Abstract

The broad goals of child support policy are to keep children in single-parent families out of poverty and to make sure that their material needs are met. One potentially important, but relatively understudied, set of measures of child well-being are health outcomes. A fixed-effects analysis of data from the Child and Young Adult file of the 1979 National Longitudinal Survey of Youth shows that, conditional upon receipt of some amount of child support, higher payment levels are associated with significantly greater odds of having private health insurance coverage and significantly lower odds of poor or declining health status. These effects persist even after controlling for other factors that are likely to be correlated with child support payments, including total family income and paternal visitation patterns.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The growing fraction of children living in single-parent families constitutes one of the most dramatic demographic transformations of the American population in the last three decades. While in 1968 only 12 % of children in the United States lived with only one of their parents, by 2008 this fraction had more than doubled to 26 % (U.S. Census Bureau 2009). An increase in the divorce rate from 2.6 % in 1967 (NVSS 1973) to 4.7 % in the early 1990s (NCHS 1995) and a nearly sevenfold increase in the fraction of births to unmarried women between 1960 and 2007 (Ventura 2009) both contributed to this trend.

The goal of the child support system in the United States is to ensure an adequate standard of living for the children of these divorced and never-married parents. While it is left to the states to set the level of cash awards, federal law mandates that all state guidelines must account for the health care needs of children. The specific concern over health outcomes is likely a reaction to the fraction of U.S. children who remained uninsured after expansions in public health insurance programs in the 1990s, as well as rising health care costs. Additionally, a number of studies document a strong, positive correlation between health in childhood and adult outcomes such as educational attainment and labor market earnings (Currie 2009; Smith 2009; Case et al. 2006).

There are several ways in which receipt of child support might lead to health improvements for children. First, a number of studies document the positive relationship between family income and child health (Yeung et al. 2002; Case et al. 2002; Case and Paxson 2002). One explanation for this comes from an economic investment model, in which parents invest both time and money in children, and money is used to purchase health and other human capital inputs (Becker 1991). In this framework, a positive effect of income on child health would be the result of some combination of higher quantity or quality of medical care, healthier food, better living conditions, or toys and activities that promote physical activity. The family process model provides an alternative explanation for the positive correlation between income and child health; in this model higher income and less uncertainty about future income are correlated with better parenting practices (Yeung et al. 2002; Case and Paxson 2002). For example, Case and Paxson (2002) find that higher-income parents are less likely to smoke and more likely to put their children in seat belts. Second, there is often a positive relationship between a non-custodial father’s child support payments and time spent with his children (DelBoca and Ribero 2001; Peters et al. 2004). Increased paternal contact may itself improve child health, either directly through time-based investments made by the father or through inclusion of the child on his or her father’s employer-sponsored health insurance plan.

The goal of this study is to determine the extent to which child support is associated with improvements in child health outcomes. Improvements might come about through increased access to private health insurance, increased affordability of medical care (due to either health insurance coverage or higher income) or the direct effect of higher income. In order to get a sense of the mechanisms for health effects, I estimate the impact of child support on a set of dependent variables, including measures of health status itself (parent-reported health status index, body weight, need for medication) and potential inputs into the production of health (insurance coverage, utilization of routine medical care).

The data used in this analysis are for the subsample of children who are not living with their biological fathers for at least 2 years from the Child and Young Adult (CYA) supplement to the 1979 National Longitudinal Survey of Youth (NLSY). The CYA file contains panel data on all children born to women in the NLSY79 and for this analysis it is matched to data on the mothers in the core file for even-numbered years between 1990 and 2004.Footnote 1 Cross-sectional estimates using these data show that receipt of any child support is associated with significantly higher odds that a child has private health insurance coverage and significantly lower odds of being uninsured. Conditional upon receiving any child support, greater amounts of support are associated with higher odds of private health insurance coverage, lower odds of uninsurance, and lower odds of being in fair/poor health, even after controlling directly for total family income from all sources including child support. As discussed in Sect. 2, the persistence of a child support effect even after controlling for total family income is not an uncommon finding in the child support outcomes literature.

My estimates a set of maternal fixed effects models indicate that differences in health insurance coverage patterns and health status between children whose mothers do and do not receive any child support is explained by maternal heterogeneity. However, the effects of conditional amount of support on private health insurance coverage and health status are robust to the fixed effects specification. Results from further specifications suggest that one possible explanation for the positive relationship between amount of child support payments and private health insurance coverage that persists even after controlling for total family income is reduced participation in public assistance programs.

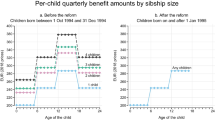

2 Income and other effects of child support

With the aim of reducing high poverty rates of children in single-parent families, the 1988 Family Support Act (FSA) mandated that states develop and use quantitative guidelines for establishing all child support awards. The FSA also created financial incentives for states to improve paternity establishment rates (Lerman 1993). The majority of US states use an “Income Shares” child support guidelines model (Morgan 2008), a model which is designed to produce a total contribution between the parents that is approximately equal to what would have been spent on the child if the family had been intact. Therefore, the primary goal of child support is to increase the income available for spending on the necessities of raising children, including items such as housing, clothing, food, child care, health care and education. Meyer and Hu (1999) show that child support raises family income significantly. In a sample of divorced and separated mothers in the 1996 March CPS, they find that 6–7 % of families in their sample rise out of poverty, despite the fact that fewer than one-third of the mothers entitled to support actually receive payments.

Receipt of child support payments also appears to significantly improve a number of non-health child outcomes. Child support has been shown to improve both academic achievement and child behavior in a number of studies (see Amato and Gilbreth (1999) for a review). Several other studies find a positive impact of child support payments on the cognitive development of young children as measured by standardized test scores (Knox 1996; Argys et al. 1998). In one study that relates to child health, Garasky and Stewart (2007) show that child support payments reduce the frequency of skipped meals and other serious forms of food insecurity in single parent families. What is, perhaps, surprising about these studies is that most of them show that receipt of child support (or increased child support income) has a positive effect on child outcomes that is above and beyond its effect on total family income.

Although the income effect of child support is economically intuitive, it is not obvious why child support would be associated with better child outcomes even after controlling for total family income. One possibility is that the effect is not causal, but simply reflects characteristics of the children receiving support (or their mothers) that we do not observe. Some authors have suggested that there are likely to be unobserved family characteristics, such as fathers’ concern for children or mothers’ organizational skills, that are correlated with both positive child outcomes and the likelihood of a child support payment (Knox 1996; Argys et al. 1998). Aizer and McLanahan (2006) argue that increased child support enforcement over time changed the composition of the population paying and receiving child support by altering the incentives facing potential fathers,Footnote 2 leading them to choose mothers who are more likely to invest in their children. In support of this hypothesis, they show that higher child support enforcement is associated with lower fertility, a slightly higher average mother age at first birth and higher rates of prenatal care.

However, although not all child support studies have accounted for unobserved heterogeneity, at least two have used methods to account for this potential bias and have still found significant effects on cognitive outcomes (Knox 1996; Argys et al. 1998). There are at least four other explanations in the literature for the effect of child support that are not driven by selection or unobserved heterogeneity. First, some have suggested that receipt of child support improves the relationship between mother and father, and that this improves the home environment for the child. Second, child support may reduce a single parent’s use of public assistance programs, and the child may benefit from reduced stigma. In the case of health insurance, the transition from public to private health insurance could also improve access to and/or quality of medical care. Third, although most traditional utility-based economic models predict that the composition of family income should not affect expenditure patterns, DelBoca and Flinn (1994) show that divorced mothers spend a higher fraction of child support income on child-related items compared to other income sources. This result aligns with the predictions of a theoretical model in which child outcomes are a public good shared by the mother and the father. Weiss and Willis (1985), also working with a public goods model, show that when information is incomplete, there is an incentive for custodial parents to increase expenditures on children as a signal to the non-custodial parent, in order to receive maximum child support payments in the future. Finally, an issue that has been addressed in some, but not all, of these studies is the role of physical contact, or visitation, between fathers and children. Most theoretical models predict a positive association between time spent with the non-custodial parent and child support payments (DelBoca and Flinn 1994; Weiss and Willis 1985; Argys and Peters 2003), although the direction of causality is not the same in all models.Footnote 3 The early literature on child support and outcomes showed a positive correlation between paternal visits and child support payments, but this could be a causal effect of payments on visitation (i.e., a mother restricts visitation when payments are not made) or a causal effect of visitation on payments (i.e., a father is better able to understand his child’s needs after visits) (Seltzer et al. 1999). After addressing this issue, Peters et al. (2004) still find a strong association between payments and visitation time; receiving any child support is associated with 27 more visitation days per year.

In the case of health outcomes, visitation time may be an important determinant of child health status because fathers in regular contact with their children are better able to observe their childrens’ health needs. They may also be more likely to cover their children as dependents on an employer-sponsored health insurance plan. However, the causality of this relationship is not clear, since a child’s health status itself may affect whether or not a father visits. At least one study suggests that new fathers have less contact with infants in poor health (Reichman et al. 2003).

There are two existing studies in the literature that each explore a single dimension of the relationship between child support and health. Hofferth and Pinzon (2011) use data from the Early Childhood Longitudinal Survey (ECLS-K) to estimate a dynamic model in which mother-reported health status of a 3rd grader is a function of the child support received when that child was in kindergarten, controlling for a rich set of demographic and family characteristics. They find that neither child support nor paternal visitation is associated with significant changes in health status, although they note that children who are healthier in kindergarten receive higher levels of support in 3rd grade. Taber (2012) uses the Survey of Income and Program Participation (SIPP) to analyze the relationship between child health insurance coverage and state laws that mandate health insurance coverage as part of a child support agreement. Her results do not show any significant effects of mandates. This analysis expands upon these studies to consider a much broader range of health outcomes, with a particular focus on trying to tease out mechanisms for the relationship between child support and health.

3 Data

The primary data for the analysis are from the NLSY 1979 CYA file. The primary adult respondents to the NSLY79 were first interviewed in 1979, when they ranged in age from 14 to 21. Since then, they have been interviewed either every year (1979–1994) or every other year (1994–2008) and information has been gathered about family structure, employment, health and other outcomes. In the most recent wave of data collection, the primary respondents are between 41 and 48 years old and have completed almost all of their lifetime childbearing. In 1986, the NLSY started to collect additional data on each of the children of the women in the NLSY79 sample; these data constitute the CYA file. This analysis is based upon six health-related outcome variables for children collected in the CYA survey; these will be discussed in detail below. Matched data from the mother’s file includes annual income by source (including child support payments as one of the sources), education, current marital status, employment status and household structure.

For the purpose of studying child health outcomes, the NLSY79 CYA sample has strengths and weaknesses. Among the strengths are the fact that this is the only panel data set on children of its length to also provide detailed, matched information on parental characteristics, including income sources, employment and marital history. However, the panel nature of the data also results in several limitations for this analysis. Because not all relevant questions were asked at all ages and in all years, and because the sample loses its representativeness of the population in the latest years, the baseline analysis will cover the years 1990–2004 for children ages 2–15. Given the ages of the primary respondents in the NLSY79, this means that the sample of children in this analysis is not fully age representative of the U.S. population. This is a common limitation in research with the NLSY79 CYA data; earlier studies cited in Sect. 2 are generally representative of younger children born to younger mothers. By 1990, the earliest-born children to the NLSY79 parents (approximately 2.5 % of the sample at that time) had aged out of the age 0–14 child questionnaire; this fraction rises to 66 % by 2004. The NLSY estimates that its original respondents have completed more than 90 % of lifetime childbearing by 2004 (CHHR 2006).

A challenge in answering the research questions posed in this study is selecting the appropriate sample for analysis because the factors that lead parents to separate are not likely to be independent of the factors that drive child support after a separation. For example, a father being unemployed could contribute to the dissolution of a relationship and also make it less likely that child support would eventually be paid. For this of reason, estimates the effects of child support from a sample consisting only of children living with their mothers could suffer from selection bias. In order to mitigate this problem, I select the sample used in this analysis using an adaptation of the approach used by Knox (1996), who included children in her panel analysis if their father had been absent from the household for at least 1 year during the 3-interview panel period. Because the time span of my analysis is significantly longer, my sample consists of children whose fathers were reported as alive but not residing in the child’s household in two or more of the eight interview years during the study period.Footnote 4 Conditional upon a father being absent 2 or more years out of the 8 in the study, the mean number of years absent is 5. In essence, what this sample selection technique does is to include pre-dissolution observations for children whose fathers eventually leave the household. The resulting sample is not fully selected on relationship status, but still focuses on a group of children who are highly likely to be impacted by child support.

The sample is also restricted to families/children with complete data for core parent and child questions, such as age, gender, family income and parental education. Additionally, in order to keep the sample size as consistent as possible across different types of outcomes, the sample contains only observations with non-missing values for health insurance and utilization questions. Table 1 provides unweighted age distributions for the child sample in 1990, 1994, 2000 and 2004. The distribution of child age is relatively normal in 1990, with a modal age of 8. Although new infants are being born in subsequent years their numbers are smaller each year, so the average child age shifts upward with every year of the panel. The modal child age is 12 years old in 1994 and by 2000 the majority of children in the sample are 10 and older.

Tables 2 and 3 present descriptive characteristics for the estimation sample. Table 2 presents demographic characteristics of the children and mothers in the sample, as well as information on family income. Across the full sample the mean child age is 8.79 years, and 8.14 % of children were Black while 25.4 % were Hispanic. The majority of children live with a mother who is a high school graduate (76.57 %) and unmarried (62.13 %). Overall, 76.57 % of mothers work. Mean family annual income across the sample is $47,112 (in $2006) and 18.47 % of families receive AFDC/TANF income, with 6.9 % receiving SSI and 26.26 % receiving Food Stamps.

Six different outcomes are used to measure the health effects of child support. The first three—private health insurance coverage, no health insurance coverage (uninsurance), and whether or not the child has had a regular, preventive care doctor visit in the past 12 months—can be thought of as potential mechanisms for any effects on health status. The American Academy of Pediatrics (2008) recommends well-child doctor visits at least once a year for children of all ages (and twice a year or more for children under age 3). If routine doctor visits provide effective preventive care, the doctor visit variable may also be an imperfect proxy for changes in health status either over a longer-run time period than the CYA measures or from conditions not picked up by the limited CYA health status questions.

The other three outcomes are more direct measures of health status, chosen from the relatively limited set of variables available from the CYA survey. The first is a rating of the child’s health by the mother on a 4 point scale (excellent, good, fair, poor). Consistent with the majority of papers in the literature on health status, I re-code this into a single discrete indicator for fair or poor health, but note that estimating models of the determinants of excellent health gives very similar (inverse-signed) results. The second health status measure is whether or not a child has a normal body weight (i.e., not overweight, obese or underweight) based upon BMI measurements. Child height and weight are recorded at each interview, and this allows me to calculate a Body Mass Index (BMI) and evaluate it relative to age and gender.Footnote 5 The final health outcome measure is a discrete indicator for whether the mother reports that the child needs to take medication regularly. Any effects on this measure need to be interpreted carefully. On one hand, lower likelihood of medication use could be a sign of better health effects that come about from child support income preventing adverse health outcomes by improving a child’s environment or access to medical care. On the other hand, given that for some conditions (e.g., Type I diabetes) medication may be necessary and desirable, higher likelihood of medication use could be a sign that the child is getting more medical care and that long run health will be better.

Table 3 summarizes the child health outcomes for the sample. Note response rates for certain variables are not 100 %. On reason is that a health status question was not asked until 1994. Additionally, not all respondents answered all questions.Footnote 6 Variation in response rates to questions is reflected in total sample sizes for each question about the dependent variables in Tables 5 and 6. Just over half of the children in the sample (54.89 %) have private health insurance coverage, while 10.34 % are uninsured. The fraction of children with a routine doctor visit in the past 12 months is 63.1 % overall. Table 3 also shows that certain poor health outcomes are relatively rare in children. Overall, slightly fewer than 4 % of children are reported by their mothers to be in fair or poor health; this is more likely the older the child. Similarly, only about 7 % of children in the full sample need regular medication; medication needs also appear to rise with age. A more common adverse health outcome is the probability of not being at a normal body weight. Only 75.79 % of the full sample is neither overweight/obese nor underweight.Footnote 7

The measure of child support used is the mother’s report of total child support income, for any/all children, during the previous year. Based upon responses to a NLSY-CYA question about how many children in a mother’s household were covered by a child support order, I calculate that only 15 % of children in the full sample live in households with an official order. However, overall, 35.5 % of the sample is in a household where the mother receives some child support. Some of this difference may reflect the fact that many mothers are getting child support that is not dictated by a legal agreement. However, it seems likely that the 15 % is not a complete measure of child support orders. Therefore, the primary dependent variables in the study are based upon annual child support income reports, rather than questions about specific child support orders.

Table 4 summarizes child support receipt and frequency of father’s visitation. The average amount received in households with positive child support income is $3,528.49 per year. For these households, child support represents about 13 % of total income, on average.

Because of the sample selection strategy, just over 1 in 4 observations in the sample are for a child whose father is in the household at the time of the interview. Children without a father in the household are much more likely to have a mother receiving child support income (44 %) compared to those with a father at home (12 %); note that mothers can be receiving support from multiple fathers and that some fathers return to the home after separation and may still be paying support. Just over 50 % of children in the sample had an absent father but received at least one visit during the past year. Among absent fathers that visited at least once per year, the modal frequency in all years was 1–3 times per month. Approximately one-third of children whose fathers were absent received a visit at least once per week.

4 Empirical analysis

4.1 Baseline model

The following simple model of the effect of child support on health outcomes can be estimated by as a logit:

where Y is a discrete variable measuring one of three types of health outcomes for child i: (1) health insurance coverage type; (2) a visit to a doctor for a “routine” medical checkup in the previous 12 months, or (3) a measure of health status. There are two different ways to measure child support receipt, CS. The first is a discrete indicator of whether the child’s mother received any positive amount of child support in the past year and the second is the natural log of the real value ($2006) of total child support payments received by the child’s mother in the past year. Models with the Any Payment variable are estimated for the entire sample. Models with ln(Real CS Payment) are estimated only for children for whom Any Payment is equal to one; therefore these models estimate the effect of additional dollars of support conditional upon receiving support at all. Child support amounts are measured at the mother/family level, subscripted m.

The vector X contains child-level control variables including age, gender, race and ethnicity. The child’s birth weight is also included in X; this controls for any health differences across children that derive from their birth outcomes. The vector Z contains controls for characteristics of the child’s mother, including age, marital status and number of adults and children in the household. Finally, because many of the women in the NLSY have multiple children in the CYA sample, the standard errors in each equation are clustered at the mother level.

Panels A and B of Table 5 present estimates of the child support effects as odds ratios for the Any Payment and ln(Real CS Payment) models, respectively. Values greater than 1 indicate a positive effect, while values less than one indicate a negative effect. Child support is associated with a significant shift in health insurance coverage patterns. In Panel A, receipt of any amount of child support is associated with 1.7 times higher odds of private health insurance coverage, along with a significantly lower odds of uninsurance. Based upon the results in Panel B, conditional upon receiving any child support, higher dollar amounts are also associated with significantly higher odds of private health insurance coverage and lower rates of uninsurance. Receipt of any child support is not associated with any significant differences in medical care utilization, but is associated with 1.3 times higher odds that a child needs regular medication. The conditional amount of support is also associated with significantly better health status; the significant estimate in Column (4) suggests that a higher level of child support is associated with much lower odds that that a child is reported to be in fair or poor health as well as marginally higher odds that a child is a normal weight. Finally, the surprising result in Panel B is that higher amounts of child support are associated with significantly lower odds of a routine doctor visit.

The top two panels of Table 5 contain suggestive evidence that child support improves several health-related outcomes. However, the existing literature on child support and outcomes shows that child support payments are likely to be positively correlated with a father’s visitation time, and visitation time may have its own effect on health outcomes. Additionally, most state child support laws suggest a payment structure based upon the incomes of one or both parents, and so total family income may be an important omitted variable in Eq. 1. Therefore, the following specification is likely to be more appropriate:

where INC m is total maternal (family) income from all sources, including child support, and the V vector includes controls for frequency of paternal visitation in order to try to disentangle the effects of time and money on child health. All of the control variables and the clustering strategy are the same as in Eq. 1.

The estimates (odds ratios) for the child support, family income and paternal visitation variables in Eq. 2 are presented in Panels C and D of Table 5. The results in Panel C show that children whose mothers receive any amount of child support are significantly more likely to have private health insurance coverage, even after controlling for total family income and the frequency of paternal visitation, although the magnitude of the effect diminishes from odds being 1.7 times higher to being 1.3 times higher. However, total income still has its own large, positive and significant effects on private health insurance coverage. Additionally, children whose fathers are at home or who visit at least once a year are significantly more likely to have private health insurance compared to children whose fathers do not visit. In Column 2, there is still a significant negative correlation between child support receipt and uninsurance even after adding visitation and income controls. Children with higher total family incomes are significantly less likely to be uninsured, but the relationship between paternal visitation and uninsurance is weaker than the relationship for private health insurance. This makes sense if the primary way that non-custodial fathers affect the health insurance coverage of children is by adding them to employer-sponsored insurance plans as dependents. In Column 6, there is still a significant positive effect of child support receipt on the probability of medication, and the magnitude of this effect is unchanged by the addition of family income and visitation controls.

Panel D contains the results for models with the ln(Real CS Payment | Payment > 0) variable. As was the case for the Any Payment models, adding additional controls reduces the magnitude of the private health insurance odds ratio, but there is still a strong and statistically significant positive association between the amount of support received and the odds of a child being covered by private health insurance. The odds ratio for uninsurance, on the other hand, is no longer statistically significant. The estimate of the effects of child support amount on fair/poor health status is still significant and slightly smaller in magnitude after adding family income and paternal visitation controls, while the estimate for normal weight is now larger and more significant. Finally, there is still a significant negative relationship between the amount of child support and the odds of a doctor visit in the past year. Since there is not an obvious theoretical explanation for this negative effect, the following sections contain several tests to see if unobserved individual heterogeneity or other empirical biases can explain it.

4.2 Mechanisms for child support effects

Although an effect of child support receipt above and beyond its dollar contribution to family income has been found in other papers, the explanation for such an effect is not obvious. The results from Eq. 2 show that the effect is not operating through a correlation between paternal visitation and child support receipt/payment level. Other possible explanations that have been mentioned in the literature include unobserved parental heterogeneity and stigma or service quality effects of public assistance program participation (which could be correlated with child support receipt). I consider each of these explanations in the following analyses.

The first explanation is unobserved heterogeneity among mothers and/or fathers. For example, mothers with better ability to get higher child support awards or better enforcement use the same skills (e.g., tenacity or good organizational skills) to get health insurance for their children and otherwise invest in child health. Some differences in mother ability may be related to education, which is already included as a control variable in the baseline model, but other differences may be unobservable. There may also be unobservable characteristics of non-custodial fathers that are correlated with both payments and health outcomes. If the fathers who are more likely to pay child support after a divorce were also the same fathers who made greater investments in their children during marriage, then a significant coefficient on child support payments might simply be picking up the persistence of health effects over time.

In order to address unobserved maternal heterogeneity, I make use of the panel nature of the NLSY-CYA data and estimate a set of maternal fixed effects models that make use of the panel nature of the data. Because of the age restriction on the sample, the maximum number of times any child can be observed in the data is seven, and this would be only for infants born at the very start of the study period. In the full analysis sample used in Table 5, the average child is observed four times during the panel, and 85 % of children are observed at least three times. Fixed effect models can only be estimated for units of observation (in this case, grouped at the mother level, since that is the level of observation for child support payments) for which an outcome changes over time; this results in a sample size reduction of anywhere between 33 % (normal weight) and 80 % (uninsurance). Further, the child support coefficients are only identified by mothers whose child support payments vary over time. In the AnyPayment models, only 45 % of children are observed both with and without any child support. However, approximately 90 % of children who receive support have a change in the amount of their real payment over time. Most of this change comes from large, discrete changes in payment level rather than a gradual inflationary adjustment. Additionally, both increases and decreases in payment amount over time are observed.

The fixed effects models take the form:

and contain mother-level (αm) and year-level (αt) fixed effects. In these models the mother fixed effects capture time-invariant unobservable characteristics of mothers that might be correlated with both payment and receipt of child support and child health and the β parameters in the model are now identified by changes in child support receipt at the mother or family level over time. The estimates from these models are therefore more likely to reflect causal relationships between child support receipt and health outcomes compared to the baseline model. Jackknife standard errors are used to calculate z-statistics for these models.

The results for the fixed effects models are presented in Table 6. The coefficients on Any Payment is still above one for private health insurance coverage and needing medication, and below one for being uninsured, but none of these estimates are statistically significant. This would tend to suggest that the association between receiving any child support and health insurance outcomes in Panels A and C of Table 5 are were driven by unobservable differences between mothers who received and did not receive child support. However, it should also be pointed out that the sample size in the fixed effects models is much lower than in the baseline models, resulting in a loss of power.

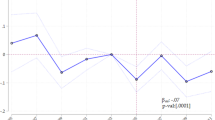

Panel B of Table 6 contains the fixed effects results for models where child support is measured as ln(Real CS Payment | Payment > 0). Here, higher dollar amounts of support are still associated with significantly higher odds of private health insurance, although the magnitude of the effect is somewhat smaller. This suggests that only a portion of the observed correlation between payment amount and private health insurance coverage rates and from Table 5 is due to maternal heterogeneity. The estimated odds ratio for doctor visits is still less than 1, but is no longer statistically significant in the fixed effects specification. Finally, in the baseline models, amount of child support received was significantly associated with lower odds of a child being in fair/poor health. There are only approximately 250 children in the sample whose health status changes to or from “fair/poor” during the panel, so there is insufficient power to test for a child support effect on this outcome. However, there is more variation in health status overall, so I create dummy variables for an increase (Better Health) or a decrease (Worse Health) on the 4-point health status scale between wave t − 1 and t of the panel. The results for these outcomes are presented in Columns 4 and 5 of Table 6. The odds ratio for increased health status is greater than one but statistically insignificant, while the odds ratio for decreased health status is significant and less than one. This suggests that there is a health-protecting effect of greater amounts of child support that is not driven by maternal heterogeneity.

Overall, the evidence from the fixed effects models shows that some of the previously observed correlation between child support receipt and better health outcomes can be attributed to unobservable maternal heterogeneity. However, relatively large effects of higher amounts of child support on private health insurance coverage and health status persist even after accounting for heterogeneity.

A second explanation in the literature for the existence of a child support effect that persists even after controlling for total income is that child outcomes may improve if children who receive child support are less likely to receive public benefits that may have poor quality (i.e., do not generate the same utility as an equivalent amount of private spending—as in the case of Food Stamps or SNAP) or generate stigma effects. Participation in most cash transfer programs is also likely to be significantly associated with maternal employment. In results not reported here, I find that the probability of child support receipt is negatively and significantly correlated with the probability of receipt of multiple types of federal and state needs-based public assistance programs. Therefore, I test to see whether this explains the significant outcomes in Table 6 by estimating a set of fixed effects models of the following form:

which contain a new control variable—Any PA mt —that indicates whether or not a child’s family received any needs-based public assistance program (AFDC, TANF, SSI or Food Stamps/SNAP) during the past year. The results in Panel A of Table 7 show that adding a public assistance control to the model decreases both the magnitude and significance of the effect of child support amount on private health insurance. On the other hand, higher amounts of child support are still associated with large and significant reductions in the odds of declining health status.

It is possible that this public assistance participation effect may be driven by the correlation between cash public assistance and Medicaid/SCHIP participation. Therefore, I estimate the following equation, in which child-level Medicaid/SCHIP participation (MED) is included as a control instead of ANYPA:

Panels C and D of Table 7 provides the results for models of changes in health status with a control for participation in Medicaid, the public program most directly related to health, instead of income assistance programs. Medicaid could possibly have negative effects on child health outcomes, above and beyond any stigma effects, if it is difficult for families to find physicians who will accept Medicaid or if the quality of Medicaid physicians is lower than those who accept private insurance. If this were true, then any switch from Medicaid to private health insurance coverage caused by increased child support might drive improvements in health status. However, the results in Panel B of Table 7 show that adding a Medicaid control does not change the fixed effects estimate for Worse Health from Table 6.

5 Conclusion

The evidence presented in this paper suggests that child support is likely to have several significant effects on child health. Although the health differences in children whose mothers receive any versus no child support disappear after controlling for maternal heterogeneity, results from fixed effects models show a significant positive effect of the total amount of child support received, conditional upon receiving any support, on the likelihood of private health insurance coverage. This effect is not explained by differences in total family income or in paternal visitation frequency. However, the magnitude and significance of the effect fall when controlling for receipt of public assistance; the most likely explanation is that mothers who receive more child support are less likely to be eligible for/participate in cash transfer programs, and are therefore less likely to participate in public health insurance programs and more likely to work and to take up private health insurance.

Higher amounts of child support are also associated with significantly lower odds that a child experiences a decline in health status over time, even after controlling for maternal heterogeneity. As with health insurance, the effect cannot be explained by total family income or in paternal visitation, nor does it appear to work through increased preventive care visits to the doctor. Additionally, the estimate does not appear to be driven by reduced use of Medicaid by families that have higher child support payments. Although the mechanism for this health status effect cannot be isolated in this analysis, there are a number of potential reasons why higher amounts of support could have a health-protecting effect, including: increased affordability of prescription medication, lower stress for both mother and child, better living conditions, and higher quality nutrition.

There are several policy implications of the results of this analysis. The first relates to insurance coverage patterns. Higher amounts of child support are associated with significant increases in private health insurance coverage, but no significant change in the odds of being uninsured; this implies that child support encourages the substitution of public health insurance for private coverage. This has meaningful budgetary implications because public health insurance programs are a major source of expenditures at both the state and federal levels. The significant, positive association between amount of child support and health status also suggests that child support plays an important role in promoting child development, not only in the cognitive and behavioral sense (as found in previous research), but also in terms of physical health. This is important because of the strong link between health in childhood and a set of adult outcomes that include not just health, but educational attainment and earnings (Currie 2009; Smith 2009; Case et al. 2006). Therefore, public policies that encourage higher levels of payment of child support by non-resident parents are likely to promote investment in human capital along a number of dimensions.

There are several limitations to this analysis. First, the fixed effects models used in the analysis control for any time-invariant heterogeneity across mothers that could potentially bias the results. However, a limitation of the fixed effects analysis is that it is impossible to rule out the possibility of an endogenous relationship between changes support receipt and outcomes over time. This would be a problem if, for example, child support awards were decreased over time in response to changes in health status. However, in this type of case, most state child support guidelines imply that child support payments would be higher for less healthy children, the ones with the highest level of medical need. This would tend to bias the coefficients on adverse health status outcomes (such as fair/poor health) downward, meaning that the results in this analysis would tend to understate rather than overstate the true causal impact of receiving child support.

Additionally, the variables available in the NLSY-CYA data are limited and do not fully capture all aspects of child health. Further, income and other determinants of child health may not produce measurable impacts immediately. Some impacts of higher income—better environmental health and better preventive medical care, for example—may not be evident until the teen or early adult years. However, studying these outcomes is beyond the scope of the current study.

Finally, researchers in the child support literature have documented that support may take both formal and informal forms (see, e.g., Nepomnyaschy and Garfinkel 2010). Informal support is likely to include financial transfers from non-resident fathers to their children that this survey does not measure, including in-kind purchases of food, clothing, diapers and toys, or even direct payment of medical bills by a father. Assuming that these transfers are of a kind to substitute for health inputs that a mother, they should also lead to improvements in child health. Alternatively, if fathers are informally providing non-health items that a mother would otherwise purchase with child support income, this would free up disposable income that could go toward health-related items. For these reasons, the results in this analysis may underestimate or incompletely capture the extent to which economic transfers from non-resident fathers to their children improve health outcomes.

Notes

Data collected in 1991 and 1993 are not used because not all health and child support questions were asked in these years. Data from years after 2004 are not used because of the non-representative nature of the very small number of births (to mothers in their 40s with unusually high incomes) in those years.

Throughout the paper, in keeping with most of the literature, I refer to custodial parents or child support recipients (legally, obligees) as mothers and non-resident parents or child support payers (legally, obligors) as fathers. In 2005, 85 % of custodial parents were mothers and 90 % of child support recipients were mothers (U.S. Census Bureau 2007).

For example, Weiss and Willis (1985) argue that more contact will lead to better monitoring of the mother’s expenditures by the father, which will lead to more child support payments. On the other hand, DelBoca and Ribero (2001) present in model in which the father essentially buys contact time from the mother in a world with imperfectly enforceable child support and custody rules.

Estimates for a smaller sample of only children whose fathers were absent in the current interview period produce similar results.

Unlike adult BMI, child BMI is not evaluated on a fixed scale, but rather against the percentile distribution for the child’s age and gender. I have used BMI growth charts produced by the National Center for Health Statistics in 2000 and adopted the definition of the 85th percentile on that chart as the cutoff for overweight and the 10th percentile as the cutoff for underweight.

The variable with the most invalid skips is the parent-reported child health status index. However, there are not any significant differences in observables between children/parents with and without missing values.

When this is broken down, most of the children not at normal body weight are overweight or obese.

References

Aizer, A., & McLanahan, S. (2006). The impact of child support enforcement on fertility, parental investments and child well-being. Journal of Human Resources, 41(1), 28–45.

Amato, P. R., & Gilbreth, J. G. (1999). Nonresident fathers and children’s well-being: A meta-analysis. Journal of Marriage and the Family, 61(3), 557–573.

American Academy of Pediatrics. (2008). Recommendations for Preventive Pediatric Health Care. http://www.aap.org/en-us/professional-resources/practice-support/Pages/PeriodicitySchedule.aspx. Accessed 25 sept 2014.

Argys, L. M., & Peters, H. E. (2003). Can adequate child support be legislated? A model of responses to child support and enforcement efforts. Economic Inquiry, 41(3), 463–479.

Argys, L. M., Peters, H. E., Brooks-Gunn, J., & Smith, J. R. (1998). The impact of child support on cognitive outcomes of young children. Demography, 35(2), 159–173.

Becker, G. (1991). A treatise on the family. Cambridge, MA: Harvard University Press.

Case, A., Fertig, A., & Paxson, C. (2006). The lasting impact of childhood health and circumstance. Journal of Health Economics, 24(2), 365–389.

Case, A., Lubotsky, D., & Paxson, C. (2002). Economic status and health in childhood: The origins of the gradient. American Economic Review, 92, 1308–1334.

Case, A., & Paxson, C. (2002). Parental behavior and child health. Health Affairs, 21(2), 164–178.

Center for Human Resource Research. (CHRR). The Ohio State University. 2006. National Longitudinal Survey of Youth 1979 Child and Young Adult Data Users Guide. December.

Currie, J. (2009). Healthy, wealthy, and wise: Socioeconomic status, poor health in childhood and human capital development. Journal of Economic Perspectives, 47(1), 87–122.

DelBoca, D., & Flinn, C. J. (1994). Expenditure decisions of divorced mothers and income composition. Journal of Human Resources, 61(3), 742–761.

DelBoca, D., & Ribero, R. (2001). The effect of child support policies on visitation and transfers. American Economic Review, 91(2), 130–134.

Garasky, S., & Stewart, S. D. (2007). Evidence of the effectiveness of child support and visitation: Examining food insecurity among children with nonresident fathers. Journal of Family and Economic Issues, 28, 105–121.

Hofferth, S. L., & Pinzon, A. M. (2011). Do nonresidential fathers’ financial support and contact improve children’s health? Journal of Family and Economic Issues, 32, 280–295.

Knox, V. W. (1996). The effects of child support payments on developmental outcomes for elementary school age children. Journal of Human Resources, 31(4), 816–840.

Lerman, R. I. (1993). Child support policies. Journal of Economic Perspectives, 7(1), 171–182.

Meyer, D., & Hu, M.-C. (1999). A note on the antipoverty effectiveness of child support among mother-only families. Journal of Human Resources, 34(1), 225–234.

Morgan, L. W. (2008). Child support guidelines: Interpretation and application. Boston: Wolters Kluwer.

National Center for Health Statistics. (NCHS). (1995). Monthly Vital Statistics Report. No. 43-9. Centers for Disease Control. April.

National Vital Statistics System. (NVSS). (1973). 100 Years of Marriage and Divorce Statistics United States, 1867–1967. DHEW Publication 74-1904.

Nepomnyaschy, L., & Garfinkel, I. (2010). Child support enforcement and fathers’ contributions to their nonmarital children. Social Service Review, 84(3), 341–380.

Peters, H. E., Argys, L. M., Heather Wynder Howard, & Butler, J. S. (2004). Legislating love: The effect of child support and welfare policies on father–child contact. Review of Economics of the Household, 2, 255–274.

Reichman, N. E., Corman, H., & Noonan, K. (2003). Effects of child health on parents’ relationship status. NBER Working Paper No. 9610.

Seltzer, J. A., Schaeffer, N. C., & Charng, H.-W. (1999). Family ties after divorce: The relationship between visiting and paying child support. Journal of Marriage and the Family, 51(4), 1013–1032.

Smith, J. P. (2009). The impact of childhood health on adult labor market outcomes. Review of Economics and Statistics, 91(3), 478–489.

Taber, J. R. (2012). The effect of health insurance mandates in child support agreements on children’s health insurance coverage. Working Paper, Cornell University.

U.S. Census Bureau. (2007). Custodial Mothers and Fathers and Their Child Support: 2005. Current Population Report P60-234, August.

U.S. Census Bureau. (2009). Living arrangements of children under 18 years old: 1960 to present. Historical Table CH-1, January.

Ventura, S. J. (2009). Changing patterns of nonmarital childbearing in the United States. Data Brief No. 18. National Center for Health Statistics. May.

Weiss, Y., & Willis, R. (1985). Children as collective goods and divorce settlements. Journal of Labor Economics, 3(3), 268–292.

Yeung, W. J., Linver, M., & Brooks-Gunn, J. (2002). How money matters for young children’s development: Parental investment and family processes. Child Development, 73(6), 1861–1879.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Baughman, R.A. The impact of child support on child health. Rev Econ Household 15, 69–91 (2017). https://doi.org/10.1007/s11150-014-9268-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11150-014-9268-3