Abstract

Understanding the dynamics of import prices is an important but challenging issue that affects our assessment of welfare. We propose an exact import price index by extending the analysis of Broda and Weinstein (Q J Econ 121(2):541–585, 2006), who include growth in product variety in their calculations of import prices. While still relying on Armington’s (Int Monet Fund Staff Pap 16(1):159–178, 1969) definition of variety, we relax two assumptions, allowing the set of products and unobserved taste and quality parameter to vary. Our modified import price index shows that gains from variety in European G7 countries, although positive, are small compared with gains from taste and quality. Using food and tobacco products as a benchmark with unchanged taste and quality, we find significant gains from shifts in consumer preferences and improving quality for Germany, France, Italy and the UK between 1995 and 2012. By comparing results based on different benchmark groups we further flag the importance of consumer taste in international trade.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Developments of import prices are important in many respects for open economies. In the presence of imports in the consumption bundle, the average price of imported goods affects consumer price index and consumer welfare. The measurement of import price developments is not straightforward, however. Differences in quality and tastes influence unit values of internationally traded goods. For that reason statistical offices mostly rely on price surveys of importers, treating the issue of changing quality by the overlap method (see Eurostat 2011). Although this is a clear improvement over the simple aggregation of changes in unit values, many problems still remain. Indeed, if consumer welfare is the subject of the analysis, one cannot ignore quality, tastes and variety issues. Reported import prices, even when partially adjusted for quality, measure changes in the price for one unit of a product, while the welfare analysis requires price per unit of unobserved utility.

The literature on the role of variety, quality and taste in international trade is numerous and expanding. As to variety, monopolistic competition models, like the one developed by Krugman (1979, 1980), put emphasis on the role of extensive margin, maintaining that greater variety of products can boost trade. The seminal paper of Feenstra (1994) shows how to incorporate new product varieties into a constant elasticity of substitution (CES) aggregate of import prices. His approach also allows for taste and quality change in existing varieties by treating it as a specific case of variety changes. The most famous empirical application of Feenstra’s (1994) approach was performed by Broda and Weinstein (2006), who include a proxy for unobservable growth in product variety in their calculations of import price index and evaluate gains from variety in the US. According to their results, ignoring changes in variety accounted for a significant upward bias in the estimates of US import prices. The welfare gains of US consumers from a broader range of variety accounted for about 0.1 % of GDP every year. However, these calculations are based on the rather restrictive assumption that consumer tastes and product quality are constant over time for all import varieties existing in both periods. Vertical product differentiation, emphasized by Flam and Helpman (1987), is to a large extent ignored in the exact import price index of Broda and Weinstein (2006). In view of rapid technological change in many sectors and possible shifts in consumer preferences this assumption may become increasingly problematic.

While Feenstra’s (1994) framework allows for taste and quality change in existing varieties, it requires to make a prior distinction between varieties with constant and altered quality. Many attempts were recently made to evaluate quality from unit value data. Hallak and Schott (2011) decompose export prices into quality versus quality-adjusted components using information on the trade balance, Khandelwal (2010) and Amiti and Khandelwal (2013) exploit price and quantity information to estimate the quality of products, Di Comite et al. (2012) use unique firm-product-country data to capture quality of products and consumer tastes. The paper by Feenstra and Romalis (2012) considers supply and demand side, which allows for the construction of quality-adjusted price indices of exports and imports. Alternatively, quality and quality-adjusted prices can be derived from data on imported product physical characteristics, like in Sheu (2011).

We contribute to the existing literature on adjusted trade prices by suggesting an alternative derivation of exact import price index. We use the framework of Broda and Weinstein (2006) and relax the assumption of unchanged taste and quality parameter for all varieties existing in both periods. We show that it is in fact possible to evaluate the unobservable taste and quality parameter within the same theoretical framework using less restrictive assumptions. After solving the optimisation problem, changes in relative taste and quality could be defined as a function of observable unit values and volumes of imports as well as unobservable elasticities of substitution between varieties and between products. Thus, we follow Hummels and Klenow (2005) and Khandelwal (2010) in spirit.

The methodology we propose has its advantages and limitations. A major advantage is the relaxation of the assumption of unchanged tastes and quality for all varieties existing in both periods, which allows us to assess the impact of changes in tastes and quality on import prices and consumer welfare. Our methodology only requires to define a benchmark product category with no major shifts in consumer preferences and physical quality over time. Comparing with Feenstra’s (1994) framework that requires unchanged quality and taste for all varieties in benchmark set, our approach is more flexible. We can allow for unchanged average taste and quality for a broad benchmark product category (e.g. food products), while taste and quality of individual varieties within benchmark category can vary. A similar price index is proposed by Sheu (2011), however her method uses characteristics for a specific product derived from micro-data, and does not allow for evaluations of price and welfare effects on the macro level. Moreover, data on product characteristics contain information on physical quality but not on taste. Our approach takes into account both, taste and quality.

One drawback of our methodology stems from traditional Armington’s (1969) definition of variety we utilise here—imports are differentiated across countries of supply.Footnote 1 As a result, any change in the number of varieties within an exporting country will be classified as change in taste and quality in our framework. The potential bias is high. Mohler (2011) reports a sixfold increase in gains from variety under the assumption of no intensive margin (this measurement can serve as an upper bound for gains in variety), while the analysis by Bloningen and Soderbery (2010) reveals a 70 % increase in gains from variety when shifting to firm-level data. Unfortunately, we are not able to disentangle taste and quality from within-country variety due to lack of firm-level data. The other limitation of our method is that we are unable to separate taste from quality. Di Comite et al. (2012) argued that this task is hard to achieve in a framework based on consumers’ utility alone and looking only at prices and quantities sold. The approach of Feenstra and Romalis (2012) is an excellent example of how the inclusion of the firms’ optimization problem into this analysis allows to distinguish between quality and taste. This requires a more complicated modelling framework, which in turn stresses another advantage of our method—its comparative ease of implementation and considerably lower data requirements.

Our goal is to evaluate the exact import price index of four European countries (Germany, France, Italy and the UK)Footnote 2 taking into account changes in variety, product set, taste and quality of imports. This is done by using highly disaggregated import data (eight-digit CN classification level from Eurostat Comext database) from 50 major trading partners between 1995 and 2012. In this paper we lay out our proposed methodology, estimate an import price index which corrects for changes in variety, the set of products, as well as tastes and quality and calculate welfare gains.

The article is structured as follows. Section 2 describes the theoretical framework based on the consumer’s utility maximization problem, outlines the main assumptions behind the conventional methodology and shows the way in which we propose to relax some of these assumptions. Section 3 briefly describes the database and reports some stylized facts. Section 4 is devoted to the estimation of substitution elasticities. In Sect. 5 we discuss the choice of a benchmark product group and calculate an exact import price index and related welfare gains. It also includes an assessment of the importance of taste for import prices. Section 6 concludes.

2 Theoretical framework

In this paper we follow closely the framework used by Broda and Weinstein (2006). At first, we describe their definition of exact price index and outline the assumptions underlying their methodology to quantify the gains from variety. We then show that it is possible to relax some of these assumptions within the same theoretical framework. Thus, our approach allows for changes in taste and quality, as well as in set of imported products.

2.1 Description of Broda–Weinstein framework

The traditional way to specify how consumers value variety is the Dixit and Stiglitz (1977) framework where utility is given by CES function with a single elasticity of substitution. However, this creates several problems as, obviously, elasticities of substitution are not the same for different goods. To overcome this problem Broda and Weinstein (2006) denote the preferences of a representative agent by a three-level utility function which is specified in the form of a nested CES. First, imported varieties are aggregated into import goods. Varieties are identified as products from different origins within the same product category, which is the well-known Armington (1969) assumption. In other words, an import good corresponds to a specific product, like beer, while imported varieties are German beer, Irish beer, Belgian beer etc. At the second level of the utility function, various imported goods (beer, wine, apples, computers etc.) are aggregated into a composite import good, which represents the utility gained from all imported products. Total utility at the upper level then includes the composite import good and the composite domestic good. This upper level of the utility function is thus defined as:

where D t is the composite domestic good, M t are composite imports, and κ is the elasticity of substitution between domestic and foreign composite good. The second level of the utility function defines composite imports as

where M gt is the subutility from consumption of imported good g, γ is elasticity of substitution between different import goods, while G denotes the set of imported goods. Finally, M gt is defined by the third level of the utility function, which is represented by a non-symmetric CES function

where m gct denotes quantity of imports g from country c, C is a set of all partner countries, d gct is a taste and quality parameter for good g from country c, and σ g is elasticity of substitution among varieties of good g. The third level of the utility function is the place where variety, taste and quality are introduced into the model. For example, the utility gained from consuming imported beer could increase not only from a higher volume of beer available, but also due to access to new varieties, e.g. Czech and Belgian beer, or due to changes in taste for already existing varieties.

We should stress that parameter d gct includes both, taste and quality, thus corresponding to the definition by Hallak and Schott (2011, p. 418) reflecting “… any tangible or intangible attribute of a good that increases all consumers’ valuation of it”. Hence this parameter encompasses physical attributes of a product (e.g. size, a set of available functions, durability, etc.), which can be summarized as quality, as well as intangible attributes (e.g. product image, brand name, etc.), which can be summarized as taste. Our model, based solely on the consumers’ utility maximization problem, is limited to the demand side and cannot be used to split quality from taste. To obtain such a split one needs to model also firms’ behaviour like Feenstra and Romalis (2012), or use individual products’ characteristics like Sheu (2011). This, however, leads to a much more complicated theoretical framework or requires for data, which are often not available for broad product ranges. That is why we are limiting ourselves to the quantification of a joint taste and quality parameter in this paper without making an attempt for further decomposition. Further, we sometimes use term quality instead of taste and quality for the ease of reading.

After solving the utility maximization problem subject to the budget constraint, the minimum unit-cost function, which corresponds to the price of utility obtained from import good g, can be represented by

where \( \phi_{gt}^{M} \) denotes minimum unit-cost of import good g, \( I_{gt} \subset C \) is the subset of all varieties of goods consumed in period t, p gct is the price of imported good g from country c, and d gt is the vector of taste and quality parameters. Equation (4) shows that the minimum unit-cost of an import good depends not only on prices, as higher valuation or quality implies lower minimum unit-costs. The minimum unit-cost function of the composite import good is then given by

where \( \phi_{t}^{M} \) denotes minimum unit-cost of a composite import good, \( G_{t} \subset G \) is the subset of all imported goods in period t.

The import price index can be defined as the ratio of minimum unit-costs in the current period to minimum unit-costs in the previous period.Footnote 3 Assuming unchanged quality, constant variety and a constant set of products, the price indices for imported good g and the composite import good M are

where \( I_{g} = I_{gt} \cap I_{gt - 1} \) is the set of varieties consumed in periods t and t − 1, \( G_{t,t - 1} = G_{t} \cap G_{t - 1} \) is the set of goods consumed in periods t and t − 1, while the taste and quality parameter is constant over time (d gt = d gt−1 = d g ). Sato (1976) and Vartia (1976) proved that for the CES utility function the exact price index will be given by

where w gct and w gt are ideal log-change weights, which are computed using cost shares s gct and s gt in the two periods as follows:

and x gct is the cost-minimizing quantity of good g imported from country c. Note that x gct is the cost-minimizing value of m gct from Eq. (3).

The underlying assumption of unchanged variety in Eq. (6) was relaxed by Feenstra (1994), who modified the price index for the case when the set of varieties is different, although overlapping in the two periods. Broda and Weinstein (2006) developed it further and assumed different elasticities of substitution between varieties (see Proposition 1 in their paper). According to them, if d gct = d gct−1 for \( c \in I_{g} = (I_{gt} \cap I_{gt - 1} ) \),Footnote 4 \( I_{g} \ne {\text{\O }} \), then the exact price index for good g is given by

where \( \lambda_{gt} = \frac{{\sum\nolimits_{{c \in I_{g} }} {p_{gct} x_{gct} } }}{{\sum\nolimits_{{c \in I_{gt} }} {p_{gct} x_{gct} } }} \) and \( \lambda_{gt - 1} = \frac{{\sum\nolimits_{{c \in I_{g} }} {p_{gct - 1} x_{gct - 1} } }}{{\sum\nolimits_{{c \in I_{gt - 1} }} {p_{gct - 1} x_{gct - 1} } }}. \)

Therefore, the price index derived in Eq. (7) is multiplied by an additional term, which captures the role of new and disappearing variety. If the expenditure share of new varieties exceeds that of disappearing varieties, the additional term is below unity and lowers the exact price index in Eq. (9). Consequently, this increases consumers’ utility. The effect from increasing variety also depends on the elasticity of substitution between varieties. If varieties are close substitutes, the additional term is close to unity and changes in variety only have a marginal effect on the exact price index and on overall utility.

Although this approach allows us to evaluate the effect of changes in variety on consumers’ welfare and on import prices, several drawbacks remain. First, also the set of imported goods can change in addition to the set of varieties (or the set of countries of origin). Proposition 2 in Broda and Weinstein (2006) implies that the set of goods is the same in both periods and the price index of the composite import good is calculated by Eq. (8), although \( \pi_{g}^{M} \) is used instead of \( P_{g}^{M} \). However, the set of imported commodities is not fixed. Many products, e.g. personal computers and mobile phones, appeared relatively recently, while some others disappeared. Second, and more important, Broda and Weinstein (2006) assume that taste and quality parameter is unchanged for all varieties of all goods (d gct = d gct−1), i.e. vertical product differentiation is ignored.Footnote 5 This is obviously a rather restrictive assumption both in terms of physical quality (think about the processor speed and memory of personal computers now and 10 years ago) as well as tastes and preferences of consumers.

In this paper we extend Broda and Weinstein’s (2006) approach in both of these dimensions. We allow for changes in the set of imported products by adding an adjustment term which captures this process. More importantly, we allow for changes in taste and quality and make an attempt to estimate this unobservable parameter.

2.2 Allowing for changes in taste and quality

If we allow the taste and quality parameter d gct to vary for all varieties of all goods, the exact price index for good g is given by

where \( \Delta d_{gt} = \prod\nolimits_{{c \in I_{g} }} {(d_{gct} /d_{gct - 1} )^{{w_{gct} }} } \) and denotes the weighted change of the taste and quality parameter for good g. Equation (10) could be seen as a modified version of Eq. (9) and the additional term \( \Delta d_{gt}^{{1/1 - \sigma_{g} }} \) captures either changes in physical properties of commodities or shifts in consumer taste. This term states that a rise in quality reduces the exact price index and increases the utility of consumers. The additional term also depends on the product-specific elasticity of substitution between varieties. If σ g is high, the term \( \Delta d_{gt}^{{1/1 - \sigma_{g} }} \) goes to unity. In other words, taste and quality play an important role for imperfect substitutes.

The main difficulty with evaluating the effect from taste and quality on international trade is the fact that these variables are not reported by statistical offices. For a long time, the usual way to assess unobserved quality was to proxy them by observed unit values. Even though this proxy has a clear advantage of simplicity in calculations, it has always been argued that such a measure is unsatisfactory because export prices may vary for other reasons, e.g. different production costs. Khandelwal (2010) argued against the strong assumption that prices alone proxy for quality and suggested to use both, price and quantity information to estimate the quality of products, as higher quality is assigned to products with higher market shares. Another approach to assess quality is proposed by Sheu (2011). She uses information on individual characteristics of products as a proxy for quality. Although this can be regarded as a “first-best” solution, it requires very detailed micro data not available for all imported products. Moreover, individual characteristics of products may not reflect intangible attributes of products or consumer tastes adequately.

Here we follow Hummels and Klenow (2005) and evaluate unobserved taste and quality using the same optimization problem which we described in Eqs. (1)–(3) above. After taking first-order conditions, transforming into log-ratios and differencing we can express changes in relative taste and quality as:

where k denotes a benchmark country (variety). Equation (11) shows that changes in relative taste and quality are to a large extent reflected in relative price dynamics. If the price of a specific good imported from country c is growing faster than the price of the same good imported from country k, this is an indication either of improving quality or increasing preference for the former. Moreover, when different varieties are close substitutes, the role of relative prices increases. It has to be noted, however, that relative price is not the only indicator of relative taste and quality. The changes in relative quantity of a single variety in total consumption also attributes to the evaluation of changes in relative taste and quality. For example, the taste for Belgian beer relative to German beer can be proxied by relative prices, as well as by relative consumption measured in pints. Increasing consumption of a certain variety is a clear sign of improving taste or quality and relative quantity is getting more important when the elasticity of substitution is small.

Equation (11) is similar to Eq. (7) in Hummels and Klenow (2005), although there is an important difference. Hummels and Klenow (2005) also take into account changes in the number of varieties exported by one country (which can be interpreted as a number of firms or brands). Knowledge of the number of brands is crucial in case one wants to assess relative levels of taste and quality. Armington’s (1969) assumption is an imperfect measure of true unobserved variety. Obviously, the number of brands exported by particular country may change over time. Also Broda et al. (2006) stress that we underestimate changes in variety when new technologies are created. Mohler (2011) flags a sixfold increase in gains from variety under the assumption of no intensive margin. This measurement can serve as an upper bound evaluation for gains in variety comparing with lower bound represented by Armington’s (1969) assumption. Bloningen and Soderbery (2010) argue that the Armington’s (1969) assumption hides substantial variety changes. According to their results the additional introduction of new varieties by foreign affiliates adds gains that are around 70 % larger than those calculated only from country of origin.

Implementation of Armington’s (1969) assumption in our framework means that any change in the number of brands within exporting country will be classified as change in taste and quality in our framework. Ideally, the evaluation of variety should utilise firm- or brand-level data.Footnote 6 Unfortunately, in the absence of firm-level data, we are forced to follow Armington’s (1969) assumption, which means that we are not able to make a clear distinction between variety and quality.

Equation (11) already gives us the possibility to evaluate the unobservable taste and quality parameter (given the caveats mentioned above). All we need is the elasticity of substitution between varieties (this issue will be discussed below), and an assumption on d gkt —the taste and quality of a benchmark variety.Footnote 7 However, such an assumption would be overly restrictive. Equation (11) requires to define a benchmark for every product g, therefore we also need an indicator of relative taste and quality between different goods (e.g. between beer and apples). The latter can be assessed using first-order conditions, combining them with Eq. (4) and obtaining the relative demand function given in Eq. (12):

where j denotes a benchmark good. This equation states that changes in the ratio of sub-utilities from goods g and j negatively depend on changes in relative prices of those goods. From Eqs. (10) and (12) it follows that

where \( \mu_{g}^{M} (I_{gt} ,I_{gt - 1} ) = \prod\nolimits_{{c \in I_{g} }} {\left( {\frac{{m_{gct} }}{{m_{gct - 1} }}} \right)^{{w_{gct} }} \left( {\frac{{\lambda_{gt} }}{{\lambda_{gt - 1} }}} \right)^{{\frac{{\sigma_{g} }}{{1 - \sigma_{g} }}}} } \).

While Eq. (11) determines changes in relative taste and quality for the same good imported from different countries, Eq. (13) determines changes in relative taste and quality of different goods. Combining these two equations allows to evaluate unobservable d gct . The only assumption we need in this framework is on taste and quality of one benchmark product imported from one benchmark country. For example, we can assume that ∆d jkt = 0.Footnote 8 Note that this assumption is much less restrictive than the assumption of constant taste and quality for all varieties existing in both periods made in Broda and Weinstein (2006).

2.3 Allowing for changes in the set of imported goods

We now turn to the assumption of a constant set of imported products. The second level of the utility function in Eq. (2) states that consumers value the differentiation of products in a similar way as they value variety within a product. Therefore, changes in the set of imported commodities may have some consequences for the calculation of aggregate import prices and welfare. To take this effect into account we derive the following equation:

where \( \Lambda_{t} = \frac{{\sum\nolimits_{{g \in G_{t,t - 1} }} {\sum\nolimits_{c \in C} {p_{gct} x_{gct} } } }}{{\sum\nolimits_{{g \in G_{t} }} {\sum\nolimits_{c \in C} {p_{gct} x_{gct} } } }} \) and \( \Lambda_{t - 1} = \frac{{\sum\nolimits_{{g \in G_{t,t - 1} }} {\sum\nolimits_{c \in C} {p_{gct - 1} x_{gct - 1} } } }}{{\sum\nolimits_{{g \in G_{t - 1} }} {\sum\nolimits_{c \in C} {p_{gct - 1} x_{gct - 1} } } }} \)

It is easy to note that we simply added one term to Eq. (8). The logic behind this term is similar as in Eq. (9) for varieties: it captures changes in the set of imported and consumed products. Equation (14) states that access to a broader set of imported goods increases consumers’ utility, thus diminishing Λ gt over time and reducing the exact price index. As before, the additional term approaches unity if products are close substitutes and γ is high. In this case, consumers do not care about product differentiation and consequently changes in the set of products have almost no effect on prices and welfare.

3 Database

For the empirical analysis, we use the trade data available from Eurostat’s Comext database. The rationale behind our choice is the time of data release—annual figures in Comext database are available approximately 3 months after the end of the year. This allows to include recent data for the crisis and post-crisis years. As we need to decompose nominal trade flows into prices and volumes, the analysis has been carried out at the most detailed eight-digit level of the CN classification. The dataset contains annual data on imports of Germany, France, Italy and the UK between 1995 and 2012. To avoid calculation burden we restrict the list of trading partners to 50 different countries inside and outside EU. The list of partner countries includes all EU member states, several CIS countries (Russia, Ukraine, Belarus, Kazakhstan) and other important trade partners (US, Japan, Canada, Australia, China, India, Brazil).Footnote 9 We use unit values (euro per kg) as a proxy for prices and trade volume (kg) as a proxy for quantities.

The use of the most detailed eight-digit CN classification has one significant drawback that can affect final results—the Combined Nomenclature is regularly revised. Each year a significant amount of CN codes is subject to reclassification whereby some product codes are simply relabelled and moved between sections while others are split or merged.Footnote 10 Pierces and Schott (2009) analysed the reclassifications in the 10-digit US Harmonized System and illustrated the importance of tracking these changes when conducting empirical research, therefore we cannot ignore this issue. The most problematic cases are splits or merges of product codes. One feasible solution is to merge values and volumes of respective categories. Although this leads to a broadening of several categories and related problems in the interpretation of unit values, it helps to retain the consistency of the analysis over time.

During the period 1995–2012 we observe around 16,300 eight-digit CN product codes (this figure differs slightly for each of the four countries in our sample). Only around 5,400 of them are not subject to reclassification issues. After the implementation of the algorithm described above, we are left with around 7,600 product codes. Obviously, a fraction of these codes refers to more than one product. However, according to the Eurostat information, the total number of CN eight-digit subheadings in 2012 is 9,383, therefore only about 1,800 are not directly observable because they are merged with other products.

We make two further adjustments to our database. First, we ignore and remove incomplete observations from the database where either values or volumes are missing and therefore it is not possible to calculate the unit value indices. The second adjustment is related to structural changes within product categories. Although we use the most detailed classification available, there remains a great deal of heterogeneity in some categories. This is indicated by large price level differences. Consequently, all observations with outlying unit value indices are excluded from the database.Footnote 11

Before we turn to the analysis of import quality, we give a brief description of the disaggregated import data here with respect to the differentiation of goods and the number of varieties imported. Table 1 describes the degree of product differentiation as measured by the number of imported goods (after taking into account the abovementioned reclassification issues). The number of products is similar for all four countries and ranges between 6,700 and 7,100 in all years. In all cases, the amount of imported products in 2012 slightly exceeds the amount in 1995. However, for all countries except the UK a temporary decline in the number of imported products is observed between 2004 and 2008.Footnote 12 These figures point to an increase of product differentiation over the sample period, although we cannot draw any conclusions about the effect on import prices and consumer welfare, as Eq. (14) states that expenditure shares of new and disappearing products are important in addition to the number of products.

Another indicator, which can be calculated immediately, is the average number of origins (countries) per imported product, which serves as a proxy for the variety of imports. Table 2 indicates that there is a clear upward trend in this proxy during the analysed period.Footnote 13 The highest variety of imports observed for Germany (more than 17 different origins per imported product out of a possible maximum of 50). As before, we should remember that it is just a proxy and it is not possible to make conclusions about prices and gains from variety, as Eq. (9) requires expenditure shares.

4 Estimation of elasticities

To apply the methodology described in Sect. 2, we first need to evaluate elasticities of substitution between varieties, σ g . Although Broda and Weinstein (2006) assume unchanged taste and quality, their estimation strategy for the elasticities of substitution can still be implemented when this assumption is relaxed as long as lnd gct follows a random walk. Here we briefly remind the main idea behind the methodology, describe the system of demand and supply equations, and discuss the problems that appear during the estimation of the parameters of the system. Afterwards, we present our main findings on elasticities of substitution in Germany, France, Italy and the UK and compare our results to those in other papers.

4.1 System of demand and supply equations, GMM estimates

To derive the elasticity of substitution, one needs to specify demand and supply equations. The demand equation is defined by re-arranging the minimum unit-cost function in terms of market shares, taking first differences and ratios to a reference country:

The export supply equation relative to country k is given by:

where ω g ≥ 0 is the inverse supply elasticity assumed to be the same across partner countries. Although in theory the choice of k could be arbitrary, Mohler (2009) shows that estimates are more stable if the dominant supplier (country exporting the respective product for the most time periods) is chosen.

The unpleasant feature of the system of Eqs. (15) and (16) is the absence of exogenous variables which would normally be needed to identify and estimate elasticities. To obtain the estimates one needs to transform the system of two equations into a single equation by exploiting Leamer’s (1981) insight and the independence of errors ε gct and δ gct .Footnote 14 This is done by multiplying Eqs. (15) and (16). After such transformations, the following equation is obtained:

where \( \theta_{1} = \frac{{\omega_{g} }}{{(1 + \omega_{g} )(\sigma_{g} - 1)}} \); \( \theta_{2} = \frac{{1 - \omega_{g} (\sigma_{g} - 2)}}{{(1 + \omega_{g} )(\sigma_{g} - 1)}} \); \( u_{gct} = \varepsilon_{gct} \delta_{gct} \).

It should be noted that the evaluation of θ 1 and θ 2 leads to inconsistent estimates, as relative price and relative market share are correlated with the error u gct . Broda and Weinstein (2006) argue that it is possible to obtain consistent estimates by exploiting the panel nature of data and define a set of moment conditions for each good g. If estimates of elasticities are imaginary or of the wrong sign the grid search procedure is implemented. In addition, Broda and Weinstein (2006) address the problem of measurement error and heteroskedasticity by adding term inversely related to the quantity and weighting the data according to the amount of trading flows. Very recent papers by Soderbery (2010, 2013), however, demonstrate that this methodology generates severely biased elasticity estimates (median elasticity of substitution is overestimated by over 35 %). Soderbery (2010, 2013) proposes to use limited information maximum likelihood (LIML) estimator instead. In case the estimates of elasticities are infeasible (\( \hat{\theta }_{1} < 0 \)), nonlinear constrained LIML is implemented. Monte Carlo analysis demonstrates that this hybrid estimator corrects small sample biases and constrained search inefficiencies. Moreover, it proves that Feenstra’s (1994) original method of controlling measurement error with a constant and correcting for heteroskedascticity by the inverse of the estimated residuals performs well. We follow Soderbery (2010, 2013) and use hybrid estimator combining LIML with a constrained nonlinear LIML to estimate elasticities of substitution between varieties using the Feenstra’s (1994) method.

4.2 Results for Germany, France, Italy and the UK

The elasticity of substitution between varieties is estimated for all products g where data on at least 3 countries of origin are available.Footnote 15 Table 3 displays the main characteristics of estimated elasticities of substitution between varieties. The median elasticities of substitution between varieties are close to 3 for all four countries: Germany—3.48, France—3.17, Italy—3.29 and UK—2.89. Figure 3 in the “Appendix” shows striking similarities for the whole distribution of substitution elasticities for all four countries.

The results given in Table 3 are comparable to those reported in Broda and Weinstein (2006) for the US.Footnote 16 To our knowledge, the only papers containing similar estimates for European countries are Mohler (2011, for Switzerland and EU-27 countries) and Mohler and Seitz (2012, for EU-27 countries). Compared to Mohler and Seitz (2012), our estimates of the mean elasticity are by 20–25 % lower,Footnote 17 which confirms findings of Soderbery (2010, 2013). However, despite differences in estimation methodology, the country ranking remains unchanged (highest median elasticity for Germany, lowest—for the UK).

Up to this point we focused solely on the elasticity of substitution between varieties of the same good, while in our extended methodology in Eqs. (13) and (14) we also need γ, the elasticity of substitution between goods. Theoretically, it is possible to apply a similar estimation methodology as the one explained in Sect. 4.1, by deriving supply and demand equations and solving the system using the panel nature of the data. However, we do not think that this approach will be appropriate here. The assumption of a single elasticity of substitution between varieties for a single good is reasonable, while the assumption of a single elasticity between all products is too restrictive. One would expect a high elasticity of substitution between highly similar products (e.g. vegetables and fruits) and a rather low substitution elasticity between radically different products (e.g. vegetables and fuel). We cannot solve this problem within the existing theoretical framework based on a CES utility function. Therefore, we calibrate the elasticity of substitution between goods in this paper. Obviously, the substitutability between different products should not exceed than between varieties. Therefore, in our calculations we assume that γ is equal to 2, close to the estimated median elasticity of substitution between varieties. This also corresponds to the elasticity used by Romer (1994).

5 Evaluation of an exact import price index

Before being able to calculate an adjusted import price index based on estimated elasticities of substitution, we still need to define a benchmark product for which we assume constant taste and quality. Our exact import price index will then control for possible changes in consumer preferences and quality of imported products relative to this benchmark, beyond controlling for changes in variety and in the set of imported goods. This allows us to evaluate the effect of taste and quality changes on import prices and quantify the welfare gains. Finally, we should check how robust these results are with respect to the choice of a benchmark product.

5.1 Choice of a benchmark product

Section 2.3 demonstrates that to evaluate the unobserved taste and quality parameter we need to make an assumption about the quality of one single benchmark product imported from one benchmark country (d jkt ). The natural and most simple assumption could be that the taste and quality of such a benchmark variety is constant over time. However, the choice of this benchmark variety is plagued by several difficulties in practice. First, the benchmark variety should feature prominently in overall trade value as this minimizes measurement error. Second, the set of commodities, for which one can plausibly assume constant physical quality, is rather small and mainly includes various food products and low-tech goods. Third, it is not fully clear how to choose the benchmark country of origin. All in all, our calculations show that the results are highly non-robust and in many cases counterintuitive, which is perhaps driven by product- and county-specific effects.

Thus, we modify the approach slightly. To avoid ambiguity related to the choice of one particular country and one particular product, the benchmark can be broadened. We can assume that the average taste for or quality of a single product imported from all countries is unchanged, or, even broader, we can assume the average taste for or quality of a product group imported from all countries is unchanged. This solution has several advantages: First of all it maintains the concept of relative taste and quality, benchmarking to the average from all origins. As such, the benchmark becomes simple and interpretable. Moreover, it increases the robustness of empirical results. By broadening the benchmark, product-specific effects are cancelled out. Technically we assume that the contribution of d gct changes in a particular group of goods into the exact price index is zero:

where G i is a set of goods belonging to a benchmark group i.

In our calculations we choose a very broad food and tobacco products section that includes HS01–24 groups, as quality and consumer tastes for products in this category could be regarded as rather stable. Of course, our choice is subjective and even for food products it could be argued there is a room for possible improvements in quality due to better processing and storage technology.Footnote 18 These quality improvements, however, can be treated as negligible in the medium run comparing to such import categories as electrical equipment or vehicles. As to the taste shifts, these are expected to be more pronounced for narrower food categories, e.g. growing concerns about personal health should move consumer preferences from meat towards fish products. At the same time the average taste for food products can arguably be viewed as unchanged as food in general remains among the basic human needs.

5.2 Results

Having collected all necessary ingredients for the calculation of an exact import price index—i.e. elasticities of substitutions and an assumption on the benchmark group of products with unchanged taste and quality—we are now able to derive an adjusted measure of import price inflation. Beyond that, this measure also allows us to assess the impact from changes in variety, the product set as well as consumer tastes and product quality on prices and welfare in terms of sign and magnitude. In order to assess the impact of each of these factors we calculate four different import price indices: The first is the conventional index using Eqs. (7) and (8). The second index is adjusted for changes in variety (as in Broda and Weinstein, 2006) using Eqs. (9) and (8), where \( \pi_{g}^{M} (I_{gt} ,I_{gt - 1} ) \) is used instead of \( P_{g}^{M} (I_{g} ) \) in (8). The third index is adjusted for changes in variety and the set of products calculated using Eqs. (9) and (14), where \( \pi_{g}^{M} (I_{gt} ,I_{gt - 1} ) \) is used instead of \( \pi_{g}^{M} (I_{gt} ,I_{gt - 1} ,\Delta d_{gt} ) \) in (14). Finally, a variety-, set-of-products-, taste- and quality-adjusted import price index is calculated using Eqs. (10) and (14). By comparing these indices we can extract the contribution of each factor and evaluate the bias introduced by neglecting it in the import price index.

Before starting this analysis, we compare our estimates of the conventional import price index to officially released import price changes from Eurostat. We want to ensure that the use of unit value data allows to proxy the figures obtained from the price surveys of importers. The results are depicted in Fig. 4 in the “Appendix”. We compare annual growth of import prices between 1996 and 2012. Although the coverage of our database is only around 85 % of total imports,Footnote 19 our estimates of annual changes in import prices for commodities are close to the figures released by Eurostat for Germany, France, Italy and the UK. The approximation is the most accurate for Germany and the least accurate for the UK, although our estimates capture appropriately the rapid increase in import prices in 2000, 2005–2006 and 2010–2011, as well as severe price drop in 2009.Footnote 20

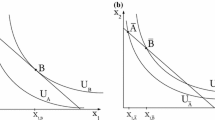

Figure 1 compares the conventional import price index with alternative adjusted import price indices described above. The effect of changes in variety on the measurement of import prices appears to be small and even negative in the case of Italy and the UK.Footnote 21 The upward bias in the conventional import price index over the period between 1995 and 2012 is estimated to range from −2.2 % for the UK to 1.8 % for Germany (see Table 4). Thus, despite evidence of an increasing number of origins per imported goods (which we took as a proxy for variety in Table 2) the upward bias in the conventional import price index due to increasing variety appears to be rather small and in one case even negative. The explanation of this inconsistency lies in the fact that the average number of origins per imported good is mostly growing for products with a relatively high elasticity of substitutions between varieties and a small share of overall imports while variety is growing only marginally, or decreasing for important product groups. In this respect, our results for European G7 countries differ substantially from the Broda and Weinstein (2006) results for the US, indicating a bias of 28 % between 1972 and 2001 or 1.2 % points/year. On the other hand, our figures are more in line with the results by Mohler and Seitz (2012), who report only a small bias and hence negligible gains from variety for Germany, France, Italy and the UK.Footnote 22 Likewise, we also estimate gains from variety to be small—between −0.5 % of GDP for the UK and 0.5 % of GDP for Germany.Footnote 23

Various price indices for total imports (1995 = 1) (conventional import price index is calculated using Eqs. (7) and (8), index adjusted for changes in variety—(9) and (8), index adjusted for changes in variety and set of products—(9) and (14), index adjusted for changes in variety, set of products, taste and quality—(10) and (14) assuming constant taste and quality for food and tobacco products (HS01–24). All prices for the UK are in GBP terms). Source: Authors’ calculations based on Eurostat Comext. a Germany, b France, c Italy, d UK

In addition to variety, changes in the set of imported commodities affect import prices and welfare. We can read from both, Fig. 1 and Table 4 that changes in the differentiation of goods produce an upward bias in the import price index in all four countries.Footnote 24 This implies that the set of imported goods is actually increasing between 1995 and 2012, which is in line with our earlier observation that the number of imported products shows an upward tendency (see Table 1). A comparison between the impact of changes in variety to changes in product differentiation points towards a slightly greater importance of the second source of bias (up to 8.0 % for Italy). Hence, we conclude that at least for European G7 countries the omission of changes in the product set creates a significant positive bias in the estimation of import prices and leads to an underestimation of the welfare gains of consumers. According to our calculations, changes in product differentiation increased consumers’ welfare by 0.2 % of GDP in the UK, 0.4 % in France, 0.7 % of GDP in Germany and 1.7 % of GDP in Italy between 1995 and 2012.

Finally, we highlight the role of shifts in tastes and quality for the measurement of import prices and welfare. This is a more challenging task, as we crucially rely on the assumption of unchanged taste and quality in our benchmark category (food and tobacco products, HS01–24). The taste and quality-adjusted import price index based on this benchmark assumption is also given in Fig. 1, while the bias to import price index and welfare gains are reported in Table 4.Footnote 25

Several conclusions can be drawn. Our results suggest that changes in taste and quality affect import prices more than the factors mentioned above. The issue of taste and quality certainly cannot be ignored and the conventional assumption of stable consumer preferences or unchanged quality introduces a huge bias in the measurement of import prices and consumers’ welfare. The potential magnitude of these biases can be read from Table 4: in the case of Germany the upward bias on conventional import price index is almost 40 %, while welfare gains from increasing quality or shifts in consumer preferences are up to 10.6 % of GDP. The impact for other European countries is smaller, although of comparable magnitude: welfare gains are 1.4 % of GDP for France, 5.7 for the UK and 5.9 for Italy. We should stress here once again, that although we can flag the importance of taste and quality issues, our methodology does not allow separating the effect coming from improved physical quality from the effect originating from shifts in consumer’s tastes.

The four European G7 countries can be divided into two groups: countries in which taste and quality of imports are gradually increasing during the whole sample period and therefore welfare gains are higher (Germany, Italy and the UK), and countries, where this process is more volatile (France). Another interesting observation concerns taste and quality changes during the financial crisis (2008–2010). The comparison of the quality-adjusted price index to other indices suggests that the valuation and quality of imports fell in all four countries in 2008–2009 and recovered in 2010. We can interpret this as a temporary shift towards lower quality or less preferred products in order to reduce expenditures during the time of a sharp drop in income. Obviously, the decrease of prices after the financial crisis was actually less pronounced, but associated welfare losses were higher when accounting for changes in taste and quality.

5.3 Robustness check

Results presented above rely on important assumption that elasticity of substitution between all products is equal to 2. We check how sensitive the results are to changes in γ and estimate exact import price index for γ = 1.5 and γ = 3.Footnote 26 The results of robustness check are reported in “Appendix”, Table 5, where welfare gains are compared for alternative levels of γ. It shows that the magnitude of welfare gains crucially depends on the assumption made about elasticity of substitution between products. In general, lower elasticity of substitution leads to higher estimates of gains from changes in the set of products or changes in taste and quality, while assumption on higher degree of substitution between products decrease these effects. This observation can be explained by smaller role of variety and quality for highly substitutable products. Equations (13) and (14) confirm this conclusion algebraically—lower elasticity of substitution between products should lead to lower gains/losses from changes in the set of products or quality. However, despite the sensitivity of results, the one important conclusion seems to be robust—welfare gains from changes in taste and quality dominates other sources of gains. Assuming that γ can vary between 1.5 and 3.0 welfare gains of German consumers from changes in taste or quality of imports vary between 7.5 and 17.6 % of GDP—these numbers by far exceed gains from changes in variety or set of products for any γ in the same range. Same pattern is observed for other big European countries—gains from quality or taste vary between 0.6 and 3.1 % of GDP for France, 4.9 and 8.2 % of GDP for Italy, 5.3 and 6.6 % of GDP for the UK.

High sensitivity to elasticity of substitution between products is not the only reason, why our findings should be taken with a pinch of salt. At least another two should be mentioned. First, our estimation procedure is limited to a common elasticity of substitution between all products. We choose γ to be equal to 2 which may still be too high for several inelastic product groups like mineral fuels and oils, metals, pulp of wood. In fact, the substitution elasticity could be even lower than unity for such groups. Overestimating the elasticity of substitution leads to excessive volatility of estimated taste and quality for such groups and may affect the results. One way to overcome this problem is to increase the number of levels in the consumers’ utility function. This would allow for different elasticities of substitution between different products. However, it is not clear how to group different products. Trade classifications were developed for custom purposes and do not necessarily reflect the similarity between goods (rather between materials used). Alternatively, one could specify a different functional form that allows for various elasticities of substitution.

Second, we already mentioned that due to the absence of firm-level data we have to adopt the Armington’s (1969) assumption. In other words we ignore the possibility that more than one brand could be imported from each country and thus possibly underestimate variety changes. This may lead to a significant bias in taste and quality estimates.

5.4 Importance of consumer taste

Finally, we perform another robustness check and calculate three additional taste and quality-adjusted import price indices (for γ = 2), assuming constant taste and quality for imports of narrower food product groups: meat and edible meat offal (HS02), fish and crustaceans (HS03), and edible fruits and nuts; peel of citrus fruit or melons (HS08). The goal of calculating additional adjusted import price indices is to assess the role of taste in European imports. We already mentioned that although the assumption of unchanged physical quality may still be regarded as reasonable for narrower groups of food products, this is not the case for consumer preferences. Regarding the abovementioned tendency for the healthy life style in Europe, we would expect consumer preferences shift from meat (viewed as unhealthy product) to fish and fruits. Therefore, the adjusted import price index based on the assumption of constant taste and quality for meat products is expected to be lower than the one based on the assumption of constant taste and quality for fish or fruits.

The results summarized in Fig. 2 confirm our expectations. Despite higher volatility of additionally calculated price indices (which is partially due to a smaller number of benchmark commodities) the ranking is the same in all countries. Indeed, during the last 17 years European consumers shifted their preferences from meat to fish products and fruits, which can be associated with an increasing preference for healthy food and vegetarianism. It is interesting to note a pronounced decrease in taste for fruits around 1997–1999 in Germany, Italy and the UK. A potential explanation could be a growing safety concern related with genetically modified products. Phillips and McNeil (2000) indicate an intensification of such concerns since 1998.

To summarise, we see two important conclusions from our results. First, our findings definitely contradict the traditional assumption on unchanged taste and quality for all products, requiring more efforts in evaluating these unobservable parameters. We contribute to the literature by proposing an adjusted import price index, which does not require very sophisticated calculations or the use of any firm-level data. While the choice of food and tobacco products as a benchmark with unchanged taste and quality seems to be reasonable, the calculations could be improved by additional research, ideally on the micro level.Footnote 27 Second, Fig. 2 suggests that changes in taste may also play a significant role in import prices and consumers welfare and should be taken into account.

6 Conclusions

In this paper we demonstrate how the seminal approach by Broda and Weinstein (2006), who introduced changes in variety into the calculation of the exact import price index, can be deepened further to allow for changes in the set of imported products as well as in relative taste and quality. Using the approach by Hummels and Klenow (2005), we relax the overly restrictive assumption of constant taste and quality for all varieties observed in both periods and replace it by a more reasonable assumption of constant average taste and quality for only one commodity group—food and tobacco products. All other products are then allowed to show changes in taste and quality parameter relative to this benchmark.

Thus, we construct a variety-, set-of-products-, taste- and quality-adjusted import price index. This index explicitly controls for three sources of bias not addressed by traditionally measured import price indices. The first one is the effect from changes in variety, whereby we adopt the Armington’s (1969) assumption and define variety as imports within the same product line but from different origins. The second source of bias originates from changes in the set of imported products, also referred to as product differentiation. The third bias is introduced by changes in the underlying taste for or quality of imported varieties. Clearly, price increases can be more than offset by higher quality or greater consumer valuation in terms of utility and consequently increased consumer welfare.

We apply this adjusted price index to imports of the four largest European economies, Germany, the UK, France and Italy over the time period 1995–2012. Our first result relates to changes in variety. Ignoring changes in variety leads to an overestimation of price increases, however in contrast to the results by Broda and Weinstein (2006) for the US and for an earlier period, this bias appears to be rather small and even negative in case of Italy and the UK. Our result is however in line with other findings for the EU-27 by Mohler and Seitz (2012). Changes in product differentiation between 1995 and 2012 created an additional upward bias in the conventional import price index for all four countries. This can be mapped into welfare gains in the magnitude up to 1.7 % of GDP in Italy.

However, the largest contribution to the price index is given by changes in underlying tastes and quality. We find that ignoring changes in consumer preferences and physical quality of products introduces a substantial upward bias in the price index, thus suggesting lower welfare gains than actually enjoyed by European consumers. Under the plausible assumption of unchanged quality and constant consumer preferences for food and tobacco products the welfare gains between 1995 and 2012 are substantial: 1.4 % of GDP in France, 5.7—in the UK, 5.9—in Italy and 10.6—in Germany. An interesting observation relates to changes in tastes and quality during the financial crisis. In all four European countries the valuation or quality of imports fell in 2008–2009 and recovered in 2010. We can interpret this fact as a temporary shift to less preferred and lower quality products in order to reduce expenditures during the time of a sharp drop in income. In other words, during the crisis the decrease of prices was actually lower, but losses in welfare actually higher than estimated without taking the taste and quality issue into account.

These results, however, should be taken with a pinch of salt. Use of Armington’s (1969) assumption may conceal the large unobserved changes in varieties within exporting countries, thus biasing our evaluation of taste and quality as well. The estimates of import prices and related welfare effects are conditional on the form of the utility function. Moreover, the nested CES function, although having obvious advantages in terms of mathematical elegance, implies severe limitations. For instance, the estimation procedure is limited to a common elasticity of substitution between all products, which is still too simplistic. It is likely that the substitution elasticity for several inelastic product groups is overestimated which in turn leads to an excessive volatility in tastes and quality. Another limitation is mostly data driven—due to the lack of detailed data on domestically produced goods, the composite domestic and imported goods are separated already in the upper level of the utility function. This significantly understates the replacement of domestic and imported varieties and, as a result, underestimates the effect of increasing taste, quality and variety of imported products on the welfare of domestic consumers.

Finally, we partially address the critique of Di Comite et al. (2012), who mentioned that the role of taste in international trade is still unexplored. Although we are not able to split taste from quality due to the lack of additional information at the firm level and limitations of our framework, some rough evaluations are done by changing the benchmark product group. Arguably, the quality of some narrowed food product imports is not expected to change a lot, while this cannot be assumed for consumer tastes—healthy lifestyle, vegetarianism, fears of genetically modified products shifted preferences of European consumers for fruits, meat and fish. Therefore, the differences in adjusted import price indices using these products as a benchmark with unchanged taste and quality primarily refer to a bias in consumer tastes. Indeed, we see a pronounced shift in preferences towards fish products and fruits, while meat products lose their popularity.

In this paper, we have clearly demonstrated the importance of addressing the issue of changes in taste and quality. Our constructed adjusted import price index allows for a relatively easy way of assessing the role of taste and quality in international trade. Our results corroborate the view that ignoring the taste and quality issue in the empirical literature can give highly misleading estimates of import prices and consumers’ welfare.

Notes

We choose four European G7 countries as an object of our investigation, however, the framework is easily applicable to any other reporting country in the database.

See Diewert (1993) for more details.

Actually, Feenstra (1994) defines I g as a strict subset of the varieties available in periods t and t − 1: \( I_{g} \subseteq (I_{gt} \cap I_{gt - 1} ) \). This allows to use Feenstra’s (1994) approach to control for possible changes in taste and quality by excluding corresponding varieties from I g . Same variety with changing taste or quality is simply treated as two different varieties. For the same reason Feenstra (1994) exclude imports from developing countries and Japan during his calculations, arguing that these countries may have changed the quality of their products over the period of estimation.

Although Feenstra’s (1994) framework allows to control changes in taste and quality in general, it requires to make a distinction between varieties with constant taste and quality (included in I g ) and changing taste and quality (excluded from I g ). Broda and Weinstein (2006) define that \( I_{g} = (I_{gt} \cap I_{gt - 1} ) \), thus assuming that quality and taste should be unchanged for all varieties imported in both periods.

Benkovskis and Rimgailaite (2011) use this approach to evaluate the relative quality with respect to a benchmark—imports from Germany.

The alternative way to achieve the same results is to exclude all varieties and products from I g and G t,t−1 except for imports of benchmark product j from country k (variety, for which we assume unchanged quality and taste, ∆d jkt = 0). Then one can apply Feenstra’s (1994) methodology. However, our approach summarised in (11) and (13) has two advantages. First, Eqs. (11) and (13) have a clear economic intuition, thus allowing to explain the evaluated changes in taste and quality. Second, our approach is superior in case of a broad benchmark (see Sect. 5.1). We can allow for unchanged average taste and quality for a broad product category (e.g. food and tobacco products), while taste and quality of individual varieties within benchmark category (e.g. fruits from Italy or meet from Spain) can vary. This is not possible in Feenstra’s (1994) framework, as it requires unchanged taste and quality for all varieties included in I g .

This sample of partners provides a representative picture of overall imports, as it covers between 87.6 % of total imports in Italy and 95.2 % of total imports in Germany in 2012.

More information on reclassifications of Combined Nomenclature can be found in http://ec.europa.eu/eurostat/ramon/nomenclatures/.

An observation is treated as an outlier if its unit value index deviates from the category median in a particular year by more than four median absolute deviations. The exclusion of outliers does not significantly reduce the coverage of the database. For example, in 2012 outliers accounted for only 0.2 % of total value in Germany, 0.3 % in France, 0.9 % in Italy and 0.7 % in the UK.

Similar results about the decline of the number of imported products are made by Mohler and Seitz (2012), who analyse disaggregated imports of EU-27 countries between 1999 and 2008.

These results are also confirmed by Mohler and Seitz (2012), who reported an increase in the mean number of countries for all EU-27 members between 1999 and 2008.

It can be argued, however, that the quality and taste parameter can implicitly enter the residual of both, the demand Eq. (15) as well as the supply Eq. (16). This is more likely when quality reflects some tangible properties of a product and as such increases the production costs of the high-qualitative product. This problem cannot be addressed without a well derived supply side in the model therefore we leave this question to further research.

The number of products for which this condition is met can be read from Table 3. Although the coverage is reduced, it still remains reasonably high and ranges between 74.3 % of total aggregated imports for the UK and 83.5 % for France in 2012 although we restricted ourselves to 50 partner countries, excluded outliers and required at least 3 countries of origin.

They report a median elasticity of 3.7 for the period between 1972 and 1988 for seven-digit (TSUSA) goods and 3.1 for the period between 1990 and 2001 for 10-digit (HTS) goods.

Mohler and Seitz (2012) report a mean elasticity of 4.67 for Germany, 4.22 for France, 4.60 for Italy and 3.84 for the UK.

Perhaps the proper choice of the benchmark is a topic for a separate research and should be done together with sectoral experts on the basis of firm-level data. Here we just demonstrate the essence of the methodology and empirical results under reasonable assumptions.

In 2006–2009 it even decreases to approximately 65–70 % for France and Italy.

Price dynamics shows different pattern for the UK due to changes in GBP/EUR exchange rate. Note that price index changes are reported in GBP for the UK.

The bias from changes in variety is calculated as \( \prod\nolimits_{{g \in G_{t,t - 1} }} {(\lambda_{gt} /\lambda_{gt - 1} )^{{w_{gt} /1 - \sigma_{g} }} - 1} . \)

One should keep in mind that we always construct the intersection of consecutive variety sets I g relative to previous year, while Broda and Weinstein (2006) and Mohler and Seitz (2012) use a base year. The difference between two approaches can be intuitively compared with difference between chain-linked GDP and GDP in prices of a base year. However, our findings do not alter qualitatively if we follow Broda and Weinstein (2006) approach and use 1995 as a base year. In this case changes in variety between 1995 and 2012 produce positive import price bias of 0.8 % for Germany, 3.4 % for France, 2.7 % for Italy and 0.4 % for the UK.

Again, despite higher degree of openness of European countries, gain figures are lower compared to the estimates of Broda and Weinstein (2006) for the US, where gains from varieties are found to be 2.6 % of GDP (between 1972 and 2001) or about 0.1 % of income each year.

The bias from changes in the set of goods is calculated as \( (\Lambda_{t} /\Lambda_{t - 1} )^{ - 1} - 1 \).

The bias from changes in quality is calculated as \( \prod\nolimits_{{g \in G_{t,t - 1} }} {\Delta d_{gt}^{{w_{gt} /\sigma_{g} - 1}} } - 1. \)

Although these changes in γ seem to be small, one should remember that it is γ − 1 and (γ − 1)/γ that enter the model. Even marginal changes in low elasticity of substitution mean significant difference in market characteristics.

Here we see the possibility to join our approach with the method of Sheu (2011). Information on product characteristics will give an opportunity to evaluate quality changes for several product groups using logit regression from Sheu (2011). These groups can then serve as the benchmark, while the quality of other products relative to the benchmark could be assessed using Eqs. (11) and (12).

References

Amiti, M., & Khandelwal, A. K. (2013). Import competition and quality upgrading. The Review of Economics and Statistics, 95(2), 476–490.

Armington, P. S. (1969). A theory of demand for products distinguished by place of production. International Monetary Fund Staff Papers, 16(1), 159–178.

Benkovskis, K., & Rimgailaite, R. (2011). The quality and variety of exports from the new EU member states: Evidence from very disaggregated data. Economics of Transition, 19(4), 723–747.

Bloningen, B. A., & Soderbery, A. (2010). Measuring the benefits of foreign product variety with an accurate variety set. Journal of International Economics, 82(2), 168–180.

Broda, C., Greenfield, J., & Weinstein, D. E. (2006). From groundnuts to globalization: A structural estimate of trade and growth. (NBER Working Paper 12512). Cambridge, MA: National Bureau of Economic Research.

Broda, C., & Weinstein, D. E. (2006). Globalization and the gains from variety. Quarterly Journal of Economics, 121(2), 541–585.

Di Comite, F., Thisse, J. F., & Vandenbussche, H. (2012). Verti-zontal differentiation in monopolistic competition. (CEPR Discussion Paper 8752). London: Centre for Economic Policy Research.

Diewert, W. E. (1993). The economic theory of index numbers: A survey. In W. E. Diewert & A. O. Nakamura (Eds.), Essays in index number theory (Vol. 1, pp. 177–221). Amsterdam: North-Holland.

Dixit, A. K., & Stiglitz, J. E. (1977). Monopolistic competition and optimum product diversity. American Economic Review, 67(3), 297–308.

Eurostat (2011). PEEIs in focus. A summary for the import price index. Luxembourg: Publications Office of the European Union.

Feenstra, R. C. (1994). New product varieties and the measurement of international prices. American Economic Review, 84(1), 157–177.

Feenstra, R. C., & Romalis, J. (2012). International prices and endogenous quality. (NBER Working Paper 18314). Cambridge, MA: National Bureau of Economic Research.

Flam, H., & Helpman, E. (1987). Vertical product differentiation and north–south trade. American Economic Review, 77(5), 810–822.

Hallak, J. C., & Schott, P. K. (2011). Estimating cross-country differences in product quality. Quarterly Journal of Economics, 126(1), 417–474.

Hummels, D., & Klenow, P. J. (2005). The variety and quality of a nation’s exports. American Economic Review, 95(3), 704–723.

Khandelwal, A. (2010). The long and short (of) quality ladders. Review of Economic Studies, 77(4), 1450–1476.

Krugman, P. R. (1979). Increasing returns, monopolistic competition, and international trade. Journal of International Economics, 9(4), 469–479.

Krugman, P. R. (1980). Scale economies, product differentiation, and the pattern of trade. American Economic Review, 70(5), 950–959.

Leamer, E. E. (1981). Is it a demand curve, or is it a supply curve? Partial identification through inequality constraints. Review of Economics and Statistics, 63(3), 319–327.

Mohler, L. (2009). On the sensitivity of estimated elasticities of substitution. (FREIT Working Paper 38). Forum for Research on Empirical International Trade, Polytechnic University of Marche.

Mohler, L. (2011). Four essays on international trade in variety. Ph.D. dissertation, University of Basel.

Mohler, L., & Seitz, M. (2012). The gains from variety in the European Union. Review of World Economics/Weltwirtschaftliches Archiv, 148(3), 475–500.

Phillips, P. W., & McNeil, H. (2000). A survey of national labelling policies for GM foods. AgBioForum, 3(4), 219–224.

Pierces, J. R., & Schott, P. K. (2009). Concording U.S. harmonized system categories over time. (NBER Working Paper 17837). Cambridge, MA: National Bureau of Economic Research.

Romer, P. M. (1994). New goods, old theory, and the welfare costs of trade restrictions. (NBER Working Paper 4452). Cambridge, MA: National Bureau of Economic Research.

Sato, K. (1976). The ideal log-change index number. Review of Economics and Statistics, 58(2), 223–228.

Sheu, G. (2011). Price, quality, and variety: Measuring the gains from trade in differentiated products. Mimeo: US Department of Justice. http://people.virginia.edu/~jh4xd/Workshop%20papers/Sheu_printer_demand_sept_2011.pdf. (Accessed December 20, 2011).

Soderbery, A. (2010). Investigating the asymptotic properties of import elasticity estimates. Economics Letters, 109(2), 57–62.

Soderbery, A. (2013). Estimating import supply and demand elasticities: Analysis and implications. Mimeo: Department of Economics, Purdue University. http://web.ics.purdue.edu/~asoderbe/Papers/soderbery_elasticity.pdf. (Accessed December 14, 2013).

Vartia, Y. (1976). Ideal log-change index numbers. Scandinavian Journal of Statistics, 3(3), 121–126.

Acknowledgments

We thank Vesna Corbo, David Hummels, Mihaly Andras Kovacs, William Powers, participants of an internal Oesterreichische Nationalbank research seminar, the 13th European Trade Study Group conference in Copenhagen and the ECB Expert Meeting on “Assessing Competitiveness” in September 2011 as well as anonymous referee for their valuable comments and recommendations. The authors assume responsibility for any errors and omissions.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Distribution of elasticities of substitution (elasticities of substitutions estimated using hybrid LIML estimator for all products where data on at least three countries of origin are available. The number of observations is 6,659 for Germany, 6,673 for France, 6,386 for Italy and 6,382 for the UK). Source: Authors’ calculations based on Eurostat Comext

Comparison of officially published import prices and calculations from disaggregated data (annual changes, %) (conventional import price index is calculated from disaggregated import data (eight-digit CN classification level, 50 partner countries) using Eqs. (7) and (8). All prices for the UK are in GBP terms). Source: Eurostat, Authors’ calculations based on Eurostat Comext. a Germany, b France, c Italy, d UK

About this article

Cite this article

Benkovskis, K., Wörz, J. How does taste and quality impact on import prices?. Rev World Econ 150, 665–691 (2014). https://doi.org/10.1007/s10290-014-0196-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-014-0196-3