Abstract

This paper shows that the effect of location in science and technology parks is not homogeneous for all firms. The proposed model contemplates a non-linear relationship between belonging to a science and technology park and innovation performance, considering the firm’s absorptive capacity as a moderating variable. A panel dataset of firms located both in and off a park is created, and three main effects are identified. Pre-catching up firms have a low absorptive capacity, and their location in a science and technology park does not improve their innovation performance. Catching up firms have a medium absorptive capacity and constitute the group that can be observed to benefit more by their presence in a science and technology park. Additionally, pre-frontier sharing firms has a high absorptive capacity; however, knowledge duplicity reduces the impact of science and technology parks on their innovation performance. Findings arise practical implications for governments (how to assign public resources to parks?), managers of parks (how to select to the firms of a park?) and managers who need to decide about the convenience of locating their companies on a park (when my company is interested in locating in a park?).

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Science and technology parks are an instrument that favours economic development both regionally and nationwide through innovation systems (Link and Link 2003; Link and Yang 2017). Authors such as Castells and Hall (1994) refer to three types of motivations for the deployment of a science and technology park: reindustrialisation, regional development, and the creation of synergies. The use of terms related to this phenomena varies depends on the country. In United States is used research park; the term science park is more prevalent in Europe, and the term technology park is more prevalent in Asia (Link 2009). In this paper we have used the term science and technology park (STP).

There is a growing interest on STPs that has materialized through the publication of works in academic journals (Fukugawa 2006). In that sense, Hobbs et al. (2017a) analyse 87 papers published from 1986 through 2016, which have been grouped in five categories: theoretical and conceptual publications (10), literature reviews (5), case studies (34), empirical studies (35) and papers related to park evaluation methods (3).

Hobbs et al. (2017a) find five literature review papers (Albahari et al. 2010; Link and Scott 2007, 2015; Phan et al. 2005; Quintas et al. 1992; Siegel et al. 2003). Other papers complete these reviews using bibliometric analysis methods (Díez-Vial and Montoro-Sánchez 2017; Mora-Valentín et al. 2018).

According to Link (2009), empirical studies on STPs can be classified according four dimensions: (1) factors affecting firm decisions to locate on STPs; (2) formation of university parks and university performance; (3) firm performance of firms located on STPs; (4) STPs and regional economic growth development. This paper is focused in the third type of studies. In this context, the question as to whether firms located in STPs improve their innovation performance has been raised. Accordingly, some studies analyse solely the innovation performance of firms located in STPs, whereas others compare these indicators between firms in and off STPs to gauge their impact on the performance of the firms that they attract (Díez-Vial and Fernández-Olmos 2017a, b; Lindelöf and Löftsen 2004; Squicciarini 2008; Vásquez-Urriago et al. 2014; Yang et al. 2009).

The evidence available is not conclusive regarding the effect that STPs have on a firm’s innovation performance. There are numerous reasons that can explain this lack of consensus. First, the evidence uses different definitions, units of analysis (region, park, firms), and metrics of innovation and firm performance. Second, although the case study is one of the most widely used methods in research on STPs, this technique does not permit the extrapolation of results or comparison with other studies (Salvador 2011). Regarding quantitative empirical studies, there are major differences in the definition of the sample and in the methods used, which means that the results cannot be compared or extrapolated (Vásquez-Urriago et al. 2014). Furthermore, small samples of firms tend to be used, often involving new start-ups, technology-based firms, or spin-offs located in STPs in the same country and in regard to a cross-sectional study. Therefore, this study conducts a quantitative analysis using a panel of 3844 firms with a total of 15,330 observations. Third, the quantitative studies that use larger samples and controls tend to record problems of selection bias and endogeneity that are not always properly addressed. Some exceptions are Díez-Vial and Fernández-Olmos (2017b) and Vásquez-Urriago et al. (2014), who employ different methods to account for selection and endogeneity problems. In this paper, a control function has been used to solve the problem of self-selection bias.

Furthermore, many studies propound a linear relationship between belonging to an STP and a firm’s innovation performance (Vásquez-Urriago et al. 2014), but we assume that the effect of being located in an STP is not homogeneous for all firms and that there is a non-linear relationship between STP location and firm performance. In view of the above and to delve further into the literature on STPs, the aim of this study is to analyse the effect of belonging to an STP on a firm’s innovation performance, considering the firm’s absorptive capacity as a moderating variable. The adaptation of the theoretical framework proposed by Cohen and Levinthal (1989) makes it possible to realise two propositions. First, firms need a minimum of absorptive capacity to exploit the learning opportunities from STPs, thereby improving their technological innovation. Second, firms with a high absorptive capacity have a knowledge duplicity problem, which reduces the value of knowledge provided by an STP and, therefore, the possibility of improving their technological innovation. Thus, a non-linear moderator role of absorptive capacity is suggested. We use a threshold regression to test these theoretical propositions.

After resolving the endogeneity bias, the results allow three firm profiles to be identified according to their absorptive capacity, whereby the effect of belonging to an STP on innovation performance depends on a firm’s absorptive capacity. The first group, denominated pre-catching up firms, has a low absorptive capacity, and being located in an STP does not improve the firms’ innovation performance. The second group, denominated catching up firms, has a medium absorptive capacity, and it is the group that can be observed to benefit more from having a presence in an STP. The third group is denominated pre-frontier sharing firms; it has a high absorptive capacity, but knowledge duplicity reduces the impact of the STP in its innovation performance.

The paper is structured as follows: the next section contains a theoretical review of the literature on STPs, with the definition of a conceptual model that enables us to analyse this effect. The third section describes the method for resolving the methodological issues that have been identified in prior studies. The fourth section presents the paper’s findings and discusses them. Finally, the paper’s fifth section presents its conclusions.

2 Theoretical framework

The International Association of Science and Technology Parks (IASP) considers that an STP is an organisation managed by specialist professionals with the underlying remit of increasing a region’s wealth and fostering a culture of innovation. STPs feature a series of infrastructures that support firm innovation. Their function, in addition to providing a quality site, is to act as a technological nexus between science and the production environment (Ondategui 2002) and to drive the competitiveness of firms and the knowledge-generating institutions installed in, or associated with, the STP.

2.1 Previous research on STP and performance

Some studies have considered whether belonging to an STP is justified by its contribution to innovation (Link and Scott 2007) or whether it is simply a strategic enclave in a specific geographical location (Bakouros et al. 2002). Accordingly, an analysis has been conducted to observe whether STPs are more innovative and perform better. Several authors have argued that STPs may act as incubators to enable firms to transform basic research into the development of technology and new products (Westhead 1997), provide access to firm networks (Poon 1998), facilitate relationships with universities and other research centres (Albahari et al. 2017; Díez-Vial and Montoro-Sánchez 2016; Hobbs et al. 2017a, b; Leyden et al. 2008; Link and Link 2003; Link and Scott 2003, 2006), and permit knowledge sharing and the exploitation of spillovers or knowledge flows (Díez-Vial and Fernández-Olmos 2015; Link 2016; Montoro-Sánchez et al. 2011), and being located in an STP positively affects product innovation by firms (Díez-Vial and Fernández-Olmos 2015; Vásquez-Urriago et al. 2014) and increases the likelihood of cooperation for innovation (Díez-Vial and Fernández-Olmos 2015; Vásquez-Urriago et al. 2016). All this may help improve a firm’s research and development (R&D) performance.

Table 1 contains the different indicators used in the literature to measure the effect of belonging to an STP on firm performance. Accordingly, we have evidence to confirm that belonging to an STP has a positive impact on firm innovation (e.g., Albahari et al. 2017; Díez-Vial and Fernández-Olmos 2017a; Felsenstein 1994; Lindelöf and Löftsen 2004; Siegel et al. 2003; Squicciarini 2008, 2009; Vásquez-Urriago et al. 2014). Nevertheless, Huang et al. (2012) report the opposite effect for a sample of firms in Taiwan. Similarly, the evidence provided by Chan et al. (2011), Colombo and Delmastro (2002), Lindelöf and Löfsten (2003), Motohashi (2013), Westhead (1997), and Westhead and Storey (1994) does not find any significant difference in a firm’s innovation performance between being located in or off an STP. Therefore, the previous literature on the relationship between an STP and innovation does not prove or disprove the hypothesis that deployment in an STP is an effective tool in innovation policy.

One of the reasons for the lack of consensus may lie in the major heterogeneity in the size of samples, the control of endogeneity, and the variables used for measuring performance. Table 1 shows how generic performance variables (growth in sales, performance, productivity) and more specific variables linked to innovative performance are used.

In addition to the methodological differences noted above, contributions that focus on analysing the role of variables that moderate the relationship between belonging to an STP and the enhancement of innovation performance should be considered. In this sense, Díez-Vial and Montoro-Sánchez (2017) “identify new research lines focusing on internal characteristics of the firm, its strategy and knowledge, the importance of supporting entrepreneurs, and the key role that these locations can play in high-technology-based firms”. Thus, Lindelöf and Löftsen (2004) report that STPs may be viewed as learning centres, and they note that scant attention has been paid to the transfer of knowledge in STPs (Chan et al. 2011). Specifically, Gordon and McCann (2000) stress that geographical proximity favours the transfer of knowledge, and along the same lines, Chan et al. (2011) highlight the importance of the networks created in an STP (networking) as an aspect that favours inter-organisational learning. Chan et al. (2011) include absorptive capacity as a decisive learning factor in firms located in an STP, with its knock-on effect on innovation performance. Díez-Vial and Fernández-Olmos (2017a) find that the benefits of belonging to a park depend of the industry maturity and the age of the firms. In addition, Díez-Vial and Fernández-Olmos (2017b) analyse the effect that STPs have on firm growth at times of economic recession and find that non-low-technology firms benefit more from being located on an STP during a recession when firms are making internal R&D investments.

2.2 Absorptive capacity and firm innovation performance

One of the new approaches to studying parks is the knowledge-based view and strategy (Díez-Vial and Montoro-Sánchez 2017). In this sense, the theory of dynamic capabilities suggests that when firms cannot develop all their technological or market capabilities internally, they may supplement their learning by acquiring outside knowledge (Collinson and Wang 2012; Hoang and Rothaermel 2010). Furthermore, the speed at which they assimilate and apply this knowledge will have an impact on their competitive advantages (Tzabbar et al. 2013). Some authors have explained the relationship between organisational learning and absorptive capacity (González-Sánchez and García-Muiña 2011; Jiménez-Barrionuevo et al. 2011; Lane and Lubatkin 1998).

Cohen and Levinthal (1989) argue that absorptive capacity allows outside knowledge to be integrated into the firm’s own knowledge, thus contributing to the development of its innovation activity. Leiponen (2005) reports that absorptive capacity, created and accumulated through internal R&D activities and the efforts of human capital, complements outside cooperation in R&D, which all favour innovation. Authors such as Gao et al. (2008) contend that firms with a high absorptive capacity are more likely to innovate. This result shows that absorptive capacity is essential for scientific knowledge, which, in turn, lays the foundations for innovation (Chan and Pretorius 2007). Absorptive capacity has been considered a pivotal source of innovation success (Chang and Chob 2008). The more difficult it is to reproduce or imitate a firm’s absorptive capacity and innovative capabilities, the more successful the firm will be in its innovation outcomes. Firms with a well-developed absorptive capacity and well-implemented relational learning mechanisms will be more likely to pursue innovation. This, in turn, will lead to the achievement of long-term competitive advantages (Cepeda-Carrión et al. 2012).

Our point of departure here is the model propounded by Cohen and Levinthal (1989), where the learning of firm i is defined by the following function \( z_{i} \):

This equation enables us to identify two sources of knowledge: R&D activities \( \left( {{\text{m}}_{\text{i}} } \right) \), which inform the distinctive competencies of a technological nature, and the skill for assimilating and exploiting the knowledge available outside the firm. We differentiate between the intra-sectorial knowledge \( \left( {\sum\nolimits_{{{\text{j}} \ne {\text{i}}}} {{\text{m}}_{\text{j}} } } \right) \) provided by all other firms in the industry and the extra-sectorial knowledge \( \left( T \right) \) provided by different institutions dedicated to innovation, such as universities.

The level of knowledge appropriation \( \left( \theta \right) \) determines outside learning. If there is no possibility of appropriation \( \left( {\theta = 0} \right), \) then the industry’s knowledge will not be available for the firm.

The skill that a firm has for identifying, assimilating and exploiting outside knowledge is called absorptive capacity (Cohen and Levinthal 1989), which we represent in the following equation:

R&D \( \left( {{\text{m}}_{\text{i}} } \right) \) facilitates learning from the environment; that is, it speeds up the appropriation of outside knowledgeFootnote 1\( \left( {\gamma_{{m_{i} }} > 0} \right) \), albeit with decreasing marginal returns \( \left( {\gamma_{{m_{i} m_{i} }} < 0} \right) \). The tacit component of outside knowledge is defined by \( \beta \), which is unclearly identified and highly complex; thus, this learning has a high cost (Kogut and Zander 1992), which means that the knowledge-gathering process is less efficient \( \left( {\gamma_{\beta } < 0} \right). \) Learning tacit knowledge requires an investment in R&D; thus, the greater the technological effort, the greater a firm’s ability to incorporate knowledge with a higher level of complexity \( \left( {\gamma_{{m_{i} \beta }} > 0} \right) \). It is therefore posited that the increase in \( \beta \) increases the marginal effect of R&D on absorptive capacity (Cohen and Levinthal 1989). Similarly, we defend the existence of a minimum level of absorptive capacity \( \left( {\gamma^{\dag } } \right) \) if a firm is to be capable of appropriating intra-industrial knowledge.

Within this context, one may assume that high technological capital implies a high absorptive capacity. However, an increase in technological capital may present a duplication problem between the knowledge of firm i and all other firms j located in the STP \( \left( {\omega_{i,j} } \right) \). The notion of relative absorptive capacity permits the incorporation of knowledge duplication in the model. Along these lines, Lane and Lubatkin (1998) “reconceptualize the firm-level construct absorptive capacity as a learning dyad-level construct, relative absorptive capacity. One firm’s ability to learn from another firm is argued to depend on the similarity of both firms’ (1) knowledge bases, (2) organizational structures and compensation policies, and (3) dominant logics”. Therefore, knowledge duplication reduces the relative absorptive capacity \( \left( {\gamma_{\omega } < 0} \right) \). This knowledge duplication reduces a potential knowledge spillover and therefore the value of the knowledge available in the STP (Lane and Lubatkin 1998; Zahra and George 2002). This leads us to consider the concept of relative absorptive capacity represented by the following expression:

We extend the function and incorporate the duplicity of knowledge that reduces the relative absorptive capacity \( \left( {\gamma_{{i{\text{j}},\omega }} < 0} \right) \). Doing so presents us with an interaction with contrasting effects: on the one hand, an increase in R&D activities facilitates the assimilation of external knowledge, but it increases knowledge duplication. Therefore, a greater technological effort does not necessarily mean more technological spillovers in the STP. The higher a firm’s technological capability is, the lower the knowledge value of all other firms in the STP. The knowledge duplicity generates a threshold \( \left( {\omega_{ij}^{ *} } \right) \) above which an increase in technological effort reduces the value of the knowledge available in the STP. The combination of both effects suggests the existence of a non-linear relationship between a firm’s technological effort and its relative absorptive capacity:

The business population is composed of n firms located off the STP and l firms located on the STP. The learning of firm i on the STP is determined by the following expression:

where \( \gamma_{i,j} \theta m_{j} \) represents the learning of firm i regarding the knowledge provided by firm j located off the STP and, similarly, \( \ddot{\gamma }_{i,k} \theta m_{k} \) represents the learning of firm i regarding the knowledge provided by firm k located in the STP. The paper’s central hypothesis posits that STPs facilitate the creation of social networks (Chan et al. 2011; Gordon and McCann 2000) that improve the conditions for knowledge appropriation \( \ddot{\gamma }_{i,k} > \gamma_{i,j} . \) In other words, firms on the STP have privileged access to the knowledge of all other firms located there, which should improve their innovation performance.

If \( z_{i}^{ '} \) represents the knowledge of firm i and if it is off the STP, then the difference with being on the STP represents the advantage of being on STP \( \alpha_{i} \).

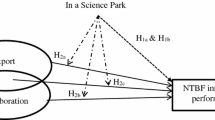

From this perspective, being located on an STP provides privileged access to specific knowledge. Its value depends on a firm’s technological capital. First, we contend that a firm should have a minimum technological capital \( \left( {m_{i}^{\dag } } \right) \) for the partial appropriation of the knowledge of all other firms on the STP. This allows us to propound the existence of a first type of firm with a paucity of technological capital, \( \left( {\gamma_{i} \le \gamma_{i}^{\dag } \left( {m_{i}^{\dag } } \right)} \right), \) which should not record a better innovation performance than firms of a similar nature located elsewhere. We refer to these firms as pre-catching up firms (Fig. 1).

We analyse what occurs when firms exceed that minimum level of knowledge. To do so, we estimate how the advantage of being located on the STP is affected by the firm’s technological capital:

Equation 8 proposes that technological capital has a non-linear effect on the STP’s contribution to the knowledge generated by the firm, which is conditioned by its absorptive capacity for assimilating the knowledge available on the STP without incurring problems of knowledge duplicity \( \left( {\gamma_{i}^{\dag } \left( {m_{i}^{\dag } } \right) < \gamma_{i} \le \gamma_{i}^{ *} \left( {m_{i}^{ *} } \right)} \right) \). These firms have enough technological capital to enhance their innovation performance by deploying on the STP. Furthermore, the growth in their technological capital will increase the STP’s contribution to the firm’s knowledge. We refer to these firms as catching up firms (Fig. 1).

We therefore propose the existence of a threshold for technological capital \( \left( {m_{i}^{ *} } \right) \) whereby knowledge duplicity reduces the relative absorptive capacity \( \left( {\frac{{\partial \gamma_{i,k} }}{{\partial m_{i} }} < 0} \right) \) and consequently reduce an STP’s contribution to a firm’s innovation performance. In other words, the third group would consist of firms with high technological capital, although knowledge duplicity reduces the learning options and, therefore, the STP’s contribution to innovation performance. This group is referred as pre-frontier sharing firms (Fig. 1).

3 Methods

3.1 Sample

The data come from the Technological Innovation Panel (PITEC) survey, conducted by The Spanish National Statistics Institute (INE), for the 2008–2011 period. It is a panel survey for studying the innovation activities of Spanish firms. A sample of firms located on an STP, in addition to a control sample of firms that are not, has been created. We have chosen to use a panel composed for 3844 firms, of which 345 are on an STP. The sample has 15,330 observations. We have included firms with three or more years to control the different behaviours of start-up firms.

3.2 Variables

3.2.1 Dependent variable

In contemporary environments, the development of new products, services and processes has become a fundamental requirement of innovations in organisations (Chen et al. 2012; Tsai 2009). Damanpour (1991) conducts a meta-analysis that concludes that the number of new products is a robust measure of innovation performance (Filatotchev et al. 2011). Innovation performance has been measured by the percentage of new products over turnover for the firm and market at time t (Díez-Vial and Fernández-Olmos 2015, 2017a; Filatotchev et al. 2011; Ramírez-Alesón and Fernández-Olmos 2018; Siegel et al. 2003; Vásquez-Urriago et al. 2014; Westhead 1997). This variable is a direct measure of innovation, i.e., it measures the market introduction of a new product or service, in addition to its applicability to all sectors, and it is a continuous variable (Kleinknecht et al. 2002).

3.2.2 Treatment variable

A variable dummy for STPs is used; \( STP_{i.t} \) takes the value of 1 if firm i is on an STP at time t 0 otherwise (Díez-Vial and Fernández-Olmos 2015, 2017a, 2017b; Siegel et al. 2003; Vásquez-Urriago et al. 2014).

3.2.3 Moderating variables

The model proposes that absorptive capacity has a moderating effect on innovation performance. Innovations that lead to the creation of new products, services or processes, or the modernisation of already existing products, services or processes, require valuable resources that may sometimes be obtained by establishing relationships with the environment and with different providers of outside knowledge (Chen et al. 2014). The concept of absorptive capacity has been linked to the availability of technological resources. In this sense, it has been measured by R&D effort (Cohen and Levinthal 1989; Veugelers and Cassiman 2005), the human capital endowment (Filatotchev et al. 2011) and the results of innovation processes such as the development of new products (Cepeda-Carrión et al. 2012; Chen et al. 2012, 2014, Tsai 2009). In this paper, we have been developed a construct through a factorial analysis (Table 2) that integrates into a factor the resources dedicated to innovation (expenditure on R&D, number of PhDs and expenditure on R&D by public funding), and to control for sectorial heterogeneity, we have divided it by the sector average. We have included the variable of absorptive capacity lagged one period (Erickson and Jacobson 1992).

3.2.4 Instrumental variables

The instrumental variables must explain the treatment decision, membership in an STP, but it must not affect innovation performance. In this sense, Vásquez-Urriago et al. (2014) propose “the number of companies located in an STP as a percentage of the total companies in the region in which the company is located”. Vásquez-Urriago et al. (2014) and Johansson and Lööf (2008) find that regional factors do not determine the innovation capacity of firms. However, the provision of affordable technological infrastructure for firms can determine the decision to enter into an STP. We do not know the number the companies located on an STP for each year. Thus, we have proposed different variables: the percentage of STPs located in each region (STPs available in a region/total number of STPs); the ratio between the available square metres of STPs in a region and the total available square metres of STPs in Spain; and a dummy variable for the region that identifies the region in which the firms realise the innovation activity. When a firm develops innovation activity for more than one region, we select that in which the firm has the highest number of employees. Only the last instrument gives an adequate design of the control function; the rest of the instruments raise a collinearity problem.

3.2.5 Control variables

Several control variables have been considered to influence innovation performance. R&D expenditure (R&D) is measured as expenditure on R&D/sales (Filatotchev et al. 2011; Lindelöf and Löftsen 2004). The relative number of PhDs (PhDs) is measured as the number of PhDs/number of employees (Colombo and Delmastro 2002; Filatotchev et al. 2011; Lindelöf and Löftsen 2004; Westhead and Storey 1994) and public funding as the expenditure on R&D funded by public organisations (Colombo and Delmastro 2002). Otherwise, cooperation is a dummy variable that takes the value of 1 if firms engage in collaboration for innovation and zero otherwise (Colombo and Delmastro 2002; Díez-Vial and Fernández-Olmos 2015; Lindelöf and Löftsen 2004; Vásquez-Urriago et al. 2014, 2016). Patents show the number of patent applications (Lindelöf and Löftsen 2004; Squicciarini 2008). Size is measured as the logarithm of the number of employees (Díez-Vial and Fernández-Olmos 2015, 2017a, b; Ferguson and Olofsson 2004; Squicciarini 2008), and age is measured as the logarithm of the number of years since the firm’s foundation (Colombo and Delmastro 2002; Díez-Vial and Fernández-Olmos 2015, 2017b; Ferguson and Olofsson 2004; Lindelöf and Löftsen 2004). Business group is a dummy that takes the value of 1 if the firm belongs to a group and zero otherwise (Díez-Vial and Fernández-Olmos 2017b; Squicciarini 2008; Vásquez-Urriago et al. 2014, 2016). Finally, we consider the export activity, i.e., export/total sales (Díez-Vial and Fernández-Olmos 2017b), and the technological level of sectors (a dummy variable for all 7 technological levels of sectors; Vásquez-Urriago et al. 2014), and we included a dummy for each year.

Table 3 summarizes the measure of variables and Table 4 presents the descriptive statistics.

3.3 Empirical methods

In this paper, we estimate the moderating role of absorptive capacity in the relationship between STP entry and improvement in technological innovation. For that purpose, we have compared the technological performance of two groups of firms: “treatment group” composed of firms located on an STP and a “control group” composed of firms located off an STP. The effect of STP on technological performance has been tested by estimating the Average Treatment Effect (ATE). However, this raises a selection bias problem, which has been treated with a control function. Finally, we have proposed that the absorptive capacity moderate the effect of STP on technological performance, and this moderation function is non-lineal. In these sense, a threshold regression analysis allows us an adequate treatment of the no-linearity. Also, the thresholds let us to identify objectively the three types of firms proposed (Table 5).

3.3.1 Are firms located in STPs more innovative than firms located off STPs?

A “treatment group” composed of firms located on an STP and a “control group” composed of firms located off an STP have been established. Some prior studies choose this methodological approach (Colombo and Delmastro 2002; Ferguson and Olofsson 2004; Lindelöf and Löftsen 2004; Squicciarini 2008; Vásquez-Urriago et al. 2014). The effect of the location of firms on an STP can be estimated with the Average Treatment Effect (ATE), which is the average of the difference between the outcomes of inside firms \( E\left( {Y_{1i} | _{{STP_{i} = 1}} } \right) \) and the outcomes that they would have obtained if they had been outside an STP \( E\left( {Y_{0i} | _{{STP_{i} = 1}} } \right) \). Perhaps \( E\left( {Y_{0i} | _{{STP_{i} = 1}} } \right) \) is unobservable, which is why we seek a control sample in which the outcome is E \( \left( {Y_{0i} | _{{STp_{i} = 0}} } \right) \). Thus, \( \widehat{ATE} = E\left( {Y_{1i} | _{{STP_{i} = 1}} } \right) - E\left( {Y_{0i} | _{{STP_{i} = 0}} } \right) \).

3.3.2 Endogeneity/selection bias

The difference between ATE and \( \widehat{ATE} \) is the selection bias. If we can consider that the treatment is assigned randomly, then \( ATE = \widehat{ATE} \), and therefore, the selection bias is without significance. However, it is possible that STPs attract firms with more highly skilled labour (Colombo and Delmastro 2002; Westhead and Storey 1994) and with greater innovation performance. Thus, it is difficult to conclude whether belonging to an STP makes a firm more innovative or, by contrast, more innovative firms tend to congregate on STPs (Felsenstein 1994; Lindelöf and Löftsen 2004). Therefore, there can self-selection into treatment (Siegel et al. 2003; Squicciarini 2008; Todo et al. 2011). This bias has been called into question if we consider that STPs tend to generate rents for ensuring their survival; the selection process may be conducted more in response to criteria of financial solvency than in response to purely scientific criteria (Felsenstein 1994; Westhead and Storey 1994). Furthermore, Squicciarini (2008) indicates that the effect on brand image (Westhead and Storey 1994) and the proximity to suppliers and customers are the main reasons why firms deploy on an STP.

If there is a selection bias (Colombo and Delmastro 2002), then we can suppose that a set of variables explains the decision to enter into an STP. In this case, we can assume independence between the assignment of the treatment and the potential outcome. We suppose conditional independence (Rosenbaum and Rubin 1983), which has been assumed by a large part of the empirical evidence (Colombo and Delmastro 2002; Ferguson and Olofsson 2004; Lindelöf and Löftsen 2004; Squicciarini 2008). We hold that \( X \) is the set of observable variables:

where \( \hat{\alpha } \) measures the effect of membership in an STP on innovation capacity.

The variables determining the entry decision into an STP can be unobservable. These variables may affect the entry decision and innovation capacity. In this case, the assumption of conditional independence must be abandoned since the results of previous methods would be inconsistent and biased. We have used a control function to solve the endogeneity problem. In these sense, we included in the model the decision to enter into an STP:

where \( Z_{it} \) includes \( X_{it} \) and at least one instrumental variable that is correlated with \( STP_{it} \) and uncorrelated with \( Y_{it} \) and \( \varepsilon \) reflect the unobservable factors (Tucker 2010).

The new model has been estimated by a two-stage procedure. In the first step, we estimate Eq. 10 based on a probit model, we measure the entrance probability from an STP. In the second steep, we estimate Eq. 9, but we include the generalised residuals of the probit model \( \left( {\upsilon_{it} } \right) \):

This identification is vulnerable to excessive disparity between the treated and untreated groups, an inappropriate assumption of multivariate normality, or the quality of instrumental variable (Bascle 2008). The instrumental variables (IV) estimator is an alternative. However, Yu (2013) shows the inconsistency of 2SLS estimators in illustrating the specialty of the endogeneity problem in threshold regression.

3.3.3 Non-linear relationship

A threshold regression analysis has been used to address the non-linear relationship. According to Hansen (2000), we use the following model specification:

where I() is a function that takes the value of 1 when the absorptive capacity is above the threshold \( th \), which allows us to segment the sample according absorptive capacity \( \left( {ABC_{it} } \right) \); STPit is a dichotomous variable that takes the value of 1 when firm i is on an STP at time t; \( ABC_{it} \) represents the firm’s absorptive capacity; \( X_{it} \) includes the control variables; \( \upsilon_{it} \) is the generalised residuals of the probit model of the previous stage; and \( \eta_{it} \) is the error term.

Threshold regression analysis (Hansen 2000) allows us to identify the levels of absorptive capacity although a change was observed in the relationship between the location in an STP and the improvement of the innovation performance. The use of methodology proposed by Hansen (2000) has allowed us to identify two thresholds. The first threshold has been reached when the absorption capacity is − 0.392 and the second threshold when the absorption capacity is 0.102 (Table 6). These thresholds let us to identify objectively the three types of firms proposed in Fig. 1:

-

The pre-catching up firms which have an absorption capacity below to − 0.392.

-

The catching up firms which have an absorption capacity between − 0.392 and 0.102.

-

The pre-frontier sharing firms which have an absorption capacity beyond 0.102.

3.4 Estimation method

For the estimation method, we have developed several analyses to solve different methodological problems (Table 7). We find no multicollinearity problems for the subsequent regression analysis. All explanatory variables have variance inflation factors (VIFs) below the rule of thumb cut-off of 10 for regression models (Kutner et al. 2004), and the condition number that was obtained is also substantially below the rule of thumb of 30 (Belsley 1991; Pesaran 2015).

3.4.1 Shorted panel data

The panel data are shortened; we have only four times observations per firm. In this case, the fixed effects model is an inconsistent estimator of the unobserved effect for a short time panel (Cameron and Trivedi 2005). Thus, we have used a random effect.

3.4.2 Dependent variable is a censored variable

The dependent variable is concentrated in two points of a large observation proportion (censored variable). Concretely, 7584 observations, 49.47% of cases, do not have new products in their portfolio \( \left( {c_{1} = 0} \right) \), and 633 observations have a value greater than or equal to \( 0.693 \left( {c_{2} = 0.693} \right) \). In accordance with Vásquez-Urriago et al. (2014), the innovation capacity is a double-censored variable. Hence, the most appropriate manner in which to perform the estimations is via double-censored Tobit models. There is a latent variable \( Y_{it}^{*} \) that equals zero when \( Y_{it}^{*} \le c_{1} \) and takes the value \( c_{2} \) when \( Y_{it}^{*} \ge c_{2} \) and \( Y_{it}^{*} = Y_{it} \) when \( c_{1} < Y_{it}^{*} < c_{2} \) (Model 1).

3.4.3 Autocorrelation, no normality and heteroscedasticity

In addition, we have an autocorrelation problem. For this reason, we estimate Model 2, which uses a random effect option and assumes for estimation that in the variance–covariance matrix the observations are independent across firms (clusters) but not necessarily within groups. This GLS model is robust to heteroscedasticity and autocorrelation (Cameron and Trivedi 2005).

We have applied the test proposed by Cameron and Trivedi (2005), which rejects the null hypothesis of homoscedasticity. Additionally, the test proposed by Skeels and Vella (1999) rejects normality. The failures of the normality and homoscedasticity assumptions have serious consequences for censored-data regression (Model 1). Hence, we estimate Model 3, which is a two-part model; in the first part (step 1), we estimate a probit equation that models the probability of placing a new technological product. The dependent variable is measured by a binary variable \( \left( {y_{1} } \right) \) that takes the value of 1 if the percentage of new products over turnover is greater than zero \( \left( {tlnewmar > 0} \right) \) and 0 otherwise. In the second part, we use an up-censored tobit regression (step 2a) and a linear regression (GLS) (Step 2b) to determine the percentage of new products over turnover for the firm \( \left( {y_{2} } \right) \); in this case, only firms with new technological products are included in the sample. The independence of the two parts is assumed, i.e., technological performance is randomly selected from firms. If we do not accept this hypothesis, the use of the selection model also known as the type-2 tobit model is involved. The two-step method proposes this conditional expectation \( E\left( {y_{2} |x,tlnewmar > 0} \right) = x_{2}^{'} \beta_{2} + \sigma_{12} \lambda \left( {x_{1}^{'} \beta_{1} } \right) \), where \( \lambda \left( {x_{1}^{'} \beta_{1} } \right) \) is the inverse Mills’ ratio of the standard errors estimated in the probit model performed in the first step. The hypothesis of independence of both decisions can be tested directly by using the lambda coefficient, that is, the error covariance \( \sigma_{12} \) (Cameron and Trivedi 2009).

4 Results and discussion

The first results come in Table 8. In specification A, we include only the STP variable; in specification B, we add the interaction between absorptive capacity and being located in an STP. In specification C, we incorporate the two thresholds previously identified.

In both tobit models (model 1.A and 1.B), the coefficient of the STP variable is significant and positive. Apparently, STPs contribute to increasing the technological performance of firms; however, non-normality and heteroscedasticity may skew these results. In fact, the two GLS models (models 2.A and 2.B) do not confirm these results. The two-part models (models 3.A and 3.B) partially explain these results. In step 1 of the probit model (models 3.1.A and 3.1.B), the coefficient of the STP variable is positive and significant. However, this variable is not significant in all specifications of the second step (models 3.2.A, 3.2.B, 3.3.A and 3.3.B). Seemingly, STPs increase the probability of marketing of new technological products (models 3.A and 3.B) but do not increase the percentage of new products over turnover (models 3.2.A, 3.2.B, 3.3.A and 3.3.B).

In specification B, the interaction between the variable of being located in an STP and absorptive capacity is not significant in all models. These results do not confirm the moderating role of absorptive capacity in the relationship between innovation performance and location in an STP.

The consideration of non-linearity in specification C enriches the results obtained. In both aggregated models (models 1.C and 2.C), the coefficients of the first threshold, which includes the firms inside an STP with low absorptive capacity \( \left[ {STP_{it} \times I\left( {ABC_{it - 1} \le - 0.392 } \right)} \right] \), are significant and negative. The coefficients for the variables that differentiate firms inside an STP with medium absorptive capacity \( \left[ {STP_{it} \times I\left( { - 0.392 < ABC_{it - 1} \le 0.102 } \right)} \right] \) are significant and positive. The coefficients for the variables that differentiate firms inside an STP with high absorptive capacity \( \left[ {STP_{it} \times I\left( {ABC_{it - 1} > 0.102 } \right)} \right] \) are not significant.

The results obtained in the two-part models confirm partially these results. In the first step (model 3.1.C), the coefficient of the first threshold is not significant, and the coefficients of the second and third thresholds are positive and significant. In the second step (models 3.2.C and 3.3.C), the coefficient for the first threshold is negative and significant; the coefficients of the remaining thresholds are not significant. Firms with low absorptive capacity inside an STP do not have a higher probability of selling their innovation than firms with low absorptive capacity outside an STP. However, for this type of firm inside an STP, the percentage of new products over turnover is lower than it is for those outside an STP. For the rest of the firms, the probability of selling innovation increases inside an STP. However, there is no difference with regard to the percentage of new products over turnover.

The treatment of endogeneity with the function control methodology modifies the previous results (Table 9). In all models, the generalised residuals of the probit model \( \left( {\upsilon_{it} } \right) \) are significant, which verifies that the decision to enter into an STP is endogenous. In specification A, the coefficients of the STP dummy are significant and positive for all models. These results confirm that membership in an STP has a positive impact on the innovation performance of firms. This result is consistent with Fernhaber and Patel (2012), Rothaermel and Alexandre (2009), and Tsai (2001). However, it contradicts the results obtained by Colombo and Delmastro (2002), Lindelöf and Löftsen (2003), Löfsten and Lindelöf (2002), Westhead (1997) and Westhead and Storey (1994). Using the same methodology as Vásquez-Urriago et al. (2014), we achieve the same results, but we go further with specifications B and C, which include the moderating effect of absorptive capacity.

Similar results are obtained in specification B (Table 9). The dummy STP variables are significant and positive in all models except in the probit model (model 3.1.B). Therefore, firms on an STP improve their percentage of new products over turnover but do not increase the probability of selling innovation. On the other hand, the coefficients of the interactions between membership in an STP and absorptive capacity are not significant in any models. These results show that absorptive capacity does not have a linear moderating effect. Chan et al. (2011) achieve these results with a different methodology.

In specification C (Table 9), the coefficients of the first thresholds \( \left[ {STP_{it} \times I\left( {ABC_{it - 1} \le - 0.392 )} \right) } \right] \) are not significant in all models. That is, firms with low absorptive capacity located in an STP do not improve their innovation performance. However, the coefficients of the dummy variables that identify firms with medium and high absorptive capacity located in an STP are positive and significant in all models. These results confirm that only firms above an absorptive capacity threshold can improve their innovation performance in an STP. In all models except the probit model (model 3.1.C), the coefficient of firms with medium absorptive capacity inside an STP is higher than the coefficient of firms with high absorptive capacity inside an STP. However, in the probit model, the two coefficients are similar. These results confirm the effects of knowledge duplicity proposed in the theoretical model. Additionally, they allow a deeper understanding of the effects since the duplicity does not modify the probability of selling innovation but, rather, increases the percentage of new products over turnover.

The inclusion of thresholds enables us to identify the following effects (model C, Table 9). Firms with lower absorptive capacity, pre-catching up firms, inside an STP do not improve their innovation performance. These firms have a paucity of technological capital, which means that they should not record a better innovation performance than firms of a similar nature located elsewhere.

For firms with medium absorptive capacity, catching up firms, their location on the STP leads to a higher innovation performance. These firms have enough technological capital to enhance their innovation performance by deploying on the STP. Furthermore, the growth in their technological capital will increase the STP’s contribution to the firm’s knowledge.

Firms with high absorptive capacity, pre-frontier sharing firms, improve their innovation performance by being on an STP, but knowledge duplicity reduces the value of the knowledge available on the STP. The effect of the STP on the improvement in the innovation performance of firms is higher for catching-up firms than for pre-frontier sharing firms. These results confirm the proposals of the theoretical model.

Considering the control variables, in Table 10, we show only the significant variables after solving the multicollinearity problems. The results show that cooperation has a positive and significant effect on innovation performance in models 1 and 3.1 Then, cooperation can be a significant variable in the generation of innovation. The prior literature has recorded similar results. Lockett et al. (2003) and Zucker et al. (2002) affirm that relationships with universities and technology centres may have a positive effect on firm innovation. In relation to age, significant and negative effects are recorded in models 3.2 and 3.3. In this sense, authors such as Díez-Vial and Fernández-Olmos (2017a), Klette and Griliches (2000) and Squicciarini (2008, 2009) have found evidence for a greater innovation performance among younger firms. Regarding the significant and positive effects of size (model 3.1), some authors have confirmed the existence of a significant and positive relationship with innovation activity (Díez-Vial and Fernández-Olmos 2017a; Huang et al. 2012; Squicciarini 2008, 2009). However, models 3.2 and 3.3 show different results. In these cases, there is a significant and negative relationship between size and innovation performance. Regarding the number of patents, some studies anticipate a positive impact on innovation performance (Squicciarini 2008, 2009). Overall, one may expect prior patents to have a positive effect on the innovation outcome (model 3.1), but models 3.2 and 3.3 reveal no significant effects. Subsidiaries and low-technology manufacturing firms have a significant negative effect (models 3.2 and 3.3).

5 Conclusions

This paper analyses the moderating effect that absorptive capacity has on the innovation performance of firms located in an STP. STPs can facilitate knowledge sharing between onsite firms and other institutions, such as universities and other research centres. Furthermore, they may also facilitate access to financing for innovation activities. Moreover, membership in an STP is expected to improve brand image (Salvador 2011; Squicciarini 2008; Westhead and Storey 1994). All this creates suitable conditions for driving the generation of innovation and its subsequent marketing. In this paper, a theoretical model that considers that the exploitation of the opportunities that an STP provides is determined by a firm’s prior experience in innovation is proposed. This experience enables a firm to acquire knowledge and to improve its absorptive capacity, making it easier for the firm to access new knowledge, assimilate it, transform it, and exploit it.

The model indicates that there should be a certain minimum absorptive capacity if deployment on an STP is to generate the required externalities. In other words, firms that already record an intermediate or high absorptive capacity may benefit from the networks and services provided by an STP and therefore enhance their innovation performance; however, being located in an STP does not improve the innovation performance for firms that record a low absorptive capacity. These results enable us to explain and qualify some of the findings reported in the prior literature: the moderating role of absorptive capacity in the non-linear relationship between being located in an STP and innovation performance.

The results of previous studies that analyse the relationship between being located in an STP and innovation are not consistent. Among them, some studies find a positive or a negative relationship, and others do not find effects. In this paper, we have found that three effects are possible. The key issue is considering the relationship a non-linear model using a threshold regression analysis in which absorptive capacity is the moderating variable. In this sense, a group of firms has been identified that we designate pre-catching up firms, which do not achieve the minimum absorptive capacity that enables a firm to exploit all of the learning opportunities provided by an STP. These firms do not record a better innovation performance than similar firms located elsewhere. This result confirms the proposition obtained in the theoretical model.

Accordingly, the effect that belonging to an STP has on innovation performance is positive and significant when the minimum threshold of absorptive capacity is exceeded. This enables us to refer to a second group of firms that we designate catching up firms, consisting of precisely those firms that exceed this threshold. These firms have enough absorptive capacity to make the absolute most of the learning opportunities that the STP provides, without falling into problems of knowledge duplicity. This leads us to the identification of the third group, namely, pre-frontier sharing firms; that improve their innovation performance by being on an STP but less than catching up firms. In that case, their learning opportunities are reduced by knowledge duplicity.

This paper has three types of practical implications for governments, managers of STPs and managers of companies who have to decide about the convenience of being on a park. Following, we have formulated a question for each kind of actors.

Related to the governments, our results help to answer to the question: How to improve the allocation of public resources to the STPs? One of the main functions of an STP is to contribute to the improvement of the innovation capacity of the business fabric of the territory in which it is located. In that sense, Link and Scott (2007) explain that there are “the assumption that research parks are an important element in the US national innovation system, and as such should be fostered because of both the knowledge and the employment based spillovers that will result”. In the case of Spain, STPs are too considered as an important part of the regional innovation system and, in addition, most of them are mainly financed by public resources. Thus, governments should develop public policies that reward and encourage parks that contribute to improving the innovative capacity of their companies. This paper offers an indicator that allows to objectively quantify this effect.

Secondly, if we consider the managers of the STPs, the question will be: What criteria SPTs’ managers should consider when selecting their companies? According with our results, managers of STPs can develop an objective selection criteria to select just firms that be able to take advantage of being in a park (cooperation, spillovers…). In that sense, STPs’ managers should select those companies with a minimum absorption capacity; in other case, they will not improve their innovation capacity and its location in a park will not justified.

Third, we focus in the managers of the firms who need to decide about the convenience of belonging to a park. The questions is: When a company is interested in locating in a park? Firms can analyse the convenience of entry into an STP. It is therefore important for managers to consider the goal pursued through such membership: cooperating, accessing resources, improving their innovation capability, obtaining finance, etc. In the light of our results, they will be more likely to enhance their innovation performance if they have an intermediate or high level of absorptive capacity. Otherwise, firms located inside an STP can use the model to decide on the convenience of being located or not in the park.

Our results also raise a number of unexplored issues. The proposed model can be tested considering other types of data, geographical contexts and temporal scopes. In addition, the direct and moderating effect of other variables such as the return on public subsidies, patents and cooperation on innovation performance can be analysed. Finally, additional variables can be included in our model such us “knowledge conversion capability” of the firm propose by Zahra et al. (2007). This variable could be a good complement of the absorptive capacity of firms.

Notes

We use the following mathematical notation \( \gamma_{{m_{i} }} \) to express the partial derivatives: \( \gamma_{{m_{i} }} = \frac{\partial \gamma }{{\partial m_{i} }} \) and, similarly, \( \gamma_{{m_{i} m_{i} }} = \frac{{\partial^{2} \gamma }}{{\partial m_{i}^{2} }} \).

References

Albahari, A., Pérez-Canto, S., Barge-Gil, A., & Modrego, A. (2017). Technology parks versus science parks: Does the university make the difference? Technological Forecasting and Social Change, 116, 13–28. https://doi.org/10.1016/j.techfore.2016.11.012.

Albahari, A., Pérez-Canto, S., & Landoni, P. (2010). Science and Technology Parks impacts on tenant organizations: A review of literature. MPRA Paper No. 41914, posted 14. https://mpra.ub.uni-muenchen.de/41914/.

Bakouros, Y. L., Mardas, D. C., & Varsakelis, N. C. (2002). Science park, a high tech fantasy? An analysis of the science parks of Greece. Technovation, 22(2), 123–128. https://doi.org/10.1016/S0166-4972(00)00087-0.

Bascle, G. (2008). Controlling for endogeneity with instrumental variables in strategic management research. Strategic Organization, 6(3), 285–327. https://doi.org/10.1177/1476127008094339.

Belsley, D. A. (1991). A guide to using the collinearity diagnostics. Computational Economics, 4(1), 33–50. https://doi.org/10.1007/BF00426854.

Cameron, A. C., & Trivedi, P. K. (2005). Microeconometrics: Methods and applications. New York: Cambridge University Press.

Cameron, A. C., & Trivedi, P. K. (2009). Microeconometrics using stata. College Station, TX: Stata Press.

Castells, M., & Hall, P. (1994). Technopolos of the world. The making of twenty-first-century industrial complexes. London: Routledge.

Cepeda-Carrión, G., Cegarra-Navarro, J. G., & Jiménez-Jiménez, D. (2012). The effect of absorptive capacity on innovativeness: Context and information systems capability as catalysts. British Journal of Management, 23(1), 110–129. https://doi.org/10.1111/j.1467-8551.2010.00725.x.

Chan, K. Y. A., Oerlemans, L. A. G., & Pretorius, M. W. (2011). Innovation outcomes of South African new technology-based firms: A contribution to the debate on the performance of science park firms. South African Journal of Economic and Management Sciences, 14(4), 361–378.

Chan, K. Y. A., & Pretorius, M. W. (2007). Networking, absorptive capacity, science parks: A proposed conceptual model for firm innovative performance. In Industrial engineering and engineering management, 2007 IEEE international conference (pp. 1925–1929). http://dx.doi.org/10.1109/IEEM.2007.4419527.

Chang, D. R., & Chob, H. (2008). Organizational memory influences new product success. Journal of Business Research, 61(1), 13–23. https://doi.org/10.1016/j.jbusres.2006.05.005.

Chen, Y. S., Qiao, S., & Lee, A. H. I. (2014). The impacts of different R&D organizational structures on performance of firms: Perspective of absorptive capacity. The Journal of High Technology Management Research, 25(1), 83–95. https://doi.org/10.1016/j.hitech.2013.12.007.

Chen, J., Reilly, R. R., & Lynn, G. S. (2012). New product development speed: Too much of a good thing? Journal of Product Innovation Management, 29(2), 288–303. https://doi.org/10.1111/j.1540-5885.2011.00896.x.

Cohen, W. M., & Levinthal, D. A. (1989). Innovation and learning: The two faces of R&D. The Economic Journal, 99(397), 569–596. https://doi.org/10.2307/2233763.

Collinson, S. C., & Wang, R. (2012). The evolution of innovation capability in multinational enterprise subsidiaries: Dual network embeddedness and the divergence of subsidiary specialisation in Taiwan. Research Policy, 41(9), 1501–1518. https://doi.org/10.1016/j.respol.2012.05.007.

Colombo, M., & Delmastro, M. (2002). How effective are technology incubators? Evidence from Italy. Research Policy, 31(7), 1103–1122. https://doi.org/10.1016/S0048-7333(01)00178-0.

Damanpour, F. (1991). Organizational innovation: A meta-analysis of effects of determinants and moderators. Academy of Management Journal, 34(3), 555–590. https://doi.org/10.2307/256406.

Dettwiler, P., Lindelöf, P., & Löfsten, H. (2006). Business environment and property management issues - a study of growth firms in Sweden. Journal of Corporate Real Estate, 8(3), 120–133. https://doi.org/10.1108/14630010610711748.

Díez-Vial, I., & Fernández-Olmos, M. (2015). Knowledge spillovers in science and technology parks: How can firms benefit most? The Journal of Technology Transfer, 40(1), 70–84. https://doi.org/10.1007/s10961-013-9329-4.

Díez-Vial, I., & Fernández-Olmos, M. (2017a). The effect of science and technology parks on a firm’s performance: A dynamic approach over time. Journal of Evolutionary Economics, 27(3), 413–434. https://doi.org/10.1007/s00191-016-0481-5.

Díez-Vial, I., & Fernández-Olmos, M. (2017b). The effect of science and technology parks on firms’ performance: How can firms benefit most under economic downturns? Technology Analysis & Strategic Management, 29(10), 1153–1166. https://doi.org/10.1080/09537325.2016.1274390.

Díez-Vial, I., & Montoro-Sánchez, A. (2016). How knowledge links with universities may foster innovation: The case of a science park. Technovation, 50–51, 41–52. https://doi.org/10.1016/j.technovation.2015.09.001.

Díez-Vial, I., & Montoro-Sánchez, A. (2017). Research evolution in science parks and incubators: Foundations and new trends. Scientometrics, 110(3), 1243–1272. https://doi.org/10.1007/s11192-016-2218-5.

Erickson, G., & Jacobson, R. (1992). Gaining comparative advantage through discretionary expenditures: The returns to R&D and advertising. Management Science, 38(9), 1264–1279. https://doi.org/10.1287/mnsc.38.9.1264.

Felsenstein, D. (1994). University-related science parks –‘seedbeds’ or ‘enclaves’ of innovation? Technovation, 14(2), 93–110. https://doi.org/10.1016/0166-4972(94)90099-X.

Ferguson, R., & Olofsson, C. (2004). Science park and the development of NTBFs-location, survival and growth. The Journal of Technology Transfer, 29(1), 5–17. https://doi.org/10.1023/B:JOTT.0000011178.44095.cd.

Fernhaber, S. A., & Patel, P. C. (2012). How do young firms manage product portfolio complexity? The role of absorptive capacity and ambidexterity. Strategic Management Journal, 33(13), 1516–1539. https://doi.org/10.1002/smj.1994.

Filatotchev, I., Liu, X., Lu, J., & Wright, M. (2011). Knowledge spillovers through human mobility across national borders: Evidence from Zhongguancun Science Park in China. Research Policy, 40(3), 453–462. https://doi.org/10.1016/j.respol.2011.01.003.

Fukugawa, N. (2006). Science parks in Japan and their value-added contributions to new technology-based firms. International Journal of Industrial Organization, 24(2), 381–400. https://doi.org/10.1016/j.ijindorg.2005.07.005.

Gao, S., Xu, K., & Yang, J. (2008). Managerial ties, absorptive capacity, and innovation. Asia Pacific Journal of Management, 25, 395–412. https://doi.org/10.1007/s10490-008-9096-1.

González-Sánchez, R., & García-Muiña, F. E. (2011). Conceptuación y medición del constructo capacidad de absorción: Hacia un marco de integración. Revista de Dirección y Administración de Empresas, 18, 43–65.

Gordon, I. R., & McCann, P. (2000). Industrial clusters: Complexes, agglomeration and/or social networks? Urban Studies, 37(3), 513–532. https://doi.org/10.1080/0042098002096.

Hansen, B. (2000). Sample splitting and threshold estimation. Econometrica, 68(3), 575–603. https://doi.org/10.1111/1468-0262.00124.

Hoang, H., & Rothaermel, F. T. (2010). Leveraging internal and external experience: Exploration, exploitation, and R&D project performance. Strategic Management Journal, 31(7), 734–758. https://doi.org/10.1002/smj.834.

Hobbs, K. G., Link, A. N., & Scott, J. T. (2017a). Science and technology parks: An annotated and analytical literature review. The Journal of Technology Transfer, 42(4), 957–976. https://doi.org/10.1007/s10961-016-9522-3.

Hobbs, K. G., Link, A. N., & Scott, J. T. (2017b). The growth of US science and technology parks: Does proximity to a university matter? Annals of Regional Science, 59(2), 495–511. https://doi.org/10.1007/s00168-017-0842-5.

Huang, K. F., Yu, C. M. J., & Seetoo, D. H. (2012). Firm innovation in policy-driven parks and spontaneous clusters: The smaller firm the better? The Journal of Technology Transfer, 37(5), 715–731. https://doi.org/10.1007/s10961-012-9248-9.

Jiménez-Barrionuevo, M. M., García-Morales, V. J., & Molina, L. M. (2011). Validation of an instrument to measure absorptive capacity. Technovation, 31(5–6), 190–202. https://doi.org/10.1016/j.technovation.2010.12.002.

Johansson, B., & Lööf, H. (2008). Innovation activities explained by firm attributes and location. Economics of Innovation and New Technology, 17(6), 533–552. https://doi.org/10.1080/10438590701407349.

Kleinknecht, A., Van Montfort, K., & Brouwer, E. (2002). The non-trivial choice between innovation indicators. Economics of Innovation and New Technology, 11(2), 109–121. https://doi.org/10.1080/10438590210899.

Klette, T. J., & Griliches, Z. (2000). Empirical patterns of firm growth and R&D investment: A quality ladder model interpretation. The Economic Journal, 110(463), 363–387. https://doi.org/10.1111/1468-0297.00529.

Kogut, B., & Zander, U. (1992). Knowledge of the firm, combinative capabilities, and the replication of technology. Organization Science, 3(3), 383–397. http://www.jstor.org/stable/2635279.

Kutner, M., Nachtsheim, C., Neter, J., & Li, W. (2004). Applied linear statistical models. New York: McGraw Hill.

Lane, P. J., & Lubatkin, M. (1998). Relative absorptive capacity and interorganizational learning. Strategic Management Journal, 19(5), 461–477. https://doi.org/10.1002/(SICI)1097-0266(199805)19:5<461::AID-SMJ953>3.0.CO;2-L.

Leiponen, A. (2005). Skills and innovation. International Journal of Industrial Organization, 23(5–6), 303–323. https://doi.org/10.1016/j.ijindorg.2005.03.005.

Leyden, D. P., Link, A. N., & Siegel, D. S. (2008). A theoretical and empirical analysis of the decision to locate on a university research park. IEEE Transactions on Engineering Management, 55(1), 23–28. https://doi.org/10.1109/TEM.2007.912810.

Lindelöf, P., & Löfsten, H. (2003). Science park location and new technology-based firms in Sweden: Implications for strategy and performance. Small Business Economics, 20(3), 245–258. https://doi.org/10.1023/A:1022861823493.

Lindelöf, P., & Löftsen, H. (2004). Proximity as a resource base for competitive advantage: University-industry links for technology transfer. The Journal of Technology Transfer, 29(3/4), 311–326. https://doi.org/10.1023/B:JOTT.0000034125.29979.ae.

Link, A. N. (2009). Research, science, and technology parks: An overview of the academic literature. In National Research Council, Understanding research, science and technology parks: Global best practices. Report of a symposium (pp. 127–196). Washington, DC: The National Academies Press. https://doi.org/10.17226/12546.

Link, A. N. (2016). Competitive advantages from university research parks. In D. B. Audretsch, A. N. Link, & M. L. Walshok (Eds.), The Oxford handbook of local competitiveness (pp. 337–344). New York: Oxford University Press.

Link, A. N., & Link, K. R. (2003). On the growth of U.S. science parks. The Journal of Technology Transfer, 28(1), 81–85. https://doi.org/10.1023/A:1021634904546.

Link, A. N., & Scott, J. T. (2003). U.S. science parks: The diffusion of an innovation and its effects on the academic missions of universities. International Journal of Industrial Organization, 21(9), 1323–1356. https://doi.org/10.1016/S0167-7187(03)00085-7.

Link, A. N., & Scott, J. T. (2006). U.S. university research parks. Journal of Productivity Analysis, 25(1–2), 43–55. https://doi.org/10.1007/s11123-006-7126-x.

Link, A. N., & Scott, J. T. (2007). The economics of university research parks. Oxford Review of Economic Policy, 23(4), 661–674. https://doi.org/10.1093/oxrep/grm030.

Link, A. N., & Scott, J. T. (2015). Research, science, and technology parks: Vehicles for technology transfer. In A. N. Link, D. S. Siegel, & M. Wright (Eds.), The Chicago handbook of university technology transfer and academic entrepreneurship. Chicago: University of Chicago Press.

Link, A. N., & Yang, U. Y. (2017). On the growth of Korean technoparks. International Entrepreneurship and Management Journal. https://doi.org/10.1007/s11365-017-0459-2.

Lockett, A., Wright, M., & Franklin, S. (2003). Technology transfer and universities: Spin-out strategies. Small Business Economics, 20(2), 185–200. https://doi.org/10.1023/A:1022220216972.

Löfsten, H., & Lindelöf, P. (2001). Science parks in Sweden: Industrial renewal and development? R&D Management, 31(3), 309–322. https://doi.org/10.1111/1467-9310.00219.

Löfsten, H., & Lindelöf, P. (2002). Science parks and the growth of new technology-based firms: Academic-industry links, innovation and markets. Research Policy, 31(6), 859–876. https://doi.org/10.1016/S0048-7333(01)00153-6.

Löfsten, H., & Lindelöf, P. (2003). Determinants for an entrepreneurial milieu: Science parks and business policy in growing firms. Technovation, 23(1), 51–74. https://doi.org/10.1016/S0166-4972(01)00086-4.

Montoro-Sánchez, M. A., Ortiz-de-Urbina-Criado, M., & Mora-Valentín, E. M. (2011). Effects of knowledge spillovers on innovation and collaboration in science and technology parks. Journal of Knowledge Management, 15(6), 948–970. https://doi.org/10.1108/13673271111179307.

Mora-Valentín, E. M., Ortiz-de-Urbina-Criado, M., & Nájera-Sánchez, J. J. (2018). Mapping the conceptual structure of science and technology parks. The Journal of Technology Transfer. https://doi.org/10.1007/s10961-018-9654-8.

Motohashi, K. (2013). The role of the science park in innovation performance of start-up firms: An empirical analysis of Tsinghua Science Park in Beijing. Asia Pacific Business Review, 19(4), 578–599. https://doi.org/10.1080/13602381.2012.673841.

Ondategui, J. C. (2002). Parques científicos e innovación en España. Quince años de experiencia. Economía Industrial, 346, 147–160.

Pesaran, M. H. (2015). Time series and panel data econometrics. Oxford: OUP.

Phan, P. H., Siegel, D. S., & Wright, M. (2005). Science parks and incubators: Observations, synthesis and future research. Journal of Business Venturing, 20(2), 165–182. https://doi.org/10.1016/j.jbusvent.2003.12.001.

Poon, T. S. C. (1998). Inter-firm networks and industrial development in the global manufacturing system: Lessons from Taiwan. Economic and Labour Relations Review, 9(2), 262–284. https://doi.org/10.1177/103530469800900206.

Quintas, P., Wield, D., & Massey, D. (1992). Academic-industry link and innovation: Questioning the science park model. Technovation, 12(3), 161–175. https://doi.org/10.1016/0166-4972(92)90033-E.

Ramírez-Alesón, M., & Fernández-Olmos, M. (2018). Unravelling the effects of science parks on the innovation performance of NTBFs. The Journal of Technology Transfer, 43(2), 482–505. https://doi.org/10.1007/s10961-017-9559-y.

Rosenbaum, P. R., & Rubin, D. B. (1983). The central role of the propensity score in observational studies for causal effect. Biometrika, 70(1), 41–55. https://doi.org/10.1093/biomet/70.1.41.

Rothaermel, F. T., & Alexandre, M. T. (2009). Ambidexterity in technology sourcing: The moderating role of absorptive capacity. Organization Science, 20(4), 759–780. https://doi.org/10.1287/orsc.1080.0404.

Salvador, E. (2011). Are science parks and incubators good “brand names” for spin-offs? The case study of Turin. The Journal of Technology Transfer, 36(2), 203–232. https://doi.org/10.1007/s10961-010-9152-0.

Siegel, D. S., Westhead, P., & Wright, M. (2003). Assessing the impact of university science parks on research productivity: Exploratory firm-level evidence from the United Kingdom. International Journal of Industrial Organization, 21, 1357–1369. https://doi.org/10.1016/S0167-7187(03)00086-9.

Skeels, C. L., & Vella, F. (1999). A Monte Carlo investigation of the sampling behavior of conditional moment tests in tobit and probit models. Journal of Econometrics, 92(2), 275–294. https://doi.org/10.1016/S0304-4076(98)00092-X.

Squicciarini, M. (2008). Science park tenants versus out-of-park firms: Who innovates more? A duration model. The Journal of Technology Transfer, 33, 45–71. https://doi.org/10.1007/s10961-007-9037-z.

Squicciarini, M. (2009). Science parks: Seedbeds of innovation? A duration analysis of firms’ patenting activity. Small Business and Economics, 32(2), 169–190. https://doi.org/10.1007/s11187-007-9075-9.

Todo, Y., Zhang, W., & Zhou, L. A. (2011). Intra-industry knowledge spillovers from foreign direct investment in research and development: Evidence from China’s “Silicon Valley”. Review of Development Economics, 15(3), 569–585. https://doi.org/10.1111/j.1467-9361.2011.00628.x.

Tsai, K. H. (2001). Knowledge transfer in intraorganizational networks: Effects of network position and absorptive capacity on business unit innovation and performance. Academy of Management Journal, 44(5), 996–1004. https://doi.org/10.2307/3069443.

Tsai, K. H. (2009). Collaborative networks and product innovation performance: Toward a contingency perspective. Research Policy, 38(5), 765–778. https://doi.org/10.1016/j.respol.2008.12.012.

Tucker, J. W. (2010). Selection bias and econometric remedies in accounting and finance research. Journal of Accounting Literature, 29, 31–57.

Tzabbar, D., Aharonson, B. S., & Amburgey, T. L. (2013). When does tapping external sources of knowledge result in knowledge integration? Research Policy, 42(2), 481–494. https://doi.org/10.1016/j.respol.2012.07.007.

Vásquez-Urriago, A. R., Barge-Gil, A., & Modrego Rico, A. (2016). Science and technology parks and cooperation for innovation: Empirical evidence from Spain. Research Policy, 45(1), 137–147. https://doi.org/10.1016/j.respol.2015.07.006.

Vásquez-Urriago, A. R., Barge-Gil, A., Modrego Rico, A., & Paraskevopoulou, E. (2014). The impact of science and technology parks on firms’ product innovation: Empirical evidence from Spain. Journal of Evolutionary Economics, 24(4), 835–873. https://doi.org/10.1007/s00191-013-0337-1.

Veugelers, R., & Cassiman, B. (2005). R&D cooperation between firms and universities. Some empirical evidence from Belgian manufacturing. International Journal of Industrial Organization, 23(5–6), 355–379. https://doi.org/10.1016/j.ijindorg.2005.01.008.

Westhead, P. (1997). R&D inputs and outputs of technology-based firms located on and off science parks. R&D Management, 27(1), 45–62. https://doi.org/10.1111/1467-9310.00041.

Westhead, P., & Storey, D. (1994). An assessment of firms located on and off science parks in the United Kingdom. London: HMSO.

Yang, C. H., Motohashi, K., & Chen, J. R. (2009). Are new technology-based firms located on science parks really more innovative? Evidence from Taiwan. Research Policy, 38(1), 77–85. https://doi.org/10.1016/j.respol.2008.09.001.

Yu, P. (2013). Inconsistency of 2SLS estimators in threshold regression with endogeneity. Economics Letters, 120(3), 532–536. https://doi.org/10.1016/j.econlet.2013.06.023.

Zahra, S. A., & George, G. (2002). Absorptive capacity: A review, reconceptualization, and extension. Academy of Management Review, 27(2), 185–203. https://doi.org/10.2307/4134351.

Zahra, S. A., Van de Velde, E., & Larrañeta, B. (2007). Knowledge conversion capability and the performance of corporate and university spin-offs. Industrial and Corporate Change, 16(4), 569–608. https://doi.org/10.1093/icc/dtm018.

Zucker, L. G., Darby, M. R., & Armstrong, J. S. (2002). Commercializing knowledge: University science, knowledge capture, and firm performance in biotechnology. Management Science, 48(1), 138–153. https://doi.org/10.1287/mnsc.48.1.138.14274.

Funding

This work was supported by the Spanish Ministry of Economy and Competitiveness of Spain (ECO2015-67434-R and ECO2017-85356-P) and for the Regional Government of Madrid and European Social Fund (EARLYFIN, S2015/HUM-3353).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ubeda, F., Ortiz-de-Urbina-Criado, M. & Mora-Valentín, EM. Do firms located in science and technology parks enhance innovation performance? The effect of absorptive capacity. J Technol Transf 44, 21–48 (2019). https://doi.org/10.1007/s10961-018-9686-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10961-018-9686-0