Abstract

This paper assesses the impact of unexpected oil price shocks on Chinese stock markets. We estimated the extent of unexpected oil price shocks to capture the uncertainty characteristics of oil price volatility. We use autoregressive distributed lag model to investigate the cointegration between unexpected oil price shocks and China stock markets. Moreover, we decompose oil price shocks into positive and negative shocks and apply nonlinear autoregressive distributed lag model to investigate whether the oil price shock has a symmetric or asymmetric effect on Chinese stock markets. The empirical results suggest that unexpected oil price shocks have different impacts on the Shanghai and Shenzhen stock markets. The unexpected positive oil prices shock in the previous period has a significant impact on Shenzhen stock market, but has insignificant impact on Shanghai stock market.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Crude oil prices have often exhibited sudden rises or surprise falls triggered by unanticipated events such as production decisions of oil-producing countries, natural disasters, and political conflicts. Since crude oil is a crucial raw material for the industry, crude oil market has been increasingly interconnected with the economy and stock market. The strong relationship between oil market and stock market in different countries has been well documented by researchers (Park and Ratti 2008; Toparlı et al. 2019; Nusair and Al-Khasawneh 2018). Given the pronounced influence of crude oil, such sharp changes in price referred to unexpected crude oil price shocks arouse growing concerns.

Since 2016, China has become the largest crude oil-importing country in the world. In addition, Shanghai crude oil futures market was launched on March 26th, 2018. The market is closer to the Asia-Pacific region, which can reflect the supply and demand relationship in the region. The huge demand for crude oil makes the Chinese stock market’s response to oil price shocks possibly different from other countries. Therefore, the study of the relationship between Shanghai crude oil futures market and Chinese stock market is important not only to China, but also important to the Asia-Pacific region and the world.

This paper aims to assess the impact of unexpected oil price shocks on Chinese stock markets. We estimated the extent of unexpected oil price shocks to capture the uncertainty characteristics of oil price volatility. We use autoregressive distributed lag (ARDL) model to investigate the cointegration between unexpected oil price shocks and China stock markets. Moreover, we decompose oil price shocks into positive and negative shocks and apply nonlinear autoregressive distributed lag (NARDL) model to investigate whether the oil price shock has a symmetric or asymmetric effect on Chinese stock markets. The empirical results suggest that there exist leverage effects in Shanghai crude oil futures prices. Negative information has more impact on Shanghai crude oil futures prices volatility than positive information. Unexpected oil price shocks have different impacts on the Shanghai and Shenzhen stock markets. The unexpected positive oil price shocks in the previous period have a significant impact on Shenzhen stock market, but has insignificant impact on Shanghai stock market. The spillover effect of unexpected oil price shocks has increased significantly since March 8th, 2021.

The rest of the paper is structured as follows. Section 2 reviews the literature about the nexus between oil price shocks and Chinese stock markets. Section 3 describes how we measure the oil price shocks and the methodology for empirical analysis. Section 4 describes the data and presents empirical results. Section 5 concludes with policy implications.

2 Literature review

The nexus of crude oil market and stock market has attracted more and more scholars’ attention. Several researchers have explored the transmission mechanism from crude oil market to the stock market. Investor sentiment (He 2020; Ding et al. 2017; Abdelhedi 2020) and exchange rates (Huang et al. 2017) are considered as mediating variables for crude oil’s effect on the economy. Wei and Guo (2017) identified the effect of different types of oil shocks, such as oil supply, aggregate demand shocks and oil demand shocks. They showed that the responses of stock returns to oil shocks vary by demand or supply shocks. Several studies provided evidences that the oil shocks from demand and supply side affect the returns and liquidity in stock markets. Ji et al. (2020) indicated that there exists asymmetric risk spillover from oil demand shock to stock returns. Zheng and Su (2017) demonstrated that oil price shocks from demand side increase stock market liquidity, while oil price shocks from supply side reduce stock markets liquidity. Bai and Koong (2018) found that positive oil supply shocks affect stock market adversely. Hu et al. (2018) used the same approach to investigate the asymmetric effect of demand and supply shocks of oil prices.

The different effects of unexpected increases and decreases in oil prices, defined as asymmetric responses or nonlinear nexus, are first proposed by Mork (1989). Hamilton (2003) provided evidence that oil price increases are much more important for the economy than oil price decreases. Mendoza and Vera (2010) found that the unexpected increases in oil price shocks had a greater impact on economy than the decreases. However, Akinsola and Odhiambo (2020) revealed that oil price decreases in oil-importing countries have significant impact on the economy, while oil price increases have not. Hashmi et al. (2021) argued that oil price shocks affect stock prices asymmetrically in the short run, but symmetrically in the long run. Rafailidis and Katrakilidis (2014) revealed the short-run and long-run differences in the relationship between the oil market and stock market. Nusair and Olson (2021) suggested that positive oil price shocks seem to have a greater effect on stock returns in bullish markets, and negative oil price shocks seem to have a greater effect on stock returns in bearish markets.

Some researchers have investigated the asymmetric effects of oil price changes in different countries or industry sectors. Stock market response to crude oil price changes is found to be stronger in importing countries than in oil exporting countries (Salisu and Isah 2017). Maghyereh and Abdoh (2020) examined and found that the asymmetric effects of uncertainty changes in oil price vary across different industries. Different from other countries, the volatility spillover from oil market to Chinese stock market is found to be unidirectional or one-way effect (Ahmed and Huo 2021). Heterogeneous reactions of industrial sectors to oil price changes are confirmed (Salisu et al. 2019; Sun et al. 2022). These studies indicate that the impact of crude oil prices on different countries and industrial sectors could be quite different and heterogeneous.

The crude oil market has a significant impact on the stock market, whereas the stock market has a limited impact on crude oil market in China (Lv et al. 2020). Fang and Egan (2018) measured the contagion from the oil market to China’s stock market. Tian et al. (2021) explored the impact of oil price on Chinese stock using implied volatility. The contagion and volatility spillover from oil market and stock market in China exhibit various characteristics, such as time-varying (Bouri et al. 2017), unstable overtime (Doko Tchatoka et al. (2019)) and nonlinear (Wen et al. 2018). Therefore, changes in oil prices are considered to be one of the reasons for the volatility of Chinese stock market. Moreover, the asymmetric impact of crude oil prices on Chinese stock prices has also been demonstrated by Jiang and Liu (2021). It is worth noting that the asymmetric effects in these studies are about oil price returns or net oil prices on stock market, which cannot reflect the nonlinear relationship between unexpected shocks of oil prices and stock market. To the best of our knowledge, there has not been study on the asymmetric effects of unexpected shocks of Shanghai crude oil future markets on Chinese stock market, and the nonlinear characteristics of the oil-stock nexus in China remain unclear. In this paper, we attempt to fill that void in the literature.

This paper extends the above studies by measuring the unexpected shocks to study the nexus between Shanghai crude oil future market and Chinese stock market. This paper estimates the symmetric and asymmetric model to reveal the asymmetric effects of oil price uncertainty shocks on Chinese stock markets in the short-run and long-run. In order to ascertain the different stock markets responses to the unexpected increase and decrease in the oil price, the paper calculates the positive and negative shocks. Moreover, the paper analyzes the long-term and short-term effects of the asymmetric shocks applying nonlinear autoregressive distributed lag (NARDL) method.

3 Methodology

3.1 Measurement of unexpected oil price shocks

Some studies used the crude oil volatility index (OVX) as a proxy for uncertainty shocks of crude oil to examine the impacts of shocks on Chinese stock market. Xiao et al. (2018) found that positive shocks of OVX have a larger impact on Chinese stock market than negative shocks. Luo and Qin (2017) confirmed that the OVX shocks negatively affect Chinese stock market, whereas oil price shocks have positive effect. Apergis and Miller (2009) analyzed the effects of oil demand shocks using real oil price as a proxy for demand shocks. The crude oil pricing mechanism can affect the uncertainty of the crude oil market. Wen et al. (2018) highlighted that China’s oil product market-oriented pricing reform in 2013 reduced the uncertainty of Chinese crude oil price, which reduced the risk of China’s stock market. However, as a volatility index, OVX cannot fully reflect the unexpected characteristics of the shocks.

To measure unexpected oil price shocks, both the magnitude and variability of forecast error based on GARCH model should be considered. Following Lee et al. (1995), we measure the oil price shocks based on the unexpected component and conditional variance of oil price GARCH-type process. Ding et al. (1993) proposed a generalized ARCH-type model, called asymmetric Power ARCH model (APARCH), which allows the power of the heteroscedasticity equation and leverage effect to be estimated. Considering the stylized facts of most financial time series, such as leptokurtosis, fat-tailed, volatility clustering, and leverage effects, we combine the ARMA(p,q)-APARCH(1,1) model to capture the oil price return process. The ARMA(p,q)-APARCH(1,1) model for crude oil returns \(O_t\), \(t=1,2,\cdots , n\) is determined as follows.

where \(O_t\) is the settle price returns of Shanghai crude oil futures; \(\mu\) is the constant term; \(\phi _i\) is the ith autoregressive coefficient; \(\theta _j\) is the jth moving average coefficient; \(\varepsilon _t\) is the error term at time t; \(\sigma _t\) is the conditional standard deviation; \(\eta _t\) is a sequence of identically distributed random variables with zero mean and unit variance. \(\omega \>0\), \(\delta \>0\), \(\alpha \ge 0\), \(\beta \ge 0\), \(-1<\gamma <1\). \(\gamma\) is the asymmetric response parameter, which reflects the leverage effect. \(\gamma <0\) indicates the impact of positive information is greater than that of negative information. Conversely, \(\gamma \>0\) indicates the impact of negative information is greater than that of positive information.

\({\hat{O}}_t=E(O_t|I_{t-1})\) is the conditional expectation of \(O_t\), \(I_{t-1}\) is the information set. The unexpected component of oil price is defined as \(e_t\le O_t-{\hat{O}}_t\). The oil shocks can be defined as in Eq. (4).

To examine the asymmetric effect of oil shocks, the oil shocks can be decomposed into Eq. (5), as proposed by Shin et al. (2014).

where \(O_{t}^{\mathrm{shock+}}\) is positive innovation, \(O_{t}^{\mathrm{shock-}}\) is negative innovation, and \(\epsilon\) is the error term. \(O_{t}^{\mathrm{shock+}}\) and \(O_{t}^{\mathrm{shock-}}\) are partial sum processes of positive and negative changes, which are represented as Eqs. (6) and (7), respectively.

3.2 The nonlinear ARDL model

Following Pesaran et al. (2001) and Pesaran and Shin (1999), we use the traditional autoregressive distributed lag (ARDL) model to investigate the long-run and short-run relationships among the time series of variables. The symmetric relationship between oil shocks and Chinese stock price returns can be represented by Eq. (8).

where \(S_t\) represents Shanghai or Shenzhen stock returns at time t; p and q are the order of lags, which are selected according to the minimum value of Akaike information criteria (AIC) from models with different lags; \(\alpha\) refers to the long run persistence; \(\theta\) and \(\varphi\) represent short-term parameters.

Equation (8) can be re-specified as Eq. (9)

Where \(\mu\) is the group-specific effect; \(\alpha _1\) is error-correlation coefficient, which measures the convergence speed to long-term equilibrium when \(O_t^{\textrm{shock}}\) changes. \(\frac{\beta _0-\mu }{\alpha _1}+S_{t-1}+\frac{\alpha _2}{\alpha _1}O_{t-i}^{\textrm{shock}}\) is the error term \(Ecm_t^s\). So, \(S_{t-1}=\frac{\mu -\beta _0}{\alpha _1}-\frac{\alpha _2}{\alpha _1}O_{t-i}^{\textrm{shock}}+Ecm_t^s\). Hence, \(-\frac{\alpha _2}{\alpha _1}\) is the long-run equlibrium relationship between \(O_t^{\textrm{shock}}\) and \(S_t\), which can measure the shock effects from \(O_t^{\textrm{shock}}\) to \(S_t\)..

The traditional ARDL model cannot capture the asymmetric effect of positive and negative changes of oil shocks. Following Shin et al. Shin et al. (2014), we introduce the positive innovation \(O_t^\text {shock+}\) and negative innovation \(O_t^{\mathrm{shock-}}\) into ARDL model to examine the asymmetric effect of oil shocks. With the incorporation of \(O_t^{\mathrm{shock+}}\) and \(O_t^{\mathrm{shock-}}\) and integration of nonlinearity into the model, the asymmetric NARDL model can be written as Eq. (10).

Where \(Ecm_{t-1}=S_{t-1}-\beta _1O_{t-1}^{\mathrm{shock+}}-\beta _2O_{t-1}^{\mathrm{shock-}}\) is the nonlinear error correlation term; the parameter \(\rho\) indicates adjustment speed. \(\sum _{i=0}^q\theta _i^{+}\) and \(\sum _{i=0}^q\theta _i^{-}\) show the short-run effects of the positive and negative innovation, respectively; \(\beta _1\) and \(\beta _2\) capture the asymmetric long-run effects of positive and negative innovations in oil shocks on Chinese stock returns, respectively. Equation (10)can be modified as Eq. (11).

The long-run effects are valid only when the variables are integrated. Resaran et al. (2001) proposed bound test approach for examining the long-run cointegration relationship among variables, which allows for the regressor to be stationary at level I(0) or first-order difference I(1) without being integrated at second difference I(2). For the symmetric ARDL, the null hypothesis of the bound testing approach is that \(H_0: \alpha _1=\alpha _2=0\),which implies there is no cointegration among the variables. For the asymmetric NARDL, the null hypothesis is that \(H_0: \rho =\beta _1=\beta _2=0\).

We can determine whether there exists long-run cointegration between two variables from the following asymptotic critical values. When F-statistic value is larger than the asymptotic critical value I(1), we can reject the null hypothesis. Then, there exists long-run cointegration between the two variables. When F-statistic value is less than the asymptotic critical value I(0), we cannot reject the null hypothesis. Then, we cannot establish the long-run equilibrium relationship between the two variables.

The long-run or short-run asymmetric effect can be examined by Wald-statistic with the null hypothesis of symmetric relationship, which follows asymptotic \(\chi ^2\) distribution. For long-run asymmetric relationship test, the null hypothesis is \(H_0: \beta _1=\beta _2\). For the short-run asymmetric relationship test, the null hypothesis is \(H_0: \sum _{i=0}^q\theta _i^{+}=\sum _{i=0}^q\theta _i^{-}\).

4 Data and empirical results

4.1 Data

We examine the asymmetric effects of oil shocks on Shanghai and Shenzhen stock market returns in this paper. All the daily data are obtained from Nasdaq’s Quandl platform, which provides rich financial data for investment researchers from hedge funds, asset managers and investment banks. The sample period is selected from September 26th, 2018, to December 30th, 2022, and the total observation is 1161. In this paper, “SSEC” represents the returns of Shanghai Securities Composite Index, “SZC” for The Shenzhen Component Index returns, and “O” the settle price returns of Shanghai Crude Oil Future Exchange Continuous Contracts. These returns are log-return, which is defined as 100 times the log-difference of price index.

Table 1 displays the descriptive statistics of the data. The mean of crude oil price returns is positive, which indicates that crude oil prices rose during the sampling period. According to the standard deviation of oil price returns, the crude oil market is more volatile than stock markets. All return series are left skewed. Crude oil price returns are right skewed with the highest kurtosis. Since the kurtosis is larger than 3, all the three-time series show fat-tail characteristic. From Jarque-Bera statistics test results, we can conclude that the null hypothesis that these variables are normally distributed is rejected at 1% significance level. All variables are non-normally distributed with fat tails.

4.2 Empirical results

4.2.1 Unexpected oil price shocks

We utilize the ARMA(p,q)-APARCH(1,1) model to fit the daily settle price returns series of Shanghai Crude Oil Future Exchange Continuous Contracts. The order of autoregressive and moving average term is selected by minimizing the value of AIC. The estimation results of parameters are summarized in Table 2. The estimated parameters are all highly significant at the level of 1%. The asymmetric parameter \(\gamma =0.1649\) is statistically significant at 1%. The effect of information shock on Shanghai crude oil future prices volatility appears to be asymmetric. Due to \(\gamma =0.1649\>0\), negative information has a greater impact on crude oil price volatility than positive information.

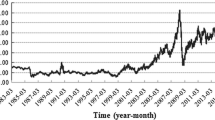

From Eq. 4, we calculate the unexpected oil shocks series \(O_t^{shock}\). The unexpected oil price shocks series is shown in Fig. 1. In Fig. 1, it is observed that unexpected crude oil price return shocks occurred in the sample from May 2019 to December 2022. The unexpected large fluctuations are one of the important characteristics of crude oil prices.

4.2.2 Effects of unexpected oil price shocks

We performed ADF and PP unit root tests to examine the stationarity of these variables. The unit root tests are presented in Table 3. We can see that the returns of Shanghai Securities Composite Index (SSEC), Shenzhen Component Index(SZC), and oil shocks(\(O^{shock}\)) are all stationary at level I(0). Hence, we can apply NARDL model to investigate the relationship between oil shocks and stock market returns.

Since unexpected crude oil price shock (\(O^{shock}\)) is a generated variable, we bootstrap the regressions with 500 replications to address the generated regressor problem. Table 4 presents the estimation result of the linear ARDL model. From Table 4, we can see the coefficients of \(\Delta O_{t-1}^{shock}\) of both stock markets are significant at 1% level. Thus, oil price shocks have significant effects on stock market in the short term. The long-run equilibrium correlation of symmetric relationship between oil shocks and Shanghai stock market is \(-\frac{0.2031}{-1.0042}\approx 0.2023\), which is larger than that of symmetric relationship between oil shocks and Shenzhen stock market (\(-\frac{0.1371}{-0.9974}\approx 0.1375\)). In the long run, the positive unexpected shocks of oil prices will drive up the index of both Shanghai and Shenzhen stock markets. In addition, the impact of positive unexpected shocks on Shanghai stock market is greater than that on Shenzhen stock market.

The F-statistic of the symmetric ARDL model indicates evidence of cointegration in China stock market. The error-correlation coefficients are significantly negative in Shanghai and Shenzhen stock market,which are −1.0042 and −0.9974, respectively. For the two stock markets, the speed of convergence of Shanghai stock market to equilibrium is faster than Shenzhen stock market. When oil price shocks deviate from the equilibrium level, it will take the Shanghai and Shenzhen stock market about one day to adjust to the equilibrium level by 100.42% and 99.74%, respectively.

We use R package nardl to estimate the parameters of the nonlinear ARDL model. We choose the best-fitted model by the minimum value of AIC, setting the maximum lag as 3. Table 5 summarizes the estimation results of NARDL model. From the F-statistics test for the two stock markets, we can confirm the existence of nonlinear cointegration between unexpected crude oil price shocks and stock returns in Chinese stock market. The Wald test (\(W_{LR}\) and \(W_{SR}\)) with the null hypothesis of long or short-run symmetry of unexpected oil price shocks is conducted to examine the existence of long- or short-run asymmetric effects between the two variables. As shown in Table 5, for Shanghai and Shenzhen stock market, both the null hypothesis of short-run symmetric impact(\(\sum _{i=0}^2\theta _i^{+}=\sum _{i=0}^2\theta _i^{-}\)) and the null hypothesis of symmetric impact in the long-run (\(\beta _1=\beta _2\)) cannot be rejected. Hence, unexpected oil price shocks affect Shanghai and Shenzhen stock markets symmetrically in short- and long-run. So, there is no significant difference in the effect of positive and negative oil price shocks on Chinese stock market in the long or short-run.

The effect of positive oil price shocks \(O_{t-1}^{shock+}\) on Shenzhen stock market is significant, but \(O_{t-1}^{shock-}\) is insignificant. Therefore, positive oil price shocks can significantly affect Shenzhen stock market in the next period, while negative oil price shocks have no significant impact on Shenzhen stock market in the next period. The long- and short- run coefficients of \(O_{t-1}^{shock+}\) and \(O_{t-1}^{shock-}\) for Shanghai stock market are all insignificant. However, the long- and short- run coefficients of \(O_{t}^{shock+}\) and \(O_{t}^{shock-}\) for Shanghai stock market are all significant. The results suggest that unexpected price shocks will lead to an increase in stock returns of Shanghai stock market concurrently, rather than in the next period.

4.2.3 Spillover effect among unexpected oil shocks and stock markets

While the effects of unexpected oil price shocks on Chinese stock markets have been examined above, the spillover effect among the three markets also needs to be explored. To measure the intensity of spillover effect among unexpected oil shocks, Shanghai Stock market and Shenzhen Stock market, we compute the total spillover index proposed by Diebold and Yilmaz (2012). Table 6 presents the total spillover index of unexpected oil price shocks and returns across the three markets. These results are derived from vector autoregressions of order 4.

From Table 6, we can see that the spillover effect from \(Oil^{shock}\) to Shanghai stock market is larger than that from \(Oil^{shock}\) to Shenzhen stock market. The spillover effect between stock markets is more prominent than that between oil market and stock market. The net volatility spillover index shows that compared with Shenzhen stock market and Shanghai crude oil futures market, Shanghai stock market is the most influential market. Although unexpected crude oil price shocks will affect the stock market, the Shanghai crude oil futures market is more susceptible to the influence of Chinese stock market.

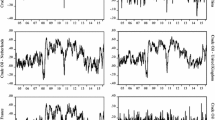

Table 6 shows the spillover index in the full sample period. Since the spillover effect of unexpected shocks in crude oil prices may have cyclical changes, we assess the spillover variation using 200-day rolling samples. The spillover index series are displayed in Fig. 2, which shows that the spillover effect of unexpected oil price shocks is highly time dependent. Unexpected shocks in oil prices were affected modestly by the stock market before March 8th, 2021. However, the spillover effect of unexpected shocks in oil prices has increased significantly since March 8th, 2021.

5 Conclusions

We first measure the unexpected shocks of crude oil price in Shanghai crude oil future market. Next, we investigate the impact of the shocks on Shanghai and Shenzhen stock markets applying ARDL and NARDL model over the period of 2018–2022. The results of this study confirm that there exist leverage effects in Shanghai crude oil futures prices. Negative information has more impact on Shanghai crude oil futures prices volatility than positive information.

Our study also reveals that there exist symmetric effects of unexpected oil price shocks on Shenzhen stock market and Shanghai stock market. Positive oil price shocks can significantly affect Shenzhen stock market in the next period, while negative oil price shocks have no significant impact on Shenzhen stock market in the next period. The unexpected drop in oil prices has a more significant impact on Shanghai stock market than the impact of the unexpected rise in oil price. The unexpected rise in oil prices has pushed up the returns of the Chinese stock market. An unexpected drop in oil prices will lead to lower returns in China’s stock markets. Unexpected negative price shocks will lead to an increase in stock returns of Shanghai stock market concurrently, rather than in the next period. Shanghai stock market and Shenzhen stock market reacted differently to previous unexpected positive shocks of oil price. The unexpected positive oil price shocks in the previous period have significant impact on the Shenzhen stock market, but have insignificant impact on the Shanghai stock market. While the unexpected shock of crude oil prices has a slight impact in the short term, it has a greater long-term impact on the Shanghai stock market. For Shanghai stock market, the speed of convergence to equilibrium level is greater than Shenzhen stock market. The Shanghai crude oil futures market reflects the underlying supply and demand relationship of China’s crude oil to certain extent.

Our results imply that due to the different effects of unexpected oil price shocks on Shanghai and Shenzhen stock market, investors in the two stock markets should adopt different investment strategies. In addition, the time-varying property of the spillover effect should be paid more attention. With the development of Shanghai crude oil futures markets, influence of oil price shocks will have an increasing impact on Chinese stock markets. It is essential to stabilize crude oil prices and to mitigate the impact of unexpected crude oil prices so as to reduce stock market price gyrations.

Data availability

The data that support the findings of this study are available from the corresponding author upon request.

References

Abdelhedi M (2020) Transmission of shocks between Chinese financial market and oil market. Int J Emerg Mark 15(2):262–286

Ahmed AD, Huo R (2021) Volatility transmissions across international oil market, commodity futures and stock markets: empirical evidence from China. Energy Econ 93:104741

Akinsola MO, Odhiambo NM (2020) Asymmetric effect of oil price on economic growth: panel analysis of low-income oil-importing countries. Energy Rep 6:1057–1066

Apergis N, Miller SM (2009) Do structural oil-market shocks affect stock prices? Energy Econ 31(4):569–575

Bai S, Koong KS (2018) Oil prices, stock returns, and exchange rates: empirical evidence from China and the United States. North Am J Econ Finance 44:12–33

Bouri E, Chen Q, Lien D, Lv X (2017) Causality between oil prices and the stock market in China: the relevance of the reformed oil product pricing mechanism. Int Rev Econ Finance 48:34–48

Diebold FX, Yilmaz K (2012) Better to give than to receive: predictive directional measurement of volatility spillovers. Int J Forecast 28:57–66

Ding Z, Granger CWJ, Engle RF (1993) A long memory property of stock market returns and a new model. J Empir Financ 1:83–106

Ding Z, Liu Z, Zhang Y, Long R (2017) The contagion effect of international crude oil price fluctuations on Chinese stock market investor sentiment. Appl Energy 187:27–36

Doko Tchatoka F, Masson V, Parry S (2019) Linkages between oil price shocks and stock returns revisited. Energy Econ 82:42–61

Fang S, Egan P (2018) Measuring contagion effects between crude oil and Chinese stock market sectors. Q Rev Econ Finance 68:31–38

Hamilton JD (2003) What is an oil shock? J Econ 113(2):363–398

Hashmi SM, Chang BH, Bhutto NA (2021) Asymmetric effect of oil prices on stock market prices: new evidence from oil-exporting and oil-importing countries. Resour Policy 70:101946

He Z (2020) Dynamic impacts of crude oil price on Chinese investor sentiment: nonlinear causality and time-varying effect. Int Rev Econ Finance 66:131–153

Hu C, Liu X, Pan B, Chen B, Xia X (2018) Asymmetric impact of oil price shock on stock market in China: a combination analysis based on SVAR model and NARDL model. Emerg Mark Finance Trade 54:1693–1705

Huang S, An H, Gao X, Wen S, Hao X (2017) The multiscale impact of exchange rates on the oil-stock nexus: evidence from China and Russia. Appl Energy 194:667–678

Ji Q, By Liu, Wl Zhao, Fan Y (2020) Modelling dynamic dependence and risk spillover between all oil price shocks and stock market returns in the BRICS. Int Rev Financial Anal 68:101238

Jiang W, Liu Y (2021) The asymmetric effect of crude oil prices on stock prices in major international financial markets. North Am J Econ Finance 56:101357

Lee K, Ni S, Ratti RA (1995) Oil shocks and the macroeconomy: the role of price variability. Energy J 16:39–56

Luo X, Qin S (2017) Oil price uncertainty and Chinese stock returns: new evidence from the oil volatility index. Finance Res Lett 20:29–34

Lv X, Lien D, Yu C (2020) Who affects who? Oil price against the stock return of oil-related companies: evidence from the US and China. Int Rev Econ Finance 67:85–100

Maghyereh A, Abdoh H (2020) Asymmetric effects of oil price uncertainty on corporate investment. Energy Econ 86:104622

Mendoza O, Vera D (2010) The asymmetric effects of oil shocks on an oil-exporting economy. Cuad Econ 47:3–13

Mork KA (1989) Oil and the macroeconomy when prices go up and down: an extension of Hamilton’s results. J Polit Econ 97(3):740–744

Nusair SA, Al-Khasawneh JA (2018) Oil price shocks and stock market returns of the GCC countries: empirical evidence from quantile regression analysis. Econ Chang Restruct 51(4):339–372

Nusair SA, Olson D (2021) Asymmetric oil price and Asian economies: a nonlinear ARDL approach. Energy 219:119594

Park J, Ratti RA (2008) Oil price shocks and stock markets in the U.S. and 13 European countries. Energy Econ 30(5):2587–2608

Pesaran MH, Shin Y (1999) An autoregressive distributed-lag modelling approach to cointegration analysis. Econ Econ Theory Twentieth Century 11:371–413

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econom 16:289–326

Rafailidis P, Katrakilidis C (2014) The relationship between oil prices and stock prices: a nonlinear asymmetric cointegration approach. Appl Financ Econ 24(12):793–800

Salisu AA, Isah KO (2017) Revisiting the oil price and stock market nexus: a nonlinear panel ARDL approach. Econ Model 66(March):258–271

Salisu AA, Raheem ID, Ndako UB (2019) A sectoral analysis of asymmetric nexus between oil price and stock returns. Int Rev Econ Finance 61:241–259

Shin Y, Yu B, Greenwood-Nimmo M (2014) Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In Festschrift in Honor of Peter Schmidt, New York, pp 281–31

Sun ZY, Cai XY, Huang WC (2022) The impact of oil price fluctuations on consumption, output, and investment in China’s industrial sectors. Energies 15(9):1–19

Tian M, Li W, Wen F (2021) The dynamic impact of oil price shocks on the stock market and the USD/RMB exchange rate: evidence from implied volatility indices. North Am J Econ Finance 55:101310

Toparlı EA, Çatık AN, Balcılar M (2019) The impact of oil prices on the stock returns in Turkey: A TVP-VAR approach. Phys A 535:122392

Wei Y, Guo X (2017) Oil price shocks and China’s stock market. Energy 140:185–197

Wen F, Xiao J, Xia X, Chen B, Xiao Z, Li J (2018) Oil prices and Chinese stock market: nonlinear causality and volatility persistence. Emerging Markets Finance and Trade 549:1558–1938

Wen X, Bouri E, Roubaud D (2018) Does oil product pricing reform increase returns and uncertainty in the Chinese stock market? Q Rev Econ Finance 68:23–30

Xiao J, Zhou M, Wen F, Wen F (2018) Asymmetric impacts of oil price uncertainty on Chinese stock returns under different market conditions: evidence from oil volatility index. Energy Econ 74:777–786

Zheng X, Su D (2017) Impacts of oil price shocks on Chinese stock market liquidity. Int Rev Econ Financ 50:136–174

Funding

The authors acknowledge funding supported from Shaanxi Education Department Key Research Base Project of Philosophy and Social Science (Grant No. 19JZ047),Shaanxi Philosophy and Social Science Fund (Grant No. 2022D219), and China Scholarship Council Fund (CSC: 201908610028).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

All authors declare that no conflict of interest exists.

Consent to participate

Not applicable.

Consent for publish

Not applicable.

Ethical approval

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Sun, ZY., Huang, WC. The effects of unexpected crude oil price shocks on Chinese stock markets. Econ Change Restruct 56, 1683–1697 (2023). https://doi.org/10.1007/s10644-023-09487-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-023-09487-8