Abstract

This paper measures the pass-through of trade costs into U.S. import prices by using actual data on duties/tariffs and freight-related costs. The key innovation is to decompose the indirect effects of trade costs (on prices) into the effects on markups, quality and productivity while measuring/interpreting the pass-through of trade costs into welfare. Robust to the consideration of variable versus constant markups, there is evidence for incomplete pass-through, mostly due to the negative indirect effects of trade costs on marginal costs, suggesting that lower trade costs are associated with imports that have higher marginal costs; markups are affected relatively less. When the effects of trade costs on marginal costs are further decomposed into their components, the positive contribution of quality dominates in all cases, followed by the negative effects of productivity, suggesting that lower trade costs are associated with higher-quality imports that have been produced with lower productivity.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Trade costs are partly determined by trade policy, and, thus, their reflection in the welfare of economic agents through prices (i.e., the pass-through of trade costs) is of political interest. Accordingly, the empirical literature on international trade has focused on the effects of changes in trade costs on export prices (of firms or source countries), referring to the gains from trade through export-oriented growth, especially by relying on dramatic liberalizations of trade for identification purposes.Footnote 1 Nevertheless, evidence on pass-through of trade costs to import prices is limited, which is important for import competition as well as household welfare in the destination country.Footnote 2

Although calculating the pass-through of trade costs into import prices is straightforward when the corresponding data are available, calculating the underlying details is the key to form trade policy, because, other than the direct effects of trade costs on import prices, one has to consider their indirect effects through other components of prices, namely markups and marginal costs, where the latter also includes information on quality and productivity (in the source country). As a simple example, if more liberal trade leads to an increase in import prices due to an increase in quality, this may be welfare improving in the importer country (depending on the trade-off between increased prices and quality), while an increase in import prices due to a reduction in productivity (with no quality effects) would be welfare worsening. Therefore, in a typical welfare analysis of an importer country, the pass-through of trade costs to prices should be controlled for markup effects as well as quality and productivity effects.

This paper achieves such an investigation by decomposing the U.S. import prices (measured at the U.S. dock) into marginal costs, markups and trade costs at the HTS 10-digit good level. Marginal costs are further decomposed into quality, productivity, and other factors. Using a demand-side model, for robustness, we consider both variable and constant markups in our investigation. After controlling for several fixed effects, we estimate the pass-through of trade costs to prices, markups, marginal costs, quality, and productivity. We also distinguish between the effects of duties and freight-related costs. Moreover, we use actual data on duties and freight-related costs to construct multiplicative trade costs; hence, our results are robust to alternative specifications of trade costs (such as additive trade costs).

When data for prices and trade costs are available (as in this paper), the main issue is the measurement of variables such as markups and marginal costs of production where the latter can further be decomposed into quality, productivity, and other factors (e.g., other local production costs). This paper introduces a new methodology for the identification of all of these variables. In particular, first, the price elasticity of demand is estimated using data on quantities and prices, where the estimation methodology of Feenstra (1994), which is robust to simultaneity bias, is used. Second, the estimated price elasticities are used to calculate markups, where we consider the cases of both variable markups (due to constant absolute risk aversion utility function of importers) and constant markups (due to constant relative risk aversion utility function of importers). Third, marginal costs of production are identified by using the data on prices and trade costs together with estimated markups. Fourth, quality measures are identified as the importer preference parameters (i.e., demand shifters) that are calculated by controlling the quantities traded for the effects of prices and other control variables (i.e., good-and-time fixed effects). Fifth, since measures of quality and marginal costs of production are shown to be positively related in the literature (as in a study by Crozet et al. 2012 who use pure data on quality), the relationship between the estimated measures of quality and marginal costs of production is tested by running a regression where all other factors are controlled for; the part of the marginal costs of production that cannot be explained either by quality or other factors is defined as the inverse of productivity. Once these variables are identified, we continue with investigating their interaction with trade costs.

The results of pass-through analyses show that the elasticity of U.S. import prices with respect to overall trade costs (i.e., duties/tariffs plus freight-related costs) is about \(-0.90\,\%\). During an episode of reducing trade costs, under the assumptions of variable (constant) markups, this elasticity of \(-0.90\,\%\) would correspond to a \(0.90\,\%\) increase in prices that is decomposed into \(1.74\,\% \left( 1.90\,\% \right) \) of an increase in marginal costs of production, \(0.16\,\% \left( 0.00\,\% \right) \) of an increase in markups and \(1.00\,\% \left( 1.00\,\% \right) \) of a reduction in trade costs (i.e., defined as direct effects of trade costs). The increase in the marginal costs of production \(1.74\,\% \left( 1.90\,\% \right) \) is further decomposed into \(1.10\,\% \left( 1.20\,\% \right) \) of an increase in quality, and \(0.63\,\% \left( 0.70\,\% \right) \) of a decrease in productivity for the cases of variable (constant) markups. Therefore, the contribution of quality has the lion’s share in explaining the effects of trade costs on prices, followed by productivity effects and markups.

Considering import competition and/or household utility, if we accept the inverse of import prices controlled for quality as a rough measure of welfare, \(1\,\%\) of a reduction in trade costs would result in \(0.20\,\% \left( 0.30\,\% \right) \) of an increase in welfare under the assumption of variable (constant) markups. When we decompose trade costs into duties/tariffs and freight-related costs, such values change as \(-0.21 \left( 0.75\right) \) for duties/tariffs and \(0.25 \left( 0.22\right) \) for freight-related costs, under the assumption of variable (constant) markups. These results show the importance of considering alternative measures of trade costs in pass-through calculations where freight-related costs play an important role, which is mostly ignored in the corresponding literature focusing on duties/tariffs.

The empirical results of this paper regarding the positive relation between tariffs and productivity are consistent with the existing literature (e.g., see Pavcnik 2002; Amiti and Konings 2007; Topalova and Khandelwal 2011, for firm-level studies within countries, and Romalis 2007, for a cross-country analysis). In terms of the data set and control variables employed, this paper has similarities with a study by Amiti and Khandelwal (2013) who find that lower trade costs are associated with quality upgrading for products close to the world quality frontier, whereas lower trade costs discourage quality upgrading for products distant from the frontier. In this paper, when the effects of overall trade costs (i.e., duties/tariffs plus freight-related costs) are considered, in the case of a reduction in trade costs, the results are in line with quality upgrading on average across products, which is consistent with studies such as by Hart (1983) who argues that competition will reduce managerial slack. However, when the effects of only duties/tariffs are considered (in this paper), in the case of a reduction in trade costs, the results are in line with quality downgrading on average across products, which is consistent with studies such as by Schumpeter (1943) who suggests that the appropriability effect would reduce incentives to innovate. Despite the consistency of the empirical results of this paper with the existing literature, however, none of the mentioned papers have considered the separate effects of duties/tariffs and freight-related costs on prices. Most importantly, these papers have not decomposed the effects of trade costs (on prices) into the effects on markups, quality and productivity while measuring/interpreting the pass-through of trade costs into welfare. This paper bridges these gaps.

In the following section, we introduce the data and estimate the tariff pass-through into prices; this section will also motivate the rest of the paper. In Sect. 3, we introduce the model that distinguishes between variable and constant markups. The implications of the model are estimated in Sect. 4 to identify markups, marginal costs, quality, and productivity. The pass-through of tariffs to the components of prices is depicted in Sect. 5. Concluding remarks are provided in Sect. 6.

2 Data

The U.S. imports data are from the US. International Trade Commission (http://dataweb.usitc.gov/) covering imports from 220 source countries at the HTS 10-digit good level between 1996 and 2012. The data set includes (i) customs value (quantity times price charged by exporters) measured at the dock of the source country, (ii) quantity traded, (iii) general import charges in values (i.e., the aggregate cost of all freight, insurance, and other charges incurred, excluding U.S. import duties), and (iv) calculated duties in values (i.e., the estimated import duties collected based on the applicable rates of duty as shown in the Harmonized Tariff Schedule).

We calculate import prices by dividing the sum of customs value, general import charges and calculated duties by the quantity traded. Overall trade costs in multiplicative terms are calculated by dividing the sum of general import charges and calculated duties by the customs value; this calculation methodology effectively converts any type of trade costs (either additive or multiplicative) into multiplicative terms. Overall trade costs are decomposed into duties/tariffs and freight-related costs; duties/tariffs are calculated by dividing the calculated duties by the customs value, while freight-related costs are calculated by dividing the general import charges by the customs value. The descriptive statistics on trade costs are given in Appendix Table 9 at the sectoral level. As is evident, mean duties have reduced about 1.1 %, while mean cost, insurance, freight (CIF) measures have reduced by 0.68 % between 1996 and 2012.

We consider a balanced panel (i.e., the number of goods and source countries are the same across time) to have a consistent comparison across goods and source countries through time; this strategy makes our estimations robust to the product replacement bias, similar to what Nakamura and Steinsson (2012) have shown in the context of price indexes. In order to control for outliers, we further filter the data by ignoring price observations that have coefficient of variation (i.e., standard deviation over mean) above one over time. This has left us with a decent number (18,360 \(=1080\times 17\)) of observations, including data from 499 goods and 64 source countries. Hence, in the final data set used, although each good/country pair has data for 17 years, the number of goods considered differ across countries.Footnote 3

Distribution of trade costs paid on the U.S. Imports. Notes Both duties and CIF are in percentage terms (i.e., log(1 + x), in particular). Sample only includes good-country pairs present in 1996 and 2012. Observations are demeaned by their time-average in 1996 to show their change over time. The values used to produce the second (third) column of figures have been obtained by taking the average across countries (goods)

Since understanding the effects of trade costs is the main interest in this paper, we need to understand their characteristics first. Figure 1 depicts the distribution of both duties and freight-related costs (CIF) across goods and/or source countries for 1996 and 2012. As is evident, trade costs are heterogeneous across goods and countries through time. Therefore, understanding the pass-through of trade costs to prices requires a micro-level investigation that controls for this heterogeneity. Accordingly, we would like to understand the pass-through of trade costs to U.S. import prices by estimating the following specification:

where \(p_{s,t}^{g}\) is the price of good \(g\) imported from country \(s\), and \(\tau _{s,t}^{g}\) represents (gross) trade costs. Since prices may get affected by many other factors, we control for time fixed effects \(\delta _{t}\), good fixed effects \(\delta ^{g}\), source fixed effects \(\delta _{s}\), together with good and time fixed effects \(\delta _{t}^{g}\) (to capture the market dynamics for each good) and source and time fixed effects (to capture macroeconomic dynamics of each source country, including exchange rate pass-through). In this specification, if there are only direct effects of trade costs on prices, \(\delta _{\tau }^{p}\) would take a value of 1.Footnote 4 However, the opposite of this argument is not true; i.e., if \(\delta _{\tau }^{p}\) would take a value of 1, we cannot say that there are only direct effects of trade costs on prices. The reason is simple: Since prices have components other than trade costs, namely marginal costs of production and markups, when \(\delta _{\tau }^{p}=1\), we cannot know whether this one-to-one relation between trade costs and prices is due to the direct effects of trade costs on prices or due to the effects of trade costs on marginal costs of production and markups cancelling each other out. This is why we will conduct a formal investigation, below, by decomposing prices into their components and analyze the effects of trade costs on each component.

Before moving to the components of prices, the results of the estimation of Eq. 1 are given in Table 1 where we distinguish between the effects of duties and freight-related costs (i.e., CIF) as measures of trade costs. As is evident, considering the statistically significant \(\delta _{\tau }^{p}\) estimates of 1.21 and 1.13, a reduction in duties (over time and/or across goods/countries) is related to a bigger reduction in prices, on average, across goods and countries through time. These estimates are consistent with Feenstra (1989) who has estimated \(\delta _{\tau }^{p}\) values ranging between 0.57 and 1.39 using data on U.S. import prices of Japanese cars, trucks, and motorcycles, although our results are based on a much wider variety of goods and source countries. However, since the estimates of both 1.21 and 1.13 are not statistically different from 1 according their confidence intervals given in brackets, either there are only direct effects of duties on prices or the effects of duties on other components of prices cancel each other out.

When freight-related costs are considered in Table 1, \(\delta _{\tau }^{p}\) estimates are significantly below zero, justifying our distinction between the effects of duties and freight-related costs. In particular, a reduction in freight-related costs are associated with increasing prices, suggesting that marginal costs of production and/or markups paid on U.S. imports would also increase after a reduction in freight-related costs; the results are very similar when overall trade costs (duties plus freight-related costs) are considered. Therefore, there are indirect effects of trade costs on prices through marginal costs and/or markups.

Accordingly, there are two main hypotheses to be tested. First, if markups are positively related to trade costs (i.e., if markups decrease after a reduction in trade costs), this may be due to increasing competition among exporters (i.e., pro-competitive effects) or vice versa. Second, if marginal costs are negatively (positively) related to trade costs, this may be due to (i) an increase (a decrease) in the quality of the goods imported after more liberal trade, or (ii) a decrease (increase) in the productivity distribution of exporters. For testing these hypotheses, we need to identify marginal costs of production, markups, quality, and productivity, which we achieve by decomposing prices into their components, below. Since this identification depends on the modeling strategy, for robustness, we consider both variable and constant markups in our investigation in the next section.

3 Model

The multi-good partial-equilibrium model is characterized by a unique U.S. importer consuming/optimizing imports from a finite number of exporters. Each exporter maximizes its profits by following a pricing-to-market strategy. Since we do not have/use any production data, to keep the model as simple as possible, we only focus on the trade implications of having constant absolute risk aversion (CARA) and constant relative risk aversion form (CRRA) utility functions, which correspond to variable and constant markups, respectively.Footnote 5

3.1 Importers

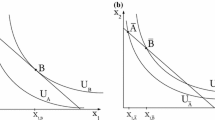

We model the utility of the U.S. importer at the good level to avoid any further assumptions for aggregation across goods. Accordingly, the U.S. importer has the following utility \(U_{t}^{g}\) out of consuming varieties of good \(g\) at time \(t\) coming from different source countries, each denoted by s:

and

where \(q_{s,t}^{g}\) is the quantity of products imported from country \(s\), \(p_{s,t}^{g}\) is the price of \(q_{s,t}^{g}\) at the destination (i.e., in the U.S.), \(\theta ^{g}>0\) represents a good-\(g\)-specific parameter (to be connected to the price elasticity of demand, below), and \(\chi _{s,t}^{g}\) represents a source-good-time-specific quality parameter that follows a random walk in log-linear terms according to:

where \(v_{s,t}^{g,\chi }\) is an i.i.d. shock with zero mean and variance \(\sigma _{\chi }^{2}\).Footnote 6

Maximizing utility subject to the budget constraint given by:

where \(E_{t}^{g}\) is the total expenditure of on good \(g\), results in the following demand function in the case of CARA:

and the following demand function in the case of CRRA:

According to these demand functions, after assuming that individual source countries have negligible impact on the U.S. price aggregates, the (absolute value of) price elasticity of demand \(\varepsilon _{s,t}^{g}\) can be obtained as follows for CARA:

and as follows for CRRA:

3.2 Exporters

Considering the demand functions given by Eqs. 6 and 7, each source/exporter country \(s\) follows a pricing-to-market strategy by maximizing the profit out of sales to the U.S.:

where \(c_{s,t}^{g}\) is the source-and-good-specific marginal cost in country \(s\) at time \(t\). We further assume that marginal costs are further given by:

where \(w_{s,t}^{g}\) represents marginal cost of production measured at the dock of the source country, and \(\tau _{s,t}^{g}\) represents (gross) multiplicative trade costs capturing duties/tariffs and freight-related costs. Both \(w_{s,t}^{g}\) and \(\tau _{s,t}^{g}\) follow random walks in log-linear terms according to:

and

where \(v_{s,t}^{g,w}\) and \(v_{s,t}^{g,\tau }\) are i.i.d. shocks with zero mean and variance \(\sigma _{w}^{2}\) and \(\sigma _{\tau }^{2}\).

The profit maximization problem results in the following pricing strategy under CARA utility:

where markups denoted by \(\mu _{s,t}^{g}\) are variable (i.e., they change with the quantity sold), and the following strategy under CRRA utility:

where markups are constant (i.e., they do not change with the quantity sold).

4 Estimation

This section depicts the details of estimating trade and destination-price implications of the CARA and CRRA cases. The main objective is to estimate markups (using an estimation methodology that is robust to simultaneity bias) to further use them in identifying marginal costs of production and quality parameters which will be important for calculating the pass-through of trade costs to these variables.

4.1 Equations to be estimated

Trade/quantity in the case of CARA given by Eq. 6 is already in the following lin-log format:

while trade/quantity in the case of CRRA given by Eq. 7 can be rewritten in a log-linear format as follows:

where expressions are very similar to each other except for the dependent variables.

The price equation can be written in log-linear terms as follows, for both CARA and CRRA cases:

where the only difference between the cases of CARA and CRRA will be due to the determination of markups and thus the decomposition of marginal costs versus markups, because we already have data for prices, \(p_{s,t}^{g}\), and trade costs, \(\tau _{s,t}^{g}\).

4.2 Estimation methodology

Since we have a possible simultaneity problem due to estimating quantity and price expressions, we will follow the estimation methodology in Feenstra (1994) that is robust to simultaneity bias.Footnote 7 Accordingly, for each good, after taking the first difference (with respect to time, to be denoted by \(\Delta \)), we will express estimated equations in relative terms (between source countries \(s\) and \(s^{\prime }\)) by considering the difference in quantities and prices. Such a strategy results in the following trade/quantity equation:

where

and the following price equation:

where

where the approximation in the first line is due to \(\ln \left( 1+x\right) \approx x\).Footnote 8 Estimation can be achieved since \(\xi _{ds}^{g,q}\) and \(\xi _{ds}^{g,p}\) are independent; recall that \(v_{s,t}^{g,\chi }\), \(v_{s,t}^{g,w}\) and \(v_{s,t}^{g,\tau }\) are i.i.d. shocks. In particular, the independence of \(\xi _{ds}^{g,q}\) and \(\xi _{ds}^{g,p}\) is used to obtain:

which corresponds to the following expression in the case of CARA:

and the following expression in the case of CRRA:

where \(\xi _{s,t}^{g}=\theta ^{g}\xi _{s,t}^{g,q}\xi _{s,t}^{g,p}\). Different from Feenstra (1994) who considers relative prices and quantities with respect to one country (i.e., Japan), we consider all independent source country pairs in our estimation. Since quantities and prices are correlated with shocks of \(v_{s,t}^{g,\chi }\), \(v_{s,t}^{g,w}\), and \(v_{s,t}^{g,\tau }\), then \(\xi _{s,t}^{g}\) is correlated with the right hand side variables in Eqs. 24 and 25. Nevertheless, \(\theta ^{g}\)’s can still be estimated consistently using instrumental-variable (IV) estimator, where instruments are source-country and source-country-pair fixed effects (the latter is to capture the effects due to considering all independent source country pairs). We achieve this estimation at the good level.

4.3 Identification of variables/parameters

Once \(\theta ^{g}\)’s are estimated, we can identify marginal costs of production \(w_{s,t}^{g}\)’s versus markups \(\mu _{s,t}^{g}\)’s using Eq. 18, since we already have data for prices \(p_{s,t}^{g}\)’s and trade costs \(\tau _{s,t}^{g}\)’s. We can also identify quality parameters of \(\chi _{s,t}^{g}\)’s as the residuals from estimating the following expressions for CARA and CRRA, respectively:

and

where, for each expression, we run only one regression for the pooled sample.

Using pure quality data, Crozet et al. (2012) show that quality and marginal costs (as defined in this paper) are positively related. Hence, in order to make sure that the residuals obtained from estimating Eqs. 26 and 27 in fact represent the quality of imports, we can test their relation according to the following specification:

where we control for several fixed effects as in Eq. 1 (with the same notation and intuition). In particular, if we can show that marginal costs are positively related to quality (i.e., \(\delta _{\chi }^{c}>0\)), we will have evidence for the residuals obtained from estimating Eqs. 26 and 27 representing the quality of imports.

In Eq. 28, it is important to emphasize that residuals of \(\log \kappa _{s,t}^{g}\)’s represent the part of (log) marginal costs of production that cannot be explained by quality or any other fixed effects (including country-time fixed effects capturing wages, exchange rates, etc.); therefore, we will consider \(\kappa _{s,t}^{g}\) as a natural (inverse log) measure of productivity which is good-country-time specific.

4.4 Estimation results

We start with depicting the estimation results for \(\theta ^{g}\), together with the implied price elasticities of demand and markups, in Table 2, where all estimates are significant at the 5 % level.Footnote 9 As is evident, price elasticity of demand values are higher under CARA, while markups are higher under CRRA. Compared to the existing literature, the distribution of estimated markups under CARA are consistent with De Loecker and Warzynski (2012), who provide several estimates of markups for Slovenian manufacturing plants ranging between 1.03 and 1.28.Footnote 10

The estimation results regarding the relation between quality and marginal costs (i.e., Eq. 28) are given in Table 3. Independent of the markup type, quality is positively related to marginal costs of production. In the case of variable markups, the relation between marginal costs of production and quality is almost one-to-one, while, in the case of constant markups, the relation is weaker (although it is still statistically significant). Hence, we have strong evidence for the validity our measure of quality. In the existing literature, using pure quality data on French wine, Crozet et al. (2012) have estimated the same relation with a coefficient of 0.22; therefore, results with constant markups are closer to their estimate, although our coefficients represent the sample pooled across goods and countries through time (rather than just French wine).

5 Pass-through of trade costs

In this section, we estimate the pass-through of trade costs to markups (only for the case of CARA), to marginal costs of production, to quality, and to productivity. We also achieve a welfare analysis to show the impacts of trade costs on welfare.

We start with estimating the pass-through of trade costs to variable markups according to:

where we control for several fixed effects as in Eq. 1 (with the same notation and intuition); the results are given in Table 4. As is evident, duties are positively related to markups (i.e., the elasticity of markups with respect to trade costs \(\delta _{\tau }^{\mu }>0\)), suggesting that more liberal trade leads to an increase in competition among exporters (i.e., pro-competitive effects). However, the results are the opposite for freight-related or overall-trade costs where lower trade costs are associated with higher markups (i.e., \(\delta _{\tau }^{\mu }<0\)); hence, pro-competitive effects of reduced trade costs disappear when freight-related or overall trade costs are considered. This latter result also corresponds to lower import competition (that the U.S. firms selling in the domestic market would benefit from).

We continue with estimating the pass-through of trade costs to marginal costs according to:

for which the results are given in Table 5, where duties have no statistically significant effects (i.e., \(\delta _{\tau }^{w}=0\) statistically), under both variable and constant markups. However, freight-related costs and overall trade costs (i.e., duties plus freight-related costs) both have negative effects on marginal costs (i.e., \(\delta _{\tau }^{w}<0\)), suggesting that lower trade costs are associated with either higher quality and/or lower productivity of goods imported. In order to distinguish between the effects on quality versus productivity, we first test the effects of trade costs on quality according to:

for which the results are given in Table 6. As is evident, duties are positively related to quality (i.e., \(\delta _{\tau }^{\chi }>0\)), implying that more liberal trade reduces quality of the goods imported. Nevertheless, freight-related costs and overall trade costs (i.e., duties plus freight-related costs) both have negative effects on quality (i.e., \(\delta _{\tau }^{\chi }<0\)), which means that reduced trade costs attract higher quality products. We also test the effects of trade costs on inverse of productivity according to:

for which the results are given in Table 7 where trade costs (either duties and/or freight-related costs) are negatively related to inverse of productivity (i.e., \(\delta _{\tau }^{\kappa }<0\)), suggesting that a reduction in trade costs would reduce productivity as well (since \(\kappa _{s,t}^{g}\) represents inverse of productivity).

Although these results are intuitive on their own, what have we learned regarding the decomposition of the effects of trade costs on U.S. import prices (i.e., \(\delta _{\tau }^{p}\) in Eq. 1)? We can answer this question by considering the following total derivative decomposition of \(\delta _{\tau }^{p}\) into \(\delta _{\tau }^{\mu }\) and \(\delta _{\tau }^{w}\) (which is an approximation, since total derivative considers small changes in variables) using Eqs. 18, 28, 29, 30, 31, and 32:

where we have used the total derivative decomposition of \(\delta _{\tau }^{w} \) into \(\delta _{\chi }^{w}\delta _{\tau }^{\chi }\) and \(\delta _{\tau }^{\kappa }\). For the calculation of this decomposition, we already have the estimates of each parameter in our earlier tables; \(\delta _{\chi }^{w}\) is given in Table 3, \(\delta _{\tau }^{\chi }\) is given in Table 6, and \(\delta _{\tau }^{\kappa }\) is given in Table 7. We depict the contribution of each effect on prices in Table 8 for alternative measures of trade costs under variable and constant markups. As is evident, the contribution of quality dominates in all cases, followed by the effects of productivity; markups (in the case of CARA) have relatively minor effects. If we focus on the results based on overall trade costs to have a basic summary of our results, under variable (constant) markups, \(1\,\%\) of a reduction in trade costs has resulted in \(0.90\,\%\) of an increase in prices, \(0.16\,\%\) \(\left( 0.00\,\% \right) \) of an increase in markups, \(1.10\,\%\) \(\left( 1.20\,\% \right) \) of an increase in quality, and \(0.63\,\%\) \(\left( 0.70\,\% \right) \) of a reduction in productivity.

The results also show that the consideration of duties versus freight-related trade costs is important in forming optimal policy, since they have different effects on the components of prices. In particular, when trade is more liberal through reduced duties (i.e., a trade policy variable), markups decrease (i.e., there are pro-competitive effects when variable markups are considered) or remain the same (when constant markups are considered), and marginal costs remain the same due to decreasing quality and increasing productivity cancelling each other’s effects. However, when trade is facilitated through reduced freight-related costs, markups increase (i.e., there are anti-competitive effects when variable markups are considered) or remain the same (when constant markups are considered), and marginal costs increase due to both increasing quality and decreasing productivity. Finally, when overall trade costs (i.e., duties plus freight-related costs) are considered, the effects of freight-related costs dominate those of duties while interpreting the results. Therefore, depending on the objective of the policy makers (e.g., pro-competitive effects or higher-quality imports), a balanced approach between reducing duties (through trade policy) and reducing freight-related costs (through innovations in the freight/insurance sectors or the productivity in ports) should be considered.

Regarding the welfare implications, if we accept the inverse of import prices controlled for quality (i.e., the inverse of the price paid for the same quality of goods) as a rough measure of welfare, we can write the elasticity of welfare with respect to trade costs as follows:

where \(1\,\%\) of a reduction in trade costs would correspond to a reduction of \(\delta _{\tau }^{WELFARE}\) percent (equivalent to increase of \(\left( \delta _{\tau }^{p}-\delta _{\chi }^{w}\delta _{\tau }^{\chi }\right) =\left( 1+\delta _{\tau }^{\mu }+\delta _{\tau }^{\kappa }\right) \) percent) in welfare. Such welfare gains from reducing trade costs are also given in Table 8, where, under variable (constant) markups, \(1\,\%\) of a reduction in trade costs would result in \(0.20\,\% \left( 0.30\,\% \right) \) of an increase in welfare due to the reduction in productivity and/or the increase in markups (only in the case of variable markups). When we decompose trade costs into duties/tariffs and freight-related costs, the effects of a \(1\,\%\) reduction in trade costs on welfare change as \(-0.21\,\% \left( 0.75\,\% \right) \) for duties/tariffs and as \(0.25\,\% \left( 0.22\,\% \right) \) for freight-related costs, under the assumption of variable (constant) markups.

Therefore, trade costs reductions are welfare improving (except for the value of \(-0.21\,\%\)) where freight-related costs play an important role in the pass-through of trade costs, which is mostly ignored in the corresponding literature only focusing on duties/tariffs. Nevertheless, from a trade-policy perspective, which would mostly consider the policy variable of duties/tariffs, welfare gains from reducing trade costs can be negative \((-0.21\,\%)\) under the assumption of variable markups where, after \(1\,\%\) of a reduction in trade costs, the reduction in markups (i.e., \(0.18\,\%\)) would not be enough to compensate for welfare losses due to the reduction in productivity (i.e., \(1.33\,\%\)).

6 Concluding remarks

The important effects of trade costs on export prices has been accepted and proven empirically in the international trade literature. However, there has been a lack of attention on the similar effects on import prices, which is important for import competition and household/individual welfare in the importer country. This paper is a first attempt to fill this gap considering pass-through of trade costs into U.S. import prices and their components at the most disaggregated good level, where indirect effects of trade costs through markups and marginal costs have shown to be playing an important role. Robust to the consideration of variable versus constant markups, when the effects of trade costs on marginal costs are further decomposed into the effects through quality, productivity, and other factors, the contribution of quality dominates in all cases, followed by the effects of productivity; markups (in the case of variable markups) have relatively minor effects.

The results also show that reduction in trade costs are mostly associated with welfare gains, with the exception in the case of variable markups where duties/tariffs are considered as the only measure of trade costs. Accordingly, depending on the objective of the policy makers (e.g., pro-competitive effects or higher-quality imports), a balanced approach between reducing duties (through trade policy) and reducing freight-related costs (through innovations in the freight/insurance sectors or the productivity in ports) should be considered. Nevertheless, since prices are affected by both duties/tariffs and freight-related costs, the benchmark number that we consider out of our calculations regarding welfare gains from reducing trade costs is about \(0.20\,\% \left( 0.30\,\% \right) \), under the assumption of variable (constant) markups. Based on this result, we conclude that there is incomplete pass-through of trade costs into welfare. The results are robust to the specification of trade costs (e.g., multiplicative versus additive trade costs), because we use actual data on duties/tariffs and freight-related costs to construct multiplicative trade costs (which are convenient for pass-through estimations in log-linear terms).

The results, however, are not without caveats. For instance, our calculation method of variable markups (i.e., considering CARA utility functions) is one of the many methodologies covered in Arkolakis et al. (2012). Although this may seem like a restrictive approach, it has come with simplicity in empirical estimation. Since we consider a balanced panel to have a consistent comparison across goods and source countries through time, our estimations ignore the effects on prices and welfare through the extensive margin (i.e., introduction of new goods); nevertheless, using a balanced panel has made the results robust to the product replacement bias, similar to what Nakamura and Steinsson (2012) have shown in the context of price indexes. Finally, we have not considered the pass-through of trade costs into other demographic data within the U.S., similar to what Porto (2006), Nicita (2009), and Marchand (2012) have achieved for Argentina, Mexico, and India, respectively; we leave this question for future research.

Notes

An earlier study by Feenstra (1989) is an exception that focuses on the effects of tariffs on U.S. prices of Japanese cars. Recent studies by Porto (2006), Nicita (2009), and Marchand (2012) have investigated the effects of tariffs on household welfare using demographic data, focusing on Argentina, Mexico, and India, respectively.

After the estimation is done and the parameters/variables are identified, in order to control for outliers in the sample, mostly due to using unit prices as measures of prices, we ignore the estimates of price elasticities and markups that are below and above the 3rd and 97th percentile of the corresponding distributions.

It is important to emphasize that direct effects of trade costs on prices taking a value of 1 is just a definition in this paper. For sure, there may be many other channels that may lead to direct effects ot rade costs on prices taking a value different from 1; e.g., the demand conditions or the share of U.S. in the worldwide sales of the exporter firm may be associated with imperfect pass-through. However, such calculations are out of the scope of this paper due to the lack of corresponding data.

It is important to emphasize that \(\chi _{s,t}^{g}\)’s may also be capturing tastes in utility. Nevertheless, we will test the relation between marginal costs and \(\chi _{s,t}^{g}\)’s, below, and show that they have a positive and statistically significant relation. Under a supplementary assumption of constant returns to scale in production (i.e., marginal costs not depending on the quantity produced through demand shifters), having a statistically significant relation between marginal costs and \(\chi _{s,t}^{g}\)’s confirms our specification. Having a quality measure different from unit values is also in line with Khandelwal (2010) who shows that using unit values as a proxy for quality would lead to biased results.

This approximation holds better especially when \(-1<x<1\) which is the CARA case in this paper where \(x=\alpha ^{g}q_{ds}^{g}\) and gross markups \(\left( \text {given\,by }\mu _{ds}^{g}=\left( 1-\alpha ^{g}q_{ds} ^{g}\right) ^{-1}\right) \) are expected to be higher than \(1\).

The estimation results at the sectoral level are given in Table 10 in the Appendix, where the sector of “Arms and Ammunition” (“Optical, Photographic Instruments”) has the highest median/mean markup under the assumption of variable (constant) markups.

The results are also in line with Yilmazkuday (2013) who estimate median variable (constant) markups of 1.04 \(\left( 4.04\right) \) using a similar methodology but a different cross-country data set covering 4-digit SITC goods. Mandel (2013) also finds significant differences across the cases of variable and constant markups where the median variable (constant) markups are about 1.80 (7.60) across goods.

References

Amiti, M., & Khandelwal, A. K. (2013). Import competition and quality upgrading. The Review of Economics and Statistics, 95(2), 476–490.

Amiti, M., & Konings, J. (2007). Trade liberalization, intermediate inputs, and productivity: Evidence from Indonesia. American Economic Review, 97(5), 1611–1638.

Arkolakis, C., Costinot, A., Donaldson, D., & Rodriguez-Clare, A. (2012). The elusive pro-competitive effects of trade. Working paper, Yale University.

Badinger, H. (2007). Has the EU’s single market programme fostered competition? Testing for a decrease in markup ratios in EU industries. Oxford Bulletin of Economics and Statistics, 69(4), 497–519.

Behrens, K., & Murata, Y. (2007). General equilibrium models of monopolistic competition: A new approach. Journal of Economic Theory, 13(1), 776–787.

Bottasso, A., & Sembenelli, A. (2001). Market power, productivity and the EU single market program: Evidence from a panel of Italian firms. European Economic Review, 45(1), 167–186.

Crozet, M., Head, K., & Mayer, T. (2012). Quality sorting and trade: Firm-level evidence for French wine. Review of Economic Studies, 79(2), 609–644.

De Loecker, J., & Warzynski, F. (2012). Markups and firm-level export status. American Economic Review, 102(6), 2437–2471.

De Loecker, J., Goldberg, P. K., Khandelwal, A. K., & Pavcnik, N. (2012). Prices, markups and trade reform. (NBER Working Paper 17925). Cambridge, MA: National Bureau of Economic Research.

Feenstra, R. C. (1989). Symmetric pass-through of tariffs and exchange rates under imperfect competition: An empirical test. Journal of International Economics, 27(1–2), 25–45.

Feenstra, R. C. (1994). New product varieties and the measurement of international prices. American Economic Review, 84(1), 157–177.

Harrison, A. E. (1994). Productivity, imperfect competition and trade reform: Theory and evidence. Journal of International Economics, 36(1/2), 53–73.

Hart, O. D. (1983). The market mechanism as an incentive scheme. Bell Journal of Economics, 14(2), 366–382.

Khandelwal, A. (2010). The long and short (of) quality ladders. Review of Economic Studies, 77(4), 1450–1476.

Kim, E. (2000). Trade liberalization and productivity growth in Korean manufacturing industries: Price protection, market power, and scale efficiency. Journal of Development Economics, 62(1), 55–83.

Krishna, P., & Mitra, D. (1998). Trade liberalization, market discipline and productivity growth: New evidence from India. Journal of International Economics, 56(2), 447–462.

Konings, J., Van Cayseele, P., & Warzynski, F. (2005). The effects of privatization and competitive pressure on firms’ price-cost margins: Micro evidence from emerging economies. Review of Economics and Statistics, 87(1), 124–134.

Levinsohn, J. (1993). Testing the imports-as-market-discipline hypothesis. Journal of International Economics, 35(1/2), 1–22.

Mandel, B. (2013). Chinese exports and US import prices. Staff Reports 591, Federal Reserve Bank of New York.

Marchand, B. U. (2012). Tariff pass-through and the distributional effects of trade liberalization. Journal of Development Economics, 99(2), 265–281.

Nakamura, E., & Steinsson, J. (2012). Lost in transit: Product replacement bias and pricing to market. American Economic Review, 102(7), 3277–3316.

Nicita, A. (2009). The price effect of tariff liberalization: Measuring the impact on household welfare. Journal of Development Economics, 89(1), 19–27.

Pavcnik, N. (2002). Trade liberalization, exit, and productivity improvements: Evidence from Chilean plants. Review of Economic Studies, 69(1), 245–276.

Porto, G. G. (2006). Using survey data to assess the distributional effects of trade policy. Journal of International Economics, 70(1), 140–160.

Romalis, J. (2007). Market access, openness and growth.’ (NBER Working Paper 13048). Cambridge, MA: National Bureau of Economic Research.

Schumpeter, J. (1943). Capitalism, socialism and democracy. London: Allen Unwin.

Topalova, P., & Khandelwal, A. K. (2011). Trade liberalization and firm productivity: The case of India. Review of Economics and Statistics, 93(3), 995–1009.

Yilmazkuday, H. (2013). Constant versus variable markups: Implications for the Law of one price. Working paper, Florida International University.

Acknowledgments

The author would like to thank Harmen Lehment, Sylvia Kuenne, an anonymous referee, Robert C. Feenstra, and the participants of 2013 International Trade Workshop at Florida International University for their helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

About this article

Cite this article

Yilmazkuday, H. Pass-through of trade costs to U.S. import prices. Rev World Econ 151, 609–633 (2015). https://doi.org/10.1007/s10290-015-0218-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-015-0218-9