Abstract

This paper deals with an economic order quantity (EOQ) model for uncertain demand when capacity of own warehouse (OW) is limited and the rented warehouse (RW) is considered, if needed. The expected average cost function is formulated for both continuous and discrete distributions of demand function by trading off holding costs and stock out penalty. The model is justified by suitable illustrations for various types of distributions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The economic order quantity (EOQ) is an elegant formula in a supply chain. In inventory literature, warehouse is a major component in a supply chain where firms/enterprises keep their inventories safely. Generally speaking, firms/enterprises purchase bulk amount when price discount is offered by the supplier or the seasonal products are harvested. The capacity of own warehouse (OW) of a firm is not unlimited. The rented warehouse (RW) is needed while order size exceeds the capacity of own warehouse due to uncertain demand in the market. The holding cost for inventory at RW is usually more than the inventory cost at OW. In this field of research, Lee and Ma (2000) found out a heuristic solution of equal production cycles of two warehouse model with time dependent demand function over a finite time horizon. Chung and Huang (2007) developed two-warehouse inventory model for perishable items, incorporating delay in payment facility. Lee and Hsu (2009) extended the model of Lee and Ma (2000) relaxing the stipulation of equal production cycle times into variable production cycle times. Chung et al. (2009) studied a two-warehouse inventory model in imperfect production processes. Liao and Huang (2010) investigated an order-level inventory model for perishable items with two-storage facilities and a permissible delay in payment. Liang and Zhou (2011) developed a two-warehouse inventory model for perishable items under conditionally permissible delay in payments. Hariga (2011) discussed an EOQ model with multiple storage facilities while RW and OW have limited stocking capacities. Sana et al. (2011) developed a two-warehouse inventory model on pricing decision for deteriorating items.

In every business organization, two major facets of the businesses are storage space facilities and uncertain demand of the customers in nature. Kalpakam and Shanthi (2006) investigated a perishable system with Poisson demands under the modified (s,S) policy at which orders are placed only at the time of demand in the market. In this model, the items have exponential life times and this problem is analyzed using Markovian techniques. Petruzzi and Dada (1999) studied an extension and comprehensive review on newsvendor problem in which the optimal order quantity and selling prices are obtained simultaneously. Li et al. (2004) developed a production–inventory–customer systems with Markovian machines, finite finished goods buffers, and random demand. Artalejo et al. (2006) developed a continuous review (s,S) inventory system based on a bidimensional Markov process. Arcelus et al. (2006) modelled the retailer’s response to temporary manufacturer’s trade deals characterized by a random time at which a special order is placed and uncertain duration at which the reordering point is activated. Zhang (2010) developed the classical newsvendor model by incorporating budget constraints and supplier quantity discount. Adida and Perakis (2010) proposed a variety of models incorporating uncertainty in a dynamic pricing and inventory control problem with no stockouts. Sana (2011) investigated a newsvendor problem, considering demand as a function of random sales price. Rossi et al. (2012) computed a constraint programming approach to obtain an optimal replenishment cycle for non-stationary stochastic demand, ordering, holding and shortage costs. Okyay et al. (2013) analysed the newsvendor model in order to obtain optimal order quantity in view of various cost factors while supply and demand rates are uncertain in nature. Jammernegga and Kischkab (2013) investigated performance measurements on important operations and marketing decisions using newsvendor model. Federgruen and Wang (2013) addressed stochastic inventory systems governed by (r,q) or (r,nq) policies. In this class of models, they provided general sufficient conditions under which each of the three optimal policy parameters, i.e., the optimal reorder level, order quantity and order-up-to level, as well as the optimal cost value vary monotonically with various model primitives. Liberopoulos et al. (2013) studied a stochastic economic lot scheduling problem for process industries where a single production facility produced several different grades of a family of products to meet random stationary demand having limited storage capacity. Demirag et al. (2013) investigated a firm’s periodic-review, stochastic and dynamic inventory control problem for a single product. Chen and Geunes (2013) proposed a stochastic resource allocation problem with normally distributed demands for multiple items and a resource capacity constraint. The noteworthy research works done by Johansen and Thorstenson (1993), Chen and Chuang (2000), Chou and Chung (2009), Wang (2010), Hsieh and Lu (2010), Xiao et al. (2010), and Taleizadeh et al. (2012) should be mentioned in newsvendor literature, among others.

In this paper, the author develops a two-warehouse inventory model while the demand of the end customers is a random variable that follows a probability distribution function. The RW is used when the ordering size exceeds the capacity of the OW. The holding cost per unit per unit time at RW is considered higher than the holding cost per unit per unit time at OW. Consequently, the stock at RW is cleared first to avoid more cost for inventory. The continuous (e.g., exponential, uniform, normal, lognormal distributions) and discrete distribution functions (Poison, general distributions) of the demand pattern are considered to develop the proposed model. Finally, three types (order size exceeds the capacity of OW, order size does not exceed the capacity of OW, the business man who does not have OW) of expected average cost functions are formulated both for continuous and discrete cases.

The rest of the paper is organised as follows: assumptions and notations are provided in Sect. 2. Mathematical formulation has been done in Sect. 3. Numerical examples are given in Sect. 4. Section 5 makes a conclusion of the model.

2 Assumptions and notations

The following assumptions and notations are adopted to formulate the proposed model:

2.1 Assumptions

The model is developed for single item

-

1.

The replenishment size is instantaneously infinite.

-

2.

The lead time is neglected.

-

3.

Own warehouse and rented warehouse are considered.

-

4.

The demand of the item follows a probability distribution function.

-

5.

Shortage due to uncertain demand is permitted and lost sale is considered in this stage.

2.2 Notation

- q :

-

Replenishment size (order size).

- x :

-

Random demand of the end customers.

- f(x):

-

Probability density function of x.

- I r (t):

-

On-hand inventory at RW at time t.

- I w (t):

-

On-hand inventory at OW at time t.

- φ :

-

Null set.

- W :

-

Capacity of OW, a non-void set.

- c h :

-

Inventory holding cost per unit per unit time at OW.

- c r :

-

Inventory holding cost per unit per unit time at RW.

- c s :

-

Shortage cost per unit per unit time.

- t r :

-

Total time elapsed to clear stock of items at RW.

- t w :

-

Total time elapsed to clear stock of items at OW.

- T :

-

Cycle length.

3 Formulation of the model

The inventory starts with lot size q at time t=0. The inventory level q is depleted gradually due to demand rate (x/T) where x is random demand over the period [0,T] that follows a probability density function f(x) such that \(\int_{0}^{\infty} f(x) =1\). In inventory system, three cases may arise for continuous distribution:

3.1 Case I: when the initial lot size q exceeds the capacity (W≠φ) of OW

In this case, q≥W, the stock in RW is cleared earliest because of higher inventory cost in RW compared to OW. The expected average cost (see Appendix A) is

Now, the objective is to minimize EAC 1(q) subject to the constraint q≥W. This problem can be solved by any calculus method for constrained optimization.

Theorem 1

If

has a solution q ∗={q∣q≥0}, then EAC 1(q) attains minimum at q ∗, otherwise EAC 1(q) is monotonic increasing function of q when

and monotonic decreasing function of q when

Proof

Now, differentiating EAC 1(q) with respect to ‘q’ we have

and

\(\int_{0}^{\infty} \frac{f(x)}{x} dx\) and \(\int_{q}^{\infty} \frac{f(x)}{x} dx\) are nonnegative real numbers.

Therefore, EAC 1(q) attains minimum at \(q^{*} = \{ q \mid \frac{d \mathit{EAC}^{1}}{dq} =0 \ \mbox{for } q\geq0 \}\) as \(\frac{d^{2} \mathit{EAC}^{1}}{d q^{2}} > 0\) at q ∗. If

does not have any solution \(q^{*} = \{ q \mid \frac{d \mathit{EAC}^{1}}{dq} =0\ \mbox{for } q\geq0 \}\), then EAC 1(q) is monotonic increasing or decreasing according as

or

respectively. Hence the proof. □

3.2 Case II: when the initial lot size q does not exceed the capacity of OW

In this case, q≤W≠φ, i.e., the storage capacity of OW is sufficient to hold the inventory. Then, the expected average cost (see Appendix B) is

The objective is to minimize EAC 2(q) subject to the constraints 0≤q≤W.

At q=W, the expressions in Eqs. (1) and (2) are same, i.e., EAC 1(W)=EAC 2(W). This implies that EAC 1(q) and EAC 2(q) are continuous at q=W.

Theorem 2

If

has a solution q ∗={q∣q≥0}, then EAC 2(q) attains minimum at q ∗, otherwise EAC 1(q) is monotonic increasing function of q when

and monotonic decreasing function of q when

Proof

Now, differentiating EAC 2(q) with respect to ‘q’ we have

and

as \(\int_{q}^{\infty} \frac{f(x)}{x} dx\) is nonnegative real number.

Therefore, EAC 2(q) attains minimum at \(q^{*} = \{ q \mid \frac{d \mathit{EAC}^{2}}{dq} =0\ \mbox{for } q\geq0 \}\) as \(\frac{d^{2} \mathit{EAC}^{2}}{d q^{2}} > 0\) at q ∗. If

does not have any solution \(q^{*} = \{ q \mid \frac{d \mathit{EAC}^{2}}{dq} =0\ \mbox{for } q\geq0 \}\), then EAC 2(q) is monotonic increasing or decreasing function according as

or

respectively. Hence the proof. □

3.3 Case III: when the firm does not have OW, i.e., W=φ

In this situation, RW is used for the whole period. Putting W=0 and c h =c r in Eq. (2), we have the expected average cost as follows;

The objective is to minimize EAC 3(q) subject to the constraints q≥0.

Theorem 3

If

has a solution q ∗={q∣q≥0}, then EAC 3(q) attains minimum at q ∗, otherwise EAC 3(q) is monotonic increasing function of q when

and monotonic decreasing function of q when

Proof

Now, differentiating EAC 3(q) with respect to ‘q’ we have

and

as \(\int_{q}^{\infty} \frac{f(x)}{x} dx\) is non negative real number.

Therefore, EAC 3(q) attains minimum at \(q^{*} = \{ q \mid \frac{d \mathit{EAC}^{3}}{dq} =0\ \mbox{for } q\geq0 \}\) as \(\frac{d^{2} \mathit{EAC}^{3}}{d q^{2}} > 0\) at q ∗. If

does not have any solution \(q^{*} = \{ q \mid \frac{d \mathit{EAC}^{3}}{dq} =0\ \mbox{for } q\geq0 \}\), then EAC 3(q) is monotonic increasing or decreasing function according as

or

respectively. Hence the proof. □

Combining the above three cases in one umbrella, we have a problem such that

Solving the above problem by any calculus or search techniques, we have the optimal strategy of the enterprises or the firms.

3.4 When distribution of demand is discrete

Let f i is the probability of the demand i∈{1,2,3,…} over the period [0,T]. Then, \(\sum_{i=1}^{\infty} f_{i} =1\) and the expected average cost of the Case I, Case II and Case III are as follows:

and

Theorem 4

n is optimal order size if

hold where

Proof

Now,

Here, \(\mathit{EAC}_{n}^{1}\) will be minimum at n if \(\mathit{EAC}_{n-1}^{1} > \mathit{EAC}_{n}^{1} < \mathit{EAC}_{n+1}^{1}\) hold. Therefore, \(\mathit{EAC}_{n}^{1} \leq \mathit{EAC}_{n+1}^{1}\) implies \(\mathit{EAC}_{n+1}^{1} - \mathit{EAC}_{n}^{1} >0\), i.e., \(\phi_{n} > \frac{c_{s}}{2} + c_{r} ( W- \frac{1}{2} ) \sum _{i=1}^{\infty} \frac{f_{i}}{i}\) where

Similarly, \(\mathit{EAC}_{n-1}^{1} - \mathit{EAC}_{n}^{1} >0\) implies \(\phi_{n-1} < \frac{c_{s}}{2} + c_{r} ( W- \frac{1}{2} ) \sum _{i=1}^{\infty} \frac{f_{i}}{i}\). Therefore, n is optimum when \(\phi_{n} > \frac{c_{s}}{2} + c_{r} ( W- \frac{1}{2} ) \sum_{i=1}^{\infty} \frac{f_{i}}{i} > \phi_{n-1}\) hold. Hence the proof. □

Similarly, for Case II and III, the following theorems hold.

Theorem 5

n is optimal order size if \(\psi_{n} < ( \frac{c_{h}}{ c_{h} + c_{s}} ) < \psi_{n-1}\) hold where \(\psi_{n} = \sum_{i=n+1}^{\infty} f_{i} - ( n+ \frac{1}{2} ) \sum_{i=n+1}^{\infty} \frac{f_{i}}{i}\).

Theorem 6

n is an optimal order size if \(\psi_{n} < ( \frac{c_{r}}{ c_{r} + c_{s}} ) < \psi_{n-1}\) hold where \(\psi_{n} = \sum_{i=n+1}^{\infty} f_{i} - ( n+ \frac{1}{2} ) \sum_{i=n+1}^{\infty} \frac{f_{i}}{i}\).

Therefore, our objective is to solve the problem:

4 Numerical example

Example 1

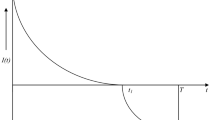

Let x follows exponential distribution such that

The values of other cost parameters and capacity of OW are c h =$0.5, c r =$0.8, c s =$2.5 and W=10 units. Then, the optimal solution of Case I is (q=10 units,EAC 1=$30.5657). In this case, EAC 1(q) is a monotonic increasing function of q (see Fig. 1, Case I) that results in minimum value (EAC 1=$30.5657) at q=10=W. The optimal solution of Case II is (q=3.74 units,EAC 2=$20.2788). In this case, EAC 2(q) is a convex function of q (see Fig. 1, Case II) that results in minimum value at q=3.74. The optimal solution of Case III is (q=3.265 units,EAC 3=$20.8797). In this case, EAC 3(q) is a convex function of q (see Fig. 1, Case III) that results in minimum value (EAC 3=$20.8797) at q=3.265. In Fig. 1, the expected average cost functions of Case II & III are clearly convex and unimodal whereas Case I is monotonic increasing function of order size. Therefore, the optimal solutions of Case I to III are unique. Among the above optimum results, (q=3.74 units,EAC 2=$20.2788) is minimum and it is the best strategy is for this particular distribution.

Example 2

Let x follows uniform distribution such that

The values of other cost parameters and capacity of OW are c h =$0.5, c r =$0.8, c s =$2.5 and W=10 units. Then, the optimal solution of Case I is (q=14.4833 units,EAC 1=$5.9869). In this case, EAC 1(q) is a convex function of q (see Fig. 4) that results in minimum value (EAC 1=$5.9869) at q=14.4833>10. The optimal solution of Case II is (q=10 units,EAC 2=$8.3153). In this case, EAC 2(q) is a monotonic decreasing function of q (see Fig. 5) that results in minimum value at q=W=10. The optimal solution of Case III is (q=15.5562 units,EAC 3=$11.9234). In this case, EAC 3(q) is a convex function of q (see Fig. 6) that results in minimum value (EAC 3=$11.9234) at q=15.5562. In Fig. 2, the expected average cost functions of Case I & III are clearly convex and unimodal whereas Case II is monotonic decreasing function of order size. Therefore, the optimal solutions of Case I to III are unique. Among the above optimum results, (q=14.4833 units,EAC 1=$5.9869)is minimum. The strategy of Case I is best optimal solution for this particular distribution.

Example 3

Let x follows normal distribution such that \(f ( x \vert m,\sigma ) = \frac{1}{\sigma \sqrt{2\pi}} e^{-0.5 ( \frac{x-m}{\sigma} ) 2}, -\infty\leq x\leq+\infty\). The values of other cost parameters and capacity of OW are m=20, σ=2.0, c h =$0.5, c r =$0.8, c s =$2.5 and W=10 units. Then, the optimal solution of Case I is (q=16 units,EAC 1=$4.66745). In this case, EAC 1(q) is a convex function of q (see Fig. 3, Case I) that results in minimum value (EAC 1=$4.66745) at q=16>10. The optimal solution of Case II is (q=10 units,EAC 2=$8.83849). In this case, EAC 2(q) is a monotonic decreasing function of q (see Fig. 3, Case II) that results in minimum value at q=W=10. The optimal solution of Case III is (q=12.0726 units,EAC 3=$9.90957). In this case, EAC 3(q) is a convex function of q (see Fig. 3, Case III) that results in minimum value (EAC 3=$9.90957) at q=12.0726. In Fig. 3, the expected average cost functions of Case I is clearly convex and unimodal whereas Case II is monotonic decreasing function of order size. The expected average cost function of Case III is multi-modal. In this case, the multi-optimal solutions are existed. The optimal solutions of Case I and II are unique. Among the above optimum results, (q=16 units,EAC 1=$4.66745) is minimum. Therefore, optimal solution of Case I for this particular distribution is the best strategy.

Example 4

Let x follows lognormal distribution such that \(f ( x \vert m,\sigma ) = \frac{1}{x\sigma \sqrt{2\pi}} e^{-0.5 ( \frac{\ln x-m}{\sigma} ) 2}\), 0≤x≤+∞. The values of other cost parameters and capacity of OW are m=15, σ=5.0, c h =$0.5, c r =$0.8, c s =$2.5 and W=10 units. Then, the optimal solution of Case I is (q=50 units,EAC 1=$80.9511). In this case, EAC 1(q) is a convex function of q (see Fig. 4, Case I) that results in minimum value (EAC 1=$4.66745) at q=50>10. The optimal solution of Case II is (q=10 units,EAC 2=$84.0897). In this case, EAC 2(q) is a monotonic decreasing function of q (see Fig. 4, Case II) that results in minimum value at q=W=10. The optimal solution of Case III is (q=556.726 units,EAC 3=$57.6648). In this case, EAC 3(q) is a convex function of q (see Fig. 4, Case III) that results in minimum value (EAC 3=$57.6648) at q=556.726. In Fig. 4, the expected average cost functions of Case I & III are clearly convex and unimodal whereas Case II is monotonic decreasing function of order size. Therefore, the optimal solutions of Case I to III are unique. Among the above optimum results, (q=556.726 units,EAC 3=$57.6648) is minimum. The strategy of Case III is our required optimal solution for this particular example.

Example 5

The values of the cost parameters and capacity of OW are considered as c h =$0.5, c r =$0.8, c s =$2.5 and W=12 units and the discrete demand distribution is as follows:

Demand (i) | 10 | 11 | 12 | 13 | 14 | 15 | 16 |

Probability (f i ) | 0.09 | 0.15 | 0.20 | 0.30 | 0.13 | 0.12 | 0.01 |

Here, the optimal solution of Case I is \(( q=n=13~\mathrm{units}, \mathit{EAC}_{n}^{1} =\$ 5.9869 )\). In this case, \(\mathit{EAC}_{n}^{1}\) is a convex discrete function of n (see Fig. 5, Case I) that results in minimum value \(( \mathit{EAC}_{n}^{1} =\$ 3.8663 )\) at q=n=13>W=12. The optimal solution of Case II is \(( q=n=12~\mathrm{units}, \mathit{EAC}_{n}^{2} =\$ 4.07805 )\). In this case, \(\mathit{EAC}_{n}^{2}\) is a monotonic decreasing function of n (see Fig. 5, Case II) that results in minimum value at q=n=W=10. The optimal solution of Case III is \(( q=n=12~\mathrm{units}, \mathit{EAC}_{n}^{3} =\$ 5.8049 )\). In this case, \(\mathit{EAC}_{n}^{3}\) is a convex function of n (see Fig. 5, Case III) that results in minimum value \(( \mathit{EAC}_{n}^{3} =\$ 5.8049 )\) at q=n=12. In Fig. 5, the expected average cost functions of Case I & III are clearly convex and unimodal whereas Case II is monotonic decreasing function of order size. Therefore, the optimal solutions of Case I to III are unique. Among the above optimum results, \(( q=n=13~\mathrm{units}, \mathit{EAC}_{n}^{1} =\$ 3.8663 )\) is minimum. So this strategy (Case I) is the best optimal solution.

Example 6

The values of the cost parameters and capacity of OW are considered as c h =$0.5, c r =$0.8, c s =$2.5, μ=15.0 and W=12 units and the discrete demand distribution follows Poison distribution with probability density function \(f_{i} = \{ e^{-\mu} \frac{\mu^{i}}{i!}, i=0,1,2,\dots\}\) Here, the optimal solution of Case I is \(( q=n=15~\mathrm{units}, \mathit{EAC}_{n}^{1} =\$ 5.86153 )\). In this case, \(\mathit{EAC}_{n}^{1}\) is a convex discrete function of n (see Fig. 6, Case I) that results in minimum value \(( \mathit{EAC}_{n}^{1} =\$ 5.86153 )\) at q=n=15>W=12. The optimal solution of Case II is \(( q = n =12~\mathrm{units}, \mathit{EAC}_{n}^{2} =\$ 6.83772 )\). In this case, \(\mathit{EAC}_{n}^{2}\) is a monotonic decreasing function of n (see Fig. 6, Case II) that results in minimum value at q=n=W=12. The optimal solution of Case III is \(( q = n =14~\mathrm{units}, \mathit{EAC}_{n}^{3} =\$ 8.01285 )\). In this case, \(\mathit{EAC}_{n}^{3}\) is a convex function of n (see Fig. 6, Case III) that results in minimum value \(( \mathit{EAC}_{n}^{3} =\$ 8.01285 )\) at q=n=14. In Fig. 6, the expected average cost functions of Case I & III are clearly convex and unimodal whereas Case II is monotonic decreasing function of order size. Therefore, the optimal solutions of Case I to III are unique. Among the above optimum results, \(( q=n=15~\mathrm{units}, \mathit{EAC}_{n}^{1} =\$ 5.86153 )\) is minimum. So this strategy (Case I) is our required optimal solution.

5 Conclusion

The newsvendor concept is a fundamental logic to solve many industrial and operations problems. In this concept, explicit formulations of the overbuying and under-buying costs and calculation of the critical ratio often lead to better economic decisions of a firm. If managers of firms can estimate the proper demand distribution and cost parameters of the specific retail type goods, they can implement the newsvendor model to make better economic decision which has a significant financial impact on the firm. The newsvendor modelling is used in many business contexts having single decision variable, uncertain demand, known overage and underage costs such as setting safety stocks, setting target inventory levels, making a final production run, and making capacity decisions, among others. The purpose of this study is to model for firms/enterprises, cost-minimization strategy when the demand of the end customers is uncertain and the capacity of OW is limited. This model also suggests to an enterpriser who does not have OW, but may do business comfortably, using RW. This paper discussed the model in the light of various types of distributions which are more appropriate in real life problems. Quite often, retail items follow Uniform, Exponential, Normal, Lognormal, Poisson and General discrete distributions. Neither the Normal nor the Poisson distributions are appropriate while the coefficient of variation (S.D./Mean) is large. The Lognormal distribution provides, in many cases, an adequate distribution that allows closed form solutions when the coefficient of variation is large. The model is tested for the above realistic distribution functions and the optimum solutions of all the cases are obtained. This model helps the firm manager to choice best strategy so that the system cost is minimized. The new major contribution of the proposed article is to consider two-warehouse systems (OW and RW) in newsvendor type problem. As far as the author’s knowledge goes, such type of two-warehouse model has not yet been published in newsvendor literature. The proposed model can be extended further in many ways: one immediate extension may be done both for stochastic supply and demand in the market. Fuzzy concept for the capacities of own warehouse and multiple rented warehouses may considered in future. Moreover, the present article may be extend incorporating the effect of sales price and promotional effort on the demand of customers in the market.

References

Adida, E., & Perakis, G. (2010). Dynamic pricing and inventory control: robust vs. stochastic uncertainty models-a computational study. Annals of Operations Research, 181, 125–157.

Arcelus, F. J., Pakkala, T. P. M., & Srinivasan, G. (2006). On the interaction between retailers inventory policies and manufacturer trade deals in response to supply-uncertainty occurrences. Annals of Operations Research, 143, 45–58.

Artalejo, J. R., Krishnamoorthy, A., & Lopez-Herrero, M. J. (2006). Numerical analysis of (s,S) inventory systems with repeated attempts. Annals of Operations Research, 141, 67–83.

Chen, M. S., & Chuang, C. C. (2000). An extended newsboy problem with shortage-level constraints. International Journal of Production Economics, 67, 269–277.

Chen, S., & Geunes, J. (2013). Optimal allocation of stock levels and stochastic customer demands to a capacitated resource. Annals of Operations Research, 203, 33–54.

Chou, Y. C., & Chung, H. J. (2009). Service-based capacity strategy for manufacturing service duopoly of differentiated prices and lognormal random demand. International Journal of Production Economics, 121, 162–175.

Chung, K., & Huang, T. (2007). The optimal retailer’s ordering policies for deteriorating items with limited storage capacity under trade credit financing. International Journal of Production Economics, 106, 127–146.

Chung, K., Her, C., & Lin, S. (2009). A two-warehouse inventory model with imperfect quality production processes. Computers & Industrial Engineering, 56, 193–197.

Demirag, O. C., Chen, Y. F., & Yang, Y. (2013). Production-inventory control policy under warm/cold state-dependent fixed costs and stochastic demand: partial characterization and heuristics. Annals of Operations Research, 208, 531–556.

Federgruen, A., & Wang, M. (2013). Monotonicity properties of a class of stochastic inventory systems. Annals of Operations Research, 208, 155–186.

Hariga, M. (2011). Inventory models for multi-warehouse systems under fixed and flexible space leasing contracts. Computers & Industrial Engineering, 61, 744–751.

Hsieh, C. C., & Lu, Y. T. (2010). Manufacturer’s return policy in a two-stage supply chain with two risk-averse retailers and random demand. European Journal of Operational Research, 207, 514–523.

Jammernegga, W., & Kischkab, P. (2013). The price-setting newsvendor with service and loss constraints. Omega, 41, 326–335.

Johansen, S. G., & Thorstenson, A. (1993). Optimal and approximate (Q,r) inventory policies with lost sales and gamma distribution lead time. International Journal of Production Economics, 30(31), 179–194.

Kalpakam, S., & Shanthi, S. (2006). A continuous review perishable system with renewal demands. Annals of Operations Research, 143, 211–225.

Lee, C., & Hsu, S. (2009). A two-warehouse production model for deteriorating inventory items with time-dependent demands. European Journal of Operational Research, 194, 700–710.

Lee, C., & Ma, C. (2000). Optimal inventory policy for deteriorating items with two-warehouse and time-dependent demands. Production Planning & Control, 11, 689–696.

Li, J., Enginarlar, E., & Meerkov, S. M. (2004). Random demand satisfaction in unreliable production–inventory–customer systems. Annals of Operations Research, 126, 159–175.

Liang, Y., & Zhou, F. (2011). A two-warehouse inventory model for deteriorating items under conditionally permissible delay in payment. Applied Mathematical Modelling, 35, 2221–2231.

Liao, J., & Huang, K. (2010). Deterministic inventory model for deteriorating items with trade credit financing and capacity constraints. Computers & Industrial Engineering, 59, 611–618.

Liberopoulos, G., Pandelis, D. G., & Hatzikonstantinou, O. (2013). The stochastic economic lot sizing problem for non-stop multi-grade production with sequence-restricted setup changeovers. Annals of Operations Research, 209, 179–205.

Okyay, H. K., Karaesmen, F., & Özekici, S. (2013). Newsvendor models with dependent random supply and demand. Optimization Letters. doi:10.1007/s11590-013-0616-7.

Petruzzi, N. C., & Dada, M. (1999). Pricing and the news vendor problem: a review with extension. Operations Research, 47, 183–194.

Rossi, R., Tarim, S. A., Hnich, B., & Prestwich, S. (2012). Constraint programming for stochastic inventory systems under shortage cost. Annals of Operations Research, 195, 49–71.

Sana, S. S. (2011). The stochastic EOQ model with random sales price. Applied Mathematics and Computation, 218, 239–248.

Sana, S. S., Mondal, S. K., Sarkar, B. K., & Chaudhuri, K. S. (2011). Two-warehouse inventory model on pricing decision. International Journal of Management Science and Engineering Management, 6, 403–416.

Taleizadeh, A. A., Niaki, S. T. A., & Makui, A. (2012). Multiproduct multiple-buyer single vendor supply chain problem with stochastic demand, variable lead-time, and multi-chance constraint. Expert Systems with Applications, 39, 5338–5348.

Wang, C. H. (2010). Some remarks on an optimal order quantity and reorder point when supply and demand are uncertain. Computers & Industrial Engineering, 58, 809–813.

Xiao, T., Jin, J., Chen, G., Shi, J., & Xie, M. (2010). Ordering wholesale pricing and lead-time decisions in a three-stage supply chain under demand uncertainty. Computers & Industrial Engineering, 59, 840–852.

Zhang, G. (2010). The multi-product newsboy problem with supplier quantity discounts and a budget constraint. European Journal of Operational Research, 206, 350–360.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: When q≥W(≠φ)

Let I r (t) is on-hand inventory at RW, I w (t) is on-hand inventory at OW and I s (t) is shortage level at time t. Here, two cases may arise for uncertain demand (x):

1.1 A.1 Case I: when shortage does not occur, i.e., q≥x

As the demand over the period [0,T] is x, the demand per unit time is x/T. The stock at Rw is cleared first. Thereafter, the stock at OW is used to adjust the demand of the customers. Now, the on-hand inventories are:

and

Using I r (t r )=0, we have t r =(q−W)T/x. Now, I w (T)≥0 implies q≥x. Therefore, the average inventory cost at RW is \(\mathrm{Inv}_{r}^{1} = \frac{c_{r}}{T} \int_{0}^{t_{r}} \{ ( q-W ) - \frac{xt}{T} \} dt = \frac{c_{r}}{2x} ( q-W )^{2}\) and the average inventory cost at OW is

1.2 A.2 Case 2: when shortage occurs

In this situation, q≤x, the on-hand inventories and shortage are as follows:

and

Now, I r (t r )=0 implies t r =(q−W)T/x and I w (t r +t w )=0 implies t w =WT/x. Therefore, the average inventories and shortage are:

and

The expected average cost, combining case 1 and case 2, we have

Appendix B: When q≤W(≠φ)

In this case, RW is not needed. Let I w (t) is on-hand inventory at OW and I s (t) is shortage level at time t. Here, two cases may arise for uncertain demand (x):

2.1 B.3 Case 1: when shortage does not occur, i.e., q≥x

As the demand over the period [0,T] is x, the demand per unit time is x/T. The stock at Rw is cleared first. Thereafter, the stock at OW is used to adjust the demand of the customers. Now, the on-hand inventory is:

Now, I w (T)≥0 implies q≥x. Therefore, the average inventory cost at OW is \(\mathrm{Inv}_{w}^{1} = \frac{c_{h}}{T} [ \int_{0}^{T} \{ q- \frac{xt}{T} \} dt ] = c_{h} [ q- \frac{x}{2} ]\).

2.2 B.4 Case 2: when shortage occurs

In this situation, q≤x, the on-hand inventory and shortage are as follows:

and

Now, I w (t w )=0 implies t w =qT/x. Therefore, the average inventory and shortage are:

The expected average cost, combining Case 1 and Case 2, we have

Rights and permissions

About this article

Cite this article

Sana, S.S. An EOQ model for stochastic demand for limited capacity of own warehouse. Ann Oper Res 233, 383–399 (2015). https://doi.org/10.1007/s10479-013-1510-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-013-1510-5