Abstract

This paper investigates whether analysts’ estimates of firm fundamental value transmit unique information to security markets. Previous work has not studied analyst value estimates because of the scarcity of the release of such data. This study circumvents that limitation by considering the one type of firm for which a large sample of value estimates, known as the net asset value (NAV), exists: Real Estate Investment Trusts (REITs). Using a sample of 200 Equity REITs from 2001 to 2015, we document significant abnormal returns and share turnover on the announcement date of NAV revisions. This response is consistent with market reactions to announcements of other types of analysts’ estimates: earnings forecasts, price targets, and buy/sell recommendations. Our findings remain significant after controlling for these, suggesting the information contained in NAV revisions is incremental to that contained in other analyst estimates. Consistent with efficient information transmission, the market absorbs this new information quickly and completely.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The information contained in analyst research has long been a topic of interest in the financial and accounting literature. Prior research concentrates on the reaction of stock prices to the release of three types of forecasts or estimates by analysts: (1) earnings forecasts, (2) recommendations, and (3) price targets.Footnote 1 The amount of prior evidence is substantial, and the consensus is that stock prices react to the release of this information.Footnote 2 All three types of forecast make their own distinctive contribution. The purpose of this paper is to investigate the information content of an unexamined set of analyst estimates, those of the fundamental value of the firm.

Research on the effects of analysts’ value estimates has been limited because of the lack of availability of the release of these numbers for most firms. Perhaps the closest that researchers have come to examining the issue is by using analyst’s estimates of the future price of a stock, or “price target.” Analysts’ estimates for a price target represent their forecast of the stock’s price at a time in the future, typically one year. However, price targets represent imperfect estimates of the present value of a firm for two primary reasons.

First, they tend to be overly optimistic on average, which in turn introduces bias into their information signal. Gleason et al. (2013) find a value of 1.32 for the mean price-targets to price ratio for a large sample of stocks. Brav and Lehavy (2003) report an average of 1.33. These premiums for one-year ahead stock prices imply an expected one-year average stock return of 32–33%, a hurdle reached by the S&P 500 Index only twice in the 50 years prior to 2016. Examining realized returns, Bradshaw et al. (2013) find that they fall short of returns implied by target prices by 15 percentage points. In the context of Real Estate Investment Trusts, Boudry et al. (2011) show that optimistic price targets from underwriter-affiliated analysts increases their likelihood of attracting business. Second, price targets are forecasts relatively far in the future. Most are forecasts for stock prices one year from the release of the estimate. These forecasts therefore contain both an assessment of the current value of the firm and a forecast of stock price changes in the future. The challenge for the investor, particularly those with a short-term orientation, is they cannot distinguish between the two. This lack of clarity induces noise into the information signal regarding the current value of the firm.

Earnings forecasts and analyst recommendations face a different set of limitations that have been documented in the literature. As Brav and Lehavy (2003) note, the information in earnings forecasts is limited because it captures an incomplete assessment of the valuation of the firm. To value a firm, one requires both a forecast of cash flows and a discount rate to apply to those cash flows to arrive at a present value of the firm. Analyst recommendations are useful because they are a current estimate of firm value relative to the stock price. However, these recommendations are in broad imprecise buckets such as “buy” or “sell”. The lack of precision introduces noise into the information signal (Francis and Soffer 1997; Brav and Lehavy 2003). An investor attempting to utilize this information is left to question at what price the “buy” recommendation is still attractive.

A useful approach might be to measure the amount of under or over valuation of a stock by comparing its current price to estimates of the firm’s current fundamental value. Unfortunately, analysts do not typically release specific point estimates of a firm’s present worth. One exception is the case of the Real Estate Investment Trust (REIT). Analysts who follow REITs assess a REIT’s value by providing an estimate of its NAV (NAV). REIT NAV estimates differ from closed-end mutual fund NAVs. Mutual funds hold traded securities with observable market prices, making the NAV easily calculable. In contrast, REITs hold non-traded physical assets (properties) with no observable market price. Thus, analysts supply a firm-level NAV based on estimated asset values of the REIT’s property portfolio.Footnote 3 REIT NAVs are intended to provide an estimate of the fundamental value of a share of the REIT’s stock.

The goal of this paper is to investigate the information content of analyst NAV estimates. We hypothesize that REIT NAV estimates contain information incremental to price targets, earnings forecasts, and recommendations because they overcome the limitations associated with each of the other analyst outputs. REIT NAVs are a current estimate of fundamental value rather than a forecast of value at some point in the future. Additionally, in contrast to price targets, these estimates do not appear to be systematically optimistically biased. Although REITs typically sell at some premium or discount to the average analyst estimate of NAV and they tend to cluster by property type and time, the average Price/NAV ratio in our sample is very close to 1. Unlike earnings forecasts, REIT NAVs require both a forecast of cash flows (net operating income) and a rate to apply to those cash flows to arrive at a present value (capitalization rate). Lastly, unlike recommendations, NAV estimates are a precise number for which to compare to the current stock price.

To address our research question, we use two measures to test for information content: abnormal returns and abnormal turnover. Abnormal returns are traditional cumulative average returns around the estimate revision date. Abnormal turnover provides another way to measure information flow by indicating whether an analyst revision induces transactions. We examine these measures around revisions of analysts’ NAV estimates to determine whether they contain information.

We document a significant market reaction to revisions of NAV estimates as measured by both abnormal returns and abnormal turnover. Mean cumulative abnormal returns (CARs) and abnormal turnover are significantly different from zero in the [0,+1] trading day window surrounding revisions. Our results are robust to the inclusion of a robust set of controls and fixed effects. Importantly, both the CAR and the abnormal turnover measures remain significant after controlling for concurrent analyst FFO forecasts, buy/sell recommendations, and price targets.Footnote 4

Our empirical method, which is standard in the information content literature, relies on the implicit assumption that the market efficiently reacts to the release of an analyst estimate because it contains unique information about the firm. If this assumption holds, we can quantify the existence of the unique information contained in these estimates by examining the short window market reaction to their release. However, if the assumption does not hold, two alternative interpretations of our results exist. First, the market may absorb the information slowly. Under this hypothesis, the short window market reaction will only reveal some portion of the information and over time the market will continue to incorporate information into the stock price. This phenomenon, known as the post announcement drift, has been well documented in the accounting literature beginning with Ball and Brown (1968). In the real estate literature, Price et al. (2012) find that post announcement drift following earnings surprises is larger for REITs than nonREITs. Second, investors may mistakenly react to analyst estimates because they falsely believe the estimates contain more information than they do. This hypothesis stems from the financial market literature, beginning with Bondt et al. (1985), and suggests that investors overreact to salient news events.

Whether the short-term market reaction to analyst estimates can be interpreted as information is central to our research question. Therefore, we distinguish between these hypotheses by examining market reactions the week following the NAV revision, which we refer to as the post announcement return window. If markets are efficient and stock prices quickly impound all unique information contained in the NAV estimate, we should find that CARs are no different from zero in the week following the [0,+1] trading day window. CARs that continue to be positively and significantly related to NAV estimates would support the existence of a post announcement drift. Lastly, evidence of a CAR reversal would suggest an investor overreaction to the release of the NAV estimate. Consistent with efficient information absorption, we document that stock prices quickly impound the information in analysts’ valuation announcements and no reversals follow. Overall, we conclude that analysts’ NAV estimates convey unique and significant information to the market.

Our work contributes broadly to three strands of literature. First, a relatively new literature examines the investor reaction to REIT information (Price et al. 2017; Doran et al. 2012; Price et al. 2012; Hardin III et al. 2019). While this strand of literature is focused on investor reaction to information provided by REIT management or accounting statements, we focus on information provided by analysts. Second, analyst estimates of REIT NAVs are frequently utilized within the real estate literature as a proxy for the fundamental value of the firm or for the value of real estate in the private market (e.g. Boudry et al. 2010; Yavas and Yildirim 2011; Brounen et al. 2013; Kim and Wiley 2019 among many others). We are the first to our knowledge to evaluate them in the context of their initial intent: an analyst estimate released to provide REIT investors with information about the value of the REIT. Lastly, our work contributes to the broader analyst information content literature. REITs provide an interesting laboratory to examine point estimates of current fundamental values of the firm. We show that the release of this information provides unique information to investors.

The paper proceeds as follows. In the next section, we discuss the previous literature and hypothesis development. We next discuss the data sources and empirical methods. We then discuss the primary results, how we rule out alternative hypotheses, and the robustness of these results. The final section provides a summary of the paper and some thoughts on future directions.

Hypothesis Development

Given prior findings that market prices respond to the release of earnings forecasts, recommendations, and price targets, why might analysts’ NAV estimates for REITs contain unique information not available in these other announcements? We propose that there are at least three reasons. NAV estimates

-

1)

consider more input information than earnings forecasts alone,

-

2)

provide a more precise measure of “buy” or “sell” strength than do recommendations, and

-

3)

are current estimates and not subject to the optimistic bias in price targets.

Earnings Forecasts

Analysts’ calculation of NAV begins by estimating two main inputs:

-

1)

a forecast of the property portfolio’s forecasted net operating income (NOI), and

-

2)

an estimate of the appropriate capitalization rate, or “cap rate,” applicable to the portfolio.

In real estate parlance, NOI is a property’s net revenue less cash operating expenses (i.e. it omits depreciation and interest expenses). The NAV is the product of dividing the NOI by the cap rate and then subtracting total liabilities, preferred equity, and any other mezzanine financing (and usually stated per share).Footnote 5

Both of these two inputs are potential sources for analyst-provided information. NOI forecasts call for analyst projections of future revenues and cash expenses. To estimate cap rates for properties, analysts typically consider sources such as surveys of general real estate and interest-rate market trends and conditions, prevailing cap rates in the property’s sector, and examination of recent sales of comparable properties in the same geographic market. Analysts distill and interpret a large amount of information during the entire estimation process, and one who is adept and skillful at doing so has the potential to add a valuable component to the final NAV estimate. Given NAV incorporates both cash flow forecasts and cap rates, it follows that analyst estimates would contain information incremental to that contained in earnings forecasts.

There are a few subtle differences between the cash flow forecasts in the NAV and the FFO that further support that NAV estimates should contain information unique to that of FFO forecasts. For example, NAV estimates attempt to calculate a stabilized portfolio level NOI in the following period. That is, the analyst may assume a long-term occupancy rate for properties that may not occur in the short term. In this case, the analyst would adjust property level projected cash flows for a NAV calculation that would not be included in an FFO forecast for the following period.Footnote 6

Recommendations

Recommendations confine opinion about a stock’s value to only a few discrete “buckets” (strong-buy/buy/hold/sell/strong-sell). On the other hand, the metric of a stock’s price divided by NAV is a measure of over or under pricing in the market. It represents a more precise opinion about the amount of a stock’s mispricing and, by extension, the “strength” of its future expected return.

In addition, investors’ transaction decisions are not only “buy” or “sell” but also the amount to transact and at what price. An investor knowing the NAV estimate (and hence a price/NAV ratio) has more information about whether to purchase a larger or smaller holding than knowing a simple buy recommendation. In addition, a point estimate of the firm’s value provides investors with a reference point for specifying a transaction limit price whereas a recommendation proves no guidance. Investors armed with NAVs therefore have more information with which to make complete transaction decisions than they do with simple buy/sell advice. We therefore anticipate that, even in the presence of analyst buy/sell recommendations, revisions of NAVs will convey information to the market. Francis and Soffer (1997) make a similar argument about the relative value of earnings forecasts versus recommendations.

Price Targets

The following quote from Graham and Dodd (1951) is used by Gleason et al. (2013) to discuss price targets:

“The analyst could do a more dependable and professional job of passing judgment on a common stock if he were able to determine some objective value, independent of the market quotation, with which he could compare the current price. He could then advise the investor to buy when price was substantially below value, and to sell when price exceeded value.”

Graham and Dodd (1951: 404-05)

However, rather than issuing an estimate for which the current price can be compared, price targets are forecasts for stock prices typically one year in the future. A forecast of this nature would require additional assumptions about industry specific growth and macroeconomic factors that may distract from the valuation of the specific firm in question. In contrast, NAV estimates more directly answer the call of Graham and Dodd because they are current value estimates, independent of the stock price, with which the current stock price can be compared. Additionally, the literature has documented that price targets are overly optimistic (e.g. Bradshaw et al. 2013; Gleason et al. 2013). To the extent NAV estimates are unbiased estimates of value, NAVs should provide more precise information to investors. We therefore expect that even in the presence of analyst price targets, NAV estimates will represent a unique information flow.

Related Literature

There is a paucity of research of analyst forecasts in the REIT literature. Devos et al. (2007) examine the value of analyst coverage in the REIT industry. One finding relevant to our study is that beginning in the year 2000, the number of analysts covering REITs and issuing NAV estimates increased markedly. Our study focuses on the post-2000 era when REIT analyst coverage and data availability are significant. Boudry et al. (2011) examine REIT analyst behavior and underwriter choice. They examine price targets and analyst recommendations for 161 REITs from 1996 to 2004 and show that optimistic price targets significantly increase an underwriter’s probability of attracting underwriting business. While analyst conflicts of interest are not the focus of this paper, their findings imply the existence of information content in analyst price targets and recommendations in the REIT industry. Downs and Güner (2006) examine the quality of REIT FFO forecasts and find they are of higher quality than EPS forecasts. This lends credibility to why we use FFO forecasts rather than EPS forecasts. A similar strand of real estate literature examines the market reaction to information released by REIT management (Price et al. 2017; Doran et al. 2012). Specifically, these papers focus on the information content of earnings conference calls. Similarly, Vincent (1999) examines the information content of management FFO disclosures. We add to this literature by examining the information content of REIT analyst information releases.

Our work is loosely related to the real estate literature that examines price discovery dynamics between public and private real estate markets (Oikarinen et al. 2011; Yavas and Yildirim 2011; Yunus et al. 2012; Ling and Naranjo 2015, and many others). Specifically, Yavas and Yildirim (2011) use REIT-level analyst consensus NAV estimates to proxy for the value of private real estate and show that price discovery generally occurs in the securitized market. As we discuss further in the empirical methods section, rather than adding to the discussion of which market price discovery occurs, we seek to isolate and quantify the portion of analyst NAV estimates that lead to stock price movements.

A mature real estate literature seeks to understand the source of the discount or premium of REIT stock price relative to NAV. Various variables have been linked to NAV premiums such as firm size, insider ownership, volatility, short sale constraints, tax structure, agency costs, leverage, and risk (Capozza and Lee 1995; Barkham and Ward 1999; Clayton and MacKinnon 2001; Anderson et al. 2005; Brounen et al. 2013; French and Price 2018 among others). We do not focus on the premium or discount to NAV, rather our analysis examines how investors react to an increase or decrease in the NAV estimate relative to the most recent consensus.

A longstanding accounting literature examines the information content of analyst earnings forecasts, recommendations, and price targets (see footnote 1 for an incomplete list). Recently, some criticism has arisen of these studies on the role analysts play in providing information to the market. Specifically, critics (Altınkılıç and Hansen 2009; and Altınkılıç et al. 2013) argue that analysts “piggy-back” on major corporate news events. They argue that reported short-window announcement returns relate to the corporate news event itself and not the analyst’s revision. In their analysis, Altınkılıç and Hansen (2009) use time-stamped earnings releases and stock transaction data to measure the market reactions just minutes after the revision time (rather than over windows of up to several days.) They find that the abnormal returns in these minutes are not significantly different from zero and therefore imply no analyst information effect.

However, Bradley et al. (2014) demonstrate that the earnings announcement timestamps in the database are not correct. They tend to occur at times systematically preceding the time recorded on the timestamp. After checking announcement timestamps using alternative news sources, these authors find that significant market reactions do occur within a 30-min window following analyst revisions.

Loh and Stulz (2011, 2018) acknowledge this debate and argue that research design can mitigate the effect of corporate news events. They suggest removing analyst revisions occurring on: (1) the same day as other analysts’ revisions for the same firm, (2) near earnings announcements, and (3) near management guidance releases. In order to address the “piggy-backing” issue, we use all of Loh and Stulz’s suggestions to the extent possible with our sample.

Sample and Summary Statistics

Data Sources

We obtain analyst NAV estimates from the database of real estate securities from SNL Financial. This sample begins in in 2001 and continues through 2015. We include all equity REITs for which quarterly financial data and analyst NAV are available in the SNL database. A REIT enters our sample when it first appears in the database and exits if it becomes acquired or defunct. Our sample is free of survivorship bias.

NAVs reported in SNL are consensus estimates on a daily basis. They equal the mean of all the individual analysts’ most recent estimates, although no estimate more than 120 days old is included. We are unable to identify days on which multiple analysts report on the same day and we recognize this as a drawback of this data source. An additional drawback associated with only observing the consensus NAV revision is we are unable to observe the actual NAV value that was issued by the analyst. It would be useful to observe whether the revised NAV estimate was above or below the current stock price (or some other relevant benchmark such as the property-sector average NAV). For example, if an analyst issued a new estimate that was higher than their previous estimate but below the current stock price, it is difficult to discern how investors should respond. However, with only a consensus value, the researchers are prohibited from such tests without making significant assumptions. This limitation biases our results towards zero.

The I/B/E/S database provides price targets, FFO forecasts, and recommendations. Because I/B/E/S reports for individual analysts, we compute in SNL fashion a daily consensus for these variables so that they will be comparable to the value estimates from SNL. We obtain stock prices from CRSP.

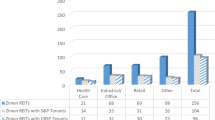

Our sample contains 200 equity REITs that have non-missing data in SNL, I/B/E/S and CRSP. The total sample consists of 323,797 total observations of which 23,025 have NAV revisions. Table 1 presents the summary statistics of the sample. Panel A shows the number of firms by real estate sector and demonstrates that the sample has representation of all major sectors in proportions consistent with the REIT industry. Panel A also presents the mean price-to-net-asset-value ratio, and it is worthy to note that the average across the full sample is very close to one. However, there is significant variation in the ratio by sector and over time.

Panel B presents summary statistics for quarterly REIT and analyst characteristics. All variables are defined in Appendix Table 8. One limitation of the SNL data is the lack of analyst-level data. Only the consensus value is available, so when there is a revision, we are unable to identify the analyst who made the revision. To mitigate this challenge, we compute two different analyst-level control variables available from I/B/E/S quarterly FFO data: analyst brokerage-firm size, and analyst experience in years. We calculate these variables for each analyst in I/B/E/S for the announcement quarter and then average them by firm.Footnote 7 To the extent the same analysts producing FFO forecasts are producing NAV estimates, these control variables serve as a reasonable proxy. We have no reason to suspect this data limitation will bias the results in a direction that distorts inference.

Measures of Information Content

The measure of information content is the percentage change in the NAV consensus estimate:

where NAV is the consensus analyst NAV per share estimate and subscripts t and t-1 denote the current and preceding trading days. Price target forecast revisions are also calculated using percentage change. FFO forecast revisions are calculated as the change in FFO forecast scaled by gross assets.Footnote 8 Consensus analyst recommendations are nonnumeric and in categories such as “strong buy” or “strong sell”. To convert recommendations to a numeric scale, we use a procedure common in prior work of assigning values from one to five (strong sell is equal to one and strong buy is equal to five). As such, we utilize the raw change of this variable in our analysis. For all four analyst revision variables, on days when no analysts issue new revisions, the database retains the previous day’s consensus estimate and the variable is equal to zero.Footnote 9

The focus of our analysis is on NAV revisions. Therefore, our analysis focuses the subsample of days on which NAV revisions occur (i.e. when ΔNAV is nonzero).Footnote 10 There are two cases when we will identify a false NAV revision using this method. First, SNL drops an analyst from the consensus calculation if the analyst does not issue a new value for 120 days. This results in a change in the consensus estimate when no revision occurs. Second, if SNL adds a new analyst to their universe of coverage, the analyst’s most recent NAV estimate will cause a change in the consensus value. However, there is no way to identify the date on which the analysts most recent estimate occurred. If the number of analysts increases, it may be a result of two possibilities. First, a new analyst issues a revision on the day it was added. Second, SNL has added a new analyst to their universe of analysts in their database. In doing so, they incorporate the analyst’s most recent NAV revision whether it occurred that day or someday previous. Discussions with SNL indicate that there is no way to differentiate between these two.

To conservatively mitigate these issues, we drop the revision from the analysis when the number of analysts following the firm changes on the date of the revision. The other analyst variables come from I/B/E/S which record the date of the revision explicitly, so we need not make any such adjustments to those variables.

Measures of Market Reaction to Information Release

We follow Loh and Stulz (2011) and use two measures of market reaction to analyst estimate releases: cumulative abnormal return and abnormal turnover. Cumulative abnormal return gauges the impact of a revision on a stock’s price, and abnormal turnover measures the ability of a revision to induce investors to trade. We compute market adjusted returns for the cumulative abnormal returns using the CRSP/Ziman value weighted index as the benchmark indexes. Alternative measures of abnormal return using the Fama-French 3-factor model appear in Table 7. We denote the cumulative abnormal return over a window around the revision day as CAR [i,j] where i and j are the start and end days respectively of the window relative to revision day are equal to zero.

Following Llorente et al. (2002), turnover is the ratio of the stock’s trading volume to the number of shares outstanding. Abnormal turnover is log turnover less the average daily log turnover over the prior 90 trading days. To avoid the problem of zero trading volume, we add a small constant, 0.00000255, to turnover before taking the log following Llorente et al. (2002). Daily trading volume is from CRSP. We account for inter-dealer double counting of trading in NASDAQ firms by dividing share volume by two. We denote the event-window abnormal turnover as ABTURN [i,j].

Addressing Alternative Hypotheses

There are two alternative hypotheses that have been put forth in the accounting and real estate literatures that could predict the behavior we find in the data. We address these alternatives to mitigate the concern they are explaining our results.

First, the piggybacking hypothesis refers to a criticism in the information content accounting literature is that analysts “piggyback” off corporate news events rather than produce new information (Altınkılıç and Hansen 2009; Altınkılıç et al. 2013). According to this hypothesis, analysts make revisions immediately following major news events. A short window around the revision date (such as [−1,+1]) therefore captures both the news and the analyst’s revision, and any significant reaction might be caused by the news and not the revision. The primary corporate news events that have been noted which can cause this problem are earnings announcement dates (Malmendier and Shanthikumar 2007) and management guidance dates (Chen et al. 2005). Bradley et al. (2008) argue that dates with revisions from multiple analysts on the same stock are also more likely associated with a significant news event.

The second hypothesis, which we call the price discovery hypothesis, is from the real estate literature and relates to the relative timing of value changes in the securitized and physical real estate markets. Yavas and Yildirim (2011) use NAV data from SNL financial and find that price discovery appears to occur in the securitized real estate market. They find that changes in REIT prices tend to lead changes in NAVs. If this relationship is complete, then there would be no information content in analysts’ NAV revisions and hence analysts’ revisions should have no influence on REIT stock prices (returns).Footnote 11 Additional real estate literature supports the claim that price discovery occurs in the securitized market (Myer and Webb 1993; Barkham and Geltner 1995; Chau et al. 2001; Chiang 2009). We do not challenge this claim in our study. Instead, we argue that analyst NAV estimates, which are often used to proxy for private prices, are first and foremost analyst estimates. An analyst’s goal is to inform public REIT investors about the current market value of the underlying real estate the REIT holds. It is from this perspective we conduct our analysis using empirical methods derived from the accounting literature.

Note that both the piggybacking and the price discovery hypotheses have the same empirical implication in our setting: prices lead revisions. Therefore, a test of either is a joint test of both. If we reject, then we can rule out both. However, if we cannot reject, then we cannot distinguish between either of the alternative hypotheses.

Loh and Stulz (2011) utilize a strategy to mitigate the piggybacking hypothesis which we implement in our study to address both hypotheses. First, to examine CAR and abnormal turnover reactions to revisions, we use a short [0,+1] day window for our tests rather than a trading window which includes days prior to the revision date. This allows us to focus explicitly on the price reactions following NAV revisions. Second, we identify observations potentially influenced or confounded by corporate news events. We identify earnings announcement dates and management guidance dates and remove analyst NAV revisions that occur within a [−1,+1] trading day window of these dates.Footnote 12 We also remove all “clustered” revisions, which we define as those that have another revision within the [−1,+1] window. The removal of clustered revisions has an intuition similar to that of Bradley et al. (2008). If multiple analysts are updating revisions in consecutive days, it is more likely there is some underlying corporate news event we have not captured in previous screens.

In addition to the screens applied by Loh and Stulz (2011) for industrial firms, other corporate events such as major property acquisitions or dispositions should be considered in the REIT context. For example, the industrial REIT Monmouth Real Estate Investment Corporation disclosed the acquisition of a $21,001,538 property in an 8-K filing on December 30, 2016.Footnote 13 This would materially impact the REITs NAV and analyst revisions around this announcement are susceptible to the piggy backing problem. To be as conservative as possible, we also remove revisions that occur within a [−1,+1] trading day window of all 8-K announcements. The full sample contains 23,025 NAV revisions with 12,162 of these removed using these screens. The final sample consists of 10,863 NAV revisions.

Summary Statistics

Table 2 contains summary statistics for NAV revisions. Panel A displays the number of revisions after applying each filter along with the distribution of the ΔNAV variable, stated as a percentage. After applying each filter, the mean value of ΔNAV decreases, through the overall distribution of the variable remains very stable. The median value of 0.17 reflects that there are more positive revisions than negative ones. This is consistent with an upward trend in firm values over time. Our final sample of 10,863 revisions contains 6380 positive revisions and 4483 negative revisions.

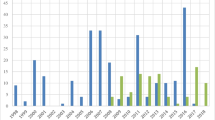

Panel B shows the total number of revisions by year. The number of analyst revisions increase almost monotonically by year. This is likely a result of a combination of the significant growth of the REIT industry during the sample period causing an increase in the number of publicly traded REITs, an increase in analyst coverage of the industry, and the expansion of SNL coverage of analysts. We also document the average price-to-NAV ratio by year for all REITs during out sample. While the average over the full sample is very close to one, there exists significant time-variation as documented in previous studies. Notable deviations include a steep discount to NAV during the financial crisis and a significant premium to NAV in the period leading up the crisis when real estate markets were hot.

Results

Univariate Market Response to NAV Revisions

Our first exploration for information content examines the market response to positive and negative revisions in NAV estimates. Table 3 presents mean CAR [0,+1] and ABTURN [0,+1] values presented separately for positive revisions (panel A) and negative revisions (Panel B). The existence of information content should result in CAR [0,+1] values that are of the same sign as ΔNAV. For the full sample (line 1 of each panel), reported CAR [0,+1] values, for both positive and negative revisions, have t-statistics that are significant at the 0.01 level with expected matching ΔNAV signs.

For share turnover, any revision (positive or negative) that contains new information should induce additional trading and yield positive abnormal turnover. As expected, the mean values for both positive and negative ΔNAV values have ABTURN [0,+1] means in Table 3 that are positive and statistically significant.

To consider effects of the alternative hypotheses, lines 2 through 4 of Panels A and B of Table 3 present results removing observations with announcements of management earnings guidance, earnings announcements, and clustered revisions within a [−1,+1] day window of the revision. Each line cumulatively removes revisions, therefore, line 4 represents the removal of all of the revisions with potentially confounding events. As we remove each of these events, the mean CAR [0,+1] and ABTURN [0,+1] values generally decrease in absolute value in both magnitude and statistical significance. This is particularly evident with abnormal turnover and is unsurprising as it demonstrates the potential existence of analyst piggybacking that we screen out. One exception is the CARs around positive revisions in which the average CAR [0,+1] is larger after removing revisions around 8-K dates. Most importantly, this trend demonstrates that our screens are useful in mitigating the piggy backing concern. After removing all potentially confounded revisions, the final sample continues to have statistical significance well above conventional significance levels.

Note that positive and negative revisions have a fairly symmetric impact on mean abnormal returns. The absolute values of the CAR [0,+1] for both Panels A and B are similar, all being between approximately 9 and 13 basis points. However, there appears to be a striking difference between abnormal turnover on positive ΔNAV days compared to days with negative ΔNAV. Mean ABTURN [0,+1] values from lines in Panel B (negative revisions) range from about 1.5 times to 3 times greater than values from positive revisions reported in Panel A. This result is consistent with the prior work showing greater reactions to negative news. For example, Williams (2015) shows when general economic uncertainty is high, investors react more to bad news than good news.

Overall, the univariate analysis supports the hypothesis that analyst value estimates provide new information to the market. While the mean CAR [0,+1] values are relatively small, they do have a magnitude of economic importance. The mean CAR [0,+1] of 0.129% for positive revisions represents approximately a $3.79 million gain in the average REIT’s total equity market value over the two-day announcement window. Similarly, the −0.122 mean for negative revisions translates to a $2.76 million loss in market value. Additionally, as noted in the Data Sources section, we only observe the consensus NAV value. This lack of information biases the CARs towards zero as we cannot identify cases in which the consensus NAV estimate increases but the individual analyst is still producing a negative outlook relative to the stock price or some another benchmark.

Figures 1, 2, and 3 provide a visual analysis of the univariate market response to analyst revisions. Figure 1 examines mean CAR [0,+1] based on sorts of ΔNAV. We define Isolated NAV revisions as those with each of the aforementioned potentially confounding revisions removed. For both the full sample and the isolated sample, we sort revisions into quintiles based on the ΔNAV values. Quintile 1 contains the largest negative revision values and quintile 5 contains the largest positive revision values. We then plot mean CARs [0,+1] within each quintile. For all revisions and for the subset removing potentially confounded observations, the relation between revision quintile and CAR [0,+1] is monotonically increasing. This suggests that investors react proportionally with the magnitude of the ΔNAV revision. The largest revisions in either direction illicit the largest investor reactions. Consistent with the findings in Table 3, the difference in CARs from the full sample and that after removing potentially confounded revisions is marginal.

Mean cumulative abnormal returns for a two-day event window (CAR [0,+1]) around analysts’ revisions for REIT NAV estimates (ΔNAV) sorted by ΔNAV quintile. The dotted line represents all NAV revisions. The solid line represents Isolated NAV revisions. Isolated NAV revisions are observations with confounding events removed, where confounding events are earnings announcements, management guidance, 8-K dates, or other NAV revisions within a [−1,+1] trading day window

Mean cumulative abnormal volume for a two-day event window (ABTURN [0,+1]) around analysts’ revisions for REIT NAV estimates (ΔNAV) sorted by ΔNAV quintile. The dotted line represents all NAV revisions. The solid line represents Isolated NAV revisions. Isolated NAV revisions are observations with confounding events removed, where confounding events are earnings announcements, management guidance, 8-K dates, or other NAV revisions within a [−1,+1] trading day window

Mean abnormal returns (AR) by trading day around NAV revisions (ΔNAV) and mean cumulative abnormal returns over event two-day and three-day (CAR [0,+1] and CAR [−1,+1]) windows. The black solid bar represents the full sample of revisions. The blue textured bar represents observations with confounding events removed. Positive and negative revisions appear separately

In a similar fashion, we repeat the analysis for abnormal turnover in Fig. 2. However, given we predict a positive abnormal turnover reaction to both positive and negative revisions, we create quintile sorts based on the absolute value of ΔNAV. Similar to Fig. 1, for both the full sample and those with potentially confounded revisions removed, the mean abnormal turnover is monotonically increasing as the magnitude of the revisions increases. Unlike Fig. 1, there is a notable difference between the full sample and subsample of revisions. The lines appear to be almost parallel. This suggests that while the relation between the absolute value of ΔNAV revisions and abnormal turnover is consistent amongst the two groups, the group with potentially confounded events removed generally illicit a smaller market reaction across all quintiles. This suggests, as expected, that there is generally more trading volume around major news events.

Figure 3 examines average abnormal returns surrounding revisions by day, classified by positive and negative revisions. We look at each day within a [−1,+1] trading day window of an analyst revision of ΔNAV. For all three days, average abnormal returns around positive (negative) revisions are positive (negative) and greatest on day 0. There appears to be a definite market response on day 0 with a smaller but consistent reaction on days −1 and + 1. The existence of an abnormal return reaction on day −1 for the full sample supports the existence of either analyst piggybacking or price discovery occurring in the public market (likely some combination of the two).

However, after removing potential confounded revisions, the market response is of significantly lesser magnitude on day −1. The significant change in day −1 abnormal returns after the screens is suggestive that analyst do appear to piggyback off corporate news events. For example, an earnings announcement occurred on day −1 and the market reacted to this information. The following day, the analyst publishes the revised the NAV estimate. Such an example reflects information from the earnings announcement being falsely attributed to the analyst. This finding underscores the importance of removing potentially confounded observations and the use of CAR [0,+1], which we do for all of the remaining tables and analysis.

Overall, at the univariate level, we consistently find results consistent with analysts’ NAV revisions containing significant information as measured by abnormal returns and turnover. We also provide evidence our screens allow us to rule out alternative hypotheses explaining our results.

Multivariate Analysis

We next turn to multivariate regression analysis to further isolate and quantify the information content of analyst NAV revisions. In the multivariate setting, we are able to control for variables measuring firm characteristics, analyst characteristics, and other analyst estimates for the firm (ΔFFO, ΔPT, and ΔREC). We can also utilize fixed effects at the firm and quarter level to control for unobserved time- and firm-invariant heterogeneity, respectively. The model is specified as follows:

where CAR [t,t + 1]i,t is the cumulative abnormal return for firm i over days t and t + 1, an is estimated coefficient for the nth variable or variable vector, \( {\overset{\rightharpoonup }{FirmVar}}_{i,t} \) is the vector of control variables related to firm i, \( {\overset{\rightharpoonup }{AnalystVar}}_{i,t} \) is the vector of controls variables related to the analysts of firm i, \( {\overset{\rightharpoonup }{AnalystEst}}_{i,t} \) is the vector of other analyst estimates for other firm variables, \( {\overset{\rightharpoonup }{Quarter}}_t \) is the vector of category (dummy) variables for the observation quarter (quarter fixed effects), and \( {\overset{\rightharpoonup }{Firm}}_i \) is the vector of category variables for each firm i (firm fixed effects). For all regressions, we double cluster standard errors by quarter and firm.

The vector of control variables related to the firm are estimated using quarterly accounting data from SNL as well as return data from CRSP. The Market Value of Equity is obtained from CRSP as of the quarter preceding the revision. Book/Market is calculated as the log of the ratio of the book value of equity and the market value of equity as of the quarter preceding the revision. Momentum is the buy and hold of the REIT from twelve months preceding the revision to the month preceding the revision. ROA is the ratio of net income to assets as of the quarter preceding the revision. Dividend Yield is the most recent dividend, annualized and expressed as a percent of the security’s price as of the quarter preceding the revision.

The vector of analyst controls is obtained from SNL and I/B/E/S. Number of Analysts is reported on a daily basis along with the NAV revision from SNL. Broker Size is the log of the mean number of analysts associated with the broker in the quarter of the revision for each analyst that gives a forecast for the REIT in I/B/E/S. Analyst Experience is the calculated as the number of quarters each analyst that makes a forecast for the REIT exists in the I/B/E/S detail file. We then take an average of this value by REIT and calculate the natural log. These variables are admittedly a noisy attempt to control for analyst characteristics given the lack of data availability of such characteristics in SNL. However, in all specifications, results are robust to the exclusion of these variables. The vector of analyst estimates is the FFO, price target, and analyst recommendations calculated as discussed in the measures of information content section.

These analyses use the subsample of REIT-days on which a NAV revision occurs. Further, all regressions are run only on NAV revisions after all potentially confounded revisions are removed. In untabulated analysis, we conduct regressions without screening the NAV revisions and unsurprisingly results are stronger.

Table 4 presents the results of Eq. (2). If analyst NAV revisions contain information, we expect to observe a positive and significant coefficient a1. All of the coefficients reported for information content (ΔNAV) in Table 4 are positive and statistically significant well beyond the 1% level of confidence. Columns (1) and (2) show results without including any of the concurrent analyst estimate revisions (ΔFFO, ΔPT, and ΔREC), and columns (3) through (8) consecutively add these variables. The importance of these added columns is that information content of ΔNAV remains positive and significant even in the presence additional concurrent releases of estimates that could also carry information to the market. Each of these additional forecast-type variables yields positive and significant coefficient estimates. This is consistent with the analyst literature which generally finds each analyst estimate contains unique information. We therefore find that, using returns as a measure of information content, analyst value estimate revisions contain significant information content beyond that contained in other analyst-estimated variables.

Analysis of information content measured by share trading volume proceeds in a similar fashion. The model is as follows:

where ABTURN [t,t + 1]i,t is the cumulative abnormal return for firm i over days t and t + 1. Note that the NAV revision variable in the model is the absolute value of ΔNAV because the hypothesis predicts that both positive and negative revisions illicit positive abnormal turnover. Each of the control variables are identical to that of eq. 2 with the exception of the other analyst forecasts and recommendations for which we take the absolute value.

The results from estimating this model are in Table 5. The coefficients of │ΔNAV│ are all positive and significant implying the existence of information flow reflected in additional trading volume. When adding the additional analyst revisions of ΔFFO, ΔPT, and ΔREC (columns (3) through (8)), the │ΔNAV│ coefficients continue to be significant at greater than the 1% confidence level. Unsurprisingly, the │ΔNAV│ values and levels of significance do decrease as the additional variables enter the model. This reflects the need to control for other analyst outputs. Overall, Tables 4 and 5 present robust evidence that analysts’ NAV revisions have significant information content.

Analysis of Post Announcement Market Reaction

Our examination of the market reaction to analysts’ revisions at this point has been over a two-day announcement window. We have argued that a market reaction during this window indicates the analyst output contained relevant information about the REIT. However, this interpretation relies on the underlying assumption that stock prices quickly and fully reflect all available information. However, two alternatives inconsistent with this interpretation exist that our tests thus far would not reveal. First, the market might absorb the implications of the news slowly and the reaction occurs over a longer time period. In this case, the information content we document would be understated. Such post announcement drift occurrence, beginning with Ball and Brown (1968), has been well documented in the accounting literature. Second, the market could overreact to the news of a revision and the CAR could reverse as market participants correct their judgments. In this case, what we interpret as information is really a market failure. The financial market literature, beginning with Bondt et al. (1985), suggests that investors might overreact to salient news events. Under this hypothesis, investors overreact to the information contained in announcements such as analysts’ forecasts because they mistakenly believe there is more information than actually exists.

The market reaction after the [0,+1] trading day window, which we call the post announcement window, allows us to identify if either of these alternative cases exist for analyst NAV revisions. If the CARs in the days following the [0,+1] trading window are positive, this would suggest the existence of a post announcement drift. Alternatively, if the CARs are negative, this would be consistent with an investor overreaction. If the CARs hover around zero, we can conclude the market quickly and efficiently impounded true information in analyst revisions.

To conduct this analysis, we examine the [+2,+7] trading day window CARs. First, we examine the univariate mean CARs by day following the revision. Figure 4 plots the results for positive and negative revisions separately as we expect CARs in opposite directions for each. Consistent with the previous analysis, Day 0 has the largest CAR positive (negative) reaction and day +1 continues to have a smaller but non-zero positive (negative) reaction following positive (negative) revisions. For both positive and negative revisions, the day +2 to day+7 CARs hover very close to zero.

Mean abnormal returns (AR) by trading day around NAV revisions (ΔNAV). The solid line represents positive NAV revisions and the dotted line represents negative NAV revisions. For both positive and negative revisions, this figure depicts Isolated NAV revisions (those with potentially confounding events removed)

Table 6 presents results from additional univariate and multivariate methods to examine CARs following the [0,+1] trading day window. Panel A presents mean CAR [+2,+7] values for quintiles sorted by ΔNAV. For reference to the announcement window, the first row of Panel A presents mean CAR [0,+1] values (these are the values used to construct Fig. 1), and the post announcement window values are in the second row. In general, Panel A supports a quick adjustment to new information in value estimate revisions. Quintiles 1 to 5 for CAR [0,+1] are monotonically increasing and statistically significant with the exception of quintile 2 which contains both positive and negative revisions. The difference between quintile 5 and quintile 1 is 38 basis points and has a t-statistic of 6.1. For CARs [+2,+7], Quintile 1 through 4 means are not different from zero and have no discernable pattern. One exception is quintile 5, which is positive and significant at the 0.05 level. The difference between quintile 5 and quintile 1 is rounded to only 4 basis points and indistinguishable from zero. Overall, we interpret this as evidence consistent with the market quickly absorbing and pricing information.

Panel B provides further evidence using the multivariate framework from Table 4. We estimate the same model as Eq. (2) but the dependent variable uses various different CAR windows. For brevity, Panel B does not present estimates for the control variables, which are all included (including concurrent analyst revisions of ΔFFO, ΔPT, and ΔREC). Column one is the same as column 8 from Table 4 for reference. Columns 2 to 6 present the same regression using various CAR windows following the [0,+1] trading day window. A result consistent with post earnings announcement drift would predict a positive coefficient on ΔNAV, a result consistent with reversal would predict a negative coefficient on ΔNAV, and a result consistent with market efficiency and NAV presents information would predict an insignificant coefficient on ΔNAV. To alleviate the concern that the [+2,+7] trading day window is arbitrarily chosen, we examine various windows. Note that the number of observations decreases very slightly with the lengthening of the trading day window because we require each day of the CAR window to be non-missing. The coefficients on all trading day windows other than the announcement window [0,+1] are consistently indifferent from zero with very low t-statistics, suggestive of an efficient information transmission. Overall, our examination of post announcement window CARs produced results that are most consistent with the market efficiently incorporating the information contained in analyst estimates of NAV.

Robustness

This final section employs two different approaches to confirm the robustness of our results. First, we use alternative measures of the dependent and independent variables. Second, we further address alternative hypotheses. All results discussed in this section use the full vector of controls utilized in Eqs. (2) and (3) but do not report them for brevity.

Alternative Measures

Our analysis in the previous sections uses market adjusted returns with the return on the CRSP-Ziman Value Weighted REIT Index as the benchmark index. To alleviate the concern that this choice of index and computation of abnormal return might affects our findings, we repeat the multivariate analysis from Table 4 using two alternative definitions of abnormal return. First, instead of the value-weighted index, we use the equally weighted version of the CRSP-Ziman REIT Index. Second, as abnormal returns we compute residuals from the market model using the Fama and French (1993) three factor model approach. We then compute the cumulative abnormal return over the two-day [0,+1] window. Panel A of Table 7 presents the results. The coefficient on ΔNAV continues to be positive and significant. Our results therefore are robust to the choice of index and method used to compute the abnormal returns dependent variable.

The analyses in previous sections use the percentage change for the NAV and price target analyst revision variables and they use FFO revisions scaled by firm gross total assets. To examine whether results are sensitive to a different computation of these variables, we repeat the multivariate analysis from Tables 4 and 5, columns (7) and (8), using two different alternative calculations of those variables. First, we simply calculate the raw change of each variable. Second, we scale the each change by the stock price three days preceding the revision. We scale by stock three days preceding the revision to ensure the price is not affected by the revision itself. This scalar is used by Park and Stice (2000) in a similar context. Table 7, Panel B presents the results of this analysis. For columns 1 and 2, the independent variable is ΔNAV and for columns 3 and 4 the independent variable is │ΔNAV│. In all specifications, coefficients of NAV revisions remain positive and significant. We conclude that specification of the revision variables is not critical to the finding of the existence of information content in NAV revisions.

An additional robustness test examines positive and negative analyst NAV revisions separately. While our previous investigation looked at positives versus negatives in a univariate setting, this robustness examination compares the two using the multivariate context. We repeat our primary regressions (Tables 4 and 5) using separate variables for positive and negative revisions (ΔNAV+ and ΔNAV-). ΔNAV+ (ΔNAV-) is equal to ΔNAV when ΔNAV is positive (negative) and set to zero when ΔNAV is negative (positive). When ABTURN [0,+1] is the dependent variable, we take the absolute value of ΔNAV- (ΔNAV+ is already always positive or zero by definition).

Results from these tests are displayed in Table 7, Panel C. In all specifications, the coefficients on both positive and negative revisions is statistically significant. In Table 3, we documented an asymmetry in the market reaction for abnormal turnover at the univariate level, where the response was greater to negative revisions than positive ones. This relation continues to hold in the multivariate specification without fixed effects. However, in the full model (column 4), the coefficient on positive and negative are almost identical. For CARs, in the full model, it appears there is a greater response to negative revisions than positive ones. Overall, the results are robust across various alternative measures of key variables.

Alternative Hypotheses

Lastly, we pursue a more sophisticated analysis to increase the confidence we can rule out the possibility that the piggybacking and price discovery hypotheses explain our results. In our setting, both hypotheses would predict that prices change before NAV revisions. We do not reject either of these hypotheses. Rather, we believe based on the evidence of previous literature that it is likely both are present. Our strategy, therefore, is not to confirm our hypothesis and reject the others. Instead, our goal is to isolate the component of analyst NAV revisions that present information relevant to investors.

Our strategy for isolating this information closely follows Loh and Stulz’s (2011) treatment of the piggybacking hypothesis. We examine the [−2,-1] day trading window return preceding revisions and remove observations that have influential pre-revision returns. We define these observations as those whose [−2,-1] return exceeds \( 1.96\times \sqrt{2}\times {\sigma}_{\varepsilon } \), where σε is the firm’s idiosyncratic volatility defined as the standard deviation of residuals from a daily estimation of the three-factor Fama-French model using the prior three-month firm returns. We also ensure the price movement preceding the NAV revision is in the same direction of the NAV revision. The goal of this design is to identify observations with significant price movements prior to analysts’ revisions of NAV. The intuition is that large price movements preceding an analyst revision increase the likelihood that prices lead NAVs, whether it be due to the piggybacking hypothesis or the price discovery hypothesis.

Panel D of Table 7 repeats the multivariate analyses of Tables 4 and 5 (columns 7 and 8) using this refined subsample. Of the 10,863 NAV revisions, we remove 739 of them flagged as having influential pre-revision price movements. The resulting subsample contains 10,124 revisions. The results show that the relation between the dependent variables for market reaction (CAR [0,+1] and ABTURN [0,+1]) and NAV revisions is robust to the exclusion of these observations. Furthermore, there is little difference between the ΔNAV coefficients in Table 7 and those in Tables 4 and 5, suggesting these revisions were not distorting our inference in the primary analysis.

Conclusion

This paper provides evidence that analyst revisions of estimates of REIT NAVs convey new information to the securities market. We find that there is a significant market reaction to these revisions as measured by both stock returns and trading volume, even after controlling for other analyst-estimated variables (recommendations, price targets, FFO forecasts). This suggests that analysts’ value estimates contain fresh information not conveyed in those other forecasts. The market response appears to quickly reflect the incremental information conveyed by the value revisions, occurring mostly on the day of the revision announcement and tapering to finish by the next day. We rule out alternative hypotheses and include additional analysis that supports the robustness of our findings.

REITs are an interesting laboratory to explore the information content of value estimates because analysts do not release such estimates for industrial firms. While a majority of the real estate literature uses analyst consensus NAV estimates as a proxy for the private market pricing of real estate, we evaluate them from the point of view of their original intent: analysts producing information about the value of the REIT to REIT investors. Further research is needed to develop our understanding of REIT NAVs from this perspective.

Notes

Prior work is ample. Studies of earnings forecasts include Givoly and Lakonishok (1979), Elton et al. (1981), Imhoff and Lobo (1984), Cornell and Landsman (1989), Stickel (1991), Peterson and Peterson (1995), and Beaver et al. (2008). Work addressing price targets includes Brav and Lehavy (2003), Asquith et al. (2005) and Gleason et al. (2013). Examinations of buy/sell recommendations include Womack (1996), Francis and Soffer (1997), Elton et al. (1986), Jegadeesh et al. (2004), Howe et al. (2009), Loh and Stulz (2011), and Green et al. (2014).

Analyst NAVs also incorporate other REIT assets and liabilities which we discuss further in the paper. However, a REIT’s properties are the dominant source of asset value.

FFO is a more relevant number than EPS for REITs, so we use analysts’ FFO forecasts.

There are other adjustments that analysts make when estimating NAVs. For example, REITs usually hold some non-real-estate assets (e.g. cash), they may have some non-real-estate operating income from a taxable REIT subsidiary, and non-cash flow producing real estate (e.g. construction in progress) is valued. However, the cash flow producing property portfolio is the major component of the NAV estimate.

We thank an anonymous reviewer for this insight.

The inclusion or exclusion of these analyst control variables has no significant impact on our results.

FFO forecasts are not percentage changes because FFO forecasts are sometimes negative (and often close to 0) making percentage change impossible.

We use only recommendation changes, not recommendation reaffirmations, as they do not change the consensus recommendation value.

An alternative empirical method would be to include all REIT-days in regression analysis and retain observations where ΔNAV is equal to zero. However, most information content papers focus only on days with analyst revisions. We repeat all regressions in this paper using all REIT-days and our results are robust to this empirical specification.

Yavas and Yildirim (2011) find that price discovery generally occurs in the securitized market but also note this relation is not absolute and they find variation in the direction of price discovery by property type and firm. Our research question, sample period, empirical strategy, and treatment of the data varies significantly from theirs.

For each screen applied, our results are robust to removing observations within a [−2,+2] trading day window of the flagged events.

References

Altınkılıç, O., & Hansen, R. S. (2009). On the information role of stock recommendation revisions. Journal of Accounting and Economics, 48(1), 17–36.

Altınkılıç, O., Balashov, V. S., & Hansen, M. R. S. (2013). Are analysts’ forecast informative to the general public? Management Science, 59(11), 2550–2565.

Anderson, R., Clayton, J., Mackinnon, G., & Sharma, R. (2005). REIT returns and pricing: the small cap value stock factor. Journal of Property Research, 22(04), 267–286.

Asquith, P., Mikhail, M. B., & Au, A. S. (2005). Information content of equity analyst reports. Journal of Financial Economics, 75(2), 245–282.

Ball, R., & Brown, P. (1968). An empirical evaluation of accounting income numbers. Journal of Accounting Research, 6(2), 159–178.

Barkham, R., & Geltner, D. (1995). Price discovery in American and British property markets. Real Estate Economics, 23(1), 21–44.

Barkham, R., & Ward, C. (1999). Investor sentiment and noise traders: discount to NAV in listed property companies in the UK. Journal of Real Estate Research, 18(2), 291–312.

Beaver, W., Cornell, B., Landsman, W. R., & Stubben, S. R. (2008). The impact of analysts’ forecast errors and forecast revisions on stock prices. Journal of Business Finance and Accounting, 35(5/6), 709–740.

Bondt, D., Werner, F. M., & Thaler, R. (1985). Does the stock market overreact? Journal of Finance, 40(3), 793–805.

Boudry, W. I., Kallberg, J. G., & Liu, C. H. (2010). An analysis of REIT security issuance decisions. Real Estate Economics, 38(1), 91–120.

Boudry, W. I., Kallberg, J. G., & Liu, C. H. (2011). Analyst behavior and underwriter choice. The Journal of Real Estate Finance and Economics, 43(1–2), 5–38.

Bradley, D., Jordan, B., & Ritter, J. (2008). Analyst behavior following the IPO: the ‘bubble period’ evidence. Review of Financial Studies, 21(1), 101–133.

Bradley, D., Clarke, J. L., & Ornthanalai, C. (2014). Are analysts’ recommendations informative? Intraday evidence on the impact of time stamp delays. Journal of Finance, 69(2), 645–673.

Bradshaw, M. T., Brown, L. T., & Huang, K. (2013). Do sell-side analysts exhibit differential target price forecasting ability? Review of Accounting Studies, 18(4), 930–955.

Brav, A., & Lehavy, R. (2003). An empirical analysis of analysts’ target prices: short-term informativeness and long-term dynamics. Journal of Finance, 58(5), 1933–1968.

Brounen, D., Ling, D. C., & Prado, M. P. (2013). Short sales and fundamental value: explaining the REIT premium to NAV. Real Estate Economics, 41(3), 481–516.

Capozza, D. R., & Lee, S. (1995). Property type, size, and REIT value. Journal of Real Estate Research, 10(4), 363–379.

Chau, K. W., MacGregor, B. D., & Schwann, G. M. (2001). Price discovery in the Hong Kong real estate market. Journal of Property Research, 18(3), 187–216.

Chiang, K. C. (2009). Discovering REIT price discovery: a new data setting. The Journal of Real Estate Finance and Economics, 39(1), 74–91.

Chen, Q., Francis, J., & Jiang, W. (2005). Investor learning about analyst predictive ability. Journal of Accounting and Economics, 39(1), 3–24.

Clayton, J., & MacKinnon, G. (2001). The time-varying nature of the link between REIT, real estate and financial asset returns. Journal of Real Estate Portfolio Management, 7(1), 43–54.

Cornell, B., & Landsman, W. R. (1989). Security price response to quarterly earnings announcements and analysts' forecast revisions. The Accounting Review, 64(4), 680–692.

Devos, E., Ong, S. E., & Spieler, A. C. (2007). Analyst activity and firm value: evidence from the REIT sector. Journal of Real Estate Finance and Economics, 35(3), 333–356.

Doran, J. S., Peterson, D. R., & Price, S. M. (2012). Earnings conference call content and stock price: the case of REITs. The Journal of Real Estate Finance and Economics, 45(2), 402–434.

Downs, D., & Güner, N. (2006). On the quality of FFO forecasts. Journal of Real Estate Research, 28(3), 257–274.

Elton, E. J., Gruber, M. J., & M., & Gultekin, M. (1981). Expectations and share prices. Management Science, 27(9), 975–987.

Elton, E. J., Gruber, M. J., & Grossman, S. (1986). Discrete expectational data and portfolio performance. Journal of Finance, 41(3), 689–713.

Fama, E. F., & French, K. R. (1993). Common risk factors in the return on stocks and bonds. Journal of Financial Economics, 33(1), 3–56.

Francis, J., & Soffer, L. (1997). The relative informativeness of analysts’ stock recommendations and earnings forecast revisions. Journal of Accounting Research, 35(2), 193–211.

French, D. W., & Price, S. M. (2018). Depreciation-related capital gains, differential tax rates, and the market value of real estate investment trusts. Journal of Real Estate Finance and Economics, 57(1), 43–63.

Givoly, D., & Lakonishok, J. (1979). The information content of financial analysts’ forecasts of earnings: some evidence on semi-strong inefficiency. Journal of Accounting and Economics, 3, 165–185.

Gleason, C. A., Johnson, W. B., & Li, H. (2013). Valuation model use and price target performance of sell-side equity analysts. Contemporary Accounting Research, 30(1), 80–115.

Graham, B., & Dodd, D. (1951). Security analysis. New York: McGraw-Hill.

Green, T. C., Jame, R., Markov, S., & Subasi, M. (2014). Access to management and the informativeness of analyst research. Journal of Financial Economics, 114(2), 239–255.

Hardin III, W., Huang, G., Liano, K., & Pan, M. (2019). Firm and industry informational content from REIT FFO announcements. Journal of Property Research, 36(2), 131–152.

Howe, J. S., Unlu, E., & Yan, X. (2009). The predictive content of aggregate analyst recommendations. Journal of Accounting Research, 47(3), 799–821.

Imhoff, E. A., & Lobo, G. J. (1984). Information content of analysts’ composite forecast revisions. Journal of Accounting Research, 22(4), 541–554.

Jegadeesh, N., Kim, J., Krische, S. D., & Lee, C. M. C. (2004). Analyzing the analysts: when do recommendations add value? Journal of Finance, 59(3), 1083–1124.

Kim, D., & Wiley, J. A. (2019). NAV premiums & REIT property transactions. Real Estate Economics, 47(1), 138–177.

Ling, D. C., & Naranjo, A. (2015). Returns and information transmission dynamics in public and private real estate markets. Real Estate Economics, 43(1), 163–208.

Llorente, G., Michaely, R., Saar, G., & Wang, J. (2002). Dynamic volume-return relation of individual stocks. The Review of Financial Studies, 15(4), 1005–1047.

Loh, R. K., & Stulz, R. M. (2011). When are analyst recommendations influential? Review of Financial Studies, 24(2), 593–627.

Loh, R. K., & Stulz, R. M. (2018). Is sell-side research more valuable in bad times? The Journal of Finance, 73(3), 959–1013.

Malmendier, U., & Shanthikumar, D. (2007). Are small investors naive about incentives?. Journal of Financial Economics, 85(2), 457–489.

Myer, F. N., & Webb, J. (1993). Return properties of equity REITs, common stocks, and commercial real estate: a comparison. Journal of Real Estate Research, 8(1), 87–106.

Oikarinen, E., Hoesli, M., & Serrano, C. (2011). The long-run dynamics between direct and securitized real estate. Journal of Real Estate Research, 33(1), 73–103.

Park, C. W., & Stice, E. K. (2000). Analyst forecasting ability and the stock price reaction to forecast revisions. Review of Accounting Studies, 5(3), 259–272.

Peterson, D. R., & Peterson, P. P. (1995). Abnormal returns and analysts’ earnings forecast revisions associated with the publication of “stock highlights” by value line investment survey. Journal of Financial Research, 18(4), 465–477.

Price, S. M., Gatzlaff, D. H., & Sirmans, C. F. (2012). Information uncertainty and the post-earnings-announcement drift anomaly: insights from REITs. The Journal of Real Estate Finance and Economics, 44(1–2), 250–274.

Price, S. M., Seiler, M. J., & Shen, J. (2017). Do investors infer vocal cues from CEOs during quarterly REIT conference calls? The Journal of Real Estate Finance and Economics, 54(4), 515–557.

Stickel, S. E. (1991). Common stock returns surrounding earnings forecast revisions: more puzzling evidence. The Accounting Review, 66(2), 402–416.

Vincent, L. (1999). The information content of funds from operations (FFO) for real estate investment trusts (REITs). Journal of Accounting and Economics, 26(1), 69–104.

Williams, C. (2015). Asymmetric responses to earnings news: a case for ambiguity. Accounting Review, 90(2), 785–817.

Womack, K. (1996). Do brokerage analysts’ recommendations have investment value? Journal of Finance, 51(1), 137–167.

Yavas, A., & Yildirim, Y. (2011). Price discovery in real estate markets: a dynamic analysis. The Journal of Real Estate Finance and Economics, 42(1), 1–29.

Yunus, N., Hansz, J. A., & Kennedy, P. J. (2012). Dynamic interactions between private and public real estate markets: some international evidence. Journal of Real Estate Finance and Economics, 45(4), 1021–1040.

Acknowledgments

The authors would like to thank our anonymous referees, research workshop participants at the University of Missouri, and participants at the following conferences: American Real Estate Society Annual Meeting (2018), European Real Estate Society Annual Meeting (2018), European Financial Management Association Doctoral Consortium (2018), Baruch College Research Symposium (2018), American Accounting Association Annual Meeting, San Diego (2017), IPAG 4th Paris Financial Management Conference (2016) and Southwestern Finance Association Annual Meeting, Little Rock (2016). We also acknowledge funding from the Jeffrey E. Smith Institute of Real Estate (Chacon and French).

Availability of Data and Material

All data comes from standard data sources (SNL Financial, Compustat, IBES, and CRSP) and is not deposited in a repository.

Funding

This study was partially funded by the Jeffrey E. Smith institute of Real Estate at the University of Missouri.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of Interest/Competing Interest

The authors declare that they have no conflict of interest.

Consent for Publication

All authors consent for publication.

Code Availability

Custom code was used for this project.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Chacon, R.G., French, D.W. & Pukthuanthong, K. The Information Content of NAV Estimates. J Real Estate Finan Econ 63, 598–629 (2021). https://doi.org/10.1007/s11146-020-09760-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-020-09760-x