Abstract

This research evaluates the role of science and technology parks as locations fostering local knowledge exchange and promoting innovation. We consider that these knowledge externalities depend on firms’ internal efforts and strategies, since their capacity to understand and exploit others’ knowledge depends on their own knowledge base. Empirical evidence has been gathered from 2007 to 2011 in a longitudinal analysis on 11,201 firms in total, using a Spanish database from PITEC (Technological Innovation Panel). Results of a two Tobit models with random effects, confirm our hypotheses. First, firms with previous cooperation agreements with universities and research institutions would benefit most from the park as they can more easily incorporate existing knowledge in the park and improve their product innovation. Secondly, results also seem to indicate that product innovation is higher when firms with internal R&D efforts can share knowledge on a reciprocal basis with other firms that are also investing in R&D.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Science and technology parks have been broadly considered as locations that improve local innovation by promoting knowledge development and transmission among co-located firms (Huang et al. 2012; McAdam and McAdam 2008). Firms in science and technology parks benefit from knowledge spillovers that can be a consequence of research, ideas, and experience stemming from universities or research centres (Hansson et al. 2005; Löfsten and Lindelöf 2005) as well as from co-located firms such as providers, clients or socially-related firms (Bakouros et al. 2002; Colombo and Delmastro 2002), among others.

Abundant research has been conducted to evaluate whether on-park firms improve innovation based on these knowledge spillovers, along with other local benefits based on services and support provided by the park (Chan and Lau 2005; Grimaldi and Grandi 2005; Squicciarini 2007). Nevertheless, empirical evidence on the relationship between innovation and physical proximity among co-located firms is not conclusive (Anselin et al. 1997; Baptista and Swann 1998). We need to consider whether on-park firms benefit differently from knowledge spillovers, whether firms learn differently from others, as they have their own ability to assimilate and replicate existing local knowledge spillovers (Ashish and Gambardella 1990; Boschma 2005; Cassiman and Veugelers 2006). In particular, firms that have developed a common knowledge base, which allows them to mutually understand each other, will benefit most from local knowledge spillovers (Ter Wal and Boschma 2009).

The objective of this research is to evaluate the effect on local innovation of belonging to a park, but considering firms’ differences in their capacity to absorb local knowledge spillovers. Consequently, this paper firstly contributes to existing literature by considering the benefits of the park dependent not only on access to external knowledge, but also on each firm’s internal efforts and strategies (Giuliani and Bell 2005; Molina-Morales and Marti´nez-Fernández 2004; Morrison and Rabellotti 2009; Zaheer and Bell 2005).

In particular, we consider that this capacity to absorb local spillovers would firstly depend on formal cooperation agreements with universities and other research institutions (Lambooy 2004). Universities have been viewed as the park’s main institution fostering regional innovation by disseminating basic research among highly innovative firms (Lee et al. 2001; McAdam and McAdam 2008). Nevertheless, empirical evidence is not conclusive (Löfsten and Lindelöf 2005; Vedovello 1997) and highlights the cost of assimilating knowledge and technologies provided by universities as well as the scarcity of university/firm linkages (Massey et al. 1992). In this regard, we contribute to this research by evaluating how having established cooperation agreements with other universities or research centres may foster these knowledge flows (Gulati and Gargiulo 1999; Johansson et al. 2005; Soda et al. 2004).

We also try to understand how each firm’s internal R&D efforts in developing new products affect their capacity to understand ideas, experiences, and knowledge from others in the park. Along with being an internal source of knowledge, R&D efforts have broadly been considered a tool to increase a firm’s capacity to recognise and assimilate external knowledge (Cohen and Levinthal 1990; Tsai 2001). However, several studies undertaken in geographically concentrated spaces have recently observed that firms with high R&D efforts tend to isolate themselves from rivals (Boschma and Ter Wal 2007; Huang et al. 2012; Morrison and Rabellotti 2009), and the effect of this on these environments has not been clearly stated. Our aim, therefore, is to contribute by evaluating the role these R&D investors play in science and technology parks in either promoting knowledge exchange or, on the contrary, reducing it.

Finally, this study provides new empirical evidence on the consequences of belonging to science and technology parks to improve firms’ innovation capacity in Spain. We use a longitudinal database from PITEC. It provides useful information for our research about 34,367 firms, either on-park or off-park, for 5 years, from 2007 to 2011, having 10,882 every year.

This paper is structured into four sections. The theoretical background and hypotheses for the study are explained after this introduction. The third section explains the sample employed to measure the variables and the main results and discussions, before the final summing up in the conclusions.

2 Hypotheses

The major justification for the existence of science and technology parks is that firms have access to services and support to commercialise their new products successfully in the market. Most of these firms are small in size and lack experience, so belonging to a park provides them with specialised services, shared resources and business, financial support, and a better reputation and more legitimacy than an increase in their innovative capacity (Ferguson and Olofsson 2004; Mian 1997; Siegel et al. 2003). Promoting local knowledge creation and dissemination, especially when it is tacit, has turned out to be the most relevant element in understanding this higher localised innovation (Hansson et al. 2005; Löwegren 2003; Rothaermel and Thursby 2005; Vásquez Urriago et al. 2010).

Access to this local knowledge can be considered a collective good, given that it is the result of a process combining pieces of knowledge owned by a variety of agents which cannot easily be traded off-park (Lambooy 2010). On-park firms can obtain knowledge from either university or other co-located firms that share their own ideas, experiences and advice (Bakouros et al. 2002; Colombo and Delmastro 2002).

University scientists and business units tend to share the same buildings in parks, so face-to-face encounters tend to be frequent, and collaborative knowledge-creation opportunities between research institutions and tenant firms’ R&D units abound (Löfsten and Lindelöf 2005). Nevertheless, the effective transfer of knowledge requires an absorptive capacity to identify, interpret and exploit new knowledge (Boschma 2005; Cohen and Levinthal 1990). Co-located firms tend to learn in close proximity to their existing knowledge, as knowledge creation is often cumulative and builds on prior related knowledge (Boschma 2005; Gorman 2002). More precisely, new knowledge is incorporated into organisational knowledge only when it is shared and assimilated into organisational routines, documents, and practices (Cohen and Levinthal 1990).

Firms are conditioned by the specific investments and complementary assets they possess, or have possessed in the past, their social context and culture, and the portfolio of activities, technologies and markets they have been involved in. All of these conditions propel firms towards a specific learning path determined by the firm’s previous and historical knowledge and reflected in their specific routines and procedures (Teece et al. 1997; Zahara and George 2002). Firms develop complex routines as a consequence of their shared knowledge base and experiences, which allow then to share and understand others’ tacit knowledge with lower coordination and communication costs (Grant 1996; Robertson and Langlois 1995). Firms sharing a similar knowledge base will rely on similar heuristics and procedures on how to conduct research and own common views on who is allowed to access their knowledge and which part of it can be released (Morrison and Rabellotti 2009).

2.1 Cooperation agreements with the university and research institutions

In science parks, the main source of tacit knowledge has been traditionally associated with universities and research institutions (Asheim and Isaksen 2002; Link and Scott 2007; Quintas et al. 1992; Westhead and Batstone 1998). They are a source of valuable knowledge by providing scientific research that firms inside a Science Park can transform into new valuable products, services or processes (Löfsten and Lindelöf 2005; Westhead 1997). The rich stock of physical and social capital universities possess, as well as the availability of expert researchers, can increase success in innovation by transmitting knowledge. They can provide local firms with basic research that can be transformed into new products and processes (Quintas et al. 1992), as well as experiences and useful advice along the process (Bakouros et al. 2002; Hansson et al. 2005).

Firms can innovate by having an interactive relationship with the university, in which the university sometimes leads the development of new technologies, and sometimes focuses on problems posed by prior developments or buyer feedback (Cohen et al. 2002; Lambooy 2004). Nevertheless, the knowledge employed in business is firm-specific and accumulative, while university knowledge outputs may be either too general, or too theoretical and fundamental, and thus too long-term to be easily usable (Löfsten and Lindelöf 2005). As a source of knowledge useful for increasing firms’ innovations, it largely depends on the capacity that each firm has to identify and apply this knowledge (Grant 1996; Kogut and Zander 1992).

Therefore, on-park firms that have also established formal relationships with universities and research institutions—R&D collaborations, analysis and testing in university departments, and the establishment of research contracts—whatever their location, would have a higher capacity to absorb these university-knowledge externalities (Johansson et al. 2005; Phillimore 1999; Vedovello 1997). These collaborative linkages involve repeated and regular meetings with the university, a focus on specific issues, and entail coordination, and close contact (Ahuja 2000). Moreover, many of these formal relationships are accompanied by informal relationships, i.e. personal contact with university staff, attendance at seminars and conferences or accessing local research, which also allow for knowledge exchange (Bakouros et al. 2002; Colombo and Delmastro 2002). By establishing formal or informal relationships with members of the university, firms develop stable relationships that foster the development of non-transferable common knowledge among parties (Grant 1996), and improve mutual understanding among firms (Gulati 1995). Moreover, both parties’ motivation to provide assistance or support is stronger under these conditions. Maintaining these formal and informal interactions requires time and effort, so firms will try to take advantage of these relationships by increasing reciprocity, trying to contribute to others, and making a major effort to be understood (Granovetter 1973; Hansen 1999).

Taking into account these arguments, we propose that:

Hypothesis 1

Cooperation with universities and research institutions would improve firms’ success in introducing new products in science parks.

2.2 Internal R&D efforts

In parks, along with knowledge externalities provided by the university and research institutions, local interactions among various firms provide them with knowledge created by an interactive dynamic and network-oriented learning (Hansson et al. 2005). In other words, firms benefit from externalities by taking advantage of knowledge created and transmitted by others, while also contributing to these externalities by dispersing their own knowledge among neighbouring firms.

As happens with knowledge from universities and research institutions, the possession of related knowledge in the firm will result in a better understanding of others’ technological developments: they are likely to have a better ability to recognise new knowledge, to identify how to incorporate it into new products or processes, to discover new commercial uses, and to enhance their business operations (Tsai 2001). In this regard, internal R&D efforts are broadly considered as an essential element in explaining a firm’s ability to absorb external knowledge (Ashish and Gambardella 1990; Cassiman and Veugelers 2006; Tsai 2001). As firms learn from their own R&D investments, they also develop their ability to understand knowledge from interactions (Ashish and Gambardella 1990; Cassiman and Veugelers 2006). Firms that invest in internal R&D can more easily combine their internal ideas with knowledge from outside and therefore create new products, services or processes (Cohen and Levinthal 1990; Tsai 2001).

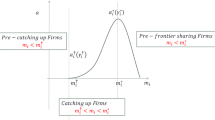

However, firms making internal R&D efforts not only improve their absorptive capacity, but also increase their attractiveness to other neighbouring firms also making R&D efforts. The higher the R&D investments undertaken by on-park firms, the higher the externalities created, so firms surrounded by low R&D investors would benefit less from these externalities (Shaver and Flyer 2000). As a consequence, firms investing in R&D would prefer to be co-located with other firms that are also making internal R&D efforts and not with ones that are taking advantage of them. Exchanges among co-located firms take the form of trading where firms can release knowledge on the basis of reciprocity (Morrison and Rabellotti 2009). Given the positive role of favouring knowledge exchange and willingness among firms, it is proposed that:

Hypothesis 2

Internal R&D efforts would improve firms’ success in introducing new products in science parks.

3 Empirical analysis

Since 1985, when the first science and technology park was established, Spain has experienced a boom in the development of these parks. The Association of Science and Technology Parks of Spain (APTE) reports that during last year, 76 science and technology parks were operating in Spain, and that 6,206 firms were located in parks, employing 146,669 members of staff, and recording a turnover of €21,587 million.

Although there is no generally accepted definition of a science and technology park (Dettwiler et al. 2006; Löfsten and Lindelöf 2005), it can be defined as a property-based initiative with links to university or other research centres designed to encourage the formation and growth of knowledge-based businesses, and with management functions to support the transfer of technology and business skills to tenant firms (Quintas et al. 1992; Zhang 2005).

3.1 Data source and measurements

For this study, we have used microdata from PITEC, which is considered the best database for observing the innovation activities of Spanish firms over timeFootnote 1 (Barge-Gil 2010). Initiated in 2003, this database is being built annually by Spain’s National Institute of Statistics (INE), the Spanish Foundation for Science and Technology (FECYT), and the Cotec Foundation (Spain’s National Institute of Statistics).

To make anonymised data as useful as possible, PITEC applies the microaggregation technique based on protecting individual data by aggregation. In particular, it replaces the firm-level observations of some quantitative variables (e.g. revenues, number of employees and innovation expenditure) with a 44-industry breakdown at 4-digit level according to NACE Codes. Abundant research has used this database, as it is considered to be a reliable source of results (López 2012). This database is of special relevance in our research since it is the only one that contains information on the innovation activities of firms located in science and technology parks. Various authors (e.g. (Montoro-Sánchez et al. 2011) have used the PITEC database to advance the understanding of the link between spillovers and the innovative behaviour of companies in Spain,Footnote 2 but as yet no publications have analysed the contribution of Spanish science parks by considering the different ways firms absorb local knowledge spillovers. That is why this paper has explored the role Spanish science and technology parks play in the interaction between collaboration and internal R&D investment.

The data used in this study covers the period between the years 2007–2011 because 2007 is the first year of the panel with information on science park location and 2011 is the last year currently available.

Initially, the panel contains information on approximately 12,800 firms. We established the following criterion by (Villalonga 2004) to obtain a more balanced panel: observations for which the available continuous time series is shorter than 3 years have been eliminated from the previous dataset. The final sample contains 10,882 every year.

Following previous research on the park effect (Löfsten and Lindelöf 2002, 2005; Siegel et al. 2003; Westhead 1997), innovation performance is measured as the introduction of new products. To measure product innovations, we use the percentage of sales from new products (new products), given that it reflects the success of new products (Cassiman and Veugelers 2006).

Cooperation with universities and technological institutions is a variable which takes the value of 1 if the firm cooperates with universities or other higher education centres, research experts, public research organisations and/or technological institutions.

Park is a binary dummy representing science park location that equals 1 if a firm is located in a science and technology park. Most previous research that has attempted to evaluate the effect of parks tends to compare being on-park with off-park, splitting the sample into these two categories (Colombo and Delmastro 2002; Ferguson and Olofsson 2004; Siegel et al. 2003; Yang et al. 2009).

We measured internal R&D strategy (internal R&D) by the ratio of internal R&D to total R&D expenditure (which is the sum of internal and external R&D). This variable is a ratio that can range from zero (when all the R&D activities are acquired in the market) to 100 (when all the R&D activities are performed internally).

When assessing the effect of belonging to a science park on a firm’s innovation performance, controlling other variables that may impact on a firm’s performance is critical. First, we take into account the firm’s innovation intensity. It is expected that higher innovation intensity increases a firm’s performance (Bloom and Van Reenen 2002; Günday et al. 2011). Traditionally, and still the most popular input indicator, is R&D expenditure (Acs et al. 2002). We use a wider input indicator, which is innovation expenditure (% of turnover).Footnote 3

The firm’s size (size) is another control variable that is usually added. This variable is expected to have a positive relationship with a firm’s innovation performance, since larger firms have more resources and might benefit from economies of scales and scope. We follow the previous literature and define firm size as the natural logarithm of the number of employees. We also control firm age, which may have a complex relationship with a firm’s performance. Old experienced firms may be more likely to grow because they have learned how to do things better, but younger firms may perhaps benefit from fewer organisational rigidities and inertia, which age brings about. As theoretical literature does not provide clear evidence of the effect of firm age on firm′s innovation performance, this issue is explored empirically allowing for the coexistence of both positive and negative effects. We define firm age as the logarithm of the number of years (plus oneFootnote 4) elapsed since the year of establishment (Anderson and Reeb 2003; Fukugawa 2006) and is used with its quadratic form (age 2) to explore the existence of nonlinear effects.

3.2 Descriptive analysis

Before assessing the impact of belonging to a park on the innovation performance of firms, we checked for heterogeneity between on-park and off-park firms. The results of the two-group t-tests are presented in Table 1, showing significant differences in the attributes of both groups.

The firms located on science parks in our study tended to establish more collaborations and have more internal R&D strategy that their off-park counterparts. Likewise, firms located in science parks tended to be both younger and have a smaller number of employees. This is consistent with the results of other comparative studies (Ferguson and Olofsson 2004; Löfsten and Lindelöf 2001). It is also quite clear in our sample that firms located in science parks report greater innovation intensity than the off-park firms (see Table 1).

Table 2 presents a Spearman’s correlation matrixFootnote 5 depicting correlations between each of the variables used in the regression. These results lead us to conclude that the presence of multicollinearity is rather unlikely to be a serious problem with the data in this study.

Firm location in a park is a dynamic variable in this study. In our data set, there is annual location information. Table 3 illustrates the values of the main variables undertaken in this research from 2007 to 2011. As can be observed, there are clear differences when comparing on-park with off-park firms. While 47 % of the on-park firms in 2007 had established a cooperation agreement with universities and institutions, only 18.3 % of the off-park firms had a similar agreement. In the same vein, on-park firms tend to make more internal R&D efforts since, in 2007, they spent 63.7 % of their total R&D expenditure on this, whilst in the same period off-park firms spent 39.4 %. The longitudinal analysis shows the evolution of these data, confirming that on-park firms tend to be engaged in cooperation agreements and internal R&D efforts more frequently than off-park firms.

3.3 Methodology and empirical findings

Given that our dependent variable “new products” is zero for a nontrivial fraction of the population but is roughly continuously distributed over positive values, and that we have panel data, a dynamic Tobit analysis is applied (Wakelin 1998; Sterlacchini 1999; Greene 2000; Wooldridge 2006). It can be written as:

Hypothesis 1 maintained that firms cooperating with universities and research institutions inside science parks would improve firms’ innovation performance in the form of new products in the market. To test this hypothesis, the general model is specified as follows:

Hypothesis 2 establishes that firms’ internal R&D efforts in science parks would improve firms’ success in introducing new products in the market. To test this hypothesis, we run the same model proposed in Eq. 1 with the exception of the interaction term, which is the product of park and internal R&D:

Exploring the relationship between internal R&D and innovation performance, we allow for the existence of individual effects that are potentially correlated with the right-hand side of regressors, such that εit = αi + μit. Here, α represents the individual effect which varies across firms, but is constant over time, and μ is a “white noise” error term. We use the Wooldridge testFootnote 6 to decide which of the two models, fixed effect or random effect, is more appropriate. First, we can look at the regressions obtained from Eqs. (1, 2), whose estimates are shown in Table 3. As the values corresponding to the Wooldridge tests on the random-effect versus fixed-effect model do not reject the null hypothesis, the estimates shown in Table 3 are obtained from the random-effect Tobit models.

Table 4 presents the estimations of two Tobit models with random effects, over the 34,367 observations available. Columns 1 and 2 show the results of Eq. 1, and columns 3 and 4 present the results for Eq. 2.

As observed in Eq. 1, the interaction effect between park and cooperation has a positive and significant coefficient (β = 7.22; SE = 4.130), which supports hypothesis 1, i.e. the combination of being located on-park and cooperating is positive, as on-park firms tend to develop a higher capacity to understand and interpret knowledge provided by universities and other research institutions. While any firm improves their innovation capacity when they establish cooperation agreements (Aschhoff and Schmidt 2008; Belderbos et al. 2004; Lööf and Broström 2008), belonging to a park leverages these benefits.

Park benefits associated with access to knowledge provided by universities or other research institutions have been under question in abundant research. As (Quintas et al. 1992) observed, there are few benefits since firms cannot incorporate basic research from the university into the market. In this regard, the park’s effect is not significant β = 5.36; SE = 4.28) and could confirm this approach. Previous studies have also found no significant benefits of belonging to a park on firms’ innovative capacity (Westhead 1997) or on performance (Bakouros et al. 2002; Dettwiler et al. 2006; Ferguson and Olofsson 2004; Löfsten and Lindelöf 2001; Massey et al. 1992).

Equation 2 shows the estimation for the interaction effect between park and internal R&D ratio. Its positive and significant (β = 0.097; SE = 0.058) result concluded that the relationship between the ratio of internal R&D to total R&D and innovation performance is dependent on firm location (i.e. either on-park or off-park), which supports hypothesis 2.

The results also show that firms’ internal R&D effort positively affects innovation performance. Consistent with previous literature (Cassiman and Veugelers 2006; Cohen and Levinthal 1990; Rothaermel and Thursby 2005), our results seem to support the notion that the level of a firm’s internal R&D efforts is an important predictor of the firm’s absorptive capacity, and hence, a predictor of their innovative capacity. Moreover, on-park firms with a high internal R&D effort would find it easier to share knowledge on a reciprocal basis with other firms that are also investing in R&D.

Regarding the effect of control variables, we can observe that innovation intensity has a positive and significant effect on firms’ capacity to introduce new products in the market (β = 0.429; SE = 0.221 in Eq. 1; β = 0.410; SE = 0.221 in Eq. 2). Age has a non-linear effect (β = -20.956; SE = 5.041 for age and β = 3.068; SE = 0.837 for age2 in Eq. 1; β = -20.922; SE = 5.041 for age and β = 3.062; SE = 0.837 for age2 in Eq. 2), suggesting that younger and older firms outperform those middle-aged firms (Almus and Nerlinger 1999; Glancey 1998). Likewise, we find a significant but negative role of firm size on innovation performance (β = −2.607; SE = 0.411 in Eq. 1; β = −2.606; SE = 0.411 in Eq. 2). When analyzing the rates of the new product success of small firms, it is important to recognise the significance of age. Some authors indicate that it is easy to observe illusory differences in growth amongst a group of small firms over time if one group is younger than the otherFootnote 7 (Dettwiler et al. 2006).

4 Conclusions and implications

This research evaluates the effect of parks on firms’ innovative capacity, measured by the percentage of sales of new products launched by the firm. We have conducted a longitudinal analysis, from 2007 to 2011, including 11,201 firms in total, using the Spanish PITEC database. Based on previous studies, we have compared on-park firms with those off-park to understand the role the park plays in promoting knowledge dissemination among on-park firms and universities. Nevertheless, rather than assuming that these park knowledge externalities are the same for any co-located firm, we condition these benefits on the park’s internal efforts and strategies.

In particular, we confirm that firms that have developed cooperation agreements with universities and other research institutions are more able to exploit on-park knowledge externalities, thus improving their innovative capacity. Firms that have undertaken these agreements are more able to understand basic research, and the experience and advice provided by university departments and researchers as part of the innovative process. Since they have developed a mutual understanding, based on share routines and procedures, firms can more easily identify and incorporate knowledge from the university not only by formal mechanisms, but also by informal encounters and meetings, which are so important on-park.

In addition, knowledge externalities are created by other co-located firms being more profitable than firms making more internal R&D efforts. They can both better understand others in the vicinity on-park and leverage the benefits of being surrounded by other innovative firms. Firms that hardly invest in internal R&D tend to be more isolated from these knowledge externalities since they contribute less to them, and other firms would be more reluctant to exchange knowledge with them.

This research has some implications for future research that can be conducted. First, it would be interesting to gain a deeper insight into the internal knowledge network created among firms and institutions, by obtaining data at a relational level. Recent research on geographical concentration has been developed by incorporating Social Network Analysis tools to better understand knowledge flows among on-park firms and institutions (Ahuja 2000; Hansson et al. 2005). By taking into account the position that the firm has in this network, interesting conclusions can be obtained such as: Do central firms in science and technology parks access more knowledge? And how does this knowledge increase innovation?

Secondly, related to the previous idea of understanding the park network at microlevel, it would be of great interest to further explore the role played by on-park technological gatekeepers. Previous studies in concentrated spaces have put into question the relevance of larger and externally connected firms in promoting local innovation, as they may find it more difficult to adapt to technological changes internally (Giuliani 2011; Morrison 2008). Future research could try to understand which kind of firms behave as technological gatekeepers on-park and their relationship with local innovation.

Thirdly, it would be compelling to evaluate other aspects of firms that can also increase their capacity to benefit from the park. Previous studies have pointed out the relevance of human resources such as the capacity to understand and process. As Simon (1991) points out, this learning takes place inside individual human heads. An organisation learns by their members learning, so it seems reasonable that human resources play a relevant role. Firms that have better educated employees can more easily identify relevant knowledge from outside the firm, understand it and exploit it in the form of new products and processes to be sold. Abundant literature on clusters has paid special attention to employees and their qualifications as this is considered an important source of local externalities (Morosini 2004; Rotemberg and Saloner 2000).

The conclusions of this research also have some policy implications, mainly related to the fact that firms benefiting from local knowledge externalities are those that have made internal efforts and strategies too. As observed, parks per se have no clear benefits on innovation. Public investment in parks is viewed as a key element in government innovation development policy, since it has been broadly considered as a local promoter. Nevertheless, this support should be calibrated taking into account the characteristics of the firms and the internal dynamic of the park fostering these benefits. Access to valuable knowledge, which has recently been considered the most important driver of innovation, requires private firms located on-park to make an effort. We cannot expect all on-park firms to benefit from their location, so we need to promote behaviour that allows firms to take advantage of it. Moreover, many of these collective benefits depend on other firms’ characteristics, such as previous experience, their local reputation, etc. As a consequence, financial aid, and access to machinery provided by laboratories would be dramatically reduced if firms did not improve their innovative capacity in the long term and local development does not take place.

Notes

The data is available online http://icono.fecyt.es/PITEC/Paginas/descarga_bbdd.aspx.

This database has also been largely used for the analysis of different objectives related to innovation in Spain (Molero and García 2008).

This indicator includes not only spending on internal and external RandD, but also non-RandD expenditure such as training, market introduction of innovations and advertising.

We add 1 year to avoid ages of zero (Fukugawa 2006).

The Kolmogorov–Smirnov test determined that the variables are not normally distributed. So we cannot use Pearson correlations.

The Hausman test cannot be employed in this research because it assumes α i and µ it to be independently and identically distributed, which is not the case.

The reason is that in proportionate terms, younger firms grow faster than older firms.

References

Acs, Z. J., Anselin, L., & Varga, A. (2002). Patents and innovation counts as measures of regional production of new knowledge. Research Policy, 31(7), 1069–1085.

Ahuja, G. (2000). Collaboration networks, structural holes, and innovation: A longitudinal study. Administrative Science Quarterly, 45(3), 425–455.

Almus, M., & Nerlinger, E. A. (1999). Growth of new technology-based firms: Which factors matter? Small Business Economics, 13(2), 141–154.

Anderson, R., & Reeb, D. (2003). Founding family ownership and firm performance: Evidence from the SandP 500. Journal of Finance, 58, 1301–1329.

Anselin, L., Varga, A., & Acs, Z. J. (1997). Local geographic spillovers between university research and high technology innovations. Journal of Urban Economics, 42(3), 422–448.

Aschhoff, B., & Schmidt, T. (2008). Empirical evidence on the success of R&D cooperation—Happy together? Review of Industrial Organization, 33, 41–62.

Asheim, B. T., & Isaksen, A. (2002). Regional innovation systems: The integration of local “sticky” and global “ubiquitous” knowledge. The Journal of Technology Transfer, 27, 77–86.

Ashish, A., & Gambardella, A. (1990). Complementarity and external linkages: The strategies of the large firms in Biotechnology. The Journal of Industrial Economics, 38(4), 361–379.

Bakouros, Y. L., Mardas, D. C., & Varsakelis, N. C. (2002). Science park, a high tech fantasy? An analysis of the science parks of Greece. Technovation, 22(2), 123–128.

Baptista, R., & Swann, P. (1998). Do firms in clusters innovate more? Research Policy, 27(5), 525–540.

Barge-Gil, A. (2010). Open, semi-open and closed innovators: Towards an explanation of degree of openness. Industry and innovation, 17(6), 577–607.

Belderbos, R., Carree, M., Diederen, B., & Lokshin, B. (2004). Cooperative R&D and firm performance. Research Policy, 33(10), 1477–1492.

Bloom, N., & Van Reenen, I. (2002). Patents, real options and firm performance. The Economic Journal, 112, 97–116.

Boschma, R. A. (2005). Proximity and innovation: A critical assessment. Regional Studies, 39(1), 61–74.

Boschma, R. A., & Ter Wal, J. (2007). Knowledge networks and innovative performance in an industrial district: The case of a footwear district in the south of Italy. Industry and Innovation, 14(2), 177–199.

Cassiman, B., & Veugelers, R. (2006). In search of complementarity in innovation strategy: Internal R&D and external knowledge acquisition. Management Science, 52(1), 68–82.

Chan, K. F., & Lau, T. (2005). Assessing technology incubator programs in the science park: The good, the bad and the ugly. Technovation, 25(10), 1215–1228.

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35(1), 128–152.

Cohen, W. M., Nelson, R. R., & Walsh, J. P. (2002). Links and impacts: The influence of public research on industrial R&D. Management Science, 48(1), 1–23.

Colombo, M. G., & Delmastro, M. (2002). How effective are technology incubators? Evidence from Italy. Research Policy, 31, 1103–1122.

Dettwiler, P., Lindelöf, P., & Löfsten, H. (2006). Utility of location: A comparative survey between small new technology-based firms located on and off Science Parks—Implications for facilities management. Technovation, 26(4), 506–517.

Ferguson, R., & Olofsson, C. (2004). Science parks and the development of NTBFs—Location, survival and growth. The Journal of Technology Transfer, 29(1), 5–17.

Fukugawa, N. (2006). Science parks in Japan and their value-added contributions to new technology-based firms. International Journal of Industrial Organization, 24(2), 381–400.

Giuliani, E. (2011). Role of technological gatekeepers in the growth of industrial clusters : Evidence from Chile. Regional Studies, 45(10), 1329–1348.

Giuliani, E., & Bell, M. (2005). The micro-determinants of meso-level learning and innovation: Evidence from a Chilean wine cluster. Research Policy, 34(1), 47–68.

Glancey, K. (1998). Determinants of growth and profitability in small entrepreneurial firms. International Journal of Entrepreneurial Behavior and Research, 4(1), 18–27.

Gorman, M. E. (2002). Types of knowledge and their roles in technology transfer. The Journal of Technology Transfer, 27, 219–231.

Granovetter, M. S. (1973). The strength of weak ties. American Journal of Sociology, 78(6), 1360–1380.

Grant, R. M. (1996). Toward a knowledge-based theory of the firm. Strategic Management Journal, 17(Winter Special Issue), 109–122.

Greene, W. H. (2000). Econometric analysis. New Jersey: Prentince Hall.

Grimaldi, R., & Grandi, A. (2005). Business incubators and new venture creation: An assessment of incubating models. Technovation, 25(2), 111–121.

Gulati, R. (1995). Does familiarity breed trust? The implications of repeated ties for contractual choice in alliances. Academy of Management Journal, 38(1), 85–112. doi:10.2307/256729.

Gulati, R., & Gargiulo, M. (1999). Where do interorganizational networks come from? American Journal of Sociology, 104(5), 1439–1493.

Günday, G., Ulusoy, G., Kılıç, K., & Alpkan, L. (2011). Effects of innovation types on firm performance. International Journal of Production Economics, 133(2), 662–676.

Hansen, M. T. (1999). The search-transfer problem: The role of weak ties in sharing knowledge across subunits organization. Administrative Science Quarterly, 44(1), 82–111.

Hansson, F., Husted, K., & Vestergaard, J. (2005). Second generation science parks: from structural holes jockeys to social capital catalysts of the knowledge society. Technovation, 25, 1039–1049.

Huang, K.-F., Yu, C.-M. J., & Seetoo, D.-H. (2012). Firm innovation in policy-driven parks and spontaneous clusters: The smaller firm the better? The Journal of Technology Transfer, 37(5), 715–731.

Johansson, M., Jacob, M., & Hellstro, T. (2005). The strength of strong ties: University spin-offs and the significance of historical relations. The Journal of Technology Transfer, 30, 271–286.

Kogut, B., & Zander, U. (1992). Knowledge of the firm, combinative capabilities, and the replication of technology. Organization Science, 3(3), 383–397.

Lambooy, J. G. (2004). The transmission of knowledge, emerging networks, and the role of universities: An evolutionary approach. European Planning Studies, 12(5), 643–657.

Lambooy, J. G. (2010). Knowledge transfers, spillovers and actors: The role of context and social capital. European Planning Studies, 18(6), 873–891.

Lee, C., Lee, K., & Pennings, J. M. (2001). Internal capabilities, external networks, and performance: A study on technology-based ventures. Strategic Management Journal, 22(6–7), 615–640.

Link, A. N., & Scott, J. T. (2007). The economics of university research parks. Oxford Review of Economic Policy, 23(4), 661–674.

Löfsten, H., & Lindelöf, P. (2001). Science parks in Sweden—industrial renewal and development? R&D Management, 31(3), 309–322.

Löfsten, H., & Lindelöf, P. (2002). Science parks and the growth of new technology-based firms—Academic-industry links, innovation and markets. Research Policy, 31(6), 859–876.

Löfsten, H., & Lindelöf, P. (2005). R&D networks and product innovation patterns—Academic and non-academic new technology-based firms on science parks. Technovation, 25, 1025–1037.

Lööf, H., & Broström, A. (2008). Does knowledge diffusion between university and industry increase innovativeness? The Journal of Technology Transfer, 33(1), 73–90.

López A (2012) Effect of microaggregation on regression results: An application to Spanish innovation data. The Empirical Economics Letters, 10(12).

Löwegren, M. (2003). New technology-based firms in science parks: A study of resources and absorptive capacity. Sweden: Lund University Press.

Massey, D., Quintas, P., & Wield, D. (1992). High-tech fantasies: Science parks in society, science and space. London: Routledge.

McAdam, M., & McAdam, R. (2008). High tech start-ups in University Science Park incubators: The relationship between the start-up’s lifecycle progression and use of the incubator’s resources. Technovation, 28(5), 277–290.

Mian, S. A. (1997). Assesing and managing the university technology business incubator: An integrative framework. Journal of Business Venturing, 12, 251–285.

Molina-Morales, F. X., & Martínez-Fernández, M. T. (2004). How much difference is there between industrial district firms? A net value creation approach. Research Policy, 33(3), 473–486.

Montoro-Sánchez, A., Ortiz-de-Urbina-Criado, M., & Mora-Valentín, E. M. (2011). Effects of knowledge spillovers on innovation and collaboration in science and technology parks. Journal of Knowledge Management, 15(6), 948–970.

Morosini, P. (2004). Industrial clusters. Knowledge integration and performance. World Development, 32(2), 305–326.

Morrison, A. (2008). All Gatekeepers of knowledge within industrial districts: Who they are, how they interact. Regional Studies, 42(6), 817–835.

Morrison, A., & Rabellotti, R. (2009). Knowledge and information networks in an Italian wine cluster. European Planning Studies, 17(7), 983–1006.

Phillimore, J. (1999). Beyond the linear view of innovation in science park evaluation an analysis of Western Australian Technology Park. Technovation, 19(11), 673–680.

Quintas, P., Wield, D., & Massey, D. (1992). Academic-industry links and innovation: Questioning the science park model. Technovation, 12(3), 161–175.

Robertson, P. L., & Langlois, R. N. (1995). Innovation, networks, and vertical integration. Research Policy, 24(4), 543–562.

Rotemberg, J. J., & Saloner, G. (2000). Competition and human capital accumulation: A theory of interregional specialization and trade. Regional Science and Urban Economics, 30, 373–404.

Rothaermel, F. T., & Thursby, M. (2005). University–incubator firm knowledge flows: Assessing their impact on incubator firm performance. Research Policy, 34(3), 305–320.

Shaver, J. M., & Flyer, F. (2000). Agglomeration economies, firm heterogeneity, and foreign direct investment in the United States. Strategic Management Journal, 21(12), 1175–1193.

Siegel, D. S., Westhead, P., & Wright, M. (2003). Science parks and the performance of new technology-based firms: A review of recent UK evidence and an agenda for future research. Small Business Economics, 20, 177–184.

Simon, H. A. (1991). Bounded rationality and organizational learning. Organization Science, 2(1), 125–134.

Soda, G., Usai, A., & Zaheer, A. (2004). Network memory: The influence of past and current networks on performance. Academy of Management Journal, 47(6), 893–906.

Squicciarini, M. (2007). Science parks’ tenants versus out-of-park firms: Who innovates more? A duration model. The Journal of Technology Transfer, 33(1), 45–71.

Sterlacchini, A. (1999). Do innovative activities matter to small firms in non-R&D intensive industries? An application to export performance. Research Policy, 28(8), 819–832.

Teece, D., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic Management Journal, 18, 509–533.

Ter Wal, A. L. J., & Boschma, R. A. (2009). Applying social network analysis in economic geography: Framing some key analytic issues. Annals of Regional Science, 43, 739–756.

Tsai, W. (2001). Knowledge transfer in intraorganizational networks: Effects of network position and absorptive capacity on business unit innovation and performance. Academy of Management Journal, 44(5), 996–1004.

Vásquez Urriago, A. R., Modrego, A., Barge-Gil, A., & Paraskevopoulou, E. (2010). The impact of science and technology parks on firms’ radical product innovation. Empirical evidence from Spain.

Vedovello, C. (1997). Science parks and university-industry interaction: Geographical proximity between the agents as a driving force. Technovation, 17(9), 491–531.

Villalonga, B. (2004). Intangible resources, Tobin’s q, and the sustainability of performance differences. Journal of Economic Behavior & Organization, 54, 205–230.

Wakelin, K. (1998). Innovation and export behavior at firm level. Research Policy, 26, 829–841.

Westhead, P. (1997). R&D “inputs” and “outputs” of technology-based firms located on and off science parks. R&D Management, 27(1), 45–62.

Westhead, P., & Batstone, S. (1998). Independent technology-based Firms: The perceived benefits of a science park location. Urban Studies, 35(12), 2197–2219.

Wooldridge, J. (2006). Introductory econometrics: A modern approach. Mason, OH: Thomson, Couth-Western.

Yang, C.-H., Motohashi, K., & Chen, J.-R. (2009). Are new tecnology-based firms located on science parks really more innovative? Research Policy, 38, 77–85.

Zahara, A. A., & George, G. (2002). Absorptive capacity: A review, reconceptualization, and extension. Academy of Management Review, 27(2), 185–203.

Zaheer, A., & Bell, G. G. (2005). Benefiting from network position: Firm capabilities, structural holes, and performance. Strategic Management Journal, 26, 809–825.

Zhang, Y. (2005). The science park phenomenon: Development, evolution and typology. International Journal of Entrepreneurship and Innovation Management, 5(1/2), 138–154.

Acknowledgments

Funding for this research was provided by the Spanish Ministry of Science and Innovation (ECO2011-29445, and ECO2012-36290-C03-01), and the CREVALOR Group of Research of Excellence.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Díez-Vial, I., Fernández-Olmos, M. Knowledge spillovers in science and technology parks: how can firms benefit most?. J Technol Transf 40, 70–84 (2015). https://doi.org/10.1007/s10961-013-9329-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10961-013-9329-4