Abstract

Extant research shows that big data analytics (BDA) capability is often employed as a part of organizational resources to enhance firm performance. Drawing upon the resource-based view, dynamic capabilities, and contingency theory, this study endeavors to examine the alignment between BDA capability and a specific type of procurement strategies (i.e., supplier development) and its impact on firm performance. The study extends the BDA capability research by investigating the direct impact of BDA capability on supplier development and firm performance, respectively, and by exploring both mediating and moderating effects on the relationship between supplier development and firm performance. The main results show that a firm’s BDA capability has not only a direct positive significant impact on supplier development, but also a direct positive significant impact on its business performance. More importantly, the results indicate strong moderating and mediating effects of BDA capability on supplier development, which in turn affects the improvement of firm performance. Theoretical and managerial implications along with future research directions are provided in the end.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The 21st-century global economy is exhibiting an unprecedented rate of change due to rapid technology and societal development. This fast-changing business environment compels management to frequently revisit and adjust firm strategies to survive and thrive. Being able to take advantage of emerging technologies effectively and to gain access to the abundant information regarding the changing market is a critical capability of achieving success in this dynamic global arena. Extant research indicates that when facing the current competitive and changing business environment, leaders are more likely to conduct the strategy setting and decision making through a data-driven process (Davenport 2006). The new world competition is no longer between organizations, instead, it is about the rivalry among supply chains (Trkman 2010).

The recent explosion of the vast amount of digital information, the so-called “big data”, such as the infinite amount of facts, opinions, conversations, videos, pictures, product information, ratings, references, and trends, has started to exert an increasingly significant impact on people, government, education, healthcare, and business (Chen et al. 2012; McAfee and Brynjolfsson 2012). The growing movement of digitization of many business activities also leads to the steady cost reduction associated with storing, processing, and transmitting big data. Organizations, who never thought that they would be affected by big data, are now facing the challenges of understanding the phenomenon and learning to apply the technology to translate the massive influx of data into operational insights (Kache and Seuring 2017; Loebbecke and Picot 2015; McAfee and Brynjolfsson 2012).

Nevertheless, the attitude towards using big data in decision making across industries varies considerably (McAfee and Brynjolfsson 2012). Results of business performance augmentation from the investment in technology, building up new capabilities, and intelligent application of big data analytics (BDA) have appeared to be mixed. Big data executive survey 2017 (NewVantage Partner 2017) revealed that among the Fortune 1000 companies, less than half of them still have not started any big data projects to improve financial performance, while a quarter of them have yet seen any value in boosting revenue or decreasing the cost with their investment. A similar 2018 survey (NewVantage Partner 2018) disclosed that although the majority of the big firms have invested in BDA, about one third have not seen any measurable results.

Major challenges to developing business strategies to harness the value of big data were addressed in Opresnik and Taisch (2015) and Mishra et al. (2017). Kache and Seuring (2017) found four supply chain level challenges that prevent firms from rendering the full benefits of big data capabilities; namely, governance and compliance, integration and collaboration, IT capabilities and infrastructure, information and cyber security. Mishra et al. (2018) classified six research streams on BDA in the supply chain context, most of which are technique based (e.g., clusters 2, 3, 5 & 6). The paper suggested future BDA research lies in assessing the ability of BDA to enhance firm performances (e.g., efficiency and effectiveness). Rialti et al. (2019) examined four clusters of research related to big data capabilities in the supply chain management domain. They argued that the majority of the research is either theoretical or qualitative, and call for “quantitative research on the phenomenon”. Similarly, Arunachalam et al. (2018) found that there is limited empirical study examining the result of business performance through managing the supply chain using BDA capability.

As the supply chain is a broad term suggesting the assimilation of various organizations and business activities, including coordinating materials, information, and financial flows, for satisfying the customer demands, discussing the management of supply chain needs an explicit reference. Some studies focused on the search for optimal supply chain decisions with inventory discounts, bidding, or lost sales with uncertain demands (Katehakis and Smit 2012; Puranam and Katehakis 2014; Katehakis et al. 2015). While others investigated the relationship between lean issues and supply chains (Zhou and Ji 2015; Zhou 2016). Wamba et al. (2015) recommended future studies should answer questions such as how big data and predictive analytics can be used to improve collaborative performance among partners in a supply chain network. In the review of BDA research, Nguyen et al. (2018) suggested several research gaps existed in some supply chain functions such as procurement. Based upon the resource-based view (RBV) and contingency theory, the alignment between BDA capability and business strategy, and the effect on firm performance are examined (Akter et al. 2016; McAfee and Brynjolfsson 2012). Moreover, some empirical studies assessed BDA capability as a moderating effect (Akter et al. 2016; Dubey et al. 2018, 2019; Shirish 2018), others explored the mediating effect of BDA capabilities from either a dynamic capability perspective (Wamba et al. 2017) or a big data strategy standpoint (Shirish et al. 2018).

In this study, we aim to investigate the relationship between BDA capability, supplier development, and firm performance. Drawn on resource-based view (Barney 1991), dynamic capabilities theory (Teece et al. 1997), and contingency theory (Venkatraman 1989), this study examines the role of BDA capability and assesses how a firm’s BDA capability, supplier development activities, affect firm performance. The objective of this study is three-fold. First, based on the strategic significance of procurement function, particularly the strategic orientation and operational aspect of supplier development to the whole supply chain performance, this study examines how a firm’s supplier development may affect its firm performance. Secondly, as the importance of big data rises in supply chain management, this study explores the direct impact of BDA capability of a firm on both its supplier development and firm performance. Thirdly, to gain a better understanding on how the alignment between a firm’s BDA capability and supplier development may affect business performance, the paper further investigates the roles (moderating and mediating) of BDA capability on the relationship between supplier development and firm performance. In summary, the study tries to answer the following main research questions: a) is there any direct link between BDA capability with firm performance? b) how is BDA capability associated with supplier development? c) how is the interaction between BDA capability and supplier development associated with firm performance? And d) how is the mediating effect of BDA capability on supplier development associated with firm performance?

The remainder of the paper is structured as follows. In the second section, the theoretical background and the proposed hypotheses are discussed. In the third section, the research methodology employed in the paper is discussed. Model results and analysis are presented in section four. Lastly, the paper concludes with discussions of theoretical and managerial implications, along with the suggestions of future research.

2 Theoretical underpinning and hypotheses development

2.1 Supplier development, resource-based view, and firm performance

Nowadays, procurement in the supply chain has evolved from the routine and opportunistic-oriented administrative purchasing function to an integrated and long-term focused value-creating process (Knoppen and Saenz 2015). The purchasing value concerning the cost of goods sold accounts for approximately 50–80% in manufacturing firms, and the amount of service purchased has also been increasing exponentially (Ellram et al. 2007; Luzzini and Ronchi 2016). Many companies have recognized the essential role of overall procurement in achieving competitive advantage due to increased outsourcing decisions. Procurement in supply chain management is viewed as a firm’s unique resource for sustaining competitive advantage (Barney 2012). Procurement strategy and how to effectively work with suppliers can impact a firm’s competitiveness (Chiou et al. 2011; Li et al. 2012).

A key component of procurement strategy is supplier development. Watts and Hahn (1993) defined supplier development as “a long-term cooperative effort between a buying firm and its suppliers to upgrade the suppliers’ technical, quality, delivery, and cost capabilities, and foster ongoing improvement”. Krause and Ellram (1997) stated that supplier development refers to “any effort of a buying firm with its supplier(s) to increase the performance and/or capabilities of the supplier and meet the buying firm’s short-and/or long-term supply needs.” Regardless the precise definition, supplier development encompasses choosing the right suppliers and proactively managing these suppliers in a long-term manner, aligning the strategic orientation and the performance of these suppliers to the buying firm’s strategy in its market and value proposition (Knoppen and Saenz 2015). Krause and Ellram (1997) found that majority of buying firms that involved in supplier development regard their suppliers as essential partners, and emphasize on some critical elements than firms who were not involved in supplier development.

Ample research has investigated the relationship between supplier development and buying firm’s business performance (Ağan et al. 2016; Carr and Kaynak 2007; Li et al. 2003; Sánchez-Rodríguez et al. 2005); yet the results are mixed. For instance, Humphreys et al. (2004) studied supplier development on the buyer’s performance among 142 electronic manufacturing companies. Some specific factors of supplier development, such as supplier’s strategic goals, effective communication, long-term commitment, and supplier evaluation, were discussed for their potential effects on the buying firm’s performance, which includes market share and cost reduction. Supplier development is found to significantly and positively impact performance outcomes. Srinivasan et al. (2011) investigated the buyer–supplier partnership quality. Interestingly, their results indicate that in the presence of high demand and supply-side risks, the link between buyer–supplier’s relationship quality and buyer’s performance is strengthened; in the presence of high environmental uncertainty, this link is weakened, suggesting that the impact of supplier development on performance may not always be significantly positive.

A case study of a UK manufacturing organization revealed that supplier development is crucial and strongly affects the operational and business performance of the organization (Dey et al. 2015). This conclusion was also reached by several earlier studies (Hartmann et al. 2012; Kannan and Tan 2002, 2006). Nonetheless, other researches do not appear to share the same view (Rozemeijer 2008; Luzzini and Ronchi 2016). For instance, Luzzini and Ronchi (2016) explored the purchasing function’s contribution to business performance and found that the external practices for relationship management with suppliers, such as supplier development, exert no effect on business performance. Thus, they suspect that the positive effect of supplier development on performance might only occur for a few categories of purchases, not necessarily within the entire supply base. Evidently, a unified conclusion regarding the relationship between supplier development and business performance has not been reached.

In this study, we attempt to empirically test the relationship between supplier development and firm performance. Supplier development is drawn upon the resource-based view (RBV) (Barney 1991, 2012; Barney et al. 2001) where resources can be viewed as either human capital (i.e. experience, judgment, relationships of individual managers and workers, physical capital, property, plant, and equipment) or organizational capital (i.e. organizational structure, planning processes, controlling and coordinating systems (Barney 1991; Größler and Grübner 2006). Thus, we propose the following:

Hypothesis 1

Supplier development is positively associated with firm performance.

2.2 Big data analytics capability, dynamic capabilities, and firm performance

The widespread adoption of digital technologies and the creation of an increasingly massive amount of data have led to the emergence of big data analytics (BDA) (Manyika et al. 2011; Purcell 2013). The implications of BDA capability in businesses, government organizations, and academic institutions have attracted growing attention among corporate leaders, government officials, and academic scholars (Chen et al. 2012; Gandomi and Haider 2015; McAfee and Brynjolfsson 2012). Big data analytics (BDA) is defined as a complex process combining big data and business analytics for managing, processing and analyzing high-volume, velocity, and a variety of information assets in order to gain insights (Russom 2011; Wang et al. 2016). Using BDA as an advanced tool is expected to measure more precise trends, provide more accurate predictive models, and optimize business processes than taking the traditional analytics approaches, particularly in the field of logistics and supply chain management, where data-driven decision-making is a key component of most job descriptions (Hazen et al. 2016; Wamba et al. 2015).

The capability of using BDA in supply chain management is described as “the ability of organizations to collect and organize supply chain data from heterogeneous systems distributed across organizational boundaries, analyze it either batch-wise, or real-time, or near real-time, and visualize it intuitively to create proactive supply chain system and support decision making” (Arunachalam et al. 2018). This capability is measured by an organization’s capacity not only in generating, visualizing, integrating, managing and analyzing data, but also in having a data-driven culture (Rozados and Tjahjono 2014). Top performing organizations such as Amazon and Walmart have embraced BDA technology and invested substantially in acquiring the BDA capability to help manage supply chain and achieve a decisive competitive advantage.

Dynamic capabilities refer to “the firm’s ability to integrate, build, and reconfigure internal and external competencies to address rapidly changing environments” (Teece et al. 1997). According to Baker et al. (2011), while the resource-based view is a static view of the firm resources, the dynamic capabilities explain that internal technological, organizational, and managerial processes enable firms to generate economic rents in settings of rapid change. From a theoretical standpoint, dynamic capabilities theory is employed as the overarching theory in understanding how BDA capability is associated with firm performance, as in most of the other research work (Côrte-Real et al. 2017; Dubey et al. 2019; Rialti et al. 2019; Shirish et al. 2018; Teece et al. 1997; Wamba et al. 2017). Thus, we posit the following:

Hypothesis 2

Big data analytics capability is positively associated with firm performance.

2.3 Big data analytics capability and supplier development

One of the critical areas where the incorporation of BDA becomes a hot topic is procurement because of its strategic importance (Wang et al. 2016). Some research has tried to understand the different dimensions of the concept and to capture BDA’s potential benefits (Chen et al. 2012; Wamba et al. 2015; Wang et al. 2016). For instance, some studies on BDA in strategic sourcing focus on collaboration and supplier relationship management, including the decisions regarding cost, quality, delivery, as well as some strategic dimensions and capabilities of the suppliers (Choi 2013; Choi et al. 2018; Huang and Handfield 2015; Kaur and Singh 2018; Singh et al. 2018). Others look into BDA’s application in supplier network development and attempt to capture changes on demand patterns, sourcing strategies, and operating cost for deciding the number, the locations, and the configuration of the supplier network (Prasad et al. 2016; Soleimani et al. 2014; Wang et al. 2016; Zhao et al. 2017). Operational benefits for tactical decision making in managing supply risk and supplier performance have also been examined (Kabak and Burmaoglu 2013; Souza 2014).

Results from the literature demonstrate that BDA can support supplier management decisions by providing in-depth information on organizational spending pattern, on trends and events through monitoring publicly available news or social media channels associated with suppliers, and on all forms of supplier data across global organizations. These may include factors such as quality, delivery, guarantee, and timeliness to aid in choosing the right suppliers; creating and optimizing complex distribution network; assessing and managing supply risk in a real-time fashion; and continuously monitoring supplier performance (Wang et al. 2016; Tiwari et al. 2018). Thus, cost-savings and performance-enhancing opportunities for organizations can be identified and implemented. It can be postulated that the firm’s BDA capability can act as an enabler of supplier development, which encompasses the method of supply selection, the ongoing supplier relationship management, the recognition of the importance of various suppliers, the alignment of supplier’s strategic orientation with that of the buying firm, as well as monitoring suppliers’ operational performance (Burt et al. 2003; Paik et al. 2009). Therefore,

Hypothesis 3

Big data analytics capability is positively associated with supplier development.

2.4 Contingency theory, moderating effect, mediating effect, and firm performance

Six types of strategic alignment are developed in the contingency theory (Venkatraman 1989), they are “Fit as Moderation”, “Fit as Mediation”, “Fit as Matching”, “Fit as Covariation”, “Fit as Profile Deviation”, and “Fit as Gestalts”. The first three types are dealing with two predict variables situation, “Fit as Matching”, unlike “Fit as Moderation” and “Fit as Mediation”, is “a measure of fit between two variables developed independently of any performance anchor (Venkatraman 1989, p. 430). Thus, in this study, we explore “Fit as Moderation” and “Fit as Mediation” between BDA capability and supplier development, and the effects on firm performance.

A basic moderating effect can be viewed as an interaction between an independent variable and a factor that specifies the appropriate conditions for its operation, and a moderator influences the strength of a relationship between two other variables (Baron and Kenny 1986; Venkatraman 1989). A number of research papers consider various factors, such as supply base complexity (Jeble et al. 2018), organizational flexibility (Dubey et al. 2018), flexible orientation and control orientation (Dubey et al. 2019), and big data culture (Wamba et al. 2017; Dubey et al. 2019), as the moderating variable and examine the interaction between BDA capability and a certain variable on firm performance.

Some research work also investigates the alignment between BDA capability and business strategy built upon the resource-based view and contingency theory (Akter et al. 2016; McAfee and Brynjolfsson 2012). In this study, we explore the alignment between BDA capability and supplier development as a procurement strategy, and its impact on firm performance. We examine whether BDA capability serves as a moderating variable in the relationship between supplier development and firm performance, in addition to its respective direct effect on supplier development and firm performance, as this research question has never been answered in the previous literature. Based on the contingency theory (i.e., Fit as Moderation) and BDA capabilities literature, we propose the following:

Hypothesis 4

The relationship between supplier development and firm performance is positively moderated by big data analytics capability.

It is speculated that the relationship between supplier development and firm performance may be enhanced by the presence of BDA capability, or weakened by the lack of it. A mediating effect of a given variable can be accounted for the relationship between a focal independent variable as a predictor and the criterion; a mediator explains the relationship between the two other variables (Baron and Kenny 1986; Venkatraman 1989). Thus, if BDA capability may serve as a full mediator, then its presence will cause the impact from supplier development on firm performance to disappear unless the mediating role is partial. This is to suggest that when a firm encounters challenges in supplier development, with all information digitally reachable and communicated in its supply chain system, the firm will seek to improve its BDA capability to serve its operations, and that enhanced supplier development will, in turn, help boost firm performance.

Past research on BDA capability includes investigating different mediating variables, such as top management commitment (Gunasekaran et al. 2017), offensive data strategy (Medeiros et al. 2020), and their mediating effects on the relationship between BDA capability and firm performance. Drawing from McAfee and Brynjolfsson (2012) and Akter et al. (2016), we investigate the mediating effect of big data capability and propose the following:

Hypothesis 5

The relationship between supplier development and firm performance is positively mediated by big data analytics capability.

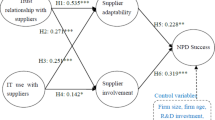

In summary, based on the extant literature, it can be argued that BDA capability not only impacts supplier development as well as the firm performance directly, but may also serve as a moderator and/or a mediator of the relationship between supplier development and firm performance. The research model (based on Akter et al. 2016; McAfee and Brynjolfsson 2012; Venkatraman 1989) of the study is proposed in Fig. 1.

3 Research methodology

3.1 Sample and data collection

Research data were gathered from 500 Chinese manufacturing firms in various industries, such as automotive, machinery, computer and electronics products, aerospace, and technology, etc. Geographically, these companies are located in more than seven provinces, covering both inland and coastline regions in China. These manufacturing firms are engaging in major supply chain/supplier development activities and BDA related practices, which provide us with a good setting to explore the research questions on firms’ BDA capability, supplier development, and firm performance.

A survey was designed and developed based upon an extensive review of related literature in supplier development and BDA capability. The first construct of supplier development intents to collect data on firms’ supplier development practices, and the items were developed based on Freeman and Cavinato (1990) and Anderson and Katz (1998). Big data analytics capability focuses on the dimensions of firms’ ability to utilize big data analytics in their operations, which were developed based upon Akter et al. (2016). Firm performance was drawn from Cao and Dowlatshahi (2005) and the references cited therein. The survey also collected demographic information of the respondents, including industry, annual sales, number of employees and these items are used as control variables (based on Gu et al. 2014) in the study. A full list of variables used in this study is provided in the appendix.

To ensure adequate levels of discrimination among the choices provided to respondents, seven-point Likert-type scales, with 1 (denotes “Strongly Disagree”) to 7 (denotes “Strongly Agree”), were employed to measure responses to questions in the first three components of the survey. The implementation of these scales is an effort to guide respondents to make an exclusive and definitive choice. A thorough review on the survey questions was made with both industrial practitioners and academic scholars who are familiar with the subjects. Based upon the received comments, a few rounds of revisions were conducted to improve the survey’s readability and validity. The survey was initially written in English and then translated into Chinese. Both versions were reviewed and verified by fields’ experts to insurance the accuracy and uniformity. The survey was typed into a commercial survey website and then distributed to target respondent companies via emails, along with a description of the purpose of the study. The total time for data collection lasted 8–10 weeks, during which time several waves of emails were sent to the respondent companies to remind them to complete the survey. After several rounds of careful screening to eliminate returned surveys with missing data, 108 usable questionnaires were retained, which represents an effective response rate of 21.6%.

To ensure the target personnel involved in the study has sufficient and accurate knowledge on the procurement operations and big data/information technology of the firms, the survey questionnaires were directed to mid-level to high-level managers who are in charge of such functions. As a result, the majority of the personnel who participated in the survey were in managerial positions in the respondent firms, which include 25% purchasing manager/director, 18.52% vice present/executive officer, 12.96% operations manager, and 9.25% materials manager. In addition, 12.04% of respondents indicated their position is a buyer. These respondents are trusted to have the necessary experience and knowledge of their companies, especially in the interested research areas in this study.

The key descriptive data obtained from the survey with respect to respondents’ background information is reported in Table 1. These data include the number of employees, type of industries, annual sales, and job title. In terms of the size of participating firms, 24.07% of respondents have 100 to 199 employees, which represent the largest portion of the surveyed companies. 20.37% of the respondents have more than 500 employees, and another 20.37% of all respondents have less than 50 employees. In addition, 2.78% of the respondents have employees between 400 and 499, which is the smallest fraction of all survey participants. Hence, the study includes companies with a relatively wide scope of sizes.

As for the firms’ operating industry, 38.89% of the respondents indicated they are in service/other industry, 15.74% of the respondents are in technology/software, and 12.96% of the surveyed firms are in electrical manufacturing. Particularly, a large part of the respondents operates in varied manufacturing industry with a combined number of 40.74%. These results show that the research covers a variety of companies that practice in different industries. Lastly, as for the annual sales of these firms, 24.07% answered that their annual sales are less than $1 million, which is the largest segment of the respondents. 15.74% of the surveyed firms’ annual sales are either larger than $50 million, or between $10 million to $15 million. And the smallest group, or 1.85% of all respondents, suggested their annual sales are between $15 million to $20 million.

Following Flynn et al. (1994), a non-response bias test was conducted by comparing the data collected from early and late respondents and the results show that there was no statistically significant differences for any of the constructs either at the p = 0.01 level or at p = 0.05 level. Additionally, demographic information between the survey respondents with that of non-respondents was compared using chi-square suggested by Kim et al. (2012) and no bias was observed.

3.2 Construct reality and validity

Both exploratory factor analysis (EFA) and confirmatory factor analysis (CFA) were employed to assess the construct validity. EFA determines factors drawing upon the raw data (Hensley 1999), while CFA is rather theoretically driven and often used to examine a priori hypotheses (Kline 1998). According to Doll and Torkzadeh (1998), for a construct to achieve uni-dimensionality applying EFA, each item of the construct needs to have loadings on its first factor to be larger than 0.3. The EFA results presented in Table 2 show high loadings for all scaled items (well above 0.3—the threshold value) and thus meeting the uni-dimensionality requirement.

We performed three separate CFA measurement models for supplier development, BDA capability, and firm performance using Stata 15. As shown in Table 3, the values of Cronbach’s Alpha, loading, composite reliability, and average variance extracted (AVE) are all above their respective cutoff points (i.e., 0.7, 0.7, 0.7, and 0.5). As such, the results indicate that the requirements of reliability and convergent validity are satisfied in the study.

To achieve discriminant validity, this study should meet the following requirement: The values of the square root of the average variance extracted (AVE) of constructs need to be greater than those of the inter-construct correlations (Chin 1998). Table 4 compares the values of the AVE values with those of the inter-construct correlations and results show the value of the square root of each construct is greater than any inter-construct correlations between the three constructs, thus indicating an adequate construct discriminant validity.

To avoid the threat of common method bias associated with the use of perceptual measures, we provided clear and concise survey questions, ensured respondents’ anonymity and confidentiality, and distributed survey questions pertaining to the same construct in various sections of the survey (Podsakoff et al. 2003; Sharma et al. 2009). Furthermore, to detect common method bias, we compared two models: the first model includes the theoretical factors while the second includes a method factor (Williams et al. 1989; Podsakoff et al. 2003). The results of the model comparison show minimal reductions in NNFI (0.015), CFI (0.017), and RMSEA (0.03). The common method factor accounts for only 4% of the variance, which is well within the acceptable threshold (Williams et al. 1989). As a result, common method variance does not appear to be a problem in the study.

Next, to verify if there exists an endogeneity, we employed Durbin-Wu-Hausman (DWH) test (Durbin 1954; Wu 1973; Hausman 1978) to examine the endogeneity of the constructs using two-stage least-squares of Stata 15 by running an IV Regression. Results of DWH tests indicated that neither BDA capability (Chi-square = 1.473, p value = 0.259) nor supplier development (Chi-square = 1.263, p value = 0.218) shows any obvious sign of endogeneity.

Lastly, we also rendered several commonly used fit indexes in Table 5 to evaluate the model fit. These include root mean square error of approximation (RMSEA), comparative fit index (CFI), goodness of fit index (GFI), chi-square, and chi-square/degree of freedom (df). Results in Table 5 show that these fit indexes meet all the recommended values for both saturated and estimated models pertaining to model fit and hence represented a good model fit in this study. Next, we are ready to further investigate the proposed model and provide computational results along with discussions.

4 Results and analysis

To test the proposed hypotheses, Structural Equation Modeling (SEM) was developed via Stata 15. For the first three direct-effects hypotheses H1, H2, and H3, computational results including path coefficient values, z-scores and, p-values are reported in Table 6.

The first hypothesis examines the relationship between supplier development and firm performance, and a positive association was proposed. The path coefficient β = -0.025 with a z-score of -0.10 and a p-value of 0.917 from the SEM analysis suggested such a positive association between them is not significant. As a result, hypothesis 1 was not supported. The second hypothesis predicts a positive relationship leading from BDA capability to supplier development in the organization. The SEM results showed that the path coefficient between BDA capability and supplier development is positive and significant with β = 0.189, z = 2.68, and p = 0.007, indicating a strong support for H2, that is BDA capability is positively associated with supplier development in the organization. Next, hypothesis 3 investigates the relationship leading from BDA capability to firm performance and a positive association was expected. Based on the SEM analysis, the path coefficient between BDA capability and firm performance is positive and significant with β = 0.276, z = 2.29, and p = 0.022. Hence H3 also receives a solid support and proves that BDA capability exerts positive significant effects on business performance.

To summarize, hypotheses 2 and 3 are robustly supported by the path analysis results, which demonstrate that: a) BDA capability has direct positive significant effects on supplier development; and b) BDA capability also has direct positive significant effects on firm performance. Hence, it can be concluded that BDA capability is indeed associated with improved levels of both supplier development and business performance of an organization. Importantly, these results first echo previous literature pertaining to the influence of the BDA capability on firm’s supplier development and performance (Huang and Handfield 2015; Wang et al. 2018; Zhao et al. 2017; Singh et al. 2018.) More importantly, these findings suggest that investing in the BDA capability is a viable strategy for firms to compete effectively in today’s dynamic environment.

Interestingly, hypothesis 1 did not receive empirical support from the results, indicating that there does not exist a positive direct association between supplier development and firm performance. This finding is in line with those from earlier studies (Srinivasan et al. 2011; Luzzini and Ronchi 2016) that also indicated that the direct association between supplier development alone on business performance is not significant. In fact, supplier development activities should be synchronized with important endeavors in other functional areas, such as operations, quality assurance, marketing, information technology and systems, etc., so as to generate measurable impacts on business performance. Indeed, information technology such as BDA is often viewed as an enabler to the supply chain management practices in firms (Burt et al. 2003; Paik et al. 2009; Chen et al. 2015; Hamister et al. 2018). Therefore, it is meaningful to examine whether BDA has an impact on the interface of supplier development and firm performance.

To test hypothesis 4 that examines the mediating effect of BDA capability on the relationship between supplier development and firm performance, a four-step procedure was followed based on Baron and Kenny (1986) and Hayes (2017):

Step1: Confirm the significance of the relationship between IV (i.e., supplier development) and DV (i.e., firm performance).

Step 2: Confirm the significance of the relationship between IV (i.e., supplier development) and the mediator (i.e., BDA capability).

Step 3: Confirm the significance of the relationship between the mediator (i.e., BDA capability) and the DV (i.e., firm performance) in the presence of the IV (i.e., supplier development).

Step 4: Confirm the insignificance (the meaningful reduction in effect) of the relationship between the initial IV (i.e., supplier development) and the DV (i.e., firm performance) in the presence of the mediator (i.e., BDA capability).

Results of the four-step mediation testing are summarized in Table 7. Observe that all four steps are supported by the coefficient in the predicted directions. Specifically, in Table 7, Step 1 shows there is a significant association between supplier development and firm performance (β = 0.121, z = 2.06, and p = 0.043). Next, Step 2 and Step 3 also confirm the significant relationships between supplier development and BDA capability (β = 0.619, z = 2.37, and p = 0.018); and between BDA capability and firm performance (β = 0.267, z = 2.40, and p = 0.016) in the presence of supplier development, respectively. Lastly, in Table 7, Step 4 proves that the insignificant relationship between supplier development and firm performance (β = -0.025, z = 0.17, and p = 0.863) when BDA capability is present.

Based on these results, it can be concluded that there exists a full mediation effect of BDA capability on the relationship between supplier development and firm performance (c.f. Baron and Kenny 1986), which provides robust support to Hypothesis 4. While the direct impact from supplier development on firm performance is not observable, its influence on the performance is significant with the existence of BDA capability in an organization. Better supplier development practices, along with the assistance of a firm’s BDA applications, could improve a firm’s performance. This finding strengthens the notion that BDA capability is a key enabler to supply chain management practices (e.g., supplier development) by previous studies (Chen et al. 2015; Hamister et al. 2018). The major takeaway of the finding is that firms not only need to invest in BDA capability but also to implement it in such a way that creates synergy resulting in firm performance improvement.

Next, it is also interesting to verify if there is a moderating effect of BDA capability on the relationship between supplier development and the performance of a firm. To this end, the hierarchical multiple regression method was exercised to explore such a moderation effect. To detect the moderation effect, it is necessary to examine two conditions: whether Model 1 (without the interaction term) and Model 2 (with the interaction term) are both significant; and whether Model 2 accounts for significantly more variance than Model 1 (Hayes 2017). Computational results of these two steps were reported in Tables 8 and 9 respectively.

Firstly, Table 8 provides the ANOVA results of the two hierarchical multiple regression models. In particular, Model 1 is significant (p = 0.039) with F (2, 105) = 3.348, while Model 2 is also significant (p = 0.009) with F (3, 104) = 4.045. These results confirm that the first condition was successfully satisfied. Secondly, results in Table 9 show that Model 2 with the interaction between BDA capability and supplier development truly accounts for significantly more variance than the case of only BDA capability and supplier development, R2 change = 0.045, p = 0.025. These outcomes indicate that there is a significant moderation between BDA capability and supplier development on firm performance. Hence, H5 received a solid support. The result is in consonance with the contingency theory aforementioned. It implies that the relationship between supplier development and firm performance is amplified by the existence of a firm’s BDA capability. The finding further pinpoints the fact that it is crucial for firms to invest the BDA capability and that it is also important for a firm to align it well with supplier development practices to ultimately achieve firm performance.

5 Conclusion

This study aims to contribute from a novelty angle and deliver original results to the research on the relationship between BDA capability, supplier development, and firm performance. It is a fresh attempt to investigate the possibly influential role and potential impacts of BDA capability in supply chain management. The new findings fill the existing gap regarding how BDA capability should be addressed in the research framework of supply chain management, particularly in the supplier development area. Through an empirical survey, comprehensive data from manufacturing firms operating in a variety of industries in a transition economy is carefully collected and thoroughly analyzed. Research hypotheses are developed and tested using structural equation modeling, which assesses the factors that affect firms’ BDA capability, supplier development practices, and their respective impacts on firm performance. The rise of big data in recent years provides firms with unprecedented challenges and opportunities to use related resources to create, maintain, and further enhance their competitiveness in the supply chains. The findings of this study offer several timely implications to researchers and practitioners in the new data-driven business environment.

5.1 Theoretical contributions

This paper extends the existing studies on harvesting the value of BDA capabilities in supply chain management. Built upon the resource-based view, dynamic capabilities, and contingency theory, it stresses the role of BDA capability and gauges how such a capability may affect the improvement of a firm’s supplier development and business performance. The results show that a company’s BDA capability has not only a direct positive significant impact on its supplier development practices, but also a direct positive significant impact on its business performance. It therefore contributes to the knowledge by offering compelling empirical evidence on how the firm’s BDA capability affects and improves these areas. Second, the result suggests that the direct association between supplier development and business performance is not observable. This is in line with the outcomes from some earlier studies (Srinivasan et al. 2011; Luzzini and Ronchi 2016) and asserts the fact that supplier development practices would need the support and participation of other activities such as operations, marketing, and information technology within a firm to materialize its impact on firm performance.

Third, the study untangles the complex relationship among a firm’s BDA capability, its supplier development, and business performance. Specifically, it discovers the potential effect from the moderating and mediating role of BDA capability to the interface of supplier development and firm performance. The findings show that BDA capability has a full mediation effect on the relationship between supplier development and firm performance. These are new and important contribution and they support the notion that while the supplier development activities do not have direct influence on firm performance, with the assistance of a firm’s BDA applications, better supplier development practices could help to enhance a firm’s performance. The results support our theorizing, which stresses that BDA capability is instrumental in supplier development in the organization.

Lastly, the study also detects a significant moderating effect between BDA capability and supplier development on the level of firm performance. The existence of BDA capability makes the relationship between supplier development and firm performance more evident and stronger. The results are in line with the contingency theory and highlight the antecedent role of BDA in improving firms’ supplier development as well as their business performance. As such, they successfully contribute to this strand of research by providing a deeper understanding of the role big data plays in supply chain management.

5.2 Managerial implications

The findings of the study deliver several important insights for management. First, the obtained results in general provide strong support to the notion that management and firms need to develop a proactive attitude toward BDA in order to take progressive actions in their organizations to realize the potential benefits. Managers should strive to gain a clear understanding of big data, make a relevant investment, and develop a concrete plan of big data implementation.

Secondly, the research framework in this study sheds light on where firms should focus on BDA to enhance their capability. In particular, our study shows that BDA capability is an important player to enhance the transparency and visibility of information, resource, and decisions within and across firms. Managers should consider using various analytical tools and programs, such as information and cost-sharing, just-in-time, real-time data sharing, and cross-organizational programs to facilitate supplier and/or vendor management. Existing information technology should be extended to big data-supply chain systems for increased utilization and expanded advantages. This observation also indicates that BDA infrastructure is of paramount importance in enhancing firms’ BDA capability. These findings should be useful to supply chain managers.

Thirdly, our findings indicate that though the direct impact from supplier development on firm performance is not evident, its influence on firm performance is more tangible and amplified with the existence BDA capability. Hence, managers should understand that BDA capability is a key enabler to business and supply chain management process (Hamister et al. 2018) and they should consider invest in and align it well with supplier development practices. With the assistance of a firm’s big data applications, better supplier development practices could improve a firm’s performance. Managers should develop effective supply chain strategies to harness their BDA capability and intelligence to enhance firm performance to achieve and sustain competitive advantages.

5.3 Limitations and future research

There are some inherent limitations in this study that should be noted. Firstly, cross-sectional data is collected to test the model and related hypotheses, which captures the perception and status of the constructs at a point in time. It does not seize the continuous process of the development of the capability in BDA, supplier development, and firm performance over time. Therefore, it would be informative to extend this research endeavor to a longitudinal study to better understand the mechanism of the effects in these areas. Secondly, in this study a single respondent is designed and implemented. As pointed out in previous research (Flynn et al. 2018; Ketchen et al. 2018), the potential for bias is an issue for all single respondent survey research. It would be proper to include different respondents to improve the quality and reliability of the research data. Thirdly, the sample of this study is fetched from companies in a single country, regional sampling could limit the generality of the research results. Although China is the biggest transition economy, the firms in this country would possess geographical, cultural, and developmental differences and might not represent their counterparts in other countries or regions. It may be beneficial to extend current research to other countries and regions or other transition economies so as to further validate and generalize the results. Finally, as the relationship between supplier development and firm performance presents mixed results from this and previous work, we also call for future studies to examine the consistency of research findings of the relationship between supplier development and firm performance using either a meta-analysis method or a bibliographic literature review.

References

Ağan, Y., Kuzey, C., Acar, M. F., & Açıkgöz, A. (2016). The relationships between corporate social responsibility, environmental supplier development, and firm performance. Journal of Cleaner Production, 112(3), 1872–1881.

Akter, S., Wamba, S. F., Gunasekaran, A., Dubey, R., & Childe, S. J. (2016). How to improve firm performance using big data analytics capability and business strategy alignment? International Journal of Production Economics, 182, 113–131.

Anderson, M., & Katz, P. (1998). Strategic sourcing. International Journal of Logistics Management, 9(1), 1–13.

Arunachalam, D., Kumar, N., & Kawalek, J. P. (2018). Understanding big data analytics capabilities in supply chain management: Unravelling the issues, challenges and implications for practice. Transportation Research Part E: Logistics and Transportation Review, 114, 416–436.

Baker, J., Jones, D. R., Cao, Q., & Song, J. (2011). Conceptualizing the dynamic strategic alignment competency. Journal of the Association for Information Systems, 12(4), 299–322.

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120.

Barney, J. B. (2012). Purchasing, supply chain management and sustained competitive advantage: The relevance of resource-based theory. Journal of supply chain management, 48(2), 3–6.

Barney, J., Wright, M., & Ketchen, D. J. (2001). The resource-based view of the firm: Ten years after 1991. Journal of Management, 27, 625–641.

Baron, R. M., & Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51, 1173–1182.

Burt, D. N., Dobler, D. W., & Starling, S. L. (2003). World class supply management: The key to supply chain management. New York: McGraw-Hill/Irwin.

Cao, Q., & Dowlatshahi, S. (2005). The impact of alignment between virtual enterprise and information technology on business performance in an agile manufacturing environment. Journal of Operations Management, 23(5), 531–550.

Carr, A. S., & Kaynak, H. (2007). Communication methods, information sharing, supplier development and performance. International Journal of Operations & Production Management, 27(4), 346–370.

Chen, H., Chiang, R. H., & Storey, V. C. (2012). Business intelligence and analytics: From big data to big impact. MIS Quarterly, 36(4), 1165–1188.

Chen, D. Q., Preston, D. S., & Swink, M. (2015). How the use of big data analytics affects value creation in supply chain management. Journal of Management Information Systems, 32(4), 4–39.

Chin, W. W. (1998). The partial least squares approach to structural equation modeling. Modern Methods Business Research, 295(2), 295–336.

Chiou, T. Y., Chan, H. K., Lettice, F., & Chung, S. H. (2011). The influence of greening the suppliers and green innovation on environmental performance and competitive advantage in Taiwan. Transportation Research Part E: Logistics and Transportation Review, 47(6), 822–836.

Choi, T. M. (2013). Optimal apparel supplier selection with forecast updates under carbon emission taxation scheme. Computers & Operations Research, 40(11), 2646–2655.

Choi, Y., Lee, H., & Irani, Z. (2018). Big data-driven fuzzy cognitive map for prioritizing IT service procurement in the public sector. Annals of Operations Research, 270(1/2), 75–104.

Côrte-Real, N., Oliveira, T., & Ruivo, P. (2017). Assessing business value of big data analytics in European firm. Journal of Business Research, 70(6), 379–390.

Davenport, T. H. (2006). Competing on analytics. Harvard Business Review, 84(1), 98–107.

Dey, P. K., Bhattacharya, A., & Ho, W. (2015). Strategic supplier performance evaluation: A case-based action research of a UK manufacturing organization. International Journal of Production Economics, 166, 192–214.

Doll, W. J., & Torkzadeh, G. (1998). The measurement of end-user computing satisfaction. MIS Quarterly, 12, 259–274.

Dubey, R., Gunasekaran, A., & Childe, S. J. (2018). Big data analytics capability in supply chain agility: the moderating effect of organizational flexibility. Management Decision, 57(8), 2092–2112.

Dubey, R., Gunasekaran, A., Childe, S. J., Blome, C., & Papadopoulos, T. (2019). Big data and predictive analytics and manufacturing performance: Integrating institutional theory, resource-based view and big data culture. British Journal of Management, 30(2), 341–361.

Durbin, J. (1954). Errors in variables. Review of the International Statistical Institute, 22, 23–32.

Ellram, L. M., Tate, W. L., & Billington, C. (2007). Services supply management: The next frontier for improved organizational performance. California Management Review, 49(4), 44–66.

Flynn, B. B., Schroeder, R. G., & Sakakibara, S. (1994). A framework for quality management research and an associated measurement instrument. Journal of Operations Management, 11(4), 339–366.

Flynn, B., Pagell, M., & Fugate, B. (2018). Editorial: Survey research design in supply chain management: The need for evolution in our expectations. Journal of Supply Chain Management, 54(1), 1–15.

Freeman, V., & Cavinato, J. (1990). Fitting purchasing to the strategic firm: Frameworks, processes, and values. Journal of Purchasing and Materials Management, 26(1), 6–10.

Gandomi, A., & Haider, M. (2015). Beyond the hype: Big data concepts, methods, and analytics. International Journal of Information Management, 35(2), 137–144.

Größler, A., & Grübner, A. (2006). An empirical model of the relationships between manufacturing capabilities. International Journal of Operations & Production Management, 26(5), 458–485.

Gu, V. C., Hoffman, J., Cao, Q., & Schniederjans, M. (2014). The effects of qrganizational culture and environmental pressures on IT project performance: A moderation perspective. International Journal of Project Management, 32(7), 1170–1181.

Gunasekaran, A., Papadopoulos, T., & R., Dubey, S. F., Wamba, S. J., Childe, B., Hazen, and S. Akter. . (2017). Big data and predictive analytics for supply chain and organizational performance. Journal of Business Research, 70, 308–317.

Hamister, J. W., Magazine, M. J., & Polak, G. G. (2018). Integrating Analytics Through the Big Data Information Chain: A Case From Supply Chain Management. Journal of Business Logistics, 39(3), 220–230.

Hartmann, E., Kerkfeld, D., & Henke, M. (2012). Top and bottom line relevance of purchasing and supply management. Journal of Purchasing and Supply Management, 18(1), 22–34.

Hausman, J. (1978). Specification tests in econometrics. Econometrica, 46(6), 1251–1271.

Hayes, A. F. (2017). Introduction to Mediation, Moderation, and Conditional Process Analysis: A Regression-Based Approach (2nd ed.). New York, NY: Guilford Press.

Hazen, B. T., Skipper, J. B., Ezell, J. D., & Boone, C. A. (2016). Big Data and predictive analytics for supply chain sustainability: A theory-driven research agenda. Computers & Industrial Engineering, 101, 592–598.

Hensley, R. L. (1999). A review of operations management studies using scale development Techniques. Journal of Operations Management, 17, 343–358.

Huang, Y. Y., & Handfield, R. B. (2015). Measuring the benefits of ERP on supply management maturity model: a “big data” method. International Journal of Operations & Production Management, 35(1), 2–25.

Humphreys, P. K., Li, W. L., & Chan, L. Y. (2004). The impact of supplier development on buyer–supplier performance. Omega, 32(2), 131–143.

Jeble, S., Kumari, S., & Patil, Y. (2018). Role of big data in decision making. Operations and Supply Chain Management, 11(1), 36–44.

Kabak, M., & Burmaoglu, S. (2013). A holistic evaluation of the e-procurement website by using a hybrid MCDM methodology. Electronic Government: An International Journal, 10(2), 125–150.

Kache, F., & Seuring, S. (2017). Challenges and opportunities of digital information at the intersection of big data analytics and supply chain management. International Journal of Operations & Production Management, 37(1), 10–36.

Kannan, V. R., & Tan, K. C. (2002). Supplier Selection and Assessment: Their Impact on Business Performance. Journal of Supply Chain Management, 38(3), 11–21.

Kannan, V. R., & Tan, K. C. (2006). The impact of supplier selection and buyer-supplier engagement on relationship and firm performance. International Journal of Physical Distribution & Logistics Management, 36(10), 755–775.

Katehakis, M. N., & Smit, L. C. (2012). On computing optimal (Q, r) replenishment policies under quantity discounts. Annals of Operations Research, 200, 279–298.

Katehakis, M. N., Melamed, B. and Shi, J. J. (2015). Optimal replenishment rate for inventory systems with compound Poisson demands and lost sales: a direct treatment of time-average cost. Annals of Operations Research, 1–27.

Kaur, H., & Singh, S. P. (2018). Heuristic modeling for sustainable procurement and logistics in a supply chain using big data. Computers & Operations Research, 98, 301–321.

Ketchen, D., Craighead, C., & Cheng, L. (2018). Achieving research design excellence through the pursuit of perfection: toward strong theoretical calibration. Journal of Supply Chain Management, 54(1), 16–22.

Kim, G., Shin, B., & Kwon, O. (2012). Investigating the value of sociomaterialism in conceptualizing IT capability of a firm. Journal of Management Information Systems, 29, 327–362.

Kline, R. B. (1998). Principles and Practices of Structural Equation Modeling. New York, NY: Guilford Press.

Knoppen, D., & Saenz, M. J. (2015). Purchasing: Can we bridge the gap between strategy and daily reality? Business Horizons, 58(1), 123–133.

Krause, D. R., & Ellram, L. M. (1997). Critical elements of supplier development: The buying-firm perspective. European Journal of Purchasing & Supply Management, 3(1), 21–31.

Li, W. L., Humphreys, P., Chan, L. Y., & Kumaraswamy, M. (2003). Predicting purchasing performance: the role of supplier development programs. Journal of Material Processing Technology, 138(1–3), 243–249.

Li, W., Humphreys, P. K., Yeung, A. C., & Cheng, T. C. E. (2012). The impact of supplier development on buyer competitive advantage: A path analytic model. International Journal of Production Economics, 135(1), 353–366.

Loebbecke, C., & Picot, A. (2015). Reflections on societal and business model transformation arising from digitization and big data analytics: A research agenda. Journal of Strategic Information Systems, 24(3), 149–157.

Luzzini, D., & Ronchi, S. (2016). Cinderella purchasing transformation: linking purchasing status to purchasing practices and business performance. Production Planning & Control, 27(10), 787–796.

Manyika, J., Chui, M., Brown, B., Bughin, J., Dobbs, R., Roxburgh, C., & Byers, A. H. (2011). Big data: The next frontier for innovation, competition, and productivity. McKinsey Global Institute: Technical Report.

McAfee, A., & Brynjolfsson, E. (2012). “Big data” the management revolution. Harvard Business Review, 90(10), 60–68.

MedeirosMaçadaFreitas Junior, M. M. D. A. C. G. JCd. S. (2020). The effect of data strategy on competitive advantage. The Bottom Line, 33(2), 201–216.

Mishra, D., Luo, Z., Jiang, S., Papadopoulos, T., & Dubey, R. (2017). A bibliographic study on big data: Concepts, trends and challenges. Business Process Management Journal, 23(3), 555–573.

Mishra, D., Gunasekaran, A., Papadopoulos, T., & Childe, S. J. (2018). Big data and supply chain management: A review and bibliometric analysis. Annals of Operations Research, 270(1–2), 313–336.

NewVantage Partners, 2018. 2018 Annual Data and Innovation Survey. http://newvantage.com/wp-content/uploads/2018/01/Infographic-1-2018-Big-Data.pdf (retrieved 15.08.2018)

NewVantage Partners, 2017. Big Data Executive Survey. http://newvantage.com/wp-content/uploads/2017/01/Big-Data-Executive-Survey-2017-Executive-Summary.pdf (retrieved 15.08.2018)

Nguyen, T., Zhou, L., Spiegler, V., Ieromonachou, P., & Lin, Y. (2018). Big data analytics in supply chain management: A state-of-the-art literature review”. Computers and Operations Research, 98, 254–264.

Opresnik, D., & Taisch, M. (2015). The value of big data in servitization. International Journal of Production Economics, 165, 174–184.

Paik, S. K., Bagchi, P. K., Skjøtt-Larsen, T., & Adams, J. (2009). Purchasing development in small and medium-sized enterprises (SMEs). Supply Chain Forum: An International Journal, 10(1), 92–107.

Podsakoff, P. M., MacKenzie, S. B., Lee, J., & Podsakoff, N. P. (2003). Common method biases in behavioral research: A critical review of the literature and recommended remedies. Journal of Applied Psychology, 88(5), 879–903.

Prasad, S., Zakaria, R., & Altay, N. (2016). Big data in humanitarian supply chain networks: A resource dependence perspective. Annals of Operations Research S.I.: Big Data Analytics in Operations & Supply Chain Management, 270, 383–413.

Puranam, K. S., & Katehakis, M. N. (2014). On optimal bidding and inventory control in sequential procurement auctions: the multi period case.". Annals of Operations Research, 217(1), 447–462.

Purcell, B. (2013). The emergence of “big data” technology and analytics. Journal of Technology Research, 4, 1–7.

Rialti, R., Marzi, G., Ciappei, C., & Busso, D. (2019). Big data and dynamic capabilities: A bibliometric analysis and systematic literature review. Management Decision, 57(8), 2052–2068.

Rozados, I.V. and Tjahjono, B. (2014). Big data analytics in supply chain management: Trends and related research. In 6th International Conference on Operations and Supply Chain Management, Bali.

Rozemeijer, F. A. (2008). Purchasing myopia revisited again? Journal of Purchasing and Supply Management, 14, 205–207.

Russom, P. (2011). Big data analytics. TDWI Best Practices Report, Fourth Quarter, tdwi.org.

Sánchez-Rodrıguez, C., Hemsworth, D., & Martınez-Lorente, A. R. (2005). The effect of supplier development initiatives on purchasing performance: A structural model. Supply Chain Management: An International Journal, 10(3), 289–301.

Sharma, R., Yetton, P., & Crawford, J. (2009). Estimating the effect of common method variance: the method-method pair technique with an illustration from TAM research. MIS Quarterly, 33(3), 473–490.

Shirish, J., Rameshwar, D., Childe, S. J., Thanos, P., Roubaud, D., & Prakash, A. (2018). Impact of big data and predictive analytics capability on supply chain sustainability. International Journal of Logistics Management, 29(2), 513–538.

Singh, A., Kumari, S., Malekpoor, H., & Mishra, N. (2018). Big data cloud computing framework for low carbon supplier selection in the beef supply chain. Journal of Cleaner Production, 202, 139–149.

Soleimani, H., Seyyed-Esfahani, M., & Kannan, G. (2014). Incorporating risk measures in closed-loop supply chain network design. International Journal of Production Research, 52(6), 1843–1867.

Souza, G. C. (2014). Supply chain analytics. Business Horizons, 57, 595–605.

Srinivasan, M., Mukherjee, D., & Gaur, A. S. (2011). Buyer–supplier partnership quality and supply chain performance: Moderating role of risks, and environmental uncertainty. European Management Journal, 29(4), 260–271.

Teece, D. J., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic Management Journal, 18(7), 509–533.

Tiwari, S., Wee, H. M., & Daryanto, Y. (2018). Big data analytics in supply chain management between 2010 and 2016: Insights to industries. Computers & Industrial Engineering, 115, 319–330.

Trkman, P. (2010). The critical success factors of business process management. International Journal of Information Management, 30(2), 125–134.

Venkatraman, N. (1989). The concept of fit in strategy research: Toward verbal and statistical correspondence. Academy of Management Review, 14(3), 423–444.

Wamba, S. F., Akter, S., Edwards, A., Chopin, G., & Gnanzou, D. (2015). How ‘big data’’ can make big impact: Findings from a systematic review and a longitudinal case study.’ International Journal of Production Economics, 165, 234–246.

Wamba, S. F., Gunasekaran, A., Akter, S., Ren, S. J., Dubey, R., & Childe, S. J. (2017). Big data analytics and firm performance: Effects of dynamic capabilities. Journal of Business Research, 70, 356–365.

Wang, G., Gunasekaran, A., Ngai, E. W., & Papadopoulos, T. (2016). Big data analytics in logistics and supply chain management: Certain investigations for research and applications. International Journal of Production Economics, 176, 98–110.

Wang, G., Gunasekaran, A., & Ngai, E. W. (2018). Distribution network design with big data: Model and analysis. Annals of Operations Research, S.I.: Big Data Analytics in Operations & Supply Chain Management, 270, 539–551.

Watts, C. A., & Hahn, C. K. (1993). Supplier development programs: An empirical analysis. International Journal of Purchasing and Materials Management, 29(1), 10–17.

Williams, L. J., Cote, J. A., & Buckley, M. R. (1989). Lack of method variance in self-reported affect and perceptions at work: Reality or artifact? Journal of Applied Psychology, 74(3), 462–468.

Wu, D. (1973). Alternative tests of independence between stochastic regressors and disturbances. Econometrica, 41(4), 733–750.

Zhao, R., Liu, Y., Zhang, N., & Huang, T. (2017). An optimization model for green supply chain management by using a big data analytic approach. Journal of Cleaner Production, 142, 1085–1097.

Zhou, B. (2016). Lean principles, practices, and impacts: A study on small and medium-sized enterprises (SMEs). Annals of Operations Research, 241, 457–474.

Zhou, S. B., & Ji, F. X. (2015). Impact of lean supply chain management on operational performance: A study of small manufacturing companies. International Journal of Business Analytics, 2(3), 1–19.

Acknowledgement

The authors would like to thank the editor-in-chief, the associate editor, and the anonymous referees for their valuable and constructive comments that help us improve the paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

About this article

Cite this article

Gu, V.C., Zhou, B., Cao, Q. et al. Exploring the relationship between supplier development, big data analytics capability, and firm performance. Ann Oper Res 302, 151–172 (2021). https://doi.org/10.1007/s10479-021-03976-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-021-03976-7