Abstract

Different environmental policies create different incentives for emission reduction. The paper examines the effect of two environmental policies, the emission abatement subsidy and emission tax policies, on a market with manufacturer investment in a green technology to reduce emission. Compared to environmental taxation, the results show that the subsidy policy offers a greater incentive to abate emission and yields higher industry profit. However, regarding social welfare, the subsidy policy leads to lower social welfare and environmental performance than the tax policy when emission is highly damaging to the environment and emission abatement is sufficiently costly. From the industrial perspective, increasing technological efficiency is not necessarily beneficial even if it is costless as the government will adjust the environmental policy accordingly for social welfare optimization, may at the manufacturer’s expense. Finally, extensions considering a combined policy (both subsidy and tax), a multiplicative emission cost function, and the problem in a supply chain context are performed to check the robustness of the results.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Environmental issues and their remediation have brought about numerous debates in both academia and practice. Greenhouse gases, wastewater, and landfills, among others, are leading to serious environmental deterioration. Facing these issues, governments can offer subsidies to firms based on their emission abatement activities, e.g., green technology investments. Alternatively, policy makers can impose taxes on firms discharging emissions to the environment. This paper discusses two typical environmental policies: subsidization and taxation and provides managerial insights by comparing difference scenarios. We also extend the base model to multiple scenarios including two competition modes (Bertrand and Cournot), combined policy, as well as supply chain context.

It is common to see environmental taxes and subsidies in practice. As a typical environmental policy, carbon tax has been extensively implemented in European countries including Denmark, Netherlands, etc., USA (Oregon, New York and Washington states), Canada (in Alberta, British Columbia and Québec), as well as in Asia (e.g., Japan and India) (European Environment Agency 2006; Andersen 2010). Germany implements energy taxes within the framework of the EU Energy Tax Directive (OECD 2018a). Specifically, Germany imposes such taxes on energy products such as petrol, electricity, natural gas, and diesel (Clean Energy Wire 2019). In 2013, UK launched a tax scheme called Carbon Price Support, with a rate of €18.05 per tonne emissions of CO2 equivalent, to be increased to €33.85 by 2020. Italy levies taxes on 84% of CO2 emissions from energy consumption, and its environmental tax revenue accounted for 3.57% of GDP in 2014 (OECD 2018b). Since 1991, Sweden has initiated carbon tax program at a rate of €24 per tonne of CO2 emissions, rising to €114 per tonne in 2019 (Government of Sweden 2019).

Alternatively, governments can subsidize emission-reducing activities such as product reuse and recycling, green product design, and pollution treatment (http://www.pollutionissues.com/A-Bo/Abatement.html#ixzz3vCuGDFau). Subsidy has also been an important policy in numerous countries for sustainable production, recycling, etc. For instance, grants and funding have been established in countries such as the USA, France, China, etc., to support firms’ emission-reducing activities (Lovei 1995; Helmer and Hespanhol 1997; Environmental Protection Agency 2015). In practice, it is common that governments support firms’ green technology investments in emission reduction by offering a lump-sum subsidy. For example, Australian government has established the national Emissions Reduction Fund program to incentivize firms’ emission abatement activities (Australian Government 2014). Furthermore, Japanese Electric Power Development Company receives lump-sum grants from the government for its investment in flue gas desulfurization (Inui 2002).

Either the subsidy or tax policy can motivate firms to make efforts in reduction emissions. For example, Ford has developed the world's largest green roof, adopted geothermal cooling systems, as well as sustainable fabrics in its vehicles and is the only company to have won the EPA Energy Star Award twice in a row (Lawson 2017). Another example is that Nissan invests in producing the less emitting vehicle model, the all-electric Nissan Leaf in the US market, which is supported by subsidies from the government (American Recovery and Reinvestment Act 2009). Similarly, General Motor’s plug-in hybrid Chevy Volt was introduced to the US market.

This paper aims to provide a systematic understanding of the effects of environmental subsidy and tax policies in a market where the manufacturer invests in a green technology contributing to emission abatement. The government can choose whether to offer a subsidy to the manufacturer’s emission abatement or impose an environmental tax on the net emissions after abatement. The subsidy depends on how much emissions can be reduced by the manufacturer’s green technology, while the environmental tax depends on the actual net emissions. The main research questions are as follows: when should a subsidy or tax policy be preferred? Which policy makes emissions abatement more effectively? Which policy is better for the manufacturer, and results in less emission and higher social welfare? How do emission abatement efficiency and degree of emission damage affect the industry, environmental performance and social welfare? This paper generates both managerial and policy insights by examining these questions in various scenarios.

The remainder of paper is structured as follows. Section 2 briefly reviews the literature. In Sect. 3, we present the problem studied in this paper. Analysis of three scenarios, including a benchmark model with no environmental policy and models with environmental subsidy and tax policies is provided in Sect. 4. Section 5 delivers managerial insights through analysis and discussions among the three scenarios. Section 6 analyze the case under two competition modes: Bertrand and Cournot. Section 7 discusses robustness of the results by extending the base model from different perspectives. Section 8 concludes the paper and provides some future research suggestions.

2 Related literature

The paper is related to the literature on the integration of environmental concerns into business strategies such as green technology innovation (Chan et al. 2018; Fang and Ma 2019; Saberi et al. 2018), green product design (Chen 2001; Li et al. 2019; Raz et al. 2013), buyer–supplier relationship (Chan et al. 2018; Xia et al. 2018), and green supply chain planning and design (Savaskan and Van Wassenhove 2006; Savaskan et al. 2004). Below we review the existing studies on two types of environmental policies: emission taxes and abatement subsidies.

First, environmental taxes have been studied since the 1920s (Baksi 2014; Cariou et al. 2019; Chen and Hao 2015; Lombardini-Riipinen 2005; Toshimitsu 2010; Xu et al. 2017). Alizamir et al. (2016) studied the effect of feed-in-tariffs on the learning and diffusion of green technologies. Some works focused on how tax and cap-and-trade policies impact a firm’s technology and capacity choices (Drake et al. 2016; Krass et al. 2013). Yang et al. (2017) discussed how firms’ cooperation affects supply chain decisions under the cap-and-trade policy. Bai et al. (2019) analyzed emission reduction with green technology under cap-and-trade. Unlike these studies focusing on environmental taxation or emission trading, we consider the case where the government chooses between environmental tax and subsidy policies facing emission reducing technology investment and discuss the effect of these environmental policies on the manufacturer’s decisions and profit, environmental impact and social welfare.

Second, the subsidy policy provides incentives to induce firms to reduce their emissions. Abatement subsidies as an emission control policy (Fredriksson 1998; Lerner 1972; Polinsky 1979). David and Sinclair-Desgagné (2010) examined the combination of emission taxes and abatement subsidies and found that taxing emission and subsidizing abatement efforts do not yield the first-best quality outcomes. Arya and Mittendorf (2015) studied the impact of subsidies on corporate social responsibility. Plambeck and Taylor (2015) discussed the effect of buyer audit on supplier social and environmental responsibility without considering government policies. By contrast, we compare the optimal social welfare under both taxation and subsidy policies and discuss how they affect firm decisions and profit. Unlike these works, we find either the tax or subsidy policy can be superior from the perspective of whole society.

Ouchida and Goto (2014) showed that total emission with subsides is lower than in the laissez-faire case with sufficiently small damage and RandD cost. Cohen et al. (2016) studied how demand uncertainty affects consumer subsidies for buying green products. Li et al. (2018) examined the optimal decision and environmental strategy under taxes to promote greening efforts in a supply chain. Chen and Ulya (2019) discussed environmental awareness and greening efforts under government reward-penalty policy in a reverse supply chain. Unlike these studies, we consider emission abatement subsidies and compare this policy with environmental taxation. We discuss endogenous decisions on emissions and abatement, as well as how they vary with respect to government policies and different parameters. We also extend the analysis to multiple scenarios to check the robustness of the results. For more review on sustainable operations, we refer to Kleindorfer et al. (2005), Atasu and Van Wassenhove (2012), Tang and Zhou (2012), Drake and Spinler (2013), Ovchinnikov et al. (2014), and Lee and Tang (2017).

3 Problem description

Suppose there is a manufacturer serving a market. The manufacturer’s production cost is c per unit. According to Spence (1976), the relationship between the market price and demand as.

where \(\alpha\) is the price cap and \(\beta\) is the sensitivity of price to demand. \(q\) denotes the production quantity and \(p\) is the corresponding market price.

Without loss of generality, we assume that, before pollution abatement, the manufacturer emits one unit of pollution from producing one unit of product. By investing in a green technology, the manufacturer can abate pollution emissions by \(a\) units, so the net emission after pollution abatement is \(e = q - a\). We assume this one-to-one relationship between product quantity and emission amount mainly to facilitate the exposition of the results and discussion. This one-to-one relationship is also adopted by many other studies such as Pal and Saha (2015), Poyago-Theotoky and Teerasuwannajak (2002), and Poyago-Theotoky (2007), to name a few. Furthermore, adding a proportional coefficient will not qualitatively change our results. The manufacturer incurs a cost of \({{\lambda a^{2} } \mathord{\left/ {\vphantom {{\lambda a^{2} } 2}} \right. \kern-\nulldelimiterspace} 2}\) due to emission abatement, depending on the actual amount of emission reduction. The coefficient \(\lambda > 0\) indicating the cost efficiency of the manufacturer’s emission abatement. A higher \(\lambda\) means that the manufacturer’s emission abatement is more costly (or less efficient). This quadratic emission abatement cost function suggests that it becomes increasingly costly for the manufacturer to reduce more emissions, which is consistent with the principle of diminishing returns. Similar emission functions have been widely adopted by previous studies such as Tsai et al. (2016) and Wang et al. (2016).

Based on Eq. (1), the traditional social welfare without considering environmental policy and emissions can be formulated as \(SW^{N} = \int_{0}^{q} {\left[ {p\left( x \right) - c} \right]dx} = \left( {\alpha - c} \right)q - \frac{1}{2}\beta q^{2}\). Consistent with Pal and Saha (2015) and the references therein, the social welfare with environmental concern is.

The last term in Eq. (2) represents the environmental damage caused by the actual emission, with the coefficient \(d > 0\) denoting the degree of production damage. A larger \(d\) indicates a higher level of environmental damage from the manufacturer’s emissions. For ease of exposition, we refer to \(d\) as the degree of damage, hereafter. The quadratic damage function characterizes diminishing returns as it shows that subsequent production emission is increasingly detrimental to the environment. This modeling of social welfare is extensively adopted by prior works such as Poyago-Theotoky and Teerasuwannajak (2002), Poyago-Theotoky (2007), and Ouchida and Goto (2014).

This damage can be justified in the sense that initial reasonable amount of emissions can be directly absorbed by nature capacity and thus causes not much damage to the environment (Ontl and Schulte 2012). However, it would cause increasing damage if the subsequent amount of emissions is beyond the nature capacity. A simple example to understand is that the nature was not damaged much when the level of industrial development is low. Nowadays, it has been increasingly important to protect the environment from being damaged by more and more emissions that beyond the capacity of nature absorption. This can also be seen from the facts more and more NGOs, governments, and individuals are calling for dealing with the climate change and reducing emissions.

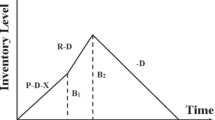

The sequence of decisions in the game is as follows. First, the government decides which policy to select with a purpose of maximizing social welfare. Specifically, the government chooses between two environmental policies: a subsidy or tax, i.e., offers a subsidy rate s on each unit of emission abatement or imposes a tax rate t on each unit of emission. If the manufacturer’s total emission is q and its abatement is a, it will gain sa under the subsidy policy or lose te under the tax policy. This is similar to existing studies such as Pal and Saha (2015) and Tsai et al. (2016). In the second stage, the manufacturer determines the pollution abatement level, given the government’s policy decision. In the third stage, the manufacturer chooses the production quantity. This decision sequence reasonably assumes that the government is the game leader in the process of interactions. From the manufacturer’s perspective, emission abatement involves technology investment, which is more strategic and longer-term than the wholesale price decision. Thus, the manufacturer makes the abatement decision followed by setting the wholesale price based on the government’s policy. The decision sequence is also described in Fig. 1 below. We solve the game backwards to ensure sub-game perfection.

4 Optimal decisions

Based on the above problem, this section analyzes the decisions of the manufacturer and the government in different scenarios. We first analyze the scenario with no environmental policy as a benchmark case in Sect. 4.1. Then the scenarios with environmental subsidy and tax are analyzed, respectively, in Sects. 4.2 and 4.3.

4.1 Benchmark: no environmental policy

Under no environmental policy, the manufacturer’s profit is.

where the superscript “N” represents the no environmental policy case and subscript “M” denotes the manufacturer.

Combining Eqs. (1) and (3), we can solve the manufacturer’s problem and obtain.

Based on Eq. (4), we have \(a^{N} = 0\), which shows that the manufacturer will not abate any emission if no environmental policy is implemented. Based on the results above, we obtain all other equilibrium outcomes in Table 1 in “Appendix”. In the absence of an environmental policy, social welfare is negative when the manufacturer’s production is sufficiently damaging (\(d > 3\beta\)). This suggests that an appropriate environmental policy is necessary to regulate emission.

4.2 Decision under the environmental subsidy policy

This subsection examines the case where the government adopts the environmental subsidy policy for emission control, under which the manufacturer’s objective is to maximize

where the superscript “S”, represents the subsidy policy. In Eq. (5), the manufacturer performs a emission abatement that costs \({{\lambda a^{2} } \mathord{\left/ {\vphantom {{\lambda a^{2} } 2}} \right. \kern-\nulldelimiterspace} 2}\) and then receives a total subsidy of \(sa\). This formulation of environmental subsidy is based on emissions reducing performance, which is consistent with real practice. For example, Australian government has established the Emissions Reduction Fund to incentivize firms’ emission abatement activities (Australian Government 2014), and Japanese Electric Power Development Company receives lump-sum grants from the government for its investment in flue gas desulfurization (Inui 2002). This modeling of environmental subsidy is extensively adopted by existing literature such as David and Sinclair-Desgagné (2010), Pal and Saha (2015), and Tsai et al. (2016).

Maximizing Eq. (5) with respect to \(q\), the manufacturer responds to the government subsidy as following:

which suggests that production quantity is invariant with respect to the subsidy, implying that the manufacturer does not pass any subsidy on to consumers, so demand quantity is not affected by the subsidy.

Based on Eq. (6), the manufacturer then determines the abatement level at

where Eq. (7) suggests that the manufacturer’s emission abatement is higher when the government offers a greater subsidy.

Knowing the responses of the manufacturer, the government sets a subsidy to maximize social welfare that equals the sum of the manufacturer’s profit (\(\Pi_{M}^{S}\)) and consumer surplus (\({{\beta q^{2} } \mathord{\left/ {\vphantom {{\beta q^{2} } 2}} \right. \kern-\nulldelimiterspace} 2}\)), minus subsidy expenditure (\(sa\)) and monetized environmental damage (\({{de^{2} } \mathord{\left/ {\vphantom {{de^{2} } 2}} \right. \kern-\nulldelimiterspace} 2}\)). Solving the government’s objective, we derive the optimal subsidy as.

which shows that the government’s subsidy increases when the emission abatement becomes costlier or the production emission is more environmentally damaging, i.e., \({{\partial s} \mathord{\left/ {\vphantom {{\partial s} {\partial d}}} \right. \kern-\nulldelimiterspace} {\partial d}} > 0\) and \({{\partial s} \mathord{\left/ {\vphantom {{\partial s} {\partial \lambda }}} \right. \kern-\nulldelimiterspace} {\partial \lambda }} > 0\). When the manufacturer’s technology is extremely inefficient (\(\lambda \to + \infty\)), there is no abatement (\(a^{S} = 0\)), which suggests that the subsidy policy reduces to the case of no environmental policy. Substituting Eq. (8) backwards, we can obtain all other equilibrium values, which are summarized in Table 2.

Regarding gross emission, we have \({{\partial q^{S} } \mathord{\left/ {\vphantom {{\partial q^{S} } {\partial d}}} \right. \kern-\nulldelimiterspace} {\partial d}} = 0\) and \({{\partial q^{S} } \mathord{\left/ {\vphantom {{\partial q^{S} } {\partial \lambda }}} \right. \kern-\nulldelimiterspace} {\partial \lambda }} = 0\). Since the manufacturer does not pass the subsidy on to consumers, the emission abatement efficiency and degree of damage have no impact on demand. For the manufacturer’s emission abatement, we have \({{\partial a^{S} } \mathord{\left/ {\vphantom {{\partial a^{S} } {\partial d}}} \right. \kern-\nulldelimiterspace} {\partial d}} > 0\) and \({{\partial a^{S} } \mathord{\left/ {\vphantom {{\partial a^{S} } {\partial \lambda }}} \right. \kern-\nulldelimiterspace} {\partial \lambda }} < 0\). This suggests that, under the subsidy policy, emission abatement is higher when its production damage is higher. The reason is that the higher subsidy induces the manufacturer to invest more in emission abatement. It also demonstrates that the amount of emission abatement decreases when it becomes costlier.

Like the benchmark model, negative social welfare arises when \(\lambda\) and \(d\) is sufficiently large under the subsidy policy. Specifically, under the subsidy policy, we have (i). If \(\lambda \le 3\beta\), \(SW^{S} > 0\). (ii). If \(\lambda > 3\beta\), \(SW^{S} > 0\) for \(d < {{3\beta \lambda } \mathord{\left/ {\vphantom {{3\beta \lambda } {\left( {\lambda - 3\beta } \right)}}} \right. \kern-\nulldelimiterspace} {\left( {\lambda - 3\beta } \right)}}\), and \(SW^{S} \le 0\) otherwise. Negative social welfare never occurs when the manufacturer’s emission abatement is sufficiently efficient because the emission can be reduced without incurring a high cost, i.e., the environmental damage of the emission can be controlled. However, when costly emission abatement and high degree of environmental damage, we can see that the emission is high and the resulting environmental damage is severe, which hurts the entire society. This result generates the implication that environmental subsidy helps reduce emissions, while it may not be able to avoid hazardous scenario with negative social welfare due to no control on the amount of gross emissions. Next, we shall discuss the case of environmental taxation which has a different consequence.

4.3 Decision under the environmental tax policy

Under environmental taxation, the manufacturer maximizes its profit given by.

where the superscript “T” denotes the tax policy. From Eq. (9), the manufacturer’s emission abatement incurs a cost of \({{\lambda a^{2} } \mathord{\left/ {\vphantom {{\lambda a^{2} } 2}} \right. \kern-\nulldelimiterspace} 2}\), leading to net emission of \(e\) and a total tax of \(te\). The formulation of environmental taxation is consistent with the practices of various countries. For example, UK launched a tax scheme called Carbon Price Support in 2013, with a rate of €18.05 per tonne of CO2 emissions, which is to be increased to €33.85 by 2020. Italy levies taxes on 84% of CO2 emissions from energy consumption, with the environmental tax revenue accounting for 3.57% of GDP in 2014 (OECD 2018b). Since 1991, Sweden has initiated carbon tax program at a rate of €24 per tonne of CO2 emissions, rising to €114 per tonne in 2019 (Government of Sweden 2019).

Based on Eq. (4), we can solve Eq. (9) for \(q\) as

which implies production quantity decreases with respect to the tax, i.e., the manufacturer transfers part of the tax burden to end consumers, which is in contrast to the case of no pass-through under the subsidy policy. Then, the manufacturer determines the abatement level based on Eq. (10) at.

Equation (11) suggests that the manufacturer abates more emissions when the government levies a higher tax. Anticipating the above responses, the government sets an optimal tax to maximize the social welfare which equals the sum of manufacturer profit (\(\Pi_{M}^{T}\)), consumer surplus (\({{\beta q^{2} } \mathord{\left/ {\vphantom {{\beta q^{2} } 2}} \right. \kern-\nulldelimiterspace} 2}\)) and tax revenue (\(te\)), minus environmental damage (\({{de^{2} } \mathord{\left/ {\vphantom {{de^{2} } 2}} \right. \kern-\nulldelimiterspace} 2}\)). Solving the government’s objective yields the optimal tax as.

where \(d^{T} = {{\beta \lambda } \mathord{\left/ {\vphantom {{\beta \lambda } {\left( {2\beta + \lambda } \right)}}} \right. \kern-\nulldelimiterspace} {\left( {2\beta + \lambda } \right)}}\). Note that, when \(d \le d^{T}\), we have \(t = 0\), which means no tax is imposed on the manufacturer if its production causes sufficiently low environmental damage. Thus, the tax policy with \(d \le d^{T}\) reduces to the no environmental policy case. To focus on the effect of taxation, hereafter we focus on the tax policy with a positive tax (\(d > d^{T}\)). Based on the optimal tax, we can derive other equilibrium values, summarized in Table 2. Unlike the subsidy policy, the tax policy always leads to positive social welfare (\(SW^{T} > 0\)).

Based on Eq. (12), we have (i). \({{\partial t} \mathord{\left/ {\vphantom {{\partial t} {\partial d}}} \right. \kern-\nulldelimiterspace} {\partial d}} > 0\); (ii). \({{\partial t} \mathord{\left/ {\vphantom {{\partial t} {\partial \lambda }}} \right. \kern-\nulldelimiterspace} {\partial \lambda }} < 0\) for \(d^{T} < d < d_{0}\), and \({{\partial t} \mathord{\left/ {\vphantom {{\partial t} {\partial \lambda }}} \right. \kern-\nulldelimiterspace} {\partial \lambda }} \ge 0\) otherwise, with equality holding at \(d = d_{0}\), where \(d_{0} = \frac{{\beta \lambda \left( {4\beta + \lambda + \sqrt {48\beta^{2} + 40\beta \lambda + 9\lambda^{2} } } \right)}}{{2\left( {4\beta^{2} + 4\beta \lambda + \lambda^{2} } \right)}}\). Intuitively, this suggests that the government tends to set a higher tax when the manufacturer’s production is more detrimental to the environment. Next, the optimal tax is non-monotonic with respect to the manufacturer’s emission abatement cost efficiency, depending on the degree of damage. Specifically, when the degree of damage is low, the government’s tax will decrease if its emission abatement is costlier. This is because, with low degree of damage, the government focuses more on economic efficiency by decreasing the tax to promote production when its emission abatement is costlier. However, with sufficiently high degree of damage, the government is more concerned about environment and suppresses production by increasing the tax. The implication from this result suggests that the government should trade off between environment conservation and economic development when choosing a tax policy.

Regarding gross emission, we have (i). \({{\partial q^{T} } \mathord{\left/ {\vphantom {{\partial q^{T} } {\partial d}}} \right. \kern-\nulldelimiterspace} {\partial d}} < 0\). (ii). \({{\partial q^{T} } \mathord{\left/ {\vphantom {{\partial q^{T} } {\partial \lambda }}} \right. \kern-\nulldelimiterspace} {\partial \lambda }} > 0\) for \(d^{T} < d < d_{0}\), and \({{\partial q^{T} } \mathord{\left/ {\vphantom {{\partial q^{T} } {\partial \lambda }}} \right. \kern-\nulldelimiterspace} {\partial \lambda }} \le 0\) otherwise, with equality holding at \(d = d_{0}\). This suggests that the tax is higher and the manufacturer passes partial tax on to consumers, leading to lower demand when the manufacturer’s production causes more environmental damage. The reason for result (ii) is that the quantity change is oppositely related to tax variation. Similar to the subsidy case, we have \({{\partial q^{T} } \mathord{\left/ {\vphantom {{\partial q^{T} } {\partial d}}} \right. \kern-\nulldelimiterspace} {\partial d}} > 0\) and \({{\partial q^{T} } \mathord{\left/ {\vphantom {{\partial q^{T} } {\partial \lambda }}} \right. \kern-\nulldelimiterspace} {\partial \lambda }} < 0\), which show that the manufacturer’s emission abatement increases with respect to its production damage. This is because a higher tax forces the manufacturer to invest more in emission abatement. Together with the corresponding result under subsidy, this result indicates that the amount of emission abatement decreases when the manufacturer’s emission-reducing technology investment becomes less efficient, regardless of the government’s policy choice.

5 Analysis and discussions

Based on the optimal decisions obtained in Sect. 4, this section first presents some theoretical properties of the results; and then gives the comparative analysis among different scenarios, which delivers important managerial insights for managers and regulators.

Lemma 1

\(e^{S}\) (\(e^{T}\)) increases in \(\lambda\) but decreases in \(d\).

Proof

See “Appendix”.\(\hfill\square\)

Lemma 1 suggests that, whether the government adopts a subsidy or tax policy, net emissions always decrease when production emissions are more detrimental or the emissions abatement is more efficient. Under subsidization, gross emission remains invariant whereas emission abatement always decreases in \(\lambda\), which leads to increased net emission. Under the tax policy, gross emission either increases or decreases in \(\lambda\), whereas emission abatement always decreases with respect to \(\lambda\). Overall, we find that the decrease of emission abatement in \(\lambda\) dominates in deciding the variation of net emission, regardless of which policy is adopted. As \(d\) increases, the manufacturer’s production decreases under taxation (and is invariant under subsidization), whereas the manufacturer’s emission abatement increases under both policies. Thus, we show that net emission always decreases in the degree of environmental damage \(d\). The insight from this result is that higher (lower) environmental damage always leads to less (more) emissions, irrespective of the government’s policies.

Proposition 1

Regarding the manufacturer’s profit, we have

-

(i)

\({{\partial \Pi_{M}^{S} } \mathord{\left/ {\vphantom {{\partial \Pi_{M}^{S} } {\partial d}}} \right. \kern-\nulldelimiterspace} {\partial d}} > 0\).

-

(ii)

\({{\partial \Pi_{M}^{S} } \mathord{\left/ {\vphantom {{\partial \Pi_{M}^{S} } {\partial \lambda }}} \right. \kern-\nulldelimiterspace} {\partial \lambda }} \ge 0\) if \(d \ge \lambda\), with equality holding at \(d = \lambda\); otherwise, \({{\partial \Pi_{M}^{S} } \mathord{\left/ {\vphantom {{\partial \Pi_{M}^{S} } {\partial \lambda }}} \right. \kern-\nulldelimiterspace} {\partial \lambda }} < 0\).

-

(iii)

\({{\partial \Pi_{M}^{T} } \mathord{\left/ {\vphantom {{\partial \Pi_{M}^{T} } {\partial d}}} \right. \kern-\nulldelimiterspace} {\partial d}} < 0\).

-

(iv)

\({{\partial \Pi_{M}^{T} } \mathord{\left/ {\vphantom {{\partial \Pi_{M}^{T} } {\partial \lambda }}} \right. \kern-\nulldelimiterspace} {\partial \lambda }} > 0\) for \(d^{T} < d < d_{1}\) and \({{\partial \Pi_{M}^{T} } \mathord{\left/ {\vphantom {{\partial \Pi_{M}^{T} } {\partial \lambda }}} \right. \kern-\nulldelimiterspace} {\partial \lambda }} \le 0\) for \(d \ge d_{1}\), with equality holding at \(d = d_{1}\), where \(d_{1}\) is the largest root of

$$ \left[ \begin{gathered} - \left( {2\beta + \lambda } \right)^{4} d^{3} - 3\beta \lambda \left( {4\beta + \lambda } \right)\left( {2\beta + \lambda } \right)^{2} d^{2} \hfill \\ + \beta^{2} \lambda^{2} \left( {60\beta^{2} + 36\beta \lambda + 5\lambda^{2} } \right)d - \beta^{3} \lambda^{3} \left( {20\beta + 7\lambda } \right) \hfill \\ \end{gathered} \right] = 0. $$

Proof

See “Appendix”.\(\hfill\square\)

Under the subsidy policy, the manufacturer’s profit increases with the degree of damage (Proposition 1(i)). This is because two effects arise when the degree of damage is higher. First, the government offers a higher subsidy, which benefits the manufacturer. Second, the higher subsidy also induces more emission abatement, which makes the manufacturer incur higher cost. The first effect is positive, while the second is negative to the manufacturer’s profitability. Our results suggest that the positive effect always dominates the negative one, and thus the manufacturer benefits when its emission has a higher degree of damage under the subsidy policy (Fig. 2a). The implication from this result is that under the subsidy policy, the manufacturer has an incentive of overestimating the harmful effect of its emissions to request more subsidies from the government.

By contrast, Proposition 1(ii) suggests that when the manufacturer’s emission abatement becomes costlier, it will accrue higher (lower) profit if the degree of damage is high (low). This can be explained as follows. The government will offer a higher subsidy if the manufacturer’s emission abatement is costlier. Whether the increase of subsidy outweighs the increase of abatement cost depends on how environmentally damaging the manufacturer’s production is. Specifically, when the degree of damage is sufficiently high, we find that the subsidy is enough to cover the emission abatement cost because, to prevent severe environmental damage, the government offers a very high subsidy to induce emission abatement; otherwise, the manufacturer earns less profit when its emission abatement becomes costlier (Fig. 2b). Interestingly, this result indicates that improving the efficiency of emission abatement is not necessarily beneficial to the manufacturer. Specifically, higher efficiency of emissions reduction worsens the manufacturer’s performance when the degree of environmental damage is sufficiently high under the subsidy policy.

Unlike the subsidy policy, the manufacturer’s profit decreases as the degree of environmental damage increases under the tax policy because the government sets a higher tax when the manufacturer’s production is more damaging to the environment, which lowers its profit (Proposition 1(iii)). The increase of tax further raises prices, which reduces the manufacturer’s profits even more (Fig. 2a). Proposition 1(iv) reveals that the manufacturer’s profitability is non-monotonic in its emission abatement cost efficiency, while the variation mode is contrary to the subsidy policy case. Specifically, if the manufacturer’s degree of damage is sufficiently low (\(d^{T} < d < d_{1}\)), the manufacturer will accrue more profit when its emission abatement costs increase because the manufacturer benefits from a lower tax. The opposite result occurs with a high degree of environmental damage (\(d \ge d_{1}\)) (Fig. 2b). This result implies that under the tax policy, improving the abatement efficiency does not pay off for the manufacturer when the degree of environmental damage is sufficiently low, which is in stark contrast to the subsidy policy.

In summary, the analysis of Proposition 1 provides useful managerial and policy insights. First, in an industry that produces sufficiently highly environmental damaging products, the manufacturer benefits from the subsidy policy but gets hurt under a tax policy when the degree of environmental damage is higher. This further implies that the manufacturer might have an incentive to deliberately exaggerate (underestimate) its degree of damage if the subsidy (tax) policy is implemented by the government. Second, improving the efficiency of emission abatement can either be beneficial or harmful to the manufacturer, depending on the government’s policy choices (tax or subsidy) and degree of environmental damage. In particular, the manufacturer does not have incentive to improve the emission abatement efficiency if the degree of environmental damage of its emissions is sufficiently high (low) under the subsidy (tax) policy. This implies that, before deciding whether to improve its efficiency of emission abatement, the manufacturer needs to make a decision that is contingent upon the government’s policy choices and estimate how damaging its emission is.

In terms of social welfare, we have \({{\partial SW^{Y} } \mathord{\left/ {\vphantom {{\partial SW^{Y} } {\partial d}}} \right. \kern-\nulldelimiterspace} {\partial d}} < 0\) and \({{\partial SW^{Y} } \mathord{\left/ {\vphantom {{\partial SW^{Y} } {\partial \lambda }}} \right. \kern-\nulldelimiterspace} {\partial \lambda }} < 0 \, \left( {Y = S,T} \right)\), which show that social welfare declines as the degree of environmental damage becomes higher or its emission abatement cost rises, irrespective of the government’s policy decision. Based on the social welfare formation (Eq. 2), this result naturally follows as increasing \(d\) (\(\lambda\)) causes greater environmental damage (abatement cost) under both environmental policies.

5.1 Comparative analysis

In this subsection, we examine which policy should be preferred, and how the result changes if the policy focus switches between environment and economy, by comparing the equilibrium values of the two environmental policies. Specifically, we have the following results.

Lemma 2

Comparing price and quantity decisions, we have \(p^{N} = p^{S} < p^{T}\) and \(q^{N} = q^{S} > q^{T}\).

Proof

See “Appendix”.\(\hfill\square\)

In the presence of pass-through (Eq. 10), the prices under the tax policy are higher than that under the subsidy policy. This naturally leads to a higher production under the subsidy policy than under the tax policy. Without pass-through, the price and quantity results under the subsidy policy are the same as the no policy case. This result indicates that the tax policy has a stronger effect on curbing production (emissions) compared to the subsidy.

Lemma 3

Under the subsidy policy, the manufacturer has a higher emission abatement incentive than under the tax policy, i.e., \(A^{S} > A^{T} > A^{N} = 0\).

Proof

See “Appendix”.\(\hfill\square\)

Lemma 3 suggests that the manufacturer will actually reduces emission under either policy, while it has a higher incentive to do so under subsidization. The rationale is as follows. First, the subsidy is fully absorbed by the manufacturer, which implies that the entire subsidy contributes to emission abatement straightforwardly. However, the environmental tax is partially transferred to consumers and thus is not fully used for emission reduction (the transferred tax contributes to curbing total production/emission). Secondly, due to the pass-through under the tax policy, the government needs to trade off between loss of economic efficiency and emission reduction while imposing an emission tax, while this concern does not exist under the subsidy policy. This difference makes the government more conservative in imposing an emission tax, but more aggressive in providing an abatement subsidy: the optimal subsidy rate is higher than the optimal tax rate. Thus, it is sensible that the manufacturer has a larger abatement incentive under the subsidy policy than under the tax policy. This result implies that, when deciding which environmental policy to implement, the government should realize that the subsidy policy always provides a greater abatement incentive than taxation, while but it does not restrain the gross production (emissions) as under the tax policy.

Proposition 2

Regarding net emission, \(e^{T} \le e^{S} < e^{N}\) if \(\lambda > \left( {\sqrt 3 - 1} \right)\beta\) and \(d \ge d_{2} \left( { > d^{T} } \right)\), with equality holding at \(d = d_{2}\); otherwise, \(e^{S} < e^{T} < e^{N}\), where \(d_{2} = \frac{{ - \beta \lambda \left( {2\beta + \lambda } \right)}}{{ - \lambda^{2} - 2\beta \lambda + 2\beta^{2} }}\).

Proof

See “Appendix”.\(\hfill\square\)

Proposition 2 demonstrates that both policies contribute to emission reduction, while the no policy case always leads to the highest emission due to no abatement. Compared with the tax policy, the net emission under the subsidy policy is higher when the manufacturer’s abatement is sufficiently costly (\(\lambda > \left( {\sqrt 3 - 1} \right)\beta\)) and its production is highly damaging (\(d > d_{2}\)) (see Fig. 3). The reason is that, when the degree of damage and abatement cost are high, the restraint of total production under the tax policy is strong due to the pass-through, which does not exist under the subsidy policy. Despite the higher abatement level under the subsidy policy, this restraint on total production is significant enough to make the net emission lower under the tax policy; otherwise, net emission under the subsidy policy is lower than that under the tax policy. A direct implication from this result is that, from the viewpoint of environmental conservation, either the subsidy or tax policy can be better for reducing emissions. Specifically, the tax policy is better than the subsidy policy if the degree of damage is sufficiently high and emission abatement is costly enough; otherwise, the subsidy policy should be preferred.

Lemma 4

The manufacturer’s profits under different cases are ranked as \(\Pi_{M}^{S} > \Pi_{M}^{N} > \Pi_{M}^{T}\).

Proof

See “Appendix”.\(\hfill\square\)

The manufacturer’s profit is lowest under the tax policy across all three cases. This is because of the pass-through effect under the tax policy but not under the subsidy policy. Furthermore, under the subsidy policy, the manufacturer keeps the entire subsidy, and thus accrues higher profit than the no policy case (Fig. 3). This result indicates that, from the manufacturer’s perspective, the subsidy policy always generates higher profit than the no policy case, which in turn is better than the tax policy.

Proposition 3

\(SW^{N} < SW^{S} \le SW^{T}\) if \(\lambda > {{\left( {\sqrt {17} - 1} \right)\beta } \mathord{\left/ {\vphantom {{\left( {\sqrt {17} - 1} \right)\beta } 2}} \right. \kern-\nulldelimiterspace} 2}\) and \(d \ge d_{4}\), with equality holding at \(d = d_{4}\); otherwise, \(SW^{N} < SW^{T} < SW^{S}\), where \(d_{4} = \frac{{\beta \lambda \left( { - 3\beta - 2\lambda - \sqrt {25\beta^{2} + 8\beta \lambda } } \right)}}{{2\left( {4\beta^{2} - \beta \lambda - \lambda^{2} } \right)}}\).

Proof

See “Appendix”.\(\hfill\square\)

Proposition 3 compares social welfare levels under different policies, which is also illustrated by Fig. 4. First, social welfare under the subsidy or tax policy is higher than that under the benchmark case, which suggests that either the subsidy or tax policy is better than the no policy case, from the perspective of social welfare. Furthermore, the tax policy yields a higher social welfare than the subsidy policy when the manufacturer’s emission abatement is very costly enough (\(\lambda > {{\left( {\sqrt {17} - 1} \right)\beta } \mathord{\left/ {\vphantom {{\left( {\sqrt {17} - 1} \right)\beta } 2}} \right. \kern-\nulldelimiterspace} 2}\)) and the degree of damage is high (\(d \ge d_{4}\)). Based on social welfare formation, there are three components: traditional social welfare, abatement costs, and environmental damage. First, compared to the tax policy, the emission abatement cost under the subsidy policy is higher, which lowers social welfare, as Lemma 3 shows. Second, traditional social welfare is higher under the subsidy policy than under the tax policy because of the tax policy’s pass-through which restricts quantity, as in Lemma 2. Third, net emission under the subsidy policy can either be higher or lower than that under the tax policy, as Proposition 3 suggests. Overall, our results suggest that the tax policy yields higher social welfare when emission abatement is costly enough and degree of damage is sufficiently high, which is because the higher net emission under the subsidy policy causes much higher environmental damage, which leads to lower social welfare than the tax policy. This comparative result provides an implication for practice in that it demonstrates under what circumstances the government should implement an environmental tax or subsidy policy based on the consideration of both economic development and environment conservation.

This result implies that the government’s choice of environmental policy for social welfare maximization critically depends on two important factors: abatement cost efficiency and degree of damage. When both are sufficiently high, then the tax policy should be adopted for emission regulation, especially when the government also has financial concern.

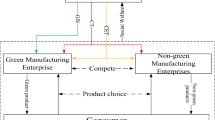

6 Analysis under competition

In this section, we extend our base model to the case with competition. Specifically, we examine two competition modes: Cournot and Bertrand.

6.1 Analysis under Cournot competition

We first analyze the case of Cournot competition where two firms (firm 1 and firm 2) engage in quantity competition. Suppose that firm 1 and firm 2 produce two substitutable products, product 1 and product 2, respectively. Following Singh and Vives (1984), we employ the stylized quadratic concave utility function expressed by.

with \(\alpha > 0\), \(\beta > 0\), and \(\theta \in \left( {0, \, 1} \right)\) measuring reservation utility and the degree of substitutability between product i and product j, respectively. Thus, consumer surplus after purchasing \(q_{i}\) units of products at price \(p_{i}\) per unit is given by.

Maximizing consumer surplus yields

6.1.1 Analysis of the environmental subsidy

This section examines the case where the government adopts an environmental policy for emission control. Specifically, the government chooses between two environmental policies: a subsidy or tax. Suppose the government offers a subsidy rate s on each unit of emission abatement or imposes a tax rate t on each unit of emission. If a manufacturer’s total emission is qi and its abatement is ai, it will gain \(sa_{i}\) under the subsidy policy or lose \(t\left( {q_{i} - a_{i} } \right)\) under the tax policy, similar to previous works such as Pal and Saha (2015) and Tsai et al. (2016).

We first consider the case where the government implements a subsidy policy, under which the manufacturer’s objective is to maximize

where the superscript “SQ” denotes the subsidy policy under Cournot (Quantity) competition. In Eq. (16), the manufacturer’s emissions abatement costs \({{\lambda a_{i}^{2} } \mathord{\left/ {\vphantom {{\lambda a_{i}^{2} } 2}} \right. \kern-\nulldelimiterspace} 2}\) and then it receives a total subsidy of \(sa_{i}\) based on its performance in emissions reduction.

Maximizing Eq. (16) with respect to \(q_{i}\), the manufacturer responds to the government subsidy as \(q_{i}^{SQ} = {{\left( {\alpha - c} \right)} \mathord{\left/ {\vphantom {{\left( {\alpha - c} \right)} {\left( {\beta \left( {\theta + 2} \right)} \right)}}} \right. \kern-\nulldelimiterspace} {\left( {\beta \left( {\theta + 2} \right)} \right)}}\), which shows that production quantity is invariant with respect to the subsidy, implying that the manufacturer does not pass any subsidy on to consumers, so demand quantity is not affected by the subsidy. Then, the manufacturer then determines the abatement level at \(a_{i}^{SQ} = {s \mathord{\left/ {\vphantom {s \lambda }} \right. \kern-\nulldelimiterspace} \lambda }\), which suggests that the manufacturer’s emission abatement is higher when the government offers a greater subsidy. Knowing the responses of the manufacturer, the government sets a subsidy to maximize social welfare. Solving the government’s objective, we derive the optimal subsidy as \(s^{SQ} = \frac{{2\lambda d\left( {\alpha - c} \right)}}{{\beta \left( {\theta + 2} \right)\left( {\lambda + 2d} \right)}}\). Based on this, we can obtain all other equilibrium values, which are summarized in Table 3.

Based on these equilibrium results, it can be easily checked that the previous results in base model qualitatively carry over to the case of Cournot competition. For the sake of space limitation, we shall not repeat them here. However, we proceed to discuss the effect of competition under the subsidy policy and Cournot (quantity) competition on various equilibrium outcomes in the following result.

Proposition 4

The effect of competition on the equilibrium results under subsidy and Cournot competition is as follows: (i) \(\frac{{\partial p_{i}^{SQ} }}{\partial \theta } < 0\); (ii) \(\frac{{\partial q_{i}^{SQ} }}{\partial \theta } < 0\); (iii) \(\frac{{\partial s^{SQ} }}{\partial \theta } < 0\); (iv) \(\frac{{\partial a_{i}^{SQ} }}{\partial \theta } < 0\); (v) \(\frac{{\partial e_{i}^{SQ} }}{\partial \theta } < 0\); (vi) \(\frac{{\partial \Pi_{Mi}^{SQ} }}{\partial \theta } < 0\); (vii) \(\frac{{\partial SW^{SQ} }}{\partial \theta } < 0\).

Proof

See “Appendix”.\(\hfill\square\)

Proposition 4 suggests that, when the level of competition is higher, both product price and quantity decrease, which means that level of gross emissions is lower. In this case, it is less imperative for the government to subsidize the manufacturer, so the level of subsidy declines with more intense competition. With a lower subsidy, the manufacturer’s incentive of reducing emissions is lower, so the amount of emission abatement decreases with more intense competition, which also leads to lower net emissions. From the manufacturer’s perspective, we find that more intense competition would decrease the manufacturer’s profit due to less profit and subsidy. While the level of discharged emissions is less with more intense competition, which as our results shows, would also reduce social welfare. The implication from this result is that more intense competition does not necessarily beneficial to the manufacturer or society under the subsidy policy and Cournot competition.

6.1.2 Analysis of the environmental tax

Under environmental taxation, the manufacturer maximizes its profit given by.

where the superscript “TQ” denotes the tax policy under Cournot (Quantity) competition. The manufacturer’s emission abatement \(a_{i}\) incurs a cost of \({{\lambda a_{i}^{2} } \mathord{\left/ {\vphantom {{\lambda a_{i}^{2} } 2}} \right. \kern-\nulldelimiterspace} 2}\), leading to net emissions of \(e_{i} = q_{i} - a_{i}\) and tax of \(t\left( {q_{i} - a_{i} } \right)\).

Based on Eq. (17), we can solve for \(q_{i}\) as \(q_{i}^{TQ} = {{\left( {\alpha - c - t} \right)} \mathord{\left/ {\vphantom {{\left( {\alpha - c - t} \right)} {\left( {\beta \left( {\theta + 2} \right)} \right)}}} \right. \kern-\nulldelimiterspace} {\left( {\beta \left( {\theta + 2} \right)} \right)}}\), which implies production quantity decreases with respect to the tax, i.e., the manufacturer passes partially the tax onto final consumers, in contrast to the case of no pass-through under the subsidy policy. Then, the manufacturer determines the abatement level at \(a_{i}^{TQ} = {t \mathord{\left/ {\vphantom {t \lambda }} \right. \kern-\nulldelimiterspace} \lambda }\), indicating that the manufacturer’s emission reduction is more when the government levies a higher tax. Anticipating the above responses, the government sets an optimal tax to maximize the social welfare, which yields the optimal tax as.

where \(d^{TQ} = \frac{\beta \lambda }{{2\left( {\beta \theta + 2\beta + \lambda } \right)}}\).

Note that when \(d \le d^{TQ}\), we have \(t^{TQ} = 0\), which means no tax is imposed if the manufacturer’s production causes sufficiently low environmental damage. In this case, the tax policy degenerates to the no environmental policy case, same as before. To focus on the effect of taxation, hereafter we focus on the tax policy with a positive tax (\(d > d^{TQ}\)). Based on the optimal tax, we can derive other equilibrium values, summarized in Table 3. Unlike the subsidy policy, the tax policy always leads to positive social welfare (\(SW^{TQ} > 0\)).

We continue to analyze the effect of competition under the tax policy and Cournot (quantity) competition on equilibrium outcomes in the following result. Compared to the case of the subsidy policy, we can see that under the tax policy, the main results remain qualitatively in terms of prices and quantities, profits as well as social welfare. Furthermore, comparing the tax policy to the subsidy under Cournot competition, we find that the comparative results of the base model qualitatively carry over to the case of competition. Therefore, we shall not repeat them here for the sake of space limitation. Next, we also check the robustness of base results by analyzing the case of Bertrand Competition. Due to space limitation, we will only show the essential results.

6.2 Analysis under Bertrand competition

In this section, we shall check whether the results under Cournot (quantity) competition mode carry over to the Bertrand competition where the firms compete in prices. To this end, we need to invert Eq. (15) to express the demand functions with prices as decision variables:

6.2.1 Analysis of the environmental subsidy

This section examines the case where the government adopts an environmental policy for emission control. Specifically, the government chooses between two environmental policies: a subsidy or tax. Suppose the government offers a subsidy rate s on each unit of emission abatement or imposes a tax rate t on each unit of emission. If a manufacturer’s total emission is \(q_{i}\) and its abatement is \(a_{i}\), it will gain \(sa_{i}\) under the subsidy policy or lose \(t\left( {q_{i} \left( {p_{i} , \, p_{j} } \right) - a_{i} } \right)\) under the tax policy, similar to previous works such as Pal and Saha (2015) and Tsai et al. (2016).

We first consider the case where the government implements a subsidy policy, under which the manufacturer’s objective is to maximize.

where the notations are the same as before except that the superscript “SP” denotes the subsidy policy under Bertrand (price) competition. Maximizing Eq. (20) with respect to prices, we have \(p_{i}^{SP} = {{\left( {\left( {1 - \beta } \right)\alpha + c} \right)} \mathord{\left/ {\vphantom {{\left( {\left( {1 - \beta } \right)\alpha + c} \right)} {\left( {2 - \beta } \right)}}} \right. \kern-\nulldelimiterspace} {\left( {2 - \beta } \right)}}\), implying that prices are invariant with respect to the subsidy, so the manufacturer does not pass any subsidy on to consumers and demand is not affected by the subsidy. Then, the manufacturer then determines the abatement level at \(a^{SP} = {s \mathord{\left/ {\vphantom {s \lambda }} \right. \kern-\nulldelimiterspace} \lambda }\), which suggests that the manufacturer’s emission abatement is higher when the government offers a greater subsidy. Knowing the responses of the manufacturer, the government sets a subsidy to maximize social welfare. Solving the government’s objective, we derive the optimal subsidy as \(s^{SP} = \frac{{2\lambda d\left( {\alpha - c} \right)}}{{\left( {1 + \beta } \right)\left( {2 - \beta } \right)\left( {\lambda + 2d} \right)}}\). Based on this, we can obtain all other equilibrium values, which are summarized in Table 4.

6.2.2 Analysis of the environmental tax

Under environmental taxation, the manufacturer maximizes its profit given by.

with same notations as before except that the superscript “TP” denotes the tax policy under Bertrand (price) competition. Based on Eq. (21), we can solve for \(p_{i}^{TP} = {{\left( {\left( {1 - \beta } \right)\alpha + c + t} \right)} \mathord{\left/ {\vphantom {{\left( {\left( {1 - \beta } \right)\alpha + c + t} \right)} {\left( {2 - \beta } \right)}}} \right. \kern-\nulldelimiterspace} {\left( {2 - \beta } \right)}}\), which implies product prices decrease with respect to the tax, i.e., the manufacturer passes partial tax onto final consumers, unlike the case of no pass-through under the subsidy policy. Then, the manufacturer determines the abatement level at \(a_{i}^{TP} = {{t^{TP} } \mathord{\left/ {\vphantom {{t^{TP} } \lambda }} \right. \kern-\nulldelimiterspace} \lambda }\), indicating that the manufacturer’s emission reduction is more when the government levies a higher tax. Anticipating the above responses, the government sets an optimal tax to maximize the social welfare, which yields the optimal tax as.

where \(d^{TP} = \frac{{\left( {1 - \beta^{2} } \right)\lambda }}{{2\left( {2 + \beta - \beta^{2} + \lambda } \right)}}\). Note that, when \(d \le d^{TP}\), we have \(t^{TP} = 0\), which means no tax is imposed if the manufacturer’s production causes sufficiently low environmental damage. In this case, the tax policy degenerates to the no environmental policy case, same as before. To focus on the effect of taxation, hereafter we focus on the tax policy with a positive tax (\(d > d^{TP}\)). Based on the optimal tax, we can derive other equilibrium values, summarized in Table 4. Unlike the subsidy policy, the tax policy always leads to positive social welfare (\(SW^{TP} > 0\)).

Based on Table 4, we can check the robustness of the main results in base model under Bertrand competition by comparing the subsidy to the tax policy. Comparing to the base model, again we find that the main results of the base model qualitatively carry over to the case of Bertrand competition as well.

7 Extensions

This section presents some possible extensions for the model, including a hybrid policy combines both subsidy and tax, a multiplicative emission function, and the analysis in a supply chain context.

7.1 Combined policy

In practice, it is possible that government implements both subsidization and taxation. In Canada, Alberta’s Climate Leadership Plan includes both Carbon levy and rebates (Alberta Government 2017). Thus, it is also worthwhile to examine a mixed policy combining the two policies together to see how they interact with each other. To include this scenario, we conduct analysis by investigating such a mixed policy with both taxation and subsidization. To achieve this purpose, we employ both the subsidy and tax terms from Eqs. (5) and (9), with the same solution procedure and analysis as before. All the equilibrium outcomes are shown by Table 5 in “Appendix”.

With a hybrid policy, we find that the government sets the subsidy (tax) rate less than that of the pure subsidy (tax) policy due to the joint interactive effect of subsidization and taxation. Consequently, this joint effect will lead to the scenario where emission abatement, product quantity, price, emission, and the profit are between those under subsidization and taxation. Besides, we also obtain new results regarding subsidy, tax, product quantity, the manufacturer’s profit and social welfare, which are given below, with the superscript “C” denoting the combined policy.

Lemma 5

With a mixed policy, we have (i). \(\frac{{\partial s^{C} }}{\partial d} < 0\) and \(\frac{{\partial s^{C} }}{\partial \lambda } < 0\); (ii). \(\frac{{\partial t^{C} }}{\partial d} > 0\) and \(\frac{{\partial t^{C} }}{\partial \lambda } > 0\); (iii). \(\frac{{\partial q^{C} }}{\partial d} < 0\) and \(\frac{{\partial q^{C} }}{\partial \lambda } < 0\).

Proof

See “Appendix”.\(\hfill\square\)

With higher degree of environmental damage or cost of emission abatement, the subsidy becomes lower while the tax increases. The underlying logic is that the subsidy cannot curb gross emission due to no pass-through (Lemma 2), while the tax can control both gross emission and abatement. Besides, the tax increase in turn makes quantity decrease when degree of damage becomes higher or emission abatement is costlier. This result implies that the government relies more on taxation than subsidization in the process of implementing a mixed policy when the degree of environmental damage or cost of emission abatement is higher.

Proposition 5

Under the mixed environmental policy, we have \(\frac{{\partial \Pi_{M}^{C} }}{\partial d} < 0\) and \(\frac{{\partial \Pi_{M}^{C} }}{\partial \lambda } < 0\).

Proof

See “Appendix”.\(\hfill\square\)

Proposition 5 suggests that the manufacturer always performs worse when the degree of environmental damage or cost of emission abatement becomes higher. This naturally follows from Lemma 5 as the decreased subsidy and increased tax both make the manufacturer’s profit lower. Furthermore, social welfare is always positive, which suggests that the hybrid policy enables the government to avoid the hazard zone as under the single subsidy policy by setting an appropriate tax rate. Also, social welfare under the mixed policy is highest compared to the pure subsidy or tax policy. This indicates that the government has the flexibility to achieve the optimal social welfare by using a hybrid policy. The implication is that the government should use both policies, if possible, to make use of flexibility and achieve the optimal social welfare.

7.2 Multiplicative emission function

In the base model, we have discussed the additive emission function \(E = q - a\) to be consistent with prior studies (Ouchida and Goto 2014; Pal and Saha 2015; Poyago-Theotoky 2007; Tsai et al. 2016). However, it is also worthwhile to investigate an alternative scenario with a multiplicative emission function \(E = q\left( {1 - a} \right)\). In this section, we examine this case as an extension. The solution procedure and analysis the same as before, except that the emission reduction function has been switched from multiplicative to additive relationship. All the equilibrium outcomes are shown by Table 6 in “Appendix”. It can be verified that all our analyses and discussions with the additive emissions function carry over well to the case of the multiplicative emission function qualitatively.

7.3 Analysis in a supply chain context

We further extend the based model to a supply chain where the manufacturer distributes products through an independent retailer who decides the quantity of products to order according to the market demand and resells to final consumers. Specifically, we consider a supply chain in a three-stage game where the government makes policy decisions, the manufacturer decides the wholesale price and pollution abatement level, and the retailer chooses order quantity. All the equilibrium outcomes are shown by Table 7 in the “Appendix”. By examining these results, we confirm that the results of the base model still hold in the supply chain case. Besides, we also find that double marginalization is intensified under the tax policy while unchanged under the subsidy policy. This is because the manufacturer transfers half of the tax burden to the downstream retailer under the tax policy, while does not pass any subsidy onto the retailer under the subsidy policy. Thus, the tax policy leads to lower profits for both the manufacturer and retailer, and thus lower supply chain efficiency.

8 Concluding remarks

This paper examines the impact of two environmental policies: emission abatement subsidy and emission tax. We find that the subsidy policy induces the manufacturer to reduce more emission than the tax policy. Nevertheless, the subsidy policy does not always result in lower net emission than the tax policy because the pass-through effect of the latter restrains total emission, while the subsidy policy does not. We show that net emission under the subsidy policy exceeds that of the tax policy when emission abatement is costly enough and the production emission is sufficiently damaging to the environment. This provides a guideline for policy makers focused on improving environmental performance.

We also find that the manufacturer benefits more from the subsidy policy than the tax policy. Interestingly, the manufacturer is not incentivized to improve emission abatement efficiency under the subsidy (tax) policy when the emission damage is high (low), even if it is costless. Our results also reveal that when the manufacturer’s emission abatement cost and environmental damage are sufficiently high, the tax policy is better. Otherwise, the subsidy policy is preferred. If government’s financial concern while implementing environmental policies is considered, our results indicate that the efficacy of subsidy should be reduced while the tax policy performs better as the former constitutes a cost while the latter brings revenue to the government. Furthermore, we have extended the base model to multiple scenarios to examine how the results of the base model change and obtained additional new results.

Regarding future research, we also recommend several possible directions. First, market uncertainty can be introduced to assess how this could affect environmental policies and their effects on other decisions. Second, examining competition between supply chains can be fruitful as it can assess its effect on various decisions. Finally, other policies such as emission standards and trade permits are worthwhile factors and their examination in a similar context could yield valuable insights.

References

Alberta Government, (2017). Climate Leadership Plan. https://www.alberta.ca/climate-leadership-plan.aspx.

Alizamir, S., de Véricourt, F., & Sun, P. (2016). Efficient feed-in-tariff policies for renewable energy technologies. Operations Research, 64(1), 52–66.

American Recovery and Reinvestment Act, (2009). https://www.fcc.gov/general/american-recovery-and-reinvestment-act-2009.

Andersen, M.S., (2010). Europe’s experience with carbon-energy taxation. SAPIENS, 3(2), Retrieved 2011–08–24.

Arya, A., & Mittendorf, B. (2015). Supply chain consequences of subsidies for corporate social responsibility. Production and Operations Management, 24(8), 1346–1357.

Atasu, A., & Van Wassenhove, L. N. (2012). An operations perspective on product take-back legislation for e-waste: Theory, practice, and research needs. Production and Operations Management, 21(3), 407–422.

Australian Government, (2014). Emissions Reduction Fund White Paper. http://www.environment.gov.au/climate-change/emissions-reduction-fund.

Bai, Q., Gong, Y., Jin, M., & Xu, X. (2019). Effects of carbon emission reduction on supply chain coordination with vendor-managed deteriorating product inventory. International Journal of Production Economics, 208, 83–99.

Baksi, S. (2014). Regional versus multilateral trade liberalization, environmental taxation, and welfare. Canadian Journal of Economics, 47(1), 232–249.

Cariou, P., Parola, F., & Notteboom, T. (2019). Towards low carbon global supply chains: A multi-trade analysis of CO2 emission reductions in container shipping. International Journal of Production Economics, 208, 17–28.

Chan, H. L., Shen, B., & Cai, Y. (2018). Quick response strategy with cleaner technology in a supply chain: Coordination and win-win situation analysis. International Journal of Production Research, 56(10), 3397–3408.

Chen, C. (2001). Design for the environment: A quality-based model for green product development. Management Science, 47(2), 250–263.

Chen, C. K., & Ulya, M. A. (2019). Analyses of the reward-penalty mechanism in green closed-loop supply chains with product remanufacturing. International Journal of Production Economics, 210, 211–223.

Chen, X., & Hao, G. (2015). Sustainable pricing and production policies for two competing firms with carbon emissions tax. International Journal of Production Research, 53(21), 6408–6420.

Clean Energy Wire, (2019). https://www.cleanenergywire.org/factsheets/putting-price-emissions-what-are-prospects-carbon-pricing-germany.

Cohen, M. C., Lobel, R., & Perakis, G. (2016). The impact of demand uncertainty on consumer subsidies for green technology adoption. Management Science, 62(5), 1235–1258.

David, M., & Sinclair-Desgagné, B. (2010). Pollution abatement subsidies and the eco-industry. Environmental and Resource Economics, 45(2), 271–282.

Drake, D. F., Kleindorfer, P. R., & Van Wassenhove, L. N. (2016). Technology choice and capacity portfolios under emissions regulation. Production and Operations Management, 25(6), 1006–1025.

Drake, D. F., & Spinler, S. (2013). OM Forum-Sustainable operations management: An enduring stream or a passing fancy? Manufacturing and Service Operations Management, 15(4), 689–700.

European Environment Agency, (2006). Market-based instruments for environmental policy in Europe. Report No. 8/2005. http://www.eea.europa.eu/publications/technical_report_2005_8.

Fang, C., & Ma, T. (2019). Technology adoption with carbon emission trading mechanism: Modeling with heterogeneous agents and uncertain carbon price. Annals of Operations Research. https://doi.org/10.1007/s10479-019-03297-w.

Fredriksson, P. G. (1998). Environmental policy choice: Pollution abatement subsidies. Resource and Energy Economics, 20(1), 51–63.

Government of Sweden. (2019). Sweden’s carbon tax. https://www.government.se/government-policy/taxes-and-tariffs/swedens-carbon-tax/.

Helmer, R., & Hespanhol, I. (Eds.). (1997). Water pollution control: A guide to the use of water quality management principles. . E & FN Spon.

Inui, T., (2002). Protecting the global environment: Initiatives by Japanese business. W. Cruz, & J.J. Warford (Eds.). World Bank Publications.

Kleindorfer, P. R., Singhal, K., & Van Wassenhove, L. N. (2005). Sustainable operations management. Production and Operations Management, 14(4), 482–492.

Krass, D., Nedorezov, T., & Ovchinnikov, A. (2013). Environmental taxes and the choice of green technology. Production and Operations Management, 22(5), 1035–1055.

Lawson, E. (2017). https://www.smartcitiesdive.com/ex/sustainablecitiescollective/9-companies-great-environmental-initiatives/1193165/.

Lee, H. L., & Tang, C. S. (2017). Socially and environmentally responsible value chain innovations: New operations management research opportunities. Management Science, 64(3), 983–996.

Lerner, A. P. (1972). Pollution abatement subsidies. American Economic Review, 62(5), 1009–1010.

Li, Q., Guan, X., Shi, T., & Jiao, W. (2019). Green product design with competition and fairness concerns in the circular economy era. International Journal of Production Research. https://doi.org/10.1080/00207543.2019.1657249.

Li, Y., Deng, Q., Zhou, C., & Feng, L. (2018). Environmental governance strategies in a two-echelon supply chain with tax and subsidy interactions. Annals of Operations Research. https://doi.org/10.1007/s10479-018-2975-z.

Lombardini-Riipinen, C. (2005). Optimal tax policy under environmental quality competition. Environmental and Resource Economics, 32(3), 317–336.

Lovei, M., (1995). Financing pollution abatement: Theory and practice. Washington, DC, World Bank. http://documents.worldbank.org/curated/en/1995/10/438843/financing-pollution-abatement-theory-practice.

OECD. (2018a). Taxing Energy Use 2018 Germany. https://www.oecd.org/tax/tax-policy/taxing-energy-use-2018-germany.pdf.

OECD. (2018b). Revenue from environmentally related taxes in Italy. https://www.oecd.org/tax/tax-policy/environmental-tax-profile-italy.pdf.

Ontl, T. A., & Schulte, L. A. (2012). Soil carbon storage. Nature Education Knowledge, 3(10), 35.

Ouchida, Y., & Goto, D. (2014). Do emission subsidies reduce emission? In the context of environmental R&D organization. Economic Modelling, 36, 511–516.

Ovchinnikov, A., Blass, V., & Raz, G. (2014). Economic and environmental assessment of remanufacturing strategies for product service firms. Production and Operations Management, 23(5), 744–761.

Pal, R., & Saha, B. (2015). Pollution tax, partial privatization and environment. Resource and Energy Economics, 40, 19–35.

Plambeck, E. L., & Taylor, T. A. (2015). Supplier evasion of a buyer’s audit: Implications for motivating supplier social and environmental responsibility. Manufacturing and Service Operations Management, 18(2), 184–197.

Polinsky, A. M. (1979). Notes on the symmetry of taxes and subsidies in pollution control. Canadian Journal of Economics, 12(1), 75–83.

Poyago-Theotoky, J. A. (2007). The organization of R&D and environmental policy. Journal of Economic Behavior & Organization, 62(1), 63–75.

Poyago-Theotoky, J., & Teerasuwannajak, K. (2002). The timing of environmental policy: A note on the role of product differentiation. Journal of Regulatory Economics, 21(3), 305–316.

Raz, G., Druehl, C. T., & Blass, V. (2013). Design for the environment: Life-cycle approach using a newsvendor model. Production and Operations Management, 22(4), 940–957.

Saberi, S., Cruz, J. M., Sarkis, J., & Nagurney, A. (2018). A competitive multiperiod supply chain network model with freight carriers and green technology investment option. European Journal of Operational Research, 266, 934–949.

Savaskan, R. C., Bhattacharya, S., & Van Wassenhove, L. N. (2004). Closed-loop supply chain models with product remanufacturing. Management Science, 50(2), 239–252.

Savaskan, R. C., & Van Wassenhove, L. N. (2006). Reverse channel design: The case of competing retailers. Management Science, 52(1), 1–14.

Spence, M. (1976). Product differentiation and welfare. American Economic Review, 66(2), 407–414.

Singh, N., & Vives, X. (1984). Price and quantity competition in a differentiated duopoly. The Rand Journal of Economics, 15(4), 546–554.

Tang, C. S., & Zhou, S. (2012). Research advances in environmentally and socially sustainable operations. European Journal of Operational Research, 223(3), 585–594.

Toshimitsu, T. (2010). On a consumer-based emission tax policy. Manchester School, 78(6), 626–646.

Tsai, T. H., Wang, C. C., & Chiou, J. R. (2016). Can privatization be a catalyst for environmental R&D and result in a cleaner environment? Resource and Energy Economics, 43, 1–13.

US Environmental Protection Agency, (2015). The US experience with economic incentives for protecting the environment. https://yosemite.epa.gov/ee/epa/eerm.nsf/vwAN/EE-0216B-08.pdf/$file/EE-0216B-08.pdf .

Wang, Q., Zhao, D., & He, L. (2016). Contracting emission reduction for supply chains considering market low-carbon preference. Journal of Cleaner Production, 120, 72–84.

Xia, L., Guo, T., Qin, J., Yue, X., & Zhu, N. (2018). Carbon emission reduction and pricing policies of a supply chain considering reciprocal preferences in cap-and-trade system. Annals of Operations Research, 268, 149–175.

Xu, X., He, P., Xu, H., & Zhang, Q. (2017). Supply chain coordination with green technology under cap-and-trade regulation. International Journal of Production Economics, 183, 433–442.

Yang, L., Zhang, Q., & Ji, J. (2017). Pricing and carbon emission reduction decisions in supply chains with vertical and horizontal cooperation. International Journal of Production Economics, 191, 286–297.

Acknowledgements

The authors thank the editors and anonymous referees for their comments that have helped improve the paper. This work is supported by the National Natural Science Foundation of China under [Grant Nos. 71871207, 71921001, 71991464/71991460, and 72091215/72091210].

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Tables and Proofs

Appendix: Tables and Proofs

See Tables 1, 2, 3, 4, 5, 6 and 7.

Proof of Lemma 1

From the “Net emission” values under the subsidy and tax policies in Table 2, we have

\(\frac{{\partial e^{S} }}{\partial d} = - \frac{{\lambda \left( {\alpha - c} \right)}}{{2\beta \left( {\lambda + d} \right)^{2} }} < 0\),

\(\frac{{\partial e^{S} }}{\partial \lambda } = \frac{{d\left( {\alpha - c} \right)}}{{2\beta \left( {\lambda + d} \right)^{2} }} > 0\),

\(\frac{{\partial e^{T} }}{\partial d} = - \frac{{\lambda \left( {2\beta + \lambda } \right)^{2} \left( {3\beta + \lambda } \right)\left( {\alpha - c} \right)}}{{\left[ {\left( {2\beta + \lambda } \right)^{2} d + \beta \lambda \left( {4\beta + \lambda } \right)} \right]^{2} }} < 0\), and.

\(\frac{{\partial e^{T} }}{\partial \lambda } = \frac{{\beta \left( {12\beta^{2} d + 8\beta d\lambda + \beta \lambda^{2} + d\lambda^{2} } \right)\left( {\alpha - c} \right)}}{{\left[ {\left( {2\beta + \lambda } \right)^{2} d + \beta \lambda \left( {4\beta + \lambda } \right)} \right]^{2} }} > 0\).

Proof of Proposition 1

(i) Differentiating the “Manufacturer’s profit” value under the subsidy policy in Table 2 with respect to d, we have \(\frac{{\partial \Pi_{M}^{S} }}{\partial d} = \frac{{\lambda^{2} d\left( {\alpha - c} \right)^{2} }}{{4\beta^{2} \left( {\lambda + d} \right)^{3} }} > 0\).

(ii) Differentiating the “Manufacturer’s profit” value under the subsidy policy in Table 2 with respect to \(\lambda\), we obtain \(\frac{{\partial \Pi_{M}^{S} }}{\partial \lambda } = \frac{{d^{2} \left( {d - \lambda } \right)\left( {\alpha - c} \right)^{2} }}{{8\beta^{2} \left( {\lambda + d} \right)^{3} }} \ge 0\) if \(d \ge \lambda\), with equality holding at \(d = \lambda\); otherwise, \(\frac{{\partial \Pi_{M}^{S} }}{\partial \lambda } < 0\).

(iii) Differentiating the “Manufacturer’s profit” value under the tax policy in Table 2 with respect to d, we have \(\frac{{\partial \Pi_{M}^{T} }}{\partial d} = - \frac{{2\beta \lambda^{3} \left( {2\beta + \lambda } \right)\left( {3\beta + \lambda } \right)^{2} \left( {\alpha - c} \right)^{2} }}{{\left[ {\left( {2\beta + \lambda } \right)^{2} d + \beta \lambda \left( {4\beta + \lambda } \right)} \right]^{3} }} < 0\).

(iv) Differentiating the “Manufacturer’s profit” value under the tax policy in Table 2 with respect to \(\lambda\), we obtain \(\frac{{\partial \Pi_{M}^{T} }}{\partial \lambda } = \frac{{f_{1} \left( d \right)\left( {\alpha - c} \right)^{2} }}{{2\left[ {\left( {2\beta + \lambda } \right)^{2} d + \beta \lambda \left( {4\beta + \lambda } \right)} \right]^{3} }}\), where.

\(f_{1} \left( d \right) = \left[ \begin{gathered} - \left( {2\beta + \lambda } \right)^{4} d^{3} - 3\beta \lambda \left( {4\beta + \lambda } \right)\left( {2\beta + \lambda } \right)^{2} d^{2} \hfill \\ + \beta^{2} \lambda^{2} \left( {60\beta^{2} + 36\beta \lambda + 5\lambda^{2} } \right)d + \beta^{3} \lambda^{3} \left( {20\beta + 7\lambda } \right) \hfill \\ \end{gathered} \right]\).

Since \({\text{sgn}} \left( {\frac{{\partial \Pi_{M}^{T} }}{\partial \lambda }} \right) = {\text{sgn}} \left( {f_{1} \left( d \right)} \right)\), we only need to discuss \({\text{sgn}} \left( {f_{1} \left( d \right)} \right)\) below. Define \(f_{1}^{{\prime}} \left( d \right)\) and \(f_{1} \left( d \right)\) as follows:

\(\left\{ \begin{gathered} f_{1}^{^{\prime}} \left( d \right) = \frac{{\partial f_{3} \left( d \right)}}{\partial d} = - 3\left( {2\beta + \lambda } \right)^{4} d^{2} - 6\beta \lambda \left( {4\beta + \lambda } \right)\left( {2\beta + \lambda } \right)^{2} d + \beta^{2} \lambda^{2} \left( {60\beta^{2} + 36\beta \lambda + 5\lambda^{2} } \right) \hfill \\ f_{1} \left( d \right) = \frac{{\partial^{2} f_{3} \left( d \right)}}{{\partial d^{2} }} = - 6\left( {2\beta + \lambda } \right)^{4} d - 6\beta \lambda \left( {4\beta + \lambda } \right)\left( {2\beta + \lambda } \right)^{2} \hfill \\ \end{gathered} \right.\).

If \(d > d^{T}\), \(f_{1} \left( d \right) < 0\), which means \(f_{1}^{^{\prime}} \left( d \right)\) decreases in d. Furthermore, it can be verified that \(f_{1}^{^{\prime}} \left( {d^{T} } \right) < 0\), which suggests \(f_{1}^{^{\prime}} \left( {d^{T} } \right) < 0\) holds for all \(d > d^{T}\). This in turn means \(f_{1} \left( d \right)\) decreases with respect to d when \(d > d^{T}\). Algebraic calculation shows that \(f_{1} \left( {d^{T} } \right) > 0\). Since the cubic and quadratic terms are negative, \(f_{1} \left( {d^{T} } \right) < 0\) must hold when d is sufficiently large. Thus, it can be proved that there exists a \(d_{1} > d^{T}\) such that \(f_{1} \left( d \right) \le 0\) for all \(d \ge d_{1}\), with \(f_{1} \left( {d_{1} } \right) = 0\) at \(d = d_{1}\), where \(d_{1}\) is the largest root of \(f_{1} \left( {d_{1} } \right) = 0\). Thus, we can conclude the required.