Abstract

This research explores the welfare implications of vertical licensing when the final goods are produced by multiple complementary inputs. We spotlight the importance of two-part tariff input terms when there is a buyer–seller relationship after vertical licensing, which has different welfare ramifications depending on the product differentiation. When the products are less differentiated, our result shows welfare improving licensing, but when the products are more differentiated, the wholesale price is set above the supplier’s marginal cost through licensing, leading to the problem of double marginalization and reducing welfare. This study offers various policy implications, which go up against conventional wisdom that welfare improving licensing may not be attainable by considering multiple complementary inputs.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Technology licensing is a common practice among firms, as many well-known firms license the production technology of their core inputs to external firms. As a sourcing strategy it transforms the licensee into the licensor’s input supplier, which is called vertical licensing. One example of vertical licensing is in the car manufacturing industry, in which Toyota created suppliers that were formerly integral units of its own company. Nippon Denso Co., which manufactures the drivetrain system, and Aisin Seiki Co., which produces engine components and systems for automobiles, started out within Toyota, but later became independent corporate entities.Footnote 1 Another example is in the commercial aircraft market, where aircraft giant Boeing licensed its wing production technology to three Japanese firms, which are Mitsubishi Heavy Industries, Kawasaki Heavy Industries Ltd., and Fuji Heavy Industries, instead of producing it in-house. They are now suppliers providing inputs related to aircraft production for Boeing. It is interesting to observe that the costs in Japan are not less than in-house costs. Hence, Boeing’s licensing decision cannot be justified based on cost savings alone.

As products become more and more sophisticated, input complementarity has also become more widespread. Taking Toyota again as an example, it buys directly from 200 component suppliers that account for 2 billion units.Footnote 2 In practice, Boeing also purchases from more than 6000 suppliers.Footnote 3 It seems that a firm licensing its input production technology to an external firm aggravates the inefficiency arising within complementary inputs. Is there a theoretical explanation to the rationality for licensing even if it aggravates inefficiency? What is the role of multiple complementary inputs on input pricing? How are licensing incentives influenced by multiple complementary inputs? Does vertical licensing improve welfare when using multiple inputs for producing final goods?

To answer the above questions, we build a model whereby two downstream firms produce two competing final goods using multiple complementary inputs, A and B. We denote A as the core input that both firms initially produce in-house respectively. One downstream firm considers licensing its core input production technology to an external firm through a fixed fee licensing contract. When licensing takes place, the downstream firm becomes a licensor, transforming the external firm into its input supplier and turns it to be a licensee. The input sourcing trades through a two-part tariff contract, including a fixed fee and a wholesale price per unit of input, whose terms are determined through Nash bargaining between the external firm and the downstream firm. The other complementary input, B, is provided by an exclusive supplier in the upstream market.Footnote 4

Following this setting, our study shows that the licensing is driven by input pricing, in which the two-part tariff input contract has some main ramifications for the welfare implications. The wholesale price can be higher or lower than the upstream licensee’s marginal cost, depending on the degree of product differentiation, and it is motivated by the simultaneous presence of two effects: the input A effect and the input B effect. The first effect refers to the fact that the input producer, the licensee, subsidizes its downstream licensor by setting the wholesale price lower than its marginal cost so as to expand its downstream licensor’s output and profits at a rival firm’s expense. The second effect, the input B effect, corresponds to the upstream licensee setting a positive mark-up to its downstream licensor so as to reduce the negative impact of the market power from the complementary input supplier, in order to lower the derived demand and the price of input B.

The key drivers of vertical licensing differ substantially among the level of product differentiation. Interestingly, when the products are less differentiated, the more severe market competition is, the larger are the upstream licensee’s incentives to enhance the competitive position of its downstream customer by setting the wholesale price below the marginal cost. Therefore, due to the intensity of the input A effect, licensing incentives exist even in markets with homogeneous products. The licensee does this, because it can extract profit from the resulting higher profits of the licensor through a fixed fee of the two-part tariff. The licensor can then capture all of its joint profits from the upstream licensee through fixed fee licensing.

When the products are more differentiated, the softer competition lowers the upstream licensee’s incentive for expansion of its downstream customer market share. However, the upstream licensee’s incentives are stronger to reduce the negative impact of the market power from the complementary input supplier by raising the wholesale price above the marginal cost, increasing the licensor’s cost instead of subsidizing the licensor. Why? Actually, in this case the licensee and the licensor use their vertical trading contract as an instrument that allows the downstream licensor to self-sabotage to extract a sufficiently large piece of the profit from the complementary input supplier. The licensor does so, because it can receive a subsidization from the licensee through a fixed fee of the two-part tariff. Lastly, the licensor uses fixed-fee licensing to capture its joint profit from the upstream licensee. This is a feature of using complementary inputs that is absent in a single-input model and may strengthen the potential negative implications of vertical licensing. Therefore, vertical licensing is desirable for the licensor, even for free licensing, but may not be desirable for the consumers and the economy due to double marginalization caused by the positive mark-up through the wholesale price when the products are more differentiated.

Our study differs from Bakaouka and Milliou (2018), as they focus on the incentives of vertical licensing with and without the licensee’s entry into the final goods market and confine their model by using a single input. Without introducing complementary inputs, they only find the input A effect, in which the licensee only has an incentive to subsidize its downstream customer to expansion. Therefore, they find that vertical licensing definitely increases social welfare due to the positive effect of subsidization on consumer surplus. Our paper conversely shows that vertical licensing in the presence of complementary inputs may cause double marginalization, thus inducing welfare reduction.Footnote 5 In their licensee’s entry case, they find that the licensee sets the wholesale price above the input’s marginal cost in order to alleviate the increased competition of the licensee’s entry. However, our intuition is quite different from theirs as follows. Our model takes a vertical trading contract as an instrument to alleviate the market power of the complementary input supplier instead. Moreover, the licensee’s entry causes an increase of product variety and greater competition, leading to positive welfare implications. In contrast, in our paper, the wholesale price is set in such a way that it only accompanies the double marginalization and profit loss of the complementary input supplier, which in turn provide negative welfare implications.

Our study also relates to the vast theoretical literature on technology licensing by introducing a vertically-related market such as by Pack and Saggi (2001) and Rey and Salant (2012). Pack and Saggi (2001) indicate that vertical international technology transfer differs substantially from horizontal technology transfer. Rey and Salant (2012) examine the impact of the licensing policies of one or more upstream owners of essential intellectual property on the variety offered by a downstream industry.Footnote 6 However, they do not introduce the complementary input in the upstream sector and also neglect a seller-buyer relationship between the licensor and the licensee. In contrast to them, the vertical trading contract is derived from the licensing, which plays a crucial role on welfare implication. Furthermore, our paper also relates to the literature on outsourcing. Various papers within this strand, such as Shy and Stenbacka (2003), Sappington (2005), Arya et al. (2008a, b) and Lim and Tan (2010), analyze a final product manufacturer’s sourcing decision through linear contracts. Milliou (2020) considers that outsourcing of a vertically integrated firm to a common input supplier can arise when non-linear (instead of linear) contracts are used and investigates the welfare implication. Our study differs in that the upstream market consists of complementary input suppliers, which has ramifications on the two-part tariff vertical contract determined and the corresponding welfare implications. The other distinction of our study is a focus on the two-part tariff input contract that is derived from vertical licensing instead of outsourcing to an already existing vertically integrated rival or an independent upstream firm. Our paper complements this literature in studying how vertical licensing affects the complementary input supplier’s price and the impacts on social welfare.

Several studies in the theoretical literature relate to the issue of complementary inputs, such as Kopel et al. (2016) who analyze a multi-input-multi-product firm’s sourcing strategy, showing that such a firm might manufacture in-house even if the marginal production cost exceeds the per-unit input price.Footnote 7 Kopel et al. (2017) then consider multi-input sourcing of a multi-input-multi-product firm, showing that purchase complementary inputs from non-integrated suppliers can be optimal. Kitamura et al. (2018) build a model of exclusive contracts in the presence of complementary inputs. Laussel and Resende (2020) investigate how asymmetric information on final demand affects strategic interaction between a downstream monopolist and a set of upstream monopolists. Although they introduce the complementary inputs, but restrain their model by the downstream monopolist. Therefore, there is the absence of an incentive of market expansion of the downstream firm.

The remainder of this paper runs as follows. Section 2 introduces the model setting. Section 3 analyzes the terms of input pricing and licensing incentives. Section 4 investigates the welfare implications of vertical licensing. Section 5 extends the model settings to check if the results derived by two complementary inputs are still robust. Finally, Sect. 6 concludes with remarks.

2 The Model

We consider a downstream market consisting of two firms, firm 1 and firm 2. Each firm i (i = 1, 2) produces a differentiated final good by using two complementary inputs, A and B. Input A is a core input that is produced in-house by each firm at marginal cost \(c > 0\), while input B is exclusively provided by supplier UB at a wholesale price per unit of input, \(w_{B}\).Footnote 8 Without loss of generality, we assume that the marginal cost of supplier UB for producing the input is null.

Both firms hold a patent for their core input production technologies. One of them (firm 1) considers licensing its core input production technology to an external firm, firm S, for a fixed licensing fee, \(F \ge 0\). When the licensing agreement is signed, the licensee (firm S) is in the position to produce input A for the licensor at marginal cost c.Footnote 9 The input sourcing terms include the terms of a two-part tariff: a fixed fee, T, and a wholesale price per unit of input, \(w_{s}\), that firm 1 pays to firm S. The two-part tariff is determined through Nash bargaining among firm S and firm 1. The bargaining power of firm S and firm 1 is given by \({\upbeta }\) and \({ }1 - {\upbeta }\), respectively, with \(0 \le \beta \le 1\). To simplify, we assume that the cost of entry in the final goods market is prohibitively high, and thus entry by firm S is blocked, or the ability of producing the core input does not suffice for production of the final good.

The inverse demand function of firm i’s final good is:

where \(p_{i}\) and \(q_{i}\) are the price and the quantity of firm i’s final good, respectively, and \(q_{j}\) is the quantity of its rival’s final good. The parameter \(r\) measures the degree of product differentiation, where \(r \in \left[ {0,{ }1} \right]\). The higher \(r\) is, the closer substitutes the final goods are.

To explore the incentives of vertical licensing and its implications, the timing of the game goes as follows. In the first stage, firm 1 decides whether to license its input technology to external firm S. In the case of licensing, firm 1 sets the licensing fee F, and in turn firm S signs or does not sign the licensing agreement. If the agreement is signed, then in the following stage firm 1 and firm S negotiate over the two-part tariff, (\(w_{s} ,T\)). In the third stage, each firm purchases input B from supplier UB. Supplier UB maximizes its profits to determine the input price, \(w_{B}\).Footnote 10 In the final stage, firm 1 and firm 2 choose their quantities simultaneously and separately. We solve for the subgame perfect Nash equilibrium of the game.

3 Vertical licensing pricing and incentives

When the licensing agreement has been signed, in the last stage firm 2 maximizes its profit as: \(\pi_{2}^{L} = \left( {1 - q_{2}^{L} - rq_{1}^{L} - c - w_{B}^{L} } \right)q_{2}^{L}\), while firm 1 maximizes instead the following profits (gross from T and F) to choose its output,\({ }q_{1}^{L}\):

where superscript “L” denotes the equilibrium with vertical licensing, and \(w_{s}\) denotes a wholesale price per unit of input A. In the third stage, supplier UB chooses \(w_{B}^{L}\) in order to maximize its own profits, which is \(\pi_{B}^{L} \equiv \pi_{B}^{L} \left( {q_{1}^{L} \left( {w_{B}^{L} } \right),q_{2}^{L} \left( {w_{B}^{L} } \right),w_{B}^{L} } \right) = w_{B}^{L} \left( {q_{1}^{L} + q_{2}^{L} } \right).\) Solving the first-order condition, we derive the equilibrium input B’s price as:

From (2), it is easy to show that an increase in the wholesale price of the core input lowers the input price of B, which is \(\frac{{\partial w_{B}^{L} }}{{\partial w_{s} }} = \frac{ - 1}{4} < 0\).

In the second stage, firm S and firm 1 negotiate over \(\left( {w_{s} ,{\text{ T}}} \right)\). In particular, they solve the following generalized Nash bargaining problem:

where \(\pi_{s}^{L} \left( {w_{s} } \right) = \pi_{s}^{L} \left( {q_{1}^{L} \left( {w_{B}^{L} \left( {w_{s} } \right),w_{s} } \right),w_{s} } \right) = \left( {w_{s} - c} \right)q_{1}^{L} \left( {w_{s} } \right)\) is firm S’s profit and \(\pi_{1}^{L} \left( {w_{s} } \right) = \pi_{1}^{L} \left( {q_{1}^{L} \left( {w_{B}^{L} \left( {w_{s} } \right),w_{s} } \right),q_{2}^{L} \left( {w_{B}^{L} \left( {w_{s} } \right),w_{s} } \right),w_{B}^{L} \left( {w_{s} } \right),w_{s} } \right)\). Note that the disagreement payoffs of firm S are equal to zero since firm S has no outside option. However, firm 1 can produce the core input in-house in case of disagreement with firm S during the negotiations. Therefore, the outside option of firm 1 is \(\pi_{1}^{N}\)(Appendix 1 for the details).

Maximizing (3) with respect to \({\text{T}}\), we find that \({\text{T}} = {\upbeta }\left[ {\pi_{1}^{L} \left( {w_{s} } \right) - \pi_{1}^{N} } \right] - \left( {1 - {\upbeta }} \right)\pi_{s}^{L} \left( {w_{s} } \right)\). Thus, it follows that the equilibrium wholesale price maximizes the joint profits of firm S and firm 1:\({\text{ U}} = \pi_{1}^{L} \left( {w_{s} } \right) + \pi_{s}^{L} \left( {w_{s} } \right) - \pi_{1}^{N}\).Footnote 11 Using the envelop theorem, we rewrite the first-order condition as (Appendix 2 for the details):

Solving (4) and then comparing \(w_{s}\) with \(c\), we haveFootnote 12:

where \(\frac{{\partial \pi_{1}^{L} }}{{\partial q_{2}^{L} }}\frac{{\partial q_{2}^{L} }}{{\partial w_{s} }} = \frac{{ - r^{2} q_{1}^{L} }}{{4 - r^{2} }} < 0\) and \(\left( {\frac{{\partial \pi_{1}^{L} }}{{\partial q_{2}^{L} }}\frac{{\partial q_{2}^{L} }}{{\partial w_{B}^{L} }} + \frac{{\partial \pi_{1}^{L} }}{{\partial w_{B}^{L} }}} \right)\frac{{\partial w_{B}^{L} }}{{\partial w_{s} }} = \frac{{2rq_{1}^{L} \left( {2 - r} \right)}}{{4\left( {4 - r^{2} } \right)}} > 0\).

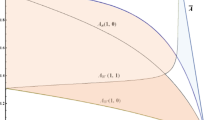

The first effect in the square brackets originally appears in the literature when they are confined the model to a single input. We refer to this as the input A effect, which is negative. Intuitively, firm S has an incentive to enlarge the output of firm 1 by charging a low wholesale price in order to increase the joint profits. Therefore, the input A effect leads to the wholesale price being set below the upstream marginal cost for the output expansion. The second effect is the input B effect, which is the extra effect when introducing the complementary inputs and is positive. An increase in the wholesale price reduces the negative impact of the market power from the complementary input supplier, lowering the derived demand and the price of input B and resulting in higher joint profits. On the other hand, a lower input price of B also benefits the rival firm and results in lower profit for firm 1. Therefore, the optimal wholesale price is determined by these two effects. According to Eq. (5), the equilibrium wholesale price is \(w_{s}^{*} = c + \frac{{2\left( {1 - c} \right)\left( {2 - r} \right)\left( {2 - 2r^{2} - r} \right)}}{{A_{1} }}\), where \(A_{1} \equiv \left( {6 + r} \right)\left( { - 4r^{2} - r + 10} \right) > 0\) due to \(0 \le r \le 1\).Footnote 13 We hereafter use \(w_{s}^{*}\) to indicate that wholesale price is an equilibrium wholesale price. Moreover, we find that \(w_{s}^{*} > c\) when the two products are more differentiated, that is \(0 \le r < \overline{r} \equiv 0.780776\). However, when the two products are less differentiated, that is \(\overline{r} \le r \le 1\), we have \(w_{s}^{*} \le c\).

As mentioned earlier, when the two products are more differentiated, the downstream competition is softer. Firm 1 is capable of bearing a higher wholesale price from firm S in order to lower the price of the complementary input B and to generate a larger profit. Firm 1 does so through the fixed fee of a two-part tariff input contract, leading to \(T^{*} < 0\). As the two products are less differentiated, we show that firm S has incentives to enhance the output of firm 1 at the rival’s expense in order to increase firm 1’s profits that it captures through T—that is, \(T^{*} > 0\).

It is worth mentioning that if there is a competitive fringe of input B suppliers, (that is, \(w_{B}^{L} = 0\) and letting \(\frac{{\partial w_{B}^{L} }}{{\partial w_{s} }} = 0\) in (5)), only the input A effect remains in (5), which is negative. This implies that firm S always subsidizes through the wholesale price to downstream firm, and the results are consistent with Jansen (2003) and Bakaouka and Milliou (2018).

Our results also relate to Kopel et al. (2016, 2017), in which we find that firm 1’s sourcing strategy for a specific input may deviate from a least-cost comparison through vertical licensing in order to lower the price of the common input. However, those two studies only focus on a monopolistic downstream firm and ignore strategic competition in the final product market, leading to the absence of the input A effect. The results are stated formally in the following lemma.

Lemma 1

When firm 1 transforms two complementary inputs into final goods and practices vertical licensing with external firm S, the wholesale price is higher than the input firm’s marginal cost \((w_{s}^{*} > c)\) if the two products are more differentiated such that \(0 \le r < \overline{r} \equiv 0.780776\) ; otherwise, the wholesale price is lower than the input firm’s marginal cost \(\left( {w_{s}^{*} \le c} \right)\) if product differentiation is low such that \(\overline{r} \le r \le 1\) .

In the extreme case of homogeneous products, the input A effect dominates the input B effect due to intensified downstream competition. This leads firm S to subsidize firm 1 to enlarge the output through the two-part tariff input contract. By contrast, Bakaouka and Milliou (2018) show that an external firm always subsidizes the licensor. However, their result no longer holds if the products are more differentiated when we further consider complementary inputs for producing the final good, in which the input B effect is newly derived.

As mentioned previously, when the products are more differentiated, the wholesale price is set above the upstream marginal cost for lowering the price of complementary input B strategically. For proof of this intuition, we use (12) in Appendix 1 and (14) in Appendix 2 with (2) and arrive at:

When the products are less differentiated, the wholesale price is set below the upstream marginal cost for firm 1’s output expansion, which leads to a higher derived demand of complementary input B and the price. Therefore, we have \(w_{B}^{N} \le w_{B}^{L}\) when the products are less differentiated; otherwise, we have \(w_{B}^{N} > w_{B}^{L}\) when the products are more differentiated.

In the first stage, we explore the incentives of firm 1 to license the production technology to firm S. The licensing fee is determined in the following way: firm S rejects the licensing agreement if and only if its profits without the agreement exceed its profits with agreement. Since the former profits are equal to 0, it follows that firm 1 will optimally set \(F = \pi_{s}^{L} \left( {w_{s}^{*} } \right) + T\). Therefore, firm 1’s net equilibrium profits with the licensing are \(\pi_{1}^{LE} = \pi_{1}^{L} \left( {w_{s}^{*} } \right) - T + F = \pi_{1}^{L} \left( {w_{s}^{*} } \right) + \pi_{s}^{L} \left( {w_{s}^{*} } \right)\), where superscript LE denotes net equilibrium profits from the licensing, in which includes the payments of two-part tariff input contract to firm S and receiving the fixed fee of the licensing contract from firm S. This shows that firm 1 captures not only the profits from its own sales in the final goods market, but also firm S’s profits from the input sales.Footnote 14 Comparing firm 1’s net equilibrium profits in the licensing case \(\pi_{1}^{LE}\) with its profits \(\pi_{1}^{N}\) in the no licensing case (Appendix 2 for the details), we have:

The above result runs in accordance with the literature on vertical separation, in which vertical separation and external input sourcing are preferred over vertical integration. As Lemma 1 mentions earlier, due to the input A effect, firm S increases the aggressiveness of firm 1 in the final goods market by subsidizing through the wholesale price, that is \(w_{s}^{*} - c < 0\), when product differentiation is low. A lower wholesale price leads to its expanded output at the expense of the rival firm’s output. Thus, it is straightforward to realize that firm 1 has an incentive to license its input technology to firm S under this case.

Intuitively, firm 1 facing a higher marginal cost is derived from licensing than with in-house production should result in no incentive for it to license when the two products are more differentiated. In fact, less competition in the downstream market strengthens the input B effect and the licensing incentives. This is because that vertical licensing comes from a strategic rise in the wholesale price, leading to a lower complementary input price at the complementary supplier’s expense instead of the rival firm’s that makes a larger pie for firm 1 and firm S.

It is important to note that the above result holds not only when firm 1 charges a positive fixed fee for the licensing agreement, but also when it offers the licensing agreement for free (\({\text{F}} = 0\)). Comparing the difference in firm 1’s profits in the case of licensing without receiving the licensing fee versus the in-house case, we have \(\pi_{1}^{LE} \left( {F = 0} \right) - T^{*} - \pi_{1}^{N} = \left( {1 - \beta } \right)\left( {\pi_{1}^{L} + \pi_{s}^{L} - \pi_{1}^{N} } \right)\) as follows:

Equation (8) shows that firm 1 has an incentive to provide its core input production technology to firm S even for free under any level of its bargaining power. This is stated in the following proposition.

Proposition 1

When firm 1 transforms two complementary inputs into final goods, it always licenses its core input production technology to the external firm for any bargaining power and even under free licensing.

Recall that firm 1 and firm S negotiate over \(\left( {w_{s} ,{\text{T}}} \right)\) by maximizing their joint profits. Therefore, \(\pi_{1}^{L} \left( {w_{s}^{*} } \right) - T^{*}\) is better off than the case of producing the core input in-house. The intuition behind this result is as follows. It is easy to understand that the positive impact from the incentive of licensing for firm 1 is due to subsidization through vertical licensing when product differentiation is low.Footnote 15 However, double marginalization arises, which leads to lower profit under licensing relative to the profit under in-house when two products are more differentiated. If the above situation is the case, then why does firm 1 have incentives to provide its input production technology to firm S even for free? Actually, firm 1 and firm S use their vertical trading contract as an instrument that allows them to behave in a pro-collusive way at the expense of the complementary input supplier. Therefore, firm 1 enjoys a larger profit even for free licensing. On the other hand, when firm 1 produces the core input in-house, the complementary input supplier B captures all the extra profit from firm 1 through the input price, which lowers the reservation profit of firm 1 without licensing. Therefore, vertical licensing always occurs even for free.

This finding is quite different from the result of Bakaouka and Milliou (2018). They conclude that free licensing occurs only if the licensor’s bargaining power is sufficiently high. However, it is interesting to note that free licensing is always profitable to a licensor under any bargaining power by considering the final product is produced by complementary inputs.

4 Welfare implications of vertical licensing

We have already seen that vertical licensing is desirable from the licensor’s viewpoint. In this section we examine whether vertical licensing is also desirable from the welfare viewpoint. Social welfare comprises consumer surplus and total industry profits. Comparing consumer surplus in the case of licensing versus that for the in-house case shows that \(CS^{L} - CS^{N} = \frac{{ - A_{2} \left( {1 - c} \right)^{2} \left( { - 2r^{2} - r + 2} \right)}}{{4\left( {2 + r} \right)^{2} A_{1}^{2} }} = \frac{{ - A_{2} \left( {1 - c} \right)\left( {w_{s}^{*} - c} \right)}}{{8\left( {2 + r} \right)^{2} \left( {2 - r} \right)A_{1} }},\) where \(A_{2} = \left( {2r^{5} + 9r^{4} - 83r^{3} - 142r^{2} + 156r + 200} \right) > 0\) due to \(0 \le r \le 1\). It shows that \(CS^{L} < \left( \ge \right) CS^{N}\) if \(0 \le r < \overline{r}\) (\(\overline{r} \le r \le 1\)). Intuitively, the input B effect dominates the input A effect, leading \(w_{s}^{*} > c\), to the detriment of the consumer surplus when products are more differentiated. Therefore, we have \(CS^{L} < CS^{N}\). Otherwise, it is conducive to the consumer surplus, in which the input B effect is dominated by the input A effect when product differentiation is low.

For proof of this intuition, using (6) and (14) in Appendix 2, we compare the production marginal cost of firm 1 in the absence of vertical licensing—that is, \(\left( {w_{B}^{N} + {\text{c}}} \right)\)—with that in the presence of vertical licensing—that is, \(\left( {w_{s}^{*} + w_{B}^{L} } \right)\). Thus, we have:

We already show that the wholesale price is set above the upstream marginal cost—that is, \(\left( {w_{s}^{*} - c} \right) > 0\)—leading to \(\left( {w_{B}^{L} - w_{B}^{N} } \right) < 0\) when the two products are more differentiated from (6). However, the benefit of lowering the price of complementary input B is dominated by the disadvantage for enhancing the wholesale price strategically, which results in lower consumer surplus. On the contrary, the benefit of \(\left( {w_{s}^{*} - c} \right) < 0\) dominates the detriment of \(\left( {w_{B}^{L} - w_{B}^{N} } \right) > 0\) when the two products are less differentiated, causing higher consumer surplus.

Comparing total industry profits in the case of licensing and for the in-house case, which is \({\Pi }^{L} - {\Pi }^{N} = \frac{{ - A_{3} \left( {1 - c} \right)^{2} \left( { - 2r^{2} - r + 2} \right)}}{{2\left( {2 + r} \right)^{2} A_{1}^{2} }} = \frac{{ - A_{3} \left( {1 - c} \right)\left( {w_{s}^{*} - c} \right)}}{{4\left( {2 + r} \right)^{2} \left( {2 - r} \right)A_{1} }}\), where \(A_{3} = \left( {6r^{5} + 41r^{4} + 43r^{3} - 178r^{2} - 124r + 280} \right) > 0\) due to \(0 \le r \le 1\). It shows that \({\Pi }^{L} < \left( \ge \right) {\Pi }^{N}\) if \(0 \le r < \overline{r}\) (\(\overline{r} \le r \le 1\)). This is because that the input B effect dominates the input A effect, leading \(w_{s}^{*} > c\) and less outputs. Therefore, the total industry profits under licensing are lower than that in the in-house case when product differentiation is higher (Appendix 3 for the details). From the above discussion, we have Proposition 2.

Proposition 2

Vertical licensing has positive (negative) implications on consumer surplus and total industry profits when product differentiation is low (high).

The above analysis shows that whether the wholesale price is set above or below the upstream marginal cost plays a crucial role in affecting the welfare in the presence of vertical licensing. When the two products are more differentiated, a higher wholesale price is intuitively charged, which lowers the derived demand and the price of complementary input B. It enhances firm 1’s profit at the expense of the complementary supplier’s profit. Therefore, the profit of complementary input supplier B is lower under the licensing case; that is, \(\pi_{B}^{L} < \pi_{B}^{N}\). Moreover, an increase in the wholesale price has bearing on the pricing externality of the rival firm, which leads to higher profit for firm 2; that is, \(\pi_{2}^{L} > \pi_{2}^{N}\).

As Proposition 1 mentions, firm 1 always has higher profit when it licenses its input production technology; that is,\(\pi_{1}^{L} + \pi_{s}^{L} \ge \pi_{1}^{N}\). However, the losses of complementary input supplier B are so significant that dominates the externality benefits of firm 2 and the higher profit of firm 1 under vertical licensing. As a result, negative welfare implications from vertical licensing appear. From the above discussion, we establish the following proposition.

Proposition 3

Vertical licensing may reduce social welfare and leads to an irreconcilable difference between the licensor and social welfare when product differentiation is high even for free technology licensing.

This result reveals that vertical licensing can inhibit welfare even when there is no foreclosure, no rise in the rival firm’s cost, and free technology licensing when products are more differentiated, which sharply differ from the positive welfare implications of technology licensing. In our paper, industry profit in the downstream market even increases through vertical licensing as products are more differentiated (Appendix 3 for the details). However, the decreased welfare is driven by a high wholesale price, \(\left( {w_{s}^{*} - c} \right) > 0\), through the two-part tariff input contract. It also results in double marginalization at the expense of consumer surplus. This is a feature of introducing complementary inputs that is absent in the single input literature.

The above results differ from Bakaouka and Milliou (2018) who find that vertical licensing is always beneficial for consumers and social welfare. However, our findings show that vertical licensing is desirable for the licensor, but not for the consumers and the economy as a whole and depends on the degree of product differentiation. In addition, our findings are also related to Kao and Peng (2016) and Kishimoto (2020), they all analyze the welfare implication of horizontal licensing. The former show that the licensor has an incentive to freely share its technology to potential entrants and conclude that free licensing is socially desirable. In contrast, we consider vertical licensing and show that it is detrimental even when the licensing is free as the two products are more differentiated. Kishimoto (2020) considers a setting in which the licensing contract is determined through asymmetric Nash bargaining. However, he focuses on the role of bargaining power with horizontal licensing on the welfare implications, while we focus on the role of input pricing with bargaining power and complementary inputs in a vertical licensing framework.

5 Extension

5.1 Transforming multiple complementary inputs into final goods

This subsection extends the model in Sect. 4 to consider that each downstream firm produces a differentiated final good using input A and n varieties of complementary input B, which are essential, and \(n \ge 1,\) where n is continuous. Moreover, input Bv is provided by complementary supplier Bv exclusively, where v = 1, 2, …, n. For simplicity, we assume that the input B suppliers have symmetric production technologies and they can produce the inputs at zero cost. The other settings are the same as in Sect. 4.Footnote 16 The price of input Bv in the third stage is \(w_{B}^{L} = \frac{{2 - c - w_{s} }}{{2\left( {1 + n} \right)}}\), which shows that when the final good consists of more varieties of complementary inputs, the input price of input Bv will be lower—that is, \(\frac{{\partial w_{B}^{L} }}{\partial n} = \frac{{ - \left( {2 - c - w_{s} } \right)}}{{2\left( {n + 1} \right)^{2} }} < 0\). In the second stage, firm S and firm 1 determine the wholesale price of input A by maximization of the Nash bargaining problem.

Comparing the equilibrium wholesale price of input A in the case of licensing with c, we deriveFootnote 17:

where \(\frac{{\partial \pi_{1}^{L} }}{{\partial q_{2}^{L} }}\frac{{\partial q_{2}^{L} }}{{\partial w_{s} }} = \frac{{ - r^{2} q_{1}^{L} }}{{4 - r^{2} }} < 0\) and \(\left( {\frac{{\partial \pi_{1}^{L} }}{{\partial q_{2}^{L} }}\frac{{\partial q_{2}^{L} }}{{\partial w_{B}^{L} }} + \frac{{\partial \pi_{1}^{L} }}{{\partial w_{B}^{L} }}} \right)\frac{{\partial w_{B}^{L} }}{{\partial w_{s} }} = \frac{{n\left( {2 - r} \right)q_{1}^{L} }}{{\left( {4 - r^{2} } \right)\left( {1 + n} \right)}} > 0\).

The above result is similar to (5), whereby the wholesale price set above or below the upstream marginal cost is determined by the input A effect and the input B effect as mentioned in Sect. 4. It also shows that the equilibrium wholesale price is \(w_{s}^{*} = c + \frac{{2\left( {1 - c} \right)\left( {2 - r} \right)\left( { - r^{2} - nr^{2} - rn + 2n} \right)}}{{\left[ {2\left( {2 - r^{2} } \right) + n\left( {6 - 2r^{2} - r} \right)} \right]\left( {rn + 2n + 4} \right)}}\), where \(w_{s}^{*} > c\) if \(0 \le r < \tilde{r} \equiv \frac{{ - n + \sqrt {n\left( {9n + 8} \right)} }}{{2\left( {1 + n} \right)}}\); otherwise, the wholesale price is set below the upstream marginal cost. Moreover, we have: \(\frac{{\partial \tilde{r}}}{\partial n} = \frac{{\left( {5n + 4} \right) - \sqrt {n\left( {9n + 8} \right)} }}{{2\left( {1 + n} \right)^{2} \sqrt {n\left( {9n + 8} \right)} }} > 0\).Footnote 18

In contrast to the results in Sect. 4, when there are n varieties of complementary inputs for producing the final good with input A, charging a higher wholesale price instead of utilizing a subsidy still holds and in fact is more likely to happen. The intuition runs as follows. The more varieties of complementary inputs that are used, the greater is the cost burden for producing final goods, causing lower output of firm 1, which reduces the profits of the downstream firms. Therefore, the input A effect tends to set the wholesale price below the upstream licensee’s marginal cost to expand the market share at a rival firm’s expense. On the other hand, complementary input suppliers have a monopoly power on their inputs that are essential for downstream firms, leading to sufficiently high prices of complementary inputs. Therefore, the increased input B effect tends to set the wholesale price above the upstream licensee’s marginal cost in order to lower the price of complementary input Bv. Moreover, the input B effect strengthens and dominates the input A effect as more varieties of complementary inputs are used. Therefore, upstream firm S is more likely to decrease the aggressiveness of downstream firm 1 in the final goods market in order to enjoy lower prices of other complementary inputs for pursuing more joint profit as more varieties of input B are used, showing that \(\frac{{\partial \tilde{r}}}{\partial n} > 0\).

We next explore the incentives of firm 1 to license the production technology of its core input to external firm S when n varieties of complementary inputs should be used. We find that the net equilibrium profits of firm 1 in the case of licensing are always higher than that in the case of no licensing; that is, \(\pi_{1}^{LE} - \pi_{1}^{N} = \frac{{\left( {1 - c} \right)^{2} \left[ {r^{2} - \left( {2 - 2r^{2} - r} \right)n} \right]^{2} }}{{\left[ {2\left( {2 - r^{2} } \right) + n\left( {6 - 2r^{2} - r} \right)} \right]\left( {rn + 2n + 4} \right)\left( {1 + n} \right)^{2} \left( {2 + r} \right)^{2} }} >\) 0. Therefore, we have the following proposition.

Proposition 4

When firm 1 transforms n varieties of complementary inputs with input A into final goods, firm 1 always licenses its core input production technology to external firm S, and the wholesale price of input A is more likely to be higher than the input firm’s marginal cost; that is, \(\frac{{\partial \tilde{r}}}{\partial n} > 0\) .

As we mentioned earlier, charging a higher wholesale price of input A through vertical licensing weakens the aggressiveness of firm 1 in the final goods market, and thus there are lower prices of complementary inputs. However, vertical licensing intensifies the double marginalization problem of the final goods and lowers the industry profits, causing a drop in welfare and a conflict of interest between the licensor and society’s desires. This result is different to the literature such as Bakaouka and Milliou (2018). In contrast, we extend their model using multiple complementary inputs, creating the input B effect and meaning that the wholesale price may be set above the upstream marginal cost. This self-sabotage behaviour is more likely to occur as more varieties of complementary inputs are used. Therefore, the double marginalization caused by vertical licensing and the pro-competitive welfare implication may not hold in our model. This result stands in line with complementary inputs literature, as first investigated by Cournot (1938). He observes that each upstream firm does not take negative externalities into account, which refer to the impact of the input price on the profits of all other upstream firms. These negative externalities stem from the goods produced by the upstream firms being perfect complements that are sold by independent firms, leading to inefficiently high prices of complementary inputs. These negative externalities also occur in our model, which strengthen the input B effects and create the double mark-up, causing anti-competitive welfare implications.

Our work also relates to papers on self-sabotage, such as Arya and Mittendorf (2011). They consider a single-input-multi-product firm where a firm can service multiple markets, in which product lines interact through the use of a common input. They point out that a firm can reduce the supplier’s price by adding a seemingly unprofitable product so as to increase the firm’s profit. In our model, licensing can be used as a way for a vertical trading contract to increase the licensor’s cost in order to reduce the complementary input supplier’s price so as to enjoy higher profit. Moreover, the downstream licensor’s self-sabotage strategy is more likely to occur as more varieties of complementary inputs are applied.

5.2 A wholesale price contract

We so far have discussed the licensing incentive when firm 1 and firm S negotiate over the input sourcing term, including the terms of a two-part tariff in the second stage. In this sub-section we extend the analysis from two-part tariffs to a wholesale price contract in the second stage, and the remaining settings are the same. In this case, we find that the optimal wholesale price, \(\hat{w}_{s}\), is always set above the upstream marginal cost. Therefore, we have \(\hat{w}_{s} \ge c\) for any product differentiation, leading firm 2 to enjoy a cost-advantage and higher profit. Therefore, we find that \(\pi_{1}^{LE} - \pi_{1}^{N} = \pi_{1}^{L} \left( {\hat{w}_{s} } \right) + F - \pi_{1}^{N} = \pi_{1}^{L} \left( {\hat{w}_{s} } \right) + \pi_{s}^{L} \left( {\hat{w}_{s} } \right) - \pi_{1}^{N} = \frac{{ - \left( {4r^{2} + 3r + 2} \right)\left( {1 - c} \right)^{2} }}{{16\left( {r + 6} \right)\left( {r + 2} \right)^{2} }} < 0\) (Appendix 5 for the details). As a result, firm 1 has no incentive to license its core input production technology to firm S with a wholesale price input contract.

The intuition behind the above goes as follows. With a two-part tariff input contract, due to the presence of fixed fees, firm S cares about the joint profit with the downstream firm. However, with a wholesale input contract, due to the absence of fixed fees, firm S only cares about the downstream firm’s output to maximize its profit instead, resulting in a positive mark-up on the wholesale price. Moreover, the wholesale input contract also causes a positive externality to the rival firm due to a lower price of complementary input, leading to a significant profit loss. Therefore, when vertical trading takes place through a wholesale price contract, licensing does not arise in equilibrium.

The above result is different from Kopel et al. (2016). They show that a multi-input-multi-product firm might have a strategic incentive even when the optimal wholesale price exceeds the marginal cost in-house when there is a wholesale price contract. This is because they confine their model to a downstream monopolist, in which the monopolist can reduce the price of a complementary input without positive externality to the rival firm so as to increase its profit through a sourcing strategy with the wholesale price set above the marginal cost.

5.3 A two-part tariff or pure royalty licensing contract

In this sub-section we consider the case in which the licensing contract is composed of a two-part tariff or pure royalty instead of a fixed fee, and the remaining settings are the same. In fact, the purpose of the fixed fee of a licensing contract is to capture all of the extra profits from firm S after licensing. We assume that firm 1 offers a two-part tariff contract in the licensing stage, as long as the joint profit maximization can be realized through a two-part tariff input contract in the following second stage. The lump sum fee of a licensing contract is enough for the instrument to capture all of the extra profits from S after licensing. Therefore, the royalty rate determined is not influential even if it is set to zero (Appendix 6 for the details). Hence, vertical licensing still occurs when the licensing contract is composed of a two-part tariff. In addition, we find that the results with a two-part tariff are equivalent to those from the fixed fee licensing.

In the case of a pure royalty licensing, lump sum fee is not available, and the licensor is not able to extract all the extra profits from firm S. However, the licensor and licensee still can reach joint profit maximization by Nash bargaining over two-part tariffs in the second stage. In this case, the wholesale price is adjusted with the royalty rate at a one-to-one proportion to ensure the joint profit maximization is realized. Therefore, the royalty rate can be any value even if it is set to zero. What about the incentive of royalty licensing? We already have proved from Proposition 1 that vertical licensing occurs even for free, not to mention the royalty revenue when royalty licensing takes place. Therefore, vertical licensing still occurs when the licensing contract is a pure royalty.

Our result differs from the result of Mukherjee and Tsai (2015). They find that both social welfare and profit are higher under two-part tariff licensing than those under fixed fee licensing by considering cost-reducing horizontal licensing. However, we conclude that the fixed fee is equivalent to the two-part tariff when we employ vertical licensing, which is accompanied by a seller-buyer relationship through the two-part tariff.

6 Concluding remarks

The environment that the pro-competitive licensing is attainable and the corresponding effects on welfare have attracted widespread attention in the field of industrial organization. This research has examined the welfare implication of vertical licensing when the final goods are produced by two complementary inputs. We specifically show that when vertical licensing takes place, the licensee has an incentive to subsidize its own downstream firm through a low wholesale price in order to enhance the downstream licensor’s output and profit at the rival firm’s expense. We refer to this as the input A effect, which is already derived from the literature by assuming a single input model. The new effect is driven by introducing complementary inputs in our study. We refer to this as the input B effect, which is absent in the literature. An increase in the wholesale price through vertical trading contract lowers the derived demand of the complementary input, resulting in a low complementary input price. When the two products exhibit less differentiation, the market is intensified, strengthening the input A effect. Therefore, it leads to subsidization from the licensee through a two-part tariff input contract, which causes higher consumer surplus and improves welfare. When the products are more differentiated, the licensor does not suffer severe competition from the market, and thus the wholesale price is set above the input’s marginal cost so as to reduce the negative impact of the market power from the complementary input supplier. However, the high wholesale price through vertical licensing generates double marginalization, which is detrimental to consumer surplus and welfare.

The above results reveal that whether the wholesale price is set above or below the upstream marginal cost has crucial ramifications in affecting the corresponding welfare implications, showing the importance of a two-part tariff input contract when there is a buyer–seller relationship after vertical licensing. However, our study also demonstrates that the licensor always has incentives to provide its input production technology to the external firm, even when the licensee has full bargaining power and licenses the technology for free. Therefore, our study offers policy implications that may go up against conventional wisdom that welfare improving licensing may not be attainable by considering multiple complementary inputs.

We also relax the setting for considering more complementary inputs for producing the final goods, in which vertical licensing to the external firm always occurs. The wholesale price is especially more likely to be higher than the input firm’s marginal cost in the case of more complementary inputs and fosters the occurrence of welfare reducing vertical licensing. Moreover, when we confine the input terms to wholesale pricing as an extension, it shows that the wholesale price is set above the marginal cost and has a positive externality on the rival firm, leading to a significant profit loss for the licensor. Therefore, vertical licensing does not arise in equilibrium. We also consider as an extension the case in which the licensing contract is composed of a two-part tariff or a per-unit royalty instead of fixed-fee licensing. We conclude that our result still remains—that is, vertical licensing occurs, as long as joint profit maximization can be realized through the vertical trading contract in the second stage.

There are several ways in which this paper could be extended for future studies. First, we could relax the assumption of the same marginal cost of the licensor and licensee to see how sensitive our results are to the asymmetric cost in this paper. Second, we assume that firm 1 licenses its technology to firm S. It is of interest to discuss the result if firm 1 decides to source input A from its rival firm 2. With this extension, we expect that the incentive of firm 1 to license to firm 2 is smaller than licensing to firm S since firm 2 will charge a higher input price to alleviate competition in the downstream markets, resulting in a lower profit of firm 1. These extensions are reserved for future research.

Notes

Who are Toyota’s Main suppliers? Investopedia (September 22, 2019) (https://www.investopedia.com/ask/answers/060115/who-are-toyotas-tyo-main-suppliers.asp).

Based on data from Toyota’s headquarters, the total value of purchased components is pegged at $300 millions a month.

For example, Boeing purchases jet engines from General Electric and avionics from Honeywell for its product portfolio.

The energy sector or power-generating sector is characterized by oligopolistic competition. As Tyagi (1999) demonstrates, the market for microprocessors, aircraft engines, and many other products are also characterized by oligopolistic competition, emphasizing that input suppliers have significant market power.

Our paper closely relates to the growing literature on complementary patents such as Shapiro (2001), Lerner and Tirole (2004) and Schmidt (2014). These papers analyze the effects of patent pools and complementary patents with n upstream firms’ technology licensing while we highlight the welfare implications of vertical licensing from a downstream firm when the final goods are produced by multiple complementary inputs. Moreover, the downstream firm in our model can produce a core input in-house while these papers assume the technologies from n upstream firms are essential.

We assume that supplier UB practices uniform input pricing, which naturally could be true, because input price discrimination is not allowed by antitrust law.

We assume that the licensee has the same marginal cost of production as the licensor for simplicity. The licensor has more (less) incentives to license its technology when the licensee is more (less) efficient than the licensor.

In this paper we focus on how the vertical trading contract between the licensor and licensee affects the incentive of vertical licensing. Therefore, we assume that the input price of a complementary input is determined by wholesale input pricing for simplification.

Substituting T into (3), the gross profits (from F) of firm S and firm 1 can be rewritten as \(\pi_{s}^{L} \left( {w_{s} } \right) + T = {\upbeta }\left[ {\pi_{1}^{L} \left( {w_{s} } \right) - \pi_{1}^{N} + \pi_{s}^{L} \left( {w_{s} } \right)} \right]\) and \(\pi_{1}^{L} \left( {w_{s} } \right) - T - \pi_{1}^{N} = \left( {1 - {\upbeta }} \right)\left[ {\pi_{1}^{L} \left( {w_{s} } \right) + \pi_{s}^{L} \left( {w_{s} } \right) - \pi_{1}^{N} } \right]\).

We have \(\left( {\frac{{\partial q_{1}^{L} }}{{\partial w_{B}^{L} }}\frac{{\partial w_{B}^{L} }}{{\partial w_{s} }} + \frac{{\partial q_{1}^{L} }}{{\partial w_{s} }}} \right) = \frac{{ - \left( {6 + r} \right)}}{{4\left( {4 - r^{2} } \right)}} < 0\) in (5).

When \(0 \le r < \overline{r}\), it shows that \(w_{s}^{*} > 0\) due to \(\left( {2 - 2r^{2} - r} \right) > 0\). When \(\overline{r} \le r \le 1\), \(w_{s}^{*} > 0\) if \(c > \frac{{2\left( {1 - c} \right)\left( {2 - r} \right)\left( {2 - 2r^{2} - r} \right)}}{{A_{1} }}\) due to \(\left( {2 - 2r^{2} - r} \right) < 0\). This condition holds if \(c\left( { - 31r^{2} - 4r + 68} \right) > 2\left( {2 - r} \right)\left( {2 - r^{2} - r} \right)\), which is always fulfilled due to \(\overline{r} \le r \le 1\). Therefore, \(w_{s}^{*}\) is positive.

In the case of homogeneous goods, firm S has to subsidize more to firm 1 then captures firm 1’s profit through T due to severe competition. Therefore, the net equilibrium profit of the licensor is not so significant when two products are homogeneous goods. In the case of independent goods, due to less competitive in the downstream market, the subsidy of firm S to firm 1 through T is small, leading a higher net equilibrium profit of the licensor.

When the two products are similar (dissimilar), the gross profit of firm 1 from T (that is, \(\pi_{1}^{L}\)) is significant (less) under licensing and results in \({\text{T}} > \left( < \right){ }0\). Please refer the details in Appendix 2.

Appendix 4 derives the equilibria in the case of no licensing and in the case of vertical licensing.

We have \(\left( {\frac{{\partial q_{1}^{L} }}{{\partial w_{B}^{L} }}\frac{{\partial w_{B}^{L} }}{{\partial w_{s} }} + \frac{{\partial q_{1}^{L} }}{{\partial w_{s} }}} \right) = \frac{{ - \left( {2n + rn + 4} \right)}}{{2\left( {4 - r^{2} } \right)\left( {1 + n} \right)}} < 0\) in (10).

We can confirm that \(\left( {5n + 4} \right) > \sqrt {n\left( {9n + 8} \right)}\) for any n.

References

Arya A, Mittendorf B (2006) Enhancing vertical efficiency through horizontal licensing. J Regul Econ 29:333–342

Arya A, Mittendorf B, Sappington D (2008a) The make-or-buy decision in the presence of a rival: strategic outsourcing to a common supplier. Manag Sci 54:1747–1758

Arya A, Mittendorf B, Sappington D (2008b) Outsourcing, vertical integration, and price vs. quantity competition. Int J Ind Organ 26:1–16

Arya A, Mittendorf B (2011) Supply chains and segment profitability: how input pricing creates a latent cross-segment subsidy. Account Rev 86:805–824

Bakaouka E, Milliou C (2018) Vertical licensing, input pricing, and entry. Int J Ind Organ 59:66–96

Chang RY, Hwang H, Peng CH (2013) Technology licensing, R&D and welfare. Econ Lett 118:396–399

Cournot AA (1938) Researches into the mathematical principles of the theory of wealth, English edition of Researches sur les principles mathematiques de la theorie des richesses. Kelley, New York

Fauli-Oller R, Sandonis J (2002) Welfare reducing licensing. Games Econom Behav 41:192–205

Jansen J (2003) Coexistence of strategic vertical separation and integration. Int J Ind Organ 21:699–716

Kao KF, Peng CH (2016) “Profit improving via strategic technology sharing. B.E. J Econ Anal Policy 16:1321–1336

Kishimoto S (2020) The welfare effect of bargaining power in the licensing of a cost-reducing technology. J Econ 129:173–193

Kitamura H, Matsushima N, Sato M (2018) Exclusive contracts with complementary Inputs. Int J Ind Organ 56:145–167

Kopel M, Loffler C, Pfeiffer T (2016) Sourcing strategies of a multi-input-multi-product firm. J Econ Behav Organ 127:30–45

Kopel M, Loffler C, Pfeiffer T (2017) Complementary monopolies and multi-product firms. Econ Lett 157:28–30

Kuo PS, Lin YS, Peng CH (2016) International technology transfer and welfare. Rev Dev Econ 20:214–227

Laussel D, Resende J (2020) Complementary monopolies with asymmetric information. Econ Theor 70:943–981

Lerner J, Tirole J (2004) Efficient patent pools. Am Econ Rev 94:691–711

Lim WS, Tan SJ (2010) Outsourcing suppliers as downstream competitors: biting the hand that feeds. Eur J Oper Res 203:360–369

Milliou C (2020) Vertical integration without intrafirm trade. Econ Lett 192:109180

Mukherjee A (2003) Licensing in a vertically separated industry. University of Nottingham Discussion Paper No. 03/01

Mukherjee A, Ray A (2007) Strategic outsourcing and R&D in a vertical structure. Manchester Sch 75:297–310

Mukherjee A, Tsai Y (2015) Does two-part tariff licensing agreement enhance both welfare and profit? J Econ 116:63–76

Pack H, Saggi K (2001) Vertical technology transfer via international outsourcing. J Dev Econ 65:389–415

Rey P, Salant D (2012) Abuse of dominance and licensing of intellectual property. Int J Ind Organ 30:518–527

Sappington D (2005) On the irrelevance of input prices for make-or-buy decisions. Am Econ Rev 95:1631–1638

Schmidt KM (2014) Complementary patents and market structure. J Econ Manag Strategy 23:68–88

Shy O, Stenbacka R (2003) Strategic outsourcing. J Econ Behav Organ 50:203–224

Shapiro C (2001) Setting compatibility standards: cooperation or collusion. In: Dreyfuss RC, Zimmerman DL, First H (eds) Expanding the boundaries of intellectual property: innovation policy for the knowledge society. Oxford University Press, Oxford, pp 81–101

Tyagi R (1999) On the effects of downstream entry. Manag Sci 45:59–73

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We are grateful to seminar participants at NTU Trade Workshop for their valuable comments, leading to substantial improvements of this paper. We also thank the Ministry of Science and Technology for funding this study (MOST 107-2410-H-431-001). The usual disclaimer applies.

Appendices

Appendix 1: Outside option for firm 1

In the absence of licensing, firm 1 produces the core input in-house. Each firm chooses its output in order to maximize its profits as \(\pi_{i}^{N} = \left( {1 - q_{i}^{N} - rq_{j}^{N} - c - w_{B}^{N} } \right)q_{i}^{N} , i = 1, 2, i \ne j\), where superscript “N” denotes the equilibrium with no licensing. Solving the resulting system of first-order conditions, we obtain the Cournot-Nash equilibrium quantities, \(q_{1}^{N} = q_{2}^{N} = \frac{{\left( {2 - r} \right) + r\left( {c + w_{B}^{N} } \right) - 2\left( {c + w_{B}^{N} } \right)}}{{4 - r^{2} }}\). In the following stage, supplier UB maximizes the profit, which is \(\pi_{B}^{N} \equiv \pi_{B}^{N} \left( {q_{1}^{N} \left( {w_{B}^{N} } \right),q_{2}^{N} \left( {w_{B}^{N} } \right),w_{B}^{N} } \right) = w_{B}^{N} \left( {q_{1}^{N} + q_{2}^{N} } \right)\), to determine the price of input B. The first-order condition of \(\pi_{B}^{N}\) leads to:

where \(\left( {\frac{{\partial \pi_{B}^{N} }}{{\partial q_{1}^{N} }}\frac{{\partial q_{1}^{N} }}{{\partial w_{B}^{N} }}} \right) = \left( {\frac{{\partial \pi_{B}^{N} }}{{\partial q_{2}^{N} }}\frac{{\partial q_{2}^{N} }}{{\partial w_{B}^{N} }}} \right) = w_{B}^{N} \left( {\frac{r - 2}{{4 - r^{2} }}} \right) < 0\), and \(\frac{{\partial \pi_{B}^{N} }}{{\partial w_{B}^{N} }} = \left( {q_{1}^{N} + q_{2}^{N} } \right) > 0\). Therefore, we have the equilibrium input price of B and the respective equilibrium profits as:

Appendix 2: Two-part tariff input pricing

In the second stage, firm S and firm 1 negotiate over \(\left( {w_{s} ,{\text{ T}}} \right)\) to determine T and \(w_{s}\). Substituting T into (3), it follows that \(w_{s}\) is chosen to maximize the following profits as \({\text{ U}} = \pi_{1}^{L} \left( {w_{s} } \right) + \pi_{s}^{L} \left( {w_{s} } \right) - \pi_{1}^{N}\). The first-order condition of (3) is:

Using the envelop theorem, we derive \(\frac{{\partial \pi_{1}^{L} }}{{\partial q_{1}^{L} }}\left( {\frac{{\partial q_{1}^{L} }}{{\partial w_{B}^{L} }}\frac{{\partial w_{B}^{L} }}{{\partial w_{s} }} + \frac{{\partial q_{1}^{L} }}{{\partial w_{s} }}} \right) = 0\), \(\frac{{\partial \pi_{1}^{L} }}{{\partial w_{s} }} = - q_{1}^{L} < 0\), and \(\frac{{\partial \pi_{s}^{L} }}{{\partial w_{s} }} = q_{1}^{L} > 0\). Therefore, we obtain the first-order condition as (4). Solving (4), we derive the equilibrium wholesale price as (5) and rewrite the wholesale price and equilibrium fixed fee as:

We can easily check that \(w_{s}^{*} > \left( \le \right)c\) if \(0 \le r < \overline{r} \equiv 0.780776\) (\(\overline{r} \le r \le 1\)).

where \(A_{4} = \left( {8r^{4} + 6r^{3} - 27r^{2} - 12r + 20} \right) > \left( \le \right)0\) if \(0 \le r < \overline{r}\) (\(\overline{r} \le r \le 1\)). Therefore, we have \(T^{*} > 0\) due to \(\left( {w_{s}^{*} - c} \right) < 0\) and \(\left[ { - 8\left( {r^{2} - 4} \right)^{2} + \beta A_{4} } \right] < 0\) as \(\overline{r} \le r \le 1\). When \(0 \le r < \overline{r}\), we find \(\left[ { - 8\left( {r^{2} - 4} \right)^{2} + \beta A_{4} } \right] > 0\) if \(\beta > \overline{\beta } \equiv \frac{{8\left( {r^{2} - 4} \right)^{2} }}{{A_{4} }}\), where \(\overline{\beta } > 1\) due to \(0 \le r \le 1\). Therefore, we have \(\left[ { - 8\left( {r^{2} - 4} \right)^{2} + \beta A_{4} } \right] < 0\) due to \(0 \le {\upbeta } \le 1\). Hence, we have \(T^{*} < 0\) due to \(\left( {w_{s}^{*} - c} \right) > 0\) and \(\left[ { - 8\left( {r^{2} - 4} \right)^{2} + \beta A_{4} } \right] < 0\). Moreover, the net equilibrium profit of firm S is:

Appendix 3: Welfare implications

The industry profits in the downstream market and in the upstream market for the in-house case are \((\pi_{1}^{N} + \pi_{2}^{N} ) = \frac{{\left( {2 - r} \right)^{2} \left( {1 - c} \right)^{2} }}{{2\left( {4 - r^{2} } \right)^{2} }}\) and \(\pi_{B}^{N} = \frac{{\left( {2 - r} \right)\left( {1 - c} \right)^{2} }}{{2\left( {4 - r^{2} } \right)}}\), respectively. The total industry profits for the in-house case are \({\Pi }^{N} = (\pi_{1}^{N} + \pi_{2}^{N} ) + \pi_{B}^{N} = \frac{{\left( {1 - c} \right)^{2} \left( {2 - r} \right)^{2} \left( {3 + r} \right)}}{{2\left( {4 - r^{2} } \right)^{2} }}\). The industry profits in the downstream market in the licensing case are \({\Pi }_{D}^{L} = (\pi_{1}^{L} - T^{*} + F) + \pi_{2}^{L} = \pi_{1}^{L} + \pi_{2}^{L} + \pi_{s}^{L} = \frac{{2\left( {1 - c} \right)^{2} \left( {2 - r} \right)\left( { - 3r^{2} - 5r + 14} \right)}}{{\left( {6 + r} \right)A_{1} }}\), and the profit of complementary input supplier B in the licensing case is \(\pi_{B}^{L} = \frac{{2\left( { - 3r^{2} - 5r + 14} \right)^{2} \left( {1 - c} \right)^{2} \left( {2 + r} \right)}}{{A_{1}^{2} }}\), in which the total industry profits in the licensing case are \({\Pi }^{L} \equiv {\Pi }_{D}^{L} + \pi_{B}^{L}\).

Comparing the difference in the profits of the downstream market between the licensing case and the in-house case, we have:

where \(A_{5} = \left( { - 6r^{3} - 21r^{2} + 12r + 44} \right) > 0\) due to \(0 \le r \le 1\). It shows that \({\Pi }_{D}^{L} > \left( \le \right)\left( {\pi_{1}^{N} + \pi_{2}^{N} } \right)\) as \(0 \le r < \overline{r}\) (\(\overline{r} \le r \le 1\)).

Comparing the difference in the profits of complementary input supplier B between the licensing case and the in-house case, we have:

where \(A_{6} = \left( {10r^{4} + 27r^{3} - 106r^{2} - 92r + 232} \right) > 0\) due to \(0 \le r \le 1\). From (18), it shows that \(\pi_{B}^{L} < \left( \ge \right) \pi_{B}^{N}\) if \(0 \le r < \overline{r}\) (\(\overline{r} \le r \le 1\)).

We already showed that \(CS^{L} < \left( \ge \right) CS^{N}\) and \({\Pi }^{L} < \left( \ge \right) {\Pi }^{N}\) if \(0 \le r < \overline{r}\) (\(\overline{r} \le r \le 1\)) in Sect. 4. Therefore, for the difference in social welfare between the licensing case and the in-house case, we find that \(SW^{L} < \left( \ge \right) SW^{N}\) if \(0 \le r < \overline{r}\) (\(\overline{r} \le r \le 1\)).

Appendix 4: Multiple varieties of complementary inputs

The profit functions of two firms with n varieties of complementary inputs when firm 1 produces the core input in-house are:

Using the first-order conditions from (19), we obtain the equilibrium outputs at the final stage. The profit function of complementary input supplier Bv, v = 1, 2, …, n, in the case of in-house is \(\pi_{Bv}^{N} = w_{Bv}^{N} \left( {q_{1}^{N} + q_{2}^{N} } \right)\). The equilibrium wholesale price of input supplier Bv is \(w_{Bv}^{N} = \frac{1 - c}{{\left( {1 + n} \right)}}\). The resulting equilibrium outputs and profits of downstream firms in the in-house case (that is, no licensing) are:

When the licensing agreement has been signed, the resulting equilibrium outputs are:

where \(w_{B1}^{L} = w_{B2}^{L} = \cdots = w_{Bn}^{L} = w_{B}^{L}\) due to symmetry.

Firm 1 and firm S maximize their joint profit. The first-order condition can thus be rewritten as:

From (22), we get the equilibrium wholesale price as (8) and rewrite it as:

It shows that \(w_{s}^{*} > \left( \le \right)c\) if \(0 \le r < \tilde{r} \equiv \frac{{ - n + \sqrt {n\left( {9n + 8} \right)} }}{{2\left( {1 + n} \right)}}\) (\(\tilde{r} \le r \le 1\)). Moreover, we have: \(\frac{{\partial \tilde{r}}}{\partial n} = \frac{{\left( {5n + 4} \right) - \sqrt {n\left( {9n + 8} \right)} }}{{2\left( {1 + n} \right)^{2} \sqrt {n\left( {9n + 8} \right)} }} > 0\).

The equilibrium wholesale price is \(w_{B}^{L} = \frac{{\left( {2 + r} \right)\left( {1 - c} \right)\left[ {n\left( {6 - 2r^{2} - r} \right) + \left( {8 - r^{2} - 4r} \right)} \right]}}{{\left[ {2\left( {2 - r^{2} } \right) + n\left( {6 - 2r^{2} - r} \right)} \right]\left( {rn + 4 + 2n} \right)}}\). The equilibrium outputs are \(q_{1}^{L} = \frac{{\left( {2 - r} \right)\left( {1 - c} \right)}}{{\left[ {2\left( {2 - r^{2} } \right) + n\left( {6 - 2r^{2} - r} \right)} \right]}}\) and \(q_{2}^{L} = \frac{{\left( {1 - c} \right)\left[ {n\left( {8 - 3r^{2} - 2r} \right) + 2\left( {4 - r^{2} - 2r} \right)} \right]}}{{\left[ {2\left( {2 - r^{2} } \right) + n\left( {6 - 2r^{2} - r} \right)} \right]\left( {rn + 4 + 2n} \right)}}\). We now have the equilibrium profits of firm 1 and firm S in the case of licensing.

The net equilibrium profit of firm 1 is:

Using (12), we can derive \(\pi_{1}^{LN} - \pi_{1}^{N} > 0\).

Appendix 5: A wholesale price contract

In the second stage, firm S and firm 1 negotiate over \(w_{s}\) instead of over \(\left( {w_{s} ,{\text{ T}}} \right)\). Under this case, they solve the following generalized Nash bargaining problem:

where \(\pi_{s}^{L} \left( {w_{s} } \right) = \pi_{s}^{L} \left( {q_{1}^{L} \left( {w_{B}^{L} \left( {w_{s} } \right),w_{s} } \right),w_{s} } \right) = \left( {w_{s} - c} \right)q_{1}^{L} \left( {w_{s} } \right)\) is firm S’s profit, and \(\pi_{1}^{L} \left( {w_{s} } \right) = \pi_{1}^{L} \left( {q_{1}^{L} \left( {w_{B}^{L} \left( {w_{s} } \right),w_{s} } \right),q_{2}^{L} \left( {w_{B}^{L} \left( {w_{s} } \right),w_{s} } \right),w_{B}^{L} \left( {w_{s} } \right),w_{s} } \right)\).

Maximizing (25) with respect to \(w_{s}\) and solving the first-order condition, we can derive \(\hat{w}_{s} \left( {\upbeta } \right)\). It shows that \(\hat{w}_{s} \left( {\upbeta } \right) \ge {\text{c}}\) and \(\frac{{\partial \hat{w}_{s} }}{\partial \beta } > 0\). If we assume \(\beta = 1\), then we can derive the wholesale price as:

We then substitute (26) into the profit function of firm S: \(\pi_{s}^{L} = \left( {w_{s} - c} \right)q_{1}\). We can derive the optimal fixed-fee licensing revenue in the first stage as:

Comparing firm 1’s equilibrium profits in the licensing case \(\pi_{1}^{LE}\) with its profits \(\pi_{1}^{N}\) in the no licensing case, we have:

\(\pi_{1}^{LE} - \pi_{1}^{N} = \pi_{1}^{L} \left( {\hat{w}_{s} } \right) + F - \pi_{1}^{N} = \frac{{ - \left( {4r^{2} + 3r + 2} \right)\left( {1 - c} \right)^{2} }}{{16\left( {r + 6} \right)\left( {r + 2} \right)^{2} }} < 0\).

As a result, firm 1 has no incentive to license its core input production technology to firm S with a wholesale price input contract in the extreme case of \(\beta = 1\).

Appendix 6: A two-part tariff or pure royalty licensing contract

In the first stage, firm 1 decides whether to license its input technology to external firm S. We consider the case in which the licensing contract is composed of two-part tariffs,\({ }\left( {k,{ }F} \right)\), instead of a fixed-fee licensing, where k is the royalty rate and F is the fixed fee. Firm S and firm 1 then negotiate over a vertical contract—that is, \(\left( {w_{s} ,{\text{ T}}} \right)\)—to determine T and \(w_{s}\) in the second stage. Following this setting and routine calculation, we substitute T into (3) in the second stage, and it follows that \(w_{s}\) is chosen to maximize the following profits as \({\text{ U}} = \pi_{1}^{L} \left( {w_{s} ,k} \right) + \pi_{s}^{L} \left( {w_{s} ,k} \right) - \pi_{1}^{N}\). The first-order condition is the same as (4). By solving the first-order condition, we derive the equilibrium \(w_{s}^{*}\) and \(T^{*}\) as:

where \(c + \frac{{2\left( {1 - c} \right)\left( {2 - r} \right)\left( {2 - 2r^{2} - r} \right)}}{{A_{1} }}\) is the same as (14), which is the optimal wholesale price under fixed-fee licensing. Here, (27) shows that \(w_{s}^{*}\) is a function of the royalty rate, k, with \(\frac{{\partial w_{s} }}{\partial k} = 1\), and fixed fee \(T^{*}\) is not related to k. Therefore, the royalty rate can be any value even if it is set to zero. By substituting \(k = 0\) into \(w_{s}^{*} \left( k \right)\), we can derive the same \(w_{s}^{*}\) in (5). The results in the first stage and the incentive for licensing are the same as (7). Therefore, it is found that vertical licensing occurs when the licensing contract is a two-part tariff.

In the case of pure royalty licensing in the first stage, which is \(F = 0\), the wholesale price in the second stage is the same as (27). Therefore, the result is similar to the above. We can derive the same \(w_{s}^{*}\) in (5) as \(k = 0\) in (27), and the results in the first stage are the same as (7). Therefore, vertical licensing still occurs when the licensing contract is a pure royalty. However, a royalty licensing cannot extract all the extra profit from firm S. Therefore, pure royalty licensing is inferior to fixed-fee or two-part tariff licensing.

Rights and permissions

About this article

Cite this article

Lin, YJ., Lin, YS. & Shih, PC. Welfare reducing vertical licensing in the presence of complementary inputs. J Econ 137, 121–143 (2022). https://doi.org/10.1007/s00712-022-00782-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-022-00782-y

Keywords

- Vertical licensing

- Two-part tariffs

- Input pricing

- Complementary inputs

- Vertically-related market

- Social welfare