Abstract

Multicriteria decision-making process explicitly evaluates multiple conflicting criteria in decision making. The conventional decision-making approaches assumed that each agent is independent, but the reality is that each agent aims to maximize personal benefit which causes a negative influence on other agents’ behaviors in a real-world competitive environment. In our study, we proposed an interval-valued Pythagorean prioritized operator-based game theoretical framework to mitigate the cross-influence problem. The proposed framework considers both prioritized levels among various criteria and decision makers within five stages. Notably, the interval-valued Pythagorean fuzzy sets are supposed to express the uncertainty of experts, and the game theories are applied to optimize the combination of strategies in interactive situations. Additionally, we also provided illustrative examples to address the application of our proposed framework. In summary, we provided a human-inspired framework to represent the behavior of group decision making in the interactive environment, which is potential to simulate the process of realistic humans thinking.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The group decision making is a complex procedure which requires humans to select an optimal alternative from multiple objects based on their satisfaction with desired criteria, including cost criteria and benefit criteria [1]. The decision-making process has been applied in various fields, such as fault diagnosis [2], industrial production [3], supply chain management [4] and supplier selections [5], attracting attention of majority researchers [6]. Many categories of decision-making processes can provide reliable outcomes, such as multiobject decision making [7] and [8]. In a real-world environment, the uncertainty and complexity are ubiquitous in our decision-making process [9]. To make group decision making applicable, many systematic methods are developed to address the above problems [10].

During a group decision-making process, the domain experts are invited to evaluate each alternative concerning desired criteria as a decision maker. Therefore, the expression of assessments is vital in the decision-making process and concerned by researchers [11]. However, due to the existence of uncertainty and subjectivity of experts caused by lacking precise information, decision makers cannot be able to provide accurate evaluations in forms of the crisp number. More specifically, the experts joining in decision process prefer an approximating evaluation rather than quantifying them to a concrete number [12]. Under this situation, it is a challenge how to model uncertainty and indeterminacy of experts’ evaluations by decision-making process [13]. In particular, Dempster–Shafer evidence theory (also known as D–S theory or evidence theory) sets a solid foundation for representing the uncertainty of human being’s assessments [14], which considered discord and nonspecific involved in experts’ judgments simultaneously [15]. D–S theory has been widely applied in various domains and has made some significant achievements [16]. However, D–S theory is incapable of expressing indeterminacy or hesitation involving in linguistic judgments [17]. For example, in a basketball game, Team A will defeat Team B with a certainty of 0.7 and 0.2 sure that Team A will lose the game and the remaining 0.1 express the indeterminacy of experts. Fuzzy set theory, which was proposed by Zadeh [18], is often seen as another useful tool in which it transforms the uncertainty into linguistic variables in the form of the fuzzy number. It eliminates subjectivity and prejudgements of decision makers in a compromising manner, yet failing to express probabilistic uncertainty and fuzzy uncertainty simultaneously. In addition, existing methods do not take consideration of priority factors when making decision process. As we know, the priority level of decision makers and criteria are not equal in practice. For an enterprise deciding to select a new product to invest, the weight of manager is usually larger than vice manager and benefits of products is more important than costs of products. Facing these dilemmas, an integrated decision method is urgently required to mitigate the current troubles [19].

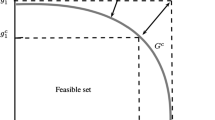

Pythagorean fuzzy sets (PFS) proposed by Yager [20] is a generation of the intuitionistic fuzzy set (IFS) [21] since it represents a wider range of uncertainty and a higher degree of imprecision. PFS satisfies the constraints that the square sum of its membership and nonmembership is less or equal than one, so it allows that PFS has potential to process special situations aside from IFS support. In addition, it is not feasible for decision makers to quantify their evaluations by a crisp number due to small-size information, and a compromise solution is to represent their opinions in the form of interval number within [0, 1]. Following this norm, the interval-valued Pythagorean fuzzy set (IVPFS) is proposed to describe the case in which membership and nonmembership’s value is in interval-form. With the existence of IVPFS, a more effective framework is developed in group decision making involving uncertainty and imprecision.

In the former researches, the decision makers’ judgements and decisions are assumed to be not affected by other joiners in decision-making process. Existing researchers mainly focused on assessing the satisfaction of each alternative to some desired criteria, yet lacking to consider external joiners on a decision maker. In terms of practical applications, a decision-making process not only involves a statistic process instead of a decision maker inter-playing with other participants, but also maximizes their benefits. The decision activities which involve more than one participant are often recognized as games. Game theory [22] provides a systematic and solid framework to study play aided by mathematical tools. Regarding this point, the traditional decision-making processes seem to induce decision makers to maximize their payoffs in games, but it can be regarded as a new interpretation of decision-making process and attracted multitudes of attentions.

An additionally significant issue of group decision making is the priority levels of decision makers and dynamic criteria [23]. For example, if an enterprise plans to select a new product to invest among many alternatives, the decision-making weight of manager is larger than vice manager who considered new products’ benefits and ignored the risks of investing in some companies. Priority average (PA) operator [24], an aggregating tool quantifying priority levels into weight, has been applied in different types of decision domains. The main thrust of this research is to establish a foundation that makes group decision making more reliable by considering all possible indexes. To achieve this goal, we proposed an interval-valued Pythagorean prioritized game framework. In specific, a game theory-extended multicriteria group decision-making model is considered to give priority in the Pythagorean interval-valued linguistic evaluation. The interval-valued Pythagorean fuzzy sets are applied to access evaluations without loss of uncertainty and indeterminacy from experts. The assessed evaluations with different priority levels are aggregated into a comprehensive assessment to extract the equilibrium of experts based on game theory.

The remaining part of the paper is organized as follows. Section 2 provides some preliminaries on the interval-valued Pythagorean fuzzy set (IVPFS), priority average (PA) operator and two-person nonconstant sum game. In Sect. 3, we presented our proposed interval-valued Pythagorean prioritized game framework in group decision-making process. In Sect. 4, an illustrative study is presented to describe the application of proposed framework and verify the validity of proposed framework. Several experiments are conducted in Sect. 5 to verify the accuracy and validation of proposed method in real decision-making process. In Sect. 6, we provide a conclusion of this study.

2 Preliminaries

2.1 Pythagorean membership functions

Yager first defined the notation of Pythagorean fuzzy set (PFS), and then, Peng developed it to a generalized form called interval-valued Pythagorean fuzzy set (IVPFS) [25], and some basic concepts and operators are defined as below:

Definition 1

Note Int([0,1]) is the set of all closed subinterval of [0,1], and X be a universe of discourse. An IVPFS \(\tilde{P}\) in X is defined as:

The function \(\mu _{\tilde{P}}: X\rightarrow {\mathrm{Int}}([0,1])\)\((x\in X \rightarrow \mu _{\tilde{P}}(x)\subseteq [0,1])\) and \(v_{\tilde{P}}\): \(X\rightarrow {\mathrm{Int}}([0,1])(x\in X \rightarrow v_{\tilde{P}}(x)\subseteq [0,1])\) denote the membership degree and nonmembership degree of element \(x\in X\) to the set \(\tilde{P},\) respectively. For every \(x\in X\), \(\mu _{\tilde{P}}(x)\) and \(v_{\tilde{P}}(x)\) are closed intervals, and their lower and upper bounds are denoted by \(\mu _{\tilde{P}}^L(x), \mu _{\tilde{P}}^U(x), v_{\tilde{P}}^L(x), v_{\tilde{P}}^U(x)\). Therefore, \(\tilde{P}\) can be expressed as follows and satisfy the conditions:

The degree of indeterminacy

For convenience, \(\tilde{P}= ([\mu _{\tilde{P}}^L, \; \mu _{\tilde{P}}^U], \; [v_{\tilde{P}}^L, \; v_{\tilde{P}}^U])\) is an interval-valued Pythagorean fuzzy set (IVPFS).

Definition 2

Let \(a_1={\{\langle s_{\theta (a_1)},[\mu _{\tilde{P}}^L(a_1), \; \mu _{\tilde{P}}^U(a_1)], \; [v_{\tilde{P}}^L(a_1), \; v_{\tilde{P}}^U(a_1)]\rangle \}}\) and \(a_2={\{\langle s_{\theta (a_2)},[\mu _{\tilde{P}}^L(a_2), \; \mu _{\tilde{P}}^U(a_2)], \; [v_{\tilde{P}}^L(a_2), \; v_{\tilde{P}}^U(a_2)]\rangle \}}\) be two IVPFSs and \(\lambda \ge 0\). Some operations of \(a_1\) and \(a_2\) are defined as follows:

- (1)

\(a_1\oplus a_2=P \Big ( \Big \langle s_{\theta (a_1)+\theta (a_2)} , \Big [\sqrt{(\mu _P^L(a_1))^2+(\mu _P^L(a_2))^2-(\mu _P^L(a_1))^2(\mu _P^L(a_2))^2},\)

\(\sqrt{(\mu _P^U(a_1))^2+(\mu _P^U(a_2))^2-(\mu _P^U(a_1))^2(\mu _P^U(a_2))^2} \Big ], \Big [v_P^L(a_1)v_P^L(a_2), v_U^L(a_1)v_P^U(a_2)\Big ] \Big \rangle \Big )\)

- (2)

\(a_1\otimes a_2=P \Big ( \Big \langle s_{\theta (a_1)\times \theta (a_2)} , \big [\mu _P^L(a_1)\mu _P^L(a_2), \mu _U^L(a_1)\mu _P^U(a_2)\big ],\)

\(\Big [\sqrt{(v_P^L(a_1))^2+(v_P^L(a_2))^2-(v_P^L(a_1))^2(v_P^L(a_2))^2}, \sqrt{(v_P^U(a_1))^2+(v_P^U(a_2))^2-(v_P^U(a_1))^2(v_P^U(a_2))^2} \Big ] \Big \rangle \Big )\)

- (3)

\(\lambda a= P \Big ( \Big \langle s_{\lambda \times \theta (a)} , \Big [ \sqrt{1-(1-(\mu _P^L(a)^2)^{\lambda }) }, \sqrt{1-(1-(\mu _P^U(a)^2)^{\lambda }) } \Big ],\)

\(\Big [(v_P^L(a))^{\lambda }, (v_P^U(a))^{\lambda }) \Big ] \Big \rangle \Big )\), \(\lambda \ge 0\)

- (4)

\(a^{\lambda } = P \Big ( \Big \langle s_{(\theta (a))^{\lambda }} , \Big [ (\mu _P^L(a))^{\lambda }, (\mu _P^U(a))^{\lambda }) \Big ],\)

\(\Big [\sqrt{1-(1-(v_P^L(a)^2)^{\lambda }) }, \sqrt{1-(1-(v_P^U(a)^2)^{\lambda }) } \Big ] \Big \rangle \Big )\), \(\lambda \ge 0\)

The score function \(s(a)=\frac{1}{2}\big [(\mu _P^L)^2+(\mu _P^U)^2-(v_P^L)^2-(v_P^U)^2\big ]\) is used to get score of a and accuracy function \(h(a)=\frac{1}{2}\big [(\mu _P^L)^2+(\mu _P^U)^2+(v_P^L)^2+(v_P^U)^2\big ]\) to evaluate the accuracy degree of a. The relation between two IVPFSs \(a_1\) and \(a_2\) are:

If \(s(a_1)<s(a_2)\), then \(a_1<a_2 .\)

If \(s(a_1)=s(a_2)\), then

If \(h(a_1)=h(a_2)\), then \(a_1=a_2 .\)

If \(h(a_1)<h(a_2)\), then \(a_1<a_2 .\)

Notice that \(s(a)\in [-1,1]\). To further our following research, a new score function is defined as:

The new score function \(S\in [0,1]\) for that \(0\le (\mu _P^L)^2, (\mu _P^U)^2\), \((v_P^L)^2, (v_P^U)^2\le 1\). Compared with original score function, the basic properties are not changed. If \(s(a_1)\le s(a_2)\), then \(S(a_1)\le S(a_2)\); on the other hand, if \(S(a_1)\le S(a_2)\), then \(s(a_1)\le s(a_2)\). Thus, the relationship derived from original score function s is not changed when replaced by our new score function S.

2.2 Prioritized average operator

The prioritized average (PA) operator was originally introduced by Yager:

Definition 3

\(C={\{C_1, C_2, \ldots , C_n\}}\) is a collection of criteria and the prioritization between the criteria is expressed by a linear ordering \(C_1\succ C_2\succ C_3\cdots \succ C_n\), the criteria \(C_i\) has a higher priority than \(C_j\) if \(j<k\). And the value \(C_i(x)\) indicated the performance of any alternative x under criteria \(C_i\) which satisfies \(C_i(x)\in [0,1]\). For:

where \(w_i=\frac{T_i}{\sum _{i=1}^nT_i}\), \(T_i=\prod _{j=1}^{i-1}C_j(x)\)\((i= 2, \ldots , n)\), \(T_1=1\). Then PA is called prioritized average operator.

2.3 Two-person nonconstant sum game

Game theory founds a systematic and solid mathematical foundation to deal with dilemmas, where the preferences, benefits, and expectations of participants are discord. Now, game theory has been widely used in various domains like theoretical biology [26], complex system [27], risk analysis [28] and other fields [29]. It could quantify the impacts exerted on participants by others in an interactive environment. In general, a strategic game consists of a set of players, set of strategies of each player and payoffs gained from each strategy. The equilibrium or solution of a game will be reached when no participants could gain by unilaterally deviating from it which is also called Nash equilibrium [30].

Two-person nonconstant sum game is a type of game in which player A has a finite set of strategies \(S_A\) which contains m strategies, while player B’s strategy set \(S_B\) of n strategies. The total payoffs of player A and player B depend on utility function \(u_A(S_a^*, S_b^*)\) and \(u_B(S_a, S_b)\) where \(S_a\in S_A\) and \(S_b\in S_B\). A pair of strategy is the solution (Nash equilibrium) of the game if it satisfies

3 The proposed interval-valued Pythagorean prioritized game framework

The general procedures of the proposed interval-valued Pythagorean prioritized game framework are displayed in Fig. 1. The details are shown as follows:

- Step 1

Game analysis

In the initial stage, we analyzed the games to identify basic elements of the game: the set of participants and their strategies when they interact with each other. The basic framework of the game is established in this step.

- Step 2

Decision-making analysis

Next, the desired criteria, as well as their prioritized levels, are identified. Meanwhile, the invited decision makers with different weights also determined the game is transferred into multicriteria group decision-making process. The linguistic terms are defined to conduct evaluating process, and utility functions are also given to calculate final payoff matrix.

- Step 3

Strategies assessment

In this stage, the invited domain decision makers judge each strategy concerning each criterion for each strategy. Of note, the assessments are expressed in the form of the interval-Pythagorean fuzzy set due to experts’ indeterminacy and uncertainty, and these evaluations are also based on game theory perspective by taking competitor’s strategies reciprocally.

- Step 4

Aggregation of multicriteria group decision making under interval-valued Pythagorean fuzzy environment

In this stage, we will introduce the IVPFPWA and IVPFPWG into the multicriteria group decision-making problems, the detailed description of interval-valued Pythagorean fuzzy prioritized operators is in “Appendix.” Assume \(X={\{x_1, x_2, \ldots , x_m\}}\) is the set of alternatives and \(C={\{c_1, c_2, \ldots , c_n\}}\) is the collection of criteria in a decision-making situation. The prioritization between the criteria is expressed by the linear ordering \(c_1\succ c_2 \ldots ,\succ c_n\) in which \(c_i \succ c_j\) means criteria i has a higher prioritization level than criteria j. In addition, \(E={\{e_1, e_2, \ldots , e_p\}}\) is the set of experts or decision makers, and there is also a prioritization expressed by the linear ordering \(e_1 \succ e_2 \succ \ldots , \succ e_p\). Let \(P^{(q)}=(p_{ij}^{(q)})_{m\times n}\) be the interval-valued Pythagorean fuzzy set decision-making matrix, where \(p_{ij}^{(q)}=([a_{ij}^{(q)}, b_{ij}^{(q)}], [c_{ij}^{(q)},d_{ij}^{(q)}])\) is the satisfaction evaluation given by experts \(e_q\) in which \([a_{ij}^{(q)}, b_{ij}^{(q)}]\) indicates the degree range alternative \(x_i\) satisfies the criteria \(c_j\) in the perspective of expert \(e_q,\) while \([c_{ij}^{(q)},d_{ij}^{(q)}]\) means the degree range alternative \(x_i\) does not satisfy criteria \(c_j\) from expert \(e_i\). Therefore,

If all the criteria \(c_j\)\((j=1,2, \ldots , n)\) are of the same type, then the criteria values do not need normalization. Otherwise, the decision maker matrix \(P^{(q)}=(p_{ij}^{(q)})_{m\times n}\) should be normalized into \(R^{(q)}=(r_{ij}^{(q)})_{m\times n}\):

3.1 Make some slight adjustments on decision maker’s opinions

Next, we should evaluate the evaluations gathered from decision makers. In some special cases, some minor adjustment will be made on experts’ opinions. This procedure is to eliminate unreasonable results aggregated from IVPFPWA and IVPFPWG operators. The reasons are explained in detailed examples:

3.1.1 Example 1

Assume \(p_i={\{\langle s_{\theta (a_i)},[\mu _{\tilde{P}}^L(a_i), \; \mu _{\tilde{P}}^U(a_i)], \; [v_{\tilde{P}}^L(a_i), v_{\tilde{P}}^U(a_i)]\rangle \}}\)\((i=1, 2, \ldots , 12 )\) are the Pythagorean fuzzy sets given by decision makers \(e_i\)\((i=1, 2, \ldots , 12 )\) to evaluate an alternative respect to a criteria. \([\mu _{\tilde{P}}^L(a_i), \; \mu _{\tilde{P}}^U(a_i)]\), \([v_{\tilde{P}}^L(a_i), v_{\tilde{P}}^U(a_i)]\) are degree range of support and degree range of nonsupport for an decision maker to an alternative, respectively. In addition, the prioritization level of experts is expressed by a linear ordering \(e_1\succ e_2 \succ \cdots \succ e_{12}\).

Then IVPFPWA operator is utilized to aggregate these IVPFSs and obtain a comprehensive performance value. In this case, we suppose this criterion is a benefit criterion, so it does not require normalization before aggregation. From the first column of Table 1, it can be seen that although 11 experts grade the very high degree of support to the alternative, with the complete nonsupport assessment ([0, 0], [1, 1]) of the first expert, the result is ([0, 0], [1, 1]). The overall results are anti-intuition and unreasonable because it means that all 11 decision maker’s opinions are not considered. Taking further analysis, we find that no matter which decision maker holds absolutely nonsupport perspective like ([0, 0], [1, 1]), the following expert’s opinions will be ignored which is unreasonable in practice. By analyzing this situation, we find it is caused by the value of \(T_i=\prod _{j=1}^{i-1}S(a_j)\). If one decision maker holds absolutely nonsupport perspective (the value of score function is equal to 0 in this case), then other decision makers behind him are fixed as 0. Actually, \(T_i\) should meet the condition \(T_i>0\). The emergence of anti-intuition results is caused by failure meeting of this requirement.

To solve this problem, a slight adjustment is made. As shown in the second column of Table 1, we transfer the absolute nonsupport evaluation ([0, 0], [1, 1]) into ([0.01, 0.02], [0.97, 0.98]). The final result turns out to be reasonable. The revised method’s outcome is of highly support. A comparatively balanced output will be obtained without changing decision maker’s basic opinion just through a slight numerical adjustment.

3.1.2 Example 2

The IVPFSs in Table 2 have the same meaning as described in Table 1.

From the first column, 11 experts with high priority grade the high degree of nonsupport to the alternative; the last decision maker's complete support degree makes an overall evaluation a full support ([1, 1], [0, 0]). The result is not reasonable.

In column 2, the last decision maker’s evaluation are adjusted to ([0.95, 0.97], [0.01, 0.02]). Then, a higher degree of nonsupport result is acquired after aggregation. It is a reasonable result.

The column 3 in Table 1 shows another unreasonable result. The last decision maker’s lowest degree of nonsupport ([0.97, 0.98], [0, 0]) results in a completely lowest degree of nonsupport to the alternative. If we slightly adjust 12th decision maker’s assessment to [0.97, 0.98], [0.01, 0.02], the result after aggregation would be correct.

3.1.3 Make slight adjustment before fusing decision maker’s opinions

According to above-mentioned unreasonable results derived from decision maker’s evaluations, a preprocessing stage that aimed at making a slight adjustment on assessment to avoid following extreme occasions is necessary.

\(p_i=([0, 0], [1, 1]);\)

\(p_i=([1, 1], [0, 0]);\)

degree of nonsupport is [0, 0].

Corollary

\({\mathrm{IVPFPWA}}(a_1, a_2, a_3, \ldots , a_n)=\frac{T_1}{\sum _{i=1}^nT_i}a_1 \oplus \frac{T_2}{\sum _{i=1}^nT_i}a_2 \oplus , \ldots , \oplus \frac{T_n}{\sum _{i=1}^nT_i}a_n\) only when \(a_i=\{ \langle x, \mu _{\tilde{P}}(x)\), \(v_{\tilde{P}}(x)\rangle | x\in X \}\ne ([0,0], [1,1])\), \(a_i={\{ \langle x, \mu _{\tilde{P}}(x), v_{\tilde{P}}(x)\rangle | x\in X \}}\ne ([1,1], [0,0])\) and\(v_{\tilde{P}}(x)\ne [0,0]\)

Proof

Taking \(a_1=([0,0], [1,1])\), in this situation the score function \(S(a_1)=0\)\(T_i=\prod _{k=1}^{i-1}S(a_k)=S(a_1)\times S(a_2)\times S(a_3)\times \cdots S(a_{i-1})=0\times S(a_2)\times S(a_3)\times \cdots S(a_{i-1})=0\)\((i=2, 3, \ldots , n)\) and \(T_1=1\), thus \({\mathrm{IVPFPWA}}(a_1, a_2, a_3, \ldots , a_n)=\frac{1}{1}a_1 \oplus \frac{0}{1}a_2 \oplus , \ldots , \oplus \frac{0}{1}a_n=\frac{1}{1}a_1=([0,0], [1,1])\). This result is not correct. \(\square\)

Of note, the slight adjustment is to revise error results obtained from extreme situations referred above, and the original view of decision maker cannot be changed.

3.2 Group decision making using IVPFPWA operator or IVPFPWG operator

Now, we conduct the group decision making under Pythagorean fuzzy environment using IVPFPWA operator and IVPFPWG operator. The primary procedures are detailed as follows:

Stage 1 Calculate the values of \(T_{ij}^{(q)}=\prod _{k=1}^{q-1}S(r_{ij}^{(q)})\)\((q=2, 3, \ldots , p)\) and \(T_{ij}^{(1)}=1\)

Stage 2 Utilize the IVPFPWA operator:

or the IVPFPWG operator

to aggregate multiple opinions from decision makers. A comprehensive decision matrix \(R=(r_{ij})_{m\times n}\) (\(i=1,2 ,3 , \ldots , m;\; j=1, 2, 3, \ldots , n\)). is obtained.

Stage 3 Calculate the \(T_{ij}\) based on: \(T_{ij}^{(q)}=\prod _{k=1}^{j-1}S(r_{ij}^{(q)})\)\((q=2, 3, \ldots , p)\) and \(T_{ij}^{(1)}=1\). (\(i=1,2 ,3 , \ldots , m;\; j=1, 2, 3, \ldots , n\))

Stage 4 Aggregate interval-valued Pythagorean fuzzy sets for each alternative \(x_i\) by operator:

or the IVPFPWG operator

Stage 5 Calculate score of each alternative:

- Step 5

Decision based on equilibrium

In the final stage, the solution of decision would be determined based on equilibrium point of the game. At first, the expected utilities of each participants’ strategies are determined using utility function. Then, the payoff matrix containing benefits of two benefits in an interactive environment is formulated. Next, the equilibrium of the game should be identified. In this research, we focus our attention on pure strategy Nash equilibrium. In some special cases, the pure strategy Nash equilibrium may not exist. Thus, decision makers are invited to re-evaluate outcome of strategies. If there are Nash equilibriums, find the optimal combination of strategy according to decision makers’ preferences. If the selected Nash equilibrium is approved, then it will be conducted.

4 An illustrative example

In this section, an example of the duopoly is given to verify the proposed interval-valued Pythagorean prioritized game framework. The background of this game is that there are two enterprises taking up markets by providing a specific product to consumers. Another prior study recognized the behaviors as well as strategies of each company of one company. Thus, one enterprise must consider its opponent’s operations when they conduct decision-making process. Let us assume that enterprise A makes some significant breakthroughs in product technology, so their production efficiency is significantly improved compared with before. In this occasion, the strategies of two company should be adjusted to maximize their benefits.

4.1 Game analysis

The participants of this game are enterprise A and enterprise B abbreviated merely as A and B, respectively. Their strategies are defined as follows:

The set of strategies of A

\(S_{A1}\): Keeping production strategies adopted before.

\(S_{A2}\): Taking new efficient product technology thus eliciting a price war.

\(S_{A3}\): Keeping the production scale unchanged and implementing new technology into production.

\(S_{A4}\): Implementing new technology into production and improving production scale level.

\(S_{A5}\): Making negotiations with B requiring a larger market.

The set of strategies of B

\(S_{B1}\): Making great efforts and devoting much financial supports to develop new production technology.

\(S_{B2}\): Decreasing production scale.

\(S_{B3}\): Cutting the price of production keeping former production scale.

\(S_{B4}\): Making some compromise to another enterprise.

4.2 Decision-making analysis

Now, we first identify the prioritized level of each criterion and decision makers. Three criteria are identified as \(C_1\) benefits, \(C_2\) further development, \(C_3\) sustainability and strategy influences \(C_4\). After experts’ evaluations and discussions, the prioritized level is observing a linear order \(C_1\succ C_2 \succ C_3\succ C_4\). And three decision makers participating in the activity are the manager (decision maker 1), vice manager (decision maker 2) and consultant (decision maker 3) with prioritized level decision maker 1 \(\succ\) decision maker 2 \(\succ\) decision maker 3.

Then, the linguistic assessments ranking is defined in Table 3.

Finally, the utility functions \(u_A\) and \(u_B\) of A and B are determined on linguistic evaluations displayed in Table 4. According to utility functions of A and B, the payoff of evaluated result could be acquired.

4.3 Strategies evaluations

In this step, multiple decision makers are invited to evaluate the strategies of each player with respect to desired criteria. The evaluation outcome addressed in the form of interval-valued Pythagorean fuzzy sets based on linguistic terms defined in decision-making analysis step. Due to limited spaces, we considered the case in which enterprise A adopts strategy \(S_{A1}\) and enterprise B adopts strategy \(S_{B1}\), and other combinations of strategy are the analogous way. Of note, the evaluation results are described in Table 5.

4.4 Aggregation of multiple criteria group decision making under interval-valued Pythagorean fuzzy environment

Stage 1 Calculate \(T_{ij}^{(1)}\), \(T_{ij}^{(2)}\), \(T_{ij}^{(3)}\)

Stage 2 Using IVPFPWA operator to aggregate three decision makers’ Pythagorean fuzzy decision matrix \(R^{(i)}\) into a comprehensive Pythagorean fuzzy decision matrix R (Table 6).

Stage 3 Calculate the values of \(T_{ij}\)\((i=1, 2, \ldots , m;\; j=1,2, \ldots , n)\)

Stage 4 Using IVPFPWA operator to fuse all evaluation values \(r_{ij}\) in the ith line of R, and get comprehensive assessment expressed by IVPFSs:

Stage 5 Calculate the scores of \(r_i,\) respectively:

4.5 Decision based on equilibrium

Finally, according to the utility functions determined in step of decision analysis, for each strategy, the expected utility of final aggregated assessment is calculated by:

where \(\Omega ={\{{\mathrm{VP}}, {\mathrm{MP}}, M, G, {\mathrm{VG}}\}},\) so the expected utility function can be calculated as:

In the same way, other utilities of strategy combinations are calculated similarly as shown in Tables 7 and 8. Furthermore, the payoff matrix containing expected utilities is formulated in Table 9.

As seen from Table 9, there is only one equilibrium point (1.24082, 1.27552) which is a combination \(S_{A4}\) of player A and \(S_{B3}\) of player B in this game. If all of them approved, the combination would be a solution for the decision. Also, it can be easily observed that equilibrium point is neither best strategy of A nor best strategy of B, and both of them make some compromise to maintain these optimal stable situation. Since these two enterprises benefit are discord, their payoffs could not be improved bilaterally, which reveals the constraints in an interactive environment.

5 Discussion

5.1 Evaluation of proposed method

In this section, six experiments have been conducted to the illustrative robustness of our proposed model. To be specific, as shown in the illustrative examples, we fixed the priority order of 4 different criteria (\(\hbox {C}1\succ \hbox {C}2\succ \hbox {C}3\succ \hbox {C}4\)) and decision makers (\(\hbox {decision maker 1} \succ \hbox {decision maker 2} \succ \hbox {decision maker 3}\)). The expected utilities of two enterprises in different strategy combinations are shown in Table 9. Of note, the optimal strategy combination is highlighted in italic. In this situation, the optimal solution for two enterprises divided into enterprise A adopting strategy \(S_{A4}\) and enterprise B adopting strategy \(S_{B3}\).

To verify the accuracy and sensitivity of the proposed approach, we changed the priority of four criteria and three decision makers. In the first three experiments, we explored the impact of priority of criteria on final optimal solutions. The priority order of four criteria (\(\hbox {C}1\succ \hbox {C}2\succ \hbox {C}3\succ \hbox {C}4\)) varies depending on different circumstances, while the decision makers’ order is consistent with that in illustrative examples (\(\hbox {decision maker 1} \succ \hbox {decision maker 2} \succ \hbox {decision maker 3}\)). Specifically, in the ‘Experiment 1,’ 4 criteria are assumed to share same priority, and the priority order of three decision makers keeps as illustrative examples (\(\hbox {C}1 = \hbox {C}2 = \hbox {C}3 = \hbox {C}4, \hbox {decision maker 1} \succ \hbox {decision maker 2} \succ \hbox {decision maker 3}\)). Similarly, in the ‘Experiment 2,’ the priority of four criteria is slightly adjusted from illustrative examples (\(\hbox {C}2\succ \hbox {C}1\succ \hbox {C}4\succ \hbox {C}3\succ , \hbox {decision maker 1} \succ \hbox {decision maker 2} \succ \hbox {decision maker 3}\)). In the ‘Experiment 3,’ the priority order of 4 criteria is different (\(\hbox {C}4\succ \hbox {C}3\succ \hbox {C}2\succ \hbox {C}1, \hbox {decision maker 1} \succ \hbox {decision maker 2} \succ \hbox {decision maker 3}\)). The expected utilities of two enterprises in these three conditions are shown in Tables 10, 11 and 12.

Analogously, the influence of priority of decision maker is quantified in the following three experiments. The priority order of four criteria is assumed consistent with illustrative examples (\(\hbox {C}1\succ \hbox {C}2\succ \hbox {C}3\succ \hbox {C}4\)), but we made adjustments on the priority order of decision maker. Specifically, in the ‘Experiment 4,’ three decision makers are assumed to share same priority and the priority order of four criteria keeps as illustrative examples (\(\hbox {C}1\succ \hbox {C}2\succ \hbox {C}3\succ \hbox {C}4\), \(\hbox {decision maker 1} =\hbox {decision maker 2} =\hbox {decision maker 3}\)). Similarly, in the ‘Experiment 5,’ the priority of three decision makers is slightly adjusted from illustrative examples (\(\hbox {C}1\succ \hbox {C}2\succ \hbox {C}3\succ \hbox {C}4, \hbox {decision maker 1} \succ \hbox {decision maker 3} \succ \hbox {decision maker 2}\)). In the ‘Experiment 6,’ the priority order of four criteria is totally different (\(\hbox {C}1\succ \hbox {C}2\succ \hbox {C}3\succ \hbox {C}4, \hbox {decision maker 3} \succ \hbox {decision maker 2} \succ \hbox {decision maker 1}\)). The expected utilities of two enterprises in these three conditions are shown in Tables 13, 14 and 15.

From Tables 10, 11, 12, 13, 14 and 15, we summarized that the final optimal outcomes depending on the priority of four criteria and three decision makers. For instance, strategy \(S_{A4}\) and \(S_{B1}\) are best strategies combination if the priority of four criteria is changed to \(\hbox {C}4\succ \hbox {C}3\succ \hbox {C}2\succ \hbox {C}1\), and the utilities are 1.22572 and 1.19682, respectively. Additionally, the optimal solutions for different situations are listed in Table 16.

For Table 16, we noted our proposed method is sensitive to the priority of criteria and decision makers, and we can choose the optimal solution depending on the different priorities of criteria and decision makers. In practical applications, practitioners require to evaluate the priority of criteria and adopt a reasonable strategy to maximize their payoffs.

5.2 Comparison with existing methods

In terms of traditional Pythagorean aggregation operators, they did not consider the priority of Pythagorean fuzzy sets. In the decision-making process, our proposed method measured the priority of Pythagorean fuzzy sets, which could eliminate subjective and objective errors.

As we state in last section, six experiments are conducted to the illustrative robustness of our proposed model and then comparing the performance between our proposed approach and other existing approaches. To eliminate the impacts of subjective decision makers’ evaluations on the final decision, it is necessary to take into consideration the priority of different decision makers (the strength of proposed approach consider this important point). For example, as shown in Table 12, the optimal solution will transfer to (\(S_{A4}\), \(S_{B1}\)), which suggested that the priority of different criteria is crucial to optimal outcomes. In terms of Table 13, the optimal strategy combination (\(S_{A2}\), \(S_{B4}\)) is different from illustrative examples (\(S_{A4}\), \(S_{B3}\)), if three decision makers are measured equally. Thus, our proposed method is more robust than existing methods.

From the outcomes of performance analysis, we noted that the optimal solutions (Nash equilibrium) are largely dependent on the priority of criteria and decision makers. The findings from in illustrative examples suggested that enterprise A adopts strategy \(S_{A4},\) while its opponent enterprise B adopts strategy \(S_{B3}\).

6 Conclusion

Since group decision making is ubiquitous in our daily life, in this study, we mainly focus on an interactive situation where each participant should take their opponent’s strategy and maximize their payoffs as much as possible. The decision maker’s judgments are unable to give a precise evaluation in crisp number due to uncertainty and their indeterminacy. To address this problem, we proposed a novel framework with integrate interval-valued Pythagorean fuzzy set and game theory. Within this framework, domain experts express their opinions in the form of interval-valued Pythagorean fuzzy sets and game theory is utilized to analyze equilibrium of the decision-making process. The proposed method provides a new perspective to solve group decision-making problem within the dynamic, interactive environment and it could be implemented in various fields. Additionally, we also pay attention to pure strategy Nash equilibrium, other types of equilibrium point like mixed strategy. In a word, the main contributions of our proposed method are summarized as follows:

- 1.

A systematic framework to simulate group decision making under uncertainty in an interactive environment is established.

- 2.

An interval-valued Pythagorean prioritized operator is established for decision making, and some unreasonable and anti-intuitionistic situations are addressed in the revision, seeking the applications in group decision making.

- 3.

The impacts of the priority of different criteria, as well as decision makers, are quantified. Our experiments implied that the priority of criteria and decision makers in group decision making would exert significant influence on an optimal solution (Nash equilibrium). In practical, practitioners could evaluate the criteria and decision makers, so that they can adopt accuracy strategy to maximize their profits.

In terms of the amount of participating players, games can be classified into two-person games and multiperson games. In this paper, we focus on solving two-person games. In the future, we pay more attention to investigate on multiperson games, named polymatrix games. It will guide practitioners to make precise decisions when there are more than one opponent in a game.

References

Liao H, Xu Z, Zeng XJ, Xu DL (2016) An enhanced consensus reaching process in group decision making with intuitionistic fuzzy preference relations. Inf Sci 329(C):274–286

Zhang X, Mahadevan S (2017) A game theoretic approach to network reliability assessment. IEEE Trans Reliab PP(99):1–18

Zhang X, Mahadevan S (2018) A bio-inspired approach to traffic network equilibrium assignment problem. IEEE Trans Cybern 48(4):1304–1315

Kannan D, Khodaverdi R, Olfat L, Jafarian A, Diabat A (2013) Integrated fuzzy multi criteria decision making method and multi-objective programming approach for supplier selection and order allocation in a green supply chain. J Clean Prod 47(9):355–367

Jiang W, Wei B, Liu X, Li XY, Zheng H (2018) Intuitionistic fuzzy power aggregation operator based on entropy and its application in decision making. Int J Intell Syst 33(1):49–67

Cao Z, Lin C-T (2018) Inherent fuzzy entropy for the improvement of eeg complexity evaluation. IEEE Trans Fuzzy Syst 2(26):1032–1035

Sayadi MK, Heydari M, Shahanaghi K (2009) Extension of vikor method for decision making problem with interval numbers. Appl Math Model 33(5):2257–2262

Lin C-T, Ding W, Cao Z (2018) Deep neuro-cognitive co-evolution for fuzzy attribute reduction by quantum leaping PSO with nearest-neighbor memeplexes. IEEE Trans Cybern. https://doi.org/10.1109/TCYB.2018.2834390

Wu S-L, Zehong JC, Wang Y-K, Huang C-S, King J-T, Chen S-A, Lu S-W, Lin C-T, Liu Y-T, Chuang C-H (2017) Eeg-based brain-computer interfaces: a novel neurotechnology and computational intelligence method. IEEE Syst Man Cybern Mag 3(4):16–26

Liu F, Qin Y, Pedrycz W, Zhang WG (2018) A group decision making model based on an inconsistency index of interval multiplicative reciprocal matrices. Knowl Based Syst 145:67–76

Zeshui X, Yager RR (2012) Dynamic intuitionistic fuzzy multi-attribute decision making. Int J Approx Reason 48(1):246–262

Mousavi SM, Foroozesh N, Gitinavard H, Vahdani B (2018) Solving group decision-making problems in manufacturing systems by an uncertain compromise ranking method. Int J Appl Decis Sci 11(1):55

Morente-Molinera JA, Kou G, Peng Y, Torres-Albero C, Herrera-Viedma E (2018) Analysing discussions in social networks using group decision making methods and sentiment analysis. Inf Sci 447:157–168

Kang B, Chhipi-Shrestha G, Deng Y, Mori J, Hewage K, Sadiq R (2017) Development of a predictive model for \(Clostridium~difficile\) infection incidence in hospitals using Gaussian mixture model and Dempster–Shafer theory. Stoch Environ Res Risk Assess 32(6):1743–1758

Dempster AP (1967) Upper and lower probabilities induced by a multivalued mapping. Ann Math Stat 38(2):325–339

Zhang L, Ding LY, Wu XG, Skibniewski MJ (2017) An improved Dempster–Shafer approach to construction safety risk perception. Knowl Based Syst 132:30–46

Zhang L, Chen HY, Li HX, Wu XG, Skibniewski MJ (2018) Perceiving interactions and dynamics of safety leadership in construction projects. Saf Sci 106:66–78

Zadeh LA (1965) Fuzzy sets. Inf Control 8(3):338–353

Liang D, Zeshui X, Liu D, Yao W (2018) Method for three-way decisions using ideal topsis solutions at Pythagorean fuzzy information. Inf Sci 435:282–295

Yager RR, Abbasov AM (2013) Pythagorean membership grades, complex numbers, and decision making. Int J Intell Syst 28(5):436–452

Chen T-Y (2014) A prioritized aggregation operator-based approach to multiple criteria decision making using interval-valued intuitionistic fuzzy sets: a comparative perspective. Inf Sci 281:97–112

Nash J (1951) Non-cooperative games. Ann Math 54(2):286–295

Zeshui X (2007) Intuitionistic preference relations and their application in group decision making. Inf Sci Int J 177(11):2363–2379

Yager RR (2008) Prioritized aggregation operators. Int J Approx Reason 48(1):263–274

Cabrerizo FJ, Morente-Molinera JA, Pedrycz W, Taghavi A, Herrera-Viedma E (2018) Granulating linguistic information in decision making under consensus and consistency. Expert Syst Appl 99:83–92

Li X, Jusup M, Wang Z, Li H, Shi L, Podobnik B, Stanley HE, Havlin S, Boccaletti S (2017) Punishment diminishes the benefits of network reciprocity in social dilemma experiments. Proc Natl Acad Sci 115(1):30–35

Wang Z, Xia C-Y, Meloni S, Zhou C-S, Moreno Y (2013) Impact of social punishment on cooperative behavior in complex networks. Sci Rep 3:3055

Wang Z, Andrews MA, Wu Z-X, Wang L, Bauch CT (2015) Coupled disease–behavior dynamics on complex networks: a review. Phys Life Rev 15:1–29

Deng XY, Zhang ZP, Deng Y, Liu Q, Chang S (2016) Self-adaptive win-stay-lose-shift reference selection mechanism promotes cooperation on a square lattice. Appl Math Comput 284:322–331

Nash JF (1950) Equilibrium points in \(n\)-person games. Proc Natl Acad Sci USA 36(1):48

Acknowledgements

The authors are grateful to anonymous reviewers for their useful comments and suggestions on improving this paper.

Funding

The work is partially supported by National Natural Science Foundation of China (Grant Nos. 61573290, 61503237) and National Undergraduate Training Program for Innovation and Entrepreneurship (Grant No. 201810635012).

Author information

Authors and Affiliations

Corresponding authors

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Human and animal rights statement

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Interval-valued Pythagorean fuzzy prioritized average operators are defined as follows:

Definition 4

Let \(a_i=\{\langle s_{\theta (a_i)},[\mu _{\tilde{P}}^L(a_i), \; \mu _{\tilde{P}}^U(a_i)]\), \([v_{\tilde{P}}^L(a_i), v_{\tilde{P}}^U(a_i)]\rangle \}\)\((i=1, 2, 3, \ldots , n)\) be a collection of IVPFSs, then their aggregated, where \([\mu _{\tilde{P}}^L(a_i), \; \mu _{\tilde{P}}^U(a_i)]\subset [0,1], [v_{\tilde{P}}^L(a_i)\), \(v_{\tilde{P}}^U(a_i)] \subset [0,1]\) and let IVPFPWA \(V^n\rightarrow V\). if:

The interval-valued Pythagorean fuzzy prioritized weighted average operator is abbreviated as IVPFPWA with \(T_i=\prod _{j=1}^{i-1}S(a_j)\)\((i= 2, \ldots , n)\), \(T_1=1\) and \(S(a_j)\) is the score of IVPFS a.

We could obtain the Theorem 1 based on the operations of IVPFSs described in Preliminary.

Theorem 1

Let\(a_i=\{\langle s_{\theta (a_i)},[\mu _{\tilde{P}}^L(a_i), \; \mu _{\tilde{P}}^U(a_i)]\), \(\quad [v_{\tilde{P}}^L(a_i)\), \(\quad v_{\tilde{P}}^U(a_i)]\rangle \}\)\((i=1, 2, 3, \ldots , n)\) be a collection of IVPFSs, then their aggregated, IVPFPWA is

where\(T_i=\prod _{j=1}^{i-1}S(a_j)\)\((i= 2, \ldots , n)\), \(T_1=1\) andS(a) is the score of IVPFSa.

Proof

In the following, we prove the first result follows quickly from Definition 2 and Theorem 1:

by using mathematical induction on n:

- (1)

For n = 2, then

$$\begin{aligned}&{\mathrm{IVPFPWA}}\left( a_1, a_2\right) =\frac{T_1}{\sum _{i=1}^2T_i}a_1+\frac{T_2}{\sum _{i=1}^2T_i}a_2 \\&\quad \frac{T_1}{\sum _{i=1}^2T_i}a_1=\left( \left\langle \left[ \sqrt{1-\left( 1-\mu _p^L(a_1)^2\right) ^\frac{T_1}{\sum _{i=1}^2T_i}},\right. \right. \sqrt{1-\left( 1-\mu _p^U(a_1)^2\right) ^\frac{T_1}{\sum _{i=1}^2T_i}} \right] , \\&\qquad \left. \left. \left[ \left( v_p^L(a_1)\right) ^\frac{T_1}{\sum _{i=1}^2T_i}, \left( v_p^U(a_1)\right) ^\frac{T_1}{\sum _{i=1}^2T_i} \right] \right\rangle \right) \frac{T_2}{\sum _{i=1}^2T_i}a_2=\left( \left\langle \left[ \sqrt{1-\left( 1-\mu _p^L(a_2)^2\right) ^\frac{T_2}{\sum _{i=1}^2T_i}},\right. \right. \right. \\&\qquad \left. \sqrt{1-\left( 1-\mu _p^U(a_2)^2\right) ^\frac{T_2}{\sum _{i=1}^2T_i}} \right] , \left. \left. \left[ \left( v_p^L(a_1)\right) ^\frac{T_2}{\sum _{i=1}^2T_i}, \left( v_p^U(a_2)\right) ^\frac{T_2}{\sum _{i=1}^2T_i} \right] \right\rangle \right) \\&{\mathrm{IVPFPWA}}\left( a_1, a_2\right) = \left( \left\langle \left[ \sqrt{1-\left( 1-\mu _p^L(a_1)^2\right) ^\frac{T_1}{\sum _{i=1}^2T_i}+1-\left( 1-\mu _p^L(a_2)^2\right) ^\frac{T_2}{\sum _{i=1}^2T_i}, \left( 1-\left( 1-\mu _p^L(a_1)^2\right) ^\frac{T_1}{\sum _{i=1}^2T_i}\right) \left( 1-\left( 1-\mu _p^L(a_2)^2\right) ^\frac{T_2}{\sum _{i=1}^2T_i}\right) },\right. \right. \right. \\&\quad \quad \left. \sqrt{1-\left( 1-\mu _p^U(a_1)^2\right) ^\frac{T_1}{\sum _{i=1}^2T_i}+1-\left( 1-\mu _p^U(a_2)^2\right) ^\frac{T_2}{\sum _{i=1}^2T_i}, \left( 1-\left( 1-\mu _p^U(a_1)^2\right) ^\frac{T_1}{\sum _{i=1}^2T_i}\right) \left( 1-\left( 1-\mu _p^U(a_2)^2\right) ^\frac{T_2}{\sum _{i=1}^2T_i}\right) }\right] , \left[ \left( v_p^L(a_1)\right) ^\frac{T_1}{\sum _{i=1}^2T_i}\left( v_p^L(a_2)\right) ^\frac{T_2}{\sum _{i=1}^2T_i},\right. \\&\quad \quad \left. \left. \left. \left( v_p^U(a_1)\right) ^\frac{T_1}{\sum _{i=1}^2T_i}\left( v_p^U(a_2)\right) ^\frac{T_2}{\sum _{i=1}^2T_i}\right] \right\rangle \right) \\&\quad =\left( \left\langle \left[ \sqrt{1-\left( 1-\mu _p^L(a_1)^2\right) ^\frac{T_1}{\sum _{i=1}^2T_i}\left( 1-\mu _p^L(a_2)^2\right) ^\frac{T_2}{\sum _{i=1}^2T_i}},\right. \right. \right. \\&\qquad \left. \sqrt{1-\left( 1-\mu _p^U(a_1)^2\right) ^\frac{T_1}{\sum _{i=1}^2T_i}\left( 1-\mu _p^U(a_2)^2\right) ^\frac{T_2}{\sum _{i=1}^2T_i}}\right] , \\&\quad \quad \left[ \left( v_p^L(a_1)\right) ^\frac{T_1}{\sum _{i=1}^2T_i}\left( v_p^L(a_2)\right) ^\frac{T_2}{\sum _{i=1}^2T_i},\right. \\&\quad \quad \left. \left. \left. \left( v_p^U(a_1)\right) ^\frac{T_1}{\sum _{i=1}^2T_i}\left( v_p^U(a_2)\right) ^\frac{T_2}{\sum _{i=1}^2T_i}\right] \right\rangle \right) \\ \end{aligned}$$ - (2)

We suppose it holds for \(n=k\), that is

$$\begin{aligned}&{\mathrm{IVPFPWA}}\left( a_1, a_2, a_3, \ldots , a_k\right) \\&\quad =\frac{T_1}{\sum _{i=1}^kT_i}a_1 \oplus \frac{T_2}{\sum _{i=1}^kT_i}a_2 \oplus , \ldots , \oplus \frac{T_n}{\sum _{i=1}^kT_i}a_n\\&\quad =\left( \left\langle \left[ \sqrt{1-\prod \limits _{i=1}^k\left( 1-\mu _p^L(a_i)^2\right) ^\frac{T_i}{\sum _{i=1}^kT_i}},\right. \right. \right. \\&\qquad \left. \sqrt{1-\prod \limits _{i=1}^k\left( 1-\mu _p^U(a_i)^2\right) ^\frac{T_i}{\sum _{i=1}^kT_i}} \right] , \\&\qquad \left. \left. \left[ \prod \limits _{i=1}^k\left( v_p^L(a_i)\right) ^\frac{T_i}{\sum _{i=1}^kT_i}, \prod \limits _{i=1}^k\left( v_p^U(a_i)\right) ^\frac{T_i}{\sum _{i=1}^kT_i} \right] \right\rangle \right) \end{aligned}$$ - (3)

We suppose it holds for \(n=k+1\), we have

$$\begin{aligned}&\frac{T_{k+1}}{\sum _{i=1}^{k+1}T_i}a_{k+1}=\left( \left\langle \left[ \sqrt{1-\left( 1-\mu _p^L\left( a_{k+1}\right) ^2\right) ^\frac{T_{k+1}}{\sum _{i=1}^{k+1}T_i}},\right. \right. \right. \\&\quad \quad \left. \sqrt{1-\left( 1-\mu _p^U\left( a_{k+1}\right) ^2\right) ^\frac{T_2}{\sum _{i=1}^{k+1}T_{k+1}}}\right] , \\&\quad \quad \left. \left. \left[ \left( v_p^L(a_{k+1})\right) ^\frac{T_{k+1}}{\sum _{i=1}^{k+1}T_{k+1}}, \left( v_p^U(a_{k+1})\right) ^\frac{T_{k+1}}{\sum _{i=1}^{k+1}T_{k+1}} \right] \right\rangle \right) \\&{\mathrm{IVPFPWA}}\left( a_1, a_2, a_3, \ldots , a_{k+1}\right) \\&\quad = \left( \left\langle \left[ \sqrt{1-\prod \limits _{i=1}^k\left( 1-\mu _p^L(a_i)^2\right) ^\frac{T_i}{\sum _{i=1}^kT_i}+1-\left( 1-\mu _p^U(a_{k+1})^2\right) ^\frac{T_{k+1}}{\sum _{i=1}^{k+1}T_i}-\left( 1-\prod \limits _{i=1}^k\left( 1-\mu _p^L(a_i)^2\right) ^\frac{T_i}{\sum _{i=1}^kT_i}\right) \left( 1-\left( 1-\mu _p^L(a_{k+1})^2\right) ^\frac{T_{k+1}}{\sum _{i=1}^{k+1}T_i}\right) },\right. \right. \right. \\&\quad\quad \left. \sqrt{1-\prod \limits _{i=1}^k(1-\mu _p^U(a_i)^2)^\frac{T_i}{\sum _{i=1}^kT_i}+1-(1-\mu _p^U(a_{k+1})^2)^\frac{T_{k+1}}{\sum _{i=1}^{k+1}T_i}-(1-\prod \limits _{i=1}^k(1-\mu _p^U(a_i)^2)^\frac{T_i}{\sum _{i=1}^kT_i})(1-(1-\mu _p^U(a_{k+1})^2)^\frac{T_{k+1}}{\sum _{i=1}^{k+1}T_i})}\right] \\&\quad \quad \left[ \left( v_P^L(a_{k+1})\right) ^\frac{T_{k+1}}{\sum _{i=1}^{k+1}T_i}\prod \limits _{i=1}^k\left( \mu _p^L(a_i)\right) ^\frac{T_i}{\sum _{i=1}^kT_i},\right. \\&\quad \quad \left. \left. \left. \left( v_P^U(a_{k+1})\right) ^\frac{T_{k+1}}{\sum _{i=1}^{k+1}T_i}\prod \limits _{i=1}^k\left( \mu _p^U(a_i)\right) ^\frac{T_i}{\sum _{i=1}^kT_i}\right] \right\rangle \right) \\&{\mathrm{IVPFPWA}}\left( a_1, a_2, a_3, \ldots , a_{k+1}\right) \\&\quad =\frac{T_1}{\sum _{i=1}^{k+1}T_i}a_1 \oplus \frac{T_2}{\sum _{i=1}^{k+1}T_i}a_2 \oplus , \ldots , \oplus \frac{T_n}{\sum _{i=1}^{k+1}T_i}a_n\\&\quad =\left( \left\langle \left[ \sqrt{1-\prod \limits _{i=1}^{k+1}\left( 1-\mu _p^L(a_i)^2\right) ^\frac{T_i}{\sum _{i=1}^{k+1}T_i}},\right. \right. \right. \\&\quad \quad \left. \sqrt{1-\prod \limits _{i=1}^{k+1}\left( 1-\mu _p^U(a_i)^2\right) ^\frac{T_i}{\sum _{i=1}^{k+1}T_i}} \right] , \\&\quad \quad \left. \left. \left[ \prod \limits _{i=1}^{k+1}\left( v_p^L(a_i)\right) ^\frac{T_i}{\sum _{i=1}^{k+1}T_i}, \prod \limits _{i=1}^{k+1}\left( v_p^U(a_i)\right) ^\frac{T_i}{\sum _{i=1}^{k+1}T_i} \right] \right\rangle \right) \end{aligned}$$

\(\square\)

Theorem 2

(Idempotency) Let\(a_i=\{\langle s_{\theta (a_i)},[\mu _{\tilde{P}}^L(a_i), \; \mu _{\tilde{P}}^U(a_i)]\), \(\quad [v_{\tilde{P}}^L(a_i)\), \(\quad v_{\tilde{P}}^U(a_i)]\rangle \}\)\((i=1, 2, 3, \ldots , n)\) be a collection of IVPFSs, if all\(a_i\)\((i=1,2,3, \ldots , n))\) are equal (\(a_i=a\)), then:

Corollary 1

If \(a_i=\{\langle s_{\theta (a_i)},[\mu _{\tilde{P}}^L(a_i), \; \mu _{\tilde{P}}^U(a_i)]\), \([v_{\tilde{P}}^L(a_i)\), \(v_{\tilde{P}}^U(a_i)]\rangle \}\)\((i=1, 2, 3, \ldots , n)\) be a collection of IVPFSs, if all \(a_i\)\((i=1,2,3, \ldots , n))=a^*=([1,1], [0,0])\), then:

After the aggregating, it is also the largest IVPFS.

Proof

In the similar way showed above:

Corollary 2

If \(a_i=\{\langle s_{\theta (a_i)},[\mu _{\tilde{P}}^L(a_i), \; \mu _{\tilde{P}}^U(a_i)], \; [v_{\tilde{P}}^L(a_i)\), \(v_{\tilde{P}}^U(a_i)]\rangle \}\)\((i=1, 2, 3, \ldots , n)\) be a collection of IVPFSs, if all\(a_i\)\((i=1,2,3, \ldots , n))=a_*=([0,0], [1,1])\), then:

After the aggregating, it is also the smallest IVPFS.

Proof

Since \(a_1=([0,0], [1,1])\), then we have the score function:

Since:

We have

Thus, \(\sum _{i=1}^nT_i=1\)

This reveals that when the criteria owning the highest priority has the smallest IVPFS, then any other criteria could not compensate it even they are all satisfied. \(\square\)

Theorem 3

(Boundary) If\(a_i=\{\langle s_{\theta (a_i)},[\mu _{\tilde{P}}^L(a_i), \; \mu _{\tilde{P}}^U(a_i)], \; [v_{\tilde{P}}^L(a_i)\), \(\quad v_{\tilde{P}}^U(a_i)]\rangle \}\)\((i=1, 2, 3, \ldots , n)\) be a collection of IVPFSs, and \(S(a_i)\) is the scores of IVPFS\(a_i\):

Then, \(a_*\le {{IVPFPWA}}(a_1, a_2, a_3, \ldots , a_n)\le a^*\)

Proof

Since \(\min _i{\mu _{\tilde{P}}^L(a_i)}\le \mu _{\tilde{P}}^L(a_i)\le \max _i{\mu _{\tilde{P}}^L(a_i)}\), \(\min _i{\mu _{\tilde{P}}^U(a_i)}\le \mu _{\tilde{P}}^U(a_i)\le \max _i{\mu _{\tilde{P}}^U(a_i)}\), \(\min _i{v_{\tilde{P}}^L(a_i)}\le v_{\tilde{P}}^L(a_i)\le \max _i{v_{\tilde{P}}^L(a_i)}\), \(\min _i{v_{\tilde{P}}^U(a_i)}\le v_{\tilde{P}}^U(a_i)\le \max _i{v_{\tilde{P}}^U(a_i)}\)

And then

In the similar way, we have:

and

then

If \(S(a_*)< S(a)< S(a^*)\) we could conclude that

Otherwise, we have \(S(a)=S(a^*)\):

Then, we have

Thus,

Then, we have

On the other hand, if \(S(a)=S(a_*)\):

Then we have:

Therefore

\(\square\)

Definition 5

Let \(a_i=\{\langle s_{\theta (a_i)},[\mu _{\tilde{P}}^L(a_i), \; \mu _{\tilde{P}}^U(a_i)], \; [v_{\tilde{P}}^L(a_i)\), \(v_{\tilde{P}}^U(a_i)]\rangle \}\)\((i=1, 2, 3, \ldots , n)\) be a collection of IVPFSs, then their aggregated, where \([\mu _{\tilde{P}}^L(a_i), \; \mu _{\tilde{P}}^U(a_i)]\subset [0,1]\), \([v_{\tilde{P}}^L(a_i), v_{\tilde{P}}^U(a_i)] \subset [0,1]\) and let IVPFPWG \(V^n\rightarrow V\). If

The interval-valued Pythagorean fuzzy prioritized weighted geometric operator is abbreviated as IVPFPWG with \(T_i=\prod _{j=1}^{i-1}S(a_j)\)\((i= 2, \ldots , n)\), \(T_1=1\) and \(S(a_j)\) is the score of IVPFS a.

Theorem 4

Let\(a_i=\{\langle s_{\theta (a_i)},[\mu _{\tilde{P}}^L(a_i), \; \mu _{\tilde{P}}^U(a_i)], \; [v_{\tilde{P}}^L(a_i)\), \(v_{\tilde{P}}^U(a_i)]\rangle \}\)\((i=1, 2, 3, \ldots , n)\) be a collection of IVPFSs, then their aggregated value is still an IVPFS by using IVPFPWG operator and:

where \(T_i=\prod _{j=1}^{i-1}S(a_j)\)\((i= 2, \ldots , n)\), \(T_1=1\) and S(a) is the score of IVPFSa.

Proof

The proof of Theorem 4 is similar to Theorem 1. \(\square\)

Theorem 5

(Idempotency) Let\(a_i=\{\langle s_{\theta (a_i)},[\mu _{\tilde{P}}^L(a_i), \; \mu _{\tilde{P}}^U(a_i)]\), \([v_{\tilde{P}}^L(a_i), \; v_{\tilde{P}}^U(a_i)]\rangle \}\)\((i=1, 2, 3, \ldots , n)\) be a collection of IVPFSs, if all\(a_i\)\((i=1,2,3, \ldots , n))\) are equal (\(a_i=a\)), then

Proof

The proof of Theorem 5 is similar to Theorem 2. \(\square\)

Theorem 6

(Boundary) If\(a_i=\{\langle s_{\theta (a_i)},[\mu _{\tilde{P}}^L(a_i), \; \mu _{\tilde{P}}^U(a_i)]\), \([v_{\tilde{P}}^L(a_i), \; v_{\tilde{P}}^U(a_i)]\rangle \}\)\((i=1, 2, 3, \ldots , n)\) be a collection of IVPFSs, and\(S(a_i)\) is the scores of IVPFS\(a_i\):

Then \(a_*\le {{IVPFPWG}}(a_1, a_2, a_3, \ldots , a_n)\le a^*\).

Proof

Rights and permissions

About this article

Cite this article

Han, Y., Deng, Y., Cao, Z. et al. An interval-valued Pythagorean prioritized operator-based game theoretical framework with its applications in multicriteria group decision making. Neural Comput & Applic 32, 7641–7659 (2020). https://doi.org/10.1007/s00521-019-04014-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00521-019-04014-1