Abstract

In this paper, we present a study on a government using subsidy policy to motivate firms’ adoption of green emissions-reducing technology when consumers are environmentally discerning. We consider two profit-maximizing firms selling two products in a price and pollution sensitive market. The products differ only in their manufacturing costs, selling prices and the amount of pollutant emissions per unit of product. The objective of each firm is to determine the selling prices of the products, taking into account the impact of green technology on costs and customer demands. Two cases are considered: (1) the government has limited budget and can choose only one firm at most to provide subsidy; (2) the government has sufficient budget and can choose both firms to provide subsidy. We discuss which firm should be selected in each case and in which situation the firm has incentive to invest in the green technology. We also show that the green technology level, environmental improvement coefficient and unit cost increase coefficient play important roles in the government subsidy strategy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In recent years, there has been a noticeable increase in the evidence of the emergence of “green consumers”, that is, consumers who have a preference for environmentally superior products and are willing to pay extra for buying “pollutant-emission-reducing” products (Bansal 2008). Some companies are also seeking opportunities to produce products at a given resource consumption level while generating lower environmental impacts than their competitors. For example, Ford, one of the world’s largest manufacturers of trucks, makes great contributions to global climate change, fuel economy, alternative fuels and electric vehicles by adopting a number of pollution-abatement technologies (Foss et al. 1999). Although benefits of the technology investment in pollution reduction are evident, firms are still cautious because of most of the technologies requiring substantial up-front capital investments as well as leading to an increase in variable production costs (Krass et al. 2013). As a result, a firm would choose a wait-and-see policy rather than actively committing itself to the development of green technology. Hence, in light of long term nature of policy goals on mitigation of pollution and environmental protection, it becomes necessary and important for a government or a regulator to implement some incentive schemes to motivate environmentally beneficial technology innovation and adoption.

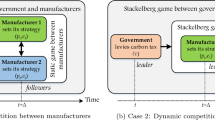

Motivated by the above practices, we present a study on a government using subsidy policy to motivate firms’ adoption of green emission-reducing technology when consumers are environmentally discerning. We aim to find out the conditions of the firms accepting the government’s subsidy and investing in the green technology, as well as the government’s subsidy strategy when the subsidy budget is limited or sufficient. Toward this end in view, we consider a leader-follower Stackelberg game between two profit-maximizing firms (the followers) and an environmentally-conscious government who aims to use subsidy policy to minimize the environmental impact of firms’ products (the leader).

The first two players are the two profit-maximizing firms that produce some desirable products. The products differ only in their manufacturing costs, selling prices and the amount of pollutant emissions per unit of product. The technology choice affects the pollutant emissions and the manufacturing costs, but not the characteristics of the final products. The objectives of the firms are to make technology investment decisions and determine the selling prices of the products taking into consideration the government’s subsidy strategy.

The government, acting as a Stackelberg leader, has two cases to consider: (1) the budget is limited and only one firm can be selected at most to provide subsidy (the government subsidizes none/ only firm 1 / only firm 2); (2) the budget is sufficient and both firms can be selected to provide subsidy (the government subsidizes none/ only firm 1 / only firm 2 / both). We analyze the government’s subsidy policy in these two cases and use numerical examples to demonstrate our results.

The rest of this article is organized as follows: Sect. 2 provides a survey of related literatures. Notations and model framework are described in Sect. 3. Strategy analyses for the firms and the government are studied in Sect. 4. Section 5 presents a numerical study and Sect. 6 discusses some extensions. Section 7 provides conclusions and topics for future research.

2 Literature review

This paper is related to two streams of literature, including emission-reduction and technology choice under emissions regulation.

The first stream explores the emission-reduction related issues. Letmathe and Balakrishnan (2005) study the firms’ decision strategies of optimal production quantities in the presence of several different types of environmental constraints. Galinato and Yoder (2010) develop a net-revenue constrained carbon tax and subsidy program to reduce carbon emissions. A number of researchers study emission permits and trading problems under carbon emissions policies (Du et al. 2015, 2013; Goulder et al. 2010; He et al. 2014; MacKenzie and Ohndorf 2012). Mandell (2008) addresses that it is more efficient to utilize a mixed regulations (i.e., a part of emissions by a cap-and-trade and the rest by an emission tax) than to use a single instrument. Subramanian et al. (2007) find that changing the number of available permits influences less in a dirty industry than in a cleaner one. Several authors investigate the relationship between economic growth, pollution emissions, and energy consumption through empirical studies (Acaravci and Ozturk 2010; Ang 2007; Apergis and Payne 2009; Arouri et al. 2012; Uçak et al. 2015; Zhang and Cheng 2009). Some researchers address the green product design and innovation (Albino et al. 2009; Chen 2001; Chen and Zhang 2013; Kurk and Eagan 2008; Sharma and Iyer 2012). Raz et al. (2013) classify the products into two types, specifically functional versus innovative products, and show that product designers should focus on the demand enhancement potential of eco-innovations, not necessarily eco-efficiency only.

The second stream of literature is concerned with the technology choice under emissions regulation (Fischer et al. 2003; Gray and Shadbegian 1998; Jaffe et al. 2002; Milliman and Prince 1989; Tarui and Polasky 2005). Hammar and Löfgren (2010) estimate firms’ probability of technological adoption in Sweden and find that the probability of a firm investing in clean technologies increases if the firm has expenditures for green R&D. Bansal (2008) examines provision of environmental quality in the presence of green consumers and finds that on certain conditions the cleaner firm may overclean and the dirty firm may underclean. Levi and Nault (2004) examine how to induce heterogeneous firms to make a major discrete conversion in technology to reduce the pollution. The results show that firms with plant and equipment in better condition will convert their technology to mitigate their environmental damage, and firms with plant and equipment in poorer condition will not. Drake et al. (2010) study the firm’s technology investment problem under two regulations (cap-and-trade and emissions tax). Gil-Moltó and Varvarigos (2013) show that increasing the tax rate on emissions does not necessarily lead to the adoption of clean technologies when consumers are environmentally conscious. Jiang and Klabjan (2012) compare investment timing of firms under cap-and-trade and command-and-control regulation and find that a firm does not always invest earlier as claimed by economists. Gong and Zhou (2013) study the dynamic production planning problem with emissions trading and cleaner technology choice. They find that in certain cases the optimal technology selection is determined by the relationship between the additional cost per allowance saved and the trading prices. Krass et al. (2013) examine the effect of environmental policies on reducing environmental pollution and inducing the choice of cleaner technology. In this paper, we continue to study the technology choice of the firms under the government subsidy policy. Specifically, we consider two competitive firms and discuss how to design a subsidy policy for the government with limited or sufficient budget.

3 Notations and model framework

We consider two firms \(F_{1}\) and \(F_{2}\). Their products are denoted by \(PRO_{1}\) and \(PRO_{2}\). The subscript 1 represents products from firm \(F_{1}\) and the subscript 2 represents products from firm \(F_{2}\). The main differences between the two products are represented by the manufacturing cost, the selling price and the amount of pollutant emissions per unit of product. Based on the assumption that the consumers are environmentally conscious and willing to pay a higher price for the products which are environmentally better, we use the following equation to represent the consumer’s utility function, which is similar to Bansal (2008).

Here, \(U_0\) is the consumption utility, which is independent of consumer type, and is large enough to guarantee non-empty market coverage. \(e_i ,i=1,2\) is the pollutant emissions per unit of product. \(i=1\) denotes \(PRO_{1}\) and \(i=2\) denotes \(PRO_{2}\). Without loss of generality, we assume that \(e_1 >e_2 \). \(j=0,1,2,3\) denotes the scenarios that are analyzed. \(j=0\) represents the scenario where neither of the two firms adopts the green technology; \(j=1\) represents the scenario where only \(F_{1}\) adopts the green technology; \(j=2\) represents the scenario where only \(F_{2}\) adopts the green technology; \(j=3\) represents the scenario where both firms adopt the green technology. t is the technology level. Technology adoption in this paper refers to a firm’s investment decision to reduce the pollutant emissions during manufacturing process. When the firm adopts a fixed technology level t, the pollutant emissions per unit of product will decrease by \(\delta t\), where \(\delta >0\) is the environmental improvement coefficient. \(p_{ij} \) is the selling price of \(PRO_{i}\) in scenario j. \(\theta \) is the sensitivity coefficient of a particular consumer to the pollutant emissions per unit of product. We notice that different consumers correspond to different values of \(\theta \). Thus we assume that \(\theta \) distributes uniformly in the interval [0, 1]. Obviously a higher \(\theta \) implies that the consumer has greater preference on environmental products. Similar to Raz et al. (2013), we assume that the total technology investment cost is a quadratic function, i.e., \(C\left( t \right) =\xi t^{2}\), where \(\xi \) is the positive parameters. This cost function implies diseconomies of scale for the green technology. The production cost per unit increases to \(c_i +\gamma t\) by adopting the green technology, where \(c_i ,i=1,2\) is production cost per unit absent technology investment and \(\gamma t\) is the additional production cost per unit. \(\gamma \) is unit cost increase coefficient. This cost structure implies that the green technology increases unit production cost. In Sect. 6, we study the situation where the green technology reduces unit production cost, i.e., \(c_i -\gamma t\). We require \(\frac{\Delta c}{\Delta e}<2\) to avoid trivial cases, otherwise the demand of \(F_{2}\) is negative.

Then the firm’s problem in its general form can be formulated as:

where \(q_{ij} \) is the demand of \(PRO_{i}\) in scenario j, s denotes the subsidy rate, and thus if technology level t is selected, the total amount of subsidy becomes ts. The firm’s profit includes three parts. The first part is the firm’s gross profit from selling in the market. The second part is the technology investment cost and the third part is the subsidy awarded by the government.

4 Strategy analyses for the firms and the government

In this section, we discuss the government subsidy policy and the firms’ investment decisions. The government, as the Stackelberg leader, determines which firm to subsidize first, then the two firms as the followers determine whether they should invest in technology and set the selling prices based on the government’s subsidy policy. We first give the firms’ pricing decisions under the four scenarios: Scenario 0: neither of the two firms adopts the green technology; Scenario 1: only \(F_{1}\) adopts the green technology; Scenario 2: only \(F_{2}\) adopts the green technology; Scenario 3: both firms adopt the green technology. After that technology selection of the firms will be demonstrated. Finally we give the subsidy strategy of the government.

4.1 Scenario 0: neither of the two firms adopts technology

In this section we analyze the scenario where there is no firm adopting technology, which amounts to setting \(t=0\). This means that there is no subsidy provided to the two firms.

We first analyze the demands of the two products. Assume that the market’s total demand is 1. If a consumer with sensitivity coefficient \(\theta ^{*}\) thinks there is no difference in selecting the two products, then \(U_0 -p_{10} -\theta ^{*}e_1 =U_0 -p_{20} -\theta ^{*}e_2 \). Thus we obtain the indifference point \(\theta ^{*}\) as:

As a result, the consumers are divided into two groups: (1) those consumers with \(\theta \in \left[ {0,\theta ^{*}} \right] \), who will select the \(PRO_{1}\); (2) those consumers with \(\theta \in \left[ {\theta ^{*},1} \right] \), who will select \(PRO_{2}\).

Thus, the demands of the two PROs are obtained as:

The firms’ problems can be formulated as follows:

The two firms simultaneously choose prices. Thus an equilibrium is given by \({\partial \pi _{10} }/{\partial p_{10} }={\partial \pi _{20} }/{\partial p_{20} }=0\). Then the optimal prices are given by:

where \(\Delta e=e_1 -e_2 \).

Combining Eqs. (4), (5), (6) and (7), we find that the sales volume of each firm equals to:

where \(\Delta c=c_2 -c_1 \).

Substituting the optimal qualities into the profit function, we have:

When neither of the two firms adopts technology, the profits are only related to \(\Delta e\) and \(\Delta c\). We next turn to examine the technology investment scenarios.

4.2 Technology investment scenarios

In this section, we introduce scenarios considering technology investment of the two firms and explore the impacts of technology level t, environmental improvement coefficient \(\delta \), unit cost increase coefficient \(\gamma \) and pollutant emission gap \(\Delta e\) on firms’ selling prices, sales volumes and the profits.

4.2.1 Scenario 1: only F\(_{1}\) adopts technology

The basic setting for this model remains the same as that in Scenario 0, except for that \(F_{1}\) adopts green technology and obtains the government subsidy. Throughout this model, we make the assumption that \(e_1 -e_2 -\delta t>0\), which means that after adopting the green technology, the pollutant emissions per unit of \(PRO_{1}\) is still larger than that of \(PRO_{2}\). We might also discuss the case that \(e_1 -e_2 -\delta t<0\), however, in this case, there is no competition between the two firms because the demand of \(PRO_{1}\) is 1 and the demand of \(PRO_{2}\) is 0. Therefore, we only consider \(e_1 -e_2 -\delta t>0\) in this scenario.

Since only \(F_{1 }\)adopts green technology, the utility functions of the two firms are given by:

The demands for the two products can be obtained respectively as:

The problems for the firms in this case are:

Using first-order conditions, the optimal pricing strategies for \(F_{1}\) and \(F_{2 }\)are given by:

Substituting the optimal prices into the demand function, we have:

Therefore the optimal profits of the two firms can be obtained as:

Next, we describe the effect of environmental improvement coefficient \(\delta \), unit cost increase coefficient \(\gamma \) and pollutant emissions gap \(\Delta e\) on the optimal prices of the two firms.

Proposition 1

The comparative statics with respect to \(\gamma \), \(\delta \) and \(\Delta e\) are:

Proposition 1 shows that when unit cost increase coefficient \(\gamma \) is high, both firms will extract a price premium from their customers and the increase in \(p_{11} \) is twice than that in \(p_{21} \). On the contrary, the increase in environmental improvement coefficient \(\delta \) will lead to prices decrease in both products. Besides, when the gap of pollutant emissions per unit of product between \(PRO_{1}\) and \(PRO_{2}\) increases, the prices of both firms will increase and if \(\Delta e\) increases by one unit, \(p_{11} \) will increase by 1/3 unit and \(p_{21} \) will increase by 2/3 unit.

4.2.2 Scenario 2: only F\(_{2}\) adopts technology

The basic setting for this model remains the same as that in Scenario 1, except for the fact that \(F_{2}\) adopts technology and obtains the government subsidy. We can obtain the selling prices, sales volumes and profits of the two firms as follows:

The effect of the problem parameters \(\gamma , \delta , t\) and \(\Delta e\) on the optimal prices of two firms when only \(F_{2}\) adopts technology can be shown as follows:

Proposition 2

The comparative statics with respect to \(\gamma , \delta , t\) and \(\Delta e\) are:

Proposition 2 obtains some similar results as those in Proposition 1. Furthermore it can be seen that the increase in technology level t will lead to prices increase in both products and the increase in \(p_{22} \) is twice than that in \(p_{12} \).

4.2.3 Scenario 3: technology investments for both firms

In reality, in order to encourage firms to make technology choices, the government awards subsidy to both firms that adopt technology. In this section, we analyze this more general case where both firms can obtain a fixed amount of subsidy from the government if they invest in the green technology.

In this case, the utility function of each firm is:

As before, the demands for each product can be obtained as:

The firms’ problems can be formulated as follows:

The optimal prices are given by first-order conditions:

Substitution of the optimal prices from above gives the following demands and optimal profits:

As before, we next investigate how the problem parameters \(\gamma , t, \delta \) and \(\Delta e\) affect the optimal prices of the two firms when both of them adopt technology.

Proposition 3

The comparative statics with respect to \(\gamma \), t, \(\delta \) and \(\Delta e\) are:

Proposition 3 shows that when unit cost increase coefficient \(\gamma \), is high, both firms will extract a price premium from their customers and the increase in \(p_{13}\) is the same as that in \(p_{23}\). Furthermore the increase in technology level t will lead to prices increase in both firms as well. Differing from the selling prices in Scenario 1 and 2, \(p_{13} \) and \(p_{23}\) are not affected by environmental improvement coefficient \(\delta \). On the other hand, when the gap of pollutant emissions per unit of product between \(PRO_{1}\) and \(PRO_{2}\) increases, the prices of both products will increase and if \(\Delta e\) increases by one unit, \(p_{13} \) will increase by 1/3 unit and \(p_{23} \) will increase by 2/3 unit.

Proposition 1–3 clearly show the impact of various problem parameters on the optimal prices of the two firms. The next proposition makes a comparison of the optimal selling price of each firm in different scenarios.

Proposition 4

Given the technology level t, when \(\frac{\gamma }{\delta }\) belongs to different intervals, the optimal selling prices in different scenarios can be compared and the results are given in Table 1.

\(\gamma /\delta \) is the ratio of the unit cost increase coefficient and the environmental improvement coefficient. When \(\gamma \) is large, unit production cost is sensitive to technology level, which refers to that a small increase in technology level will result in a large increase in unit production cost. Therefore the highest selling prices of \(PRO_{1}\) and \(PRO_{2}\) are generated when both firms adopts technology. On the other hand, when \(\gamma \) is small and \(\delta \) is large, the production cost per unit is not sensitive to technology level. However the environmental performance per unit is sensitive to technology level, which means that a small increase in technology level will largely improve the product’s environmental performance, while production cost per unit will not increase a lot. In this situation, the highest selling prices of \(PRO_{1}\) and \(PRO_{2}\) are generated when only \(F_{2}\) adopts technology.

4.3 The firms’ technology accepting strategy

Based on the analyses from Sects. 4.1 and 4.2, we discuss how the two firms make pricing strategies in response to the subsidy policy set by the government. We next give necessary conditions of the firms accepting the subsidy policy and investing in the green technology.

Proposition 5

-

(1)

Under the condition that the government has limited budget and can choose at most one firm to provide subsidy and it chooses \(F_{1}\) to subsidize, the necessary condition of \(F_{1 }\) accepting the subsidy policy and investing in technology is

$$\begin{aligned} s>s_1 \end{aligned}$$(8)where \(s_1 =-\frac{2}{9}\left( {\frac{\delta \left( {\delta ^{2}t^{2}-\left( {\Delta e} \right) ^{2}+t^{2}\delta \gamma \left( {2\delta +\gamma } \right) -2\Delta e\gamma \left( {\Delta e+\Delta c} \right) +\delta \left( {\Delta c} \right) ^{2}} \right) }{\delta ^{2}t^{2}-\left( {\Delta e} \right) ^{2}}} \right) +\xi t.\)

-

(2)

Under the condition that the government has limited budget and can choose at most one firm to provide subsidy and it chooses \(F_{2}\) to subsidize, the necessary condition of \(F_{2}\) accepting the subsidy policy and investing in technology is

$$\begin{aligned} s>s_2 \end{aligned}$$(9)where \(s_2 =-\frac{2\delta }{9}\left( {4+\frac{\left( {\gamma t-\Delta c} \right) ^{2}}{\delta ^{2}t^{2}-\left( {\Delta e} \right) ^{2}}} \right) +\xi t\).

-

(3)

Under the condition that the government has enough budget and can choose at most both firms to provide subsidy and it only chooses \(F_{1} (F_{2}\) will never be chosen alone in this scenario) to subsidize, the necessary condition of \(F_{1 }\) accepting the subsidy policy and investing in technology is

$$\begin{aligned} s>s_3 \end{aligned}$$(10)where \(s_3 =-\frac{2}{9}\left( {\frac{\delta \left( {\delta ^{2}t^{2}-\left( {\Delta e} \right) ^{2}+t^{2}\delta \gamma \left( {2\delta +\gamma } \right) -2\Delta e\gamma \left( {\Delta e+\Delta c} \right) +\delta \left( {\Delta c} \right) ^{2}} \right) }{\delta ^{2}t^{2}-\left( {\Delta e} \right) ^{2}}} \right) +\xi t.\)

-

(4)

Under the condition that the government has enough budget and can choose at most both firms to provide subsidy and it chooses both firms to subsidize, the necessary condition of both firms accepting the subsidy policy and investing in technology is

$$\begin{aligned} s>s_4 \end{aligned}$$(11)where

$$\begin{aligned} s_4 =\max \left\{ {\begin{array}{l} \frac{\left( {\Delta e} \right) ^{2}\delta +2\left( {\Delta e} \right) ^{2}\gamma +\Delta e\delta ^{2}t+2\Delta e\delta t\gamma +2\Delta e\Delta c\gamma +\Delta e\gamma ^{2}t-\left( {\Delta c} \right) ^{2}\delta }{9\Delta e\left( {\Delta e+\delta t} \right) }+\xi t, \\ \frac{-4\left( {\Delta e} \right) ^{2}\delta +4\left( {\Delta e} \right) ^{2}\gamma +4\Delta e\delta ^{2}t-4\Delta e\delta t\gamma -2\Delta e\Delta c\gamma +\Delta e\gamma ^{2}t+\left( {\Delta c} \right) ^{2}\delta }{9\Delta e\left( {\Delta e-\delta t} \right) }+\xi t \\ \end{array}} \right\} \end{aligned}$$

Proof

See Appendix 1

That is, it largely depends on the subsidy level whether the firm accepts the subsidy policy and invests in technology. The thresholds \(s_1, s_2, s_3, s_4 \) define a downward boundary for the subsidy level. As long as there is sufficient subsidy, the firm will adopt the green technology and the corresponding selling prices, sales volumes and profits can be obtained from Sect. 4.2. Next, we analyze the problem of the government (Stackelberg leader) and give necessary conditions of the government subsidy strategy.

4.4 Environmental impact

From the above mentioned, the government’s goals are to motivate firms’ adoption of green technology and to improve environmental impact. We use the amount of pollutant emissions to measure environmental impact. By calculating the pollutant emissions for each scenario (Scenario 1/2/3), we can assess the total change in environmental impact when technology innovation happens.

When a firm invests in green technology, the amount of pollutant emissions per unit of product after adopting a fixed technology t will decrease from \(e_i\) to \(e_i -\delta t\), and the overall change in environmental impact can be obtained and we define it as \(\Delta E_k ,k=1,2,3\). \(k=\)1 denotes only \(F_{1}\) invests in technology; \(k=2\) denotes only \(F_{2}\) invests in technology and \(k=3\) denotes both firms invest in technology. Thus, if only \(F_{1}\) invests in technology, the overall change in environmental impact can be given as:

If only \(F_{2}\) invests in technology, the overall change in environmental impact can be given as:

If both firms invest in technology, the overall change in environmental impact can be given as:

The first part of Eq. (12) is the overall change in pollutant emission of \(F_{1}\). When only \(F_{1}\) invests in green technology, the amount of pollutant emissions per unit of product decreases from \(e_1\) to \(e_1 -\delta t\), the sales volume changes from \(q_{10}\) to \(q_{11} \). The change in environmental impact of \(F_{1}\) is \(e_1 q_{10} -\left( {e_1 -\delta t} \right) q_{11} \). As for \(F_{2}\), the amount of pollutant emissions per unit of product does not change because only \(F_{1 }\) invests in green technology. However, sales volume changes from \(q_{20}\) to \(q_{21} \). Thus, the change in environmental impact of \(F_{2}\) is \(e_2 \left( {q_{20} -q_{21} } \right) \). The overall change in environmental impact includes the change in environmental impact of \(F_{1}\) plus \(F_{2}\). Note that a positive \(\Delta E\) indicates an improvement (less pollutant emissions), while a negative value indicates that the environmental impact worse. As expected, the overall change in environmental impact is increasing in technology level t and the environmental improvement coefficient \(\delta \).

4.5 The government’s subsidy policy

Based on the definition of environmental impact in Sect. 4.4, in this section we analyze the problem of the government that participates in the firms’ reaction to the environmental subsidy policy. As the leader of the game, the goal of the government is to motivate firms’ adoption of green technology and maximize the total change in environmental impact. Two different cases are considered: (1) the government has limited budget and can choose only one firm at most to provide subsidy; (2) the government has sufficient budget and can choose both firms to provide subsidy. Proposition 6 gives the necessary conditions of the government selecting strategy.

Proposition 6

-

(1)

Under the condition that the government has limited budget and can choose at most one firm to provide subsidy, \(F_{1 }\) is chosen if

$$\begin{aligned} \delta <2\gamma ; \end{aligned}$$ -

(2)

Under the condition that the government has limited budget and can choose at most one firm to provide subsidy, \(F_{2 }\) is chosen if

$$\begin{aligned} \delta >2\gamma ; \end{aligned}$$ -

(3)

Under the condition that the government has enough budget and can choose at most both firms to provide subsidy, only \(F_{1} (F_{2}\) will never be chosen alone in this case) is chosen if

$$\begin{aligned} \delta <\frac{\gamma }{2}; \end{aligned}$$ -

(4)

Under the condition that the government has enough budget and can choose at most both firms to provide subsidy, both firms are chosen if

$$\begin{aligned} \delta >\frac{\gamma }{2}. \end{aligned}$$

Proof

See Appendix 2

Proposition 6 indicates that two factors determine the government’s subsidy policy: the environmental improvement coefficient \(\delta \) and the unit cost increase coefficient \(\gamma \). If the government has limited budget and can choose at most one firm to provide subsidy, the larger the environmental improvement effect, the more willingness does the government have to choose \(F_{2}\) to subsidize. On the other hand, if the government has enough budget and can choose at most both firms to provide subsidy, only \(F_{1}\) will be selected when \(\delta \) is less than \(\gamma /2\); otherwise the government will subsidize both of them.

5 The numerical study

In this section, numerical experiments will be emerged to corroborate and supplement the previous developments. Based on the models we have proposed above, we aim to investigate the government’s subsidy policy and compare the results of firms’ choices in different situations. Two examples are presented to illustrate our findings.

Example 1

The values of parameters in Example 1 can be seen in Table 2.

We can calculate \(\Delta E_1 , \Delta E_2 , \Delta E_3 (\Delta E_1 =0.467, \Delta E_2 =0.533, \Delta E_3 =1)\) and \(s_1 , s_2 , s_3 , s_4 (s_1 =1.038, s_2 =0.756, s_3 =1.038, s_4 =1.2)\) using Eqs. (8)–(14). Under the condition that the government has limited budget and can choose at most one firm to provide subsidy, \(F_{2}\) will be chosen \((\Delta E_2 >\Delta E_1 )\), and because \(s>s_2 , F_{2}\) will accept the subsidy policy and invest in technology. Then the corresponding prices, sales volumes and profits can be obtained in Table 3.

Under the condition that the government has enough budget and can choose at most both firms to provide subsidy, both firms will be chosen \((\Delta E_3 >\Delta E_2 >\Delta E_1 )\), and because \(s>s_4\), both firms will accept the subsidy policy and invest in technology. Then the optimal prices, sales volumes and profits can be obtained and presented as Table 3. In order to compare with the model without technology investment, we calculate the prices, sales volumes and profits in Scenario 0 and Table 3 shows the results.

From Table 3, if only \(F_{2}\) adopts technology, the prices of \(PRO_{1}\) and \(PRO_{2}\) increase compared with those in Scenario 0. The sales volume of \(PRO_{1}\) increases, however, the sales volume of \(PRO_{2}\) decreases. The profits of both firms increase. On the other hand, if \(F_{1}\) and \(F_{2}\) both adopt technology, the prices increase, however, less than those in Scenario 2 which only \(F_{2}\) adopts technology. Note that the sales volumes of the two products are the same as those in Scenario 0 which no firms adopt technology. This is because, when both firms invest in technology, the gap of pollutant emission per unit of product between \(PRO_{1}\) and \(PRO_{2}\) remains the same and thus the demand of each product remains the same as that in Scenario 0. Moreover, for \(PRO_{1}\), \(\pi _{13} \) increases and is larger than \(\pi _{12} \), and for \(PRO_{2}\), although the profit increases compared with \(\pi _{20} \), it decreases compared with \(\pi _{22} \).

Example 2

In this example, the parameter values are the same as those in Example 1 except for \(\delta =0.2\) and \(\gamma =0.5\), which means that the environmental improvement effect of the green technology per unit of product is smaller than that in Example 1 and the unit cost increase effect is larger than that in Example 1. Calculating the overall change in environmental impact we obtain \(\Delta E_1 =0.47, \Delta E_2 =-0.07, \Delta E_3 =0.4\). We find that whether the government has enough budget or not, it will only choose \(F_{1}\) to provide subsidy (\(\Delta E_1 >\Delta E_3 >\Delta E_2 )\). On the other hand, because \(s=1.5>s_1 (s_1 =1.1, s_2 =1.0), F_{1}\) will accept the subsidy policy and invest in technology. Then the corresponding prices, sales volumes and profits can be obtained in Table 4.

From Table 4, when only \(F_{1}\) adopts technology, the prices of \(PRO_{1}\) and \(PRO_{2}\) increase compared with those in Scenario 0. Interestingly, the sales volume of \(PRO_{1}\) decreases after investing in technology. This is because investing in the green technology increases the selling price of \(PRO_{1}\) too much and as a result, customers who would like to buy \(PRO_{1}\) originally switch to buy \(PRO_{2}\). Furthermore, the profits of \(F_{1}\) and \(F_{2}\) both increase and they both benefit from \(F_{1}\)’s technology innovation.

6 Extensions

Thus far, we have assumed that the green technology increases the unit production cost of a product. We next incorporate the possibility of the firms investing in cost reduction technology. Specifically, the unit production cost decreases to \(c_i -\gamma t\) by adopting the green technology.

Similar as that in Sect. 4, we consider a leader-follower Stackelberg game between the government and the two firms. The government, as the Stackelberg leader, determines which firm to be subsidized first, then the two firms as the followers determine whether or not to invest in technology and set the selling prices based on the government’s subsidy policy. The method of obtaining the selecting strategies of the three players is the same as that in Sect. 4.

6.1 Scenario 0: neither of the two firms adopts technology

The selling prices, sales volumes and profits of the two firms without technology invest are given as followers:

where \(\Delta e=e_1 -e_2 \).

where \(\Delta c=c_2 -c_1 \).

6.2 Technology investment scenarios

6.2.1 Scenario 1: only \(F_{1}\) adopts technology

The utility functions of \(PRO_{1}\) and \(PRO_{2}\) in Scenario 1 are:

Making the assumption that \(e_1 -e_2 -\delta t>0\), the demands for the two products can be obtained respectively as:

The problems for the two firms are:

The firms simultaneously choose prices. Thus an equilibrium is given by \({\partial \pi _{11} }/{\partial p_{11} }={\partial \pi _{21} }/{\partial p_{21} }=0\). Then the optimal prices are given by:

The demands of the products can be obtained as:

While the profits of the two firms are:

Proposition 7

The comparative statics with respect to \(\gamma , \delta \) and \(\Delta e\) are:

Proposition 7 shows that the increase in cost reduction coefficient \(\gamma \) will lead to prices decrease in both firms, and the decrease in \(p_{11} \) is twice than that in \(p_{21} \). Besides, the increase in environmental improvement coefficient \(\delta \) leads to prices decrease in both products as well. However, the decrease in \(p_{21} \) is twice than that in \(p_{11} \). On the other hand, when the gap of pollutant emissions per unit of product between \(PRO_{1}\) and \(PRO_{2}\) increases, the prices of both firms increase and if \(\Delta e\) increases by one unit, \(p_{11} \) will increase by 1/3 unit and \(p_{21} \) will increase by 2/3 unit.

6.2.2 Scenario 2: only \(F_{2}\) adopts technology

When only \(F_{2}\) adopts technology, the selling prices, sales volumes and profits of the two firms are given as followers:

Proposition 8

The comparative statics with respect to \(\gamma , \delta , t\) and \(\Delta e\) are:

Proposition 8 shows that the increase in cost reduction coefficient \(\gamma \) will lead to prices decrease in both firms, and the decrease in \(p_{22} \) is twice than that in \(p_{12} \). Besides, the increase in environmental improvement coefficient \(\delta \) will lead to prices increase in both products. Furthermore, increasing the technology level t, the selling prices of the two products will increase if \(\delta >\gamma \), otherwise the selling prices of both products will decrease. On the other hand, when the gap of pollutant emissions per unit of product between \(PRO_{1}\) and \(PRO_{2}\) increases, the prices of both firms increase and if \(\Delta e\) increases by one unit, \(p_{12} \) will increase by 1/3 unit and \(p_{22} \) will increase by 2/3 unit.

6.2.3 Scenario 3: technology investments for both firms

Considering the case that both firms invest in technology, the selling prices, sales volumes and profits of the two firms are given as followers:

Proposition 9

The comparative statics with respect to \(\gamma \), t and \(\Delta e\) are:

It can be seen that increasing the cost reduction coefficient \(\gamma \), the selling prices of both firms decrease and the decrease in \(p_{13} \) is the same as that in \(p_{23} \). Furthermore the increase in technology level t will lead to prices decrease in both firms as well.

6.3 The firms’ technology accepting strategy

Based on the results from Sects. 6.1 and 6.2, we discuss how the two firms acting in response to the subsidy policy set by the government. We give necessary conditions of the firms accepting the subsidy policy and investing in the technology.

Proposition 10

-

(1)

Under the condition that the government has limited budget and can choose at most one firm to provide subsidy and it chooses \(F_{2}\) (\(F_{1}\) will never be chosen in this case) to subsidize, the necessary condition of \(F_{2 }\) accepting the subsidy policy and investing in technology is

$$\begin{aligned} s>\max \left\{ {\begin{array}{l} \frac{1}{9\Delta e\left( {\Delta e+\delta t} \right) }\left( {\left( {\Delta c} \right) ^{2}\delta -4\left( {\Delta e} \right) ^{2}\delta +4\left( {\Delta e} \right) ^{2}\gamma -4\Delta e\delta ^{2}t+4\Delta e\delta t\gamma -2\Delta e\Delta c\gamma -\Delta e\gamma ^{2}t} \right) +\xi t, \\ \frac{2\delta }{9\left( {\left( {\Delta e} \right) ^{2}-\delta ^{2}t^{2}} \right) }\left( {-4\left( {\Delta e} \right) ^{2}+\left( {\Delta c} \right) ^{2}+\gamma ^{2}t^{2}+2\Delta c\gamma t+4\delta ^{2}t^{2}} \right) +\xi t \\ \end{array}} \right\} \end{aligned}$$ -

(2)

Under the condition that the government has enough budget and can choose at most both firms to provide subsidy and it only chooses \(F_{2}\) to subsidize, the necessary condition of \(F_{2 }\) accepting the subsidy policy and investing in technology is

$$\begin{aligned} s>\max \left\{ {\begin{array}{l} \frac{1}{9\Delta e\left( {\Delta e+\delta t} \right) }\left( {\left( {\Delta c} \right) ^{2}\delta -4\left( {\Delta e} \right) ^{2}\delta +4\left( {\Delta e} \right) ^{2}\gamma -4\Delta e\delta ^{2}t+4\Delta e\delta t\gamma -2\Delta e\Delta c\gamma -\Delta e\gamma ^{2}t} \right) +\xi t, \\ \frac{1}{9\left( {\left( {\Delta e} \right) ^{2}-\delta ^{2}t^{2}} \right) }\left( {-4\left( {\Delta e} \right) ^{2}+\left( {\Delta c} \right) ^{2}+\gamma ^{2}t^{2}+2\Delta c\gamma t+4\delta ^{2}t^{2}} \right) +\xi t \\ \end{array}} \right\} \end{aligned}$$ -

(3)

Under the condition that the government has enough budget and can choose at most both firms to provide subsidy and it chooses both firms to subsidize, the necessary condition of both firms accepting the subsidy policy and investing in technology is

$$\begin{aligned} s>\max \left\{ {\begin{array}{l} \frac{1}{9\Delta e\left( {\Delta e+\delta t} \right) }\left( {\left( {\Delta e} \right) ^{2}\delta -\left( {\Delta c} \right) ^{2}\delta -2\left( {\Delta e} \right) ^{2}\gamma +\Delta e\delta ^{2}t-2\Delta e\delta t\gamma -2\Delta e\Delta c\gamma +\Delta e\gamma ^{2}t} \right) +\xi t, \\ \frac{1}{9\Delta e\left( {\Delta e-\delta t} \right) }\left( {-4\left( {\Delta e} \right) ^{2}\delta -4\left( {\Delta e} \right) ^{2}\gamma +\left( {\Delta c} \right) ^{2}\delta +\Delta e\gamma ^{2}t+4\Delta e\delta t\gamma +2\Delta e\Delta c\gamma +4\Delta e\delta ^{2}t} \right) +\xi t, \\ \\ \xi t \\ \end{array}} \right\} \end{aligned}$$

Proof

See Appendix 2

6.4 Environmental impact

If only \(F_{1}\) decides to invest in technology, the overall change in environmental impact can be given as:

If only \(F_{2}\) decides to invest in technology, the overall change in environmental impact can be given as:

If both firms decide to invest in technology, the overall change in environmental impact can be given as:

6.5 The government’s subsidy policy

Based on the definition of environmental impact in Sect. 6.4, we analyze the problem of the government and give necessary conditions of the government selecting strategy, which can be seen in the following proposition.

Proposition 11

-

(1)

Under the condition that the government has limited budget and can choose at most one firm to provide subsidy, \(F_{1}\) will never be chosen.

-

(2)

Under the condition that the government has limited budget and can choose at most one firm to provide subsidy, \(F_{2 }\) will be chosen.

-

(3)

Under the condition that the government has enough budget and can choose at most both firms to provide subsidy, only \(F_{2}\) is chosen if

$$\begin{aligned} \delta <\gamma \end{aligned}$$ -

(4)

Under the condition that the government has enough budget and can choose at most both firms to provide subsidy, both firms are chosen if

$$\begin{aligned} \delta >\gamma \end{aligned}$$

Proof

See Appendix 2

Proposition 11 indicates that two factors determine the government’s subsidy policy: the environmental improvement coefficient \(\delta \) and the cost reduction coefficient \(\gamma \). If the government has limited budget and can choose at most one firm to provide subsidy, \(F_{2 }\)will be chosen to be subsidized. On the other hand, if the government has enough budget and can choose at most both firms to provide subsidy, \(F_{2}\) will be chosen if \(\delta \) is less than \(\gamma \); otherwise the government will have both of them subsidized.

7 Conclusions

In this paper, we present a study on a government using subsidy policy to motivate firms’ adoption of green emissions-reducing technology to their production process.

We show that, in general, the government subsidy policy is affected largely by cost increase coefficient \(\gamma \) and the environmental improvement coefficient \(\delta \). If the government has limited budget and can only choose one firm to provide subsidy, the larger the environmental improvement coefficient \(\delta \), the more willingness does the government have to choose \(F_{2}\) to subsidize. On the other hand, if the government has enough budget, \(F_{1}\) will be selected when is less than \(\gamma /2\); otherwise the government will subsidize both of them. Considering the two firms, whether they would invest in technology or not depends on the subsidy rate. When the subsidy rate is large enough, both firms would like to invest in technology.

Our numerical studies show that when the environmental improvement coefficient is high and the unit cost increase coefficient is low, the government is willing to motivate both firms to invest in green technology. On the contrary, when the environmental improvement coefficient is low and the cost increase coefficient is high, the government would only prefer \(F_{1 }\)to invest in green technology even though the government has enough budget to provide subsidy to both firms.

Our model assumes that the green technology level is fixed. However, when various technologies with different levels can be provided for the firms to choose, how can the government induce the firms to choose the cleaner technology with higher level can be further discussed based upon our current study. The subsidy to different firms is assumed the same due to a fixed technology level assumed in the paper. It would be an interesting topic to explore the indifferent subsidy to firms with different scales. For competing firms in the market, a mixed policy (e.g., mix of subsidy and cap-and-trade) from the government to induce firms’ green technology investments can be another future research.

References

Acaravci, A., & Ozturk, I. (2010). On the relationship between energy consumption, CO\(_{2}\) emissions and economic growth in Europe. Energy, 35(12), 5412–5420.

Albino, V., Balice, A., & Dangelico, R. M. (2009). Environmental strategies and green product development: an overview on sustainability-driven companies. Business Strategy and the Environment, 18(2), 83–96.

Ang, J. B. (2007). CO\(_{2}\) emissions, energy consumption, and output in France. Energy Policy, 35(10), 4772–4778.

Apergis, N., & Payne, J. E. (2009). CO\(_{2}\) emissions, energy usage, and output in central America. Energy Policy, 37(8), 3282–3286.

Arouri, M. E. H., Ben Youssef, A., M’henni, H., & Rault, C. (2012). Energy consumption, economic growth and CO\(_{2}\) emissions in Middle East and North African countries. Energy Policy, 45, 342–349.

Bansal, S. (2008). Choice and design of regulatory instruments in the presence of green consumers. Resource and Energy Economics, 30(3), 345–368.

Chen, C. (2001). Design for the environment: a quality-based model for green product development. Management Science, 47(2), 250–263.

Chen, C., & Zhang, J. (2013). Green product design with engineering tradeoffs under technology efficient frontiers: Analytical results and empirical tests. IEEE Transactions on Engineering Management, 60(2), 340–352.

Drake, D., Kleindorfer, P. R., & Van Wassenhove, L. N. (2010). Technology choice and capacity investment under emissions regulation. Working paper, INSEAD. http://www.insead.edu/facultyresearch/research/doc.cfm?did=46205. Accessed 20 Jan 2016.

Du, S., Ma, F., Fu, Z., Zhu, L., & Zhang, J. (2015). Game-theoretic analysis for an emission-dependent supply chain in a ‘cap-and-trade’ system. Annals of Operations Research, 228(1), 135–149.

Du, S., Zhu, L., Liang, L., & Ma, F. (2013). Emission-dependent supply chain and environment-policy-making in the ‘cap-and-trade’ system. Energy Policy, 57, 61–67.

Fischer, C., Parry, I. W., & Pizer, W. A. (2003). Instrument choice for environmental protection when technological innovation is endogenous. Journal of Environmental Economics and Management, 45(3), 523–545.

Foss, M. M., Gonzales, E., & Noyen, H. (1999). Ford motor company. Corporate incentives and environmental decision making (pp. 35–52). Houston, Tx: Houston Advanced Research Center.

Galinato, G. I., & Yoder, J. K. (2010). An integrated tax-subsidy policy for carbon emission reduction. Resource and Energy Economics, 32(3), 310–326.

Gil-Moltó, M. J., & Varvarigos, D. (2013). Emission taxes and the adoption of cleaner technologies: The case of environmentally conscious consumers. Resource and Energy Economics, 35(4), 486–504.

Goulder, L. H., Hafstead, M. A. C., & Dworsky, M. (2010). Impacts of alternative emissions allowance allocation methods under a federal cap-and-trade program. Journal of Environmental Economics and Management, 60(3), 161–181.

Gong, X., & Zhou, S. X. (2013). Optimal production planning with emissions trading. Operations Research, 61(4), 908–924.

Gray, W. B., & Shadbegian, R. J. (1998). Environmental regulation, investment timing, and technology choice. The Journal of Industrial Economics, 46(2), 235–256.

Hammar, H., & Löfgren, Å. (2010). Explaining adoption of end of pipe solutions and clean technologies–determinants of firms’ investments for reducing emissions to air in four sectors in Sweden. Energy Policy, 38(7), 3644–3651.

He, P., Zhang, W., Xu, H., & Bian, Y. (2014). Production lot-sizing and carbon emissions under cap-and-trade and carbon tax regulations. Journal of Cleaner Production. 103, 241–248.

Jaffe, A. B., Newell, R. G., & Stavins, R. N. (2002). Environmental policy and technological change. Environmental and Resource Economics, 22(1–2), 41–70.

Jiang, Y., & Klabjan, D. (2012). Optimal emissions reduction investment under greenhouse gas emissions regulations. Working paper. Northwestern University.

Krass, D., Nedorezov, T., & Ovchinnikov, A. (2013). Environmental taxes and the choice of green technology. Production and Operations Management, 22(5), 1035–1055.

Kurk, F., & Eagan, P. (2008). The value of adding design-for-the-environment to pollution prevention assistance options. Journal of Cleaner Production, 16(6), 722–726.

Letmathe, P., & Balakrishnan, N. (2005). Environmental considerations on the optimal product mix. European Journal of Operational Research, 167(2), 398–412.

Levi, M. D., & Nault, B. R. (2004). Converting technology to mitigate environmental damage. Management Science, 50(8), 1015–1030.

MacKenzie, I. A., & Ohndorf, M. (2012). Cap-and-trade, taxes, and distributional conflict. Journal of Environmental Economics and Management, 63(1), 51–65.

Mandell, S. (2008). Optimal mix of emissions taxes and cap-and-trade. Journal of Environmental Economics and Management, 56(2), 131–140.

Milliman, S. R., & Prince, R. (1989). Firm incentives to promote technological change in pollution control. Journal of Environmental economics and Management, 17(3), 247–265.

Raz, G., Druehl, C. T., & Blass, V. (2013). Design for the environment: Life-cycle approach using a newsvendor model. Production and Operations Management, 22(4), 940–957.

Sharma, A., & Iyer, G. R. (2012). Resource-constrained product development: Implications for green marketing and green supply chains. Industrial Marketing Management, 41(4), 599–608.

Subramanian, R., Gupta, S., & Talbot, B. (2007). Compliance strategies under permits for emissions. Production and Operations Management, 16(6), 763–779.

Tarui, N., & Polasky, S. (2005). Environmental regulation with technology adoption, learning and strategic behavior. Journal of Environmental Economics and Management, 50(3), 447–467.

Uçak, H., Aslan, A., Yucel, F., & Turgut, A. (2015). A dynamic analysis of CO\(_{2}\) emissions and the GDP relationship: Empirical evidence from high-income OECD countries. Energy Sources, Part B: Economics, Planning and Policy, 10(1), 38–50.

Zhang, X. P., & Cheng, X. M. (2009). Energy consumption, carbon emissions, and economic growth in China. Ecological Economics, 68(10), 2706–2712.

Acknowledgments

All authors have made equal contributions to the work. The authors would like to thank anonymous reviewers for their helpful comments and suggestions which have significantly improved earlier versions of the paper. Financial support from National Natural Science Foundation of China (Grant Nos. 71271195, 71171181 and 71322101) and USTC Foundation for Innovative Research Team (WK2040160008) are acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

Proof of Proposition 5

-

(1)

Under the condition that the government has limited budget and can choose at most one firm to provide subsidy and it chooses \(F_{1}\) to subsidize, the necessary condition of \(F_{1 }\) accepting the subsidy policy and investing in technology is \(F_{1}\)’s profit satisfy: \(\pi _{11} >\pi _{10} \) and \(\pi _{11} >\pi _{12} \), equivalently,

$$\begin{aligned} \frac{1}{9\left( {\Delta e-\delta t} \right) }\left( {\Delta e-\delta t+\Delta c-\gamma t} \right) ^{2}-\xi t^{2}+ts>\frac{1}{9\Delta e}\left( {\Delta e+\Delta c} \right) ^{2} \end{aligned}$$and

$$\begin{aligned} \frac{1}{9\left( {\Delta e-\delta t} \right) }\left( {\Delta e-\delta t+\Delta c-\gamma t} \right) ^{2}-\xi t^{2}+ts>\frac{1}{9\left( {\Delta e+\delta t} \right) }\left( {\Delta e+\delta t+\Delta c+\gamma t} \right) ^{2}. \end{aligned}$$Simplifying these conditions we get

$$\begin{aligned} s>-\frac{2}{9}\left( {\frac{\delta \left( {\delta ^{2}t^{2}-\left( {\Delta e} \right) ^{2}+t^{2}\delta \gamma \left( {2\delta +\gamma } \right) -2\Delta e\gamma \left( {\Delta e+\Delta c} \right) +\delta \left( {\Delta c} \right) ^{2}} \right) }{\delta ^{2}t^{2}-\left( {\Delta e} \right) ^{2}}} \right) +\xi t. \end{aligned}$$ -

(2)

Under the condition that the government has limited budget and can choose at most one firm to provide subsidy and it chooses \(F_{2}\) to subsidize, the necessary condition of \(F_{2 }\) accepting the subsidy policy and investing in technology is \(F_{2}\)’s profit satisfy: \(\pi _{22} >\pi _{20} \) and \(\pi _{22} >\pi _{21} \), equivalently,

$$\begin{aligned} \frac{1}{9\left( {\Delta e+\delta t} \right) }\left( {2\Delta e+2\delta t-\Delta c+\gamma t} \right) ^{2}-\xi t^{2}+ts>\frac{1}{9\Delta e}\left( {2\Delta e-\Delta c} \right) ^{2} \end{aligned}$$and

$$\begin{aligned} \frac{1}{9\left( {\Delta e+\delta t} \right) }\left( {2\Delta e+2\delta t-\Delta c+\gamma t} \right) ^{2}-\xi t^{2}+ts>\frac{1}{9\left( {\Delta e-\delta t} \right) }\left( {2\Delta e-2\delta t-\Delta c+\gamma t} \right) ^{2}. \end{aligned}$$Simplifying these conditions we get \(s>-\frac{2\delta }{9}\left( {4+\frac{\left( {\gamma t-\Delta c} \right) ^{2}}{\delta ^{2}t^{2}-\left( {\Delta e} \right) ^{2}}} \right) +\xi t\).

-

(3)

Under the condition that the government has enough budget and can choose at most both firms to provide subsidy and it only chooses \(F_{1}\) to subsidize, the necessary condition of \(F_{1 }\) accepting the subsidy policy and investing in technology is \(F_{1}\)’s profit satisfy: \(\pi _{11} >\pi _{10} \) and \(\pi _{11} >\pi _{12} \), equivalently

$$\begin{aligned} \frac{1}{9\left( {\Delta e-\delta t} \right) }\left( {\Delta e-\delta t+\Delta c-\gamma t} \right) ^{2}-\xi t^{2}+ts>\frac{1}{9\Delta e}\left( {\Delta e+\Delta c} \right) ^{2} \end{aligned}$$and

$$\begin{aligned} \frac{1}{9\left( {\Delta e-\delta t} \right) }\left( {\Delta e-\delta t+\Delta c-\gamma t} \right) ^{2}-\xi t^{2}+ts>\frac{1}{9\left( {\Delta e+\delta t} \right) }\left( {\Delta e+\delta t+\Delta c+\gamma t} \right) ^{2}. \end{aligned}$$Simplifying these conditions we get

$$\begin{aligned} s>-\frac{2}{9}\left( {\frac{\delta \left( {\delta ^{2}t^{2}-\left( {\Delta e} \right) ^{2}+t^{2}\delta \gamma \left( {2\delta +\gamma } \right) -2\Delta e\gamma \left( {\Delta e+\Delta c} \right) +\delta \left( {\Delta c} \right) ^{2}} \right) }{\delta ^{2}t^{2}-\left( {\Delta e} \right) ^{2}}} \right) +\xi t. \end{aligned}$$ -

(4)

Under the condition that the government has enough budget and can choose at most both firms to provide subsidy and it chooses both firms to subsidize, the necessary condition of both firms accepting the subsidy policy and investing in technology is the profits of \(F_{1}\) and \(F_{2}\) satisfy: \(\pi _{13} >\max \left\{ {\pi _{10} ,\pi _{12} } \right\} \) and \(\pi _{23} >\max \left\{ {\pi _{20} ,\pi _{21} } \right\} \), equivalently

$$\begin{aligned} \frac{1}{9\Delta e}\left( {\Delta e+\Delta c} \right) ^{2}-\xi t^{2}+ts>\max \left\{ {\frac{1}{9\Delta e}\left( {\Delta e+\Delta c} \right) ^{2}, \frac{1}{9\left( {\Delta e\hbox {+}\delta t} \right) }\left( {\Delta e\hbox {+}\delta t+\Delta c\hbox {+}\gamma t} \right) ^{2}} \right\} \end{aligned}$$and \(\frac{1}{9\Delta e}\left( {2\Delta e-\Delta c} \right) ^{2}-\xi t^{2}+ts>\max \Big \{ \frac{1}{9\Delta e}\left( {2\Delta e-\Delta c} \right) ^{2}, \frac{1}{9\left( {\Delta e-\delta t} \right) }( 2\Delta e-\hbox {2}\delta t-\Delta c\hbox {+}\gamma t )^{2} \Big \}\) Simplifying these conditions we get

$$\begin{aligned} s>\max \left\{ {\begin{array}{l} \frac{1}{9\Delta e\left( {\Delta e+\delta t} \right) }\left( {\left( {\Delta e} \right) ^{2}\delta +2\left( {\Delta e} \right) ^{2}\gamma +\Delta e\delta ^{2}t+2\Delta e\delta t\gamma +2\Delta e\Delta c\gamma +\Delta e\gamma ^{2}t-\left( {\Delta c} \right) ^{2}\delta } \right) +\xi t, \\ \frac{1}{9\Delta e\left( {\Delta e-\delta t} \right) }\left( {-4\left( {\Delta e} \right) ^{2}\delta +4\left( {\Delta e} \right) ^{2}\gamma +4\Delta e\delta ^{2}t-4\Delta e\delta t\gamma -2\Delta e\Delta c\gamma +\Delta e\gamma ^{2}t+\left( {\Delta c} \right) ^{2}\delta } \right) +\xi t \\ \end{array}} \right\} . \end{aligned}$$

Proof of Proposition 6

-

(1)

Under the condition that the government has limited budget and can choose at most one firm to provide subsidy, \(F_{1 }\)is chosen if the total change in pollutant emissions satisfy\(\Delta E_1 >0\) and \(\Delta E_1 >\Delta E_2 \), equivalently, \(\frac{1}{3}t\left( {\delta +\gamma } \right) >0\)and \(\frac{1}{3}t\left( {\delta +\gamma } \right) >\frac{1}{3}t\left( {2\delta -\gamma } \right) \). Simplifying these conditions we get \(\delta <2\gamma \).

-

(2)

Under the condition that the government has limited budget and can choose at most one firm to provide subsidy, \(F_{2 }\)is chosen if the total change in pollutant emissions satisfy \(\Delta E_2 >0\) and \(\Delta E_2 >\Delta E_1 \), equivalently \(\frac{1}{3}t\left( {2\delta -\gamma } \right) >0\) and \(\frac{1}{3}t\left( {2\delta -\gamma } \right) >\frac{1}{3}t\left( {\delta +\gamma } \right) \). Simplifying these conditions we get \(\delta >2\gamma \).

-

(3)

Under the condition that the government has enough budget and can choose at most both firms to provide subsidy, only \(F_{1 }\)is chosen if the total change in pollutant emissions satisfy \(\Delta E_1 >0\), \(\Delta E_1 >\Delta E_2 \) and \(\Delta E_1 >\Delta E_3 \), equivalently \(\frac{1}{3}t\left( {\delta +\gamma } \right) >0\), \(\frac{1}{3}t\left( {\delta +\gamma } \right) >\frac{1}{3}t\left( {2\delta -\gamma } \right) \), and \(\frac{1}{3}t\left( {\delta +\gamma } \right) >\delta t\). Simplifying these conditions we get \(\delta <\gamma /2\).

-

(4)

Under the condition that the government has enough budget and can choose at most both firms to provide subsidy, both firms are chosen if the total change in pollutant emissions satisfy \(\Delta E_3 >0\), \(\Delta E_3 >\Delta E_1 \), and \(\Delta E_3 >\Delta E_2 \), equivalently \(\delta t>0\), \(\delta t>\frac{1}{3}t\left( {\delta +\gamma } \right) \) and \(\delta t>\frac{1}{3}t\left( {2\delta -\gamma } \right) \). Simplifying these conditions we get \(\delta >\gamma /2\).

Appendix 2

Proof of Proposition 10

-

(1)

Under the condition that the government has limited budget and can choose at most one firm to provide subsidy and it chooses \(F_{2}\) to subsidize, the necessary condition of \(F_{2 }\) accepting the subsidy policy and investing in technology is \(F_{2}\)’s profit satisfy: \(\pi _{22} >\max \left\{ {\pi _{20} ,\pi _{21} } \right\} \), equivalently,

$$\begin{aligned} \frac{1}{9\left( {\Delta e+\delta t} \right) }\left( {2\Delta e+2\delta t-\Delta c-\gamma t} \right) ^{2}-\xi t^{2}+ts> \max \left\{ {\begin{array}{l} \frac{1}{9\Delta e}\left( {2\Delta e-\Delta c} \right) ^{2}, \\ \frac{1}{9\left( {\Delta e-\delta t} \right) }\left( {2\Delta e-2\delta t-\Delta c-\gamma t} \right) ^{2} \\ \end{array}} \right\} . \end{aligned}$$Simplifying these conditions we get

$$\begin{aligned} s>\max \left\{ {\begin{array}{l} \frac{1}{9\Delta e\left( {\Delta e+\delta t} \right) }\left( {\left( {\Delta c} \right) ^{2}\delta -4\left( {\Delta e} \right) ^{2}\delta +4\left( {\Delta e} \right) ^{2}\gamma -4\Delta e\delta ^{2}t+4\Delta e\delta t\gamma -2\Delta e\Delta c\gamma -\Delta e\gamma ^{2}t} \right) +\xi t, \\ \frac{1}{9\left( {\left( {\Delta e} \right) ^{2}-\delta ^{2}t^{2}} \right) }\left( {-4\left( {\Delta e} \right) ^{2}+\left( {\Delta c} \right) ^{2}+\gamma ^{2}t^{2}+2\Delta c\gamma t+4\delta ^{2}t^{2}} \right) +\xi t \\ \end{array}} \right\} . \end{aligned}$$ -

(2)

Under the condition that the government has enough budget and can choose at most both firms to provide subsidy and it only chooses \(F_{2}\) to subsidize, the necessary condition of \(F_{2 }\)accepting the subsidy policy and investing in technology is \(F_{2}\)’s profit satisfy: \(\pi _{22} >\max \left\{ {\pi _{20} ,\pi _{21} } \right\} \) and we get

$$\begin{aligned} s>\max \left\{ {\begin{array}{l} \frac{1}{9\Delta e\left( {\Delta e+\delta t} \right) }\left( {\left( {\Delta c} \right) ^{2}\delta -4\left( {\Delta e} \right) ^{2}\delta +4\left( {\Delta e} \right) ^{2}\gamma -4\Delta e\delta ^{2}t+4\Delta e\delta t\gamma -2\Delta e\Delta c\gamma -\Delta e\gamma ^{2}t} \right) +\xi t, \\ \frac{1}{9\left( {\left( {\Delta e} \right) ^{2}-\delta ^{2}t^{2}} \right) }\left( {-4\left( {\Delta e} \right) ^{2}+\left( {\Delta c} \right) ^{2}+\gamma ^{2}t^{2}+2\Delta c\gamma t+4\delta ^{2}t^{2}} \right) +\xi t \\ \end{array}} \right\} \end{aligned}$$ -

(3)

Under the condition that the government has enough budget and can choose at most both firms to provide subsidy and it chooses both firms to subsidize, the necessary condition of both firms accepting the subsidy policy and investing in technology is the profits of \(F_{1}\) and \(F_{2}\) satisfy: \(\pi _{13} >\max \left\{ {\pi _{10} ,\pi _{12} } \right\} \) and \(\pi _{23} >\max \left\{ {\pi _{20} ,\pi _{21} } \right\} \), equivalently,

$$\begin{aligned} \frac{1}{9\Delta e}\left( {\Delta e+\Delta c} \right) ^{2}-\xi t^{2}+ts_0 >\max \left\{ {\begin{array}{l} \frac{1}{9\Delta e}\left( {\Delta e+\Delta c} \right) ^{2}, \\ \frac{1}{9\left( {\Delta e+\delta t} \right) }\left( {\Delta e+\delta t+\Delta c-\gamma t} \right) ^{2} \\ \end{array}} \right\} \end{aligned}$$and

$$\begin{aligned} \frac{1}{9\Delta e}\left( {2\Delta e-\Delta c} \right) ^{2}-\xi t^{2}+ts_0 >\max \left\{ {\begin{array}{l} \frac{1}{9\Delta e}\left( {2\Delta e-\Delta c} \right) ^{2}, \\ \frac{1}{9\left( {\Delta e-\delta t} \right) }\left( {2\Delta e-2\delta t-\Delta c-\gamma t} \right) ^{2} \\ \end{array}} \right\} . \end{aligned}$$Simplifying these conditions we get

$$\begin{aligned}s>\max \left\{ {\begin{array}{l} \frac{1}{9\Delta e\left( {\Delta e+\delta t} \right) }\left( {\left( {\Delta e} \right) ^{2}\delta -\left( {\Delta c} \right) ^{2}\delta -2\left( {\Delta e} \right) ^{2}\gamma +\Delta e\delta ^{2}t-2\Delta e\delta t\gamma -2\Delta e\Delta c\gamma +\Delta e\gamma ^{2}t} \right) +\xi t, \\ \frac{1}{9\Delta e\left( {\Delta e-\delta t} \right) }\left( {-4\left( {\Delta e} \right) ^{2}\delta -4\left( {\Delta e} \right) ^{2}\gamma +\left( {\Delta c} \right) ^{2}\delta +\Delta e\gamma ^{2}t+4\Delta e\delta t\gamma +2\Delta e\Delta c\gamma +4\Delta e\delta ^{2}t} \right) +\xi t, \\ \\ \xi t \\ \end{array}} \right\} \end{aligned}$$

Proof of Proposition 11

-

(1)

Because \(\Delta E_2 >\Delta E_1 \), \(F_{1}\) will never be chosen when the government has limited budget and can choose at most one firm to provide subsidy

-

(2)

Under the condition that the government has limited budget and can choose at most one firm to provide subsidy, \(F_{2 }\)will be chosen because \(\Delta E_2 >\Delta E_1 \) and \(\Delta E_2 >0\).

-

(3)

Under the condition that the government has enough budget and can choose at most both firms to provide subsidy, only \(F_{2 }\)will be chosen if the total change in pollutant emissions satisfy \(\Delta E_2 >\Delta E_3 \), equivalently, \(\frac{1}{3}t\left( {2\delta +\gamma } \right) >\delta t\). Simplifying these conditions we get \(\delta <\gamma \).

-

(4)

Under the condition that the government has enough budget and can choose at most both firms to provide subsidy, both firms are chosen if the total change in pollutant emission satisfy \(\Delta E_3 >0\) and \(\Delta E_3 >\Delta E_2 \), equivalently \(\delta t>0\) and \(\delta t>\frac{1}{3}t\left( {2\delta +\gamma } \right) \). Simplifying these conditions we get \(\delta >\gamma \).

Rights and permissions

About this article

Cite this article

Bi, G., Jin, M., Ling, L. et al. Environmental subsidy and the choice of green technology in the presence of green consumers. Ann Oper Res 255, 547–568 (2017). https://doi.org/10.1007/s10479-016-2106-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-016-2106-7