Abstract

Environmental impact is one of the major causes of tax and subsidy interactions between the government and firms. The government sets the tax of the upstream impact and designs the subsidy threshold value to promote the green effort of firms. This paper presents the optimal decision of the supply chain and the effective environmental governance strategy of the government. A Stackelberg game between the government and a two-echelon supply chain is constructed, where a supplier makes core parts for a manufacturer. First, we compared the effects of subsidy on the pricing decisions of firms and identified the profitable condition of the green effort of manufacturers. Results corroborate that a negotiated space for suppliers and manufacturers exists to reduce the environmental impact from the source, especially when the tax legislation is strict. Second, we obtained the optimal upstream contract of environmental impact in supply chains, which appears a phenomenon of the Matthew effect under any type of governance strategies. This finding affirms that subsidies make supply chains inclined to choose a greener upstream decision. The condition when subsidies make sense by effective environment improvement in the supply phase was further derived. Finally, with tax and subsidy governance strategies, the multi-perspective social welfare was simulated and analyzed. Accordingly, we verified that the growth boundary of the supply-chain profit with high subsidy threshold is better than that of the social welfare or the environment performance. It implies that setting the green subsidy standard originally high is a comprehensively sustainable choice for social welfare. In addition, the simulations of three tax structures were analyzed in extensions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Troubling environmental impacts (see Raz et al. 2013) during the production and consumption of products give rise to the pressing concern of emerging economies (Du et al. 2015). For instance, humankind manufactured 8.3 billion metric tons of plastic and generated 6.3 billion metric tons of plastic waste in 2015, of which the vast majority, 79%, was tossed (Geyer et al. 2017). The nexus between economic activities and environmental dynamics is definitely more complex than what we have considered thus far (Colapinto et al. 2017). Apart from the cost reduction, holistic measures considering the environment and society matter as well (Shibin et al. 2017). Regulators are paying considerable attention to construct sustainable supply chains. However, a nascent research area remains in operation management literature because different partners in supply chains have different self-interests and the interaction between the government and the supply chain involves multistage decisions (Agrawal et al. 2012).

On the one hand, firms have to bring various environmental aspects into their supply chains (Basu et al. 2017). The environmental motivation of firms grows out of the growing demand for natural resources, the consideration of the expected opportunity cost of environmental punishment, the consideration of meeting the green preference of consumers, and the establishment of corporate reputation. The sustainable consideration from the supply side of the supply chain is extremely crucial. However, these firms are still cautious about pollution reduction because most of the green effort requires substantial up-front capital investments that lead to an increase in costs (Dmitry et al. 2013; Bi et al. 2017).

On the other hand, governments of different countries continue working hard to carry out governance strategies. The revenue from environmentally related taxes averages roughly 2% of GDP in OECD Member countries (OECD 2001). The fiscal supply of risk capital for green technology is expanded by the government to stimulate sustainable innovation. United Kingdom’s Green Investment Bank is capitalized with USD 4.5 billion (OECD 2012). Traditionally, the government has chosen mandatory and rewarding efforts (sticks and carrots) to improve corporate environmental practices (Sharma and Ruud 2003). The method of “sticks and carrots” is hereby interpreted as the governance strategy of tax and subsidy as follows.

- 1.

Tax: Governments tax upstream firms in the supply chain for environmental impacts. Environmental taxes can be levied directly on contaminated emissions, such as carbon taxes, and on pollutant components, such as energy and resource taxes (Chen 2011). The EU defines a community strategy. With the strategy, a price in the form of a tax or charge is fixed to pay for pollution. In China, environmental protection tax is written into the law, which is levied on enterprises and institutions that discharge taxable pollutants directly to the environment (GOV.CN 2017). When firms reduce the environmental impact in supply activities, tax reductions are implemented. For instance, the government of the United Kingdom imposes a capital reduction based on CCL (Climate Change Levy), which reduces the amount of environmental taxes if firms buy energy saving or low/zero carbon technology (GOV.UK 2017).

- 2.

Subsidy: Subsidies probably total over USD1 trillion per year, and the subsidy for explicit environmental purposes is one of the major types (Pearce 2003). Government subsidies influence the operation strategies of firms due to the negative incentives and repetitive effects of R&D investment (Kleer 2010). In the United States, environmentally friendly products are subsidized with low-interest loans, preferential tax treatment, and green procurement (U.S. Environmental Protection Agency 2017). Finland’s Fuel Cell Programme 2007–2013 also has a budget of USD 185 million to develop alternative energy solutions (Finland-OECD 2012).

It is highly challenging to guide business operations with regulatory interventions to release conflicting sustainable pressures. Pearce (2003) conclude the opinions of OECD Workshop on Environmentally Harmful Subsidies. He stresses the need “to define subsidies carefully” and “to detail the criteria by which their effects can be judged beneficial or detrimental to the sustainable goal”. It remains to be discussed whether subsidies are not harmful to sustainable development.

Specifically, we attempt to solve the following questions: (1) Are the optimal decisions of firms under manufacturer subsidies and consumer subsidies the same? (2) What is the optimal decision of price and the preferred choice of green effort? (3) What is the optimal supply contract basing on the optimal pricing decisions of firms? Is the optimal contract on upstream environmental impact affected by different governance strategies? (4) In the sense of sustainable development, how does the government value the objective function of social welfare? How to find an effective design of the subsidy threshold? (5) How do the results of social welfare vary under the different fiscal structures of the government?

To demonstrate these points, this article is organized as follows. Section 3 presents the model. Sections 4, 5, and 6 solve the model by backward induction. Specifically, Sect. 4 compares the different types of subsidy, obtains the optimal prices under certain governance strategies, and discusses the decision whether to conduct green effort. Section 5 shows the green decision of supply contracts about the upstream environmental impact. From a multi-dimension perspective, Sect. 6 proposes an alternative solution for the government to make the subsidy decision and simulates the corresponding social welfare under a Stackelberg game results. Section 7 expands the discussion of fiscal structures affecting simulations.

2 Literature review

This paper builds on the two streams of literature to reduce the environmental impact among supply chains: the operation literature on firms’ consideration of environmental impact in supply chains and the environmental governance strategies including environmental taxes and green subsidies.

In the first steam of literature, firms play an important role in addressing sustainable concerns. The green effort of the firm in supply chains holds three features. First, this behavior generally requires technical and costly innovation (Lenox et al. 2000). Second, the environmental beliefs of consumers accelerate the sustainable process of firms, and market expansion occurs because of its product sustainability performance (Gadenne et al. 2011). Third, in the regulatory environment, firms can be financially compensated under the incentive mechanism of tax deduction or innovation subsidies (Cohen et al. 2016). Therefore, manufacturers restrict the environmental impact of suppliers in the green procurement contract and consider energy-saving or low-carbon environmental factors in the manufacture of products.

Many studies focus on the downstream environmental concerns, such as the studies of reverse supply chain channel (Li et al. 2016b; Wang et al. 2017), recycling channel (Feng et al. 2017), e-waste recycling operations (Xu and Yan 2017), the methods of remanufactured designs (Wei et al. 2015), and the reverse revenue sharing contract (Giovanni 2014). In comparison, although the upstream phase plays an important role in the sustainable property of products from the source, fewer literatures focus on supply chain research on the upstream environmental impact (Allevi et al. 2016; Basu et al. 2017). Therefore, in the model of this study, the environment factors in the upstream and downstream are systematically concerned in the context of the green preference of consumers and the tax and subsidy strategies of governance. We further carry out the observations of the optimal supply contract over environmental impact in the supply phase.

In the second stream of literature, the environmental governance strategies mainly include environmental taxes and green subsidies. On the one hand, the environmental taxation is “an indirect tool, with the regulators trying to provide proper incentives for firms to make the ‘right’ technology choices” (Dmitry et al. 2013). Song et al. (2015) find that in emissions trading system the impact by environmental taxes on the existing firm’s choices of optimal discharging amounts is uncertain. Effects of directive environmental regulations and incentive environmental regulations on technological progress and pollutant discharge are discussed (Song et al. 2016). In addition, studies on resource taxes affirm the resource-based paradox about resource and environmental consumption. For instance, Zhang et al. (2013) verify that the main contribution of the resource tax reform is to increase local government finances not to save energy and reduce carbon emissions. These phenomena examine the effect of environmental tax policy on environmental impact reduction.

On the other hand, the subsidy is another economic stimulus to environmental problems. The real challenge of policymakers is choosing the most appropriate tool. Subsidy is set to motivate firms’ adoption of green emission-reducing technology when consumers are environmentally discerning (Bi et al. 2017). Green subsidies are studied in the context of uncertain demands, dual-channel closed-loop supply chains, and R&D subsidies to investors (Cohen et al. 2016; Ma et al. 2013; Kleer 2010). In the study of the purchase subsidy incentive program of the government for electric vehicles, Huang et al. (2013b) validate that high subsidies may not lead to significant reductions in environmental hazards. Incentive effect is closely related to the design of strategy, and results may be contrary to the facts. To summarize the two strategies, studies on tax and subsidy share the same goal of stimulating environment improvement but run into the same problem of verify the effectiveness of incentives.

The link of the two above streams raises the question about social welfare. Relevant studies of scholars appear different. They consider the impact of environmental intervention on social welfare and corporate behavior, which connects the internal firm activities with the external policy maker (Dmitry et al. 2013; Li et al. 2014a, b). Lee and Tang (2017) emphasize triple goals and stakeholders. However, the environment and the economy are commonly contradictory, especially in the process of target setting. Certain researchers consider the improvement of unilateral benefits. Atasu and Subramanian (2012) compare how product recovery affects economic welfare in collective and individual producer responsibility models. Ata et al. (2012) study on how the social planner maximizes the quantity of landfill transfer with the improvement of the environmental correlation coefficient. Researchers consider the various components of social welfare, which generally builds the optimization problem of social welfare (Aflaki and Mazahir 2015; Sunar and Plambeck 2016). Huang et al. (2013a) examine the relationship between bounded rationality and social welfare affirming that the neglect of bounded rationality can lead to significant income and welfare losses. Substantial literatures also pay attention to the key questions about the effectiveness or even harmfulness of subsidies (Kosmo 1987; Cairns et al. 1999; Pearce 2003). The subsidy problems, however, still need to be detailed in the context of specific operation under environmental governance strategies in the level of supply chains.

The relationship between production and operations management decisions and public policy is bi-directional, which requires a joint examination of operational decisions with policy considerations (Joglekar et al. 2016). Nevertheless, in prior studies on the green behavior of firms, the study of environmental regulation rarely connects the external governance specific decisions with the internal supply contract and pricing decisions. On the strength of the previous studies of sustainable supply chain governance (Li et al. 2014b, 2016a), we built a model connecting the decisions of supply members and the government and tried to find a substantial solution considering the economic and environment performance of the supply chain.

3 Model framework

We consider a Stackelberg game between the government as a regulator and a two-echelon supply chain where a supplier makes core parts for a manufacturer. We take two typical environmental impacts into account: (1) In the downstream, the environment-related R&D process of the manufacturer determines the environmental impact of the product at the consumption stage, such as the energy consumption and the recycle cost. (2) In the upstream, the environmental impact accompanies with the raw material acquisition, carbon emissions, and toxic pollution.

From the view of the governance environment, two borders are involved: internal governance systems (influenced by the two-echelon supply chain), and external governance borders (influenced by the policy design and the green preference in consumer markets). Governance paths and logistic situations are shown through dotted lines and solid lines with arrows in Fig. 1, respectively. Key parameters are noted as follows. The government imposes environmental tax (t) on the supplier. t is adjusted by the upstream green aptitude of the supply chain members, which refers to the environmental impact in the upstream per unit (α). The minimum threshold (θg) of the government subsidy (s) is set to stimulate the manufacturer to invest a total manufacturing cost with green effort θ (θ ≥ 1).

From the external governance system to the internal operation, the decision sequences of a Stackelberg game turn out as external governance decision making, supply relationship matching decision-making, and internal governance decision-making. First, the government entitles manufacturers/consumers to obtain special subsidies basing on the minimum green effort level, which constructs the external governance. Second, the manufacturer cooperates with the upstream supplier with an aptitude of α, which forms the specific internal governance structure. The supplier and the manufacturer then make decisions respectively. Figure 2 generalizes the decision timeline.

Particularly, in accordance with the theory of supply chain governance (Li et al. 2016a), “Type Matching” process in Fig. 2 acts as a window linking of policy design and supply chain operation decisions. Other than the general supply chain static environment, we consider the multi-supplier and multi-manufacturer dynamic matching process. Similar to the competitive markets for multiple suppliers and multiple buyers (Xia et al. 2008), “Type Matching” is the matching of the green quality of the supplier to the expectations of the manufacturer.

Assuming that the total market demand is 1, p is the suggested retail price of the manufacturer, w is the wholesale price of the supplier, cs is the purchasing cost of the raw material, and cm is unit manufacturing cost without green effort, while \( \theta c_{m} (\uptheta \ge 1) \) is the unit manufacturing cost with green effort. Different from existed literatures on the quadratic cost function for green effort (Raz et al. 2013; Song et al. 2015), the green effort in our model linearly depends on the scale of production for the investigation of the early stages of innovation. θ − 1 reflects the green effort of manufacturers compared to cm. μ (0 < μ < 1) represents the average green preference parameter of consumers. The price sensitivity is reduced by the green effort with \( \mu \left( {\theta - 1} \right) \), which is the common knowledge of the manufacturer and supplier. Thus, the demand of products is

The amounts of environmental tax and subsidy per unit are \( t \left( {0 \le t < 1} \right) \) and \( s \left( {0 \le s < 1} \right) \), respectively. \( \alpha \in \left[ {\alpha_{L} ,\alpha_{H} } \right] \) is the environmental impact of the unit product in the upstream of supply chains. In practices of assessing the environmental impact in the supply chain, α can be estimated by the method of life-cycle assessment and material flow analysis (Hawkins et al. 2007).

4 Firms’ decision under governance strategy

Comparative analyses of the manufacture subsidy of the manufacturer (model Sm) and the purchase subsidy of consumers (model Sc) are made in this section. Besides, 4.2.2 distinguishes the profitability conditions of green effort for manufacturers to decide whether to conduct green effort.

4.1 Comparison of the two forms of subsidies

Superscripts Sm and Sc stand for the manufacture subsidy and the purchase subsidy, and the subscripts s and m represent the supplier and the manufacturer, respectively. As the price sensitivity always exists, we obtain the following:

The profits over the entire supply chain in are \( \pi^{{S_{m} }} = \pi_{s}^{{S_{m} }} \left( {w^{{S_{m} }} } \right) + \pi_{m}^{{S_{m} }} \left( {p^{{S_{m} }} } \right) \) and \( \pi^{{S_{c} }} = \pi_{s}^{{S_{c} }} \left( {w^{{S_{c} }} } \right) + \pi_{m}^{{S_{c} }} \left( {p^{{S_{c} }} } \right) \). Table 1 shows the objective functions of the two Sm and Sc. Accordingly, optimal decisions are derived in Proposition 1.

Proposition 1

The equilibrium price decisions of the two scenarios are as follows:

Hence, the relationship between two optimal results is clear.

- 1.

\( w^{Sc*} = w^{{S_{m} *}} \). Who receives the subsidy has no influence on the wholesale price of the supplier.

- 2.

\( p^{Sc*} = p^{{S_{m} *}} + s \). The amount of subsidy that manufactures attach to the final price maintains the gross price of two scenarios.

- 3.

\( \pi^{Sc*} = \pi^{{S_{m} *}} \). The two forms of the subsidy have the same profit.

Regardless of subsidizing the manufacturer or the consumer, the profit and unit gross price is the same. We see the two models under tax and subsidy governance as the same scenario and take the optimal solution of model Sm as the representative solution of subsidy model S. That is

4.2 Firms’ pricing and investment decision

4.2.1 Comparison of optimal decisions under different governance strategies

We analyze the decision of firms with three governance strategies. Superscripts *, 1, and 0 represent the optimal results of mix governance model S, single tax governance model R, and non-governance benchmark model N, respectively.

Proposition 2

The equilibrium prices under governance strategies of tax and subsidy, tax-only, and non-governance are obtained in the order.

If \( {\text{t}} > 0, \theta \ge \theta_{g} \) , then the equilibrium prices under tax and subsidy governance strategies of model S are as follows:

If\( {\text{t}} > 0, \theta < \theta_{g} \), then the equilibrium prices under the tax-only governance strategies of model R are the following:

If\( {\text{t}} = 0, \theta < \theta_{g} \), then the equilibrium prices under the non-governance strategies of model N are as follows:

Similar to Proposition 1, optimal decisions of three governance scenarios are solved in Proposition 2. On the whole, the comprehensive governance of tax and subsidy has an absolute increase in the wholesale price, and the effect on the price depends on the relationship between the environmental tax and the green subsidy.

The comparisons of optimal solutions of three governance strategies are as follows:

- 1.

Comparing the optimal prices of S and R: \( w^{*} = w^{1} + \frac{s}{2} \) and \( p^{*} = p^{1} - \frac{s}{4} \). Once the subsidy is added in the tax governance, the wholesale price of the supplier will be increased by \( \frac{s}{2} \), and the price of the manufacturer is reduced by \( \frac{s}{4} \).

- 2.

Comparing the optimal prices of R and N: \( w^{1} = w^{0} + \frac{\alpha t}{2} \) and \( p^{1} = p^{0} + \frac{\alpha t}{4} \). A single tax governance strategy leads to a price rise, which is related to α. The cost of environmental impact is transferred to the buyer.

- 3.

Comparing the optimal prices of S and N: \( w^{*} = w^{0} + \frac{\alpha t + s}{2} \) and \( p^{*} = p^{0} + \frac{\alpha t - s}{4} \). The unit amount of tax and subsidy exerts influence on the decisions.

Proposition 3

The sensitivity analyses of θ, μ, and α are as follows.

-

1.

\( w^{*} \)increases with θ if\( \theta > \frac{\mu + 1}{\mu } - \sqrt {\frac{1}{{\mu c_{m} }}} \); Otherwise, w* decreases with\( \theta , if \theta < \frac{\mu + 1}{\mu } - \sqrt {\frac{1}{{\mu c_{m} }}} \). p* increases with θ.

-

2.

With the higher μ, we get the higher w* and p*.

-

3.

Both p* and w* increase with α.

Proof

See “Appendix 1”.

From Proposition 3, with the same level of μ, we accordingly affirmed that, when cm is large enough to satisfy the condition \( \theta < \frac{\mu + 1}{\mu } - \sqrt {\frac{1}{{\mu c_{m} }}} \), high θ leads to high p* and low w*, and the environment investment is partly paid by consumers. Otherwise, when \( \theta > \frac{\mu + 1}{\mu } - \sqrt {\frac{1}{{\mu c_{m} }}} \), high θ leads to high p* and w*.

The size of μ is another key point to limit the green behavior of firms. Moreover, we find that the sensitivity of p* to μ is 1.5 times w* to μ; hence, the green preference of consumers has considerable influence on manufacturers.

As for \( \frac{{\partial w^{*} }}{\partial \alpha } = \frac{t}{2} \)\( \frac{{\partial p^{*} }}{\partial \alpha } = \frac{t}{4} \), the impact of α on pricing decisions depends on the intensity of the tax. The influence of α on supplier pricing decisions is twice that of the manufacturer. Therefore, suppliers are motivated to reduce the environmental impact in the supply phase to get a price advantage.

4.2.2 Discussion on manufacturers’ green effort

Manufacturers conduct green effort θ ≥ 1 during the manufacturing process. The willingness of the manufacturer to invest in green effort depends on his final profit. Different from certain studies (see Raz et al. 2013) that satisfy certain necessary Hessian conditions before obtaining the unique optimal decision combination, our study expands the application of the solution set to various parameter settings and consider the general green decision on whether to conduct green effort, that is, θ = 1 or θ > 1. The profitability conditions of the green effort of the manufacturer with two different governance strategies are as follows.

Proposition 4

According to their own sustainable strategic positioning, the manufacturer can choose whether to invest in green effort on the basis of the profit condition as follows.

-

1.

When 1 < θ < θg, the manufacturer cannot receive the subsidy. The green effort is implemented on the following condition:

$$ \left( {\frac{1}{{\sqrt {1 - \mu \left( {\theta - 1} \right)} }} - \left( {\theta c_{m} + c_{s} + \alpha t} \right)} \right)^{2} > \left( {1 - \left( {c_{m} + c_{s} + \alpha t} \right)} \right)^{2} . $$ -

2.

When θ ≥ θg, the manufacturer has a chance to receive the subsidy. The green effort is implemented on the following condition:

$$ \left( {\frac{1}{{\sqrt {1 - \mu \left( {\theta - 1} \right)} }} - \left( {\theta c_{m} + c_{s} + \alpha t - s} \right)} \right)^{2} > \left( {1 - \left( {c_{m} + c_{s} + \alpha t - s} \right)} \right)^{2} . $$

Proof

See “Appendix 1”.

The optimality conditions of Hessian π*(p*, θ*) are commonly complex and impossible to be applied to all firm environments. In a sense, however, Proposition 4 is more in accordance with the normal business practices. In addition, Proposition 4 is applied to the definition of Δm in Definition 1 in Sect. 6, where we can see the relationship between π* and θ visually.

5 Optimal contract of supply chain

The supply contract is formed when the supplier can sufficiently meet the environmental expectation of the manufacturer in the upstream of supply chains. Considering the joint decisions of supply chains on the upstream environmental impact (α), the maximization process represents the type matching phase between the supplier and the manufacturer. The formation of the supply contract in the two-echelon supply chain bases on the same value of α. The problems of firms on establishing the contract on α in Model R and Model S are as follows:

As the similar structure of the two profit formulas, the optimization of the supply chain’s total profit of π1(α) and π*(α) accords with the profit of the supplier and the manufacturer. The range α ∈ [αL, αH] shows the extent to which the supply chain may reach on the supply side at the current technical level. Less α indicates that less environmental impact of the product will be brought to the supply process. To distinguish the optimal decision on \( \alpha \) under the two strategies, we use superscripts R and S to represent the decision under single tax governance and tax and subsidy governance.

Proposition 5

Let\( \hat{\alpha }^{R} = \frac{{1 - \left( {1 - \mu \left( {\theta - 1} \right)} \right)\left( {\theta c_{m} + c_{s} } \right)}}{{\left( {1 - \mu \left( {\theta - 1} \right)} \right)t}} \) and \( \hat{\alpha }^{S} = \frac{{1 - \left( {1 - \mu \left( {\theta - 1} \right)} \right)\left( {\theta c_{m} + c_{s} - s} \right)}}{{\left( {1 - \mu \left( {\theta - 1} \right)} \right)t}} \). The optimal contract on upstream environmental impact under tax-only governance is as follows:

while that under tax and subsidy governance is the following:

Proof

See “Appendix 1”.

The value \( \frac{{\alpha_{H} + \alpha_{L} }}{2} \) reflects the overall level of α. The optimal contract relies on the size of \( \hat{\alpha }^{R} \) or \( \hat{\alpha }^{S} \), of which the former is less than the latter. For both governance situations, we verify that the optimal upstream contract turns out a phenomenon of the Matthew effect. Take the first situation of α1 as an example when the overall environmental impact of the supply phase is low \( (\alpha_{H} < \hat{\alpha }^{R} ) \), the optimal contract turns out to be αL. On the contrary, when the overall impact is high \( (\alpha_{L} > \hat{\alpha }^{R} ) \), the optimal contract changes into \( \upalpha_{\text{H}} \). Moreover, the possibility that \( \hat{\alpha }^{S} \ge \frac{{\alpha_{H} + \alpha_{L} }}{2} \) is larger than \( \hat{\alpha }^{R} \ge \frac{{\alpha_{H} + \alpha_{L} }}{2} \) because \( \hat{\alpha }^{R} < \hat{\alpha }^{S} \). Therefore, the manufacturer under tax & subsidy governance is more inclined to choose the environmentally friendly contract (αL) than the tax-only situation. Proposition 6 shows the difference between the specific optimal contracts of Model R and Model S.

Proposition 6

Comparison between R and S contributes the following results:

-

1.

If\( \hat{\alpha }^{R} \ge \frac{{\alpha_{H} + \alpha_{L} }}{2} \), αR* = αS* = αL;

-

2.

If\( \hat{\alpha }^{S} < \frac{{\alpha_{H} + \alpha_{L} }}{2} \), αR* = αS* = αH;

-

3.

If\( \hat{\alpha }^{R} < \frac{{\alpha_{L} + \alpha_{H} }}{2} \le \hat{\alpha }^{S} \), αR* = αH, αS* = αL.

The subsidy has no influence on the optimal decision of firms when the overall level of the industry in the upstream of the supply chain is high or low. Notably, when \( \hat{\alpha }^{R} < \frac{{\alpha_{L} + \alpha_{H} }}{2} \le \hat{\alpha }^{S} \), the optimal decisions in Model R and Model S are separated. The subsidy will affect the formation of several supply chains with low upstream environmental impact, which brings environment improvement.

As the supply chain is closely related to the government subsidy policy, α* will be influenced by the subsidy threshold of the government θg, which will be analyzed later. Considering the influence of θg, the decision of α* is as follows:

6 Government’s decision on subsidy threshold

The government designs the minimum subsidy standard according to the social welfare. In addition to the financial income of the government, the main components of social performance in the supply chain are economic performance, consumer surplus, and environment improvement. Section 6.1 analyzes the relationship between environment performance (Y) and green effort (θ) with the optimal solution of α*. Section 6.2 identifies the optimal subsidy threshold of the government (θg*) by considering all the optimal decisions under different optimization structures.

6.1 Environment performance

Simulation in 6.1 focuses on θ’s influence on environmental impact before the discussion about the social welfare. Regarding the expression of environmental impact, certain studies measure the environmental impact by multiplying the unit environmental impact with the production of products (Agrawal et al. 2012; Raz et al. 2013). Following Aflaki and Mazahir (2015) and Raz et al. (2013), we assume that environmental impacts can be expressed in monetary form, where θ reflects the environmental impact of unit products. Given that the environmental impact in the upstream is α, we assume the environmental impact of the downstream is β, which is reduced by θ. The environmental performance of the entire supply chain is Y(θ) = (θ − α*(θ) − β)q*(θ) = (θ − α*(θ) − β)(1 − k(θ)p*(θ)). That is

Let k(θ) = 1 − μ(θ − 1). According to Eq. (8), we get the following:

Proposition 7

Let

-

1.

If\( \hat{\alpha }^{S} \left( \theta \right) \ge \frac{{\alpha_{H} + \alpha_{L} }}{2} \), then α*(θ) = αL; \( \hat{\alpha }^{S} \left( \theta \right) < \frac{{\alpha_{H} + \alpha_{L} }}{2} \), α*(θ) = αH.

-

2.

At the same level of α*, if φ < 0, \( Y\left( \theta \right) \)increases in θ (Case 1); if φ > 0, then the local maximum and minimum values of Y(θ) are obtained at θ1and θ2. Y(θ) increases in θ when θ2 < 1; Y(θ) decreases in θ first and increases in θ later when θ1 < 1 ≤ θ2(Case 3); Y(θ) shows a wavelike increasing trend when\( \theta_{1} \ge 1 \)(Case 2 and 4).

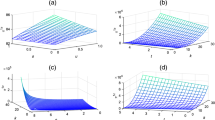

For a vivid understanding, let αL = 0, αH = 1. Figure 3 draws how environment performance Y(θ) changes with different value of θ in several cases, and Table 2 shows the specific scope of θ and optimal conditions. Under the optimal condition, when \( \hat{\alpha }^{S} \left( \theta \right) \ge \frac{{\alpha_{H} + \alpha_{L} }}{2} \) or \( \hat{\alpha }^{S} \left( \theta \right) < \frac{{\alpha_{H} + \alpha_{L} }}{2} \) always holds in Case 1 and Case 2, for example, the improvement trend of Y(θ) is smooth. Under the optimal condition when \( \hat{\alpha }^{S} \left( \theta \right) \ge \frac{{\alpha_{H} + \alpha_{L} }}{2} \) and \( \hat{\alpha }^{S} \left( \theta \right) < \frac{{\alpha_{H} + \alpha_{L} }}{2} \) coexist as Case 3 and Case 4, the chop point occurs in Y(θ). Take Case 4, for example, in the interval of \( 1 \le \theta < 5.2069 \), Y(θ) obtains local maximum improvements at point of θ1 (θ1 = 2.9466). In the interval of 5.2069 ≤ θ < 14.6681, Y(θ) turns out negative with a sharp decrease and reaches the minimum at θ2 (θ2 = 11.0116) and then turns positive when θ ≥ 14.6681, and becomes increasingly large with θ.

The relationship between environment performance and green effort level is nonlinear and closely related to the design of environmental impact in the upstream and the government regulation. We found the risk segment of θ, where results oppose the purpose. For instance, in the case of φ > 0 in Proposition 7, the environment becomes worse with the effort in the range of [θ1, θ2].

An invalid area exists for government subsidies. Let Y(1)= h, in addition to \( \theta = 1 \), two other roots are denoted as \( \acute{\theta} \) and \( \grave{\theta} \), respectively (\( \acute{\theta}<\grave{\theta} \)). The government subsidy standard to improve the environment performance in \( [\acute{\theta}, \grave{\theta}] \) is invalid or even counter-effect. In the case of θ1 < 1 ≤ θ2, if the green subsidy standard satisfies θg ∈ (1, 2θ2 − 1], then Y(θg) ≤ Y(1) in which the subsidy is ineffective or even counterproductive to the environment performance; if θg > 2θ2 − 1, then Y(θg) > Y(1), environment performance increment is increasing with the rise of θ where the green effort has a learning effect. When θ2 < 1, the green subsidy of the government has a long-term positive effect on the improvement of environment performance and also has a learning effect.

6.2 Social welfare

The model of social welfare generally includes measurable economic component and product environment footprint (Aflaki and Mazahir 2015). Certain researchers consider the maximization of social welfare including profits of firms, consumer surplus, government revenue from taxing emissions, and the social cost of emission (Sunar and Plambeck 2016). This section analyzes social welfare through three main dimensions, such as economic surplus (supply chain profit), government fiscal surplus (tax and subsidy), and environment performance (as the measurement method in Sect. 6.1) to further discuss the green threshold design of government. Although consumer surplus is also shown in our simulation, we disregarded it as a main dimension because its threshold appears the same property as supply chain profit. Therefore, we know that:

k(θ) = 1 − μ(θ − 1). The maximum profit of supply chain is as follows:

Consumer surplus is as follows:

Government’s fiscal surplus is the following:

Environment performance is as follows:

Social welfare comes up to the following:

Definition 1

Let δ be small and δ > 0, θ + δ denote the right neighborhood of θ. The expressions of thresholds with different dimensions are as follows:

- 1.

If the government subsidy is only set to meet the maximization of social welfare, then the minimum subsidy threshold is as follows:

$$ \theta_{g}^{*} = arg\;max\;\left\{ {SW\left( \theta \right)} \right\}. $$ - 2.

If government subsidies are expected to have positive growth in social welfare, then the minimum threshold for setting is the following:

$$ \theta_{g}^{*} = min\left\{ {\Delta_{s} } \right\}. $$ - 3.

If the government subsidies are set considering the single stimulate for positive economic incentives or effective environment improvement, then the minimum threshold is determined as follows:

$$ \theta_{g}^{*} = min\left\{ {\Delta_{m} } \right\}\; or\;\theta_{g}^{*} = min\left\{ {\Delta_{e} } \right\}. $$ - 4.

If the government subsidy aims to select the minimum subsidy threshold for any two of the positive growth intentions, then the minimum threshold is determined as follows:

$$ \theta_{g}^{*} = min\left\{ {\Delta_{s} \cap \Delta_{m} } \right\},\theta_{g}^{*} = min\left\{ {\Delta_{s} \cap \Delta_{e} } \right\}\;or\;\theta_{g}^{*} = min\left\{ {\Delta_{m} \cap \Delta_{e} } \right\} $$

The four practice limitations of the subsidy design in Definition 1 are as follows: In situation (1), the government pursues the entire social welfare maximization, which is common in academic research and policy practice. However, subsidy design in this way may ignore changes in supply chain profit or environment performance and the government is likely to design the highest possible subsidy threshold to pursue great social welfare, which may exclude many enterprises. Thus, this method is unreasonable and should be excluded. In situation (2), the government sets the minimum threshold for the total social welfare but there will be the problem of unilateral growth and the dilemma of how to balance its different components. Similar unbalance occurs in situations (3) and (4). Taking θg* = min{Δs ∩ Δm} as an example, θg* aiming at social welfare growth and effective economic incentives ensures that many enterprises are involved in green innovation, but the original governance goal to “reduce environmental impact” is neglected. This will lead to the social prosperity and production promoting at the expense of the environment degradation.

To sum up, we hold the belief that the government must first ensure the effective growth of both the overall welfare and of the welfare components. Accordingly, the improved \( \theta_{g}^{ *} \) is defined in Definition 2.

Definition 2

Judging by the comprehensive goal of social welfare, the government set the minimum subsidy threshold for:

Therefore, the government consider the impact of triple comprehensive welfare to ensure the positive growth of the three dimensions of welfare, relative to the condition where \( \theta = 1,s = 0 \), the government minimum subsidy threshold considers three dimensions:

- 1.

Δs conforms to the overall promotion of social welfare. SWʹ(θs + δ) > 0 stands for the rising trend, which makes the minimum threshold of subsidy conform to the rising path of green technology.

- 2.

Δm guarantees that the green effort of the supply chain is economical and that the core business will lead the green behavior spontaneously.

- 3.

Δe is set for effective environment performance. Yʹ(θe + δ) ≥ 0 ensures that environment performance and business effort are positively correlated.

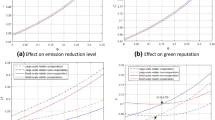

Let αL = 0 and αH = 1. Parameters are given in Table 3 (see in “Appendix 2”), in which θα separates the different values of \( \alpha^{ *} \), and Rx(x = s, m, c, e) defines the beneficial region of θ [e.g. Rs is the beneficial region where SW(θ) ≥ SW(1)]. Figure 4 shows the simulation results. The simulation of the graphics based on the triple benefits in Definition 2 shows the final results with optimal solution set of \( \theta_{g}^{ *} \), \( \alpha^{ *} \), \( w^{ *} \) and \( p^{ *} \). The change in consumer surplus part of the social welfare is

which however does not affect our results. θα denotes the threshold value where the optimal decision of α changes. The graphs of the four cases are closely related to the critical values of θα and θm. Simultaneously, we conclude the interesting phenomena in Proposition 8.

Proposition 8

From the simulation, we obtain the following results:

-

1.

Thresholds under different single dimensions turn out a relation of θs < θm = θc.

-

2.

The threshold of environment performance always equals to that of the environment parameters on the supply side of the supply chain, that is θe = θα(in the double-threshold case, it equals to the large one, which is θe = θα2).

-

3.

Simulation results all satisfy θg* = θm = θc.

From (1) of Proposition 8, when the policy designers plan the green subsidy standard only considering the positive growth of the comprehensive social welfare (θg* = θs) and ignoring the profit growth boundary of the enterprise, they may drown the original intention of enhancing the environment performance and realizing enterprise green innovation. In addition, θm = θc. The growth margins of consumer utility are consistent with the profit margins of supply chain profits and can be regarded as the same social welfare dimension, which we can obtain by \( \pi^{*} \left( \theta \right) = \frac{3}{2}CS\left( \theta \right) \).

From (2) of Proposition 8, on the one hand, the positive growth of environment performance is closely related to the environment parameters on the supply side of the supply chain. When θ ≥ θα, α = αL, and the enterprise adopts a more environmentally friendly supply designs. On the other hand, in the four simulation environments, θe = θα is satisfied when θα exists. The mutation value caused by α* directly affects the net profit of the unit product, and the large θα is correlated with the growth condition of social welfare at the environment level.

From (3), θg* according to Definition 2 relies on the green input of manufacturers to acquire positive profit growth. θg* obtains different degrees to the acceleration of the upgrade in other dimensions of social welfare simultaneously.

7 Extensions

Case 2 in the above simulations is similarly analyzed in the context of tax neutrality in some chain supply chain model solving. The following simulations analyze the government finance part composed of tax and subsidy as the expansion study. On the basis of Case 2 in 6.2, three cases are simulated with the different two fiscal parameters: Case 2.1 is tax neutral (s = t), Case 2.2 denotes subsidies less than taxes (s < t), and Case 2.3 denotes subsidies more than taxes (s > t). We compare their simulation results of \( SW\left( \theta \right), Y\left( \theta \right), \pi \left( \theta \right),CS\left( \theta \right), \) respectively in Fig. 5. Table 4 exhibits the parameters (see in “Appendix 2”).

Proposition 9

The trend of θ under the three different fiscal structures of the government follows the results in Proposition 8 and satisfies the following:

- 1.

θg2.1* = θg2.3* = θg2.2*;

- 2.

α* appears to be separated in different cases. α2.1* = α2.3* = αL, and

$$ \alpha_{2.2}^{*} = \left\{ {\begin{array}{ll} {\alpha_{H} } &\quad {1.7620 \le \theta < 3.0505} \\ {\alpha_{L} } &\quad {else;} \\ \end{array} } \right. $$ - 3.

θe < θs < θm = θc.

Case 2.2 is special: (1) shows that when the government in triple-dimension threshold θg* under the structure of three types of tax subsidies is the same, the critical value of θs on behalf of the social welfare minimally increases from s = t to s > t, and maximizes when s < t. Thus, θs in Case 2.2 is the most close to θg*, which is the optimal value in triple dimensions. By (2) values among \( \left[ {1.7620, 3.0505} \right] \) have high upstream environmental impact, and graphic of π in this area shows a partial concave function in Case 2.2. Accordingly, when the enterprise cannot reach the investment level of 3.7991 in this case, the optimal value α* will likely ignore environmental impact. Furthermore, in different fiscal setting, from (3), we verify that the profit margin of enterprises is more effective than the growth boundary of comprehensive social welfare or environment performance.

8 Conclusions

The solution to the environmental impact problem depends on collaborative supply chain governance, including government, consumer, and supply chain members (Li et al. 2016a). The internal coordination among supply chain and the external governance are responsible for the environmental impact.

First, we corroborated that the collection of environmental taxes and fees does not always lead to an increase in the wholesale price in the firm level, which is also affected by the green behavior of the manufacturer, the cost structure, and the upstream environmental impact of the product. Given that the environmental incentives of the supplier are greater than that of the manufacturer, negotiated spaces exist for suppliers and manufacturers to establish contract on a green design to reduce the environmental impact from the source, especially when the tax legislation is strict. Taking Anmeilite’s green raw material innovation of complete UI-Stone production equipment and technology for example, with a stringent tax policy, certain suppliers lead the sustainable innovation from the upstream supply side (Anmeilite 2017).

The study also confirms the important role social environment and consumer play in motivating firms to adopt green efforts. Due to the pressure of high costs from fierce competition, firms tend to give up the effort if they do not have sufficient confidence in the expected environmental preference or the transparent assessment system. This scenario reminds us that the cultivation of social innovative behaviors and legislation propulsions are fundamental for the subsidy stimulation of green effort, which is the source of the market confidence for a firm to conduct green effort spontaneously.

Second, in the supply chain level, we found that the environment decision (\( \alpha^{ *} \)) of upstream appears a Matthew effect, the better becomes better and the worse becomes worse in the upstream performance of firms. Proposition 6 further shows that subsidy has no influence to the optimal decision of firms when the overall level of the industry in the upstream of the supply chain is high or low. Moreover, we also affirmed that subsidies persuade manufacturers inclined to choose to reduce the environmental impact for product designs. Afterward, we obtained the difference of \( \alpha^{ *} \) decision between the tax subsidy and the single tax situation. We defined the condition of the separation of optimal decisions in Models R and S where Model S provides additional upstream environmental improvements.

Third, policy decisions are complex evolution systems involving top-down and bottom-up considerations in the external governance level (Joglekar et al. 2016). Thus, we defined the effectiveness of governance strategies in a mathematic and emulational way. The relationship between the subsidy standard and the environment performance is obtained in the view of developing green effort. The risk area of the green subsidy standard is defined. Importantly, with governance strategies, we conducted a three-dimensional analysis of social welfare. Four types of subsidy standard designs are defined in Definition 1, and an improved one is showed in Definition 2. The improved threshold achieves the positive growth of social welfare and ensures the effective corporate green behavior. In Proposition 8, we affirmed that the profit boundary of an enterprise with high subsidy threshold (θg*) is superior to the growth boundary of comprehensive social welfare (θs) or environment performance (θe) in these simulations, which show that original high-level subsidy threshold is an effective sustainable choice in the long run.

The results also highlight the importance of the upstream environmental impact and of the unit product profitability. And we confirmed that for a product, environmental governance strategies for encouragement may face the helpless or bad situation. The limited knowledge and the market uncertainty may trigger the risk of disable stimulation. Therefore, the improvement of environment performance brought by subsidies is conditional. The government should avoid certain risk area and decide the subsidy threshold cautiously. In addition, the size of the upstream environmental impact of the model is based on the dynamic matching of the manufacturer and the supplier. Further research can focus on establishing a coordinated plan of the green design by the manufacturer and the supplier.

References

Aflaki, S., & Mazahir, S. (2015). Recovery targets and taxation/subsidy policies to promote product reuse. Rochester: Social Science Electronic Publishing.

Agrawal, V. V., Ferguson, M., Toktay, L. B., & Thomas, V. M. (2012). Is leasing greener than selling? Management Science,58(3), 523–533.

Allevi, E., Gnudi, A., Konnov, I. V., & Oggioni, G. (2016). Evaluating the effects of environmental regulations on a closed-loop supply chain network: A variational inequality approach. Annals of Operations Research,1, 1–43.

Anmeilite. (2017). Green technology (online). http://en.anmeilite.com/index.php?catid=17. Accessed 10 Nov 2017.

Ata, B., Lee, D., & Tongarlak, M. H. (2012). Optimizing organic waste to energy operations. Manufacturing & Service Operations Management,14(2), 231–244.

Atasu, A., & Subramanian, R. (2012). Extended producer responsibility for e-waste: Individual or collective producer responsibility? Production & Operations Management,21(6), 1042–1059.

Basu, R. J., Subramanian, N., Gunasekaran, A., & Palaniappan, P. L. K. (2017). Influence of non-price and environmental sustainability factors on truckload procurement process. Annals of Operations Research,250(2), 1–26.

Bi, G., Jin, M., Ling, L., & Yang, F. (2017). Environmental subsidy and the choice of green technology in the presence of green consumers. Annals of Operations Research,255(1), 1–22.

Cairns, J., Myers, N., & Kent, J. V. (1999). Perverse subsidies: Tax $s undercutting our economies and environments alike. BioScience,49(4), 334–336.

Chen, S. Y. (2011). Marginal cost of emission reduction and China’s environmental tax reform. Chinese Journal of Social Sciences,3, 85–100.

Cohen, M. C., Lobel, R., & Perakis, G. (2016). The impact of demand uncertainty on consumer subsidies for green technology adoption. Management Science,62(4), 868–878.

Colapinto, C., Liuzzi, D., & Marsiglio, S. (2017). Sustainability and intertemporal equity: A multicriteria approach. Annals of Operations Research,251(1–2), 271–284.

Dmitry, K., Timur, N., & Anton, O. (2013). Environmental taxes and the choice of green technology. Production & Operations Management,22(5), 1035–1055.

Du, S., Ma, F., Fu, Z., Zhu, L., & Zhang, J. (2015). Game-theoretic analysis for an emission-dependent supply chain in a ‘cap-and-trade’ system. Annals of Operations Research,228(1), 135–149.

Feng, L., Govindan, K., & Li, C. (2017). Strategic planning: Design and coordination for dual-recycling channel reverse supply chain considering consumer behavior. European Journal of Operational Research,260(2), 601–612.

Finland-OECD. (2012). Science and Innovation: Finland (online). http://www.oecd.org/finland/sti-outlook-2012-finland.pdf. Accessed 24 July 2018.

Gadenne, D., Sharma, B., Kerr, D., & Smith, T. (2011). The influence of consumers’ environmental beliefs and attitudes on energy saving behaviours. Energy Policy,39(12), 7684–7694.

Geyer, R., Jambeck, J. R., & Law, K. L. (2017). Production, use, and fate of all plastics ever made. Science Advances,3(7), e1700782.

Giovanni, P. D. (2014). Environmental collaboration in a closed-loop supply chain with a reverse revenue sharing contract. Annals of Operations Research,220(1), 135–157.

GOV.CN. (2017). Environmental protection tax law of the People’s Republic of China (online). http://www.chinalaw.gov.cn/art/2017/4/5/art_11_88264.html. Accessed 28 Dec 2017.

GOV.UK. (2017). Environmental taxes, reliefs and schemes for businesses (online). http://www.gov.uk/green-taxes-and-reliefs. Accessed 20 Oct 2017.

Hawkins, T., Hendrickson, C., Higgins, C., Matthews, H. S., & Suh, S. (2007). A mixed-unit input-output model for environmental life-cycle assessment and material flow analysis. Environmental Science and Technology,41(3), 1024.

Huang, T., Allon, G., & Bassamboo, A. (2013a). Bounded rationality in service systems. Manufacturing & Service Operations Management,15(2), 263–279.

Huang, J., Leng, M., Liang, L., & Liu, J. (2013b). Promoting electric automobiles: Supply chain analysis under a government’s subsidy incentive scheme. IIE Transactions,45(8), 826–844.

Joglekar, N. R., Davies, J., & Anderson, E. G. (2016). The role of industry studies and public policies in production and operations management. Production & Operations Management,25, 1977–2001.

Kleer, R. (2010). Government R&D subsidies as a signal for private investors. Research Policy,39(10), 1361–1374.

Kosmo, M. N. (1987). Money to burn?: The high costs of energy subsidies. Washington DC: World Resources Institute.

Lee, H. L., & Tang, C. S. (2017). Socially and environmentally responsible value chain innovations: New operations management research opportunities. Management Science,64, 983–996.

Lenox, M., King, A., & Ehrenfeld, J. (2000). An assessment of design-for-environment practices in leading us electronics firms. Interfaces,30(3), 83–94.

Li, X., Li, Y., & Govindan, K. (2014a). An incentive model for closed-loop supply chain under the EPR law. Journal of the Operational Research Society,65(1), 88–96.

Li, W., Li, Y., & Shi, D. (2016a). Research on the theory of supply chain governance: Concept, connotation and normative analysis framework. Nankai Management Review,19(1), 4–15.

Li, Y., Xu, F., & Zhao, X. (2016b). Governance mechanisms of dual-channel reverse supply chains with informal collection channel. Journal of Cleaner Production,155, 125–140.

Li, Y., Zhao, X., Shi, D., & Li, X. (2014b). Governance of sustainable supply chains in the fast fashion industry. European Management Journal,32(5), 823–836.

Ma, W. M., Zhao, Z., & Ke, H. (2013). Dual-channel closed-loop supply chain with government consumption-subsidy. European Journal of Operational Research,226(2), 221–227.

OECD. (2001). Environmentally related taxes in OECD countries: Issues and strategies. New York: Humana Press.

OECD. (2012). Green technology and innovation (online). https://www.oecd.org/sti/outlook/e-outlook/stipolicyprofiles/newchallenges/greentechnologyandinnovation.htm. Accessed 20 Oct 2017.

Pearce, D. (2003). Environmentally harmful subsidies: Barriers to sustainable development. Environmentally harmful subsidies: Policy issues and challenges. Paris: OECD.

Raz, G., Druehl, C. T., & Blass, V. (2013). Design for the environment: Life-cycle approach using a newsvendor model. Production and Operations Management,22(4), 940–957.

Sharma, S., & Ruud, A. (2003). On the path to sustainability: Integrating social dimensions into the research and practice of environmental management. Business Strategy and the Environment,12(4), 205–214.

Shibin, K. T., Dubey, R., Gunasekaran, A., Hazen, B., Roubaud, D., Gupta, S., & Foropon, C. (2017). Examining sustainable supply chain management of SMEs using resource based view and institutional theory. Annals of Operations Research. https://doi.org/10.1007/s10479-017-2706-x.

Song, M., Wang, S., & Wu, K. (2016). Environment-biased technological progress and industrial land-use efficiency in China’s new normal. Annals of Operations Research. https://doi.org/10.1007/s10479-016-2307-06.

Song, M. L., Zhang, W., & Qiu, X. M. (2015). Emissions trading system and supporting policies under an emissions reduction framework. Annals of Operations Research,228(1), 125–134.

Sunar, N., & Plambeck, E. (2016). Allocating emissions among co-products: Implications for procurement and climate policy. Manufacturing & Service Operations Management,18(3), 414–428.

U.S. Environmental Protection Agency. (2017). Subsidies for Pollution Control (online). http://yosemite.epa.gov/ee/epa/eerm.nsf/vwAN/EE-0216B-08.pdf/$file/EE-0216B-08.pdf.

Wang, L., Cai, G. G., Tsay, A. A., & Vakharia, A. J. (2017). Design of the reverse channel for remanufacturing: Must profit-maximization harm the environment? Production and Operations Management,26, 1585–1603.

Wei, S., Tang, O., & Liu, W. (2015). Refund policies for cores with quality variation in OEM remanufacturing. International Journal of Production Economics, 170, 629–640.

Xia, Y., Chen, B., & Kouvelis, P. (2008). Market-based supply chain coordination by matching suppliers’ cost structures with buyers’ order profiles. Management Science,54(11), 1861–1875.

Xu, Y., & Yan, C. H. (2017). Sustainability-based selection decisions for e-waste recycling operations. Annals of Operations Research,248(1–2), 531–552.

Zhang, Z., Guo, J. E., Qian, D., Xue, Y., & Cai, L. (2013). Effects and mechanism of influence of China’s resource tax reform: A regional perspective. Energy Economics,36, 676–685.

Acknowledgements

We acknowledge the support of (i) National Natural Science Foundation of China (NSFC), Research Fund Nos. 71372100 and 71725004 for Y.J. Li; and (ii) National Natural Science Foundation of China (NSFC), Research Fund No. 71702129 for C. Zhou.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Proofs

Proof of Proposition 1

Taking the scenario of subsidizing manufacturer as an example, the proof of the other conditions can be alike. Taking the first order derivative of \( \pi_{m}^{{S_{m} }} \left( p \right) \) regarding \( p \), we obtained:

which implies that

Substituting \( p \) with (A1) and taking the first order derivative of \( \pi_{s}^{{S_{m} }} \left( w \right) \) regarding \( w \), we acquired:

which implies that

Substituting \( w \) with the optimal expression (A2) in (A1), we obtained the results of Proposition 1. Reasonably supposing that consumers are always sensitive to the price, we obtained the following:

Thus, we acquired the second order derivative of \( \pi_{s}^{{{\text{S}}_{\text{m}} }} \left( {\text{w}} \right) \) and \( \pi_{m}^{{{\text{S}}_{\text{m}} }} \left( {\text{p}} \right), \) respectively, as follows:

The solution satisfies the optimal conditions; thus, \( \left( {w^{{S_{m} *}} ,p^{{S_{m} *}} } \right) \) is an optimal price decision.

Proof of Proposition 3

As

we acquired the result (1) in Proposition 3.

As

we obtained the result (2) in Proposition 3.

As

we acquired the result (3) in Proposition 3.

Proof of Proposition 4

With optimal results in Proposition 2, we obtained the profit as follows.

Condition (1) in Proposition 4 can be obtained by simplifying the following:

i.e.,

Condition (2) in Proposition 4 can be obtained by the simplifying the following:

i.e.,

Proof of Proposition 5

Taking Model R as an example. Given that the first and second order derivative of \( \pi^{1} \left( \alpha \right) \) satisfy

and

\( \pi^{1} \left( \alpha \right) \) is on the convexity of \( \alpha \). \( \hat{\alpha }^{R} \) stands for the level of environment impact in supply phase, where profit of the manufacturer is minimum, and the quadratic function graph are right-and-left symmetric. The minimum value of \( \pi^{1} \left( \alpha \right) \) is obtained when \( \alpha = \hat{\alpha }^{R} \). Therefore, the supplier and the manufacturer will choose the value farthest from \( \hat{\alpha }^{R} \). Similar result of \( \pi^{*} \left( \alpha \right) \) is derived in Model S under the tax & subsidy governance.

Proof of Proposition 6

Given that

When \( \hat{\alpha }^{R} \ge \frac{{\alpha_{H} + \alpha_{L} }}{2} \), \( \alpha_{L} \) is the farthest point from both the symmetry axis \( \hat{\alpha }^{R} \) and \( \hat{\alpha }^{S} \). Therefore, \( \pi^{1} \left( \alpha \right) \) and \( \pi^{*} \left( \alpha \right) \) reach the maximum at \( \alpha_{L} \). Afterward, we obtained the result (1) in Proposition 6.

When \( \hat{\alpha }^{S} < \frac{{\alpha_{H} + \alpha_{L} }}{2} \), \( \alpha_{H} \) is the farthest point from the symmetry axis \( \hat{\alpha }^{R} \) and \( \hat{\alpha }^{S} \). Therefore, \( \pi^{1} \left( \alpha \right) \) and \( \pi^{*} \left( \alpha \right) \) reach the maximum at \( \alpha_{L} \). Afterward, we acquired the result (2) in Proposition 6.

When \( \hat{\alpha }^{R} < \frac{{\alpha_{L} + \alpha_{H} }}{2} \le \hat{\alpha }^{S} \),\( \pi^{1} \left( \alpha \right) \) and \( \pi^{*} \left( \alpha \right) \) appear as different trends. \( \alpha_{H} \) is the farthest point from \( \hat{\alpha }^{R} \). On the contrary, \( \alpha_{L} \) is the farthest point from \( \hat{\alpha }^{S} \). Afterward, we obtained the result (3) in Proposition 6.

Appendix 2: Simulations

Rights and permissions

About this article

Cite this article

Li, Y., Deng, Q., Zhou, C. et al. Environmental governance strategies in a two-echelon supply chain with tax and subsidy interactions. Ann Oper Res 290, 439–462 (2020). https://doi.org/10.1007/s10479-018-2975-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-018-2975-z