families. (1999). Access to child care for low-income working families. Retrieved September 2003, from: www.acf.dhhs.gov/programs/ccb/research/ccreport/ccreport.

U.S. Department of Health and Human Services, Administration for Children and Families. (2005). Child care and development fund: Report of state plans, FY2004-2005. Retrieved January 2005, from: http://www.nccic.org/pubs/stateplan/.

U.S. General Accounting Office. (1994). Child care: Child care subsidies increase likelihood that low-income mothers will work. (Report No. HEHS-95-20). Washington, DC: U.S. General Accounting Office.

U.S. General Accounting Office. (1999). Education and care: Early childhood programs and services for low-income families. Report No. HEHS-00-11. Washington, DC: U.S. General Accounting Office.

U.S. House of Representatives, Committee on Ways and Means. (2004). Green book, background on material and data on programs within the jurisdiction of the committee on ways and means. Washington, D.C.: Government Printing Office.

Acknowledgments

This research was supported by a grant (No. 90YE0083) from the Child Care Bureau, Administration on Children, Youth, and Families, U.S. Department of Health and Human Services (DHHS). The contents are solely the responsibility of the author and do not represent the official views of the funding agency, nor does publication in any way constitute an endorsement by the funding agency. I would like to thank the following individuals for their advice and/or technical assistance: Bill Galston, Mark Lopez, Jonah Gelbach, Burt Barnow, Randi Hjalmarsson, Peter Reuter, Sandra Hofferth, Gil Crouse, Jean Kimmel, and Patricia Anderson. I also thank Joseph Hotz and Rebecca Kilburn for generously providing their child care regulation data. Seminar participants from the University of Maryland, Johns Hopkins University, Arizona State University, American University, and RAND provided useful comments.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Herbst, C.M. The labor supply effects of child care costs and wages in the presence of subsidies and the earned income tax credit. Rev Econ Household 8, 199–230 (2010). https://doi.org/10.1007/s11150-009-9078-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11150-009-9078-1