Abstract

This paper examines the impact of oil price fluctuations on a large set of stock market returns in net-oil importer countries and net-oil exporter countries. It applies multivariate cDCC-GARCH model, which has greater flexibilities, allowing the conditional variance covariance matrix of stock market returns to vary over time. Daily data spanning from January 2005 to February 2016 is used to obtain dynamic correlations between crude oil and stock market returns. Moreover, it employs the commonly recognized vector auto regression (VAR) specification and the corresponding Granger causality test in order to examine the linear relationship between crude oil and stock market volatility within each country, revealing whether there is a causal relationship between the variables in terms of time precedence. The influence of bullish and bearish market conditions is also measured by dividing the sample period into two sub-periods: Global Financial Crisis Period (2007–2010) and Post-Crisis Period (2010–2016). Main findings of this research indicate time-varying correlation of oil and stock prices for oil-importing countries is more pronounced than that for oil-exporting countries. This result shows that the correlation between the volatilities of stock market and oil price returns varies depending on the net position of the country in global oil market.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Great importance has been attached to the essential role of crude oil prices on economic and political development of industrialized and emerging countries. Furthermore, changes in the price of oil and in its volatility have been recently examined in relation to stock market returns. The theoretical basis for this relationship is that oil price changes influence macroeconomic variables such as inflation; economic growth etc., which in turn affects expected stock markets earnings. For instance, an increase in oil prices results in a reduction in production, as input becomes more expensive and contributes directly to the level of inflation, which fosters a decrease in investors’ earnings expectation from the stock market. Hence, this relationship is watched closely by policy makers, as oil is considered as a key driver of industrial and economic activity, and also by portfolio managers, searching for international diversification benefits.

Despite a considerable body of literature on oil price movements and stock markets focuses on the aggregate market, there is no consensus among economists and academicians about this relationship. The study by Jones and Kaul (1996) was the first to investigate the response to oil shocks by four developed stock markets (Canada, Japan, the UK, and the US), employing a standard present value model. They found that crude oil price movements have significant negative impact on stock market returns and changes in stock returns can be partially accounted for by the effect of oil price movements on current and future cash flows. Similarly, subsequent studiesFootnote 1 reached parallel conclusions with Jones and Kaul (1996), and discovered that oil price changes have a negative effect on stock returns. By contrast, other studiesFootnote 2 indicated a positive relationship between oil prices and stock returns, while no significant link was found by Chen et al. (1986), Huang et al. (1996), Wei (2003) and Cong et al. (2008). Moreover, Narayan and Sharma (2011) and Phan et al. (2015a, b) documented mixed results at the micro-level. Phan et al. (2015a) found that oil price changes affect producers and consumers differently; similarly Phan et al. (2015b) and Narayan and Sharma (2011) indicated that oil price changes affect stock returns differently depending on the firm’s sectoral location. In detail, the related literature reflects diverse interpretations about the influence of such oil-price shocks on stock prices, contingent on whether the market is more or less reliant on oil-related products.

There is a limited research into the relationship between oil prices and emerging stock markets in Europe, Asia and Latin America, as most research into the relationship between oil and stock prices has been conducted in developed economies.Footnote 3 Less attention has been paid to the smaller emerging markets, especially in the GCC countries that constitute the world’s largest oil exporting countries. Arouri and Rault (2012), Fayyad and Daly (2011) and Naifar and Al Dohaiman (2013) also provided evidence towards such a negative relationship between oil and stock prices which supported the findings of Jones and Kaul (1996) in these countries.

Almost all of the abovementioned papers examined the effects of oil prices on stock markets, whereas few attempts have approached possible volatility dynamics between oil and stock markets within a multivariate framework. Using the various specifications of Engle and Kroner (1995)’s multivariate BEKK-GARCH models, some recent papers documented significant volatility spillover between oil and stock markets. Malik and Hammoudeh (2007) employed trivariate GARCH models, and found evidence of volatility spillover effect running from oil prices to GCC stock markets. Hammoudeh and Aleisa (2004), Basher and Sadorsky (2006), Malik and Ewing (2009), Awartani and Maghyereh (2013) and Jouini (2013) found bidirectional volatility spillover between GCC stock markets and oil prices, whereas Arouri et al. (2011) reported unidirectional causal links running from oil price to GCC stock markets. In a study employing bivariate models, Arouri et al. (2012) indicates significant volatility spillovers between oil prices and stock indices for the US and Europe. On the other hand, Chang et al. (2013) found no significant evidence of volatility spillovers between oil prices and US and UK stock prices. This paper complements and extends this line of study by focusing the dynamics of volatility transmission using multivariate GARCH framework. It also analyses volatility transmission and contagion effect among major net oil-exporting and oil-importing countries. Some researchFootnote 4 has addressed the issue of oil price volatility and stock markets in the context of these countries, and generally the literature indicates that the stock markets of net oil-exporting countries benefit from rising oil prices, although the stock markets of net oil-importing countries can suffer. Nevertheless, none of these studies paid much attention on the disparities of the impact of oil price changes on net oil importer and exporter countries’ stock markets. Therefore, it is worthwhile to clearly recognize the relationship between volatility of oil prices and stock prices which is driven by demand and supply.

This study aims to empirically investigate the impact of oil price fluctuations on a large set of stock market returns in net-oil importer and exporter countries. An accurate understanding of the volatility linkages between oil prices and stock markets will be valuable for policy makers and investors since oil prices represent an information flow which can be incorporated into the volatility generating process of the stock markets. The study applies multivariate cDCC-GARCH model, which is more flexible, allowing the conditional variance covariance matrix of stock market returns to vary over time. In this study, daily data from January 2005 to December 2016 is used to obtain dynamic correlations between crude oil and stock market returns. It employs the commonly recognized vector auto regression (VAR) specification and the corresponding Granger causality test (Granger 1969) in order to examine the linear relationship between crude oil and stock market volatility within each country, thus revealing whether there is a causal relationship between the variables in terms of time precedence. The main findings indicate that time-varying correlation of oil and stock prices for oil-importing countries is more pronounced than for oil-exporting countries during the global financial crisis period. Therefore, it is concluded that the oil market cannot protect investors from stock market losses, and portfolio managers cannot diversify their portfolios by making investment in both commodity and stock market in oil-importing countries. In contrast to existing studies (see for example Filis et al. 2011 and Guesmi and Fattoum 2014), this result shows that countries differ in the correlation between the volatilities of stock market and oil price returns depending on their net position in global oil market. Moreover, the results point out the evidence of bidirectional causality in conditional variance from stock index to oil price among most of the oil-importing and oil-exporting countries which is not consistent with those reported by Arouri et al. (2012) and Bouri (2015).

This article makes important contributions to the existing literature in two respects. Firstly, to the authors’ best knowledge; it is the first study that explores the existence of dynamic volatility linkages between crude oil and stock market returns in both net oil importer and exporter countries by employing multivariate cDCC-GARCH model. The recognition of probable fluctuations in conditional correlations during the sample period is accommodated by using DCC model, which facilitates the detection of dynamic investor behavior in reaction to crude oil volatility. Additionally, this paper is among the few attempts which make a distinction between net oil importer and exporter countries on the issue of oil price volatility and stock markets, employing data from twenty countries. Secondly, this paper contributes significantly to the growing body of literature on time-varying correlation between oil prices and stock markets by dividing the sample period into two sub-periods, as bearish and bullish periods. It provides a comprehensive analysis for exploring discrepancies of dynamic volatility linkages between crude oil and selected stock markets during the global financial crisis and post-crisis periods. Furthermore, causal links between stock indices and oil price are also tested by employing VAR specification and Granger causality tests.

The remainder of this paper is organized as follows. The next section provides the data description. Section 3 outlines the empirical methodology employed in this study. Section 4 reports the main empirical results. The article concludes with remarks and implications.

2 Data

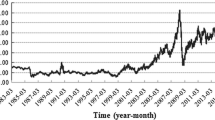

The data used in the analysis is obtained from Thomson Reuters Eikon Database, and consists of daily closing (settlement) crude oil prices and main stock indices of the stock exchange markets of the ten countries with the highest crude oil imports; namely United States, Germany, Japan, China, Netherlands, United Kingdom, France, South Korea, Singapore, and India, and also the ten countries with the highest exports; namely Russia, Saudi Arabia, Kuwait, Venezuela, Canada, United Arab Emirates, Qatar, Norway, Nigeria, and Oman. The respective stock market indexes chosen to represent each country are DOW 30 (United States), DAX (Germany), NIKKEI 225 (Japan), China A50 (China), AEX (Netherlands), FTSE 100 (United Kingdom), CAC 40 (France), KOSPI (South Korea), FTSE Singapore (Singapore), BSE Sensex (India), MICEX (Russia), Tadawull All Share (Saudi Arabia), Kuwait Main (Kuwait), Bursatil (Venezuela), S&P/TSX (Canada), ADX General (United Arab Emirates), QE General (Qatar), Oslo (Norway), NSE 30 (Nigeria) and MSM 30 (Oman). A major purpose of this study is to explore the dynamic volatility linkages between crude oil prices and the selected stock market indices preceding the global crisis, when commodities’ prices experienced a long-term positive trend. Thus, the sample period ranges from January 4, 2005 through February 29, 2016.

In the original dataset, the starting date for stock indexes differs according to country. Thus, to achieve the consistency in the sample for all countries, the latest starting date, January 4, 2005, was chosen. Despite the resulting loss of observations from dataset, the final sample period included 2605 observations for each series, considered sufficient to conduct and interpret further analyses. Since in the Arab States of the Persian Gulf (Saudi Arabia, Kuwait, United Arab Emirates, Qatar and Oman) the weekend focus on either Thursday-Friday or Friday-Saturday, the data points when the stock market were closed, were dropped from the sample in order to avoid any bias towards oil price.

During the following phase of the data adjustment procedure, the price series of the countries, originally quoted in domestic currency, were converted into US $ to achieve consistency in the data set. Accordingly, the natural logarithms of the prices were taken and then differenced in order to produce return series of each country’s stock market index return data.

Data availability and the degree of representativeness of the sample countries are defined as two main criteria for the sample formation. Moreover, the initial date of the data for these twenty countries allows the exploration of the dynamic volatility linkages between crude oil and selected stock market preceding to the global crisis, which as indicated is one of the primary purposes of the study previously. The ranking of the countries in terms of the amount of net crude oil import and export is based on EIA’s 2013 statistics (U.S. Energy Information Administration 2013).

According to the literature, accurately defining the crisis period is a challenging process (Kaminsky and Schmukler 1999). Therefore, to avoid any confusion, this study prefers to consider news based data for its definition. Regarding the existing literature, the first signal of the global financial crisis appears on July 17, 2007, when complications related to Bear Stearns hedge funds were abnormal. Currently, many studies selected this date (Dungey 2009). Thus, July 17, 2007 is employed as initial point of the crisis period; therefore this study’s pre-crisis period spans from 03.01.2005 through 16.07.2007 and the crisis period from 17.07.2007 through 04.01.2010. In the case of the definition of the start of the post-crisis period similar approach is employed, and literature based date, January 4, 2010 was chosen (Bhimjee et al. 2016). As a result, January 4, 2010 is employed as the end of crisis period; therefore, post-crisis period covers data from 17.07.2007 through 29.02.2016. Besides defining crisis period via event dates, country specific structural break test results are also provided in Table 5 in order to provide support for the defined crisis period; the structural break points of each series corresponded to a narrow range of dates. The mid-point of this range (20.10.2007) complies with the initial point of the defined crisis period (17.07.2007).

This section delivers the preliminary analyses, including the explanation of pertinent statistical aspects of the variables under consideration. These analyses are performed in three stages: in the first stage, descriptive statistics for the variables (return series) are produced; in the second stage, unit root test using the Augmented Dickey Fuller (ADF) unit root test is conducted, and in the final stage, the existence of ARCH effects in the series is verified via applying ARCH LM test. All stages are represented in Table 1.

The degree of relationship between crude oil and stock market returns are also appraised by means of an unconditional correlation analysis. The results reveal a positive relationship between crude oil and stock market returns with about 25.77% degree of relationship on average in the sample of crude oil importing countries, and 14.27% for the sample of crude oil exporting countries. In addition, cross-market correlations between crude oil and stock market returns are high, and the positive sign is an indication that, an average stock indices and crude oil price move in the same direction.

Table 1 indicates that the median values for all countries’ stock market return series are close to the mean values, signifying that the data satisfies even distribution around the mean. Moreover, the skewness parameters are around zero for all countries, indicating that the distribution of the return series approximate to normal distribution. Concerning the statistical distributions of the variables, with the exceptions of Venezuela and Nigeria, the whole series is negatively skewed, implying that the left tail is particularly extreme, while Venezuela and Nigeria’s series are positively skewed, and thus, in this case, the right tail is to the extreme. Conversely, as indicated by Jarque-Berra statistics, the series are dispersed from normal distribution. In addition, the kurtosis parameters revealed that the price series fit in platykurtic distribution which has a wider peak and a shorter tail.Footnote 5

The initial diagnostic test to conduct the volatility analysis is to determine whether or not the return series contain unit root. Unit root tests are conducted using Augmented Dickey-Fuller (ADF) method. ADF tests are performed for each return series by means of the following structural equation:

In Eq. (1), t represents trend and \( \beta_{1} \) represents the intercept term. In this study, ADF test is applied in the form of including both intercept and trend. During the testing procedure maximum lags are set to 10, and lag length is determined using the modified Schwarz Information Criterion. The results indicate that all return series fully confirm stationarity.

The following specification is utilized to test the presence of ARCH effect in the residuals. In the below specification, the null hypothesis indicates no ARCH effect (Engle 1982):

Here n is the number of data-points available for the second regression. The rejection of the null hypothesis requires that at least one of the estimated ρ coefficients must be significant, which indicates the presence of ARCH components in the residuals. The results of ARCH-LM test are displayed in Table 1. As observed, the null hypothesis, that is specifying no ARCH effect, is rejected according to the LM test statistics, which are significant at 95% confidence level (Engle 1982). Therefore, the results indicate that the residuals of the return series for all sample countries include ARCH effect. In this regard, different ARCH specifications can be employed to estimate the return series.

3 Methodology

3.1 Consistent Dynamic Conditional Correlation

cDCC-GARCH model of Aielli (2013) was applied to test the existence of dynamic volatility linkages between crude oil and stock market returns. The main advantage of this model is that it allows for the recognition of probable fluctuations in conditional correlationsFootnote 6 during the sample period, which enables the detection of dynamic investor behavior in reaction to crude oil volatility. Furthermore, the occurrence of herding behavior in financial markets during crises periods makes it appropriate to employ the dynamic conditional correlations as a measure of the possible contagion effects (see for example; Tsuchiya 2015; Angela-Maria 2015; Burzala 2016). An additional contribution of DCC-GARCH model is that the model estimates correlation coefficients of the standardized residuals; therefore, heteroscedasticity is directly taken into consideration (Chiang et al. 2007). The time varying correlation implicates no bias from volatility, as volatility is attuned by the process. Different from Forbes and Rigobon (2002), where cross market correlations are adjusted by volatility, DCC-GARCH continuously adjusts the correlation by the time-varying volatility. Consequently, DCC-GARCH delivers a more accurate measure in terms of correlation (Cho and Parhizgari 2008).

The dynamic correlations between crude oil and stock market returns are obtained by the cDCC model of Aielli (2013). In order to introduce cDCC model, the initial step is the brief review of the DCC modeling (Engle 2002) methodology. Representing the \( K \times 1 \) vector of the asset returns at time t by way of \( y_{t} = \left( {y_{1,t} , \ldots ,y_{K,t} } \right)^{{\prime }} \), then assuming that

where \( E_{t} \left[ \cdot \right] \) represents the conditional expectation on \( y_{t} ,y_{t - 1} , \ldots , \) the asset conditional covariance matrix could be denoted as

where \( R_{t} = \left[ {\rho_{ij,t} } \right] \) represents the diagonal matrix of the asset conditional variances, which is specified via \( D_{t} = diag\left( {h_{1,t} , \ldots ,h_{K,t} } \right) \), besides the asset conditional correlation matrix. In structure, \( R_{t} \) stands for the conditional covariance matrix of the asset standardized returns, that is \( E_{t - 1} \left[ {\varepsilon_{t} \varepsilon_{t}^{{\prime }} } \right] = R_{t} \), where \( \varepsilon_{t} = \left[ {\varepsilon_{1,t} , \ldots ,\varepsilon_{K,t} } \right] \), and \( \varepsilon_{i,t} = {{y_{i,t} } \mathord{\left/ {\vphantom {{y_{i,t} } {\sqrt {h_{i,t} } }}} \right. \kern-0pt} {\sqrt {h_{i,t} } }} \). Engle (2002) reproduces the right hand side of Eq. (4) rather than \( H_{t} \) directly

where \( Q_{t} \equiv \left[ {q_{ij,t} } \right] \), \( S_{t} \equiv \left[ {s_{ij,t} } \right] \), \( Q_{t}^{*} = diag\left\{ {Q_{t} } \right\} \) and \( \alpha \) and \( \beta \) are scalars. The resultant model is named as DCC-GARCH.

The cDCC-GARCH model undertakes the assumption that the correlation motivating procedure is

Overtly, in terms of the bivariate case the correlation is defined as

where \( \omega_{ij,t} \equiv {{\left( {1 - \alpha - \beta } \right)s_{ij} } \mathord{\left/ {\vphantom {{\left( {1 - \alpha - \beta } \right)s_{ij} } {\sqrt {q_{ii,t} q_{jj,t} } }}} \right. \kern-0pt} {\sqrt {q_{ii,t} q_{jj,t} } }} \). Since \( E_{t - 1} \left[ {\varepsilon_{i,t} \varepsilon_{j,t} } \right] = \rho_{ij,t} \), the formula for \( \rho_{ij,t} \) associates a kind of GARCH procedures for the pertinent historical values and advances into a correlation-like ratio. \( \alpha \) and \( \beta \) stand for the dynamic parameters of the correlation GARCH procedures. The time-varying intercept \( \omega_{ij,t} \) can be perceived as an extemporized correction that is essential for purposes of tractability (Aielli 2013).

3.2 Bivariate linear causality

This study employs the commonly recognized vector auto regression (VAR) specification and the corresponding Granger causality test (Granger 1969) with the purpose of scrutinizing the linear relationship between crude oil and stock market volatility within each country. This approach enables the determination of whether there is a causal relationship between the variables in terms of time precedence. For example, if variable \( x_{t} \) Granger causes variable \( y_{t} \), lags of \( x_{t} \) can explain the current values of \( y_{t} \). The specification of the utilized bivariate VAR model is represented as follows:

where, in our case, \( x_{t} \) is the stock market volatility in first differences and \( y_{t} \) is the crude oil volatility in first differences, n is the optimal lag length based on the well-known information criteria, such as the Schwarz, Akaike and Hannan-Quinn information criteria, and \( \varepsilon_{1t} \) and \( \varepsilon_{2t} \) are the residuals. Furthermore, \( \varphi_{1} \) and \( \varphi_{2} \) are constants where the estimated coefficients \( \alpha_{i} \), \( \beta_{i} \), \( \gamma_{i} \) and \( \delta_{i} \), \( i = 1, \ldots ,n \), denote the linear relationship between variables \( x_{t} \) and \( y_{t} \). The null hypothesis of the Granger causality test is that the variable \( y_{t} \) does not Granger cause \( x_{t} \) which is rejected if the coefficients \( \beta_{i} \) are mutually significantly not equal to zero. If \( y_{t} \) Granger causes \( x_{t} \), the past values of \( y_{t} \) provide further information on \( x_{t} \). Likewise, the null hypothesis that \( x_{t} \) does not Granger cause \( y_{t} \) is rejected if the estimated coefficients \( \gamma_{i} \) are mutually significantly not equal to zero. Consequently, bidirectional causality occurs if causality runs in both ways for \( x_{t} \) and \( y_{t} \).

4 Empirical results

To improve understanding of the linkages among crude oil and stock markets in terms of shocks and volatility, cDCC specifications of the GJR-MGARCH model are estimated, given by Eq. (7). The estimate results of crude oil-importing and -exporting countries for crisis, post-crisis and full periods are reported in Tables 2 and 3, respectively. As for the estimates of the model, the results provide evidence that, as expected, for three cases, the time-varying correlation of oil and stock prices for oil-importing countries is more pronounced than that for oil-exporting countries.

From mid-2007 to early 2010, there was a sharpe increase in conditional correlations for most oil-exporting and -importing countries. The estimates of the conditional correlations parameter, \( \rho_{1i} \), are positive and statistically significant for the sample of oil-importing countries, except the US and India, while for oil exporting countries, the values of \( \rho_{1i} \) parameter are positive and statistically significant for Saudi Arabia, Canada, UAE, Qatar and Oman. The highest correlation is for the UK (43.2%), followed by the Netherlands (39.7%) in oil-importing countries, whereas Canada (53.6%) and Saudi Arabia (22.8%) represent the highest correlation in oil-exporting countries during the crisis period. The global financial crisis triggered recessions in Europe, Asia and especially in the United States, which reduced consumption and demand for imports. Moreover, at this time, exporting countries lost sales and their economies were seriously affected, which caused stock markets to enter bearish territory and oil prices to decline rapidly, as documented by Creti et al. (2013). However, after the crisis period, oil importers should benefit from lower oil prices, which raise household and corporate real incomes. These findings are in line with Hamilton (2009) and Kilian and Park (2009), who suggest that aggregate demand-related oil price shocks, originating from world economic growth, have a positive impact on stock prices. The exact magnitude of the growth benefits and external improvements largely depends on country-specific circumstances.

Stock markets in emerging countries may behave differently from those in developed countries due to their dependence upon petroleum products. This can be seen after the crisis period, when the combined impact of a rapid rebound in commodity prices and declining interest rates supporting capital flows to developing countries, and created particularly favorable conditions for commodity exporting emerging countries. Although oil production in India has slightly trended upwards in recent years, it has failed to keep pace with demand, and saw a decline during the crisis period due to slowing economic growth rates and the recent global financial crisis. Due to its rapid economic growth after the crisis period, the conditional sensitivity of India’s stock market returns to oil prices become positive and significant. In the US, the positive effect of demand is shown to be persistent and stronger than in other importing countries, attributed to higher economic growth rates.

For the post-crisis period, there is significant evidence supporting the existence of conditional correlation in all oil-importing countries with the exception of Japan. However, for exporting countries, only for Russia and Norway was the estimated conditional correlation between the volatility of crude oil returns and stock index return highly significant after the crisis period, while the relevant parameter is insignificant during the crisis for these two countries. Our results indicate that among high-income countries, the estimated correlation between crude oil and stock market returns is more significant for the US, the UK, the Netherlands, Canada and Norway than for the Euro Area, Japan, or developing countries, owing in part to different mixes of energy consumption, price regulations and exchange rate patterns. Regarding the conditional correlations between the oil and stock markets in Kuwait, Venezuela and Nigeria, almost all correlations were zero, suggesting crucial diversification benefits from investing in both markets. Based on the rationale that correlation is a measure of stock market integration, this finding implies a significant and weak level of integration between oil markets and the UAE, Qatar, Oman, Japan, China stock markets, providing substantial space for hedging opportunities.

The insights are further apprehended through the plots of estimated conditional correlations between oil and stock market returns for oil-exporting and -importing countries shown in Figs. 1 and 2. Not surprisingly, the correlations are highly unstable and fluctuate substantially over the financial crisis of 2008 for the sample data, although highly oil-dependent countries’ oil and stock market correlation behavior is stable.

Table 4 reports the results of bivariate causality of conditional variances among oil and stock markets for during and post-crisis periods and the full period. The results indicate evidence of unidirectional causality links running from stock index to oil price in the US, China, Russia and Canada, while the causal links from oil price to stock index are displayed in three oil-exporting countries, Kuwait, Qatar and Oman. Overall, for all importing and exporting countries except Venezuela, the analysis shows evidence of bidirectional causality in conditional variance from stock index to oil price.

The empirical findings obtained from the estimation of the cDCC specifications of the GJR-MGARCH model and linear causality model improve the understanding of whether the volatility of crude oil prices are correlated with the price volatility in the stock markets of oil-exporting and -importing countries, and therefore should be of a particular interest for market participants, academic researchers and policymakers in terms of investment diversification.

5 Conclusion

This paper examines the impact of oil price fluctuations on a large set of stock market returns in largest net-oil importer and net-oil exporter countries by employing cDCC-GARCH model of Aielli (2013). The empirical investigation focuses on a sample of twenty countries’ stock and oil markets over the period from January 2005 to February 2016. While previous studies concentrated mainly on developed countries, this study differentiates oil-exporter countries from oil-importer countries by testing the existence of dynamic volatility linkages between crude oil and stock market returns. Another feature of this study is that the potential influence of global financial crisis on market conditions were examined by dividing the sample period into bearish and bullish periods. The findings show that the time-varying correlation of oil and stock prices are highly dependent on whether the country is a crude oil net exporter or importer according to cDCC specifications of the GJR-MGARCH model estimates. The results are more pronounced for importing than for exporting countries for the global financial crisis and post-crisis periods. Oil price fluctuations have some effects on the economy through cost of production, corporate profits and inflation. It is apparent that an increase in oil prices will increase cost of production in oil-importing countries, which in turn reduce corporate profits and negatively affect stock prices. Therefore, importer countries are expected to exhibit a more pronounced relation between oil price volatility and stock price returns.

The empirical analysis revealed some important characteristics of the oil price shocks and stock index returns in different periods. In particular, global financial crisis had significant impact on the interdependency between oil price fluctuations and stock index returns in oil-importer countries. This suggests that the oil market cannot protect investors from stock market losses through diversification during such financial turmoil. After the crisis, however, the results indicate a significant and weak level of integration between oil markets and the UAE, Qatar, Oman, Japan, China stock markets, providing substantial space for hedging opportunities. In contrast, there were almost zero correlations for Kuwait, Venezuela and Nigeria, suggesting that investors in these markets may still achieve diversification benefits through holding oil and stocks in their portfolios.

Moreover, bivariate causality results of conditional variances show that unidirectional causality links run from stock index to oil price in the US, China, Russia and Canada, while the causal links from oil price to stock index are displayed in only three oil-exporting countries, Kuwait, Qatar and Oman. This indicates that information flow from stock market to oil market is generally important for oil demanders, but for these three exporting countries, oil prices should be closely watched by portfolio managers who are seeking for international diversification benefits.

The findings of the study can provide useful information for participants in financial markets for better understanding of the recent dynamics of the stock markets in oil-importer and oil-exporter countries. The empirical results can assist investors, oil traders and government agencies in handling stock market uncertainty in relation with the oil price fluctuations. An understanding of and an ability to measure the relationship between oil price and stock index return volatilities will help portfolio managers aiming to invest in both oil and stock markets.

Notes

Sadorsky (1999), Ciner (2001), Driesprong et al. (2008), Malik and Hammoudeh (2007), Kilian and Park (2009) for the US, Park and Ratti (2008) for the US and 12 European oil importing countries, O’Neil et al. (2008) for the US, the UK and France and Apergis and Miller (2009) for eight developed countries.

Papapetrou (2001) for Greece, Maghyereh (2004) for 22 emerging countries, Basher and Sadorsky (2006) for 21 emerging stock markets, Cong et al. (2008) for China, Narayan and Narayan (2010) for Vietnam, Masih et al. (2011) for South Korea, Nguyen and Bhatti (2012) for Vietnam and China, Asteriou and Bashmakova (2013) for 10 Central and Eastern European Countries, Ghosh and Kanjilal (2014) for India, and Zhu et al. (2014) for 10 Asian-Pacific countries.

If the excess kurtosis (Kurtosis-3) is less than zero, then the distribution is assumed to be platykurtic and it has shorter tails compared to a uniform normal distribution.

Lau et al. (2014).

References

Aielli, G. P. (2013). Dynamic conditional correlation: On properties and estimation. Journal of Business & Economic Statistics, 31(3), 282–299.

Aloui, C., Nguyen, D. K., & Njeh, H. (2012). Assessing the impacts of oil price fluctuations on stock returns in emerging markets. Economic Modelling, 29(6), 2686–2695.

Angela-Maria, F. (2015). An empirical investigation of herding behavior in CEE stock markets under the global financial crisis. Procedia Economics and Finance, 25, 354–361.

Apergis, N., & Miller, S. M. (2009). Do structural oil-market shocks affect stock prices? Energy Economics, 31(4), 569–575.

Arouri, M. E. H., Jouini, J., & Nguyen, D. K. (2012). On the impacts of oil price fluctuations on European equity markets: Volatility spillover and hedging effectiveness. Energy Economics, 34(2), 611–617.

Arouri, M. E. H., Lahiani, A., & Nguyen, D. K. (2011). Return and volatility transmission between world oil prices and stock markets of the GCC countries. Economic Modelling, 28(4), 1815–1825.

Arouri, M. E. H., & Rault, C. (2012). Oil prices and stock markets in GCC countries: Empirical evidence from panel analysis. International Journal of Finance & Economics, 17(3), 242–253.

Asteriou, D., & Bashmakova, Y. (2013). Assessing the impact of oil returns on emerging stock markets: A panel data approach for ten Central and Eastern European Countries. Energy Economics, 38, 204–211.

Awartani, B., & Maghyereh, A. I. (2013). Dynamic spillovers between oil and stock markets in the Gulf Cooperation Council Countries. Energy Economics, 36, 28–42.

Basher, S. A., & Sadorsky, P. (2006). Oil price risk and emerging stock markets. Global Finance Journal, 17(2), 224–251.

Bhimjee, D. C., Ramos, S. B., & Dias, J. G. (2016). Banking industry performance in the wake of the global financial crisis. International Review of Financial Analysis. doi:10.1016/j.irfa.2016.01.005.

Bjørnland, H. C. (2009). Oil price shocks and stock market booms in an oil exporting country. Scottish Journal of Political Economy, 56(2), 232–254.

Bouri, E. (2015). Return and volatility linkages between oil prices and the Lebanese stock market in crisis periods. Energy, 89, 365–371.

Boyer, M. M., & Filion, D. (2007). Common and fundamental factors in stock returns of Canadian oil and gas companies. Energy Economics, 29(3), 428–453.

Burzala, M. M. (2016). Contagion effects in selected European capital markets during the financial crisis of 2007–2009. Research in International Business and Finance, 37, 556–571.

Chang, C. L., McAleer, M., & Tansuchat, R. (2013). Conditional correlations and volatility spillovers between crude oil and stock index returns. The North American Journal of Economics and Finance, 25, 116–138.

Chen, N. F., Roll, R., & Ross, S. A. (1986). Economic forces and the stock market. Journal of Business, 59(3), 383–403.

Chiang, T. C., Jeon, B. N., & Li, H. (2007). Dynamic correlation analysis of financial contagion: Evidence from Asian markets. Journal of International Money and Finance, 26, 1206–1228.

Cho, J. H., & Parhizgari, A. M. (2008). East Asian financial contagion under DCC-GARCH. International Journal of Banking and Finance, 6(1), 17–30.

Ciner, C. (2001). Energy shocks and financial markets: Nonlinear linkages. Studies in Nonlinear Dynamics & Econometrics, 5(3), 203–212.

Cong, R. G., Wei, Y. M., Jiao, J. L., & Fan, Y. (2008). Relationships between oil price shocks and stock market: An empirical analysis from China. Energy Policy, 36(9), 3544–3553.

Creti, A., Joëts, M., & Mignon, V. (2013). On the links between stock and commodity markets’ volatility. Energy Economics, 37, 16–28.

Driesprong, G., Jacobsen, B., & Maat, B. (2008). Striking oil: Another puzzle? Journal of Financial Economics, 89(2), 307–327.

Dungey, M. (2009). The tsunami: Measures of contagion in the 2007–08 credit crunch. Cesifo Forum, 9(4), 33–34.

El-Sharif, I., Brown, D., Burton, B., Nixon, B., & Russell, A. (2005). Evidence on the nature and extent of the relationship between oil prices and equity values in the UK. Energy Economics, 27(6), 819–830.

Engle, R. F. (1982). Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica, 50(4), 987–1007.

Engle, R. F. (2002). Dynamic conditional correlation. Journal of Business & Economic Statistics, 20(3), 987–1007.

Engle, R. F., & Kroner, K. F. (1995). Multivariate simultaneous generalized ARCH. Econometric Theory, 11(01), 122–150.

Fayyad, A., & Daly, K. (2011). The impact of oil price shocks on stock market returns: Comparing GCC countries with the UK and USA. Emerging Markets Review, 12(1), 61–78.

Filis, G., Degiannakis, S., & Floros, C. (2011). Dynamic correlation between stock market and oil prices: The case of oil-importing and oil-exporting countries. International Review of Financial Analysis, 20(3), 152–164.

Forbes, K. J., & Rigobon, R. (2002). No contagion, only interdependence: Measuring stock market comovements. The Journal of Finance, 57(5), 2223–2261.

Ghosh, S., & Kanjilal, K. (2014). Co-movement of international crude oil price and Indian stock market: Evidences from nonlinear cointegration tests. Energy Economics, 53, 111–117.

Gogineni, S. (2008). The stock market reaction to oil price changes. Division of Finance, Michael F. Price College of Business, University of Oklahoma, Norman.

Granger, C. W. (1969). Investigating causal relations by econometric models and cross-spectral methods. Econometrica, 37(3), 424–438.

Guesmi, K., & Fattoum, S. (2014). Return and volatility transmission between oil prices and oil exporting and oil-importing countries. Economic Modelling, 38, 305–310.

Hamilton, J. D. (2009). Causes and Consequences of the Oil Shock of 2007–08 (No. w15002). National Bureau of Economic Research.

Hammoudeh, S., & Aleisa, E. (2004). Dynamic relationships among GCC stock markets and NYMEX oil futures. Contemporary Economic Policy, 22(2), 250–269.

Huang, R. D., Masulis, R. W., & Stoll, H. R. (1996). Energy shocks and financial markets. Journal of Futures Markets, 16(1), 1–27.

Jones, C. M., & Kaul, G. (1996). Oil and the stock markets. The Journal of Finance, 51(2), 463–491.

Jouini, J. (2013). Return and volatility interaction between oil prices and stock markets in Saudi Arabia. Journal of Policy Modeling, 35(6), 1124–1144.

Jung, H., & Park, C. (2011). Stock market reaction to oil price shocks. Journal of Economic Theory and Econometrics, 22, 1–29.

Kaminsky, G. L., & Schmukler, S. L. (1999). What triggers market jitters?: A chronicle of the Asian crisis. Journal of International Money and Finance, 18(4), 537–560.

Kilian, L., & Park, C. (2009). The impact of oil price shocks on the US stock market. International Economic Review, 50(4), 1267–1287.

Lau, M. C. H., Su, Y., Tan, N., & Zhang, Z. (2014). Hedging China’s energy oil market risks. Eurasian Economic Review, 4, 99–112.

Maghyereh, A. (2004). Oil price shocks and emerging stock markets: A generalized VAR approach. International Journal of Applied Econometrics and Quantitative Studies, 1(2), 27–40.

Malik, F., & Ewing, B. T. (2009). Volatility transmission between oil prices and equity sector returns. International Review of Financial Analysis, 18(3), 95–100.

Malik, F., & Hammoudeh, S. (2007). Shock and volatility transmission in the oil, US and Gulf equity markets. International Review of Economics & Finance, 16(3), 357–368.

Masih, R., Peters, S., & De Mello, L. (2011). Oil price volatility and stock price fluctuations in an emerging market: Evidence from South Korea. Energy Economics, 33(5), 975–986.

Naifar, N., & Al Dohaiman, M. S. (2013). Nonlinear analysis among crude oil prices, stock markets’ return and macroeconomic variables. International Review of Economics & Finance, 27, 416–431.

Narayan, P. K., & Narayan, S. (2010). Modelling the impact of oil prices on Vietnam’s stock prices. Applied Energy, 87(1), 356–361.

Narayan, P. K., & Sharma, S. S. (2011). New evidence on oil price and firm returns. Journal of Banking & Finance, 35(12), 3253–3262.

Nguyen, C. C., & Bhatti, M. I. (2012). Copula model dependency between oil prices and stock markets: Evidence from China and Vietnam. Journal of International Financial Markets, Institutions and Money, 22(4), 758–773.

O’Neil, T. J., Penm, J., & Terrell, R. D. (2008). The role of higher oil prices: A case of major developed countries. Research in Finance, 24, 287–299.

Papapetrou, E. (2001). Oil price shocks, stock market, economic activity and employment in Greece. Energy Economics, 23(5), 511–532.

Park, J., & Ratti, R. A. (2008). Oil price shocks and stock markets in the US and 13 European countries. Energy economics, 30(5), 2587–2608.

Phan, D. H. B., Sharma, S. S., & Narayan, P. K. (2015a). Oil price and stock returns of consumers and producers of crude oil. Journal of International Financial Markets, Institutions and Money, 34, 245–262.

Phan, D. H. B., Sharma, S. S., & Narayan, P. K. (2015b). Stock return forecasting: Some new evidence. International Review of Financial Analysis, 40, 38–51.

Sadorsky, P. (1999). Oil price shocks and stock market activity. Energy Economics, 21(5), 449–469.

Sadorsky, P. (2001). Risk factors in stock returns of Canadian oil and gas companies. Energy Economics, 23(1), 17–28.

Tsuchiya, Y. (2015). Herding behavior and loss functions of exchange rate forecasters over interventions and financial crises. International Review of Economics & Finance, 39, 266–276.

U.S. Energy Information Administration. (2013). Annual Energy Outlook 2013 with Projections to 2040. Office of Integrated and International Energy Analysis: Washington D.C.

Wei, C. (2003). Energy, the stock market, and the putty-clay investment model. The American Economic Review, 93(1), 311–323.

Yurtsever, C., & Zahor, T. (2007). Oil price shocks and stock market in the Netherlands. In University of Groningen Working Paper.

Zhu, H. M., Li, R., & Li, S. (2014). Modelling dynamic dependence between crude oil prices and Asia-Pacific stock market returns. International Review of Economics & Finance, 29, 208–223.

Author information

Authors and Affiliations

Corresponding author

Appendix

Rights and permissions

About this article

Cite this article

Aydoğan, B., Tunç, G. & Yelkenci, T. The impact of oil price volatility on net-oil exporter and importer countries’ stock markets. Eurasian Econ Rev 7, 231–253 (2017). https://doi.org/10.1007/s40822-017-0065-1

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40822-017-0065-1