Abstract

We analyse the effects of emissions taxes set by a developing country within a two-country model, with two asymmetric downstream firms and a foreign upstream eco-industry, and under the assumption that the more efficient firm may either obtain the environmental technology from the foreign innovator, or engage in abatement effort or finally do not abate at all. A tougher climate policy may become the key driver for inducing the more efficient firm to engage in production of the abatement technology, leading also to a fall in total emissions. The impact on aggregate welfare is not clear-cut and heavily depends on firms’ heterogeneity: only if the cost asymmetry is low enough the transition to the mixed equilibrium with one licensee and the other firm exerting abatement effort would make the society better off.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Rising pollution in the developing world is undoubtedly a major concern nowadays: China became the largest greenhouse gas emitter in 2005 and still remains in this position, followed by the United States and the European Union, while Brazil and India rank fifth and eighth biggest polluters, respectively (Outlook on the Global Agenda 2015, World Economic Forum).

Yet, the “bottom up” approach, implemented through goals defined at the national level, that emerged during the negotiations leading to the Paris 2015 Climate Conference (COP 21), implies that climate policy will remain sub-global and uneven in the near future. In Paris agreement it was explicitly recognized that developed countries should have a leading role in reducing their domestic emissions, and that some degree of flexibility and technological and financial support should be guaranteed to developing countries. Helping these countries to cope with the impact of increasing greenhouse emissions and climate change is thus a key issue which also intersects with multiple international initiatives aimed at liberalizing trade for the so-called environmental goods (EGs).Footnote 1

In particular, the EU and other members of the World Trade Organization (WTO) aim at boosting international trade in these products and services that directly contribute to environmental protection by liberalising trade in EGs through negotiating an Environmental Goods Agreement (EGA).Footnote 2 Reducing barriers to trade in environmental goods and services has been on the global agenda since the launch of the WTO Doha Round: the rationale is that a successful outcome would create a double win, for trade and for the environment. This is because “the lower prices for abatement goods resulting from liberalizing trade in the sector will enhance environmental protection worldwide and benefit developing as well as developed countries” (Sinclair-Desgagnè 2008). However, the gain from trade liberalization in EGs accruing to developing countries is far from established. For instance De Melo and Solleder (2018) argue that current negotiations involve mainly high-income countries, with the exception of China and Costa Rica, and show that, in order to have real benefits, an increase in regulatory convergence and in the number of participants to the agreement would be required. In a similar vein, Zugravu-Soilita (2017) empirically assesses the total effects of trade flows in environmental goods, finding that “negative, indirect technique effects do not compensate the positive, direct scale-composition effects in the EGs’ net importing countries, with the total effect on pollution being harmful”.

During the last two decades, due to the increasing importance of the EG sector, a growing body of theoretical literature on the relationship between environmental policy and the market for abatement goods and services has appeared. The main upshot of these studies is to analyse the consequences of imperfect competitionFootnote 3 in this market for second-best emission taxes. The issue was first tackled by David and Sinclair-Desgagnè (2005), proving that the optimal pollution tax must depart from the Pigouvian rule and be set above the marginal social cost of damage, in order to compensate for the lower level of abatement induced by higher prices of EGs. Several extensions were developed (see Canton et al. 2008; David and Sinclair-Desgagnè 2010; Perino 2010; David et al. 2011; Canton et al. 2012, among the others) mainly under the assumption of a closed economy.

Framing the issue in an open economy setting, Feess and Muehlheusser (2002) first integrate the eco-industry into the theory of strategic environmental policy and challenge the conventional wisdom on ecological dumping showing that tighter environmental regulation may benefit the country where the eco-industry is located.Footnote 4 More closely related to our paper, Nimubona (2012) considers the effects of trade liberalization—leading to an exogenous reduction of EG-import tariffs—on a developing country that imports all its consumption of EGs from a monopolistic eco-industry located in a developed country. The key question addressed in this study is how lower barriers to trade in EG affect the quality of the environment in developing countries. The answer is not unequivocal, as, notwithstanding the fall in EG prices, the regulator may strategically respond by setting laxer pollution taxes with a worsening in pollution.

Other related papers are Canton (2007) and Dijkstra and Mathew (2016). In the former study, in a set-up where abatement goods are supplied in two countries (say North and South) characterized by different abilities to produce them and under perfect competition among polluting firms, the role of trade liberalization in reducing pollution is questioned. The latter work considers one domestic downstream polluting firm and two upstream firms (one domestic and one foreign) and examines the impact of liberalization on the domestic upstream firm’s R&D incentive, reaching ambiguous results. Most attention, however, was devoted to revisiting the Pigouvian tax rule taking into account both the market power of the eco-industry and international rent-shifting intents. Notably, both Canton (2007) and Nimubona (2012) conclude that, in the presence of an international eco-industry, EG-importing countries are led to set lower emission taxes—with respect to a closed-economy scenario—so to shift some rent from foreign EG suppliers.

The aim of our paper is to contribute to the above recalled debate. In particular, our aim is to answer to a complementary question with respect to Nimubona (2012), namely we wonder whether it is beneficial for a developing country, both for the environment and for the whole society, to fully rely on EGs produced abroad. To this end, we build a two-country model (a developed and a developing country) with two (heterogenous) polluting firms producing and selling in the developing country and competing à la Cournot. Given an environmental tax set in the developing country, the two firms may import all their consumption of the EG from a monopolistic innovator (firm M) located in the developed country. The licensed eco-technology enables firms to reduce pollution and thus expenditure on emissions tax. The less efficient firm, if not licensed, will continue to emit pollution. The more efficient firm, further to buying the EG from the foreign innovator, has the capability to engage in abatement effort. The foreign innovator sells its pollution abatement goods through a fixed-fee licensing contract and operates with zero production costs.

Climate policy enacted in the developing country is assumed to be exogenous; as recognized in the policy debate, the tax rate on GHG emissions is moderate. The problem is structured as a three-stage game: at the first stage the foreign innovator announces the number of available licenses. Then the two polluting firms decide whether or not to purchase the license, or—for firm 1—to engage in abatement effort. Finally, at the third stage, firm 1 and firm 2 simultaneously choose their output and abatement levels.

Our paper borrows in large part from Kim and Lee (2016), as to modelling choices. Their set-up, however, does not tackle the possibility for firms to produce in-house their abatement goods and services, is mostly framed in terms of a closed economy, and is aimed at comparing two different types of licensing contracts, fixed-fee versus auction licensing.

Besides, we adopt many of the hypotheses in Nimubona (2012) about the presence of an eco-industry owned and located in the North and selling EGs in both countries markets, being these markets segmented. Also, we share with this study the attention devoted to the consequences on environmental quality in the South of easing the access to EGs produced abroad. However Nimubona (2012) does not allow for local firms engaging in abatement effort, and assumes that the consumption good is supplied in a perfectly competitive market. The novelty of our approach is clearly acknowledged by some of the most influential scholars in this strand of literature.Footnote 5

We argue that our set-up captures some relevant features of EG supply and of their consumption in developing countries. First, there is evidence of an increasing concentration in the environmental industry, pursued also by means of mergers and acquisitions.Footnote 6 Second, due also to multiple initiatives to reduce tariffs, the demand for EGs is rapidly expanding in developing countries, whilst the domestic sector is still immature.Footnote 7 Finally, as explicitly recognized in Zhang (2011), developing countries, in the face of trade liberalization, are taking different courses: some of them—for instance South Africa—are reducing tariffs to import abatement technologies at lower cost, whilst others—e.g. India, China and Ukraine—are imposing high tariffs or local content requirements to develop local productive capacities. This justifies our attention to “mixed” configurations, where some firms become licensees while others start to develop abatement technologies by their own.

We find that, provided the cost asymmetry is not very pronounced and under moderate climate policy, the “mixed” configuration with one firm (the more efficient one) engaging in environmental innovation and the rival firm obtaining the license (henceforth E, L) represents an equilibrium for the developing country for a wide set of parameters values. As to the impact of climate policy enacted in the developing country on environmental quality, it is shown that a marginal increase in the tax rate may trigger a regime switching—from the L, N to the E, L equilibrium—accompanied by a fall in total emissions. Thus a tougher climate policy may become the key driver for inducing the more efficient firm to engage in production of the abatement technology, being also effective in terms of emissions reduction. Finally, the effects on aggregate welfare depend heavily on firms’ heterogeneity: only if the cost asymmetry between polluting firms in the developing country is low enough the transition to the E, L equilibrium would succeed in making the society better off.

Thus our study does not support global and uniform trade liberalisation for EGs. Rather it recognizes that making cleaner technologies developed abroad more easily available might be beneficial for developing countries insofar as this spurs the adoption of tighter emissions policies and the transition to an equilibrium where the more efficient firms engage in environmental innovation.

The paper unfolds as follows. Section 2 presents the model and analyses the optimal licensing strategy. Section 3 explores the effectiveness of emissions taxation under the different equilibrium configurations. Section 4 deals with some welfare implications. In Sect. 5 we discuss an extension of the model. Finally, Sect. 6 draws some conclusions.

2 The model

Let us consider a partial equilibrium model with two downstream firms, firm 1 and firm 2, and two countries. Country I and II represent respectively a developed country—or a group of nations—located in the North, and a developing country—or geographical area—located in the South. We assume that the two firms manufacture and sell the same homogeneous good in country II. Following Nimubona (2012), Dijkstra and Mathew (2016) and Greaker and Rosendahl (2008), we posit that the downstream output markets are separated in the two countries, so that firm 1 and firm 2 compete locally à la Cournot and there is no international trade for this good. When producing, both firms also generate pollution and face an exogenous environmental tax t, with \(0< t <t_I\), meaning that environmental policy is less stringent than in country I.

The inverse demand function is linear and writes as \(P=A-Q\), where \(Q= (q_{1}+q_{2})\) denotes total output and \(q_{i}\) is firm i’s output level. The duopoly is asymmetric and the two firms face a constant marginal (and unit) production cost \(c_{i}\), \(i=1,2\). For the sake of simplicity we normalize the unit production cost of firm 1 at zero; thus the production cost of firm 2 is such that \(A/2>c_{2}\geqslant c_{1}=0\).Footnote 8

In our set-up, we consider that the eco-industry, i.e. the upstream sector supplying polluting firms in abatement goods and services, is not viable for technological and/or financial reasons in the South of the world, being owned and located in the developed country (country I).Footnote 9

As common in the literature on EG supply (see e.g. Nimubona 2012; David and Sinclair-Desgagnè 2010; Perino 2010), we assume that the eco-industry is a monopoly selling an environmental good in both markets. However these markets can be seen as segmented, due to differences in local environmental regulations and standards. It is well-documented that abatement goods and services are nowadays supplied by a few firms operating in an imperfectly competitive market, characterized by significant barriers to entry in the form of high fixed costs, IPR patent protection and economies of scope (David and Sinclair-Desgagnè 2010; Perino 2010). Moreover, as argued in Nimubona (2012), “EG-exporting countries might be engaged in a number of policies aimed at promoting their exports, including actions that enhance the market power of their eco-industrial firms through contracting and subcontracting”. Since efforts for trade liberalization have at least partially succeeded in easing the access to EGs produced abroad for polluting firms in country II, we consider no tariffs nor transport costs. Henceforth we will refer to the monopolistic provider of the eco-technology as the external innovator (or firm M), namely the foreign firm able to produce abatement goods and to license its technology to one or two polluting firms by means of a fixed-fee licensing contract. Also, as in Kim and Lee (2016), we set the production cost of the external innovator to zero.Footnote 10

The licensed eco-technology enables firms to reduce pollution and consequently expenditure on emissions tax. We introduce in this basic set-up the possibility for the more efficient firm (firm 1) to engage in abatement effort. In other words, the more capable firm, instead of buying the licensed technology from the external innovator, may carry out environmental innovation and produce the eco-technology by itself, whilst the choice of the other firm is, as in Kim and Lee (2016), between buying or not the licensed technology provided by the foreign innovator. We assume that, if firm 1 provides by itself for the environmental good, its abatement function is additively separable. Thus, following Ulph (1996) and Petrakis and Xepapadeas (2003), we adopt the specification for firm 1’s cost function, when it exerts abatement effort: \(c(q_{1},a_{1})= c_{1}q_{1}+\left( \frac{a_{1}^{2}}{2}\right) \) where \(\left( \frac{a_{1}^{2}}{2}\right) \) are the environmental innovation costs. This is additively separable in production costs and environmental innovation costs and characterized by constant returns to scale in production and decreasing returns in abatement effort.

To summarize, the set of abatement options for firm 1 is given by \(S_{1}=\left\{ E,L,N\right\} \), where E stands for engaging in abatement effort, L for obtaining a license, and N for doing nothing, neither exerting effort nor buying the license. Instead, for firm 2, it is given by \(S_{2}=\left\{ L,N\right\} \).

The emission function is defined as \(e_{i} =e(q_{i},a_{i})=\frac{(q_{i}-a_{i})^{2}}{2}\), where \(i=1,2\) and \(a_{i}\) is the amount of abatement goods purchased by polluters from the innovator or produced by the firm to reduce the emissions level, with \(0\leqslant a_{i}\) \(\leqslant q_{i} \).Footnote 11 As customary in this literature, it holds that \(e_{q_{i}}(q_{i} ,a_{i})>0\), meaning that more production implies more pollution, \(e_{a_{i}}(q_{i},a_{i})<0\), so that more abatement lowers total emissions, \(e_{q_{i}q_{i}}(q_{i},a_{i})>0\), i.e. the more the firm produces, the more the last unit pollutes, and \(e_{a_{i}a_{i}}(q_{i},a_{i})>0\), i.e. there are decreasing returns in abatement. Lastly, we have that \(e_{q_{i}a_{i}}(q_{i},a_{i})<0\), i.e. the higher the abatement the lower the pollution generated by the last unit of output. The environmental damage function is assumed to be quadratic in aggregate emissions and given by: \(D(E)=dE=\sum_{i=1}^2 \frac{d}{2}(q_{i}-a_{i})^{2}\), where d is marginal environmental damage which is constant in total emissions level.

The game runs as follows: in the first stage, for a given emission tax, an eco-innovator located in country I announces the availability of a number k of licenses for a fixed-fee, f(k). In the second stage, two polluting firms located in country II simultaneously decide whether or not to purchase a license, or (for firm 1) to engage in abatement effort. In the third stage, they determine their abatement levels and choose their outputs competing a’ la Cournot. As usual, the sub-game perfect Nash equilibrium is derived through backward induction.

2.1 The scenarios with no endogenous effort

L, N case: firm 1 is licensed, firm 2 is not licensed. We briefly recap in what follows the results obtained (see Kim and Lee 2016) in a scenario where there is just one firm able to produce the environmental technology in country I. This firm (firm M) announces a number \(k=1\) of licenses and charges the same fixed fee, \(f(k)=f(1)\). Notice that, being the upstream and downstream markets in country I and in country II segmented, we proceed to solve the model only for the developing country.

The objective functions of a licensed firm and non-licensed firm are, respectively:

where \(q_{i}^{L}\) and \(q_{j}^{N}\) are the output of the licensed firm and the output of the non-licensed firm, with \(Q=q_{i}^{L}+q_{j}^{N}\), \(e_{i} ^{L}=\frac{(q_{i}^{L}-a_{i}^{L})^{2}}{2}\) and \(e_{j}^{N}=\frac{(q_{j}^{N} )^{2}}{2}\) for \(i, j=1,2\), \(i\ne j\).

When the efficient firm is the licensee, by solving the first-order conditions, we obtain that:

Notice that \(\frac{\partial \hat{a}_{1}^{L}}{\partial t}>0\). As expected, the abatement level of the licensed firm is positively correlated with the level of taxation.

The equilibrium profit of the efficient firm buying the license is then:

while the equilibrium profit of the inefficient firm that does not buy the license and pollutes is:

N, L case: firm 1 is not licensed, firm 2 is licensed. When an inefficient firm obtains a license, solving the profit maximization problem, it comes out that:

The equilibrium profits of the efficient firm are:

while, for the less efficient firm, equilibrium profits read as:

It is now possible to calculate the value of the license with \(k=1\) and no endogenous abatement effort. In order to be incentive-compatible, the fixed fee f(1) for the eco-technology has to be equal to the maximum profit difference of each licensee between the circumstances of acceptance and rejection of the licensing offer, given that the other firm is not accepting the license at Nash equilibrium. Therefore \(f_{i}(1)\) is such that \(\hat{\pi }_{i}^{L}(1)-\hat{\pi }_{i} ^{N}(0)=0\), and likewise for \(f_{j}(1)\).

For each firm the maximum willingness to pay is given by:

where \(g(A,t,c_{2})=[2At^{4}+2(7A+c_{2})t^{3}+12(3A+c_{2})t^{2}+3(13A+8c_{2} )t+15(A+c_{2})]\) and \(h(A,t,c_{2})=[2(A-c_{2})t^{4}+2(7A-8c_{2})t^{3} +12(3A+4c_{2})t^{2}+3(13A+21c_{2})t+15(A+2c_{2})]\).

Since \(f_{1}(1)>f_{2}(1)>0\) the innovator will set the fixed fee at \(f_{1}(1)=\max [f_{1}(1),f_{2}(1)]\) and sell the license to the efficient firm.

The equilibrium profits of the external innovator (firm M), due to the assumption of zero production costs, are equal to the fixed fee for the sold license, namely:

where “NO” stands for “no endogenous effort”. It is easily shown that \(\frac{\partial \pi ^M_{\mathrm{NO}}(1) }{\partial c_2}>0\) and \(\frac{\partial \pi ^M_{\mathrm{NO}}(1) }{\partial t}>0\). This means that, when the cost gap (i.e. \(c_2\)) increases, the value of the license (and therefore the external innovator profit) increases as well. As expected, an increase in the tax rate also boosts firm M’s equilibrium profits.

L, L case: firm 1 is licensed, firm 2 is licensed. If the number of licenses that the external innovator may offer is two, i.e. \(k=2\), we obtain that \(\hat{q_1}^L=\frac{A+c_2}{3}\) and \(\hat{q}_2^L=\frac{A-2c_2}{3}\).

The profits, at the equilibrium, are then:

and

In this scenario, since the external innovator wants to allocate both licenses, the value of the license has to be equal to the lower value between the willingness to pay of the two firms. The maximum willingness to pay for the more efficient firm can be obtained from \(\hat{\pi }_1^L(2)-\hat{\pi }_1^N(1)=0\); it turns out to be: \(f_1(2)=\frac{t(A+c_2)^2(8t+15)}{18(3+2t)^2}\).

The maximum willingness to pay for the less efficient firm can be derived from \(\hat{\pi }_2^L(2)-\hat{\pi }_2^N(1)=0\) and reads as follows: \(f_2(2)=\frac{t(A-2c_2)^2(8t+15)}{18(3+2t)^2}\). Since \(f_1(2)>f_2(2)\), the external innovator will set the optimal fixed fee at \(f_2(2)=\min [f_1(2),f_2(2)]\). Therefore \(\hat{\pi }_1^L(2)=(\frac{A+c_2}{3})^2-f_2(2)\) and \(\hat{\pi }_2^L(2)=(\frac{A-2c_2}{3})^2-f_2(2)\).

The equilibrium profit for the external innovator when \(k=2\) is thus:

2.2 Introducing endogenous abatement effort

Again, at the first stage of the game, the foreign innovator announces the number of available licenses k, with \(k\in \{1,2\}\). In this scenario we introduce the possibility of environmental innovation. Instead of buying the license from an external innovator or to pollute, firm 1 may exert abatement effort by developing environmentally-clean production technologies able to reduce emissions. We remind that, in our set-up, it is a prerogative of the more efficient firm to produce by itself the abatement technology.Footnote 12

E, L case: firm 1 exerts abatement effort, firm 2 is licensed. In this case, with \(k=1\), the objective function for the firm that does not buy the license and exerts abatement effort is as follows:

where the superscript “E” stands for “endogenous abatement effort”. The less efficient firm can instead buy the license since we assume that it does not have the capabilities to develop the abatement technology. The profit of a licensed firm is then:

where \(c_1=0\), \(e_i=e(q_i,a_i)=\frac{(q_i-a_i)^2}{2}\), and \(i, j =1,2, i\ne j\).

From firms’ profit maximization problem, we obtain that: \(\tilde{q}_2^L=\tilde{a}_2^L=\frac{(2t+1)A-(3t+2)c_2}{5t+3}\), \(\tilde{q}_1^E=\frac{(A+c_2)(1+t)}{5t+3}\) and \(\tilde{a}_1^E=\frac{t(A+c_2)}{5t+3}\).

Notice that, as expected, the endogenous effort of the more efficient firm is positively correlated with the tax rate. Due to the specific features of the licensed eco-technology—which allows at the equilibrium for an abatement equal to output, the effort of firm 1 (\(\tilde{a}_1^E\)) is not always higher than the environmental good level (\(\tilde{a}_2^L\)) bought by the less efficient firm; when the efficiency gap is high, the endogenous effort of the efficient firm is surely greater than the abatement of the less efficient one.Footnote 13

The resulting equilibrium profits read as follows:

E, N case: firm 1 exerts abatement effort, firm 2 is not licensed. With \(k=0\), the objective functions are:

By solving the profit maximization problem we get: \(\tilde{q}_1^E=\frac{(1+t)(A(1+t)+c_2)}{3t^2+7t+3}\), \(\tilde{q}_2^N=\frac{A(2t+1)-c_2(2+3t)}{3t^2+7t+3}\) and \(\tilde{a}_1^E=\frac{t\,\left( A(1+t)+c_{2}\right) }{3\,t^2+7\,t+3}\).

Therefore equilibrium profits are given by:

Under the assumption that firm 1 may enact environmental innovation and with \(k=1\), the value of the license has to be such that firm 1 is indifferent between buying the license—with payoff \(\hat{\pi }_1^L(1)\) as in Eq. (5)—and enacting environmental innovation, gaining \(\tilde{\pi }_1^E(0)\), as in Eq. (19). This means that \(f_1(1)\) is such that \(\hat{\pi }_1^L(1)-\tilde{\pi }_1^E(0)=0\).

The value of the license for the efficient firm is then:

where \(\Delta =[A(1+t)+c_2]\).

For the less efficient firm the cost of the license \(f_2(1)\) has to be such that \(\tilde{\pi }_2^L(1)-\tilde{\pi }_2^N(0)=0\).

The value of \(f_2(1)\) is then:

with \(\Phi =[A (1+2t)-c_{2} (2+3t)]\).

Let us define now

Carrying out the comparison between the values of the license when \(k=1\) and firm 1 may engage in environmental innovation, we can state that:

Proposition 1

With \(k=1\), and for a given t, when \(0<c_2<c_f\) the optimal fixed fee is \(f_2(1)\) and the less efficient firm obtains the license. When \(c_2>c_f\) the optimal fixed fee is \(f_1(1)\) and the more efficient firm obtains the license.

Proof

See Appendix A. \(\square \)

It can be proved (see Appendix A) that the inequality \(f_2(1)> (<)\; f_1(1)\) always holds for every value of t when \(c_2< (>)\;c_f\).

This proposition shows that, when the cost asymmetry is pronounced, the external innovator opts for an exclusive licensing contract with the more efficient firm, and vice versa, when it is low, firm 2 is the licensee. This is due to the fact that a high \(c_{2}\) depresses output and thus consumption of the environmental good by the less efficient firm, thereby making licensing to this firm less attractive. Conversely, a pronounced cost asymmetry boosts both production and willingness to pay for the license by firm 1. Besides, it is interesting to point out that \(c_f\) is positively related with t meaning that a stringent environmental policy (i.e. a quite high tax rate) will stimulate the efficient firm to perform environmental innovation.

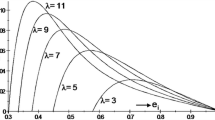

As Fig. 1 highlights, in the area below \(c_f\), the foreign innovator (firm M) sets the license price at the maximum possible price \(f_2(1)\), and the less efficient firm obtains the license. Hence, when \(k=1\) and \(c_2<c_f\) the equilibrium configuration E, L may occur, where the less efficient firm buys the license (L) while the efficient one is engaged in environmental innovation (E).

When \(k=1\) and \(c_2>c_f\) the equilibrium configuration is given by L, N, where no effort arises, the more efficient firm buys the license and the other does abate at all. This is not the preferred outcome if the government goal in the developing country is to induce innovation by local firms.

The equilibrium profit of the external innovator (firm M) is either

or

where “end” stands for “endogenous effort”.

2.3 Value of the license with endogenous effort and \(k=2\)

The hypothesis of endogenous effort plays an important role when we analyse the license value with \(k=2\), because, differently from the set-up in Kim and Lee (2016), the efficient firm faces a choice between buying the license from the external provider or performing environmental innovation and producing the environmental good by itself.Footnote 14 As usual, each firm’s maximum willingness to pay for the license has to respect the incentive compatibility constraint, which is modified accordingly.

Thus, for the efficient firm, the value of \(f_1(2)\) has to be such that \(\hat{\pi }_1^L(2)-\tilde{\pi }_1^E(1)=0\) where \(\hat{\pi }_1^L(2)\) is as in Eq. (12) and \(\tilde{\pi }_1^E(1)\) is as in Eq. (17). Therefore:

Likewise, for the less efficient firm, \(f_2(2)\) has to be such that \(\hat{\pi }_2^L(2)-\tilde{\pi }_2^N(0)=0\) where \(\hat{\pi }_2^L(2)\) is as in Eq. (13) and \(\tilde{\pi }_2^N(0)\) is as in Eq. (20).

Thus:

with \(\Phi =[A (1+2t)-c_{2} (2+3t)]\).

Proposition 2

With \({k}=2\) the optimal fixed fee is \(f_2(2)\) and both firms obtain the license.

Proof

See Appendix B. \(\square \)

As shown in Appendix B, it can be proved that \(f_1(2)>f_2(2)\) for feasible values of the tax rate t. In order to sell both licenses, the external innovator will set the license price equal to \(min\{f_1(2),f_2(2)\}=f_2(2)\). The external innovator profit is thus \(\pi ^M(2)=2\, min \{f_2(2),f_1(2)\}=2f_2(2)\) since it sells two licenses at fee \(f_2(2)\) having no production costs.

Carrying out some comparative statics, it turns out that \(\frac{\partial \pi ^M(2)}{\partial t}>0\). This means that a tougher environmental policy spurs the external innovator profits because the licensees will increase their willingness to pay to reduce their tax burden. Also, \(\frac{\partial \pi ^M(2)}{\partial c_2}>0\), implying that the higher is the efficiency gap, the better off is the external innovator.

Moreover, it is possible to show that:

Proposition 3

The profit of the foreign innovator when the efficient firm may exert abatement effort is lower than in the case when he is the only innovator.

Proof

See Appendix C. \(\square \)

Comparing both \(\pi _{\mathrm{end}}^M(1)=f_2(1)\) and \(\pi _{\mathrm{end}}^M(1)=f_1(1)\) with \(\pi _{\mathrm{NO}}^M(1)\) from Eq. (11), we get that the external innovator can extract more value when the efficient firm does not have the capability to develop environmental innovation. The same conclusion holds if one compares \(\pi ^M(2)=2f_2(2)\) with \(\pi ^M_{\mathrm{NO}}(2)\) from Eq. (14). This means that, in the absence of other options, the maximum willingness to pay for the license by local firms is greater, thus boosting firm M’s profits.

2.4 Optimal licensing strategy

At the first stage of the game the external innovator announces the number of licenses he will provide. In order to make this decision the foreign producer of the eco-technology compares the equilibrium profits for \(k=1\) and \(k=2\), depending also on the cost asymmetry between the two polluting firms. It comes out that:

Proposition 4

If \(0\le c_2<c_h\), then \(\pi ^M(2)>\pi ^M(1)\) and firm M will provide two licenses. If \(c_2>c_h\), then \(\pi ^M(2)<\pi ^M(1)\) and he will provide only one license to the inefficient firm.

Proof

See Appendix D. \(\square \)

Moreover,

Proposition 5

If \(0\le c_2<c_g\), the external innovator prefers to sell two licenses w.r.t licensing to the efficient firm, whereas, when \(c_2>c_g\) he prefers to sell one license to the more efficient firm.

Proof

See Appendix D. \(\square \)

As shown in Appendix D, for a reasonable range of values of the tax rate t, we are allowed to consider a threshold ranking such that \(0<c_h<c_g<c_f\), as depicted in Fig. 2.Footnote 15 Hence, for a given t, and combining the results in the two Propositions here above, the equilibrium licensing strategies are as follows:

-

if \(c_2\) is above the threshold \(c_f\) the external innovator does not have the incentive to provide two licenses since he can extract more profit by selling only one license to the efficient firm. He will therefore optimally set the number of licenses equal to one (\(k=1\)). The equilibrium configuration is thus L, N where firm 1 buys the license and firm 2 does not abate at all;

-

when \(c_h<c_2<c_f\), the external innovator sets the number of licenses equal to one (\(k=1\)) and the efficient firm will engage in abatement effort. Instead, the less efficient firm will buy the license at the price specified in Eq. (21). The equilibrium configuration arising in this case is E, L;

-

finally, when \(c_2\) is below the threshold \(c_h\), the external innovator will sell two licenses and the equilibrium configuration L, L occurs, where both firms are licensees.

The equilibrium regions are summarized in Fig. 2, according to the degree of cost asymmetry between the two firms (\(c_2\)) and to the stringency of environmental policy set in the developing country.

Notice that in our set-up, provided the cost asymmetry is not very high, there is always room for an equilibrium where a firm exerts effort and produces by itself the environmental good, namely the E, L case. In other words, if a firm may engage in environmental innovation, the equilibrium with \(k=2\) is less likely to occur, as compared to a set-up where firms’ options are restricted to being a licensee or do not abate at all. This is because a “mixed” equilibrium arises for \(c_h< c_2< c_f\), in contrast with the results in Kim and Lee (2016), where, below a certain threshold value for \(c_2\), the innovator’s optimal strategy is to provide two licenses (\(k=2\)). Notice also that the likelihood of the E, L equilibrium is enhanced under moderate climate policy, a condition very common in developing economies.

3 Licensing strategies and total emissions

In this section we carry out a comparison of total emission levels under the different scenarios. Our aim in so doing is to assess the environmental effectiveness of mitigation measures, assuming that pollution is not transboundary.Footnote 16 We remind that the emission function we employ is defined as: \(e_i=e(q_i,a_i)=\frac{(q_i-a_i)^2}{2}\) where \(i=1,2\). Thus total emissions level is given by \(E=e_1+e_2\).

L, N case, \(k=1\). When firm 1 is the licensee and firm 2 is not (L, N case), we obtain that total emissions are as follows:

Notice that this scenario represents the equilibrium outcome (see Sect. 2.4) when \(c_2>c_f\).

E, N case, \(k=0\). In this scenario, i.e. when firm 1 exerts abatement effort and firm 2 does not buy the license, total emissions are given by:

E, L case, \(k=1\). In this scenario firm 1 performs environmental innovation and firm 2 is the licensee. Thus total emissions read as:

We remind that this case represents an equilibrium whenever \(c_h<c_2<c_f\).

L, L case, \(k=2\). When \(k=2\) both firms buy the license. Therefore \(e_1^L=0\), \(e_2^L=0\), and total emissions are null. This is an equilibrium outcome when \(c_2< c_h\).

E, E case, \(k=0\). For the sake of comparison, we also solved the model under the hypothesis that, ceteris paribus, both firms engage in abatement effort. Therefore the emissions by firm 1 and by firm 2 are given, respectively, by:

and total emissions are then:

N, N case, \(k=0\). Finally a scenario which could be of some interest, representing a sort of benchmark, is when both firms do not buy the license nor carry out environmental innovation. At the equilibrium, their emissions are:

Thus total emissions read as:

Considering the three different scenarios occurring at the equilibrium, it is immediate to find out that the L, L configuration dominates over all other cases in terms of minimizing total emissions.Footnote 17 Moreover, it is possible to show that:

Proposition 6

If \(t>(3c_{2})/(A-4c_{2})>0\), then total emissions under the E, L scenario are lower than under the L, N case.

Proof

Straightforward. First consider that \(E_\text {L,N}-E_{\mathrm{E,L}}\) is an increasing and concave function of t. This is solved for \(t_{1}=((3c_{2})/(A-4c_{2}))\) and for \(t_{2}=(-3(2A-c_{2})/(7A-8c_{2}))\), with \(t_{2}<0\) and \(t_{1}>0\) for \(A>4c_{2}>0\). \(\square \)

Interestingly, the function \(E_\text {L,N}-E_{\mathrm{E,L}}\) increases in A, for \(A>4c_{2}>0\), meaning that the superior performance of the E, L configuration, in terms of leading to lower emissions, is magnified as market size in country II increases.

While Figs. 3 and 4 illustrate the relationship between total emissions and the tax rate in all possible scenarios (and for “sufficiently low” and “quite high” values of \(c_{2}\), respectively), Figs. 5 and 6 focus on equilibrium scenarios (again, for “sufficiently low” and “quite high” values of \(c_{2}\)).

For low levels of the tax rate, irrespective of the cost asymmetry, the total emission level is minimized, but for the L, L configuration, when the efficient firm is the licensee and the inefficient firm does not abate at all (L, N scenario). However, for intermediate values of t, the mixed equilibrium E, L yields the lowest level of emissions, performing better than the case where both firms carry out environmental innovation. Notice that only when the tax rate is high enough, the scenario where both firms exert abatement effort would lead to an overall level of emissions comparable with the L, N case (but still higher with respect to the E, L scenario). Nevertheless, when t reaches that level, the equilibrium outcome would be represented by the L, L configuration.

From the assessment of total emissions, it turns out that increasing the tax rate may bring about a regime switching—from the L, N to the E, L equilibrium configuration—associated with a reduction in overall emissions. The threshold value of t leading to a regime switching is higher the greater is the cost heterogeneity among firms: when \(c_2\) becomes particularly high the economy might be “trapped” in the L, N equilibrium configuration with a suboptimal emissions level. In other words, a tougher climate policy may become the key driver for inducing the more efficient firm to engage in production of the abatement technology, being also effective in terms of emissions reduction.

This result somehow mimics well-established findings from the empirical literature about the relevant role played by regulation and environmental policy for the diffusion of climate change-mitigation technologies. Notably, since 1990 environmental policies have accelerated the pace of innovation and technology transfer by creating a market for environmentally-sound technologies (Dechezleprêtre et al. 2011). At the same time, and interestingly for our work, the availability of new technologies (and thus the increasing integration of the international technology space) seems to have affected the regulation decision of non-innovative countries, accelerating the adoption of more stringent measures in developing countries. Evidence of this virtuous circle is documented by Lovely and Popp (2011).

Through the lenses of our model, easing the access to EGs produced abroad for developing countries would be beneficial insofar as it spurs the adoption of tighter emissions policies, thus bringing about a regime switching, from the L, N to the E, L equilibrium configuration.

4 Some considerations on welfare

In this section we propose a comparison of the welfare properties of the different possible scenarios, with the aim of providing some policy implications.Footnote 18 Again, we examine all the scenarios, even the cases that are not equilibrium configurations, in order to obtain an exhaustive picture. However, we will pay a particular attention to the equilibrium configurations, depending on the degree of local firms’ heterogeneity.

L, N case, \(k=1\). When \(k=1\), and the efficient firm is the licensee while the other firm does not buy the license, the total welfare function is given by:

E, L case, \(k=1\). In this case the foreign innovator provides the license only to the less efficient firm while the other performs environmental innovation. Thus total welfare reads as:

L, L case, \(k=2\). When \(k=2\) and an external innovator provides the license to both firms, total welfare is as follows:

For the sake of comparison we consider also:

E, E case, \(k=0\). This is the case with \(k=0\), where both firms exert abatement effort. Total welfare is given by:

N, N case, \(k=0\). Finally, when \(k=0\), and both firms do nothing, neither buy the license or exert effort, the welfare function is:

The highly non-linear nature of the aggregate welfare measures, evaluated at equilibrium quantities and abatement levels, prevents us from obtaining general results. Therefore, the analysis of the welfare properties of the different configurations is carried out by means of numerical methods. We argue that this methodology does not unduly restrict the significance of our analysis.

For a quite low level of \(c_2\) (see Fig. 7), and for a moderate level of taxation, the equilibrium configurations are given by L, N and E, L, depending on the tax rate. In this scenario, switching from the equilibrium where firm 1 is the licensee and the other firm does not abate at all (L, N ) to the mixed equilibrium where the efficient firm exerts effort and the less efficient one gets the license (E, L) brings about also an increase in aggregate welfare. However, as the figure highlights, under tougher climate policy (i.e. higher t), inducing both firms to engage in the production of environmental goods (i.e. the E, E scenario) would make the society better off.

On the other hand, when the cost asymmetry is more pronounced, namely for a higher value of \(c_2\) (see Fig. 8), it turns out that switching from the L, N equilibrium to the configuration with endogenous effort (E, L) would imply a decrease in aggregate welfare. More precisely, there exists a range of t values such that having any configuration with at least one licensee or a duopoly with both firms producing their environmental technology would deliver more welfare with respect to the E, L configuration. This finding might be due to the particular emissions technology function, which allows firms to abate all their emissions when they are licensees, coupled with the positive correlation in the E, L case between abatement costs born by firm 1 and the cost asymmetry parameter, while the less efficient firm pays a license fee increasing in \(c_2\).

It is noteworthy to mention that in both cases, either with low or with high cost asymmetry, the configuration with \(k=2\) (L, L) delivers the highest level of aggregate welfare. Nevertheless, if the heterogeneity is quite pronounced, switching to the L, L equilibrium would require a tight emissions taxation regime, a condition uncommon (and suboptimal) in developing countries.

Moreover, as \(c_2\) increases, the economy might be “trapped” in the L, N equilibrium configuration. In this last case, as shown in Fig. 9, the level of aggregate welfare is always suboptimal, regardless of the tax rate value.

5 Intellectual property rights regimes: discussion of results

Introducing endogenous abatement effort can be interpreted as allowing the efficient firm in the developing country to imitate a patented technology developed abroad (i.e. in country I), due to a regime of weak patent protection or to patenting of the eco-technology only in the developed country.Footnote 19 To explore this, one can consider a game where at the first stage the regime of IPR protection is chosen in country II, being the strategy set for the government in the developing country given by \(S= \{W, ST \}\), namely Weak or Strong. Thus, under the Weak regime, the more efficient firm is able to engage in abatement effort through costly imitation of the technology owned by the foreign innovator. On the other hand, if the Strong regime is in place, i.e. when patent protection is strong (or the technology is patented in both countries), both polluting firms cannot develop the technology by their own and—as in Sect. 2.1—can either buy the license or do not abate at all.

As a matter of fact, Kim and Lee (2016) solve for the subgame perfect Nash equilibrium when the Strong regime is in place , while in our model (in Sect. 2.2 et seq.) we derive equilibrium strategies for the subgame under the Weak IPR regime. In particular, for the former subgame, it is found that the external innovator licenses to both firms (only to the efficient firm) if \(c_2\le c_f (c_2>c_f)\) or for t small enough (greater than \(t_f\)) (see Kim and Lee 2016, Proposition 1).Footnote 20 For the latter subgame (Weak) we remind that the equilibria are represented by N, L, or E, L or finally L, L, according to the values of the parameter \(c_2\) and to the tax rate (see Propositions 4 and 5 here above and Fig. 2).

Notice that, as shown in Proposition 3, all the strategies in the subgame with endogenous abatement effort are dominated by the strategies in subgame with strong IPR protection, i.e. when firm M is the only innovator. Thus, if the foreign innovator could influence the choice of the IPR regime, he would strictly prefer, as expected, strong patent protection in both countries, in order to discourage imitation.

Regarding the effects on total emissions, we found that, for a low degree of cost asymmetry (say \(c_2=2\)), having strong IPR protection would lead to a “regime switch”—from L, L to L, N equilibrium—accompanied by a worsening in environmental quality for \(t>1.6\), as compared with the regime allowing for imitation.Footnote 21 Yet, for a higher degree of cost asymmetry (e.g. with \(c_2=3.5\)), the equilibrium would be given by N, L, \(\forall t\), with an increase in total emissions for \(t>0.5\), with respect to the alternative regime.Footnote 22

We then performed numerical simulations, following the approach in Sect. 4, with the aim of comparing the welfare properties of the two subgames at hand, in the case with imitation by the efficient firm, and in the scenario with strong patent protection. Notably, we considered, for the subgame with Strong IPR protection, the following equilibrium welfare functions:

where \(f_{1}(1)\) is as in Eq. (9), and

with \(f_{2}(2) = \frac{t(A-2c_2)^2(8t+15)}{18(3+2t)^2}\) (see Sect. 2.1). As to the subgame with Weak patent protection, we took into account \(W_\text {L,N}(1)\) from Eq. (32), \(W_{\mathrm{E,L}}(1)\) as in Eq. (33) and \(W_\text {L,L}(2)\) as in Eq. (34).

For any degree of cost asymmetry, we found that, reasonably, letting strong patent protection is never the preferred choice for the government in country II.Footnote 23 The rationale for this result could be due to the higher willingness to pay for the abatement technology in the subgame with strong IPR protection, which boosts firm M’s profits accruing to the developed country and consequently depresses welfare in country II.

6 Main conclusions

We contribute to the debate on trade liberalization for abatement goods and services by comparing different equilibrium configurations occurring in a developing country, one of them involving also domestic production of the abatement technology.

With this aim in mind, we developed a two-country model with two downstream firms and one upstream eco-sector, which is consistent with several stylized facts about environmental goods provision and consumption in developing countries. We obtain that fully relying on EGs supplied by an external foreign innovator is not always desirable if policy makers in the developing country want to promote environmental quality and enhance social welfare.

Under rather general conditions, increasing the emissions tax rate and switching from the N, L to the E, L equilibrium would lead to a fall in total emissions. Hence there is scope for climate policy to become a driver for in-house production of the abatement technology by the more efficient firms, being also effective in terms of emissions reduction. In other words, efforts for trade liberalization in EGs could imply—making the abatement technology more easily available and inducing a more stringent emissions taxation—the transition to an equilibrium where some local firms in developing countries engage in environmental innovation with an improvement in environmental quality.

Nevertheless, the effects on aggregate welfare are not clear-cut, as they heavily depend on firms’ heterogeneity: only if the cost asymmetry is low enough the transition to the E, L equilibrium would make the society better off. Thus one should carefully consider the specific industrial structure of a developing country before embarking in policy prescriptions.

In our view, the paper also sheds light on the importance of additional conditions affecting over time the outcome of trade-liberalization efforts, notably market size, learning-by-doing processes resulting in firms’ costs diminishing over time and technological spillovers enhancing the transfer of knowledge across firms. On this regard, an interesting case is represented by Chile, as reported in Sauvage (2014), where a relatively open trade and foreign investment regime along with a commitment to environmental protection have been in place since the second half of the 1990s. This induced foreign firms in the EG sector to invest and open local subsidiaries, including partnerships with Chilean firms. The country initially experienced an increase in imports of abatement technologies and higher FDI inflows. But over time this stimulated production of EGs by local firms, which succeeded in accumulating know-how and expertise, so that nowadays Chile is a regional hub for Latin America and a regional leader in the provision of these goods and services.

To conclude, we are aware of the simplifying hypotheses adopted in our study, in particular the fact that the contract for the licensed technology always involves a fixed fee. A more careful modelling of the foreign market for imported EGs, introducing monopolistic competition (for instance a dominant firm along with a competitive fringe) would enrich the analysis. Moreover, we focussed on the impact of climate policy assuming an exogenous tax rate. Needless to say, the model should be extended endogenizing environmental policy. Besides, it would be interesting to hypothesize the presence of foreign subsidiaries producing EGs in the developing country and interacting through knowledge spillovers with local firms. These issues are left for future research.

Notes

The OECD/Eurostat Informal Working Group on the Environment Industry developed at the end of the 1990’s a widely-shared definition and classification for the environmental goods industry. According to this, “the environment industry consists of activities which produce goods and services to measure, prevent, limit, minimize or correct environmental damage to water, air, and soil, as well as problems related to waste, noise and eco-systems” (Organization for Economic Cooperation and Development/Eurostat 1999). It is well-documented that pollution abatement accounts for most of the industry income. In the same decade the European Commission recognized the role of this industrial sector, emphasising how “the development of a strong environmental goods and services industry can make a major contribution to enabling enterprises to better integrate cleaner technologies and environmental practices in production and more generally improve environmental performance” (Communication from the Commission on Environment and Employment, Building a Sustainable Europe, COM(97)592 final).

Since July 2014, a group of WTO members launched plurilateral negotiations for the establishment of the EGA, with the aim of eliminating tariffs on selected environmental goods. Since then, the number of participants has grown, with currently 46 WTO members. From 2014 to 2016, intensive negotiations and discussions were carried out, resulting in a “landing zone” of 304 products. Yet, progress on reaching an agreement since then has stalled and participation of developing countries in these plurilateral initiatives was limited. At the regional level, a noteworthy initiative is the APEC Agreement on Environmental Goods, which aims to voluntarily reduce applied tariffs on 54 product categories of environmental goods, representing so far the most concrete trade liberalization commitment among a large group of countries (UNEP 2018).

Data and stylized facts indicate clearly that abatement goods and services are delivered by a monopoly or by a Cournot oligopoly or finally by a monopolistic competitive market structure.

Feess and Muehlheusser (2002) consider an international duopoly with one firm in each country selling on a third market, and introduce an eco-firm in the home country (say the North) supplying both downstream firms at an exogenous price.

Notably, David and Sinclair-Desgagnè (2010) close their paper by claiming that “Studying the consequences of other relevant and more complex industry structures, however, (with asymmetric environment firms or polluters also able to make their own abatement goods, notably) will require additional research”.

Global trade in selected environmental goods increased from USD 0.9 trillion in 2006 to its peak of USD 1.6 trillion in 2014, with developing countries accounting for a small, but increasing, portion of the global imports of EGs (UNEP 2018). According to a report by the International Trade Center, market size is already substantial in developed countries, while growth rates are particularly high for developing countries in Asia, the Middle East and Africa (see http://www.intracen.org/publication/Trade-in-environmental-goods-and-services-Opportunities-and-challenges/).

This condition guarantees interior solutions for output and abatement effort at the equilibrium.

The environmental goods and services sector is sometimes called eco-industry or environmental industry. According to the definition proposed by OECD and by the Statistical Office of the European Commission (Eurostat), “The environment industry consists of activities which produce goods and services to measure, prevent, limit, minimize or correct environmental damage to water, air, and soil, as well as problems related to waste, noise and eco-systems. These include cleaner technologies, products and services which reduce environmental risk and minimize pollution and resource use” (Organization for Economic Cooperation and Development/Eurostat 1999). It is widely recognized that pollution abatement accounts for most of the industry income. For an in-depth analysis of the sector and its evolution over time see Sinclair-Desgagnè (2008) and Eurostat (2016).

On this point Kim and Lee (2016) prove that fixed-fee licensing is preferred to royalty licensing when the innovator’s production cost is either zero or sufficiently small. This finding can be seen as a justification of our assumption.

This formulation follows Canton et al. (2012) and Kim and Lee (2016). Notice that many studies considering EG provision (see, e.g., David and Sinclair-Desgagnè 2005, 2010; Canton 2007; David et al. 2011) employ an additively separable emission function, implicitly assuming that firms carry out just end-of-pipe pollution abatement. Introducing a more general emission function—as in Greaker and Rosendahl (2008)—allows to include in the analysis additional segments of the eco-industry.

If \(A>4c_2\), then \({\tilde a}_1^{E}<{\tilde a}_2^{L}\), \(\forall t\). If \(2c_2<A<4c_2\), \({\tilde a}_1^{E}> {\tilde a}_2^{L}\) for \(t>\frac{A-c_2}{4c_2-A}\ge \frac{1}{2}\).

Notice that the N, L configuration is dominated by the L, N one, as shown in Sect. 2.1. Therefore, also the E, L equilibrium is strictly preferred to the N, L one. Accordingly, we neglect this scenario in what follows.

Assuming that the tax rate on emissions is moderate is coherent with stylized facts about developing countries, as recognized in the policy debate. Moreover, the theoretical literature suggests that, in the presence of abatement technology trade, the tax rate that maximizes domestic welfare in country II should be lower than marginal damage.

As claimed in Nimubona (2012), considering transboundary pollution with asymmetric countries would make the analysis cumbersome. We foresee that, under this hypothesis, regulators in both countries should coordinate their efforts to deal with inefficiencies due to the presence of the the eco-industry. The issue of pollution leakage is tackled in Canton (2008), assuming that polluting firms are price-takers, countries are symmetric, and taxes are imposed also on the eco-industry.

In this equilibrium configuration emissions are zero, which is mainly driven by the emission function we employ. With a different specification, the utterly superior performance of the licensed technology would be mitigated.

The full analytical expressions for equilibrium welfare functions are not reported here below for lack of space. They are available from the authors upon request.

We are indebted to an anonymous referee for suggesting this point.

We found that the threshold \(c_f\) is a decreasing convex function of t, such that for \(c_2\) and/or t small, the equilibrium configuration is given by L, L, and vice versa for \(c_2\) and/or t high enough, the equilibrium strategies are L, N.

Analytical results and numerical simulations are available from the authors upon request.

In order to guarantee feasible values of \(c_h\) we consider only the solution with the minus.

References

Canton, J. (2007). Environmental taxation and international eco-industries. FEEM Working Paper No. 26-2007, Fondazione Eni Enrico Mattei (FEEM), Milano.

Canton, J. (2008). Redealing the cards: How an eco-industry modifies the political economy of environmental taxes. Resource and Energy Economics, 30, 295–315.

Canton, J., David, M., & Sinclair-Desgagnè, B. (2012). Environmental regulation and horizontal mergers in the eco-industry. Strategic Behaviour and the Environment, 2, 107–132.

Canton, J., Soubeyran, A., & Stahn, H. (2008). Environmental taxation and vertical cournot oligopolies: How eco-industries matter. Environment and Resource Economics, 40, 369–382.

David, M., Nimubona, A., & Sinclair-Desgagnè, B. (2011). Emission taxes and the market for abatement goods and services. Resource & Energy Economics, 33, 179–191.

David, M., & Sinclair-Desgagnè, B. (2005). Environmental regulation and the eco-industry. Journal of Regulatory Economics, 28, 141–155.

David, M., & Sinclair-Desgagnè, B. (2010). Pollution abatement subsidies and the eco-industry. Environmental & Resource Economics, 45, 271–282.

De Melo, J., & Solleder, J.-M. (2018). Barriers to trade in environmental goods: How important they are and what should developing countries expect from their removal. CEPR Discussion Paper No. DP13320.

Dechezleprêtre, A., Glachant, M., Hascic, I., Johnstone, N., & Ménière, Y. (2011). Invention and transfer of climate change mitigation technologies: A global analysis. Review of Environmental Economics and Policy, 5, 109–30.

Dijkstra, B. R., & Mathew, A. J. (2016). Liberalizing trade in environmental goods and services. Environmental Economics and Policy Studies, 18(4), 499–526.

EUROSTAT (2016) Environmental goods and services sector accounts—Handbook. Publications Office of the European Union, Luxembourg.

Feess, E., & Muehlheusser, G. (2002). Strategic environmental policy, clean technologies and the learning curve. Environmental and Resource Economics, 23, 149–166.

Forslid, R., Okubo, T., & Ulltveit-Moe, K.H. (2011) International trade, CO\(_2\) emissions and heterogeneous firms. In CEPR Discussion Paper No. DP8583.

Forslid, R., Okubo, T., & Ulltveit-Moe, K. H. (2018). Why are firms that export cleaner? International trade, abatement and environmental emissions. Journal of Environmental Economics and Management, 25, 166–183.

Greaker, M., & Rosendahl, K. E. (2008). Environmental policy with upstream pollution abatement technology firms. Journal of Environmental Economics and Management, 56, 246–259.

Kim, S. L., & Lee, S. (2016). The licensing of eco-technology under emission taxation: Fixed fee vs. auction. International Review of Economics and Finance, 45, 343–357.

Lovely, M., & Popp, D. (2011). Trade, technology, and the environment: Does access to technology promote environmental regulation? Journal of Environmental Economics and Management, 61(1), 16–35.

Nimubona, A. (2012). Pollution policy and trade liberalization of environmental goods. Environmental & Resource Economics, 53, 323–346.

OECD/Eurostat. (1999). The environmental goods and services industry: Manual for data collection and analysis. Paris: OECD Publishing.

Petrakis, E., & Xepapadeas, A. (2003). Location decisions of a polluting firm and the time consistency of environmental policy. Resource and Energy Economics, 25, 197–214.

Sauvage, J. (2014). The stringency of environmental regulations and trade in environmental goods. In OECD Trade and Environment Working Papers.

Sinclair-Desgagnè, B. O. (2008). The environmental goods and services industry. International Review of Environmental and Resource Economics, 2(1), 69–99.

Ulph, A. (1996). Environmental policy and international trade when governments and producers act strategically. Journal of Environmental Economics and Management, 30, 265–281.

UNEP (United Nations Environment Programme). (2018). Trade in environmentally sound technologies: Implications for developing countries.

Zhang, Z. X. (2011). Trade in environmental goods, with focus on climate-friendly goods and technologies. FEEM Working Paper No. 77.2011. Available at SSRN: https://ssrn.com/abstract=1962527 or https://doi.org/10.2139/ssrn.1962527.

Zugravu-Soilita, N. (2017). Trade in environmental goods: Empirical exploration of direct and indirect effects on pollution by country’s trade status. FEEM Working Paper No. 056.2017, Fondazione Eni Enrico Mattei (FEEM), Milano.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We wish to thank the editor, two anonymous referees, Gianluca Iannucci and Edilio Valentini for their valuable suggestions and comments. The usual disclaimer applies.

Appendices

Appendix A

Let \(\vartheta\) be the difference between the value of the two licenses, \(f_1(1)\) and \(f_2(2)\)

We want to assess whether \(\gamma >0\). Solving \(\gamma \) w.r.t \(c_2\) we obtain two different solutions of \(c_2\), say \(c_f (-)\) and \(c_f (+)\).

where \(\sigma =\sqrt{\left( 3\,t+5\right) \,\left( 2\,t^2+6\,t+3\right) \,\left( 18\,t^3+59\,t^2+54\,t+15\right) }\). Let us label \(c_f (-)\) the solution with the minus and \(c_f (+)\) the solution with the plus. In our work we focus only on \(c_f (-)\) as it implies feasible values of \(c_2\). In particular the solution \(c_f (+)\) does not satisfy the condition \(c_2<A/2\). In the interval within \(c_f (-)\) and \(c_f (+)\) we have that \(\gamma >0\), and then \(f_1(1)>f_2(1)\), while below \(c_f (-)\) and above \(c_f (+)\) we have that \(f_2(1)>f_1(2)\).

Appendix B

We want to prove that \(f_1(2)>f_2(2)\). We define \(\gamma =f_1(2)-f_2(2)\), that is:

We want to demonstrate that \(\gamma > 0\), \(\forall t\). Knowing that \(\frac{A}{2} > c_2\), we can substitute in the above equation \(A=2c_2\) obtaining that:

It is easily found that Eq. (40) is always strictly positive. Moreover \(\gamma (A,t,c_2)>0\) for feasible parameter values: a sufficient condition for this condition to hold is that \(0<t<c_2\).

Appendix C

Let \(\lambda \) be the difference between \(\pi _{\mathrm{NO}}^M(1)\) in Eq. (11) and \(\pi _{\mathrm{end}}^M(1)\) in Eq. (24). By assumption we have that \(\frac{A}{2} > c_2\). If we minorate the function \(\lambda \) substituting \(\frac{A}{2}\) with \(c_2\), we obtain the expression:

where \(\Gamma = 2 (5t+3)^2(3t^2+7t+3)^2 (3+t)^2(1+t)^2\). This expression is strictly positive provided \(t>0\) and \(c_2>0\). It is easily found that \(\frac{\partial \lambda }{\partial A} >0\). Thus it always holds that \(\lambda > 0\).

Besides, let \(\theta \) be the difference between \(\pi _{\mathrm{NO}}^M(1)\) in Eq. (11) and \(\pi _{\mathrm{end}}^M(1)\) in Eq. (25). By simple calculations, we have that:

which is clearly strictly positive. Finally, letting \(\epsilon =\pi ^M_{\mathrm{NO}}(2)- \pi ^M (2)\), where \(\pi ^M(2)= 2 f_2 (2)\) and \(f_2 (2)\) is as in Eq. (26), we obtain that

Substituting for \(A=2 c_2\), the numerator in \(\epsilon \) boils down into \(t c_2(2t+3)> 0 \). Since \(\epsilon \) is clearly increasing in A, the result follows, i.e. \(\epsilon >0\), provided \(t>0\) and \(c_2>0\).

Appendix D

For the sake of exposition, when \(k=1\), we refer to the case with \(0\le c_2<c_f\), where the E, L equilibrium configuration arises, as to “Scenario A”. Likewise, when \(c_2>c_f\), i.e. the equilibrium configuration without endogenous effort (L, N) may occur, we refer to “Scenario B”. In Scenario A, where the case E, L may arise, we have that \(\pi ^{M}(2) = \pi ^{M}(1)\), with \(\pi ^{M}(1) = \pi _{\mathrm{end}}^{M}(1)\) as in Eq. (24), for a value of \(c_2\), say \(c_h\), with:

where \(\Gamma=\sqrt{8\,t^4+\frac{436\,t^3}{9}+\frac{856\,t^2}{9}+68\,t+16}\) and \( \Delta=2142\,t^5+10347\,t^4+18502\,t^3+15579\,t^2+6264\,t+972\). It is easily shown that, if \(0\le c_2<c_h\), then \(\pi ^{M}(2)-\pi ^{M}(1)>0\) and the innovator will provide two licenses (L, L case). If \(c_2>c_h\) then \(\pi ^{M}(2)-\pi ^{M}(1)<0\) and he will provide only one license (E, L case).Footnote 24

In Scenario B, when the efficient firm buys the license (L, N case), we have that \(\pi ^{M}(2)=\pi ^{M}(1)\), with \(\pi ^{M}(1) = \pi _{\mathrm{end}}^{M}(1)\) in Eq. (25), for \(c_2=c_g\) with

where \( \Gamma=\sqrt{\frac{32\,t^4}{3}+\frac{220\,t^3}{3}+\frac{1624\,t^2}{9}+186\,t+66}\) and \( \Delta=576\,t^5+3768\,t^4+9490\,t^3+11394\,t^2+6453\,t+1377\). Moreover, \(\pi ^{M}(2)>\pi ^{M}(1)\) when \(0\le c_2<c_g\), and then the external innovator sells two licenses. On the other hand, \(\pi ^{M}(2)<\pi ^{M}(1)\) when \(c_2>c_g\), and he will sell only one license to the more efficient firm.

Regarding the ranking between \(c_f\), \(c_g\) and \(c_h\), evaluating \(c_f(A,t)\), \(c_h(A,t)\) and \(c_g(A,t)\) for \(t=0\), and for a given value of A, we obtain that \(c_f(\bar{A},0)>c_g(\bar{A},0)>c_h(\bar{A},0)\), with \(c_f(A,0)=0\), \(\forall A\), and \(c_h(\bar{A},0)< c_g(\bar{A},0)<0\). Also \(c_h(A,0)\) and \(c_g(A,0)\) are decreasing in A. So the ranking \(c_f(A,0)>c_g(A,0)>c_h(A,0)\) holds for any value of A. It is possible to show that all these functions are increasing in t, though at a decreasing rate. In particular, for a given A, it holds that \(\frac{\partial c_h(A,t)}{\partial t}> \frac{\partial c_g(A,t)}{\partial t} > \frac{\partial c_f(A,t)}{\partial t}\), and that \(\frac{\partial ^{2} c_h(A,t)}{\partial t^{2}}< \frac{\partial ^{2} c_g(A,t)}{\partial t^{2}}< \frac{\partial ^{2} c_f(A,t)}{\partial t^{2}}<0\). Accordingly, \(c_f(\bar{A},t)>c_g(\bar{A},t)>c_h(\bar{A},t)\) for \(0\le t<t^*\), while \(c_h(\bar{A},t)>c_g(\bar{A},t)>c_f(\bar{A},t)\) for \(t\ge t^*\). This ranking is found to be robust to changes in the parameter A. Being the value of \(t^*\) quite high (around 6.5, irrespective of the value of A) and unrealistic in the context of developing countries, in our analysis we focussed on the former scenario. Thus, for \(t < t^*\), combining the results in Propositions 4 and 5, the E, L equilibrium occurs for \(c_h<c_2<c_f\), while for \(c_2>c_f\) the equilibrium is given by L, N, and finally for \(c_2<c_h\) the equilibrium is L, L. Instead, for a high level of t, namely for \(t>t^*\), the L, N equilibrium would arise for \(c_2>c_g\), while the equilibrium configuration would be given by L, L whenever \(c_2<c_g\).

Rights and permissions

About this article

Cite this article

Sestini, R., Pugliese, D. To buy or to do it yourself? Pollution policy and environmental goods in developing countries. J. Ind. Bus. Econ. 48, 105–135 (2021). https://doi.org/10.1007/s40812-020-00150-1

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40812-020-00150-1