Abstract

This paper studies an optimal dividend problem for a company with non-exponential discounting. The surplus process is described by a dual model, and the target is to find a dividend strategy that maximizes the expected discounted value of dividends until ruin. The non-exponential discount function leads to a time-inconsistent problem. We aim at seeking the equilibrium strategy derived by taking our problem as a non-cooperate game, which is a time-consistent strategy. An extended Hamilton–Jacobi–Bellman equation system and a verification theorem are provided to derive the equilibrium strategy and the equilibrium value function. For the case of pseudo-exponential discount function, closed-form expressions for the equilibrium strategy and the equilibrium value function are derived. In addition, some numerical illustrations of our results are showed.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The problem of optimal dividend is a classical topic in finance and actuarial science. The idea of the problem is that a company wants to pay out some of its surplus as dividends and to determine a dividend strategy that maximizes the expected discounted dividends received by the shareholders until the time of ruin. In the pioneering work of De Finetti [1], a barrier strategyFootnote 1 that maximizes the expected discounted dividends until the ruin time of a company, is derived under a random walk model, where the discount rate is a constant. Since then, with the development of mathematical tools, in particular with the establishment of dynamic programming approach and stochastic control theory, the problem of optimal dividend has been extensively studied under more general situations.

In the literature on the problem of optimal dividend, the surplus process of a company is usually described by the diffusion approximation model or by the Cramér–Lundberg (C–L) model. Under the diffusion approximation model and the bounded dividend rate assumption, Jeanblanc-Picqué and Shiryaev [2] and Asmussen and Taksar [3] show that the optimal dividend strategy is a barrier strategy. For some related works on this subject, see [4–7] and references therein. Under the C–L model, the problem of optimal dividend is first studied by Gerber [8], who solves a general dividend problem via a limit of an associated discrete problem. Later on, Azcue and Muler [9] and Gerber and Shiu [10] study the optimal dividend problem by using stochastic control theory. In addition, some scholars adopt more general models to describe the surplus process. For example, Jin and Yin [11] study the problem of optimal dividend under a regime-switching jump-diffusion model with numerical methods.

Recently, the dual model has been used in some interesting papers. It is well known that the C–L model is appropriate to model an insurance company, whereas its dual model seems to be natural and appropriate to model a company, such as a pharmaceutical company and a petroleum company, which has occasional gains. Particularly, the dual model might be appropriate to describe an annuity or a pension fund. For this type of companies, the surplus process is assumed to follow a Lévy process with positive jumps, where the jumps are viewed as the net value of future gains from inventions or discoveries. Zajic [12] considers an optimal dividend problem with compound Poisson income. Avanzi et al. [13] study an optimal dividend problem by using Laplace transforms in the dual model. In the context of the dual model, the optimal dividend problem is also considered by Yao et al. [14], Bayraktar et al. [15], Afonso et al. [16], Dimitrova et al. [17], etc.

Among the literature mentioned above, the discount rate is constant, namely, the discount factor is an exponential discount function. However, there is solid evidence that people discount the future rewards with non-exponential discounting and they may indulge in immediate gratification even if the delayed cost is high. Ainslie [18] adopts empirical studies on human and animal behavior and finds that individual behavior is well described by hyperbolic discounting. Loewenstein and Prelec [19] present four anomalies of exponential discount functions, propose a model which accounts for these anomalies, and discuss some implications. Due to empirical results, hyperbolic discounting has received much attention in the area of behavioral economics and behavioral finance. This paper aims at studying an optimal dividend problem in the case, where the psychological discount function is non-exponential. The problem of optimal dividend with non-exponential discounting is challenging since non-exponential discounting leads to a time-inconsistent problem. That is, Bellman’s principle of optimality does not hold and the dynamic programming approach cannot be applied in this case. As a result, a strategy which is optimal for the decision-maker at time 0 is no longer optimal for the decision-maker at some time \(t>0\), and hence, it will not be implemented by the decision-maker at time \(t>0\) unless there exists some commitment mechanism. In other words, the strategy is time-inconsistent.

The time-inconsistent problem is first formally treated by Strotz [20] and then studied by Peleg and Menahem [21], Goldman [22], Harris and Laibson [23], Krusell and Smith [24], Ekeland and Lazrak [25], Ekeland and Pirvu [26], and so on. Recently, Björk and Murgoci [27] develop a general theory of time-inconsistent stochastic control problems with various forms of time-inconsistent objective functions in a Markovian setting and derive an extension of the standard Hamilton-Jacobi-Bellman (HJB) equation system. Björk et al. [28] study the mean-variance portfolio selection problem with a state-dependent risk aversion. Ekeland et al. [29] study the optimal consumption and investment problems with non-exponential discounting.

For insurers’ time-inconsistent problems, Zeng and Li [30] are the first to consider the time-consistent investment and reinsurance strategies. Chen et al. [31] consider an optimal dividend problem with a class of time-inconsistent preferences, where the surplus process is described by a compound Poisson process perturbed by a Brownian motion, and Zhao et al. [32] study the dividend strategies for a shareholder with non-constant discount rate in a diffusion approximation model.

In this paper, we study a dividend problem for a company when the psychological discount function is not exponential and the surplus process of the company is modeled by a dual model. In order to make the problem tractable, the jump sizes of the compound Poisson process are assumed to be exponentially distributed. With non-exponential discounting, the optimal dividend problem is time-inconsistent. To seek a time-consistent strategy, we follow [26, 27, 29] to consider an equilibrium strategy from the game theoretic point of view and characterize the equilibrium value function by an extension of HJB equation system. Particularly, for the pseudo-exponential discount function, we derive closed-form expressions for the equilibrium strategy and the equilibrium value function.

It is worth noting that the present paper differs from [32] in the following aspects. Firstly, in this paper, the surplus of the company is described by a dual model which is a compound Poisson process with negative drift and positive jumps, while in [32], it is described by a diffusion model. Secondly, compared with the extended HJB equation system in [32], this paper provides a simplified extended HJB equation system, which is more concise, at least, in form. Thirdly, the HJB equation system of [32] is a second-order differential equation, while that of this paper involves an integral–differential equation. Therefore, the results of [32] cannot be applied to our dual model.

In addition, this paper also differs from [31] in three aspects. Firstly, the discount functions are different. The quasi-hyperbolic discount function is adopted in [31], while a pseudo-exponential discount function is used in this paper. Secondly, the surplus processes are different. A dual model is adopted to describe the surplus in this paper, while the C–L model with a Brownian motion is used in [31]. Since the HJB equation system is a variational inequality in [31]; therefore, the third difference between the two articles lies in different verification theorems.

The contribution of this paper is threefold. Firstly, it is the first to study a time-inconsistent dividend problem in a dual model within a game theoretic framework. Secondly, it derives closed-form expressions of the equilibrium dividend strategy and the equilibrium value function for the case of pseudo-exponential discount function. Finally, the results in this paper show a significant effect of non-exponential discounting on the equilibrium dividend strategy and the equilibrium value function. We also illustrate that both the dividend threshold and corresponding value function will increase with the decreasing of the discount rate.

The remainder of this paper is organized as follows. Section 2 models our problem. An extended HJB equation system and a verification theorem are presented in Sect. 3. Closed-form expressions for the equilibrium dividend strategy and the equilibrium value function are derived when the pseudo-exponential discount function is adopted in Sect. 4. Numerical analysis and economic explanations are provided in Sect. 5. Section 6 concludes this paper. Proofs are provided in appendices as supplementary material.

2 Mathematical Model

Let \((\varOmega ,\mathcal {F},P)\) be a probability space with a filtration \(\mathbb {F} = (\mathcal {F}_{t})_{t\ge 0}\) satisfying the usual conditions, i.e., \(\mathbb {F}\) is right-continuous and P-complete, where \(\mathcal {F}_{t}\) represents the information available at time t, and any decision made at time t is based on this information. Suppose that all stochastic processes and random variables below are defined on the filtered probability space \((\varOmega ,\mathcal {F},\mathbb {F},P)\).

2.1 Surplus Process

Without dividend control, the surplus of a company is assumed to follow

where \(x>0\) is the initial surplus level; \(\mu >0\) can be viewed as the rate of expenses; and \(S_t =\sum _{k=1}^{N(t)}Y_{k}\) is the total gain/income amount up to time t, in which N(t) represents the number of gains up to time \(t \ge 0\) and \(Y_k\) represents the amount of the kth gain. We assume that \(S_t\) is a compound Poisson process, that is, \(\{N(t)\}_{t\ge 0}\) is an \(\mathbb {F}\)-adapted homogeneous Poisson process with intensity \(\lambda \), i.e., \(N(t)\sim Poi(\lambda t)\), and \(\{Y_k\}_{k\in N}\) is a sequence of positive independent and identically distributed random variables following the exponential distribution \(f(y)=\delta \hbox {e}^{-\delta y}, ~y\ge 0\). Furthermore, we assume that N(t) and \(\{Y_k\}_{k\in N}\) are independent. Eq. (1) is known as the dual modelFootnote 2 of the classical C–L model. We assume that the net profit condition, \(\mu < E(S_1)=\frac{\lambda }{\delta }\), is valid, where \(\frac{1}{\delta } = E(Y_1)\). This condition means that the expected gain per unit of time is larger than the expense. In addition, suppose that the company will not be able to obtain external finance, so the company will declare ruin when its level of reserve falls below zero.

A dividend strategy \(L:=\{L_t\}_{t\ge 0}\) is an \(\mathbb {F}\)-adapted nonnegative process which is left continuous and right limits, where \(L_t\) represents the cumulative amount of dividends distributed up to time t. In this paper, we restrict ourselves to the class of bounded dividend strategies, i.e., the dividend strategy L has a bounded density process. More precisely, the dividend strategy \(\{L_t\}_{t\ge 0}\) admits an adapted nonnegative density process \(\ell :=\{l_t\}_{t\ge 0}\) such that \( L_t=\int _0^t l_sds, \) where the density process is bounded, \(0 \le l_t \le M < +\infty \) for all \(t \ge 0\), and the positive constant M is the maximum dividend rate. Since \(\{L_t\}_{t\ge 0}\) is determined by \(\{l_t\}_{t\ge 0}\) uniquely, we need only to consider the bounded dividend rate \(\{l_t\}_{t\ge 0}\) rather than the cumulative amount of dividends \(\{L_t\}_{t\ge 0}\). Instead of L, we call \(\ell =\{l_t\}_{t\ge 0}\) a dividend strategy. Moreover, we restrict ourselves to Markov feedback controls, namely, \(l_t\) is given by \(l_t=l(t,x)\), where x is the surplus level at time t. Under the dividend strategy \(\ell \), the controlled surplus process evolves according to

A dividend strategy \(\ell \) is said to be admissible if \(0 \le l_t \le M\) for all \(t \ge 0\). We denote by \(\mathbb {L}\) the set of all admissible dividend strategies \(\ell \).

Definition 2.1

The time of ruin \(\tau _{t,x}^\ell \) is defined as the first entrance time of the controlled surplus process \(R_{s}^{\ell }\) to \(]-\infty , 0[\) after time t when \(R_t^\ell =x\), i.e.,

Due to the fact that \(R_s^{\ell }\) is Markovian, \(\tau _{t,x}^{\ell }-t\) only depends on x, or more accurately, \(\tau _{t,x}^{\ell }-t\) equals to \(\tau _{0,x}^{\ell }\) in distribution. To avoid payments after ruin, we additionally require \(l_s = 0\) for \(s \ge \tau _{t,x}^\ell \).

2.2 Discount Factor

In conventional dividend problems, the discount rate is assumed to be a constant, and the discount factor is an exponential discount function. In this paper, we do not restrict ourselves to the framework of exponential discounting. Let \(\varphi : [0,+\infty [ \rightarrow \mathbb {R}\) be the discount function, which is continuously differentiable and

We note that \(\varphi (t) = \hbox {e}^{-\rho t}\) is the exponential case when the discount rate \(\rho \) is constant. This paper considers non-exponential discounting. In particular, we will concern on a special non-exponential discounting

where \(0<\rho _1\le \rho _2\), \(0\le \omega \le 1\) and are constant. It is called the pseudo-exponential discount function and is first considered in [25]. For a more detailed discussion about the pseudo-exponential discount function, see [25, 26].

2.3 Optimization Problem and Equilibrium Strategy

The target of the company is to choose an admissible strategy \(\ell \in \mathbb {L}\) to maximize the expected value of discounted dividend payments until the time of ruin:

where \(E_{t,x}[\cdot ]=E[\cdot |R_t^{\ell }=x]\) and \(\varphi (\cdot )\) is the discount factor.

Since \(\varphi (s-t)\) is non-exponential, this problem is time-inconsistent in the sense that Bellman’s principle of optimality does not hold. As a result, a strategy that is optimal at time 0 will not be optimal at later time. More precisely, if for some fixed initial point (0, x), we determine a strategy \(\tilde{\ell }\in \mathbb {L}\) that maximizes \(J(0, x, \ell )\), then at some later point \((s, R_s^{\tilde{\ell }})\), the strategy \(\tilde{\ell }\) will be no longer optimal. That is, the strategy \(\tilde{\ell }\) is time-inconsistent.Footnote 3

We can treat our problem as a non-cooperate game. When the decision-maker chooses a strategy at time t, she should be aware that she will have different objective functionals at future times. We can take this as a game with an infinite number of distinct players at every time t. The player at time t is named as player t. From the game theoretic point of view, we will study the subgame perfect Nash equilibrium strategies. Next, we present a formal definition of equilibrium strategy.

Definition 2.2

For an admissible strategy \(\hat{\ell }=\{\hat{l}_s\}_{s\ge 0}\in \mathbb {L}\), construct a strategy \(\ell _h\) by

where \(l\in [0, M]\), \(h >0\) and \((t, x)\in [0, +\infty [\times \mathbb {R}_+\) are arbitrarily chosen. We say that \(\hat{\ell }\) is an equilibrium strategy iff

for all \(l\in [0, M]\) and \((t, x)\in [0, +\infty [\times \mathbb {R}_+\). The equilibrium value function V is defined as \(V(t, x) := J(t, x, \hat{\ell })\).

Based on the definition above, the equilibrium strategy is a time-consistent one. About this, the readers can refer to [29] for detailed discussion. In fact, the decision-maker takes possible future revisions into account and thereby makes her strategy time-consistent. Moreover, we note that the definitions of the equilibrium strategy and the equilibrium value function coincide with the definitions of the optimal strategy and the optimal value function in a time-consistent setting.

3 Extended HJB Equation System and Verification Theorem

This section provides an extended HJB equation system to characterize the equilibrium value function and presents a verification theorem to guarantee that the solution of the extended HJB equation system is the equilibrium value function.

Following [27], we assume that there exists an equilibrium strategy \(\hat{\ell }\), and define the extended HJB equation system for the equilibrium strategy \(\hat{\ell }\) and the corresponding equilibrium value function V. For convenience, denote

and for any \(g(t,x)\in C^{1,2}\) and \(\ell \in \mathbb {L}\), define the infinitesimal generator

where \(g_t(t,x)=\frac{\partial g(t,x)}{\partial t}\) and \(g_x(t,x)=\frac{\partial g(t,x)}{\partial x}\). In addition, we rewrite (4) as

where \(U(t, s, l(s,R_s^{\ell }))=\varphi (s-t)l(s,R_s^{\ell }).\)

Definition 3.1

For the dividend problem with objective function (5), the extended HJB equation system for the equilibrium value function V is defined as follows: For all \(r\ge t\ge 0, \ x\ge 0\),

where \(l=l(t,x)\), \(\hat{\ell }\) is the dividend strategy, which realizes the supremum in (6), \(u^s(t,t,x)\) is defined by

and

Remark 3.1

In Definition 3.1, the difference between \(u^s(t,t, x)\) and \(u^{ts}(t, x)\) is that, we view \(u^s\) as a function of the three variables \(t^{\prime }\), t and x with \(t^{\prime }=t\), whereas \(u^{ts}\) is, for a fixed s, viewed as a function of the two variables t and x.

Remark 3.2

(i) We have a system of deterministic recursion equations for the simultaneous determination of V (t, x) and \(u^s(t, t, x)\); (ii) in order to obtain V by solving (6), we need to know \(u^{ts}\), but it is determined by the optimal control law \(\hat{\ell }\), which in turn is determined by (6); (iii) we can view the system as a fixed point problem, and for detailed discussion, the readers are refereed to [27]; in fact, we rather expect this fixed point property because we are looking for a Nash equilibrium point; (iv) we have the probabilistic interpretations

Theorem 3.1

(Verification Theorem) Assume that \(( V , u^{rs})\) is a solution of the extended HJB equation system in Definition 3.1, and that the dividend strategy \(\hat{\ell }\) realizes the supremum in (6). Then, \(\hat{\ell }\) is an equilibrium strategy, and V is the corresponding equilibrium value function.

The extended HJB equation system in Definition 3.1 can further be simplified.

Proposition 3.1

The extended HJB equation system for the dividend problem with objective function (5) has the following form:

where \(l=l(t,x)\), and \(\hat{\ell }\) is the strategy which realizes the supremum in (10).

For convenience and simplifying the notation, we denote

It is a complicated problem to seek the equilibrium strategy and the corresponding equilibrium value function for the non-exponential discounting dividend problem. We are able to deal with some specific discount functions and will adopt the pseudo-exponential discount function in next section. Before doing that, we first discuss the extended HJB equation system for a general discount function. According to Proposition 3.1, (10) can be rewritten as

Motivated by the conventional optimal dividend theory, we assume that there exists a constant \(b\ge 0\) such that \(V_x(t,x)\ge 1\) when \(0\le x< b\), while \(V_x(t,x)<1\) when \(x\ge b\). It follows from (12) and the verification theorem that the equilibrium strategy \(\hat{\ell }=\{\hat{l}(t,x)\}_{t\ge 0}\) is given by:

Since \(R_s^{\hat{\ell }}\) is a Markov process, \((R_{t+s}^{\hat{\ell }}, \tau _{t,x}^{\hat{\ell }}-t)\) conditioning on \(R_t=x\) has the identical distribution with \((R_{s}^{\hat{\ell }}, \tau _{0,x}^{\hat{\ell }})\) conditioning on \(R_0=x\). And because \(\hat{l}(t,x)\) is independent of t, we have

This means that V(t, x) is independent of t, i.e., V can be taken as a function of only x. Henceforth, let V(x) denote the equilibrium value function. Therefore, (12) can be simplified as

4 Case of Pseudo-Exponential Discount Function

This section considers the case of pseudo-exponential discount function (3). According to (11), we can derive

Let

Then we can obtain

Moreover,

Hence, to derive V(x), we only need to derive \(V_1(x)\) and \(V_2(x)\). According to (13), we assume that, for \(i=1,2\), \(V_i(x)\) satisfies the following equations

In terms of the analogous techniques in [10], we can obtain the solution to (17). Applying operator \((\frac{\hbox {d}}{\hbox {d}x}-\delta )\) to (17) yields

The solution of (18)–(19) under condition \(V_i(0)=0\) in (17) is given by

where \(\zeta _1\) and \(\zeta _2\) are the roots of \(\alpha \, y^2-\beta \, y -\eta =0\) and are given by

We note that \(\zeta _1(\mu +M, \mu \delta +M\delta -\lambda -\rho _i, \rho _i \delta )<0\) and \(\zeta _2(\mu +M, \mu \delta +M\delta -\lambda -\rho _i, \rho _i \delta )>0\). Moreover, \(V_i(x)>0\) for \(x>0\), and \(V_i(x)\) will not exceed \(\int _0^{\infty }\hbox {e}^{-\rho _i z}Mdz=\frac{M}{\rho _i}\) for \(x\ge 0, i=1, 2\). Therefore \(B_i<0\) and \(\bar{B}_i=0\), \(i=1, 2\).

According to the smooth-fit condition at b, we can derive the following equations and obtain the value of \(A_1, A_2, B_1, B_2\) and b by solving them:

Here, the first four equations hold because \(V_i(x)\) are continuously differentiable, and the last one holds due to (12) and related discussion in Sect.3.

Taking (16) and (20) into (21), we have

where

From (22)–(25), \(A_i\) and \(B_i\) can be expressed as

Moreover, we present some properties of \(A_i\) and \(B_i\) in the following lemma.

Lemma 4.1

\(A_1, A_2, B_1\) and \(B_2\) given by (27)–(30) are negative, i.e.,

Substituting \(B_1\) and \(B_2\) given by (29)–(30) into (26), we have

with \(P=\frac{M\xi _5}{\rho _1}\) and \(Q=\frac{M\xi _6}{\rho _2}\).

Define

Then \(F(0) = - [~\omega P+(1-\omega )Q+1~]\). To show that \(F(b)=0\) has a unique positive root, we need the following lemma, which is analogous to Lemma 2.1 of [3].

Lemma 4.2

P and Q have the following properties:

- (i):

-

\( (P+1)\xi _2 > \xi _5\) and \((Q+1)\xi _4 > \xi _6\);

- (ii):

-

If \(~\omega P+(1-\omega )Q+1<0,~\) then \(~F(b)=0~\) has a unique positive root.

Theorem 4.1

For pseudo-exponential discount function \(\varphi (t)\), there exists a continuously differentiable concave function V(x) which satisfies (12), and

- (i):

-

If \(\omega P+(1-\omega )Q+1\ge 0,\) then \(b=0\), that is, the equilibrium strategy is always to pay dividend according to the maximal dividend rate M, and the equilibrium value function is given by

$$\begin{aligned} V(x)=\omega \frac{M}{\rho _1}(1-\hbox {e}^{\xi _5 x}) + (1-\omega )\frac{M}{\rho _2}(1-\hbox {e}^{\xi _6 x}),\quad x\ge 0; \end{aligned}$$(32) - (ii):

-

If \(\omega P+(1-\omega )Q+1<0,\) then the dividend threshold b is the unique positive root of \(F(b)=0\) and the equilibrium value function is given by

$$\begin{aligned} V(x)= {\left\{ \begin{array}{ll} \omega A_1(\hbox {e}^{\xi _1 x}-\hbox {e}^{\xi _2 x}) + (1-\omega )A_2(\hbox {e}^{\xi _3 x}-\hbox {e}^{\xi _4 x}), \quad 0<x<b, \\ \omega \left( \frac{M}{\rho _1}+B_1\hbox {e}^{\xi _5 x}\right) + (1-\omega )\left( \frac{M}{\rho _2}+B_2\hbox {e}^{\xi _6 x}\right) ,\qquad \quad x\ge b, \\ \end{array}\right. } \end{aligned}$$(33)

Remark 4.1

Note that when \(M\rightarrow \infty \), our problem becomes an unrestricted dividend optimization problem. So we can take the unrestricted dividend payment problem as the limit of the bounded dividend rate problem.

5 Numerical Illustrations

This section provides some numerical examples to illustrate our results and analyze the influence of parameters \(\mu \), \(\lambda \), \(\delta \), M, \(\rho _1\), \(\rho _2\) and \(\omega \) to the equilibrium dividend strategy and the equilibrium value function.

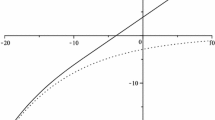

Figure 1 depicts the equilibrium value function with parameters \(\mu =1\), \(\lambda =2\), \(\delta =1.2\), \(M=1.2\), \(\rho _1=0.2\) and \(\rho _2=0.4\) for different \(\omega \). We find that the larger the weight \(\omega \), the larger the function V(x). Specially, \(\omega =0\) and 1 are extreme cases. In the case of \(\omega =0\) or 1, our dividend problem is time-consistent, and the equilibrium value function V(x) is the optimal value function in the case of a standard time-consistent setting. Figure 1 shows that equilibrium value functions V(x) with \(\omega =0.3\) and 0.8 are both between the two optimal value functions with \(\omega =0\) and 1. We also obtain that the dividend threshold b are 0.4644, 0.6487, 1.0295 and 1.1997, respectively, for corresponding \(\omega =0, 0.3, 0.8\) and 1. It means that the larger the weight \(\omega \), the larger the dividend threshold b.

Figure 2 plots the equilibrium value function with parameters \(\mu =1\), \(\lambda =2\), \(\delta =1.2\), \(M=1.2\) and \(\omega =0.8\) for different \(\rho _1\) and \(\rho _2\), which reveals that the larger both the discount rates \(\rho _1\) and \(\rho _2\), the less the function V(x). We also derive that the dividend threshold b are 1.0295, 0.6262, 0.4033 and 0.2813, respectively, for corresponding \((\rho _1, \rho _2)=(0.2, 0.4)\), \((\rho _1, \rho _2)=(0.3, 0.5)\), \((\rho _1, \rho _2)=(0.4, 0.6)\) and \((\rho _1, \rho _2)=(0.5, 0.6)\). This implies that the larger both the discount rates \(\rho _1\) and \(\rho _2\), the less the dividend threshold b. From the above numerical results, Figs. 1 and 2, we can see that the time-inconsistent preference has a significant impact on the equilibrium strategy and the equilibrium value function. In fact, we can see from the numerical results, Figs. 1 and 2, that the less the discount rate \(-\varphi '/\varphi \), the larger both the dividend threshold b and the value function V(x). This is identical with our intuition.

The influence of parameters \(\mu \) and \(\lambda \) to equilibrium dividend threshold b is illustrated in Fig. 3, which plots the equilibrium dividend threshold b against \(\mu \) with parameters \(\delta =1.2\), \(M=1.2\), \(\rho _1=0.2\), \(\rho _2=0.4\) and \(\omega =0.3\) for different \(\lambda \). From this figure, we find that the equilibrium dividend threshold b increases at the beginning and then decreases with the increasing of the parameter \(\mu \) for each \(\lambda \). Moreover, for each \(\lambda \), there exists some point \(\mu ^*\), the larger the parameter \(\lambda \), the less the equilibrium dividend threshold b before \(\mu ^*\), while the larger the parameter \(\lambda \), the larger the equilibrium dividend threshold b after \(\mu ^*\).

Figure 4 shows the influence of parameters M and \(\delta \) to equilibrium dividend threshold b and plots the equilibrium dividend threshold b against M with parameters \(\mu =1\), \(\lambda =2\), \(\rho _1=0.2\), \(\rho _2=0.4\) and \(\omega =0.8\) for different \(\delta \). In this figure, we find that for all \(\delta \), the equilibrium dividend threshold b increases (but is bounded and has a limit) with parameter M, which is the admissible maximum dividend rate. This means that the larger the admissible maximum dividend rate M, the larger the equilibrium dividend threshold b in order to prevent the company from ruin, while the larger the parameter \(\delta \), the less the equilibrium dividend threshold b. Since \(E(S_1)=\frac{\lambda }{\delta }\) is the expected gain or income per unit of time, the larger the parameter \(\delta \), the less the expected gain or income per unit of time. A possible interpretation is as follows: When the expected gain or income of the company decreases, the decision-maker of the company will reduce the dividend threshold b to maximize the discounted dividend payment.

6 Conclusions

Different from the traditional optimal dividend model with an exponential discount function, in this paper, we have investigated a dividend problem with a non-exponential discount function. The non-exponential discounting leads the dividend problem to be time-inconsistent, in the sense that Bellman’s principle of optimality does not hold. From a game theoretic point of view, we focus on the equilibrium (time-consistent) strategy of the dividend problem. As far as we know, it is the first to study a time-inconsistent dividend problem in a dual model. In the case of a pseudo-exponential discount function, we have derived the closed-form solution, and showed that the non-exponential discounting (time-inconsistent preference) has a significant impact on the dividend strategy and value function. In particular, we have illustrated that the dividend threshold value will increase with the decreasing of the discount rate. Furthermore, the equilibrium dividend strategy and the equilibrium value function in the pseudo-exponential discount function case can degenerate to the optimal dividend strategy and the optimal value function in the case of the exponential discount function.

In future research, it would be interesting to extend our analysis to some more general situations. For example, we can consider a restricted optimal dividend problem, or study the case, where the surplus process follows a jump-diffusion process or a general Lévy process, or adopt other non-exponential discount functions. Furthermore, we can also consider the optimal dividend problems involving some other controls, such as investment, financing. These problems may be more complicated. To solve them, we may need to adopt some more sophisticated techniques.

Notes

A barrier strategy is that, when the controlled surplus is above a barrier, whatever amount exceeds the barrier level is paid out as dividend, but no dividend is paid out when the controlled surplus is below the barrier.

We note that the classical C–L model, \(R_{t}=x+\mu t-S_{t}\), is a Lévy process with sample paths that are skip-free upwards. However, the sample paths of stochastic process, in Eq. (1), are skip-free downwards, and if we turn the sample paths of C–L model upside down (rotate \(180^{\circ }\)) and look at them from right to left, we get the shape of sample paths of model (1) (see [16]). Because of the symmetry of the two processes’ sample paths, the model (1) is called the dual model of the classical C–L model in the actuarial literature. About the more detailed discussion of the connection between the classical C–L model and the dual model, we can refer to Avanzi et al. [13], Afonso et al. [16], Dimitrova et al. [17].

We can also state the time-inconsistent strategy as follows: We determine the optimal strategy \(\tilde{\ell }=\{\tilde{l}(t)\}_{t\ge 0}\) for the objective functional \(J(0, x, \ell )\) at initial point (0, x); and at some intermediate time s, we also determine the optimal strategy \(\bar{\ell }=\{\bar{l}(t)\}_{t\ge s}\) at state \((s, R_s^{\tilde{\ell }})\). If \(\tilde{l}(t)\ne \bar{l}(t)\) at least some \(t\ge s\), then \(\tilde{l}\) is a time-inconsistent strategy.

References

De Finetti, B.: Su un’impostazione alternativa dell teoria colletiva del rischio. Trans. XVth Int. Congr. Actuar. 2, 433–443 (1957)

Jeanblanc-Picqué, M., Shiryaev, A.N.: Optimization of the flow of dividends. Russ. Math. Surv. 50, 257–277 (1995)

Asmussen, S., Taksar, M.: Controlled diffusion models for optimal dividend pay-out. Insur. Math. Econ. 20, 1–15 (1997)

Asmussen, S., Højgaard, B., Taksar, M.: Optimal risk control and dividend distribution policies. Example of excess of loss reinsurance for an insurance corporation. Finance Stoch. 4(3), 299–324 (2000)

Paulsen, J.: Optimal dividend payments until ruin of diffusion processes when payments are subject to both fixed and proportional costs. Adv. Appl. Probab. 39(3), 669–689 (2007)

Paulsen, J.: Optimal dividend payments and reinvestments of diffusion processes with both fixed and proportional costs. SIAM J. Control Optim. 47(5), 2201–2226 (2008)

Bai, L., Hunting, M., Paulsen, J.: Optimal dividend policies for a class of growth-restricted diffusion processes under transaction costs and solvency constraints. Finance Stoch. 16(3), 477–511 (2012)

Gerber, H.U.: Entscheidungskriterien fuer den zusammengesetzten Poisson-prozess. Schweiz. Aktuarver. Mitt. 1, 185–227 (1969)

Azcue, P., Muler, N.: Optimal reinsurance and dividend distribution policies in the Cramér–Lundberg model. Math. Finance 15(2), 261–308 (2005)

Gerber, H.U., Shiu, E.S.W.: On optimal dividend strategies in the compound poisson model. N. Am. Actuar. J. 10(2), 76–93 (2006)

Jin, Z., Yin, G.: Numerical methods for optimal dividend payment and investment strategies of markov-modulated jump diffusion models with regular and singular controls. J. Optim. Theory Appl. 159, 246–271 (2013)

Zajic, T.: Optimal dividend payout under compound poisson income. J. Optim. Theory Appl. 104(1), 195–213 (2000)

Avanzi, B., Gerber, H.U., Shiu, E.S.W.: Optimal dividends in the dual model. Insur. Math. Econ. 41(1), 111–123 (2007)

Yao, D.J., Yang, H.L., Wang, R.M.: Optimal dividend and capital injection problem in the dual model with proportional and fixed transaction costs. Eur. J. Oper. Res. 211, 568–576 (2011)

Bayraktar, E., Kyprianou, A., Yamazaki, K.: On optimal dividends in the dual model. ASTIN Bull. 43(03), 359–372 (2013)

Afonso, L.B., Cardoso, R.M., Egidio dos Reis, A.D.: Dividend problems in the dual risk model. Insur. Math. Econ. 53(3), 906–918 (2013)

Dimitrova, D.S., Kaishev, V.K., Zhao, S.: On finite-time ruin probabilities in a generalized dual risk model with dependence. Eur. J. Oper. Res. 242, 134–148 (2015)

Ainslie, G.W.: Picoeconomics. Cambridge University Press, London (1992)

Loewenstein, G., Prelec, D.: Anomalies in intertemporal choice: evidence and an interpretation. Q. J. Econ. 107, 573–597 (1992)

Strotz, R.: Myopia and inconsistency in dynamic utility maximization. Rev. Financ. Stud. 23(3), 165–180 (1956)

Peleg, B., Menahem, E.: On the existence of a consistent course of action when tastes are changing. Rev. Econ. Stud. 40, 391–401 (1973)

Goldman, S.: Consistent plans. Rev. Econ. Stud. 47, 533–537 (1980)

Harris, C., Laibson, D.: Dynamic choices of hyperbolic consumers. Econometrica 69(4), 935–957 (2001)

Krusell, P., Smith, A.: Consumption and savings decisions with quasi-geometric discounting. Econometrica 71, 366–375 (2003)

Ekeland, I., Lazrak, A.: Being serious about non-commitment: subgame perfect equilibrium in continuous time. arXiv preprint (2006). http://arxiv.org/abs/math/0604264

Ekeland, I., Pirvu, T.A.: Investment and consumption without commitment. Math. Financ. Econ. 2, 57–86 (2008)

Björk, T., Murgoci, A.: A general theory of Markovian time inconsistent stochastic control problems. Working paper (2010). Stockholm School of Economics

Björk, T., Murgoci, A., Zhou, X.: Mean-variance portfolio optimization with state dependent risk aversion. Math. Finance 24(1), 1–24 (2014)

Ekeland, I., Mbodji, O., Pirvu, T.A.: Time-consistent portfolio management. SIAM J. Financ. Math. 3(1), 1–32 (2012)

Zeng, Y., Li, Z.F.: Optimal time-consistent investment and reinsurance policies for mean-variance insurers. Insur. Math. Econ. 49(1), 145–154 (2011)

Chen, S.M., Li, Z.F., Zeng, Y.: Optimal dividend strategies with time-inconsistent preference. J. Econ. Dyn. Control 46, 150–172 (2014)

Zhao, Q., Wei, J.Q., Wang, R.M.: On dividend strategies with non-exponential discounting. Insur. Math. Econ. 58, 1–13 (2014)

Acknowledgments

The authors are grateful to the two anonymous referees for valuable comments for the revision of the paper. This research is partially supported by Grants of the National Natural Science Foundation of China (Nos. 71231008, 71201173), Guangdong Natural Science for Research Team (2014A030312003), Guangdong Natural Science for Distinguished Young Scholar and Natural Science Foundation of Guangdong Province of China (No. S2013010011959).

Author information

Authors and Affiliations

Corresponding author

Additional information

Communicated by Moawia Alghalith.

Appendices

Appendix 1: Proof of Theorem 3.1

We first show that V is the value function corresponding to \(\hat{\ell }\), i.e., that \(V (t, x) = J(t, x, \hat{\ell })\). Note that

By Dynkin’s Theorem for \(u^{rs}\), we have

Thus, using (34) and boundary condition \(u^{rs}(t,0)=0\), we have

and

Next, by the extended HJB equation system for V, we have

and (34). Thus we have equation

Using Dynkin’s Theorem for V, we thus have

Hence, we get

By using Dynkin’s Theorem for \(u^s\), we have

Using (35), (36) and boundary conditions for V and \(u^s\), we can derive

We now show that \(\hat{\ell }\) is indeed an equilibrium strategy. For any \(h > 0\) and an arbitrary \(l\in [0, M]\), define the strategy \(\ell _h\) as in Definition 2.2. Without loss of generality, suppose that \(t+h<\tau _{t,x}^{\ell _h}\). Then we have

Using Dynkin’s Theorem for V, we have

Then

Noting the fact that \(V (t, x) = J(t, x, \hat{\ell })\), we obtain

So

The last inequality follows from

\(\square \)

Appendix 2: Proof of Proposition 3.1

Note that

and

Then

Thus,

and

Inserting (37)–(38) into equations of Definition 3.1, we complete the proof. \(\square \)

Appendix 3: Proof of Lemma 4.1

Note that

- (i):

-

If \(\xi _5-\xi _1>0\), then \(A_1<0\).

- (ii):

-

If \(\xi _5-\xi _1<0\), then \((\xi _5-\xi _1)\hbox {e}^{\xi _1b}>\xi _5-\xi _1\) and \((\xi _2-\xi _5)\hbox {e}^{\xi _2b}>\xi _2-\xi _5\).

So

and then \(A_1<0\).

Similarly, we can prove \(A_2<0,\;\; B_1<0\), and \(B_2<0.\) \(\square \)

Appendix 4: Proof of Lemma 4.2

\((\mathbf {i})\) We only prove the first inequality \((P+1)\xi _2 > \xi _5\). The second one is similar. Inequality \((P+1)\xi _2 > \xi _5\) is equivalent to \(\frac{M}{\rho _1} < \frac{1}{\xi _2} - \frac{1}{\xi _5}.\)

Firstly, note that

In addition, according to Cauchy inequality, we have

Next, we split the problem into the following three situations.

(1) If \((\mu +M)\delta -\lambda -\rho _1>0\) and \(\mu \delta -\lambda -\rho _1<0,\) then we have

i.e.,

(2) If \((\mu +M)\delta -\lambda -\rho _1\le 0\), we have \(\mu \delta -\lambda -\rho _1<0.\) Hence, we have

i.e.,

(3) If \(\mu \delta -\lambda -\rho _1\ge 0,\) we have \((\mu +M)\delta -\lambda -\rho _1>0.\) Thus

Combining (1), (2) and (3), we complete the proof of \((\mathbf {i})\).

\((\mathbf {ii})\) If \(\omega P+(1-\omega )Q+1<0\), we have \(F(0)>0.\) Note

According to \((\mathbf {i})\), we have

Furthermore,

Therefore, \(F(b)=0\) has a unique positive root. The proof of \((\mathbf {ii})\) is completed. \(\square \)

Appendix 5: Proof of Theorem 4.1

\((\mathbf {i})\) We can verify that V(x) defined by (32) is a continuously differentiable concave function and satisfies \(V(0)=0\). Since

\(V^{\prime }(x)\le 1\) for all \(x\ge 0\) and

In addition, we know that the function V given by (32) satisfies

Adding the inequality (39) to the equality (40), we can obtain (12).

\((\mathbf {ii})\) \(V(0)=0\) is obvious. The first-order derivative of V(x) given by (33) is:

From Lemma 4.1, we have that \(V^{\prime }(x)>0\) for all \(x>0\), which implies that V(x) is a strictly increasing function.

In addition, we can derive the second-order derivative of V(x) as follows:

From Lemma 4.1, we have that \(V^{\prime \prime }(x)<0\) for all \(x\ge b\). Now, we consider the case when \(0<x<b\). Note that

Thus \(V^{\prime \prime \prime }(x)>0\) and \(V^{\prime \prime }(x)\) is increasing on interval (0, b). Then we have that \(V^{\prime \prime }(x)< V^{\prime \prime }(b-)\) for \(0<x<b\).

Besides, from (16), (18) and (19), we have

and

Noting that \(V^{\prime }(b)=1\), we have \(\mu V^{\prime \prime }(b-)=(\mu +M)V^{\prime \prime }(b+)\le 0. \) Therefore, \(V^{\prime \prime }(x)< 0\) for \(0<x<b\).

In conclusion, V(x) defined by (33) is an increasing and continuously differentiable concave function on \(]0, +\infty [\). This implies the uniqueness of b.

In addition, we can adopt the same way as (i) to verify that V(x) given by (33) satisfies Eq. (12), and here we omit it. \(\square \)

Rights and permissions

About this article

Cite this article

Li, Y., Li, Z. & Zeng, Y. Equilibrium Dividend Strategy with Non-exponential Discounting in a Dual Model. J Optim Theory Appl 168, 699–722 (2016). https://doi.org/10.1007/s10957-015-0742-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10957-015-0742-8

Keywords

- Non-exponential discount function

- Equilibrium strategy

- Dividend payment

- Dual model

- Hamilton–Jacobi–Bellman equation