Abstract

We show that nonlinearly discounted nonlinear martingales are related to no arbitrage in two price economies as linearly discounted martingales were related to no arbitrage in economies satisfying the law of one price. Furthermore, assuming risk acceptability requires a positive physical expectation, we demonstrate that expected rates of return on ask prices should be dominated by expected rates of return on bid prices. A preliminary investigation conducted here, supports this hypothesis. In general we observe that asset pricing theory in two price economies leads to asset pricing inequalities. A model incorporating both nonlinear discounting and nonlinear martingales is developed for the valuation of contingent claims in two price economies. Examples illustrate the interactions present between the severity of measure changes and their associated discount rates. As a consequence arbitrage free two price economies can involve unique discount curves and measure changes that are however specific to both the product being priced and the trade direction. Furthermore the developed valuation operators call into question the current practice of Debt Valuation Adjustments.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

It has now long been recognized (Harrison and Kreps 1979; Harrison and Pliska 1981; Delbaen and Schachermayer 1994) that the absence of arbitrage in a financial market is, under conditions, equivalent to the existence of a probability measure on the space of price paths, under which discounted asset prices, in the absence of dividends, are martingales. Furthermore, such a measure, often referred to as a martingale measure, is also unique when markets are complete (Harrison and Pliska 1983). The financial markets studied in these papers, are infinitely liquid, permitting trading in both directions at the same price, or equivalently, the law of one price prevails.

There have, however, been numerous studies where the law of one price is abandoned and one may note in particular the literature on transactions costs and the study of no arbitrage in the presence of bid ask spreads (Jouini and Kallal 1995; Bion-Nadal 2009b; Guasoni et al. 2012). More recently Madan (2012) considers financial equilibria where in equilibrium one has illiquidity by construction. There is a fundamental illiquidity that is unrelated to considerations of costs in transacting otherwise liquid markets. In equilibrium there are only the two separate prices at which one may buy from or sell to the market. The convergence to one price fails on account of an accumulation of aggregate market wide risk exposures that are not financially acceptable. In such financial economies, financial systems are employed to enhance economic activity beyond the presumed, unachievable or unrealistic, constraints of market clearing. The focus of this paper is on the no arbitrage implications for such fundamentally illiquid economies.

For such two price financial economies with risk exposures related to the absence of enforcing market clearing, the absence of arbitrage leads to valuation operators exhibiting nonlinearity in both time value discounting and the choice of martingale measures. In fact, under fairly general conditions one may have uniqueness of interest rates employed for discounting and measure changes employed for valuation, that are product and trade direction specific. Hence the nonlinearity. Each contingent claim then has, for each of two trade directions, a single time value discount curve and a single probability assessment of events consistent with its bid price and another such choice for its ask price. It may be observed that such a theoretical conclusion conforms with valuation practices being widely adopted across the financial industry since the financial crisis of 2008.

On the one hand there is the development of multicurve approaches to accounting for time value of money as studied for example in Ametrano and Bianchetti (2009), Mercurio (2010), Pallavicini and Tarenghi (2010) and Bianchetti and Carlichhi (2012). In fact many banks have made substantial investments into the construction of multiple yield curves that has come to be called \(n-way\) cooking. The constructions allow for considerable product specificity in the construction of yields curves and the magnitude of investment in their development signals the end of a single curve regime for time value accounting. We shall observe here that the valuation operators of two price financial economies characteristically employ \(n-way\) cooking of yield curves.

The nonlinearity of two price financial economies is not restricted to yield curves and links up with other developments in the literature. Yet another strand of the literature has studied the construction of nonlinear conditional expectation operators related to the solution of backward stochastic differential Eqs. (El Karoui et al. 1997; Peng 2004, 2006; Cohen and Elliott 2010). Peng (2010) has gone on to define nonlinear conditional expectations of a terminal random variable as a nonlinear martingale. We show here that a two price financial economy is free of arbitrage just if each of its two price processes when suitably nonlinearly discounted are then also nonlinear martingales. Hence multicurve time value accounting and nonlinear martingales are to no arbitrage in two price financial economies as single curve discounting and martingales were to no arbitrage in one price economies. The economics of two price financial economies is thereby inherently linked to the mathematics of nonlinear conditional expectations now called nonlinear martingales and the \(n-way\) cooking of yield curves.

The valuation operators of two price financial economies are linked in continuous time models to the solution of nonlinear partial integro-differential equations. The embedded nonlinearities simultaneously endogenize worst case or conservative valuations for assets at the bid price and similar worst case or ask price valuations for liabilities. Consequently they provide natural candidates for asset write downs and liability add-ons for risk management purposes. Additionally the operators may also serve as corporate objective functions designed to maximize a concave and conservative market value functional. In contrast the law of one price yields a linear objective function ill suited to locating interior optimal decisions.

A specific valuation operator synthesizing multicurve accounting and nonlinear martingales is developed here by extending the discrete time nonlinear martingale construction formulated in Madan and Schoutens (2012). Interactions between rates and measure changes are incorporated by providing better discount rates when valuations are subjected to more severe risk charges. Discount rates are reduced when cash flows are exposed to greater stress in evaluating expectations. The underlying trade-offs are part of the primitives defining a financial economy. A financial economy must not only specify a cone of risk acceptability as modeled in Madan (2012) and Madan and Schoutens (2012), but it must also define the trade-off between risk charges and time value discounting.

For the valuation operator developed here, one may deduce that ask prices for nonnegative liabilities must be priced at maximal stress and minimal discount rates. Nonnegative liabilities may be viewed as true liabilities and the valuation principle we deduce is in keeping with the Heckman (2004) principle that they be valued as if they were to be paid. Current Debt Valuation Adjustment (DVA) practices of crediting oneself with an assessment of an inability to meet ones liabilities is thereby called into question as a dangerous and fallacious practice.

Furthermore, we note that martingale theory of a one price economy synthesizes asset pricing theory on recognizing that excess returns are just the negative of return covariations with the pricing kernel (see for example Back 1991). Similarly one obtains, here, a nonlinear asset pricing theory for two price economies whereby excess returns on the two prices may be seen as the infima or suprema of return covariations with a set of pricing kernels. Just as asset pricing theory has led to an extensive literature testing this theory on data presumed to be coming from a one price economy, we anticipate that one may develop similar tests for the nonlinear asset pricing theory on data presumed to be coming from a two price financial economy. We present here a first test of one of the early implications of no arbitrage in two price economies. The initial implications are extended by a factor theoretic approach to asset pricing in two price economies leveraging the built in nonlinearity. This results in a system of asset pricing inequalities. Research questions related to the development of econometric procedures for testing asset pricing inequalities are opened up.

Just as the details for connecting no arbitrage and martingales in one price economies rely on subtle technical considerations related to the topological structure of infinite dimensional spaces the counterpart result for two price economies will face similar technical difficulties. With a view to reducing technical considerations and focusing attention on the economic and financial considerations involved we address these questions in a finite dimensional space by considering an economy living on a finite probability space.

Section 2 formulates the structure of a two price financial economy living on this finite probability space and develops the consequences of no arbitrage. Section 3 addresses issues related to the span of the set of zero cost attainable claims and completeness in two price financial economies. Section 4 introduces the concept of risk acceptability and develops the equations for the prices of an arbitrage free two price financial economy. Section 5 establishes the link to nonlinearly discounted nonlinear martingales. Section 6 develops a specific valuation model incorporating interactions between risk resiliency and discount rates. Section 7 presents the related nonlinear asset pricing theory and develops an initial testable implication. The test is conducted on data for daily ask high and bid low prices as presumed to be that of a two price economy in Sect. 8. Factor theoretic extensions are taken up in Sect. 9. Section 10 concludes.

2 Two price financial economy on a finite state space

We adopt the structure of a finite probability space as described, for example, in Delbaen and Schachermayer (2000). The probability space is \(\Omega =\left\{ \omega _{1},\omega _{2},\ldots ,\omega _{N}\right\} \), with a probability \(P\), and \(P\left[ \omega _{n}\right] =p_{n}>0\), \(n=1,\ldots ,N\). Denote by \(\mathcal {F}\) the power set of \(\Omega \). In addition there are finitely many time points \(t=0,1,\ldots ,T\) at which trading may occur. The information filtration is given by an increasing sequence of \(\sigma -algebras\) \(\left( \mathcal {F}_{t}\right) _{t=0}^{T}\) with \(\mathcal {F}_{T}= \mathcal {F}\).

In a one price economy it is customary to begin with a specification of the price process. Two price economies have also been studied, for example in Jouini and Kallal (1995) by a specification of the price processes. Here we wish to go beyond characterizing no arbitrage and to eventually develop operators relating prices to the associated promised cash flows. As a consequence, though the mathematical methods we shall employ relate to those of the classical analysis of Kreps (1981) and Yan (1980), the context is substantially different. First we do not have price processes but processes for the two prices at which the remaining uncertainty may be transacted with the market. As a result the prices are those of different assets and depart from the classical view of the current price, be it in a one or two price market, for some terminal random variable. Additionally, given the absence of unique discount curves, monies cannot be moved across time on predetermined terms and we are forced to work with the mathematics of processes as opposed to an aggregated analysis on the space of terminal random variables. Alternatively put, we do not have numeraire assets that one may use to account for values, as we shall take the law of one price as failing essentially universally.

Hence we begin by specifying the set of promised cash flows being traded in the market. Given the focus on synthesizing nonlinear discounting or multi curve accounting with nonlinear martingales we introduce two sets of traded cash flows.

The first consists of state contingent cash flows \(c_{t}^{i}\), \(i=1,\ldots ,M\) that pay the sum \(c_{t}^{i}\) at time \(t\). The cash flows \(c^{i}=(c_{t}^{i},0\le t\le T)\) are adapted to the filtration \(\left( \mathcal {F}_{t}\right) _{t=0}^{T}\). The values \(c_{t}^{i}\) may be signed and the receipt of a negative magnitude is read as the payment of the absolute value.

The second consists of trading at all times \(t\), pure discount bonds indexed by \(u>t\) that pay at \(u\) the unit cash flow. These are traded at all times \(t<u\) with cash flows denoted as \(\mathbf {1}_{u}\).

Definition 2.1

The set of traded state contingent cash flows consist of \(c=(c^{1},\ldots c^{M})\) where for each \(i\), \(c^{i}=(c_{t}^{i})_{t=0}^{T}\) is a process adapted to the filtered stochastic base \(\left( \Omega ,\mathcal {F},\left( \mathcal {F}_{t}\right) _{t=0}^{T},P\right) \). We assume \(c_{0}^{i}=0\) for all \(i\). Also traded are pure discount bonds with cash flows \(\mathbf {1}_{u}\) paying unity at time \(u\).

A two price financial economy consists of a pair of adapted price processes \(a_{t}^{i}\ge b_{t}^{i}\) allowing all economic agents to, access or deliver, the cash flows \(c_{t^{\prime }}^{i}\) for \(t^{\prime }>t\), that are to be delivered or received by the market. The market is viewed as an abstract counterparty to all transactions by all agents. There are then two associated zero cost cash flows associated with each \(c\) for each \(t\). There is one zero cost cash flow for buying contingent claim \(i\) at time \(t\), denoted \(U^{it}=(U_{s}^{it})_{s=0}^{T}\) where

Similarly the agent may sell the contingent claim \(i\) at time \(t\) to receive the bid price and access the zero cost cash flow \(V^{it}=\left( V_{s}^{it}\right) _{s=0}^{T}\) where

We also have a pair of bid and ask prices for the pure discount bonds denoted by \(g_{t}^{u}\le h_{t}^{u}\le 1\) for \(t<u\) that access the zero cost cash flows \(\left( W_{s}^{ut}\right) _{s=0}^{T}\) and \(\left( X_{s}^{ut}\right) _{s=0}^{T}\) where

and

Remark 2.1

The ask prices may be reduced to bid prices by closing the set of traded cash flows under negation. By allowing for the trading of the negative cash flow \(\widetilde{c}_{t}^{i}=-c_{t}^{i}\) we see that the ask price for \(\widetilde{c}^{i}\) at time \(t\), say \(\widetilde{a}_{t}^{i}\) accesses for times \(t\) and above the cash flows

By construction this is the cash flow

On the other hand the bid price for the original cash flow \(c\) accesses the zero cost cash flow

Comparing (3) and (4) we thus deduce that one must have

Thus the ask price for \(\widetilde{c}\) equal to \(-c\) is the negative of the bid price for \(c\). Equivalently, on changing signs, we conclude that the ask price for \(c\) is the negative of the bid price for \(-c\).

Thus by relating selling to buying the negative and allowing the negative to trade, we reduce the two price financial economy to just the study of the bid prices, for both \(c\) and \(-c\). With this remark we focus attention on just the bid prices \(b_{t}^{i}\) and \(g_{t}^{u}\), supposing that the set of securities traded have claims to cash flows closed under a change of sign. We therefore have cash flows \(c_{t}^{i}\), \(\widetilde{c}_{t}^{i}\), \(\mathbf {1}_{u}\), \(\widetilde{\mathbf {1}}_{u}\) where the superscript \(^{\sim }\) denotes the negative cash flow and the pure discount bonds for time \(u\) are traded at times \(t<\) \(u\). There are associated bid prices \(b_{t}^{i}\), \(\widetilde{b}_{t}^{i}\), for \(i=1,\ldots ,M\) and \(g_{t}^{u}\), \(\widetilde{g}_{t}^{u}\), for \(t<u\le T\) and zero cost cash flows \(V^{it}=(V_{s}^{it})_{s=0^{T}}\), \(\widetilde{V}^{it}=(\widetilde{V}_{s}^{it})_{s=0}^{T}\), \(X^{ut}=(X_{s}^{ut})_{s=0}^{T}\) and \(\widetilde{X} ^{ut}=(\widetilde{X}_{s}^{ut})_{s=0}^{T}\).

Definition 2.2

The financial market consists of the zero cost cash flows \(V=\left( V^{it}\right) \), \(i=1,\ldots ,M\), and \(t=0,\ldots T-1\) where \(V^{it}=\left( V_{s}^{it}\right) _{s=0}^{T}\) is defined as in (1). Other zero cost cash flow include \(\widetilde{V}=\left( \widetilde{V}^{it}\right) \), \(i=1,\ldots ,M\) and \(t=0,\ldots ,T-1\) with \(\widetilde{V}^{it}=\left( \widetilde{V}_{s}^{it}\right) _{s=0}^{T}\) defined in accordance with (1). In addition we have the pure discount bonds \(X=(X^{ut})\), \(u=1,\ldots ,T\), \(t=0,\ldots u-1\) and \(\widetilde{X}=(\widetilde{X}^{ut})\), \(u=1,\ldots ,T,t=0,\ldots u-1\).

Definition 2.3

The set of trading strategies consists of nonnegative adapted processes \((H,\widetilde{H},K,\widetilde{K})\), \(H=(H^{i})_{i=1}^{N},\widetilde{H}=(\widetilde{H}^{i})_{i=1}^{N}\), \(H^{i}=(H_{t}^{i})_{t=0}^{T-1}\), \(\widetilde{H}^{i}=(\widetilde{H} _{t}^{i})_{t=0}^{T-1}\), and \(K=(K_{t}^{u}),\widetilde{K}=(\widetilde{K}_{t}^{u})\), \(t<u\), \(1\le u\le T\).

The trading strategy \((H,\widetilde{H},K,\widetilde{K})\) receives the zero cost cash flow \(z=(z_{t})_{t=0}^{T}\) where

Definition 2.4

We call \(\mathcal {Z}\) the set of all cash flows accessible by trading strategies \(\left( H,\widetilde{H},K,\widetilde{K} \right) \), the set of zero cost attainable cash flows.

Remark 2.2

Unlike the situation with the law of one price when the set of zero cost attainable cash flows forms a subspace of the space of adapted cash flows, the set \(\mathcal {Z}\) of zero cost attainable cash flows here is just a convex cone in the space of adapted processes. Furthermore in the classical case we may transfer all funds to the final date via an accounting with the bank account in a numeraire asset. For the attainable cash flows, we thereby focus attention on the space of terminal random variables. Here we cannot make such aggregations as transfers across time depend on agent choices at loan rates that are different for borrowing and lending. Hence the space of cash flows is different from the space of terminal random variables and remains the space of adapted cash flows.

Definition 2.5

We call the convex cone \(C\) of adapted processes defined by

the set of processes super-replicable at zero cost.

Let \(W\) be the set of nonnegative adapted processes.

Definition 2.6

A financial market \((V,\widetilde{V},X,\widetilde{X})\) satisfies the no-arbitrage condition \((NA)\) if

where \(0\) denotes the identically zero adapted process.

Let \(L\) denote the subspace of liquid zero cost attainable claims or cash flows that may be traded in both directions at the same price. For a financial market satisfying no arbitrage the set of zero cost attainable cash flows may contain some liquid cash flows \(z\) for which both \(z\) and \(-z\) are in \(\mathcal {Z}\).

Proposition 2.7

Assume the financial market satisfies \((NA)\) then

Proof

Clearly \(L\subseteq C\cap \left( -C\right) \). Suppose \(y\in C\cap \left( -C\right) \) then \(y=z_{1}-h_{1}\) for \(h_{1}\) nonnegative and \(z_{1}\in Z\) but also \(-y=z_{2}-h_{2}\) for \(h_{2}\) nonnegative and \(z_{2}\in Z\). It follows that \(z_{1}+z_{2}=h_{1}+h_{2}\) belongs to \(C\cap W\) and hence \(h_{1}=h_{2}=0\) and \(y=z_{1}\in Z\), also \(-y=z_{2}\in Z\) and hence \(y\in L\). \(\square \)

Definition 2.8

A two price financial economy has no liquid assets if the cone \(C\) is pointed and

We shall suppose, except when explicitly indicated otherwise, that we are dealing with economies with no liquid assets.

Proposition 2.9

A financial market satisfies no arbitrage (NA) if and only if there exists a strictly positive adapted process \(\theta =\left( \theta _{t}\right) _{t=0}^{T}\) satisfying

Proof

Application of the Kreps–Yan theorem (See for example Rokhlin 2005) to the separating duality between the Banach spaces of adapted processes \(y=(y_{t},t=0,1,\ldots ,T)\) and \(\theta =(\theta _{t},t=0,1,\ldots ,T)\) for the bilinear form

\(\square \)

2.1 Separating hyperplanes, time value and measure changes

We decompose in this subsection every separating hyperplane into the product of a multicurve discounting function and a measure change martingale. Consider first the pure discount bond trading at time \(t\) of maturity \(t+1\). The cash flows

and hence by the separation property (5) it follows that

or

In particular we may write

Define the candidate one period spot rate process \(r_{t}\) by

Define inductively the following entities

We may now write

and hence

where the last equality follows on noting that \(\Gamma _{t+1}\) is \(\mathcal {F }_{t}\) measurable.

We observe that the process

is a positive martingale and one may use it to define a measure change to the measure \(Q\) by

We thus associate with the separating hyperplane a spot rate process \(r_{t}\) or equivalently

and a probability measure \(Q\) defined by the martingale \(\theta _{t}/\Gamma _{t}\). We now see our separating hyperplane as

Every separating hyperplane is the product of a discount function \(\Gamma _{t}\), at the spot rate process \(r_{t}\) and a change of measure martingale \(M_{t}\).

2.2 Bid, ask, multi curve discounting, and risk neutral measures

The separation property (5) and the observation that \(V^{it}\), \(\widetilde{V}^{it}\in \mathcal {Z}\) imply that

Consequently,

We may then write

or that

The bid price is bounded above by a discounted expectation of the future cash flows while the ask price is bounded below by the same using the multi curve discounting process \(\Gamma _{t}\) for time value accounting and the associated martingale \(M_{t}\) for the measure change.

3 Acceptable risks in a two price economy

We now define by \(\mathcal {M}\) the set of all separating hyperplanes \(\theta =(\theta _{t})_{t=0}^{T}\) that perform a separation of the set of zero cost attainable claims \(\mathcal {Z}\) from the set of nonnegative nonzero cash flows. Associated with each such hyperplane is a discount process \(\Gamma =\left( \Gamma _{t}\right) _{t=0}^{T}\) and a measure \(Q\) defined by the change of measure martingale \(M=(M_{t})_{t=0}^{T}\) with \(M_{t}=\theta _{t}/\Gamma _{t}\).

Definition 3.1

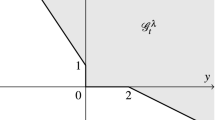

For each \(t\) define the set \(\mathcal {A}_{t}\) to be the set of all adapted processes \(x=\left( x_{t^{\prime }},t^{\prime }\ge t\right) \) satisfying

By construction \(\mathcal {A}_{t}\) is a convex cone containing the nonnegative adapted processes and we define it to be the set of current and future cash flows acceptable at time \(t\).

Furthermore we have shown by virtue of \(V^{it},\widetilde{V}^{it}\in \mathcal {Z}\) that the process \(c=(b_{t},-c_{t^{\prime }}^{i}\), \(t^{\prime }>t)\) with \(b_{t}<b_{t}^{i}\), is not an element of \(\mathcal {A}_{t}\). Define by \(\mathcal {Z}_{t}\) the set of processes in \(\mathcal {Z}\) that are zero before time \(t\). Consider the set \(\mathcal {Z}_{t}\cap \mathcal {A}_{t}\), for \(z\in \mathcal {Z}_{t}\cap \mathcal {A}_{t}\) we have that

But as \(z\in \mathcal {Z}\) then for all \(\theta \in \mathcal {M}\)

or

and equivalently that

Hence

As a consequence both \(z\) and \(-z\) belong to \(\mathcal {Z}_{t}\cap \mathcal {A}_{t}\) and this set is the subspace of liquid zero cost cash flows as one may trade these cash flows at zero cost in both directions. If there are no liquid cash flows for which the law of one price holds then \(\mathcal {Z}_{t}\cap \mathcal {A}_{t}=\{0\}\). In fact \(\mathcal {A}_{t}=-\mathcal {Z}_{t}\) and \(\mathcal {Z}_{t}\) is a pointed cone in the absence of liquid assets. We assume henceforth the absence of liquid assets.

In particular one may conclude that for all zero cost traded cash flows we have that \(b_{i}^{i}<a_{t}^{i}\) and there exists \(\Gamma ,M\) and \(\Gamma ^{\prime },M^{\prime }\) satisfying

and

3.1 Best bid price

Consider \(V^{it}\in \mathcal {Z}\) by which for all \(\theta \in \mathcal {M}\) we have

Equivalently for all \(\theta \in \mathcal {M}\) it is the case that

or that

It then follows that for any \(b<b_{t}^{i}\) we have that \((-b,c_{t^{\prime }}^{i},t^{\prime }>t)\in \mathcal {A}_{t}\). There is then a maximal value \(b_{*}\) such that \(\left( -b_{*},c_{t^{\prime }}^{i},t^{\prime }>t\right) \in \mathcal {A}_{t}\) and is either a boundary point or an extreme point of \(\mathcal {A}_{t}\).

For this best or maximal bid price there is a separating hyperplane \(\theta ^{*}=(\theta _{t^{\prime }}^{*},t^{\prime }\ge t)\) for which the lower bound of zero is attained

Hence \(\theta ^{*}\) is positive and for this best bid price we have \( \Gamma ^{*}\), \(M^{*}\) and \(Q^{*}\) such that

It follows that for general probability spaces

By the relationship between bid and ask prices we also have that

The best bid and ask prices defined in Eqs. (6) and (7) are nonlinear prices with the bid price being a concave functional while the ask price is a convex functional. The nonlinearities involve both a selection of a discounting function and the choice of a probability measure and in general one would expect some interactions being involved in these choices.

For future reference we also observe that since

we have that

3.2 Uniqueness of product and trade direction specific discount functions and martingale measures

A recent paper by He and Xu (2013) establishes that the support hyperplanes of convex sets \(A\) defined as the level sets

for a convex function \(\phi \) are unique. This suggests that if we model a convex cone of acceptable claims as cones generated by scaling such convex level sets then every financial cash flow or contingent claim will have a bid price consistent with a unique discount function and measure change. The ask price being associated with a cash flow in the other direction will also have its own discount function and measure change. As a result we would have product and trade direction specific unique multi-curve time value accounting and measure changes or probability assessments. We shall use these considerations in formulating an example of a valuation model.

4 Dynamic consistency and nonlinearly discounted nonlinear martingales

We now introduce a dynamic consistency hypothesis with respect to the best bid prices for future cash flows.

Definition 4.1

Markets are said to be dynamically consistent if for \(x\in \mathcal {A}_{_{t}}\) and \(b_{t+1}\) the best bid price for \((x_{t^{\prime }},t^{\prime }>t+1)\) we have that

Under this dynamic consistency hypothesis, we have \(c^{*}=(-b_{*t}^{i},c_{t^{\prime }}^{i}\), \(t^{\prime }>t)\in \mathcal {A}_{_{t}}\) and assuming no liquid assets so that \(\mathcal {Z}_{t}=-\mathcal {A}_{_{t}}\) we have that \((b_{*t}^{i},-c_{t^{\prime }}^{i},t^{\prime }>t)\in \mathcal {Z}_{t}\). The dynamic consistency then yields that

It follows that

Coupled with Eq. (8) we conclude that

Equation (9) expresses the bid prices of an arbitrage free two price financial economy as a nonlinearly discounted nonlinear martingale. At each time step the price is a suitably selected discounted conditional expectation of its value at the next time point. Note that both the discount factor and the measure change depend in principle via the infimum operation on the cash flow being priced, and hence the dual nonlinearity.

From the relationship between bid and ask prices one may write

One then infers that the ask prices of a two price financial economy are also nonlinearly discounted nonlinear martingales where the nonlinearity comes from the dual supremum operation over both discount functions and measure changes.

It is interesting to note that post the financial crisis the financial world has become accustomed to multiple discount curves and much has been written in the growing literature on Credit, Debt and Funding Valuation Adjustments (CVA, DVA and FVA) on how to work with these curves within the context of the law of one price. For two price financial economies however, both the discount rates and the associated probability measures are product and trade direction dependent and we have a multitude of discount curves and measures. Under the dynamic consistency hypothesis and Eq. (9) these product and trade direction dependent discount rates and probability measures may be constructed one time step at a time by solving at each time step for the one period discount rate and the one step ahead conditional probabilities that put the one step ahead cash flow on the boundary of the set of zero cost tradeable cash flows. Both the discount rate and the conditional probabilities are then to be inferred from the supporting and separating hyperplane.

5 Spanning and completeness for two price financial economies

In a classical one price economy the set of zero cost attainable and adapted cash flows is a subspace by virtue of being able to trade in both directions at the same price. Completeness is then defined as all cash flows lying in the linear span of the zero cost traded claims modula a constant that constitutes the price. The linear span is relevant as one may combine the zero cost cash flows by freely going long or short. For a two price economy, however, the set \(\mathcal {Z}\) of zero cost attainable claims may only be combined by taking long positions in the separate cash flows for buying or selling at different terms. One might then ask what are the set of cash flows now spanned by the zero cost claims.

Definition 5.1

An arbitrary cash flow process \(w=(w_{s})\) that is zero before \(t\) with \(w_{s}=0\) for \(s<t\) is in the span of \(\mathcal {Z}\) if there exists a constant \(a\) and \(x\in \mathcal {Z}\) with \(x_{s}=0\), for \(s<t\) satisfying

The constant \(a\) allows for an initial price at time \(t\) that may be coupled with a zero cost claim to create \(c\).

For an arbitrary cash flow \(w\) in a two price economy one may use the cones of acceptability \(\mathcal {A}_{t}\) to define the bid and ask prices for arbitrary claims.

Definition 5.2

We say that the time \(t\) bid price for the arbitrary cash flow \(w\) is the largest constant \(b\) for which the cash flow \(d\) defined by

satisfies

It follows then that for all separating hyperplanes \(\Gamma _{t}M_{t}\) and measure \(Q\) defined by \(M_{T}\) we must have that

Proposition 5.3

The bid and ask prices of arbitrary cash flow \(w\) in a two price economy are given by \(b(w),a(w)\) where

Definition 5.4

The two price economy is complete if every cash flow \(w\) is in the span of \(\mathcal {Z}\).

Proposition 5.5

A two price economy is complete if and only if every cash flow has a finite bid and ask price.

Proof

Suppose an arbitrary cash flow process \(w\), starting at \(t\), takes the form

\(\square \)

Since \(x\in \mathcal {Z}\) we have that for every separating hyperplane \(\Gamma _{t}M_{t}\) and measure \(Q\) defined by \(M_{T}\) it is the case that

As a consequence

Suppose on the other hand that we have a finite ask price and there exists a constant \(a\) such that

Now define

and observe that as \(\mathcal {Z}_{t}=-\mathcal {A}_{t}\) that \(x\in \mathcal {Z}_{t}\). It follows that \(w\) is in the span of the zero cost traded claims.

The span therefore contains cash flows with discounted expectations uniformly bounded above for all the admissible discount functions and associated measures. Market completeness is then equivalent to the upper bound for all discounted expectations being finite for all cash flows. Working with \(-w\) in place of \(w\) one obtains finite lower bounds for all cash flows as well under completeness. A two price economy is then complete if all cash flows have finite bid and ask prices. The gap between them may be large but there is a finite market price for buying from or selling to the market. Market completeness in a one price economy is a strong proposition delivering unique pricing of all cash flows. For a two price economy it merely requires the bid and ask prices to be finite.

6 A valuation model with rate risk interactions

We move in this section from an analysis of the abstract structure for the pricing operators for arbitrage free two price economies towards the explicit modeling of such nonlinear pricing operators. In this regard we follow literature that has already exhibited such operators when discount curves or time value accounting may be conducted under the law of one price. Our contribution here is to extend these operators to simultaneously modeling nonlinearity with respect to time value accounting along with nonlinear martingale constructions with a particular focus on the interactions possibly present between them.

The literature has recently introduced nonlinear dynamic valuation operators that are conservative valuation methodologies connected to the theory of coherent risk measures. From a static perspective one may cite Carr et al. (2001), Föllmer and Schied (2004), Staum (2004), Barrieu and El Karoui (2005) and Cherny and Madan (2010). Dynamic generalizations for a discrete time context may be found in Cheridito et al. (2006), Jobert and Rogers (2008), Detlefsen and Scandolo (2005), Föllmer and Penner (2006), and Madan and Schoutens (2012). Continuous time formulations may be found in Bion-Nadal (2008, 2009a) and Eberlein et al. (2014a, b). In the special case when the set of risks acceptable to the market at any point of time are closed under the scaling of positions by a positive multiple they form a cone and we refer to the resulting economy as a conic one. We restrict attention in this paper to such conic economies.

The nonlinearity in these studies was restricted to measure changes with discounting accomplished at rates obtained from an underlying law of one price for loans. The above analysis of no arbitrage in two price economies makes it clear that the nonlinearity involved is dual and operates over both discount functions and measure changes. The objective of this section is to build explicit models for the valuation of financial claims in two price economies that exhibits interactions between choices for discount functions and measure changes.

6.1 Review of nonlinear martingale constructions in the absence of interactions

We begin by briefly reviewing the construction with nonlinearity restricted to measure changes. Once the discount function is fixed the dynamically time consistent bid price \(b^{w}=(b_{s}^{w},0\le s\le T)\) for \(w=(w_{s},0\le s\le T)\) may be written locally at a single time step as

and the construction is completed on specifying the one step ahead conditional probability laws over which one has to take the infimum. Financial risk acceptability is equivalently modeled by requiring

Two hypotheses lead to an explicit construction for the one step ahead bid price. The first hypothesis is that of additivity for comonotone risks. In general via the infimum operator and the resulting concavity the bid price for the sum of two risks \(X,Y\) is above the sum of component bid prices. When the two risks have no negative comovements, they are said to be comonotone, and we ask for the additivity in this case or that \(b(X+Y)=b(X)+b(Y)\) for \(X,Y\) comonotone. The second hypothesis is that of law invariance whereby the bid price of a risk is just a function of the probability law of the risk and independent of how the random variable is defined. Kusuoka (2001) studied the restriction of defining acceptability under these two hypotheses. In the current context the relevant distribution function would be the distribution function for \(w_{t+1}+b_{t+1}^{w}\) conditional on \(\mathcal {F}_{t}\) that we denote by \(F_{t}^{w}(x)\). Kusuoka (2001) showed that the bid price must then be of the form

for some concave distribution \(\Psi \) on the unit interval. The computation in Eq. (10) is referred to as a distorted expectation or an expectation under a concave distortion. Expectation under a concave distortion (10) can also be seen as an expectation under a change of measure whereby

where \(f_{t}^{w}(x)=F_{t}^{w\prime }(x)\) is the original probability density, and the measure change is then seen to be \(\Psi ^{\prime }(F_{t}^{w}(x))\) and is based on the risk quantile.

The set of probability measures \(\mathcal {M}\) defining such local acceptability are shown in Madan et al. (2013) to consist of all measures \(Q\) equivalent to the base probability \(P\) that satisfy

Cherny and Madan (2009) introduced a sequence of concave distortions \(\Psi ^{\gamma }\) for \(\gamma \ge 0\) that are pointwise increasing in \(\gamma \), thereby requiring approval by a larger and larger set of measures to gain acceptability with respect to \(\Psi ^{\gamma }\). The parameter \(\gamma \) may be viewed as an index of acceptability. The desire to reweight losses upwards to infinity and gains down to zero led to the choice of the functional form termed \(minmaxvar\) in Cherny and Madan (2009),

The nonlinear martingales constructed in Madan and Schoutens (2012), for example, employed a fixed choice of \(\gamma \) and the recursion of Eq. (10).

6.2 Introducing rate measure change interactions

We now wish to incorporate in our modeling choices, an interaction between discount rate choices and measure changes in modeling risk acceptability. Consider momentarily first a one period two date case. The two dates are \(0,1\) and time one states are indexed by \(s\). We have acceptability just if

Consider the acceptability to the market of market paying \(b\) and receiving at time \(1\) the random cash flow \(X_{1}=(X_{1s})\). This acceptability now requires that

It follows that we must have

and this is a discounted expectation under a measure change. We may keep in line with the prior literature we seek to generalize, by introducing in it some rate measure change interactions, and choose to continue to model the measure change by a suitably selected and parametric distorted expectation

On the interpretation of the ratio

We have acceptability at stress level \(\gamma \) provided

For a zero stress level the discount factor merely adjusts for time value between the two periods. In fact at a zero stress level, if the base probability is the real world physical probability then the discount rate should be a risk adjusted rate possibly close to the mean rate of return. Once we raise \(\gamma \), thereby introducing a substantial risk adjustment we anticipate that \(h(\gamma )\) will fall and we may demand acceptability at the larger values of \(\gamma \) provided we lower the discount rate closer to a risk free rate by accommodating a rebate say of \((1+\rho (\gamma ))\) for \(0\le \gamma \le \overline{\gamma }\). More specifically, letting \(\delta \) be the zero stress rate, we define acceptability if at all stress levels in the range \(0\le \gamma \le \overline{\gamma }\)

We anticipate that \(\rho (\gamma )\) is near zero for low values of \(\gamma \) but then rises to accommodate rebates for high stress levels. The best bid price is then given by

One may interpret \(\delta (\gamma )\) defined by

as a stress dependent discount rate. There is then an interaction possible between the severity of the measure change and the discount rate employed by letting the latter explicitly depend on the former. Specifically the discount rate is reduced for higher stress levels to accommodate for an expected decline in \(h(\gamma )\).

More generally let \(\rho _{t}(\gamma )\) be the \(\mathcal {F}_{t}\) measurable premium rate to be applied at time \(t\) for the distortion level \(\gamma \). The bid price at time \(t\) for a cash flow \(w\) is then given by

Given a risk \(X\), tradeability requires that the sale price \(b\) satisfy

or that

By virtue of the infimum and the concavity of \(h_{t}^{X}(\gamma )\) for fixed \(\gamma \) in \(X\), the inequality (14) is a scaling of the level set of a convex function.

Since the acceptability cone is the negative of the tradeability cone acceptability requires

One step ahead acceptability then requires that the distorted expectation at all levels \(\gamma \) below \(\overline{\gamma }\), adjusted for rebate at these levels dominate the one step ahead futures price \(b(1+\delta )\). This is just a restatement of (12).

It follows from the result of He and Xu (2013) referenced earlier that there is an associated unique discount function and measure change. In fact we have

where

The risky discount rate is \(\delta _{t}(\gamma ^{*})\) defined analogously with Eq. (13) and the measure change is

with respect to \(f_{t}(x)\).

6.3 Remark on ask prices of cash flows with a positive bid price

We show in this subsection that cash flows with a positive bid price have ask prices that are computed at the highest distortion and discounted at the lowest rate. Hence for such cash flows that include corporate bonds, it is the case that liability valuation at ask should be evaluated at maximum stress and discounted least. Both operations lead towards a maximum liability value assessment. Such valuation procedures are consistent with the principles set out in Heckman (2004) where it is argued that liabilities should be valued as if they would be paid. Here we deduce this property as a consequence of our bid pricing principles, for all true or nonnegative liabilities. Thus the current practice of Debt Valuation Adjustments (DVA) that allow entities to credit themselves with an assessment of their inability to meet their liabilities is thus called into question.

This feature is a consequence of negative values for \(h(\gamma )\) at single relevant \(\gamma \). The bid price minimizes over \(\gamma \) the expression

Now

and if \(h(\gamma )<0\) then as \(h^{\prime }\le 0\) and \(\rho ^{\prime }\ge 0\) we have \(v^{\prime }\le 0\) and \(\gamma \) must be raised to the point it reaches \(\overline{\gamma }\) the maximal stress with the minimal discount of \(\delta (\overline{\gamma })\).

For a cash flow \(X\) with a positive bid price \(h_{X}(\gamma )>0\) and as the ask price is the negative of the bid price of \(-X\), the distorted expectation for \(-X\) at level \(\gamma \), \(h_{-X}(\gamma )\) must be negative as

6.4 Bid pricing for cash flows distributed as geometric brownian motion

We present in this subsection a stylized construction of bid prices for cash flows distributed as unit mean log normal variates with different volatilities. The functions employed to define bid and ask prices and their parameters are modeling choices that can be varied and finally estimated from market data. One such exercise of calibration to data is conducted in Madan (2014).

The bid price is given by

The distribution function is that of a lognormal variate and the distortion employed will be \(minmaxvar\) as introduced earlier. It remains to specify the rebate function. The rebate function \(\rho (\gamma )\) is increasing in \( \gamma \), starts at zero and finishes at say \(\theta \delta \) for \(\theta \) somewhat below unity for \(\gamma =\overline{\gamma }\). One could write

for \(H\) a distribution function on the unit interval. We could use a beta cumulative distribution function where

In order to have \(\rho \) near zero for small \(\gamma \) we want \(A>1\). At maximum stress the rebate should speed up towards its maximum and this suggests \(B<1\). We consider \(B=1/A\). We explore the structure for valuing geometric Brownian motion at different levels of volatility ranging in steps of \(2\,\%\) from 10 to \(80\,\%\), with \(\theta =.9\), \(\delta =.05\), \(\overline{\gamma }=.75\) and \(A=2,1.5\).

We present four graphs in Figs. 1, 2, 3 and 4 for the trade-off between discount rates and stress levels, the graph of the bid price against the volatility, the graph of the discount rate against volatility and the graph of the stress level against volatility for the two different values for the parameter \(A\) that controls the speed of the rebate response to the stress level. The higher volatilities receive higher stress levels, greater rebates and thus lower discount rates, and lower valuations.

6.5 The rebate function calibrated to market data

One may observe from Fig. 2 for example that the bid price falls quite rapidly with volatility for the stylized parameter settings adopted in this graph. This could lead to spreads of ask relative to bid that are an order of magnitude higher than those observed in markets and one may wish to seek rebate functions that are closer to spreads observed in markets. With this in mind we constructed first a study of spreads in markets and in particular their relationship to the underlying volatilities. For this purpose we took data on the daily ask high and the daily bid low on the top \(105\) stocks of the \( S \& P\) \(500\) index and related the ratio of this ask to bid to the underlying volatility. For each stock and each date between April 3, 2007 and December 31, 2012 we computed the stock volatility in annualized terms from data on returns for the prior quarter or \(63\) days. We then regressed the spread on each day on the the prior quarterly volatility and its square. The data was restricted to prior quarter volatilities below \(80\,\%\). The total number of stockdays in the regression or the sample size was \(136,301\). The result of this regression was

The \(R^{2}\) was \(38.86\,\%\) and the \(t-statistics\) were \(88.50\) for volatility and \(-19.2\) for its square. This suggests a positive and concave relationship between spreads and volatility peaking at a spread of \(1.06\) for an \(80\,\%\) volatility.

We then sought parameteric specifications for the rebate function that would generate comparable spreads for geometric Brownian motion with volatilities in this range. We reduced the maximum stress from \(.75\) to \(.15\) to get the model spread shown in Fig. 5. The model spreads are for a holding period of a year. The holding periods for the market spreads are not clear but are probably considerably less than a year.

6.6 Bid and ask pricing of a simple loan

Consider first a simple loan that pays unity at year end with probability \((1-p)\) and defaults with a recovery rate of \(\eta =0.4\) otherwise. Let \(p\) range from \(1\) to \(500\) basis points and let us price the loan with the acceptability settings at \(\delta =0.03\), \(\overline{\gamma }=0.15\), \(\theta =0.9\) and \(A=1.5\). Figure 6 presents a graph of the bid and ask prices as a function of the default probability. We observe that the ask price is not very sensitive to the default probability and this reconfirms the remarks made in Eberlein et al. (2012) with clear implications for \(DVA\) computations.

The interaction between discount rates and stress levels applies to bid prices and Fig. 7 presents a graph of how the discount rate varied with the stress level at which the infimum was attained. The higher default probabilities attain their infimum at higher stress levels with lower bid prices and discount rates reflecting the rebates.

6.7 A dynamic example illustrating rate and stress level interactions

This subsection illustrates the interaction between the stress in the measure change and the discount rate across the space and time dimensions. The dependence on time will occur in line with the time inhomogeneity induced by nonstationarities embedded in financial products by variations in the time to maturity of finite maturity contracts. For space inhomogeneity we consider a spatially inhomogeneous process for the underlying asset price with volatility, skewness and excess kurtosis depending on the level of the spot price. We model the logarithm of the stock price as variance gamma distributed with parameters specified as functionally dependent on the level of the stock price. The current stock price is set at \(100\) and the parameters \(\sigma ,\nu ,\theta \) of the variance gamma model are \(0.2\), \(1\), and \(-0.3\) respectively when the spot price of the stock is at \(100\). When the stock price drops to \(67\) we model an increase in volatility to \(0.5\) with an increase in skewness to \(-0.5\) and an increase in excess kurtosis to \(2\). Similarly when the spot price rises to \(150\) the parameter \(\sigma \) drops to \(0.1\) while skewness falls to \(-0.1\) and excess kurtosis drops to \(0.5\). Between \(67\) and \(150\) the parameters are interpolated from these values using a cubic interpolation and outside this range they are extrapolated using nearest neighbor. We simulate the stock price in discrete time at monthly time points as a positive martingale with this specification for the intermonthly distribution.

For this underlying discrete time stock price motion we consider the pricing of locally floored and capped cliquets written on the monthly return. Let \(x_{t}\) denote the monthly gross return at the end of month \(t\) then the one year locally floored and capped cliquet with floor \(f\) and cap \(c\) has the payoff at year end of

We consider three cliquets with the settings \(f=-.1,c=.1\); \(f=-.1,c=\infty \); \(f=-\infty ,c=.1\). For each of these three products we define bid and ask price matrices of dimension \(101\times 12\) where each column contains the appropriate price, bid or ask, for the remaining cash flows not yet resolved, at month end \(t\) conditional on the stock price being at level \(S_{i}=50+100i\), for \(i=0,1,\ldots ,100\). Given that the ask price is the negative of the bid price for the negative cash flow, we define just the recursion just for bid prices.

Given bid prices at time \(t+1\) as specified by column \(t+1\) of the bid price matrix we construct the bid price at time \(t\) in row \(i\) as follows. We simulate \(M=10000\) readings for the stock price \(S_{j}\), \(j=1,\ldots ,M\) at time \(t+1\) from the appropriate variance gamma distribution and define the gross return as \(x_{j}=S_{j}/S_{i}\). The bid price \(b_{j}\) at time \(t+1\) is obtained by interpolation from column \(t+1\) of the bid price matrix using nearest neighbor extrapolation. The remaining unresolved cash flow value is given by

These cash flows are sorted in increasing order as \(z_{(j)}\) and the bid price at time \(i\) column \(t\) is defined by

The stress level \(\gamma ^{*}\) attaining the infimum is saved in row \(i\) and column \(t\) of an associated stress level matrix \(G_{it}\) and the associated discount rate defined by \(\delta -\rho (\gamma ^{*})\) is stored in row \(i\) and column \(t\) of an associated discount rate matrix \(D_{it}\). The bid and ask price computations produce price matrices \(B_{it}\), \(A_{it}\) for the remaining unresolved cash flows along with associated stress level and discount rate matrices \(G_{it}^{b}\), \(G_{it}^{a}\) and \(D_{it}^{b},D_{it.}^{a}\) We set \(\overline{\gamma }=.15\), \(\delta =0.085\), and the rebate parameters were \(\theta =0.9\) and \(A=1.5\)

We wish to present the space time dependence of stress levels and discount rates embedded in the bid and ask prices. As we are valuing nonnegative cash flows by construction the bid prices are positive and hence as already observed, the ask prices are associated maximum stress and minimal discount rates. We therefore need only present the space time dependence embedded in bid prices. We label the three contracts as \(FC\), \(F\), and \(C\) for, respectively, the floored and capped cliquet, just the floored cliquet, and just the capped cliquet. For each of these products we regress the bid price \(B_{it}\), the associated stress level \(G_{it}\), and the discount rate \(D_{it}\) on a constant, the level of the stock price relative \(S_{i}/S_{0}\), the calendar time \(t\) and the three second order terms. There are then \(6\) coefficients for each of three regressions for each product. The results of these regressions are presented in three Tables (1, 2, 3), one for each product, with three regressions per table.

We observe that the products have stress levels and discount rates significantly sensitive to the time of valuation and the level of the spot. The bid price itself clearly depends on the space variable and the valuation time. In general we anticipate that the bid prices at arbitrary points in space time employ a variety of measure changes with discount rates that are related to the embedded stress level. We present in Fig. 8 the range of stress levels and discount rates encountered in the valuation of the product \(C\) across the space and time dimensions. The stress levels rise and the discount rates fall as we approach maturity and the number of unresolved cash flows diminishes. This trade-off will vary over space and time if the cone of acceptability has parameters varying stochastically with time and space itself. Here it was assumed to be stationary.

7 Asset pricing theory for two price financial economies

We now suppose the existence of a true probability measure \(P\) under which one wishes to explain the expected or mean rates of return of market prices. For two price economies the only observed prices are the bid or lower price and the ask or upper price, there being no two way price for any financial products, claims or loans. Further suppose that the set of measures \(Q\) associated with separating planes are absolutely continuous with respect to \(P\) and there is a valid density or change of probability \(\Lambda _{t}\). One may then write the bid price as

In the absence of intermediate cash flows and using a more conventional notation one may also write

Defining the return on bid prices as

with

On making elementary transformations to Eq. (15) at a choice of \((r_{t}^{b},\Lambda _{t+1}^{b})\) attaining the infimum we may write in terms of the covariance operator \(cov_{t}\) that

and equivalently for the ask price at the choice \((r_{t}^{a},\Lambda _{t+1}^{a})\) attaining the supremum we have

where

If we further suppose that loans are priced in a one price market at the rate \(r_{t}\) then we may write

The Eqs. (16, 17) and (18, 19) are the asset pricing equations for two price economies depending respectively on whether loans are priced in a two price or one price market. The resulting asset pricing theory is a nonlinear pricing theory as discount rates and pricing kernels are not independent of the asset being priced.

An implication of the joint hypothesis of no arbitrage in two price economies, dynamically consistent markets, loans being priced in a one price market and the hypothesis that acceptability requires a positive expected return or \(P\in \mathcal {M}\) is the following. For \(P\in \mathcal {M}\) the identity function \(\Lambda \in \mathcal {M}\) and as a consequence the infimum on the right of (18) is nonpositive. Similar the supremum on the right of (19) is nonnegative. It follows that

and in particular that ask price drifts are dominated by bid price drifts. This implication is a broad consequence of general structure and follows before we model the set \(\mathcal {M}\) of test measures defining risk acceptability. It is however a consequence of supposing the \(P\in \mathcal {M}\). Such a hypothesis is of interest in its own right and addresses the issue of whether a cash flow with a negative mean would be market acceptable. If the market is viewed as an abstract counterparty with no hedging needs of its own then one should expect that cash flows with negative means would not be acceptable.

8 Testing the hypothesis that ask drifts are dominated by bid drifts

For a first test of the hypothesis that mean ask returns are dominated by mean bid returns we took data on the top \(105\) stocks of the \( S \& P\) \(500\) index and proxied the ask by the daily ask high and the bid by the daily bid low from January 3, 2007 to December 31, 2012. We had a total of \(147663\) stock days for which we computed the return on the ask and the return on the bid. We then formed \(147663\) excess returns for the bid return less the ask return. A \(t\)-test based on the mean and standard deviation of these returns gave a t-statistic of \(2.7238\).

The skewness of the excess return was \(-0.04\) while the kurtosis was \(4.91\). These observations suggest a nonnormal distribution and so we also implemented a maximum likelihood estimation of the variance gamma \((VG)\) model for these \(147663\) excess returns. The parameters are \(\mu .\sigma ,\nu ,\theta \) where the variance gamma density is based on a gamma density for the gamma distributed variable \(G\) with mean unity and variance \(\nu \) and a standard normal variate \(Z\). The variance gamma variable \(X\) is constructed (Madan and Seneta 1990; Madan et al. 1998) as

The parameter \(\sigma \) captures the base volatility. The kurtosis is captured by the variance \(\nu \) of \(G\) and skewness is reflected in \(\theta \). Table 4 presents the parameter estimates and t-statistics. The parameters \(\mu ,\sigma \) and \(\theta \) are annualized percentages.

Both tests support the hypothesis that \(P\in \mathcal {M}\). Figure 9 presents in addition a graph of the observed log frequency and the fitted variance gamma predicted probability.

9 Factor models for two price economies

For modeling returns on bid and ask prices, proxied for example by the daily bid low and ask high respectively, we may begin with Eq. (15). In general one may expect interactions between the set of probability measure and rate pairs that belong to \(\mathcal {M}\). Empirical studies of Chordia et al. (2002), and Chen et al. (2013) suggest the possibility that the set of measures implicit in market spreads and thereby the market spreads themselves may interact with rates or the factors driving rates. If higher rates are associated with higher spreads then the set of measures associated with a rate level may depend on the rate level. Abstracting from such interactions and allowing for two prices in the market for loans we have at any time two rates, one for lending to the market \(r_{L}<r_{B}\) the rate for borrowing from the market. In the absence of interactions we may assume that ask prices are discounted at \(r_{L}\) with a view to attaining the supremum while bid prices are discounted at \(r_{B}\). This leads to the bid and ask price equations

As a consequence we obtain

Recognizing that the factor models of interest are those driving \((1-\Lambda )\) or more exactly correlations with \((1/\Lambda )\) we may rewrite as

For different candidate choices of factors for the martingale difference \(1-\Lambda \) as driven by factors \(F^{(k)}\) for the \(k^{th}\) candidate \(\Lambda _{k}\in \mathcal {M}\) let

where \(F^{(k)}\) are a set of zero mean drivers of \(1-\Lambda \) and \(\lambda ^{(k)}\) is the associated set of market prices for factor risk. We then obtain the two price economy asset pricing inequalities

where

Asset pricing theory for two price economies leads to asset pricing inequalities. Econometric methodologies for testing inequalities are what is called for in the development of asset pricing tests for two price economies.

10 Conclusion

When the law of one price prevails, absence of arbitrage is equivalent to the martingale property for discounted prices under a change of measure. We show here that the absence of arbitrage in two price economies is related to both prices being nonlinearly discounted nonlinear martingales. The nonlinearly discounted nonlinear martingales are constructed as infima or suprema of valuations with respect to probability measures and discount rates embedded in the set of hyperplanes separating the convex set of zero cost attainable claims from the set of nonnegative non zero adapted cash flows. Acceptable risks are defined as those having a positive discounted expectation under all discount curves and measures embedded in the separating hyperplanes.

Relying on the uniqueness of supporting hyperplanes for convex sets defined by the level sets of a convex function one may obtain unique discounting functions and measure changes for pricing each specific product traded in a specific direction. There are then a multiplicity of discount functions and measure changes that vary with the product and trade direction but only one when the product and its trade direction is fixed. A specific valuation model giving favorable discounting treatment to cash flows that are resilient to stress is formulated and applied to the valuation of particular products.

It is shown that for economies with the law of one price for pure discount bonds and in which risk acceptability requires a positive expectation under the physical measure the expected rate of return on ask prices should be dominated by the expected rate of return on bid prices. A preliminary investigation proxying the ask by the daily ask high and the bid by the daily bid low supports this hypothesis. Asset pricing theory for two price economies is shown to lead to asset pricing inequalities.

References

Ametrano, F.M., Bianchetti, M.: Bootstrapping the illiquidity multiple curve construction for coherent forward rate estimation. In: Mercurio, F. (ed.) Modelling Interest Rates Latest Advances for Derivatives Pricing. Risk Books, London (2009)

Back, K.: Asset pricing for general processes. J Math Econ 20, 371–395 (1991)

Barrieu, P., El Karoui, N.: Inf convolution of risk measures and optimal risk transfer. Financ Stoch 9, 269–298 (2005)

Bianchetti, M., Carlichhi, M.: Interset rates after the credit crunch: multiple-curve vanilla derivatives and SABR. arXiv.org/pdf/1103.2567 (2012)

Bion-Nadal, J.: Dynamic risk measures: time consistency and risk measures from BMO martingales. Financ Stoch 12, 219–244 (2008)

Bion-Nadal, J.: Time consistent dynamic risk processes. Stoch Process Appl 119, 633–654 (2009a)

Bion-Nadal, J.: Bid-ask dynamic pricing in financial markets with transactions costs and liquidity risk. J Math Econ 45, 738–750 (2009b)

Carr, P., Geman, H., Madan, D.: Pricing and hedging in incomplete markets. J Financ Econ 62, 131–167 (2001)

Chen, R., Cheng, X., Wu, L.: Dynamic interactions between interest rate and credit risk: theory and evidence on the credit default term structure. Rev Financ 17, 401–441 (2013)

Cheridito, P., Delbaen, F., Kupper, M.: Dynamic monetary risk measures for bounded discrete time processes. Electron J Prob 11, 57–106 (2006)

Cherny, A., Madan, D.B.: New measures for performance evaluation. Rev Financ Stud 22, 2571–2606 (2009)

Cherny, A., Madan, D.B.: Markets as a counterparty: an introduction to conic finance. Int J Theor Appl Financ 13, 1149–1177 (2010)

Chordia, T., Roll, R., Subrahmanyam, A.: Market liquidity and trading activity. J Financ 56, 501–530 (2002)

Cohen, S., Elliott, R.J.: A general theory of finite state backward stochastic difference equations. Stoch Process Appl 120, 442–466 (2010)

Delbaen, F., Schachermayer, W.: A general version of the fundamental theorem of asset pricing. Math Ann 300, 463–520 (1994)

Delbaen, F., Schachermayer, W.: The Mathematics of Arbitrage. Springer Finance, Berlin (2000)

Detlefsen, K., Scandolo, G.: Conditional and dynamic convex risk measures. Financ Stoch 9, 539–561 (2005)

El Karoui, N., Peng, S., Quenez, M.C.: Backward Stochastic differential equations in finance. Math Financ 7, 1–71 (1997)

Eberlein, E., Gehrig, T., Madan, D.B.: Pricing to acceptability: with applications to the pricing of one’s own credit risk. J Risk 15, 91–120 (2012)

Eberlein, E., Madan, D.B., Pistorius, M., Schoutens, W., Yor, M.: Two price economies in continuous time. Ann Financ 10, 71–100 (2014a)

Eberlein, E., Madan, D.B., Pistorius, M., Yor, M.: Bid and ask prices as non-linear continuous time G-expectations based on distortions. Math Financ Econ 8, 265–289 (2014b)

Föllmer, H., Penner, I.: Convex risk measures and the dynamics of penalty functions. Stat Decis 24, 61–96 (2006)

Föllmer, H., Schied, A.: Stochastic Finance: An Introduction in Discrete Time. Second Edition, de Gruyter studies in Mathematics, 27 (2004)

Guasoni, P., Lepinette, E., Rasonyi, M.: The fundamental theorem of asset pricing under transactions costs. Financ Stoch 16, 741–777 (2012)

Harrison, J., Kreps, D.: Martingales and arbitrage in multiperiod securities markets. J EconTheory 20, 381–408 (1979)

Harrison, J.M., Pliska, S.R.: Martingales and stochastic integrals in the theory of continuous trading. Stoch Process Appl 11, 215–260 (1981)

Harrison, J.M., Pliska, S.R.: A stochastic calculus model of continuous trading: complete markets. Stoch Process Appl 15, 313–316 (1983)

He, S., Xu, H.-K.: Uniqueness of supporting hyperplanes and an alternative to solutions of variational inequalities. J Glob Optim 57, 1375–1384 (2013)

Heckman, P.: Credit standing and the fair value of liabilities: a critique. N Am Actuar J 8, 70–85 (2004)

Jobert, A., Rogers, L.C.G.: Valuations and dynamic convex risk measures. Math Financ 18, 1–22 (2008)

Jouini, E., Kallal, H.: Martingale and arbitrage in securities markets with transaction cost. J Econ Theory 66, 178–197 (1995)

Kreps, D.M.: Arbitrage and equilibrium in economies with infinitely many commodities. J Math Econ 8, 15–35 (1981)

Kusuoka, S.: On law invariant coherent risk measures. Adv Math Econ 3, 83–95 (2001)

Madan, D.B.: A two price theory of financial equilibrium with risk management implications. Ann Financ 8, 489–505 (2012)

Madan, D.B.: Modeling and monitoring risk acceptability in markets: the case of the credit default swap market. J Bank Financ 47, 63–73 (2014)

Madan, D.B., Schoutens, W.: Tenor specific pricing. Int J Theor Appl Financ 15, 6 (2012). doi:10.1142/S0219024912500434

Madan, D., Seneta, E.: The variance gamma (V.G.) model for share market returns. J Bus 63, 511–524 (1990)

Madan, D., Carr, P., Chang, E.: The variance gamma process and option pricing. Eur Financ Rev 2, 79–105 (1998)

Madan, D.B., Pistorius, M., Stadje, M.: On consistent valuation based on distortions: from multinomial random walks to Lévy processes. arxiv:1301.3531 [math.PR] (2013)

Mercurio, F.: Modern LIBOR market models: using different curves for projecting rates and for discounting. Int J Theor Appl Financ 13, 113–137 (2010)

Pallavicini, A., Tarenghi, M.: Interest-Rate Modeling with Multiple Yield Curves. arXiv:1006.4767v1 [q-fin.PR] (2010)

Peng, S.: Dynamically Consistent Nonlinear Evaluations and Expectations. Preprint No. 2004–1, Institute of Mathematics, Shandong University. arXiv:math/0501415v1 [math.PR] (2004)

Peng, S.: G-Expectation, G-Brownian Motion and Related Stochastic Calculus of Itô Type. arXiv:math/0601035v2 [math.PR] (2006)

Peng, S.: Nonlinear Expectations and Stochastic Calculus under Uncertainty. arXiv:1002.4546 [math.PR] (2010)

Rokhlin, D.B.: The Kreps-Yan theorem for \(L^{\infty }\). Int J Math Math Sci 17, 2749–2756 (2005)

Staum, J.: Fundamental theorems for asset pricing for good deal bounds. Math Financ 14, 141–161 (2004)

Yan, J.A.: Caractérisation d’une classe d’ensembles convexes de \(L^{1}\) ou \(H^{1}\). Seminar on Probability XIV, Lecture Notes in Mathematics 784, pp. 220–222. Springer, Berlin (1980)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Madan, D.B. Asset pricing theory for two price economies. Ann Finance 11, 1–35 (2015). https://doi.org/10.1007/s10436-014-0255-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10436-014-0255-8