Abstract

Oil is the basic factor of economic development, and its impacts of international crude oil market on stock markets have attracted wide attention from scholars. Based on the historical data of stock markets in China and the United States and international crude oil price during January 2003–December 2016, this paper employs the Vector Auto Regression-Generalized Auto Regressive Conditional Heteroskedasticity (VAR-GARCH) model to explore the mean and volatility spillover effects between international crude oil market and stock market. The results show that, first, there are two-way mean spillover effects between the US stock market and international crude oil market, while only one-way volatility effects from international crude oil market to the US stock market. Second, only one-way mean spillover effects from international crude oil market to Chinese stock market, and there is no evidence of volatility spillover effects between Chinese stock market and international crude oil market. The relationship between international crude oil price and China’s stock market shows a gradual strengthening trend, the linkage between them should not be ignored.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

As the basic energy of economic development, oil plays an important role in economic development. In recent years, the international crude oil price fluctuates substantially, take the West Texas Intermediate Crude Oil price (WTI) as an example (Fig. 1), since twenty-first Century, affected by the Iraq war, the global financial crisis and the dollar exchange rate and other factors, there has been a great volatility in the international crude oil price (Zhang and Zhang 2015; Zhang et al. 2015; Zhang and Yao 2016).Because of the importance of oil in regional economic development, its price fluctuation will have a profound impact on regional economic development. Oil not only has the traditional resource attributes, with the improvement of oil futures market and the use of oil derivatives, financial attribute of oil has become increasingly prominent (Zhang and Sun 2016). As an important raw material for industrial production, the price increase of oil will reduce the profit space of enterprises, and will directly affect the output of enterprises, which will affect the development of a country’s economy. The dividend discount model of stock price shows that the stock market is related to the operation of an enterprise, and it is also a reflection of the national economy. Therefore, as a barometer of macroeconomy, the stock market will also be affected by international crude oil price fluctuations (Zhang and Wei 2011; Awartani and Maghyereh 2013; Chang et al. 2013; Broadstock and Filis 2014).

With China’s rapid economic growth, oil consumption demand is growing. However, owing to China’s ‘‘rich coal, oil-poor, less gas’’ energy storage characteristics, China’s annual crude oil imports in 2016 exceeded the United States for the first time, becoming the world’s largest net importer crude oil, foreign dependence reached 65.4%. China is still in the “emerging plus transition” stage, there are still many problems in China stock market, such as the high percentage of individual investors, investment philosophy is not mature enough, higher stock market turnover and higher speculation, more prone to “herding effect” and other excessive effects (Demirer et al. 2010). Based on the above China’s oil consumption and actual development of the stock market, it has great significance for the government to maintain the stability of the stock market and make energy policy through exploring the linkages between the international crude oil price and the Chinese stock market. By contrast, as the commanding point of the global economy, the stock market of the United States is relatively mature and perfect. Through the comparative study of the spillover effects between international crude oil market and the stock markets in China and the United States, revealing whether international crude oil market has different effects on the stock markets with different degrees of development. Meanwhile, China’s oil pricing mechanism that oil prices are linked with international oil price needs further reform, to play a better role in the allocation of price on resources, it can also provide a reference for China’s oil market reform through the comparative study.

2 Literature review

From the beginning of 1980s, a large number of scholars have conducted the research on the relationship between international oil price and the stock market, there are abundant research achievements, mainly focus on three aspects, the overall relationship between international oil price and the stock market, changes between international oil price and the stock market before and after the economic crisis, and influence of international crude oil price fluctuations on different industries.

In initial studies, price of oil was used as the influence factor of stock pricing, which was introduced into the variable factor model (Chen et al. 1986; Hamao 1988; Ferson and Harvey 1994; Kaneko and Lee 1995).However, the study of oil price and stock price as the main research content began in the mid and late 1990s, and most of them focus on the spillover effects of oil price and stock market. Sadorsky (1999) used vector autoregressive (VAR) model to study the relationship between oil price and the stock market, the results show that oil prices and fluctuations play an important role in the impact of stock returns, the oil price fluctuations can account for a certain percentage of the stock returns prediction error variance, and the impact of oil price shocks on the economy shows asymmetric characteristics, that is, the impact of rising oil prices is greater than that falling oil prices. There are also different conclusions about spillover effects between oil price and stock markets due to different research methods and selected research objects. Chang et al. (2013) used CCC, VARMA-GARCH and VARMA-AGARCH model to analyze conditional relationship and volatility spillover effect between international crude oil price and stock returns, found that the volatility spillover effect between crude oil prices and financial markets is very weak. Based on daily and monthly data, Kang et al. (2015) studied influence of oil price shocks on the covariance between U.S. stock market returns and volatility, found that there are significant spillover effects of oil price volatility and covariance between stock market returns and volatility. In addition, some other scholars have come to similar conclusions, supporting that there is a significant spillover effect between oil market and stock markets (Broadstock and Filis 2014; Du and He 2015; Khalfaoui et al. 2015; Ewing and Malik 2016; Liu et al. 2017; Boubaker and Raza 2017; Mensi et al. 2017).

All of the above studies are about oil market and developed countries, while some scholars have studied the impact of oil price on emerging stock markets. Based on data of stock market in GCC countries, Awartani et al. (Awartani and Maghyereh 2013) explored returns volatility spillover effects of oil price and stock market, using a new spillover effect measurement method proposed by Diebold and Yilmaz (2009, 2012), results show that there are two-way returns and volatility spillover effects in two markets, which are asymmetrical. In the information transmission mechanism between oil market and stock market, oil price is dominant. Zhu et al. (2014) studied impact of oil price on Asia–Pacific stock markets, found that interdependent relationships between crude oil prices and the Asia–Pacific stock markets are weak.

Along with further research, some scholars have found that impacts of financial crisis on spillover effect between oil market and stock market can not be ignored. Zhu et al. (2014) found that before the global financial crisis, the relationship between crude oil prices and the Asia Pacific stock market returns is relatively weak, and after the crisis, this dependence increased significantly. Bouri (2015) used variance causal analysis method to study the difference between international crude oil price and risk spillover effect of the Jordanian stock market before and after the financial crisis. It was found that spillover effect between the two markets was very weak before the crisis, and after the crisis, there is a one-way spillover effect from international crude oil market to stock market. Wen et al. (2012) and Zhu et al. (2014) found that after the economic crisis, interdependence between crude oil market and stock market was significantly enhanced. However, some other studies show that during the financial crisis, relationship between oil market and financial market was significantly enhanced, this relationship will be weakened after the crisis (Chen and Lv 2015; Kang et al. 2017).

In addition, some scholars have studied relationships between oil market and stock market in some specific industries. Bondia et al. (2016) studied relationships between international crude oil prices and stock price of clean energy companies. The results show that oil prices have a significant impact on the stock price of alternative energy companies in the short term, but little impact in the long run. Singhal and Ghosh (2016) studied returns and volatility linkages between international crude oil price, metal and other stock indices in India, found that direct volatility spillover effects of oil markets on the Indian stock market is not significant at the aggregate level, while it is significant in case of auto, power finance sector. Some scholars have studied contagion effect of international crude oil price volatility on the stock market investor sentiment from the perspective of market participants. Ding et al. (2017) found that oil price fluctuations significantly Granger cause Chinese stock market investor sentiment, and oil price volatility has negative Contagion effectiveness on stock market investor sentiment.

From the literature review above, we can find that scholars have extensively studied impacts of oil market on stock market in main developed countries and regions, while little research on the emerging stock market, especially few studies about China’s stock market, lack of comparative analysis about different impacts of international crude oil prices on developed and emerging stock markets.

3 Data and research framework

3.1 Data selection

The Shanghai and Shenzhen 300 Index (HS300), the S&P 500 index (SP500) were selected to depict the trend of Chinese and the US stock market respectively, US West Texas Intermediate Crude Oil (WTI) price was selected to represent the trend of international oil price. Research data in this paper are all from Wind data base. Due to differences in the date of each market transaction, this paper eliminated misaligned observation data of the trading day. Therefore, considering the availability of data, the sample observation interval in this paper is from January 2, 2003 to December 23, 2016, a total of 3277 observation periods.

3.1.1 Statistical description of returns

First of all, logarithmic returns of stock market and oil price were described, the calculation is as formula 1.

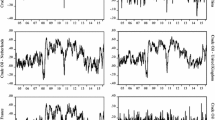

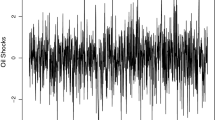

Among them, i = 1, 2, r 1,t , r 2,t represent returns of stock market and oil price in the t period respectively, P i,t , P i,t−1 represent closing prices of index in the t and t − 1 periods respectively. Returns of oil prices, China’s stock market and the U.S. stock market are shown in Fig. 2.

Table 1 presents a statistical description of returns of stock market and oil prices. Looking from the mean value, China’s stock market is the largest, while oil market is the smallest. From the standard deviation, volatility of the oil market is the largest, China’s stock market follows, the U.S. stock market is the smallest. From the maximum and minimum value, extreme value of the oil market is higher than that of Chinese and the US stock market. Finally, from the JB statistic, skewness coefficient and kurtosis coefficient, returns of oil market, Chinese and the US stock market are left distribution, with peakcharacteristics. These features can also be seen in Fig. 2.

3.1.2 Test of returns

In order to avoid spurious regression problem, the stationarity of the return series was tested before model estimation. The ADF test was used to test the unit root of the return sequence, with no trend and no constant term. The results show that stock market and oil price return are stable at the significance level of 1%, and the results are shown in Table 2.

Sequence autocorrelation usually exists in financial asset returns.The Q-statistic of Ljung–Box with 20 periods of delay was used to test the stock market and oil price returns. At the 1% significance level, the original hypothesis that there is no sequence autocorrelation is rejected, which indicates that there is significant autocorrelation in the stock market and oil price returns.

There are two ways to test the ARCH effect of the return series: one is to test the autocorrelation of the residual sequence square in the mean equation, and the other is to test the return series by ARCH-LM test. According to the Q2 (20) statistics in Table 2, we can see that the ARCH effect exists in the residuals, and the same results are obtained by ARCH-LM test for the lag of 5 and 10 order.

3.2 Model construction

In this paper, the VAR-GARCH-BEKK model was used to test spillover effects between international oil market and China’s stock market, international oil market and the U.S. stock market.

First, VAR model was used to estimate mean spillover effect, and then based on the residual of VAR, BEKK model was used to estimate volatility spillover effect. VAR model was set as follows:

Among them, i = 1, 2, r 1,t , r 2,t represent returns of stock market and oil price in the t period respectively, c 1 , c 2 are constant terms, \(\theta ,\phi\) are the lag coefficient estimations, ɛ represent the residuals.

When θ is not all equal to 0, it shows that lags of stock market and oil price returns have impacts on their own current returns. When ϕ is not all equal to 0, indicating that lags of stock market and oil price returns have impacts oneach other’s current returns, means that the current market’s returns will be affected by another market’s returns of previous period. At this point, mutual impacts between stock market and oil price returns can be determined through the size and significance of ϕ, and mean spillover effects between the two markets can be determined through the Grainger causality test.

Although there are many possibilities in BEKK(p,q),most studies have shown that BEKK (1,1) is sufficient to fit the volatility of multiple financial asset returns.The binary BEKK of stock market and oil prices was set as follows:

Among them, \(H_{t} = \left[ {\begin{array}{*{20}c} {h_{11,t} } & {h_{12,t} } \\ {h_{21,t} } & {h_{22,t} } \\ \end{array} } \right]\), are conditional variance and covariance matrix of stock market and oil price in the tperiod. h 11,t , h 22,t represent conditional variance of stock market and oil price respectively, h 12,t , h 21,t represent conditional covariance of stock market and oil price respectively. C is the upper triangular matrix, a constant parameter estimation. A is the ARCH coefficient, the main diagonal items reflect the stock market and oil prices of their respective ARCH effect, the non-main diagonal term indicates the ARCH volatility spillover of the two markets. B is the GARCH coefficient, the main diagonal items reflect the stock market and oil prices of their respective GARCH effect, the non-main diagonal term indicates the GARCH volatility spillover of the two markets. There are a total of 11 parameters to be estimated in A, B, C, the specific forms are as follows.

Expand the formula (3) to obtain the specific form of conditional variance and covariance:

From the formulas (5), (6), (7) we can see that volatility of stock market and oil prices comes from two aspects: first, their own residuals, the other residuals and mutual influence, that is ARCH item in the former bracket of formulas (5), (6). Second, their own fluctuations in the previous period, the other fluctuations in the previous period and mutual influence, that is GARCH item in the latter bracket of formulas (5), (6).

When a 12 = b 12 = 0, indicating fluctuations of stock market are only affected by its early residuals and fluctuations, no volatility spillover effect from oil prices to stock market. When a 21 = b 21 = 0, indicating fluctuations of oil prices are only affected by its early residuals and fluctuations, no volatility spillover effect from stock market to oil prices. When a 12 = b 12 = 0 and a 21 = b 21 = 0 at the same time, indicating no volatility spillover effect between stock market and oil prices.

Finally, the autocorrelation test of standardized residuals instock market and oil price was carried out to ensure the adequacy of the model fitting.

4 Empirical analysis

4.1 Spillover effects of U.S. stock market and international crude oil market

Spillover effect was estimated in two steps, the first is the mean spillover effect estimation, using the VAR model; the second is the volatility spillover effect estimation, using the BEKK model, the data from the residuals in the VAR estimation equation.

4.1.1 Mean spillover effect estimation

Using AIC, SC, HQ, FPE information criterion to determine lag orders of VAR model. In the lag 6 order, the information criterion values of each lag period are shown in Table 3. The optimal lag period of AIC, HQ and FPE is 5, that of SC is 1. Generally, the AIC lag criterion is chosen as the optimal one, so the model with lags of 5 was selected.

The estimated results are shown in Table 4.

From the estimation coefficient, we can see that returns of the U.S. stock market and oil price are significantly affected by their own lags. Among them, lag 1 period, 2 period and 5 period of stock market returns have significant impacts on its current returns, lag 1 period, 4 period and 5 period of oil price returns have significant impacts on its current returns. From the interrelationship, lag 4 and 5 periods of oil price returns have significant impacts on stock market returns, while lag 1–3 periods of stock market returns have significant impacts on oil price returns. Then the Granger causality test was used to determine whether mean spillover effect exists between stock market and oil prices. The results of mean spillover effect test are shown in Table 5.

The two mean spillover tests both reject the original hypothesis, indicating that the US stock market has significant impacts on oil market, and oil market also has significant impacts on the US stock market, there are significant two-way mean spillover effects between the two markets.

4.1.2 Volatility spillover effect estimation

As with most studies, it is assumed that the residuals obey the normal distribution. After 36 iterations, the model converges, and after adjusting the steady variance of HAC, the coefficients are estimated, as shown in Table 6. The model tests are shown in Table 7, the autocorrelation test is carried out on standardized residuals and residuals square of estimated stock market and oil price. At the 1% significance level, the original hypothesis can not be rejected, indicating no sequence autocorrelation in the residuals of stock market and oil price, the information extraction is complete and the model is fitted adequately.

BEKK estimation results show that, in the conditional variance equation, a 11 , a 22 , b 11 , b 22 are significant at the 1% level, indicating that there is volatility agglomeration in the US stock market and oil market. a 12 is near 0 and the coefficient is not significant at any level, b 12 is significant at the 5% level, indicating that there is ARCH volatility spillover from fluctuations of oil market in the early period to current US stock market, no GARCH volatility spillover. a 21 , b 21 are not significant at any level, indicating that there is no significant effects of US stock market in the early periodon current oil market, no volatility spillover from stock market to oil market. From the initial coefficient analysis, we can see that there is volatility agglomeration in the US stock market and oil market, and there is one-way volatility spillover from oil market to US stock market.

The Wald test is used to test the matrix elements of volatility spillover effect, which is the joint test for the significance of the model coefficients.

From the volatility spillover test in Table 8, we can see that there is no volatility spillover from US stock market to oil market, while there is significant volatility spillover from oil market to US stock market. The one-way volatility spillover effect between the US stock market and oil market is verified.

4.1.3 Summary of spillover effect analysis

During the observation periods, spillover effect between the U.S. stock market and oil market has the following characteristics: about mean spillover, there is two-way mean spillover effect between the U.S. stock market and oil market, lag 4 and 5 periods of oil price returns have significant impacts on stock market returns, while lag 1–3 periods of stock market returns have significant impacts on oil price returns. About volatility spillover, there is only one-way volatility spillover from oil market to the U.S. stock market.

The United States is the world’s largest economy and the largest oil consuming country, the American economic situation has strong impacts on international oil prices. The U.S. stock market is very mature and effective, can effectively reflect the future economic situation, thus affecting the oil demand. Therefore, there is a strong linkage between international crude oil prices and the U.S. stock market.

4.2 Spillover effects of Chinese stock market and international crude oil market

4.2.1 Mean spillover effect estimation

Using AIC, SC, HQ, FPE information criterion to determine lag orders of VAR model. In the lag 8 order, the information criterion values of each lag period are shown in Table 9. The optimal lag period of AIC and FPE is 7, that of HQ and SC is 1. Generally, the AIC lag criterion is chosen as the optimal one, so the model with lags of 7 was selected.

The estimated results are shown in Table 10.

From the estimation coefficient, we can see that returns of Chinese stock market and oil price are significantly affected by their own lags. Among them, lag 3–7 periods of stock market returns have significant impacts on its current returns, lag 1 period, 4 period and 5 period of oil price returns have significant impacts on its current returns. From the interrelationship, lag 1 and 7 periods of oil price returns have significant impacts on stock market returns, while lag 3 period of stock market returns have impacts on oil price returns. Then the Granger causality test was used to determine whether mean spillover effect exists between stock market and oil prices.

From the mean spillover effect test in Table 11, it can be seen that there is only one-way mean spillover from Chinese oil market to international oil market, while no mean spillover from Chinese stock market to the international oil market.

4.2.2 Volatility spillover effect estimation

It is assumed that the residuals obey the normal distribution. After 69 iterations, the model converges, and after adjusting the steady variance of HAC, the coefficients are estimated, as shown in Table 12. The model testsare shown in Table 13, the autocorrelation test is carried out on standardized residuals and residuals square of estimated stock market and oil price, At the 1% significance level, the original hypothesis cannot be rejected, indicating no sequence autocorrelation in the residuals of stock market and oil price, the information extraction is complete and the model is fitted adequately.

BEKK estimation results show that, in the conditional variance equation, a 11 , a 22 , b 11 , b 22 are significant at the 1% level, indicating that there is volatility agglomeration in the US stock market and oil market. a 12 and b 12 are significant at the 5% level, indicating that fluctuations of oil market in the early period have impacts on current Chinese stock market, but impacts are not significant, indicating that there are not significant volatility spillover from oil market to Chinese stock market. a 21 , b 21 are not significant at any level, indicating that there is no significant effects of US stock market in the early periodon current oil market, no volatility spillover from stock market to oil market. There is volatility agglomeration in Chinese stock market and oil market, and there is one-way volatilityspillover from oil market to Chinese stock market.

The Wald test is used to test the matrix elements of volatility spillover effect, which is the joint test for the significance of the model coefficients.

From the volatility spillover test in Table 14, we can see thatat any significant level, the original hypothesis can not be rejected, which indicates that there is no significant volatility spillover effect between Chinese stock market and oil market.

4.2.3 Summary of spillover effect analysis

During the observation periods, spillover effect between Chinese stock market and oil market has the following characteristics: about mean spillover, there is only one-way mean spillover effect from oil market to Chinese stock market, is mean spillover two-way, lag 1 and 7 periods of oil price returns have significant impacts on Chinese stock market returns. Although lag 3 period of stock market returns have impacts on oil price returns, the impacts are not significant. Overall, there is no significant mean spillover from Chinese stock market to international oil market. About volatility spillover, there is no significant volatility spillover between Chinese stock market and international oil market.

The development of China’s stock market is not mature enough, the characteristics of policy market and higher speculative in China’s stock market have reduced spillover effects of the international crude oil prices on the stock market China, and the refined oil pricing mechanism in China is not fully market-oriented, so the correlation between Chinese refined oil prices and international crude oil prices is relatively low, also significantly reduces the impacts of international crude oil prices on China’s stock market. Therefore, most of the previous studies found that there is no spillover effect of international crude oil price on China’s stock market. But this study indicates that there is mean spillover effect from international crude oil prices to China’s stock market, which is related to the increasing dependence on foreign oil and improvement of effectiveness in China’s stock market. Especially in 2009, Chinese refined oil pricing mechanism reform achieved a major breakthrough in the linkage between Chinese oil prices and international oil price, and further enhanced the marketization of Chinese refined oil pricing mechanism. With the increase of linkages between Chinese oil prices and international oil price and rising effectiveness of stock market, mutual influence between international crude oil price and China’s stock market will become increasingly strong, linkages between the two can not be ignored.

5 Conclusions

In this paper, daily data from January 2, 2003 to December 23, 2016 were taken as samples to analyze spillover effects between international crude oil market and Chinese and American stock markets.The Shanghai and Shenzhen 300 Index returns, the S&P 500 index returns were selected to represent Chinese and the US stock marketreturns respectively, US West Texas Intermediate Crude Oil price was selected to represent international crude oil price.

The spillover effects of the US stock market and the oil market show that, there are two-way mean spillover effects between the US stock market and the oil market, while only one-way volatility effects from oil market to the US stock market. The spillover effects of Chinese stock market and the oil market show that, only one-way mean spillover effects from international oil market to Chinese stock market, and there is no evidence of volatility spillover effects between Chinese stock market and international oil market.

Compared with the U.S. stock market, linkage between international crude oil market and Chinese stock market is relatively weak. The main reasons for this phenomenon may be as follows: (1) There are drawbacks in Chinese oil pricing mechanism. Domestic refined oil began to monthly link with international market price from June 2000, and domestic refined oil prices are set by the National Development and Reform Commission (NDRC).When international oil price rises, taking into account the affordability of the economy, NDRC will limit rise in domestic oil prices, which will bring a certain degree of disjunction between domestic oil prices and international oil prices, leading to a problem that there is no significant impacts of international oil price changes on China’s economy. (2) China’s energy consumption is dominated by coal. In 2015, coal, oil and natural gas accounted for 64, 18.1 and 5.9% of Chinese total energy consumption respectively. While energy consumption structures of developed countries are mainly based on oil and gas, in 2015, coal, oil and natural gas accounted for 16, 36 and 29% of American total energy consumption. Chinese and American energy consumption structures are obviously different, in contrast, there are small effects of international crude oil market on Chinese economy. (3) Chinese stock market is not mature. At present, Chinese stock market participants have problems of investment philosophy, investors often do not consider long-term value investment, only to take short-term investment behavior. There is no direct relationship between the stock market participants’ future expectation of stock market and whether quoted companiesare profitable, but mainly focus on the participants’ ability to capture information in the news, which makes the investment ability of the stock market weaken and speculative behavior is excessive. Making Chinese stock market can not effectively reflect the reality of Chinese economic development, so Chinese stock market is not closely linked with international oil prices.

Based on the above reasons, although the linkage between international crude oil price and China’s stock market is relatively weak, with the reform of Chinese refined pricing mechanism, further improvement of oil price marketization, and rising effectiveness of China’s stock market, the mutual influence between international crude oil price and China’s stock market will be more intensive. If the linkage between the two is ignored, it is possible to underestimate the impacts of international crude oil price fluctuations on China’s economy, and it is not conducive for regulatory authorities to make scientific and rational policies.

References

Awartani B, Maghyereh AI (2013) Dynamic spillovers between oil and stock markets in the Gulf Cooperation Council Countries. Energy Econ 36:28–42

Bondia R, Ghosh S, Kanjilal K (2016) International crude oil prices and the stock prices of clean energy and technology companies: evidence from non-linear cointegration tests with unknown structural breaks. Energy 101:558–565

Boubaker H, Raza SA (2017) A wavelet analysis of mean and volatility spillovers between oil and BRICS stock markets. Energy Econ 64:105–117

Bouri E (2015) A broadened causality in variance approach to assess the risk dynamics between crude oil prices and the Jordanian stock market. Energy Policy 85:271–279

Broadstock DC, Filis G (2014) Oil price shocks and stock market returns: new evidence from the United States and China. J Int Financ Mark Inst Money 33:417–433

Chang C, McAleer M, Tansuchat R (2013) Conditional correlations and volatility spillovers between crude oil and stock index returns. North Am J Econ Financ 25:116–138

Chen Q, Lv X (2015) The extreme-value dependence between the crude oil price and Chinese stock markets. Int Rev Econ Financ 39:121–132

Chen NF, Roll R, Ross SA (1986) economic forces and the stock market. J Bus 59(3):383–403

Demirer R, KutanA M, Chen C (2010) Do investors herd in emerging stock markets?: Evidence from the Taiwanese market. J Econ Behav Organ 76(2):283–295

Diebold FX, Yilmaz K (2009) Measuring financial asset return and volatility spillovers, with application to global equity markets*: Koç University-TUSIAD Economic Research Forum Working Papers

Diebold FX, Yilmaz K (2012) Better to give than to receive: predictive directional measurement of volatility spillovers. Int J Forecast 28(1):57–66

Ding Z, Liu Z, Zhang Y et al (2017) The contagion effect of international crude oil price fluctuations on Chinese stock market investor sentiment. Appl Energy 187:27–36

Du L, He Y (2015) Extreme risk spillovers between crude oil and stock markets. Energy Econ 51:455–465

Ewing BT, Malik F (2016) Volatility spillovers between oil prices and the stock market under structural breaks. Global Financ J 29:12–23

Ferson WE, Harvey CR (1994) Sources of risk and expected returns in global equity markets ☆. J Bank Financ 18(4):775–803

Hamao Y (1988) An empirical examination of the arbitrage pricing theory: using Japanese data. Jpn World Econ 1(1):45–61

Kaneko T, Lee BS (1995) Relative importance of economic factors in the U.S. and Japanese stock markets. J Jpn Int Econ 9(3):290–307

Kang W, Ratti RA, Yoon KH (2015) The impact of oil price shocks on the stock market return and volatility relationship. J Int Financ Mark Inst Money 34:41–54

Kang SH, McIver R, Yoon S (2017) Dynamic spillover effects among crude oil, precious metal, and agricultural commodity futures markets. Energy Econ 62:19–32

Khalfaoui R, Boutahar M, Boubaker H (2015) Analyzing volatility spillovers and hedging between oil and stock markets: evidence from wavelet analysis. Energy Econ 49:540–549

Liu X, An H, Huang S et al (2017) The evolution of spillover effects between oil and stock markets across multi-scales using a wavelet-based GARCH–BEKK model. Phys A 465:374–383

Mensi W, Hammoudeh S, Shahzad SJH et al (2017) Modeling systemic risk and dependence structure between oil and stock markets using a variational mode decomposition-based copula method. J Bank Financ 75:258–279

Sadorsky P (1999) Oil price shocks and stock market activity. Energy Econ 21(5):449–469

Singhal S, Ghosh S (2016) Returns and volatility linkages between international crude oil price, metal and other stock indices in India: evidence from VAR-DCC-GARCH models. Resours Policy 50:276–288

Wen X, Wei Y, Huang D (2012) Measuring contagion between energy market and stock market during financial crisis: a copula approach. Energy Econ 34(5):1435–1446

Zhang YJ, Sun YF (2016) The dynamic volatility spillover between European carbon trading market and fossil energy market. J Clean Prod 112:2654–2663

Zhang YJ, Wei YM (2011) The dynamic influence of advanced stock market risk on international crude oil returns: an empirical analysis. Quant Financ 11(7):967–978

Zhang YJ, Yao T (2016) Interpreting the movement of oil prices: driven by fundamentals or bubbles? Econ Model 55:226–240

Zhang YJ, Zhang L (2015) Interpreting the crude oil price movements: evidence from the Markov regime switching model. Appl Energy 143:96–109

Zhang JL, Zhang YJ, Zhang L (2015) A novel hybrid method for crude oil price forecasting. Energy Econ 49:649–659

Zhu H, Li R, Li S (2014) Modelling dynamic dependence between crude oil prices and Asia-Pacific stock market returns. Int Rev Econ Financ 29:208–223

Acknowledgements

The authors gratefully acknowledge the respected editors and the anonymous referees for their suggestions in this article. Special thanks are given to financial supports provided by the National Natural Science Foundation of China (71573255).

Author information

Authors and Affiliations

Corresponding authors

Rights and permissions

About this article

Cite this article

Liu, Z., Ding, Z., Li, R. et al. Research on differences of spillover effects between international crude oil price and stock markets in China and America. Nat Hazards 88, 575–590 (2017). https://doi.org/10.1007/s11069-017-2881-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11069-017-2881-8