Abstract

This paper examines the relationship between mergers & acquisitions (M & As), diversification and financial performance in the U.S. property-liability insurance industry over the period 1989–2004. The risk-adjusted return on assets (ROA), return on equity (ROE), Z-score and total risk measured by earnings volatility are considered as a relevant indicator of performance. We find that acquirers’ financial performance decreases and earnings volatility increases during the gestation period after the M & As perhaps due to increased frictional costs associated with post-merger integration and agency problems. We find that more focused insurers outperform the product-diversified insurers, implying that the costs of diversification outweigh the benefits. These findings are robust to alternative risk and diversification measures. We also find that marginal increases in commercial line share are associated with higher risk-adjusted profits, but these gains are offset by the extra costs from product diversity when its initial share is low. For insurers initially concentrated in commercial line, a marginal increase in commercial line share is related to higher performance due to positive effects of both direct exposure and indirect focus.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

A surge of mergers and acquisitions (M & As) of the U.S. insurance industry in the 1990s draw widespread attention for commentators to investigate economic justifications and consequences of M & A activity. Among them, BarNiv and Hathorn (1997) find that mergers serve as an alternative form of market exit for insurers that are financially distressed. Chamberlain and Tennyson (1998) suggest M & A activity may be a reaction by the industry to fundamental shocks such as industry-wide depletions of capital due to large catastrophes, unanticipated inflation or even adverse asset returns. Cummins et al. (1999) suggest technological advances and increasing financial sophistication provide insurance firms with incentives to seek improvements in X-efficiency and economies of scale through M & As. They also find that M & As improve the efficiency of target insurers in the U.S. life insurance industry.

Despite growing research on the M & A effects, there is little study on the relationship between M & A activity and financial performance in the U.S. property-liability insurance industry. Hence, this paper seeks to provide the first evidence on whether acquirers’ financial performance measured by the return on assets (ROA) and the return on equity (ROE) is enhancing or reducing following M & As. We also use the risk-adjusted ROA, ROE and Z-score as alternative performance measures to control for risk-return relationship. It is worthwhile to examine how the volatility of acquirers’ financial returns changes as a consequence of M & A transactions because regulators and shareholders care about the variability of profits and total risk. Thus, we intend to provide new evidence on the relationship between M & As and total risk measured by earnings volatility. We consider total risk as a relevant performance indicator in this paper.

Prior studies focus on investigating the performance effects of diversification based on two alternative hypotheses—the strategic focus hypothesis and the conglomeration hypothesis. Several authors have examined empirically the validity of the strategic focus and conglomeration hypotheses. Cummins and Nini (2002) find a positive relation between ROE and product line Herfindahl index in the property-liability insurance industry, consistent with the strategic focus hypothesis. Meador et al. (2000) conducted efficiency analysis to investigate the effects of product diversification for U.S. life insurers. Their results suggest that diversified life insurers are more X-efficient than their more focused counterparts. Berger et al. (2000) provide evidence that conglomeration hypothesis holds more for large personal lines insurers, while strategic focus hypothesis may apply more to small insurers that emphasize commercial lines. Their results suggest that the strategic focus hypothesis dominates for some types of insurers and the conglomeration hypothesis dominates for other types. Cummins et al. (2010) examine whether it is advantageous for insurers to offer both property-liability and life-health insurance or to focus on one or a few specialized area by estimating efficiency scores using data envelopment analysis. Their results provide evidence that strategic focus is a better strategy than conglomeration. In this paper, we aim to shed light on this controversial issue by analyzing the effect of product line diversification on the risk-adjusted performance using more recent data.

We define a different set of product diversification variables to examine the impact of a choice of a particular product line on the performance difference. We include the commercial line proportion in terms of the percent of premiums written as an explanatory variable in addition to product concentration index in the performance regression specification. Because a variation in commercial product line proportion is correlated to a variation in the product concentration index, an increase in the commercial line share affects performance in two ways: a direct exposure effect as shares of commercial line increase and an indirect diversification (focus) effect as the sources of net income are more diversified (focused). Similar to Stiroh and Rumble (2006), we attempt to differentiate theses two different impacts of a product shift on the risk-adjusted profits.

The paper is organized as follows: Section 2 reviews literature on the effects of M & As and diversification. The main hypotheses are also formulated in Section 2. Variable definitions, data and sample selection criteria are discussed in Section 3. Section 4 describes empirical methodology and analyzes results. Section 5 concludes.

2 Hypotheses development

M & As can be motivated to achieve economies of scale or scope. Insurers operating at below-optimal scale are able to achieve scale gains more quickly through M & As than through organic growth. As the size of the insurer increases by merging with others, the fixed costs are spread over a lager base and thus average costs can be reduced, improving the insurer’s profitability. Studies for the U.S. insurance industry have found some evidence in favor of exploiting scale economies. Cummins and Weiss (1993) and Hanweck and Hogan (1996) provide evidence of scale economies for small and intermediate-size firms in the property-liability insurance industry. Scale economies are also found in the life insurance industry (Grace and Timme 1992; Cummins and Zi 1998). Cummins et al. (1999) argue that operating at larger scale can lead to decrease in firm’s cost of capital if earnings volatility is inversely related to firm size. Cost scope economies can arise from the shared use of resources such as information technology, customer databases, managerial expertise, marketing distribution systems, and brand names (Teece 1980). Revenue scope economies are often said to arise from the opportunities of “one-stop shopping” that can reduce consumer search costs and improve service quality (Gallo et al. 1996).

On the other hand, the argument for economies of scale as a major driver of M & A activity may be criticized if frictional costs due to post-merger integration problems, organizational diseconomies of operating larger institutions, or agency problems outweigh any potential scale gains. Larger organizations may be more complex to manage and may not be able to react quickly to changing market conditions, creating the possibility of inefficiency. Studies of US banks find that mergers produce no improvement in cost efficiency, especially for the transactions that involve very large banks (Akhavein et al. 1997). Berger and Humphrey (1992) investigate the postmerger changes in performance of acquiring banks for about 100 large bank M & As. They find that M & As do not result in any significant postmerger improvements on average in cost X-efficiency. The recent study by Cummins and Xie (2005) investigates scale economies in the U.S. property-liability insurance industry. They provide evidence that the majority of small to medium-size firms operate with increasing returns to scale and most large insurers show scale diseconomies, implying that large insurers with decreasing returns to scale are already too large to be scale efficient. Cummins and Xie (2008) provide evidence that larger insurers are more likely to be acquirers. They find no evidence that scale economies play an essential role in the insurer’s M & As since non-decreasing returns to scale is unrelated to being an acquirer. Jensen and Meckling (1976) argue that the interests of firm’s managers and shareholders are not perfectly aligned and managers may not necessarily act in the best interest of shareholders. Managers, when not well monitored by shareholders, can make suboptimal self-maximizing decisions. These suboptimal decisions includes aggressively growing the firm (i.e., “empire building”) where managers can easily act in their own interests, sacrificing firm value (Jensen 1986). Assuming that managers’ value- decreasing incentives to merge rely on the level of their entrenchment, Hughes et al. (2003) examine the evidence of managerial entrenchment in the relationship of ownership structure with financial performance. They find that asset acquisitions aggravate the performance of US bank holding companies when management is entrenched, indicating that some bank mergers are associated with empire building.Footnote 1

M & As can be efficient way to achieve financial synergies. Myers and Majluf (1984) suggest that value may be created in mergers when firms rich in financial slack acquire slack-poor firms. More specifically, a combination of a firm with excess cash and limited investment opportunities with a firm that has limited cash and high-return investment opportunities can yield higher value for both slack-rich and slack-poor firms. The slack-poor firm could gain from the merger by implementing positive net present value projects that might otherwise have been passed up due to costly external financing. The slack-rich firm can also create value by the investment opportunities brought about by the merger. Hubbard and Palia (1999) find strong support for the financial synergy hypothesis, where diversifying acquisitions involve target firms that are financially constrained.

It is well documented by several authors that conglomeration may improve financial efficiency by creating internal capital markets. Weston (1970) states that resource allocation is more efficient in internal than in external capital markets, and thus conglomeration leads to a more efficient resource allocation by creating a larger internal capital market. Gertner et al. (1994) argue that takeovers may be value enhancing. In their study of external versus internal capital markets, the authors suggest that takeovers have an advantage in the efficient redeployment of the assets that are performing poorly under existing management. Because internal markets provide senior managers with the residual right of control of the firm’s assets, these control rights offer increased monitoring incentives for the firm’s senior management as they receive more gains from monitoring. Houston et al. (1997) state that bank holding companies create internal capital markets to allocate insufficient capital among subsidiaries. They find that the benefits of internal capital markets exceed the additional agency costs involved in coordinating actions within the holding company.

In contrast, Berger and Ofek (1995), Shin and Stulz (1998), and Scharfstein (1998) point out some deficiencies associated with internal capital markets. They argue that conglomeration may lead to inefficient cross-subsidization across segments that allow poor segments to drain resources from better-performing segments.Footnote 2 Shin and Stulz (1998) find some evidence of cross-subsidization in diversified conglomerates. Scharfstein (1998) argues that M & A activities destroy value because management in merging firms does a poor job allocating capital-underinvesting in divisions with relatively good investment opportunities and overinvesting in divisions with relatively poor investment opportunities. Rajan et al. (2000) and Scharfstein and Stein (2000) argue that internal capital markets can hinder investment efficiency because of agency problem that may generate inefficient subsidization across business segments. Campello (2002) examines the function of internal capital markets in the investment allocation process of financial conglomerates using data from bank holding companies. He finds that internal capital market result in inefficient cross-subsidization within small bank holding companies, but internal capital markets tend to play an efficiency-enhancing role in large bank holding companies.

The U.S. property-liability insurance industry provides a particularly interesting environment where to analyze internal capital markets since capital transfers are active among affiliated insurers. It is very common for insurers to be affiliates of an insurance group and insurers are required to report capital transfers among affiliates to state insurance regulators in mandatory filings.Footnote 3 Powell and Sommer (2007) provide evidence that internal capital markets are more active and play a larger role in the groups of insurance companies than in the non-financial firms. Insurers can easily exchange capital by means of reinsurance transactions. Because reinsurer pays for some portions of assumed liability shifted from ceding company, reinsurance can be used to increase a ceding insurer’s underwriting capacity and surplus (capital) position. Insurer can also increase its surplus by selling its assets to affiliates for a price above book value or at the current market value (Powell et al. 2008). Powell et al. (2008) explore the efficiency of internal capital market in the U.S. property-liability insurance industry. They provide evidence that capital is allocated to subsidiaries with best expected performance, consistent with efficient internal capital markets. They also find that reinsurance among affiliates is the most common form of internal capital transfers and dividend payment to affiliates and capital contributions are second most common transactions.Footnote 4

The agency theory of M & As proposed by Jensen (1986), suggests that M & A activity is driven by the manager’s incentive to grow firm beyond its optimal size. It is the managers of the acquiring firm who decide whether to carry out the acquisition and how much to pay for it, rather than stockholders of the firm. Given these circumstances, the motive for acquisitions may not be stockholder wealth maximization, but managerial self-interests that pursue manager’s private benefits. Shleifer and Vishny (1989) argue that takeovers can be viewed as managerial strategies to make themselves indispensable to their firm at the expense of shareholders. If the potential private gains to the managers from the transaction are large, it might blind them to the costs created for their stockholders.

The managerial hubris hypothesis suggests that M & As may not create value or even destroy value because they may be the result of poor decisions by overconfident managers (Roll 1986). Roll (1986) argues that acquisitions are motivated by managerial hubris. Rau and Vermaelen (1998) find that managers are more likely to overestimate their abilities to deal with an acquisition. Out of over optimism, bidding firm managers may overvalue the target firm, leading to overbidding. This may cause shareholder wealth of acquiring firm to decline, while the wealth of target firm rises. Bouwman et al. (2003) find that during periods of high stock market valuation, managers are more likely to suffer from hubris and make poor acquisition decisions. Although the market initially welcomes acquisition announcements during stock market booms, the hubris-driven acquisitions undertaken during high market valuation periods earn negative abnormal returns in the long run. This suggests that the market learns over time as the true quality of the acquisition is revealed.

It appears that there is no single dominating hypothesis or theory that justifies M & A activity. In any given case, more than one motive may underlie the decision to merge. From the above discussions, we hypothesize that the financial performance of acquiring insurers is likely to decrease following M & A perhaps due to scale diseconomies and increased frictional costs associated with post-merger managerial integration and agency problems. M & A activity can lead to increase in costs due to the aggravated agency problems and inefficiencies of internal capital market. As firms become larger and more complex, managerial monitoring becomes more difficult and thus the costs of governance will increase. In addition, managers are more likely to engage in activities that maximize their private benefits and to subsidize poor business segments. An alternative hypothesis is that the performance of acquiring insurers is likely to improve following an M & A if M & A activity is driven by value maximizing motivations. Value increasing may arise from economies of scale or scope, financial efficiency, and earnings diversification. The earnings diversification can be particularly applicable to insurers, because the essence of insurance is risk diversification through pooling. By increasing the magnitude of the insurance pool through geographical or product line diversification, expected losses become more predictable and earnings volatility can be reduced. The less volatile earnings that reduce the expected costs of financial distress or bankruptcy may permit insurers to hold less equity capital for risks underwritten, providing a potentially significant source of cost reduction (Cummins et al. 1999).

The relationship between diversification and performance has been discussed based on two competing hypotheses. Pro-focus arguments state that firms can maximize value by concentrating on core businesses and core competencies where the firm has a comparative advantage. It is also argued that conglomeration may aggravate agency problems by allowing cross-subsidization to poor subsidiaries (Jensen 1986; Berger and Ofek 1995; Shin and Stulz 1998; Scharfstein 1998). In contrast, pro-conglomeration hypothesis asserts that operating multiple segments of business can add value from taking advantage of cost or revenue scope economies. Conglomeration may also improve financial efficiency by creating internal capital markets (Gertner et al. 1994; Stein 1997). We expect that product diversity is positively related to financial performance if the benefits of diversification exceed its costs. Conversely, the expected relationship is negative if the potential costs of diversification outweigh its benefits.

3 Definitions and data

3.1 Variable definitions

The variables we describe in this section fall into three categories: performance measures, M & A and product diversification measures, and control variables.

3.1.1 Performance measures

The key performance measures used in our analyses are identified from a thorough literature review. We first employ accounting profitability ratios such as return on assets (ROA) and return on equity (ROE) as a proxy for measurements of the insurer’s financial performance. ROA and ROE are widely used measures in the diversification-performance literature (e.g., Greene and Segal 2004, Elango et al. 2008; Liebenberg and Sommer 2008). ROA is defined as net income after policyholder dividend but before taxes divided by total admitted assets and ROE is the ratio of net income after policyholder dividend but before taxes to the insurer’s equity capital.

The traditional quantitative performance measures from the theory of finance are based on accurately capturing risk (volatility) and excess returns.Footnote 5 Costly external financing due to market imperfections relates firm value to the total volatility of returns and a large variation in asset returns may raise costs, e.g., bankruptcy costs, inducing regulators and shareholders to care about total risk. In this aspect, it is important to take into account the uncertainty of asset returns for performance assessment. Thus, we consider total risk measured by volatility of profit ratios as a related indicator of performance. Similar to Lai and Limpaphayom (2003) and Liebenberg and Sommer (2008), the standard deviations of ROA and ROE over the past 5 years are calculated to measure the total variability of earnings. The costs of the higher returns may be greater variability of earnings distribution and higher probabilities of insolvency. To capture this risk-return tradeoff, we use risk-adjusted returns calculated by dividing an insurer’s ROA and ROE by its corresponding standard deviation. Both risk-adjusted ROA and ROE assess insurer operations in terms of accounting returns per unit of total risk. Following the literature (Hannan and Hanweck 1988; Eisenbeis and Kwast 1991; Sinkey and Nash 1993; Stiroh and Rumble 2006), we calculate a Z-score as a proxy measure of the likelihood of insurer insolvency. The Z-score is a function of the insurer’s profit ratio, the variation in that profit ratio, and the equity capital available to absorb that variation. The Z-score is defined as

The Z-score measures the number of standard deviations by which profits should decline to direct an insurer into default. The Z-score is inversely related to the probability of insolvency, with higher Z-score indicating a lower probability of default. Summary and definitions of performance measures used in our analysis are presented in Table 1.

3.1.2 M & A and product diversification measures

We employ an M & A indicator variable to identify the difference between the pre-M & A performance and the post-M & A performance. Following Sapienza (2002), an indicator variable is defined as equal to one in 1 year, 2 years, and 3 years after M & A for an acquiring firm, and zero otherwise. We use 3 years after M & As because it is argued by both academics and practitioners that the gestation period of restructuring following a merger can be as long as 3 years (Berger et al. 1998).

To measure the extent of an insurer’s product diversification, Herfindahl index method is used following the previous studies (e.g., Cummins and Nini 2002; Cummins and Xie 2008). We first break product scope of the property-liability insurance into two major segments of activity: personal property-liability vs. commercial property-liability lines of business. The firm’s decision to choose the proportion of their activities between these two insurance types may have a significant impact on the performance. Our modified version of product diversification measure accounts for the variation of a product line proportion in the breakdown of product scope into two broad categories. Based on Fiegenbaum and Thomas (1990) and Stiroh and Rumble (2006), our first product diversity measure, PRODDIV(1) is calculated as

where PMS is the relative size of an insurer’s personal line measured by the percentage of direct premium written and CMS is the share of an insurer’s commercial line. Specifically PMS and CMS are defined as

Thus, an insurer with a higher value of PRODDIV is considered to have a more diversified and less concentrated business mix while an insurer that operates on a single product line takes the value of zero for the PRODDIV measure.

We also divide product scope into 23 lines of business to particularly consider entire number of product lines presented by the National Association of Insurance Commissioners’ (NAIC) annual statutory filings.Footnote 6 Product line Herfindahl index is now calculated by the sum of the squares of the percentages of direct premium written across all lines of business (k = 1 to 23) for each insurer i in each year t.

The product diversification variable, PRODDIV(2), is defined as one minus Herfindahl index (HHI kt ) to make the interpretation consistent with the results of Eq. 2 in the empirical analysis. As a consequence, an insurer that focuses on writing only one or a few lines of business has a lower Herfindahl index, whereas a firm that offers a wider range of product lines has a higher Herfindahl index, indicating higher diversification.

3.1.3 Control variables

Firm characteristics that affect insurers’ performance are included as explanatory variables. The natural logarithm of total admitted assets is used to control for firm size. We also include the square of firm size to examine possible nonlinear relationship between firm size and its performance. The potential collinearity problem may arise because the variables, firm size and its quadratic term, are often highly correlated when their values have the same sign. We introduce the centering method to deal with this issue following the statistics textbook (e.g., Hocking 2003; Demaris 2004).Footnote 7 The effect of correlation can be substantially reduced by centering the values of both firm size and its square. The centering in this case implies that we subtract the average of firm size from each of the elements in the firm size and the square of firm size columns.Footnote 8

The ratio of equity capital to total assets is included to control for the effects of capitalization on firm performance. Investment income is an important element of an insurer’s overall profitability. Following Fiegenbaum and Thomas (1990), the proportion of stocks from two major sources of investment categories, stocks and bonds, is included to control for the effect of an insurer’s investment strategy on the performance. Geographical diversity index is also included as an additional explanatory variable to examine whether geographically diversified insurers outperform focused insurers. Geographical diversity is equal to one minus geographical Herfindahl index defined as the sum of the squares of the percentages of direct premium written across 50 states for each insurer. Firm performance will be affected by different distribution systems. The property-liability insurance product is distributed by a variety of distribution systems: direct writers, independent agents, brokers and mixed systems.Footnote 9 These systems have coexisted in insurance markets for many decades, despite evidence that independent-agency insurers are less cost efficient on average than direct-writing insurers (Berger et al. 1997). We revisit the issue of the coexistence of multiple distribution systems for insurance industry by including indicator variables for direct writing, brokerage, and mixed distribution. Independent agency is omitted in the regression as a reference category. We use an indicator variable equal to one for mutual firms and zero for stock insurers to control for organizational form. A dummy variable equal to one for unaffiliated companies and zero otherwise is included to control for different firm structure. M & A year dummies are used to control for time effects, with 1989 as the base year.

3.2 Data and sample selection

Annual financial statement data are obtained from the National Association of Insurance Commissioners (NAIC). Our initial sample includes all firms in the NAIC database. Insurance companies may structure as an unaffiliated single insurer or as an affiliate of a large insurance group. Because corporate strategies such as M & A decisions and investment strategies are likely performed at the group level (Berger et al. 2000), affiliated insurance companies that belong to the same group are aggregated as one observation unit in our sample. In the case where multiple insurers are grouped as one unit, the values of indicator variable (i.e. organizational structure or distribution systems) on the groups are chosen from the largest insurer in the group based on the size of assets.

The samples involved in M & As are initially identified through the list of Best’s Insurance Reports-Property/Casualty. We cross-check the list of M &A related insurers from Best’s Insurance Reports against NAIC demographic files to identify insurance company codes. Those M &A related insurers which could not be verified in NAIC demographic files are excluded from the sample. Thus, our final samples of M &A involved insurers should be listed both in NAIC demographic files and in the Best’s Insurance Reports.

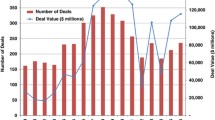

Some sample selection criteria are imposed to ensure that insurance firms analyzed are actively engaged in the writing insurance contracts as ongoing concerns, and thus, reported financial data are meaningful measures. Accordingly, the insurers that report positive values for premiums written, surplus and total admitted assets are included in our sample. Mergers and acquisitions of shell, inactive, or run-off companies are excluded from the sample since the focus of the study is on the viable operating entities. We also omit insurers that were retired, or put into liquidation or receivership at merger and acquisition or within 2 years thereafter. We initially identified 538 firms that were involved in M & As during the period, 1990–2003 through a search of Best’s Insurance Reports. We first exclude any acquirer that merges with a shell company (44 firms), with reinsurers (24 firms) or with life insurers (seven firms). Also excluded from the sample were insurers that merge into inactive firms, or put into liquidation within 1 year or 2 years after M & A (21 firms).Footnote 10 Some insurers are involved in multiple M & A transactions within the same year or within 2 years before or after the transactions. We omit them (53 firms) to prevent double counting in the sample. The 66 firms are eliminated because the company codes of those merging or acquiring firms are not found in the NAIC demographic files. The 51 firms that exhibit negative premiums, negative equity, or unusual financial ratios are also excluded. We also exclude 82 insurers that have negative outputs and inputs and negative prices in calculating efficiency scores. A total of 190 firms are eventually considered as acquirers that pass our sample selection criteria.

Table 2 reports summary statistics on the firm performance, financial and operating characteristics for all insurers in the sample. Table 3 compares means and medians of financial performance between acquirers and non-acquirers one and 2-year before and one and 2-year after M & As. It appears that on average, acquiring insurers experience lower financial performance than non-acquirers across all periods. Although our univariate results provide interesting comparisons between acquirers and non-acquirers, it is still questionable to figure out whether acquirers’ overall performance is improving or declining after M & As. Thus, it is necessary to run a multivariate regression model to clarify this issue.

4 Methodology and results

4.1 Regression methodology

To examine the relationship between M & A activity, diversification and performance, we conduct regressions using a series of pooled, cross-sectional, and time-series data. We also investigate several exogenous factors that affect insurers’ performance by including firm characteristics as explanatory variables. We use unbalanced panel data to avoid survivor bias and to maximize the number of observations. Because M & A decisions are likely to be influenced by firm performance, we use the lagged-structure model to correct for potential endogeneity. The basic regression model to test our hypotheses is written as follows:

where Y i,t+1 is several types of different performance measures for an insurer i at time t+1 as described in Table 1. M&A i,t is an indicator variable that takes the value of one in 1 year, 2 years, and 3 years after M & A if the firm is an acquiring insurer, and zero otherwise. A negative (positive) value for the coefficient of M&A i,t indicates that an acquiring firm’s performance is decreasing (improving) after M & As. Similar to Sapienza (2002), we include other insurers that are not involved in M & A activity as a control group in the regression to control for economy-wide factors and changes in the regulatory framework that may influence firm performance. The M&A i,t indicator for these firms is always equal to zero. X i,t is a vector of other control variables which are described in Section 3.1. d t is a vector of time fixed-effect and ε i,t is error term.

The first part of our regression analysis uses a product diversification measure, PRODDIV(1), estimated by Eq. 2 and includes the share of an insurer’s commercial line, CMS.Footnote 11 The coefficient of PRODDIV(1) measures the effect of diversification, while the coefficient of CMS gauges how performance varies with changes in commercial product line exposure. From the product diversity measure in Eq. 2 and the fact that PMS + CMS = 1 from Eq. 3, the product diversification measure is rewritten as

The variables PRODDIV(1) and CMS are functionally correlated, but the relationship is nonlinear. Thus, our regression specification does not violate the assumption of no multicollinearity. The nonlinear relationship between PRODDIV(1) and CMS has an interesting characteristic that decomposes direct and indirect effects of a shift in the commercial line share. We can verify this by taking partial derivatives of performance, Y with respect to the share of commercial line, CMS:

The first term on the right-hand side measures the marginal impact of a change in CMS on Y through changes in product diversification (focus), which is referred to as the indirect diversification (focus) effect of a weight variation in commercial line. It is observed that this effect relies on both the sign of \( {\hat{\beta }_2} \) and the scale of commercial line share. Note that the sign of \( \frac{{\partial PRODDIV}}{{\partial CMS}} \)will be positive if an insurer has an initial share of commercial line less than 0.5, suggesting that the marginal increase in CMS is considered diversifying. In contrast, \( \frac{{\partial PRODDIV}}{{\partial CMS}} \)will have a negative sign if an initial share of commercial line is greater than 0.5, indicating that the marginal increase in CMS is considered concentrating. The second term on the right-hand side of Eq. 7 identifies the direct exposure effect of increased commercial line share. The sum of the indirect and direct effects measures the net effect of a change in commercial line share on the performance.

4.2 Results

Table 4 shows estimations of the parameters from the Eq. 5 using four performance measures (ROA, ROE, and standard deviations of ROA and ROE) as dependent variables.Footnote 12 The dummy variable, M&A is significantly negatively related to returns and positively related to risk measures, indicating that an acquiring firm’s profit ratios are decreasing while their corresponding volatilities are increasing during the gestation period after M & As. The coefficient of product diversity, PRODDIV(1) is negative and significant in both return and risk equations (except for standard deviation of ROA), showing that ROA and ROE for diversified firms are lower than for single-line firms and diversified portfolio appears to be associated with less volatile profits. The positive coefficients on the share of the commercial line (CMS) across all return and risk cases indicate that a larger portion in commercial line is related to higher returns and higher volatile profits. This result suggests that commercial policies are more complex and riskier than personal lines and thus risky lines have more opportunities to generate greater returns.

The coefficients of firm size and the square of firm size are statistically significant across all performance measures in Table 4. The significance of quadratic terms in both returns and risk measures suggests that the relationships between firm size and the insurer’s performance are nonlinear. Notably, the coefficient on firm size is positive and the coefficient on its square term is negative in returns equation, indicating that its relationship with performance has a parabolic shape. The implication is that up to certain values of asset, an additional asset has an increasing effect on performance and beyond some critical value of asset, the effect might become decreasing, outweighing any potential scale efficiency benefits.Footnote 13 The negative sign on the coefficient of the quadratic term confirms the intuition of recent studies that the majority of large insurers with decreasing returns to scale present scale diseconomies (Cummins and Xie 2005, 2008; Cummins et al. 2010).

The ratio of equity capital to total assets is significantly positively related to ROA and ROE, suggesting that better capitalized firms are more likely to charge higher prices and higher prices will translate into higher earnings. The negative sign of this capital ratio on the risk equation indicates that firms with high capitalization experience lower volatile profit ratios. The proportion of stock investment is significantly negatively related to returns, while it is positively associated with the volatility of an insurer’s profits. This finding suggests that more stock investments foster greater volatility of returns and impair the insurer’s overall financial performance. The geographic diversification is found to be negatively significant both in the return and in the risk equations (except for standard deviation of ROA), indicating that geographically focused insurers are likely to have greater financial performance than geographically diversified insurers and firms with geographically diversified portfolio have less volatile profits. The results imply that the costs associated with operating across different states outweigh risk-reduction benefits. The signs on direct marketing system are positive and significant in the return equation, consistent with the view that insurers using direct marketing system have higher financial returns than insurers with independent agency system because independent agency distributors are likely to have higher costs than direct writers. It appears that independent agency system performs better than brokerage and mixed distribution systems. The mutual variable has a significant negative sign, showing that stock insurers tend to demonstrate better performance than mutuals. The result is consistent with the argument that mutual managers are not well monitored in capital markets as compared to mangers of stock insurers and thus, the pressure to maximize firm value is far less in a mutual firm (Colquitt et al. 1999). An unaffiliated single firm indicator is positive and significant, implying that an unaffiliated company is likely to be more risk averse and managers of unaffiliated firms may have more incentive to minimize costs and maximize revenues than those of affiliated insurance groups. Both mutual and unaffiliated single firm indicators appear to be inversely related to the volatility of earnings.

The results using risk-adjusted measures of financial performance as dependent variables are presented in Table 5. As noted earlier, the standard deviation of ROA and ROE for the past 5 years is used as a risk control. Three equations are estimated: risk-adjusted ROA, ROE and Z-score. The key results are consistent with the findings of ROA and ROE regressions reported in Table 4. The coefficients on the indicator variable for M & A (t ≤ +3) are negative and significant in all three cases, providing support for the inverse relationship between M & A activity and risk-adjusted financial performance. The results thus far suggest that M & A activities have a negative impact on the insurer’s financial performance during the gestation period (1 year, 2 years, and 3 years after M & A). We explore whether acquirers’ performance is persistently diminishing for further subsequent years after the gestation period by modifying our basic specification. We introduce a new indicator variable for each of one (t = +1), two (t = +2), three (t = +3), four (t = +4), and five (t = +5) years after M & As to investigate how performance changes over time after the merger event. More specifically, the indicator variable for M & A, (t = +1) takes the value of one in 1 year after M & A if the firm is an acquiring insurer, and zero otherwise. Similarly, the indicator variable for M & A, (t = +5) takes the value of one in 5 years after M & A if the firm is an acquiring insurer, and zero otherwise. The results listed in the second columns (2) of respective risk-adjusted return equation of Table 5 reinforce our previous findings that acquirers’ performance is decreasing only during the gestation period and the effect is not statistically significant in the long run.Footnote 14

The coefficients of product diversity (1) are negatively significant in all estimations, consistent with the hypothesis that insurers with higher levels of product diversification experience lower financial performance than insurers with a less diversified product profile. This result implies that the costs related to diversification outweigh any potential synergistic benefits. At the same time, the coefficients of the share of the commercial line are, however, positive and significant in all estimations, indicating that financial performance for insurers with a relatively larger proportion in commercial line is higher than for insurers with more shares in personal line. This positive relationship between performance and the share of commercial line is consistent with the findings of Elango et al. (2008). The results for other explanatory variables are statistically similar to prior findings in Table 4. In particular, it is worthwhile to note that statistical significance of natural log of asset and its quadratic term implies a diminishing marginal effect of firm size on the insurer’s risk-adjusted performance. As described in Section 3.1, we use the centering to reduce potential collinearity between firm size and its square. To examine the degree of collinearity among explanatory variables, we calculate the variance-inflating factor (VIF) that shows how the variance of an estimator is inflated by the presence of multicollinearity. The values of the VIF of all variables are less than 2.62 after centering and thus, there is no indication of multicollinearity problem in our quadratic model.

To assess the net effect between negative impact of diversification and positive impact from the increased share to the commercial business line, we consider estimating both coefficients together as discussed in Section 4.1. Because the Eq. 7 indicates that net effect varies depending on the magnitude of commercial line share (CMS), we measure the indirect, direct and net effects at various percentile ranks (10th, 25th, 50th, and 75th percentile) of CMS. The 10th, 25th, 50th, and 75th percentile correspond to the commercial line shares of 0.049, 0.244, 0.580, and 0.999, respectively. The estimates presented in Table 6 are based on the result of risk-adjusted ROA regression from the first column of Table 5.Footnote 15 Interestingly, the indirect effect shows that a marginal increase in CMS is diversifying when the shares of commercial line are below 0.5 (10th and 25th percentile) and product diversification is negatively related to risk-adjusted performance. In contrast, the marginal increase in CMS is concentrating when the shares are above 0.5 (50th and 75th percentile) and product focus appears to be positively associated with risk-adjusted performance. In addition, insurers with relatively smaller commercial line share (10th percentile) have higher diversification costs from a shift toward commercial line, while insurers with relatively larger commercial line share (75th percentile) have higher focus gains from more exposure to commercial line. The direct effect in Table 6 indicates that 1% increase in commercial line share is associated with 0.2% increase in risk-adjusted ROA.Footnote 16 The net effect shows that the costs associated with increased product diversification offset the positive gains from an increase in commercial line share when firms have a relatively lower commercial line share (10th and 25th percentile). The net effect, however, becomes significantly positive when firms are highly concentrated in commercial line (50th and 75th percentile), indicating that increased shifts toward commercial product line and a resulting focus on the advantageous product line are related to higher risk-adjusted profits.

We are also interested in how the impact of M & A differs with a variation in the product concentration index and the firm’s production strategy. Specifically, we attempt to provide further information concerning the difference in the effects of product diversification and choice of product line between before and after M & A using interaction terms. Table 7 presents estimation results with M & A indicator variable interacted with product diversity (column 2), with the share of commercial line (column 3), and with both (column 4).Footnote 17 If the coefficient estimate for the interaction variable is significant, this means that product diversity (the share of commercial line) has a different effect before M & A versus after M & A. Surprisingly, none of these interaction coefficient estimates are significant, indicating that there is no differential effect that product diversity and the share of business line have on the performance for before M & A versus after M & A activity.Footnote 18 This uninformative consequence may result from the fact that we do not distinguish the difference between changes in the level of product diversification and in the share of an insurer’s business lines caused by M & A and those observations not affected by M & A activity due to data limitations.Footnote 19

We examine the robustness of our results to an alternative risk measure by replacing standard deviation of returns with firm portfolio risk (SIGMA). We follow Cummins and Sommer (1996) and Myers and Read (2001) to calculate an insurer’s portfolio risk.Footnote 20 The overall measure of portfolio risk has some advantages over the traditional risk measure used in the literature because this portfolio risk measure enables us to quantify the insurer’s distinctive portfolio risk more accurately by incorporating the volatility of asset and insurance underwriting returns as well as correlations between them (Cummins and Sommer 1996). The risk-adjusted ROA and ROE are newly calculated by dividing an insurer’s ROA and ROE by the portfolio risk (SIGMA). To investigate whether our results are robust to an alternative diversification measure, we repeat our regressions using product diversity (2), PRODDIV(2). As noted in Section 3.1, PRODDIV(2) is measured by splitting insurance business into 23 lines.

The estimation results using risk-adjusted returns and firm portfolio risk (SIGMA) as dependent variables are reported in Table 8 where the first column of each regression uses PRODDIV(1) estimated by Eq. 2, while the second column employs PRODDIV(2). We focus our discussion on the most interested variables, M & A indicator and product diversity since the results of other control variables are generally similar to those presented in Tables 4 and 5. The indicator variable for M & A (t ≤ +3) is significantly inversely related to risk-adjusted ROA and ROE and positively related to portfolio risk, demonstrating that our earlier results are robust to an alternative risk measure. The results strongly support the hypothesis that acquiring insurers’ performance declines during the gestation period following M & As, perhaps due to operational and managerial inefficiencies associated with post-merger integration and/or increased earnings volatility after M & As. The coefficients of product diversity are significant and negative in both PRODDIV(1) and PRODDIV(2) specifications across all risk-adjusted returns and risk estimates, indicating that the results using an alternative risk measure confirm the inverse relationship between risk-adjusted performances, total risk and product diversity found in the earlier regressions and the extended product diversification measure also strengthens our earlier findings. The inverse relationship between product diversity and risk-adjusted performance suggests that more focused insurers are rewarded with higher performance. This result supports the strategic focus hypothesis, consistent with the findings of Cummins and Nini (2002), Liebenberg and Sommer (2008), and Cummins et al. (2010). In separate regressions (not reported), we reestimate the product diversity by breaking insurance business into four lines: personal property (PP), personal liability (PL), commercial property (CP) and commercial liability (CL) lines.Footnote 21 We include the shares of PP, PL, and CP lines instead of CMS as additional explanatory variables in the regression, omitting the share of CL line as the reference category. We find that the coefficients of M & A indicator and product diversity remain the same sign and statistically significant.Footnote 22 We also find that the type of business that insurers operate is found to be relevant to performance. Insurers with a higher proportion of business in CP line exhibit greater risk-adjusted profits than those with more businesses in PP, PL, and CL lines.

5 Conclusion

The paper explores the relationship between M & As, product diversification and financial performance using the sample of the U.S. property-liability insurers over the sample period 1989–2004. The risk-adjusted ROA, ROE and Z-score are estimated to represent an insurer’s financial performance. The total risk measured by earnings volatility is considered as a relevant indicator of performance in our analysis. The empirical tests indicate that acquirers’ overall financial performance decreases and the volatility of earnings increases during the gestation period following M & As. We consistently show that the results are robust to an alternative risk measure. One possible explanation is that expansion of the firm through M & As has the potential to create financial inefficiency possibly due to increased earnings volatility. As firms become larger and more complex, M &A benefits tend to be offset by the additional costs. Operational and managerial inefficiencies associated with post-merger integrations such as combination of different information systems may lead to higher costs. Bonding different organizations has more potential to create managerial conflict and agency problems since managerial monitoring becomes more difficult. An alternative explanation is that the target firms may be considerably badly performing and thereby acquiring firms appears to perform poorly after M & A transactions.

We provide evidence supporting for the strategic focus hypothesis that more focused insurers outperform the product-diversified insurers, suggesting that the insurer can maximize value by focusing on one or a few specialized area where the firm has a comparative advantage. This result implies that potential benefits from diversification are likely to be offset by the extra costs associated with product diversity. Our results are consistent with the findings of recent study on the diversification–performance relationship (e.g., Liebenberg and Sommer 2008). We attempt to disentangle the separate influences of a change of the commercial line proportion on the risk-adjusted performance. A shift toward commercial insurance line influences profitability in two ways, directly due to the increased exposure and indirectly due to the diversification (or focus) effect. We find that marginal increases in commercial line share are associated with higher risk-adjusted profits, but these gains are offset by the extra costs from increased product diversity especially when the initial share of commercial line is low. Thus, the net effect becomes significantly negative in the lower commercial line proportion. For insurers initially concentrated in commercial product line, a marginal increase in commercial line share is significantly positively related to risk-adjusted accounting profitability due to both direct positive effect of the increased exposure and indirect positive effect of resultant product focus.

Our study provides some interesting results with respect to several control variables. We provide new evidence that firm size has a non-monotonic effect on the insurer’s risk-adjusted performance. We find that insurers with direct marketing system have higher financial performance than insurers with independent agency system. We find that mutual insurers are less profitable than stock insurers and unaffiliated insurers tend to outperform affiliated insurer groups. We also present new evidence on the effects of an insurer’s capitalization and investment strategy. We find that better capitalized insurers experience higher risk-adjusted profits and lower volatility of profit ratios. We provide evidence that insurers with more proportion of stock investment experience lower profitability and increased volatility, suggesting insurers’ profits suffer when the volatility of the investment portfolio is increased. Future work may investigate the performance of the targets to figure out whether the decrease of financial performance for acquiring insurers is attributable to target firms.

Notes

Hughes et al. (2003) also show that at banks with less entrenched management an increase in acquired assets is associated with improved performance.

Furthermore, Berger and Ofek (1995) document that merging firms trade at an average discount in U.S. stock markets relative to stand-alone firms.

Insurers report capital transfers among affiliates in the Schedule Y (Part 2: Summary of the Insurer’s Transactions with any Affiliates) of the annual statement.

Shareholder dividends are dividends paid to affiliates if they own a portion of the reporting insurer’s shares. Capital contributions are capital transfers from one affiliate to another in the form of cash, securities, real estate and surplus notes.

For example, Sharp ratio (also known as reward-to-volatility ratio) measures excess returns relative to volatility. Sharpe ratio indicates the excess return per unit of risk associated with the excess return and can be obtained by a risk-return frontier.

NAIC’s annual statement indicates that there are approximately 30 different lines of business insurance companies underwrite and these numbers slightly change in any given year. Some lines of business with similar underwriting risks and payout patterns are grouped together in our calculation. For example, Accident and health include Group accident and health (line13 from the Exhibit of Premiums and Losses of annual statement), Credit accident and health (line 14), and other types of accident and health (lines 15.1–15.7). Similar to Liebenberg and Sommer (2008), the final list includes the following 23 lines: Fire and Allied lines, Farmowners’, Homeowners’, Commercial Multi Peril, Mortgage Guaranty, Ocean Marine, Inland Marine, Financial Guaranty, Medical Malpractice, Earthquake, Accident and Health, Workers’ Compensation, Other Liability, Products Liability, Personal Auto, Commercial Auto, Aircraft, Fidelity, Surety, Burglary and Theft, Boiler and Machinery, Credit, and International.

The centering method is widely used in the survival analysis where lifetime is always positive (Lawless 2003).

The input variable (firm size) is centered prior to taking its square.

Direct writing includes exclusive agents and insurer employees. An exclusive agent represents a single insurer, but is not technically insurer’s employee. An independent agent represents more than one insurer. A broker represents the customer, negotiates with multiple insurers and tends to focus more on the commercial lines of business for larger-scale customers. Mixed distribution includes using both independent agency and direct writing or using both brokerage and direct writing.

For example, some insurers merge into inactive firms in other states even merged firms do not operate with no assets or premiums because acquiring firms may want to move their headquarters to other states.

The share of the personal line (PMS) is dropped as the reference category.

We repeat regressions using ROA (ROE) defined as the ratio of net income before policyholder dividends and before taxes to total assets (equity capital). The key results are unchanged.

The turnaround value of asset size can be estimated at the coefficient on firm size over twice the absolute value of the coefficient on the square of firm size. For this purpose, we repeat regressions without centering the values of both firm size and the square of firm size. The result shows that returns can be maximized in a range approximately between $1.2 billion and $4.8 billion in total admitted assets, implying that an increase in asset beyond this range may have a diminishing effect on performance. Our result is consistent with the findings of Hunter et al. (1990) and Noulas et al. (1990) that maximum returns to scale can be achieved with assets between $2 billion and $10 billion in US banks.

To control for changes in the fundamental characteristics of a firm, we modify our basic specification in a way that an M & A indicator takes the value of one if the insurer was involved in a merger in the past three years and a vector of firm characteristics are measured at time t − 1. Similar to Sapienza (2002), we also introduce five new indicator variables that take the value of one if the insurer was involved in a merger one (t = −1), two (t = −2), three (t = −3), four (t = −4), and five (t = −5) years ago, respectively. We repeat our regression analysis with these alternative specifications. The results are unaffected (not reported here).

Similar to Stiroh and Rumble (2006), indirect and direct effects are estimated at a 1% increase in the commercial line share.

The estimates of direct effect do not change across percentiles of commercial line share because the estimated relationship is linear. See Stiroh and Rumble (2006).

Column 1 repeats the estimates of risk-adjusted ROA from Table 5 for comparison.

The values of the variance-inflating factor (VIF) indicate that there is no serious multicollinearity problem in our interaction regressions.

Although product diversity (PRODDIV) may absorb some of the effect of M & A, variations in product diversity and in the share of business lines might occur due to reasons other than M & As, such as an insurer’s expanding its operations to potentially profitable lines or closing unprofitable lines strategically.

Personal property lines of business include Homeowners, Farmowners, Earthquake, and Auto Physical Damage. Personal liability line includes Private Passenger Auto Liability. Commercial property lines include Fire, Allied Lines, Commercial Multiple Peril, Mortgage Guaranty, Inland Marine, Financial Guaranty, Group Accident and Health, Credit and Other Accident and Health, Fidelity, Surety, Burglary and Theft, Credit. Commercial liability lines include Medical Malpractice, Other Liability, Product Liability, Workers’ Compensation, Ocean Marine, Commercial Auto Liability, Aircraft, Boiler and Machinery, International, Reinsurance.

We also repeat regressions using a discrete measure of product diversity which is commonly used in the diversification-performance literature (e.g., Berger and Ofek 1995; Servaes 1996; Liebenberg and Sommer 2008). The level of product diversification is identified by calculating the number of insurance business lines a firm operates. We find that the key results are still unchanged.

References

Akhavein JD, Berger AN, Humphrey DB (1997) The effects of megamergers on efficiency and prices: evidence from a bank profit function. Rev Ind Organ 12:95–139

BarNiv R, Hathorn J (1997) The merger or insolvency alternative in the insurance industry. J Risk Insur 64:89–113

Berger AN, Humphrey DB (1992) Megamergers in banking and the use of cost efficiency as an antitrust defense. Antitrust Bull 37:541–600

Berger PG, Ofek E (1995) Diversification’s effect on firm value. J Financ Econ 37:39–65

Berger AN, Cummins JD, Weiss MA (1997) The co-existence of multiple distribution systems for financial services: the case of property-liability insurance. J Bus 70(4):515–546

Berger AN, Saunders A, Scalise JM, Udell GF (1998) The effects of bank mergers and acquisition on small business lending. J Financ Econ 50:187–229

Berger AN, Cummins JD, Weiss MA, Zi H (2000) Conglomeration versus strategic focus: evidence from the insurance industry. J Financ Intermed 9:323–362

Bouwman C, Fuller K, Nain A (2003) The performance of stock-price driven acquistions. Working Paper

Campello M (2002) Internal capital markets in financial conglomerates: evidence from small bank responses to monetary policy. J Finance 57:2773–2805

Chamberlain LS, Tennyson S (1998) Capital shocks and merger activity in the property-liability insurance industry. J Risk Insur 65:563–595

Colquitt LL, Sommer DW, Godwin NH (1999) Determinants of cash holding by property-liability insurers. J Risk Insur 66:401–415

Cummins JD, Weiss MA (1993) Measuring cost efficiency in the property liability insurance industry. J Bank Finance 17:463–482

Cummins JD, Sommer DW (1996) Capital and risk in property-liability insurance markets. J Bank Finance 20:1069–1092

Cummins JD, Zi H (1998) Comparison of frontier efficiency methods: an application to the U.S. life insurance industry. J Prod Anal 10:131–152

Cummins JD, Nini G (2002) Optimal capital utilization by financial firms: evidence from the property-liability insurance industry. J Financ Serv Res 21:15–53

Cummins JD, Xie X (2005) Efficiency and scale economies in the U.S. property-liability insurance industry. Working paper. University of Pennsylvania

Cummins JD, Xie X (2008) Mergers & acquisitions in the U.S. property-liability insurance industry: productivity and efficiency effects. J Bank Finance 32:30–55

Cummins JD, Tennyson S, Weiss MA (1999) Consolidation and efficiency in the U.S. life insurance industry. J Bank Finance 23:325–357

Cummins JD, Weiss MA, Xie X, Zi H (2010) Economies of scope in financial services: a DEA efficiency analysis of the US insurance industry. J Bank Finance 34:1525–1539

Demaris A (2004) Regression with social data: modeling continuous and limited response variables. A Wiley-Interscience Publication. Wiley

Eisenbeis RA, Kwast ML (1991) Are real estate specializing depositories viable? Evidence from commercial banks. J Financ Serv Res 5:5–24

Elango B, Ma Y, Pope N (2008) An investigation into the diversification–performance relationship in the U.S. property-liability insurance industry. J Risk Insur 75:567–591

Fiegenbaum A, Thomas H (1990) Strategic groups and performance: The U.S. insurance industry, 1970–84. Strateg Manage J 11:197–215

Gallo JG, Apilado VP, Kolari JW (1996) Commercial bank mutual fund activities: implications for bank risk and profitability. J Bank Finance 20:1775–1791

Gertner RH, Scharfstein DS, Stein JC (1994) Internal versus external capital markets. Q J Econ (November):1211–1230

Grace MF, Timme SG (1992) An examination of cost economies in the U.S. life insurance industry. J Risk Insur 59:72–103

Greene WH, Segal D (2004) Profitability and efficiency in the U.S. life insurance industry. J Prod Anal 21:229–247

Hannan TH, Hanweck GA (1988) Bank insolvency risk and the market for large certificates of deposit. J Money Credit Bank 20:203–211

Hanweck GA, Hogan AM (1996) The structure of the property/casualty insurance industry. J Econ Bus 48:141–155

Hocking RR (2003) Methods and applications of linear models: regression and the analysis of variance, 2nd ed. A Wiley-Interscience Publication. Wiley

Houston J, James C, Marcus D (1997) Capital market frictions and the role of internal capital markets in banking. J Financ Econ 46:135–164

Hubbard G, Palia D (1999) A re-examination of the conglomerate merger wave in the 1960s: an internal capital market view. Journal of Finance 54:1131–1152

Hughes J, Lang W, Mester L, Moon C, Pagano M (2003) Do bankers sacrifice value to build empires? managerial incentives, industry consolidation, and financial performance. J Bank Finance 27:417–447

Hunter WC, Timme SG, Yang WK (1990) An examination of cost subadditivity and multiproduct production in large U.S. banks. J Money Credit Bank 22:504–525

Jensen M (1986) Agency costs of free cash flow, corporate finance, and takeovers. Am Econ Rev 76:323–329

Jensen M, Meckling W (1976) Theory of the firm: managerial behavior, agency costs, and capital structure. J Financ Econ 3:305–360

Lai GC, Limpaphayom P (2003) Organizational structure and performance: evidence from the nonlife insurance industry in Japan. J Risk Insur 70:735–758

Lawless JF (2003) Statistical models and methods for lifetime data. 2nd ed. A Wiley-Interscience Publication. Wiley

Liebenberg AP, Sommer DW (2008) Effects of corporate diversification: evidence from the property-liability insurance industry. J Risk Insur 75:893–919

Meador JW, Ryan HE, Schellhorn CD (2000) Product Focus versus Diversification: Estimates of X-Efficiency for the US Life Insurance Industry. In: Patrck TH, Savros AZ (eds) Performance of financial institution: efficiency, innovation, regulation. Cambridge University Press, New York

Myers SC, Majluf NS (1984) Corporate financing and investment decisions when firms have information that investors do not have. J Financ Econ 13:187–221

Myers SC, Read JA (2001) Capital allocation for insurance companies. J Risk Insur 68:545–580

Noulas AG, Ray SC, Miller SM (1990) Returns to scale and input substitution for large U.S. banks. J Money Credit Bank 22:94–108

Powell LS, Sommer DW (2007) Internal versus external capital markets in the insurance industry: the role of reinsurance. J Financ Serv Res 31:173–188

Powell LS, Sommer DW, Eckles DL (2008) The role of internal capital markets in financial intermediaries: evidence from insurance groups. J Risk Insur 75:439–461

Rajan RG, Servaes H, Zingales L (2000) The cost of diversity: the diversification discount and inefficient investment. J Finance 55:35–80

Rau PR, Vermaelen T (1998) Glamour, value and the post-acquisition performance of acquiring firms. J Financ Econ 49:223–253

Roll R (1986) The hubris hypothesis of corporate takeovers. J Bus 59:197–216

Sapienza P (2002) The effects of banking mergers on loan contracts. J Finance 57:329–367

Scharfstein DS (1998) The dark side of internal capital markets II: evidence from diversified conglomerates. NBER Working Paper No. 6352

Scharfstein DS, Stein JC (2000) The dark side of internal capital markets: divisional rent-seeking and inefficient investment. J Finance 55:2537–2564

Servaes H (1996) The value of diversification during the conglomerate merger wave. J Finance 51:1201–1225

Shim J (2010) Capital-based regulation, portfolio risk and capital determination: empirical evidence from the US property-liability insurers. J Bank Financ 34:2450–2461

Shin H, Stulz RM (1998) Are internal capital markets efficient? Quarterly Journal of Economics, May, pp 531–552

Shleifer A, Vishny R (1989) Management entrenchment: the case of manager-specific investment. J Financ Econ 25:123–139

Sinkey JF, Nash RC (1993) Assessing the riskiness and profitability of credit-card banks. J Financ Serv Res 7:127–150

Stein JC (1997) Internal capital markets and the competition for corporate resources. J Finance 52:111–133

Stiroh KJ, Rumble A (2006) The dark side of diversification: the case of US financial holding companies. J Bank Finance 30:2131–2161

Teece DJ (1980) Economies of scope and the scope of the enterprise. J Econ Behav Organ 1:223–247

Weston JF (1970) The nature and significance of conglomerate firms. St John’s Law Rev 44:66–80

Acknowledgements

The author is very grateful to an anonymous referee and Haluk Unal (the editor) for insightful comments and suggestions, which have led to substantial improvements in the paper. Any remaining errors or omissions are the sole responsibility of the author.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Estimation of portfolio risk (SIGMA)

According to Cummins and Sommer (1996) and Myers and Read (2001), the insurer’s portfolio risk (SIGMA) is quantified from the respective volatility of asset returns (\( \sigma_V^2 \)) and liability returns (\( \sigma_L^2 \)) and covariance of asset and liability returns (σ VL ):\( {\hbox{SIGMA}} = \sqrt {{\sigma_V^2 + \sigma_L^2 - 2{\sigma_{VL}}}} \). The corresponding volatilities and covariance can be estimated using the following:

where \( {y_i} = {V_i}/V \)is the proportion of assets from asset type i, \( {x_i} = {L_i}/L \) is the proportion of liabilities from line i, ρ ViVj is the correlation between log asset type i and log asset type j, ρ LiLj is the correlation between log line i liabilities and log line j liabilities, ρ ViLj is the correlation between log asset type i and log line j liabilities, σ Vi is the volatility of asset type i, and σ Lj is the volatility of log line j liabilities. N(M) represents the number of asset categories (lines of insurance business).

Rights and permissions

About this article

Cite this article

Shim, J. Mergers & Acquisitions, Diversification and Performance in the U.S. Property-Liability Insurance Industry. J Financ Serv Res 39, 119–144 (2011). https://doi.org/10.1007/s10693-010-0094-3

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10693-010-0094-3