Abstract

We consider a firm’s incentive for foreign direct investment (FDI) and international technology licensing in a polluting industry. We explain the rationale and the welfare implications of complementarity between FDI and licensing, i.e., the firm’s strategy of “FDI and licensing” (FL), which is empirically relevant but ignored in the literature. When the environmental tax cannot be committed, the firm adopts the licensing strategy if the pollution intensity is not high, and the licensing strategy may create lower consumer surplus and welfare compared to both FDI and FL. However, if the pollution intensity is high, the firm undertakes FL, which provide higher consumer surplus and welfare compared to both licensing and FDI. When the government can commit to the environmental tax, the firm always prefers FL. The host-country welfare is higher but the consumer surplus and world welfare may be lower under the committed tax policy compared to the non-committed tax policy. These results hold under Cournot competition and Stackelberg competition. We further show that FL can be the equilibrium strategy of the foreign firm if there is fixed-fee licensing instead of a two-part tariff licensing, which is considered in the main analysis.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Many developing countries and transitional economies liberalized their economies in last few decades, and foreign direct investment (FDI) and international technology licensing constitute two important ways to serve the host-country markets by the foreign firms.Footnote 1 There is a vast literature examining the profitability and the implications of FDI and licensing strategies, which we review in the next section. However, this literature is restrictive for two reasons. First, they mostly ignored polluting industries. However, given the climate change problem at hand, it is important to investigate how environmental policies affect these strategies and the corresponding welfare. Secondly, the extant literature mostly considered FDI and licensing as substitutes, while evidence shows that foreign firms often undertake FDI and also license their technologies to the host-country firms in the same market. In other words, there is a complementarity between FDI and licensing. We explain this phenomenon and its welfare implications.

The evidence of “FDI and licensing” (FL for brevity) in polluting industries, such as petrochemical and pharmaceutical industries, is abound. For example, BP (UK) has a plant in China, and licensed its latest generation technology to China’s Dongying Weilian Chemical Co., Ltd.Footnote 2 LyondellBasell is operating three polypropylene compounding plants in China,Footnote 3 and also licensed its polypropylene technology to Chinese companies, such as Qingdao Jinneng New Material Co., Ltd,Footnote 4 Shandong Chambroad Sinopoly New Materials Co., Ltd.,Footnote 5 and Wanhua Chemical Group Co., Ltd.Footnote 6 Belderbos (1998) illustrates that Shell has by far grown into the third largest fully integrated oil company in Japan, and licensed its technology to Japanese companies, such as Sumitomo Chemical, Seibu Oil, and Chiyoda Kako Kentetsu from 1981 to 1986.

There are also evidences where the foreign firms only license to the host-country firms.Footnote 7 As Sikimic et al. (2013) documented, several leading Italian pharmaceutical and biotech companies adopted technology licensing as the foreign market-entry mode.

Given this background, we examine a foreign monopolist’s decision on FDI, licensing, and FL, in a polluting industry and show the corresponding welfare implications. Since the foreign monopolist needs to internalize the effects of its strategies on the emission fee (or the environmental tax) imposed by the host-country government, whether the host-country government can commit to its policies may play important roles.

In Section 4, we follow the literature on non-committed government policies where the governments cannot commit to their policies (often because of the time inconsistency problem) and adjust their policies after firms’ decisions. Since licensing or FL by the foreign monopolist transfers (part of) its production to the host-country firm, it encourages the host-country government to reduce the emission fee. A higher marginal cost of the host-country licensee because of a positive royalty rate charged by the foreign monopolist also helps to reduce the emission fee by reducing pollution. Thus, a less stringent emission fee resulted from licensing or FL makes the foreign monopolist better off compared to FDI.Footnote 8

When comparing between licensing and FL, lower competition and less stringent emission fee under licensing make the foreign monopolist better off compared to FL if the pollution intensity is not high. Hence, depending on the pollution intensity, the foreign monopolist prefers licensing only (FL) when the pollution intensities are mild (high).Footnote 9

When looking at the welfare implications, we find that licensing as a substitute of FDI reduces the host-country welfare, and may reduce consumer surplus and world welfare (which is the host-country welfare plus the profit of the foreign monopolist) compared to FDI, although the market structure is the same under licensing and FDI. However, if the foreign monopolist does FL where licensing complements FDI, it increases consumer surplus and welfare in the host country compared to FDI. FL also increases the host-country welfare and world welfare compared to licensing, but it reduces consumer surplus compared to licensing when the pollution intensity is low. Hence, licensing reduces (increases) the host-country welfare compared to FDI if it substitutes (complements) FDI.

Therefore, internalizing the foreign monopolist’s entry decision, we find that if the pollution intensity is not high, the foreign monopolist adopts the licensing strategy, which may create lower consumer surplus and welfare compared to both FDI and FL. However, if the pollution intensity is high, the foreign monopolist does FL, which creates higher consumer surplus and welfare compared to both licensing and FDI.

Section 5 considers the case of a committed government policy where the host-country government can commit to an emission fee before the foreign monopolist’s decision. This may be due to the administrative or political difficulties in policy adjustment that may affect the reputation of the government. We find that the foreign monopolist is better off under FL compared to licensing and FDI since FL helps to reduce the total tax payment compared to licensing and FDI. We also show that the committed policy reduces pollutant emission, increases domestic welfare, and may increase or decrease consumer surplus compared to the non-committed policy.

We assume in Sectsion 4 and 5 that firms play Cournot competition under FL. Section 6 considers Stackelberg competition under FL. The above-mentioned results derived from Cournot competition still hold under Stackelberg competition. In Section 7, we consider a licensing contract with fixed-fee only. In this situation, the foreign monopolist prefers FL under the non-committed policy when the pollution intensity is high and always prefers it under the committed policy.

Thus, we contribute to the literature by providing a new framework that considers FDI and licensing in a polluting industry, explains environmental tax as a rationale for FL, and shows the implications of committed and non-committed host-country policies, Cournot and Stackelberg competition under FL, and two-part tariff and fixed-fee licensing contracts. Hence, in contrast to the existing literature on FDI and licensing, we consider a polluting industry, and show the existence of FL (i.e., complementarity between FDI and licensing) even if there is a monopolist final good producer under FDI or licensing. Rather than the business stealing incentive in the product market, the foreign firm has the incentive to create competition in the product market through FL to manipulate the environmental tax.

The remainder of the paper is organized as follows. Section 2 reviews the relevant literature. Section 3 describes the model. Section 4 investigates the situation where the government cannot commit to an emission fee before the foreign monopolist’s market-entry decision. Section 5 examines the situation where the government can commit to the emission fee before the foreign monopolist’s market-entry decision, and compares the results under the committed and non-committed policies. While Sections 4 and 5 consider Cournot competition under FL, Sect. 6 extends the analysis by considering Stackelberg competition under FL. Section 7 consider a licensing contract with fixed-fee only. Section 8 concludes.

2 Literature Review

While the proximity-concentration hypothesis explains the multinational firms’ incentive for FDI compared to export (see, e.g., Krugman 1983, Horstman and Markusen, 1992, Brainard 1993 and 1997), there is another literature examining the multinational firms’ benefits from the internalisation strategies, such as FDI, compared to their arm’s length transactions, such as technology licensing, which is the focus of this paper.

Started with Dunning (1958), the literature examining the multinational firms’ benefits from FDI compared to technology licensing focused on different types of transaction costs arising from technology licensing. Rugman (1986) provides a survey of the earlier literature on the internationalisation theory focusing on different types of transaction costs.

Horstman and Markusen (1987) show that the foreign firm’s risk of losing reputation under licensing due to a lower quality product provided by the licensee may create the incentive for FDI. Saggi (1996) shows that a foreign firm’s incentive for FDI and licensing may depend on the trade-off created by the foreign firm’s loss of profit under FDI due to a higher product-market competition and its loss of profit in other markets due to the licensee’s opportunistic behaviour under licensing.

Saggi (1999) considers a two period model where a foreign firm chooses licensing or FDI (but not licensing and FDI) in each period. In this set up, it explores how the trade-off between a lower knowledge spillover under FDI and higher rent dissipation under FDI due to an increased product-market competition affects the foreign firm’s decision on FDI and licensing.

Wright (1993) shows how the information asymmetry about the technology type and the cost of FDI interact to determine a foreign firm’s decision on export, FDI, or licensing. It shows that the market share restrictions and per-unit royalties can signal the technology type and make licensing the most attractive option for the foreign firm.

Vishwasrao (1994) considers the foreign firm’s decision on export, FDI, or licensing when the licensee has private information about its ability to imitate the technology of the foreign firm under licensing. It considers a screening framework where the foreign firm uses the licensing contract to gain information about the licensee’s ability to imitate the technology. It shows that FDI dominates licensing if the probability of imitation is high.

Considering a quality ladder model of innovation, Glass and Saggi (2002) show the effects of the foreign firm’s mode of operation (licensing or FDI) on innovation by the foreign firm. If the foreign firm needs to sacrifice more rent to the licensee or the cost disadvantage of FDI reduces, the foreign firm’s incentive for FDI increases compared to licensing. Further, the firm doing FDI chooses larger innovation compared to the firm undertaking licensing.

Yang and Maskus (2009) show the implications of the host-country patent protection on a foreign firm’s decision on export, FDI, or licensing. It shows that a foreign firm prefers FDI in countries with weak patents and lower costs of setting subsidiaries; strengthening the patent protection in this situation creates the incentive for licensing by the foreign firm.

While the above mentioned papers provide several important insights, unlike this paper, they consider FDI and licensing as substitutes.

Sinha (2010) considers a framework where a foreign firm, competing with a host-country firm, decides on FDI or export after taking a decision on licensing its technology to the host-country competitor. It shows that licensing reduces the possibility of FDI. However, if the fixed cost of FDI is not high, the foreign firm undertakes FDI after licensing. Wang et al. (2016a) extend Sinha (2010) to show the implications of better information acquisition under FDI about the market condition. In contrast to Sinha (2010), it shows that, due to the benefit of better information acquisition under FDI, licensing may increase the incentive for FDI.Footnote 10 Although these papers consider the possibility of FDI after offering the licensing contract, we differ from them in some important ways. First, unlike our paper, those papers did not consider a polluting industry. Second, the incentive for FDI after licensing occurs in those papers due to the foreign firm’s incentive for stealing market share from the host-country licensee, since, unlike our paper, licensing does not create a monopoly market structure in those papers.

Mukherjee (2000) and Mukherjee and Pennings (2006) show that strategic host-country tax policy and strategic tariff imposed by the importing countries may encourage foreign innovators to license their technologies to host-country firms. However, these papers neither looked at the environmental problems nor considered the strategy of FL.

While Mukherjee (2000) and Mukherjee and Pennings (2006) showed the implications of strategic government policies, Arya and Mittendorf (2006) and Mukherjee et al. (2008) showed a monopolist final goods producer’s incentive for creating competition through licensing when there is strategic input price determination. Shepard (1987) and Farrell and Gallini (1988) showed a monopolist input supplier’s incentive for technology licensing to another input supplier to reduce the hold-up problem faced by the final goods producers. Unlike these papers, we consider an open economy with market entry where the host-country environmental policy is the reason for encouraging the foreign monopolist to license its technology.Footnote 11

In contrast to the vast literature considering exogenously given outside innovators, which do not compete with the licensees, or inside innovators, which compete with the licensees (see, e.g., Rostoker 1984, Kamien 1992, Saggi 2002 and Mukherjee 2009, for surveys of this literature), the endogenous decision on licensing and FL in our analysis makes the foreign monopolist an outside innovator (in the case of licensing only) or inside innovator (in the case of FL) endogenously.

Our paper also contributes to the growing literature on welfare reducing technology licensing. Licensing may reduce welfare by creating collusive outcome (Faulí-Oller and Sandonis 2002; Erkal 2005), affecting the R&D organization (Mukherjee 2005), creating excessive entry (Mukherjee and Mukherjee 2008), affecting the mode of entry of the foreign firm (Sinha 2010), reducing R&D incentive (Chang et al. 2013), and increasing (decreasing) the government’s subsidy bill (tax revenues) (Ghosh and Saha 2015). In contrast, we show the welfare reducing licensing in a polluting industry. Further, when the government cannot commit to an emission fee, licensing reduces welfare in our analysis if it acts as a substitute of FDI but increases welfare if it complements FDI.

In our analysis, licensing only gives the host-country licensee the exclusive right to use the technology, since only the licensee uses the technology in this situation. On the other hand, FL gives the host-country licensee the non-exclusive right to use the technology, since both firms use the technology in this situation. Hence, our paper can also be related to the literature on exclusive contracts.Footnote 12 In that literature, the buyers and sellers, which decide on exclusive contrasts, are not competitors in the product market. In contrast, we consider whether a foreign monopolist prefers to give a host-country firm the exclusive right to use its technology or prefers to offer a non-exclusive right where it competes with the licensee. Further, unlike that literature, we consider a polluting industry with emission fee.Footnote 13

3 The Model

Consider a foreign innovator, called firm 1, which holds patent for a new product that has no substitutes. Firm 1 wants to sell the product in a host-country, called domestic country. Firm 1 can serve the domestic country through FDI or licensing or “FDI and licensing” (FL).

FDI

Under FDI, only firm 1 produces and sells the product in the domestic country. Firm 1 can produce the good at a constant marginal cost, \(c\).

Licensing

Under licensing, firm 1 licenses its technology to a domestic firm exclusively, called firm 2. Hence, only firm 2 produces and sells the product in the domestic country. Firm 2 can also produce the good at the constant marginal cost, c.

FL

Under FL, firm 1 licenses its technology to firm 2, and both firms 1 and 2 produce and sell the product in the domestic country like Cournot duopolists.Footnote 14 Both firms produce the products at the constant marginal cost, c.

As mentioned in the introduction, our paper follows the literature examining the preference for and consequences of FDI and licensing. Hence, we assume away firm 1’s choice for exporting to the host-country. High international transportation cost, lower cost of production in the domestic country, tariff imposed by the domestic country and environmental tax imposed by the home country of firm 1 provide some reasons to exclude exporting as an option for firm 1. The absence of exporting also helps us to focus on the effects of the domestic environmental policy by ignoring the effects of the trade policies, which are discussed in Kabiraj and Marjit (2003) and Mukherjee and Pennings (2006).

We assume that pollution is a by-product of the production process. Without loss of generality, we normalize the emission-to-output ratio to one. The producers can abate pollution by investing in pollution abatement technologies. If firm \(i\) (\(i=1, 2\)) produces \({q}_{i}\) units of output and chooses the amount of pollution abatement as \({a}_{i}\) (\(0\le {a}_{i}\le {q}_{i}\)),Footnote 15 the pollutant emission level is \({q}_{i}-{a}_{i}\). However, pollution abatement is costly and the cost of pollution abatement \({a}_{i}\) is \(CA=\frac{1}{2}{a}_{i}^{2}\), for the ith firm where \(i=1, 2\).

In line with the existing literature (see, e.g., Ulph 1996, Barcena-Ruiz and Garzon 2002, Long and Soubeyran 2005, Antelo and Loureiro 2009 and Pal 2012), we consider that the environmental damage from pollution is \(ED=\frac{1}{2}d{\left(q-a\right)}^{2}\), where \(q={q}_{1}+{q}_{2}\) is the total output, \(a={a}_{1}+{a}_{2}\) is the total pollution abatement, and \(d>0\) shows the pollution intensity in the domestic country.

We assume that the domestic government imposes an emission fee, \(t\) (\(t\ge 0\)), per-unit of pollutant emitted. In other words, we assume away the possibility of output subsidy, which, e.g., may occur to reduce the distortion created by the imperfect product market competition. However, given the climate change problem at hand, it may be difficult to get a public support for output subsidy in a polluting industry. Hence, we confine our analysis to \(d>\frac{1}{3}\) so that the emission fee under licensing is positive.

Assume that the inverse market demand function is \(p=A-q\), which comes from the utility function \(U=Aq-\frac{1}{2}{q}^{2}+\zeta\) of a representative consumer, where \(p\) is the price, \(\zeta\) is the numeraire good, and \(A>c\). Given this utility function, the consumer surplus is \(CS=Aq-\frac{1}{2}{q}^{2}-pq=Aq-\frac{1}{2}{q}^{2}-\left(A-q\right)q=\frac{1}{2}{q}^{2}\).Footnote 16

The domestic government sets an emission fee to maximize welfare of the domestic economy, which is the sum of the consumer surplus, the profit of the domestic firm after deducting the cost of pollution abatement \({\pi }_{2}\), and the tax revenue \(T=t\left(q-a\right)\), minus the environmental damage \(ED\), i.e.:

As mentioned in the introduction, we will consider the following two situations in the next two sections respectively. Section 4 will consider that the government cannot commit to an emission fee before firm 1’s market-entry decision. This can be motivated by the observation that the government policies are often “time inconsistent”, implying that the government has an incentive to reverse the preannounced policies. According to Staiger and Tabellini (1987), governments may find it difficult to commit when it has some degree of discretionary power to decide its policy. In the case of energy policy, Helm et al. (2003) noticed that no commitment by the government might occur since the energy policy is used to achieve multiple objectives, such as international competitiveness, political interests, and lower energy prices.Footnote 17 Thus, this situation is in line with the papers considering the effects of the non-committed government policies.Footnote 18 Section 5 will consider that the government can commit to its policy before firm 1’s decision due to the administrative or political difficulties in policy adjustment that may affect the reputation of the government.

4 Non-Committed Policy

In this section, we consider the following three-stage game. In stage 1, firm 1 decides whether to do FDI, licensing or FL. In case of licensing, firm 1 makes a take-it-or-leave-it offer to firm 2. Following the literature on technology licensing, we assume that the licensing contract (under licensing only or under FL) consists of a two-part tariff with a non-negative up-front fixed-fee (\(L\)) and a non-negative per-unit output royalty (\(r\)), and firm 2 accepts the offer if its payoff under licensing is not less than that of under no licensing, which is normalized to zero.

In stage 2, the government sets the emission fee (\(t\)) to maximize the domestic welfare given by (1).

In stage 3, the producers determine the amount of pollution abatements \({a}_{1}\), \({a}_{2}\), and outputs \({q}_{1}\), \({q}_{2}\), and the profits are realized.

We solve the game through backward induction.

4.1 FDI

First, consider the case where firm 1 undertakes FDI. Firm 2 is inactive in this situation, and the maximization problem for firm 1 in stage 3 is:

The equilibrium output and the pollution abatement by firm 1 are

In stage 2, the domestic government determines the emission fee to maximize (1) subject to (3), (4), \({q}_{2}=0\), \({a}_{2}=0\), and \({\pi }_{2}^{F}=0\). The equilibrium emission fee is:

The equilibrium emission fee \({t}^{F}\) is increasing with \(d\). This is intuitive since the government would like to set a higher emission fee to reduce pollution if the pollution intensity increases. Thus, from (3) and (4), it is obvious that the equilibrium output is decreasing with \(d\) while the equilibrium pollution abatement is increasing with \(d\).

Substituting (5) into (3) and (4), we get the equilibrium output and pollution abatement under FDI as:

Hence, under FDI, the equilibrium pollutant emission, profit of firm 1, domestic welfare, and world welfare (\(GW\)), which is the sum of profit of firm 1 and domestic welfare, are as follows:

They are all decreasing with \(d\).Footnote 19

4.2 Licensing

Now consider the case where firm 1 does not produce through FDI but licenses the technology to firm 2 in stage 1. Hence, firm 1 earns the licensing payment:

Firm 1 receives the up-front fixed-fee, \(L\), in stage 1 and gets the royalty payment, \(r{q}_{2}\), in stage 3. However, both \(L\) and \(r\) are determined in stage 1.

The maximization problem for firm 2 in stage 3 is:

The equilibrium output and the pollution abatement by firm 2 can be found as:

In stage 2, the government determines the emission fee to maximize (1) subject to (9), (10), \({q}_{1}=0\), \({a}_{1}=0\), and (11). The first order condition gives the equilibrium emission fee asFootnote 20:

Since firm 2 produces under the licensing contract, the domestic government takes firm 2’s profit into account when setting the emission fee, while firm 1’s profit under FDI does not affect the emission fee. By comparing (12) with (5), we get \(t<{t}^{F}\) for \(r\ge 0\), implying that the transfer of production to the domestic firm through licensing encourages the domestic government to reduce the emission fee even if firm 1 sets \(r=0\), thus making the output higher, the pollution abatement lower and the pollutant emission higher compared to FDI. This makes the profit of firm 1 higher compared to FDI even if it sets \(r=0\).

In addition, although a positive royalty rate has adverse effects on the output and profit, it helps to reduce pollutant emission and the tax payment by reducing the output, for a given emission fee. The expression (12) indicates that a higher royalty rate may increase the profit by inducing the government to set a lower emission fee, which encourages the producer to reduce its investment in pollution abatement and may reduce the tax payment.

Firm 1 maximizes the following expression in stage 1 to determine the licensing fee:

where (14) is the participation constraint for firm 2.

Since firm 1 makes a take-it-or-leave-it licensing contract to firm 2, the optimal \(L\) makes the profit of firm 2 under licensing equal to \(0\), implying that the equilibrium \(L\) equals to \(\left(A-{q}_{2}-c-r\right){q}_{2}-t\left({q}_{2}-{a}_{2}\right)-\frac{1}{2}{a}_{2}^{2}\). Hence, (13) reduces to

with \({q}_{2}\) given by (10), \({a}_{2}\) given by (11) and \(t\) given by (12).Footnote 21 As a result, the equilibrium royalty rate under licensing, \({r}^{L}\), is as follows.

Hence, under licensing, we get the equilibrium emission fee, pollution abatement, output, pollutant emission, fixed-fee, profit of firm 1, domestic welfare and world welfare, as follows:

We have \(\frac{\partial {t}^{L}}{\partial d}=\frac{\partial {a}^{L}}{\partial d}=\frac{12(27{d}^{2}+30d+19)(A-c)}{{(27{d}^{2}+54d+11)}^{2}}>0, \frac{\partial {r}^{L}}{\partial d}=-\frac{12\left(A-c\right)\left(27{d}^{2}-18d-29\right)}{{\left(27{d}^{2}+54d+11\right)}^{2}}>0\) for \(d<\frac{3+4\sqrt{6}}{9}, \frac{\partial {q}^{L}}{\partial d}=-\frac{288\left(d+1\right)\left(A-c\right)}{{\left(27{d}^{2}+54d+11\right)}^{2}}<0, \frac{\partial \left({q}^{L}-{a}^{L}\right)}{\partial d}=-\frac{12\left(27{d}^{2}+54d+43\right)\left(A-c\right)}{{\left(27{d}^{2}+54d+11\right)}^{2}}<0, \frac{\partial {\pi }_{1}^{L}}{\partial d}=-\frac{144\left(d+1\right){\left(A-c\right)}^{2}}{{\left(27{d}^{2}+54d+11\right)}^{2}}<0, \frac{\partial {W}^{L}}{\partial d}=-\frac{36(d+1)(3d-1)(9{d}^{2}+18d+25){\left(A-c\right)}^{2}}{{(27{d}^{2}+54d+11)}^{3}}<0\) and \(\frac{\partial {GW}^{L}}{\partial d}=-\frac{36(d+1)(27{d}^{3}+153{d}^{2}+273d+19){(A-c)}^{2}}{{(27{d}^{2}+54d+11)}^{3}}<0\), indicating that the emission fee and pollution abatement increase with the pollution intensity, \(d\), the royalty rate increases with \(d\) for \(d<\frac{3+4\sqrt{6}}{9}\),Footnote 22 the outputs, pollutant emission, the profit of firm 1, domestic welfare and world welfare decrease with \(d\). Interestingly, under licensing, firm 1 would like to set a higher royalty rate to induce the domestic government to reduce the emission fee for a higher pollution intensity if \(d<\frac{3+4\sqrt{6}}{9}\).

By comparing the above-mentioned values with those under FDI, we get the following two lemmas.

Lemma 1

Firm 1 prefers licensing compared to FDI, and the equilibrium licensing contract consists of a positive fixed-fee and a royalty. The emission fee and pollution abatement are lower but the pollutant emission is higher under licensing compared to FDI.

Proof

Appendix 1.

Lemma 2

Compared to FDI, the licensing contract (i) reduces the consumer surplus if and only if \(d>{d}^{\prime}\)(\(=\frac{2\sqrt{3}-1}{3}\approx 0.82137\)),Footnote 23 (ii) reduces the domestic welfare, and (iii) reduces the world welfare if and only if \(d>\widehat{d}\), where \(\widehat{d}\approx 0.64101\).Footnote 24

Proof

Appendix 2.

The reasons for Lemmas 1 and 2 are as follows.

As stated before, licensing (compared to FDI) tends to reduce the output by increasing the effective marginal cost of production due to the positive royalty rate, but it tends to increase the output by reducing the emission fee. Further, the lower the pollution intensity \(d\) is, the lower the emission fee is. This indicates that for a lower \(d\), the positive effect can overweigh the negative effect. Hence, the positive effect of a lower emission fee on the output is greater (less) than the negative effect of royalty on the output if \(d<{d}^{\prime}\) (\(d>{d}^{\prime}\)). Thus, licensing reduces the output and consumer surplus compared to FDI if and only if \(d>\frac{2\sqrt{3}-1}{3}\).

Although the effect of licensing with a positive royalty rate is ambiguous on the output, less stringent emission fee under licensing helps to reduce pollution abatement, which dominates the effect on the output, thus making the pollutant emission under licensing higher than that of under FDI, i.e. \({q}^{L}-{a}^{L}>{q}^{F}-{a}^{F}\).

Since firm 1 uses the fixed-fee to extract the profit of firm 2, the profit of firm 2 does not help to increase the domestic welfare. But lower tax revenue and higher environmental damage from increased pollutant emission under licensing compared to FDI dominate the effect of licensing on the consumer surplus. As a result, licensing reduces the domestic welfare compared to FDI, i.e. \({W}^{L}<{W}^{F}\).

It follows from the above discussion that licensing makes the foreign firm better off compared to FDI by inducing the government to set a lower emission fee, but it reduces the domestic welfare compared to FDI. As the pollution intensity increases (i.e. \(d\) increases), the foreign firm’s benefit from licensing reduces since the emission fee reducing effect of licensing weakens.Footnote 25 Hence, the positive effect on the world welfare due to a higher profit of the foreign firm is greater (less) than the negative effect on the domestic welfare if \(d<\widehat{d}\) (\(d>\widehat{d}\)). Thus, licensing reduces the world welfare compared to FDI if and only if \(d>\widehat{d}\).

4.3 FL

Now consider the situation where firm 1 undertakes FDI and licenses to firm 2 in stage 1. Hence, the profits of firms 1 and 2 are respectively:

The maximization problems for the firms in stage 3 give the equilibrium outputs and the pollution abatementsFootnote 26 as:

In stage 2, the government determines the emission fee to maximize (1) subject to (18), (19) and (20). Because \(q_2\;\gtreqless\;t\) for \(t\;\lesseqgtr\;t_0\;=\;\frac{A-c-2r}4\), the government has two strategies. One is to set \(t\le {t}_{0}\) making \({a}_{2}=t\) in stage 3, and the other is to set \(t\ge {t}_{0}\) making \({a}_{2}={q}_{2}\) in stage 3. As shown in Appendix 3, by comparing the domestic welfare under these two strategies, the equilibrium emission fee set by the government in stage 2 is as follows and it is dependent on the royalty rate set in stage 1.

In stage 1, firm 1 maximizes the following expression to determine the licensing fee:

Since firm 1 offers a take-it-or-leave-it licensing contract to firm 2, the equilibrium \(L\) is \(L=\left(A-{q}_{1}-{q}_{2}-c-r\right){q}_{2}-t\left({q}_{2}-{a}_{2}\right)-\frac{1}{2}{a}_{2}^{2}\). Hence, (22) reduces to:

with \({q}_{1}\) and \({q}_{2}\) given by (19), \({a}_{1}\) and \({a}_{2}\) given by (20) and \(t\) given by (21). As shown in Appendix 4, the equilibrium royalty rate under FL is \({r}^{FL}=\frac{2(d+2)(8d+23)(A-c)}{144{d}^{2}+380d+233}\) which is greater than \(\frac{7(A-c)}{16d+18}\), indicating that the government will set \(t\ge {t}_{0}\) in stage 2 to make \({a}_{2}={q}_{2}\) in stage 3.

Hence, under FL, we get the equilibrium emission fee, pollution abatements, outputs, pollutant emission, fixed-fee, profits, domestic welfare and world welfare, as follows:

We get \(\frac{\partial {t}^{FL}}{\partial d}=\frac{98(64{d}^{2}+152d+97)(A-c)}{{(144{d}^{2}+380d+233)}^{2}}>0\), \(\frac{\partial {r}^{FL}}{\partial d}=-\frac{14(368{d}^{2}+1360d+1199)(A-c)}{{(144{d}^{2}+380d+233)}^{2}}<0\), \(\frac{\partial {a}^{FL}}{\partial d}=\frac{56(136{d}^{2}+404d+313)(A-c)}{{(144{d}^{2}+380d+233)}^{2}}>0\), \(\frac{\partial {q}^{FL}}{\partial d}=-\frac{14(4d+1)(44d+53)(A-c)}{{(144{d}^{2}+380d+233)}^{2}}<0\), \(\frac{\partial ({q}^{FL}-{a}^{FL})}{\partial d}=-\frac{126(80{d}^{2}+208d+145)(A-c)}{{(144{d}^{2}+380d+233)}^{2}}<0\), \(\frac{\partial\pi_1^{FL}}{\partial d}=\frac{56(d-5)(10d+13){(A-c)}^2}{{(144d^2+380d+233)}^2}\;\lesseqgtr\;0\) for \(d\;\lesseqgtr\;5\), \(\frac{\partial {W}^{FL}}{\partial d}=-\frac{7(59456{d}^{4}+290960{d}^{3}+513444{d}^{2}+400364d+120935){(A-c)}^{2}}{2{(144{d}^{2}+380d+233)}^{3}}<0\) and \(\frac{\partial {GW}^{FL}}{\partial d}=-\frac{7(36416{d}^{4}+315408{d}^{3}+850884{d}^{2}+933500d+363255){(A-c)}^{2}}{2{(144{d}^{2}+380d+233)}^{3}}<0\), indicating that the emission fee and pollution abatement increase with the pollution intensity, \(d\), the royalty rate, outputs, pollutant emission, domestic welfare and world welfare decrease with \(d\), while the profit of firm 1 decreases first and then increases with \(d\). In contrast to licensing, firm 1 will set a lower royalty rate under FL as the pollution intensity increases.

By comparing the above-mentioned values with those under FDI, we get the following two lemmas.

Lemma 3

Firm 1 prefers FL compared to FDI in a polluting industry, and the equilibrium licensing contract under FL consists of a fixed-fee and a royalty. The emission fee is lower, but the pollution abatement and the pollutant emission are higher under FL compared to FDI.

Proof

Appendix 5.

Lemma 4

FL increase the consumer surplus, the domestic welfare and the world welfare compared to FDI.

Proof

Appendix 6.

The intuitions for Lemmas 3 and 4 are as follows.

Both firms 1 and 2 produce under FL. Although firm 2 pays a positive royalty rate, increased product-market competition under FL increases the output and pollutant emission, for a given emission fee. Increased pollutant emission gives the host-country government an incentive to increase the emission fee. On the other hand, since firm 2 produces under FL, the domestic government takes firm 2’s profit into account when setting the emission fee, which helps to reduce the emission fee. The latter effect dominates and induces the government to set a lower emission fee under FL compared to FDI, i.e. \({t}^{FL}<{t}^{F}\).

Lower emission fee reduces firm 1’s incentive for pollution abatement under FL compared to FDI. However, as firm 2 also abates its pollution under FL, the total pollution abatement becomes higher under FL compared to FDI, i.e. \({a}^{FL}>{a}^{F}\).

Although licensing increases competition, it helps to reduce the total tax payments by the firms for a given emission fee,Footnote 27 and it also helps to reduce the emission fee. Further, firm 1 can choose the royalty rate appropriately to soften competition in the product-market, and use the fixed-fee to extract all the gains from licensing. As a result, the benefit from licensing helps to increase the total profits under FL compared to FDI, i.e. \({\pi }_{1}^{FL}>{\pi }_{1}^{F}\).

On the one hand, FL increases the output, but on the other hand, it increases the pollution abatement. We find that the former effect overweighs the latter, making the pollutant emission under FL higher compared to FDI, i.e. \({q}^{FL}-{a}^{FL}>{q}^{F}-{a}^{F}\).

FL (compared to FDI) increases the total output and consumer surplus by increasing competition and reducing the emission fee. Although the profit of firm 2 does not help to increase the domestic welfare,Footnote 28 higher consumer surplus under FL compared to FDI dominates the negative effect due to a higher environmental damage and lower tax revenue. As a result, compared to FDI, FL increases domestic welfare, and the world welfare, since it also makes the foreign firm better off.

4.4 Equilibrium Choice: Licensing or FL

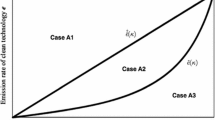

We have shown that firm 1 prefers both licensing and FL compared to FDI. Now we determine firm 1’s optimal mode of entry by comparing licensing with FL and see the corresponding welfare implications. We attain \(\pi_1^L\;\gtreqless\;\pi_1^{FL}\) for \(d\;\lesseqgtr\;\overline{d }\), where \(\overline{d } \approx 0.88753\).Footnote 29 Hence, we have the following proposition immediately.

Proposition 1

Firm 1 prefers licensing compared to FL if and only if \(d\le \overline{d }(\approx 0.88753)\).

Licensing (compared to FL) not only creates lower product-market competition but also creates lower emission fee for a low pollution intensity.Footnote 30 However, the effective marginal cost of production under licensing is higher than that of firm 1 under FL since firm 2 has to pay a royalty rate, which is low if the pollution intensity is not high. Hence, lower competition and lower emission fee under licensing make firm 1 better off compared to FL if the pollution intensity is not high.

4.5 Welfare Implications

Now look at the welfare implications. While FL increases consumer surplus, domestic welfare and world welfare compare to FDI, the licensing strategy reduces domestic welfare and may reduce consumer surplus and world welfare compared to FDI. By comparing the consumer surplus and welfare under licensing with those under FL, we get the following Lemma.

Lemma 5

Compared to licensing, FL.

-

(i)

increases (reduces) the consumer surplus if

, where

, where Footnote 31

Footnote 31 -

(ii)

increases the domestic welfare and world welfare.

Proof

Appendix 7.

We know from Lemmas 2 and 4 that the consumer surplus under FL is always higher than that of under FDI which is higher than that of under licensing for \(d>\frac{2\sqrt{3}-1}{3}\). However, the consumer surplus under licensing is higher than that of under FDI for \(d<\frac{2\sqrt{3}-1}{3}\).

On the one hand, higher competition under FL compared to licensing tends to create higher consumer surplus under the former than the latter. On the other hand, if the pollution intensity is not high, higher royalty rate and emission fee under FL compared to licensing tend to reduce consumer surplus under the former than the latter. As a result, the consumer surplus under FL is lower than that of under licensing for low pollution intensity, i.e. \(d <\) .

.

Compared to FDI, licensing reduces the domestic welfare while FL increases it. Hence, it is obvious that the domestic welfare under FL is higher than that of under licensing.

Compared to FL, licensing tends to increase the world welfare by making the foreign firm better off for \(d\le \overline{d }\), but tends to decrease the world welfare by reducing the domestic welfare. The latter effect dominates the former effect, thus making the world welfare lower under licensing compared to FL.

To sum up, since \({d}^{\prime}=\frac{2\sqrt{3}-1}{3}\approx 0.82137<0.88753\approx \overline{d }\), We get the following two results from Lemmas 2, 4 and 5, and Proposition 1.

Proposition 2

(i) For \(d\le \overline{d }(\approx 0.88753)\), firm 1 prefers licensing. In this situation, licensing

-

(a)

increases the consumer surplus compared to both FDI and FL if and only if \(d<\check{d}(\approx 0.354329)\),

-

(b)

increases the consumer surplus compared to FDI but decreases it compared to FL if and only if

\(<d <{d}^{\prime}\left(\approx 0.82137\right)\),

\(<d <{d}^{\prime}\left(\approx 0.82137\right)\), -

(c)

decreases the consumer surplus compared to both FDI and FL if and only if \({d}^{\prime}<d \le\overline{d }\).

(ii) For \(d>\overline{d }\), firm 1 prefers FL, which benefits the consumers compared to both licensing and FDI.

Proposition 3

(i) For \(d\le \overline{d }(\approx 0.88753)\), firm 1 prefers licensing. In this situation, licensing

-

(a)

reduces the domestic welfare compared to both FDI and FL,

-

(b)

increases (decreases) the world welfare compared to FDI for \(d<\widehat{d}(\approx 0.64101)\) (\(\widehat{d}<d\le \overline{d }\)), but always decreases it compared to FL.

(ii) For \(d>\overline{d }\), firm 1 prefers FL, which creates higher domestic welfare and world welfare compared to both licensing and FDI.

Figure 1 shows firm 1’s choice and the implications on the consumers, domestic welfare and world welfare.

5 Committed Policy

Now we consider a situation where the domestic government can commit to its policy before firm 1’s market-entry decision. Hence, in terms of the game structure, the order of stages 1 and 2 in the previous section is switched. To be specific, the government sets an emission fee (\(t\)) to maximize the domestic welfare in stage 1, and firm 1 decides whether to do FDI, licensing or FL in stage 2.

5.1 Market-Entry Decision of Firm 1

The problem and solutions in stage 3 here are totally the same as those under the non-committed policy. Hence, given the emission fee set by the domestic government in stage 1, we examine the market-entry decision of firm 1 by comparing its profits under FDI, licensing and FL in stage 2.

5.1.1 FDI

If firm 1 undertakes FDI in stage 2, the profit of firm 1 under FDI is \({\pi }_{1}=\frac{{\left(A-c-t\right)}^{2}+2{t}^{2}}{4}\)

5.1.2 Licensing

If firm 1 licenses the technology to firm 2 but does not produce through FDI in stage 2, firm 1 maximizes the expression (13) to determine the licensing fee. Since the equilibrium \(L\) equals \(\left(A-{q}_{2}-c-r\right){q}_{2}-t\left({q}_{2}-{a}_{2}\right)-\frac{1}{2}{a}_{2}^{2}\), the profit of firm 1 reduces to \({\pi }_{1}=\frac{{\left(A-c-t\right)}^{2}+2{t}^{2}-{r}^{2}}{4}\). It is obvious that the optimal royalty rate is 0 and the profit of firm 1 under licensing in stage 2 is \({\pi }_{1}=\frac{{\left(A-c-t\right)}^{2}+2{t}^{2}}{4}\), the same as that of under FDI. This result is very different from the situation of the non-committed policy. The reason is that, under the committed policy, firm 1 has no ability to induce the host-country government to reduce the emission fee by licensing.

5.1.3 FL

If firm 1 undertakes FL in stage 2, the maximization problem for firm 1 is similar to the situation in subSection 4.3 with the exception that the emission fee is given in stage 1 here. Because \(q_2\;\gtreqless\;t\) for \(r\;\lesseqgtr\;\frac{A-c-4t}2\), \({a}_{2}={t}\) if the royalty rate determined by firm 1 is not greater than \(\frac{A-c-4t}{2}\); otherwise \({a}_{2}={q}_{2}\). We get the equilibrium royalty rate under FL as \(r=\frac{A-c-3t}{2}\),Footnote 32 making \({a}_{2}={q}_{2}\) and the profit of firm 1 under FL is \({\pi }_{1}=\frac{3{\left(A-c-t\right)}^{2}+10{t}^{2}}{12}\), which is greater than that of under FDI or licensing. Hence, firm 1 prefers FL to both FDI and licensing.

The reason for this is as follows. Although licensing under FL creates competition and the emission fee is not affected by firm 1’s decision, FL saves the total tax payments by reducing firm 1’s output and pollutant emission.Footnote 33 In addition, firm 1 can use a positive royalty rate to soften competition from firm 2.

5.2 Equilibrium

In stage 1, the government determines the emission fee to maximize (1) with \({q}_{1}\) and \({q}_{2}\) given by (19), \({a}_{1}\) given by (20), \({a}_{2}={q}_{2}\), \(r=\frac{A-c-3t}{2}\) and \({\pi }_{2}=0\). We find the equilibrium emission fee under the committed policy is \({t}^{C}=\frac{3(11d+5)(A-c)}{121d+131}\). The corresponding equilibrium pollution abatements, outputs, pollutant emission, royalty rate, fixed-fee, profits, domestic welfare and world welfare are as follows:

Thus, the following proposition is immediate from the above analysis.

Proposition 4:

Firm 1 always prefers FL compared to both FDI and licensing in a polluting industry when the host-country government commits to the emission fee before firm 1’s market-entry decision. The equilibrium licensing contract under FL consists of a positive fixed-fee and a royalty.

We have \(\frac{\partial t^C}{\partial d}=\frac{2508(A-c)}{{(121d+131)}^2}>0,\frac{\partial r^C}{\partial d}=-\frac{3762\left(A-c\right)}{\left(121d+131\right)^2}<0,\frac{\partial a^C}{\partial d}=\frac{4180\left(A-c\right)}{\left(121d+131\right)^2}>0,\frac{\partial q^C}{\partial d}=-\frac{418\left(A-c\right)}{\left(121d+131\right)^2}<0,\frac{\partial\left(q^C-a^C\right)}{\partial d}=-\frac{4598\left(A-c\right)}{\left(121d+131\right)^2}<0,\frac{\partial\pi_1^C}{\partial d}=\frac{27588\left(d-3\right)\left(A-c\right)^2}{\left(121d+131\right)^3}\;\lesseqgtr\;0\) for \(d\;\lesseqgtr\;3,\frac{\partial W^C}{\partial d}=-\frac{722{(A-c)}^2}{{(121d+131)}^2}<0\) and \(\frac{\partial {GW}^{C}}{\partial d}=-\frac{494(121d+359){\left(A-c\right)}^{2}}{{(121d+131)}^{3}}<0\), indicating that similar to FL under the non-committed policy, the emission fee and pollution abatement increase with the pollution intensity, \(d\), the royalty rate, outputs, pollutant emission, domestic welfare and world welfare decrease with \(d\), while the profit of firm 1 decreases first and then increases with \(d\).

5.3 Comparison with the Non-Committed Policy

Now compare the equilibrium values under the committed host-country policy with those of under the non-committed host-country policy. We denote the equilibrium values under the non-committed host-country policy by superscript N. Hence, they are equal to those under licensing for \(d\le \overline{d }\) and those under FL for \(d>\overline{d }\) as shown in Section 4. For example, the equilibrium emission fee under the non-committed host-country policy is \({t}^{N}={t}^{L}\) for \(d\le \overline{d }\) and \({t}^{N}={t}^{FL}\) for \(d>\overline{d }\).

As Fig. 2(a) shows, the emission fee under the committed policy is higher than that of under the non-committed policy, i.e. \({t}^{C}>{t}^{N}\), if and only if \(d<{d}_{1}(\approx 24.032)\).Footnote 34

Compared to the non-committed policy, the pollution abatement is higher while pollutant emission is lower under the committed policy, as shown in Fig. 2(b) and 2(c) respectively.

Figure 2(d) shows that although firm 1 makes the market-entry decision after the committed emission fee, its profit is higher under the committed policy compared to the non-committed policy if and only if \({d}_{2}(\approx 4.00676)<d<{d}_{3}(\approx 42.8541)\).Footnote 35

Figure 2(e) shows that the total output under the committed policy is lower than that of under the non-committed policy if \(d<{d}_{4}(\approx 0.41446)\) or \(\overline{d }<d<{d}_{5}(\approx 6.68214)\),Footnote 36 indicating that the committed policy makes the consumers worse off compared to the non-committed policy if \(d<{d}_{4}\) or \(\overline{d }<d<{d}_{5}\).

The domestic welfare under the committed policy is higher than that of under the non-committed policy, as shown in Fig. 2(f). However, as the committed policy lowers the profit of firm 1 for \(d<{d}_{2}\), it makes the world welfare worse off if and only if \(\overline{d }<d<{d}_{6}(\approx 2.47245)\), as shown in Fig. 2(g).Footnote 37

Based on the aforementioned comparisons, we have the following two results immediately.

Proposition 5

Compared to the non-committed host-country policy, the committed host-country policy increases the pollution abatement and decreases the pollutant emission. However, the profit of firm 1 is higher under the committed policy than the non-committed policy if and only if \({(\overline{d }<)d}_{2}(\approx 4.00676)<d<{d}_{3}(\approx 42.8541)\).

Proposition 6

Compared to the non-committed host-country policy, although the committed host-country policy increases the domestic welfare, it reduces the consumer surplus if \(d<{d}_{4}(\approx 0.41446)\,{or}\,\overline{d }<d<{d}_{5}(\approx 6.68214), \, and \, reduces \, world \, welfare \, if \overline{d }<d<{d}_{6}(\approx 2.47245)\).

The intuitions for Propositions 5 and 6 are as follows. Firm 1 prefers licensing for \(d<\overline{d }\) and FL for \(d>\overline{d }\) under the non-committed host-country policy, while it prefers FL under the committed host-country policy. First, consider \(d<\overline{d }\). Here, both firms produce under the committed policy while only firm 2 produces under the non-committed policy. Compared to the non-committed policy, this tends to increase the output and pollutant emission for a given pollution abatement and emission fee, which induces the government to set a higher emission fee under the committed policy. As a result, firms choose a higher pollution abatement and a lower pollutant emission occurs under the committed policy compared to the non-committed policy.

At the same time, higher product-market competition gives firm 1 the incentive to set a higher royalty rate under the committed policy.Footnote 38 Although the product-market competition under the committed policy is higher, higher marginal cost due to a higher emission fee and a higher royalty rate makes the output under the committed policy lower compared to the non-committed policy for \(d<{d}_{4}\).

Although the consumer surplus under the committed policy may be lower, the lower environmental damage from the reduced pollutant emission makes the domestic welfare higher under the committed policy compared to the non-committed policy.

Higher product-market competition under the committed policy helps to decrease the profit of firm 1 under the committed policy compared to the non-committed policy. However, this effect is dominated by the higher domestic welfare under the committed policy to make the world welfare under the committed policy higher compared to the non-committed policy.

Now consider \(d>\overline{d }\), where both firms compete in the product-market under the non-committed and committed policies. On the one hand, for a given royalty rate, the non-committed policy allows the host-country government to charge a higher emission fee compared to the committed policy by allowing to the government to move after firm 1.Footnote 39 On the other hand, firm 1 tries to induce the host-country government to lower the emission fee by charging a higher royalty rate under the non-committed policy compared to the committed policy. Since a higher pollution intensity tends to increase the emission fee, the royalty rate is more effective to reduce the emission fee if the pollution intensity is not very high. Hence, if the pollution intensity is not very high (i.e. \(d<{d}_{1}\)), the emission fee is higher under the committed policy than the non-committed policy.

The emission fee under the committed policy may be lower or higher than that of under the non-committed policy. However, if the pollution intensity is not very high (i.e. \(\overline{d }<d<{d}_{5}(<{d}_{1})\)), although the royalty rate under the non-committed policy is higher than that of under the committed policy, the emission fee under the non-committed policy becomes much lower than that of under the committed policy to make the marginal cost lower under the former than the latter. As a result, the output and consumer surplus under the committed policy is lower compared to the non-committed policy for \(\overline{d }<d<{d}_{5}\).

A higher royalty rate under the non-committed policy compared to the committed policy not only helps to reduce pollution abatement by firm 1 by lowering the emission fee, it also helps to reduce the pollution abatement by firm 2 by reducing its output. Thus, the pollution abatement under the committed policy is higher compared to the non-committed policy. This makes the pollutant emission lower under the committed policy than the non-committed policy, even though the output under the former may be higher than that of under the latter.

For a given royalty rate, the host-country government tends to set a lower emission fee under the committed policy compared to the non-committed policy, thus making the profit of firm 1 higher under the former than the latter. However, the higher royalty rate under the non-committed policy compared to the committed policy may increase the profit of firm 1 by lowering the emission fee and reducing the intensity of product-market competition. If the pollution intensity is low, the higher royalty rate is effective to reduce the emission fee significantly under the non-committed policy, thus making the profit of firm 1 higher under the non-committed policy compared to the committed policy. If the pollution intensity is high, the higher royalty rate makes the profit of firm 1 higher under the non-committed policy compared to the committed policy by reducing the product-market competition under the former than the latter. Therefore, the profit of firm 1 is higher under the committed policy compared to the non-committed policy for moderate pollution intensity (i.e. \({d}_{2}<d<{d}_{3}\)).

The domestic welfare is higher under the committed policy compared to the non-committed policy since the committed policy helps to curb firm 1’s power to manipulate the emission fee through the royalty rate.

Although the committed policy helps to increase the domestic welfare compared to the non-committed policy, the committed policy reduces the profit of firm 1 compared to the non-committed policy for low and high pollution intensity. This lower profit of firm 1 under the committed policy makes the world welfare lower under the committed policy compared to the non-committed policy if the pollution intensity is not high, i.e., \(d<{d}_{6}\).

6 Stackelberg Competition Under FL

We have considered so far that the firms behave like Cournot duopolists under all arrangements. In this section we want to show the implications of Stackelberg competition under FL where, in stage 3, firm 1 chooses output \({q}_{1}\) and pollution abatement \({a}_{1}\) like the Stackelberg leader and firm 2 chooses output \({q}_{2}\) and pollution abatement \({a}_{2}\) like the Stackelberg follower. We find that all our main results hold under Stackelberg competition.

6.1 Non-Committed Policy

6.1.1 FL

Under FL, the maximization problems for the firms under Stackelberg competition in stage 3 give the equilibrium outputs and the pollution abatements as:

In stage 2, the government determines the emission fee to maximize (1) subject to (18), (19') and (20'). As shown in Appendix 8, the equilibrium emission fee set by the government in stage 2 is as follows.

As shown in Appendix 9, in stage 1, we can have the equilibrium royalty rate under FL as \({r}^{FL}=\frac{(6d+31)(A-c)}{3(18d+23)}\). Accordingly, under FL, we get the equilibrium emission fee, pollution abatement, outputs, pollutant emission, fixed-fee, profits, domestic welfare and world welfare, as follows:

By comparing the above-mentioned values with those under FDI as shown in Appendix 10, we find that Lemmas 3 and 4 hold with the exception that the pollution abatement under FL is higher compared to FDI only for \(d>\frac{\sqrt{769}-13}{36}\). This happens since, compared to Cournot competition, the output and pollution abatement of firm 2 is lower.

6.1.2 Equilibrium Choice and Welfare Implications

Even if the firms compete like Stackelberg duopolists, firm 1 still prefers FL compared to FDI (see Appendix 10). We also get \(\pi_1^L\;\gtreqless\;\pi_1^{FL}\) for \(d\;\lesseqgtr\;\overline d^S\), where \({\overline{d} }^{S}\approx 1.26372\), indicating that the result shown in Proposition 1 also holds.Footnote 40

As shown in Appendix 11, by comparing the consumer surplus and welfare under licensing with those under FL, we get that a result similar to Lemma 5 holds in this section with a different cutoff value  \(\approx 0.387691\). Hence, the results like Propositions 2 and 3 also hold even if the firms behave like Stackelberg duopolists under FL.

\(\approx 0.387691\). Hence, the results like Propositions 2 and 3 also hold even if the firms behave like Stackelberg duopolists under FL.

6.2 Committed Policy

6.2.1 FL

The equilibrium outputs and the pollution abatements under FL in stage 3 are given by (19') and (20'). Because \(q_2\;\gtreqless\;t\) for \(r\;\lesseqgtr\;\frac{A-c-5t}2\), we get \({a}_{2}=t\), if the royalty rate determined by firm 1 is not greater than \(\frac{A-c-5t}{2}\); otherwise \({a}_{2}={q}_{2}\). The equilibrium royalty rate under FL is \(r=\frac{3(A-c)-7t}{6}\),Footnote 41 making \({a}_{2}={q}_{2}\) and the profit of firm 1 under FL as \({\pi }_{1}=\frac{3{\left(A-c-t\right)}^{2}+8{t}^{2}}{12}\), which is greater than that of under FDI or licensing. Hence, firm 1 prefers FL to both FDI and licensing.

6.2.2 Equilibrium

In stage 1, the government determines the emission fee to maximize (1) with \({q}_{1}\) and \({q}_{2}\) given by (19'), \({a}_{1}\) given by (20'), \({a}_{2}={q}_{2}\), \(r=\frac{3(A-c)-7t}{6}\) and \({\pi }_{2}=0\). We get the equilibrium emission fee under the committed policy as \({t}^{C}=\frac{3(9d+5)(A-c)}{81d+107}\). The corresponding equilibrium pollution abatements, outputs, pollutant emission, royalty rate, fixed-fee, profits, domestic welfare and world welfare are as follows:

Thus, it is immediate from the above analysis that a result like Proposition 4 holds if there is Stackelberg competition under FL.

6.3 Comparison Between the Non-Committed Policy and the Committed Policy

In order to compare the equilibrium values under the committed and non-committed host-country policies, we denote the equilibrium values under the non-committed host-country policy by superscript N as before. Hence, they are equal to those under licensing for \(d\le {\overline{d} }^{S}\) as shown in Section 4 and those under FL for \(d>{\overline{d} }^{S}\) as shown in subSection 6.1.1. We find the following results.

As Fig. 3(a) shows, the emission fee is higher under the committed policy than the non-committed policy, i.e. \({t}^{C}>{t}^{N}\). Thus, compared to Cournot competition, the range of \(d\) for which \({t}^{C}>{t}^{N}\) is wider under Stackelberg competition.Footnote 42

Compared to the non-committed policy, the pollution abatement is higher while pollutant emission is lower under the committed policy, as shown in Fig. 3(b) and 3(c) respectively. This is similar to Cournot competition.

Figure 3(d) shows that although firm 1 makes the market-entry decision after the committed emission fee, its profit is higher under the committed policy compared to the non-committed policy for \({d}_{2}^{S}<d\).Footnote 43 We find that compared to Cournot competition, the range of \(d\) for which \({\pi }_{1}^{C}>{\pi }_{1}^{N}\) is wider under Stackelberg competition.Footnote 44

Figure 3(e) shows that the total output under the committed policy is lower than that of under the non-committed policy if \(d<{d}_{4}^{S}\) or \({\overline{d} }^{S}<d\),Footnote 45 indicating that the committed policy makes the consumers worse off compared to the non-committed policy if \(d<{d}_{4}^{S}\) or \({\overline{d} }^{S}<d\). It can be seen that compared to Cournot competition, the range of \(d\) for which \({q}^{C}<{q}^{N}\) is wider under Stackelberg competition.Footnote 46

The domestic welfare under the committed policy is higher than that of under the non-committed policy, as shown in Fig. 3(f). This is the same as under Cournot competition. However, the committed policy reduces the world welfare for \(d<{d}_{6}^{S}\), as shown in Fig. 3(g).Footnote 47 Therefore, compared to Cournot competition, the range of \(d\) for which \({GW}^{C}<{GW}^{N}\) is narrower under Stackelberg competition.Footnote 48

The analysis above shows that the main qualitative results derived under Cournot competition in subSection 5.3 hold under Stackelberg competition.

7 Fixed-Fee Licensing

We have considered so far that firm 1 has full flexibility to charge the royalty rate and the fixed-fee while licensing. However, there may be situations where a licenser may need to charge a restrictive licensing contract in the sense that it may not be able to charge the royalty rate, since the output of the licensee may not be verifiable or the licensee may imitate the technology of the licenser (Rockett 1990). In this section, we consider the implications of a fixed-fee licensing contract under the assumption that the outputs of the licensee are not verifiable or the licensee can imitate the technology of the licenser costlessly. We want to see whether FL can occur under the fixed-fee licensing contract, when the firms play Cournot competition under FL.

7.1 Non-Committed Policy

We first consider the situation where the host-country government cannot commit to its environmental policy.

7.1.1 FDI

If firm 1 undertakes FDI in the stage 1, as shown in subSection 4.1, its profit is \({\pi }_{1}^{F}=\frac{3(9{d}^{2}+22d+17){\left(A-c\right)}^{2}}{2{(9d+11)}^{2}}\)

7.1.2 Licensing

Now consider the case where firm 1 licenses the technology to firm 2 in stage 1. The analysis is similar to subSection 4.2 by taking \(r=0\). Thus, the equilibrium emission fee is \({t}^{L}=\frac{(3d-1)(A-c)}{9d+5}\),Footnote 49 and the profit of firm 1 is \({\pi }_{1}^{L}=\frac{(27{d}^{2}+30d+19){\left(A-c\right)}^{2}}{2{(9d+5)}^{2}}\). By comparison, we have \({\pi }_{1}^{L}>{\pi }_{1}^{F}\) indicating that firm 1 always prefers licensing to FDI.Footnote 50

7.1.3 FL

Now consider the situation where firm 1 undertakes FDI and licenses to firm 2 in stage 1. The analysis in stage 3 is similar to subSection 4.3 with \(r=0\). In stage 3, we get \({q}_{1}={q}_{2}=\frac{A-c-t}{3}\) and \({a}_{1}={a}_{2}=t\). Thus, in stage 2, the equilibrium emission fee set by the host-country government is \({t}^{FL}=\frac{16d(A-c)}{64d+33}\), making the equilibrium profit of firm 1 \({\pi }_{1}^{FL}=\frac{2(384{d}^{2}+352d+121){(A-c)}^{2}}{{(64d+33)}^{2}}\).

By comparisons, we have \(\pi_1^{FL}\;\gtreqless\;\pi_1^F\) for \(d\;\gtreqless\;\underline d\), and \(\pi_1^{FL}\;\gtreqless\;\pi_1^L\) for \(d\;\gtreqless\;\overline d'\), where \(\underline{d}\approx 0.78709\) and \(\overline d'\approx 1.52691\).Footnote 51 Hence, unlike the two-part tariff licensing contract, firm 1 prefers FL to FDI under the fixed-fee licensing contract if and only if \(d>\underline{d}\). We also get that firm 1 prefers FL to licensing under the fixed-fee licensing contract if and only if \(d>\overline d'\).

7.2 Committed Policy

Now we consider a situation where the domestic government can commit to its policy before firm 1’s market-entry decision.

7.2.1 FDI

If firm 1 undertakes FDI in stage 2, its profit is \({\pi }_{1}=\frac{{\left(A-c-t\right)}^{2}+2{t}^{2}}{4}\) as shown in subSection 5.1.1.

7.2.2 Licensing

From the result shown in subSection 5.1.2 (where we consider a two-part tariff licensing), i.e., the optimal royalty rate is 0, we can infer that the profit of firm 1 in stage 2 under licensing with fixed-fee only is \({\pi }_{1}=\frac{{\left(A-c-t\right)}^{2}+2{t}^{2}}{4}\), which is the same as that of under FDI.

7.2.3 FL

Now consider the situation where firm 1 undertakes FL in stage 2. The analysis in stage 3 is similar to subSection 4.3 with \(r=0\). In stage 3, we get \({q}_{1}={q}_{2}=\frac{A-c-t}{3}\) and \({a}_{1}={a}_{2}=t\). Hence, the profit of firm 1 in stage 2 is \({\pi }_{1}=\frac{{2\left(A-c-t\right)}^{2}+9{t}^{2}}{9}\), which is not less than that of under FDI or licensing if and only if \(t\ge \frac{(3\sqrt{2}-1)(A-c)}{17}\). In other words, if the host-country government sets \(t\ge \frac{(3\sqrt{2}-1)(A-c)}{17}\) (\(t\le \frac{(3\sqrt{2}-1)(A-c)}{17}\)) in stage 1, firm 1 will undertake FL (FDI or licensing) in stage 2.

7.2.4 The Equilibrium

Now we examine the decision of the host-country government on emission fee by comparing the domestic welfare under a high emission fee (i.e. \(t\ge \frac{(3\sqrt{2}-1)(A-c)}{17}\)) and a low emission fee (i.e. \(t\le \frac{(3\sqrt{2}-1)(A-c)}{17}\)). As shown in Appendix 12, the host-country government prefers a high emission fee in stage 1. Accordingly, firm 1 undertakes FL in equilibrium.

To sum up, when the licensing contract is fixed-fee only, firm 1 still undertakes FL if the pollution intensity is high under the non-committed policy, and it always undertakes FL under the committed policy as the host-country government would like to set a high emission fee in this case. Hence, FL occurs as the equilibrium strategy of firm 1 even under the restricted licensing contract where firm 1 licenses only under a fixed-fee.

8 Conclusion

There is a vast literature examining the multinational firms’ incentives for FDI and technology licensing. However, that literature ignored two important aspects. It ignored polluting industries and considered FDI and licensing as substitutes. We fill this gap in this literature and show a foreign monopolist final goods producer’s incentive for FDI, licensing, and FL (FDI and licensing) in a polluting industry.

We find that when the emission fee cannot be committed by the host-country government, the foreign monopolist always licenses, but prefers licensing compared to FL if the pollution intensity is not high. If the foreign monopolist chooses licensing, it reduces the host-country welfare and may reduce consumer surplus and world welfare compared to both FDI and FL. Hence, the domestic government needs to be careful about technology licensing in a polluting industry, as it may hurt the consumers and the country.

If the pollution intensity is high, the foreign firm does FL, which provides higher consumer surplus and welfare compared to both licensing and FDI.

When the host-country can commit to its policy, the foreign monopolist always prefers FL to both licensing and FDI. Compared to the non-committed host-country policy, the committed host-country policy decreases pollutant emission and increases pollution abatement.

Thus, the choice between licensing and FL by the foreign firm in a polluting industry depends on the host-country’s policy and the pollution intensity. Based on our analytical results, one possible reason for BP (UK) and LyondellBasell to do FL in China, and Shell to do FL in Japan is that the pollution intensity is high in those industries, while the reason for several leading Italian pharmaceutical and biotech companies to adopt technology licensing as the foreign market-entry mode may be that the pollution intensity is not high and the host-country could not commit to its policy.

In our analysis, FDI is always dominated by licensing and FL. This happened because we assumed that the domestic firm and the foreign firm could use the technology of the foreign firm with the same efficiency. However, it is trivial that if the foreign firm could use its technology more efficiently compared to the domestic firm, FDI could dominate licensing and FL if the domestic firm’s efficiency in using the foreign firm’s technology is sufficiently lower than that of the foreign firm. In the extreme case where the domestic firm is not capable to use the technology, licensing would not be an option.

In our main analysis, we have considered a two-part tariff licensing contract and Cournot competition under FL. We have extended our analysis to show the effects of Stackelberg competition under FL and the effects of a restricted licensing contract where the foreign firm can use only the fixed-fee under licensing. We show that our main qualitative results hold under these extensions.

It is worth mentioning that the environmental policy-making process in some countries may be different from our model. For example, the dual carbon target in China is mainly based on national development in the long run. If the host-country government in our analysis maximizes welfare subject to a constraint on the emission level, our analysis will be unaffected if that constraint is not binding. However, our analysis needs to be modified and a detailed analysis is required if the constraint on the emission level is either binding or the environmental policies not only include tax, but also include other requirements, such as adopting new green technology. We leave these issues for future research.

Data Availability

Data sharing not applicable to this article as no datasets were generated or analysed during the current study.

Notes

FDI stock in developing economies is over US$12 trillion in 2020 (UNCTAD Handbook of Statistics, 2021).

For example, North Carolina-based vTv Therapeutics signed an exclusive licensing agreement with Hangzhou Zhongmei Huadong Pharmaceutical Co., Ltd., in China, for the rights to develop and commercialize vTv Therapeutics’ GLP-1r agonist program in China and other Pacific Rim countries (See https://www.businesswire.com/news/home/20171221005238/en/vTv-Therapeutics-Announces-Licensing-Agreement-with-Hangzhou-Zhongmei-Huadong-Pharmaceutical-Co.-to-Rights-for-vTv%E2%80%99s-GLP-1r-Agonist%C2%A0Diabetes-Program-in-China-and-Other-Pacific-Rim-Territories). Huadong Medicine Co., Ltd., in China won the exclusive rights for two autoimmune products, Arcalyst (rilonacept) and mavrilimumab, of Kiniksa Pharmaceuticals (UK) Ltd. in the Asia Pacific region (including China, South Korea, Australia and 18 other countries, excluding Japan) (see http://www.pharmadj.com/en/cms/detail.htm?item.id=ecb845cca8cb11ecbee6fa163e42049a).

The literature on pollution haven hypothesis shows the effects of environmental regulation in the host countries on inward FDIs (see, e.g., Dijkstra et al. 2011, Chung 2014 and Cai et al. 2016, for some recent contributions, and the references therein). Zhao et al. (2019) compare the welfare effects of FDI in polluting industries to that under closed polluting sectors. In contrast, we consider the choice between FDI, licensing, and FL.

There is a related literature where exogenous entry of a new final goods producer may increase the profits of the incumbent firms or the industry profit in the absence of strategic government policies. See, e.g., Tyagi (1999), Naylor (2002a, b), Mukherjee et al. (2009), Matsushima (2006) and Mukherjee (2019) for strategic input price determination, Pal and Sarkar (2001) and Mukherjee and Zhao (2017) for Stackelberg competition, Ishibashi and Matsushima (2009) for vertical product differentiation and heterogeneous consumer groups, Ishida et al. (2011) for innovation by asymmetric cost firms, and Fanti and Buccella (2017) for network externality with corporate social responsibility.

Banerjee and Poddar (2019) and Niu (2019) considered exclusive versus non-exclusive licensing in a closed economy and in a non-polluting industry. Hence, unlike our paper, those papers neither considered FDI and licensing, nor considered a polluting industry. Saggi (1996) compared the incentive for FDI and licensing with the possibility of exclusive and non-exclusive licensing. However, unlike our paper, he neither considered a polluting industry nor considered the possibility of FDI and licensing as complement.

We will consider Stackelberg competition under FL in Section 6.

The pollution abatement technology can reduce pollutant emission to zero at most. Hence, a producer has no incentive to choose an abatement that is greater than its output.

See Varian (1992, p. 164–166) for a discussion on consumer surplus for a quasilinear utility function, which is widely used in the partial equilibrium analysis like ours.

As mentioned in Iida and Mukherjee (2020), “the Australian government repealed the Clean Energy act 2011 and abolished the carbon price mechanism to lower the cost of domestic production and consumption (see the website of the Australian Department of the Environment http://www.environment.gov.au/).” Helm et al. (2003) also provide examples of time inconsistency problems for the energy policies.

For the effects of non-committed environmental policies, one may look at Poyago-Theotoky (2007), Golombek et al. (2010) and Hattori (2013) for environmental investments, Eerola (2006), Dijkstra et al. (2011) and De Santis and Stähler (2009) for firms’ location decisions, and Iida and Mukherjee (2020) for bi-sourcing. For the effects of non-committed non-environmental policies, one may look at Staiger and Tabellini (1987), Al-Saadon and Das (1996), Mukherjee (2000), Neary and Leahy (2000), Mukherjee and Pennings (2006), Mukherjee and Tsai (2013), Lee et al. (2018) and Basak and Mukherjee (2022).

We have \(\frac{\partial {\pi }_{1}^{F}}{\partial d}=-\frac{96{\left(A-c\right)}^{2}}{{\left(9d+11\right)}^{3}}<0\), \(\frac{\partial {W}^{F}}{\partial d}=-\frac{8{(A-c)}^{2}}{{(9d+11)}^{2}}<0\) and \(\frac{\partial {GW}^{F}}{\partial d}=-\frac{8(9d+23){(A-c)}^{2}}{{(9d+11)}^{3}}<0\).

Since the lump-sum payment \(L\) is determined before the emission fee, it will not affect the emission fee.

Thus, we have \({\pi }_{1}=\frac{(27{d}^{2}+30d+19){\left(A-c\right)}^{2}+8(3d-1)(A-c)r-(27{d}^{2}+54d+11){r}^{2}}{2{(9d+5)}^{2}}\). We get the equilibrium royalty rate by maximizing this expression.

It is shown in subSection 4.4 that licensing is the equilibrium choice of firm 1 for \(d<\overline{d }\), where \(\overline{d }\approx 0.88753<\frac{3+4\sqrt{6}}{9}\).

\({d}^{\prime}\) is the cutoff value of the pollution intensity for which the consumer surplus under licensing is the same to that of under FDI.

\(\widehat{d}\) is the cutoff value of the pollution intensity for which the world welfare under licensing is the same to that of under FDI.

\(\frac{\partial \left({t}^{F}-{t}^{L}\right)}{\partial d}=-\frac{12\left(729{d}^{4}+1944{d}^{3}+3726{d}^{2}+5016d+2057\right)\left(A-c\right)}{{\left(9d+11\right)}^{2}{\left(27{d}^{2}+54d+11\right)}^{2}}<0\).

As \(\frac{{\partial }^{2}{\pi }_{2}}{\partial {a}_{2}^{2}}=-1\), the equilibrium \({a}_{2}\) is a corner solution under the constraint of \({a}_{2}\le {q}_{2}\) if \({q}_{2}\le t\).

This will be more apparent in the next section.

The reason is that firm 1 uses the fixed-fee to extract the profit of firm 2.

\(\overline{d }\) is a solution of the equation \(108{d}^{4}+396{d}^{3}+389{d}^{2}-202d-471=0\), and is the cutoff value of the pollution intensity for which the profit of firm 1 under FL is the same to that of under licensing. It increases with Stackelberg competition under FL, as shown in subSection 6.1.2.

We have \({t}^{L}<{t}^{FL}\) for \(d<{d}_{0}\), where \({d}_{0}\) (\({d}_{0}\approx 1.57688\)) is a solution of the equation \(108{d}^{4}+225{d}^{3}-97{d}^{2}-563d-421=0\), and is the cutoff value of the pollution intensity for which the emission fee under FL is the same to that of under licensing.

is the cutoff value of the pollution intensity for which the consumer surplus is the same under FL and under licensing. As shown in subSection 6.1.2, it increases with Stackelberg competition under FL.

is the cutoff value of the pollution intensity for which the consumer surplus is the same under FL and under licensing. As shown in subSection 6.1.2, it increases with Stackelberg competition under FL.If firm 1 chooses \(r\le \frac{A-c-4t}{2}\), it attains the maximum profit \(\frac{{\left(A-c-t\right)}^{2}+3{t}^{2}}{4}\) (\(<\frac{3{\left(A-c-t\right)}^{2}+10{t}^{2}}{12}\)) at \(r=\frac{A-c-4t}{2}\).

The tax payment under FL (which is \(\frac{t\left[3\left(A-c\right)-11t\right]}{6}\)) is less than that of under FDI or licensing (which is \(\frac{t\left(A-c-3t\right)}{2}\)) by \(\frac{{t}^{2}}{3}\).

\({d}_{1}\) is the cutoff value of the pollution intensity for which the emission fee under the committed policy is the same to that of under the non-committed policy.

\({d}_{2}\) and \({d}_{3}\) are two cutoff values of the pollution intensity for which the profit of foreign firm under the committed policy is the same to that of under the non-committed policy.

\({d}_{4}\) and \({d}_{5}\) are two cutoff values of the pollution intensity for which the total output under the committed policy is the same to that of under the non-committed policy.

\({d}_{6}\) is the cutoff value of the pollution intensity for which the world welfare under the committed policy is the same to that of under the non-committed policy.

We find \({r}^{C}-{r}^{L}=\frac{\left(297{d}^{3}+303{d}^{2}+1355d+997\right)\left(A-c\right)}{\left(121d+131\right)\left(27{d}^{2}+54d+11\right)}>0\).

When both firms compete in the product market, the host-country government sets a high emission fee, making \({a}_{2}={q}_{2}\) in equilibrium under the non-committed and committed policies. Thus, with \({q}_{1}\) and \({q}_{2}\) given by (19), \({a}_{1}=t\) and \({a}_{2}={q}_{2}\), for a given royalty rate that is less than \(\frac{(4d+15)(A-c)}{7(4d+5)}\), the optimal emission fee under the non-committed policy, i.e., \(\frac{(4d+1)(A-c+r)}{16d+25}\), is higher than that of under the committed policy, i.e. \(\frac{(4d-1)(A-c)+(4d+5)r}{4(4d+5)}\). At the same time, we get \(\frac{(4d+15)(A-c)}{7(4d+5)}>{r}^{FL}>{r}^{C}\) from \(\frac{(4d+15)(A-c)}{7(4d+5)}-{r}^{FL}=\frac{\left(2d+11\right)\left(4d+1\right)\left(16d+25\right)\left(A-c\right)}{7\left(4d+5\right)(144{d}^{2}+380d+233)}>0\) and \({r}^{FL}-{r}^{C}=\frac{(352{d}^{3}+1162{d}^{2}+2447d+2033)(A-c)}{(121d+131)(144{d}^{2}+380d+233)}>0\).

\({\overline{d} }^{S}\) is a solution of the equation \(972{d}^{4}+2268{d}^{3}+1287{d}^{2}-2262d-6253=0\), and is the cutoff value of the pollution intensity for which the profit of firm 1 under licensing is the same to that of under FL.

If firm 1 chooses \(r\le \frac{A-c-5t}{2}\), it attains the maximum profit \(\frac{{\left(A-c-t\right)}^{2}}{4}\) (\(<\frac{3{\left(A-c-t\right)}^{2}+8{t}^{2}}{12}\)) at \(r=\frac{A-c-5t}{2}\).

Other things being equal, the total output and pollutant emission under Stackelberg competition would be higher compared to Cournot competition. This induces the host-country government to set a higher emission fee, especially under the committed policy.

\({d}_{2}^{S}\approx 3.86518\) is the cutoff value of the pollution intensity for which the profit of firm 1 under the committed policy is the same to that of under the non-committed policy. It is less than \({d}_{2}\) in subSection 5.3.