Abstract

On the one hand, management accounting systems increase in complexity, and the frequency and intensity of use of the provided information for decision-making are rising. On the other hand, there is evidence that the provided information is inaccurate, which in most cases incurs economic costs. This paper analyzes the impact of biases in raw accounting data on the accuracy of the provided decision-influencing information. The simulation study presents results concerning single and multiple biases which are intendedly entered into traditional costing systems. The presented results give insights into interactions among biases and indicate that multiple input biases do not necessarily affect the information quality negatively. Surprisingly, in some setups interactions among biases lead to a mitigation or even a compensation among themselves. Furthermore, the findings can constitute the basis for generating efficient organizational data quality policies, i.e., results indicate where (not) to tolerate biases and how to prioritize actions regarding information quality with respect to accuracy and cost of accuracy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In its most simple form, management accounting can be defined as collecting and recording useful accounting and statistical data as well as reporting them to decision makers (Bruns and McKinnon 1993; Crossman 1958; Singer 1961; Feltham 1968; Chenhall 2003; Bouwens and Abernethy 2000; Cassia et al. 2005; Brignall 1997; Horngren et al. 2005). The environment in which management accounting takes place appears to have changed. As a response to increased turbulence, competition and uncertainty, advances in information technology and new management practices, a variety of management accounting systems (MAS) and techniques has emerged in order to fulfill this basic management accounting function (Garg et al. 2003; Heidmann et al. 2008; Burns and Scapens 2000; Ezzamel et al. 1996; Bouwens and Abernethy 2000). While MAS increase in complexity, the intensity and frequency of use of these systems increase as well (Chong 1996; Paradice and Fuerst 1991; Labro and Vanhoucke 2007; Leitner 2012). Many decisions are based on information provided by MAS (Garg et al. 2003; Horngren et al. 2002). Hence, the scope of MAS can be defined as providing decision-makers with data that reflect the real world (Cooper and Kaplan 1988; Shim and Sudit 1995; Orr 1998). Consequently, the quality of information is critical (Paradice and Fuerst 1991).

MAS are unlikely to be error-free in application (Labro and Vanhoucke 2007, 2008; Orr 1998; Banham 2002). There is evidence that data used for decision-making is distorted between 5 and 10 % (Madnick and Wang 1992; Tee et al. 2007). Redman (1996, 1998) reports error-rates of up to 30 %. Inaccurate MAS-output could result in suboptimal or wrong decisions or even in failing to recognize the need to make a decision (Ballou et al. 2003; Biros et al. 2002; Klein 2001; Lillrank 2003; Orr 1998; Wang and Strong 1996; Fox 1961; Cooper and Kaplan 1988). Respective impacts can range from disruptions in operations to organizational extinction (Tee et al. 2007; Fox 1961). According to elaborations by Christensen (2010), biases are inevitable due to the fact that MAS serve many purposes. Although little is known about the effects biases have on processed MAS-output their occurrence is broadly accepted among users of MAS (Labro and Vanhoucke 2007). In order to react appropriately to biased data in MAS, decision-makers have to know effects of biases and effects of interactions among biases on the quality of the provided information (Labro and Vanhoucke 2007; Tee et al. 2007). This emphasizes the need for research on the nature and extent of biases in MAS.

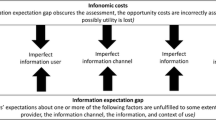

Information processed by MAS serves two important roles: (1) assist in planning and managerial decision-making and (2) motivate individuals, i.e., to help to mitigate the divergence of interests between the headquarters and the decentralized units in order to solve organizational control problems (Zimmerman 2000; Sprinkle 2003; Young and Lewis 1995). These two roles of MAS are also referred to as the decision-facilitating and the decision-influencing role (Demski and Feltham 1976), whereby this paper focuses on the decision-influencing perspective. At a general level, MAS can be differentiated into (1) capital budgeting systems, (2) costing systems and (3) accounting systems for planning and control (Horngren et al. 2002). Among the range of different types of MAS, this paper focuses on costing systems. On the one hand, several loops of cost-reallocation indicate that costing systems might be characterized by a larger number of arithmetic operations than the other types of MAS. This potentially affects the propagation of errors. On the other hand, costing systems are usually highly integrated into organizational processes with a large number of agents interacting with the the system in order to enter data (Leitner 2012, 2013). Among different conceptions of costing systems this paper surveys biases in traditional costing systems, due to a higher practical relevancy. According to investigations by Drury and Tayles (1995) and Garg et al. (2003), traditional costing systems are widely used while newer conceptions show a much lower rate of usage. The decision-influencing role of the information provided by costing systems inter alia covers (1) the controlling of the efficiency of organizational decision-making and (2) might also build the basis for an incentivization that motivates the decision-makers towards a cost-effective behavior. If the provided information is biased, these functions might not be fulfilled as desired, which potentially affects the organizational performance negatively.

This paper analyses effects of intentionally distorted input data that result from interactions of agents with the costing system. In particular, the following research-questions are analyzed: What are the effects of (1) intended single input biases and (2) intended multiple input biases in input data on the quality of the decision-influencing information provided by costing systems.

In order to face the complexity of the research question, this investigation employs a simulation approach. Costing systems are a collection of interacting components, i.e. processing steps (cf. Table 1; Fig. 1), whereby some of the components are more influential than others but no component controls the behavior of the whole system. Simple patterns of interactions among components of costing systems and repeated individual interaction can lead to complex situations with their outcome being nearly impossible to predict (Gilbert 1995). There are many agents interacting with the costing system who might act opportunistically. The accuracy of the costing systems’ output is inextricably linked to the individual judgments, decisions and actions of the interacting agents (Sprinkle 2003). The consideration of different agents’ actions would lead to intractable dimensions of formal modeling (Davis et al. 2007). It is widely believed that simulation is a powerful research method for challenging this complexity (Resnick 1999). Furthermore, simulations make it possible to analyze macro level outcomes, i.e., the accuracy of the costing systems’ output, that result from micro level interactions, i.e., the (opportunistic) agents’ behavior and the interaction of the costing system’s components (Ma and Nakamori 2005). Therefore, simulation might support management in generating knowledge about the linkages between individual level behaviors and the overall system level outcomes (North and Macal 2007). Estimating biases in costing systems in empirical research would be particularly difficult. Results regarding the effects of independent on dependent variables under research might be contaminated because the respective effects cannot necessarily be disentangled from other effects. Furthermore, dependent and independent variables themselves might be measured imprecisely, i.e., the variables contain systematic noise (Sprinkle 2003). Apart from these concerns, it is nearly impossible to determine a true costing benchmark in order to calculate effects of biases, while controlled simulation experiments allow for this possibility and also allow for studying cause-and-effect relations under uncontaminated conditions (Kerlinger and Lee 2000). Thus, due to the dimensions of formal modeling and the limitations of empirical research, a simulation approach appears appropriate.

This paper contributes to management accounting research and practice in the following ways. First, the presented results give insights into the impact of biases in input data on costing systems’ accuracy. The results indicate that biases do not necessarily affect costing system accuracy negatively (cf. Table 5b). Rather, the results show that interactions among biases lead to mitigation or even compensation among themselves. Second, the generated knowledge can assist in assessing information quality in costing systems and can constitute the basis for individual prioritization of actions for improving information quality in the best possible way. Thus, the presented results potentially constitute the basis for the decision where (not) to tolerate biases and also allow for assessing actions regarding data quality with respect the trade-off between accuracy and cost of accuracy.

The remainder of this paper is structured as follows: in Sect. 2, the concept of bias is elaborated more precisely. Section 3 outlines the computational model of the costing system and the behavioral model of the interacting agents. Section 4 presents the methodology of data analysis and discusses the key parameters for the simulation experiments. In Sect. 5, the results are presented. Section 6 discusses the presented results, concludes and suggests avenues for future research.

2 The concept of bias

For the concept of bias, this investigation follows Dechow et al. (2010), who state that accounting systems’ accuracy is affected by estimations and judgments which inherently entail unintentional errors and intentional biases. The applied concept of bias also refers to elaborations by Barefield (1970), who distinguishes unintentional and intentional biases in the context of forecasting, whereby unintentional bias corresponds to the concept of unintentional error as elaborated by Dechow et al. (2010). Specifically, Barefield (1970) defines unintentional biases as the difference of an agents’ estimate and the forecast of an ideal observer who has the best knowledge of the respective estimation and has no incentive do distort the forecast based on this estimation. Intentional biases, on the contrary, are defined as the difference of the agents’ estimate of the forecast and the actually reported forecast.

In the present study, intentional biasing behavior is considered to have two distinct characterizations: (1) agents observe correct data but intentionally distort data introduced into the costing system due to personal objectives, and (2) agents intentionally reduce their effort for observing correct data to be introduced into the costing system. Thus, agents have no knowledge about unbiased data and introduce the observed (and biased) data into the costing system. The term unintentional biasing behavior is used for unintentional distortions of data introduced into the costing system. In particular, unintended (input) biases might occur due to limitations of bounded rationality (cf. Simon 1957), e.g. limited knowledge, limited understanding or human fallibility (Hendry 2002; Simon 1991). Intended biases that result from reduced effort for determining correct data and unintentional biases cannot be distinguished in all cases. In this paper, the focus is set on distortions that result from intentional biasing behavior.

3 The simulation model

In order to comprehend the simulation model, there are three aspects that have to be described more precisely. This section discusses these three aspects. First, the formal model of the costing systems defines the way data is processed by the system’s different components and provides the mode of interactions among these components. Second, the behavioral model gives the behavioral assumptions from which the biases under investigation are deduced. Third, an outline of how the structure of biases is incorporated into the computational model of the costing system is necessary.

3.1 The formal model of the costing system

Costing systems are designed modularly, whereby the computational model of the costing system introduced in this section can be subdivided into the modules (1) determination and classification of costs, (2) building of direct cost pools, (3) allocation of indirect costs to cost centers, (4) internal cost allocation and (5) cost allocation to product (for an overview cf. also Fig. 1 and Table 1). The following sections are organized accordingly.

3.1.1 Determination and classification of costs

The simulation model considers cost information to be collected from business cases. In order to represent these business cases, a number of input cost objects which contain information on incurred costs is generated. The cost information contained in the input cost objects is randomly drawn from the exogenously given interval \(U[\underline{a}^{ico}; \overline{a}^{ico}]\). Input cost objects are denoted as \(co_{in_{i}} \in CO_{in}\) with \(i \in \{1,\ldots ,|CO_{in}|\}\). In a further step, a cost category \(ka_{j} \in KA\) is assigned to each input cost object whereby \(j \in \{1,\ldots ,|KA|\}\). The assignment of cost categories to input cost objects is captured by the function \(f^{co}\left( co_{in_{i}}\right) = ka_{j}\).

Incurred costs can be subdivided into direct and indirect costs. Direct costs are costs that can be specifically assigned to a certain cost objective. On the contrary, indirect costs cannot be identified exclusively as belonging to a certain cost objective in an economic feasible way (Horngren et al. 2002). Accordingly, the set of cost categories can be disjunctively divided into a subset of direct and a subset of indirect cost categories. Direct and indirect cost categories are denoted as \(ka_{j} \in KA^{dir}\) and \(ka_{j} \in KA^{indir}\), respectively. On the basis of the assigned cost categories, input cost objects can be classified as either direct or indirect. For further elaborations, input cost objects that have assigned a direct cost category of \(ka_{j} \in KA^{dir}\) are denoted as \(co_{in_{i}} \in CO^{dir}_{in}\) and input cost objects that have assigned an indirect cost category \(ka_{j} \in KA^{indir}\) are denoted as \(co_{in_{i}} \in CO^{indir}_{in}\).

3.1.2 Building of direct cost pools

In the simulation model, direct costs are mapped in a way that they can be exclusively identified as belonging to a certain cost center. Direct cost categories can be clustered into direct cost pools \(ka^{dir,grp}_{k} \in KA^{dir,grp}\) with \(k \in \{1,\ldots ,|KA^{dir,grp}|\}\). The clustering of direct cost categories is captured by the function \(f^{ka} \left(ka_{j}\right) = ka^{dir,grp}_{k}\).

By summing up cost information contained in input cost objects \(co_{in_{i}}\) which have assigned a direct cost category of the same direct cost pool, the total costs per direct cost pool \(costs^{dir}_{k}\) can be calculated, i.e.,

3.1.3 Allocation of costs to cost centers

Input cost objects that cannot be exclusively identified with one certain cost objective have to be allocated to certain cost centers, i.e., allocation type 1 (Horngren et al. 2002). Allocation type 1 usually is based on plausible and reliable output measures (Horngren et al. 2002). In the simulation model, these output measures are randomly drawn from the exogenously given interval \(U[\underline{a}^{cd:type1};\overline{a}^{cd:type1}]\). The keys for allocation type 1 are denoted as matrix \(\mathbf V \). Matrix \(\mathbf V \) contains elements \(v_{n,i}\) where \(n\) indicates cost centers \(m_{n} \in M\) and \(i\) indicates input cost objects \(co_{in_{i}} \in CO^{indir}_{in}\). Allocation type 1 takes place by multiplying the (indirect) input cost objects with the respective allocation keys. In the formal model, matrix \(\mathbf G \) represents the indirect costs allocated to cost centers whereby elements \(g_{n,i}\) of matrix \(\mathbf G \) are calculated as \(g_{n,i} = co_{in_{i}} \cdot v_{n,i}\) where \(n\) indicates cost centers and \(i\) indicates input cost objects \(co_{in_{i}} \in CO^{indir}_{in}\). Hence, \(g_{n,i}\) represents the share \(v_{n,i}\) of the business case \(co_{in_{i}}\) allocated to cost center \(m_{n}\). Based on matrix \(\mathbf G \), the primary costs, i.e., the costs allocated to cost centers in allocation type 1, can be calculated, i.e.,

3.1.4 Internal cost allocation

If organizational units provide services or products to other organizational units, costs that incur at the providing unit have to be reallocated to the receiving units (Horngren et al. 2002). In the model of the costing system applied in this paper, a number of cost centers that solely support other departments are considered. The set of cost centers \(M\) can be disjunctively divided into a subset of direct and a subset of indirect cost centers. Direct and indirect cost centers are denoted as \(m_{n} \in M^{dir}\) and \(m_{n} \in M^{indir}\), respectively, whereby indirect cost centers refer to the providing units. Thus, costs \(costs^{prim}_{n}\) allocated to \(m_{n} \in M^{indir}\) in allocation type 1 are fully reallocated to direct cost centers \(m_{n} \in M^{dir}\) in allocation type 2.

The reallocation of costs from indirect to direct cost centers is based on cost center output which is randomly drawn from the exogenously given interval \(U[\underline{a}^{cd:type2};\overline{a}^{cd:type2}]\). The cost center output is denoted as \(r_{l,n,u} \in R\) where \(l \in \{1,\ldots ,|R|\}\) indicates the basis of allocation type 2, \(n,u \in \{1,\ldots ,|M|\}\) indicate cost centers, \(m_{n}\) is the providing unit, \(m_{u}\) is the receiving unit and \(n \ne u\). Which cost center output is actually applied in order to allocate costs from cost center \(m_{n}\) to cost center \(m_{u}\) in allocation type 2 is captured by the function \(f^{cd} \left( m_{n};m_{u} \right) = r_{l,n,u}\).

The model considers a step-down method for allocation type 2, i.e., services rendered from indirect cost centers to other indirect cost centers are partially considered (cf. also Horngren et al. 2002). Allocation type 2 is divided into two steps. In the first step, internal cost allocation among indirect cost centers takes place, while in the second step, costs are fully reallocated to direct cost centers. In step one, the secondary costs \(costs^{sec}_{n,u}\) allocated from indirect cost centers \(m_{n} \in M^{indir}\) to indirect cost centers \(m_{u} \in M^{indir}\) are calculated, i.e.,

According to the applied step-down method, once costs assigned to indirect cost centers are reallocated, other cost centers do not allocate costs back. In the second step of allocation type 2, costs allocated to indirect cost centers are fully reallocated to direct cost centers. As a result, the entire costs \(costs^{ent}_{n}\) allocated to direct cost centers \(m_{n} \in M^{dir}\) in allocations type 1 and 2 can be calculated, i.e.,

3.1.5 Cost allocation to products and calculation of costs per cost center

All costs allocated to organizational units in allocations type 1 and 2 have to be assigned to cost objectives, e.g., products, services or activities (Horngren et al. 2002). This last step of cost allocation is referred to as allocation type 3. In order to allocate costs to cost objectives, this simulation study considers overhead rates whereby the model of the costing systems distinguishes between direct cost centers \(M^{dir,dcp}\) with direct cost pools and direct cost centers \(M^{dir,mc}\) with manufacturing costs as the basis of allocation type 3. \(M^{dir,dcp}\) and \(M^{dir,mc}\) are disjunct subsets of \(M^{dir}\).

For cost centers \(M^{dir,dcp}\) function \(f^{dcp}\left( m_{n} \right) = ka^{dir,grp}_{k}\) defines which direct cost pool is used as the basis of allocation type 3. Function \(f^{\underline{dcp}} \left(m_{n}\right) = k\) gives the subscript that indicates the respective direct cost pool. Overhead rates \(b_{n}\) for cost centers \(m_{n} \in M^{dir,dcp}\) are calculated on the basis of entire costs allocated to the respective cost centers and the entire costs of the corresponding direct cost pool, i.e.,

For cost centers \(M^{dir,mc}\), the manufacturing costs (i.e., all costs allocated to direct cost centers \(M^{dir,dcp}\) in allocations type 1 and 2) are the basis of allocation type 3. These cost centers might capture functions such as administration, sales or marketing. Thus, for cost centers \(m_{n} \in M^{dir,mc}\) overhead rates \(b_{n}\) result in

Finally, after having finished allocation type 3 and having calculated all overhead rates, the entire production costs \(costs^{prod}_{n}\) per direct cost center \(m_{n} \in M^{dir}\) can be calculated. As in the case of overhead rates, the calculation mode is different for \(M^{dir,dcp}\) and \(M^{dir,mc}\). In particular, for direct cost centers with direct cost pools as the basis of allocation type 3, the entire costs of production result in

while for direct cost centers with the manufacturing costs as the basis of allocation type 3, the entire costs of production result in

3.2 The behavioral model and resulting biases

This section introduces an agency model from which the biases under investigation are deduced. The simulated organizations incorporate a large number of principal-agent relationships between the headquarters and various agents. The organizations are mapped to consist of headquarters and a set of cost centers which are under the responsibility of cost center managers. For each cost center, there is one agent. Furthermore, for each organization an accounting department which responsible to an accounting department manager is considered. The agency model is introduced in two steps. In a first step, the commonalities of the principal-agent relationships are described in a generalized model. In a second step, the delegation relationships are put into concrete terms for each agent based on the generalized model and respective biases are deduced.

3.2.1 The generalized model of principal-agent relationships

In the simulated organizations, there are delegation relationships between one principal \(P\) and a number of agents \(h \in H\) whereby the principal is assumed to be risk-neutral and the agents are assumed to be risk-averse. The principal delegates tasks \(l \in L\) to agents. While there is no task that is delegated to more than one agent, some agents might be engaged in multiple tasks. The set of tasks delegated to agent \(h\) is denoted as \(L^{h}\). For each task, the function \(f^{l}\left(l\right) = h\) gives the agent \(h\) who the respective task \(l\) is assigned to. Exchanges between agents (e.g. side-contracts) remain unconsidered. The principal offers contracts to agents. The contracts are exogenously given. This simulation study does not aim at optimizing contracts, rather, this investigation analyses effects of biasing behavior on costing systems’ accuracy in case of the given contracts.

The main elements of the contracts offered by the principal are (1) the task(s) delegated to the respective agent, (2) the way to fulfill these task(s) requested by the principal in order to achieve the desired outcome, (3) the reward scheme related to the fulfillment of the respective task(s) and (4) the base(s) for the variable compensation component. The model assumes that the agent cannot obtain better alternatives from the market and, hence, accepts the offered contract. After having accepted the contract, each agent is assumed to privately take an action \(a^{h,l} \in A^{h,l}\) whereby \(A^{h,l}\) stands for the set of actions agent \(h\) can select in order to fulfill task \(l\). With respect to the quality of information provided by costing systems, the principal desires the agents to enter accurate data into the costing system. If the principal accepted biased data to be entered into the costing system without fixing thresholds for the extent of distortion it might be expected that the extent of input bias increases over time. This would probably lead to a decreasing quality of information. Knowledge about the impact of input biases on information quality and knowledge of interactions among biases might support the principal in fixing a threshold for each type of bias which can be accepted.

Following the assumption that both the principal and the agent seek to maximize their own utility functions (Jensen and Meckling 1994) and that the chosen actions result in direct disutility for the agents, the principal and the various agents might have conflicting target functions (Holmstrom 1979). In consideration of these potentially divergent interests, actions chosen by agents in order to fulfill delegated tasks do not necessarily correspond to the action defined in the contract. In the simulation model, by selecting an action, agents decide whether or not to fulfill the task as desired by the principal or to act opportunistically and to intentionally distort the data entered into the costing system in order to increase the personal utility. During the simulation runs, the decision whether or not to distort the entered data is made randomly (for the operationalization of the investigated types of biases cf. also Sect. 3.2.2). The actions chosen by agents are not observable, neither for the principal nor for other agents.

According to the model of the costing system (cf. Sect. 3.1), there are a number of interactions among its components. Due to these interactions, data entered into the costing system and the outcome of different tasks might be reciprocally interdependent. In order to capture this interdependence, the model considers a state of interactions among biases \(\theta ^{l}\) for each task \(l \in L\). The state of interactions realized with calculation steps during the simulation runs, stands for interactions that affect the outcome of task \(l\). In particular, \(\theta {^l}\) denotes the impact of actions chosen by agent \(k \in H\) that affect the outcome of task \(l \in L^{h}\) where \(h \ne k\). Thus, the outcome \(W^{h,l}\) associated with each delegated task \(l \in L\) depends on the action \(a^{h,l}\) selected by the respective agent \(h \in H\) and the state of interactions among biases \(\theta ^{l}\), i.e, \(W^{h,l} = f^{w^{h,l}} \left( a^{h,l}; \theta ^{l}\right)\). The outcome per task is observable for the principal without incurring costs. In addition, the principal can observe the overall outcome \(W^{ent}\) which is a function of selected actions and states of interactions, i.e., \(W^{ent} = f^{w^{ent}}\left(a^{i=1,j=1},\ldots ,a^{i=|H|,j=|L|};\theta ^{j=1},\ldots ,\theta ^{j=|L|}\right)\). Also, overall outcome is calculated on the basis of data which is probably biases and, hence, might be inaccurate.

Team-compensation is only beneficial if side-contracting is considered as well (Holmstrom and Milgrom 1990). Thus, the model considers agents to be rewarded individually. For all agents, the compensation consists of a fixed and a variable compensation component. The fixed compensation component for agent \(h\) is denoted as \(S^{h}_{0}\). The variable compensation component is based on the outcome of the tasks delegated to agent \(h\) and is given by \(f^{s,h}\left( \sum _{\forall l \in L : f^{l}\left(l\right) = h} W^{h,l}\right)\). The principal’s utility is based on the overall outcome minus the agents’ compensation, i.e.,

The agents’ utility is given by the utility of compensation minus the disutility of selected actions in order to fulfill tasks. Utility of compensation is captured by function \(f^{v^{h}}\left(\cdot \right)\) while disutility of effort is given by function \(f^{g^{h}}\left(\cdot \right)\). The agents’ utility function results as

Opportunistic agents are assumed to aim at maximizing their own utility in two ways. First, they might manipulate the performance measure that builds the basis for their variable compensation component in a way that \(U^{h}\) increases. Second, if the offered compensation function is not sufficiently attractive to the agents and does not provide an acceptable level of perceived utility, they might minimize their disutility of effort by selecting an action not equal to the action desired by the principal.

3.2.2 Principal-agent relationships and resulting biasing behaviors

The principal-agent relationships investigated in this simulation study comprise three different tasks delegated to agents, i.e., (1) the introduction of cost information, (2) the assignment of cost categories to the entered cost information, and (3) the introduction of cost center output (production of goods and services). These tasks are delegated to three different types of agents, i.e., managers of direct cost centers \(H^{dir}\), managers of indirect cost centers \(H^{indir}\) and the manager of the accounting department \(H^{acc}\). Table 2 gives an overview of the principal-agent relationships considered in this simulation study. In addition, the performance measures by which the fulfillment of the delegated task are measured are given in Table 2.

After goods and services are produced, all cost center managers are in charge of entering cost information into the costing system. When selecting an action in order to fulfill the delegated task, the agents decide whether the data introduced into the costing system is free of bias or inaccurate. Two types of biases for the context of cost information are considered, i.e., input biases on input cost objects and input biases on the basis of allocation type 1.

In the case of input biases on input cost objects, when selecting an action in order to fulfill the task of entering cost information into the costing system the agents might decide for a certain number of input cost objects to be inaccurate, i.e., in order to increase their personal utility, agents introduce a smaller extent of costs into the costing system than actually incurred. If the input cost object \(co_{in_{i}}\) is affected by input biases on input cost objects, it is replaced by \(co^{biased}_{in_{i}} = co_{in_{i}} \cdot (1+\delta ^{ico}_{i})\). The error-term \(\delta ^{ico}_{i}\) is randomly drawn from the exogenously given interval \(U[\underline{a}^{ico};\overline{a}^{ico}]\). Input biases on input cost objects are indicated by \(ico\) and occur with the exogenously given probability of occurrence \(p^{ico}\).

Input biases on the basis of allocation type 1 might be entered into the costing system by managers of direct and indirect cost centers. In order to increase their personal utility, when selecting an action in order to fulfill the delegated task they aim at decreasing the costs allocated to their own area of responsibility. The respective agents act opportunistically and manipulate the allocation keys for allocation type 1 given by matrix \(\mathbf V \). An agent responsible for cost center \(m_{n}\) distorts two elements of the matrix \(\mathbf V \). In particular, the agent replaces an element \(v_{n,i} \ne 0\) by \(v^{biased}_{n,i} = 0\) and replaces an element \(v_{u\ne n,i}\) by \(v^{biased}_{u\ne n,i} = v_{u \ne n,i} + v_{n,i}\). As a result, the share \(v_{n,i}\) of input cost object \(co_{in_{i}}\) which should originally have been allocated to cost center \(m_{n}\) is allocated to cost center \(m_{u}\) instead. The subscript \(type1\) indicates this type of bias for further elaborations.

The second task delegated to agents is (2) to assign cost categories to the previously generated input cost objects. This task is delegated to the accounting department’s manager. The behavioral model assumes this agent to aim at increasing the personal utility by decreasing the disutility of effort which leads to a certain number of input cost objects being categorized incorrectly, i.e., the function \(f^{co} \left( co_{in_{i}} \right) = ka_{j}\) is replaced by the function \(f^{co,biased} \left( co_{in_{i}} \right) = ka_{b \ne j}\) with exogenously given probability \(p^{acc}\). This type of bias is referred to as input biases on the assignment of cost categories and indicated by subscript \(acc\). As a result, input cost object \(co_{in_{i}}\) has been assigned cost category \(ka_{b}\) instead of cost category \(ka_{j}\). The effects of this miscategorization are random, e.g., the input cost object is categorized as direct instead of indirect, the direct cost category belongs to the wrong direct cost pool, etc.

The final principal-agent relationship investigated in this simulation study involves the task of entering cost center output into the costing system. In order to increase their personal utility, managers of indirect cost centers are assumed to enter a higher cost center output into the costing system than actually provided. This type of bias is referred to as input biases on the basis of allocation type 2. In the model of the costing system, the determination of the cost driver activity which is the basis in order to allocate costs from cost center \(m_{n}\) to cost center \(m_{u}\) is represented by the function \(f^{cd} \left( m_{n};m_{u}\right)\). In the case of a bias being entered, this function is replaced by the function \(f^{cd,biased} \left( m_{n};m_{u};\delta ^{type2}_{n,u}\right) = r_{l,n,u} \cdot \left(1 + \delta ^{type2}_{n,u}\right)\). The error-term \(\delta ^{type2}_{n,u}\) is drawn from \(U[\underline{a}^{type2}; \overline{a}^{type2}]\). Input biases on the basis of allocation type 2 occur with the probability \(p^{type2}\). The subscript \(type2\) indicates this type of bias.

In the economic literature, judgment in (financial) reporting which aims at influencing the contractual outcome is referred to as earnings management (Healy and Wahlen 1999). The revelation principle claims that each mechanism which involves earnings management, i.e., non-truthful reporting, can be beaten by an equilibrium mechanism in which truthful reporting is induced (Lambert 2001; Myerson 1979). For economic explanations of earnings management, one or more assumptions of the revelation principle need to be violated (Dye 1988). The revelation principle assumes that (1) communication is not blocked (i.e., it is free of costs to establish communication channels that allow the agents to fully report their private information), (2) the form of contract is not blocked (i.e., there are no limitations regarding the design of the contract), and (3) the principal commits to using the information provided by the agents in a pre specified-manner (Arya et al. 1998). Due to the fact that in the applied model of the costing system the agents deal with aggregated information, the revelation principle’s assumptions do not hold from the very start. Costing systems are designed for a certain aggregation-level of data to be entered. Thus, reporting more detailed data would lead to additional costs for communication. For this reason, the revelation principle does not hold for the given setup (Arya et al. 1998).

4 Simulation experiments and data analysis

This simulation study is set up in accordance with prior work on accounting errors (Labro and Vanhoucke 2007, 2008; Babad and Balachandran 1993; Gupta 1993; Datar and Gupta 1994). It builds on a framework that assumes an unbiased costing benchmark and a number of scenarios where biased data is entered into the costing system. According to the elaborations above, the simulation run in which the unbiased costing benchmark is calculated refers to a scenario in which all delegated tasks are fulfilled as desired by the principal.

In order to analyze the impact of biases on information quality in a representative sample of costing systems, a wide variety of costing systems’ architectures is automatically generated on the basis of exogenously given parameterization. Since there is little research on the current practice in the design of costing systems, there is only little empirical evidence that helps to choose realistic key parameters for generating costing systems (Drury and Tayles 1995; Labro and Vanhoucke 2007). Table 3 summarizes the selected key parameterization. The presented results are based on 100 randomly generated costing system architectures, i.e., on the basis off the parameterizaton given in Table 3, the structure of cost categories, the pooling of direct cost categories, the structure of cost centers and the the interrelations of cost centers are randomly generated. For each costing system structure, 100 simulation runs are executed, i.e., each presented number is based on 10.000 simulations.

For all types of input biases, as introduced in Sect. 3.2.2, the probability of occurrence is varied in the simulation experiments. In particular, the impact in the case of a probability of occurrence of 0.1, 0.2 and 0.3 is investigated. For input biases on input cost objects and input biases on the basis of allocation type 2, the operationalization of biases requires an exogenously given interval from which the extent of bias is randomly drawn. These intervals are assumed to be uniformly distributed. For input biases on input cost objects, the interval is set to \(U[-0.10,0.00[\). Thus, the error term \(-0.10 \le \delta ^{ico}_{i} < 0\) indicates the percentage distortion of the introduced cost information. For input biases on the basis of allocation type 2, the interval is set to \(U]0.00;0.10]\). Accordingly, the error term \(0 > \delta ^{type2}_{n,u} \ge 0.10\) is drawn from a uniformly distributed interval and indicates the relative distortion of the cost center output entered into the costing system which constitutes the basis of allocation type 2.

In this simulation study, a maximum of two biases are investigated at the same time. The denotation of costs per cost center, as introduced in Eqs. 7 and 8, is expanded by the respective types of biases \(x\) and \(y\) and superscript \(z\) which indicates the simulation runs, i.e., cost per cost center \(m_{n}\) calculated in simulation run \(z\) are denoted as \(costs^{prod,z}_{n,x,y}\). Subscripts \(x\) and \(y\) indicate biases whereby \(x,y \in \{ico; type1; acc; type2; 0\}\). In addition to the subscripts introduced in Sect. 3.2.2, \(0\) is a potential characterization for \(x\) and \(y\). \(0\) indicates that no respective bias is entered into the costing system. Thus, \(costs^{prod,z}_{n, x=0, y=0}\) denotes the (unbiased) benchmark costs for cost center \(m_{n}\) at simulation run \(z\). For all simulation runs \(z\) and all direct cost centers \(m_{n} \in M^{dir}\) a relative error is calculated, i.e.,

Based on the relative errors, this simulation study reports the Euclidean Distance as a condensed measure for information quality, cf. also Babad and Balachandran (1993); Hwang et al. (1993); Homburg (2001); Labro and Vanhoucke (2007, 2008); Leitner (2012, 2013). The Euclidean Distance is calculated as

In addition to the Euclidean Distance, this simulation study reports the mean absolute relative error \(e^{mean}_{x,y}\) as a further measure for information quality (Christensen and Demski 1997). The mean absolute relative error is calculated as

As these measures are symmetric and do not give any information on the economic consequences, for all scenarios the probability for overcosting \(\overline{p}_{x,y}\) (i.e., \(costs^{ent,z}_{n,x,y}\!>\! costs^{ent,z}_{n,x=0,y=0}\)) and the probability for undercosting \(\underline{p}_{x,y}\) (i.e., \(costs^{ent,z}_{n,x,y}\!<\! costs^{ent,z}_{n,x=0,y=0}\)) are reported.

In order to illustrate interactions among biases, the measure \(\rho _{x,y}\) is introduced, i.e.,

whereby \(\rho _{x,y}>1\) indicates that input biases \(x\) and \(y\) interact overproportionally, i.e., they reinforce each other regarding their impact on information quality. If \(\rho _{x,y}<1\), the two types of input biases mitigate each other, i.e., the Euclidean Distance in the case of simultaneously entered input biases \(x\) and \(y\) is lower than a notional Euclidean Distance with assumed linear interactions among the two types of biases (Leitner 2012, 2013).

Furthermore, this simulation study investigates whether interactions among biases lead to compensational effects. For this purpose, the measure \(\nu _{x,y}\) is introduced, i.e.,

If \(\nu _{x,y} \le 0\), the impact of input bias \(x\) on information quality is compensated by interactions among biases \(x\) and \(y\). Consequently, if \(\nu _{x,y}>0\), no compensation can be observed (Leitner 2012, 2013).

5 Results

The presentation of the results is organized in three sections. First, Sect. 5.1 deals with the impact of single input biases on information quality. Second, Sect. 5.2 presents interactions among biases. Finally, Sect. 5.3 discusses the robustness of the presented results to the parameterization for generating costing systems.

5.1 Single input bias scenarios

On the basis of the results presented in Table 4, a ranking of biases can be made from the single input bias perspective with respect to their impact on the quality of information provided by the costing system. The highest Euclidean Distance can be observed in the case of input biases on the assignment of cost categories, followed by input biases on the basis of allocation type 1, input biases on input cost objects and input biases on the basis of allocation type 2. In contrast, due to differences in the distribution of relative output errors, the mean absolute relative errors suggest input biases on input cost objects to be ranked second and input biases on the basis of allocation type 1 to be ranked third.

Input biases on input cost objects appear to lead to undercosting in all cases while input biases on the basis of allocation type 1 and input biases on the assignment of cost categories lead to under- and overcosting with almost the same probability. For the case of input biases on the basis of allocation type 2, a slight trend towards undercosting can be observed.

5.2 Multiple input bias scenarios

The results referring to interactions among biases in costing systems (cf. Table 5a) suggest that for the majority of scenarios, an underproportional interaction can be observed. In particular, the measure for interactions among biases \(\rho _{x,y}\) is below 0.940 except for the combination of input biases on the assignment of cost categories with input biases on the basis of allocation type 2. For the combination of input biases on input cost objects with input biases on the assignment of cost categories and input biases on the basis of allocation type 1, a decreasing measure for compensation can be observed, i.e., with increasing probabilities of occurrence, the extent of offsetting among biases appears to increase as well. An increase in the measure for interactions among biases can be observed for the cases of input biases on input cost objects in combination with input biases on the basis of allocation type 2 and input biases on the assignment of cost categories in combination with input biases on the basis of allocation type 1. In these two scenarios, increasing the probabilities of occurrence of the respective biases appears to lead to a decrease in the extent of offsetting among biases. Results suggest stable measures for interactions among biases for input biases on the basis of allocation type 1 in combination with input biases on the basis of allocation type 2.

The results concerning compensations among biases in costing systems cf. Table 5b) suggest that an offsetting can be observed or 3 scenarios while for the remaining scenarios, the extent of mitigation (as listed in Table 5a) appears not to lead to an offsetting. In particular, a compensation among biases can be observed for (1) input biases on the assignment of cost categories in combination with input biases on input cost objects and (2) input biases on the basis of allocation type 2 as well as for (3) input biases on the basis of allocation type 2 in combination with input biases on the basis of allocation type 1. For all three scenarios, the results indicate that the extent of compensation increases with increasing probabilities of occurrence of the respective biases whereby the highest extent of offsetting among biases can be observed for the case (1) followed by (2) and (3).

Table 6a–c give additional information on the impact of multiple input biases on the quality of the provided information, i.e., Table 6a presents the Euclidean Distances, Table 6b presents the mean absolute relative errors and Table 6c presents the probabilities for undercosting.

5.3 Sensitivity to costing system sophistication

The results presented in Sects. 5.1 and 5.2 have been tested on robustness to the parameterization for generating costing systems. Basically, this sensitivity analysis is based on two measures that express the costing systems’ complexity. The first measure is referred to as cost center sophistication and captures the relation between direct and indirect cost centers, i.e., \(soph^{cent} = |M^{dir,dcp}| / |M^{indir}|\). The second measure is referred to as cost category sophistication and captures the relation between direct and indirect cost categories, i.e., \(soph^{cat} = |KA^{dir}| / |KA^{indir}|\). In order to test the robustness of the presented results, simulations with the following ranges for the sophistication measures were executed:

The simulations cover single input bias scenarios and all combinations of the two sophistication measures. Thus, the sensitivity analysis covers 100 different levels of costing system sophistication whereby 10.000 simulation runs were executed for each level of costing system sophistication and each type of bias. The analyses are based on the mean absolute relative errors as introduced in Eq. 13. For each type of input bias, 100 mean absolute relative errors are calculated. Out of these, the minimum \(\underline{e}^{mean}_{x,y=0}\) and the maximum characterization \(\overline{e}^{mean}_{x,y=0}\) are determined. In order to express the sensitivity to costing system sophistication, for each input bias \(x\) the range \(\delta _{x}\) between the minimum \(\underline{e}^{mean}_{x,y=0}\) and the maximum \(\overline{e}^{mean}_{x,y=0}\) mean absolute relative error is calculated, i.e., \(\delta _{x} = \overline{e}^{mean}_{x,y=0} - \underline{e}^{mean}_{x,y=0}\). Ranges below \(0.005\) are regarded as negligible while ranges above this threshold indicate input bias \(x\) to be sensitive to costing system sophistication.

The results presented in Table 7 indicate that input biases on the assignment of cost categories and input biases on the basis of allocation type 1 appear to be sensitive to the level of costing system sophistication whereby only a slight sensitivity can be observed for the latter type of bias. Figures 2 and 3 show the mean absolute relative errors for all different combinations of sophistication measures.

Figure 2 indicates that for input biases on the assignment of cost categories, a strong sensitivity to cost category sophistication can be observed. The results in Sects. 5.1 and 5.2 are based on a level of cost category sophistication of 1. Thus, increasing the cost category sophistication would lead to a stronger impact on information quality while decreasing the cost category sophistication would weaken the impact (at least until the level of cost category sophistication 10/6).

Figure 3 suggests that input biases on the basis of allocation type 1 are slightly sensitive to cost center sophistication. The level of cost center sophistication used for generating the results presented in Sects. 5.1 and 5.2 is 1. Increasing or decreasing the sophistication measure would lead to just very slight changes in the impact on information quality and, hence, would only marginally affect the presented results.

6 Discussion and conclusion

There is evidence that individuals act opportunistically in order to serve their own ends and that firms might suffer a loss in efficiency because of the resulting agency problems (Sprinkle 2003; Luft 1997). Studies conducted by Baiman and Lewis (1989) and Harrell and Harrison (1994) suggest that individuals misrepresent their private information, e.g., enter inaccurate data into the costing system, for even small increases in personal wealth. If not identified and corrected, poor information quality might affect the economic health of organizations negatively (Wang and Strong 1996). In order to react appropriately to distortions in information provided by costing systems, decision-makers have to know the impact of (multiple) input biases in costing systems (Labro and Vanhoucke 2007; Leitner 2012; Leitner 2013). Contrary to conventional wisdom, the results presented in this paper indicate that entering multiple input biases into the costing system does not necessarily affect information quality negatively from a technical point of view. If the results are applied within organizations, it appears to be necessary that the impact on the agents’ behavior also needs to be considered, i.e., accepting one type of bias might lead to agents’ maximizing their individual utility by means of increasing the respective probability of occurrence. This indicates that an ongoing evaluation of the agents’ behavior and the progression of the information quality appears to be necessary.

On the basis of the results presented in Table 4, a ranking of biases can be made with respect to their impact on information quality in single input bias scenarios. The results indicate that on the basis of the Euclidean Distance as well as on the basis of the mean absolute relative error, input biases on the assignment of cost categories lead to the highest extent of distortion. The least impact on information quality can be observed for input biases on the basis of allocation type 2. Thus, prioritizing appears to be smart. Knowledge about the impact of biases on the quality of information allows for determining whether or not to invest resources in order to eliminate the respective biases. The decision whether or not to eliminate biases depends on two major points. First, the threshold of distortion with respect to information quality. This threshold depends on the organizations’ respective expectations. Second, the costs to eliminate or to reduce biases. The threshold of distortion and the costs to reduce biases are organization-specific. Thus, it cannot be generalized when to accept, reduce or eliminate biases. These two points in combination with the knowledge about the impact of biases on information quality can constitute the basis for this decision.

Labro and Vanhoucke (2007) investigated biases in activity-based costing systems and inter alia found that it is more beneficial to reduce errors in later steps of the allocation processes. In the case of traditional costing systems, the presented results indicate that earlier steps of cost allocation have a stronger impact on information quality. Thus, in order to increase the quality of the information generated by traditional cost accounting systems in the best possible way, this implies a primary focus on biases in the earlier steps of cost allocation. In activity-based cost accounting systems, however, the best possible way to increase the information quality would be to focus on later steps of cost allocation.

For multiple input bias scenarios, the results presented in Table 5a suggest that two types of interactions can be observed or the investigated biases: (1) biases interact almost linearly, and (2) biases interact underproportionally, i.e., they mitigate each other. For the case of a (1) linear interaction, the decision where (not) to tolerate biases can be made on the basis of the results presented for single input bias scenarios (cf. Table 4). For these scenarios, eliminating one bias does not affect the impact of the remaining type of bias. Thus, in order to increase the information quality in the best possible way, the type of bias for which a stronger impact on information quality can be observed should be eliminated with the higher priority. If the type of bias for which the weaker impact on information quality can be observed is eliminated first, the information quality increases, however, not in the best possible way. A better information quality can obviously be achieved by eliminating the bias which involves the higher extent of output error. e.g., (almost) linear interactions can be observed for the combination of input biases on the assignment of cost categories and input biases on the basis of allocation type 2 (cf. Table 5a). In single input bias scenarios, the latter type of bias has the weaker impact on information quality. Hence, with respect to the best possible way to increase information quality, the results suggest eliminating input biases on the assignment of cost categories with the higher priority and accepting the latter type of bias at least temporarily. Of course, also for multiple input bias scenarios, the decision on whether or not to invest resources in order to improve the information quality depends on the respective impact on information quality, the organization-specific threshold for distortions in accounting information and the cost which are incurred by reducing or eliminating the respective type of bias.

For scenarios in which biases (2) interact underproportionally, it has to be considered whether there is an offsetting among biases. If there is no offsetting, the optimal data quality policy can be derived similar to the case of linear interactions. In particular, results on single input bias scenarios give the extent of distortion after one type of bias is eliminated. Thus, the type of bias with the weaker impact on information quality should be accepted (at least temporarily). As outlined above, if the wrong type of bias is eliminated first, there is an increase in information quality but not in the best possible way. E.g., a mitigation (and no offsetting) among biases can be observed for input biases on the assignment of cost categories in combination with input biases on the basis of allocation type 1 (cf. Table 5a,b). Results concerning single input bias scenarios suggest that the latter type of bias has the weaker impact on information quality (cf. Table 4). This indicates that input biases on the assignment of cost categories should be eliminated first. However, eliminating input biases on the basis of allocation type 1 first would induce an increase in information quality whereby eliminating the other type of bias would be more efficient. On the contrary, if results indicate an offsetting among biases, eliminating the wrong type of bias first would lead to a decrease in information quality because the compensating effect is eliminated as well. An offsetting among biases can be observed for input biases on the assignment of cost categories in combination with input biases on input cost objects. In this case, in addition to a suboptimal data quality policy as in the other cases, eliminating the latter type of bias first would lead to a decrease in information quality. Eliminating the input bias on the assignment of cost categories first would be the most efficient way to increase data quality for this scenario.

The presented results give insights into the impact of specific types of biases on information quality. On the one hand, this knowledge supports management in generating more efficient data quality policies. On the other hand, some implications for the design of costing systems might be derived. Without knowledge about interactions among biases it is nearly impossible for management to find the best possible way to increase the quality of the generated information. This is due to a lack of understanding of offsetting effects and mitigations among biases. As indicated by the scenarios above, the most critical scenarios contain offsetting among biases. While in scenarios with a mitigation among biases, the presented results allow management to optimize the course of actions with respect to data quality, for scenarios with a mitigation among biases the results prevent from data quality policies which lead to a decrease in information quality. However, in scenarios with a mitigation (and no offsetting), eliminating one type of bias always leads to an increase in information quality. In these cases, the results support management in determining whether or not the impact of the respective bias is among the situation-specific threshold for distortion and, consequently, whether or not actions in order to eliminate the bias should be taken. In cases with an offsetting among biases, the results prevent management from eliminating compensational effects among biases and, as a consequence, decreasing information quality by mistake. With respect to the (temporal) acceptance of biases in organizations, the agent’s behavior might be affected. Therefore, it appears to be necessary to also communicate that the type of bias is accepted as long as the respective occurrence is below a certain level. This level is determined by the impact of the type of bias on information quality, i.e., biases can only be accepted as long as their effect on information quality is below the defined threshold. Otherwise, it can be expected that the occurrence of the respective bias increases over time, which also leads to an increasing extent of output error. As inter alia suggested by Merchant and Shields (1993) in the design of costing systems, some types of biases might be (intendedly) considered in order to increase accuracy. For traditional costing systems, this particularly applies to situations in which the results presented above indicate a compensation among biases so that the acceptance of one type of bias leads to a (partial) offsetting of the impact of another type of bias on information quality. Of course, each organization has to find its specific threshold for distortions in accounting data. Information generated by cost accounting systems serves different purposes. As the organizations’ expectations on information quality might vary in different decision-making situations, this threshold cannot be generalized. e.g., in the context of price-setting decisions or the fixing of short-term minimum prices, the extent of distortion might be expected to be marginal. In the context of rather long-term decision-making, the accepted output error might be relatively larger. However, with an increasing extent of output error the risk for suboptimal decision-making increases. It is necessary for organizations to be aware of this risk and, with this in mind, to fix a situation-specific threshold with respect to information quality. On the basis of this threshold and the presented results, in can be derived when to accept biases and when to eliminate them. Thus, the presented results can constitute the basis for individual prioritization of actions or for evaluating efforts for improving data quality in costing systems from a cost-benefit perspective.

The main benefit of this simulation study is to give guidance in generating efficient data quality policies. However, there are some limitations at the same time. The simulations cover full-costing systems and single-product setups. Setups with multiple products might not only affect the impact of the investigated biases, but might also lead to other types of biases investigated. Of course, the set of biases under investigation is not exhaustive. Hence, one avenue for future research might be to extend the set of biases and investigate their impact on information quality in marginal-costing systems as well. Furthermore, the simulation model is designed in a way that probabilities, distributions and intervals for biases are exogenously given. The sensitivity of the presented results to the exogenously given intervals and distributions should be tested in future research. This might also limit the presented results. In future research, some more variables could be endogenized into the simulation model. For example, the decision of which bias to introduce under which circumstances or the magnitude of bias could be made by agents themselves and the dynamics of the simulation model could be designed in a more agent-driven way. In addition, investigating the impact of randomly generated types of biases on information quality and the extensive investigation of different impacts of cost allocation approaches on information quality might be avenues for future research.

References

Arya A, Glover J, Sunder S (1998) Earnings management and the revelation principle. Rev Acc Stud 3(1):7–34

Babad YM, Balachandran BV (1993) Cost driver optimization in activity-based costing. Acc Rev 68(3): 563–575

Baiman S, Lewis BL (1989) An experiment testing the behavioral equivalence of strategically equivalent employment contracts. J Acc Res 27(1):1–20

Ballou D, Madnick S, Wang R (2003) Special section: assuring information quality. J Manag Inf Syst 20(3):9–11

Banham R (2002) Reality budgeting. CIO Insight 17:43

Barefield RM (1970) A model of forecast biasing behavior. Acc Rev 45(3):490–501

Biros DP, George JF, Zmud GW (2002) Inducing sensitivity to deception in order to improve decision making performance: a field study. MIS Q 26(2):65–65

Bouwens J, Abernethy MA (2000) The consequences of customization on management accounting system design. Acc Org Soc 25(3):221–241

Brignall S (1997) A contingent rationale for cost system design in services. Manag Acc Res 8(3):325–346

Bruns JWJ, McKinnon SM (1993) Information and managers: a field study. J Manag Acc Res 5:84–108

Burns J, Scapens RW (2000) Conceptualizing management accounting change: an institutional framework. Manag Acc Res 11(1):3–25

Cassia L, Paleari S, Redondi R (2005) Management accounting systems and organisational structure. Small Bus Econ 25(4):373–391

Chenhall RH (2003) Management control systems design within its organizational context: findings from contingency-based research and directions for the future. Acc Org Soc 28(2–3):127–168

Chong VK (1996) Management accounting systems, task uncertainty and managerial performance: a research note. Acc Org Soc 21(5):415–421

Christensen J (2010) Accounting errors and errors of accounting. Acc Rev 85(6):1827–1838

Christensen J, Demski J (1997) Product costing in the presence of endogenous subcost functions. Rev Acc Stud 2(1):65–87

Cooper R, Kaplan RS (1988) Measure costs right: make the right decision. Harv Bus Rev 66(5):96–103

Crossman PT (1958) The nature of management accounting. Acc Rev 33(2):222

Datar S, Gupta M (1994) Aggregation, specification and measurement errors in product costing. Acc Rev 69(4):567–591

Davis JP, Eisenhardt KM, Bingham CB (2007) Developing theory through simulation methods. Acad Manag Rev 32(2):480–499

Dechow P, Ge W, Schrand C (2010) Understanding earnings quality: a review of the proxies, their determinants and their consequences. J Acc Econ 50(2–3):344–401

Demski JS, Feltham GA (1976) Cost determination. A conceptual approach. Iowa State University Press, Ames

Drury C, Tayles M (1995) Issues arising from surveys of management accounting practice. Manag Acc Res 6(3):267–280

Dye RA (1988) Earnings management in an overlapping generations model. J Acc Res 26(2):195–235

Ezzamel M, Lilley S, Willmott H (1996) The view from the top: Senior executives’ perceptions of change management practices in UK companies. BRIT J Manage 7(2):155–168

Feltham GA (1968) The value of information. Acc Rev 43(4):684–696

Fox HW (1961) Statistical error concepts related to accounting. Acc Rev 36(2):282

Garg A, Ghosh D, Hudick J, Nowacki C (2003) Roles and practices in management accounting today. Strateg Financ 85(1):30–35

Gilbert N (1995) Simulation: an emergent perspective. http://alife.ccp14.ac.uk/cress/research/simsoc/tutorial.html. Accessed 05 Oct 2010

Gupta M (1993) Heterogeneity issues in aggregated costing systems. J Manag Acc Res 5:180–212

Harrell A, Harrison P (1994) An incentive to shirk, privately held information, and managers’ project evaluation decisions. Acc Org Soc 19(7):569–577

Healy PM, Wahlen JM (1999) A review of the earnings management literature and its implications for standard setting. Acc Horiz 13(4):365–383

Heidmann M, Schaffer U, Strahringer S (2008) Exploring the role of management accounting systems in strategic sensemaking. Inf Syst Manag 25(3):244–257

Hendry J (2002) The principal’s other problems: honest imcompetence and the specification of objectives. Acad Manag Rev 27(1):98–113

Holmstrom B (1979) Moral hazard and observability. Bell J Econ 10(1):74–91

Holmstrom B, Milgrom P (1990) Regulating trage among agents. J Inst Theor Econ 146:85–105

Homburg C (2001) A note on optimal cost driver selection in abc. Manag Acc Res 12(2):197–205

Horngren CT, Sundem GL, Stratton WO (2002) Introduction to management accounting, 12th edn. Prentice Hall, Upper Saddle River

Horngren CT, Bhimani A, Datar S, Foster G (2005) Management and cost accounting. Financial Times Prentice Hall, Harlow

Hwang Y, Evans JH, Hegde VG (1993) Product cost bias and selection of an allocation base. J Manag Acc Res 5:213–242

Jensen MC, Meckling WH (1994) The nature of man. J Appl Corp Financ 7(2):4–19

Kerlinger FN, Lee HB (2000) Foundations of behavioral research, 4th edn. Harcourt College Publ, Fort Worth

Klein BD (2001) Detecting errors in data: clarification of the impact of base rate expectations and incentives. Omega 29(5):391–404

Labro E, Vanhoucke M (2007) A simulation analysis of interactions among errors in costing systems. Acc Rev 82(4):939–962

Labro E, Vanhoucke M (2008) Diversity in resource consumption patterns in costing system robustness to errors. Manag Sci 54(10):1715–1730

Lambert RA (2001) Contracting theory and accounting. J Acc Econ 32(1–3):3–87

Leitner S (2012) Interactions among biases in costing systems: a simulation approach. In: Teglio A, Alfarano S, Camacho-Guena E, Gilns-Vilar M (eds) Managing market complexity (Lecture Notes in Economics and Mathematical Systems), vol 662. Springer, Berlin, pp 209–220

Leitner S (2013) Information quality and management accounting, (Lecture Notes in Economics and Mathematical Systems), vol 664. Springer, Berlin

Lillrank P (2003) New research. The quality of information. Int J Qual Reliab Manag 20(6):691–703

Luft JL (1997) Fairness, ethics and the effect of management accounting on transaction costs. J Manag Acc Res 9:199–216

Ma T, Nakamori Y (2005) Agent-based modeling on technological innovation as an evolutionary process. Eur J Oper Res 166(3):741–755

Madnick S, Wang R (1992) Introduction to the tdqm research program. http://web.mit.edu/tdqm/papers/92/92-01.html. Accessed 05 Sept 2010

Merchant KA, Shields MD (1993) When and why to measure costs less accurately to improve decision making. Acc Horiz 7(2):76–81

Myerson R (1979) Incentive compatibility and the bargaining problem. Econometrica 47:61–74

North MJ, Macal CM (2007) Managing business complexity. Discovering strategic solutions with agent-based modeling and simulation. Oxford University Press, Oxford

Orr K (1998) Data quality and systems theory. Commun ACM 41(2):66–71

Paradice DB, Fuerst WL (1991) An mis data quality methodology based on optimal error detection. J Inform Syst Spring:48–66

Redman TC (1996) Data quality for the information age. Artech House, Boston

Redman TC (1998) The impact of poor data quality on the typical enterprise. Commun ACM 41(2):79–82

Resnick M (1999) Turtles, termites and traffic jams. Explorations in massively parallel microworlds, 5th edn. Complex adaptive systems, MIT Press, Cambridge

Shim E, Sudit EF (1995) How manufacturers price products. Manag Acc 76(8):37–39

Simon HA (1957) Administrative behavior. A study of decision-making processes in administrative organizations, 2nd edn. Free Pr., New York, NY

Simon HA (1991) Organizations and markets. J Econ Perspect 5(2):25–44

Singer FA (1961) Management accounting. Acc Rev 36(1):112

Sprinkle GB (2003) Perspectives on experimental research in managerial accounting. Acc Org Soc 28(2–3):287–318

Tee SW, Bowen PL, Doyle P, Rohde FH (2007) Factors influencing organizations to improve data quality in their information systems. Acc Financ 47:335–355

Wang RY, Strong DM (1996) Beyond accuracy: what data quality means to data consumers. J Manag Inform Syst 12(4):5–34

Young SM, Lewis BL (1995) Experimental incentive-contracting research in managerial accounting. In: Ashton RH, Ashton AH (eds) Judgment and decision making research in accounting and auditing. Cambridge University Press, Cambridge, pp 55–75

Zimmerman JL (2000) Accounting for decision making and control, 3rd edn. Irwin/McGraw-Hill, Boston

Acknowledgments

I would like to thank three anonymous reviewers, Univ.-Prof. Dr. Friederike Wall, Univ.-Prof. Dr. Franz Rendl, Ass.-Prof. Dr. Alexandra Rausch, Mag. Katharina Rodgers, the participants of the \(1^\mathrm{{st}}\) Venice-Klagenfurt Workshop on Agent-Based Simulation 2011, the participants of the Workshop of the Austrian Working Group on Banking and Finance 2011, the participants of the stream Simulation and Management Accounting at the European Conference on Operational Research 2012, and the participants of the Artificial Economics 2012 for their valuable comments on earlier drafts of this paper.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Leitner, S. A simulation analysis of interactions among intended biases in costing systems and their effects on the accuracy of decision-influencing information. Cent Eur J Oper Res 22, 113–138 (2014). https://doi.org/10.1007/s10100-012-0275-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10100-012-0275-2