Abstract

Over the last decade, European Union members have experienced a steady increase in imports. This increase was accompanied by a strong growth in the number of imported goods and trading partners, suggesting positive welfare gains for consumers via an extended set of consumption possibilities, as pointed out in the “New Trade Theory”. In this paper, we apply the methodology developed by Feenstra (Am Econ Rev 84(1):157–177, 1994) and Broda and Weinstein (Q J Econ 121(2):541–585, 2006) to structurally estimate the gains from imported variety for the 27 countries of the European Union using highly disaggregated trade data at the CN-8 level from Eurostat for the period from 1999 to 2008. Our results show that, within the European Union, especially “newer” and smaller member states exhibit high gains from newly imported varieties. Furthermore, we find that the majority of the gains from variety for consumers stems from intra-European Union trade.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The European Union (EU) with its 27 member states today constitutes the largest single market in the world. Over the past decade, several historical events have deepened the economic integration of economies within Europe but also of EU member states into the world economy. First, the euro was introduced as book money in 1999 and today is the official currency of 17 EU member states. Second, the transition of the Eastern European economies from planned economies to market economies after the fall of the Iron Curtain was accompanied by a surge and redirection of trade flows towards the “old” member states as well as a strong increase of trade between Eastern European countries themselves. This transition led to the eastern enlargement in 2004, when ten new member states joined the EU, followed by Romania and Bulgaria in 2007. Finally, the EU and its member states were confronted with the integration of fast-growing emerging markets into the world trading system over the last decade, with China and other East Asian economies at the forefront.

These dynamic processes of economic integration were paralleled by a strong increase in trade flows for most member states. From 1999 to 2008 the total value of imports for all EU countries combined has more than doubled. This surge in trade flows was accompanied by an increase in the number of imported product varieties available to consumers. The establishment of new trade linkages (new goods and new trading partners) raised this number of imported varieties by 18 %, a value that suggests large gains for consumers as a result of newly available products.

In this contribution, we adopt the methodology of Feenstra (1994) and Broda and Weinstein (2006) to structurally estimate the gains from imported variety for all 27 EU member states for the period from 1999 to 2008. We explore a rich data set of highly disaggregated trade data at the 8-digit level of the Combined Nomenclature product classification (CN). The effects on consumer welfare of newly available products are particularly interesting with regard to EU economies, since the EU consists of several small and medium-sized economies with a high degree of political and economic integration within the EU as well as within the world economy. In addition, studying a variety of countries allows us to analyze and interpret results across different economies, adding another dimension to this approach.

Our results can be summarized as follows. For most countries the gains from variety are positive. However, the results largely differ across member states. We identify three different groups of economies. First, for the largest four members of the EU (in terms of GDP), the impact of imported variety is only slightly above zero or even negative for the considered period. This can be explained by small import shares and the fact that these economies were already well integrated within the EU and the world economy in 1999. Second, for the smaller “old” member states, we find modestly positive gains, all below 1 % of GDP. Third, for the “new” member states of the EU, with the exception of Malta, the gains from variety are strongly positive, mostly larger than 1 % of GDP. For example, variety gains in Latvia amount to 3.0 % of GDP, which is of the same magnitude as Broda and Weinstein (2006) find for the United States when examining the longer period from 1972 to 2001. Our results imply that especially for fast-growing, less-developed and smaller countries, the establishment of new trade linkages are an important source of trade-based welfare gains. When we split up the gains regarding regions of origin, we find that for a typical country about 70 % of the gains stem from intra-EU trade, indicating the importance of the European integration process regarding trade flows and imported variety.

Our paper mainly contributes to two strands of the empirical trade literature. We add to the literature on the “love for variety” motive, a key element of the “New Trade Theory” laid out in the theoretical models of Krugman (1979, 1980, 1981). Contributions on this subject include, for example, Feenstra (1992) who shows in a numerical example how trade barriers can affect the number of available products and reduce consumer welfare. Following this idea, Romer (1994) calibrates a model with fixed export costs and finds that a substantial reduction in trade barriers will lead to more exported varieties, resulting in an increase of GDP of up to 20 %. The first extensive empirical analysis of the variety gains from trade was done by Broda and Weinstein (2006). These authors extend the methodology developed by Feenstra (1994) to construct an artificial price index that measures the impact of traded varieties on consumer welfare. Using highly disaggregated trade data and the assumption that goods are differentiated across countries, they show that the growth in product variety has been an important source of welfare gains. Covering US import data from 1972 to 2001, their results suggest an upward bias in the conventional price index of the magnitude of 1.2 % per year, which translates into an overall effect of 2.6 % of GDP for the overall period. Put differently, consumers are willing to pay roughly 0.1 % of their annual income to gains access to a larger set of goods and varieties. Similarly, and based on previous work by Klenow and Rodríguez-Clare (1997), Arkolakis et al. (2008) analyze how trade liberalization in Costa Rica has affected product variety and consumer welfare. They find, however, that the welfare increase after trade liberalization via an extended product variety set is very limited, since new products are imported in small quantities. Footnote 1 In summary, some empirical evidence on the variety gains from trade exists; it is, however, restricted to very few country analyses. With our contribution, we add results for 27 countries to this literature.

While the European integration process has attracted substantial interest in the literature, the analysis of EU trade flows, and in particular of their positive effects on consumer welfare, has been scarce. In the European trade literature three prominent lines can be identified. First, several studies have tried to quantify the positive effect of the introduction of the euro on trade: see Baldwin (2006) for a survey. Second, researchers have studied the effect of European integration and the role of national borders on intra-EU trade flows, including Nitsch (2000) and Chen (2004). Third, Buch and Piazolo (2001) and Manchin and Pinna (2009) study the implications of the Eastern European enlargement in 2004 on growth and the redirection of trade flows towards the EU. All these studies rely on aggregated trade data. A notable exception is Funke and Ruhwedel (2005) who provide an empirical analysis of disaggregated trade data on export variety and economic growth in Eastern European countries and find a high correlation between increased imported variety and economic growth. Footnote 2 However, none of the papers in this literature dealing with Europe covers the potential effect of variety changes on consumer welfare. This is at the heart of our contribution.

The rest of the paper is organized as follows. In Sect. 2, we describe the data set and provide detailed descriptive statistics on the number of imported varieties for all the member states. Section 3 briefly reviews the methodology developed by Feenstra (1994) and Broda and Weinstein (2006) to account for variety changes in import price indices, and Sect. 4 presents the results for the 27 members of the EU. Also, several robustness checks are carried out. Section 5 concludes.

2 Data and descriptive statistics

For our analysis, we use highly disaggregated trade data from Eurostat. Approximately 10,000 product categories at the CN-8 level for the period from 1999 to 2008 are defined in this data set. Table 1 provides some detailed information on the product categories defined in the Eurostat data. We use quarterly data from the first quarter of 1999 to the first quarter of 2008 to rule out potential seasonality effects. For each member state, we collect information on the value and quantity of all imported products from all worldwide trading partners. Footnote 3

2.1 Aggregate European Union import flows and variety

We first present statistics on import flows at the aggregate EU level and for different country subgroups: Given the diverse structure of the EU economies and their differences in terms of size (GDP), growth rate, import value and share, as well as accession date, EU members were affected differently by the integration process. We identify three different types of countries in the EU. First, the “large old” economies including Germany, Italy, France and the United Kingdom with the largest GDP in the EU, accounting for over 60 % of total EU GDP in 2008; second, the eleven “small old” member states that had joined the EU by 1995; and third, the twelve fast-growing, less-developed “new” member states, mostly from Eastern Europe, which joined the EU in 2004 and 2007, respectively. These definitions are applied throughout our analysis.

From the first row in columns (1) and (2) of Table 2, we can infer that aggregate nominal import values of the EU member states from worldwide trading partners have more than doubled from 487 billion euros in the first quarter of 1999 to 979 billion euros in the first quarter of 2008. Since one focus of our study is to analyze trade flows within the EU, we split up total imports into imports from other EU countries (internal imports) and imports from the rest of the world (ROW, external imports) in rows two and three. We observe that trade within the EU accounts for more than 60 % of all imports. Both internal and external trade flows have grown at rapid rates and roughly doubled in this period. This strong increase in imports was accompanied by another effect, a strong increase in the number of imported varieties. In our analysis, a good is defined as a CN-8 product category. Following Armington (1969), a variety is then assumed to be a particular good imported from a particular country. Based on this definition, we find a strong increase from 1.678 million to 1.970 million imported varieties during the last decade (columns (1) and (2) of row four). About two-thirds of imported varieties stem from EU internal imports (rows five and six). Given the relatively small number of potential trading partners for a single product within the EU, this is a large share and highlights the importance of intra-EU trade as a source of new product varieties for consumers. Footnote 4

In columns (3) to (8), we decompose the import flows according to our defined country blocks. The “large four” economies account for nearly half of all imports. Despite the strong growth in import value, the total number of imported varieties increased modestly by 8 % from roughly 457,000 to 497,000, indicating that imports have grown at the intensive margin. Footnote 5 While 65 % of total imports stem from the EU-27 member states, they account for 58 % of imported varieties in 1999. Both shares slightly decrease over time, emphasizing the growing importance of trade with non-EU member states over the last decade. We obtain a similar picture for the “small old” member states, although internal EU-27 imports are even more important on average for these economies. In contrast to the “large four”, imports have also substantially grown along the extensive margin. This increase in variety is, to a large extent, due to trade with non-EU members. In this category, the number of imported varieties has grown substantially from about 217,000 to 291,000. Finally, for the “new” member states, we obtain a somewhat different picture. First, trade with other European member states is of central importance for this group of countries and amounts to 70 % of total imports. Second, although the nominal import value from both EU and non-EU members in 2008 was roughly four times larger than in 1999, the fact that the number of varieties imported from other EU members has grown by nearly 50 % (from approximately 367,000 to 488,000), while the number of varieties from the rest of the world has been slightly decreasing (from about 192,000 to 189,000), is striking. Footnote 6

2.2 Imported variety of the 27 European Union member states

We now focus on country data to provide a more detailed picture of the evolution of the imported variety set for each single member state. Given our assumption that products are differentiated across countries, there are two potential sources for new varieties. First, an entirely new good’s category can be imported, and second, the number of supplying countries within an already imported category can increase. Table 3 tabulates the number of imported goods (columns (1) and (2)) and the average number of trading partners (columns (3) and (4)) that supply these goods for all 27 EU members. Larger and high-income countries tend to import a larger set of goods from a more diverse set of countries. Footnote 7

From columns (1) and (2), we infer that for all but one of the “old” member states, the number of imported product categories decreases slightly, while modest to substantial increases have been realized by some of the “new” member states. For example, in Latvia the number of product categories that have been imported increased from 6,274 in 1999 to 7,228 in 2008. At the same time, columns (3) and (4) reveal that the average number of supplying countries has increased for all countries, except for Hungary and Malta. The relative increase in the average number of supplying countries are modest in the four largest members, but larger than 30 % in many “small old” and “new” member states. For example, in Romania the average number of supplying countries per product category has grown from 6.50 to 9.30. Combining columns (1) to (4), this translates into an overall increase in imported varieties for all countries except Cyprus, Hungary, and Malta, as can be inferred from columns (5) and (6).

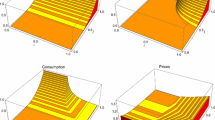

Our data show that the overall growth rate of new varieties has been relatively low for the “large old” economies, with an average increase of about 6 %; more substantial for the “small old” member states with growth rates of between 12 and 36 %; and even higher with growth rates of up to 68 % in the case of Latvia, and an average increase of roughly 35 % for the “new” member states. The size of the relative change in the number of imported varieties is depicted in the top panel of Fig. 1. Columns (7) and (8) of Table 3 display the turnover of varieties in the member states during the considered decade. In many countries the turnover rate is around 50 % of the total number of varieties; that is, about 50 % of the varieties that existed in 1999 are no longer present in 2008 (column (7)), and roughly 50 % of the new varieties present in 2008 had not been available ten years earlier (column (8)). This result qualitatively holds for all 27 members, although in some “new” member states, the turnover rate is even higher. Thus, not only has the absolute number of imported varieties increased, but also the origin and composition of imported varieties has changed substantially over the last decade.

Adjustments in the variety set of EU internal and external imports. A good is defined after the CN-8 classification and a variety is defined as a good from a particular country. For convenience we ordered the table according to our definition of our three subgroups of EU member states from left to right

2.3 Variety adjustments of internal and external imports

Figure 1 provides summary statistics on the contribution of internal and external EU trade flows on the imported variety in each country. The top panel displays the absolute number of new imported varieties, split up into the contribution of internal and external trade flows. Footnote 8 For example, in Denmark (DNK) the number of new imported varieties amounts to 19,943, implying a relative increase of imported varieties of 36 %. Of this total, the smaller share (7,774 varieties) can be attributed to the import of new varieties from non-EU member states and the larger share (12,169 varieties) to the import of new varieties from EU member states. On the one hand, we observe that for most of the “old” EU members the establishment of new trade linkages outside the EU accounts for approximately 60 % of new imported varieties. On the other hand, in many of the new member states, more than 90 % of new imported varieties stem from internal EU trade partners. For some of the new member states such as Poland and the Czech Republic, the number of imported varieties from non-EU member states is even decreasing, an observation that is in line with the numbers from Table 2. Footnote 9

In the middle and bottom panel of Fig. 1, we further decompose the contribution of internal (middle panel) and external (bottom panel) trade flows; the percentage change again depicts the relative change of imported varieties. We split up the contribution along two dimensions. First, we calculate the number of new imported varieties from product categories that have already been imported in 1999 (New partners). Second, we compute the number of new imported varieties due to imports of entirely new product categories, including all countries supplying these products (New products).

The middle panel analyzes the change of internally traded varieties. For nearly all “old” members, over 90 % of new internal varieties can be attributed to the emergence of entirely new products rather than the increase in trading partners within already imported goods. For the “new” member states, the EU has been an important source of both, new products and new partners. For example, in Romania (ROM), the number of internally imported varieties increased by 21,685 (a 66 % relative increase). Of this total, the smaller share (7,669 varieties) is due to imports from extending the set of trading partners within existing product categories, while the larger share (14,016 varieties) is due to imports of entirely new product categories.

Finally, the bottom panel reveals that for the “old” EU-15 members, the number of imported varieties from non-EU countries has been increasing, mainly due to imports of entirely new product categories. Footnote 10 For example, in Italy (ITA) the number of externally imported varieties has grown by 8,498 (a 22 % relative increase), whereof the majority (5,870 new varieties) can be attributed to imports of entirely new product categories. In contrast, for many of the Eastern European countries, the number of trading partners as well as the number of new products from non-EU members has been unchanged or slightly decreased. In a nutshell, Fig. 1 depicts a diverse pattern of extensive margin adjustments of the 27 EU economies’ imports. Before turning to the empirical analysis, we lay out the methodology used to analyse these variety changes.

3 Methodology

In this section, we briefly review the methodology used to determine the gains from variety. It was mainly developed by Feenstra (1994) and extended by Broda and Weinstein (2006).

We follow Feenstra (1994) to derive an exact price index for a constant elasticity of substitution (CES) utility function for each imported good with a constant number of varieties. This index is then extended by allowing for new and disappearing varieties. We then aggregate the goods’ indices to an aggregate import price index based on the contribution of Broda and Weinstein (2006). We start with a simple CES utility function with the following functional form for a single imported good. To define a variety of a good, we assume that imports of one good g are treated as differentiated across countries of supply, c. Consumers’ utility M gt is defined as

where C denotes the set of available countries, and hence of all potentially available varieties. M gct is the subutility derived from the imported variety c of good g in period t, and d gct > 0 is the corresponding taste or quality parameter. The elasticity of substitution among varieties is given by σ g and is assumed to be larger than one. Using standard cost minimization gives us the minimum unit-cost function

where p gct is the price of variety c of good g in period t, and \(\vec{d}_{gt}\) is the vector of taste or quality parameters. \(I_{gt} \subset C\) is the subset of varieties of good g imported at time t. Suppose the set of available product varieties I gt in period t and t − 1 is identical, the taste parameters \(\vec{d}_{gt}\) are also constant over time, and \(\vec{x}_t\) and \(\vec{x}_{t-1}\) are the cost-minimizing consumption bundle vectors for the varieties of one good for the given price vectors. In this case, Diewert (1976) defines an exact price index as the ratio of the minimum cost functions

where the price index does not depend on the unknown taste parameters \(\vec{d}_{gt}\). Sato (1976) and Vartia (1976) have derived the exact price index for our CES unit-cost function. It can be written as the geometric mean of the individual price changes

where the weights are calculated using the following expenditure shares:

So far, we have assumed that all varieties of one good are available in both periods. The price index developed by Feenstra (1994) allows us to incorporate new and disappearing product varieties. The effects of a change in the variety set are given by the following proposition.

Proposition

For every good g, if d gct = d gct−1 for \(c \in I_g = ((I_{gt} \cap I_{gt-1});\;\; I_g \neq \emptyset,\) then the exact price index for good g with change in varieties is given by

where

The idea of the Feenstra (1994) index is to correct the conventional price index P g by multiplying it with an additional term which measures the influence of new and disappearing varieties and is called the lambda ratio. The numerator λ gt measures the impact of new varieties: Varieties available at t, but not at t − 1 (i.e., new varieties), are comprised in the set I gt but not in the set I g , and therefore expenditures on such varieties lower λ gt . Analogously, expenditures on varieties available at, t − 1 but not at t (i.e., disappearing varieties) lower the term λ gt−1. Hence, the price index is corrected downward if expenditure on new varieties is relatively large and expenditure on disappearing varieties is relatively small. Furthermore, a high elasticity of substitution causes the term \((\frac{\lambda_t}{\lambda_t-1})^\frac{1}{\sigma-1}\) to approach unity and, consequently, dampens the effect of the lambda ratio on the price index. This is intuitive, since new and disappearing products will only have a minor influence on the welfare of consumers if close substitutes exist. We use the methodology proposed by Feenstra (1994) in our empirical analysis to obtain consistent estimates for the elasticity of substitution, see “Appendix”. Having derived the exact price index for one good, we can now aggregate the imported goods to an aggregate import price index as in Broda and Weinstein (2006). This is done by building a geometric mean of the price indices. The aggregate import price index is then given by

where the weights w gt are analogously defined as in Eqs. (5) and (6). Equation (11) shows that the aggregate exact import price index is the product of the conventional import price index, CIPI(I), and the aggregated lambda ratios. The factor correcting the conventional import price index can thus be expressed by the ratio of the corrected import price index and the conventional import price index—called the endpoint ratio (EPR).

Using a simple Krugman (1980) structure of the economyFootnote 11, the inverse of the EPR can be weighted by the share of imports on the GDP to obtain the gains from variety (GFV):

where w M t is the import share.

4 Empirical results

In this section, we present and discuss the variety gains estimates for the EU member states. We also show where these gains originate geographically and provide some robustness measures.

4.1 The gains from variety in the countries of the European Union

In the first step of our calculation, we use Eq. (9) to calculate the lambda ratios for each imported product category of each country. The lambda ratios are a more precise measure of variety growth than the count data used in Table 3, since they take the consumer budget decision into account by using expenditure shares as weights. Summary statistics for these ratios are presented in Table 4.Footnote 12 For example, the median lambda ratio for Ireland is 0.96 < 1, implying that the typical imported product category in Ireland experienced a positive variety growth of about 4 %.Footnote 13

In the largest four EU economies, the average growth in imported variety has been moderate, with median lambda ratios of 0.98 or 0.99, indicating a weighted variety growth of 1 or 2 %. In the “small old” member states, the median lambda ratios range from 0.95 in the case of Greece to 1.00 for Luxembourg. The “new” member states have experienced a higher increase in imported varieties. The median lambda ratio can be as low as 0.79 in Latvia or 0.81 in Bulgaria, indicating a variety growth of up to 25 %. Exceptions are Malta, Hungary, and Poland with median lambda ratios of 0.99 or 1.00. From the quantiles displayed in the last two columns of Table 4, it can be inferred that there is substantial variation across product categories with respect to variety growth.

As pointed out by our theoretical framework, this observed variety growth does not directly imply an increase in consumer welfare, since the degree of substitutability within the different product categories is essential in our model. On the one hand, the availability of a new variety of car fuel is expected to have a low impact on consumer welfare, since fuel is a homogeneous good. Within a CES framework, this homogeneity is expressed by a high value of the elasticity of substitution. On the other hand, consumers do care about different varieties within differentiated product groups, such as footwear, furniture or automobiles. Consequently, these product categories exhibit low elasticities of substitution, and therefore new varieties in these product categories lower the price index substantially.Footnote 14 We estimate the elasticities of substitution for every imported product category of each country following Feenstra (1994). Table 5 reports descriptive statistics of the estimated elasticities.Footnote 15

Our estimation of the elasticities of substitution reveals that the median elasticity of countries ranges from 3.41 to 4.89. These values are of similar magnitude as those obtained in other studies, as for example in Broda and Weinstein (2006), Broda et al. (2006) or Berry et al. (1995). Based on the assumption of a Krugman-type economy, this translates into median markups of between 25 and 42 %. The last two columns of Table 5 show the 5 and 95 % percentiles, indicating large differences across products regarding the substitutability of varieties. In the case of Sweden, for example, 5 % of all elasticities are higher than 22.54. Such high values imply almost perfectly homogeneous varieties from the viewpoint of a CES consumer.

We test whether our estimated elasticities are sensible from a practical point of view. First, we categorize them according to the classification of Rauch (1999).Footnote 16 We find that our estimates fit the expectations well: Homogeneous product categories exhibit a median elasticity of 4.8, reference priced products of 4.3, and differentiated products of 4.0. This also holds for the individual countries in our data set. Second, we estimate the elasticities at different product aggregation levels; i.e., CN-6 and CN-4. We find that the elasticities tend to decrease in broader defined product categories. These results strengthen our confidence in our elasticity estimates.

Our results do not suggest any apparent systematic differences between median elasticities across different countries; e.g., between small and large or between “old” and “new” member states. This is noteworthy, given the different structure of the EU economies in terms of size, growth rate and development.

Using our estimated elasticities of substitution and the lambda ratios, we calculate the corrected price indices following Eq. (8) for each of the product categories in all member states. Following Eq. (11), these indices are then aggregated into the corrected import price index. The ratio of the conventional import price index and the corrected import price index then results in the EPR as displayed by Eq. (12). We obtain the bias in the conventional import price index (in the following simply referred to as the “bias”) by calculating 1/EPR − 1. The EPR and the bias are depicted in Table 6. For example, a bias of 3.66 % in Estonia implies that the conventional import price index overstates the actual price evolution by 3.66 %, by not taking the change in the variety set into account. Finally, by weighting the bias by the import share as in Eq. (13), we obtain the GFV expressed as a percentage of GDP.

The biases in the “large four” countries are small in magnitude. In the case of France and Germany, they are even slightly negative, implying an increase in the import price index and hence a consumer loss through variety. Given the relatively small import shares of these large economies, this translates into small gains or losses from imported varieties, not substantially different from zero.

In the “small old” economies of the EU, we observe that the conventional import price index is biased upwards in all countries except in the case of Finland, where the bias is negative, but close to zero. The magnitude of the biases is larger on average than in the “large four” economies, with Austria, Denmark, Ireland, the Netherlands, Portugal, Spain and Sweden experiencing a bias of more than 0.7 % over the considered time span. Weighting the biases with the generally higher import shares results in GFV that mostly lie between 0.2 and 0.75 % of GDP. GFV for consumers remain limited in these countries.

In all “new” member states—with the exception of Malta—the change in the variety set translates into lower import prices as shown by the positive biases. The magnitude of the correction in the price index is much larger than in the “old” member states, with Estonia and Latvia experiencing lower import prices of over 3 %, while in Bulgaria, Lithuania, Romania, and Slovakia, the bias is larger than 2 %. For Poland, we observe the lowest positive bias with 0.96 %. Consumers in these countries have thus benefited from lower import prices to a greater extent than consumers of the “old” member states. Expressed relative to total production, the gains amount to as much as 3.02 % of GDP in the case of Latvia. High GFV above 1.5 % of GDP are also found in Bulgaria, Estonia and Slovakia. Cyprus, the Czech Republic, Hungary, Lithuania, Romania, and Slovenia exhibit modest gains that still lie above 0.8 % of GDP. In Poland, the GFV are small with only 0.34 % of GDP—a result also driven by the relatively low import share. Such variety gains can be interpreted in the following way. Consumers in Latvia are willing to spend 3.02 % of their GDP in the year 2008 to gain access to the larger set of imported varieties available in 2008 compared to the set of varieties available in 1999.

4.2 Geographical origin of the variety gains from trade

In a next step, we analyze whether the GFV stem from internal EU trade or from trade with countries outside the EU. The methodology presented in Sect. 3 allows us to compute the EPR for each trading partner, or, more appropriately here, the EPR stemming from trade with a group of countries. For each country group i, in our case the EU and ROW, the EPR is computed as follows:

where W igt is the ideal log-change weight of country group i on good g.Footnote 17 By multiplying both EPR i , the total EPR as reported in Table 6 is obtained. In our case,

The bias in the price index can then be calculated as described above and the results for all 27 EU members are given in Table 7.Footnote 18 Columns (1) and (2) depict the EPR resulting from the imports from other EU member states and from the ROW, respectively, while columns (3) and (4) display the bias in the import price index resulting from these imports.Footnote 19 For example, Greek consumers gain from the change in the variety set imported from its EU trading partners, expressed by a bias of 1.16 %, depicted in column (3). At the same time, Greece loses from the change in imported variety of its ROW trading partners—with a negative bias in the import price index of −0.69 %, as displayed in column (4). In Latvia, the country with the highest gains from variety, the upward bias of the import price index is 5.18 % considering just imports from other EU members, but only 0.63 % regarding ROW imports. Hence, the GFV predominantly stem from intra-EU trade.

Most countries experience lower import prices due to both variety imports from other EU members and from ROW countries. However, in all these countries, the upward bias stemming from internal imports is much higher than from external imports.Footnote 20 Other countries, such as the Czech Republic, Luxembourg and Finland gain from the higher variety from intra-EU trade, but lose part of these gains due to the lower variety imported from ROW countries. In Finland, this loss dominates the gains.Footnote 21

4.3 Interpretation of the results

Our results can be summarized as follows: The average bias of the import price index (the total GFV) for the “large four” amounts to 0.18 % (0.04 %).Footnote 22 Internal EU trade flows contributed about 60 % to this low value. For the “smaller old” member states, we estimate positive gains with an average bias in the price import index (total GFV) of 1.11 % (0.39 %). Although these countries benefited from both, internal and external imports, our results show that more than 70 % of the gains can be attributed to imports from other EU members. Finally, in the “new” member states the upward bias of the import price index (the total GFV) amounts to 1.74 % (0.92 %) on average. These countries have benefited substantially from internal EU trade over the last decade. Internal trade accounts for about 85 % of the total gains from imported varieties.

One explanation for this pattern of the gains from variety makes use of the ongoing process of European integration as well as globalization in general: The “large four” countries already played a key role in the global economy at the beginning of the observation period and had well-established trade links within the EU as well as within the global trading system. Consequently, access to new varieties via important new trade linkages was limited, given their already diverse structure of imports in 1999. Hence, we observe that most trade was growing at the intensive margin, resulting in relatively low variety gains. Besides these reasons, the smaller import shares also play a role in these countries when calculating the gains from variety.

For the high-income, “small old” member states, we observe in Sect. 2 that import diversity is somewhat more limited compared with the largest economies. The increase over the last decade, however, has been more substantial and their large import shares make imports, and the imported variety of products in particular, an important source of welfare gains. At the same time, trade of these countries with other EU members was already well diversified by the year 1999, with the EU being a particularly important source of imports for decades. These countries were part of the EU for a longer period and had already adopted important institutions like the single market program before 1999. This also explains the slower growth rate of new trade linkages within the EU trade network compared to the higher growth rate of trade linkages with non-EU trading partners as described in Sect. 2. However, our analysis shows that when using the more sophisticated structural estimation technique, most of the gains from variety actually stem from new imported varieties from EU trading partners. This can be explained by the fact that most of the new imported varieties from non-EU partners were imported at relatively low values.

The “new” member countries were less well integrated within the world trading system and the EU in 1999 and consequently took advantage of the dynamic globalization process over the last decade to diversify and extend their imported variety set. Our results imply that most of the gains stem from internal EU imports—the descriptives statistics in Sect. 2 have already shown that new trade linkages were established predominantly with other EU members. With the reorientation of the transition economies towards “old” Europe in combination with the reduction in trade barriers and the adoption of important institutions of the EU during the accession period, the trade linkages of these countries with all the other EU-27 members have grown at a rapid rate, resulting in substantial consumer welfare gains via the existence of a more diverse set of products and varieties.

4.4 Robustness of the results

The empirical approach used in our study rests on a few strong assumptions. First, one potential issue is the dependence of the results on the estimated elasticities of substitution. Second, the trade data set used for our analysis dictates that a particular definition of an imported variety is adopted, which, in turn, drives the results. Third, the methodology used above is based on a Krugman (1980) model, and hence it only focuses on imported varieties and assumes away any changes in domestic variety. We provide a short discussion on how this simplification may influence our results.

Estimating elasticities of substitution from trade data is a difficult task. Due to the data restrictions, several strong assumptions have to be made to identify this parameter. It is beyond the scope of this paper to discuss this in detail.Footnote 23 To assess the impact of the estimated elasticities on our results, we keep the elasticities for each country and each product group constant at different levels and calculate the variety gains using a fixed elasticity of σ = 3, σ = 4, σ = 6 or σ = 8. Under all specifications, the qualitative implications of our results presented above continue to hold. The “large four” exhibit the lowest gains, close to zero for all four countries. Gains in the “small old” members are positive—with the exception of Finland—but lower than the gains in the “new” member states. For example, using σ = 6, Estonian consumers enjoy variety gains amounting to 2.32 % (down from 2.76 % using the estimated elasticities) of GDP, while in the Netherlands and in the United Kingdom the gains amount to 0.59 % (0.59 %) and 0.10 % (0.07 %). Hence, the observed differences between countries predominantly stem from fundamental differences in the import variety set as observed in the trade data.Footnote 24

In our contribution, a variety is defined as a particular good imported from a particular country. Blonigen and Soderbery (2010) argue that the variety definition imposed by conventional trade data hides some variety growth. Using a detailed market data set on the U.S. automobile market, the authors show that the gains from variety double if more disaggregated variety definitions (i.e., different car brands and models) are used. Bernard et al. (2009) comment in the same vein and argue that new (and still scarce) firm-level data imply higher variety gains from trade, since every firm produces several different varieties. From this point of view, our results provide a conservative measure for the GFV.

Given the data restrictions, we cannot assess how a more detailed variety definition might affect our results. However, we can re-estimate the variety gains using different aggregation levels of the trade data; e.g., CN-6, to analyze how less detailed data influence our results. For this purpose, we also re-estimate the elasticities of substitution to match them with the now broader product categories. The variety gains turn out to be robust to a change in the product definition from CN-8 to CN-6. For example, in Estonia the GFV decrease from 2.76 to 2.62 % of GDP; in Italy, they remain at 0.15 %; and in Belgium welfare gains slightly increase from 0.51 to 0.67 %. Hence, even though varieties are now more broadly defined and some variety growth captured at the CN-8 level is excluded, our results remain robust. One explanation for this result is the fact that the elasticities of substitution generally decrease if products are defined in a broader manner. Hence, by using less disaggregated data, we potentially miss some variety growth. However, the broader defined varieties are estimated as being more differentiated, and this has an opposite effect on our estimated gains.

More importantly, we observe that although we use different variety definitions, the qualitative assessments discussed above—for example that “new” members gain more from imported variety—remain the same.Footnote 25

Since our model is based on Krugman (1980) we implicitly assume that the number of domestically produced varieties is not affected by trade liberalization. Or put differently, we assume that domestically produced goods cannot be substituted by imported goods. Hence, a change in the variety of imported goods does not affect the domestic economy, or more specifically, the variety of domestically produced goods. The same stark assumption is used by Broda and Weinstein (2006). Several contributions address this issue theoretically. For example in Melitz (2003), more productive foreign firms crowd out less productive domestically producing firms, leading to a decrease in domestically produced varieties.Footnote 26 As Arkolakis et al. (2008) or Baldwin and Forslid (2010) show, the total number of varieties consumed in a country can even decrease after trade liberalization in such a model.

In a recent contribution, Ardelean and Lugovskyy (2010) address this issue empirically by setting up a simple model, in which domestically produced and imported varieties can be substituted. Depending on the magnitude of the elasticities and relative productivity of the domestic sectors, domestic varieties are assumed to be replaced by imported varieties upon trade liberalization. The authors quantify a potential bias resulting from ignoring this possible substitution and find that the bias of the price index is not more than 8 % in US manufacturing.Footnote 27 It is difficult to say how this result relates to the gains found for the countries of the EU. Member states differ in various aspects that determine the potential crowding-out of domestically produced varieties. Further research is needed beyond the scope of this paper to address these important questions.

5 Conclusion

Over the last decade, the member states of the EU have been part of a dynamic economic integration process within Europe as well at a global level, resulting in a strong increase in imported products and varieties. In this paper, we adopt the methodology outlined by Feenstra (1994) and Broda and Weinstein (2006) to estimate the effects of variety growth on consumer welfare for all EU member states for the period from 1999 to 2008.

Our results show that for most countries the import price index is biased upwards due to the omission of newly imported varieties. This gives rise to positive welfare gains to consumers stemming from an increased product variety. However, our analysis also reveals substantial differences across countries. Based on the assumption of a Krugman-type economy, we were unable to identify any sizable gains from newly imported varieties for the largest four countries of the EU over the last decade. The gains are more substantial for the smaller and especially the younger member states of the EU. Our results suggest positive welfare gains of 3 % of GDP in the case of Latvia. Especially for smaller and fast-growing economies, the creation and extension of trade linkages thus present an important source of welfare, a fact often neglected in the discussion about the positive effects of globalization and economic integration.

To shed further light on the source of these gains, we identify to what extent intra-EU and non-EU imports contribute to the gains from variety. Our analysis shows that the majority of the welfare gains can be attributed to increased variety imports from other EU members. Imports from non-EU countries did not contribute much to the gains; on the contrary, according to our results these imports often even contributed negatively, thus mitigating the positive effects of variety growth in the total imports. These results prove to be reasonably robust under several different specifications.

Notes

Detailed and consistent quarterly trade data for Eastern European economies are available from 1999 onwards. Given the relatively short time period, using quarterly data allows us to estimate the elasticities of substitution more precisely. To conserve consistency, we also use quarterly data to calculate the lambda ratios.

Our data set includes 189 countries. Hence, each member state is faced with 26 potential internal trading partners in each product category and with 162 external ones.

Growth at the intensive margins of trade is defined as an increase in value of existing varieties. This is in line with the findings of Besedes and Prusa (2007) for high-income countries. Growth at the extensive margin is defined as an increase in the number of varieties.

A further decomposition of the number of imported varieties at the country level has shown that the main suppliers in terms of varieties of EU economies in 2008 were (in decreasing order) Germany, Italy, the Netherlands, the United Kingdom, Belgium and the United States. The driving suppliers of new varieties between 1999 and 2008 are China, Poland, the Czech Republic, Turkey, Belgium, Austria, the Netherlands, Spain and Hungary. Hence, besides established suppliers, some emerging EU and non-EU economies have been the main contributors to the substantial variety growth observed above.

Netted out; i.e., disappearing varieties are subtracted from new varieties.

This observation may hint at a trade diversion effect due to the redirection of trade flows to EU trading partners following the Eastern Enlargement in 2004. However, we do not test this assertion in our contribution. Our interest lies in the investigation of the variety gains given the realized trade flows.

This seems to contradict the observation that the number of product categories mostly decreased in these countries (Table 2). However, new product categories were imported from more countries than disappearing categories, which leads to this result.

There are fewer lambda ratios calculated than product groups: Some lambda ratios cannot be defined at the CN-8 level, since there is no common variety at the beginning and the end of the chosen time period. In this case, we follow Broda and Weinstein (2006) and define the lambda ratio at the SITC-5 or even the SITC-3 level. The sigma for these categories is obtained by calculating the weighted average of all corresponding CN-8 sigmas. Hence, we use all sigmas estimated at the CN-8 level.

Calculated as 1/0.96-1 = 4.2 %.

We test whether these presumptions about the elasticities of homogeneous and differentiated goods are true.

A total of 2,093 estimated elasticities in Malta may seem too few, considering that this country imported 5,517 goods in 1999 alone. However, some product categories in very small countries are imported from very few trading partners and for only a very short time span. For these goods, it is not possible to estimate the elasticities of substitution. See Feenstra (1994) for more information about this estimation technique. In the calculation of the variety gains below, we replace the missing elasticities at the CN-8 level by estimates at the CN-4 product level.

Rauch (1999) classifies goods as homogeneous if they are traded on organized exchanges, as reference priced if the goods can be identified by referring to list prices, meaning that prices can be quoted without mentioning the name of the manufacturer, and as differentiated if products differ over a multitude of dimensions including, for example, a brand name or the place of selling.

With \(W_{igt}=\left(\frac{s_{igt} - s_{igt-1}} {\ln s_{igt} - \ln s_{igt-1} }\right)/\sum_{i = EU, ROW}\left(\frac{s_{igt} - s_{igt-1}} {\ln s_{igt} - \ln s_{igt-1} }\right)\) and \(s_{igt}=\frac{p_{igt} x_{igt}}{\sum_{i = EU, ROW}{p_{igt} x_{igt}}}\).

Alternatively, the EPRs for EU and ROW can be calculated using country block specific lambda ratios, i.e. \(\frac{\lambda_{git}}{\lambda_{git-1}}\). This better accounts for the heterogeneity in product variety growth in the two country blocks but renders the property expressed in Eq. (15) invalid. Importantly, applying this alternative approach, results remain similar to the ones presented in Table 7.

To calculate this bias, we make the implicit assumption that when the variety set supplied by EU countries changes, the composition of ROW imports remains the same—and vice versa.

Again, this seems to contrast with some results from the descriptive analysis, especially for the “old” members where we have seen that the greater part of the variety count increase stems from ROW countries. However, these statistics neglect the weighting of varieties. Varieties from EU countries are often imported at greater value than ROW varieties. The results highlight the necessity of relying on more sophisticated variety measures instead of using simple count data.

One exception is Malta. This country experiences variety losses from both blocks, the losses from EU trading partners being larger in magnitude.

We calculate the weighted average bias of the import price index using the size of each country in terms of its GDP. This is done to obtain a clearer picture of the differences between the three country blocks.

This is not to say that country- and product-specific elasticities are not important for finding the true gains. In fact, the distribution of product-specific elasticities is highly skewed and thus it is hard to justify an “average” elasticity that is applied on all products. For example, Broda and Weinstein (2006) show that by using the median elasticity instead of the full distribution, the variety gains are overestimated by 100 %.

We also perform the exercise using product categories defined at CN-4. The qualitative results remain the same. However, GFV generally decrease using this definition which only defines about 1,000 products. Thus, the missed variety growth lowers the gains, while the lower elasticities do not fully compensate this decrease.

Of course, one still has to weight these varieties by the expenditure shares. Thus, these results themselves do not imply that the gains from variety would be negative. In fact, Feenstra (2010) shows that using the Melitz (2003) model, gains from imported variety and losses from domestically produced varieties have to cancel each other out.

Concentrating on the automobile sector, Blonigen and Soderbery (2010) show that by taking domestically produced automobiles into account, variety gains even increase.

Using shares helps to avoid the problems of measurement error of unit-value indices as pointed out by Kemp (1962).

If ω g = 0 we get the special case of a horizontal supply curve.

References

Ardelean, A., & Lugovskyy, V. (2010). Domestic productivity and variety gains from trade. Journal of International Economics, 80(2), 280–291.

Arkolakis, C., Demidova, S., Klenow, P. J., & Rodríguez-Clare, A. (2008). Endogenous variety and the gains from trade. American Economic Review, 98(2), 444–450.

Armington, P. S. (1969). A theory of demand for products distinguished by place of production. International Monetary Fund Staff Papers, 16(1), 159–178.

Baldwin, R. (2006), The euro’s trade effect (ECB Working Paper Series 594). Frankfurt: European Central Bank.

Baldwin, R. E., & Forslid, R. (2010). Trade liberalization with heterogeneous firms. Review of Development Economics, 14(2), 161–176.

Bernard, A. B., Eaton, J., Jensen, J. B., & Kortum, S. S. (2003). Plants and productivity in international trade. American Economics Review, 93(4), 1268–1290.

Bernard, A. B., Jensen, J. B., Redding, S. J., & Schott, P. K. (2009). The margins of US trade. American Economic Review, 99(2), 487–493.

Berry, S., Levinsohn, P., & Pakes, A. (1995). Automobile prices in market equilibrium. Econometrica, 63(4), 841–890.

Besedes, T., & Prusa T. J. (2007). The role of extensive and intensive margins and export growth (NBER Working Paper 13628). Cambridge, MA: National Bureau of Economic Research.

Blonigen, B. A., & Soderbery, A. (2010). Measuring the benefits of foreign product variety with an accurate variety set. Journal of International Economics, 82(2), 168–180.

Broda, C., Greenfield, J., & Weinstein, D. E. (2006). From groundnuts to globalization: A structural estimate of trade and growth (NBER Working Paper 12512). Cambridge, MA: National Bureau of Economic Research.

Broda, C., & Weinstein, D. E. (2004). Variety growth and world welfare. American Economic Review, 94(2), 139–144.

Broda, C., & Weinstein, D. E. (2006). Globalization and the gains from trade. Quarterly Journal of Economics, 121(2), 541–585.

Buch, C., & Piazolo, D. (2001). Capital and trade flows in Europe and the impact of enlargement. Economic Systems, 253(3), 183–214.

Chen, N. (2004). Intra-national versus international trade in the European Union: Why do national borders matter? Journal of International Economics, 63(4), 93–118.

Diewert, W. E. (1976). Exact and superlative index numbers. Journal of Econometrics, 4(2), 115–145.

Feenstra, R. C. (1991). New goods and index numbers: U.S. import prices (NBER Working Paper 1902). Cambridge, MA: National Bureau of Economic Research.

Feenstra, R. C. (1992). How costly is protectionism? Journal of Economic Perspectives, 6(3), 159–178.

Feenstra, R. C. (1994). New product varieties and the measurement of international prices. American Economic Review, 84(1), 157–177.

Feenstra, R. C. (2010). Measuring the gains from trade under monopolistic competition. Canadian Journal of Economics, 43(1), 1–28.

Feenstra, R. C., & Kee, H. L. (2008). Export variety and country productivity: Estimating the monopolistic competition model with endogenous productivity. Journal of International Economics, 74(2), 500–518.

Feenstra, R. C., & Markusen, J. R. (1994). Accounting for growth with new inputs. International Economic Review, 35(2), 429–447.

Funke, M., & Ruhwedel, R. (2005). Export variety and economic growth in East European transition economies. Economics of Transition, 13(1), 25–50.

Hanson, G. H. (2005). Market potential, increasing returns and geographic concentration. Journal of International Economics, 67(1), 1–24.

Hausman, J. A. (1981). Exact consumer surplus and deadweight loss. American Economic Review, 71(4), 664–676.

Hausman, J. A. (1994). Valuation of new goods under perfect and imperfect competition (NBER Working Paper 4970). Cambridge, MA: National Bureau of Economic Research.

Hummels, D., & Klenow, P. J. (2005). The variety and quality of a nation’s trade. American Economic Review, 95(3), 704–723.

Kemp, M. C. (1962). Errors of measurement and bias in estimates of import demand parameters. Economic Record, 38(83), 369–372.

Klenow, P. J., & Rodríguez-Clare A. (1997). Quantifying variety gains from trade liberalization. Unpublished, University of Chicago.

Krugman, P. R. (1979). Increasing returns, monopolistic competition, and international trade. Journal of International Economics, 9(4), 469–479.

Krugman, P. R. (1980). Scale economies, product differentiation, and the pattern of trade. American Economic Review, 70(5), 950–959.

Krugman, P. R. (1981). Intraindustry specialization and the gains from trade. Journal of Political Economy, 89(5), 959–973.

Manchin, M., & Pinna, A. M. (2009). Border effects in the enlarged EU area: Evidence from imports to accession countries. Applied Economics, 41(14), 1835–1854.

Melitz, M. J. (2003). The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica, 71(6), 1695–1725.

Nitsch, V. (2000). National borders and international trade: Evidence from the European Union. Canadian Journal of Economics, 33(4), 1091–1105.

Rauch, J. E. (1999). Networks versus markets in international trade. Journal of International Economics, 48(1), 7–35.

Romer, P. M. (1994). New goods, old theory, and the welfare costs of trade restrictions. Journal of Development Economics, 43(1), 5–38.

Sato, K. (1976). The ideal log-change index number. Review of Economics and Statistics, 58(2), 223–228.

Soderbery, A. (2010). Investigating the asymptotic properties of import elasticity estimates. Economics Letters, 109(2), 57–62.

Trajtenberg, M. (1989). Welfare analysis of product innovations, with an application to computed tomography scanners. Journal of Political Economy, 97(2), 444–479.

Vartia, Y. O. (1976). Ideal log-change index numbers. Scandinavian Journal of Statistics, 3(3), 121–126.

Yi, K.-M. (2003). Can vertical specialization explain the growth of world trade? Journal of Political Economy, 111(1), 52–102.

Acknowledgments

We are grateful to Dalia Marin and Rolf Weder for constant advice on the project. We thank our colleagues at the University of Basel and the Ludwig-Maximilians-University of Munich, the participants of the SMYE in Istanbul, the ITFA Meeting in Las Vegas, the EEA Congress in Glasgow, the ESWC in Shanghai and CEA in Quebec for helpful comments and fruitful discussions. Lukas Mohler thankfully acknowledges the financial support of the WWZ Forum Basel and of the Swiss National Science Foundation (project no. 100014-124975).

Author information

Authors and Affiliations

Corresponding author

Appendix: Estimation of the elasticities of substitution

Appendix: Estimation of the elasticities of substitution

We briefly review the estimator developed by Feenstra (1994). Based on our utility function (1), we can derive the import demand equation for a single variety using expenditure shares s as defined above.Footnote 28 Taking logs and first differences results in:

where σ g is equal across countries, \(\varphi_{g,t} = (\sigma_g -1) \ln [\phi{g,t}^M (d_t)/\phi_{g,t-1}^M (d_{t-1})]\) is a random effect, since d t is unobserved and \(\varepsilon_{gct}=\Updelta \ln\,d_{gct}\). The export supply equation in logs and first differences is specified by

where ω g ≥ 0 is the good specific inverse supply elasticityFootnote 29 (assumed to be constant across countries) and δ g,c,t is an error term. We assume that the the error terms between the demand and supply curve (\(\varepsilon_{gct},\delta_{gct}\)) are uncorrelated after controlling for good- and time-specific effects. To take advantage of this assumption, we first eliminate the random terms \(\varphi_{g,t}\) and ψ g,t from the equations above by taking differences relative to a reference country k:

where \(\Updelta^{k} K_{gct}=\Updelta K_{gct}-\Updelta K_{g,k,t}\,\,for\,\,K =(\ln p,\ln s), \varepsilon_{gct}^{r}=\varepsilon_{gct}-\varepsilon_{g,r,t}\) and δ r g c t = δ g c t − δ g,r,t . We can now use the assumption of the independent error terms to multiply the two equations above and dividing by (1 − ρ g )(σ g − 1) to obtain

with obvious definitions of θ1,g and θ2,g . Since the error term u g c t is correlated with the prices and expenditure shares in X 1,g c t and X 2,g c t , we do not get a consistent estimator for θ1,g and θ2,g . Feenstra (1994) shows how to exploit the panel structure of the data to get a consistent estimator by averaging the last equation over all t. Hence, we can use the GMM estimator developed by Hanson (2005) to run a regression on the transformed equation to estimate θ1,g and θ2,g consistently.

where upper bars on variables denote sample means over t. This will produce consistent and efficient estimates of θ1,g and θ2,g as long as for some countries i ≠ k and j ≠ k

Once, we have consistent estimators of θ1,g and θ2,g we can calculate the elasticity of substitution σ g :

As long as θ1,g > 0, σ g can be estimated as

-

(a)

if \(\widehat{\theta}_{2,g}>0\) then \(\widehat{\rho}_g=\frac{1}{2}+\left(\frac{1}{4}-\frac{1}{4(\widehat{\theta}_{2,g}^2/\widehat{\theta}_{1,g})}\right)^{1/2}\), (b) if \(\widehat{\theta}_{2,g}<0\) then \(\widehat{\rho}_g=\frac{1}{2}-\left(\frac{1}{4}-\frac{1}{4(\widehat{\theta}_{2,g}^2/\widehat{\theta}_{1,g})}\right)^{1/2}\),

and in either case,

About this article

Cite this article

Mohler, L., Seitz, M. The gains from variety in the European Union. Rev World Econ 148, 475–500 (2012). https://doi.org/10.1007/s10290-012-0126-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-012-0126-1