Abstract

We study the successfulness of Science Parks (SPs) as seedbeds of innovation. We investigate whether SPs enhance the innovative output of their tenants and if tenants outperform comparable outside-SPs firms. We rely on original matching datasets regarding in- and out-SP Finnish firms and their patenting activity over 1970–2002. We estimate and compare the ‘before-versus-after’ hazard rates of patenting of both samples. The results suggest that, given the existence of a common tendency to slow down the pace at which all firms patent during their life cycle, Park tenants exhibit a comparatively better performance. Results are robust to various model specifications and to Wald tests performed over the pooled samples.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Science Parks (SPs) are organizations bridging research and industry. Their aim is to promote the competitiveness and culture of innovation of their associated businesses and knowledge-based institutions. To this end, SPs should stimulate and manage the flow of knowledge and technology amongst universities, R&D institutions and companies. Parks should also facilitate the creation and growth of innovation-based firms, support incubation and spin-offs, and provide value-added services and facilities (IASP 2002; OECD 1997). These multi-objectives multi-sponsors organizations constitute a very heterogeneous phenomenon. SPs have in fact spread worldwide taking each time different forms in terms of, e.g., the relation between the private and public sector, the kind of companies hosted, the type and quality of services provided, and so on.

The diffusion and relevance of the SPs movement motivated several scholars to engage in the difficult task to systematically evaluate and compare the performance of the Parks. Their aim has been to shed light on the effectiveness of Science Parks as innovation policy instruments. Among the aspects analysed there are the value- added of SPs to new technology-based firms (NTBFs), the establishment of University–industry links, the regional dimension of the SPs’ experience, and Parks’ growth.

The present paper contributes to this empirical literature by investigating the role of Science Parks as seedbeds of innovation. We do so by analysing the lifelong innovative output performance of the firms located inside the Parks vis-à-vis that of comparable outside-the-SPs firms. Our goal is ultimately to verify if locating inside a Science Park enhances the innovative output performance of the tenants, and if tenants out-perform comparable non-SPs competitors. To this end, we assess the change in the patenting activity of those firms that—at a certain point in their life time—moved onto a SP. We then contrast it with the patenting activity of matched out-of-Parks firms. By out-of-Park firms we mean firms that never became Parks’ tenants or received any support from the SPs. Firms are matched on the basis of the field(s) in which they actively innovate, i.e., patent. We specify two alternative matching criteria (by ‘IPC’ and by ‘activity’), in order to verify how sensitive estimates are to the different criterion used.

The study builds on the SP literature and incorporates further insights offered by the literature on R&D and innovation, knowledge and knowledge spillovers, patents, and firms’ characteristics and innovativenessFootnote 1—including the Product Life Cycle (PLC) studies.

The analysis is based on first-hand data and covers the period 1970–2002. The data regard the Finnish SPs, their tenants’ characteristics and patenting activity, and the characteristics and innovative activity of a matching sample of firms located outside the Science Parks (see Sect. 3).

Finland looks like a natural candidate for our SPs’ assessment exercise, given that no such analysis has been carried out so far despite the country’s emphasis on Science and Technology (S&T) and innovation policies.Footnote 2

The econometric analysis draws upon the programme evaluation literature.Footnote 3 However, the very heterogeneous nature of SPs makes it impossible to estimate the probability of a firm to get the treatment, i.e., to locate inside the SP and enjoy the tenancy status. Hence we cannot replicate any of the typical instruments of this literature. We can instead only follow the logic of the difference-in-differences method and do so to contrast the ‘before’ versus ‘after’ performance of the participants to the SP programme with that of comparable non-participants. To this end we carry out a survival analysis of the firms’ lifetime patenting performance, over both the in-SPs and out-SPs samples, and compare the relative estimates. The estimates follow Prentice, Williams and Peterson’s (PWP, 1981) conditional risk-set model and take care of issues as censoring, changes of status and unobserved heterogeneity. A particular feature of our model is that it holds patenting as a repeated and event-dependent phenomenon. In this way it accounts for the persistency of innovative activities (Cefis 2003) and the cumulativeness of knowledge.

The structure of the paper is as follows. Section 2 reviews the literature and motivates the study. Section 3 illustrates the methodology followed to construct the samples and the matching criteria used (Sect. 3.1). It then shows some descriptive statistics (Sect. 3.2) and states the purpose of the matching exercise (Sect. 3.3). Section 4 illustrates the main features of the econometric model (Sects. 4.1 and 4.2), and describes the variables used and the hypotheses made (Sect. 4.3). Estimates are shown in Sect. 5, alongside with some robustness checks (Sect. 5.1). Conclusions, innovation policy implications and some issues for future research are proposed in Sect. 6.

2 Science Parks and innovation

The heterogeneous nature of the Science Parks experience is mirrored by the many varieties of analyses that attempt to evaluate the SPs’ value-added contributions. We here focus on those studies Hodgson (1996) defines as ‘relative performance’ and ‘impact evaluation’ assessments, i.e., studies investigating the links between the Parks’ features and activities and the associated outcomes. The analyses we refer to are shown in Table 1, where we list them by author(s) and country.

The Science Parks assessment tradition was initiated in the UK by the seminal work of Monck et al. (1988) who investigated the extent to which SPs add value to businesses. Their contribution also includes a first-hand survey-based dataset of high-technology firms located in and out the Science Parks, database later updated and used in many other UK studies. Various measures have been utilized to evaluate the UK Science Parks. In particular: SPs firms’ R&D intensity, tendency to patent, launch of new products and services, links with Universities and Higher Education Institutions (HEIs), survival/closure rates, outturn measures (e.g., creation and multiplier effects), as well as the SPs’ ability to constitute seed-bed areas for NTBFs. Independently of the type of analysis carried out, evidence is mixed with respect to the Parks’ effectiveness. Overall the results do not corroborate the hypothesis that UK Science Parks have been successful in accomplishing their policy mission.

More recent Swedish studies instead offer a somewhat more positive, although not clear-cut, picture of the SP experience. For instance, Löfsten and Lindelöf (2002) and Lindelöf and Löfsten (2004) find the Park milieu to have a positive impact on the tenants’ growth, in terms of sales and employment, whereas Ferguson and Olofson (2004) find these same differences to be insignificant. No significant differences emerge with respect to the profitability of the NTBFs located in and out-SPs (Löfsten and Lindelöf 2005 ), but in-SP NTBFs are found more likely to have links with HEIs than out-of-Park firms (Löfsten and Lindelöf, 2002; Lindelöf and Löfsten, 2004).

Conversely, Colombo and Delmastro’s (2002) analysis of Italian NTBFs located in and out the SPs altogether supports the view that Science Parks are important technology policy tools, especially in countries characterized by weak national innovation systems. They find in-SP firms to show comparatively higher growth rates; to perform better in terms of adoption of new technologies, links with HEIs and other collaborative agreements; and to more successfully get access to public subsidies. A generally positive SP assessment is also offered by Fukugawa (2006), who investigates the ability of in and out Japanese Parks’ NTBFs to establish links with HEIs.

Different and interesting elements are brought into the discussion by the US Science Parks’ assessments. Luger and Goldstein (1991) construct a success/failure classification based on the rate at which Parks foster the creation of new jobs at the regional level. Link and Scott (2003, 2006), instead, shift the unit of analysis away from the firms located inside SPs and focus on the diffusion and growth of the US Science Parks themselves. In particular, Link and Scott (2003, 2006) are concerned with the role of universities and with University Research Parks (URP). URPs are property-based ventures having contractual, ownership or operational relationships with one or more universities or other higher education institutions. They are deemed important for the transfer of academic research, as a source of knowledge spillovers, and as catalysts for national and regional economic growth. Link and Scott’s (2006) findings suggest that Parks that are located closer to universities, are operated by private organizations and have a specific technology focus grow faster than the average. US Parks themselves are also at the centre of Appold’s (2004) analysis of the SPs’ ability to affect the growth in the number of local laboratories. His findings suggest that, rather than constituting effective local development tools, SPs benefited from the growth of the research activities in the considered area.Footnote 4

Summarising, the studies surveyed do not prove or disprove the hypothesis of Science Parks representing effective innovation policy tools. Evidence is mixed no matter the unit of analysis, the measure of performance and the specific econometric tool used. This calls for further in-depth assessments of Science Parks’ performance. In particular, we reckon the role of Science Parks as seedbeds of innovation (as in Felsenstein 1994) to deserve further attention. The need to focus on the relationship between Science Park location and the innovation level of the firms is motivated by the very rationale behind the creation of Science Parks.

Science Parks are innovation and competitiveness enhancing regional policy tools. Emphasis is on innovation as evidence shows that higher innovative outputs are positively correlated with firms’ productiveness (Crépon et al. 1998) and competitiveness. SPs should hence accomplish their mission by ‘taking care’ of the most important determinants of innovation, i.e. by opportunely managing the knowledge and knowledge spillovers generated within their premises. In fact, both incoming and outgoing spillovers exist (Cassiman and Veugelers 2002) and the positive effect that the diffusion of knowledge may have on innovation can be counterbalanced by lack of appropriability. Whether spillovers favour or hinder innovation ultimately depends on which of these two effects is predominant (e.g., Katz 1986; Aghion and Tirole 1994; Klette 1996; Sena 2004). This in turn depends on the channels through which spillovers work, in particular geographical proximity (e.g., Audretsch and Feldman 1996; Henderson et al. 1995; Feldman and Audretsch 1999). All the above seem to be behind the conception of Science Parks as innovation-fostering milieus, where geographical proximity should make firms better able to benefit from the spatial dimension of R&D spillovers.

However, to empirically verify if SPs succeed in constituting seedbeds for innovation, one needs some objective innovation output measures. Patents may indeed serve the purpose (e.g., Griliches 1990). Hence the idea to study the ‘before versus after’ patenting activity of innovative firms that moved inside the SPs vis-à-vis that of comparable out-of-Parks competitors. Our study does not focus solely on new NTBFs, but investigates the effect that locating inside a Science Park might have on firms of any age. The only prerequisite for the firms to be included in the present study is that they are innovative, i.e., Finnish firms having at least one patent in their portfolio.

The choice of Finland aims to fill a gap that exists in the empirical literature. To the best of our knowledge, no systematic analysis of performance of the Finnish SPs exists, despite the importance the country attaches to S&T and innovation policies and Finland’s overall innovativeness and competitiveness.

3 The data

3.1 The samples: in-SP and out-SP firms

The data were collected between the second half of the year 2002 and the beginning of the 2003. Firstly we looked for the Science Parks existing and functioning in Finland during the year 2002. These basically correspond to all the SPs established in Finland up to 2002, as no SP was shut down until that very year. The Science Parks considered in the present study are all organizations that meet the criteria stated in the official definition of the International Association of Science Parks (IASP) and are member of either the Finnish SP Association (Tekel) or the IASP, or both.Footnote 5Overall 21 SPs were identified, whose location basically mirrors the distribution of both the Finnish population and economic activities. For each Science Park we recorded: the year when it was established; its ownership (public versus private); if it had a specific industry focus (e.g., biotechnology); the presence of incubators; the presence of technical universities/research centres inside the Parks.

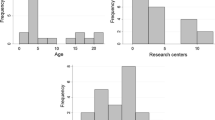

Figure 1 shows the histogram of Parks’ formation by year of creation, whose cumulative pattern follows the logistic curve typically characterising population growth. Table 2 instead presents some descriptive statistics regarding: SP size, in terms of number of tenants; SP age, i.e., the years since they were established until the 2002; and the Parks’ technology focus, in terms of number of sectors covered.

For 15 SPs (71.43%) we also obtained the name of the firms located inside the Parks in the year 2002, whereas three Parks stated not to not host any firm.Footnote 6 For each of them, we gathered the following data: degree of independence, i.e., if the tenant firm belonged to a holding/group; industry; size, in terms of number of employees in Finland in 2002; multiple SP locations, i.e., if the firm had several branches inside one or more SPs; year the firm was established; year when the firm moved inside the Science Park. Last, we recorded each firm’s innovative output, in terms of patents (if any) applied for both in Finland (National Board of Patents and Registration of Finland, PRH) and at the European level (European Patent Office, EPO). A questionnaire was then sent to all the firms in the sample, in order to double-check their demographical and location data. The questionnaire did not include any innovation or patent-related questions, to avoid self-selection among the respondents.

Overall, 1089 firms were actually contacted (out of 1228). Three hundred and forty five of them responded (33.06% rate of response).Footnote 7 To avoid duplications, from the respondents’ sample we eliminated all but one of the branches/units belonging to the same firm. Overall, 14 cases were dealt with, considering elements as units’ size, function and age of the various branches as well as some information provided by the firms themselves. Further, we pulled out the outliers, i.e., those firms having more than 4000 employees in Finland.Footnote 8 We did so as it would have been impossible to verify how being SP tenants had shaped (if at all) the outliers’ patenting activity.

After this data cleaning we were left with a sample of 252 firms, all born from 1970 onwards and still located inside the Finnish Science Parks in the year 2002. This sample proved to be representative of the universe of firms located inside the Finnish Science Parks (in the year 2002) in terms of sector, size, age, ownership and innovative activity (see Squicciarini 2005b). For the purpose of the present study we rely on a sub-sample of 48 firms, i.e. all the firms included in the original dataset that had patented at least once in their lifetime. We do so as our analysis uses patents as innovation output indicators but not all 252 firms had patents in portfolio.

Next, to construct the matching sample, the ‘out-SP’ dataset, we listed the IPC main classes of the SP tenants’ patent applications. By ‘IPC main class’ we mean the main technology field the innovation belongs to, as stated in the patent document and defined at the level of subclasses. Exploiting the database of the National Board of Patents and Registration of Finland (NBPR) we found out who, beyond the in-SP firms, had patented in those technological areas. We thus gathered the data of all patents applied for in those very IPC classes in Finland from 1970—i.e., the first year for which NBPR data are available—until 2002. In total we found 2801 patents applied for in 94 subclasses by 1103 innovators. From this list of innovators we pulled out those firms that the Science Parks’ had mentioned among their tenants (106 firms), as well as the ‘independent inventors’, i.e., patent owners apparently not linked to any company (279 individuals). We then retrieved information about the remaining out-SP firms, and in particular their: type of business; dimension, in terms of number of employees; status, i.e., whether they belonged to a holding/group; geographical location; and overall patenting activity, over time.

Last, to make the out-SP sample homogeneous with respect to the SP-tenants’ database, we pulled out of the sample the firms patenting in Finland but exclusively located outside the country (428 firms/institutions). Those patenting institutions that were not firms (e.g., Academy of Finland) were also eliminated, together with those firms that ceased to exist before the year 2002 (133 in total). We also excluded the firms with more than 4000 employees in Finland and those part of a holding/group already accounted for (in total 81 firms); as well as the firms born before 1970 (4 firms). The matching dataset thus built includes 72 Finnish firms characterized by their being located outside the Science Parks and by their having patented in the same IPC fields as the SP tenants have.

The in-SP and out-SP firms have been matched, on an individual basis, following two different criteria: per ‘IPC’ and per ‘Activity’.

The IPC match uses as bridging element the IPC main class in which the firms in the two samples have at least one patent application. If several matches are possible, i.e. if both the in- and out-SP firms have patented in two or more common fields, the preferred IPC class is the more heavily represented in the patent portfolio of both firms. By more heavily represented we mean the IPC class in which both the in-SP firm and the control sample’s one have the absolute highest number of patents. In the activity match correspondences are instead created, always individually per each firm, on the basis of firms’ overall patent portfolio. To this end, we consider all IPC classes each firm has innovated in, as well as their relative importance in the firm’s overall patent portfolio. We then match the firms by maximising the number and relevance of the IPC fields they have in common.

In both the IPC and activity match case, as the two samples are of different size, one or more out-SPs firms have been matched with the same Park tenant.

3.2 Descriptive statistics

The datasets include 48 and 72 firms located, respectively, inside and outside the Finnish Science Parks. These firms’ patenting activity is recorded over the period 1970–2002.Footnote 9

Figure 2 shows the composition of the samples by sector. Softict denotes the software and information and communication technologies (ICT) firms. Electr accounts for the firms in the electrics and electronics sector, whereas biotech for the biotechnology, pharmaceutical and medical devices enterprises. The composition of the datasets looks very similar indeed. The electr sector is represented in exactly the same proportion in both samples, whereas only small differences emerge in the other sectors.

Overall, firms located outside the SPs show to be on average bigger in size than Parks’ tenants. Moreover differences across sectors emerge, with tenants being generally smaller (but the softict) and more heterogeneous in size than their competitors located outside the Science Parks (see Table 3).

We rule out the possibility that such differences in size might be due to some sort of SPs’ space constraint, given that we follow Acs and Audretsch (1988) and refer to the size of the entire firm—i.e., the overall number of staff employed in Finland—rather than the sole personnel physically operating within the Parks. Some market/business structure characteristics, as well as age, might help explaining the observed and sometimes marked (as in the biotech case) differences in firm size. The data in Table 4 support such conjecture: Science Parks’ tenants are on average much younger than their competitors located outside the Parks. This is especially true for the firms in the biotech sector. These findings are in line with those of Westhead and Storey (1994) and Westhead (1997) and were somewhat to be expected, given that some of the in-SP firms joined the Parks to get incubated. Hence, they could have not been but very young at the time the tenancy began. This, paired with the fact that the first Finnish Science Park was established in 1982, makes it more likely for the off-Park companies to be older than the SP tenants, given that the period considered is 1970–2002.

With respect to innovating, the overall figures (Table 5) would suggest out-SPs firms to patent more. However, dividing the number of patent applications by firm age makes relative numbers look much more alike (Table 6 and Fig. 3): in-SP and out-SP firms seem to keep the same pace when patenting.

3.3 Matching the samples and evaluating firms’ innovative performance

We match the samples to carry out a test of relative performance over both the in-SP and out-SP firms. Our ultimate aim is to verify if acquiring the status of Science Park tenant makes firms better off than comparable out-SP competitors. We consider the Science Park tenancy as a programme and want to test the following hypothesis. If Parks manage to successfully accomplish their innovation-supporting mission, the in-SP firms should improve their patenting performance after joining the SPs and over-perform their matched out-SP firms.

To verify if such a hypothesis holds, we need to evaluate and contrast firms’ innovativeness over their lifetime. To this end, we begin by noticing that acquiring the status of Parks’ tenants—i.e., the moment in which firms enter the Parks—splits the firms’ life span into a ‘before’ and an ‘after’ the treatment periods. By ‘before’ we refer to the period going from the date the firm was established to the day in which it moved inside the SP. By ‘after’ we refer to the time the firm has been on the Park’s premises, since it joined the SP, until the end of the year 2002 (our end of observation date). In this way, per each of the firms in the in-SP sample, we obtain a ‘before versus after’ time ratio. We then use these firm-specific ratios to (one by one) subdivide the matched out-SPs firms’ lifetime into corresponding ‘before’ and ‘after’ periods. We do so twice, for the IPC and the activity match.

Hence, to see if empirical evidence supports our expectations, we carry out a ‘before-versus-after’ survival analysis over each sample, separately. Our aim is to evaluate the relative patenting performance of the firms in both datasets, i.e., in the ‘after’ period relative to the ‘before’ performance, and to then contrast the outcomes of the program’s participants (the in-SP firms) with that of the non-participants (out-SP firms). We do so following Prentice, Williams and Peterson’s (1981) conditional risk-set model, structured in inter-event times. We estimate the before-versus-after hazard rate of patenting, i.e., the probability that the ith firm would apply for the kth patent during the time interval considered, [t, t + Δt], conditional on its survival (i.e., not having patented any invention) up to time t. We repeat the exercise twice for the matching sample, to check the sensitivity of the results to the matching criterion used (the IPC and the activity one).

Before describing the model, it is necessary to explain why we do not use any of the typical treatment evaluation measures and what our test does and does not do. With respect to the former, the reason is that our data place strong restrictions on the counterfactual that can be identified. Unfortunately, we have no information about firms’ eligibility requirements and the Parks’ selection criteria, i.e., whether there existed any such criteria and whether these changed over time. However, we believe that moving inside an SP constitutes a fairly random process, which is not determined by the main event we study, i.e., the firms’ likelihood to patent. On the one hand, the SP literature (e.g., Felsenstein 1994; Westhead and Storey 1994) suggests that Parks are also rent seeking organizations that would prefer to fill up their premises rather than selecting prospect tenants. The information acquired for the case of Finland support the hypothesis that SPs do behave as rent-seeking organizations. Besides, if and when selection happens, it is operated with respect to characteristics that are not related to the patenting activity of the firm (e.g., financial viability). On the other hand, the qualitative data gathered through the questionnaire suggest that firms choose to locate inside the Parks simply because they find the premises particularly suitable, or to enhance their image, or to stay close to their suppliers/customers. The existence of selection and decided problems determined by the variable of interest, i.e., the firms’ patenting activity, can thus be reasonably ruled out together with the endogeneity problems it would trigger.

With respect to what our test does and does not do, as said by using a control sample we do not attempt to address problems as the possible existence of selection and self-selection mechanisms. Nor we can carry out a ‘what if’ analysis, i.e., getting a flavour of what would have happened to the firms had they never joined the Science Park. We cannot either verify if Parks would have performed any better if different (types of) firms had been allowed to enter/or had voluntarily decided to locate inside the Parks. We instead pursue the assessment of the Science Parks’ programme by verifying who shows the highest before-versus-after likelihood to patent of two groups of comparable firms that innovate in the same fields, firms whose major difference is having or having not enjoyed the SP tenancy status.

4 The model

4.1 Model’s main features

Our duration model holds patenting as a repeated and event-dependent phenomenon and takes care of issues as change of status, censoring and unobserved heterogeneity.

Thinking of patenting as a repeated and event-dependent phenomenon implies supposing that those firms that have already applied for a first patent will be more likely to apply for a second, third or nth patent than those that have not. Three main reasons back our assumption. Firstly, filing the first patent may signal that the company is innovation-oriented. We can thus reasonably expect that the firm would continue doing so in the future. We believe a first-patent threshold effect exists (Cefis 2003), by which the probability to patent the nth invention, where n > 1, is higher than the probability of patenting for the first time. Secondly, ‘dynamic economies of scale’ (see Geroski et al. 1997, in this respect) might exist, by which, at any point in time, increases in the volume of innovations produced by a firm, up to that very moment, make it more likely for the firm to continue innovating. Thirdly, and most fundamentally, we deem patents to be event-dependent phenomena as we hold knowledge to be cumulative. Innovative firms are likely to build on their innovation portfolio, thus determining some sort of individually-generated and company-specific path of ‘cumulative inventions’ (Grossman and Helpman 1990), possibly also dependent upon the incoming spillovers firms are able to absorb. Econometrically, event-dependent phenomena represent a problem because they violate the assumption that events occur independently. If we treated repeated events as independent, we would overstate the amount of information each observation provides, incorrectly estimate standard errors, and implicitly impose—possibly mistakenly—that the influence of the covariates is the same across events (Box-Steffensmeier and Zorn 2002). We instead opt for weighting less subsequent patents, to avoid overestimating the likelihood to patent firms show in the ‘after’ periods.

Our duration model also pays attention to unobserved heterogeneity as the firms in the samples may well differ with respect to characteristics that we do not explicitly control for in the model, but that might contribute to determine their innovative performance (e.g., financial support received from the National Technology Agency of Finland; exogenous shocks, etc). Even if models with unobserved heterogeneity are computationally burdensome, we prefer not to ignore it, as doing so generally leads to inconsistent inferences (Van den Berg 2001).

Further, our model accounts for the firms’ change of status, i.e., their transition into the ‘after’ phases of their lifetimes. We treat the event of becoming an SP tenant (or correspondingly, for the out-SP sample, to enter the ‘after’ stage) as a change of status as we hold that such a change should not be determined by the main event we study, i.e., the companies’ likelihood to patent. Changes of status do not pose major theoretical or empirical problems but from a conceptual point of view they need being distinguished from ‘simple’ events.

Last, our data are type I right censored (Klein and Moeschberger 1997), as we only observe those patenting events that occur until the 31st December 2002; as well as left censored, given that the firms enter the study at different times, i.e., when founded. Both right and left censoring are in any case, easily dealt with in parametric as well as semiparametric models.

4.2 The econometrics

To analyse the firms’ likelihood to patent we follow the conditional risk-set model of Prentice, Williams and Peterson in 1981 (PWP), estimated in inter-event or ‘gap’ time. The PWP model is a variance-corrected Cox’s proportional hazard model.Footnote 10 Estimators are based on sandwich estimates, whereby observations are assumed to be independent across firms but not necessarily within firms. The variance and covariance matrix is adjusted in such a way as to account for the individual-specific effects that may remain.Footnote 11 The need to use a variance corrected model arises because the standard Cox model requires events to occur independently and, evidently, repeated and event-dependent processes violate this assumption.

In the PWP model the risk set for an event k (i.e., applying for the kth patent) at time t is represented by all the subjects that at time t have experienced the event k − 1 but have not experienced event k yet. Estimates are stratified by event rank (i.e., first patent, second patent, etc.), the baseline hazards are allowed to vary with the different event considered and robust standard errors are calculated. The PWP model accounts for the order of the events and thus provides efficiency gains over the model proposed by Wei et al. (1989).

Following the notation used by Kelly and Lim (2000), we denote by T ik the ‘true’ total time of the kth event for the ith subject, and by C ik the censoring time for the kth event in the ith subject. X ik is the corresponding observed duration, with X ik = min(T ik , C ik ). The censoring indicator is δ ik = I(T ik ≤ C ik ), where I(·) is the indicator variable. I(E) = 1 if E is true and I(E) = 0 otherwise. Inter-event times are defined as G ik = X ik − X i,k − 1 X i0 = 0 is the time when the firm enters the study, i.e., when it established.

The hazard function for the kth event for the ith subject at time t is λ ik (t), with

where \(Z_{ik} = (Z1_{ik} ,....,Z_{pik} )'\) is the covariate vector for the ith subject with respect to the kth event, and K is the maximum number of events (i.e., patent applications) within a subject. λ 0 (t) denotes a common baseline hazard for all events and λ 0k (t) is the event specific baseline hazard for the kth event. Finally, \( \beta = (\beta _1 ,...,\beta _p )' \) is the p × 1 vector of regression parameters to be estimated.

The partial likelihood L is defined as:

where d is the observed number of events.

If we let the ordered event times be \(t_{(1)} < t_{(2)} < ... < t_{(d)} \), where t (j) is the jth ordered event time, and R(t (i)) the set of individuals at risk at time t (i), our PWP model’s partial likelihood function, in inter-event time, is given by:

where Y ik (t) = I(G ik > t) and Z jk (X ik ) is replaced by Z ik (X i,k − 1 + G ik ).

We empirically model the time to patent of the firms in the two samples as a continuous-time framework, given that our data are recorded on a daily basis. The set of covariates we use are both time-varying and fixed and accounts for the firms’ main characteristics. The functional form in which the covariates enter the model reflects the results of the Schoenfeld-residuals-based tests performed to check the proportional hazards assumption. Such tests are based on the generalization by Grambsch and Therneau (2000) and, together with the martingale residuals, indicate the most appropriate form in which the covariates should enter the model.Footnote 12

4.3 Variables and hypotheses

The first covariate we use is a continuous and time invariant variable, called size. It represents the square root of the overall number of employees the firm had in Finland in the year 2002. The use of the square root, instead of the actual number of personnel, allows us to somehow contain the role played by the bigger firms while leaving more explanatory power to be determined by the smaller ones. Ceteris paribus, we expect the coefficient of the size regressor to be significant and positive. We do so supported, among others, by: Scherer (1980, 1984); by Pavitt et al. (1987), who conclude the number of innovations per employee to be above average in both firms with less than 1000 and more than 10000 employees; and by Acs and Audtretsch (1990, 1991), who find small firms to generate more innovation per thousand employees than large companies. Using the year 2002’s personnel data only is not a first-best solution, but we have been unable to track the changes of the firms’ dimension over time. In any case, our modelling choice would bias the estimates only if we presuppose the existence of a systematic measurement error linked to the way in which companies grow (in a fashion similar to, e.g., Jovanovic 1982; Evans 1987; Hall 1987). However, it is not clear that companies grow only or principally as a consequence of their patenting activity. In fact, if the different patterns happen randomly, our estimates should not be off the mark.

The second covariate specified in the model is n1pat. This non-negative, continuous and time-varying regressor reflects the number of patents the ith applicant has in portfolio by the time it applies for the kth patent. If, as we assume, patenting is an event-dependent phenomenon, we would expect the n1pat coefficient to be significant and positive, i.e., that the more a company has innovated in the past, the more likely it is that it will keep doing so. However, such reasoning does not imply that firms should patent more often, as decreasing returns to R&D may exist.

The third variable used, group, is time invariant, as well as invariant are the three sector dummies that we include in the model, softict, electr and biotech.

Group denotes whether the ith firm belongs to a holding/group or not. Following Geroski et al. (1997), who find that being independent has a strong positive effect on the innovation spell length, we expect that being part of a group would diminish the firms’ likelihood to patent. Our explanation is linked to the possible existence of corporate patenting rules. Sometimes, patents may be assigned to the mother company or to other affiliates, to serve corporate interests and/or to avoid ex post licensing problems, and hence go undetected.

Softict, electr and biotech account for the sector the ith firms belongs to. We control for the possible industry-specific effects that may exist as these effects can be even more important than firm size in shaping the companies’ R&D intensity (Cohen et al. 1987) and, we add, likelihood to patent. This being the case, we would expect the industry variables to show significant coefficients.

Agesoft, agelectr and agebio are all time-varying covariates denoting how ‘old’ the ith company is at the time t of the kth event, given that i belongs to one of the mentioned sectors. Firms start being ‘at risk’ on the very date they are established. As for the age-related part of the variable, on the one hand, if we hold knowledge to be cumulative, we would expect its coefficient to be significant and positive. On the other hand, if we suppose the existence of diminishing returns to R&D, in a similar fashion to Klette and Griliches (2000), we would expect the variable to exhibit a negative coefficient, thus implying that the older the company, the slower the pace at which it would generate new innovations. Hence, when comparing two companies which are equal in size, have the same number of patents in portfolio (at time t), belong to the same industry and have the same standalone/group connotation, being ‘older’ means having a worse patenting performance, in that less innovations are produced over the same period of time. Therefore, considering that we introduce the age-related variables after having controlled for the above characteristics, we might as well expect that, ceteris paribus, age would negatively affect the innovators’ patenting performance. In any case, we let the estimates tell us which effect prevails.

Finally, we use a dummy variable to account for the status of the companies considered, i.e., for their being in their ‘before’ or ‘after’ periods. Such variable will be differently prefixed, according to the sample we refer to and to the type of match taken into account. More precisely, onoff accounts for the in-SP sample’s companies to be outside (onoff = 0) or inside the Science Parks (onoff = 1); ipc_onoff for the IPC-matched companies to be in their ‘before’ (ipc_onoff = 0) or ‘after’ (ipc_onoff = 1) periods; whereas actitiy_onoff supplies us with an analogous piece of information about the status of the control samples’ companies, when activity-matched.

The variables and their corresponding acronyms can be found in Table 7.

5 Estimates

We separately estimate the two samples’ hazard rate of patenting, holding the number of observations constant while progressively including one regressor at a time, to better capture the covariates’ explanatory power. The exercise is carried out twice over the out-SP sample, for the IPC- and the activity-match. Samples are kept separated to avoid that the estimates reflect the contribution of both samples’ values and thus hinder the possibility to see how the covariates affect the patenting activity of each group of firms. Although pooling the samples would give more observations, we nonetheless prefer to avoid that the onoff values (i.e., onoff, ipc_onoff and activity_onoff) might resent of averaged estimates. We instead let them get right on the target and merge the datasets only later, when carrying out some robustness checks.

To improve the efficiency of our estimates we have also attempted to parameterise the baseline hazards. Lacking good reasons to believe that the hazard would follow a certain shape, we tried the Exponential, Gompertz and Weibull parameterizations.Footnote 13 These, however, prove not represent viable options, as their log-likelihoods become positive. Conversely, the Cox-Snell residuals, used to assess the overall model fit, further confirm that the PWP variance-corrected Cox proportional hazard model has been adequately parameterized and well specified.

Table 8 presents the results of, respectively, the IPC- and activity matched control sample’s estimates, as well as the in-SP firms’ ones. To facilitate comparisons, we present only two of the models we estimated per each sample and matching criterion used (the most comprehensive ones, called Model 9 and 10 after the number of variables included). Moreover, the estimates are shown in the form of exponentiated coefficients, which have the interpretation of the ratio of the hazards for a one-unit change in the corresponding covariate. These are accompanied by the z-statistics, which facilitate the interpretation of the figures.

We see the workforce contribution (size) to the firms’ likelihood to patent to be more important for the in-SP firms, with each additional employee making patenting 6–9% more likely. The corresponding figure for the out-SP sample is 4.2% in the IPC-match case and 2.7–4.1% in the activity-match one. These coefficients possibly reflect a higher proportion of R&D personnel employed by the in-SP firms, conjecture backed by Monck et al’s (1988) findings.

The effect of the number of applications already in portfolio at the time of the k patenting event (n1pat) is always significant and positive, in both samples. Again, the firms’ past patenting activity exhibits a higher coefficient in the in-SP case, with each additional patent in stock making in-SP firms 12.3–14.8% more likely to patent again, against out-SP figures ranging between 2–2.8% (IPC match) and 1.9–2.9% (activity match).

Nothing can be said about if and how, ceteris paribus, belonging to a holding/group affects the likelihood to patent of the firms in the control sample, under either matching scenarios. Conversely, the in-SP firms’ estimates confirm that not being independent has a negative effect over patenting (Squicciarini 2005b). The group in-SP coefficient is always significant and strongly negative, with non-standalone firms being 70–74% less likely to apply for a patent in the future.

In terms of sector dummies (softict, electr, biotech) big differences emerge. The control samples’ estimates suggest the existence of very strong industry-related effects, whereas such effects still exist, but are much more contained, in the case of the in-SP firms.

In general, the results for the in-SP sample confirm those obtained in Squicciarini 2005(b), where we estimated the PWP model over a bigger sample of in-Park firms—including both patenting and non-patenting firms. This suggests that the analysis is not sensitive to the selection of particular sub-samples.

The effect that age has on the firms’ likelihood to patent looks generally negative: ceteris paribus, being 1 year older makes innovators less likely to patent. In the out-SP firms case, when IPC-matched each additional year makes the softwarict and biotech firms respectively 21.67–22.76% and 25.67–30.13% less likely to apply for further patents. Nothing can instead be said about agelectr, as its coefficient never becomes significant. When activity-matched, if 1 year older the out-SP softict firms look 21.53–23.15% less likely to patent; the electr ones have a 9.65% lower patenting pace, whereas the biotech firms reduce their patenting activity by 28.69–29.12%.

The in-SP sample is generally less affected by age than the out-Park one, with the softict and the electr firms respectively being 15.51–15.42% and 14.24–14.45% less likely to patent if one year older. Nothing can be said about in-SP biotech firms, as their coefficient is never significant.

Finally, the behaviour of the onoff variables should tell us if and to what extent locating inside a Science Park makes firms better off, with respect to patenting, than comparable out-SP competitors. In this respect, a feature common to all firms emerges: both the out-SP and the in-SP onoff coefficients are smaller than 1 in magnitude. This indicates that firms slow down the pace at which they innovate in the ‘after’ part of their lifetime, no matter where they are located. This feature, which is in line with the Product Life Cycle literature, seems to more strongly characterize the control samples’ firms. In fact, we observe a 69.28% (47.43%) lower rate of patenting in the after period of the out-SP firms when IPC-matched (activity-matched), against a 41.88% lower hazard rate of patenting of the in-SP firms.

One might explain this less intense patenting activity in several ways. For instance, firms might pursue several innovative paths in the early part of their life—depending upon the market structure, technological regimes, and so on. If successful, such an exploratory phase may lead to the resulting inventions being patented. Firms then might slow down the pace at which they innovate and concentrate on maximising the returns on their investments in innovation, i.e., to mainly or solely focus on exploiting them, and/or decide to focus solely on core business(es). A somewhat similar explanation is offered by Shane’s (2001) analysis of the effect of technological opportunities over new firm creation. He shows that the importance, radicalness and patent scope of an invention influence the probability that inventions will be commercialized through firm formation. If the ultimate objective of firm creation is mainly or solely to exploit previously created knowledge, then the observed initial patenting activity of firms would fade over time. Alternatively, Stein’s (1997) model of repeated innovation with knowledge spillovers might help explaining why firm-specific learning-by-doing processes may (in some circumstances) dramatically reduce the long-run average level of innovation. A further explanation might be that firms tend to growth faster in the earlier part of their lives, and that, as Chakrabarti (1990) finds, growing firms are likely to spend proportionately more on R&D and output measures (including patents) are correlated—in different ways for different industries—to the average level of R&D spending.

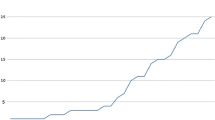

In any case, whatever the explanation of the generally lower ‘after’ periods’ hazard rate one might prefer, no definitive conclusion can be drawn, given that the in-SP onoff coefficient is not significant. We thus need to check if the difference between the two samples’ onoff coefficients is significant. Before doing so, however, we show a simple plot that seems to suitably synthesize the results thus far illustrated. Figure 4 shows the cumulative number of patents applied over time by the firms in the two groups. On the left-hand-side-y axe, the scale reflects the number of patents applied for by the firms in the out-SP sample, whereas on the right-hand-side scale we measure the patenting activity of the in-SP firms.

5.1 Robustness checks: are there best performers?

We verify if the onoff variables, measured in each of the two independent samples considered, could be assumed to come from the same underlying population or not. Finding a significant difference would imply that the two datasets do differ in the variable of interest and allow us to be more confident when comparing the results. To carry out the robustness checks, we first merge the two samples and use the dummy variable matched to identify the observations related to the firms in the out-SP dataset (matched = 1). We then create some new onoff variables to estimate how the firms’ likelihood to patent has changed through time, per each sub-sample considered. We denote by onoffSP and onoffmatched the IPC-match dummies accounting for, respectively, the in-SP and out-SPs firms being in their ‘before’ (onoffSP and onoffmatched = 0) or ‘after’ periods (onoffSP and onoffmatched = 1). For the activity-match scenario, we use the dummies onoffSP_a and onoffmatched_a to characterize the ‘before’ and ‘after’ periods of, respectively, the in-SP and the out-SP firms. OnoffSP and onoffSP_a are identical, of course.

A couple of tests are performed per each type of matching hypothesized.

We first run the PWP variance-corrected Cox regression over the merged sample. The model we specify is identical to the one we already estimated, but for the onoff variable. This last regressor is each time replaced by other two, i.e., either onoffSP and onoffmatched or onoffSP_a and onoffmatched_a, depending upon the type of matching used. What we are after is not to get new estimates of the onoff-related coefficients, but to see if the coefficients keep being different in size, to then test for such a difference to be statistically significant. Finding out that the samples’ underlying populations differ would allow to say that the onoff regressors are significantly different. To this end, we perform a Wald chi-square test over the onoff coefficients, to test the null hypothesis that the two onoff-related coefficients are the same.Footnote 14

The second robustness check carried out sees the introduction of interaction variables. The aim is to capture the residual effects determined by the contribution of the out-SP sample’s observations. Consequently, the model specified includes, besides the regressors already used, an equally numerous set of the same variables, each multiplied by the matched dummy. Over this 20 variable model (i.e., including the nine original regressors, plus the nine matched-multiplied variables, plus the two onoff related dummies), we perform a Wald test to check if, under this new specification, the onoff coefficients keep differ significantly.

Table 9 shows the results of the robustness checks.Footnote 15 The first part of the table shows: the matching criterion used; the specification of the model (i.e., with or without the interaction terms); the number of variables included; the number observations; the log-likelihood of the overall model; the value of its Wald chi-square test, and the probability attached to it. In the second part of the table we again show the matching criterion used and the specification of the model, and include the hazard ratio’s values of the onoff variables, accompanied by the result of the Wald tests.

Under both the IPC- and the activity-match the Wald tests over the without-interaction models allow us to reject at, respectively, the 7% and 2% level the hypothesis that the two populations, the in-SP’s and out-SP sample, are the same. Conversely, the Wald tests performed over the ‘with interaction’ models do not augment our knowledge of the underlying populations. Overall we might conclude that, given what appears to be a general tendency of all firms to slow down the pace at which they patent over time, differences emerge between the two groups. Locating inside the Science Parks may make firms better off, as the in-SP firms show to be able to keep a higher patenting rate in the ‘after’ phase than their matched out-SP counterparts.

The plots of the survival and failure functions of both groups of firms, stratified by onoff are shown in Figs. 5 and 6. They make it clear that, when IPC-matched, the ‘before’ likelihood to patent of the two groups looks very much alike. Conversely the probability that the kth patenting event would happen in the ‘after’ period is, basically always higher for the in-SP firms. Moreover, the ‘on’ and ‘off’ curves of the companies located inside the Science Parks are much more similar among themselves than the outside firms’ ones. On the contrary, under the activity-match, the in-SP’ ‘before’ likelihood to patent is always higher than the one showed by the out-SP firms and the ‘on’ and ‘off’ matched curves lie much closer than they do in the IPC case. Generally, the in-SP firms’ ‘after’ performance remains more remarkable than the out-SP competitors.

6 Conclusions

Our ‘in-SP versus out-SP’ aims to verify if Science Parks enhance the patenting activity of the firms located on their premises, and do so to the extent of making tenants more likely to patent than comparable firms located outside the SPs. To this end we check who shows the highest ‘before-versus-after’ hazard rate of patenting of two groups of firms innovating in the same fields, whose major difference is their having been or having not been SP tenants. Our analysis also addresses the existence of patenting time trends.

We see that the personnel contribution to the firms’ likelihood to patent is more important for the in-SP firms than for their out-SP counterparts. Likewise, the firms’ past patenting activity, which is always significant and positive, exhibits a higher coefficient in the in-SP case than it does in the control sample. The in-SP firms’ estimates also confirm the negative role exerted by being part of a holding/group, whereas nothing can be said in this respect for the out-SP firms, under either matching scenarios. Big differences emerge in terms of sector dummies between the two samples. In particular, the out-SP sample estimates, both in the IPC- and the activity-match case, strongly suggest that belonging to certain sectors may make companies substantially more likely to patent, whereas the in-SP coefficients are still positive but less ‘impressive’. As for the way age affects the patenting performance of the companies in both samples, the general picture that emerges is one where, ceteris paribus, being older implies being less likely to patent.

An important common feature emerges with respect to the existence of time trends. In line with the Product Life Cycle type of literature, we see that firms slow down the pace at which they innovate in the second part of their lifetime, no matter where they are located. Such a trend, however, seem to more strongly characterize the out-SP firms, as the robustness checks also confirm. We can thus conclude that, given what seems to be a general tendency of all firms to slow down, over time, the pace at which they patent, locating inside the Science Parks can represent an asset. In-SP firms show to maintain a higher patenting pace in the ‘after’ phase of their lifetime then their matched out-SP counterparts. Policy-wise our results might imply that Science Parks may be able to help firms keeping a higher patenting—and hence innovative—activity over time. In this respect, they would seem to accomplish their policy mission of constituting seedbeds of innovation.

However, given the small size of our sample and the other problems that we have been highlighting in due course, the result of the present exercise cannot be ‘definitively’ conclusive. The study should be carried out on a larger number of firms to check if our results truly mirror the Science Parks’ experience. Selection and self-selection mechanisms certainly deserve further investigation. Moreover, the use of more time-varying covariates would allow to more precisely estimate the effect that the regressors have on the firms’ patenting performance. Patent quality indicators and other input and output measures, if included, could certainly contribute to obtain a clearer picture. The above, we reckon, are only some of the research perspectives that, if pursued, would help policy makers verifying the effectiveness of Science Parks as innovation policy tools vis-à-vis other instruments.

Notes

See Sect. 2 for a review of the literature

Innovation has also been one of the priorities of the Finnish Presidency of the Council of the European Union (II semester 2006, www.eu2006.fi).

A regional perspective is also guiding Kang’s (2004) analysis of the Korean experience, which aims to establish development models for SPs depending upon the framework conditions under which the Parks are supposed to be built.

According to the IASP official definition “A Science Park is an organization managed by specialized professionals, whose main aim is to increase the wealth of its community by promoting the culture of innovation and the competitiveness of its associated businesses and knowledge-based institutions. To enable these goals to be met, a Science Park stimulates and manages the flow of knowledge and technology amongst universities, R&D institutions, companies and markets; it facilitates the creation and growth of innovation-based companies through incubation and spin-off processes; and provides other value-added services together with high quality space and facilities.” (IASP International Board, 6 February 2002). The fact that the Parks considered in the study are either members of Tekel or IASP or both makes them easily distinguishable from business parks and similar initiatives, thus eliminating a possible source of heterogeneity.

No information could be obtained about the remaining three Science Parks.

Sheehan (2001) finds response rates to oscillate between 21.6% and 36% and Jobber and Saunders (1993) indicate that the rate of response in business-oriented studies is more sensitive than consumers’ ones to characteristics as the number of questions, the length of the survey, etc.

The type of companies we refer to are Nokia, Sonera, Orion and the like.

These samples look very tiny indeed but one should bear in mind that patenting in Finland is not a ‘massive’ phenomenon. The NBPR has in fact dealt with 2200–2900 patent files per year over the period the 1998–2002. Furthermore, the number of patents applications at the Finnish level has steadily decreased during the last decade, often in favour of EPO, PCT, etc. applications.

The strength of Cox’s approach—where the hazard is of the form λ (t; x) = κ(x) λ 0 (t), κ (·) > 0 is a nonnegative function of x and λ 0 (t) > 0 is the baseline hazard—is that the effect of the covariates can be estimated very generally, without having to specify the baseline hazard.

All the tables, in their full versions, are available from the author, upon request.

Wald tests are chi-square statistics, pure significance tests against the null hypothesis that a parameter is zero, i.e., that the corresponding variable has no effect given that the other variables are in the model (Greene 2000)

Table 1A, in Appendix, shows the result of the Wald tests obtained while holding the number of observations constant.

References

Acs, Z. J., & Audretsch, D. B. (1991). Firm size and innovative activity. In Z. J. Acs, D. B. Audretsch (Eds.), Innovation and technological change. Harvester Wheatsheaf.

Acs, Z. J., & Audretsch, D. B. (1988). Innovation in large and small firms: An empirical analysis. American Economic Review , 678 – 690.

Acs, Z. J., & Audretsch, D. B. (1990). Innovation and small firms, MIT Press, Cambridge.

Aghion, P., & Tirole, J. (1994). The management of innovation. The Quarterly Journal of Economics,109, 1185–1209.

Appold, S. J. (2004). Research Parks and the location of industrial research laboratories: An analysis of the effectiveness of a policy intervention. Research Policy, 33, 225–243.

Audretsch, D. B., & Feldman, M. P. (1996). R&D spillovers and the geography of innovation and production. American Economic Review, 86(3), 630 – 640.

Borgan, Ø., & Langholz, B. (2005). Using martingale residuals to assess goodness-of-fit for sampled risk set data. Statistical Research Report, Dept. of Math., University of Oslo, n. 8.

Box-Steffensmeier, J. M., & Zorn, C. (2002). Duration models for repeated events. The Journal of Politics, 1069–1094.

Cameron, A. C., & Trivedi, P. K. (2005). Microeconometrics. Cambridge University Press.

Cassiman, B., & Veugelers, R. (2002). R&D cooperation and spillovers: Some empirical evidence from Belgium. American Economic Review, 92(4), 1169–1184.

Cefis, E. (2003). Is there persistence in innovative activities? International Journal of Industrial Organization, 21, 489–515.

Chakrabarti, A. K. (1990). Scientific output of small and medium size firms in high tech industries. IEEE Transactions on Engineering Management, 37(1), 48–52.

Cleves, M. A., Gould, W. W., & Gutierrez, R. G. (2002). An introduction to survival analysis using stata. USA: Stata Corporation.

Cohen, W. M., Levin, R. C., & Mowery, D. C. (1987). Firm size and R&D intensity: A re-examination. Journal of Industrial Economics, 543 – 565.

Colombo, M., & Delmastro, M. (2002). How effective are technology incubators? Evidence from Italy. Research Policy, 31, 1103–1122.

Crépon, B., Duguet, E., & Mairesse, J. (1998). Research, innovation, and productivity: an econometric analysis at the firm level, NBER Working Papers n. 6696.

Evans D. S. (1987). Tests of alternative theories of firm growth. The Journal of Political Economy, 95 (4), 657–674.

Feldman, M. P., & Audretsch D. B. (1999). Innovation in cities: Science-based diversity, specialization and localized competition. European Economic Review, 43, 409–429.

Felsenstein D., (1994). University-related science parks: “seedbeds” or “enclaves” of innovation? Technovation, 14, 93–110.

Ferguson, R., & Olofsson C. (2004) Science parks and the development of NTBFs - location, survival and growth. Journal of Technology Transfer, 29, 5–17.

Fukugawa, N. (2006). Science parks in Japan and their value-added contributions to new technology- based Firms. International Journal of Industrial Organization 24, 381– 400.

Geroski, P. A., Van Reenen, J., & Walters, C. F. (1997). How persistently do firms innovate? Research Policy, 26(1), 33 – 48.

Greene, W. H. (2000). Econometric analysis (IV ed.). Prentice Hall International.

Griliches Z., (1990). Patent statistics as economic indicators: A survey. Journal of Economic Literature, 28 (4), 1661–1707.

Grossman, G., & Helpman, E. (1990). Trade, innovation and growth. American Economic Review, 80 (2), 86–91.

Hall, B. H. (1987). The relationship between firm size and firm growth in the US manufacturing sector. The Journal of Industrial Economics, 35 (4), 583–606.

Heckman, J., Ichimura, H., & Todd, P. E. (1997). Matching as an econometric evaluation estimator: Evidence from evaluating a job training programme. The Review of Economic Studies, 64(4), 605–654.

Heckman, J., Ichimura, H., & Todd, P. (1998). Matching as an econometric evaluation estimator. The Review of Economic Studies, 65(2), 261–294.

Heckman, J., Ichimura, H., Smith, J. A., & Todd, P. (1998). Characterizing selection bias using experimental data. Econometrica, 66(5), 1017–1098.

Heckman, J., & Navarro-Lozano, S. (2004). Using matching, instrumental variables, and control functions to estimate economic choice models. The Review of Economics and Statistics, 86(1), 30–57.

Heckman, J., & Smith, J. A. (1999). The pre-programme earning dip and the determinants of participation in a social programme. Implications for simple programme evaluation strategies. The Economic Journal, 109 (457), 313–348.

Heckman J., & Vytlacil, E. J. (2001) Local instrumental variables. In C. Hsiao, K. Morimune, & J. L. Powell (Eds.), Nonlinear statistical modeling: Proceedings of the Thirteen International Symposium in Economic Theory and Econometrics: Essays in Honor of Takeshi Amemiya(pp. 1–46). Cambridge, UK: Cambridge University Press.

Henderson, V., Kuncoro, A., & Turner, M., (1995). Industrial development in cities. Journal of Political Economy, 103, 1067–1090.

Hosmer, D. W. Jr, & Lemeshow, S. (1999). Applied survival analysis. Regression modeling of time to event data. New York: J. Wiley & Sons Inc.

Ichimura, H., & Taber, C. (2001). Propensity-score matching with instrumental variables. American Economic Review, 91(2), 119–124.

International Association of Science Parks, www.iasp.ws

Hodgson, B. (1996). A methodological framework to analyse the impact of Science and Technology Parks. In M. Guedes, & P. Formica (Eds.), The Economics of Science Parks. IASP and AURRP.

Jaffe, A. B., & Trajtenberg, M. (2002). Patents, citations and innovations. Cambridge (MA): The MIT Press.

Jobber, D., & Saunders, J. (1993). A note on the applicability of the Brurold-Comer model for mail survey response rates to commercial populations. Journal of Business Research, 223–236.

Jovanovic, B. (1982). Selection and the evolution of industry. Econometrica, 649–670.

Kang, B.-J. (2004). A study of the establishing development model for Research Parks. Journal of Technology Transfer, 29, 203–210.

Katz M. L., (1986). An analysis of cooperative research and development. RAND Journal of Economics, 17, 527–543.

Kelly, P. J., & Lim, L. L.-Y. (2000). Survival analysis for recurrent event data: An application to child infectious diseases. Statistics in Medicine, 19, 13–33.

Klein, J. P., & Moeschberger, M. L. (1997). Survival analysis. Techniques for censored and truncated data. New York: Springer-Verlag.

Klette, T. J. (1996). R&D, scope economies, and plant performance. RAND Journal of Economics, 27(3), 502–522.

Klette, T. J., & Grliches, Z. (2000). Empirical patterns of firm growth and R&D investment: A quality ladder model interpretation. The Economic Journal, 110, 363– 387.

Lancaster, T. (1990). The econometric analysis of transition data. Cambridge: Cambridge University Press.

Lin, D. Y., & Wei, L. J. (1989). The robust inference for the Cox proportional hazards model. Journal of the American Statistical Association, 84, 1074–1078.

Link, A. N., & Scott, J. T. (2003). US science parks: The diffusion of an innovation and its effects on the academic missions of universities. International Journal of Industrial Organization, 21, 1323–1356.

Link, A. N., & Scott, J. T. (2006). US university research parks. Journal of Productivity Analysis, 25, 43–55.

Lindelöf, P., & Löfsten, H. (2003). Science parks location and new technology-based firms in Sweden—implications for strategy and performance. Small Business Economics, 20, 245–258.

Lindelöf, P., &, Löfsten, H. (2004). Proximity as a resource base for competitive advantage: University-industry links for technology transfer. Journal of Technology Transfer 29, 311–326.

Löfsten, H., & Lindelöf, P. (2001). Science parks in Sweden: Industrial renewal and development? R&D Management 31, 309–322.

Löfsten, H., & Lindelöf, P. (2002). Science parks and the growth of new technology-based firms—academic-industry links, innovation and markets. Research Policy, 31, 859–876.

Löfsten, H.,& Lindelöf,P. (2005). R&D networks and product innovation patterns—academic and non- academic new technology-based firms on science parks, Technovation, 25, 1025– 1037.

Luger, M. I., & Goldstein, H. A. (1991). Technology in the garden, Chapel Hill, UNC Press.

Massey, D., Quintas, P., & Wield, D. (1992). High-tech fantasies. Science parks in society, science and space. London: Routledge.

Monck, C. S. P., Porter, R. B., Quintas, P., Storey, D. J., & Wynarczyk, P. (1988). Science parks and the growth of high technology firms. Peat Marwick McLintock.

Organisation for Economic Co-operation and Development (OECD). (1997). Technology incubators: Nurturing young firms, OCDE/GD (97) 202.

Pavitt, K., Robson, M., & Townsend, J. (1987). The size distribution of innovating firms in the UK: 1945–1983. The Journal of Industrial Economics, 35(3), 373–379.

Prentice, R. L., Williams, B. J., & Peterson, A. V. (1981). On the regression analysis of multivariate failure time data. Biometrika, 68, 373–379.

Sasieni, P. D., & Winnett, A. (2003). Martingale difference residuals as a diagnostic tool for the Cox model. Biometrika, 899–912.

Scherer F. M., (1980) Industrial market structure and economic performance. Rand Mc Nally.

Scherer, F. M. (1984). Using linked patent and R&D data to measure interindustry technology flows. In Z. Griliches (Ed.), R&D, patents and productivity. Chicago: Chicago University Press.

Sena, V. (2004). The return of the Prince of Denmark: a survey on recent developments in the economics of innovation. The Economic Journal, 114, 312–332.

Shane, S. (2001). Technological opportunities and new firm creation. Management Science, 47(2), 205–220.

Sheehan, K. (2001). E-mail survey response rates: A review. Journal of Computer-Mediated Communication.

Siegel, D. S., Westhead, P., & Wright, M. (2003). Assessing the impact of University Science parks on research productivity: Exploratory firm-level evidence from the United Kingdom. International Journal of Industrial Organization, 21, 1357–1369.

Smith, P. E., & Todd, J. A. (2005). Does matching overcome LaLonde’s critique of nonexperimental estimators? Journal of Econometrics, 125 , 305–353.

Squicciarini, M. (2005b). Do Science parks encourage innovation? Evidence from the tenants’ patenting activity—a duration model, working paper presented at the 4th International Industrial Organization Conference, Boston.

Squicciarini, M. (2005a). Science parks’ characteristics and companies’ innovative performance: Evidence from Finland, working paper presented at the 7th Conference on “Innovations and Intellectual Property”, Applied Econometrics Association, Paris.

Stein J. C. (1997). Waves of creative destruction: Firm-specific learning-by-doing and the dynamics of innovation. The Review of Economic Studies, 64(2), 265 – 288.

Struthers, C. A., & Kalbfleish, J. D. (1984). Misspecified proportional hazard models. Biometrica, 73, 363–369.

Therneau, T. M., & Grambsch, P. M. (2000). Modeling survival data: Extending the Cox model. New York: Springer.

Van den Berg, G. J. (2001). Duration models: Specification, identification and multiple durations in handbook of econometrics, (Vol. 5). Elsevier Science.

Wei, L. J., Lin, D. Y., & Weissfeld, L. (1989). Regression analysis of multivariate incomplete failure time data by modeling marginal distributions. Journal of the American Statistical Association, 84, 1065–1073.

Westhead, P. (1997). R&D ‘inputs’ and ‘outputs’ of technology-based firms located on and off Science parks. R&D Management, 27(1), 45–62.

Westhead, P., & Storey, D. J. (1994). An assessment of firms located on and off Science parks in the United Kingdom. UK: SME Centre, University of Warwick.

Acknowledgements

I am particularly indebted to Pierre Regibeau, Steve Pudney, David Audretsch, Marco Francesconi, Gabriella Conti and Otto Toivanen. Thanks also go to Zoltan Acs, Mariana Mazzucato and the participants in various seminars and conferences, especially the EARIE 2006, for helpful comments. The usual disclaimers apply.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Squicciarini, M. Science Parks’ tenants versus out-of-Park firms: who innovates more? A duration model. J Technol Transfer 33, 45–71 (2008). https://doi.org/10.1007/s10961-007-9037-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10961-007-9037-z